UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to _________

Commission file number 000-56253

FUEL DOCTOR HOLDINGS, INC.

(Exact name of registrant as specified in charter)

| Delaware | | 26-2274999 |

(State or jurisdiction of

Incorporation or organization) | | I.R.S Employer

Identification No. |

| 20 Raul Wallenberg Street, Tel Aviv, Israel | | 6971916 |

| (Address of principal executive offices) | | (Zip code) |

(678) 558-5564

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $0.0001 per share.

Indicate by check mark whether the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller Reporting Company | ☒ |

| | | Emerging Growth Company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act) Yes ☐ No ☒

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive- based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

The aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant as of December 31, 2023, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $133 million.

Number of shares of common stock outstanding as of December 31, 2023 was 1,372,656,029.

Documents Incorporated by Reference: None.

Table of Contents

PART I

In this Annual Report on Form 10-K, unless the context requires otherwise, the terms “we,” “our,” “us,” or “the Company” refer to Fuel Doctor Holdings, Inc., a Delaware corporation, and its wholly-owned subsidiary, Charging Robotics, Ltd.

References to “U.S. dollars” and “$” are to currency of the United States of America, and references to “NIS” are to New Israeli Shekels. Unless otherwise indicated, U.S. dollar translations of NIS amounts presented in this Annual Report on Form 10-K for the year ended on December 31, 2023, are translated using the rate of NIS 3.6270 to $1.00, based on the exchange rate reported by the Bank of Israel on that date.

On August 28, 2023, Fuel Doctor Holdings Inc. filed an amended and restated certificate of incorporation, or the Amended and Restated Certificate of Incorporation, to (i) change its name to Charging Robotics Inc., and (ii) effect a one-for-one hundred fifty reverse stock split, (the “Reverse Stock Split”) of its outstanding shares of common stock, par value $0.0001 per share.

The Company has submitted an Issuer Company-Related Action Notification Form to the Financial Industry Regulatory Authority, Inc. (“FINRA”) regarding the foregoing name change and Reverse Stock Split. FINRA’s approval of the name change and Reverse Stock Split is currently pending, and accordingly all information in this Annual Report on Form 10-K relating to shares or price per share does not reflect the 1-for-150 reverse stock split effected by us on August 28, 2023. The Company intends to file a subsequent Current Report on Form 8-K upon receipt of approval from FINRA announcing the effectiveness of the Name Change and Reverse Stock Split.

CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains “forward-looking statements.” In some cases, you can identify forward-looking statements by terminology such as “may”, “will”, “should”, “could”, “expects”, “plans”, “intends”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of such terms and other comparable terminology. These forward-looking statements include, without limitation, statements about our market opportunity, our strategies, competition, expected activities and expenditures as we pursue our business plan, and the adequacy of our available cash resources. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Actual results may differ materially from the predictions discussed in these forward-looking statements. The economic environment within which we operate could materially affect our actual results. Additional factors that could materially affect these forward-looking statements and/or predictions include, among other things: the Company’s need for and ability to obtain additional financing, security, political and economic instability in the Middle East that could harm our business, including due to the current war between Israel and Hamas and the demand for the Company’s products, and other factors over which we have little or no control; and other factors discussed in the Company’s filings with the Securities and Exchange Commission (“SEC”).

The foregoing sets forth some, but not all, of the factors that could affect our ability to achieve results described in any forward-looking statements. You should read this Annual Report on Form 10-K and the documents that we reference herein and have filed as exhibits to the Annual Report on Form 10-K, completely and with the understanding that our actual future results may be materially different from what we expect. You should assume that the information appearing in this Annual Report on Form 10-K is accurate as of the date hereof. Because the risk factors referred to in this Annual Report on Form 10-K, could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us or on our behalf, you should not place undue reliance on any forward-looking statements.

Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of the information presented in this Annual Report on Form 10-K, and particularly our forward-looking statements, by these cautionary statements.

ITEM 1. BUSINESS

About Charging Robotics

Charging Robotics was formed in February 2021, as an Israeli corporation, with the main goal of developing an innovative wireless electric vehicles (EV) charging technology. At the heart of the technology is a wireless power transfer module that uses resonance induction coils to transfer electricity wirelessly. This module can be used for various products such as robotic and stationary platforms. The robotic platform will include a component which is small enough to fit under the vehicle, and which will automatically position itself for maximum-efficiency charging, and upon charging completion will automatically return to its docking station or to charge the next vehicle.

In June 2023, the Company decided to focus its resources on supplying wireless charging solution for the Automated Parking System (APS) market. APSs are used to store vehicles automatically when a driver arrives to the parking facility, and retrieve them when such driver wishes to depart. The vehicles are stored in areas with no human access, which make charging an EV using the traditional cable-and-plug system impractical, since drivers cannot reach their vehicles in order to connect the plug. The Company’s innovative solution utilizes wireless electrical transfer modules via robotics to solve the charging needs of EVs in APSs. The Company’s solution will be used transfer electricity wirelessly from the APS’s building’s electrical grid to the vehicle (or alternatively, to a carrier plate on which the vehicle is located). This will enable EVs to charge in “no access” areas of APSs. Currently, the Company is engaged in a pilot project to implement its solution in an APS in Tel Aviv, Israel.

The EV Market

The EV market is growing globally, due to favorable government policies and support (e.g., subsidies and grants), growing sensitivity toward a cleaner environment and demand for zero-emission vehicles, and resulting heavy investments in R&D from vehicle manufacturers. EV market growth requires charging infrastructure to grow as well. EV chargers are used to provide charging to EVs with a battery and the electrical source that helps to charge the battery. Currently the most common and leading solution are charging cables. Under a scenario where EV will hit 30% market share by 2030, the International Energy Agency forecasts that as many as 30 million public chargers would be needed to serve regular passenger vehicles – a number 50 times more than today’s installation-based vehicles.

We aim to become world’s first wireless charging solution that is set on an autonomous robot, for seamless charging experience. Our growth strategy is to primarily focus on public parking lots. Later in our growth strategy we aim to address private mass markets. In addition to entering markets with our technology, we aim to expand our development, design, and manufacturing capabilities.

Industry Overview and Market Challenges

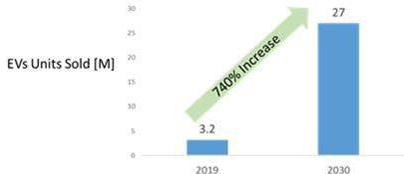

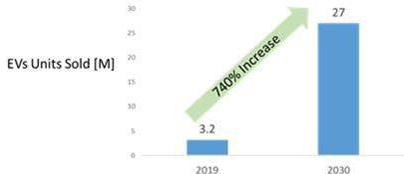

After entering commercial markets in the first half of the decade, EV sales have soared to 7.2M vehicles in 2019, surpassing 2018 – already a record year. Number of electric cars sold is expected to grow to 26.9 million by 2030.

At the end of 2019, there were only 7.3 million EV chargers installed worldwide, and according to some research entities, developing public charging infrastructures to meet the demand is a key challenge to the EV industry.

A lack of public charging stations is keeping people from giving up their gas-guzzling vehicles. A recent University of California-Davis survey of EV owners in California found that 20% switched back to a gas car because charging was too much of burden.

Some countries are also taking major actions to face the challenge of EV charging. By way of example, the U.S. Bipartisan Infrastructure Law passed in November 2021, and includes a budget of $7.2 billion, designated solely to EV charging infrastructure. It’s part of the White House’s broader goal to fight climate change and get more Americans into zero-emission vehicles.

Currently, the main charging solution that is adopted globally is cable charging. But this is about to change. Wireless charging technology for the automotive industry is expected to be the fastest growing segment of the wireless charging solutions entire market by year 2027.

The automotive wireless charging market is highly driven by an increase in sales of EVs and their demand for the safer, convenient, and faster wireless charging system compared to cables.

An increase in R&D activities by the leading automotive giants such as BMW, Nissan, and Chevrolet is expected to boost the growth of the market. The Mercedes Benz model S550e–the hybrid version of its Flagship S class sedan, adopted Qualcomm’s wireless charging technology. This suggests that the wireless charging market has huge potential in the EV & consumer electronics sector.

Our Solution

Our current product which we are pilot testing with an APS supplier in Israel is a system that wirelessly charges EVs in APSs. Upon arrival at the APS, the driver parks the EV on a plate used by the APS to transport the EV to the final parking location. The EV remains on the plate until it is retrieved by the APS and the driver enters the EV departs. When a driver parks an EV on these chagrining plates, they connect a regular charging cable to a socket installed on the plate, at which point the plate moves through the APS via conveyors and elevators to the parking location. Our system is installed in two parts. The electricity receiving component is installed on the plate and consists of a receiving coil and supporting electronics and a socket where the driver connects a cable to the charging socket of the EV. The system’s transmitting component is installed in the APS facility and consists of a transmitting coil and the supporting electronics. As the driver parks the EV and connects the cable from the plate to the EV, he initiates that charging using our mobile application. Once initiated, the system goes into standby mode. Upon the plate arriving at its final parking location, charging of the EV begins. When the plate and EV are in the final parking position, the transmitting coil and the receiving coil are in proximity and by way of electromagnetic induction, electricity passes from the stationary part (transmitting) of the system to the moving (receiving) part of the system. This enables the charging of EVs in places where drivers can not enter and manually connect a plug.

Although we have decided to currently focus on the solution for APSs, longer term future products will include the robotic solutions on which the Company was founded. We have succeeded in developing a tethered robotic solution. This robot was intended to charge an EV of a disabled driver and offer an automatic method for wireless charging of EVs. This solution will offer a big benefit for disabled drivers who have difficulty using a regular plug-and-cable-based charger. For these drivers, it is merely impossible to exit the EV, go to the charger, take the cable and connect the plug to the EV. Using our solution, charging will be performed automatically using the tethered robot. As the driver parks the EV, that robot will recognize the EV and will automatically navigate under the EV and charge it wirelessly. For this we have developed a patent-pending technology to navigate to the EV using data obtained by lidar (laser-based) sensors viewing only the EV’s wheels.

The following is a depiction of the robotic system for wireless charging of EV of disabled drivers:

The tethered robotic platform designed for wireless charging EV of disabled drivers. Transmitting coil seen above the robot. Lidar sensors for navigation are seen in front of the robot. Tether cable for supplying electricity and communication is seen behind the robot.

While we have nearly completed the development of this system, we have decided to shift our attention and entirely focus on the solution for wireless charging to EV in APSs, and subsequently return to completion of the development of this robotic-based solution once market conditions become more favorable. We expect this solution will consist of a robotic wireless charging system platform to carry the Wireless Power Transfer (WPT) from charging station or charging truck, to a driver’s EV that needs electric charging. State of the art, autonomous WPT technology will charge the EV quickly and autonomously.

We expect the robotic solution’s signature characteristics will include:

| ● | Fully autonomous and wireless: A robotic platform that is fully autonomous and wireless or plugged into a 230V/110V socket and travel freely. It can return to a charging station and charge itself. GPS-based location transmitter and communication via cellular network. AI-based system for robot navigation. Bluetooth communication with the EV or a receiver on a EV. |

| | | |

| ● | Seamless charging: The robot travels under the EV and charges it without driver or operator assistance. EV can leave the parking space while the robot is still under the EV. |

| | | |

| ● | Motherships: Motherships act as a smart grid element. |

| | | |

| ● | Efficient Charging: The charging coils are dynamically aligned by the robot to maximize the charging rate and efficiency. Robot can identify the type and model of the EV to be charged. System can act as an energy storage for smart grid. Leverage high low electricity prices and grid load balancing. |

We expect the robotic solution to function as follows:

| ● | Step I: Driver submits charging request to current location via our app. |

| | | |

| ● | Step II: Robot approaches EV. AI identifies EV type for charging method and driver for billing purposes. |

| | | |

| ● | Step III: Robot moves to optimal charging position and charging begins. |

| | | |

| ● | Step IV: When battery is fully charged, or as otherwise instructed by the driver, the robot returns to home dock for self-charging. Driver is billed for electricity transferred. |

Competition

Wireless charging solutions that are currently being developed are usually in the form of a pad or surface. Companies developing such technology include Robert Bosch GmbH (Germany), Continental AG (Germany), WiTricity Corporation (U.S.), ZTE Corporation (China), and HELLA KGaA Hueck & Co. (Germany), Qualcomm Technologies Inc./WiTricity Corporation, to name a few.

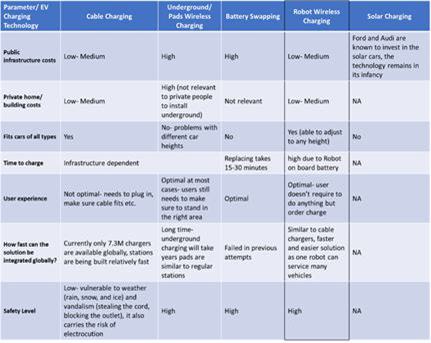

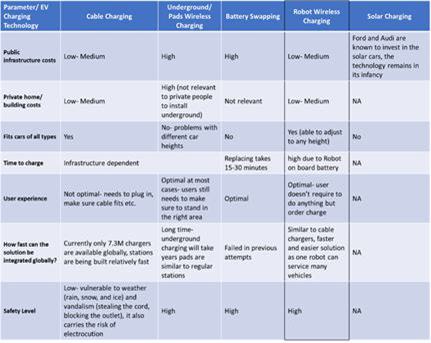

Below is a competitive analysis of our solution in comparison to other EV charging technologies, either existing or currently in development. Analysis is based on the Company’s best knowledge and understating.

Strategy and Business Model

Our goal is to become a global leader in EV wireless charging by providing efficient, effortless, affordable, and scalable solutions. We intend to achieve our goal by implementing the following strategies:

B2B channel as a market penetration. Our go-to-market strategy is based on offering our solutions on a B2B basis. We intend to market our solution to owners and/or operators of public parking spaces of many varieties, such as shopping malls, office buildings, entertainment centers, hospitals, sports centers etc.

Variety of business models. The Company will sell three different products, each utilizing different business models:

| 1. | Stationary EV Wireless Charging System. These systems will be used to charge vehicles in APSs. These systems will be sold to the end-user as capital equipment with payment at the installation of the system and recurring revenues for services after the warranty period has concluded. |

| | | |

| 2. | Software as a Service (SaaS). The user interface that is used to operate our system is developed in cooperation with Make My Day (a company specializing in app development for EV fleet management). This user interface is used by the driver to get recommendations for a driving route that optimizes EV electricity consumption, and also has functions which assist the driver in utilizing our system upon arrival to an APS. Based on the benefits that this solution provides drivers, we intend to monetize it to generate another revenue stream by way of subscription fees and/or advertisements once we’ve sufficiently scaled to reach a wider driver audience. |

| | | |

| 3. | Robotics System. Upon completion of development of the robotics system, we intend to introduce this new business model. This business model will be based on installing the robotics system in APSs at our own expense, and subsequently charging the end user for the electricity purchased to charge the EVs. We expect this will also provide a recurring revenue stream. |

We intend to offer these different types of business models to increase our technology adoption. Such business models are selling robots to end users, operating the robots and generating revenues from selling electricity, renting robots to end users and charging a subscription fee for the app used to optimize EV battery usage.

Addressing niche markets that requires alternative to cable charging. Since the foundation of our Company, we came across other potential niche EV charging markets that are in search for alternatives to traditional cable-based charging. As mentioned above, a prime example where our solution could make a significant difference for users is with respect to charging stations for handicap people. Our robotic technology could potentially be a unique and optimal solutions for EV handicap people who struggle with cable charging for their EVs.

Cooperation with EV charging infrastructure companies and EV manufacturers. Part of our strategy is to establish cooperation or joint ventures with EV charging infrastructure companies and EV manufacturers. We believe that, with such partnerships, we could work on additional robotic-based solutions, enhance relevant robot or charging capabilities and create faster go-to-market channels.

Building a brand. We believe the Company can become a global known brand for robotic charging solutions. We intend to make significant efforts in growing our brand recognition and building a global market footprint and market position.

Government Regulation

We are subject to the same regulations as regular charging stations. Since governments are globally playing a major role in the growth of the EV Supply Equipment market, as they mandate policies and set targets related to the adoption of EVs and charging infrastructure, there are markets where more regulation has the potential to positively impact our growth and success. We intend to focus on these markets and countries where we believe regulation could boost adoption of our solution and our sales.

Intellectual Property

We currently own, either jointly or solely, several intellectual property (IP) assets, at various stages, pursuant to the following table:

| Patent Title or Published Patent Application Title | | Ownership | | Jurisdiction | | Estimated

Expiration | |

| System and method for Wireless Vehicle Battery Charging | | Owned | | US | | 2041 | |

| Circuit and method for controlling a high-frequency resonant power conversion system having components with fluctuating parameters | | Exclusive license | | US | | 2039 | |

| Generalized single-side compensation networks for inductive wireless power transfer systems | | Exclusive license | | PCT | | 2043 | |

| Wireless Power Transfer Links Attaining Zero-Phase Angle and Arbitrary Load-Independent Voltage Gain | | Exclusive license | | PCT | | 2043 | |

| System and method for alignment of wireless power transfer systems | | Jointly owned with BGU | | PCT | | 2042 | |

| ** | Designates that IP which is either exclusively licensed from Ben Gurion University in Be’er Sheva, Israel (BGU), or jointly owned with BGU. |

We also rely on trade secrets, know-how, and continuous innovation to develop and maintain our competitive position. We cannot be certain that patents will be granted with respect to any patent applications filed by us in the future, nor can we be assured that any patents granted to us in the future will be commercially useful in protecting our technology.

Our success depends, in part, on an IP portfolio that supports future revenue streams and erects barriers to our competitors.

Despite these measures, any of our IP and proprietary rights could be challenged, invalidated, circumvented, infringed or misappropriated. IP and proprietary rights may not be sufficient to permit us to take advantage of current market trends or otherwise to provide competitive one.

Employees

Currently, we have three senior management positions (CEO and CFO), who we engage in part-time capacities via consulting agreements. In addition, we have four engineers working for us as part-time consultants. All of our engineers and management is located in Israel. At present we do not employ any of our personnel, and none are represented by labor unions or covered by collective bargaining agreements. We believe that we maintain good working relationships with our management and our engineers. As a result of Charging Robotics being located in Israel, to the extent that we enter into employment agreements, we will be subject to certain Israeli labor laws, regulations and national labor court precedent rulings, as well as certain provisions of collective bargaining agreements applicable to us by virtue of extension orders issued in accordance with relevant labor laws by the Israeli Ministry of Economy and which apply such agreement provisions to our employees even though they are not part of a union that has signed a collective bargaining agreement.

All of our consulting agreements include undertakings by our personnel with respect to confidentiality, non-competition and assignment to us of IP rights developed in the course of their engagement. Our consulting agreement with our CEO includes provisions with respect to assignment to us of intellectual property rights developed in the course of employment and confidentiality. The enforceability of such provisions is subject to Israeli law.

Properties

Our corporate headquarters are located at 20 Raul Wallenberg Street, Tel Aviv, Israel 6971916, under a lease held by our shareholders, free of rent to the company. In addition, we operate a small laboratory for research and development purposes at 7 Hasahlavim Street, Kadima, Israel 6095216, which property is owned by our CEO, and which is also operated free of rent to the company.

Legal Proceedings

We are not aware of any pending or threatened legal proceedings involving our Company or its assets.

Company Information

Our principal executive offices are located at 20 Raul Wallenberg Street, Tel Aviv, Israel 6971916, and our telephone number is (678) 558-5564. Our website address is www.chargingrobotics.com. Any information contained on, or that can be accessed through, our website is not incorporated by reference into, nor is it in any way a part of, this Annual Report on Form 10-K.

We use our website (www.chargingrobotics.com) as a channel of distribution of Company information. The information we post through this channel may be deemed material. Accordingly, investors should monitor our website, in addition to following our press releases, SEC filings and public conference calls and webcasts. The contents of our website are not, however, a part of this Annual Report on Form 10-K.

Corporate History

Fuel Doctor Holdings, Inc. (the “Company”) was incorporated in the State of Delaware on March 25, 2008 as Silver Hill Management Services, Inc. On August 24, 2011, the Company amended its Certificate of Incorporation and changed its name to Fuel Doctor Holdings, Inc.

On March 28, 2023, the Company entered into a Securities Exchange Agreement (the “Acquisition Agreement”) with the stockholders of Charging Robotics Ltd. (“Charging Robotics”). Pursuant to the Acquisition Agreement, at the closing, which occurred on April 7, 2023 (the “Closing”), the Company acquired 100% of the issued and outstanding stock of Charging Robotics (the “Acquisition”), making Charging Robotics a wholly owned subsidiary of the Company, in exchange for the issuance of a total of 921,750,000 newly-issued shares of the Company’s common stock to the former shareholders of Charging Robotics.

Charging Robotics was formed in February 2021, as an Israeli corporation, with the main goal of developing an innovative wireless electric vehicles (EV) charging technology. At the heart of the technology is a wireless power transfer module that uses resonance coils to transfer electricity wirelessly. This module can be used for various products such as robotic and stationary platforms. The robotic platform will include a component which is small enough to fit under the vehicle, and which will automatically position itself for maximum-efficiency charging, and upon charging completion will automatically return to its docking station. Charging Robotics also developed a Wireless EV Charging System for automatic parking lots based on our wireless electricity transfer module.

On April 6, 2023, the Company issued a total of 136,500,000 newly issued shares of the Company’s common stock in respect of a private placement for total proceeds of $500.

On August 28, 2023, the Company filed an amended and restated certificate of incorporation (the “Amended and Restated Certificate of Incorporation”), to (i) change its name to Charging Robotics Inc. (the “Name Change”); and (ii) effect a one-for-one hundred and fifty reverse stock split (the “Reverse Stock Split”) of its outstanding shares of Common Stock.

The Company submitted an Issuer Company-Related Action Notification Form to the Financial Industry Regulatory Authority, Inc. (“FINRA”) regarding the Name Change and Reverse Stock Split within FINRA’s required time frame, on August 30, 2023. FINRA’s approval of the Name Change and Reverse Stock Split is currently still pending.

As a result of the Reverse Stock Split, shares of the Company’s common stock will be assigned a new CUSIP number which will be announced prior to the effective date of the Reverse Stock Split. The Reverse Stock Split does not affect the total number of shares of capital stock, including the common stock, that the Company is authorized to issue, or the par value of the Company’s common stock, which shall remain as set forth pursuant to the Amended and Restated Certificate of Incorporation. No fractional shares of common stock will be issued in connection with the Reverse Stock Split, all of which were rounded up to the nearest whole number. The Company’s outstanding warrants and equity awards will be adjusted as a result of the Reverse Stock Split, as required by the terms of such warrants and equity awards.

On November 22, 2023, the Company announced that Charging Robotics received approval for funding from the Israel Innovation Authority (“IIA”) for a pilot project that includes installing and demonstrating its solution for wireless charging of electric vehicles (EVs) in automated parking systems. The total approved budget for this project is approximately $445, of which the IIA will finance 50%. The Company is now engaged in a pilot project to implement the solution in an APS in Tel Aviv.

ITEM 1A. RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the following risk factors and the other information in this Annual Report on Form 10-K before investing in our common stock. Our business and results of operations could be seriously harmed by any of the following risks. The risks set out below are not the only risks we face. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business, financial condition and/or operating results. If any of the following events occur, our business, financial condition and results of operations could be materially adversely affected. In such case, the value and trading price of our common stock could decline, and you may lose all or part of your investment.

Summary Risk Factors

The principal factors and uncertainties that make investing in our Common Stock risky, include, among others:

Risks Related to Our Financial Condition and Capital Requirements

We are a development-stage company and have a limited operating history on which to assess the prospects for our business, have incurred significant losses since the date of our inception, and anticipate that we will continue to incur significant losses until we are able to successfully commercialize our products.

We are a development-stage company with a limited operating history. We have incurred net losses since our inception, including net losses of approximately $775,000 for the year ended December 31, 2023. As of December 31, 2023, we had accumulated losses of approximately $1,942,000.

We have devoted most of our financial resources to developing our products. The amount of our future net losses will depend, in part, on completing the development of our products, the rate of our future expenditures and our ability to obtain funding through the issuance of our securities, strategic collaborations or grants. We expect to continue to incur significant losses until we are able to successfully commercialize our products. We anticipate that our expenses will increase substantially if and as we:

| ● | continue the development of our products; |

| ● | establish a sales, marketing, distribution and technical support infrastructure to commercialize our products; |

| ● | seek to identify, assess, acquire, license, and/or develop other products and subsequent generations of our current products; |

| ● | seek to maintain, protect, and expand our intellectual property portfolio; |

| ● | seek to attract and retain skilled personnel; and |

| ● | create additional infrastructure to support our operations as a public company and our product development and planned future commercialization efforts. |

Our financial statements contain an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern, which could prevent us from obtaining new financing on reasonable terms or at all.

Our audited financial statements for the period ended December 31, 2023 contain an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern. This going concern opinion could materially limit our ability to raise additional funds through the issuance of equity or debt securities or otherwise. Future financial statements may include an explanatory paragraph with respect to our ability to continue as a going concern. Until we can generate significant recurring revenues, we expect to satisfy our future cash needs through debt or equity financing. We cannot be certain that additional funding will be available to us on acceptable terms, if at all. If funds are not available, we may be required to delay, reduce the scope of, or eliminate research or development plans for, or commercialization efforts with respect to our products. This may raise substantial doubts about our ability to continue as a going concern.

We have not generated any significant revenue from the sale of our current products and may never be profitable.

While we have commenced commercialization efforts, we have not generated any significant revenue since our inception. Our ability to generate revenue and achieve profitability depends on our ability to successfully complete the development of, and to commercialize, our products. Our ability to generate future revenue from product sales depends heavily on our success in many areas, including but not limited to:

| ● | completing development of our products; |

| ● | establishing and maintaining supply and manufacturing relationships with third parties that can provide adequate (in amount and quality) products to support market demand for our products; |

| ● | launching and commercializing products, either directly or with a collaborator or distributor; |

| ● | addressing any competing technological and market developments; |

| ● | identifying, assessing, acquiring and/or developing new products; |

| ● | negotiating favorable terms in any collaboration, licensing or other arrangements into which we may enter; |

| ● | maintaining, protecting and expanding our portfolio of intellectual property rights, including patents, trademarks, trade secrets and know-how; and |

| ● | attracting, hiring and retaining qualified personnel. |

We expect that we will need to raise substantial additional capital before we can expect to become profitable from sales of our products. This additional capital may not be available on acceptable terms, or at all. Failure to obtain this necessary capital when needed may force us to delay, limit or terminate our product development efforts or other operations.

We expect that we will require substantial additional capital to commercialize our products. In addition, our operating plans may change as a result of many factors that may currently be unknown to us, and we may need to seek additional funds sooner than planned. Our future capital requirements will depend on many factors, including but not limited to:

| ● | the scope, rate of progress, results and cost of product development, and other related activities; |

| ● | the cost of establishing commercial supplies of our products; |

| ● | the cost and timing of establishing sales, marketing, and distribution capabilities; and |

| ● | the terms and timing of any collaborative, licensing, and other arrangements that we may establish. |

Any additional fundraising efforts may divert our management from their day-to-day activities, which may adversely affect our ability to develop and commercialize our products. In addition, we cannot guarantee that future financing will be available in sufficient amounts or on terms acceptable to us, if at all. Moreover, the terms of any financing may adversely affect the holdings or the rights of our shareholders and the issuance of additional securities, whether equity or debt, by us, or the possibility of such issuance, may cause the market price of our common stock to decline. The incurrence of indebtedness could result in increased fixed payment obligations, and we may be required to agree to certain restrictive covenants, such as limitations on our ability to incur additional debt, limitations on our ability to acquire, sell or license intellectual property rights and other operating restrictions that could adversely impact our ability to conduct our business. We could also be required to seek funds through arrangements with collaborative partners or otherwise at an earlier stage than otherwise would be desirable, and we may be required to relinquish rights to some of our technologies or products or otherwise agree to terms unfavorable to us, any of which may have a material adverse effect on our business, operating results and prospects. Even if we believe that we have sufficient funds for our current or future operating plans, we may seek additional capital if market conditions are favorable or if we have specific strategic considerations.

If we are unable to obtain funding on a timely basis, we may be required to significantly curtail, delay or discontinue one or more of our research or development programs or the commercialization of our products or be unable to expand our operations or otherwise capitalize on our business opportunities, as desired, which could materially affect our business, financial condition and results of operations.

Our operating results and financial condition may fluctuate.

Even if we are successful in marketing its products to the market, our operating results and financial condition may fluctuate from quarter to quarter and year to year and are likely to continue to vary due to several factors, many of which will not be within our control. If our operating results do not meet the guidance that we provide to the marketplace or the expectations of securities analysts or investors, the market price of the Common Stock will likely decline. Fluctuations in our operating results and financial condition may be due to several factors, including those listed below:

| ● | the degree of market acceptance of our products and services; |

| ● | the mix of products and services that we sell during any period; |

| ● | changes in the amount that we spend to develop, acquire or license new products, technologies or businesses; |

| ● | changes in the amounts that we spend to promote our products and services; |

| ● | changes in the cost of satisfying our warranty obligations and servicing our installed base of systems; |

| ● | delays between our expenditures to develop and market new or enhanced systems and consumables and the generation of sales from those products; |

| ● | development of new competitive products and services by others; |

| ● | difficulty in predicting sales patterns and reorder rates that may result from a multi-tier distribution strategy associated with new product categories; |

| ● | litigation or threats of litigation, including intellectual property claims by third parties; |

| ● | changes in accounting rules and tax laws in relevant jurisdictions; |

| ● | changes in regulations and standards; |

| ● | the geographic distribution of our sales; |

| ● | our responses to price competition; |

| ● | general economic and industry conditions that affect end-user demand and end-user levels of product design and manufacturing; |

| ● | changes in interest rates that affect returns on our cash balances and short-term investments; |

| ● | changes in dollar-shekel exchange rates that affect the value of our net assets, future revenues and expenditures from and/or relating to our activities carried out in those currencies; and |

| ● | the level of research and development activities by our company. |

Due to all of the foregoing factors, and the other risks discussed herein, you should not rely on quarter-to-quarter comparisons of our operating results as an indicator of our future performance.

Risks Related to Our Business and Industry

We operate in an evolving market which makes it difficult to evaluate our business and future prospects.

Our products are designed to compete in a rapidly evolving market. The market for alternative automobile charging technologies is in its early stages. Accordingly, our business and future prospects may be difficult to evaluate. We cannot accurately predict the extent to which demand for its products and services will develop, if at all. The challenges, risks and uncertainties frequently encountered by companies in rapidly evolving markets could impact our ability to do the following:

| ● | generate sufficient revenue to reach and maintain profitability; |

| ● | acquire and maintain critical market share; |

| ● | achieve or manage growth in operations; |

| ● | develop and renew existing contracts; |

| ● | attract and retain additional engineers and other highly-qualified personnel; |

| ● | successfully develop and commercially market new products; |

| ● | adapt to new or changing policies and spending priorities of governments and government agencies; and |

| ● | access additional capital when required and on reasonable terms. |

If we fail to successfully address these and other challenges, risks and uncertainties, its business, results of operations and financial condition would be materially harmed.

We face uncertainty and adverse changes in the economy.

Adverse changes in the economy could negatively impact our business. Future economic distress may result in a decrease in demand for our products and/or a decrease in the demand for electric vehicles, which could have a material adverse impact on the Company’s operating results and financial condition. Uncertainty and adverse changes in the economy could also increase costs associated with developing products, increase the cost and decrease the availability of sources of financing, and increase our exposure to material losses from bad debts, any of which could have a material adverse impact on our financial condition and operating results.

We depend on key personnel to operate our business. An inability to retain, attract, and integrate qualified personnel would harm our ability to develop and successfully grow our business.

Our success and growth strategy depend on our ability to attract and retain key management and operating personnel, including skilled developers, marketing personnel, project managers, product managers and content editors. Our future success depends on our continuing ability to attract, develop, motivate and retain highly qualified and skilled employees. Qualified individuals are in high demand, and we may incur significant costs to attract and retain them. Experienced developers and marketing personnel, who are critical to the success of our business, are also in particularly high demand. Competition for their talents is intense, making it difficult to retain such qualified individuals.

If we fail to manage rapid growth effectively, our brand, business, financial condition and results of operations could be adversely affected.

Rapid growth may impose significant responsibilities on our management, including the need to identify, recruit and integrate additional employees with relevant expertise, expand the scope of our current technological platform and invest in improved controls over technology, financial reporting and information disclosure. If we fail to manage the growth of our business and operations effectively, the quality of our service and the efficiency of our operations could suffer, which could adversely affect our business, financial condition, and results of operations.

In addition, our rapid growth may make it difficult to evaluate our future performance. Our ability to forecast our future results of operations is subject to a number of uncertainties, including our ability to model future growth. If we fail to achieve the necessary level of efficiency in our company as it grows, or if we are not able to accurately forecast future growth, our business would be negatively impacted.

If critical components or raw materials used to manufacture our products become scarce or unavailable, then we may incur delays in manufacturing and delivery of our products, which could damage our business.

We obtain hardware components, various subsystems and systems from a limited group of suppliers. We do not have long-term agreements with any of these suppliers that obligate it to continue to sell us components, subsystems, systems or products. Our reliance on these suppliers involves significant risks and uncertainties, including whether its suppliers will provide an adequate supply of required components, subsystems or systems of sufficient quality, will increase prices for the components, subsystems or systems and will perform their obligations on a timely basis.

In addition, certain raw materials and components used in the manufacture of our products are periodically subject to supply shortages, and its business is subject to the risk of price increases and periodic delays in delivery. If we are unable to obtain components from third-party suppliers in the quantities and of the quality that it requires, on a timely basis and at acceptable prices, then it may not be able to deliver its products on a timely or cost-effective basis to its customers, which could cause customers to terminate their contracts with the Company, increase our costs and seriously harm our business, results of operations and financial condition. Moreover, if any of our suppliers become financially unstable, then it may have to find new suppliers. It may take several months to locate alternative suppliers, if required, or to redesign our products to accommodate components from different suppliers. We may experience significant delays in manufacturing and shipping its products to customers and incur additional development, manufacturing and other costs to establish alternative sources of supply if we loose any of these sources or is required to redesign its products. We cannot predict if it will be able to obtain replacement components within the time frames that it requires at an affordable cost, if at all.

Our products may be subject to recall or returns.

Products are sometimes subject to the recall or return of their products for a variety of reasons, including product defects, safety concerns, packaging issues and inadequate or inaccurate labeling disclosure. If any of the Company’s equipment were to be recalled due to an alleged product defect, safety concern or for any other reason, we could be required to incur unexpected expenses of the recall and any legal proceedings that might arise in connection with the recall. We may lose a significant amount of sales and may not be able to replace those sales at an acceptable margin or at all. In addition, a product recall may require significant management time and attention. Additionally, product recalls may lead to increased scrutiny of our operations by regulatory agencies, requiring further management time and attention and potential legal fees, costs and other expenses.

If we release defective products or services, our operating results could suffer.

Products and services designed and released by us involve complex software programs and physical products, which are difficult to develop and distribute. While we have quality controls in place to detect and prevent defects in its products and services before they are released, these quality controls are subject to human error, overriding, and reasonable resource constraints. Therefore, these quality controls and preventative measures may not be effective in detecting and preventing defects in our products and services before they have been released into the marketplace. In such an event, we could be required, or decide voluntarily, to suspend the availability of the product or services, which could significantly harm its business and operating results.

Our products and services are complex and could have unknown defects or errors, which may give rise to legal claims against us, diminish our brand or divert our resources from other purposes.

Despite testing, our products have contained defects and errors and may in the future contain defects, errors or performance problems when first introduced, when new versions or enhancements are released or even after these products have been used by our customers for a period of time. These problems could result in expensive and time-consuming design modifications or warranty charges, delays in the introduction of new products or enhancements, significant increases in our service and maintenance costs, exposure to liability for damages, damaged customer relationships and harm to our reputation, any of which could materially harm our results of operations and ability to achieve market acceptance. In addition, increased development and warranty costs could be substantial and could significantly reduce our operating margins.

The markets in which we plan to compete are characterized by rapid technological change, which requires us to develop new products and product enhancements, and could render our existing products obsolete.

Continuing technological changes in the market for our products could make its products less competitive or obsolete, either generally or for particular applications. Our future success will depend upon its ability to develop and introduce a variety of new capabilities and enhancements to its planned product and service offerings, as well as introduce a variety of new product offerings, to address the changing needs of the markets in which it offers products. Delays in introducing new products and enhancements, the failure to choose correctly among technical alternatives or the failure to offer innovative products or enhancements at competitive prices may cause existing and potential customers to purchase our competitors’ products.

If we are unable to devote adequate resources to develop new products or cannot otherwise successfully develop new products or enhancements that meet customer requirements on a timely basis, its products could lose market share, its revenue and profits could decline, and we could experience operating losses.

If we fail to successfully promote our products and brand, this could have a material adverse effect on our business, prospects, financial condition and results of operations.

We believe that brand recognition is an important factor to its success. If we fail to promote our brands successfully, or if the expenses of doing so are disproportionate to any increased net sales it achieves, it would have a material adverse effect on our business, prospects, financial condition and results of operations. This will depend largely on our ability to maintain trust, be a technology leader, and continue to provide high-quality and secure technologies, products and services. Any negative publicity about us or its industry, the quality and reliability of our technologies, products and services, our risk management processes, changes to our technologies, products and services, its ability to effectively manage and resolve customer complaints, its privacy and security practices, litigation, regulatory activity, and the experience of buyers with our products or services, could adversely affect our reputation and the confidence in and use of our technologies, products and services. Harm to our brand can arise from many sources, including failure by us or our partners to satisfy expectations of service and quality; inadequate protection of sensitive information; compliance failures and claims; litigation and other claims; employee misconduct; and misconduct by our partners, service providers, or other counterparties. If we do not successfully maintain a strong and trusted brand, our business could be materially and adversely affected.

Our planned international operations will expose us to additional market and operational risks, and failure to manage these risks may adversely affect our business and operating results.

We expect to derive a substantial percentage of our sales from international markets. Accordingly, we will face significant operational risks from doing business internationally, including:

| ● | fluctuations in foreign currency exchange rates; |

| ● | potentially longer sales and payment cycles; |

| ● | potentially greater difficulties in collecting accounts receivable; |

| ● | potentially adverse tax consequences; |

| ● | reduced protection of intellectual property rights in certain countries, particularly in Asia and South America; |

| ● | difficulties in staffing and managing foreign operations; |

| ● | laws and business practices favoring local competition; |

| ● | costs and difficulties of customizing products for foreign countries; |

| ● | compliance with a wide variety of complex foreign laws, treaties and regulations; |

| ● | an outbreak of a contagious disease, such as the resurgence of COVID-19, which may cause us, third party vendors and manufacturers and/or customers to temporarily suspend our or their respective operations in the affected city or country; |

| ● | tariffs, trade barriers and other regulatory or contractual limitations on our ability to sell or develop our products in certain foreign markets; and |

| ● | being subject to the laws, regulations and the court systems of many jurisdictions. |

Significant disruptions of our information technology systems or breaches of our data security could adversely affect our business.

A significant invasion, interruption, destruction or breakdown of our information technology systems and/or infrastructure by persons with authorized or unauthorized access could negatively impact our business and operations. We could also experience business interruption, information theft and/or reputational damage from cyber-attacks, which may compromise our systems and lead to data leakage either internally or at our third-party providers. Our systems are expected to be the target of malware and other cyber-attacks. Although we have invested in measures to reduce these risks, we cannot assure you that these measures will be successful in preventing compromise and/or disruption of our information technology systems and related data.

We rely on business partners, and they may be given access to sensitive and proprietary information in order to provide services and support to our customers.

We rely on various business partners, including third-party service providers, vendors, licensing partners, development partners and licensees, among others, in some areas of our business. In some cases, these third parties are given access to sensitive and proprietary information in order to provide us services and support. These third parties may misappropriate our information and engage in unauthorized use of it. The failure of these third parties to provide adequate services and technologies, or the failure of the third parties to adequately maintain or update their services and technologies, could result in a disruption to our business operations. Further, disruptions in the financial markets and economic downturns may adversely affect our business partners and they may not be able to continue honoring their obligations to us. Alternative arrangements and services may not be available to us on commercially reasonable terms or we may experience business interruptions upon a transition to an alternative partner or vendor. If we lose one or more significant business partners, our business could be harmed.

We may be subject to electronic communication security risks.

A significant potential vulnerability of electronic communications is the security of transmission of confidential information over public networks. Anyone who is able to circumvent our security measures could misappropriate proprietary information or cause interruptions in its operations. We may be required to expend capital and other resources to protect against such security breaches or to alleviate problems caused by such breaches.

Risks Related to Our Intellectual Property

If we are unable to obtain and maintain effective intellectual property rights for our products, we may not be able to compete effectively in our markets.

Historically, we have relied on trade secret protection and confidentiality agreements to protect the intellectual property related to our technologies and products. Our success depends in large part on intellectual property protection in the United States and in other countries with respect to our proprietary technology and new products.

We may seek to protect our proprietary position by filing patent applications in Israel, the United States and in other countries, with respect to our novel technologies and products, which are important to our business. Patent prosecution is expensive and time consuming, and we may not be able to file and prosecute all necessary or desirable patent applications at a reasonable cost or in a timely manner. It is also possible that we will fail to identify patentable aspects of our research and development output before it is too late to obtain patent protection.

If we seek patent protection, we cannot offer any assurances about which, if any, patent applications will issue, the breadth of any such patent or whether any issued patents will be found invalid and unenforceable or will be threatened by third parties. Any successful opposition to these patents or any other patents owned by or licensed to us after patent issuance could deprive us of rights necessary for the successful commercialization of any new products that we may develop.

Further, there is no assurance that all potentially relevant prior art relating to our patent applications has been found, which can invalidate a patent or prevent a patent from issuing from a pending patent application. Even if patents do successfully issue, and even if such patents cover our products, third parties may challenge their validity, enforceability, or scope, which may result in such patents being narrowed, found unenforceable or invalidated. Furthermore, even if they are unchallenged, our patent applications and any future patents may not adequately protect our intellectual property, provide exclusivity for our new products, or prevent others from designing around our claims. Any of these outcomes could impair our ability to prevent competition from third parties, which may have an adverse impact on our business. If we cannot obtain and maintain effective patent rights for our products, we may not be able to compete effectively, and our business and results of operations would be harmed.

Further, international trade conflicts could have negative consequences on the demand for our products and services outside Israel. Other risks of doing business internationally include political and economic instability in the countries of our customers and suppliers, changes in diplomatic and trade relationships and increasing instances of terrorism worldwide. Some of these risks may be affected by Israel’s overall political situation.

Intellectual property rights of third parties could adversely affect our ability to commercialize our products, and we might be required to litigate or obtain licenses from third parties in order to develop or market our product candidates. Such litigation or licenses could be costly or not available on commercially reasonable terms.

It is inherently difficult to conclusively assess our freedom to operate without infringing on third party rights. Our competitive position may be adversely affected if existing patents or patents resulting from patent applications issued to third parties or other third-party intellectual property rights are held to cover our products or elements thereof, or our manufacturing or uses relevant to our development plans. In such cases, we may not be in a position to develop or commercialize products or our product candidates unless we successfully pursue litigation to nullify or invalidate the third-party intellectual property right concerned or enter into a license agreement with the intellectual property right holder, if available on commercially reasonable terms. There may also be pending patent applications that if they result in issued patents, could be alleged to be infringed by our new products. If such an infringement claim should be brought and be successful, we may be required to pay substantial damages, be forced to abandon our new products or seek a license from any patent holders. No assurances can be given that a license will be available on commercially reasonable terms, if at all.

It is also possible that we have failed to identify relevant third-party patents or applications. Patent applications in the United States and in most of the other countries are published approximately 18 months after the earliest filing for which priority is claimed, with such earliest filing date being commonly referred to as the priority date. Therefore, patent applications covering our new products or platform technology could have been filed by others without our knowledge. Additionally, pending patent applications which have been published can, subject to certain limitations, be later amended in a manner that could cover our platform technologies, our new products or the use of our new products. Third party intellectual property right holders may also actively bring infringement claims against us. We cannot guarantee that we will be able to successfully settle or otherwise resolve such infringement claims. If we are unable to successfully settle future claims on terms acceptable to us, we may be required to engage in or continue costly, unpredictable and time-consuming litigation and may be prevented from or experience substantial delays in pursuing the development of and/or marketing our new products. If we fail in any such dispute, in addition to being forced to pay damages, we may be temporarily or permanently prohibited from commercializing our new products that are held to be infringing, and/or we might be forced to redesign our new products to avoid infringing upon the third party’s intellectual property rights. Any of these events, even if we were ultimately to prevail, could require us to divert substantial financial and management resources that we would otherwise be able to devote to our business.

We may be involved in lawsuits to protect or enforce our intellectual property, which could be expensive, time consuming, and unsuccessful.

Competitors may infringe our intellectual property. If we were to initiate legal proceedings against a third party to enforce a patent covering one of our new products, the defendant could counterclaim that the patent covering our product candidate is invalid and/or unenforceable. In patent litigation in the United States, defendant counterclaims alleging invalidity and/or unenforceability are commonplace. Grounds for a validity challenge could be an alleged failure to meet any of several statutory requirements, including lack of novelty, obviousness, or non-enablement. Grounds for an unenforceability assertion could be an allegation that someone connected with prosecution of the patent withheld relevant information from the United States Patent and Trademark Office, or USPTO, or made a misleading statement, during prosecution. The validity of U.S. patents may also be challenged in post-grant proceedings before the USPTO. The outcome following legal assertions of invalidity and unenforceability is unpredictable.

Derivation proceedings initiated by third parties or brought by us may be necessary to determine the priority of inventions and/or their scope with respect to our patent or patent applications or those of our licensors. An unfavorable outcome could require us to cease using the related technology or to attempt to license rights to it from the prevailing party. Our business could be harmed if the prevailing party does not offer us a license on commercially reasonable terms. Our defense of litigation or interference proceedings may fail and, even if successful, may result in substantial costs and distract our management and other employees. In addition, the uncertainties associated with litigation could have a material adverse effect on our ability to raise the funds necessary to continue our research programs, license necessary technology from third parties, or enter into development partnerships that would help us bring our new products to market.

Furthermore, because of the substantial amount of discovery required in connection with intellectual property litigation, there is a risk that some of our confidential information could be compromised by disclosure during this type of litigation. There could also be public announcements of the results of hearings, motions, or other interim proceedings or developments. If securities analysts or investors perceive these results to be negative, it could have a material adverse effect on the price of our Common Stock.

We may be subject to claims challenging the inventorship of our intellectual property.

We may be subject to claims that former employees, collaborators or other third parties have an interest in, or right to compensation, with respect to our current patent and patent applications, future patents or other intellectual property as an inventor or co-inventor. For example, we may have inventorship disputes arise from conflicting obligations of consultants or others who are involved in developing our products. Litigation may be necessary to defend against these and other claims challenging inventorship or claiming the right to compensation. If we fail in defending any such claims, in addition to paying monetary damages, we may lose valuable intellectual property rights, such as exclusive ownership of, or right to use, valuable intellectual property. Such an outcome could have a material adverse effect on our business. Even if we are successful in defending against such claims, litigation could result in substantial costs and be a distraction to management and other employees.

We may not be able to protect our intellectual property rights throughout the world.

Filing, prosecuting, and defending patents on products, as well as monitoring their infringement in all countries throughout the world would be prohibitively expensive, and our intellectual property rights in some countries can be less extensive than those in the United States. In addition, the laws of some foreign countries do not protect intellectual property rights to the same extent as federal and state laws in the United States.

A substantial part of our commercial success will depend on its ability to maintain, establish and protect its intellectual property assets, maintain trade secret protection, register copyrights and trademarks, and operate without infringing the proprietary rights of third parties. There is a further risk that the claims of a patent application, when filed, may change in scope during examination by the patent offices. Further, if and where a patent is granted, there can be no guarantee that such patent will be valid or enforceable or that the patent will be granted in other jurisdictions.

Competitors may use our technologies in jurisdictions where we have not obtained patent protection to develop their own products and may also export otherwise infringing products to territories where we have patent protection, but enforcement is not as strong as that in the United States. These products may compete with our products. Future patents or other intellectual property rights may not be effective or sufficient to prevent them from competing.

Many companies have encountered significant problems in protecting and defending intellectual property rights in foreign jurisdictions. The legal systems of certain countries, particularly certain developing countries, do not favor the enforcement of patents, trade secrets, and other intellectual property protection, which could make it difficult for us to stop the marketing of competing products in violation of our proprietary rights generally. Proceedings to enforce our patent rights in foreign jurisdictions, whether or not successful, could result in substantial costs and divert our efforts and attention from other aspects of our business, could put our future patents at risk of being invalidated or interpreted narrowly and our patent applications at risk of not issuing and could provoke third parties to assert claims against us. We may not prevail in any lawsuits that we initiate, and the damages or other remedies awarded, if any, may not be commercially meaningful. Accordingly, our efforts to monitor and enforce our intellectual property rights around the world may be inadequate to obtain a significant commercial advantage from the intellectual property that we develop or license.

We may become subject to claims for remuneration or royalties for assigned service invention rights by our employees, which could result in litigation and adversely affect our business.

A significant portion of our intellectual property has been developed by our employees in the course of their employment for us. Under the Israeli Patent Law, 5727-1967, or the Patent Law, inventions conceived by an employee during the scope of his or her employment with a company are regarded as “service inventions,” which belong to the employer, absent an agreement between the employee and employer providing otherwise. The Patents Law also provides that if there is no agreement between an employer and an employee determining whether the employee is entitled to receive consideration for service inventions and on what terms, this will be determined by the Israeli Compensation and Royalties Committee, or the Committee, a body constituted under the Patents Law. Case law clarifies that the right to receive consideration for “service inventions” can be waived by the employee and that in certain circumstances, such waiver does not necessarily have to be explicit. The Committee will examine, on a case-by-case basis, the general contractual framework between the parties, using interpretation rules of the general Israeli contract laws. Further, the Committee has not yet determined one specific formula for calculating this remuneration, but rather uses the criteria specified in the Patents Law. Although we generally enter into agreements with our employees pursuant to which such individuals assign to us all rights to any inventions created during and as a result of their employment with us, we may face claims demanding remuneration in consideration for assigned inventions. As a consequence of such claims, we could be required to pay additional remuneration or royalties to our current and/or former employees, or be forced to litigate such monetary claims (which will not affect our proprietary rights), which could negatively affect our business.

Risks Related to Our Common Stock

We are an “emerging growth company” and our compliance with the reduced reporting and disclosure requirements applicable to “emerging growth companies” may make our Common Stock less attractive to investors.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act, or JOBS Act, and we have elected to take advantage of certain exemptions and relief from various reporting requirements that are applicable to other public companies that are not “emerging growth companies.” These provisions include, but are not limited to: being permitted to have only two years of audited financial statements and only two years of related management’s discussion and analysis of financial condition and plan of operation disclosures; being exempt from compliance with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act; being subject to reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements; and not being required to hold nonbinding advisory votes on executive compensation or on any golden parachute payments not previously approved.

In addition, while we are an “emerging growth company,” we will not be required to comply with any new financial accounting standard until such standard is generally applicable to private companies. As a result, our financial statements may not be comparable to companies that are not “emerging growth companies” or elect not to avail themselves of this provision.

We may remain an “emerging growth company” until the fiscal year-end following the fifth anniversary of the completion of our initial public offering, though we may cease to be an “emerging growth company” earlier under certain circumstances, including if (i) we have more than $1.07 billion in annual revenue in any fiscal year, (ii) we become a “large accelerated filer,” with at least $700 million of equity securities held by non-affiliates as of the end of the second quarter of that fiscal year, or (iii) we issue more than $1.0 billion of non-convertible debt over a three-year period.

The exact implications of the JOBS Act are still subject to interpretations and guidance by the SEC and other regulatory agencies, and we cannot assure you that we will be able to take advantage of all of the benefits of the JOBS Act. In addition, investors may find our common stock less attractive to the extent we rely on the exemptions and relief granted by the JOBS Act. If some investors find our Common Stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may decline or become more volatile.

If we fail to maintain effective internal controls over financial reporting, the price of our common stock may be adversely affected.

We are required to establish and maintain appropriate internal controls over financial reporting. Failure to establish those controls, or any failure of those controls once established, could adversely impact our public disclosures regarding our business, financial condition or results of operations. Any failure of these controls could also prevent us from maintaining accurate accounting records and discovering accounting errors and financial fraud.

In addition, management’s assessment of internal controls over financial reporting may identify weaknesses and conditions that need to be addressed or other matters that may raise concerns for investors. Any actual or perceived weaknesses and conditions that need to be addressed in our internal control over financial reporting, disclosure of management’s assessment of our internal controls over financial reporting may have an adverse impact on the price of our common stock.

Management has identified control deficiencies regarding inadequate accounting resources, the lack of segregation of duties and the need for a stronger internal control environment. Management of the Company believes that these material weaknesses are due to the small size of the Company’s accounting staff. The small size of the Company’s accounting outsourced staff may prevent adequate controls in the future due to the cost/benefit of such remediation.

Compliance with changing regulation of corporate governance and public disclosure will result in additional expenses.