UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | |

| ☐ | | Preliminary Proxy Statement |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | | Definitive Proxy Statement |

| ☐ | | Definitive Additional Materials |

| ☐ | | Soliciting Material Pursuant to §240.14a-12 |

| | | |

ZS PHARMA, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | | No fee required. |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies: |

| | | | | |

| | | (2) | | Aggregate number of securities to which transaction applies: |

| | | | | |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | | |

| | | (4) | | Proposed maximum aggregate value of transaction: |

| | | | | |

| | | (5) | | Total fee paid: |

| | | | | |

| ☐ | | Fee paid previously with preliminary materials: |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| | | (1) | | Amount previously paid: |

| | | | | |

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | | | |

| | | (3) | | Filing Party: |

| | | | | |

| | | (4) | | Date Filed: |

| | | | | |

ZS PHARMA, INC.

805 VETERANS BLVD., SUITE 300

REDWOOD CITY, CA 94063

(650) 458-4100

NOTICE OF 2015 ANNUAL MEETING OF

STOCKHOLDERS

To Be Held On June 18, 2015

To our Stockholders:

NOTICE IS HEREBY GIVEN that the annual meeting of stockholders of ZS Pharma, Inc. will be held on Thursday, June 18, 2014 at 1:30 p.m., Pacific Daylight Time, at the offices of Sofinnova Ventures, 3000 Sand Hill Road, Building 4, Suite 250, Menlo Park, California 94025. At the meeting, stockholders will consider and vote on the following matters:

| 1. | The election of Mr. Martin Babler and Ms. Kim Popovits as Class I directors, each to serve for a three-year term expiring at the 2018 annual meeting of stockholders; |

| 2. | The approval of our 2015 Employee Stock Purchase Plan; |

| 3. | The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2015; and |

| 4. | The transaction of any other business that may properly come before the annual meeting or any adjournment thereof. |

Stockholders of record at the close of business on April 30, 2015 are entitled to vote at the meeting.

We have elected to provide access to our proxy materials over the internet under the Securities and Exchange Commission’s “notice and access” rules. We believe that providing our proxy materials over the internet expedites stockholders’ receipt of proxy materials, lowers costs and reduces the environmental impact of our annual meeting. A Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) will be mailed to our stockholders on or about May 8, 2015.

We encourage all stockholders to attend the annual meeting in person. Whether or not you plan to attend the annual meeting in person, we encourage you to read this proxy statement and submit your proxy or voting instructions as soon as possible. Please review the instructions on each of your voting options described in the proxy statement.

Thank you for your ongoing support and continued interest in ZS Pharma, Inc.

By Order of the Board of Directors,

Robert Alexander

Chief Executive Officer

Redwood City, CA

May 8, 2015

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

STOCKHOLDER MEETING TO BE HELD ON JUNE 18, 2015

The proxy statement and annual report to stockholders are available at www.proxyvote.com.

In accordance with rules and regulations adopted by the U.S. Securities and Exchange Commission (the “SEC”), we are pleased to provide access to our proxy materials over the Internet to all of our stockholders rather than in paper form. Accordingly, a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) has been mailed to our stockholders on or about May 8, 2015. Stockholders will have the ability to access the proxy materials on the website listed above, or to request a printed set of the proxy materials be sent to them by following the instructions in the Notice of Internet Availability. By furnishing a Notice of Internet Availability and access to our proxy materials by the Internet, we are lowering the costs and reducing the environmental impact of our annual meeting.

The Notice of Internet Availability will also provide instructions on how you may request that we send future proxy materials to you electronically by electronic mail or in printed form by mail. If you choose to receive future proxy materials by electronic mail, you will receive an electronic mail next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by electronic mail or printed form by mail will remain in effect until you terminate it. We encourage you to choose to receive future proxy materials by electronic mail, which will allow us to provide you with the information you need in a more timely manner, will save us the cost of printing and mailing documents to you and will conserve natural resources. These documents are also available to any stockholder who wishes to receive a paper copy by calling 1-800-579-1639 or emailing sendmaterial@proxyvote.com.

Table of Contents

805 VETERANS BLVD., SUITE 300

REDWOOD CITY, CA 94063

(650) 458-4100

PROXY STATEMENT

2015 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 18, 2015

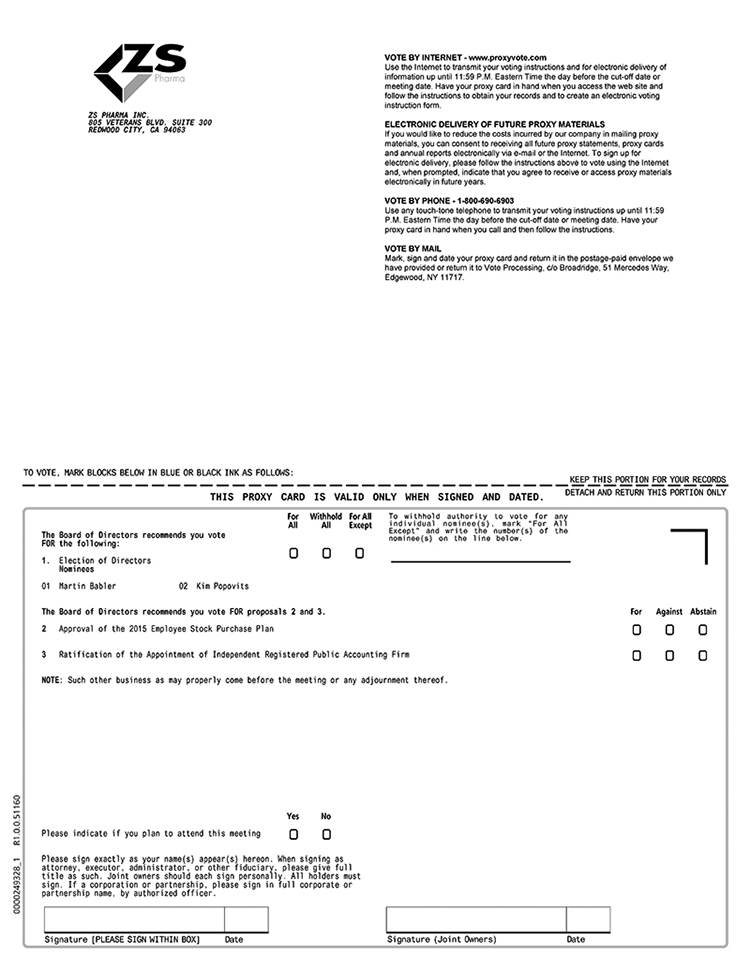

This proxy statement and the enclosed proxy card are being furnished in connection with the solicitation of proxies by the board of directors of ZS Pharma, Inc. for use at the annual meeting of stockholders of ZS Pharma, Inc. to be held on Thursday, June 18, 2015 at 1:30 p.m., Pacific Daylight Time, at the offices of Sofinnova Ventures, 3000 Sand Hill Road, Building 4, Suite 250, Menlo Park, California 94025 and at any adjournment thereof. Except where the context otherwise requires, references to “ZS Pharma,” “we,” “us,” “our” and similar terms refer to ZS Pharma, Inc.

This proxy statement summarizes information about the proposals to be considered at the annual meeting of stockholders and other information you may find useful in determining how to vote. The proxy card is the means by which you actually authorize another person to vote your shares in accordance with your instructions. We are making this proxy statement, the related proxy card and our annual report to stockholders for the fiscal year ended December 31, 2014 available to stockholders for the first time on or about May 8, 2015.

A copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2014, as filed with the Securities and Exchange Commission, or SEC, except for exhibits, will be furnished without charge to any stockholder upon written request to ZS Pharma, Inc., 805 Veterans Blvd., Suite 300, Redwood City, California 94063, Attention: Investor Relations and will also be available at www. proxyvote.com. This proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2014 are also available on the SEC’s website atwww.sec.gov.

By Order of the Board of Directors,

Robert Alexander

Chief Executive Officer

Redwood City, CA

May 8, 2015

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

| | | | | |

| Q. | Why did I receive these proxy materials? |

| | |

| A. | Our board of directors has made these materials available to you on the Internet in connection with the solicitation of proxies for use at our 2015 annual meeting of stockholders to be held at the offices of Sofinnova Ventures, 3000 Sand Hill Road, Building 4, Suite 250, Menlo Park, CA 94025 on Thursday, June 18, 2015 at 1:30 p.m., Pacific Daylight Time. As a holder of common stock, you are invited to attend the annual meeting and are requested to vote on the items of business described in this proxy statement. This proxy statement includes information that we are required to provide to you under SEC rules and that is designed to assist you in voting your shares. |

| | |

| Q. | Why did I receive a notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials? |

| | |

| A. | In accordance with the SEC rules, we may furnish proxy materials, including this proxy statement and our annual report, to our stockholders by providing access to such documents on the Internet instead of mailing printed copies. |

| | |

| Q. | What is the purpose of the annual meeting? |

| | |

| A. | At the annual meeting, stockholders will consider and vote on the following matters: |

| | |

| | 1. | The election of Mr. Martin Babler and Ms. Kim Popovits as Class I directors, each to serve for a three-year term expiring at the 2018 annual meeting of stockholders (proposal 1); |

| | | |

| | 2. | The approval of our 2015 Employee Stock Purchase Plan (proposal 2); |

| | | |

| | 3. | The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2015 (proposal 3); and |

| | | |

| | 4. | The transaction of any other business that may properly come before the meeting or any adjournment thereof. |

| | | |

| Q. | Who can vote at the annual meeting? |

| | |

| A. | To be entitled to vote, you must have been a stockholder of record at the close of business on April 30, 2015, the record date for our annual meeting. There were 24,992,801 shares of our common stock outstanding and entitled to vote at the annual meeting as of the record date. |

| | |

| Q. | How many votes do I have? |

| | |

| A. | Each share of our common stock that you own as of the record date will entitle you to one vote on each matter considered at the annual meeting. |

| | |

| Q. | How do I vote? |

| | |

| A. | If you are the “record holder” of your shares, meaning that your shares are registered in your name in the records of our transfer agent, American Stock Transfer & Trust Company, LLC, you may vote your shares at the meeting in person or by proxy as follows: |

| | |

| | (1) | Over the Internet: To vote over the Internet, please go to the following website: www.proxyvote.com, and follow the instructions at that website for submitting your proxy electronically. If you vote over the Internet, you do not need to complete and mail your proxy card or vote your proxy by telephone. |

| | | |

| | (2) | By Telephone: To vote by telephone, please call 1-800-579-1639 and follow the instructions provided on the proxy card. If you vote by telephone, you do not need to complete and mail your proxy card or vote your proxy over the Internet. |

| | | |

| | (3) | By Mail: To vote by mail, you must mark, sign and date the proxy card and then mail the proxy card in accordance with the instructions on the proxy card. If you vote by mail, you do not need to vote over the Internet or by telephone. If you return your proxy card but do not specify how you want your shares voted on any particular matter, they will be voted in accordance with the recommendations of our board of directors. |

| | | |

| | (4) | In Person at the Meeting: If you attend the annual meeting, you may deliver your completed proxy card in person or you may vote by completing a ballot, which we will provide to you at the annual meeting. |

| | | |

| | | If your shares are held in “street name,” meaning they are held for your account by an intermediary, such as a broker, then you are deemed to be the beneficial owner of your shares and the broker that actually holds the shares for you is the record holder and is required to vote the shares it holds on your behalf according to your instructions. The proxy materials, as well as |

| | | | | |

| | | voting and revocation instructions, should have been forwarded to you by the broker that holds your shares. In order to vote your shares, you will need to follow the instructions that your broker provides to you. Many brokers solicit voting instructions over the Internet or by telephone. If you do not give instructions to your broker, it will still be able to vote your shares with respect to certain “discretionary” items. The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm (proposal three) is considered a discretionary item. Accordingly, your broker may vote your shares in its discretion with respect to that matter even if you do not give instructions to do so. However, under Nasdaq rules that regulate voting by registered brokerage firms, the election of our nominees to serve as Class I directors (proposal one) and the approval of our 2015 Employee Stock Purchase Plan (proposal two) are not considered to be discretionary items. Accordingly, your broker may not vote your shares with respect to such matters if you do not give it voting instructions on the proposals and your shares will be counted as “broker non-votes” with respect to those proposals. A “broker non-vote” occurs when shares held by a broker are not voted with respect to a particular proposal because the broker does not have or did not exercise discretionary authority to vote on the matter and has not received voting instructions from its clients with respect to such shares. Regardless of whether your shares are held in street name, you are welcome to attend the annual meeting. You may not vote shares held in street name in person at the annual meeting, however, unless you obtain a proxy, executed in your favor, from the holder of record (i.e., your broker). |

| | |

| Q. | Can I change my vote? |

| | |

| A. | If your shares are registered directly in your name, you may revoke your proxy and change your vote at any time before the vote is taken at the annual meeting. To do so, you must do one of the following: |

| | |

| | (1) | Vote over the Internet or by telephone as instructed above. Only your latest Internet or telephone vote is counted. |

| | | |

| | (2) | Sign and return a new proxy card. Only your latest dated proxy card will be counted. |

| | | |

| | (3) | Attend the annual meeting and vote in person as instructed above. Attending the annual meeting will not alone revoke your Internet vote, telephone vote or proxy card submitted by mail, as the case may be. |

| | | |

| | (4) | Give our corporate secretary written notice before or at the annual meeting that you want to revoke your proxy. |

| | | |

| | | If your shares are held in “street name,” you may submit new voting instructions with a later date by contacting your broker. |

| | | |

| Q. | How many shares must be represented to have a quorum and hold the annual meeting? |

| | |

| A. | A majority of our shares of common stock outstanding at the record date must be present in person or represented by proxy to hold the annual meeting. This is called a quorum. For purposes of determining whether a quorum exists, we count as present any shares that are voted over the Internet, by telephone, by completing and submitting a proxy by mail or that are represented in person at the meeting. Further, for purposes of establishing a quorum, we will count as present shares that a stockholder holds even if the stockholder votes to abstain or only votes on one of the proposals. In addition, we will count as present shares held in “street name” by brokers who indicate on their proxies that they do not have authority to vote those shares. If a quorum is not present, we expect to adjourn the annual meeting until we obtain a quorum. |

| | |

| Q. | What vote is required to approve each matter and how are votes counted? |

| | |

| A. | Proposal 1—Elect Class I Directors |

| | | | A nominee will be elected as a director at the annual meeting if the nominee receives a plurality of the votes cast “for” the applicable seat on the board of directors. |

| | | | |

| | Proposal 2—Approval of the 2015 Employee Stock Purchase Plan |

| | |

| | | | The affirmative vote of the holders of shares of common stock representing a majority of the votes cast on the matter is required to approve the 2015 Employee Stock Purchase Plan. |

| | | | |

| | Proposal 3—Ratification of the Appointment of Independent Registered Public Accounting Firm |

| | |

| | | | The affirmative vote of the holders of shares of common stock representing a majority of the votes cast on the matter is required for the ratification of the appointment of Ernst & Young, LLP as our independent registered public accounting firm for the year ended December 31, 2015. |

| | | | | |

| | | | Shares which abstain from voting and “broker non-votes” with respect to a matter will not be counted as votes in favor of such matter and will also not be counted as shares voting on such matter. Accordingly, abstentions and “broker non-votes” will have no effect on the voting on the proposals referenced above. |

| | |

| Q. | Who will count the vote? |

| | |

| A. | The votes will be counted, tabulated and certified by Broadridge Financial Solutions. |

| | |

| Q. | How does the board of directors recommend that I vote on the proposals? |

| | |

| A. | Our board of directors recommends that you vote: |

| | | | FOR the election of the two nominees to serve as Class I directors, each for a three year term; FOR the approval of our 2015 Employee Stock Purchase Plan; and FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2015. |

| Q. | Are there other matters to be voted on at the annual meeting? |

| | |

| A. | We do not know of any matters that may come before the annual meeting other than the election of our Class I directors, the vote on the approval of the 2015 Employee Stock Purchase Plan and the ratification of the appointment of our independent registered public accounting firm. If any other matters are properly presented at the annual meeting, the persons named in the accompanying proxy intend to vote, or otherwise act, in accordance with their judgment on the matter. |

| | |

| Q. | Where can I find the voting results? |

| | |

| A. | We plan to announce preliminary voting results at the annual meeting and will report final voting results in a Current Report on Form 8-K filed with the Securities and Exchange Commission, or SEC, within four business days following the end of our annual meeting. |

| | |

| Q. | What are the costs of soliciting these proxies? |

| | |

| A. | We will bear the cost of soliciting proxies. In addition to solicitation by mail, our directors, officers and employees may solicit proxies by telephone, e-mail, facsimile and in person without additional compensation. We may reimburse brokers or persons holding stock in their names, or in the names of their nominees, for their expenses in sending proxies and proxy materials to beneficial owners of our common stock. |

| | |

Implications of being an “emerging growth company”

We are an “emerging growth company” under applicable federal securities laws and therefore permitted to take advantage of certain reduced public company reporting requirements. As an emerging growth company, we provide in this proxy statement the scaled disclosure permitted under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, including the compensation disclosures required of a “smaller reporting company,” as that term is defined in Rule 12b-2 promulgated under the Securities Exchange Act of 1934, as amended, or the Exchange Act. In addition, as an emerging growth company, we are not required to conduct votes seeking approval, on an advisory basis, of the compensation of our named executive officers or comply with requirements regarding the frequency with which such votes must be conducted. We will remain an “emerging growth company” until the earliest of (1) December 31, 2019, (2) the last day of the fiscal year in which we have total annual gross revenue of at least $1.0 billion, (3) the date on which we are deemed to be a large accelerated filer, which means the market value of our common stock that is held by non-affiliates exceeds $700 million as of the prior June 30th, and (4) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period.

Stockholders Sharing the Same Address

Some brokers and other nominee record holders may be “householding” our proxy materials. This means a single notice and, if applicable, the proxy materials, will be delivered to multiple stockholders sharing an address unless contrary instructions have been received. We will promptly deliver a separate copy of the notice and, if applicable, the proxy materials, to you if you call or write us at our principal executive offices, 805 Veterans Parkway, Suite 300, Redwood City, CA 94603, Attn: Investor Relations, telephone: (650) 458-4100. In the future, if you want to receive separate copies of the proxy materials, or if you are receiving multiple copies and would like to receive only one copy per household, you should contact your broker, or you may contact us at the above address and telephone number.

PROPOSAL 1

ELECTION OF DIRECTORS

Directors and Nominees for Directors

In accordance with our seventh amended and restated certificate of incorporation, our board of directors is divided into three classes with staggered, three-year terms. At each annual meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following election. Our directors are divided among the three classes as follows:

| | | |

| | • | the Class I directors are Mr. Babler and Ms. Popovits, and their terms expire at the annual meeting of stockholders to be held in 2015; |

| | | |

| | • | the Class II directors are Mr. Nohra and Dr. Ostro, and their terms expire at the annual meeting of stockholders to be held in 2016; and |

| | | |

| | • | the Class III directors are Dr. Alexander, Mr. Whiting and Dr. Akkaraju, and their terms expire at the annual meeting of stockholders to be held in 2017. |

Our board of directors, on the recommendation of our nominating and corporate governance committee, has nominated Martin Babler and Kim Popovits for election as class I directors at the annual meeting to hold office until the 2018 annual meeting of stockholders and until his or her successor is elected and qualified. Each of the nominees is presently a director, and each has indicated a willingness to continue to serve as director, if elected. If a nominee becomes unable or unwilling to serve, however, the proxies may be voted for substitute nominees selected by our board of directors.

Our seventh amended and restated certificate of incorporation provides that the authorized number of directors may be changed only by resolution of the board of directors. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. The division of our board of directors into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control of our company.

Below are the names, ages and certain other information for each member of the board, including the nominees for election as Class I directors. There are no familial relationships among any of our directors, nominees for director and executive officers. In addition to the detailed information presented below for each of our directors, we also believe that each of our directors is qualified to serve on our board and has the integrity, business acumen, knowledge and industry experience, diligence, freedom from conflicts of interest and the ability to act in the interests of our stockholders.

Class I Directors

Martin Babler, age 50, has served as a member of our board of directors since February 2015. Mr. Babler has been the Chief Executive Officer of Principia Biopharma since April 2011. From December 2007 to March 2011, Mr. Babler was President and Chief Executive Officer of Talima Therapeutics. From July 1998 to January 2007, Mr. Babler was a senior executive at Genentech in various roles, including Vice President, Immunology Sales and Marketing, where he oversaw the successful product launches of Xolair and Rituxan for Rheumatoid Arthritis. During his tenure at Genentech, he also helped prepare for the launches of additional novel products such as Avastin, Tarceva, and Lucentis. Mr. Babler began his pharmaceutical industry career at Eli Lilly and Company with positions in sales management, global marketing and business development. Mr. Babler has been a Guest Lecturer for the BioExec Institute at the Haas School of Business at the University of California, Berkeley. From 2008 to 2014, Mr. Babler served on the board of directors of Infinity Pharmaceuticals, Inc. He also serves on the BIO Emerging Companies Section Governing Board. Mr. Babler holds a Swiss Federal Diploma in Pharmacy from the Federal Institute of Technology in Zurich. Mr. Babler also graduated from the Executive Development Program at the Kellogg Graduate School of Management at Northwestern University. We believe Mr. Babler is qualified to serve on our board of directors due to his significant industry knowledge and expertise in the commercialization of biopharmaceutical products, including several recent successful product launches.

Kim Popovits,age 56, has served as a member of our board of directors since May 2015. Ms. Popovits is currently serving as the Chairman and Chief Executive Officer of Genomic Health, roles she has held from 2012 and 2009, respectively. From 2002 to 2009, Ms. Popovits served as Genomic Health’s Chief Operating Officer. Prior to joining Genomic Health, Ms. Popovits served as Senior Vice President, Marketing and Sales at Genentech, Inc., a biotechnology company, dedicated to using human genetic information to discover, develop, manufacture and commercialize medicines to treat patients with serious or life-threatening medical conditions. During her 15 years at Genentech, Ms. Popovits led the successful commercialization of 14 new therapies, including Herceptin. Before joining Genentech, Ms. Popovits served as division manager for American Critical Care, a division of American Hospital Supply Corporation. She holds a Bachelor of Arts degree in Business from Michigan State University. We believe Ms. Popovits is qualified to serve on our board of directors due to her experience in the commercialization of biopharmaceutical products and her leadership experience in this field.

Class II Directors

Marc Ostro, Ph.D., age 65, has served as a member of our board of directors since November 2011. Dr. Ostro has been a General Partner at Devon Park Bioventures, a venture capital fund targeting investments in therapeutics companies and, in certain cases, medical device, diagnostic and drug discovery technology companies, since February 2006. Previously, from January 2002 to February 2006, Dr. Ostro was a managing partner at TL Ventures, L.P., a Pennsylvania-based venture capital firm. From 1997 to 2002, he was Senior Managing Director and Head of KPMG’s Life Science Group (Mergers and Acquisitions) and he was Senior Vice President of Ross Financial Corporation from August 1997 to December 1997. Dr. Ostro was a Managing Director of UBS Securities from 1994 to 1997, where he was involved with numerous IPOs and secondary offerings and was with Mabon Securities from 1993 to 1994, where he initiated and grew the firm’s biotechnology practice. In 1981, Dr. Ostro co-founded The Liposome Company, a biotechnology company, and served as President, Vice Chairman, and Chief Science Officer. He also founded the Journal of Liposome Research. To date, Dr. Ostro has served on the boards of directors of seventeen biotechnology companies. Dr. Ostro received a B.S. in Biology from Lehigh University, a Ph.D. in Biochemistry from Syracuse University, and was a Postdoctoral Fellow and Assistant Professor at the University of Illinois Medical School. We believe Dr. Ostro is qualified to serve on our board of directors due to his investment and industry experience and extensive service on other biotechnology companies’ boards of directors.

Guy Nohra, MBA, age 55, has served as a member of our board of directors since June 2013. Mr. Nohra is a co-founder of and has been a managing director at Alta Partners since 1996, and was also a partner at Burr, Egan, Deleage & Co. from 1989 to 1997. He has been involved in the funding and development of notable medical technology and life science companies including AcelRx Pharmaceuticals, ATS Medical, Cutera, Innerdyne, R2 Technology, deCODE genetics, and Vesica. From November 1983 to June 1987, Mr. Nohra was Product Manager of Medical Products with Security Pacific Trading Corporation. He was responsible for a multi-million dollar product line and traveled extensively in Korea, Taiwan, Hong Kong, China and Southeast Asia. Currently, Mr. Nohra serves on the board of directors of several companies, including Bioventus, Carbylan Biosurgery, Cerenis Therapeutics, PneumRx and Vertiflex, and is the Chairman of the Board of USGI Medical. He also served on the board of directors of the Medical Device Manufacturing Association from June 2003 to June 2013. Mr. Nohra served as the President of the Silicon Valley chapter of The Leukemia and Lymphoma Society from April 2010 to December 2013. He has a B.A. in History from Stanford University and an MBA from the University of Chicago. We believe Mr. Nohra is qualified to serve on our board of directors due to his longtime involvement in the development of life science companies and extensive service on other boards of directors for similar pharmaceutical companies.

Class III Directors

Robert Alexander, Ph.D.,age 45, has served as a member of our board of directors since October 2012 and has served as our Chief Executive Officer since December 2013. From March 2013 to March 2014, Dr. Alexander served as Chairman of our board of directors. From November 2005 to March 2013, Dr. Alexander served as a Director at Alta Partners, a venture capital firm in life sciences. In addition, he acted as Executive Chairman and interim Chief Executive Officer of SARcode Biosciences (acquired by Shire plc in April 2013), a biopharmaceutical company. During his time at Alta, he led investments in SARcode Biosciences, Sonexa Therapeutics, Allakos, Lumena Pharmaceuticals, and ZS Pharma. From April 2004 to November 2005, Dr. Alexander was a Principal in MPM Capital’s BioEquities fund where he sourced opportunities and led due diligence efforts for both public and private investments. From December 2000 to April 2004, Dr. Alexander worked in the Business Development group at Genentech, Inc. (now a member of the Roche Group), a biotechnology company, where he was responsible for sourcing and screening product opportunities based on scientific merit and strategic fit, leading diligence teams and negotiating terms and definitive agreements. Dr. Alexander joined Genentech after completing his post-doctoral fellowship at Stanford University in the Pathology department. He also holds a Ph.D. in Immunology from the University of North Carolina and a B.A. in Zoology from Miami University of Ohio. We believe Dr. Alexander is qualified to serve on our board of directors based on his background and experience in the life sciences sector.

John Whiting, MBA, age 60, has served as a member of our board of directors since June 2014. Mr. Whiting is currently the head of finance for Calico Biosciences, a position he has held since May, 2015. From October 2010 to April 2015, Mr. Whiting was at the Gladstone Institutes, most recently in the position of Executive Vice President, Chief Financial and Administrative Officer. Mr. Whiting provided overall direction and leadership to a wide range of Gladstone’s finance and administrative functions, including finance and accounting, extramural funding and grants and contracts, human resources, information technology, operations and facilities management, and purchasing. Prior to joining Gladstone Institutes, Mr. Whiting was at Genentech, Inc. (now a member of the Roche Group) from March 1989 to July 2009, most recently as Deputy Chief Financial Officer from February 2009 to July 2009. Mr. Whiting’s responsibilities at Genentech, included accounting and financial reporting, financial planning, treasury, divisional controllerships, mergers and acquisitions and strategic planning. Mr. Whiting served on the board of directors for the non-profit Larkin Street Youth Services from October 2010 to May 2014. Since June 2014, Mr. Whiting has been on the honorary board of directors of Larkin Street Youth Services. Mr. Whiting has also served on the board of directors for MacPherson’s, an art supply and distribution company, since August 2011. He has served as chair of MacPherson’s audit committee since August 2011. Mr. Whiting earned both a bachelor’s degree in biology and an MBA at the University of Oregon. He is an inactive certified public accountant licensed in California. We believe Mr. Whiting is qualified to serve on our board of directors due to his longtime experience in the industry and strong record of service on other companies’ boards of directors as chair of both a finance and an audit committee.

Srinivas Akkaraju, M.D., Ph.D., age 47, has served as a member of our board of directors since June 2014. Dr. Akkaraju has over 16 years of investment and operational experience in the life sciences sector. Dr. Akkaraju has served as a General Partner, concentrating on biopharmaceutical investments, of Sofinnova Ventures since April 2013. Prior to Sofinnova Ventures, Dr. Akkaraju served as a Managing Director at New Leaf Venture Partners from January 2009 to April 2013. Prior to New Leaf Venture Partners, Dr. Akkaraju was a founding Managing Director at Panorama Capital, the venture spin-out from the arm of J.P. Morgan Partners that specialized in biotech and information technology investments. Before forming Panorama Capital, he was a part of the biotech investment team of J.P. Morgan Partners from April 2001 to July 2006, most recently serving as Partner. Prior to J.P. Morgan Partners, Dr. Akkaraju held business and corporate development positions at Genentech, Inc. (now a member of the Roche Group), from October 1998 to March 2001. Dr. Akkaraju’s past board memberships have included Piramed Ltd. (acquired by Roche), Eyetech Pharmaceuticals, Inc. and Synageva BioPharma Corp. He currently serves on the boards of Seattle Genetics, Inc., Intercept Pharmaceuticals, Inc., and Versartis, Inc. Dr. Akkaraju received his B.A. degrees in both Biochemistry and Computer Science from Rice University and M.D. and Ph.D. degrees in Immunology from Stanford University School of Medicine. We believe Dr. Akkaraju is qualified to serve on our board of directors due to his investment and industry experience and service on other boards of directors of life science companies.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE ELECTION OF MARTIN BABLER AND KIM POPOVITS TO SERVE AS CLASS I DIRECTORS.

CORPORATE GOVERNANCE

General

We believe that good corporate governance is important to ensure that our company is managed for the long-term benefit of our stockholders. We periodically review our corporate governance policies and practices and compare them to those suggested by various authorities in corporate governance and the practices of other public companies. As a result, we have adopted policies and procedures that we believe are in the best interests of ZS Pharma and our stockholders.

Board Composition

We currently have seven directors. Our directors hold office until their successors have been elected and qualified or, if earlier, until their death, resignation or removal.

Director Independence

Under applicable rules of The Nasdaq Global Market, or the Nasdaq rules, a director will only qualify as an “independent director” if, in the opinion of our board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Our board of directors has determined that all of our directors, other than Dr. Alexander, are independent directors, as defined by the applicable Nasdaq rules. In making such determination, the board of directors considered the relationships that each such non-employee director has with our company and all other facts and circumstances that the board of directors deemed relevant in determining their independence. In particular, in considering the independence of our directors, our board of directors considered the association of certain of our directors with the holders of more than 5% of our common stock as well as the effect of each of the transactions described in the “Certain Relationships and Related Party Transactions” section of this proxy statement.

There are no family relationships among any of our directors or executive officers.

Leadership Structure of the Board

Our amended and restated bylaws and corporate governance guidelines provide our board of directors with flexibility to combine orseparate the positions of Chairman of the Board and Chief Executive Officer and/or the implementation of a lead director in accordance with its determination that utilizing one or the other structure would be in the best interests of our company.

Our board of directors has concludedthat our current leadership structure is appropriate at this time. However, our board of directors will continue to periodically review our leadership structure and may make such changes in the future as it deems appropriate.

Role of Board in Risk Oversight Process

Risk assessment and oversight are an integral part of our governance and management processes. Our board of directors encourages management to promote a culture that incorporates risk management into our corporate strategy and day-to-day business operations. Management discusses strategic and operational risks at regular management meetings, and conducts specific strategic planning and review sessions during the year that include a focused discussion and analysis of the risks facing us. Throughout the year, senior management reviews these risks with the board of directors at regular board meetings as part of management presentations that focus on particular business functions, operations or strategies, and presents the steps taken by management to mitigate or eliminate such risks.

Our board of directors does not have a standing risk management committee, but rather administers this oversight function directly through our board of directors as a whole, as well as through various standing committees of our board of directors that address risks inherent in their respective areas of oversight. In particular, our board of directors is responsible for monitoring and assessing strategic risk exposure and our audit committee is responsible for overseeing our major financial risk exposures and the steps our management has taken to monitor and control these exposures. The audit committee also monitors compliance with legal and regulatory requirements. Our nominating and governance committee monitors the effectiveness of our corporate governance guidelines and considers and approves or disapproves any related-persons transactions. Our compensation committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking.

Board and Committee Meetings

Our board of directors held 5 meetings during 2014. During 2014, each of the directors then in office attended at least 75% of the aggregate of all meetings of the board of directors and all meetings of the committees of the board of directors on which such director then served. All directors are encouraged to attend the annual meeting of stockholders. This is our first annual meeting of stockholders since we became a public company in June 2014.

We have established an audit committee, a compensation committee and a nominating and corporate governance committee. Each ofthese committees operates under a charter that has been approved by our board of directors. A copy of each charter can be found under the “Corporate Governance” section of our website atwww.zspharma.com and the charter of our audit committee is attached hereto asExhibit B.

Audit Committee

Our audit committee consists of Mr. Whiting, Dr. Akkaraju and Mr. Babler, with Mr. Whiting serving as chairman of the committee. Our board of directors has determined that Mr. Whiting, Dr. Akkaraju and Mr. Babler meet the independence requirements of Rule 10A-3 under the Exchange Act and the applicable listing standards of The Nasdaq Global Market. Our board of directors and our nominating and corporate governance committee, respectively, have determined that Mr. Whiting and Mr. Babler are “audit committee financial experts” within the meaning of the SEC regulations and applicable listing standards of The Nasdaq Global Market. The audit committee held 4 meetings during our 2014 fiscal year. The audit committee’s responsibilities include:

| | • | appointing our independent registered public accounting firm; |

| | • | evaluating the independent registered public accounting firm’s qualifications, independence and performance; |

| | • | determining the engagement of the independent registered public accounting firm; |

| | • | reviewing and approving the scope of the annual audit and the audit fee; |

| | • | discussing with management and the independent registered public accounting firm the results of the annual audit and the review of our quarterly financial statements; |

| | • | approving the retention of the independent registered public accounting firm to perform any proposed permissible non-audit services; |

| | • | monitoring the rotation of partners of the independent registered public accounting firm on our engagement team as required by law; |

| | • | reviewing our financial statements and our management’s discussion and analysis of financial condition and results of operations to be included in our annual and quarterly reports to be filed with the SEC; |

| | • | reviewing our critical accounting policies and estimates; and |

| | • | annually reviewing the audit committee charter and the committee’s performance. |

Compensation Committee

Our compensation committee consists of Mr. Nohra, Dr. Ostro and Dr. Akkaraju, with Dr. Ostro serving as chairman of the committee. Our board of directors has determined each member of the compensation committee is “independent” as defined under the applicable listing standards of The Nasdaq Global Market. The compensation committee held 2 meetings during our 2014 fiscal year. The compensation committee’s responsibilities include:

| | • | annually reviewing and approving individual and corporate goals and objectives relevant to the compensation of our executive officers; |

| | • | evaluating the performance of our executive officers in light of such individual and corporate goals and objectives and determining the compensation of our executive officers; |

| | • | appointing, compensating and overseeing the work of any compensation consultant, legal counsel or other advisor retained by the compensation committee; |

| | • | conducting the independence assessment outlined in Nasdaq rules with respect to any compensation consultant, legal counsel, or other advisor retained by the compensation committee; |

| | • | annually reviewing and reassessing the adequacy of the committee charter in its compliance with the listing requirements of The Nasdaq Global Market; |

| | • | overseeing and administering our compensation and similar plans; |

| | • | reviewing and approving our policies and procedures for the grant of equity-based awards; |

| | • | reviewing and making recommendations to the board of directors with respect to director compensation; |

| | • | reviewing and discussing with management the compensation discussion and analysis to be included in our annual proxy statement or Annual Report on Form 10-K; |

| | • | preparing the compensation committee report required by the rules of the SEC to be included in our annual proxy statement; |

| | • | reviewing and discussing with the board of directors corporate succession plans for the chief executive officer and other senior management positions; and |

| | • | periodically reviewing our Company’s overall policies, practices, and plans. |

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee consists of Mr. Nohra and Dr. Ostro, with Mr. Nohra serving as chairman of the committee. Our board of directors has determined that each member of the nominating and corporate governance committee is “independent” as defined under the applicable listing standards of The Nasdaq Global Market. The nominating and corporate governance did not hold any meetings during our 2014 fiscal year. The nominating and corporate governance committee’s responsibilities include:

| | • | developing and recommending to the board of directors criteria for board and committee membership; |

| | • | establishing procedures for identifying and evaluating board of director candidates, including nominees recommended by stockholders; |

| | • | identifying individuals qualified to become members of the board of directors; |

| | • | recommending to the board of directors the persons to be nominated for election as directors and to each of the board’s committees; and |

| | • | developing and recommending to the board of directors a set of corporate governance principles and guidelines. |

Our board of directors may establish other committees from time to time.

Compensation Committee Interlocks and Insider Participation

Since our IPO closed on June 23, 2014, our compensation committee has consisted of Dr. Ostro, Mr. Nohra and Dr. Akkaraju. From December 2012 through April 2013, our compensation committee consisted of Dr. McKearn, Dr. Ostro, Mr. Truitt and Dr. Alexander, our current Chief Executive Officer, who prior to March 2013, was not employed by us. From April 2013 through May 2014, our compensation committee consisted of Dr. McKearn, Dr. Ostro and Mr. Nohra. None of the members of our compensation committee has at any time been one of our officers or employees other than Dr. Alexander. None of our executive officers currently serves, or in the past fiscal year has served, as a member of the board of directors or compensation committee of any entity that has one or more executive officers on our board of directors or compensation committee.

Board Diversity

Our nominating and corporate governance committee is responsible for reviewing with the board of directors, on an annual basis, the appropriate characteristics, skills and experience required for the board of directors as a whole and its individual members. In evaluating the suitability of individual candidates (both new candidates and current members), the nominating and corporate governance committee, in recommending candidates for election, and the board of directors, in approving (and, in the case of vacancies, appointing) such candidates, takes into account many factors, including the following:

| | • | personal and professional integrity; |

| | • | experience in corporate management, such as serving as an officer or former officer of a publicly held company; |

| | • | experience in the industries in which we compete; |

| | • | experience as a board member or executive officer of another publicly held company; |

| | • | diversity of expertise and experience in substantive matters pertaining to our business relative to other board members; |

| | • | conflicts of interest; and |

| | • | practical and mature business judgment. |

Our board of directors evaluates each individual in the context of the board of directors as a whole, with the objective of assembling a group that can best maximize the success of the business and represent stockholder interests through the exercise of sound judgment using its diversity of experience in these various areas.

Stockholders also have the right under our bylaws to directly nominate director candidates, without any action or recommendation on the part of the committee or our board of directors, by following the procedures set forth in the section of this proxy statement entitled “Stockholder Proposals.”

Code of Business Conduct and Ethics

We have a code of business conduct and ethics that applies to all of our employees, officers and directors, including those officersresponsible for financial reporting. The code of business conduct and ethics is available on our website atinvestors.zspharma.com/corporate-governance.cfm. We expect that any amendments to the code, or any waivers of its requirements, will be promptly disclosed on our website. The inclusion of our website address in this proxy statement does not incorporate by reference the information on or accessible through our website into this proxy statement.

Limitation on Liability and Indemnification Matters

Our seventh amended and restated certificate of incorporation contains provisions that limit the liability of our directors for monetary damages to the fullest extent permitted by Delaware law. Consequently, our directors are not personally liable to us or our stockholders for monetary damages for any breach of fiduciary duties as directors, except liability for:

| | • | any breach of the director’s duty of loyalty to us or our stockholders; |

| | • | any act or omission not in good faith or that involves intentional misconduct or a knowing violation of law; |

| | • | unlawful payments of dividends or unlawful stock repurchases or redemptions as provided in Section 174 of the Delaware General Corporation Law; or |

| | • | any transaction from which the director derived an improper personal benefit. |

Our seventh amended and restated certificate of incorporation and amended and restated bylaws provide that we are required to indemnify our directors and officers, in each case to the fullest extent permitted by Delaware law. Our amended and restated bylaws also provide that we are obligated to advance expenses incurred by a director or officer in advance of the final disposition of any action or proceeding, and permit us to secure insurance on behalf of any officer, director, employee or other agent for any liability arising out of his or her actions in that capacity regardless of whether we would otherwise be permitted to indemnify him or her under Delaware law. We have entered and expect to continue to enter into agreements to indemnify our directors as determined by our board of directors. With specified exceptions, these agreements provide for indemnification for related expenses including, among other things, attorneys’ fees, judgments, fines and settlement amounts incurred by any of these individuals in any action or proceeding. We believe that these bylaw provisions and indemnification agreements are necessary to attract and retain qualified persons as directors. We will also maintain directors’ and officers’ liability insurance.

The limitation of liability and indemnification provisions in our seventh amended and restated certificate of incorporation and amended and restated bylaws may discourage stockholders from bringing a lawsuit against our directors and officers for breach of their fiduciary duty. They may also reduce the likelihood of derivative litigation against our directors and officers, even though an action, if successful, might benefit us and our stockholders. Further, a stockholder’s investment may be adversely affected to the extent that we pay the costs of settlement or damages.

Communication from Stockholders

The board will give appropriate attention to written communications that are submitted by stockholders, and will respond ifand as appropriate. The Corporate Secretary will maintain a log of such communications and will transmit them as soon as practicable to the board or a particular director. Communications that are abusive, in bad taste or that present safety or security concerns may be handled differently, as determined by the Corporate Secretary.

All directors areencouraged to attend the annual meeting of stockholders.

Director Compensation

Dr. Alexander, our Chief Executive Officer and Dr. Keyser, our Chief Operating Officer and Secretary, receive no compensation for their service as directors in 2014. Dr. Keyser resigned from our board of directors on May 1, 2015. As of December 31, 2014, Dr. Alexander, Dr. Guillem and Dr. Keyser held options to purchase 715,911, 543,459 and 506,338 shares of our common stock, respectively.

Our board of directors adopted a non-employee director compensation policy that is designed to provide a total compensation package that enables us to attract and retain, on a long-term basis, high caliber non-employee directors. Under the policy, all non-employee directors are paid as set forth below:

| | | | | |

Board of Directors | | Annual Retainer |

| All non-employee members | | $ | 35,000 | (1) |

| Additional retainer for Non-Executive Chairman of the Board | | $ | 20,000 | (1) |

| Audit Committee | | | | |

| Chairman | | $ | 7,500 | (1) |

| Compensation Committee | | | | |

| Chairman | | $ | 5,000 | (1) |

| Nominating and Corporate Governance Committee | | | | |

| Chairman | | $ | 5,000 | (1) |

| Stock Options | | | | |

| All non-employee members | | | 12,000 | (2)(3) |

| (1) | Payable quarterly in arrears. |

| (2) | Options for shares of our common stock under the 2014 Incentive Plan. |

| (3) | On the date of the annual meeting of stockholders, each continuing non-employee director will be eligible to receive an annual option grant to purchase up to 12,000 shares of our common stock, which terms will be determined by our compensation committee at the time of the grant. All options will be granted at fair market value on the date of grant. |

Director Compensation

The compensation earned during fiscal year 2014 by Messrs. Nohra and Whiting and Drs. Akkaraju and Ostro for serving as a member of our board of directors is set forth in the following table.

| | | | | | | | | | |

Name | | Fees earned or paid in cash | | Option awards(1) | | All other compensation | | Total |

| Guy Nohra | | $60,000 | | $282,620 | | — | | | $342,620 |

| Srinivas Akkaraju | | $18,306 | | $282,620 | | — | | | $300,926 |

| Marc Ostro | | $40,000 | | $282,620 | | — | | | $322,620 |

| John Whiting | | $22,227 | | $282,620 | | — | | | $304,847 |

| (1) | Each of Mr. Nohra, Dr. Akkaraju, Mr. Whiting and Dr. Ostro were granted options to purchase 12,000 shares of our common stock in 2014. |

PROPOSAL 2

APPROVAL OF THE 2015 EMPLOYEE STOCK PURCHASE PLAN

Our stockholders are being asked to approve the adoption of the ZS Pharma, Inc. 2015 Employee Stock Purchase Plan (the “ESPP”), which would provide for 400,000 shares of our common stock to be available for purchase by eligible employees. The number of shares of our common stock available under the ESPP will increase each January 1 by the excess of 1.5% of our total outstanding shares over the number of shares available under the ESPP at that time. On May 1, 2015, our board of directors unanimously approved the adoption of the ESPP, subject to stockholder approval at the annual meeting.

The purpose of the ESPP is to secure for us and our stockholders, through the purchase of shares of common stock by eligible employees, the benefits of the additional incentive that comes with ownership of our common stock by our eligible employees, who are important to us, and to help us secure and retain the services of such eligible employees. We intend to use the additional shares authorized for future offerings under the ESPP.

Description of the ESPP

The following is a brief summary of the ESPP. The following description is only a summary of the material terms of the ESPP, and is qualified in its entirety by reference to the ESPP, a copy of which is attached to this proxy statement asExhibit A.

Administration

The ESPP is administered by the committee designated by our board of directors to administer the ESPP. Our board of directors and the committee members do not receive any compensation from the assets of the ESPP. The committee has full authority to make, administer and interpret such rules and regulations regarding administration of the ESPP as it may deem advisable, and such decisions are final and binding.

Eligible Employees

Under the ESPP, our eligible employees and those of our “Designated Companies” may be given the opportunity to purchase shares of our common stock through installment payments to be deducted from the eligible employee’s salary, wages, commissions, incentive compensation, bonuses, and payments for overtime and shift premium. Eligible employees include all of our U.S.-based employees and those of our “Designated Companies” whose customary employment is 20 or more hours per week and more than five months in any calendar year. “Designated Companies” include all of our U.S. subsidiaries, except any subsidiaries that the committee has determined are ineligible to participate in the ESPP. In no event will an employee who is deemed to own 5% or more of the total combined voting power or value of all classes of our capital stock or the capital stock of any parent or subsidiary be eligible to participate in the ESPP, and no participant in the ESPP may purchase shares of common stock that, following the purchase (and including all options held by such participant), would cause him or her to be deemed to own 5% or more of the total combined voting power or value of all classes of our capital stock or the capital stock of any parent or subsidiary.

Offering Periods and Purchase Price

Offering periods under the ESPP are eighteen months long and run from January 1 or July 1 to June 30 or December 31 of the following year. We may choose to start a new offering period every six months. During each offering period, there will be three six-month purchase periods. The committee may determine a different starting date or duration for an offering period or purchase period and the committee may authorize additional offering periods to be conducted consecutively or overlapping with existing offering periods. Eligible employees who participate receive an option to purchase shares of common stock at a purchase price equal to the lower of 85% of (A) the closing price per share of common stock on the final day of the applicable purchase period or (B) the closing price per share of common stock on the first day of the applicable offering period. If our shares of common stock are not traded on the final day of a purchase period, the immediately preceding trading day will be used. Eligible employees participate by authorizing payroll deductions before the beginning of an offering period.

Participants may not acquire rights to purchase shares of our stock under all employee stock purchase plans of ZS Pharma which accrue at a rate that exceeds $25,000 of the fair market value of such shares of stock, determined at the time such option is granted, for each calendar year in which such option is outstanding and exercisable at any time. In addition, a Participant will not be permitted to purchase more than 5,000 shares of our stock in one purchase period and more than 15,000 shares of our stock in one offering period.

Cancellation of Election to Purchase

A participant may cancel his or her participation entirely at any time by withdrawing all, but not less than all, of his or her contributions credited to his or her account and not yet used to exercise his or her option under the ESPP. However, a participant may not change the rate of his or her contributions during an offering period unless permitted by the committee in its sole discretion.

Termination of Employment

If a participant ceases to be eligible to participate in the ESPP, for any reason, he or she will be deemed to have elected to withdraw from the ESPP and the contributions credited to his or her account during the offering period but not yet used to purchase shares of common stock under the ESPP will be returned to the participant, or, in the case of his or her death, to his or her designated beneficiary.

Merger or Change of Control

In the event of a merger or change in control, each outstanding option will be assumed, or an equivalent option will be substituted by the successor corporation or a parent or subsidiary of the successor corporation. If the successor corporation refuses to assume or substitute for the option, the offering period for that option will be shortened by setting a new exercise date on which the offering period will end.

Adjustments to Shares

In the event that any subdivision or consolidation of outstanding shares of common stock, declaration of a dividend payable in shares of common stock or other stock split, other recapitalization or capital reorganization of ZS Pharma, any consolidation or merger of ZS Pharma with another corporation or entity, the adoption by ZS Pharma of any plan of exchange affecting the common stock or any distribution to holders of common stock of securities or property, the committee, in order to prevent dilution or enlargement of the benefits or potential benefits intended to be made available under the ESPP, will, in such manner as it may deem equitable, adjust the number and class of common stock that may be delivered under the ESPP, the purchase price per share and the number of shares of common stock covered by each option under the ESPP that has not yet been exercised, and the share limits of the ESPP.

Rights as Shareholder

A participant will have no rights as a stockholder with respect to our shares that the participant has an option to purchase in any offering until those shares have been issued to the participant.

Rights Not Transferable

A Participant’s rights under the ESPP are exercisable only by the participant and may not be sold, transferred, pledged, or assigned in any manner other than by will or the laws of descent and distribution.

Amendment or Termination

Our board of directors or the committee, in their sole discretion, may amend, suspend, or terminate the ESPP, or any part thereof, at any time and for any reason. If the ESPP is terminated, our board of directors or the committee, in their discretion, may elect to terminate all outstanding offering periods either immediately or upon completion of the purchase of common stock on the next exercise date (which may be sooner than originally scheduled, if determined by our board of directors or the committee in its discretion), or may elect to permit offering periods to expire in accordance with their terms.

Term

The ESPP will continue for ten years, unless earlier terminated by our board of directors or the committee.

Federal Income Tax Consequences Relating to the ESPP

The foregoing is a general summary of the material U.S. federal income tax consequences of the ESPP and is intended to reflect the current provisions of the Internal Revenue Code and the regulations thereunder. This summary is not intended to be a complete statement of applicable law, nor does it address foreign, state, local and payroll tax considerations. Moreover, the U.S. federal income tax consequences to any particular participant may differ from those described herein by reason of, among other things, the particular circumstances of such participant. The foregoing is not to be considered as tax advice to any person who may be a participant, and any such persons are advised to consult their own tax counsel.

The ESPP is intended to qualify as an “employee stock purchase plan” within the meaning of Section 423(b) of the Internal Revenue Code. The ESPP is not qualified under Section 401(a) of the Internal Revenue Code.

If a participant does not dispose of common stock transferred to him or her under the ESPP within two years after the right to purchase the shares is granted and within twelve months after his or her purchase of such shares, the participant will not realize ordinary compensation income upon the purchase of the shares, and any gain or loss subsequently realized by him or her will be treated as a long-term capital gain or loss, as the case may be, except that upon a disposition of the shares purchased, or in the event of the participant’s

death (whenever occurring) while owning such shares, the participant will be taxed on an amount of ordinary compensation income equal to the lesser of (i) the excess, if any, of the fair market value of the shares on the first day of the offering period over the purchase price or (ii) the excess, if any, of the fair market value of such shares at the time the shares were disposed of, or at the time of death, as the case may be, over the purchase price. The basis of such shares will be increased by an amount equal to the amount taxable as ordinary compensation income, and any further gain or loss on such a disposition would be taxable as a long-term capital gain or loss. We will not be entitled to a deduction for federal income tax purposes with respect to the offer of such shares, the sale of such shares upon the completion of the offering period, or the subsequent disposition of shares purchased.

If the shares issued under the ESPP are disposed of prior to the expiration of the required holding periods described above, the participant will realize ordinary compensation income in the year in which the disqualifying disposition occurs, the amount of which will generally be the excess of the fair market value of such shares of common stock at the time of purchase over the purchase price. Such amount will ordinarily be deductible by us for federal income tax purposes in the same year. In addition, the excess, if any, of the amount realized on a disqualifying disposition over the fair market value of the shares on the date of purchase will be treated as a long-term or short-term capital gain. If the amount received upon disposition is less than such fair market value, the difference will be treated as long-term or short-term capital loss.

New Plan Benefits

Because participation in the ESPP is entirely discretionary and benefits under the ESPP depend on the fair market value of our common stock at various future dates, it is not possible to determine the benefits that will be received by employees if they participate in the ESPP.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE APPROVAL OF THE ESPP.

EQUITY COMPENSATION PLAN INFORMATION

The following table contains information about our equity compensation plan as of December 31, 2014.

Plan Category | | Number of securities to be issued upon exercise of outstanding options, warrants and rights | | | Weighted-average exercise price of outstanding options, warrants and rights | | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | |

| | | | (a) | | | | (b) | | | | (c) | |

| Equity compensation plans approved by security holders | | | 4,732,564 | | | | $7.52 | | | | 1,215,385 | |

| Equity compensation plans not approved by security holders | | | — | | | | — | | | | — | |

| Total | | | 4,732,564 | | | | $7.52 | | | | 1,215,385 | |

PROPOSAL 3

RATIFICATION OF THE APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

Our audit committee has appointed the firm of Ernst & Young LLP, an independent registered public accounting firm, as independent auditors for the fiscal year ending December 31, 2015. Although stockholder approval of our audit committee’s appointment of Ernst & Young LLP is not required by law, our board of directors believes that it is advisable to give stockholders an opportunity to ratify this appointment. If this proposal is not approved at the annual meeting, our audit committee will reconsider its appointment of Ernst & Young LLP. Representatives of Ernst & Young LLP are expected to be present at the annual meeting and will have the opportunity to make a statement, if they desire to do so, and will be available to respond to appropriate questions from our stockholders.

Principal Accountant Fees and Services

Ernst & Young LLP, an independent registered public accounting firm, audited our financial statements for the year ended December 31, 2014. The following table summarizes the fees of Ernst & Young LLP, our independent registered public accounting firm, billed to us for each of the last two fiscal years.

| | | 2014 | | | 2013 | |

| | | (in thousands) | |

| Audit Fees(1) | | $ | 976 | | | $ | 110 | |

| Tax Fees(2) | | | 50 | | | | — | |

| All Other Fees(3) | | | — | | | | — | |

| (1) | “Audit Fees” consist of fees for the audit of our annual financial statements, the review of the interim financial statements included in our quarterly reports on Form 10-Q, our initial public offering which was completed in June 2014, and consultations on miscellaneous SEC filings and other professional services provided in connection with regulatory filings or engagements. |

| (2) | “Tax Fees” consist of fees for tax compliance, advice and tax services, including fees for tax preparation. |

| (3) | “All Other Fees” consists of fees billed for products and services, other than those described above under Audit Fees and Tax fees. |

All such accountant services and fees were pre-approved by our audit committee in accordance with the “Audit Committee Pre-Approval Policies and Procedures” described below.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2015.

Audit Committee Pre-Approval Policies and Procedures

The audit committee charter provides that the audit committee will pre-approve audit services and non-audit services to be provided by our independent registered public accounting firm based on independence, qualifications and, if applicable, performance before the firm is engaged to render these services. The audit committee may consult with management in making its decision, but may not delegate this authority to management. The audit committee may delegate its authority to pre-approve services to one or more committee members, provided that the persons designated present the pre-approvals to the full committee at the next committee meeting.

All of the non-audit services rendered by Ernst & Young LLP with respect to the 2014 and 2013 fiscal years were pre-approved by the audit committee in accordance with this policy.

AUDIT COMMITTEE REPORT

The following is the report of the audit committee with respect to ZS Pharma’s audited consolidated financial statements for the year ended December 31, 2014.

Our audit committee has reviewed our audited consolidated financial statements for the fiscal year ended December 31, 2014 and discussed them with our management and our independent registered public accounting firm, Ernst &Young LLP.

Our audit committee has also received from, and discussed with, Ernst &Young LLP various communications that Ernst &Young LLP is required to provide to our audit committee, including the matters required to be discussed by the statement on Auditing Standards No. 16, as amended (AICPA,Professional Standards, Vol. 1, AU section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T.

In addition, Ernst & Young LLP provided our audit committee with the written disclosures and the letter required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accounting firm’s communications with the audit committee concerning independence, and has discussed with the company’s independent registered public accounting firm their independence.

Based on the review and discussions referred to above, our audit committee recommended to our board of directors that the audited consolidated financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2014.

By the audit committee of the board of directors of ZS Pharma, Inc. as of March 31, 2015.

John Whiting, Chair

Srinivas Akkaraju, Ph.D.

Marc Ostro

EXECUTIVE COMPENSATION

This section describes the material elements of compensation of our named executive officers, or NEOs. Our NEOs for the year ended December 31, 2014 were Robert Alexander, Ph.D., our Chief Executive Officer, Mark Asbury, our Senior Vice President and General Counsel and Alvaro Guillem, Ph. D., our President. This discussion contains forward-looking statements that are based on our current plans, considerations, expectations and determinations regarding future compensation programs. Actual compensation programs that we adopt may differ materially from currently planned programs as summarized in this discussion. As an “emerging growth company” as defined in the JOBS Act, we are not required to include a Compensation Discussion and Analysis section and have elected to comply with the scaled disclosure requirements applicable to emerging growth companies.

Summary Compensation Table

The following table sets forth information regarding the compensation awarded to or earned by our NEOs during the years ended December 31, 2013 and December 31, 2014.

Name and Principal Position | | Year | | Salary ($) | | | Option

Awards ($)(1) | | | Non-Equity Incentive Plan Compensation ($)(2) | | | All Other

Compensation ($)(3) | | | Total ($) | |

| Robert Alexander(4) | | 2014 | | | 435,231 | | | | 2,430,888 | | | | 217,733 | | | | 41,105 | | | | 3,124,957 | |

| Chief Executive Officer | | 2013 | | | 291,667 | | | | 799,710 | | | | 87,740 | | | | 26,397 | | | | 1,205,514 | |

| Alvaro Guillem | | 2014 | | | 347,500 | | | | 1,443,923 | | | | 121,647 | | | | 36,161 | | | | 1,949,231 | |

| President | | 2013 | | | 325,000 | | | | 278,160 | | | | 113,750 | | | | 27,065 | | | | 743,975 | |

| Mark Asbury | | 2014 | | | 151,250 | | | | 2,016,319 | | | | 57,980 | | | | 19,474 | | | | 2,245,023 | |

| General Counsel | | 2013 | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| (1) | The amounts reported in the Option Awards column represent the grant date fair value of the stock options granted to our NEOs during 2014 as computed in accordance with ASC 718. The assumptions used in calculating the grant date fair value of the stock options reported in the Option Awards column are set forth in Note 1 to the audited financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2014.. The amounts reported in this column exclude the impact of estimated forfeitures related to service-based vesting conditions. Note that the amounts reported in this column reflect the accounting cost for these stock options, and do not correspond to the actual economic value that may be received by the NEOs from the options. |

| (2) | The amounts reported in the Non-Equity Incentive Plan Compensation column represent annual cash bonus payments awarded upon the achievement of certain Company and individual performance targets, as established by the board of directors, which the NEOs earned for services performed in the years ended December 31, 2013 and December 31, 2014. |

| (3) | The amounts reported in the All Other Compensation column consist of premiums we paid with respect to each of our NEOs for medical, dental, vision, and term life insurance, pursuant to the terms of each NEO’s employment agreement with us and 401(k) contributions made by the company. |

| (4) | We accepted Dr. Alexander’s voluntary resignation as our Chairman on March 21, 2014. Dr. Alexander continues to serve as the Chief Executive Officer and as a member of our board of directors. |

Narrative Disclosure to 2014 Summary Compensation Table

Employment Agreements with our NEOs