NYSE MKT: IDI © 2015 IDI, Inc. All rights reserved. THE NEXT GENERATION OF DATA FUSION Exhibit 99.1 |

This presentation contains "forward-looking statements," as that term is defined under the Private Securities Litigation Reform Act of 1995 (PSLRA), which statements may be identified by words such as "expects," "plans," "projects," "will," "may," "anticipate," "believes," "should," "intends," "estimates," and other words of similar meaning. Such forward-looking statements include non-historical statements about our expectations, beliefs or intentions regarding our business, technologies and products, financial condition, strategies or prospects. There are a number of important factors that could cause actual results or events to differ materially from those indicated by such forward-looking statements, including: the risks set forth in IDI’s Annual Report on 10-K, filed with the SEC on April 15, 2015, as may be supplemented or amended by IDI's Quarterly Reports on Form 10-Q, as well as the other factors described in the IDI's filings that IDI makes with the SEC from time to time. You are cautioned not to place undue reliance on these forward-looking statements, which are based on our expectations as of the date of this presentation and speak only as of the date of this presentation. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. Forward-Looking Statements © 2015 IDI, Inc. All rights reserved. |

Additionally, IDI’s cross-functional core systems and processes are designed to deliver products and solutions to the marketing industry and to enable the public and private sectors to layer our solutions over their unique data sets, providing otherwise unattainable insight. IDI Overview An information solutions provider strategically positioned within the emerging data fusion market, delivering otherwise unattainable insight into the ever-expanding universe of consumer- and business-centric data. Through its proprietary linking technology, advanced systems architecture and massive data repository, IDI addresses the rapidly growing need for actionable intelligence to support the entirety of the risk management industry, including the following primary use cases: • Due diligence • Risk assessment • Fraud detection and prevention • Authentication and verification © 2015 IDI, Inc. All rights reserved. |

IDI Value Proposition Established core market Proprietary Systems IDI is strongly positioned within the rapidly growing, multi-billion dollar data fusion industry Next-generation technology to support the increasing needs of multiple industries Established information technology business to expedite growth Experienced executives with proven success building the leading data fusion providers 01 03 02 04 Proven Management Strong Foundation Increasing Margins 05 Fixed COGS model, generating increasing margins as IDI scales and matures © 2015 IDI, Inc. All rights reserved. |

IDI Management Team IDI’s executive leadership team represents over half a century of combined experience in the data industry. As proven strategists, innovators and operators, the team is well equipped to grow the current business platform into the leading data fusion provider. Founder: Michael Brauser An investor and operator in the data fusion market since its infancy, Mr. Brauser has built market-leading companies with revenues totalling over $2 billion, including: • Kertz Security (CEO/President) – Security company acquired in 1995 by Wayne Huizenga for $28 million. After additional rollups within the security business, sold to Ameritech (now ADT) for $660 million. • Naviant (Founder/CEO) – Internet marketing company, acquired in 2001 by Equifax for $135 million. • Seisint (Founder/Board Director) – Data fusion company, acquired in 2004 by Reed Elsevier for $775 million. • 5to1 (Founder) – Internet advertising company, acquired by Yahoo in 2011 for $28 million. • Interclick (Founder/Chairman) – Internet advertising network, acquired by Yahoo in 2011 for $280 million. © 2015 IDI, Inc. All rights reserved. |

Co-Chief Executive Officer: Derek Dubner For 15 years, Mr. Dubner worked closely with the late Hank Asher, the creator of market leaders Seisint and TLO and often referred to as “the father of data fusion.” Most recently, Dubner served as general counsel of TLO from inception through the sale of substantially all of the assets to TransUnion in December of 2013. Prior roles include vice president and associate group counsel at Equifax, general counsel and chief compliance officer at Naviant (acquired by Equifax) and corporate counsel at Seisint (acquired by Reed Elsevier’s LexisNexis). President and Chief Operating Officer: James Reilly Mr. Reilly has served in an executive management capacity within the data fusion industry for the last six years, with over 15 years of executive experience in data markets. Most recently, Reilly served as an executive with TLO and was responsible for building revenue from start-up to sale. Additionally, Reilly was responsible for all customer- facing departments, the company’s strategic initiatives and relationship management of key strategic partners and distributors. Chief Science Officer: Ole Poulsen Mr. Poulsen was the primary systems architect of leading data fusion products Accurint (now a LexisNexis offering) and TLOxp (now a TransUnion offering). The preeminent expert in this field, Poulsen’s experience, expertise and proven technology leadership enables rapid expansion and an advanced delivery platform. © 2015 IDI, Inc. All rights reserved. |

IDI Key Shareholders © 2015 IDI, Inc. All rights reserved. Michael Brauser Founder, Executive Chairman & Major Shareholder Mr. Brauser was formerly a founder and director of Seisint, which sold to Reed Elsevier for $775 million. Prior to that, he was a founder and CEO of Naviant, which sold to Equifax for $135 million. Brauser is currently an active investor in various verticals and has extensive experience building market-leading data companies. Phillip Frost, M.D. Major Shareholder Dr. Frost has been the CEO and Chairman of OPKO Health (NYSE: OPK) since March 2007. He served as Chairman of the Board of Teva Pharmaceuticals (NYSE: TEVA) from March 2010 to December 2014, and previously served as Vice Chairman from January 2006, when Teva acquired IVAX Corporation. Dr. Frost had served as Chairman of the Board of Directors and Chief Executive Officer of IVAX since 1987. He was named Chairman of the Board of Ladenburg Thalmann Financial Services Inc. (NYSE MKT: LTS) in July 2006. Steven D. Rubin Director Mr. Rubin has served as Executive Vice President and director of OPKO Health since 2007. He served as the Senior Vice President, General Counsel and Secretary of IVAX from August 2001 until September 2006. Rubin brings extensive leadership, business and legal experience to the board. He currently serves on the boards of CoCrystal Pharma (COCP), Neovasc (Nasdaq: NVCN) and Castle Brands (ROX), among others. |

Data Fusion Markets & IDI Solutions Risk Management Marketing & Data Analytics Needs: Faced with business, legislative and regulatory compliance, businesses must rely on service providers to help identify, assess and prioritize risks. Solution: IDI provides actionable intelligence, enabling businesses to obtain information on consumers, businesses and assets; facilitate the location of individuals and identity verification; and support criminal, legal, financial, insurance and corporate investigations and due diligence. Needs: An ever-increasing universe of data has companies struggling to make sense of it all, leaving valuable metrics unavailable. Solution: Leveraging IDI’s core data fusion technology, the Company is uniquely positioned to allow businesses to more fully leverage their data and other data assets, gathering information across all channels and consolidating it into a common view, providing invaluable insight to drive marketing and other business efforts forward. © 2015 IDI, Inc. All rights reserved. Estimated Combined Markets: $13.6 Billion |

IDI Competitors Thomson Reuters (CLEAR®) – Approximate revenue: $13 billion per year A leading source of information for businesses and professionals, TR’s CLEAR offering has been an investigative tool in the public records market for over two decades. $32 billion market cap* $17 billion market cap* Reed Elsevier (LexisNexis (Accurint®)) – Approximate revenue: $9 billion per year LexisNexis segments the products originally developed by Hank Asher and Ole Poulsen within its Accurint® business line. With estimated revenue of $600-$900 million per year, Accurint serves more than 400,000 public and private customers. $1.2 billion annual revenue* TransUnion (TLOxp®) – Approximate revenue: $1.2 billion per year One of the three major credit bureaus, TransUnion expanded its data solution offerings by acquiring TLOxp in late 2013. TLOxp continues to serve as an investigative and due-diligence tool for over 20,000 entities. Direct Competitors © 2015 IDI, Inc. All rights reserved. * As of May 2015 Approx. $20 billion valuation Palantir – Palantir is a private company and leading data integration platform that builds data fusion platforms for integrating, managing and securing any kind of data. The Palantir Platform works at any scale and empowers the entire analysis stack through its ability to access any data store in the enterprise while enforcing robust security and civil liberties protections. |

IDI Business Differentiators © IDI, Inc. All rights reserved. 01 TECHNOLOGY Legacy providers are built on outdated technology and linking theory. IDI’s next generation data fusion system will surpass the previous, now dated, technology. 02 EXPANDED LEVERAGING OF DATA IDI will leverage expansive amounts of data not previously integrated into data fusion systems, creating additional insight and value for its customers. 03 INCREASED VALUE, REDUCED COST By building a more efficient and intelligent platform, IDI will leverage reduced costs related to data, hardware and personnel to provide a higher quality product at a reduced price point. 04 CONSTANT INNOVATION Continued interaction with industry experts, direct communication with its client base and a continual focus on advancing the technology forward will set IDI’s platforms apart from systems that have remained relatively stagnant since their introduction to the market. IDI is focusing on several key differentiators to address the demands of the industry: |

IDI Background Formed through the acquisition of a legacy, niche data provider and subsequent merger with a NYSE MKT listed entity, IDI is now aggressively expanding across the entirety of the risk management industry and providing intuitive data analytics in other key segments. Several key factors contribute to the Company’s expanding growth platform: © 2015 IDI, Inc. All rights reserved. Experienced management team with proven success in this field World-class technology team led by the preeminent systems architect in the industry Established core agreements with major data suppliers Established compliance and security history with all requisite certifications in place Strong base of initial customers |

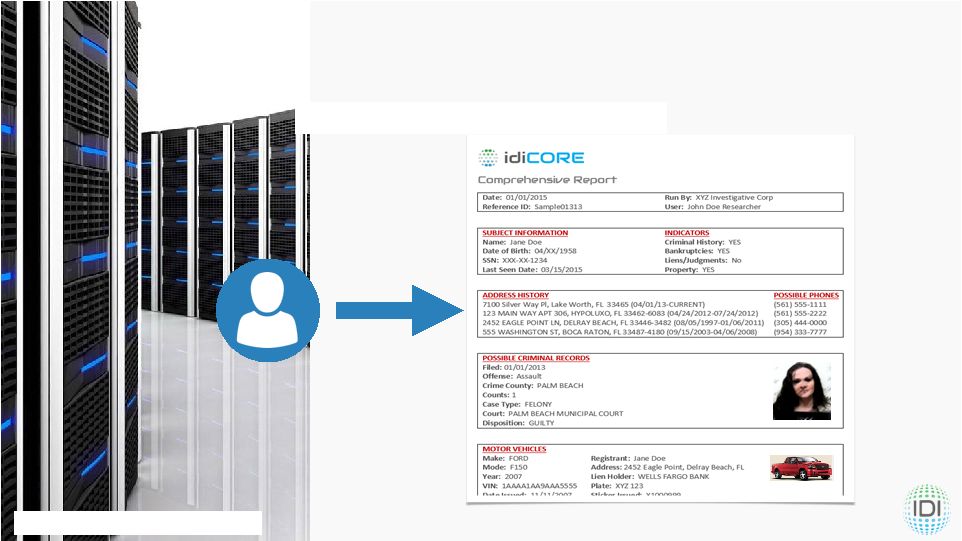

IDI Product Examples © 2015 IDI, Inc. All rights reserved. Online Data Access (visual) Discover: • Criminal histories • Motor vehicle data • Property data • Vital records data • Place of employment • Financial indicators • Affiliated businesses • Social media connections • ….and more |

IDI Product Examples © 2015 IDI, Inc. All rights reserved. Full Comprehensive Reports in Seconds…. |

IDI Product Examples Batch Processing Utilizing a base of massive amounts of consumer-related data, IDI verifies, or appends, client data to provide additional insight for a variety of uses within a large number of industries. Processing is conducted through secure file transfers or real-time data flow. Online Data Access Through intuitive and powerful online interfaces, IDI offers researchers efficient means of performing verification, due diligence and investigative functions: idiBASIC offers immediate location and contact information associated with a consumer. Uses include skip tracing for collection agencies and law firms with other users including, repossessors, bail bond agents and process servers. Currently in development with an expected release date of Q4 2015, idiCORE represents the next generation of data fusion technology. Offering instant, comprehensive views of individuals, businesses, assets and the connections between, idiCORE is poised to become the de-facto solution for investigative purposes within multiple industries, including Law Enforcement, Government, Insurance, Banking, Corporate Risk and many more. Custom Data Solutions Leveraging our powerful computing technology and proprietary, advanced linking algorithms, IDI can perform deep analytics, data verification and data cleansing to provide powerful views of customers’ own data, creating never before seen value and actionable insight. © 2015 IDI, Inc. All rights reserved. |

Business Vertical Focus Actionable insight on consumers, business, assets and the connections between to support demand from a variety of industries. Examples include: Banking and Financial Services Insurance Healthcare / Medical Retail / Corporate Risk Attorneys / Law Firms Collection Agencies Background Screening and Investigative Agencies Law Enforcement and Government © 2015 IDI, Inc. All rights reserved. |

IDI’s Significant Growth Opportunity While leveraging the current client base affords short-term revenue growth, IDI is now aggressively pursuing an accelerated expansion of opportunities, fueled by management experience and rapid innovation from its technology team: Brand Positioning and Market Focus – Currently expanding to over a dozen new industry segments. Evolution of Industry Technology – Work is well underway on the next-generation data fusion platform (software and supporting hardware), which will effectively shift all current competitor offerings to second-tier, dated technology. Marketing and Data Analytics – As owners of significant data fusion IP, IDI will license technology and processing capabilities to support market data analytics needs in multiple markets. Strategic Relationships – Developing key distributor and reseller channels with established entities to accelerate entry into multiple market segments. Strategic Acquisitions – Aggressively pursuing both competitive and complementary target entities within an extremely fragmented market to speed customer acquisition and revenue growth. $10 Million Registered Direct Offering – In July 2015, the Company raised $10 million, providing surplus to funds required for development and launch of next-generation system. © 2015 IDI, Inc. All rights reserved. |

Market Snapshot © 2015 IDI, Inc. All rights reserved. Stock Symbol: IDI (NYSE MKT) State of Incorporation: Delaware Price: $6.44 (9/1/15) 52 Week Range: $2.25 - $12.80 Avg. Daily Volume (90 day): 88,974 Common Shares Outstanding: 15.4 Million Market Cap: $99.6 Million Price & volume quotes from Yahoo! Finance and other reliable sources |

Contact Information IDI, Inc. Derek Dubner, Co-CEO 561-757-4000 derek@ididata.com 2650 N. Military Trail, Ste 300 Boca Raton, FL 33431 101 Yesler Way, Ste 207 Seattle, WA 98104 3057 Peachtree Industrial Blvd, Ste 100 Duluth, GA 30097 Media and Investor Relations: IRTH Communications Robert Haag, Managing Director 866-976-4784 idi@irthcommunications |