UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant o

Filed by a Party other than the Registrant x

Check the appropriate box:

o Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2))

o Definitive Proxy Statement

x Definitive Additional Materials

o Soliciting Material Under Rule 14a-12

TELEPHONE AND DATA SYSTEMS, INC. |

| (Name of Registrant as Specified in Its Charter) |

GAMCO ASSET MANAGEMENT INC. MARIO J. GABELLI RYAN J. MORRIS |

| (Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

¨ Fee paid previously with preliminary materials:

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

(1) Amount previously paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

GAMCO Asset Management Inc. (“GAMCO”), together with the other participants named herein, has made a definitive filing with the Securities and Exchange Commission of a proxy statement and accompanying BLUE proxy card to be used to solicit votes for the election of its director nominee at the 2013 annual meeting of stockholders of Telephone and Data Systems, Inc., a Delaware corporation.

On May 15, 2013, GAMCO sent the following letter to stockholders:

Dear Fellow Shareholders,

GAMCO Asset Management Inc and its affiliates (together, “GAMCO”) has been one of the largest shareholders of Telephone and Data Systems, Inc. (“TDS” or the “Company”) for over 15 years. As the Company itself highlights, now is a time of great change for TDS and the industry. Given the numerous upcoming capital allocation and strategic decisions, we believe it is more important now more than ever that our nominee, Ryan J. Morris, should join the Board of Directors of TDS (the “Board”) to add a fresh and unique perspective as a director elected by the common shareholders.

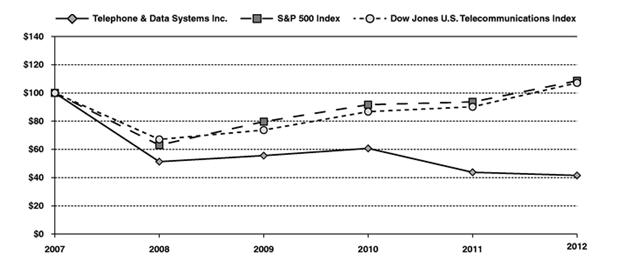

TDS stock performance has lagged far behind the market and peers

The following chart provides a comparison of TDS’ cumulative total return to shareholders (stock price appreciation plus dividends) during the last five years to the returns of the Standard & Poor’s 500 Composite Stock Price Index and the Dow Jones U.S. Telecommunications Index. As of December 31, 2012, the Dow Jones U.S. Telecommunications Index was composed of the following companies: AT&T Inc., CenturyLink Inc., Cincinnati Bell Inc., Crown Castle International Corp., Frontier Communications Corp., Leucadia National Corp., Level 3 Communications Inc., MetroPCS Communications Inc., NII Holdings Inc., SBA Communications Corp., Sprint Nextel Corp., Telephone and Data Systems, Inc. (TDS), TW Telecom, Inc., Verizon Communications Inc., and Windstream Corp.

CUMULATIVE TOTAL RETURN TO SHAREHOLDERS

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | |||||||||||||||||||

| Telephone and Data Systems Common Shares (NYSE: TDS) | $ | 100 | $ | 51.28 | $ | 55.58 | $ | 60.70 | $ | 43.75 | $ | 41.52 | ||||||||||||

| S&P 500 Index | 100 | 63.00 | 79.67 | 91.68 | 93.61 | 108.59 | ||||||||||||||||||

| Dow Jones U.S. Telecommunications Index | 100 | 67.07 | 73.68 | 86.75 | 90.19 | 107.14 | ||||||||||||||||||

Note: Assumes $100.00 invested at the close of trading on the last trading day preceding the first day of 2007, in TDS Common Shares, S&P 500 Index and the Dow Jones U.S. Telecommunications Index.

Capital allocation has been destructive over the past 5 years

Over the last 5 years (i.e. 2008 through 2012), TDS Telecommunications Corporation (“TDS Telecom”), a wholly-owned subsidiary of TDS, has spent $818 million on capital expenditures and another $248 million on acquisitions (including $187 million on acquisitions in the Hosted & Managed Services (HMS) area and $61 million on ILEC (independent local exchange carrier) and other wireline acquisitions).

Despite spending $1.066 billion of shareholder funds on capital expenditures and acquisitions during 2008-2012, TDS Telecom’s EBITDA has declined by 21% from $301.6mm in 2007 to $237.6mm in 2012.

| TDS (ex-US Cellular) | 2008 | 2009 | 2010 | 2011 | 2012 | Cumulative | ||||||||||||||||||

| EBITDA | $ | 302.2 | $ | 263.3 | $ | 280.2 | $ | 278.8 | $ | 237.6 | ||||||||||||||

| CAPEX | 149.3 | 124.4 | 172.0 | 204.0 | 168.0 | 817.7 | ||||||||||||||||||

| Acquisitions: HMS businesses | - | - | 64.6 | 81.7 | 40.7 | 187.0 | ||||||||||||||||||

| ILEC, other | 47.5 | 13.5 | - | - | - | 61.0 | ||||||||||||||||||

| Total | 47.5 | 13.5 | 64.6 | 81.7 | 40.7 | 248.0 | ||||||||||||||||||

| Total CAPEX & Acquisitions | 196.8 | 137.9 | 236.6 | 285.7 | 208.7 | 1,065.8 | ||||||||||||||||||

The market price implies the current Board will in our opinion continue to destroy shareholder capital

We believe that TDS has a valuable business with many strategic opportunities to realize and grow shareholder value. However, the current market price of TDS stock is at such a low valuation as to imply that capital will continue to be destroyed going forward. Subtracting the market value of TDS’ interest in United States Cellular Corporation (“U.S. Cellular”), an 84%-owned subsidiary, implies a negative equity value for the TDS business and a mere 1.03x EV/EBITDA valuation when the net debt is included.

While we do not focus on short-term stock price fluctuations, we are concerned about TDS’ situation which has persisted for an extended period of time. For a business as capital intensive as TDS, such a deep discount to fair value significantly limits the strategic options for the business by imposing a noncompetitive cost of capital.

| TDS shares o/s | 108.1 | |||||||

| Market Price (5/10/13) | $ | 22.60 | ||||||

| TDS - Equity Market Cap | 2,443 | |||||||

| Less: value of TDS’ stake in USM (mark-to-market) | ||||||||

| USM shares owned by TDS (84.6%) | 70.8 | |||||||

| USM market price (5/10/13) | $ | 37.87 | (2,681 | ) | ||||

| Add: Net debt & preferred (ex-USM) | 482 | |||||||

| TDS Telecom implied segment value | 244 | |||||||

| 2012A EBITDA - TDS Telecom | 238 | |||||||

| Implied Valuation Multiple | 1.03 | |||||||

Operating performance has lagged behind peers

EBITDA margin at TDS’ largest business, U.S. Cellular, declined from 23.9% in 2008 to 18.1% in 2012 and was significantly lower than peer average in each of the last five years. (Peer group includes Verizon Wireless, AT&T Mobility, Sprint, T-Mobile USA, MetroPCS, Leap Wireless – see details below).

| Wireless EBITDA margin | 2008 | 2009 | 2010 | 2011 | 2012 | |||||||||||||||

| US Cellular | 23.9 | % | 22.0 | % | 18.8 | % | 19.6 | % | 18.1 | % | ||||||||||

| Peer average | 28.5 | % | 27.6 | % | 28.0 | % | 26.2 | % | 27.5 | % | ||||||||||

| Wireless EBITDA margin | 2008 | 2009 | 2010 | 2011 | 2012 | |||||||||||||||

| Verizon Wireless | 39.3 | % | 39.5 | % | 41.1 | % | 37.8 | % | 39.2 | % | ||||||||||

| AT&T Mobility | 35.9 | % | 37.1 | % | 37.1 | % | 34.2 | % | 35.5 | % | ||||||||||

| Sprint Nextel | 22.3 | % | 18.7 | % | 15.8 | % | 14.1 | % | 12.7 | % | ||||||||||

| T-Mobile USA | 27.0 | % | 26.1 | % | 27.8 | % | 26.6 | % | 28.9 | % | ||||||||||

| MetroPCS | 27.0 | % | 26.1 | % | 27.8 | % | 26.6 | % | 29.6 | % | ||||||||||

| Leap Wireless | 19.3 | % | 17.8 | % | 18.1 | % | 17.8 | % | 18.9 | % | ||||||||||

| Peer average | 28.5 | % | 27.6 | % | 28.0 | % | 26.2 | % | 27.5 | % | ||||||||||

TDS has historically failed to pursue a coherent or shareholder-friendly strategy

In 2007, TDS received an approximately $100/share buyout offer from a “well-resourced, strategic acquirer” as disclosed in a 13D/A filed by Southeastern Asset Management, Inc. with the SEC on May 15, 2008. This offer was rejected by the Board and neither the offer nor any of the Board’s deliberations were disclosed to shareholders by TDS. Southeastern highlighted the Board’s “defeatist attitude” in their filing. TDS stock has declined 58% since 2007 as shown in the chart above which is based on information disclosed in the Company’s 2012 Annual Report.

In 2005, TDS issued special common shares to use as a currency for acquisition to build the business. These special common shares with limited voting rights traded at a persistent discount to the common shares, and we believe limited – rather than added to – TDS’ strategic options due to the resulting uncompetitive cost of capital and reluctance of investors to accept disjointed economic and voting interests. These special common shares were retired in 2012 as the strategic direction changed towards divestitures and entry into new businesses where the Company lacks experience, such as managed hosting and now cable and is at a competitive disadvantage.

Yet, TDS’ poor capital structure persists. TDS has Series A Common Shares with 10 votes per share, whose holders elect 8 out of the 12 directors that comprise the entire Board. The aggregate percentage voting power of the Series A Common Shares on matters other than the election of directors is capped at 56.7%. TDS’ Common Shares with 1 vote per share, elect only 4 out of the 12 directors. The aggregate percentage voting power of the Common Shares on matters other than the election of directors is capped at 43.3%.

A voting trust representing the ownership interests of the Carlson family (the “TDS Voting Trust”) owns 6.8 million Series A Common Shares (out of 7.2 million outstanding) and 6.1 million Common Shares (out of 100.9 million outstanding). The TDS Voting Trust’s ownership represents an 11.9% economic interest, 56.4% voting power in matters other than election of directors (with 53.7% related to ownership of Series A Common Shares and 2.6% related to ownership of Common Shares), 94.8% voting power in the election of 8 out of 12 directors, and 6.1% voting power in election of the other 4 directors.

In 2012, a shareholder proposal to reconstitute TDS’ capital structure so that each share of outstanding voting security has one vote per share was supported by an overwhelming majority of the Common Shares with 72.87% of the total non-TDS Voting Trust votes cast in favor. Further, in 2012, Institutional Shareholder Services (ISS) expressed “High Concern” over Board Structure as TDS scored ZERO out of 100 as a governance risk indicator. The Company has failed to adopt the proposal.

Now is the time to bring a fresh perspective to the Board

The issues highlighted above, which demonstrate underperformance related to stock price, operational performance, destructive capital allocation decisions, and governance, have all persisted under the watch of the current Board that TDS is asking you to re-elect.

We are seeking to add to the Board a single new member with a fresh perspective, focus on shareholder interests, and capital allocation experience. Ryan J. Morris, as Chairman of the Board of two public companies, has demonstrated an ability to drive significant board and business change for the better while avoiding disruption to important operations.

We urge you to vote on the BLUE proxy card at www.proxyvote.com

Thank you,

/s/ Mario Gabelli

Mario Gabelli