UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

| | ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| | x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2014 |

OR

| | ¨ | TRANSITIONAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | |

| | ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | Date of event requiring this shell company report __________ |

For the transition period from __________ to __________

Commission file number: 001-34427

TRI-TECH HOLDING INC.

(Exact name of Registrant as specified in its charter)

Cayman Islands

(Jurisdiction of incorporation or organization)

#1205 Tower B, Haidian Cultural and Arts Building,

Jia 28 Zhongguancun St. Haidian District, Beijing 100086

People’s Republic of China (Address of principal executive offices) |

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

| Ordinary Shares, $0.001 par value per share | NASDAQ Capital Market |

Securities registered or to be registered pursuant to Section 12(g) of the Act:None.

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:None.

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

As of December 31, 2014, there were 8,470,874 shares of the registrant’s Ordinary Shares outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes¨Nox

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes¨Nox

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YesxNoo

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YesxNoo

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act). (Check one):

| Large accelerated filero | | Accelerated filero | | Non-accelerated filer x |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| US GAAP x | | International Financial Reporting Standards as issued by the International Accounting Standards Boardo | | Othero |

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes oNox

TABLE OF CONTENTS

SPECIAL CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

Certain matters discussed in this report may constitute forward-looking statements for purposes of the Securities Act of 1933, as amended (the “Securities Act”), and the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from the future results, performance or achievements expressed or implied by such forward-looking statements. The words “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “estimate,” and similar expressions are intended to identify such forward-looking statements. Our actual results may differ materially from the results anticipated in these forward-looking statements due to a variety of factors, including, without limitation, those discussed under “Item 3—Key Information—Risk Factors,” “Item 4—Information on the Company,” “Item 5—Operating and Financial Review and Prospects,” and elsewhere in this report, as well as factors which may be identified from time to time in our other filings with the Securities and Exchange Commission (the “SEC”) or in the documents where such forward-looking statements appear. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by these cautionary statements.

The forward-looking statements contained in this report reflect our views and assumptions only as of the date this report is signed. Except as required by law, we assume no responsibility for updating any forward-looking statements.

PART I

Unless the context requires otherwise, references in this report to “Tri-Tech,” “we,” “us,” “our company,” and “our” refer to Tri-Tech Holding Inc. (“TRIT” when referring solely to our Cayman Islands listing company); our wholly-owned subsidiary, Tri-Tech International Investment Inc., a British Virgin Islands company (“TTII”); Tri-Tech Infrastructure, LLC, a Delaware limited liability company (“TIS”) and Tri-Tech (Beijing) Co., Ltd., a Chinese limited liability company (“TTB”), which are TTII’s wholly-owned subsidiaries; Tri-Tech Beijing Co., Ltd. (Buxar) (“Buxar”), Tri-Tech Beijing Co., Ltd. (Begusarai) (“Begusarai”), and Tri-Tech Beijing Co., Ltd. (Hajipur) (“Hajipur”), which are TTB’s project offices registered in India; TIS’s partly-owned subsidiaries, Tri-Tech Infrastructure (India) Pvt., Ltd., an Indian limited liability company (“TII”) and Tri-tech India Pvt., Ltd., an Indian limited liability company (“WOS”); TTB’s contractually controlled affiliates Tranhold Environmental (Beijing) Tech Co., Ltd. (“Tranhold”), Beijing Zhi Shui Yuan Water Tech Co., Ltd. (“Zhi Shui Yuan”), which was deconsolidated on October 28, 2014, and Beijing Yanyu Water Tech Co., Ltd. (“Yanyu”), which was deconsolidated on October 28, 2014), which are all Chinese limited liability companies; Ordos Tri-Tech Anguo Investment Co., Ltd. (“TTA”), Buerjin Tri-Tech Industrial Co. Ltd. (“Buerjin”), and Xushui Tri-Tech Sheng Tong Investment Co., Ltd. (“Xushui”), which are all partly-owned subsidiaries of TTB, and Tianjin Baoding Environmental Technology Co., Ltd. (“Baoding”), a wholly-owned subsidiary of TTB, Beijing Huaxia Yuanjie Water Technology Co., Ltd. (“Yuanjie”), which was deconsolidated on April 21, 2014, which are all partly-owned subsidiaries of TTB.

| Item 1. | Identity of Directors, Senior Management and Advisers |

Not applicable for annual reports on Form 20-F.

| Item 2. | Offer Statistics and Expected Timetable |

Not applicable for annual reports on Form 20-F.

| | A. | Selected Financial Data |

The following table presents the selected consolidated financial information for our company. The selected consolidated statements of comprehensive income/(loss) data for the three years ended December 31, 2014, 2013 and 2012 and the consolidated balance sheets data as of December 31, 2014 and 2013 have been derived from our audited consolidated financial statements, which are included in this annual report beginning on page F-1. The selected consolidated statements of comprehensive income/(loss) data for the years ended December 31, 2012, 2011 and 2010 and the selected consolidated balance sheets data as of December 31, 2012, 2011 and 2010 have been derived from our audited consolidated financial statements for the years ended December 31, 2012, 2011 and 2010, which are not included in this annual report. Our historical results do not necessarily indicate results expected for any future periods. The selected consolidated financial data should be read in conjunction with, and are qualified in their entirety by reference to, our audited consolidated financial statements and related notes and “Item 5. Operating and Financial Review and Prospects” below. Our audited consolidated financial statements are prepared and presented in accordance with U.S. GAAP.

TRI-TECH HOLDING INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE (LOSS)/INCOME

| | | For The Years Ended December 31, | |

| | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| Revenues: | | | | | | | | | | | | | | | | | | | | |

| System integration | | | 6,625,239 | | | | 33,871,122 | | | | 57,904,449 | | | | 82,401,473 | | | | 38,821,190 | |

| Hardware products | | | 1,146,336 | | | | 6,775,425 | | | | 4,668,354 | | | | 3,460,610 | | | | 3,202,318 | |

| Software products | | | - | | | | - | | | | - | | | | 10,838 | | | | 1,511,209 | |

| Total revenues | | | 7,771,575 | | | | 40,646,547 | | | | 62,572,803 | | | | 85,872,921 | | | | 43,534,717 | |

| Cost of revenues | | | | | | | | | | | | | | | | | | | | |

| System integration | | | 6,056,377 | | | | 26,925,812 | | | | 44,185,917 | | | | 61,677,449 | | | | 26,061,987 | |

| Hardware products | | | 867,242 | | | | 5,606,154 | | | | 3,328,662 | | | | 2,338,269 | | | | 2,665,441 | |

| Software products | | | - | | | | - | | | | - | | | | 1,734 | | | | 40,316 | |

| Total cost of revenues | | | 6,923,619 | | | | 32,531,966 | | | | 47,514,579 | | | | 64,017,452 | | | | 28,767,744 | |

| Gross profit | | | 847,956 | | | | 8,114,581 | | | | 15,058,224 | | | | 21,855,469 | | | | 14,766,973 | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | |

| Selling and marketing expenses | | | 1,269,470 | | | | 3,141,502 | | | | 4,148,861 | | | | 2,164,363 | | | | 1,271,446 | |

| General and administrative expenses | | | 9,052,952 | | | | 15,304,437 | | | | 13,904,424 | | | | 8,772,446 | | | | 4,562,042 | |

| Research and development expenses | | | 650,461 | | | | 1,832,239 | | | | 174,726 | | | | 179,396 | | | | 279,477 | |

| Total operating expenses | | | 10,972,883 | | | | 20,278,178 | | | | 18,228,011 | | | | 11,116,205 | | | | 6,112,965 | |

| (Loss)/Income from operations | | | (10,124,927 | ) | | | (12,163,597 | ) | | | (3,169,787 | ) | | | 10,739,264 | | | | 8,654,008 | |

| Other expense: | | | | | | | | | | | | | | | | | | | | |

| Other (expense) income, net | | | (727,405 | ) | | | 2,849,738 | | | | 1,958,726 | | | | 607,674 | | | | 7,522 | |

| Interest income | | | 384,786 | | | | 215,776 | | | | 230,020 | | | | 284,950 | | | | 66,091 | |

| Interest expense | | | (948,091 | ) | | | (2,454,522 | ) | | | (2,407,209 | ) | | | (695,475 | ) | | | (3,024 | ) |

| Tax rebates | | | - | | | | - | | | | - | | | | - | | | | 147,595 | |

| Other investment gain/loss | | | - | | | | - | | | | - | | | | (6,985 | ) | | | - | |

| Loss on deconsolidation of BSST | | | - | | | | (3,781,800 | ) | | | - | | | | - | | | | - | |

| Loss on deconsolidation of Yuanjie | | | (348,125 | ) | | | - | | | | - | | | | - | | | | - | |

| Gain on deconsolidation of Yanyu and Zhi Shui Yuan | | | 3,457,327 | | | | - | | | | - | | | | - | | | | - | |

| Fair Value change on contingent investment consideration | | | - | | | | - | | | | 85,558 | | | | (200,000 | ) | | | - | |

| Total other income (expenses) | | | 1,818,492 | | | | (3,170,808 | ) | | | (132,905 | ) | | | (9,836 | ) | | | 218,184 | |

| (Loss) Income before income tax, non-controlling interest, and discontinued operations | | | (8,306,435 | ) | | | (15,334,405 | ) | | | (3,302,692 | ) | | | 10,729,428 | | | | 8,872,192 | |

| Income taxes for continuing operations | | | 403,218 | | | | 29,625 | | | | 1,218,607 | | | | 1,958,864 | | | | 1,424,858 | |

| Net (loss) income from continuing operations | | | (8,709,653 | ) | | | (15,364,030 | ) | | | (4,521,299 | ) | | | 8,770,564 | | | | 7,447,334 | |

| Income from discontinued operations, net | | | 1,186,570 | | | | 531,106 | | | | 1,769,426 | | | | - | | | | - | |

| Net (loss) income | | | (7,523,083 | ) | | | (14,832,924 | ) | | | (2,751,873 | ) | | | 8,770,564 | | | | 7,447,334 | |

| Less: Net (loss) income attributable to noncontrolling interests from continuing operations | | | (1,192,994 | ) | | | (899,764 | ) | | | (487,799 | ) | | | 682,190 | | | | 370,326 | |

| Net (loss) income attributable to Tri-Tech Holding Inc. shareholders | | $ | (6,330,089 | ) | | $ | (13,933,160 | ) | | $ | (2,264,074 | ) | | $ | 8,088,374 | | | $ | 7,077,008 | |

| Net (loss) income | | | (7,523,083 | ) | | | (14,832,924 | ) | | | (2,751,873 | ) | | | 8,770,564 | | | | 7,447,334 | |

| Other comprehensive income | | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation adjustment | | | 1,363,672 | | | | 1,891,873 | | | | 527,672 | | | | 3,052,049 | | | | 1,354,504 | |

| Comprehensive (loss) income | | | (6,159,411 | ) | | | (12,941,051 | ) | | | (2,224,201 | ) | | | 11,822,613 | | | | 8,801,838 | |

| Less: Comprehensive (loss) income attributable to noncontrolling interests | | | (2,592,515 | ) | | | (783,284 | ) | | | (487,799 | ) | | | 880,992 | | | | 362,128 | |

| Comprehensive (loss) income attributable to Tri-Tech Holding Inc. | | $ | (3,566,896 | ) | | $ | (12,157,767 | ) | | $ | (1,736,402 | ) | | $ | 10,941,621 | | | $ | 8,439,710 | |

| Weighted average number of ordinary shares outstanding: | | | | | | | | | | | | | | | | | | | | |

| Basic | | | 8,449,774 | | | | 8,342,056 | | | | 8,211,089 | | | | 8,142,867 | | | | 7,102,436 | |

| Diluted | | | 8,449,774 | | | | 8,342,056 | | | | 8,211,089 | | | | 8,238,291 | | | | 7,208,969 | |

| Net (loss) income attributable to Tri-Tech Holding Inc. shareholders per share are: | | | | | | | | | | | | | | | | | | | | |

| Net (loss) income from continuing operations per share - basic | | $ | (0.89 | ) | | $ | (1.73 | ) | | $ | (0.49 | ) | | $ | 0.99 | | | $ | 1.00 | |

| Net (loss) income from continuing operations per share - diluted | | $ | (0.89 | ) | | $ | (1.73 | ) | | $ | (0.49 | ) | | $ | 0.98 | | | $ | 0.98 | |

| Net income from discontinued operations per share – basic and diluted | | $ | 0.14 | | | $ | 0.06 | | | $ | 0.21 | | | $ | - | | | $ | - | |

| Net (loss) income per share - basic | | $ | (0.75 | ) | | $ | (1.67 | ) | | $ | (0.28 | ) | | $ | 0.99 | | | $ | 1.00 | |

| Net (loss) income per share - diluted | | $ | (0.75 | ) | | $ | (1.67 | ) | | $ | (0.28 | ) | | $ | 0.98 | | | $ | 0.98 | |

| | | As of December 31, | |

| | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| Consolidated Balance Sheets Data: | | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 453,934 | | | $ | 3,935,587 | | | $ | 8,098,657 | | | $ | 11,935,746 | | | $ | 23,394,995 | |

| Restricted cash | | $ | 5,544,794 | | | $ | 3,221,411 | | | $ | 4,352,443 | | | $ | 2,087,920 | | | $ | 1,505,617 | |

| Long-term restricted cash | | $ | - | | | $ | 2,930,512 | | | $ | 3,464,524 | | | $ | 2,541,958 | | | $ | 203,418 | |

| Total Assets | | $ | 107,078,700 | | | $ | 136,799,889 | | | $ | 156,678,066 | | | $ | 138,650,678 | | | $ | 82,762,703 | |

| Total Liabilities | | $ | 49,725,417 | | | $ | 69,023,741 | | | $ | 76,771,967 | | | $ | 57,903,753 | | | $ | 18,441,637 | |

| Total Tri-Tech Holding Inc. shareholders' equity | | $ | 55,129,053 | | | $ | 62,959,403 | | | $ | 74,306,070 | | | $ | 74,729,186 | | | $ | 62,293,149 | |

| Total equity | | $ | 57,353,283 | | | $ | 67,776,148 | | | $ | 79,906,099 | | | $ | 80,746,925 | | | $ | 64,321,066 | |

Exchange Rate Information

Our business ranges from Asia to America, however, periodic reports made to shareholders will include current period amounts translated into U.S. dollars using the then current exchange rates for the convenience of the readers. The conversion of RMB into U.S. dollars and of INR into U.S. dollars in this annual report is based on the historical noon buying rates available on the OANDA Corporation website (www.Oanda.com).

The following table sets forth information concerning exchange rates for the periods indicated.

| | | Period-End | | | Average | |

| | | RMB per U.S. Dollar | | | INR per U.S. Dollar | | | RMB per U.S. Dollar | | | INR per U.S. Dollar | |

| 2014 | | | 6.1460 | | | | 63.6595 | | | | 6.1457 | | | | 60.9596 | |

| 2013 | | | 6.1122 | | | | 61.8488 | | | | 6.1943 | | | | 58.5169 | |

| 2012 | | | 6.3011 | | | | 54.8390 | | | | 6.3116 | | | | 53.6119 | |

| 2011 | | | 6.3009 | | | | - | | | | 6.4588 | | | | - | |

| 2010 | | | 6.6227 | | | | - | | | | 6.7695 | | | | - | |

| | B. | Capitalization and Indebtedness |

Not applicable for annual reports on Form 20-F.

| | C. | Reasons for the Offer and Use of Proceeds |

Not applicable for annual reports on Form 20-F.

Risks Related to Our Business

We are engaged in litigation with our former Chief Executive Officer regarding the company’s relationship with a significant subsidiary.

Mr. Guang (Gavin) Cheng is the former Chief Executive Officer of the Company and current Legal Representative of BSST. On November 11, 2013, Mr. Cheng took possession of BSST’s corporate chops and other materials without the Company’s permission. Each legally registered Company in China is required to have company chops, which have to be registered with the Public Security Bureau (“PSB”). The company chops are required on all official documents such as contracts, bank account applications and labor contracts. The company chops legally represent a company in dealing with third parties and are therefore valid even without a signature.

The Company is now engaged in litigation with Mr. Cheng who has intended to challenge the validity of the contractual relationship by which the Company controlled BSST. If the litigation has an unfavorable outcome for us, it could have a negative impact on our business operations and financial condition.

We have experienced negative cash flow recently, and we may not be able to secure additional financing to meet our future capital needs.

We currently rely on cash flow from operations, cash on hand, and bank financing to fund our operating and capital needs. As reflected in the Company’s consolidated financial statements, the Company had a net loss and negative cash flows from operating activities for the year ended December 31, 2014. But as of December 31, 2014, the Company’s current assets exceed current liabilities by $15.3 million. Given our financial condition, we may be unable to secure financing on terms acceptable to us, or at all, at the time when we need such funding. Our inability to raise additional funds on a timely basis would make it difficult for us to achieve our business objectives and would have a negative impact on our business, financial condition and results of operations.

We operate in a very competitive industry and may not be able to maintain our revenues and profitability.

Our competitors include both domestic companies and international companies. Some of these competitors have significantly greater financial and marketing resources and name recognition than we do. As the Chinese government continues to dedicate funds to our industry, more domestic and international competitors may enter the market. We believe that while the Chinese market for our services is subject to intense competition, the number of large competitors is relatively limited, and, as such, while we effectively compete in our market, our competitors occupy a substantial competitive position. If the Chinese government continues to allocate spending on environmental protection and continues to allocate funds to the water protection industry, the number of our competitors will likely increase and there can be no assurance that we will be able to effectively compete in our industry.

In addition, as the Chinese government increases spending in the water protection industry, our competitors may devote more resources to introducing new water protection systems. If these new systems are more attractive to customers than the systems we currently provide or are able to develop, we may be unable to attract new customers and may lose market share. We believe that competition may become more intense as more integrated automation service providers, including Chinese/foreign joint ventures, become qualified to conduct business. We believe it is likely that competitors will devote significant resources to competing more effectively in our market as the Chinese government continues to emphasize spending in the environmental protection and specifically water protection industry. We cannot assure you that we will be able to compete successfully against any new or existing competitors, or against any new water protection systems our competitors may implement. All of these competitive factors could have a material adverse effect on our revenues and profitability.

Our revenues are highly dependent on several large customers that vary from year to year.

We operate on a project-by-project basis, and this particular nature of our operation does not typically involve long-term relationships with our customers. We negotiate with various government agencies, municipalities, industrial enterprises and/or their primary contractors in order to secure and undertake our various contracts. Our major customers usually account for a high percentage of our total sales. Our top five customers collectively represented 30%, 18% and 53% of our total revenue for the years ended December 31, 2014, 2013 and 2012, respectively. While we do not expect our revenues to be dependent on these particular customers in the future, we do expect our revenues to be dependent upon several large projects each year. Disruption, delay, or loss of any such project could materially harm our operations.

Our customers may make claims against us and/or terminate our services in whole or in part prematurely should we fail to implement projects which fully satisfy their requirements and expectations.

Failure to implement projects which fully satisfy the requirements and expectations of our customers or defective system structure or products as a result of design or workmanship or due to acts of nature may lead to claims against us and/or termination of our services in whole or in part prematurely. This may arise from a variety of factors including unsatisfactory design or implementation, staff turnover, human errors or misinterpretation of and failure to adhere to regulations and procedures. This may adversely affect our profits and reputation.

We are subject to risks associated with technological changes.

We may not be able to protect our processes, technologies and systems against claims by other parties. Although we have 1 product patent and 14 software copyrights in respect of the processes, technologies and systems we use frequently in our systems, we have not purchased or applied for any patents other than these as we are of the view that it may not be cost-effective to do so. For such other processes, technologies and systems for which we have not applied for or purchased or been licensed to use patents or copyrights, we may have no legal recourse to protecting our rights in the event that they are replicated by other parties. If our competitors are able to replicate our processes, technologies and systems at lower costs, we may lose our competitive edge and our profitability will be adversely affected.

We may face claims for infringement of third-party intellectual property rights.

Although we develop our software products, each is based upon middleware developed by third parties, including Microsoft, Oracle and Intouch. We integrate this technology, licensed by ourselves or our customers from third parties, in our software products. If we or our customers, as applicable, are unable to continue to license any of this third party software, or if the third party licensors do not adequately maintain or update their products, we would face delays in the releases of our software until equivalent technology can be identified, licensed or developed, and integrated into our software products. These delays, if they occur, could harm our business, operating results and financial condition.

There has been a substantial amount of litigation in the software and Internet industries regarding intellectual property rights. It is possible that in the future third parties may claim that our current or potential future software solutions infringe their intellectual property. We expect that software product developers will increasingly be subject to infringement claims as the number of products and competitors in our industry segment grows and the functionality of products in different industry segments overlap. In addition, we may find it necessary to initiate claims or litigation against third parties for infringement of our proprietary rights or to protect our trade secrets. Although we may disclaim certain intellectual property representations to our customers, these disclaimers may not be sufficient to fully protect us against such claims. Any claims, with or without merit, could be time consuming, result in costly litigation, cause product shipment delays or require us to enter into royalty or license agreements. Royalty or licensing agreements, if required, may not be available on terms acceptable to us or at all, which could have a material adverse effect on our business, operating results and financial condition.

We may need additional capital in the future, and we may be unable to obtain such capital in a timely manner or on acceptable terms, or at all.

In order for us to grow, remain competitive, develop new products, and expand our distribution network, we may require additional capital in the future. Our ability to obtain additional capital in the future is subject to a variety of uncertainties, including:

| | · | our future financial condition, results of operations and cash flows; |

| | · | general market conditions for capital raising activities by water treatment companies and other related companies; and |

| | · | economic, political and other conditions in China and elsewhere. |

We may be unable to obtain additional capital in a timely manner or on acceptable terms or at all. Furthermore, the terms and amount of any additional capital raised through issuances of equity securities may result in significant shareholder dilution.

Foreign Operational Risks

Adverse changes in economic and political policies of the PRC government could have a material adverse effect on the overall economic growth of China, which could adversely affect our business.

Substantially all of our business operations are conducted in China. Accordingly, our results of operations, financial condition and prospects are subject to economic, political and legal developments in China. China’s economy differs from the economies of most developed countries in many respects, including with respect to the amount of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources.

While the PRC economy has grown more rapidly in the past 30 years than the world economy as a whole, growth has been uneven across different regions and among various economic sectors of China. The PRC government has implemented various measures to encourage economic development and guide the allocation of resources. Some of these measures benefit the overall PRC economy, but may also have a negative effect on us. For example, our financial condition and results of operations may be adversely affected by government control over capital investments or changes in tax regulations that are applicable to us. Since early 2004, the PRC government has implemented certain measures to control the pace of economic growth. Such measures may cause a decrease in the level of economic activity in China, which in turn could adversely affect our results of operations and financial condition.

We may be subject to foreign exchange controls in the PRC.

Our PRC subsidiary and affiliates are subject to PRC rules and regulations on currency conversion. In the PRC, the State Administration for Foreign Exchange (“SAFE”) regulates the conversion of the RMB into foreign currencies. Currently, foreign investment enterprises (“FIEs”) are required to apply to SAFE for “Foreign Exchange Registration Certificate for FIEs.” TTB is a FIE. With such registration certifications (which need to be renewed annually), FIEs are allowed to open foreign currency accounts including the “recurrent account” and the “capital account.” Currently, conversion within the scope of the “recurrent account” can be effected without requiring the approval of SAFE. However, conversion of currency in the “capital account” (e.g., for capital items such as direct investments, loans, and securities) still requires the approval of SAFE.

If the investing public’s perception of smaller companies from China worsens, our share price may decrease and we may have difficulty accessing U.S. capital markets.

In recent years, a number of smaller companies from China have had the trading of their securities in the United States halted, delisted or otherwise affected for a variety of reasons. As a result, investors may be concerned about purchasing the securities of any smaller Chinese company. To the extent the investing community is reluctant to purchase such securities or discounts the value of the securities of companies that operate primarily or exclusively in China, our share price may also be adversely affected, regardless of whether there are specific concerns about our company. This could not only harm our share price but could also make it more difficult for us to conduct any future offering of our securities at a price that is acceptable to our company or at all.

We do not have business interruption, litigation or natural disaster insurance.

The insurance industry in China is still at an early stage of development. In particular PRC insurance companies offer limited business products. As a result, we do not have any business liability or disruption insurance coverage for our operations in China. Any business interruption, litigation or natural disaster may result in our business incurring substantial costs and the diversion of resources.

The Chinese enterprise income tax law will affect tax exemptions on the dividends we receive and increase the enterprise income tax rate applicable to us.

We are a holding company incorporated under the laws of the Cayman Islands. We conduct substantially all of our business through our wholly owned Chinese subsidiaries and we derive all of our income from these subsidiaries. Prior to January 1, 2008, dividends derived by foreign legal persons from business operations in China were not subject to the Chinese enterprise income tax.

On March 16, 2007, the National People’s Congress of the PRC passed the PRC Enterprise Income Tax Law (the “EIT Law”), which took effect on January 1, 2008. Such tax exemptions ceased with the effectiveness of the EIT Law.

Under the EIT Law, if we are deemed to be a non-resident enterprise for Chinese tax purposes, a withholding tax at the rate of 10% would be applicable to any dividends paid by our Chinese subsidiaries to us. However, if we are deemed to have a “de facto management organization” in China, we would be classified as a resident enterprise for Chinese tax purposes and thus would be subject to an enterprise income tax rate of 25% on all of our income. At present, the Chinese tax authority has not issued any guidance on the application of the EIT Law and its implementing rules on non-Chinese enterprises or group enterprise controlled entities whose structures are like ours. As a result, it is unclear what factors will be used by the Chinese tax authorities to determine whether we are a “de facto management organization” in China. However, as substantially all members of our management team are located in China, we may be deemed to be a resident enterprise and therefore subject to an enterprise income tax rate of 25% on our worldwide income, with the possible exclusion of dividends received directly from another Chinese tax resident. As a result of such changes, our historical operating results will not be indicative of our operating results for future periods and the value of our shares may be adversely affected.

Governmental control of currency conversion may affect the value of your investment.

The PRC government imposes controls on the convertibility of the Renminbi into foreign currencies and, in certain cases, the remittance of currency out of China. We receive the majority of our revenues in Renminbi. Under our current corporate structure, our income is derived from payments from TTB. Shortages in the availability of foreign currency may restrict the ability of TTB to remit sufficient foreign currency to pay dividends or other payments to us, or otherwise satisfy their foreign currency denominated obligations. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from trade-related transactions, can be made in foreign currencies without prior approval from SAFE by complying with certain procedural requirements. However, approval from appropriate government authorities is required where Renminbi is to be converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of bank loans denominated in foreign currencies. The PRC government may also at is discretion restrict access in the future to foreign currencies for current account transactions. If the foreign exchange control system prevents us from obtaining sufficient foreign currency to satisfy our currency demands, we may not be able to pay dividends in foreign currencies to our shareholders.

Fluctuation of the Renminbi could materially affect our financial condition and results of operations.

The value of the Renminbi against the U.S. dollar and other currencies may fluctuate and is affected by, among other things, changes in political and economic conditions. On July 21, 2005, the PRC government changed its decade-old policy of pegging the value of the Renminbi to the U.S. dollar. Under the new policy, the Renminbi is permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. This change in policy has resulted in an appreciation of the Renminbi against the U.S. dollar. While the international reaction to the Renminbi revaluation has generally been positive, there remains significant international pressure on the PRC government to adopt an even more flexible currency policy, which could result in a further and more significant appreciation of the Renminbi against the U.S. dollar. Any significant revaluation of Renminbi may materially and adversely affect our cash flows, revenues, earnings and financial position, and the value of, and any dividends payable on, our common shares in U.S. dollars. For example, an appreciation of Renminbi against the U.S. dollar would make any new Renminbi denominated investments or expenditures more costly to us, to the extent that we need to convert U.S. dollars into Renminbi for such purposes.

If PRC law were to phase out the preferential tax benefits currently being extended to certified high technology companies or if we were to fail to be certified to receive such a benefit, we would have to pay more taxes, which could have a material and adverse effect on our financial condition and results of operations.

Under PRC laws and regulations, a company may enjoy preferential tax benefits if it is certified as a high technology enterprise. As a certified high technology enterprise, we are subject to an enterprise income tax rate of 15% tax rate so long as we continue to be so certified. If the PRC law were to phase out preferential tax benefits currently granted to certified high technology enterprises or if we were to fail to be certified to receive such a benefit, we would be subject to the standard statutory tax rate, which currently is 25%.

If relations between the United States and China worsen, our share price may decrease and we may have difficulty accessing U.S. capital markets.

At various times during recent years, the United States and China have had disagreements over political and economic issues. Controversies may arise in the future between these two countries. Any political or trade controversies between the United States and China could adversely affect the market price of our common shares and our ability to access U.S. capital markets.

The PRC legal system embodies uncertainties that could limit the legal protections available to you and us.

The PRC legal system is a civil law system based on written statutes. Unlike common law systems, it is a system in which decided legal cases have limited precedential value. In 1979, the PRC government began to promulgate a comprehensive system of laws and regulations governing economic matters in general. The overall effect of legislation over the past three decades has significantly increased the protections afforded to various forms of foreign investment in China. Our PRC operating subsidiary, TTB, is a foreign-invested enterprise and is subject to laws and regulations applicable to foreign investment in China as well as laws and regulations applicable to foreign-invested enterprises. These laws and regulations change frequently, and their interpretation and enforcement involve uncertainties. For example, we may have to resort to administrative and court proceedings to enforce the legal protections that we enjoy either by law or contract. However, since PRC administrative and court authorities have significant discretion in interpreting and implementing statutory and contractual terms, it may be more difficult to evaluate the outcome of administrative and court proceedings and the level of legal protection we enjoy than in more developed legal systems. These uncertainties may also impede our ability to enforce the contracts we have entered into. As a result, these uncertainties could materially and adversely affect our business and operations.

Recent PRC regulations relating to offshore investment activities by PRC residents may increase the administrative burden we face and create regulatory uncertainties that could restrict our overseas and cross-border investment activity, and a failure by our shareholders who are PRC residents to make any required applications and filings pursuant to such regulations may prevent us from being able to distribute profits and could expose us and our PRC resident shareholders to liability under PRC law.

In October 2005, SAFE promulgated regulations that require PRC residents and PRC corporate entities to register with and obtain approvals from relevant PRC government authorities in connection with their direct or indirect offshore investment activities. These regulations apply to our shareholders who are PRC residents in connection with our prior and any future offshore acquisitions.

The October 2005 SAFE regulation required registration by March 31, 2006 of direct or indirect investments previously made by PRC residents in offshore companies prior to the implementation of the Notice on Issues Relating to the Administration of Foreign Exchange in Fund-Raising and Reverse Investment Activities of Domestic Residents Conducted via Offshore Special Purpose Companies on November 1, 2005. If a PRC shareholder with a direct or indirect stake in an offshore parent company fails to make the required SAFE registration, the PRC subsidiaries of such offshore parent company may be prohibited from making distributions of profit to the offshore parent and from paying the offshore parent proceeds from any reduction in capital, share transfer or liquidation in respect of the PRC subsidiaries. Furthermore, failure to comply with the various SAFE registration requirements described above could result in liability under PRC law for foreign exchange evasion.

We previously notified and urged our shareholders, and the shareholders of the offshore entities in our corporate group, who are PRC residents to make the necessary applications and filings, as required under this regulation. However, as these regulations are relatively new and there is uncertainty concerning their reconciliation with other approval requirements, it is unclear how they, and any future legislation concerning offshore or cross-border transactions, will be interpreted, amended and implemented by the relevant government authorities. While we believe that these shareholders submitted applications with local SAFE offices, some of our shareholders may not comply with our request to make or obtain any applicable registrations or approvals required by the regulation or other related legislation. The failure or inability of our PRC resident shareholders to obtain any required approvals or make any required registrations may subject us to fines and legal sanctions, prevent us from being able to make distributions or pay dividends, as a result of which our business operations and our ability to distribute profits to you could be materially and adversely affected.

Because our operations are located in China, information about our operations are not readily available from independent third-party sources.

Because TTB is based in China, our shareholders may have greater difficulty in obtaining information about it on a timely basis than would shareholders of a U.S.-based company. TTB’s operations will continue to be conducted in China and shareholders may have difficulty in obtaining information about it from sources other than TTB itself. Information available from newspapers, trade journals, or local, regional or national regulatory agencies such as issuance of construction permits and contract awards for development projects will not be readily available to shareholders and, where available, will likely be available only in Chinese. Shareholders will be dependent upon management for reports of their progress, development, activities and expenditure of proceeds.

| Item 4. | Information on the Company |

| A. | History and Development of the Company |

Tri-Tech Holding Inc. (“TRIT”), incorporated in the Cayman Islands, through its subsidiaries and contractually-controlled variable interest entities (“VIE”) (collectively the “Company”), provides self-manufactured, proprietary and third-party products, system integration and other services.

Since its incorporation in 2002, the Company has successfully implemented more than 500 projects in 30 provinces, municipalities and autonomous regions throughout China. The Company aims to provide reliable and affordable solutions to complex environmental challenges faced by governments and private enterprises. Its major clients are a combination of government agencies, municipalities, and industrial companies located throughout China and other countries such as the U.S. and India.

Tri-Tech is an innovative provider of consulting, engineering, procurement, construction and technical services. The Company supports government, state-owned entities and commercial clients by providing water and wastewater treatment, water resource management, and industrial emission and, prior to November 27, 2013, safety control solutions. As described in greater detail below, effective November 27, 2013, Tri-Tech deconsolidated Beijing Satellite S&T Co., Ltd. (“BSST”) due to a loss of control of BSST as of such date. With intellectual properties and capable employees in China, the U.S. and India, Tri-Tech’s capabilities span the cycle of innovation from development through implementation and operation.

For the year ended December 31, 2014, the Company has three reportable operating segments. The three reportable operating segments are:

1. Water, Wastewater Treatment and Municipal Infrastructure;

2. Water Resource Management System and Engineering Service; and

3. Industrial Pollution Control and Safety.

As of October 28, 2014, operations in the Water Resource Management System and Engineering Service segment ceased.

Through its subsidiaries, variable interest entity (“VIE”) and joint venture partnership, the Company:

| | 1. | Provides proprietary and third-party products, integrated systems and other services for water resource monitoring, development, utilization and protection; |

| | 2. | Designs water works and customized facilities for reclaiming and reusing water and sewage treatment for China’s municipalities; |

| | 3. | Designs systems that track natural waterway levels for flood and drought control, monitor groundwater quality, manage water resources and irrigation systems; and |

| | 4. | Provides systems for volatile organic compound (“VOC”) abatement, odor control, water and wastewater treatment, water recycling facilities design, project engineering, procurement and construction for petroleum refineries, petrochemical and power plants as well as clean production technologies for oil and gas field exploration and pipelines. Prior to the deconsolidation of BSST, the Company also provided safety-related technologies for these industries. |

Recent Developments

On February 10, 2015, TTB entered into a joint venture agreement (the “JV Agreement”) with Richmond Biosciences Private Limited, a company incorporated under the laws of India (“RBPL”) in order to manage TTB’s projects (the “Projects”) awarded on October 19, 2011 to TTB by the Bihar Urban Infrastructure Development Corporation Limited (“BUIDCO”). According to the JV Agreement, RBPL and TTB will create a joint venture pursuant to which TTB contributes $4 million and receives 40% of the share capital of such joint venture, and RBPL contributes $6 million and receives 60% of the share capital of such joint venture, subject to adjustment upon completion of due diligence. TTB’s contribution will consist of efforts and expenditures to date made in regard to the Projects. RBPL’s contribution will consist of cash and replacement and the cancellation of certain guarantees made by TTB.

Subsequently, RBPL and TTB held a number of meetings to discuss details regarding to the schedule of investments committed by RBPL as well as the cancellation of certain guarantees made by TTB. Both parties failed to agree on such matters. On April 28, 2015, RBPL proposed to withdraw from the joint venture and terminate the JV Agreement. Despite management’s reasonable assurance that termination of the joint venture will not have a material adverse impact on the Projects, management is still exercising due diligence in evaluating RBPL’s proposal to terminate the joint venture.

On August 1, 2014, TTB entered into the Xushui Dawangdian Waste Water Processing Factory Project Agreement (the "Project Agreement") with Beijing Liyuanshida Technology Co., Ltd., a company incorporated under the laws of China ("Liyuanshida") in order to arrange for payment for the ownership interests in Xushui. The parties entered into an Amendment to the Project Agreement revising certain terms (the "Amendment") on May 5, 2015. On July 22, 2015, the State Administration of Industry and Commerce ("SAIC") approved the change of registered shareholders and legal representative of Xushui. As of August 10, 2015, Liyuanshida has paid RMB 25,632,000 to TTB for 100% of the equity interests in Xushui, and the outstanding amount Liyuanshida owed was RMB 1,000,000.

As of December 31, 2014, and during the period from that date to the effective date of our response, two subsidiaries of Tri-Tech, Beijing Satellite Science & Technology Co. ("BSST") and Tranhold Environmental (Beijing) Tech Co. Ltd. ("Tranhold"), are involved in two separate litigation matters:

| A. | BSST vs. Guang (Gavin) Cheng |

BSST filed a lawsuit against Mr. Guang (Gavin) Cheng in the Beijing Chaoyang People's Court on March 12, 2014, demanding Mr. Cheng to return the company chops and business licenses of BSST. A hearing was held on April 16, 2015, with both parties present. The key issues of this case are whether Mr. Warren Zhao is entitled to file this case against Mr. Cheng on behalf of BSST and whether the company chops and business license are under the control of Mr. Cheng. We claimed Mr. Zhao has the right to vote on behalf of Mr. Cheng as shareholder of BSST based on the Proxy Agreement and was appointed as the legal representative of BSST by the Resolution of Shareholders' Meeting on December 25, 2013. However, Mr. Cheng argued that the Proxy Agreement is invalid and submitted a new Resolution of Shareholders' Meeting confirming Mr. Cheng as the legal representative of BSST. Both parties have declined to seek an out-of-court settlement and the court will make any final determination.

| B. | Tranhold vs. Guang (Gavin) Cheng |

Tranhold filed a lawsuit against Mr. Cheng in the Beijing Chaoyang People's Court on January 6, 2014 demanding Mr. Cheng to restitute BSST’s 42% equity interest held by him to Tranhold. Mr. Cheng raised an objection to jurisdiction of the Beijing Chaoyang People's Court on July 30, 2014 and appealed to the Beijing Third Intermediate Court on November 6, 2014. A hearing was held on March 10, 2015 with both parties present. During the hearing, Tranhold claimed that appropriate contracts were never created and thus any transferred equity interest shall be returned to Tranhold. Mr. Cheng has argued that such contracts were created and there is no legal basis to return any equity interests to Tranhold. Both parties have declined to seek an out-of-court settlement and the court will make any final determination.

A class action lawsuit was filed in the United States District Court for the Southern District of New York on behalf of all persons who purchased our securities between March 26, 2012 and December 12, 2013. The complaint alleges, among other things, that we made false and misleading statements and/or failed to disclose that we lacked adequate disclosure and internal controls relating to our control over our funds.

On April 6, 2015, the lead plaintiffs in the suit and the Company executed a Stipulation of Settlement (the “Settlement”) subject to approval of the court. In the Settlement, the Company denies any wrongdoing, fault, liability, or damages associated with the claims alleged. If approved by the Court, the Company will pay $975,000 to create a settlement fund for a class of all persons and entities who purchased the Company’s common stock between September 10, 2009 and December 12, 2013 (inclusive of any attorneys’ fees and expenses awarded to counsel for the plaintiffs), and the class action will be dismissed and the claims of putative class members (other than any who exclude themselves from the Settlement) against us and the individual defendants shall be released.

On April 7, 2015, the lead plaintiffs filed an unopposed motion for preliminary approval of the Settlement, seeking an order (a) preliminarily certifying the class for the purposes of Settlement; (b) preliminarily approving the terms of the Settlement; (c) establishing a date for the Settlement hearing to determine the fairness, reasonableness, and adequacy of the Settlement; and (d) providing for notice to Class Members of the hearing on the proposed Settlement and dismissal of the litigation.

On July 8, 2015, the court issued an order preliminarily approving the proposed Settlement and providing for notice to class members. Under the Settlement, the Company shall pay or cause to be paid the $975,000 settlement amount into an escrow account within 20 business days of that order. As negotiated with the Company’s directors and officers liability insurance carrier, the Company is to pay $610,000 of that sum and the insurance carrier to pay $365,000. The court has scheduled a hearing on final approval of the Settlement for October 16, 2015.

Business Segments

Segment 1: Water, Wastewater Treatment and Municipal Infrastructure (“WWTM”)

WWTM focuses on municipal water supply and distribution, wastewater treatment and gray water recycling, through the procurement and construction of proprietary build-transfer (“BT”) processing equipment and processing control systems. The Company also provides municipal facilities engineering and operation management services for related infrastructure construction projects.

Segment 2: Water Resource Management System and Engineering Service (“WRME”)

WRME involves projects relating to water resource management, flood control and forecasting, irrigation systems, and similar ventures through system integration of proprietary and third-party hardware and software products. On October 28, 2014, Yanyu and Zhi Shui Yuan, the only entities of this segment, were divested, and operations in this segment ceased.

Segment 3: Industrial Pollution Control and Safety (“IPCS”)

Equipped with a variety of technologies and products, such as zero liquid discharge (“ZLD”), multi-effect evaporation, multi-flash evaporation, as well as emissions control, IPCS focuses on industrial water, wastewater treatment and seawater desalination for industrial production and pollution control in the petroleum and power industries. Projects in this segment include traditional Engineering Procurement Construction (“EPC”) of equipment and modules, and the operation and maintenance of industrial wastewater treatment plants. For petroleum refineries, petrochemical factories and power plants, the Company provides systematic solutions for volatile organic compound abatement, odor control, water and wastewater treatment, and water recycling. Prior to November 27, 2013 through BSST, the Company also provided safe and clean production technologies for oil and gas field exploration and pipeline transportation.

The following table sets forth our revenues by geographic area:

| | | For the years ended December 31, | |

| | | 2014 | | | 2013 | | | 2012 | |

| Revenues: | | | | | | | | | | | | |

| PRC | | $ | 4,924, 401 | | | $ | 33,175,995 | | | $ | 47,670,986 | |

| India | | | 1,841,374 | | | | 1,758,570 | | | | 10,387,941 | |

| Middle-East | | | (183,606 | ) | | | 2,609,919 | | | | 1,264,625 | |

| U.S. | | | 1,189,406 | | | | 3,102,063 | | | | 3,249,251 | |

| Total: | | $ | 7,771,575 | | | $ | 40,646,547 | | | $ | 62,572,803 | |

Competition

The Company operates in a highly competitive industry characterized by rapid technological development and evolving industrial standards. The Company competes primarily on the basis of technical qualification, customer recognition, product innovation and pricing structure. The Company offers services and products of technological advancement when competing with domestic rivals. The Company competes with multinational competitors by offering a competitive price and a local delivery and distribution. To maintain a competitive edge, the Company provides a comprehensive set of products. If competition in the industry increases, the Company could see these advantages decrease or disappear.

Generally, the Company identifies market opportunities through information available on electronic bulletin boards, newspapers, and through clients and partners the Company worked with in the past. The Company employs sales representatives to follow up on these market opportunities.

Seasonality

The Company’s operating revenues normally tend to fluctuate due to different project stages and U.S. GAAP requirements on revenue recognition. As the scope of its business extended to the civil construction activities, certain weather conditions, including severe winter storms, may result in the temporary suspension of outdoor operations, which can significantly affect the operating results of the affected regions. The operating results for the first quarter often reflect the business slowdown for the Chinese traditional holidays, the Spring Festival, which could last anywhere from 7 days up to one month.

Employees

As of December 31, 2014, the Company employed 136 personnel, 61 of which focused on projects. Of all employees, 42.6% were in technical, 2.9% were in sales, 32.4% were in manufacture, 10.3% were in accounting and finance, and 11.8% were in administration. There were no part-time employees. As required by PRC regulations, we participate in various employee benefit plans that are organized by municipal and provincial governments, including pension, work-related injury benefits, maternity insurance, and medical and unemployment benefit plans. We are required under PRC law to make contributions to the employee benefit plans at specified percentages of the salaries, bonuses, housing funds and certain allowances of our employees, up to a maximum amount specified by the local government from time to time.

Regulations

Restriction on Foreign Ownership

The principal regulation governing foreign ownership of water treatment businesses in the PRC is the 2011 Foreign Investment Industrial Guidance Catalogue (the “Catalogue”). The Catalogue classifies the various industries into four categories: encouraged, permitted, restricted and prohibited. As confirmed by the government authorities, TTB is engaged in an encouraged industry. Such a designation offers businesses distinct advantages. For example, businesses engaged in encouraged industries:

| • | are not subject to restrictions on foreign investment, and, as such, foreign can own a majority in Sino-foreign joint ventures or establish wholly-owned foreign enterprises in the PRC; |

| | • | provided such company has total investment of less than $100 million, the company is subject to regional (not central) government examination and approval which are generally more efficient and less time-consuming; and |

| | • | may import certain equipment while enjoying a tariff and import-stage value-added tax exemption. |

The National Development and Reform Commission and the Ministry of Commerce periodically jointly revise the Foreign Investment Industrial Guidance Catalogue. As such, there is a possibility that our company’s business may fall outside the scope of the definition of an encouraged industry in the future. Should this occur, we would no longer benefit from such designation.

Regulation of Foreign Currency Exchange

The principal regulations governing foreign currency exchange in China are the Foreign Exchange Administration Regulations (1996), as amended, and the Administration Rules of the Settlement, Sale and Payment of Foreign Exchange (1996). Under these regulations, Renminbi are freely convertible for current account items, including the distribution of dividends, interest payments, trade and service-related foreign exchange transactions, but not for most capital account items, such as direct investment, loan, repatriation of investment and investment in securities outside China, unless the prior approval of SAFE or its local counterparts is obtained. In addition, any loans to an operating subsidiary in China that is a foreign invested enterprise, cannot, in the aggregate, exceed the difference between its respective approved total investment amount and its respective approved registered capital amount. Furthermore, any foreign loan must be registered with SAFE or its local counterparts for the loan to be effective. Any increase in the amount of the total investment and registered capital must be approved by the PRC Ministry of Commerce or its local counterpart. We may not be able to obtain these government approvals or registrations on a timely basis, if at all, which could result in a delay in the process of making these loans.

The dividends paid by the subsidiary to its shareholder are deemed shareholder income and are taxable in China. Pursuant to the Administration Rules of the Settlement, Sale and Payment of Foreign Exchange (1996), foreign-invested enterprises in China may purchase or remit foreign exchange, subject to a cap approved by SAFE, for settlement of current account transactions without the approval of SAFE. Foreign exchange transactions under the capital account are still subject to limitations and require approvals from, or registration with, SAFE and other relevant PRC governmental authorities.

Regulation of Dividend Distribution

The principal regulations governing the distribution of dividends by foreign holding companies include the Foreign Investment Enterprise Law (1986), as amended, and the Administrative Rules under the Foreign Investment Enterprise Law (2001).

Under these regulations, foreign investment enterprises in China may pay dividends only out of their retained profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, foreign investment enterprises in China are required to allocate at least 10% of their respective retained profits each year, if any, to fund certain reserve funds unless these reserves have reached 50% of the registered capital of the enterprises. These reserves are not distributable as cash dividends.

Notice 75

On October 21, 2005, SAFE issued Notice 75, which became effective as of November 1, 2005. According to Notice 75, prior registration with the local SAFE branch is required for PRC residents to establish or to control an offshore company for the purposes of financing that offshore company with assets or equity interests in an onshore enterprise located in the PRC. An amendment to registration or filing with the local SAFE branch by such PRC resident is also required for the injection of equity interests or assets of an onshore enterprise in the offshore company or overseas funds raised by such offshore company, or any other material change involving a change in the capital of the offshore company.

Moreover, Notice 75 applies retroactively. As a result, PRC residents who have established or acquired control of offshore companies that have made onshore investments in the PRC in the past are required to complete the relevant registration procedures with the local SAFE branch. Under the relevant rules, failure to comply with the registration procedures set forth in Notice 75 may result in restrictions being imposed on the foreign exchange activities of the relevant onshore company, including the increase of its registered capital, the payment of dividends and other distributions to its offshore parent or affiliate and capital inflow from the offshore entity, and may also subject relevant PRC residents to penalties under PRC foreign exchange administration regulations.

PRC residents who control our company are required to register with SAFE in connection with their investments in us. Such individuals completed this registration in 2007, and 2008, as amended. If we use our equity interest to purchase the assets or equity interest of a PRC company owned by PRC residents in the future, such PRC residents will be subject to the registration procedures described in Notice 75.

Trademark Rights

The PRC Trademark Law, adopted in 1982 and revised in 2001, with its implementation rules adopted in 2002, protects registered trademarks. The Trademark Office of SAIC, handles trademark registrations and grants trademark registrations for a term of ten years.

Regulations on Offshore Parent Holding Companies’ Direct Investment in and Loans to Their PRC Subsidiaries

An offshore company may invest equity in a PRC company, which will become the PRC subsidiary of the offshore holding company after investment. Such equity investment is subject to a series of laws and regulations generally applicable to any foreign-invested enterprise in China, which include the Wholly Foreign Owned Enterprise Law, the Sino-foreign Equity Joint Venture Enterprise Law, the Sino-foreign Contractual Joint Venture Enterprise Law, all as amended from time to time, and their respective implementing rules; the Tentative Provisions on the Foreign Exchange Registration Administration of Foreign-Invested Enterprise; and the Notice on Certain Matters Relating to the Change of Registered Capital of Foreign-Invested Enterprises.

Under the aforesaid laws and regulations, the increase of the registered capital of a foreign-invested enterprise is subject to the prior approval by the original approval authority of its establishment. In addition, the increase of registered capital and total investment amount shall both be registered with SAIC and SAFE.

Shareholder loans made by offshore parent holding companies to their PRC subsidiaries are regarded as foreign debts in China for regulatory purpose, which is subject to a number of PRC laws and regulations, including the PRC Foreign Exchange Administration Regulations, the Interim Measures on Administration on Foreign Debts, the Tentative Provisions on the Statistics Monitoring of Foreign Debts and its implementation rules, and the Administration Rules on the Settlement, Sale and Payment of Foreign Exchange.

Under these regulations, the shareholder loans made by offshore parent holding companies to their PRC subsidiaries shall be registered with SAFE. Furthermore, the total amount of foreign debt that can be borrowed by such PRC subsidiaries, including any shareholder loans, shall not exceed the difference between the total investment amount and the registered capital amount of the PRC subsidiaries, both of which are subject to the governmental approval.

| C. | Organizational structure |

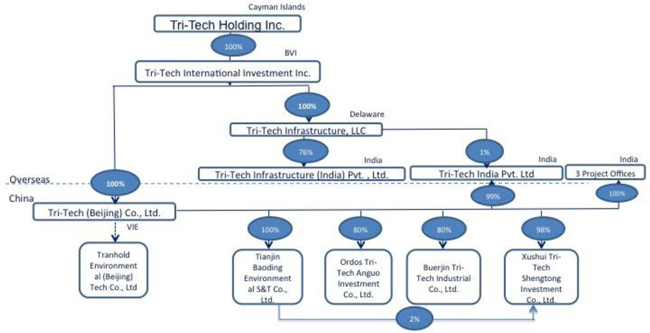

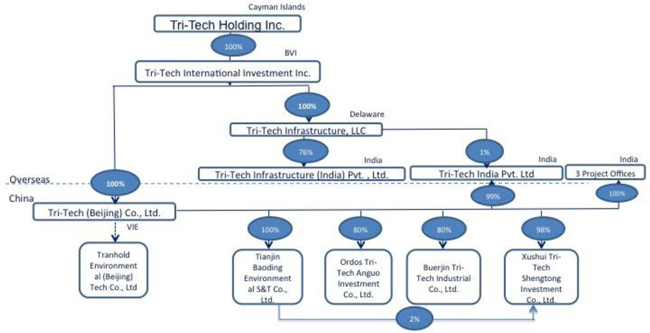

As of December 31, 2014, Tri-Tech Holding Inc., our Cayman Islands holding company has thirteen subsidiaries, a VIE and joint venture partnerships: (1) Tri-Tech International Investment, Inc. (“TTII”), (2) Tri-Tech (Beijing) Co., Ltd. (“TTB”), (3) Tianjin Baoding Environmental Technology Co., Ltd. (“Baoding”), (4) Tranhold Environmental (Beijing) Tech Co., Ltd. (“Tranhold”), (5) Tri-Tech Infrastructure LLC, a Delaware limited liability company (“TIS”), (6) Ordos Tri-Tech Anguo Investment Co., Ltd. (“TTA”), (7) Buerjin Tri-Tech Industrial Co. Ltd. (“Buerjin”), (8) Tri-Tech Infrastructure (India) Pvt., Ltd. (“TII”), (9) Xushui Tri-Tech Sheng Tong Investment Co., Ltd. (“Xushui”), (10)Tri-Tech Beijing Co., Ltd. (Buxar) (“Buxar”), (11) Tri-Tech Beijing Co., Ltd. (Begusarai) (“Begusarai”), (12) Tri-Tech Beijing Co., Ltd. (Hajipur) (“Hajipur”) and (13) Tri-tech India Pvt.,Ltd.(“WOS”). Three entities were deconsolidated during 2014: (1) Beijing Zhi Shui Yuan Water Tech Co., Ltd. ("Zhi Shui Yuan") on October 28, 2014, (2) Beijing Yanyu Water Tech Co., Ltd. (“Yanyu”) on October 28, 2014, and (3) Beijing Huaxia Yuanjie Water Technology Co., Ltd. (“Yuanjie”) on April 21, 2014.

As of December 31, 2014, our corporate structure was as follows:

Our registered office in the Cayman Islands is Portcullis TrustNet (Cayman) Ltd., Marquee Place, Suite 300, 430 West Bay Road, P.O. Box 32052, Grand Cayman KY1-1208, Cayman Islands, British West Indies.

| D. | Property, Plant and Equipment |

The following is a list of properties leased and occupied by our company during the year ended December 31, 2014:

| Office | | Address | | Rental Term Expiration | | Space |

| Principal Executive Office | | 10th Floor of Tower B, Baoneng Center, Futong East Road, Chaoyang District, Beijing, China | | March 31, 2015 | | 576.71 square meters |

| | | | | | | |

| Indian Executive Office | | H. No. 55, 1st and 2nd Floor, Kehar Singh Estate, Westend Marg, Saidulajab, Opp D-Block, Saket, New Delhi, India | | March 31, 2016 | | 186 square meters on 1st Floor; 186 square meters on 2nd Floor |

| | | | | | | |

| American Executive Office | | 123 Center Park Drive Suite No. 224, No. 225 & No. 229 Knoxville, Tennessee 37922 | | October 31, 2015 | | 35.5 square meters for No. 224 & No. 225; 18.5 square meters for No. 229 |

On March 30, 2015, the Company moved its principal Executive Office to:

| Office | | Address | | Rental Term Expiration | | Space |

| Principal Executive Office | | #1205 Tower B, Haidian Cultural and Arts Building, Jia 28 Zhongguancun St. Haidian District, Beijing 100086, People’s Republic of China | | February 28, 2018 | | 448.26 square meters |

On April 30, 2015, we vacated Suite No. 229 and have continued to use Suite No. 224 and No. 225 in our Knoxville, Tennessee executive offices.

On May 31, 2015, we vacated the 2nd Floor and have continued to use the 1st Floor in our New Delhi executive offices.

| Item 4A. | Unresolved Staff Comments |

Not applicable.

| Item 5. | Operating and Financial Review and Prospects |

Overview

The operating revenues are primarily derived from system design and integration, hardware product design and manufacturing and sales. Yuanjie was consolidated from January 1, 2014 to April 21, 2014. Yanyu and Zhi Shui Yuan were consolidated from January 1, 2014 to October 28, 2014. Key metrics for 2014 include the following:

| | · | Total revenues decreased by 80.9% in 2014 from the same period of 2013. |

| | · | Total cost of revenues decreased by 78.7% from 2013 to 2014. |

| | · | Total operating expenses were $10,972,883 for 2014, a decrease of 45.9% compared to 2013. |

| | · | Operating loss was $10,124,927 in 2014, compared with operating loss of $12,163,597 in 2013. |

| | · | Comprehensivenet loss attributable to TRIT was $3,566,896 for 2014, including net loss from Yuanjie of $120,227 from January 1, 2014 to April 21, 2014 and Yanyu of $3,686,792 from January 1, 2014 to October 28, 2014. The loss on deconsolidation of Yuanjie and the gain on deconsolidation of Zhi Shui Yuan and Yanyu were $348,125 and $3,457,327 for 2014, respectively. Comprehensive net loss attributable to TRIT was $12,157,767 for 2013. |

We analyze the attributions to those changes separately in this section. The following are the operating results for 2014, 2013 and 2012:

| | | Year Ended

December

31,2014 ($) | | | % of Sales | | | Year Ended

December

31,2013 ($) | | | % of Sales | | | Year Ended

December

31,2012 ($) | | | % of Sales | |

| Revenue | | | 7,771,575 | | | | 100.0 | % | | | 40,646,547 | | | | 100.0 | % | | | 62,572,803 | | | | 100.0 | % |

| Cost of Revenues | | | 6,923,619 | | | | 89.1 | % | | | 32,531,966 | | | | 80.0 | % | | | 47,514,579 | | | | 75.9 | % |

| Selling and Marketing Expenses | | | 1,269,470 | | | | 16.3 | % | | | 3,141,502 | | | | 7.7 | % | | | 4,148,861 | | | | 6.6 | % |

| General and Administrative Expenses | | | 9,052,952 | | | | 116.5 | % | | | 15,304,437 | | | | 37.7 | % | | | 13,904,424 | | | | 22.2 | % |

| Research and Development Expenses | | | 650,461 | | | | 8.4 | % | | | 1,832,239 | | | | 4.5 | % | | | 174,726 | | | | 0.3 | % |

| Total Operating Expenses | | | 10,972,883 | | | | 141.2 | % | | | 20,278,178 | | | | 49.9 | % | | | 18,228,011 | | | | 29.1 | % |

| Operating Loss | | | (10,124,927 | ) | | | (130.3 | )% | | | (12,163,597 | ) | | | (29.9 | )% | | | (3,169,787 | ) | | | (5.1 | )% |

| Other Income (Expenses), net | | | 1,818,492 | | | | 23.4 | % | | | (3,170,808 | ) | | | (7.8 | )% | | | (132,905 | ) | | | (0.2 | )% |

| Loss before Provision for Income Taxes | | | (8,306,435 | ) | | | (106.9 | )% | | | (15,334,405 | ) | | | (37.7 | )% | | | (3,302,692 | ) | | | (5.3 | )% |

| Provision for Income Taxes | | | 403,218 | | | | 5.2 | % | | | 29,625 | | | | 0.1 | % | | | 1,218,607 | | | | 1.9 | % |

| Net Loss from continuing operations | | | (8,709,653 | ) | | | (112.1 | )% | | | (15,364,030 | ) | | | (37.8 | )% | | | (4,521,299 | ) | | | (7.2 | )% |

| Income from discontinued operations, net | | | 1,186,570 | | | | 15.3 | % | | | 531,106 | | | | 1.3 | % | | | 1,769,426 | | | | 2.8 | % |

| Net loss | | | (7,523,083 | ) | | | (96.8 | )% | | | (14,832,924 | ) | | | (36.5 | )% | | | (2,751,873 | ) | | | (4.4 | )% |

| Foreign currency translation adjustment | | | 1,363,672 | | | | 17.5 | % | | | 1,891,873 | | | | 4.7 | % | | | 527,672 | | | | 0.8 | % |

| Comprehensive loss | | | (6,159,411 | ) | | | (79.3 | )% | | | (12,941,051 | ) | | | (31.8 | )% | | | (2,224,201 | ) | | | (3.6 | )% |

| Less: Comprehensive loss attributable to non-controlling interests | | | (2,592,515 | ) | | | (33.4 | )% | | | (783,284 | ) | | | (1.9 | )% | | | (487,799 | ) | | | (0.8 | )% |

| Comprehensive loss attribute to Tri-Tech Holding Inc. | | | (3,566,896 | ) | | | (45.9 | )% | | | (12,157,767 | ) | | | (29.9 | )% | | | (1,736,402 | ) | | | (2.8 | )% |

Year Ended December 31, 2014 Compared to Year Ended December 31, 2013

Revenue

The Company’s revenue for the year ended December 31, 2014 was $7,771,575, a decrease of 80.9%, compared with $40,646,547 in 2013. This decrease is primarily attributable to the decrease in the system integration category revenue, which decreased from $33,871,122 for the year ended December 31, 2013 to $6,625,239 in 2014. The Ordos project, which belongs to system integration category, decreased from $1,416,790 for the year ended December 31, 2013 to $0 in 2014 because the project was substantially completed. Tranhold’s revenues decreased by $2,448,911 due to the slow project progress caused by the cash shortage in 2014.

Yanyu was divested in October 2014. The revenues of Yanyu decreased by $12,860,400 to $4,813,356 in 2014 from $17,673,756 in 2013. Yuanjie was divested in April 2014. The revenue from Yuanjie in 2014 decreased by $2,837,865 to $389,820 in 2014 from $3,227,685 in 2013.

Cost of Revenue

Cost of revenue is based on total actual costs incurred plus estimated costs to completion applied to percentage of completion as measured at different stages. It includes material costs, equipment costs, transportation costs, processing costs, packaging costs, quality inspection and control, outsourced construction service fees and other costs that directly relate to the execution of the services and delivery of projects. Cost of revenue also includes freight charges, purchasing and receiving costs and inspection costs when they are incurred.

Cost of revenue was $6,923,619 in the year ended December 31, 2014, a decrease of78.7%, from $32,531,966 in the same period of 2013. The system integration category, which was the largest contributor to revenue, decreased by $20,869,435. The decrease of cost of revenue was mainly caused by the decrease of revenue and the divesting of subsidiaries.

Gross Margin

The Company’s gross margin decreased from 20.0% in 2013 to 10.9% in 2014. This decrease was largely a result of increases in material and equipment costs and labor subcontracting costs. The Company was affected by its cash shortage in 2014, which slowed down our project in process, the indirect cost and the service cost to the clients attributing to their decreased gross margin.

Operating Expenses

The Company’s total operating expenses decreased to $10,972,883 in the year ended December 31, 2014 from $20,278,178 in the same period of 2013, a decrease of 45.9%. The decrease was due to the Company’s downsizing caused by cash shortage and divesting of subsidiaries; as a consequence, selling and marketing expenses, general and administration expenses and research and development expenses decreased.

Selling and Marketing Expenses

Selling and marketing expenses decreased from $3,141,502 in the year ended December 31, 2013 to $1,269,470 in the same period of 2014, a decrease of 59.6%. Decreased headcount of our sales force contributed to the decrease of every related expense such as travel expenses, compensation-related expenses and entertainment expenses.

General and Administrative Expenses

General and administrative expenses consist primarily of compensation costs, rental expenses, professional fees, and other overhead expenses. General and administrative expenses decreased from $15,304,437 in 2013 to $9,052,952 in 2014, a decrease of 40.8%.

The salaries, human resources expenses, endowment and other social insurance all decreased from 2013 to the same period 2014 because of the downsizing, the decrease ranged from 27.0% to 52.9%. $444,626 was for Rent, decreased by 50.3%, from 2013 to 2014 due to office relocation. Professional fees increased by 13.6%, from $955,266 to $1,084,961, which was mainly for costs of litigation and decreased project consulting service fees. Amortization expense of intangible assets and software decreased by 58.0%, Depreciation expense increased by 40.3%. Other general and administrative expenses decreased by 43.1%, from $8,012,003 to $4,556,308 in 2014, including office expenses, utilities, travel, communication, other services support option expense and the bad debt expenses. During the year ended December 31, 2014, $1,581,223 of the bad debt was related to the divestiture of Yuanjie, Zhi Shui Yuan and Yanyu. We had $379,763 and $427,004 non-cash option expense as a part of other general and administrative expense in 2014 and 2013; respectively.

General and administrative expenses for 2014 and 2013 were approximately 116.5% and 37.7% of total revenues, respectively. Although the Company's G&A expenses decreased significantly compared with that in 2013, it still stayed at a relatively high level, because the Company needed to maintain necessary human resources and administrative structure to implement the Company’s current projects and to gain new projects.

Provision for Income Tax

The Company provides for deferred income taxes using the asset and liability method. Under this method, it recognizes deferred income taxes for tax credits, net operating losses available for carry-forwards and significant temporary differences. The Company classifies deferred tax assets and liabilities as current or non-current based upon the classification of the related asset or liability in the financial statements or the expected timing of their reversal if they do not relate to a specific asset or liability. The Company provides a valuation allowance to reduce the amount of deferred tax assets if it is considered more likely than not that some portion or all of the deferred tax assets will not be realized.