GRAHAM ALTERNATIVE INVESTMENT FUND I LLC

General Development of Business

Graham Alternative Investment Fund I LLC (“GAIF I”) is a Delaware Series Limited Liability Company established through an amendment to the certificate of formation, effective March 28, 2013. Prior to March 28, 2013, GAIF I was organized as a Delaware Limited Liability Company which was formed on May 16, 2006. GAIF I was formed to enable U.S. taxable investors to achieve long-term capital appreciation through professionally managed trading in both U.S. and foreign markets, primarily in futures contracts, forward currency and metals contracts, spot currency contracts and associated derivative instruments such as options and swaps. GAIF I commenced operations on August 1, 2006.

The Core Macro Portfolio (formerly known as Blended Strategies Portfolio) uses a systematic trading program and a discretionary trading program. The Core Macro Portfolio units of interest (the “Units”) of GAIF I are registered under the Securities Exchange Act of 1934, as amended, (the “Exchange Act”) and the financial information and statements contained herein are solely with respect to that Portfolio.

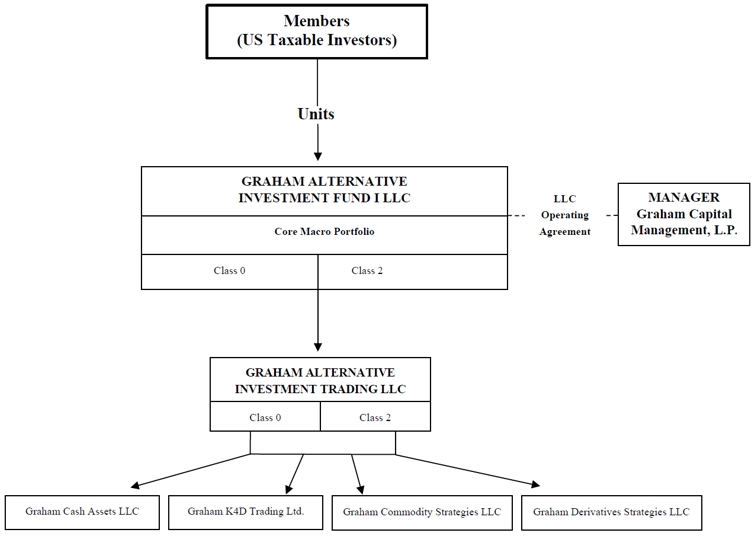

GAIF I invests in Graham Alternative Investment Trading LLC, a Delaware limited liability company (the “Feeder Fund”). Specifically, the assets of GAIF I subscribed for investment in the Core Macro Portfolio will be invested in Graham Alternative Investment Trading LLC. Trading on behalf of the Fund (as defined below) will be conducted in separate master funds (in a “master-feeder” fund structure) managed by the Manager (as defined below). For the purposes of this report, the term “Fund” shall include GAIF I, the Feeder Fund and the master funds in which they invest, unless the context implies otherwise. Graham Capital Management, L.P. (the “Manager”) is the Fund’s manager and the investment advisor to the Fund. The Manager’s website is www.grahamcapital.com.

The investment objective of the portfolio of the Fund is to achieve long-term capital appreciation through professionally managed trading in both U.S. and foreign markets, primarily in futures contracts, forwards contracts, spot currency contracts and associated derivative instruments such as options and swaps. The Fund may also trade futures on virtual currencies. The Fund seeks profit opportunities in the global financial markets, including interest rate futures, foreign exchange, global stock indices and energy, metals and agricultural futures, as a professionally managed multi-strategy investment vehicle.

The portfolio of the Fund consists of multiple trading strategies of the Manager, which the Manager has combined in an effort to diversify the investment exposure of the portfolio and to make the performance returns of the portfolio less volatile and more consistently profitable. The Manager seeks to combine in one portfolio investment strategies that trade in different markets and display relatively low correlation to each other. Through such composition, the Manager aims to provide the portfolio with the potential to make profits and have strong risk-adjusted returns in both rising and falling markets and during both expanding and recessionary economic cycles. In discretionary programs, a trader determines trades subjectively based on his personal assessment of trading data and trading experience, while in systematic programs, trades are based almost entirely on computerized mathematical models. The Fund, at all times, will look primarily to commodity interests as its principal intended source of gains and anticipates that at all times commodity interests will present the Fund’s primary risk of loss, and the Fund will not acquire any financial instrument or enter into any financial transaction if to do so would cause the Fund to look to securities as its principal intended source of gains or anticipate that securities will present the Fund’s primary risk of loss.

The Manager believes strongly in the importance of research and development of new trading programs, and expects to develop additional trading systems and strategies for the Fund and to modify or replace the systems currently in use for the Fund over time. The Manager also seeks to add new trading strategies to its discretionary programs and to modify such strategies over time. There is no maximum number of trading programs that the Manager may see fit to include in the Core Macro Portfolio, and the Manager may increase or decrease the number of programs included in the portfolio over time or increase the number of markets or contracts that are traded on behalf of the portfolio. The Manager continually updates and modifies its trading programs and may make such additions or deletions of trading programs or make any other changes to the Core Macro Portfolio at any time– such as changes in the leverage of, or in the asset allocations to, any of the Fund’s trading programs – in its sole discretion. The Fund is not required to provide prior, or any, notice of any such changes to investors.

Under the Amended and Restated Limited Liability Company Agreement of GAIF I (the “Company Agreement”), the Manager has complete and exclusive responsibility for management and administration of the affairs of GAIF I. The Manager is currently registered as a commodity pool operator (“CPO”) and commodity trading advisor (“CTA”) with the Commodity Futures Trading Commission (“CFTC”), as an investment adviser with the Securities and Exchange Commission (“SEC”) and is a member of the National Futures Association (“NFA”). GAIF I is not required to be, and is not, registered under the Investment Company Act of 1940, as amended. Investors purchasing units of interests (the “Units”) in GAIF I have no rights to participate in the management of the Fund. Units are sold through dealers that are not affiliated with the Fund or the Manager.

Pursuant to the Company Agreement, GAIF I’s term will end upon the first to occur of the following:

| • | the withdrawal (voluntary or involuntary), bankruptcy or an assignment for the benefit of creditors or dissolution of the Manager; or |

| • | any date prior to December 31, 2050 on which the Manager elects to dissolve GAIF I. |

GAIF I’s business constitutes only one segment for financial reporting purposes (i.e., a speculative commodity pool). GAIF I does not engage in sales of goods or services.

As of February 28, 2022, the aggregate Net Asset Value (as defined below under “Allocation of Profit and Loss”) of the Units in GAIF I was $27,004,626. GAIF I operates on a calendar fiscal year.

Narrative Description of Business

GAIF I offers two classes (each a “Class”) of Units, being Class 0 Units and Class 2 Units of the Core Macro Portfolio. As further described below under “Fees,” Class 0 and Class 2 Units of the portfolio differ only as to their applicable fees. Subscriptions for Units of any Class may be accepted by GAIF I as of the first business day of each month upon written notice of at least three business days prior to the last business day of the preceding month, and on such other notice and dates as the Manager may permit in its sole and absolute discretion.

Units of each Class are offered at their Net Asset Value per Unit as of the end of each month. The minimum initial investment for Class 0 Units is $10,000 (this Class is primarily for “wrap fee programs”) and the minimum additional investment is $5,000. Wrap fee programs bundle the various services provided to a client by a broker or financial advisor in a single fee arrangement rather than charging the client fees for specific transactions. The minimum initial investment for Class 2 Units is $10,000 and the minimum additional investment is $5,000. GAIF I will be continuously offered and has no limit on the maximum aggregate amount of subscriptions that may be contributed to it.

Capital contributions by a single subscriber for any Class of Units, upon acceptance of the subscriber as a member, represent a single interest in GAIF I for that subscriber’s respective Class of Units. A Unit of each Class reflects a member’s interest in GAIF I’s member’s capital with respect to the Class of Units owned by the member. Although separate Classes of Units in a portfolio are offered, all capital contributions to a particular portfolio are pooled by GAIF I and invested in GAIT. Units may be purchased only by investors who qualify as accredited investors under Regulation D of the Securities Act of 1933 (“Securities Act”). The principal differences among the separate Classes of Units within the same portfolio are their fees. Holders of Units, regardless of which Class of a portfolio they hold, participate pro rata in the profits and losses of that portfolio in proportion to the Net Asset Value of the Class and have identical rights, as members, under the Company Agreement.

(ii) The Manager

The Manager was organized in May 1994 as a Delaware limited partnership. The general partner of the Manager is KGT, Inc., a Delaware corporation of which Kenneth G. Tropin is the sole director and ultimate sole shareholder. KGT, Inc. became a listed Principal of the Manager effective July 27, 1994. The Manager has been registered as a CPO and CTA under the Commodity Exchange Act (“CEA”) and has been a member of the NFA since July 27, 1994 and is also registered as an investment adviser with the Securities and Exchange Commission since March 20, 2012. As of March 1, 2023, the Manager has approximately 193 personnel and manages assets of over $18.8 billion. The Manager’s principal office is located at 40 Highland Avenue, Rowayton, Connecticut 06853 and its telephone number is (203) 899-3400. The Manager’s advisory services may in part be performed out of its branch office in West Palm Beach, Florida and the office of the Manager’s London affiliate, Graham Capital LLP.

(iii) The Trading Program

The Manager’s Investment Committee, which is comprised of Kenneth G. Tropin, Pablo Calderini, Brian Douglas, Barry S. Fox, Christopher McCann, Timothy Sperry, Edward Tricker, Kelly Tropin Whitridge, George Schrade and Jennifer Ancker Whelen

makes decisions with respect to the selection of strategies traded on behalf of the Fund.

Biographical information regarding the members of the Investment Committee as of December 31, 2022 is set forth below.

Kenneth G. Tropin, 69, is the Chairman and the founder of the Manager. In May 1994, he founded the Manager and became an Associated Person and Principal effective July 27, 1994. Mr. Tropin developed the firm's original trading programs and

is responsible for the overall management of the organization, including the investment of its proprietary trading capital.

Pablo Calderini, 58, is the President and Chief Investment Officer of the Manager and, is responsible for the management and oversight of the discretionary and quantitative trading businesses at the Manager. He joined the Manager in August 2010 and became an Associated Person and Principal of the Manager effective August 13, 2010. Mr. Calderini received a B.A. in Economics from Universidad Nacional de Rosario in 1987 and a Masters in Economics from Universidad del Cema in 1989, each in Argentina.

Brian Douglas, 49, C.P.A., is the Chief Executive Officer of the Manager. In July 2004, he joined the Manager as Manager of Financial Reporting. Mr. Douglas became Director of Financial Reporting in April 2008. Mr. Douglas became Chief Financial Officer in April 2013, Chief Operating Officer in March 2019 and Chief Executive Officer in October 2021. Mr. Douglas is responsible for the management and oversight of the finance, administration, investor services, technology, human resources, legal and compliance departments. He became an Associated Person of the Manager effective February 1, 2013 and a Principal on April 1, 2013. Mr. Douglas received a B.A. in accounting from Western Connecticut State University in May 1996.

George Schrade, 48, C.P.A., is the Chief Financial Officer of the Manager, responsible for overseeing the Manager’s Middle Office, Financial Reporting, Treasury Operations, and Corporate Accounting groups. He became an Associated Person of the Manager effective December 21, 2016 and a Principal on February 28, 2019. In June 2007, he joined the Manager as Senior Analyst in Financial Reporting and has held positions of increasing responsibility prior to becoming Chief Financial Officer in March 2019. Mr. Schrade received a B.S in Accounting from Quinnipiac University in May 1996.

Barry S. Fox, 59, is Managing Director of Quantitative Operations and Execution of the Manager. He became an Associated Person of the Manager effective November 10, 2000 and a Principal on November 15, 2007. Mr. Fox joined the Manager in August 2000. Mr. Fox received a B.S. in Business Administration from State University of New York at Buffalo in 1986.

Christopher McCann, 52, is the Chief Risk Officer of the Manager, responsible for identifying, monitoring and acting upon financial risks relative to financial returns in Manager's diverse trading strategies. He joined the Manager in May 2009 and became an Associated Person of the Manager effective May 29, 2009 and a Principal effective June 24, 2019. He was previously registered as a Principal of the Manager effective September 12, 2012 through February 22, 2016. Mr. McCann received an M.B.A. in Finance from New York University Stern School of Business in May 1998, a M.S. in Industrial Engineering from Rutgers University in May 1995, and a B.S. in Chemical Engineering from Washington University in May 1992.

Tim Sperry, 55, is Executive Director and Chief Compliance Officer of the Manager. He joined the Manager in June 2004. As Chief Compliance Officer, he oversees compliance and regulatory matters related to the firm’s business. He became an Associated Person of the Manager effective October 9, 2012 and a Principal on October 10, 2012. Mr. Sperry received a J.D. from New England School of Law in May 1998 and a B.A. in Political Science in 1989 from Boston University.

Edward Tricker, 39, is Chief Investment Officer of Quant Strategies of the Manager. He is currently responsible for the management and oversight of the firm's Quantitative Strategies team, including quantitative operations and execution, research, alpha technology, and data science. He became an Associated Person of the Manager effective February 4, 2013 and a Principal on April 30, 2014. Dr. Tricker joined the Manager in June 2011 as a quantitative research analyst. Dr. Tricker received a Ph.D. in Statistics from Imperial College of Science and Technology in London in October 2009 and a B.S. in Mathematics and Statistics from the University of Oxford in June 2005.

Kelly Tropin Whitridge, 32, is Chief Economist and Senior Managing Director of the Manager. Mrs. Tropin Whitridge is responsible for leading the Manager’s economic research efforts in addition to playing a key role in the management of the firm’s discretionary trading team. She joined the Manager in May 2014 and became an Associated Person and Principal of the Manager effective September 6, 2018. Mrs. Tropin Whitridge received a Bachelor of Arts in Government from Dartmouth College in June 2013.

Jennifer Ancker Whelen, 49, is Chief Client Officer, Co-Head of Institutional Relations, and Managing Director of the Manager. She joined the Manager in April 2007 and became an Associated Person of the Manager effective June 6, 2007 and a Principal January 15, 2021. Mrs. Ancker Whelen is responsible for the development of strategic relationships with the Manager’s global client base, including consultants and institutional investors. Mrs. Ancker Whelen graduated cum laude from Colby College in 1995 with a B.A. in Economics and a minor in Sociology.

The discretionary traders for any discretionary investment strategy selected to trade on behalf of the Fund make the trading decisions for that discretionary strategy. The Manager has developed sophisticated proprietary software to study optimal portfolio weighting strategies and the effect of specific markets on the performance, risk, correlation and volatility characteristics of each of its trading strategies. As a result, the weighting or leverage that a trading strategy uses in each market may change to address changes in market conditions or to reflect other trading strategies trading in that market. With such software, the Manager devotes considerable attention to risk management at the portfolio level in an effort to ensure balance between markets and that the overall leverage used by the portfolio is consistent with the Manager’s overall views on risk. The Manager’s objective in forming the investment program of the portfolio is to provide the portfolio with significant potential for capital appreciation in both rising and falling markets and during expanding or recessionary economic cycles. Currently, 50% of the assets of the Core Macro Portfolio are allocated to trading the Manager’s Discretionary Trading Program and 50% of the assets are allocated to trading to a sole systematic program, the Manager’s K4D Program (formerly referred to as the K4D-15V Program), but the Manager may alter these allocations at any time within its sole discretion.

The Fund will trade actively in both U.S. and foreign markets, primarily on major futures exchanges as well as the inter-bank cash currency and swaps markets. The Fund also engages in exchange for physical (EFP) transactions, which involve a privately negotiated and simultaneous exchange of a futures position for a corresponding position in the underlying physical commodity, and the Fund may use options and other derivatives in addition to swaps. The Manager may also trade other financial instruments, such as emerging market currencies, global stock index futures and futures on virtual currencies, as it endeavors to achieve superior results for investors and enhanced portfolio diversification. The Manager may trade without geographic or market restriction, with new and existing discretionary and quantitative strategies routinely expanding or otherwise modifying the types of instruments traded for the Fund. The Manager reserves the right in extraordinary market conditions to reduce leverage and portfolio risk if it feels in its sole discretion that it is in the potential best interest of the Fund. While such actions are anticipated to occur very infrequently, no assurance can be given that the Manager’s actions will enhance performance or that any efforts by the Manager to achieve portfolio diversification will be successful.

The Manager expects to add additional trading strategies and programs to the portfolio and to modify or replace the strategies currently in use for the portfolio over time and may in the future offer other portfolios. There is no maximum number of strategies and programs that the Manager may see fit to include in the Fund or the portfolio, and the Manager may increase or decrease the number of strategies and programs included in the Fund or the portfolio over time or increase the number of markets or contracts that are traded on behalf of the Fund or the portfolio. The Manager may make such additions or deletions of trading programs to the Fund or the portfolio at any time and may make such additions, deletions or any other changes, such as changes in the leverage or volatility targets of, or in the asset allocations to, any of the Fund’s trading strategies and programs, in its sole discretion and without prior notice to members. The Core Macro Portfolio does not currently have an annual leverage or volatility target, and even to the extent such targets are established by the Manager in the future, there can be no assurance that the Core Macro Portfolio's programs (or any trading systems or programs utilized by the Fund) will meet such targets in any given period.

The Manager conducts risk analysis and employs risk management controls at various levels of the Fund, including portfolio risk, strategy risk, market risk and execution risk. The objectives of its risk management approach are to measure a Portfolio’s quantitative and qualitative exposures to the risks identified; formulate appropriate policies and procedures in an effort prudently to manage overall risk; monitor compliance with the Manager’s risk policies and procedures; and report identified and measured risks to the Manager’s Risk Committee and risk management team.

In constructing a Portfolio, the Manager employs various risk management protocols. Using a proprietary asset allocation model and its own qualitative assessments, the Manager’s Investment Committee determines the appropriate strategies for a Portfolio and the weighting of each in the Portfolio. The Manager has developed a trade execution and reporting infrastructure designed to minimize the risk of errors. For example, where appropriate, trades are manually checked for accuracy by the Manager’s middle office staff and are subject to additional cross checking using computerized means. Each discretionary trader’s positions must adhere to established risk management guidelines and position limits, which are regularly monitored by the Manager��s risk management team.

Effective testing, reporting and review are critical elements of the Manager’s risk management process. Daily stress testing is performed to evaluate a strategy’s risk exposure. Daily reporting of Value-at-Risk (VaR), plus intraday reporting of net gains or losses for each strategy enables the Manager’s Risk Committee and the Investment Committee to observe each strategy’s adherence to its investment profile as well as market exposure. VaR is a probabilistic measure of the amount of loss, often referred to as the threshold, that a portfolio of investments may experience over a specified time period. Each strategy is formally reviewed by the Investment Committee on a monthly basis.

The Manager’s quantitative trading programs (including the quantitative traders primarily responsible for implementing such programs) typically use proprietary portfolio construction and embedded risk management techniques within the programs themselves to manage exposure across individual markets and sectors. The quantitative risk management process incorporates the outputs of the underlying trading models with a sophisticated risk management process in an effort to enhance returns and maintain diversification and portfolio volatility targets. Notwithstanding the foregoing, certain quantitative traders may be subject to risk policies similar in whole or in part to the risk policies described below with respect to discretionary traders.

With respect to the discretionary traders who trade on behalf of the Fund, the Manager works closely with each discretionary trader to design an appropriate investment profile, including return objective and volatility level, for each individual trading strategy. Through continuous monitoring and an active dialogue with every discretionary trader, the Manager seeks to identify and minimize any deviations from the investment profile. In addition, the Manager has implemented a uniform set of risk guidelines for all discretionary traders designed to reduce a strategy’s downside risk. Each discretionary trader’s positions must adhere to established risk management guidelines and position limits, which are regularly monitored by the Manager’s risk management team.

The Manager subjects the trading of all of its discretionary traders to a risk monitoring regime that includes a set of defined drawdown limits and a series of risk measurements. Drawdown limits are used as a risk management tool to enforce risk reduction on a discretionary strategy if the discretionary trader is experiencing losses and has not yet reduced overall risk levels. The Manager generally defines a drawdown as losses experienced over a specified period of time, expressed as a percentage of net assets at the beginning of the period. The Manager imposes daily, monthly, and overall drawdown limits for all discretionary traders. The Manager establishes a daily move limit that requires a prompt report to the risk department, a monthly peak to trough drawdown that likely will lead to risk reduction, and a total peak to trough drawdown that likely leads to risk reduction. There is also a drawdown limit where the Manager’s Investment Committee would meet to consider closing a given program. Further, the Manager conducts a daily risk process measuring VaR and reviewing stress tests for the portfolio. The Manager evaluates the validity of VaR as a risk management tool by comparing the number of instances that profit and loss exceeded expected parameters over various time frames. For example, the Manager utilizes a one day 97.5% VaR, which means that in respect of the Portfolio that it is analyzing it expects the Portfolio to experience a loss in excess of VaR on approximately 1 out of every 40 days. In addition, the Manager runs an extensive series of stress tests, including historical scenarios as well as specific foreign exchange, equity and interest rate shocks. In managing strategy risk, the Manager limits the size and structure of positions taken on behalf of the Portfolio to ensure that they comply with various risk parameters, both those defined by the Manager for the underlying trading strategies and those defined by each of the discretionary traders that trade on behalf of the Portfolio.

In addition to the risk monitoring procedures employed by the Manager, each discretionary trader trading on behalf of a discretionary program for the Fund has established his or her own proprietary risk measures and parameters. These generally include measures of first order sensitivities (i.e., the sensitivity of the Portfolio to a change in a parameter of the underlying instruments) to the most relevant risk factors for a given book (for example, the dollar value of a basis point in the case of interest rate products), measurement of stress loss in extreme market events, or the use of explicit stop loss points. When individual limits on any of these are breached, the discretionary trader likely will reduce risk even if within the Manager’s guidelines.

The Fund currently employs a master-feeder structure for its individual trading programs such that the portfolio’s trading program may, but will not necessarily in all cases, be conducted through one or more master funds. Each of the master funds is managed by one or more employees of the Manager. The master funds were organized by the Manager in order to facilitate the management of various funds and accounts managed by the Manager using in whole or in part the same trading program. The Fund, alternatively, may trade its individual trading programs through one or more managed accounts in the Fund’s name.

Discretionary Trading Program

The Manager has been trading discretionary programs since February 1998. Discretionary programs, unlike systematic programs which are based almost entirely on computerized mathematical models, determine trades subjectively on the basis of a trader’s personal assessment of trading data and trading experience. Although the Manager has had over a decade of experience trading various discretionary programs, Discretionary Trading Program (“DTP”) itself commenced trading as of August 2008. DTP seeks to invest in various global macro markets that are highly liquid. DTP consists of several of the Manager’s leading discretionary strategies traded by employees of the Manager that focus on the global fixed income, stock index, currency, energy, commodity and metals markets, but over time it may participate in any other liquid market that is available as the Manager deems appropriate. The Fund may also trade futures on virtual currencies.

The Manager’s discretionary programs have generally displayed a significant degree of non-correlation with traditional and other alternative investments, including with the Manager’s own quantitative investment programs. In its composition of DTP, the Manager will seek an investment portfolio that continues to offer such non-correlation and that provides diversification to other investments. DTP may take both long and short positions and thus may generate successful performance results in both rising and declining markets. The holding periods of its positions may range, depending on the individual trading strategies, from just a few hours to months, such that DTP may potentially profit in markets that exhibit either short-term moves or long-term trends. As with its systematic investment programs, the Manager may add or delete trading strategies or trading markets in DTP or alter their individual weightings or leverage as it deems appropriate, and no notice will be given to investors of such allocation changes. The Manager may make such allocation changes based on a proprietary allocation model, its assessment of market conditions or the availability of additional discretionary trading strategies, in its discretion.

The descriptions contained herein of DTP should not be understood as in any way limiting its investment activities. In addition, the Fund may engage in investment strategies and programs not described herein that the Manager considers appropriate.

Systematic Trading Program

The Manager’s systematic investment programs employ various quantitatively based systems that are designed to participate selectively in potential profit opportunities that can occur in a diverse number of U.S. and international markets. Such systems generally are based on computerized mathematical models and can rely both on technical (i.e., historic price and volume data) and fundamental (i.e., general economic, interest rate and industrial production data) information as the basis for their trading decisions. The systems establish positions in markets where the price action of a particular market signals the computerized systems used by the Manager that a potential move in prices is occurring. The systems are designed to analyze mathematically the recent trading characteristics of each market and to statistically compare such characteristics to the historical trading patterns of the particular market. The systems also employ proprietary risk management and trade filter strategies that seek to benefit from price moves while reducing risk and volatility exposure.

Each systematic investment program of the Manager incorporates trading strategies developed by the Manager’s research department. While the Manager’s systematic investment programs have employed long-term systematic strategies from their inception, the programs may also include trend systems with varying time horizons.

The Manager believes strongly in the importance of research and development of new trading strategies and expects to develop additional trading systems and strategies and to modify or replace the systems currently in use in its systematic programs over time in its ongoing efforts to keep pace with changing market conditions. The decision to add or subtract systems or strategies from any investment program or to change the leverage of, or the asset allocations to, any of the trading strategies of such investment program shall be at the Manager’s sole discretion. The Manager anticipates that the constellation of trading strategies comprising the K4D program will continue to grow and evolve over time. There is no maximum number of strategies that the Manager may include in the K4D investment program.

In connection with its programs’ systematic trading, the Manager may employ discretion in determining the leverage and timing of trades for new accounts and the market weighting and participation. In unusual or emergency market conditions, the Manager may also utilize discretion in establishing positions or liquidating positions or otherwise reducing portfolio risk where the Manager believes, in its sole discretion, that it is in the potential best interest of the Fund to do so. While such actions are anticipated to occur very infrequently, no assurance can be given that the Manager’s discretionary actions in these programs will enhance performance.

The K4D Program features the first system that the Manager developed, which began trading client accounts in 1995. It utilizes multiple computerized trading models and offers broad diversification in both financial and non-financial markets, currently trading in approximately 90-100 global markets. The K4D Program includes trend-following systems as well as carry, fundamental value/reversion strategies as well as strategies that in the aggregate are intended to be diversifying from trend-following

, and is intended to generate significant returns over time with an acceptable degree of risk and volatility. The computer models are currently based on price-based data and non-priced based macroeconomic and fundamental information

.

The investment objectives and methods summarized above represent the Manager’s current intentions. Depending on conditions in the financial and securities markets and the economy in general, the Manager may pursue other objectives, employ other investment techniques or purchase any type of financial instrument that it considers appropriate and in the best interests of the Fund, whether or not described in this section.

Northern Trust International Banking Corporation serves as the Fund’s banker for purposes of receiving subscription funds, disbursing redemption payments and processing cash transactions not directly related to the Fund’s portfolio.

Bank of America, N.A. serves as the Fund’s banker for transactions on behalf of the portfolio. A significant portion of the Fund’s assets may be held by Bank of America, N.A. in addition to the futures clearing brokers utilized on behalf of the Fund as well as OTC counterparties. The Fund may also hold excess funds not required for trading in bank accounts at Bank of America, N.A. JPMorgan Chase Bank, N.A. or elsewhere. The Manager, in its discretion, may change the brokerage and custodial arrangements described herein without notice to investors.

GAIF I currently has no direct arrangement with any futures commission broker; rather each master fund that trades on behalf of the Fund may have its separate clearing arrangements with one or more futures broker. At present, BofA Securities Inc., Wells Fargo Securities, LLC and Barclays Capital Inc. are the primary futures clearing brokers for the master funds, but neither the Fund nor the master funds are required or under any contractual obligation to continue to employ them as futures clearing brokers (together with additional or replacement clearing brokers the Manager may select from time to time without notice to investors, the “Futures Brokers”). The Manager is authorized to determine the Futures Brokers (or the counterparty, if concerning a foreign currency or swap transaction) to be used for the portfolio transactions for the Fund. The Manager is not affiliated with any futures commission merchant or broker-dealer.

Each Futures Broker will obtain, safe-keep and maintain custody of all of the Fund’s fully paid assets held by it in a customer account identified on the books of the Futures Broker as belonging to the Fund and segregated from the broker’s own proprietary positions. All of the Fund’s assets, funds, securities and other property held by each Futures Broker are held as security or collateral for the Fund’s obligations to the broker. The margin levels required to initiate or maintain open positions are established from time to time by each Futures Broker and applicable regulatory authorities. Each Futures Broker may close out positions, purchase securities, or cancel orders for the Fund’s account at any time it deems necessary for its protection, generally without the consent of or notice to the Fund.

Agreements with Futures Brokers in general provide that the broker will not be liable in connection with the execution, clearing, handling, purchasing, or selling of commodities, or other property, or other action, except for negligence or misconduct on the broker’s part. Such agreements also may provide that the Futures Broker will be indemnified and held harmless by the Fund from and against any loss, claim, or expense (including attorney’s fees) incurred by the broker in connection with it acting or declining to act for the Fund, and that the Fund will fully reimburse the broker for any legal or other expenses (including the cost of any investigation and preparation) which the broker may incur in connection with any claim, action, proceeding, or investigation arising out of or in connection with the agreement or the transactions contemplated thereunder.

In addition to trading in the Interbank market for foreign exchange, the Fund currently trades on all the major U.S. futures exchanges and may also trade on, but is not limited to, the following foreign exchanges:

ASX Trade24

Bolsa de Mercadorias and Futuros

Borsa Italiana (IDEM)

EUREX

EURONEXT/London International Financial Futures and Options Exchange

EURONEXT/Derivatives Paris

EURONEXT/Derivatives Amsterdam

European Options Exchange

Hong Kong Exchanges and Clearing Ltd.

ICE Endex

ICE Futures Canada

ICE Futures Europe

Intercontinental Exchange

JSE Equity Derivatives Market

Korea Futures Exchange

London Metal Exchange Ltd.

Montreal Exchange

OMX Nordic Exchange Stockholm

Osaka Securities Exchange

Singapore Exchange Ltd.

South African Exchange

Tokyo Commodity Exchange

Tokyo Financial Exchange

Tokyo Stock Exchange

Turkish Derivatives Exchange

In connection with such trading on foreign exchanges, the Fund’s assets may be deposited by the futures brokers with foreign brokers or banks. Although these foreign brokers or banks are subject to local regulation in their jurisdiction, the protections afforded by foreign regulatory bodies and rules may differ significantly from those afforded by United States regulators and rules.

The Fund earns interest on cash not required to be posted as margin for its trading. Cash not required by the Fund’s investment programs for trading is currently invested by the Manager in a separate cash management master fund, Graham Cash Assets LLC (“Cash Assets”), managed by the Manager. The Fund pays the Manager no additional fees for managing the Fund’s assets invested in Cash Assets. It is currently anticipated that on average between 70% and 95% of the assets of the portfolio will be invested in Cash Assets. Other affiliates of the Manager and investment funds and accounts managed by the Manager may invest in Cash Assets and each such entity bears its proportional share of the operating expenses of Cash Assets. Cash Assets may pay some third-party fees to unaffiliated custodians or managers in connection with the management of its portfolio, which fees will effectively be borne pro rata by all investment vehicles that invest in Cash Assets. Cash Assets may deposit a portion of its assets in an interest bearing bank account with Bank of America N.A. and JPMorgan Chase Bank, N.A. or other banks or in brokerage accounts, or it may purchase securities (directly or through repurchase or reverse repurchase agreements) which are direct obligations of or obligations guaranteed as to principal or interest by the United States (e.g. U. S. Treasury Bills or Bonds), or other securities issued or guaranteed by corporations in which the United States has a direct or indirect interest (e.g., U.S. government agency securities) which have been designated pursuant to section 3(a)(12) of the Securities Exchange Act of 1934 as exempted securities.

In addition to exchange-traded futures contracts and swaps, the Fund trades spot and forward contracts on foreign currencies and, to a lesser degree, OTC swap and derivatives contracts. The Fund does not currently anticipate trading any other non-CFTC regulated instruments. The Manager estimates that 20-60% of the Fund’s trades for the portfolio may be in forward contracts and 0-10% in swap contracts, but depending on market conditions, the percentage of the portfolio’s trades constituted by forward or swap contracts may fall substantially outside that range. Bank of America, N.A. and Barclays currently serve as the Fund’s primary counterparties for foreign currency forward transactions. All of the Fund’s assets, funds, securities, and other property held by Bank of America, N.A. or Barclays as a Fund counterparty, and any other bank or broker-dealer acting as a foreign currency forward counterparty or OTC swap counterparty of the Fund are held as security or collateral for the Fund’s obligations to such entity. The forward and OTC swap markets bear additional risks (e.g., the credit risk of trading with counterparties) not present in exchange-traded futures and swaps trading. Under the Dodd–Frank Wall Street Reform and Consumer Protection Act, the CFTC, sometimes together with the SEC, has enacted regulations to govern these contracts and requires many of them to be cleared through an exchange or clearinghouse.

The Manager determines, in its sole and absolute discretion, the amount of distributions, if any, to be made by the Fund. It is expected that dividends ordinarily will not be paid and that all portfolio earnings will be retained for reinvestment (subject to the redemption privilege).

Fees

Pursuant to the Company Agreement, each Class of the Core Macro Portfolio of the Fund paid the Manager an advisory fee (the “Advisory Fee”) at an aggregate annual rate equal to 1.50% of the Net Asset Value of such Class. For purposes of calculating the Advisory Fee, the Net Asset Value of each Class equals the total fair market value of the assets of the Fund attributable to that Class less the liabilities of the Fund attributable to that Class. Profits and losses are allocated among the Classes in proportion to their respective Net Asset Values (before accrual of the Sponsor Fee and the Incentive Allocation set forth below). The Advisory Fee is payable monthly in arrears calculated as of the last business day of each month (before giving effect to any redemptions as of the last business day of the month and subscriptions as of the beginning of the next business day, and before deduction or accrual of fees payable to the Manager and the Incentive Allocation). A portion of the Advisory Fee may be paid to third parties as compensation for offering or selling activities in connection with the Fund. If the Manager is terminated as the manager of the Fund as of a date other than the last business day of a month, the Advisory Fee will be prorated through the termination date.

Each Class 0 and Class 2 of the Fund pays the Manager a sponsor fee (the “Sponsor Fee”) at an annual rate of the Members’ Capital specified in the table below. The Sponsor Fee, in each case payable monthly in arrears, determined in the same manner as the Advisory Fee.

| Class 0 | Class 2 |

| | |

| 0.50% | 1.25% |

A significant portion of the Sponsor Fees is paid to third parties as compensation for offering or selling activities in connection with the Fund. The Manager may pay initial service fees as well as on-going service fees to its selling agents. When an initial service fee is paid, the on-going service fee to a selling agent will generally commence the 13th month with respect to which the Fund investor introduced by such selling agent has been invested in the Fund. The service fees paid by the Manager to selling agents range up to 2% of net assets with respect to Class 2 investors.

| (iii) | Incentive Allocation |

Each Class of the Core Macro Portfolio bears a quarterly Incentive Allocation, payable to Graham Capital LLC, an affiliate of the Manager (“Graham LLC”), as of the end of each calendar quarter, equal to 20% of the net profits of the Class for the quarter, subject to a “loss carryforward” provision. The loss carryforward provision generally provides that Graham LLC will not receive an Incentive Allocation in respect of the Class for a calendar quarter to the extent that the Class experiences net loss since the last calendar quarter for which an Incentive Allocation was earned, and such loss has not been recouped through subsequent net profits. The Incentive Allocation is calculated and paid as follows: At the end of each calendar quarter, the Incentive Allocation is deducted from the Net Asset Value of each Class and credited to the Capital Account of Graham LLC in the Feeder Funds, in an amount equal to 20% of New High Net Trading Profits (as defined below) with respect to each class of the Core Macro Portfolio for such period. “New High Net Trading Profits” for any Class for any quarter shall mean the Net Capital Appreciation (which includes unrealized gains and losses and interest income and expense, less all accrued debts, liabilities and obligations of the Class (but before any accrual for the Incentive Allocation) for such period) for the quarter minus the Carryforward Loss (as defined below), if any, as of the beginning of the quarter, for such Class. The “Carryforward Loss” shall be increased as of the end of each calendar quarter by the amount of any Net Capital Depreciation with respect to such Class during the quarter then ended and shall be decreased (but not below zero) as of the end of each calendar quarter by the amount of any Net Capital Appreciation with respect to such Class during the quarter then ended. In addition, the Carryforward Loss for a Class for any calendar quarter shall be proportionately reduced effective as of the date of redemption of any Units of such Class by multiplying (i) the Carryforward Loss for such Class immediately prior to such redemption by (ii) the ratio that the amount of assets redeemed from such Class bears to the Net Assets of such Class immediately prior to such redemption. The Carryforward Loss of a Class must be recouped before any subsequent Incentive Allocation can be made to Graham LLC. The Incentive Allocation is also accrued and allocable on the date of redemption with respect to any Units that are redeemed on any date not the end of a calendar quarter, as if the date of redemption were the end of a calendar quarter and the Incentive Allocation shall only be deducted with respect to such redeemed Units.

A portion of any of the above fees (including the Incentive Allocation) may be paid by the Manager or its affiliates to third parties as compensation for offering or selling activities in connection with the Fund.

For 2022, each Class of the Fund was responsible for its proportionate share of the Fund’s operating, administrative, trading and other direct expenses of the relevant Portfolio, including all trading commissions (including exchange and clearing and regulatory fees relating to its trades), legal expenses, internal and external accounting, audit and tax preparation expenses, fees and expenses of an Administrator, costs of preparing any required regulatory filings, and printing and mailing costs, together with a proportionate share of the costs incurred in connection with the organization of the Fund (including government incorporation charges and professional fees and expenses in connection with the preparation of the Fund’s offering documents and the preparation of the basic corporate and contract documents of the Fund) and the Fund’s continuing offering of Units.

Beginning June 2022, each Class of the Fund shall pay or reimburse the Manager for all direct costs associated with its assets allocated to the various trading strategies, whether discretionary or quantitative, as the case may be, utilized on the Fund’s behalf and all other expenses related to the operations and business of the Fund including, but not limited to,

all expenses of investment transactions such as brokerage commissions and exchange, clearing or regulatory fees and expenses; interest, commitment fees and other costs related to borrowing; transaction fees, finder’s fees, sourcing fees, investment banking fees, origination fees and other similar fees and expenses; fees and expenses of the Administrator;

custodial fees; bank service fees;

costs of news, research, data and quotation services, software and equipment, including Bloomberg terminals; third-party investment and trading, risk-management and portfolio management related services, licensing, systems, hardware and software (including the third-party installation, programming or servicing related thereto), including trade order management, collateral and margin management and accounting services, licensing, systems, hardware and software; costs of connectivity services; data storage costs;

fees and expenses related to the Fund’s currency conversion and hedging activities; other hedging costs;

membership, license and similar charges in connection with exchange memberships; income taxes, withholding taxes, transfer taxes

and other governmental charges and duties; governmental,

registration, license, membership or related fees

or expenses payable to any regulatory or self-regulatory organization

(including costs associated with preparing and filing regulatory reports such as Form 10-K, Form 10-Q, NFA Form PQR and MiFID trade and transaction reports)

or in connection with the distribution of the Units in any jurisdiction;

costs of compliance with FATCA, CRS or other similar rules; professional fees of tax advisors, accountants and attorneys; costs for D&O, E&O, cybersecurity and other insurance for the Fund and the Manager;

the costs of maintaining the Fund’s registered office;

the costs of printing and distributing offering materials and Net Asset Value reports and notices to Members or holding meetings of Members; fees and expenses paid to outside counsel, accountants, experts

and other third parties

in connection with sourcing, investigating, analyzing, evaluating and conducting due diligence and surveillance on, monitoring and conducting background checks in connection with, existing and potential investments (whether or not consummated);

costs of negotiating trading counterparty and service provider agreements;

legal and third party costs incurred in connection with settling trades; legal fees and costs (including settlement costs) arising in connection with any litigation, arbitration, investigation or other proceeding related to any portfolio investment; legal and compliance expenses (including responding to formal and informal inquiries, indemnification expenses and expenses associated with regulatory filings relating to the Fund and its portfolio investments); legal and tax structuring expenses; costs of any external appraisers; direct expenses or fees for third parties related to monitoring and responding to class action and other claims (including contingency fees);

and all other expenses incurred in connection with locating, evaluating, purchasing, selling or holding investments. The Fund’s operating, administrative and trading expenses are estimated, based on recent experience of the Fund and recent experience with respect to the types of costs and expenses that are expected to be borne by the Fund in the future, to amount to approximately 1.12% of net assets annually for the Core Macro Portfolio, but actual expenses may exceed the estimated amount. These expenses will be calculated and payable monthly in arrears in the same manner as the Advisory Fee.

The Manager provides and pays for its own professional and administrative staff, office space, and other general overhead expenses incidental to its advisory services. For 2022, the Manager also provided and paid for its expenses related to business equipment and facilities.

Extraordinary expenses of the Fund or any other fees or expenses not described above in the section “Fees,” will also be separately borne by the Fund. All fees and expenses of the Fund (including the Incentive Allocation) will be assessed at the Feeder Fund level.

Each investor should understand that the costs of the Fund’s operating, administrative and trading expenses may vary, and that these costs (including the costs described above) are not limited and may be higher than the above estimated amounts. The Fund makes no representation that in the future these expenses may not increase and may not exceed these estimates.

The Manager determines how certain expenses are allocated among the Fund and other funds and accounts managed by the Manager. The Manager will allocate the above expenses (including the investment and operating expenses of the Master Funds) among the funds and accounts the Manager manages in proportion to their respective net asset values, in proportion to their respective participation in a particular investment, strategy or program, or in any other manner that the Manager determines to be equitable (which may be based on the Manager’s assumptions as to relative usage or resources allocated among the funds and accounts). The Manager has established expense allocation policies in an effort to address such matters and may amend such policies or establish additional expense allocation policies in an effort to address potential conflicts of interest that may arise in the future.

Allocation of Profit and Loss

A separate Capital Account is maintained for each member with respect to each Class of Units held by such member. The initial balance of each Capital Account of each member will equal the net initial contribution to the Fund by such member with respect to the Class to which such Capital Account relates. Each Capital Account of each member is increased by any additional capital contributions by such member with respect to the Class to which such Capital Account relates and decreased by any redemptions of Units of such Class by such member. Net realized and unrealized appreciation or depreciation in the value of assets of the portfolio of the Fund, including investment income and expenses, is allocated at the end of each fiscal period among the Capital Accounts of the members in proportion to the relative values of such Capital Accounts as of the commencement of such fiscal period (in the case of any month end that is not also the end of a calendar year, before any accrual for the Incentive Allocation).

On the last day of each fiscal period, an allocation is made of the net profit or net loss attributable to the investments of the portfolio for such fiscal period. The net profit or net loss for a fiscal period is allocated among all the Classes of the portfolio pro rata in the proportion that the Net Asset Value of each Class as of the date of the commencement of such fiscal period bears to the Net Asset Value of the portfolio as of such date.

The Net Asset Value of each Class means the total value of the Fund’s assets, at fair value, attributable to that Class less the liabilities of the Fund attributable to that Class. The Net Asset Value per Unit of any Class is determined as of the close of business on the last business day of the month (a “Valuation Day”) by dividing the Net Asset Value of that Class by the number of outstanding Units of that Class. Such deductions will include an accrual for the Incentive Allocation and the fees to be paid to the Manager.

The net profit or net loss of each Class for a fiscal period in turn is allocated among all holders of Units of that Class pro rata in the proportion that the Net Asset Value of each member’s holding of Units of that Class as of the date of the commencement of such fiscal period (after adjustment for any contributions to the capital of the Fund which are effective on such date) bears to the aggregate Net Asset Value of that Class as of such date.

The Manager is responsible for determining the value of the Fund’s assets. The Fund has appointed SEI Global Services Inc. as the Fund’s independent administrator (“Administrator”), and in connection with that role SEI is responsible, subject to the ultimate supervision of the Manager, for calculating the Net Asset Value of the Fund and the Net Asset Value per Unit of each Class of Units. In determining the Net Asset Value of the Fund and the Net Asset Value per Unit of each Class of Units, the Administrator will follow the valuation policies and procedures adopted by the Fund as set out below. If and to the extent that the Manager is responsible for or otherwise involved in the pricing of any of the Fund’s portfolio assets, the Administrator may accept, use and rely on such prices in determining the Net Asset Value of the Fund and shall not be liable to the Fund, any investor in the Fund, the Manager or any other person in so doing.

For all purposes, including subscriptions, redemptions and the calculation of the fees paid to the Manager, the Manager shall determine the fair market value of any investment made by the Fund. In general, investments will be valued as follows:

| a. | The value of unrealized gain or loss on open futures contracts shall be recorded as the difference between the contract price on the trade date and the closing price reported as of the Valuation Day on the primary exchange on which such contracts are traded. |

| b. | The value of any option listed or traded on any recognized foreign or U.S. exchange shall be the settlement price published by the principal exchange on which it is traded on the relevant Valuation Day. If the recognized foreign or U.S. exchange does not publish a settlement price, the value of any option listed or traded on any recognized foreign or U.S. securities exchange shall be the last reported sale price on the relevant Valuation Day on the principal exchange on which such option is traded. If no such sale of such option was reported on that date, the market value shall be the average of the last reported bid and asked price. The market value of any over-the-counter option for which representative broker’s quotations are available shall be determined in like manner by reference to the last reported sale price, or, if none is available, to the average of the last reported bid and asked quotation. Premiums for the sale of such options written by the Fund shall be included in the assets of the portfolio, and the market value of such options shall be included as a liability. |

| c. | The value of any U.S. government security shall be the cost of such security plus accrued interest and discount.

|

The fair value of any assets not referred to in clauses (a) through (c) above (or the valuation of any assets referred to therein in the event that the Manager shall determine that there is no active market or that another method of valuation is advisable in the circumstances) shall be determined by or pursuant to the direction of the Manager. Prospective investors should be aware that situations involving uncertainties as to the valuation of portfolio positions could have an adverse effect on Net Asset Value if management’s judgments regarding appropriate valuations should prove incorrect. Absent bad faith or manifest error, the Fund’s Net Asset Value determinations are conclusive and binding on all investors. Net Asset Values are expressed in U.S. dollars, and any items denominated in other currencies are translated at prevailing exchange rates as determined by the Administrator in consultation with the Manager.

The Manager may, in its sole and absolute discretion, permit any other method of valuation to be used if it considers that such method of valuation better reflects fair value and is in accordance with good accounting practice.

Reporting

The Fund is required to furnish audited annual reports to its members containing financial statements examined by the Fund’s independent registered public accounting firm. The Fund is also required to provide members with monthly performance updates and monthly unaudited financial statements.

Regulation

The Manager has been registered as a CPO and CTA under the CEA, and as an investment adviser with the SEC and has been a member of the NFA since July 27, 1994. GAIF I is regulated as a commodity pool by the CFTC and NFA.

The CFTC may suspend a CPO’s or CTA’s registration if it finds that its trading practices tend to disrupt orderly market conditions or in certain other situations. In the event that the registration of the Manager was terminated or suspended, the Manager would be unable to continue to manage the business of the Fund. The Fund is expected to be terminated should the Manager’s registration be suspended, termination of GAIF I might result. In addition to such registration requirements, the CFTC and certain commodity exchanges have established limits on the maximum net long or net short positions that any person may hold or control in particular commodities. Most exchanges also limit the changes in futures contract prices that may occur during a single trading day.

All persons who provide services directly to the Fund (as opposed to those persons who provide services through a third-party service provider) are employed by the Manager. The Fund has no employees of its own.

All investments risk the loss of capital. No guarantee or representation is made that either portfolio of the Fund will achieve its investment objective. An investment in the Fund is speculative and involves certain considerations and risk factors that prospective investors should consider before subscribing. The practices of leverage and derivatives trading and other investment techniques, which the Fund expects to employ, can, in certain circumstances, result in significant losses. Under certain circumstances, an investment in the Fund involves the risk of a substantial loss of such investment. Investors should be able to bear the loss of their entire investment in the Fund, and their investment in the Fund should not be their sole significant investment.

Past performance is not necessarily indicative of future results.

Class 0 of the Fund has been operating since August 1, 2006, and Class 2 since November 1, 2007 with respect to its original portfolio, now the Core Macro Portfolio. Moreover, DTP became a part of the Core Macro Portfolio as of August 2008. There can be no assurance that any portfolio of the Fund will achieve its investment objective.

Risks Related to Trading and Market Conditions

Futures and Options Trading Is Speculative and Volatile. Futures and options prices are highly volatile. Such volatility may lead to substantial risks and returns, generally much larger than in the case of equity or fixed-income investments. Price movements for futures are influenced by, among other things: changing supply and demand relationships; weather; agricultural, trade, fiscal, monetary, and exchange control programs and policies of governments; macro political and economic events and policies; changes in national and international interest rates and rates of inflation; currency devaluations and revaluations; and emotions of other marketplace participants. None of these factors can be controlled by the Fund and no assurance can be given that the Manager’s advice will result in profitable trades for a participating customer or that a customer will not incur substantial losses. The purchaser of an option is subject to the risk of losing the entire purchase price of the option, while the writer of an option is subject to an unlimited risk of loss, namely the risk of loss resulting from the difference between the premium received for the option and the price of the futures contract or other asset underlying the option which the writer must purchase or deliver upon exercise of the option.

The Fund may purchase call and put options in respect of specific futures contracts, and may write and sell covered or uncovered call and put option contracts. A call option gives the purchaser of the option the right to buy, and obligates the writer to sell, the underlying contract at a stated exercise price at any time prior to the expiration of the option. Similarly, a put option gives the purchaser of the option the right to sell, and obligates the writer to buy, the underlying contract at a stated exercise price at any time prior to the expiration of the option. A covered call option sold by the Fund, which is a call option with respect to which the Fund owns the underlying contract, exposes the Fund during the term of the option to possible loss of opportunity to realize appreciation in the market price of the underlying contract or to possible continued holding of a contract which might otherwise have been sold to protect against depreciation in the market price of the contract. A covered put option sold by the Fund, which is a put option with respect to which the Fund has sold short an equivalent number of the underlying contract or owns an offsetting put option, exposes the Fund during the term of the option to possible loss of opportunity to realize profit due to a decline in price of the underlying contract.

The Fund may engage in “uncovered” option transactions, where the writer of a call option does not own an equivalent number of the underlying contracts or, in the case of a put option, the writer has not segregated cash to fulfill the obligation, has not sold short an equivalent number of contracts and does not own a put option covering an equivalent number of contracts with an exercise price equal to or greater than the exercise price of the put written. Regarding uncovered options, the purchaser of an option is subject to the risk of losing the entire purchase price of the uncovered option, while the writer of an uncovered option is subject to an unlimited risk of loss, namely the risk of loss resulting from the difference between the premium received for the option and the price of the futures contract or other asset underlying the option which the writer must purchase and deliver upon exercise of the option.

Thus, an investment in the Fund is suitable only for those investors with speculative capital who understand the risks of futures and options markets.

The Fund’s Trading Is Highly Leveraged, Which May Result in Substantial Losses for the Fund. The Fund trades futures, currencies, swaps, options, and other instruments on a leveraged basis due to the low margin deposits normally required for trading. As a result, a relatively small price movement in a contract may result in immediate and substantial gains or losses for the Fund. For example, $3,000 in margin may be required to hold a U.S. Treasury futures contract with a face value of $100,000. If the value of the contract were to decline by 3%, the entire margin deposit would be lost. There is no cap on the amount of leverage that the Fund may employ.

Market Illiquidity May Cause Less Favorable Trade Prices. Futures trading at times may be illiquid. Most United States commodity exchanges limit price fluctuations in certain commodity interest prices during a single day by means of “daily price fluctuation limits” or “daily limits.” The daily limit, which is set by most exchanges for all but a portion of the expiration month, imposes a floor and a ceiling on the prices at which a trade may be executed, as measured from the last trading day’s close. While these limits were put in place to lessen margin exposure, they may have certain negative consequences for the Fund’s trading. For example, once the price of a particular contract has increased or decreased by an amount equal to the daily limit, thereby producing a “limit-up” or “limit-down” market, positions in the contract can neither be taken nor liquidated unless traders are willing to effect trades at or within the limit. Contract prices in various commodities have occasionally moved the daily limit for several consecutive days with little or no trading. Similar occurrences could prevent the Fund from promptly liquidating unfavorable positions, subjecting the Fund to substantial losses, or prevent it from entering into desired trades. Other investment positions held by the Fund may be or become illiquid. The Fund may invest in instruments traded on non-U.S. exchanges. The Fund may not be readily able to dispose of illiquid investments, and in some cases may be contractually prohibited from disposing of an investment for a specified period of time. An exchange or regulatory authority may suspend trading in a particular instrument, order immediate liquidation and settlement of a particular contract, or order that trading in a particular contract be conducted for liquidation only.

Exchange for Physicals (“EFPs”). The Fund may engage in transactions in physical commodities, including exchange for physical transactions. An exchange for physical (“EFP”) is a transaction permitted under the rules of many futures exchanges in which two parties holding futures positions may close out their positions without making an open, competitive trade on the exchange. Generally, the holder of a short futures position buys the physical commodity, while the holder of a long futures position sells the physical commodity. The prices at which such transactions are executed are negotiated between the parties.

The Fund May Invest in Swaps and Swaptions. Whether the Fund’s use of swap agreements or swaptions will be successful will depend on the Manager’s ability to select appropriate transactions for the Fund. Swap agreements and options on swap agreements (“swaptions”) can be individually negotiated and structured to include exposure to a variety of different types of investments, asset classes or market factors. Depending on their structure, swap agreements may increase or decrease the holder’s exposure to, for example, long-term or short-term interest rates, foreign currency values, credit spreads or other factors. Swap agreements can take many different forms and are known by a variety of names. Though the Fund’s investment portfolio is generally expected to be liquid, certain swap transactions may be highly illiquid and may increase or decrease the volatility of the Fund’s investment portfolio. Moreover, the Fund bears the risk of loss of the amount expected to be received under a swap agreement in the event of the default or insolvency of its counterparty. The Fund will also bear the risk of loss related to swap agreements, for example, for breaches of such agreements or the failure of the Fund to post or maintain required collateral. It is possible that developments in the swap markets, including potential government regulation, could adversely affect the Fund’s ability to terminate swap transactions or to realize amounts to be received under such transactions.

Virtual Currency Futures. The Fund may trade futures on virtual currencies. There are relatively few futures currently available with respect to virtual currencies. Futures with respect to virtual currencies typically have higher collateral and margin deposit requirements than apply to futures with respect to other asset classes, thereby limiting the ability of the Fund to leverage such investments. As margin deposit requirements are set as a percentage of the value of a particular contract, the inherent price volatility of the underlying virtual currency may result in substantial increases in margin requirements for long or short positions of related futures if the price of the underlying virtual currency rises or falls. If FCMs and exchanges lower such margin or collateral requirements in the future, this would increase the inherent leverage of such products, thus increasing the risk of such positions.

In light of the comparatively small number of market participants and trading volume compared to traditional markets and the volatile demand for the underlying virtual currencies, it may be more difficult to liquidate virtual currency futures at desired prices. In addition, FCMs and virtual currency exchanges may, in the future, impose position limits, prohibit naked shorting, or prohibit give-in transactions, among other restrictions on customer activity. Such restrictions may restrict the Fund 's ability to exit a position during a period of high volatility. Whether due to government action, virtual currency network failure or compromise, market disruptions or exchange or FCM imposed limits, the Fund’s inability to liquidate a position at the desired price or in general may result in substantial losses for the Fund.

Virtual currencies are not issued or controlled by any central governmental or non-governmental authority. The value of virtual currencies will depend on market demand by investors and market participants. As a result, the market prices for virtual currencies can be very volatile. In addition, tax, commodity and securities laws and regulations applicable to virtual currencies are still developing. In the future, CFTC and SEC rulemaking and other regulatory developments may impact the manner in which virtual currencies and related derivatives may be held or traded. One or more countries, including the United States, may take regulatory actions in the future that could severely restrict the right to acquire, own, hold, sell or use virtual currencies or to exchange virtual currencies for other currencies. Any such regulation could have a significant impact on the value of virtual currencies.

In Times of Market Stress, the Fund May Not Be Able to Diversify Its Portfolio and Risk Management Systems May Not be Effective. Where the markets are subject to exceptional stress, trading strategies and programs may become less diversified and more highly correlated as the stress may cause diverse and otherwise unrelated markets all to act in a similar manner. Efforts by the Manager to diversify the Fund’s trading strategies and investment exposure may not succeed in protecting the Fund from significant losses in the event of severe market disruptions. Furthermore, certain risk measures used by the Advisor as part of its risk management systems and procedures, including VaR, are dependent on inputs derived from historical scenarios and data. Such inputs based on historical scenarios and data may not be reliable during periods of unusual or distressed market conditions where the market ceases to function in a typical manner. As a result, the Advisor’s risk management systems and procedures may not operate as anticipated or be effective to prevent losses, in unusual or distressed market conditions. A significant risk of any risk management system using stop loss limits is “gap risk,” which is the risk that liquidity suddenly becomes unavailable and/or markets simply move too quickly through the desired stop level, resulting in greater than expected losses. The inability of a Portfolio or other investors to sell certain types of investments could also lead to a potential inability of the Portfolio and other investors to meet margin calls or fund withdrawals, the impact of which can be further aggravated as dealers and counterparties reduce available credit lines and investors withdraw additional capital. The COVID-19 outbreak initially placed tremendous stress on global markets, leading to a breakdown in typical asset class correlations, decreasing liquidity in the cash markets, and increasing volatility across all markets, although those effects have become muted in response to global vaccination measures to combat the outbreak and fiscal relief measures to support businesses and households.

The Fund Has Credit and Market Risks With Respect to Its Cash Management. The Fund currently invests all assets not required for trading in Cash Assets, which in turn presently holds deposits in bank accounts or invests broadly in U.S. government or agency securities. With respect to its cash deposited in bank accounts, although the bank accounts themselves may be insured by the United States Federal Deposit Insurance Corporation, the balances in such accounts will be largely uninsured, as the maximum amount of insurance available to such accounts will not be material relative to the balances that are expected to be maintained in the accounts. With respect to its investment in U.S. government or agency securities, Cash Assets currently intends to hold them until they mature and values them at amortized cost which approximates fair value. Some of these securities may not mature for a year or longer. If Cash Assets were forced to sell some of its securities in the open market before they mature to meet unanticipated redemption requests (whether from the Fund or other entities affiliated with the Manager), the market value of the securities at such time may be below their amortized cost causing a loss for Fund investors. In addition, if interest rates rise, the interest rate that Cash Assets pays its investors (including the Fund) will not fully reflect the new rates because its pre-existing investments are still yielding interest at lower rates.

The Fund May Also Borrow Money to Support its Trading, Which Could Increase the Level of Volatility in its Performance and Expose the Fund to Greater Losses. In addition to the leverage implicit in trading futures, the Fund may borrow money from brokers or their affiliates and other lenders. A significant portion of the funds borrowed by the Fund may be obtained from brokerage entities in the form of margin loans collateralized by assets held in the Fund’s brokerage account with such brokerage firms. The Fund does not have any limits on borrowing or leverage.

The Fund May Be Terminated at Any Time. Unforeseen circumstances, including substantial losses, the retirement or loss of key personnel of the Manager, the withdrawal of the Manager or the decision of the Manager not to continue to manage the Fund, could cause the Fund to terminate prior to its stated termination date of December 31, 2050. Early termination of the Fund could disrupt an investor’s overall investment portfolio plan resulting in the loss of some or all of its investment.

There is no Secondary Market for the Units, Therefore Investors Should Consider Their Investment in the Fund to be Illiquid. It is not anticipated that an active secondary market will develop in the Units. The Units will not be transferable without the consent of the Manager (which may be granted or withheld in its discretion and on such terms as it determines). Units are not being registered so as to permit a public offering under the securities laws of any jurisdiction. Moreover, there are limitations on the ability of an investor to require the Fund to redeem Units. Consequently, the Units will be illiquid investments.

The Fund Does Not Anticipate Paying Dividends or Making Distributions, Therefore an Investment in the Fund is Not Appropriate for Investors Seeking Current Income. Since the Fund does not presently intend to pay dividends or other distributions, an investment in the Fund may not be suitable for investors seeking current returns for financial or tax planning purposes.

Regulatory and Related Risks