Third Quarter 2015 Investor Presentation

Forward-Looking Statements This presentation contains forward-looking statements within the meaning of section 27A of the Securities Act of 1933, as amended, and section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements reflect our current views with respect to, among other things, future events and our financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would” and “outlook,” or the negative version of those words or other comparable of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. The following risks, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: (1) the businesses of Atlantic Capital Bancshares, Inc. (“Atlantic Capital”) and First Security Group, Inc. (“First Security”) may not integrate successfully or the integration may be more difficult, time-consuming or costly than expected; (2) the expected growth opportunities and cost savings from the transaction may not be fully realized or may take longer to realize than expected; (3) revenues following the transaction may be lower than expected as a result of losses of customers or other reasons, including issues arising in connection with integration of the two banks; (4) deposit attrition, operating costs, customer loss and business disruption following the transaction, including difficulties in maintaining relationships with employees, may be greater than expected; (5) reputational risks and the reaction of the companies’ customers to the acquisition of First Security; (6) diversion of management time on merger related issues; (7) changes in asset quality and credit risk; (8) the cost and availability of capital; (9) customer acceptance of the combined company’s products and services; (10) customer borrowing, repayment, investment and deposit practices; (11) the introduction, withdrawal, success and timing of business initiatives; (12) the impact, extent, and timing of technological changes; (13) severe catastrophic events in our geographic area; (14) a weakening of the economies in which the combined company will conduct operations may adversely affect its operating results; (15) the U.S. legal and regulatory framework, including those associated with the Dodd-Frank Wall Street Reform and Consumer Protection Act could adversely affect the operating results of the combined company; (16) the interest rate environment may compress margins and adversely affect net interest income; (17) changes in trade, monetary and fiscal policies of various governmental bodies and central banks could affect the economic environment in which we operate; (18) our ability to determine accurate values of certain assets and liabilities; (19) adverse behaviors in securities, public debt, and capital markets, including changes in market liquidity and volatility; (20) our ability to anticipate interest rate changes correctly and manage interest rate risk presented through unanticipated changes in our interest rate risk position and/or short- and long-term interest rates; (21) unanticipated changes in our liquidity position, including but not limited to our ability to enter the financial markets to manage and respond to any changes to our liquidity position; (22) adequacy of our risk management program; (23) increased costs associated with operating as a public company; (24) competition from other financial services companies in the companies’ markets could adversely affect operations; and (25) other factors described in Atlantic Capital’s reports filed with the Securities and Exchange Commission and available on the SEC’s website (www.sec.gov). 2

Proprietary & Confidential Overview Atlantic Capital was organized in 2007 with initial equity capital raise of $125 million Focused on banking: Small to mid-sized enterprises with revenues between $5mm-$250mm Highly-select group of institutional caliber commercial real estate developers and investors Principals of our commercial clients, professionals and their practices, and other affluent families Differentiated by providing superior expertise, competitive capabilities, and high touch service delivery Completed acquisition of First Security Group on October 31 70% stock – 8.79 million common shares of ACBI 30% cash – $47.1 million 3

Proprietary & Confidential Atlantic Capital Strategy Become a premier southeastern business and private banking company Investing in people and capabilities to accelerate organic growth and build profitability Results are evidence of meaningful progress Attractive interest rate risk position Completed merger with First Security Group on October 31 New market expansion through mergers and acquisitions and de novo entry Patient and disciplined approach with focus on shareholder value 4 Accelerated Organic Growth Strategic Expansion

Proprietary & Confidential Atlantic Capital Highlights Opened in 2007 to serve middle market in Southeastern US Organically grew to $1.4 billion in assets despite market downturn Well positioned to capitalize on Atlanta market recovery, new market expansion and higher interest rates Supplemented by recently completed strategic acquisition of FSGI Domain expertise Market continuity Focused on middle market commercial, emerging growth companies and high net worth clients Initiatives in place to maintain robust top line growth Operating model will produce enhanced efficiencies going forward Consistently high asset quality NPAs/assets have averaged 0.43% since inception 5 Organic Growth Story in Desirable Markets Accomplished Management Team Attractive Business Mix Strong Growth Prospects Disciplined Risk Management

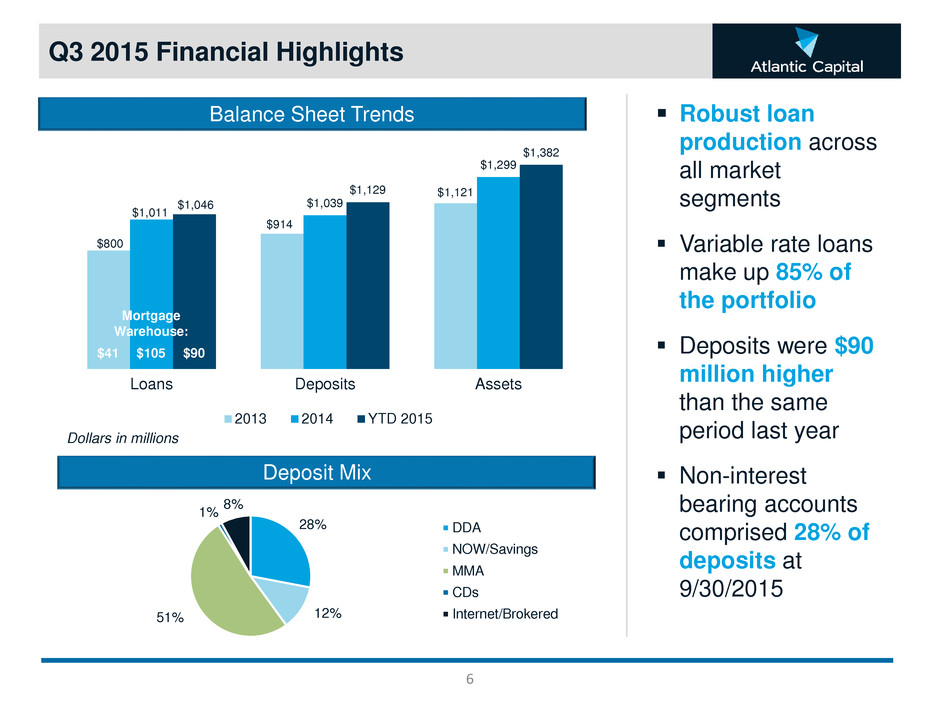

$800 $914 $1,121 $1,011 $1,039 $1,299 $1,046 $1,129 $1,382 Loans Deposits Assets 2013 2014 YTD 2015 Deposit Mix Q3 2015 Financial Highlights Robust loan production across all market segments Variable rate loans make up 85% of the portfolio Deposits were $90 million higher than the same period last year Non-interest bearing accounts comprised 28% of deposits at 9/30/2015 Mortgage Warehouse: Dollars in millions 6 28% 12% 51% 8% 1% DDA NOW/Savings MMA CDs Internet/Brokered Balance Sheet Trends $41 $105 $90

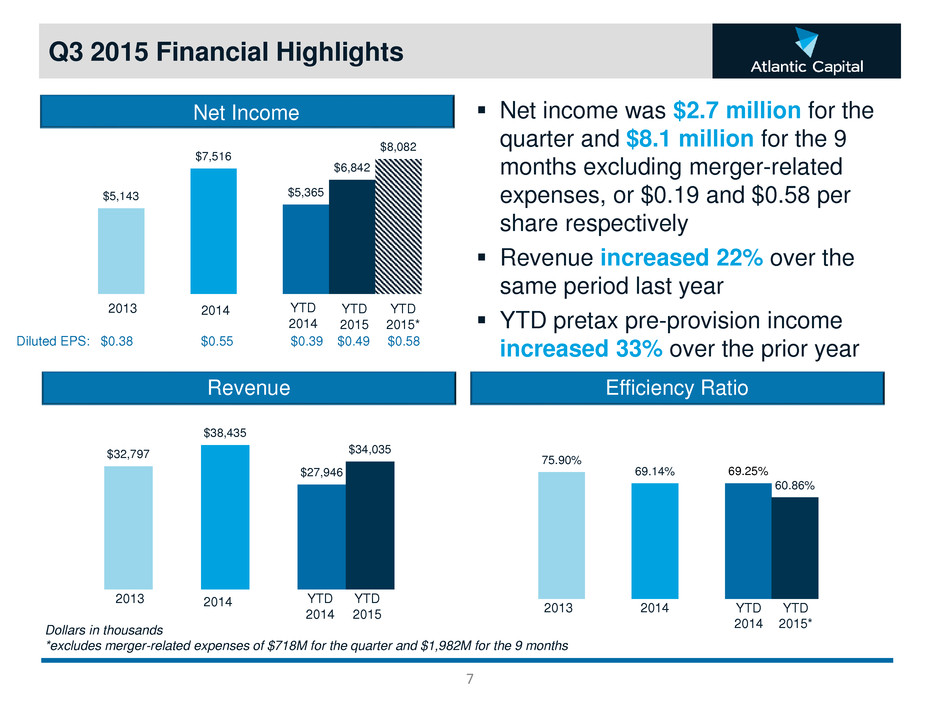

Q3 2015 Financial Highlights Net income was $2.7 million for the quarter and $8.1 million for the 9 months excluding merger-related expenses, or $0.19 and $0.58 per share respectively Revenue increased 22% over the same period last year YTD pretax pre-provision income increased 33% over the prior year 7 Net Income Revenue Dollars in thousands *excludes merger-related expenses of $718M for the quarter and $1,982M for the 9 months Efficiency Ratio Diluted EPS: $0.38 $0.55 $0.39 $0.49 $0.58 $5,143 $7,516 $5,365 $6,842 $8,082 2014 YTD 2014 YTD 2015* $32,797 $38,435 $27,946 $34,035 2013 YTD 2015 2014 YTD 2014 75.90% 69.14% 69.25% 60.86% 2013 YTD 2015* 2014 YTD 2014 YTD 2015 2013

8 Acquired First Security Group (FSGI) on October 31 70% stock – 8.79 million common shares of ACBI 30% cash – $47.1 million Private placement of $25 million common stock at $12.60 per share on October 31 Private placement of $50 million 6.25% subordinated notes on September 28 ACBI began trading on NASDAQ on November 2 Conversion scheduled for Q3 2016 Acquisition of First Security Group 8

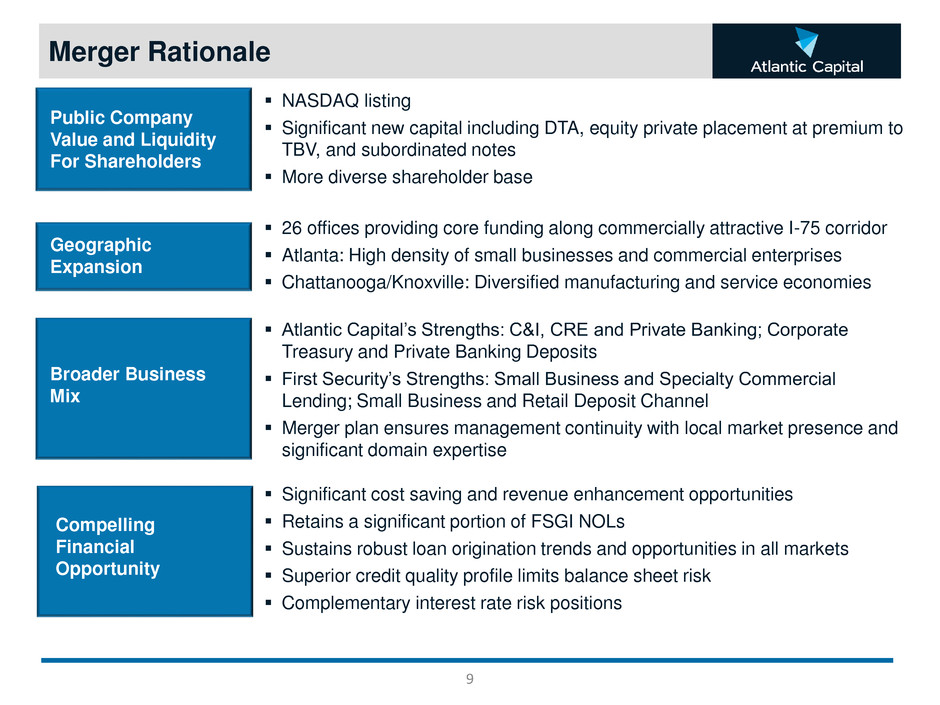

Merger Rationale NASDAQ listing Significant new capital including DTA, equity private placement at premium to TBV, and subordinated notes More diverse shareholder base 26 offices providing core funding along commercially attractive I-75 corridor Atlanta: High density of small businesses and commercial enterprises Chattanooga/Knoxville: Diversified manufacturing and service economies Atlantic Capital’s Strengths: C&I, CRE and Private Banking; Corporate Treasury and Private Banking Deposits First Security’s Strengths: Small Business and Specialty Commercial Lending; Small Business and Retail Deposit Channel Merger plan ensures management continuity with local market presence and significant domain expertise Significant cost saving and revenue enhancement opportunities Retains a significant portion of FSGI NOLs Sustains robust loan origination trends and opportunities in all markets Superior credit quality profile limits balance sheet risk Complementary interest rate risk positions 9 Public Company Value and Liquidity For Shareholders Geographic Expansion Broader Business Mix Compelling Financial Opportunity

Atlantic Capital/First Security Merger Snapshot C o m b in e d (1 ) Financial information as of Sept. 30, 2015 (1)See pro forma balance sheet as of June 30, 2015 Form 424B3 filed September 15, 2015 • Headquartered in Atlanta, GA • Privately held • Single office location • Corporate and private banking • Atlanta focus • Headquartered in Chattanooga, TN • NASDAQ listed (FSGI) • 25 offices • Small business and retail banking • Chattanooga and Knoxville focus • $1.1 billion in deposits • $1.0 billion in total loans • $933 million in deposits • $842 million total loans • Middle market corporate banking • Commercial real estate finance • SBA / Franchise lending • Private banking • Treasury services • Small business lending • Credit tenant loans • Mortgage banking • Trust and wealth management • Retail deposit channel 10 Corporate Overview Financial Scale Business Strengths • Headquartered in Atlanta, GA • Listed on NASDAQ (ACBI) • 26 offices (prior to potential consolidations / sales) • Expanded footprint along I-75 • $2.0 billion in deposits • $1.8 billion total loans • Broad commercial platform • Significant fee income businesses • Diversified funding mix

Creates a leading middle market commercial bank operating along the I-75 corridor Attractive Market Demographics Atlanta-Sandy Springs-Roswell, GA MSA • Total Population 2014: Approximately 5.6 million • 2014-2019E Population Growth: 6.4% projected • Median Household Income 2014: $52,533 • Total Deposits in Market: Approximately $130 billion Chattanooga, TN-GA MSA • Total Population 2014: Approximately 544 thousand • 2014-2019E Population Growth: 4.0% projected • Median Household Income 2014: $41,704 • Total Deposits in Market: Approximately $8.5 billion Knoxville, TN MSA • Total Population 2014: Approximately 855 thousand • 2014-2019E Population Growth: 3.1% projected • Median Household Income 2014: $44,405 • Total Deposits in Market: Approximately $14.7 billion Source: Nielsen, SNL Financial 11 Georgia Atlanta Tennessee Chattanooga Knoxville

Merger Integration 12 Integrate Organizations with Common Culture Complete Integration and Realize Cost Savings and Revenue Synergies Integrate operating platforms and product capabilities by Q3 2016 Evaluate geographic footprint to maximize efficiency Leverage combined technology and product capabilities for greater efficiency and better service Add middle market corporate banking effort in east Tennessee Expand mortgage and trust/wealth management effort to Atlanta Cross-sell treasury services support to east Tennessee

The New Atlantic Capital Three attractive growth markets Focus on corporate, business and private banking Solid relationship deposit funding Sound credit quality Positioned for interest rate increase Pursuing disciplined strategic expansion with a focus on shareholder value Organic Growth Strategic Opportunities 13

APPENDIX

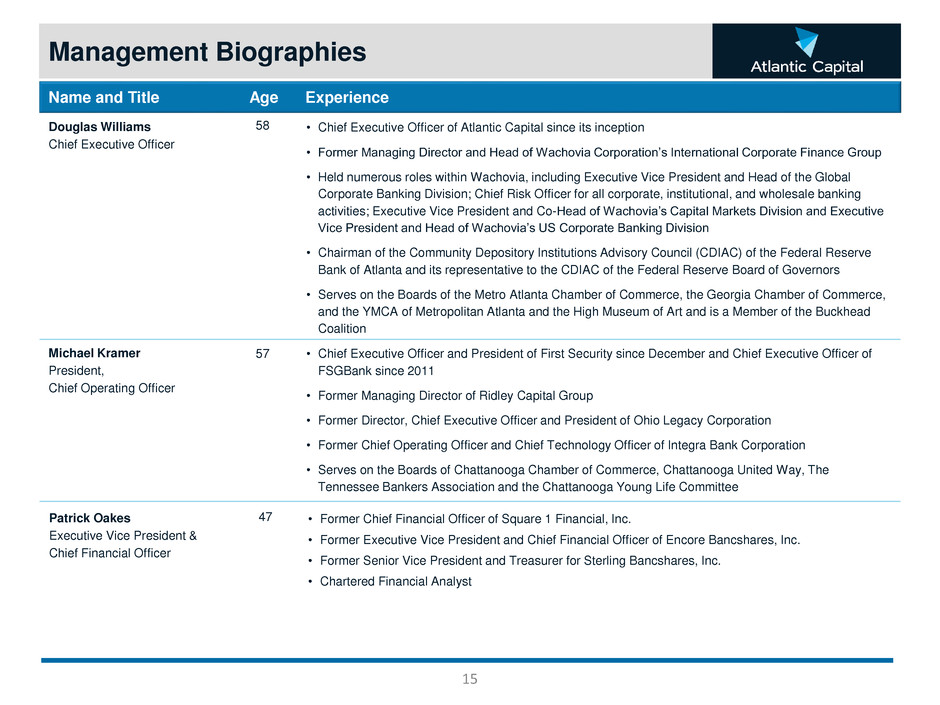

Management Biographies Name and Title Age Experience Patrick Oakes Executive Vice President & Chief Financial Officer 47 • Former Chief Financial Officer of Square 1 Financial, Inc. • Former Executive Vice President and Chief Financial Officer of Encore Bancshares, Inc. • Former Senior Vice President and Treasurer for Sterling Bancshares, Inc. • Chartered Financial Analyst Douglas Williams Chief Executive Officer 58 • Chief Executive Officer of Atlantic Capital since its inception • Former Managing Director and Head of Wachovia Corporation’s International Corporate Finance Group • Held numerous roles within Wachovia, including Executive Vice President and Head of the Global Corporate Banking Division; Chief Risk Officer for all corporate, institutional, and wholesale banking activities; Executive Vice President and Co-Head of Wachovia’s Capital Markets Division and Executive Vice President and Head of Wachovia’s US Corporate Banking Division • Chairman of the Community Depository Institutions Advisory Council (CDIAC) of the Federal Reserve Bank of Atlanta and its representative to the CDIAC of the Federal Reserve Board of Governors • Serves on the Boards of the Metro Atlanta Chamber of Commerce, the Georgia Chamber of Commerce, and the YMCA of Metropolitan Atlanta and the High Museum of Art and is a Member of the Buckhead Coalition Michael Kramer President, Chief Operating Officer 57 • Chief Executive Officer and President of First Security since December and Chief Executive Officer of FSGBank since 2011 • Former Managing Director of Ridley Capital Group • Former Director, Chief Executive Officer and President of Ohio Legacy Corporation • Former Chief Operating Officer and Chief Technology Officer of Integra Bank Corporation • Serves on the Boards of Chattanooga Chamber of Commerce, Chattanooga United Way, The Tennessee Bankers Association and the Chattanooga Young Life Committee 15

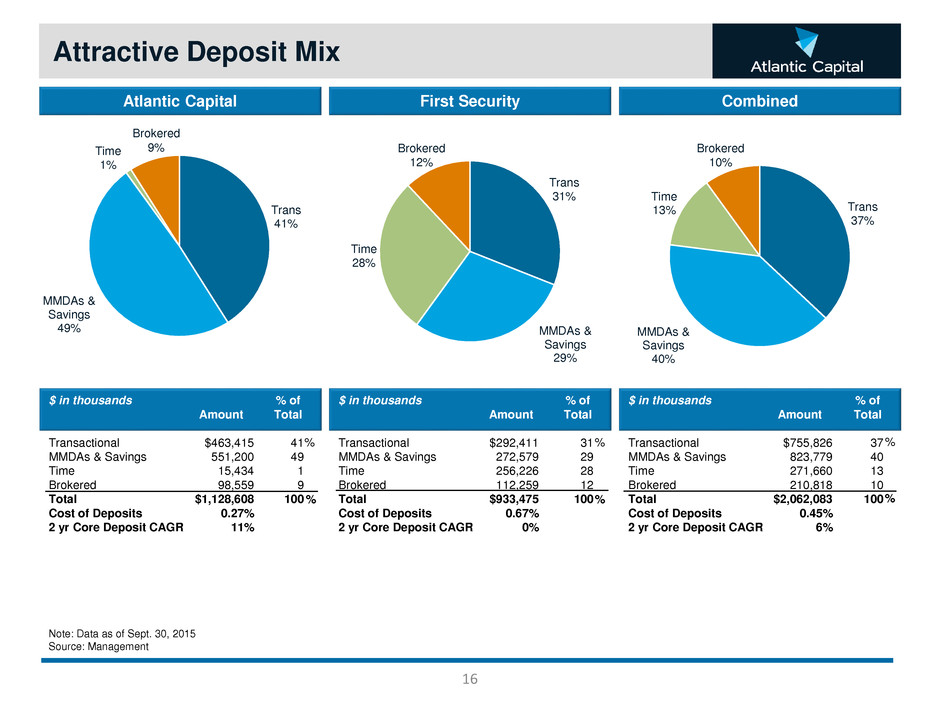

First Security Trans 31% MMDAs & Savings 29% Time 28% Brokered 12% $ in thousands Transactional MMDAs & Savings Time Brokered Total Cost of Deposits 2 yr Core Deposit CAGR Amount $292,411 272,579 256,226 112,259 $933,475 0.67% 0% % of Total 31 29 28 12 100 % % Attractive Deposit Mix Note: Data as of Sept. 30, 2015 Source: Management Combined Trans 41% MMDAs & Savings 49% Time 1% Trans 37% MMDAs & Savings 40% Time 13% Brokered 10% $ in thousands Transactional MMDAs & Savings Time Brokered Total Cost of Deposits 2 yr Core Deposit CAGR Amount $755,826 823,779 271,660 210,818 $2,062,083 0.45% 6% % of Total 37 40 13 10 100 % Atlantic Capital Brokered 9% $ in thousands Transactional MMDAs & Savings Time Brokered Total Cost of Deposits 2 yr Core Deposit CAGR Amount $463,415 551,200 15,434 98,559 $1,128,608 0.27% 11% % of Total 41 49 1 9 100 % % % 16

Atlantic Capital 1-4 Family 3% Multifamily 5% Comm RE 20% Owner Occupied 16% C&I 35% C&D 10% Cons & Other 11% $ in thousands 1-4 Family Multifamily Comm RE Owner Occupied C&I C&D Consumer & Other Total Portfolio Yield NPAs/Assets* 2yr CAGR Amount $27,912 55,352 205,075 165,210 366,830 106,934 119,124 $1,046,437 3.58% 0.00% 14% % of Total 3 5 20 16 35 10 11 100 % % Diversified Loan Mix Combined 1-4 Family 12% Multifamily 4% Comm RE 27% C&I 24% C&D 8% Cons & Other 8% $ in thousands 1-4 Family Multifamily Comm RE Owner Occupied C&I C&D Consumer & Other Total Portfolio Yield NPAs/Assets 2yr CAGR Amount $223,295 72,976 512,404 324,261 461,117 151,591 143,265 $1,888,909 4.05% 0.30% 19% % of Total 12 4 27 17 24 8 8 100 First Security 1-4 Family 23% Multifamily 2% Comm RE 37% Owner Occupied 19% C&I 11% C&D 5% Cons & Other 3% $ in thousands 1-4 Family Multifamily Comm RE Owner Occupied C&I C&D Consumer & Other Total Portfolio Yield NPAs/Assets 2yr CAGR Amount $195,383 17,624 307,329 159,151 94,287 44,657 24,141 $842,472 4.63% 0.66% 25% % of Total 23 2 37 19 11 5 3 100 % % % % Note: Data as of Sept. 30, 2015; loans include held for sale Source: Management *excludes performing TDRs 17 Owner Occupied 17%

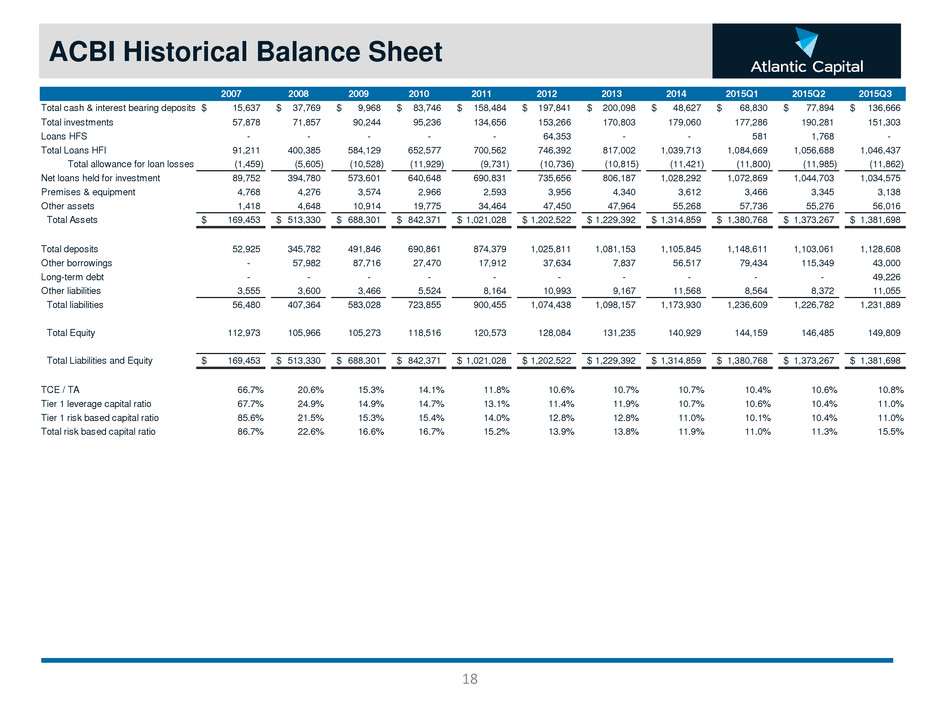

ACBI Historical Balance Sheet 18 2007 2008 2009 2010 2011 2012 2013 2014 2015Q1 2015Q2 2015Q3 Total cash & interest bearing deposits 15,637$ 37,769$ 9,968$ 83,746$ 158,484$ 197,841$ 200,098$ 48,627$ 68,830$ 77,894$ 136,666$ Total investments 57,878 71,857 90,244 95,236 134,656 153,266 170,803 179,060 177,286 190,281 151,303 Loans HFS - - - - - 64,353 - - 581 1,768 - Total Loans HFI 91,211 400,385 584,129 652,577 700,562 746,392 817,002 1,039,713 1,084,669 1,056,688 1,046,437 Total allowance for loan losses (1,459) (5,605) (10,528) (11,929) (9,731) (10,736) (10,815) (11,421) (11,800) (11,985) (11,862) Net loans held for investment 89,752 394,780 573,601 640,648 690,831 735,656 806,187 1,028,292 1,072,869 1,044,703 1,034,575 Premises & equipment 4,768 4,276 3,574 2,966 2,593 3,956 4,340 3,612 3,466 3,345 3,138 Other assets 1,418 4,648 10,914 19,775 34,464 47,450 47,964 55,268 57,736 55,276 56,016 Total Assets 169,453$ 513,330$ 688,301$ 842,371$ 1,021,028$ 1,202,522$ 1,229,392$ 1,314,859$ 1,380,768$ 1,373,267$ 1,381,698$ Total deposits 52,925 345,782 491,846 690,861 874,379 1,025,811 1,081,153 1,105,845 1,148,611 1,103,061 1,128,608 Other borrowings - 57,982 87,716 27,470 17,912 37,634 7,837 56,517 79,434 115,349 43,000 Long-term debt - - - - - - - - - - 49,226 Other liabilities 3,555 3,600 3,466 5,524 8,164 10,993 9,167 11,568 8,564 8,372 11,055 Total liabilities 56,480 407,364 583,028 723,855 900,455 1,074,438 1,098,157 1,173,930 1,236,609 1,226,782 1,231,889 Total Equity 112,973 105,966 105,273 118,516 120,573 128,084 131,235 140,929 144,159 146,485 149,809 Total Liabilities and Equity 169,453$ 513,330$ 688,301$ 842,371$ 1,021,028$ 1,202,522$ 1,229,392$ 1,314,859$ 1,380,768$ 1,373,267$ 1,381,698$ TCE / TA 66.7% 20.6% 15.3% 14.1% 11.8% 10.6% 10.7% 10.7% 10.4% 10.6% 10.8% Tier 1 leverage capital ratio 67.7% 24.9% 14.9% 14.7% 13.1% 11.4% 11.9% 10.7% 10.6% 10.4% 11.0% Tier 1 risk based capital ratio 85.6% 21.5% 15.3% 15.4% 14.0% 12.8% 12.8% 11.0% 10.1% 10.4% 11.0% Total risk based capital ratio 86.7% 22.6% 16.6% 16.7% 15.2% 13.9% 13.8% 11.9% 11.0% 11.3% 15.5%

ACBI Historical Income Statement ($ in thousands) 19 2007 2008 2009 2010 2011 2012 2013 2014 2015 YTD Interest income 4,728$ 15,169$ 23,292$ 28,213$ 29,682$ 30,933$ 32,537$ 36,542$ 30,727$ Interest expense 612 4,997 5,768 5,992 4,991 4,196 3,615 3,449 2,631 Net interest income 4,116 10,172 17,524 22,221 24,691 26,737 28,922 33,093 28,096 Provision for loan losses 1,459 4,146 10,087 2,813 7,144 (1,322) 246 488 412 Non-interest income 521 210 477 1,365 2,237 2,861 3,708 5,283 5,939 Total realized gains - - - 214 560 27 167 59 - Non-interest expense 11,534 14,284 17,375 17,556 17,643 21,768 24,893 26,574 22,694 Income (loss) before income tax (8,356) (8,048) (9,461) 3,431 2,701 9,179 7,658 11,373 10,929 Income tax expense (benefit) - - - (8,607) 1,009 3,248 2,515 3,857 4,087 Net income (loss) (8,356)$ (8,048)$ (9,461)$ 12,038$ 1,692$ 5,931$ 5,143$ 7,516$ 6,842$ Merger expense 1,982 Net income excluding merger expense 8,082$ Key ratios ROAA -9.29% -2.69% -1.52% 1.57% 0.20% 0.58% 0.46% 0.60% 0.67% ROAA excluding merger expense 0.79% ROAE -11.14% -7.37% -8.89% 11.09% 1.40% 4.79% 3.96% 5.46% 6.30% ROAE excluding merger expense 7.44% NIM 4.85% 3.46% 2.83% 2.93% 2.99% 2.75% 2.75% 2.85% 2.90% Efficiency Ratio 248.71% 137.59% 96.52% 73.76% 64.18% 73.48% 75.90% 69.14% 66.68% Non-interest expense / average assets 12.82% 4.77% 2.79% 2.29% 2.06% 2.12% 2.23% 2.18% 2.23%

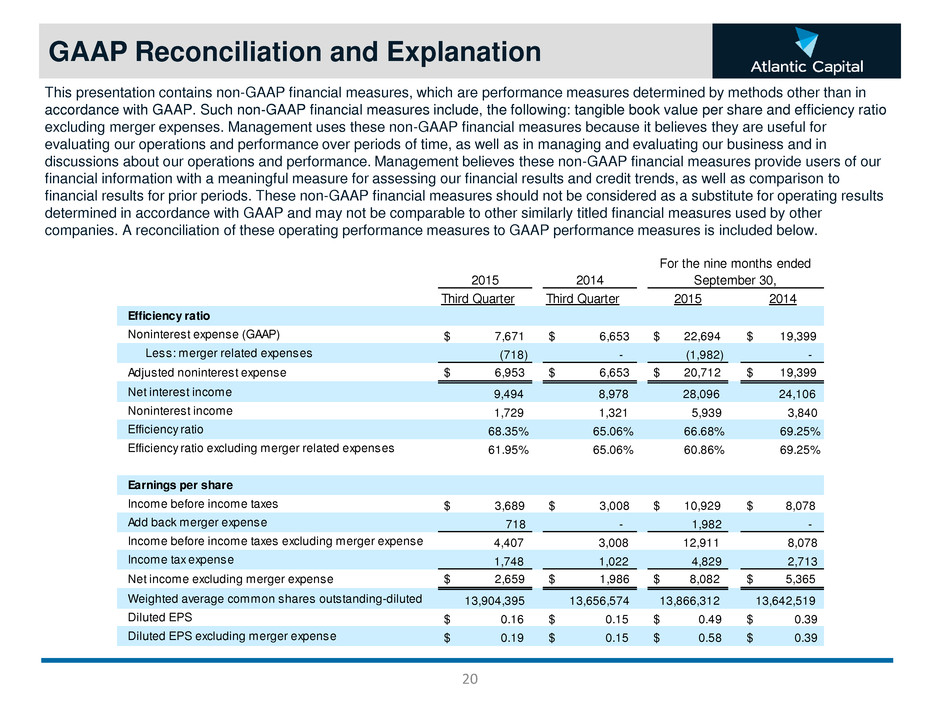

GAAP Reconciliation and Explanation This presentation contains non-GAAP financial measures, which are performance measures determined by methods other than in accordance with GAAP. Such non-GAAP financial measures include, the following: tangible book value per share and efficiency ratio excluding merger expenses. Management uses these non-GAAP financial measures because it believes they are useful for evaluating our operations and performance over periods of time, as well as in managing and evaluating our business and in discussions about our operations and performance. Management believes these non-GAAP financial measures provide users of our financial information with a meaningful measure for assessing our financial results and credit trends, as well as comparison to financial results for prior periods. These non-GAAP financial measures should not be considered as a substitute for operating results determined in accordance with GAAP and may not be comparable to other similarly titled financial measures used by other companies. A reconciliation of these operating performance measures to GAAP performance measures is included below. 20 2015 2014 Third Quarter Third Quarter 2015 2014 Efficiency ratio Noninterest expense (GAAP) $ 7,671 $ 6,653 $ 22,694 $ 19,399 Less: merger related expenses (718) - (1,982) - Adjusted noninterest expense $ 6,953 $ 6,653 $ 20,712 $ 19,399 Net interest income 9,494 8,978 28,096 24,106 Noninterest income 1,729 1,321 5,939 3,840 Efficiency ratio 68.35% 65.06% 66.68% 69.25% Efficiency ratio excluding merger related expenses 61.95% 65.06% 60.86% 69.25% Earnings per share Income before income taxes $ 3,689 $ 3,008 $ 10,929 $ 8,078 Add back m ger expense 718 - 1,982 - I co b for income taxes excluding merger expense 4,407 3,008 12,911 8,078 Income tax expense 1,748 1,022 4,829 2,713 Net income excluding merger expense $ 2,659 $ 1,986 $ 8,082 $ 5,365 Weighted average common shares outstanding-diluted 13,904,395 13,656,574 13,866,312 13,642,519 Diluted EPS $ 0.16 $ 0.15 $ 0.49 $ 0.39 Diluted EPS excluding merger expense $ 0.19 $ 0.15 $ 0.58 $ 0.39 For the nine months ended September 30,