Forward-Looking Statements This presentation contains forward-looking statements within the meaning of section 27A of the Securities Act of 1933, as amended, and section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements reflect our current views with respect to, among other things, future events and our financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “target,” “intend,” “plan,” “projection,” “would” and “outlook,” or the negative version of those words or other comparable of a future or forward-looking nature. These forward- looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. The following risks, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: the cost savings from our exit of the Tennessee and northwest Georgia markets may not be fully realized or may take longer to realize than expected; the funding impact from the loss of deposits following the sale of our Tennessee and northwest Georgia branches; our strategic decision to focus on the greater Atlanta market may not positively impact our financial condition in the expected timeframe, or at all; costs associated with our growth initiatives in the Atlanta market area; risks associated with increased geographic concentration, borrower concentration and concentration in commercial real estate and commercial and industrial loans resulting from our exit of the Tennessee and northwest Georgia markets and our strategic realignment; changes in asset quality and credit risk; the cost and availability of capital; customer acceptance of our products and services; customer borrowing, repayment, investment and deposit practices; the introduction, withdrawal, success and timing of business initiatives; the impact, extent, and timing of technological changes; severe catastrophic events in our geographic area; a weakening of the economies in which we conduct operations may adversely affect our operating results; the U.S. legal and regulatory framework could adversely affect the operating results of the company; the interest rate environment may compress margins and adversely affect net interest income; our ability to anticipate or respond to interest rate changes correctly and manage interest rate risk presented through unanticipated changes in our interest rate risk position and/or short- and long- term interest rates; changes in trade, monetary and fiscal policies of various governmental bodies and central banks could affect the economic environment in which we operate; our ability to determine accurate values of certain assets and liabilities; adverse developments in securities, public debt, and capital markets, including changes in market liquidity and volatility; unanticipated changes in our liquidity position, including but not limited to our ability to enter the financial markets to manage and respond to any changes to our liquidity position; the impact of the transition from LIBOR and our ability to adequately manage such transition; adequacy of our risk management program; increased competitive pressure due to consolidation in the financial services industry; risks related to security breaches, cybersecurity attacks and other significant disruptions in our information technology systems; the effect of changes in tax law, such as the effect of the Tax Cuts and Jobs Act that was enacted on December 22, 2017; and other risks and factors identified in our Annual Report on Form 10-K as filed with the Securities and Exchange Commission on March 14, 2019 in Part I, Item 1A under the heading “Risk Factors” and in Part II, Item 7 under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” 2

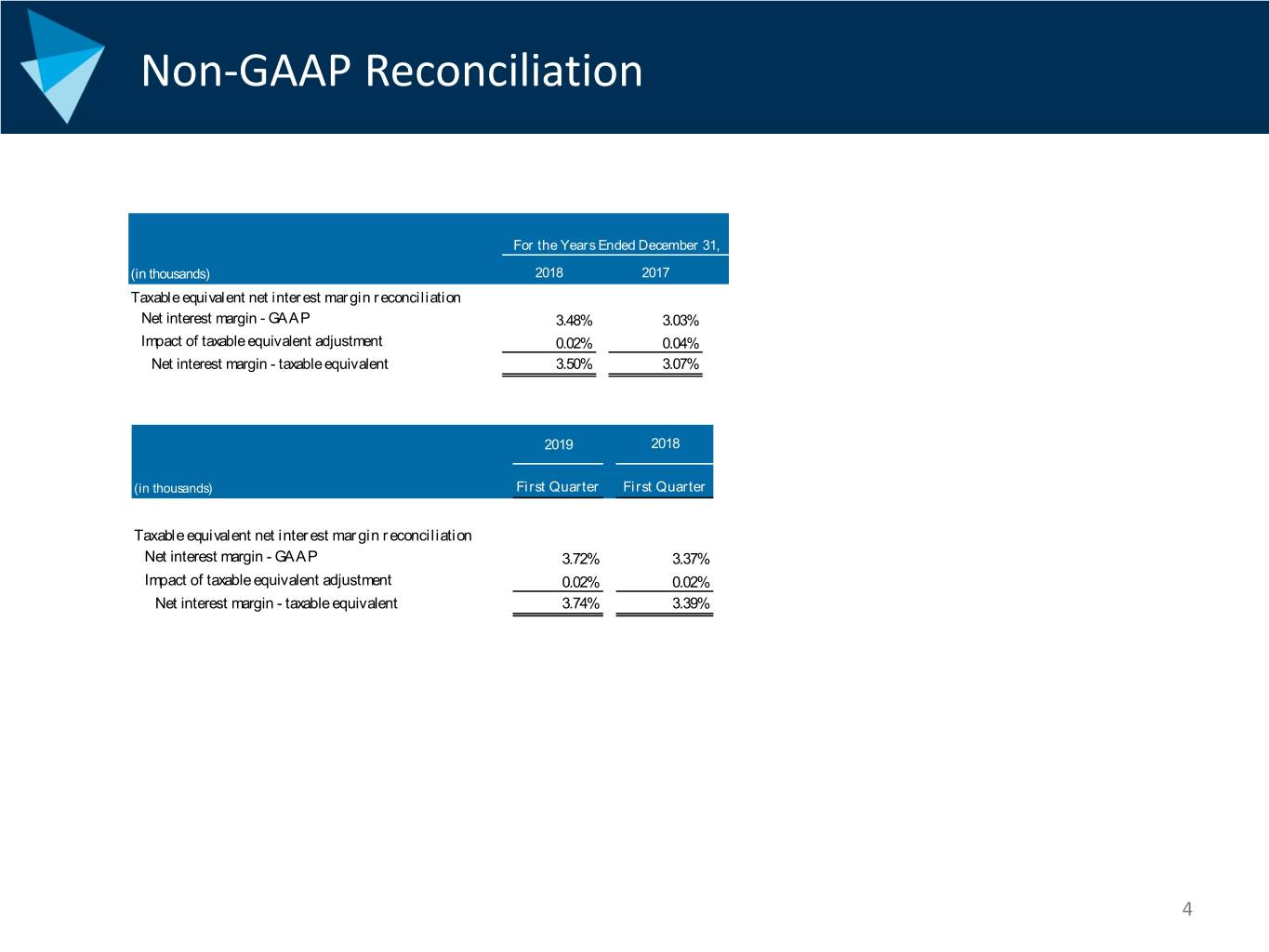

Non-GAAP Financial Information Statements included in this annual report include non-GAAP financial measures and should be read along with the accompanying tables, which provide a reconciliation of non-GAAP financial measures to GAAP financial measures. Atlantic Capital management uses non-GAAP financial measures, including taxable equivalent net interest margin. Management believes that non-GAAP financial measures provide a greater understanding of ongoing performance and operations, and enhance comparability with prior periods. Non-GAAP financial measures should not be considered as an alternative to any measure of performance or financial condition as determined in accordance with GAAP, and investors should consider Atlantic Capital’s performance and financial condition as reported under GAAP and all other relevant information when assessing the performance or financial condition of the Company. Non-GAAP financial measures have limitations as analytical tools, and investors should not consider them in isolation or as a substitute for analysis of the results or financial condition as reported under GAAP. Non-GAAP financial measures may not be comparable to non-GAAP financial measures presented by other companies. On April 5, 2019, Atlantic Capital completed the sale to FirstBank of its Tennessee and northwest Georgia banking operations, including 14 branches and the mortgage business. The banking business and branches subsequently sold to FirstBank are reported as discontinued operations. Discontinued operations have been reported retrospectively for periods presented prior to December 31, 2018. 3

We Fuel Prosperity WE ARE A team of talented, experienced and entrepreneurial bankers WE SERVE Clients who value high-touch relationships and deep expertise WE WIN With creativity, expertise, teamwork, humility, and confidence 6