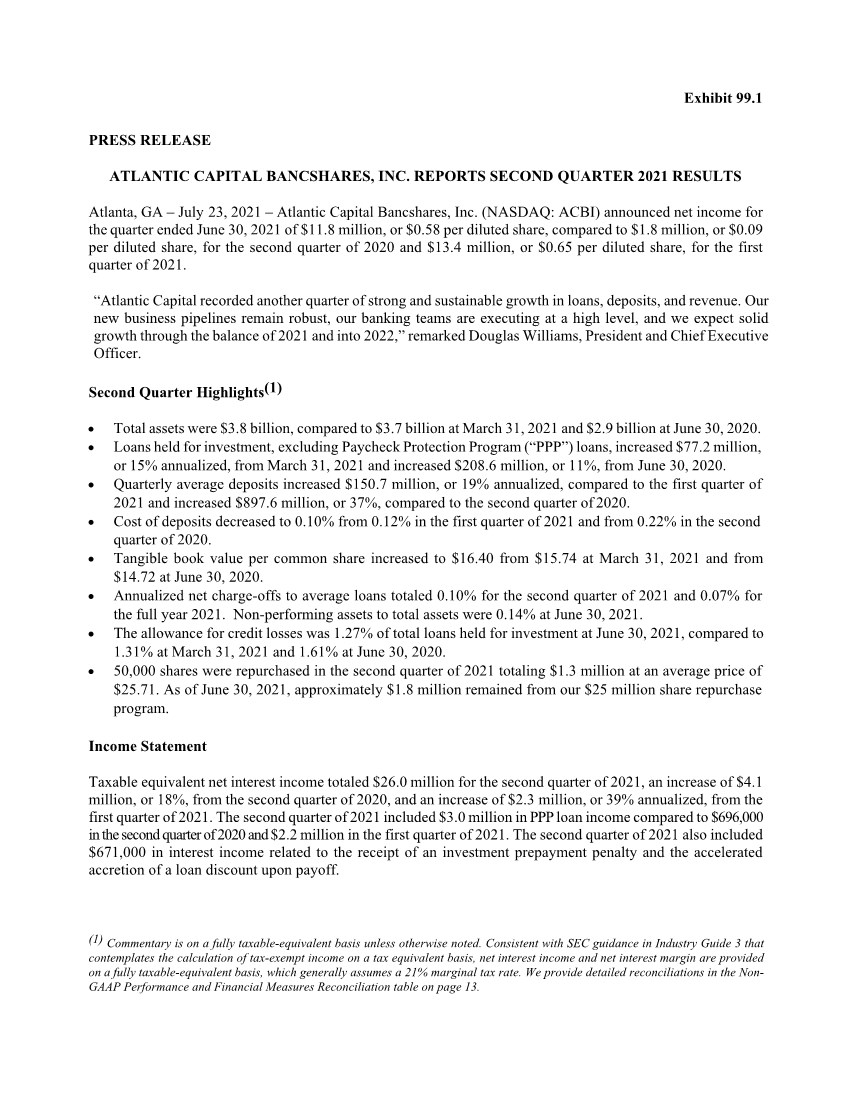

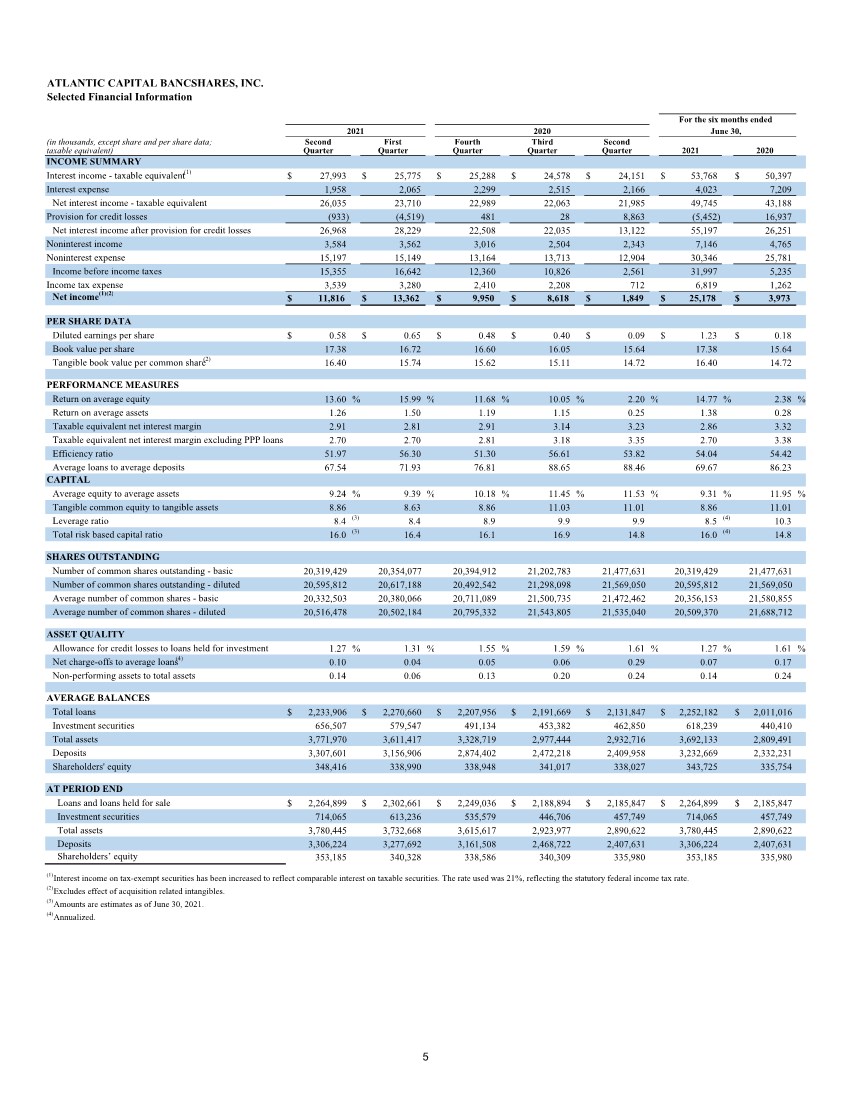

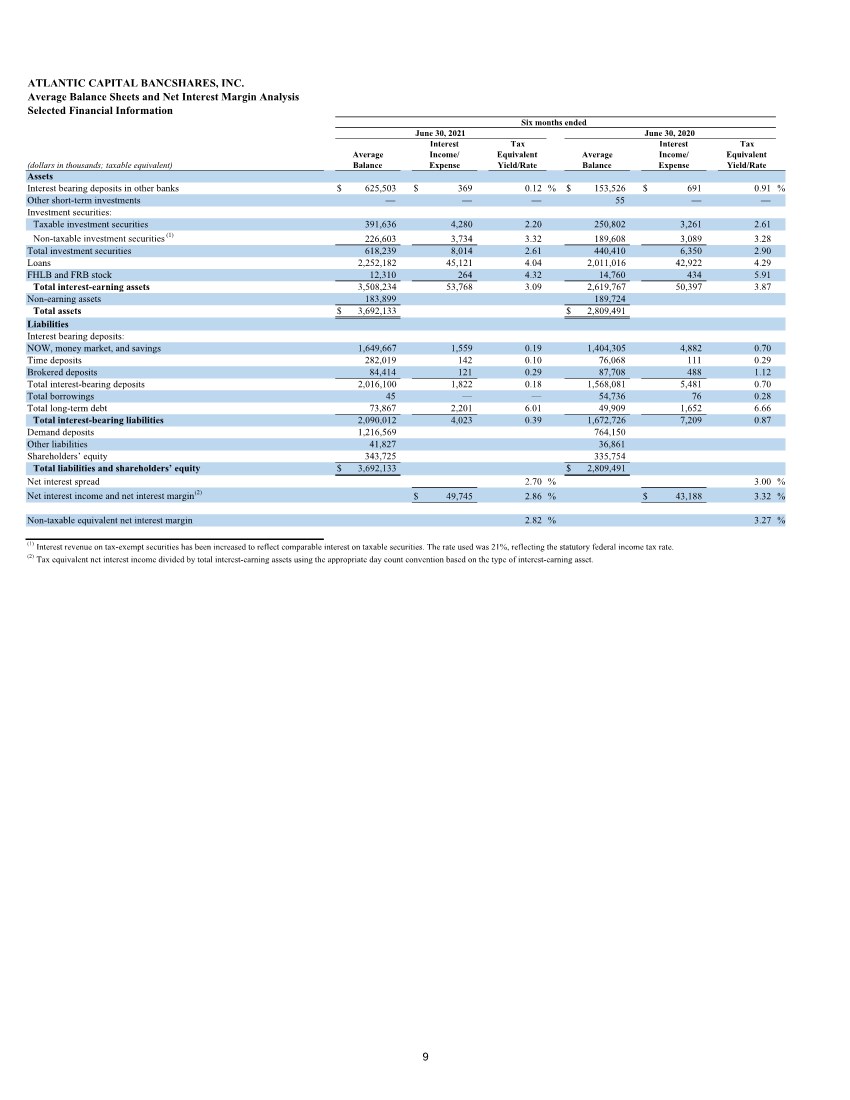

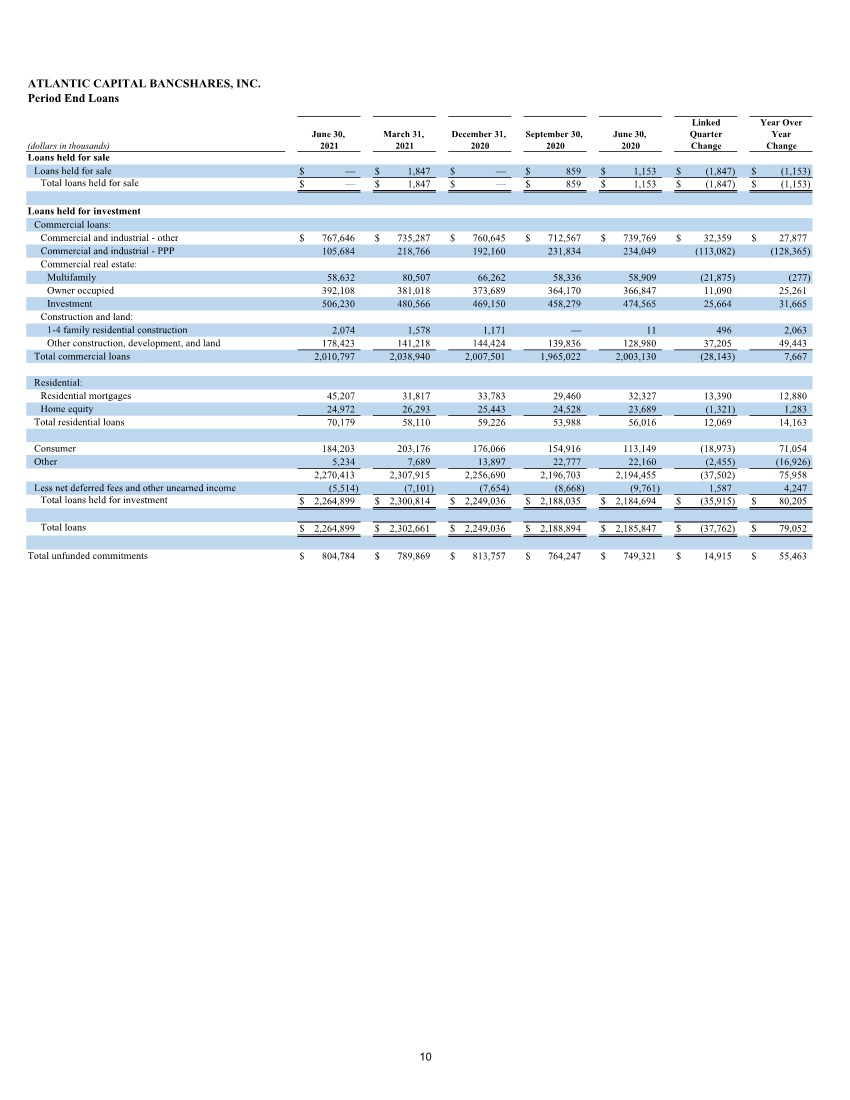

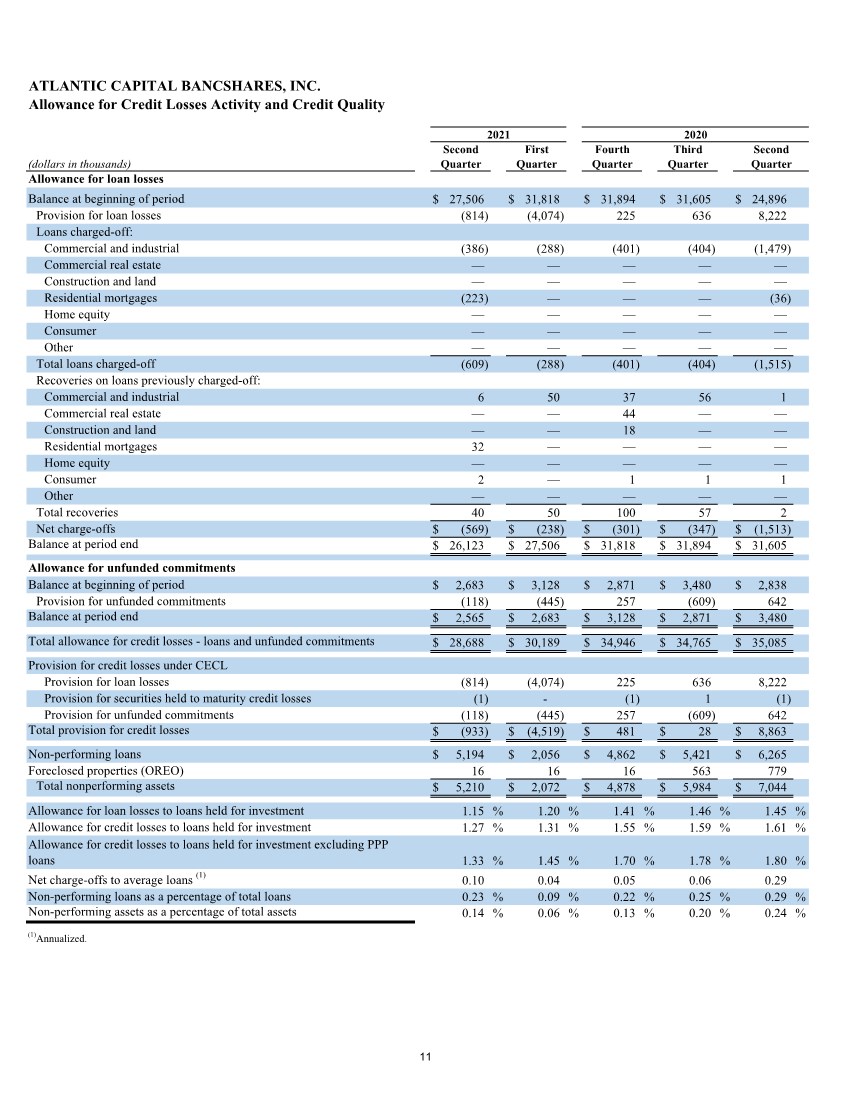

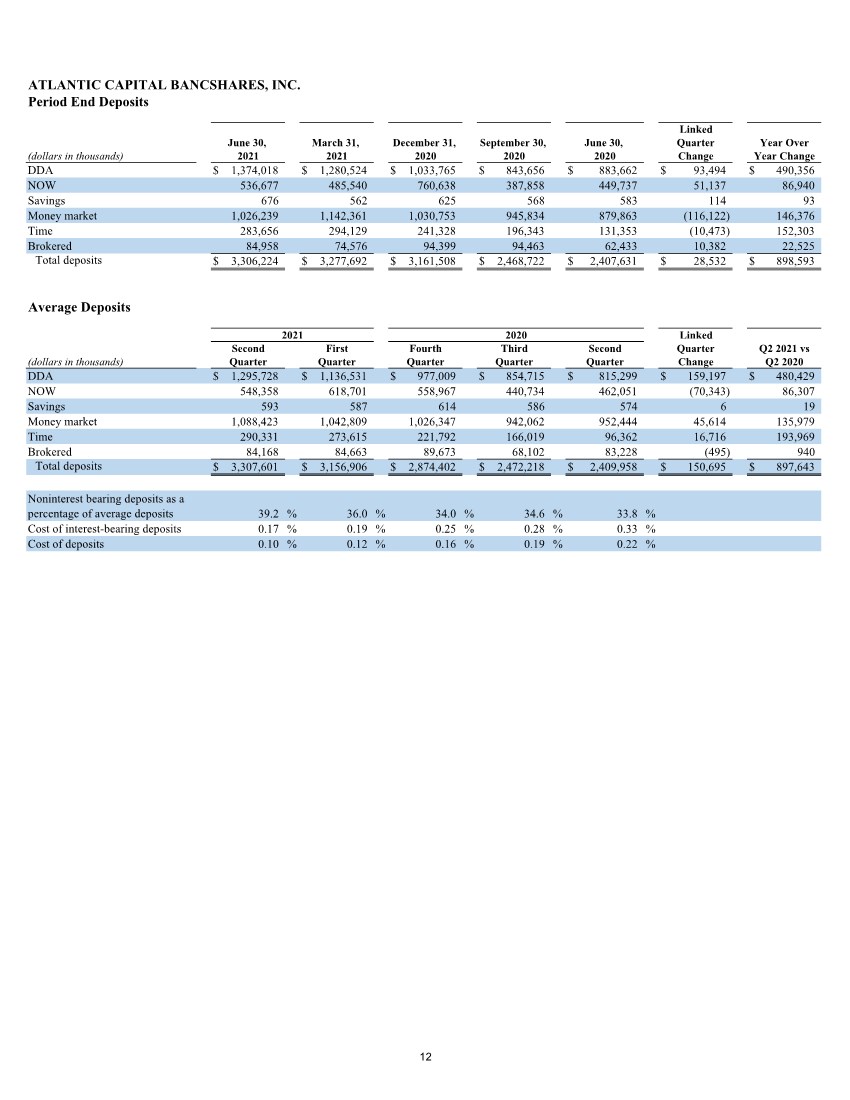

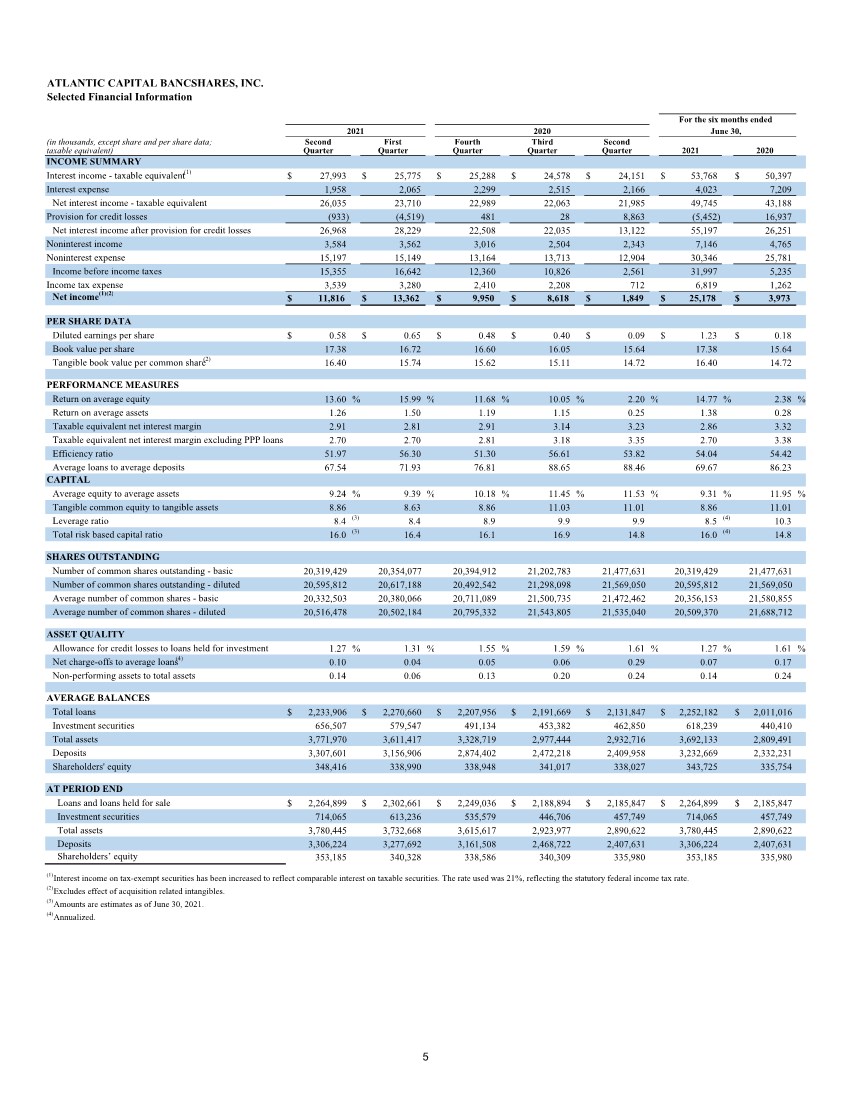

| ATLANTIC CAPITAL BANCSHARES, INC. Selected Financial Information (in thousands, except share and per share data; taxable equivalent) INCOME SUMMARY Interest income - taxable equivalent (1) $ 27,993 $ 25,775 $ 25,288 $ 24,578 $ 24,151 $ 53,768 $ 50,397 Interest expense 1,958 2,065 2,299 2,515 2,166 4,023 7,209 Net interest income - taxable equivalent 26,035 23,710 22,989 22,063 21,985 49,745 43,188 Provision for credit losses (933) (4,519) 481 28 8,863 (5,452) 16,937 Net interest income after provision for credit losses 26,968 28,229 22,508 22,035 13,122 55,197 26,251 Noninterest income 3,584 3,562 3,016 2,504 2,343 7,146 4,765 Noninterest expense 15,197 15,149 13,164 13,713 12,904 30,346 25,781 Income before income taxes 15,355 16,642 12,360 10,826 2,561 31,997 5,235 Income tax expense 3,539 3,280 2,410 2,208 712 6,819 1,262 Net income(1)(2) $ 11,816 $ 13,362 $ 9,950 $ 8,618 $ 1,849 $ 25,178 $ 3,973 PER SHARE DATA Diluted earnings per share $ 0.58 $ 0.65 $ 0.48 $ 0.40 $ 0.09 $ 1.23 $ 0.18 Book value per share 17.38 16.72 16.60 16.05 15.64 17.38 15.64 Tangible book value per common share (2) 16.40 15.74 15.62 15.11 14.72 16.40 14.72 PERFORMANCE MEASURES Return on average equity 13.60 % 15.99 % 11.68 % 10.05 % 2.20 % 14.77 % 2.38 % Return on average assets 1.26 1.50 1.19 1.15 0.25 1.38 0.28 Taxable equivalent net interest margin 2.91 2.81 2.91 3.14 3.23 2.86 3.32 Taxable equivalent net interest margin excluding PPP loans 2.70 2.70 2.81 3.18 3.35 2.70 3.38 Efficiency ratio 51.97 56.30 51.30 56.61 53.82 54.04 54.42 Average loans to average deposits 67.54 71.93 76.81 88.65 88.46 69.67 86.23 CAPITAL Average equity to average assets 9.24 % 9.39 % 10.18 % 11.45 % 11.53 % 9.31 % 11.95 % Tangible common equity to tangible assets 8.86 8.63 8.86 11.03 11.01 8.86 11.01 Leverage ratio 8.4 (3) 8.4 8.9 9.9 9.9 8.5 (4) 10.3 Total risk based capital ratio 16.0 (3) 16.4 16.1 16.9 14.8 16.0 (4) 14.8 SHARES OUTSTANDING Number of common shares outstanding - basic 20,319,429 20,354,077 20,394,912 21,202,783 21,477,631 20,319,429 21,477,631 Number of common shares outstanding - diluted 20,595,812 20,617,188 20,492,542 21,298,098 21,569,050 20,595,812 21,569,050 Average number of common shares - basic 20,332,503 20,380,066 20,711,089 21,500,735 21,472,462 20,356,153 21,580,855 Average number of common shares - diluted 20,516,478 20,502,184 20,795,332 21,543,805 21,535,040 20,509,370 21,688,712 ASSET QUALITY Allowance for credit losses to loans held for investment 1.27 % 1.31 % 1.55 % 1.59 % 1.61 % 1.27 % 1.61 % Net charge-offs to average loans (4) 0.10 0.04 0.05 0.06 0.29 0.07 0.17 Non-performing assets to total assets 0.14 0.06 0.13 0.20 0.24 0.14 0.24 AVERAGE BALANCES Total loans $ 2,233,906 $ 2,270,660 $ 2,207,956 $ 2,191,669 $ 2,131,847 $ 2,252,182 $ 2,011,016 Investment securities 656,507 579,547 491,134 453,382 462,850 618,239 440,410 Total assets 3,771,970 3,611,417 3,328,719 2,977,444 2,932,716 3,692,133 2,809,491 Deposits 3,307,601 3,156,906 2,874,402 2,472,218 2,409,958 3,232,669 2,332,231 Shareholders' equity 348,416 338,990 338,948 341,017 338,027 343,725 335,754 AT PERIOD END Loans and loans held for sale $ 2,264,899 $ 2,302,661 $ 2,249,036 $ 2,188,894 $ 2,185,847 $ 2,264,899 $ 2,185,847 Investment securities 714,065 613,236 535,579 446,706 457,749 714,065 457,749 Total assets 3,780,445 3,732,668 3,615,617 2,923,977 2,890,622 3,780,445 2,890,622 Deposits 3,306,224 3,277,692 3,161,508 2,468,722 2,407,631 3,306,224 2,407,631 Shareholders’ equity 353,185 340,328 338,586 340,309 335,980 353,185 335,980 (1)Interest income on tax-exempt securities has been increased to reflect comparable interest on taxable securities. The rate used was 21%, reflecting the statutory federal income tax rate. (2)Excludes effect of acquisition related intangibles. (3)Amounts are estimates as of June 30, 2021. (4)Annualized. Quarter Fourth Quarter Second 2020 2021 First Third Quarter Quarter For the six months ended 2021 2020 Quarter June 30, Second 5 |