UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant o

Filed by a Party other than the Registrant x

Check the appropriate box:

o Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2))

x Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Under Rule 14a-12

CASELLA WASTE SYSTEMS, INC. |

| (Name of Registrant as Specified in Its Charter) |

JCP INVESTMENT PARTNERSHIP, LP JCP SINGLE-ASSET PARTNERSHIP, LP JCP INVESTMENT PARTNERS, LP JCP INVESTMENT HOLDINGS, LLC JCP INVESTMENT MANAGEMENT, LLC JAMES C. PAPPAS BRETT W. FRAZIER |

| (Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

¨ Fee paid previously with preliminary materials:

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

(1) Amount previously paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

JCP INVESTMENT PARTNERSHIP, LP

September 29, 2015

Dear Fellow Casella Stockholder:

JCP Investment Partnership, LP (together with its affiliates, “JCP” or “we”) and the participants in this solicitation are the beneficial owners of an aggregate of 2,326,670, inclusive of call options, shares of Class A common stock, par value $0.01 per share (the “Class A Common Stock”), of Casella Waste Systems, Inc., a Delaware corporation (“Casella” or, the “Company”), representing approximately 5.80% of the outstanding shares of Class A Common Stock. For the reasons set forth in the attached Proxy Statement, we believe meaningful changes to the composition of the Board of Directors of the Company (the “Board”) are necessary in order to ensure that the Company is being run in a manner consistent with your best interests. We are seeking your support for the election of our two (2) nominees at the annual meeting of stockholders scheduled to be held at The Mountain Top Inn & Resort, located at 195 Mountain Top Road, Chittenden, Vermont 05737, on Friday, November 6, 2015 at 10:00 a.m., Eastern Time (including any adjournments or postponements thereof and any meeting which may be called in lieu thereof, the “Annual Meeting”). We are seeking representation on the Board because we believe that the Board will benefit from the addition of directors with relevant skill sets and a shared objective of enhancing value for the benefit of all Casella stockholders. The individuals that we have nominated are highly-qualified, capable and ready to serve the stockholders of Casella.

Our interests are fully aligned with the interests of all Casella stockholders. We believe that there is significant value to be realized at Casella. However, we are concerned that the Board is not taking the appropriate actions to address the Company’s perennial underperformance. Given the Company’s financial and stock price underperformance and poor corporate governance under the oversight of the current Board, we strongly believe that the Board must be reconstituted to ensure that its directors take the necessary steps to reinforce stockholder rights and realize the maximum value of the stockholders’ investments.

The Company has a classified Board, which is currently divided into three (3) classes. The terms of three (3) directors expire at the Annual Meeting. We are seeking your support at the Annual Meeting to elect our two (2) nominees in opposition to two (2) of the Company’s director nominees for the class with terms ending in 2018. We believe that any attempt to increase or decrease the size of the current Board or the number of directors up for election at the Annual Meeting would constitute an improper manipulation of Casella’s corporate machinery. Your vote to elect our nominees will have the legal effect of replacing two (2) incumbent directors with our nominees. If elected, our nominees will constitute a minority on the Board and there can be no guarantee that our nominees will be able to implement the actions that they believe are necessary to unlock stockholder value.

Through the attached Proxy Statement, we are soliciting proxies to elect not only our two (2) nominees, but also the candidate who has been nominated by the Company other than John W. Casella and William P. Hulligan. This gives stockholders who wish to vote for our nominees the ability to vote for all three (3) directorships up for election. The names, backgrounds and qualifications of the Company’s nominees, and other information about them, can be found in the Company’s proxy statement. There is no assurance that any of the Company’s nominees will serve as directors if our nominees are elected.

We urge you to carefully consider the information contained in the attached Proxy Statement and then support our efforts by signing, dating and returning the enclosed GOLD proxy card today. The attached Proxy Statement and the enclosed GOLD proxy card are first being furnished to the stockholders on or about September 30, 2015.

If you have already voted for the incumbent management slate, you have every right to change your vote by signing, dating and returning a later dated GOLD proxy card or by voting in person at the Annual Meeting.

If you have any questions or require any assistance with your vote, please contact InvestorCom, Inc., which is assisting us, at its address and toll-free numbers listed below.

| Thank you for your support, |

| /s/ James C. Pappas |

| James C. Pappas |

| JCP Investment Partnership, LP |

If you have any questions, require assistance in voting your GOLD proxy card, or need additional copies of JCP’s proxy materials, please contact InvestorCom at the phone numbers listed below.  65 Locust Avenue, Suite 302 New Canaan, CT 06840 Shareholders call toll free at (877) 972-0090 Banks and Brokers may call collect at (203) 972-9300 |

2015 ANNUAL MEETING OF STOCKHOLDERS

OF

CASELLA WASTE SYSTEMS, INC.

_________________________

PROXY STATEMENT

OF

JCP INVESTMENT PARTNERSHIP, LP

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED GOLD PROXY CARD TODAY

JCP Investment Partnership, LP (“JCP Partnership”), JCP Single-Asset Partnership, LP (“JCP Single-Asset”), JCP Investment Partners, LP (“JCP Partners”), JCP Investment Holdings, LLC (“JCP Holdings”), JCP Investment Management, LLC (“JCP Management”) and James C. Pappas (collectively, “JCP” or “we”) are significant stockholders of Casella Waste Systems, Inc., a Delaware corporation (“Casella” or, the “Company”), who, together with the other participants in this solicitation, beneficially own 2,326,670 shares of Class A common stock of the Company, inclusive of call options, par value $0.01 per share (the “Class A Common Stock”), representing approximately 5.80% of the outstanding shares of Class A Common Stock. We believe that the Board of Directors of the Company (the “Board”) must be meaningfully reconstituted to ensure that the Board takes the necessary steps for the Company’s stockholders to realize the maximum value of their investments. We have nominated directors who have strong, relevant backgrounds and who are committed to fully exploring all opportunities to unlock stockholder value. We are seeking your support at the annual meeting of stockholders scheduled to be held at The Mountain Top Inn & Resort, located at 195 Mountain Top Road, Chittenden, Vermont 05737, on Friday, November 6, 2015 at 10:00 a.m., Eastern Time (including any adjournments or postponements thereof and any meeting which may be called in lieu thereof, the “Annual Meeting”), for the following:

| 1. | To elect JCP’s two (2) director nominees, Brett W. Frazier and James C. Pappas (each a “Nominee” and, collectively, the “Nominees”), to the Board as Class III directors to serve until the 2018 annual meeting of stockholders and until their respective successors are duly elected and qualified; |

| 2. | To hold an advisory vote on executive compensation; |

| 3. | To ratify the selection of McGladrey LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2015; and |

| 4. | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

We believe that the Company is in urgent need of a fresh perspective and a focus on enhancing shareholder value, which, we believe, the Nominees will provide. The Nominees do not have specific plans for the Company and if elected, will evaluate open-mindedly all reasonable strategies in accordance with their fiduciary duties as directors of the Company.

As of the date hereof, the members of JCP own 2,286,670 shares of Class A Common Stock and the Nominees collectively own 40,000 shares of Class A Common Stock, for an aggregate 2,326,670 shares of Class A Common Stock owned among JCP and the Nominees (the “JCP Group Shares”). We intend to vote the JCP Group Shares FOR the election of the Nominees, AGAINST the approval of the advisory vote to approve executive compensation, and FOR the ratification of the selection of McGladrey LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2015, as described herein.

The Company has set the close of business on September 18, 2015 as the record date for determining stockholders entitled to notice of and to vote at the Annual Meeting (the “Record Date”). The mailing address of the principal executive offices of the Company is 25 Greens Hill Lane, Rutland, Vermont 05701. The Company has two (2) classes of stock whose holders are entitled to vote at the Annual Meeting: (i) Class A Common Stock and (ii) Class B common stock, par value $0.01 per share (the “Class B Common Stock”). Stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. According to the Company, as of the Record Date, there were 39,978,784 shares of Class A Common Stock outstanding and 988,200 shares of Class B Common Stock outstanding. Other than one (1) director who the holders of Class A Common Stock are entitled to elect while voting separately as a class (the “Class A Director”), the holders of Class A Common Stock and Class B Common Stock vote together on all matters, as a single class. Each share of Class A Common Stock is entitled to one (1) vote per share and each share of Class B Common Stock is entitled to ten (10) votes per share. The Class A Director is not up for election at the Annual Meeting.

THIS SOLICITATION IS BEING MADE BY JCP AND NOT ON BEHALF OF THE BOARD OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE THE ANNUAL MEETING OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH JCP IS NOT AWARE OF AT A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED GOLD PROXY CARD WILL VOTE ON SUCH MATTERS IN OUR DISCRETION.

JCP URGES YOU TO SIGN, DATE AND RETURN THE GOLD PROXY CARD IN FAVOR OF THE ELECTION OF THE NOMINEES.

IF YOU HAVE ALREADY SENT A PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS DESCRIBED IN THIS PROXY STATEMENT BY SIGNING, DATING AND RETURNING THE ENCLOSED GOLD PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting—This Proxy Statement and our GOLD proxy card are available at http://www.fixcasella.com

______________________________

IMPORTANT

Your vote is important, no matter how few shares of Class A Common Stock you own. JCP urges you to sign, date, and return the enclosed GOLD proxy card today to vote FOR the election of the Nominees and in accordance with JCP’s recommendations on the other proposals on the agenda for the Annual Meeting.

| · | If your shares of Class A Common Stock are registered in your own name, please sign and date the enclosed GOLD proxy card and return it to JCP, c/o InvestorCom, Inc. (“InvestorCom”), in the enclosed postage-paid envelope today. |

| · | If your shares of Class A Common Stock are held in a brokerage account or bank, you are considered the beneficial owner of the shares of Class A Common Stock, and these proxy materials, together with a GOLD voting form, are being forwarded to you by your broker or bank. As a beneficial owner, you must instruct your broker, trustee or other representative how to vote. Your broker cannot vote your shares of Class A Common Stock on your behalf without your instructions. |

| · | Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosed voting form. |

Since only your latest dated proxy card will count, we urge you not to return any proxy card you receive from the Company. Even if you return the management proxy card marked “withhold” as a protest against the incumbent directors, it will revoke any proxy card you may have previously sent to us. Remember, you can vote for our two (2) Nominees only on our GOLD proxy card. So please make certain that the latest dated proxy card you return is the GOLD proxy card.

If you have any questions, require assistance in voting your GOLD proxy card, or need additional copies of JCP’s proxy materials, please contact InvestorCom at the phone numbers listed below.  65 Locust Avenue, Suite 302 New Canaan, CT 06840 Shareholders call toll free at (877) 972-0090 Banks and Brokers may call collect at (203) 972-9300 |

Background to the Solicitation

The following is a chronology of events leading up to this proxy solicitation:

| · | In March of 2010, JCP began investing in the Company. |

| · | On April 9, 2014, members of JCP had a call with representatives of the Company to discuss Casella and several initiatives. |

| · | In December 2014, members of JCP had another call with representatives of the Company to discuss Casella and get an update on several initiatives. |

| · | Late February 2015, members of JCP arranged a visit to the Company’s headquarters in Vermont. |

| · | On March 17, 2015, members of JCP met with John Casella, the CEO and Edmond R. Coletta, the CFO, of Casella at the Company’s headquarters in Vermont. JCP indicated it had been investing in Casella since 2010 and raised questions about the Company’s state and planned initiatives. |

| · | On April 7, 2015, JCP Partnership delivered a letter to the Company to provide notice in accordance with the Company’s Third Amended and Restated By-Laws (the “Bylaws”) of JCP’s intention to nominate James C. Pappas, Brett W. Frazier and Joseph B. Swinbank for election to the Board at the Annual Meeting. |

| · | On April 13, 2015, Michael K. Burke, a member of the Board and the Board’s nominations and governance committee (the “Nominations Committee”), spoke with Mr. Pappas, the Managing Member of JCP Management and the sole member of JCP Holdings, and indicated that the Nominations Committee would like to conduct interviews with the Nominees. Mr. Pappas agreed to make the Nominees, including himself, available for phone interviews for the Nominations Committee rather than in-person interviews, due to scheduling conflicts, as both Messrs. Frazier and Swinbank were travelling. |

| · | On or about April 14, 2015, Michael K. Burke, a member of the current Board, spoke with Mr. Pappas to coordinate phone interviews for the Nominees. |

| · | On April 17, 2015, members of the Nominations Committee conducted phone interviews with two (2) of the Nominees, Mr. Pappas and Mr. Swinbank. |

| · | On April 21, 2015, members of the Nominations Committee conducted a phone interview with Mr. Frazier. |

| · | On April 24, 2015 and again on April 27, 2015, Mr. Pappas spoke with Mr. Burke to communicate his desire to avoid a proxy contest and find a mutually-agreeable resolution. Mr. Pappas offered to arrange a meeting if such a constructive resolution could be reached. Mr. Burke refused to discuss the issue with Mr. Pappas. Instead, Mr. Burke communicated to Mr. Pappas that despite having conducted phone interviews with all Nominees and having been provided all information with respect to each Nominee that is required in connection with a director candidate of a public company, the Nominations Committee would not consider the candidacy of Messrs. Frazier, Pappas and Swinbank until they had further conducted in-person interviews. |

| · | On April 27, 2015, without notice to JCP, the Company announced it had moved the date of its annual meeting from its previously disclosed July meeting date, to an “undetermined” date. The Company stopped reaching out to Mr. Pappas following such announcement and has not resumed discussions to date. |

| · | On April 28, 2015, the members of JCP jointly filed a Schedule 13D (the “Schedule 13D”) with the Securities and Exchange Commission (the “SEC”) to report that, as of April 21, 2015, JCP and its affiliates had together become the beneficial owners of approximately five-percent (5%) of the issued and outstanding shares of the Class A Common Stock. |

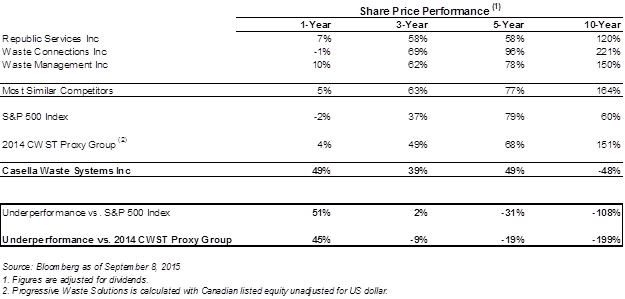

| · | Also on April 28, JCP issued a press release disclosing the nominations and highlighting its serious concerns with the Company’s history of underperformance and poor corporate governance. JCP pointed out negative total shareholder returns over each of the -3 and -10 years’ periods, and underperformance of the Company, relative to the 2014 Proxy Group and the S&P 500 Index, over each of the -1, -3, -5 and -10 years’ periods. JCP further noted that the unbalanced dual class capitalization structure of the Company effectively allows insider control with a lesser economic stake in the Company, and related party transactions have worked to the detriment of stockholders. JCP also cited financial and operational indicators that implied deterioration, rather than growth of the business over the past decade. JCP concluded that its Nominees would provide much needed perspective and expertise on the Board. |

| · | On May 27, 2015, JCP proposed a settlement to the Company that contemplated, among other things, the Company expanding the size of the Board from nine (9) to ten (10) members, having two (2) incumbent members of the Board resign and the Company adding the Nominees to the Board. JCP also requested that the Company agree to seek stockholder approval to eliminate the staggered terms of directors. On June 2, 2015, the Company’s outside legal counsel informed JCP’s outside legal counsel that the Board had rejected the proposed settlement. |

| · | On May 29, 2015, JCP issued an open letter to the Board. In its letter, JCP highlighted its concern that the Board is not open-mindedly exploring strategic opportunities to capitalize on significant acquisition interest in Casella. JCP also expressed disappointment over the Company’s delay of its Annual Meeting and urged the Board to refrain from any further dilutive offerings. JCP concluded that the Company urgently needed stockholder representation in the boardroom to ensure that decisions at a critical time for the Company are made with the best interests of stockholders as a paramount objective. |

| · | Also on May 29, 2015, JCP filed an amended Schedule 13D disclosing it then owned approximately 5.4% of the Class A Common Stock. |

| · | On June 2, 2015, Mr. Pappas and Edmond R. Coletta, the Company’s Senior Vice President and Chief Financial Officer, spoke briefly at the 2015 WasteExpo regarding the issues facing the Company and JCP’s related concerns. Mr. Pappas further indicated JCP believes there are numerous opportunities within the control of the Board and management to unlock value and offered to engage in constructive discussions on Board reconstitution that would position the Company to capitalize on these opportunities. |

2

| · | On July 7, 2015, the Company publicly announced that it had appointed James E. O’Connor to the Board as a Class III director, effective July 7, 2015, replacing then incumbent director John F. Chapple III, who retired from the Board. As a Class III director, Mr. O’Connor is standing for election at the Annual Meeting. |

| · | Also on July 7, 2015, the Company publicly announced that the Annual Meeting would be held on Friday, November 6, 2015, at 10:00 a.m., Eastern Time. |

| · | On August 7, 2015, Mr. Pappas contacted John W. Casella, the Company’s Chairman and Chief Executive Officer, and the two had a telephone call. During the course of this call, Mr. Pappas expressed his desire to find a mutually-agreeable resolution that provides for meaningful shareholder representation on the Board and commitment to certain critical corporate governance and financial enhancements that are in the best interests of all stockholders. Mr. Casella led Mr. Pappas to believe that he was open to such an agreement and asked Mr. Pappas to submit a formal written proposal in the form of a written agreement. |

| · | On August 9, 2015, as requested, JCP sent the Company a formal settlement proposal in the form of a draft written agreement. As previously communicated to Mr. Casella, JCP’s settlement contemplated that two (2) of the candidates nominated by JCP, Messrs. Pappas and Frazier, would be appointed to the Board and that the Company would seek stockholder approval at the Annual Meeting to declassify the Board immediately beginning with the election of directors at the Annual Meeting. To facilitate a compromise rather than having two (2) directors resign, JCP’s proposal contemplated that the size of the Board would be increased from nine (9) to ten (10) members and only one (1) incumbent member of the Board would resign. JCP’s proposal also contemplated that the Company would agree to repurchase at least $10 million of its common stock and would commit to decrease leverage to a debt / adjusted EBITDA of no more than 4.75x, both of which in JCP’s view would meaningfully increase stockholder value. |

| · | On August 18, 2015, JCP received a letter from the Company rejecting the settlement proposal in its entirety and implying that no further settlement discussions were to be had. The letter cited “fundamental differences” without identifying them and without providing any counteroffer or suggestion for any compromise or alternative solution. |

| · | On September 1, 2015, the Company publicly announced that it had appointed William P. Hulligan to the Board as a Class III director, effective September 1, 2015, replacing then incumbent director James P. McManus, who retired from the Board. As a Class III director, Mr. Hulligan is standing for election at the Annual Meeting. Also, on September 1, 2015, the Company announced that the Board had adopted a number of corporate governance changes. |

| · | On September 4, 2015, the Company filed its preliminary proxy statement with the SEC with respect to the Annual Meeting. |

3

REASONS FOR THE SOLICITATION

WE BELIEVE CASELLA NEEDS MORE THAN JUST REACTIVE TANGENTIAL CHANGES

CHANGE MUST GO TO THE CORE OF THE ISSUES AND MUST BOLSTER THE RIGHTS AND VALUE OF CASELLA’S PUBLIC SHAREHOLDERS

WE BELIEVE THAT SIGNIFICANT IMPROVEMENT TO CASELLA’S BOARD IS NEEDED NOW

JCP has been investing in Casella since 2010. Over the past few months, we have made every effort to lead a constructive dialogue with the Board and management. We have privately and publicly demonstrated the causes for our concerns with Casella. We have clearly articulated our views about the challenges Casella faces and the future opportunities it can hope to capture over the long term. However, as the Company has continued to struggle under the current Board’s and CEO’s watch, we have come to the conclusion that significant change in the boardroom is necessary as a predicate to any meaningful improvement at Casella.

Overall, we are disappointed by this Board’s failure to adequately address the issues that we have identified, and we question whether the Board, as currently composed and including its recent additions, will take the necessary steps to maximize opportunities for value creation. We question whether the recent Board additions and recently announced governance changes would have ever been undertaken by the current Board had they not been under pressure from JCP. We also remain concerned that the Board is purporting to appease shareholders with tangential changes while the core problems, like growth deterioration, excessive leverage and dual-class structure detrimental to public shareholders, to name a few, all remain in place.

We believe that real and urgent change is needed on the Board. We are convinced that change should go to the core of the issues at Casella, and we are adamant that any change should bolster the rights and the value of the public shareholders of Casella. Therefore, we are soliciting your support to elect our Nominees at the Annual Meeting, who we believe would bring significant and relevant experience and focus on representing the best interests of the public shareholders in the boardroom.

We Are Concerned with the Company’s Prolonged Underperformance

Casella’s stock has produced a negative forty-eight percent (48%) return over the past ten (10) years and has dramatically underperformed the Company’s peers over each of the last 3-, 5- and 10- years' periods. Since its initial public offering under the leadership of Casella Chairman, President and CEO, John Casella, the Company’s stock price has dwindled from $18.00 a share to $6.60 today.

“The market value of our company - your company - grew by over seventy percent since the pricing of our initial public offering last fall. This growth in shareholder value is the simplest measure of our success.”

- John Casella, Shareholder Letter, 1998

4

* |  | |

| *The companies that comprise the “Most Similar Competitors Group” were selected by JCP for inclusion within the group because JCP believes that the operations of the included companies are most similar to the operations of Casella; however, JCP acknowledges and understands that the included companies’ market capitalizations are not similar. |

We believe that Casella’s dismal relative stock price performance over each of the -5 years’ and -10 years’ period, which is significantly reflective of the Company’s long-term performance, demonstrate shareholders’ extreme frustration with the current performance and direction of the Company. In our view, the primary reason for what we deem to be Casella’s long-term stock price underperformance are lapses in leadership judgment and a governance and value construct that has served the interests of insiders with executive positions and super-voting Class B stock at the expense of the public shareholders.

We Are Concerned with the Board’s Poor Capital Allocation Decisions

Under Chairman and CEO John Casella, from 2005 through the last twelve (12) months, the Company has spent more than $770 million in capital expenditures, while EBITDA has gone from approximately $112 million to approximately $104 million.

Despite generating cumulatively +$600 million in cash flow from operations, the Company has not increased its earning power. Nearly $90 million has been spent over the last ten (10) years on acquisitions. Over this period in time, the share count is up more than fifty percent (50%) with, in our assessment, no incremental value added.

5

We Are Concerned about the Company’s Excessive Leverage and Dilution of the Class A Public Shareholders

The Company’s leverage far exceeds the leverage of its peers. While the Company is leveraged at approximately 5.0x, its peers, such as Republic Services, Inc., Progressive Waste Solutions Ltd., and Waste Connections, Inc., are leveraged at less than 3.5x. Yet this excessive leverage over the last several years has not, in our assessment, produced incremental revenues or cash flows for Casella’s public shareholders. Along with continuously increasing leverage, the Board, led by Mr. Casella, has repeatedly diluted the Class A shareholders. Meanwhile, the Class B share count has remained unchanged.

We Are Concerned that the Company’s Dual Class Structure Undermines the Rights of Public Shareholders

The Company has a dual class stock structure that creates a gap between the economic investment of shareholders and their voting power. The Class B shares, which have ten (10) votes per share, are 100% held by Chairman and CEO John Casella and his brother and fellow director Doug Casella. The Class B shares entitle the Casella brothers to more than twenty two-percent (22.0%) of the voting power of the Class A and Class B voting as a single class (as they do on the election of directors). In our view, such an unbalanced capitalization structure effectively allows insider control with a lesser economic stake in the Company and significantly impairs the rights of public shareholders.

“We've also been asked by many of our shareholders if we plan to issue equity. Our answer is no.”

- John Casella, CWST Earnings Call Q42011

11.5 million Class A shares were issued on September 28, 2012, at $4.00 per share.

We are Concerned John Casella’s Role as a Chairman and CEO, in addition to a Class B Holder, Generates Conflicts and Misalignment of Interests with the Public Shareholders

We are troubled that in addition to holding supervoting shares, and together with his brother commanding a disproportionate voting power, John Casella also serves as both the Chairman of the Board and the CEO of the Company. Combining the Chairman and CEO roles is largely considered by governance experts and commentators to be a governance flaw because of the undue concentration of control and the inherent conflicts. Collectively, the supervoting rights, Chairmanship and CEO roles give undue influence to someone who wears three different hats that may impose conflicting demands and create misalignment of interests between John Casella on the one hand and public shareholders on the other hand.

We believe that the Board’s ineffectiveness at tackling what we deem to be the persistent destruction of shareholder value is in large part a function of a troubling misalignment of interests between the directors and Casella’s shareholders. Together, the Chairman and CEO John Casella and his brother and fellow director Doug Casella own approximately six percent (6.0%) of the outstanding stock of the Company, excluding grant awards, but retain more than a twenty-two percent (22.0%) voting interest in the Company. 1 According to our review of publicly available information, John Casella has never purchased a single Class A share in the open market. We believe the Board’s collective lack of a substantial vested economic interest in shares of Casella, while maintaining a disproportionate amount of voting power, may compromise the Board’s ability to properly evaluate and address the serious challenges facing the Company.

We are Concerned about the Large Related Party Transactions with the Casella Brothers

During the past ten (10) years, the Company has paid more than $80 million to Casella Construction, Inc. (“Casella Construction”) at which John Casella is a director and an executive officer and John Casella’s brother, Doug Casella, serves as director as well as President. In addition to Doug Casella serving as the Vice Chairman of the Company and President of Casella Construction, and therefore being on both sides of the transaction. The +$80 million paid to Casella Construction over a decade represents just under half the current market cap of the Company. We believe that it is troubling that these large outlays of funds on both absolute and relative basis have continued to be paid to Casella Construction, even as the Company’s shareholders have suffered significant losses over the same period. In addition, for many years, the Company, led by Chairman and CEO John Casella, paid Vice Chairman Doug Casella a salary of more than $100,000 and in some years $200,000, from a subsidiary of the Company. The Board led by John Casella also authorized making a loan to the former COO of the Company in the amount of nearly $1 million. We believe that it is also concerning that the loan was made at the prime rate while the Company was borrowing more expensively at significantly higher rates. We believe that this persistent pattern of costly related-party transactions raises serious questions as to whether John Casella’s actions appropriately place the best interests of public shareholders above his personal interests and those of other insiders.

| 1 | 1 Note: Ownership interests were approximated based upon Casella’s revised preliminary proxy statement, filed with the SEC on September 16, 2015 |

6

We Are Concerned about the Company’s Poor Corporate Governance

The misalignment of interest between insiders and public shareholders, that we believe is inherent in the disproportionate voting power and combined Chairman/CEO roles, is further exacerbated by what we deem to be severe restrictions on the ability of shareholders to effect Board change. Shareholders are prohibited from calling special meetings and cannot act by written consent, which effectively means that shareholders cannot seek Board change between annual meetings.

Further, the Board is classified and continues to be stale. Despite two (2) recent director additions, which we believe were made in response to JCP’s involvement, the Board’s average tenure is ten (10) years. Chairman and CEO John Casella has been at the helm of the Company in his combined Chairman/CEO role for eighteen (18) years. During his tenure, as detailed above, the shareholders have suffered what we deem to be significant value destruction.

THERE IS A BETTER WAY FORWARD

We strongly believe that despite management’s and the Board’s apparent failures, Casella’s assets remain strong and replete with potential for future growth and value enhancement over the long-term. If elected, our Nominees will aim to work with the rest of the Board to conduct a rigorous analysis of management’s and the Board’s current strategy on a rationally risk-adjusted basis, as well as a review of all available alternatives to enhance shareholder value. Our Nominees are committed only to maximizing value for all stockholders over the long term. We are confident that there are actions directly within the control of the Board and management team that represent a tremendous opportunity to improve the Company’s growth and margin profits, reduce balance sheet risk and produce significantly higher returns for stockholders.

OUR TWO (2) NOMINEES HAVE THE EXPERIENCE, QUALIFICATIONS AND COMMITMENT NECESSARY TO FULLY EXPLORE AVAILABLE OPPORTUNITIES TO UNLOCK VALUE FOR SHAREHOLDERS

We have identified who we believe to be two (2) highly-qualified, independent directors with relevant business and financial experience who we also believe will bring fresh perspective into the boardroom and would be valuable in assessing and executing initiatives to unlock value at the Company. Further, we believe that Casella’s continued underperformance, at this critical time for the future of the Company, warrants the addition of directors whose interests are closely aligned with those of public shareholders, and who will work constructively with the other members of the Board to protect the best interests of Casella’s shareholders.

7

Brett W. Frazier is a former executive officer of Waste Management, Inc. (NYSE:WM) (“Waste Management”), North America’s leading provider of comprehensive waste management environmental services. He most recently served at Waste Management as senior vice president – Southern Group, and Senior Vice President – Eastern Group. From 1980 until 1999, Mr. Frazier held various leadership roles with Browning-Ferris Industries, Inc., formerly the second largest solid waste disposal company in the world.

James C. Pappas is Managing Member of JCP Management and the sole member of JCP Holdings. He is currently a board member of Jamba, Inc. (NASDAQ:JMBA), a leading health and wellness brand and the leading retailer of freshly squeezed juice, since January 2015, at which he is also a member of each of the nominating and corporate governance committee and the audit committee. Previously, Mr. Pappas worked for The Goldman Sachs Group, Inc. (NYSE:GS) (“Goldman Sachs”), a multinational investment banking and securities firm, in its Investment Banking / Leveraged Finance Division. As part of the Goldman Sachs Leveraged Finance Group, Mr. Pappas advised private equity groups and corporations on appropriate leveraged buyout, recapitalization and refinancing alternatives.

8

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Company currently has a classified Board, which is divided into three (3) classes. The directors in each class are elected for terms of three (3) years so that the term of office of one (1) class of directors expires at each annual meeting of stockholders. We believe that the terms of three (3) Class III directors expire at the Annual Meeting. We are seeking your support at the Annual Meeting to elect our two (2) Nominees, Brett W. Frazier and James C. Pappas, in opposition to two (2) of the Company’s director nominees for terms ending in 2018. Your vote to elect the Nominees will have the legal effect of replacing two (2) incumbent directors of the Company with the Nominees. If elected, the Nominees will represent a minority of the members of the Board, and therefore it is not guaranteed that they will be able to implement any actions that they may believe are necessary to enhance stockholder value, as described in further detail above.

THE NOMINEES

The following information sets forth the name, age, business address, present principal occupation, and employment and material occupations, positions, offices, or employments for the past five (5) years of each of the Nominees. The nominations were made in a timely manner and in compliance with the applicable provisions of the Company’s governing instruments. The specific experience, qualifications, attributes and skills that led us to conclude that the Nominees should serve as directors of the Company are set forth above in the section entitled “Reasons for the Solicitation” and below. This information has been furnished to us by the Nominees. All of the Nominees are citizens of the United States.

Brett W. Frazier, age 60, is currently retired after serving in multiple executive roles for Waste Management, North America’s leading provider of comprehensive waste management environmental services, from 2000 until July 2012. Mr. Frazier most recently served as Senior Vice President – Southern Group, at which he had full P&L accountability for Waste Management’s largest and most profitable operating group, and Senior Vice President – Eastern Group, at which he had full P&L responsibility for the thirteen (13) states in the northeast. From 1980 until 1999, Mr. Frazier held various leadership roles with Browning-Ferris Industries, Inc., formerly the second largest solid waste disposal company in the world, including Area Vice President – Marketing and Sales and Vice President of Investor Relations. Mr. Frazier’s professional experience also includes serving as a Regional Vice President for TruGreen Limited Partnership, America’s top lawn care company, based on market share. Mr. Frazier earned a MBA from Tulane University.

JCP believes that Mr. Frazier’s extensive leadership experience and expertise in the waste management services industry will make him a valuable addition to the Board.

James C. Pappas, age 34, is the Managing Member of JCP Management and the sole member of JCP Holdings since June 2009. Mr. Pappas has also served as a director of Jamba, Inc. (NASDAQ: JMBA), a leading health and wellness brand and the leading retailer of freshly squeezed juice, since January 2015, at which he is also a member of each of the nominating and corporate governance committee and the audit Committee. Previously, Mr. Pappas served on the board of directors of The Pantry, Inc. (formerly NASDAQ: PTRY), a leading independently operated convenience store chain in the southeastern United States and one of the largest independently operated convenience store chains in the country, from March 2014 until the completion of its sale in March 2015. He also previously served as Chairman of the board of Morgan’s Foods Inc. (formerly, ticker: MRFD), a then publicly traded company, from January 2013 until the completion of its sale in May 2014, after originally joining its board as a director in February 2012, at which he also served as chairman of the Compensation and Leadership Committee. Mr. Pappas also served as a director of Samex Mining Corp, a junior resource company, in 2013. From 2005 until 2007, Mr. Pappas worked for Goldman Sachs, a multinational investment banking and securities firm, in its Investment Banking / Leveraged Finance Division. As part of the Goldman Sachs Leveraged Finance Group, Mr. Pappas advised private equity groups and corporations on appropriate leveraged buyout, recapitalization and refinancing alternatives. Prior to Goldman Sachs, Mr. Pappas worked at Banc of America Securities, the investment banking arm of Bank of America (NYSE:BAC), a multinational banking and financial services corporation, at which he focused on Consumer and Retail Investment Banking, providing advice on a wide range of transactions including mergers and acquisitions, financings, restructurings and buy-side engagements. Mr. Pappas received a BBA, and a masters in finance from Texas A&M University.

9

JCP believes Mr. Pappas’ significant experience in the valuation and management of investment securities, based on his decade of experience in the financial industry including as the founder and chief investment officer of JCP, his masters degree in finance, serving on four (4) public company boards of directors, in addition to his experience in investment banking and corporate finance from his career with major investment banking firms will enable him to provide invaluable oversight to the Board.

The principal business address of Mr. Frazier is 16310 Wimbledon Forest Drive, Spring, Texas 77379. The principal business address of Mr. Pappas is c/o JCP Investment Management, LLC, 1177 West Loop South, Suite 1650, Houston, Texas 77027.

As of the date hereof, Mr. Frazier beneficially owned 40,000 shares of Class A Common Stock. Mr. Pappas, by virtue of his relationship with JCP Management as further explained elsewhere in this Proxy Statement, may be deemed the beneficial owner of the 2,286,670 shares of Class A Common Stock beneficially owned in the aggregate by JCP Partnership and JCP Single-Asset.

Each Nominee may be deemed to be a member of the Group (as defined below) for the purposes of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Each Nominee specifically disclaims beneficial ownership of shares of Class A Common Stock that he does not directly own. For information regarding purchases and sales during the past two (2) years by the Nominees and by the members of the Group of securities of the Company, see Schedule I.

The members of JCP have signed letter agreement pursuant to which they agreed to indemnify Mr. Frazier against claims arising from the solicitation of proxies from the Company’s stockholders in connection with the Annual Meeting and any related transactions.

The members of JCP and the Nominees are collectively referred to as the “Group” herein.

Other than as stated herein, there are no arrangements or understandings between the members of JCP and any Nominee or any other person or persons pursuant to which the nomination of the Nominees described herein is to be made, other than the consent by each Nominee to be named in this Proxy Statement and to serve as a director of the Company if elected as such at the Annual Meeting. None of the Nominees is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries in any material pending legal proceeding.

Each Nominee presently is, and if elected as a director of the Company would be, an “independent director” within the meaning of (i) applicable NASDAQ listing standards applicable to board composition and (ii) Section 301 of the Sarbanes-Oxley Act of 2002. No Nominee is a member of the Company’s compensation, Nominating or audit committee that is not independent under any such committee’s applicable independence standards.

10

We do not expect that the Nominees will be unable to stand for election, but, in the event any Nominee is unable to serve or will not serve, the shares of Class A Common Stock represented by the enclosed GOLD proxy card will be voted for substitute nominee(s), to the extent this is not prohibited under the Bylaws and applicable law. In addition, we reserve the right to nominate substitute person(s) if the Company makes or announces any changes to the Bylaws or takes or announces any other action that has, or if consummated would have, the effect of disqualifying any Nominee, to the extent this is not prohibited under the Bylaws and applicable law. In any such case, we would identify and properly nominate such substitute nominee(s) in accordance with the Bylaws and shares of Class A Common Stock represented by the enclosed GOLD proxy card will be voted for such substitute nominee(s). We reserve the right to nominate additional person(s), to the extent this is not prohibited under the Bylaws and applicable law, if the Company increases the size of the Board above its existing size or increases the number of directors whose terms expire at the Annual Meeting. Additional nominations made pursuant to the preceding sentence are without prejudice to the position of JCP that any attempt to increase the size of the current Board or to reconstitute or reconfigure the classes on which the current directors serve constitutes an unlawful manipulation of the Company’s corporate machinery.

WE URGE YOU TO VOTE “FOR” THE ELECTION OF THE NOMINEES ON THE ENCLOSED GOLD PROXY CARD.

11

PROPOSAL NO. 2

ADVISORY VOTE ON EXECUTIVE COMPENSATION

As discussed in further detail in the Company’s definitive proxy statement, the Company is asking stockholders to indicate their support for the compensation of the Company’s named executive officers. This proposal, commonly known as a “Say-on-Pay” proposal, is not intended to address any specific item of compensation, but rather the overall compensation of the Company’s named executive officers and the philosophy, policies and practices described in the Company’s proxy statement. Accordingly, the Company is asking stockholders to vote for the following resolution:

As disclosed in the Company’s proxy statement, the stockholder vote on the Say-on-Pay Proposal is an advisory vote only, and is not binding on the Company, the Board or any committee of the Board; however, the Compensation Committee of the Board may take into account the outcome of the vote when making future compensation decisions for named executive officers.

WE MAKE NO RECOMMENDATION WITH RESPECT TO THIS SAY-ON-PAY PROPOSAL AND INTEND TO VOTE OUR SHARES “AGAINST” THIS PROPOSAL.

12

PROPOSAL NO. 3

RATIFICATION OF THE SELECTION OF AUDITORS

As discussed in further detail in the Company’s definitive proxy statement, the audit committee of the Board has appointed McGladrey LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2015 and is proposing that stockholders ratify such appointment. The Company is submitting the appointment of McGladrey LLP for ratification of the stockholders at the Annual Meeting.

As disclosed in the Company’s proxy statement, stockholder approval is not required to appoint McGladrey LLP as the Company’s independent registered public accounting firm, but the Company is submitting the selection of McGladrey LLP to stockholders for ratification as a matter of good corporate governance. If the stockholders do not ratify the appointment, the Audit Committee will investigate the reasons for stockholder rejection and consider whether to retain McGladrey LLP or appoint another independent registered public accounting firm. Even if the appointment is ratified, the Board and the Audit Committee, in their discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if they determine that such a change would be in the best interests of the Company and its stockholders.

WE MAKE NO RECOMMENDATION WITH RESPECT TO THE RATIFICATION OF THE SELECTION OF MCGLADREY LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM OF THE COMPANY FOR THE FISCAL YEAR ENDING DECEMBER 31, 2015 AND INTEND TO VOTE OUR SHARES “FOR” THIS PROPOSAL.

13

VOTING AND PROXY PROCEDURES

Only stockholders of record on the Record Date will be entitled to notice of and to vote at the Annual Meeting. Stockholders who sell their shares of Class A Common Stock or Class B Common Stock before the Record Date (or acquire them without voting rights after the Record Date) may not vote such shares. Stockholders of record on the Record Date will retain their voting rights in connection with the Annual Meeting even if they sell such shares after the Record Date. Based on publicly available information, JCP believes that the outstanding classes of securities of the Company entitled to vote at the Annual Meeting are Class A Common Stock and Class B Common Stock. Each share of Class A Common Stock is entitled to one (1) vote per share and each share of Class B Common Stock is entitled to ten (10) votes per share.

Shares of Class A Common Stock represented by properly executed GOLD proxy cards will be voted at the Annual Meeting as marked and, in the absence of specific instructions, will be voted FOR the election of the Nominees, AGAINST the Say-on-Pay Proposal, and FOR the ratification of McGladrey LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2015, and in the discretion of the persons named as proxies on all other matters as may properly come before the Annual Meeting, as described herein.

According to the Company’s proxy statement for the Annual Meeting, the current Board intends to nominate three (3) candidates for election at the Annual Meeting. This Proxy Statement is soliciting proxies to elect not only our two (2) Nominees, but also the candidate who has been nominated by the Company, other than John W. Casella and William P. Hulligan. This gives shareholders who wish to vote for our Nominees the ability to vote for all three (3) directorships up for election. The names, backgrounds and qualifications of the Company’s nominees, and other information about them, can be found in the Company’s proxy statement. There is no assurance that any of the Company’s nominees will serve as directors if our nominees are elected. The participants in this solicitation intend to vote all of the Group Shares in favor of the Nominees.

QUORUM; BROKER NON-VOTES; DISCRETIONARY VOTING

A quorum is the minimum number of shares of capital stock that must be represented at a duly called meeting in person or by proxy in order to legally conduct business at the meeting. The presence, in person or by proxy, of shares representing a majority of the votes entitled to be cast at the Annual Meeting by the holders of the Class A Common Stock and the Class B Common Stock, voting together as a class, is necessary to constitute a quorum for the transaction of business at the Annual Meeting.

Abstentions are counted as present and entitled to vote for purposes of determining a quorum. Shares represented by “broker non-votes” also are counted as present and entitled to vote for purposes of determining a quorum. However, if you hold your shares in street name and do not provide voting instructions to your broker, your shares will not be voted on any proposal on which your broker does not have discretionary authority to vote (a “broker non-vote”). Under rules of The NASDAQ Stock Market, your broker will not have discretionary authority to vote your shares at the Annual Meeting on any of the proposals.

If you are a stockholder of record, you must deliver your vote by mail, attend the Annual Meeting in person and vote, vote by Internet or vote by telephone in order to be counted in the determination of a quorum.

If you are a beneficial owner, your broker will vote your shares pursuant to your instructions, and those shares will count in the determination of a quorum. Brokers do not have discretionary authority to vote on any of the proposals at the Annual Meeting. Accordingly, unless you vote via proxy card or provide instructions to your broker, your shares of Class A Common Stock will count for purposes of attaining a quorum, but will not be voted on the proposals.

14

VOTES REQUIRED FOR APPROVAL

Election of Directors ─ The Company has adopted a plurality vote standard for non-contested and contested director elections. As a result of our nomination of the Nominees, the director election at the Annual Meeting will be contested, so the two (2) nominees for director receiving the highest vote totals will be elected as directors of the Company. With respect to the election of directors, only votes cast “FOR” a nominee will be counted. Proxy cards specifying that votes should be withheld with respect to one or more nominees will result in those nominees receiving fewer votes but will not count as a vote against the nominees. Neither an abstention nor a broker non-vote will count as a vote cast “FOR” or “AGAINST” a director nominee. Therefore, abstentions and broker non-votes will have no direct effect on the outcome of the election of directors.

Advisory Vote on Executive Compensation ─ According to the Company’s definitive proxy statement, although the vote is non-binding, assuming that a quorum is present, the advisory vote on executive compensation will be approved if a majority of the votes cast at the Annual Meeting vote in favor of approval of the resolution. The Company has indicated that broker non-votes and abstentions will have no effect on the approval of the resolution..

Ratification of the Selection of Accounting Firm ─ According to the Company’s proxy statement, assuming that a quorum is present, the selection of McGladrey LLP will be deemed to have been ratified if a majority of the votes cast at the Annual Meeting vote in favor of ratification. The Company has indicated that broker non-votes and abstentions will have no effect on the approval of the resolution.

Under applicable Delaware law, none of the holders of Class A Common Stock or Class B Common Stock is entitled to appraisal rights in connection with any matter to be acted on at the Annual Meeting. If you sign and submit your GOLD proxy card without specifying how you would like your shares voted, your shares will be voted in accordance with JCP’s recommendations specified herein and in accordance with the discretion of the persons named on the GOLD proxy card with respect to any other matters that may be voted upon at the Annual Meeting.

REVOCATION OF PROXIES

Stockholders of the Company may revoke their proxies at any time prior to exercise by attending the Annual Meeting and voting in person (although, attendance at the Annual Meeting will not in and of itself constitute revocation of a proxy) or by delivering a written notice of revocation. The delivery of a subsequently dated proxy which is properly completed will constitute a revocation of any earlier proxy. The revocation may be delivered either to JCP in care of InvestorCom at the address set forth on the back cover of this Proxy Statement or to the Company at 25 Greens Hill Lane, Rutland, Vermont 05701 or any other address provided by the Company. Although a revocation is effective if delivered to the Company, we request that either the original or photostatic copies of all revocations be mailed to JCP in care of InvestorCom at the address set forth on the back cover of this Proxy Statement so that we will be aware of all revocations and can more accurately determine if and when proxies have been received from the holders of record on the Record Date of a majority of the shares entitled to be voted at the Annual Meeting. Additionally, InvestorCom may use this information to contact stockholders who have revoked their proxies in order to solicit later dated proxies for the election of the Nominees.

15

IF YOU WISH TO VOTE FOR THE ELECTION OF THE NOMINEES TO THE BOARD, PLEASE SIGN, DATE AND RETURN PROMPTLY THE ENCLOSED GOLD PROXY CARD IN THE POSTAGE-PAID ENVELOPE PROVIDED.

SOLICITATION OF PROXIES

The solicitation of proxies pursuant to this Proxy Statement is being made by JCP. Proxies may be solicited by mail, facsimile, telephone, telegraph, Internet, in person and by advertisements.

Members of JCP have entered into an agreement with InvestorCom for solicitation and advisory services in connection with this solicitation, for which InvestorCom will receive a fee not to exceed $50,000, together with reimbursement for its reasonable out-of-pocket expenses, and will be indemnified against certain liabilities and expenses, including certain liabilities under the federal securities laws. InvestorCom will solicit proxies from individuals, brokers, banks, bank nominees and other institutional holders. JCP has requested banks, brokerage houses and other custodians, nominees and fiduciaries to forward all solicitation materials to the beneficial owners of the shares of Class A Common Stock they hold of record. JCP will reimburse these record holders for their reasonable out-of-pocket expenses in so doing. It is anticipated that InvestorCom will employ approximately 25 persons to solicit stockholders for the Annual Meeting.

The entire expense of soliciting proxies is being borne by JCP. Costs of this solicitation of proxies are currently estimated to be approximately $250,000 (including, but not limited to, fees for attorneys, solicitors and other advisors, and other costs incidental to the solicitation). JCP estimates that through the date hereof its expenses in connection with this solicitation are approximately $100,000. To the extent legally permissible, if JCP is successful in its proxy solicitation, JCP intends to seek reimbursement from the Company for the expenses it incurs in connection with this solicitation. JCP does not intend to submit the question of such reimbursement to a vote of security holders of the Company.

ADDITIONAL PARTICIPANT INFORMATION

The Nominees and the members of JCP are participants in this solicitation. The principal business of each of JCP Partnership and JCP Single-Asset is investing in securities. The principal business of JCP Partners is serving as the general partner of each of JCP Partnership and JCP Single-Asset. The principal business of JCP Holdings is serving as the general partner of JCP Partners. The principal business of JCP Management is serving as the investment manager of each of JCP Partnership and JCP Single-Asset. The principal occupation of Mr. Pappas is serving as the managing member of JCP Management and sole member of JCP Holdings.

The address of the principal office of each of JCP Partnership, JCP Single-Asset, JCP Partners, JCP Holdings, JCP Management and Mr. Pappas is 1177 West Loop South, Suite 1650, Houston, Texas 77027.

As of the date hereof, JCP Partnership beneficially owned 1,571,819 shares of Class A Common Stock, including 12,500 shares underlying certain call options exercisable within sixty (60) days of the date hereof. As of the date hereof, JCP Single-Asset beneficially owned 714,851 shares of Class A Common Stock, including 12,500 shares underlying certain call options exercisable within sixty (60) days of the date hereof. JCP Partners, as the general partner of each of JCP Partnership and JCP Single-Asset, may be deemed the beneficial owner of the 2,286,670 shares of Class A Common Stock beneficially owned in the aggregate by JCP Partnership and JCP Single-Asset. JCP Holdings, as the general partner of JCP Partners, may be deemed the beneficial owner of the 2,286,670 shares of Class A Common Stock beneficially owned in the aggregate by JCP Partnership and JCP Single-Asset. JCP Management, as the investment manager of each of JCP Partnership and JCP Single-Asset, may be deemed the beneficial owner of the 2,286,670 shares of Class A Common Stock beneficially owned in the aggregate by JCP Partnership and JCP Single-Asset. Mr. Pappas, as the managing member of JCP Management and sole member of JCP Holdings, may be deemed the beneficial owner of the 2,286,670 shares of Class A Common Stock beneficially owned in the aggregate by JCP Partnership and JCP Single-Asset.

16

Each participant in this solicitation is a member of a “group” with the other participants for the purposes of Section 13(d)(3) of the Exchange Act. The Group may be deemed to beneficially own the 2,326,670 shares of Class A Common Stock owned in the aggregate by all of the participants in this solicitation. Each participant in this solicitation disclaims beneficial ownership of the shares of Class A Common Stock that he or it does not directly own. For information regarding purchases and sales of securities of the Company during the past two (2) years by the participants in this solicitation, see Schedule I.

The shares of Class A Common Stock directly beneficially owned by each of JCP Partnership and JCP Single-Asset were purchased with working capital (which may, at any given time, include margin loans made by brokerage firms in the ordinary course of business).

Except as set forth in this Proxy Statement (including the Schedules hereto), (i) during the past ten (10) years, no participant in this solicitation has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors); (ii) no participant in this solicitation directly or indirectly beneficially owns any securities of the Company; (iii) no participant in this solicitation owns any securities of the Company which are owned of record but not beneficially; (iv) no participant in this solicitation has purchased or sold any securities of the Company during the past two (2) years; (v) no part of the purchase price or market value of the securities of the Company owned by any participant in this solicitation is represented by funds borrowed or otherwise obtained for the purpose of acquiring or holding such securities; (vi) no participant in this solicitation is, or within the past year was, a party to any contract, arrangements or understandings with any person with respect to any securities of the Company, including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies; (vii) no associate of any participant in this solicitation owns beneficially, directly or indirectly, any securities of the Company; (viii) no participant in this solicitation owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Company; (ix) no participant in this solicitation or any of his or its associates was a party to any transaction, or series of similar transactions, since the beginning of the Company’s last fiscal year, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company or any of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000; (x) no participant in this solicitation or any of his or its associates has any arrangement or understanding with any person with respect to any future employment by the Company or its affiliates, or with respect to any future transactions to which the Company or any of its affiliates will or may be a party; and (xi) no participant in this solicitation has a substantial interest, direct or indirect, by securities holdings or otherwise, in any matter to be acted on at the Annual Meeting.

There are no material proceedings to which any participant in this solicitation or any of his or its associates is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries. With respect to each of the Nominees, none of the events enumerated in Item 401(f)(1)-(8) of Regulation S-K of the Exchange Act occurred during the past ten (10) years.

17

OTHER MATTERS AND ADDITIONAL INFORMATION

JCP is unaware of any other matters to be considered at the Annual Meeting. However, should other matters, which JCP is not aware of at a reasonable time before this solicitation, be brought before the Annual Meeting, the persons named as proxies on the enclosed GOLD proxy card will vote on such matters in their discretion.

STOCKHOLDER PROPOSALS

Proposals of stockholders intended to be presented at the 2016 Annual Meeting of Stockholders (the “2016 Annual Meeting”) must, in order to be included in the Company’s proxy statement and the form of proxy for the 2016 Annual Meeting, be delivered to the Company’s Corporate Secretary at 25 Greens Hill Lane, Rutland, Vermont 05701 by May 26, 2016.

Under the Bylaws, any stockholder intending to present any proposal (other than a proposal made by, or at the direction of, the Board) at the 2016 Annual Meeting, must give written notice of that proposal to the Company’s Secretary not less than ninety (90) days nor more than one-hundred and twenty (120) days prior to the first anniversary of the preceding year’s annual meeting (subject to certain exceptions if the annual meeting is advanced or delayed a certain number of days). Therefore, to be presented at the 2016 Annual Meeting, such a proposal must be given between July 9, 2016 and August 8, 2016. However, in the event the 2016 Annual Meeting is scheduled to be held on a date before October 17, 2016, or after January 5, 2017, which are dates twenty (20) days before or sixty (60) days after the anniversary date of the Annual Meeting, then such advance notice must be received by us not earlier than the 120th day prior to the 2016 Annual Meeting and not later than the close of business on the later of (1) the 90th day prior to the 2016 Annual Meeting and (2) the 10th day following the day on which notice of the date of the 2016 Annual Meeting is mailed or public disclosure of the date of the 2016 Annual Meeting is made, whichever first occurs.

The information set forth above regarding the procedures for submitting stockholder proposals for consideration at the 2016 Annual Meeting is based on information contained in the Company’s proxy statement and the Bylaws. The incorporation of this information in this proxy statement should not be construed as an admission by JCP that such procedures are legal, valid or binding.

INCORPORATION BY REFERENCE

WE HAVE OMITTED FROM THIS PROXY STATEMENT CERTAIN DISCLOSURE REQUIRED BY APPLICABLE LAW THAT IS EXPECTED TO BE INCLUDED IN THE COMPANY’S PROXY STATEMENT RELATING TO THE ANNUAL MEETING BASED ON THE RELIANCE OF RULE 14A-5(C). THIS DISCLOSURE IS EXPECTED TO INCLUDE, AMONG OTHER THINGS, CURRENT BIOGRAPHICAL INFORMATION ON THE COMPANY’S DIRECTORS, INFORMATION CONCERNING EXECUTIVE COMPENSATION, AND OTHER IMPORTANT INFORMATION. SEE SCHEDULE II FOR INFORMATION REGARDING PERSONS WHO BENEFICIALLY OWN MORE THAN 5% OF THE SHARES AND THE OWNERSHIP OF THE SHARES BY THE DIRECTORS AND MANAGEMENT OF THE COMPANY.

The information concerning the Company contained in this Proxy Statement and the Schedules attached hereto has been taken from, or is based upon, publicly available information.

| JCP Investment Partnership, LP |

| September 29, 2015 |

18

SCHEDULE I

TRANSACTIONS IN SECURITIES OF THE COMPANY BY THE PARTICIPANTS DURING THE PAST TWO YEARS

Shares of Class A Common Stock Purchased / (Sold) | Date of Purchase / Sale |

| JCP INVESTMENT PARTNERSHIP, LP | |

| 50 | 07/22/2015 |

| 10,000 | 07/21/2015 |

| 21,755 | 07/20/2015 |

| 10,000 | 07/16/2015 |

| 25,450 | 07/15/2015 |

| 150 | 07/15/2015 |

| 8,129 | 07/13/2015 |

| 350 | 07/10/2015 |

| 12,500* | 07/10/2015 |

| 50,000 | 04/21/2015 |

| 41,667 | 04/20/2015 |

| 83,333 | 04/17/2015 |

| 45,250 | 04/16/2015 |

| 42,882 | 04/15/2015 |

| 31,134 | 04/14/2015 |

| 23,019 | 04/13/2015 |

| 75,000 | 04/07/2015 |

| 20,742 | 04/06/2015 |

| 20,364 | 04/02/2015 |

| 25,000 | 03/30/2015 |

| 34,354 | 03/27/2015 |

| 7,038 | 03/27/2015 |

| 7,887 | 03/26/2015 |

| 3,513 | 03/25/2015 |

| 100 | 03/24/2015 |

| 7,550 | 03/23/2015 |

| 16,744 | 03/20/2015 |

| 170 | 03/18/2015 |

| 49,999 | 03/18/2015 |

| 164,750 | 03/16/2015 |

| 50,000 | 03/13/2015 |

| 22,100 | 03/12/2015 |

| 13,891 | 03/10/2015 |

| 71,490 | 03/09/2015 |

| 3,600 | 03/06/2015 |

| 33,410 | 03/05/2015 |

| 20,303 | 03/04/2015 |

| 30,000 | 03/03/2015 |

| 30,000 | 03/02/2015 |

| 30,027 | 02/27/2015 |

| 30,000 | 02/26/2015 |

| 60,000 | 02/25/2015 |

| 30,000 | 02/24/2015 |

| 29,900 | 02/23/2015 |

| 50,000 | 02/23/2015 |

| 100 | 02/23/2015 |

| 50,000 | 02/17/2015 |

| 10,000 | 02/06/2015 |

| 20,000 | 02/04/2015 |

| 5,000 | 01/22/2015 |

| 5,000 | 01/14/2015 |

| 70,000 | 01/08/2015 |

| 10,000 | 01/07/2015 |

| 5,000 | 01/05/2015 |

| 5,000 | 12/31/2014 |

| 2,000 | 12/15/2014 |

I-1

| 10,000 | 12/11/2014 |

| 5,000 | 12/08/2014 |

| (3,882) | 06/20/2014 |

| 30,000 | 05/30/2014 |

| 5,000 | 05/27/2014 |

* Represents shares underlying American-style call options purchased in the over the counter market. These call options expire on December 18, 2015.

| JCP SINGLE-ASSET PARTNERSHIP, LP | |

| 50 | 07/22/2015 |

| 10,000 | 07/21/2015 |

| 21,754 | 07/20/2015 |

| 10,000 | 07/16/2015 |

| 25,450 | 07/15/2015 |

| 150 | 07/15/2015 |

| 8,130 | 07/13/2015 |

| 349 | 07/10/2015 |

| 12,500* | 07/10/2015 |

| 10,000 | 05/13/2015 |

| 15,000 | 05/12/2015 |

| 30,000 | 05/11/2015 |

| 50,000 | 05/08/2015 |

| 24,798 | 05/07/2015 |

| 10,000 | 04/21/2015 |

| 8,333 | 04/20/2015 |

| 16,667 | 04/17/2015 |

| 9,050 | 04/16/2015 |

| 8,576 | 04/15/2015 |

| 6,227 | 04/14/2015 |

| 4,604 | 04/13/2015 |

| 75,000 | 04/07/2015 |

| 20,743 | 04/06/2015 |

| 20,364 | 04/02/2015 |

| 25,000 | 03/30/2015 |

| 34,353 | 03/27/2015 |

| 7,039 | 03/27/2015 |

| 7,886 | 03/26/2015 |

| 3,513 | 03/25/2015 |

| 100 | 03/24/2015 |

| 7,550 | 03/23/2015 |

| 16,745 | 03/20/2015 |

| 169 | 03/18/2015 |

| 50,001 | 03/18/2015 |

| 164,750 | 03/16/2015 |

* Represents shares underlying American-style call options purchased in the over the counter market. These call options expire on December 18, 2015.

BRETT W. FRAZIER

| 40,000 | 04/29/2015 |

I-2

SCHEDULE II

The following table is reprinted from the definitive proxy statement filed by Casella Waste Systems, Inc. with the Securities and Exchange Commission on September 22, 2015.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth as of September 10, 2015 information regarding the beneficial ownership of our capital voting stock by (a) each person or entity known by us to beneficially own more than 5% of any class of our common stock, (b) our directors and director nominees, (c) our named executive officers and (d) our directors and executive officers as a group.

We have determined beneficial ownership in accordance with the rules of the SEC. Shares of Class A common stock that an individual or entity has a right to acquire within 60 days after September 10, 2015, including pursuant to options to purchase Class A common stock, Class B common stock convertible into Class A common stock and restricted stock unit awards subject to vesting, are included in the number of shares of Class A common stock beneficially owned by the person or entity and are deemed outstanding for purposes of computing the percentage of beneficial ownership owned by the person or entity, but are not deemed outstanding for purposes of computing the percentage beneficially owned by any other person or entity. Each share of Class B common stock is convertible at the discretion of the holder thereof into one share of Class A common stock. As of September 10, 2015, a total of 39,978,784 shares of Class A common stock were outstanding and a total of 988,200 shares of Class B common stock were outstanding. Except as otherwise indicated by footnote, we believe that the persons named in this table, based on information provided by these persons, have sole voting and investment power with respect to the securities indicated. Unless otherwise indicated, the address of each beneficial owner listed in the table is care of Casella Waste Systems, Inc., 25 Greens Hill Lane, Rutland, Vermont 05701.

| Class A | Class B | Combined | ||||||||||||||||||

Common Stock | Common Stock | Voting | ||||||||||||||||||

Name of Beneficial Owner | # of Shares | % of Class | # of Shares | % of Class | Percentage (1) | |||||||||||||||

| 5% Stockholders | ||||||||||||||||||||

Rutabaga Capital Management LLC (2) 64 Broad Street, 3rd Floor Boston, MA 02109 | 3,192,741 | 7.99 | % | — | — | 6.40 | % | |||||||||||||

RMB Capital Management, LLC (3) 115 S. LaSalle Street, 34th Floor Chicago, IL 60603 | 3,012,481 | 7.54 | % | — | — | 6.04 | % | |||||||||||||

BlackRock, Inc. (4) 40 East 52nd Street New York, NY 10022 | 2,916,833 | 7.30 | % | — | — | 5.85 | % | |||||||||||||

Portolan Capital Management (5) 2 International Place, 26th Floor Boston, MA 02110 | 2,473,288 | 6.19 | % | — | — | 4.96 | % | |||||||||||||

JCP Investment Partnership, LP (6) 1177 West Loop South, Suite 1650 Houston, TX 77027 | 2,109,903 | 5.28 | % | — | — | 4.23 | % | |||||||||||||

| Executive Officers and Directors | ||||||||||||||||||||

| John W. Casella (7) | 913,775 | 2.25 | % | 494,100 | 50.0 | % | 10.74 | % | ||||||||||||

| Edmond R. Coletta (8) | 110,710 | * | — | — | * | |||||||||||||||

| Edwin D. Johnson (9) | 421,373 | 1.05 | % | — | — | * | ||||||||||||||

| David L. Schmitt (10) | 56,764 | * | — | — | * | |||||||||||||||

| Christopher B. Heald (11) | 46,160 | * | — | — | * | |||||||||||||||

| Michael K. Burke (12) | 101,124 | * | — | — | * | |||||||||||||||

| James F. Callahan, Jr. (13) | 170,082 | * | — | — | * | |||||||||||||||

| Douglas R. Casella (14) | 1,214,279 | 3.00 | % | 494,100 | 50.0 | % | 11.34 | % | ||||||||||||

| Joseph Doody (15) | 97,582 | * | — | — | * | |||||||||||||||

| William P. Hulligan (16) | 108,333 | * | — | — | * | |||||||||||||||

| Emily Nagle Green (17) | 29,792 | * | — | — | * | |||||||||||||||

| James E. O’Connor (18) | 13,912 | * | — | — | * | |||||||||||||||

| Gregory B. Peters (19) | 111,766 | * | — | — | * | |||||||||||||||

| Executive officers and directors as a group (13 people) (20) | 3,395,652 | 8.19 | % | 988,200 | 100.0 | % | 24.41 | % |

II-1

| * | Represents less than 1% of the outstanding shares of the respective class of our voting stock and/or less than 1% of total ownership of equity securities. |

| (1) | This column represents voting power rather than percentage of equity interest as each share of Class A common stock is entitled to one vote, while each share of Class B common stock is entitled to ten votes. Combined, the Class A common stock (39,978,784 votes) and the Class B common stock (9,882,000 votes) entitle their holders to an aggregate of 49,860,784 votes as of September 10, 2015. The Class A common stock and Class B common stock vote together as a single class on all matters submitted to a vote of our stockholders, except as may otherwise be required by law. |

| (2) | We obtained information regarding beneficial ownership of these shares solely from a Form 13G that was filed with the SEC by Rutabaga Capital Management on February 13, 2015. Rutabaga Capital Management reports sole voting power with respect to 2,694,341 shares, shared voting power with respect to 498,400 shares and sole dispositive power with respect to 3,192,741 shares. |