Cempra Investor & Analyst Day June 23, 2016 Millennium Hotel, NYC Exhibit 99.1

Forward Looking Statements This presentation contains forward-looking statements regarding future events. These statements are just predictions and are subject to risks and uncertainties that could cause the actual events or results to differ materially. These risks and uncertainties include, among others: our and our strategic partners’ ability to obtain FDA and foreign regulatory approval of our product candidates; risks related to the costs, sources of funding, timing, regulatory review and results of our studies and clinical trials and those of our strategic partners; our need to obtain additional funding and our ability to obtain future funding on acceptable terms; our ability to commercialize and launch whether on our own or with a strategic partner any product that receives regulatory approval; our anticipated capital expenditures and our estimates regarding our capital requirements; our dependence on the success of solithromycin and TAKSTA; the unpredictability of the size of the markets for, and market acceptance of, any of our products, including solithromycin and TAKSTA; our ability to produce and sell any approved products and the price we are able to realize for those products; our ability to retain and hire necessary employees and to staff our operations appropriately; the possible impairment of, or inability to obtain, intellectual property rights and the costs of obtaining such rights from third parties; our ability to compete in our industry; innovation by our competitors; and our ability to stay abreast of and comply with new or modified laws and regulations that currently apply or become applicable to our business. Please refer to the documents that we file from time to time with the Securities and Exchange Commission.

Agenda CABP Clinical Update Expert Panel CABP Market Update CABP Counts Campaign Market Development Forecast Review Brand Plans Targeting Plans Managed Care Update

Thomas M. File, Jr, MD, MSc, MACP, FIDSA, FCCP Chair, Division of Infectious Disease Summa Health System Professor of Internal Medicine and Master Teacher Chair, Infectious Disease Section Northeast Ohio Medical University Community-Acquired Bacterial Pneumonia (CABP): A Serious, Resistant, Deadly, and Costly Disease

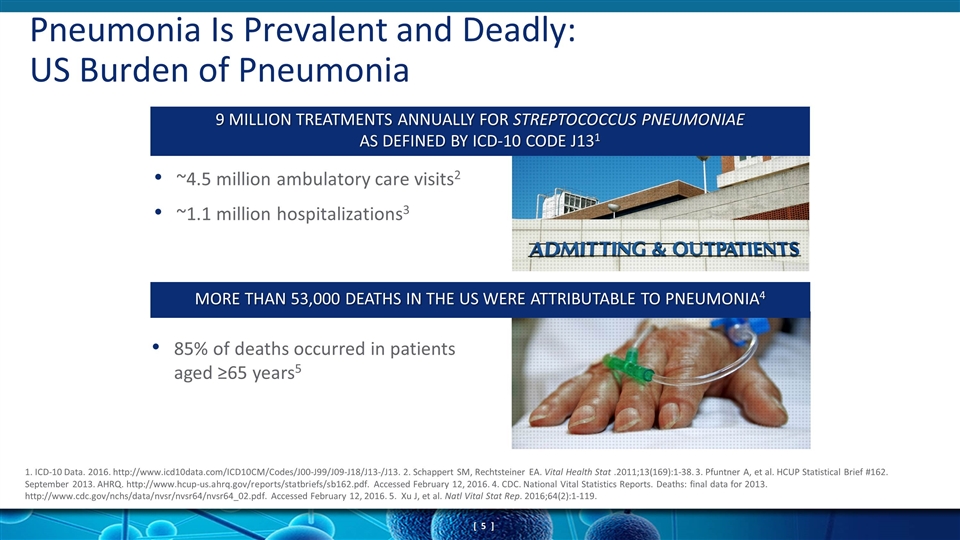

~4.5 million ambulatory care visits2 ~1.1 million hospitalizations3 Pneumonia Is Prevalent and Deadly: US Burden of Pneumonia 9 MILLION TREATMENTS ANNUALLY FOR STREPTOCOCCUS PNEUMONIAE AS DEFINED BY ICD-10 CODE J131 MORE THAN 53,000 DEATHS IN THE US WERE ATTRIBUTABLE TO PNEUMONIA4 1. ICD-10 Data. 2016. http://www.icd10data.com/ICD10CM/Codes/J00-J99/J09-J18/J13-/J13. 2. Schappert SM, Rechtsteiner EA. Vital Health Stat .2011;13(169):1-38. 3. Pfuntner A, et al. HCUP Statistical Brief #162. September 2013. AHRQ. http://www.hcup-us.ahrq.gov/reports/statbriefs/sb162.pdf. Accessed February 12, 2016. 4. CDC. National Vital Statistics Reports. Deaths: final data for 2013. http://www.cdc.gov/nchs/data/nvsr/nvsr64/nvsr64_02.pdf. Accessed February 12, 2016. 5. Xu J, et al. Natl Vital Stat Rep. 2016;64(2):1-119. 85% of deaths occurred in patients aged ≥65 years5

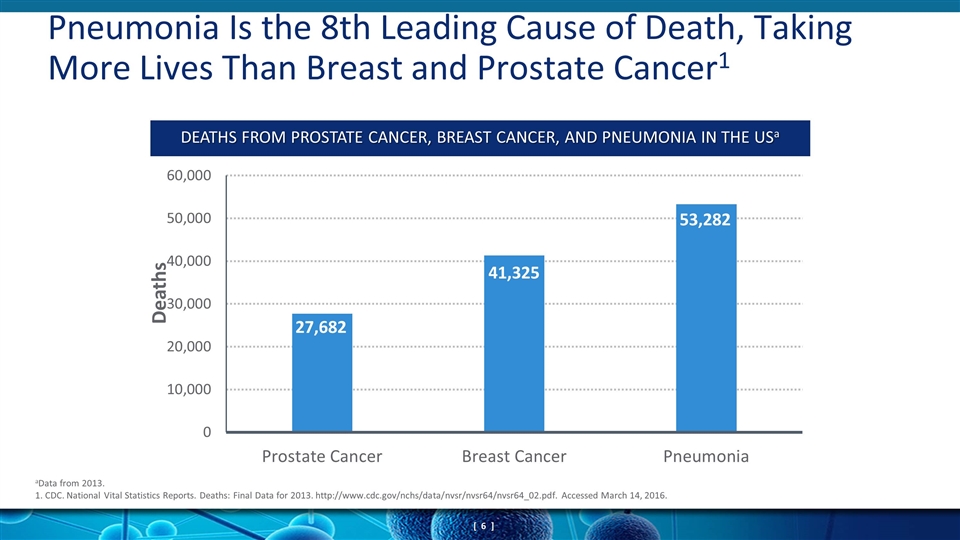

Pneumonia Is the 8th Leading Cause of Death, Taking More Lives Than Breast and Prostate Cancer1 aData from 2013. 1. CDC. National Vital Statistics Reports. Deaths: Final Data for 2013. http://www.cdc.gov/nchs/data/nvsr/nvsr64/nvsr64_02.pdf. Accessed March 14, 2016. DEATHS FROM PROSTATE CANCER, BREAST CANCER, AND PNEUMONIA IN THE USa

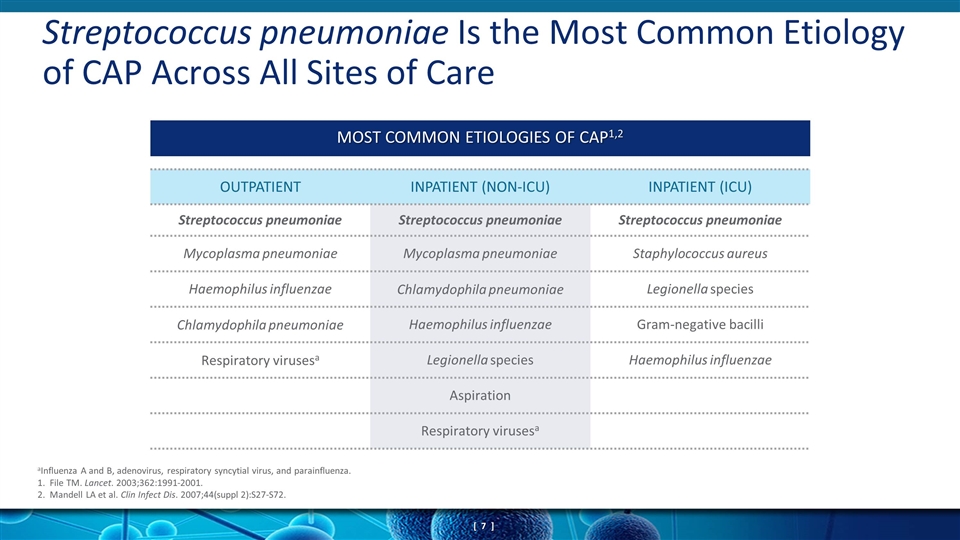

Streptococcus pneumoniae Is the Most Common Etiology of CAP Across All Sites of Care OUTPATIENT INPATIENT (NON-ICU) INPATIENT (ICU) Streptococcus pneumoniae Streptococcus pneumoniae Streptococcus pneumoniae Mycoplasma pneumoniae Mycoplasma pneumoniae Staphylococcus aureus Haemophilus influenzae Chlamydophila pneumoniae Legionella species Chlamydophila pneumoniae Haemophilus influenzae Gram-negative bacilli Respiratory virusesa Legionella species Haemophilus influenzae Aspiration Respiratory virusesa MOST COMMON ETIOLOGIES OF CAP1,2 aInfluenza A and B, adenovirus, respiratory syncytial virus, and parainfluenza. 1. File TM. Lancet. 2003;362:1991-2001. 2. Mandell LA et al. Clin Infect Dis. 2007;44(suppl 2):S27-S72.

Even when advanced diagnostic methods are used, bacterial pathogens are not frequently confirmed in CABP The remaining causative pathogens are either viral or unidentified However, in most instances of CAP, antibiotics are prescribed empirically As part of its rationale for approving new antibiotics, the FDA has redefined treatment indications to reflect the need to prescribe these drugs for proven or suspected bacterial infections Thus, the FDA now refers to Community-Acquired Pneumonia as Community Acquired Bacterial Pneumonia (CABP) Evolution of the Term Pertaining to Community-Acquired Pneumonia

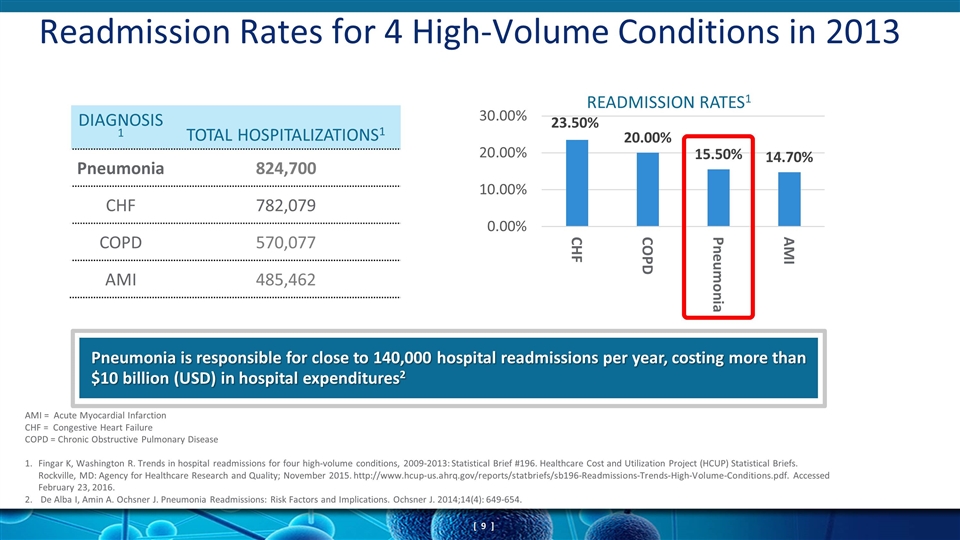

Readmission Rates for 4 High-Volume Conditions in 2013 DIAGNOSIS1 TOTAL HOSPITALIZATIONS1 Pneumonia 824,700 CHF 782,079 COPD 570,077 AMI 485,462 Pneumonia is responsible for close to 140,000 hospital readmissions per year, costing more than $10 billion (USD) in hospital expenditures2 AMI = Acute Myocardial Infarction CHF = Congestive Heart Failure COPD = Chronic Obstructive Pulmonary Disease 1. Fingar K, Washington R. Trends in hospital readmissions for four high-volume conditions, 2009-2013: Statistical Brief #196. Healthcare Cost and Utilization Project (HCUP) Statistical Briefs. Rockville, MD: Agency for Healthcare Research and Quality; November 2015. http://www.hcup-us.ahrq.gov/reports/statbriefs/sb196-Readmissions-Trends-High-Volume-Conditions.pdf. Accessed February 23, 2016. 2. De Alba I, Amin A. Ochsner J. Pneumonia Readmissions: Risk Factors and Implications. Ochsner J. 2014;14(4): 649-654.

Antimicrobial Resistance Is a Major Public Health Concern and Continues to Rise

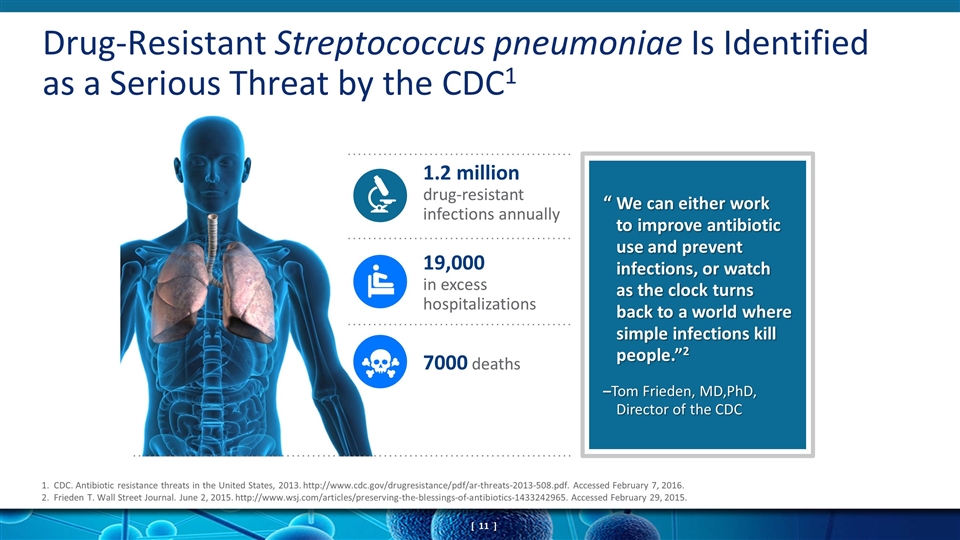

Drug-Resistant Streptococcus pneumoniae Is Identified as a Serious Threat by the CDC1 1.2 million drug-resistant infections annually 19,000 in excess hospitalizations 7000 deaths 1. CDC. Antibiotic resistance threats in the United States, 2013. http://www.cdc.gov/drugresistance/pdf/ar-threats-2013-508.pdf. Accessed February 7, 2016. 2. Frieden T. Wall Street Journal. June 2, 2015. http://www.wsj.com/articles/preserving-the-blessings-of-antibiotics-1433242965. Accessed February 29, 2015. “ We can either work to improve antibiotic use and prevent infections, or watch as the clock turns back to a world where simple infections kill people.”2 –Tom Frieden, MD,PhD, Director of the CDC

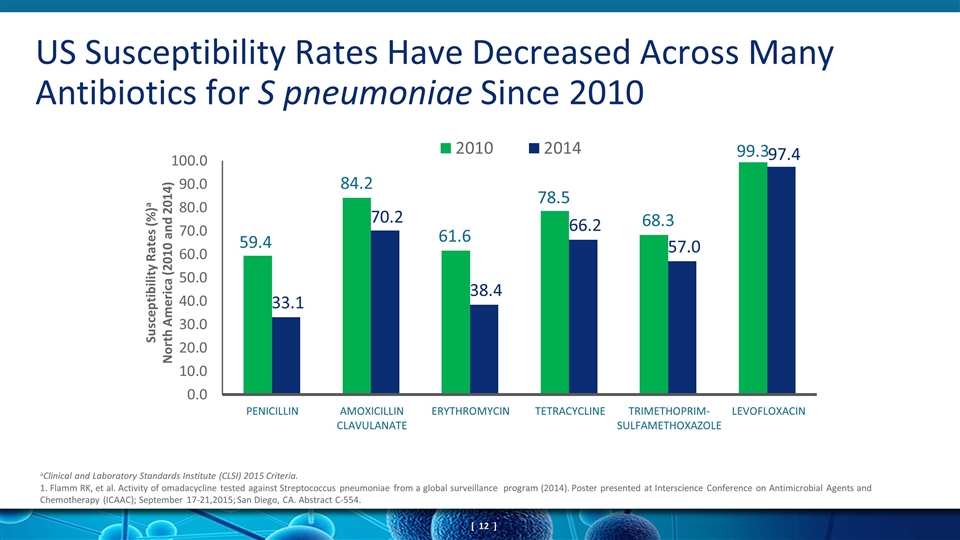

US Susceptibility Rates Have Decreased Across Many Antibiotics for S pneumoniae Since 2010 aClinical and Laboratory Standards Institute (CLSI) 2015 Criteria. 1. Flamm RK, et al. Activity of omadacycline tested against Streptococcus pneumoniae from a global surveillance program (2014). Poster presented at Interscience Conference on Antimicrobial Agents and Chemotherapy (ICAAC); September 17-21,2015; San Diego, CA. Abstract C-554. PENICILLIN AMOXICILLIN CLAVULANATE TETRACYCLINE ERYTHROMYCIN TRIMETHOPRIM- SULFAMETHOXAZOLE LEVOFLOXACIN Susceptibility Rates (%)a North America (2010 and 2014)

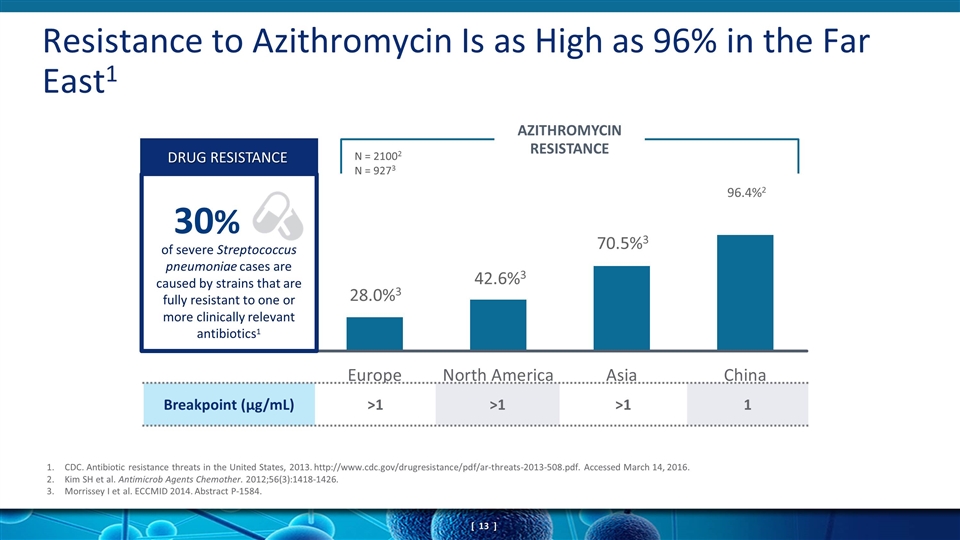

Resistance to Azithromycin Is as High as 96% in the Far East1 AZITHROMYCIN RESISTANCE Breakpoint (µg/mL) >1 >1 >1 1 of severe Streptococcus pneumoniae cases are caused by strains that are fully resistant to one or more clinically relevant antibiotics1 DRUG RESISTANCE 30% 96.4%2 N = 21002 N = 9273 1.CDC. Antibiotic resistance threats in the United States, 2013. http://www.cdc.gov/drugresistance/pdf/ar-threats-2013-508.pdf. Accessed March 14, 2016. Kim SH et al. Antimicrob Agents Chemother. 2012;56(3):1418-1426. Morrissey I et al. ECCMID 2014. Abstract P-1584.

Current CABP Treatment Guidelines and Behaviors

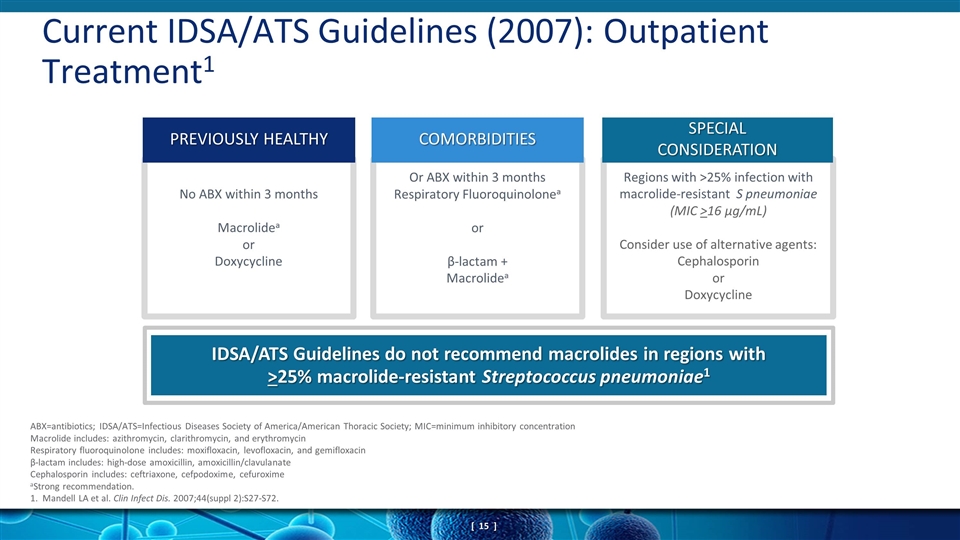

Or ABX within 3 months Respiratory Fluoroquinolonea or β-lactam + Macrolidea Regions with >25% infection with macrolide-resistant S pneumoniae (MIC >16 μg/mL) Consider use of alternative agents: Cephalosporin or Doxycycline Current IDSA/ATS Guidelines (2007): Outpatient Treatment1 No ABX within 3 months Macrolidea or Doxycycline ABX=antibiotics; IDSA/ATS=Infectious Diseases Society of America/American Thoracic Society; MIC=minimum inhibitory concentration Macrolide includes: azithromycin, clarithromycin, and erythromycin Respiratory fluoroquinolone includes: moxifloxacin, levofloxacin, and gemifloxacin β-lactam includes: high-dose amoxicillin, amoxicillin/clavulanate Cephalosporin includes: ceftriaxone, cefpodoxime, cefuroxime aStrong recommendation. 1. Mandell LA et al. Clin Infect Dis. 2007;44(suppl 2):S27-S72. IDSA/ATS Guidelines do not recommend macrolides in regions with >25% macrolide-resistant Streptococcus pneumoniae1 PREVIOUSLY HEALTHY COMORBIDITIES SPECIAL CONSIDERATION

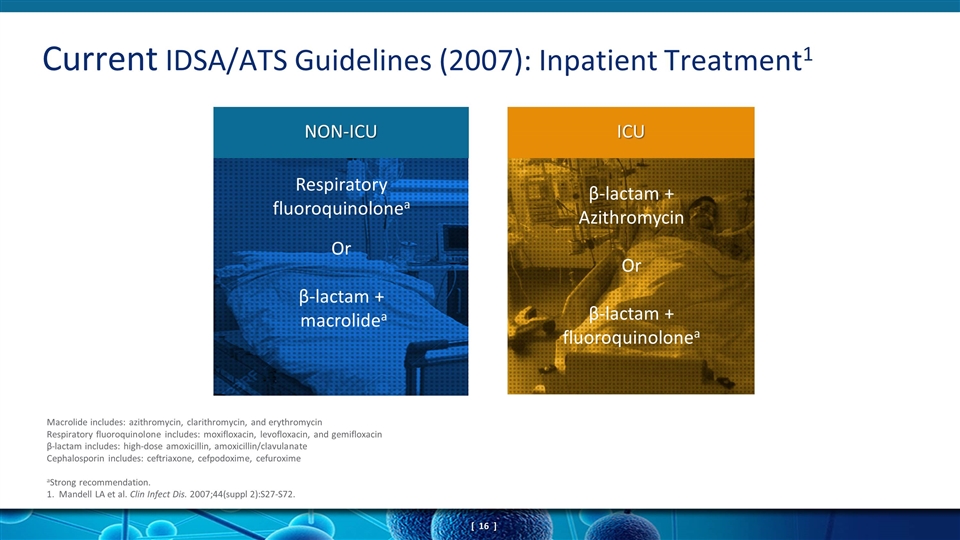

Current IDSA/ATS Guidelines (2007): Inpatient Treatment1 Macrolide includes: azithromycin, clarithromycin, and erythromycin Respiratory fluoroquinolone includes: moxifloxacin, levofloxacin, and gemifloxacin β-lactam includes: high-dose amoxicillin, amoxicillin/clavulanate Cephalosporin includes: ceftriaxone, cefpodoxime, cefuroxime aStrong recommendation. 1. Mandell LA et al. Clin Infect Dis. 2007;44(suppl 2):S27-S72. β-lactam + Azithromycin Or β-lactam + fluoroquinolonea Respiratory fluoroquinolonea Or β-lactam + macrolidea NON-ICU ICU

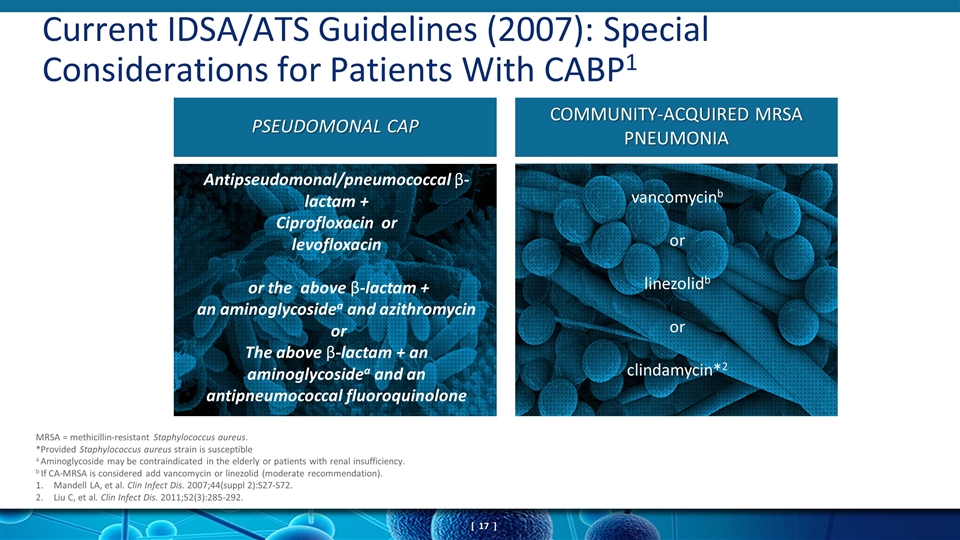

Current IDSA/ATS Guidelines (2007): Special Considerations for Patients With CABP1 MRSA = methicillin-resistant Staphylococcus aureus. *Provided Staphylococcus aureus strain is susceptible a Aminoglycoside may be contraindicated in the elderly or patients with renal insufficiency. b If CA-MRSA is considered add vancomycin or linezolid (moderate recommendation). Mandell LA, et al. Clin Infect Dis. 2007;44(suppl 2):S27-S72. Liu C, et al. Clin Infect Dis. 2011;52(3):285-292. Antipseudomonal/pneumococcal β-lactam + Ciprofloxacin or levofloxacin or the above β-lactam + an aminoglycosidea and azithromycin or The above β-lactam + an aminoglycosidea and an antipneumococcal fluoroquinolone vancomycinb or linezolidb or clindamycin*2 PSEUDOMONAL CAP COMMUNITY-ACQUIRED MRSA PNEUMONIA

Safety and Tolerability of Currently Approved Antimicrobials

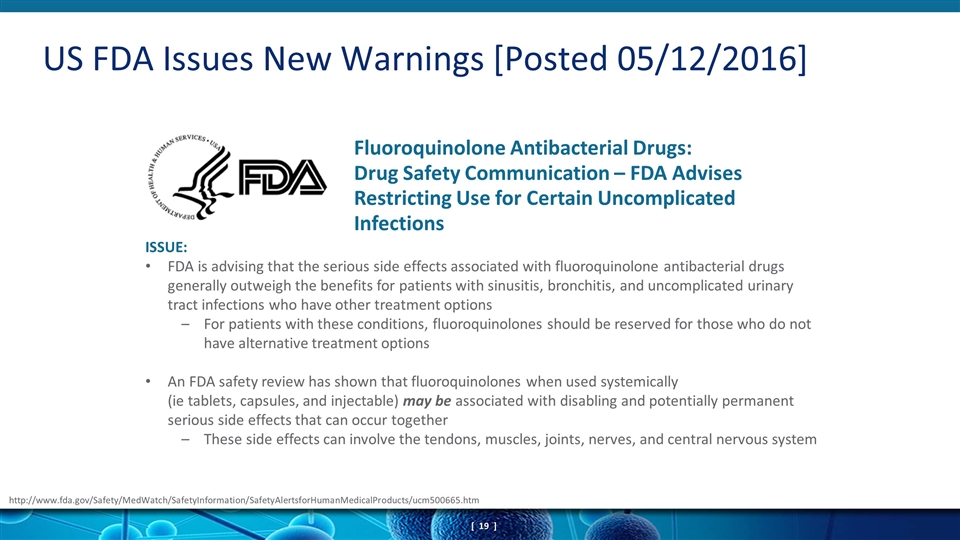

US FDA Issues New Warnings [Posted 05/12/2016] http://www.fda.gov/Safety/MedWatch/SafetyInformation/SafetyAlertsforHumanMedicalProducts/ucm500665.htm Fluoroquinolone Antibacterial Drugs: Drug Safety Communication – FDA Advises Restricting Use for Certain Uncomplicated Infections ISSUE: FDA is advising that the serious side effects associated with fluoroquinolone antibacterial drugs generally outweigh the benefits for patients with sinusitis, bronchitis, and uncomplicated urinary tract infections who have other treatment options For patients with these conditions, fluoroquinolones should be reserved for those who do not have alternative treatment options An FDA safety review has shown that fluoroquinolones when used systemically (ie tablets, capsules, and injectable) may be associated with disabling and potentially permanent serious side effects that can occur together These side effects can involve the tendons, muscles, joints, nerves, and central nervous system

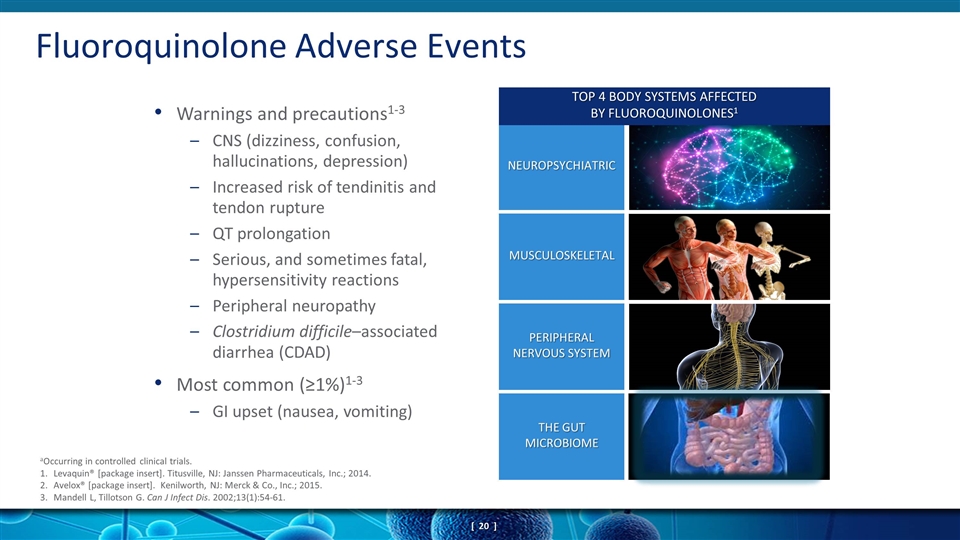

Fluoroquinolone Adverse Events aOccurring in controlled clinical trials. 1.Levaquin® [package insert]. Titusville, NJ: Janssen Pharmaceuticals, Inc.; 2014. 2.Avelox® [package insert]. Kenilworth, NJ: Merck & Co., Inc.; 2015. 3.Mandell L, Tillotson G. Can J Infect Dis. 2002;13(1):54-61. Warnings and precautions1-3 CNS (dizziness, confusion, hallucinations, depression) Increased risk of tendinitis and tendon rupture QT prolongation Serious, and sometimes fatal, hypersensitivity reactions Peripheral neuropathy Clostridium difficile–associated diarrhea (CDAD) Most common (≥1%)1-3 GI upset (nausea, vomiting) NEUROPSYCHIATRIC PERIPHERAL NERVOUS SYSTEM TOP 4 BODY SYSTEMS AFFECTED BY FLUOROQUINOLONES1 MUSCULOSKELETAL THE GUT MICROBIOME

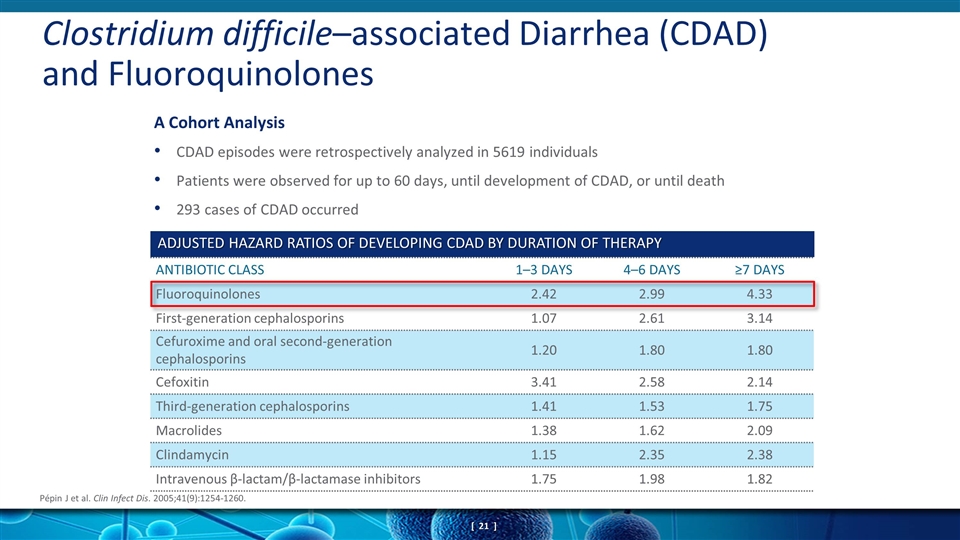

CDAD episodes were retrospectively analyzed in 5619 individuals Patients were observed for up to 60 days, until development of CDAD, or until death 293 cases of CDAD occurred A Cohort Analysis Clostridium difficile–associated Diarrhea (CDAD) and Fluoroquinolones Pépin J et al. Clin Infect Dis. 2005;41(9):1254-1260. ANTIBIOTIC CLASS 1–3 DAYS 4–6 DAYS ≥7 DAYS Fluoroquinolones 2.42 2.99 4.33 First-generation cephalosporins 1.07 2.61 3.14 Cefuroxime and oral second-generation cephalosporins 1.20 1.80 1.80 Cefoxitin 3.41 2.58 2.14 Third-generation cephalosporins 1.41 1.53 1.75 Macrolides 1.38 1.62 2.09 Clindamycin 1.15 2.35 2.38 Intravenous β-lactam/β-lactamase inhibitors 1.75 1.98 1.82 ADJUSTED HAZARD RATIOS OF DEVELOPING CDAD BY DURATION OF THERAPY

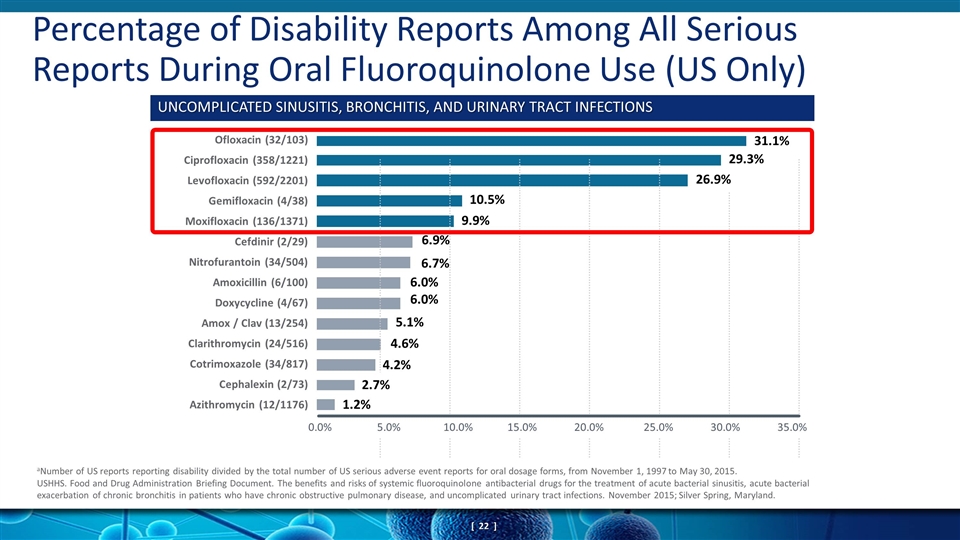

Percentage of Disability Reports Among All Serious Reports During Oral Fluoroquinolone Use (US Only) 31.1% 29.3% 26.9% 10.5% 9.9% 6.9% 6.7% 6.0% 6.0% 5.1% 4.6% 4.2% 2.7% 1.2% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% Ofloxacin (32/103) Ciprofloxacin (358/1221) Levofloxacin (592/2201) Gemifloxacin (4/38) Moxifloxacin (136/1371) Cefdinir (2/29) Nitrofurantoin (34/504) Amoxicillin (6/100) Doxycycline (4/67) Amox / Clav (13/254) Clarithromycin (24/516) Cotrimoxazole (34/817) Cephalexin (2/73) Azithromycin (12/1176) aNumber of US reports reporting disability divided by the total number of US serious adverse event reports for oral dosage forms, from November 1, 1997 to May 30, 2015. USHHS. Food and Drug Administration Briefing Document. The benefits and risks of systemic fluoroquinolone antibacterial drugs for the treatment of acute bacterial sinusitis, acute bacterial exacerbation of chronic bronchitis in patients who have chronic obstructive pulmonary disease, and uncomplicated urinary tract infections. November 2015; Silver Spring, Maryland. UNCOMPLICATED SINUSITIS, BRONCHITIS, AND URINARY TRACT INFECTIONS

Antibiotic Stewardship

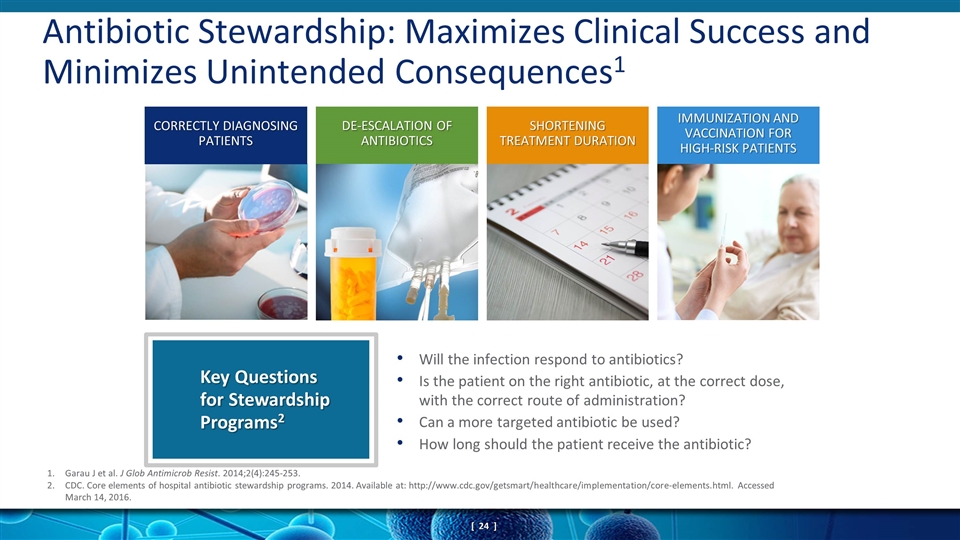

Antibiotic Stewardship: Maximizes Clinical Success and Minimizes Unintended Consequences1 Will the infection respond to antibiotics? Is the patient on the right antibiotic, at the correct dose, with the correct route of administration? Can a more targeted antibiotic be used? How long should the patient receive the antibiotic? DE-ESCALATION OF ANTIBIOTICS Garau J et al. J Glob Antimicrob Resist. 2014;2(4):245-253. CDC. Core elements of hospital antibiotic stewardship programs. 2014. Available at: http://www.cdc.gov/getsmart/healthcare/implementation/core-elements.html. Accessed March 14, 2016. Key Questions for Stewardship Programs2 CORRECTLY DIAGNOSING PATIENTS SHORTENING TREATMENT DURATION IMMUNIZATION AND VACCINATION FOR HIGH-RISK PATIENTS

Summary

CABP is a deadly, serious, and resistant disease, significantly affecting healthcare costs Increasing rates of antibiotic resistance pose a challenge to effective CABP treatment Current CABP treatment options often oblige physicians to make prescribing trade-offs between drug efficacy and safety Antibiotic stewardship must address the unmet needs of avoiding hospitalization, hospital readmissions, selection of appropriate antimicrobial at site-of-care, and adequate duration of therapy Summary

Commercial Update David Moore, CCO

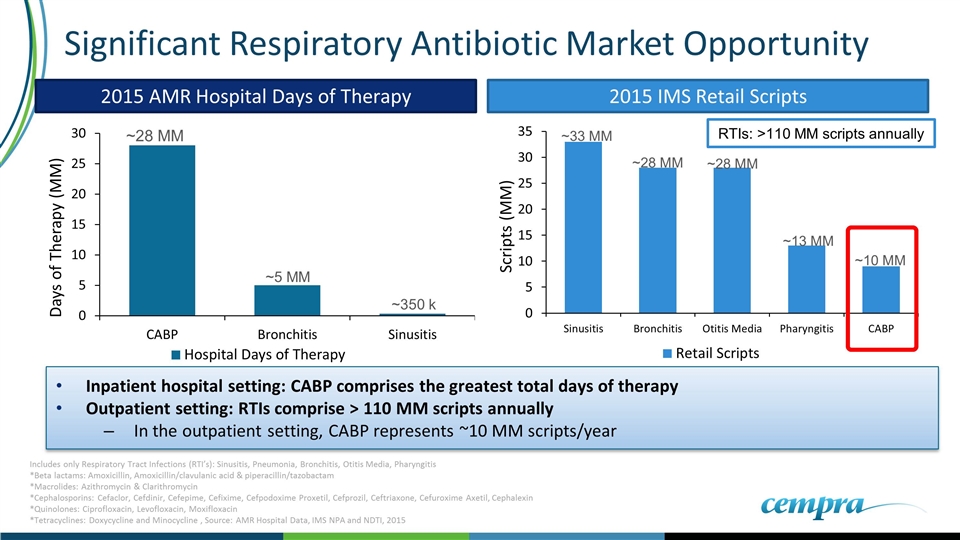

Significant Respiratory Antibiotic Market Opportunity ~28 MM ~5 MM ~350 k 2015 AMR Hospital Days of Therapy 2015 IMS Retail Scripts ~33 MM ~28 MM ~28 MM ~13 MM ~10 MM Inpatient hospital setting: CABP comprises the greatest total days of therapy Outpatient setting: RTIs comprise > 110 MM scripts annually In the outpatient setting, CABP represents ~10 MM scripts/year RTIs: >110 MM scripts annually Includes only Respiratory Tract Infections (RTI’s): Sinusitis, Pneumonia, Bronchitis, Otitis Media, Pharyngitis *Beta lactams: Amoxicillin, Amoxicillin/clavulanic acid & piperacillin/tazobactam *Macrolides: Azithromycin & Clarithromycin *Cephalosporins: Cefaclor, Cefdinir, Cefepime, Cefixime, Cefpodoxime Proxetil, Cefprozil, Ceftriaxone, Cefuroxime Axetil, Cephalexin *Quinolones: Ciprofloxacin, Levofloxacin, Moxifloxacin *Tetracyclines: Doxycycline and Minocycline , Source: AMR Hospital Data, IMS NPA and NDTI, 2015

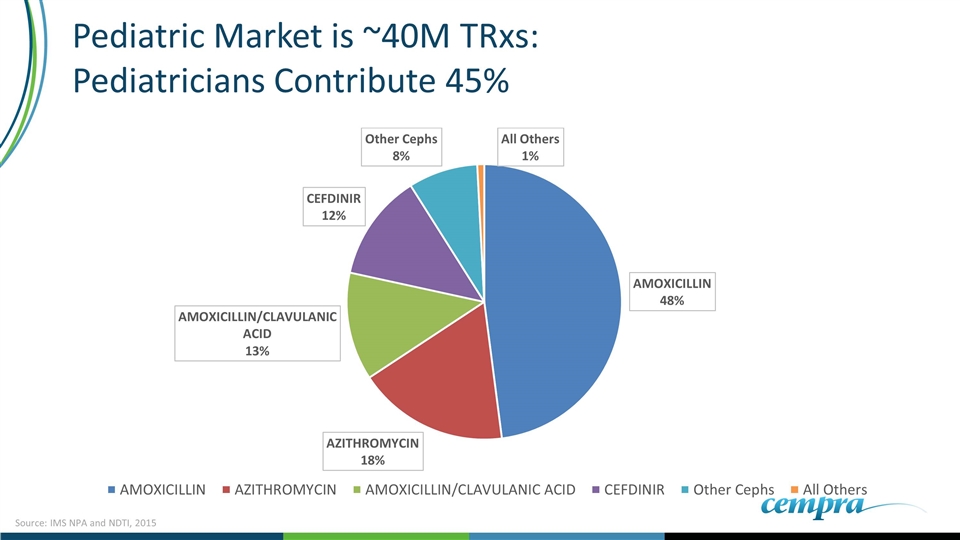

Pediatric Market is ~40M TRxs: Pediatricians Contribute 45% Source: IMS NPA and NDTI, 2015

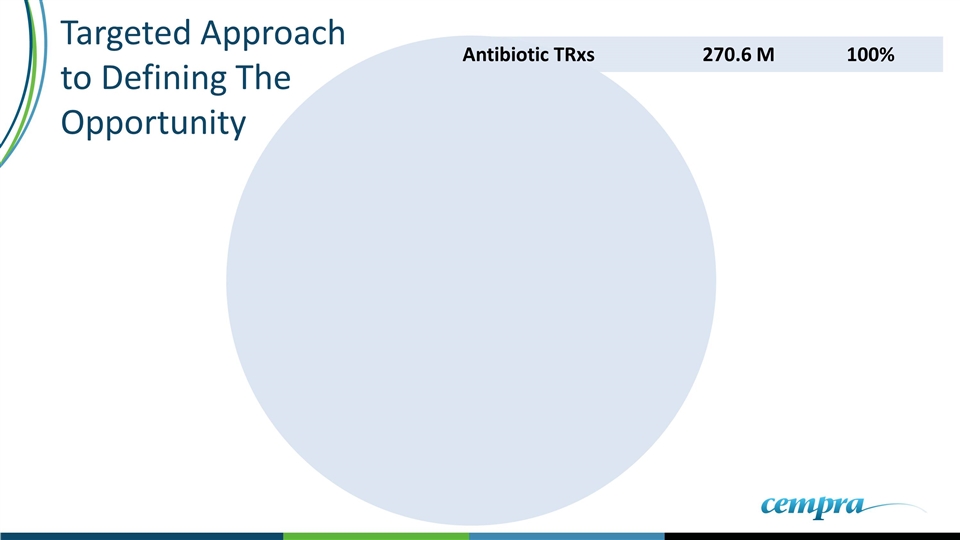

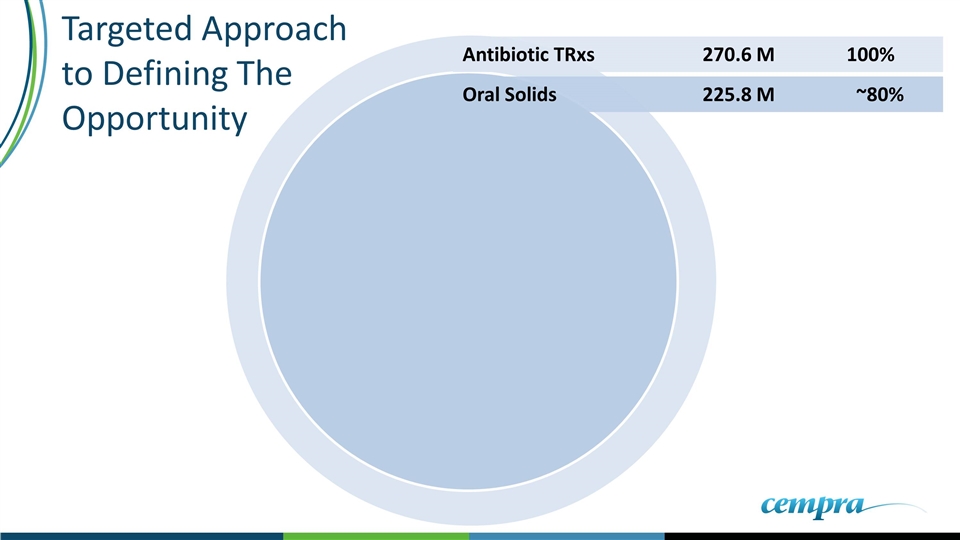

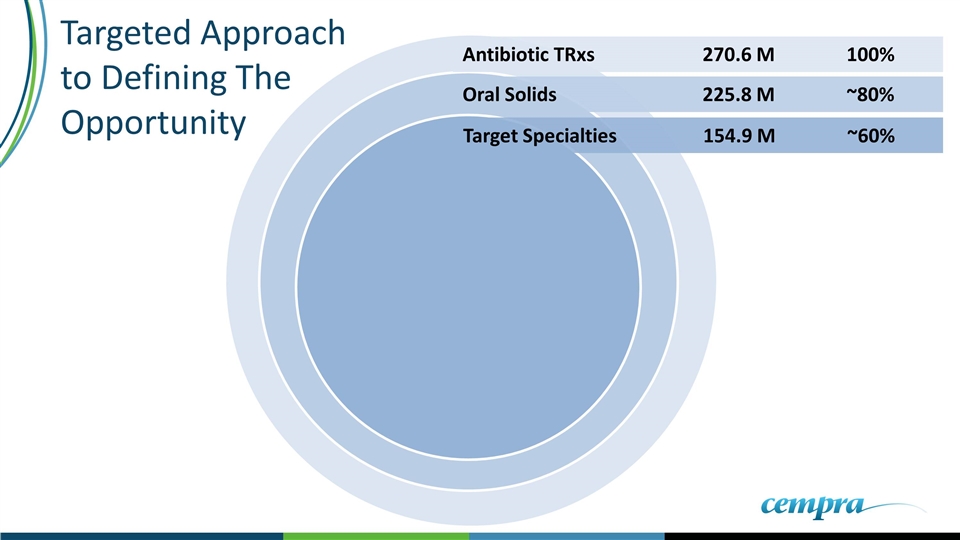

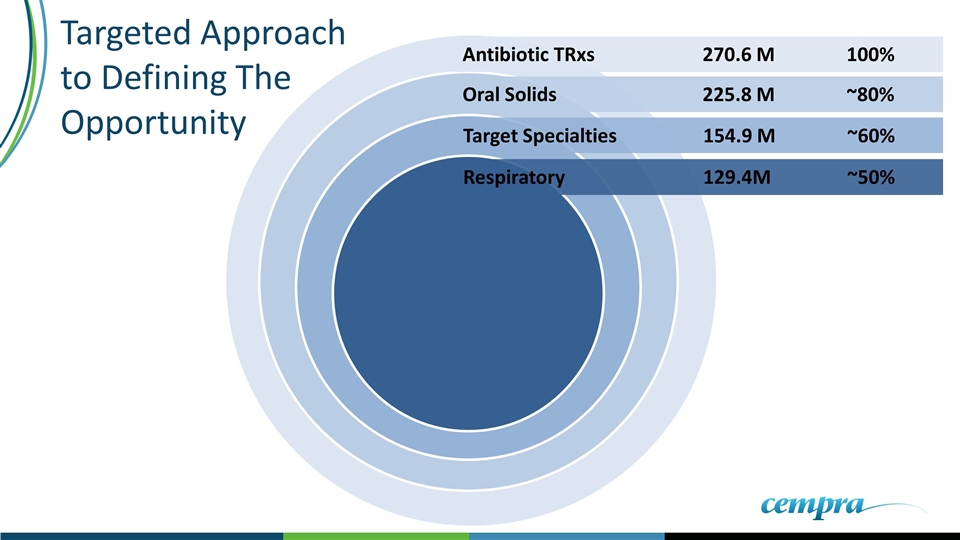

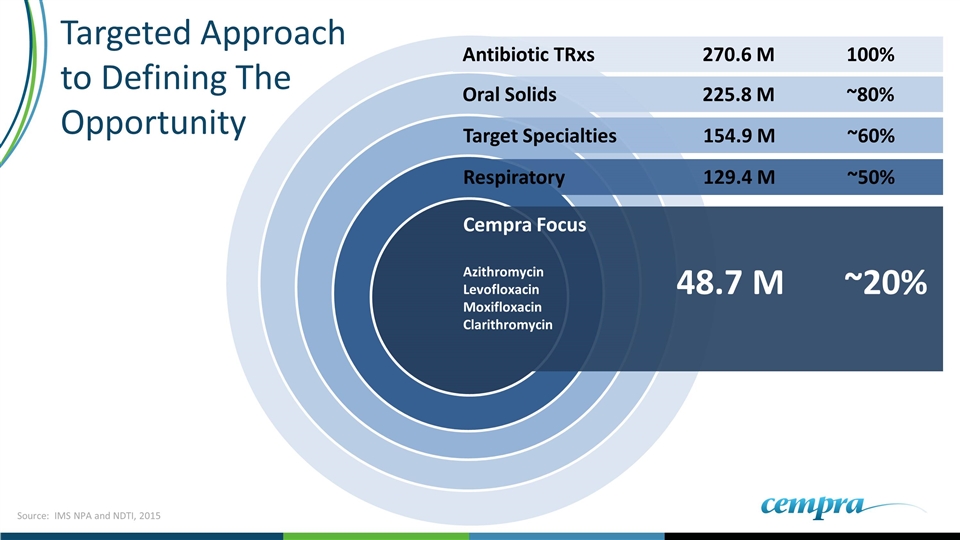

Targeted Approach to Defining The Opportunity Antibiotic TRxs270.6 M100%

Oral Solids 225.8 M ~80% Antibiotic TRxs270.6 M100% Targeted Approach to Defining The Opportunity

Oral Solids 225.8 M ~80% Antibiotic TRxs270.6 M100% Target Specialties154.9 M~60% Targeted Approach to Defining The Opportunity

Respiratory 129.4M ~50% Oral Solids 225.8 M ~80% Antibiotic TRxs270.6 M100% Target Specialties154.9 M~60% Targeted Approach to Defining The Opportunity

Respiratory 129.4 M ~50% Oral Solids 225.8 M ~80% Antibiotic TRxs270.6 M100% Target Specialties154.9 M~60% Cempra Focus Azithromycin Levofloxacin Moxifloxacin Clarithromycin 48.7 M ~20% Targeted Approach to Defining The Opportunity Source: IMS NPA and NDTI, 2015

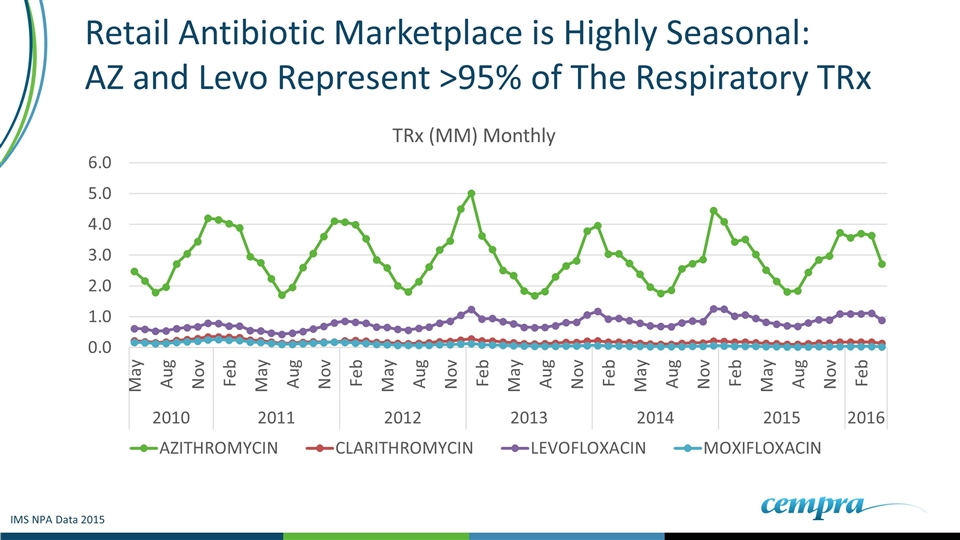

Retail Antibiotic Marketplace is Highly Seasonal: AZ and Levo Represent >95% of The Respiratory TRx IMS NPA Data 2015

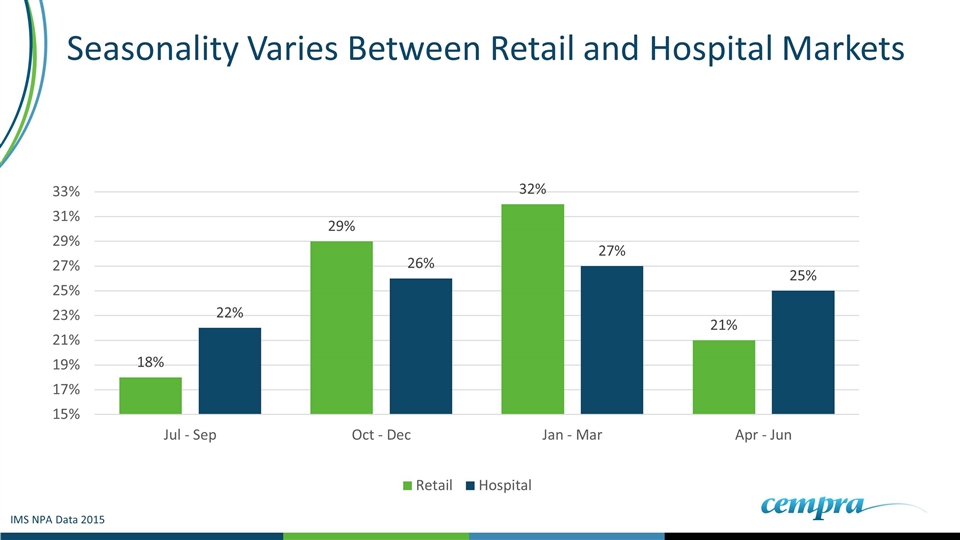

Seasonality Varies Between Retail and Hospital Markets IMS NPA Data 2015

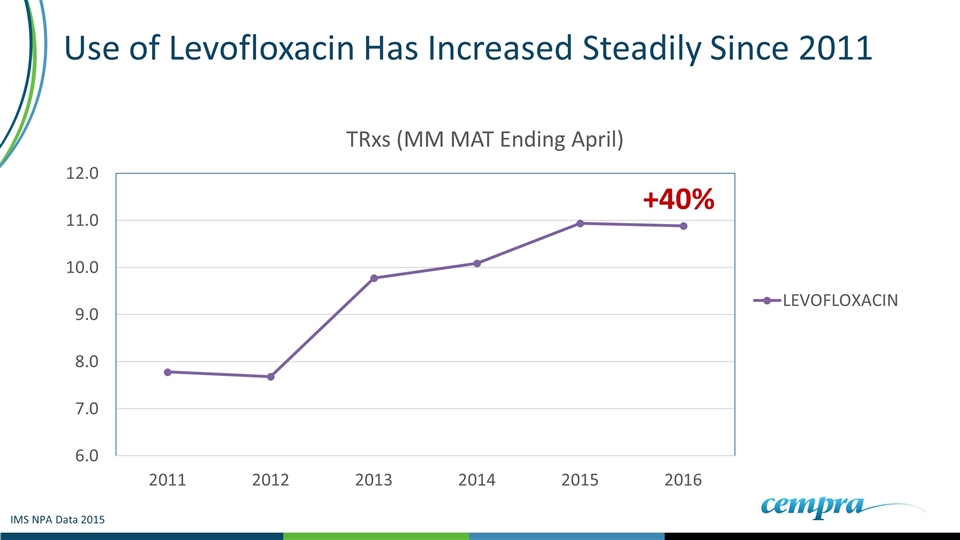

In The Last Five Years Levofloxacin TRxs Have Continued to Increase IMS NPA Data 2015

Use of Levofloxacin Has Increased Steadily Since 2011 IMS NPA Data 2015 +40%

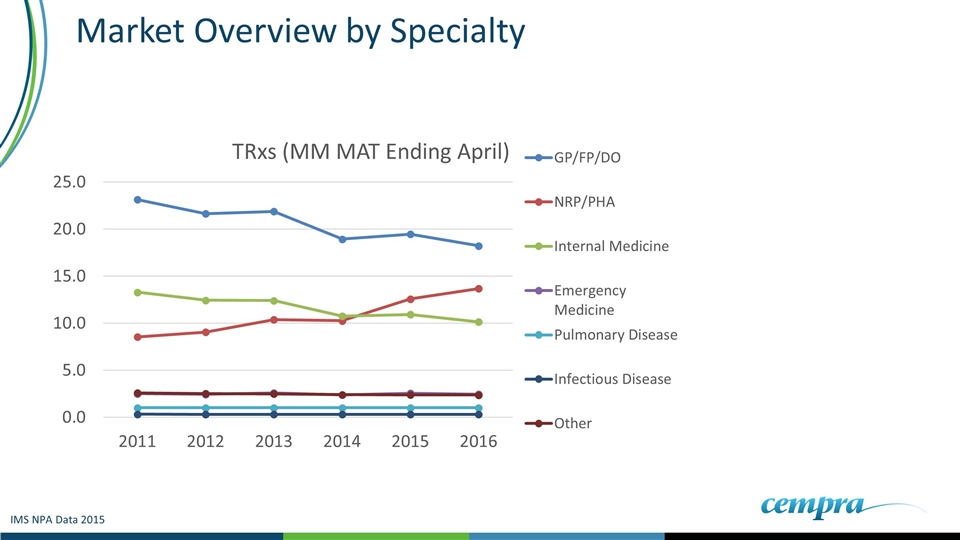

Market Overview by Specialty IMS NPA Data 2015

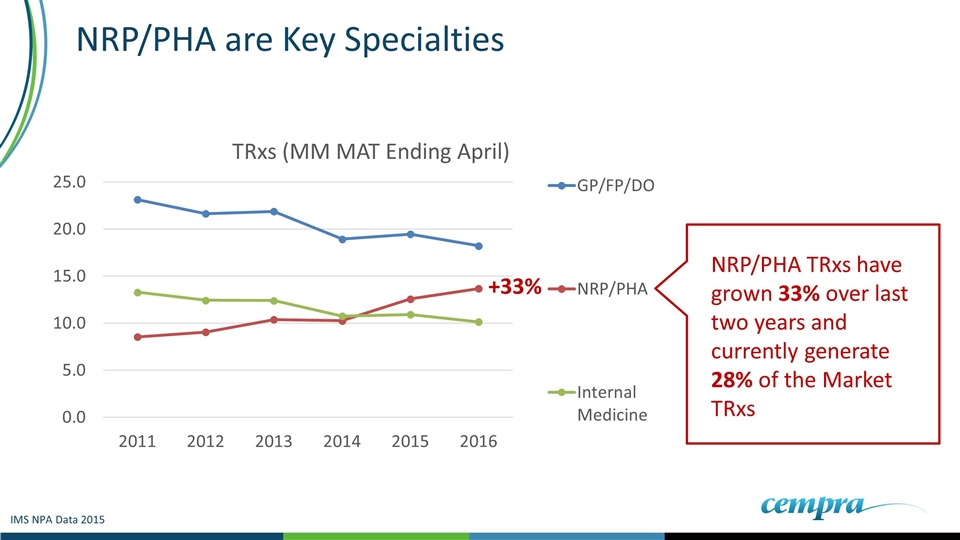

NRP/PHA are Key Specialties NRP/PHA TRxs have grown 33% over last two years and currently generate 28% of the Market TRxs +33% IMS NPA Data 2015

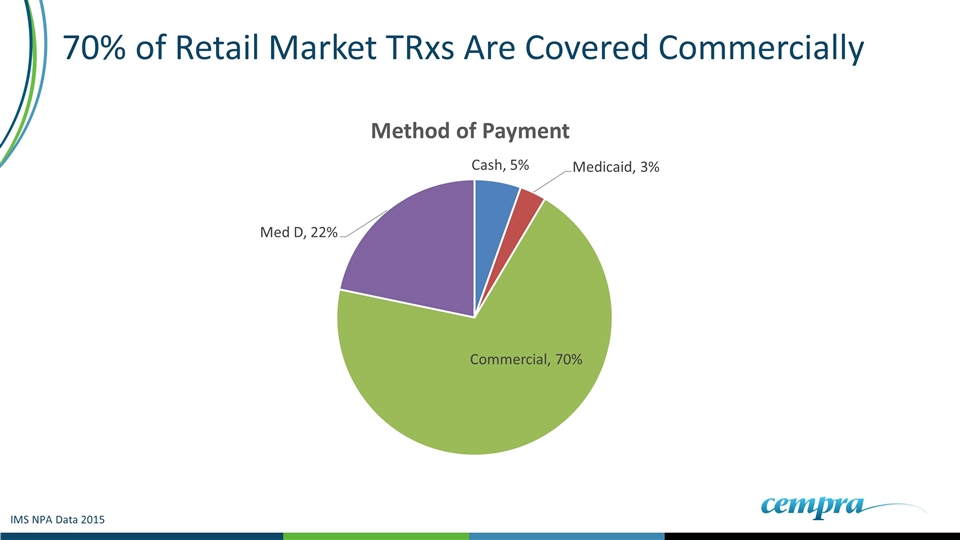

70% of Retail Market TRxs Are Covered Commercially IMS NPA Data 2015

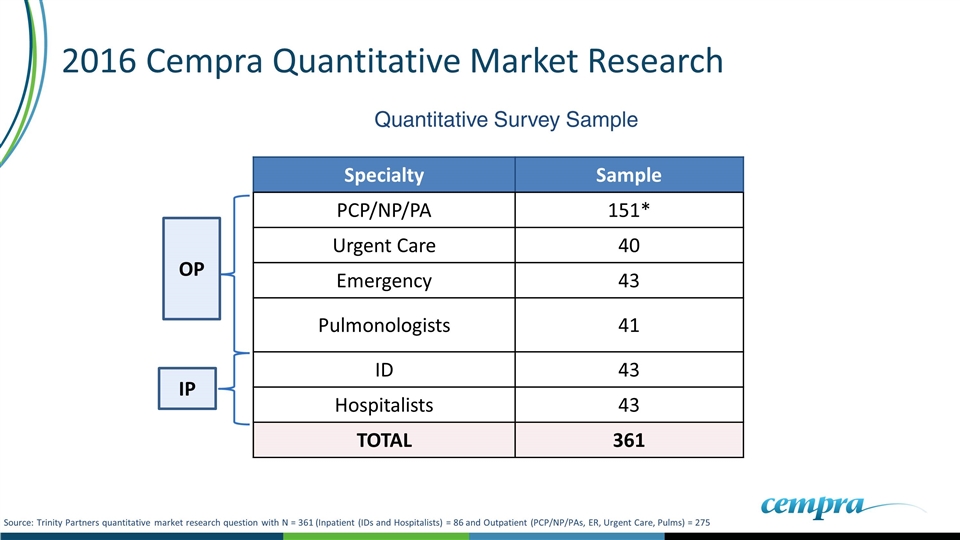

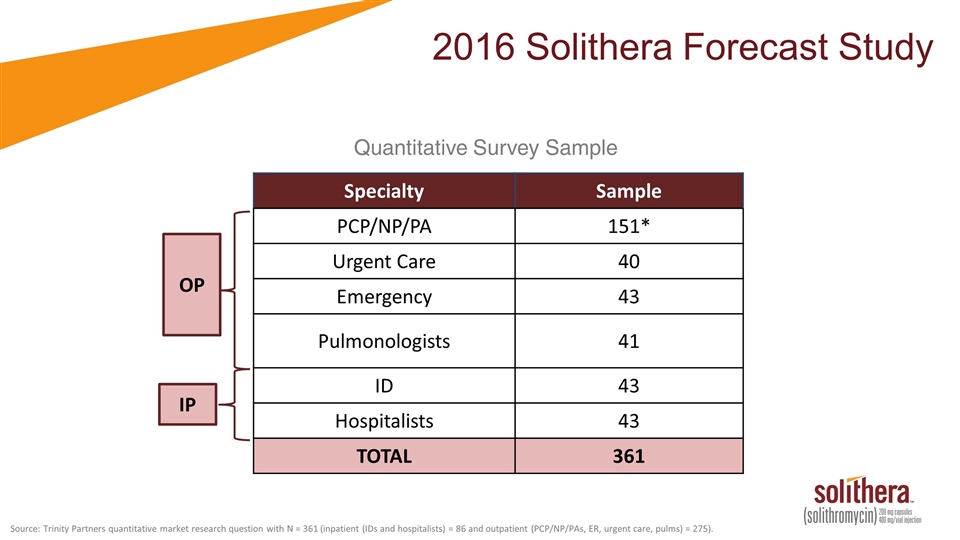

2016 Cempra Quantitative Market Research OP IP Specialty Sample PCP/NP/PA 151* Urgent Care 40 Emergency 43 Pulmonologists 41 ID 43 Hospitalists 43 TOTAL 361 Quantitative Survey Sample Source: Trinity Partners quantitative market research question with N = 361 (Inpatient (IDs and Hospitalists) = 86 and Outpatient (PCP/NP/PAs, ER, Urgent Care, Pulms) = 275

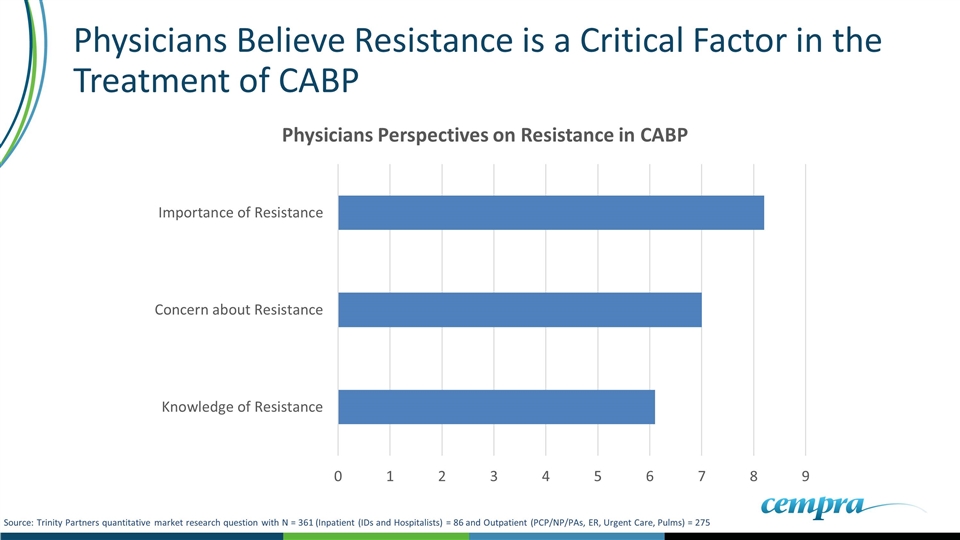

Physicians Believe Resistance is a Critical Factor in the Treatment of CABP Source: Trinity Partners quantitative market research question with N = 361 (Inpatient (IDs and Hospitalists) = 86 and Outpatient (PCP/NP/PAs, ER, Urgent Care, Pulms) = 275

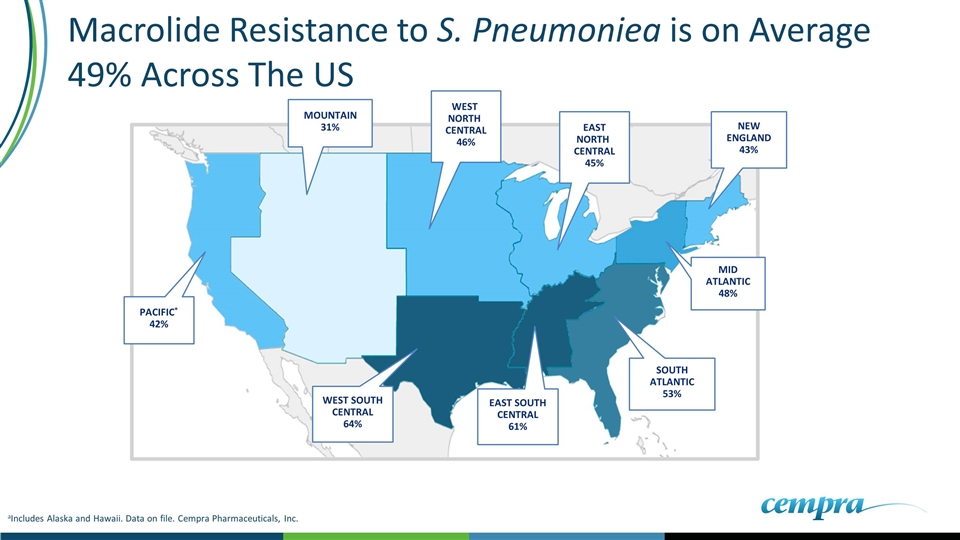

aIncludes Alaska and Hawaii. Data on file. Cempra Pharmaceuticals, Inc. NEW ENGLAND 43% SOUTH ATLANTIC 53% MID ATLANTIC 48% EAST SOUTH CENTRAL 61% PACIFIC* 42% MOUNTAIN 31% WEST NORTH CENTRAL 46% WEST SOUTH CENTRAL 64% EAST NORTH CENTRAL 45% Macrolide Resistance to S. Pneumoniea is on Average 49% Across The US

Physicians Severely Underestimate the Level of Macrolide Resistance That Exists in The United States Source: Trinity Partners quantitative market research question with N = 361 (Inpatient (IDs and Hospitalists) = 86 and Outpatient (PCP/NP/PAs, ER, Urgent Care, Pulms) = 275 64%

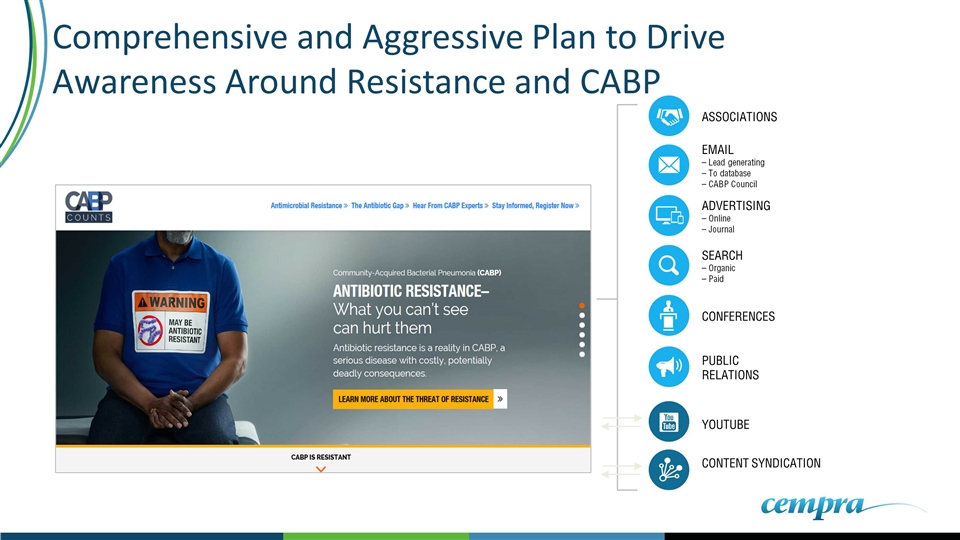

Comprehensive and Aggressive Plan to Drive Awareness Around Resistance and CABP EMAIL – Lead generating – To database – CABP Council YOUTUBE CONTENT SYNDICATION CONFERENCES ADVERTISING – Online – Journal PUBLIC RELATIONS SEARCH – Organic – Paid ASSOCIATIONS

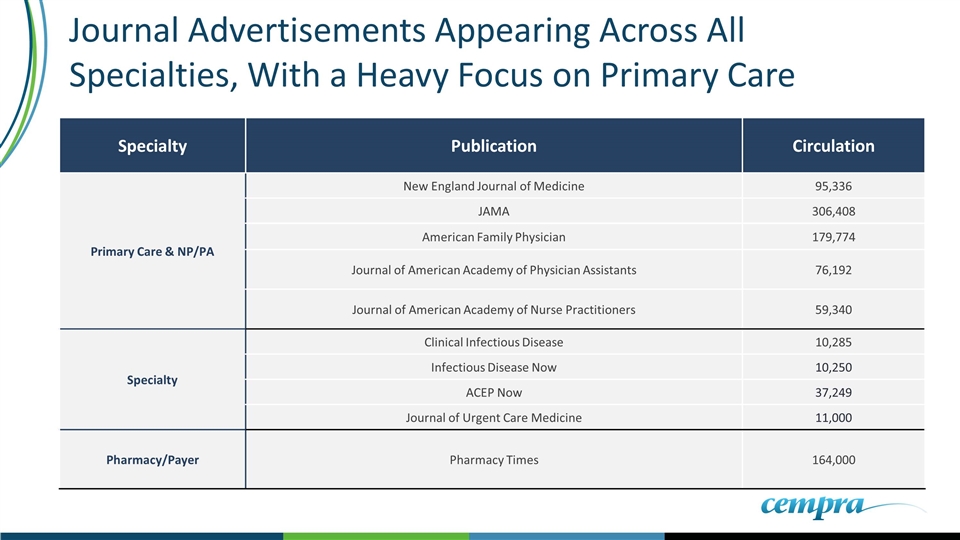

Journal Advertisements Appearing Across All Specialties, With a Heavy Focus on Primary Care Specialty Publication Circulation Primary Care & NP/PA New England Journal of Medicine 95,336 JAMA 306,408 American Family Physician 179,774 Journal of American Academy of Physician Assistants 76,192 Journal of American Academy of Nurse Practitioners 59,340 Specialty Clinical Infectious Disease 10,285 Infectious Disease Now 10,250 ACEP Now 37,249 Journal of Urgent Care Medicine 11,000 Pharmacy/Payer Pharmacy Times 164,000

CABPCounts.com Update Launched in May

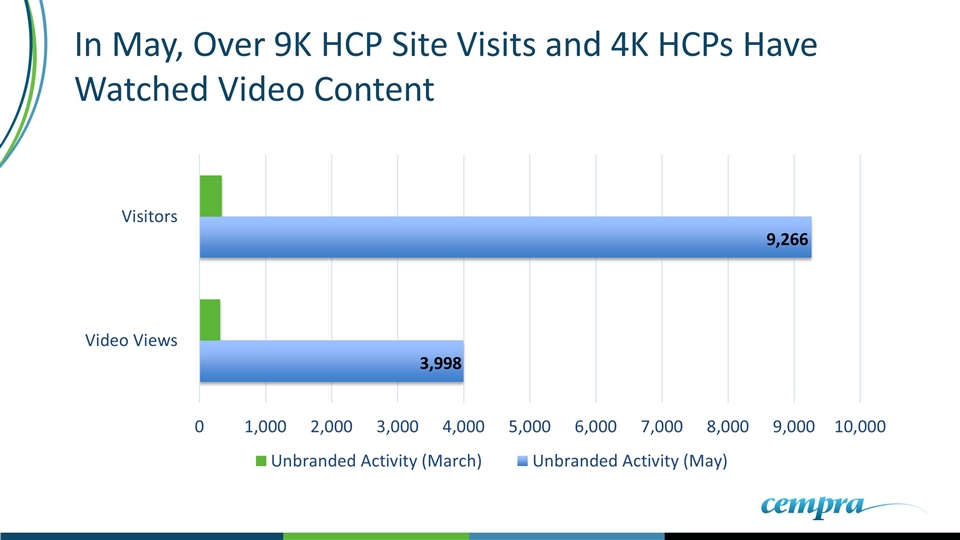

In May, Over 9K HCP Site Visits and 4K HCPs Have Watched Video Content

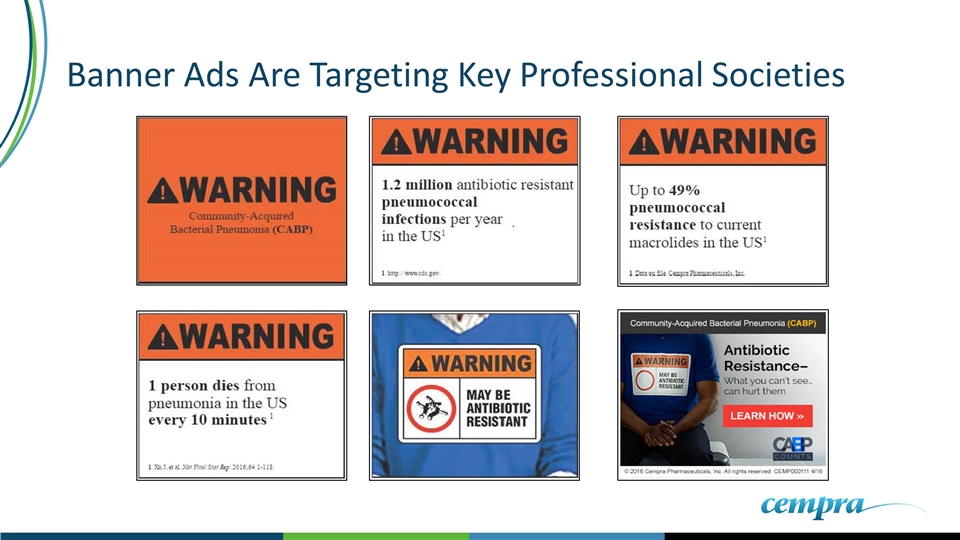

Banner Ads Are Targeting Key Professional Societies

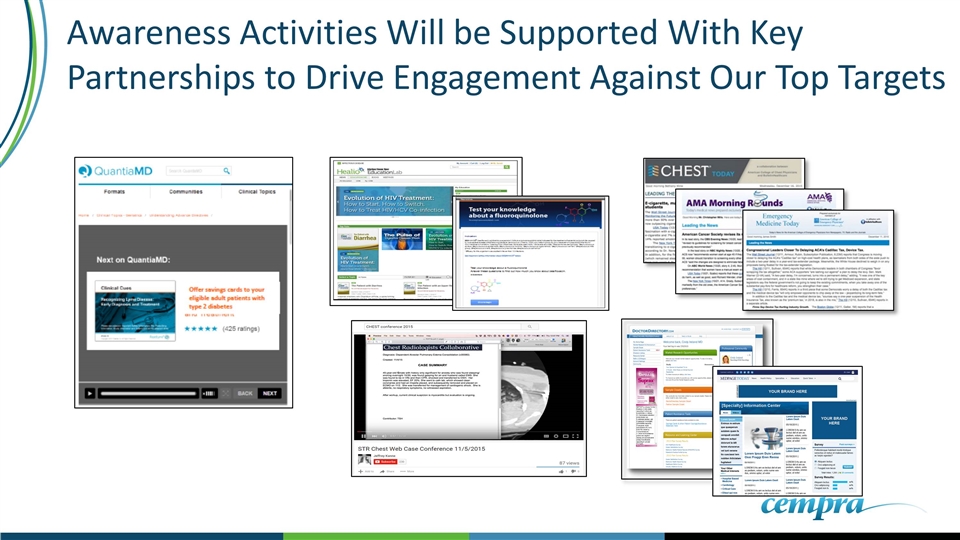

Awareness Activities Will be Supported With Key Partnerships to Drive Engagement Against Our Top Targets

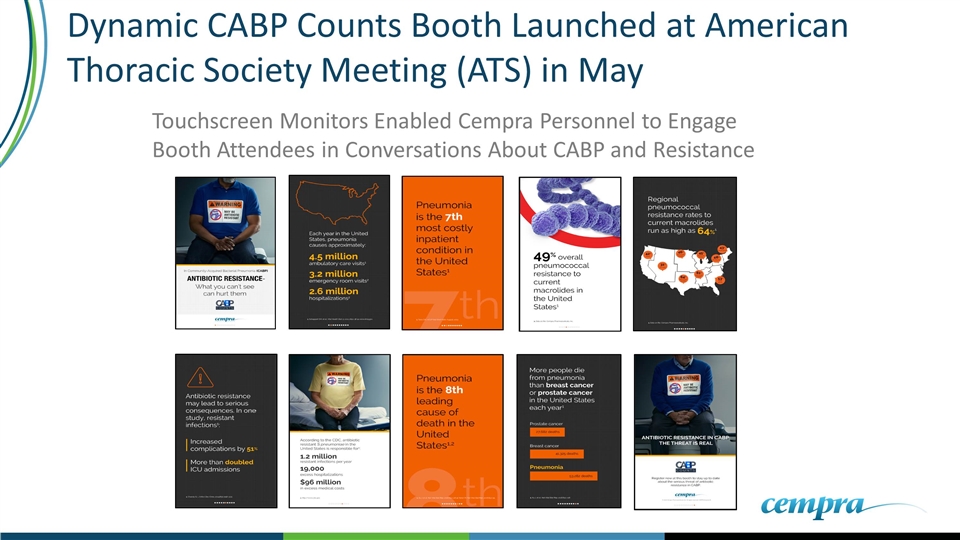

Dynamic CABP Counts Booth Launched at American Thoracic Society Meeting (ATS) in May CABP Counts Updated Booth

Dynamic CABP Counts Booth Launched at American Thoracic Society Meeting (ATS) in May Warning Label Monitor Highlights Issues With CABP and Resistance

Dynamic CABP Counts Booth Launched at American Thoracic Society Meeting (ATS) in May Touchscreen Monitors Enabled Cempra Personnel to Engage Booth Attendees in Conversations About CABP and Resistance

Aggressive Convention Plan to Engage Key Stakeholders

Market Development Update

Market Development Activities CABP Council Advisory Board Summary Speaker Bureau

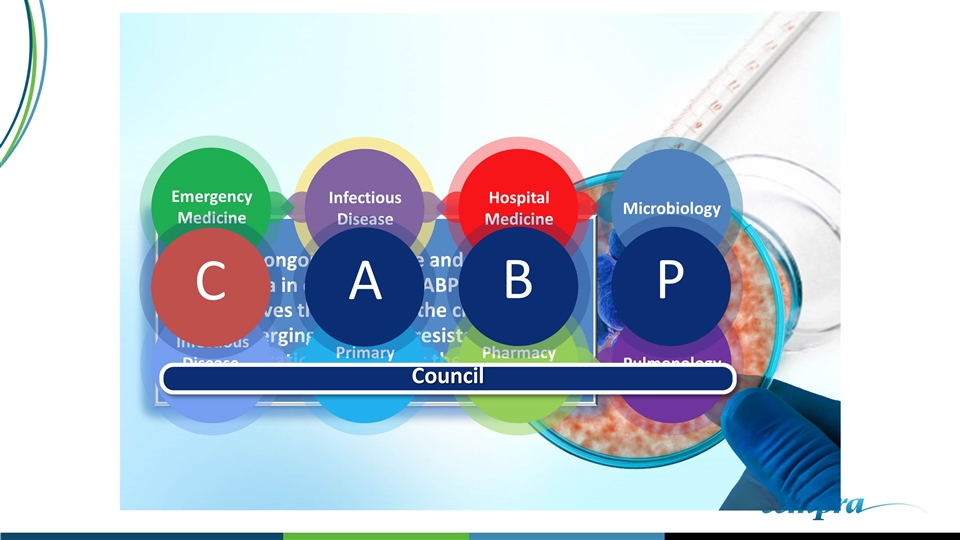

Infectious Disease Pulmonology Emergency Medicine Primary Care Hospital Medicine Infectious Disease, PharmD Pharmacy Directors Microbiology

Infectious Disease Emergency Medicine Hospital Medicine Pharmacy Directors Primary Care Infectious Disease, PharmD Pulmonology Microbiology

Provide ongoing guidance and assistance to Cempra in developing CABP educational initiatives that address the challenges of emerging antibiotic resistance and limitations of current therapies Pharmacy Directors Hospital Medicine Primary Care Infectious Disease, Pharm D Emergency Medicine Pulmonology Microbiology Infectious Disease C A B P Council

CABP Counts Website Editorial Board Branded KOL Video Vignettes Roundtable Discussions CABP Council e-communications Publication Planning Guidance Fall CABP Council Meeting CABP Council Upcoming Activities

Advisory Boards

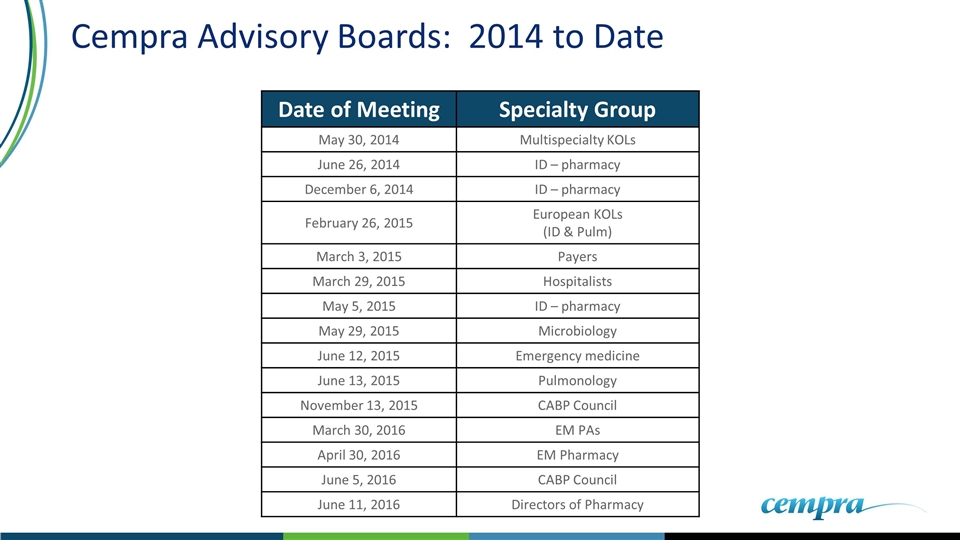

Cempra Advisory Boards: 2014 to Date Date of Meeting Specialty Group May 30, 2014 Multispecialty KOLs June 26, 2014 ID – pharmacy December 6, 2014 ID – pharmacy February 26, 2015 European KOLs (ID & Pulm) March 3, 2015 Payers March 29, 2015 Hospitalists May 5, 2015 ID – pharmacy May 29, 2015 Microbiology June 12, 2015 Emergency medicine June 13, 2015 Pulmonology November 13, 2015 CABP Council March 30, 2016 EM PAs April 30, 2016 EM Pharmacy June 5, 2016 CABP Council June 11, 2016 Directors of Pharmacy

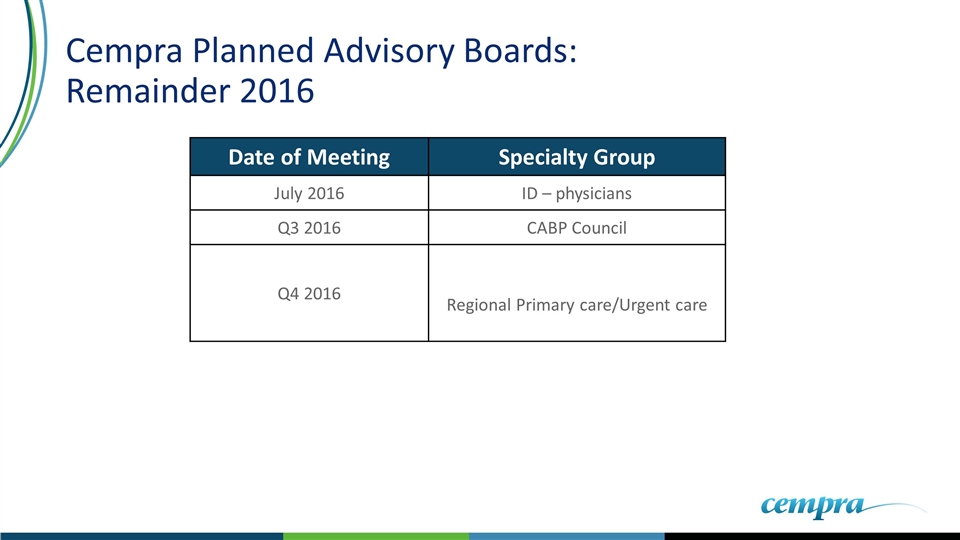

Cempra Planned Advisory Boards: Remainder 2016 Date of Meeting Specialty Group July 2016 ID – physicians Q3 2016 CABP Council Q4 2016 Regional Primary care/Urgent care

Cempra Speaker Bureau

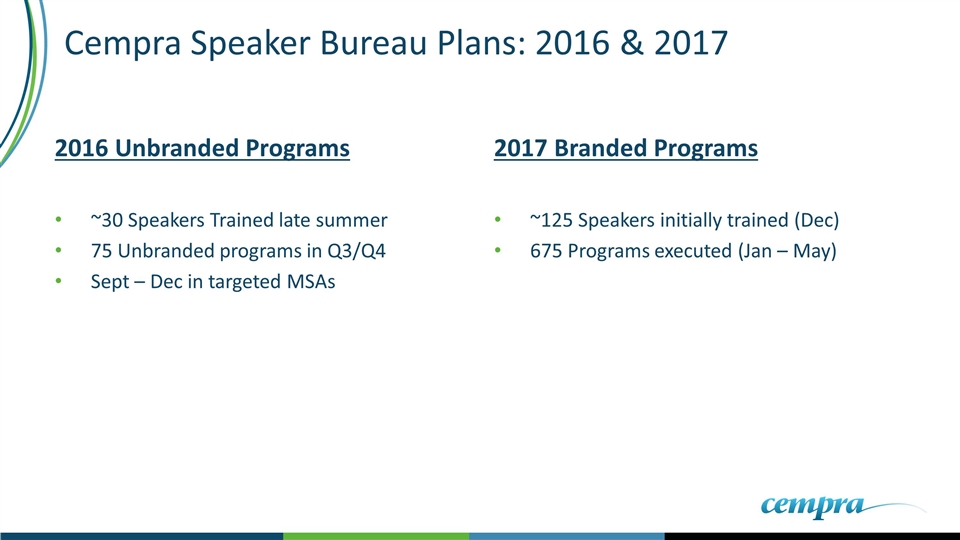

Cempra Speaker Bureau Plans: 2016 & 2017 2016 Unbranded Programs ~30 Speakers Trained late summer 75 Unbranded programs in Q3/Q4 Sept – Dec in targeted MSAs 2017 Branded Programs ~125 Speakers initially trained (Dec) 675 Programs executed (Jan – May)

Medical Affairs Update

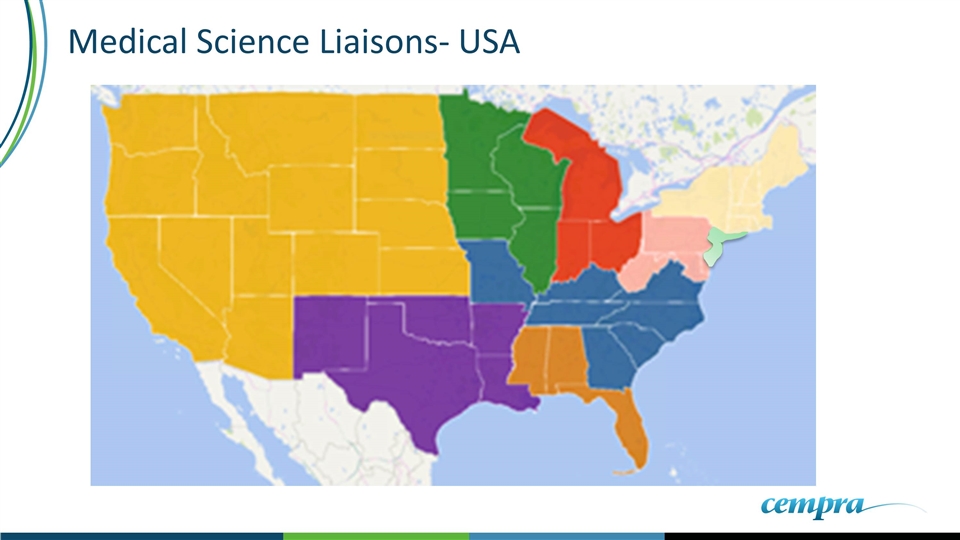

Medical Science Liaisons- USA

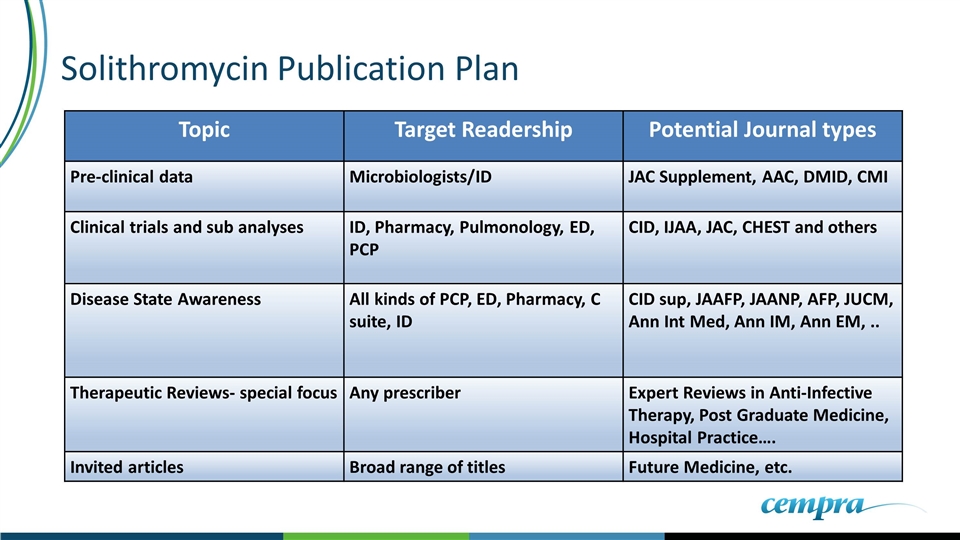

Solithromycin Publication Plan Topic Target Readership Potential Journal types Pre-clinical data Microbiologists/ID JAC Supplement, AAC, DMID, CMI Clinical trials and sub analyses ID, Pharmacy, Pulmonology, ED, PCP CID, IJAA, JAC, CHEST and others Disease State Awareness All kinds of PCP, ED, Pharmacy, C suite, ID CID sup, JAAFP, JAANP, AFP, JUCM, Ann Int Med, Ann IM, Ann EM, .. Therapeutic Reviews- special focus Any prescriber Expert Reviews in Anti-Infective Therapy, Post Graduate Medicine, Hospital Practice…. Invited articles Broad range of titles Future Medicine, etc.

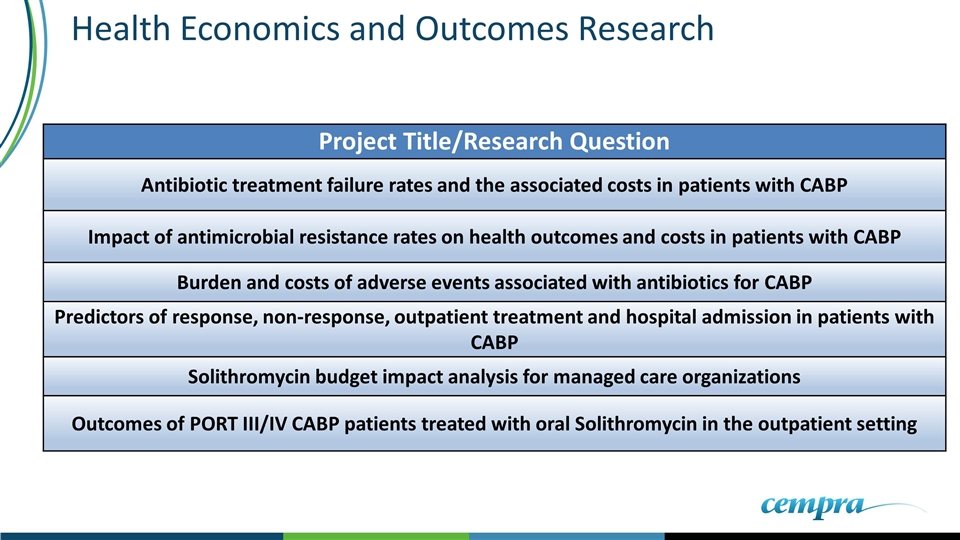

Health Economics and Outcomes Research Project Title/Research Question Antibiotic treatment failure rates and the associated costs in patients with CABP Impact of antimicrobial resistance rates on health outcomes and costs in patients with CABP Burden and costs of adverse events associated with antibiotics for CABP Predictors of response, non-response, outpatient treatment and hospital admission in patients with CABP Solithromycin budget impact analysis for managed care organizations Outcomes of PORT III/IV CABP patients treated with oral Solithromycin in the outpatient setting

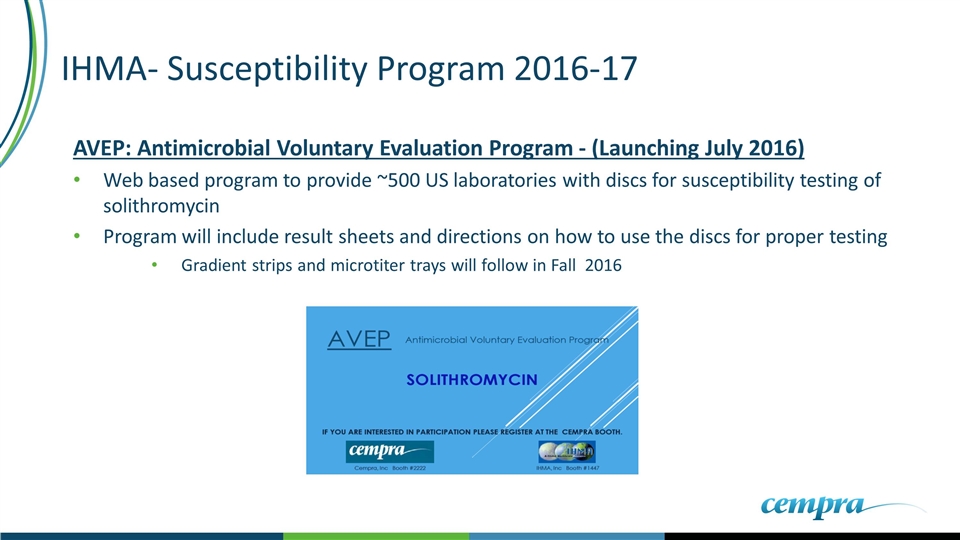

IHMA- Susceptibility Program 2016-17 AVEP: Antimicrobial Voluntary Evaluation Program - (Launching July 2016) Web based program to provide ~500 US laboratories with discs for susceptibility testing of solithromycin Program will include result sheets and directions on how to use the discs for proper testing Gradient strips and microtiter trays will follow in Fall 2016

Commercial Leadership Team

Leadership Team Experience Team has average of 27 years industry experience Entire team has “Carried the Bag” Has deep rooted antibiotic background Exceptional long term relationships Responsible for launching 19 drugs in Sr. leadership positions

Leadership Team Experience

Team’s Antibiotic & Respiratory Sales & Marketing Experience Responsible for marketing/sales of 27 antibiotics Levaquin, Augmentin, Keflex, Ceclor, Ceftin, Vancomycin, Cubicin, Merrem, Dificid, Sivextro, Zerbaxa, Cephalothin, Cefazolin, Tobramycin, Ceftazidime, Moxalactam, Floxin, Zinacef, Fortaz, Xifaxan, Alinia, Amoxil, Mezlocillin, Azlocilliin, Cipro, Doripenem, Solodyne Responsible for marketing/sales 5 respiratory products Ventolin, Becolvent, Flovent, Serevent, Advair

Solithera is the Conditionally Approved Trade Name

Solithera Launch SKUs

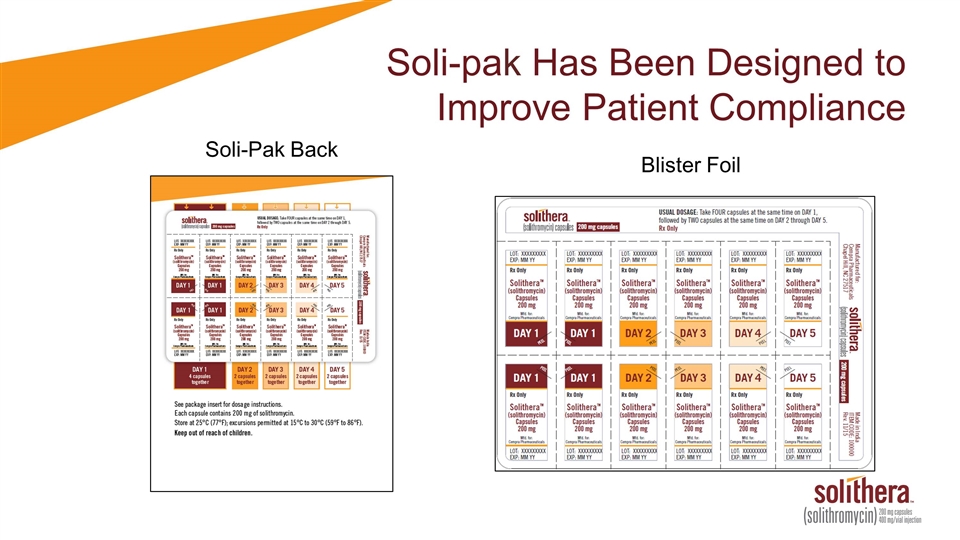

Soli-pak to be Available in Retail Pharmacies at Launch

Soli-pak Has Been Designed to Improve Patient Compliance Blister Foil Soli-Pak Back

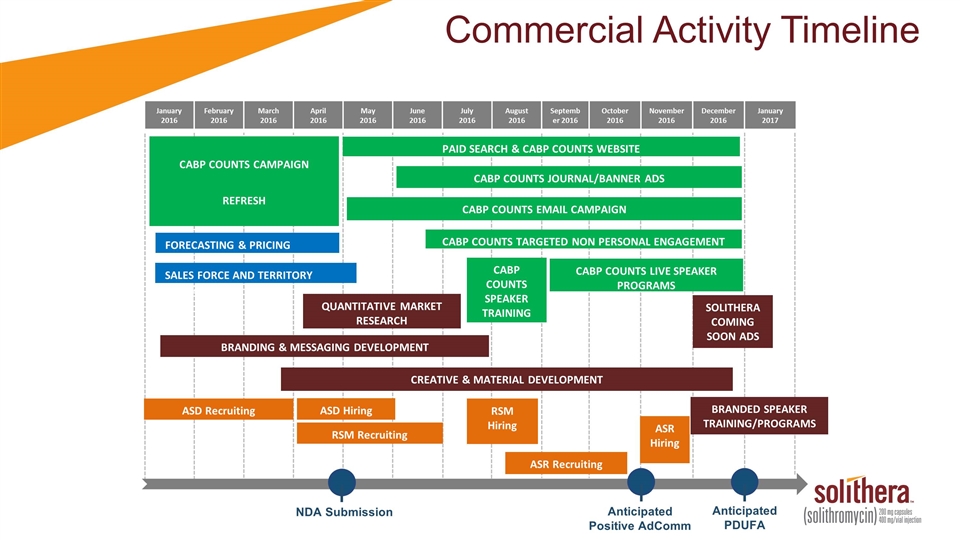

Commercial Activity Timeline January 2016 February 2016 March 2016 April 2016 May 2016 June 2016 July 2016 August 2016 September 2016 October 2016 November 2016 December 2016 January 2017 SOLITHERA COMING SOON ADS BRANDING & MESSAGING DEVELOPMENT CREATIVE & MATERIAL DEVELOPMENT Anticipated PDUFA FORECASTING & PRICING STUDIES SALES FORCE AND TERRITORY SIZING CABP COUNTS LIVE SPEAKER PROGRAMS NDA Submission CABP COUNTS SPEAKER TRAINING PAID SEARCH & CABP COUNTS WEBSITE CABP COUNTS JOURNAL/BANNER ADS CABP COUNTS EMAIL CAMPAIGN CABP COUNTS TARGETED NON PERSONAL ENGAGEMENT QUANTITATIVE MARKET RESEARCH CABP COUNTS CAMPAIGN REFRESH BRANDED SPEAKER TRAINING/PROGRAMS Anticipated Positive AdComm ASD Recruiting ASD Hiring RSM Recruiting RSM Hiring ASR Recruiting ASR Hiring

2016 Solithera Forecast Study OP IP Specialty Sample PCP/NP/PA 151* Urgent Care 40 Emergency 43 Pulmonologists 41 ID 43 Hospitalists 43 TOTAL 361 Quantitative Survey Sample Source: Trinity Partners quantitative market research question with N = 361 (inpatient (IDs and hospitalists) = 86 and outpatient (PCP/NP/PAs, ER, urgent care, pulms) = 275).

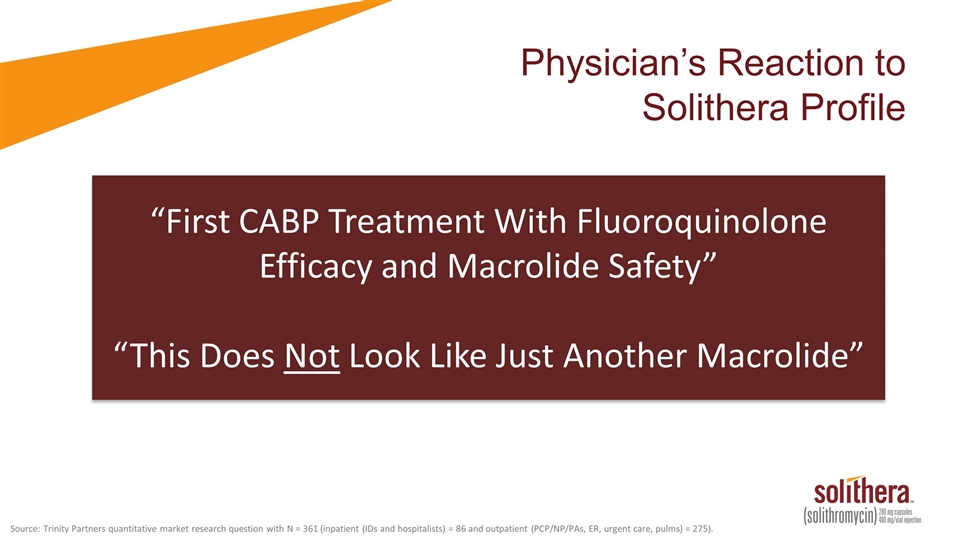

Physician’s Reaction to Solithera Profile “First CABP Treatment With Fluoroquinolone Efficacy and Macrolide Safety” “This Does Not Look Like Just Another Macrolide” Source: Trinity Partners quantitative market research question with N = 361 (inpatient (IDs and hospitalists) = 86 and outpatient (PCP/NP/PAs, ER, urgent care, pulms) = 275).

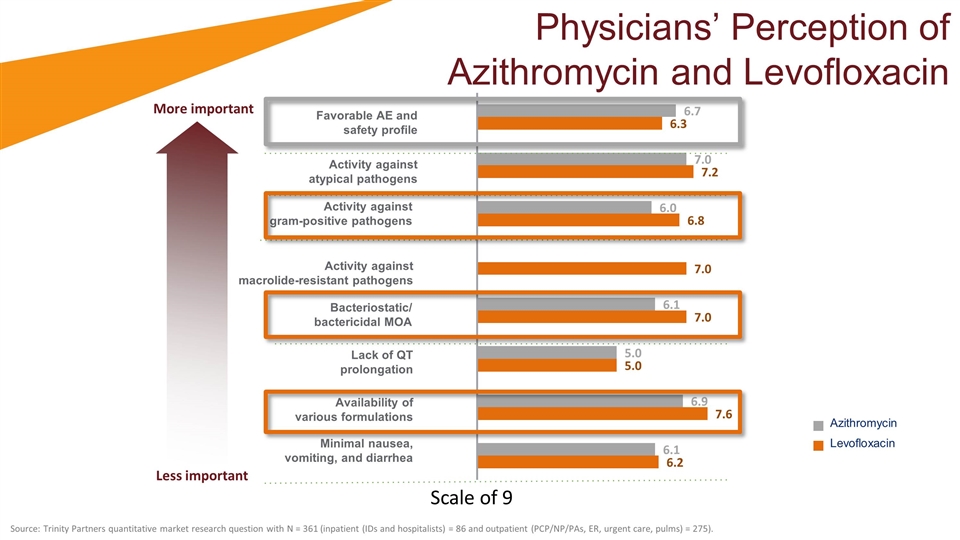

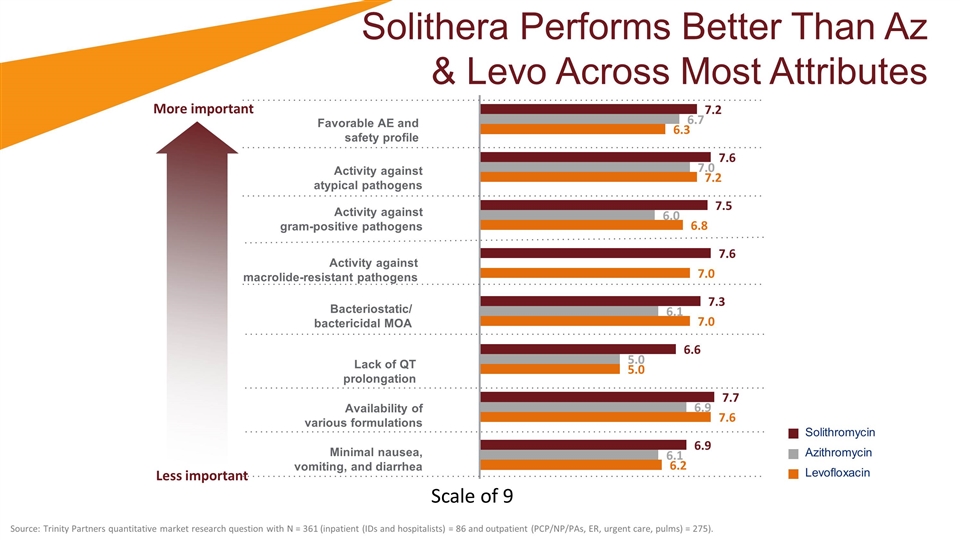

Physicians’ Perception of Azithromycin and Levofloxacin Azithromycin Levofloxacin Favorable AE and safety profile Activity against atypical pathogens Activity against gram-positive pathogens Activity against macrolide-resistant pathogens Bacteriostatic/ bactericidal MOA Lack of QT prolongation Availability of various formulations Minimal nausea, vomiting, and diarrhea Source: Trinity Partners quantitative market research question with N = 361 (inpatient (IDs and hospitalists) = 86 and outpatient (PCP/NP/PAs, ER, urgent care, pulms) = 275). Less important More important Scale of 9

Solithera Performs Better Than Az & Levo Across Most Attributes Solithromycin Azithromycin Levofloxacin Favorable AE and safety profile Activity against atypical pathogens Activity against gram-positive pathogens Activity against macrolide-resistant pathogens Bacteriostatic/ bactericidal MOA Lack of QT prolongation Availability of various formulations Minimal nausea, vomiting, and diarrhea Less important More important Source: Trinity Partners quantitative market research question with N = 361 (inpatient (IDs and hospitalists) = 86 and outpatient (PCP/NP/PAs, ER, urgent care, pulms) = 275). Scale of 9

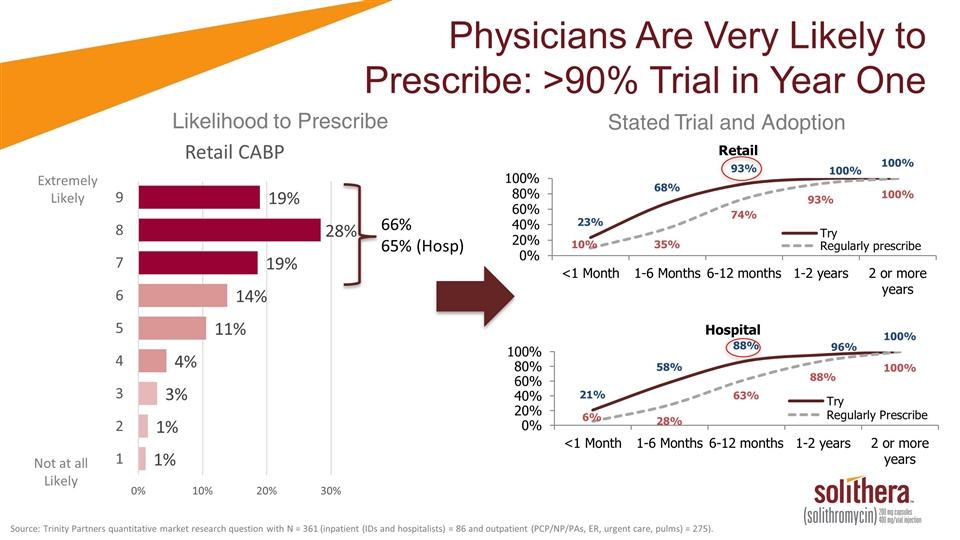

Extremely Likely Not at all Likely Stated Trial and Adoption Likelihood to Prescribe Physicians Are Very Likely to Prescribe: >90% Trial in Year One 66% 65% (Hosp) Source: Trinity Partners quantitative market research question with N = 361 (inpatient (IDs and hospitalists) = 86 and outpatient (PCP/NP/PAs, ER, urgent care, pulms) = 275).

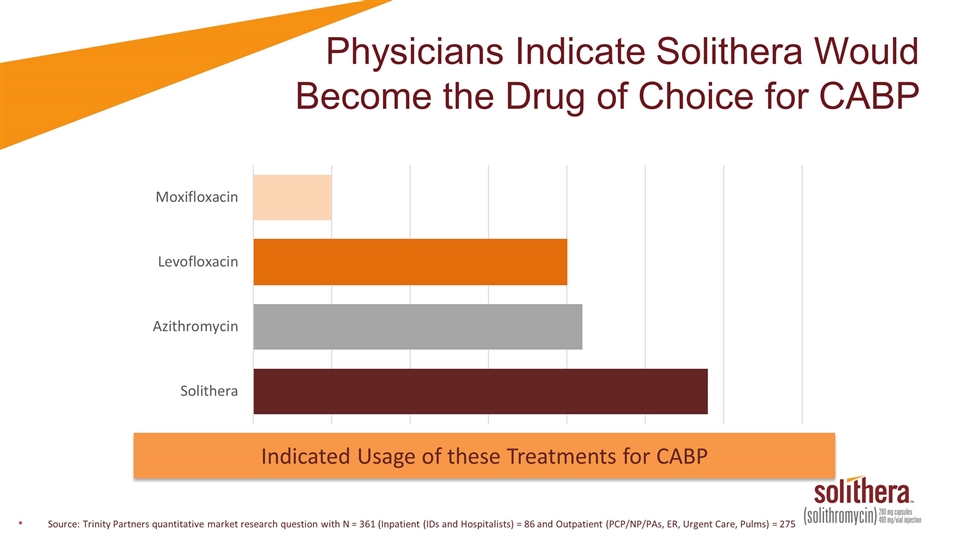

Physicians Indicate Solithera Would Become the Drug of Choice for CABP Source: Trinity Partners quantitative market research question with N = 361 (Inpatient (IDs and Hospitalists) = 86 and Outpatient (PCP/NP/PAs, ER, Urgent Care, Pulms) = 275 Indicated Usage of these Treatments for CABP

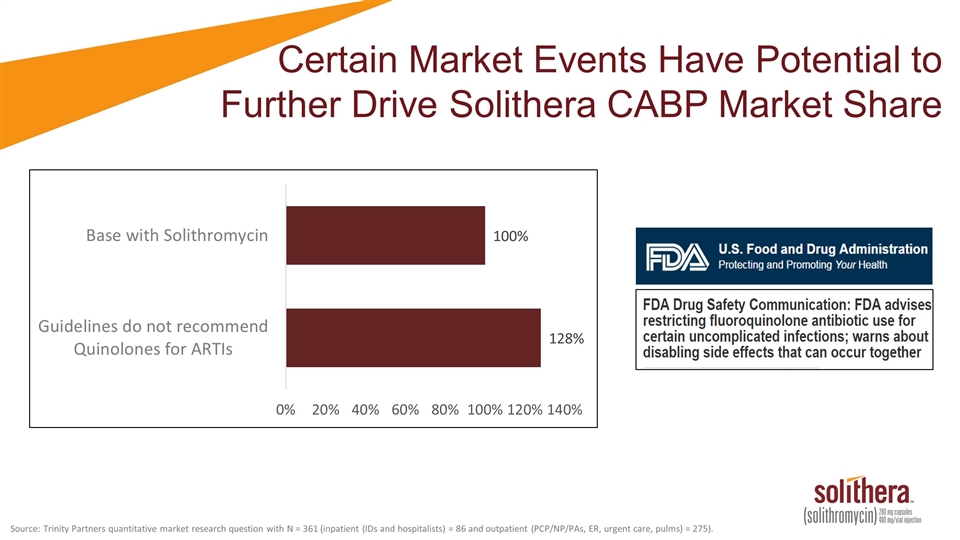

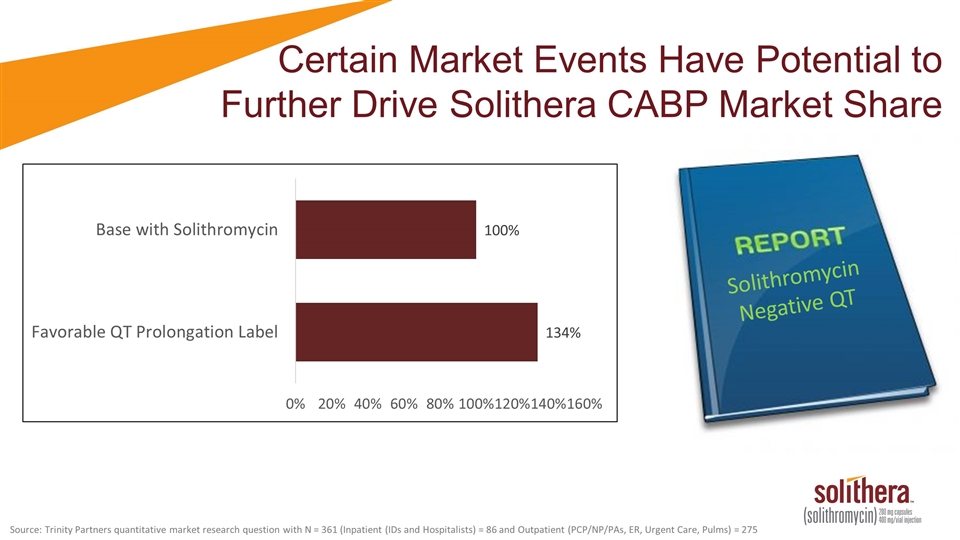

Certain Market Events Have Potential to Further Drive Solithera CABP Market Share Source: Trinity Partners quantitative market research question with N = 361 (inpatient (IDs and hospitalists) = 86 and outpatient (PCP/NP/PAs, ER, urgent care, pulms) = 275).

Certain Market Events Have Potential to Further Drive Solithera CABP Market Share Source: Trinity Partners quantitative market research question with N = 361 (inpatient (IDs and hospitalists) = 86 and outpatient (PCP/NP/PAs, ER, urgent care, pulms) = 275).

Source: Trinity Partners quantitative market research question with N = 361 (Inpatient (IDs and Hospitalists) = 86 and Outpatient (PCP/NP/PAs, ER, Urgent Care, Pulms) = 275 Solithromycin Negative QT Certain Market Events Have Potential to Further Drive Solithera CABP Market Share

Quotes from Market Research “Activity at 3 sites should fend off resistance” “The ability to use IV and discharge with an effective agent is attractive” “A macrolide with quinolone efficacy would be a useful product” “It looks like a product I am already familiar with” Source: Trinity Partners quantitative market research question with N = 361 (inpatient (IDs and hospitalists) = 86 and outpatient (PCP/NP/PAs, ER, urgent care, pulms) = 275).

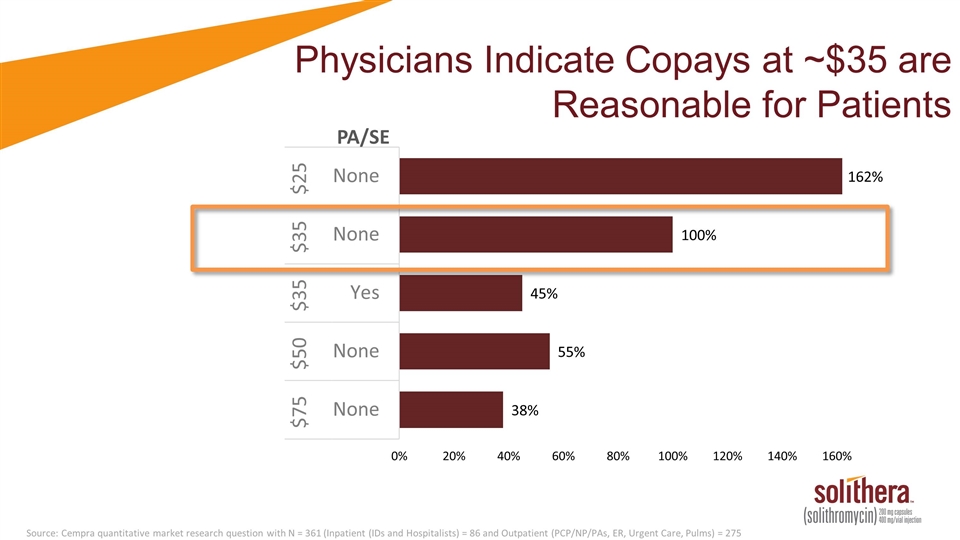

Physicians Indicate Copays at ~$35 are Reasonable for Patients Source: Cempra quantitative market research question with N = 361 (Inpatient (IDs and Hospitalists) = 86 and Outpatient (PCP/NP/PAs, ER, Urgent Care, Pulms) = 275 PA/SE

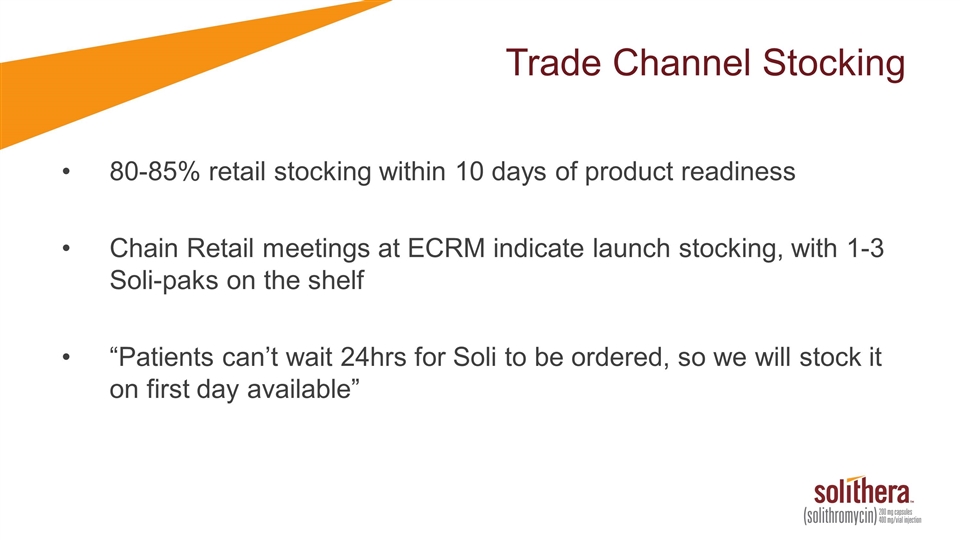

Trade and Managed Care Channel

Trade Channel Stocking 80-85% retail stocking within 10 days of product readiness Chain Retail meetings at ECRM indicate launch stocking, with 1-3 Soli-paks on the shelf “Patients can’t wait 24hrs for Soli to be ordered, so we will stock it on first day available”

Payer Research Summary Hospital 104 Pharmacy Directors and ID/PharmDs on P&T Committee Academic and Community hospitals of various sizes 3 Advisory Boards MCO/PBM 25 Pharmacy and Medical Directors on P&T Committee National & Regional Plans Covering ~85% of Covered Lives Advisory Board and one-on-one meetings

Feedback from MCOs/PBMs and Hospitals Soli fills a void in their current Preferred Drug List of approved antibiotics CABP is a “difficult to block” indication Acute, Hospital v. Outpatient, CABP Indication, Empiric Payers plan to let prescribers determine appropriate therapy for CABP Alarmed by increasing pneumococcal resistance in the last few years Feedback on our launch approach has been constructive Open to Tier 2 contracting (MCO) Placement on hospital formulary for CABP is achievable

Sales Force Targeting

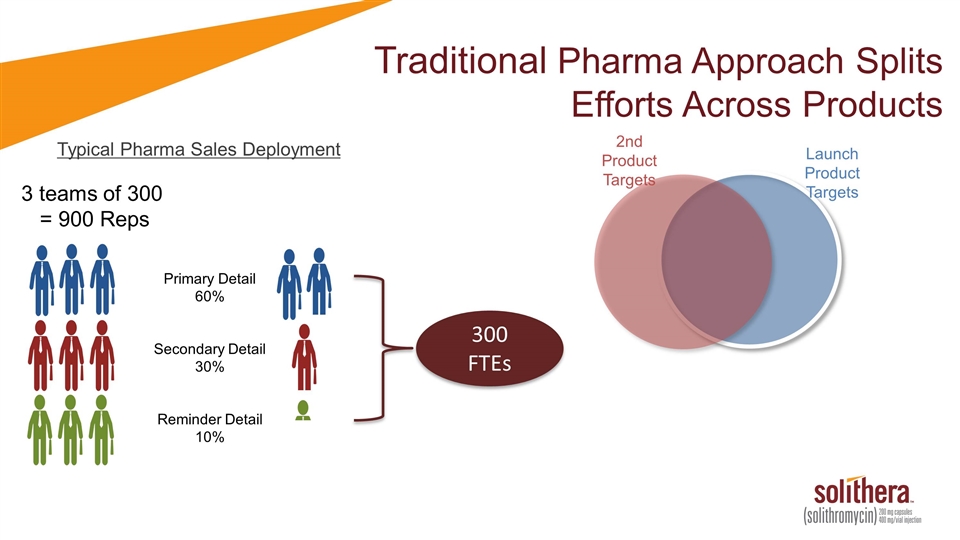

Traditional Pharma Approach Splits Efforts Across Products Typical Pharma Sales Deployment 3 teams of 300 = 900 Reps

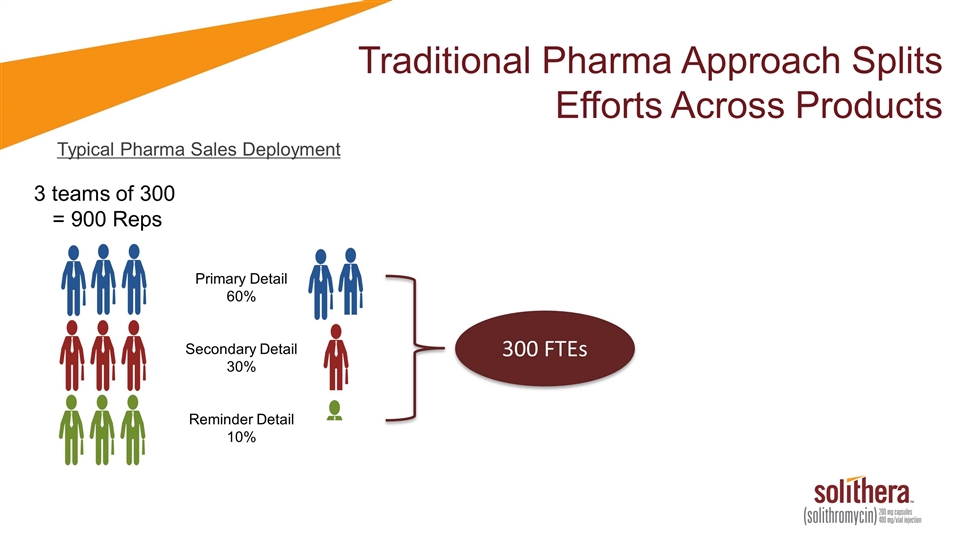

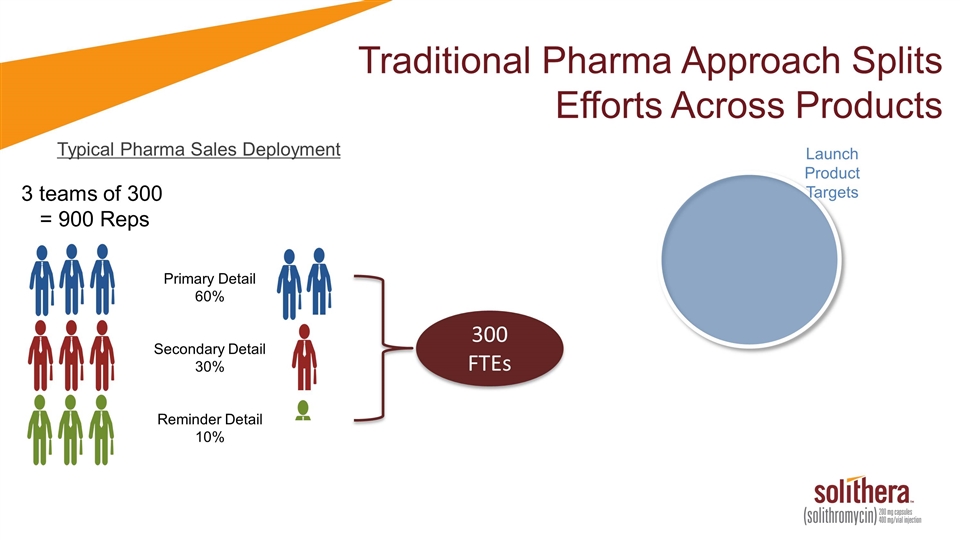

Traditional Pharma Approach Splits Efforts Across Products Typical Pharma Sales Deployment 3 teams of 300 = 900 Reps Primary Detail 60% Secondary Detail 30% Reminder Detail 10% 300 FTEs

Traditional Pharma Approach Splits Efforts Across Products Typical Pharma Sales Deployment 3 teams of 300 = 900 Reps Primary Detail 60% Secondary Detail 30% Reminder Detail 10% 300 FTEs Launch Product Targets

Traditional Pharma Approach Splits Efforts Across Products Typical Pharma Sales Deployment 3 teams of 300 = 900 Reps Primary Detail 60% Secondary Detail 30% Reminder Detail 10% 300 FTEs Launch Product Targets 2nd Product Targets

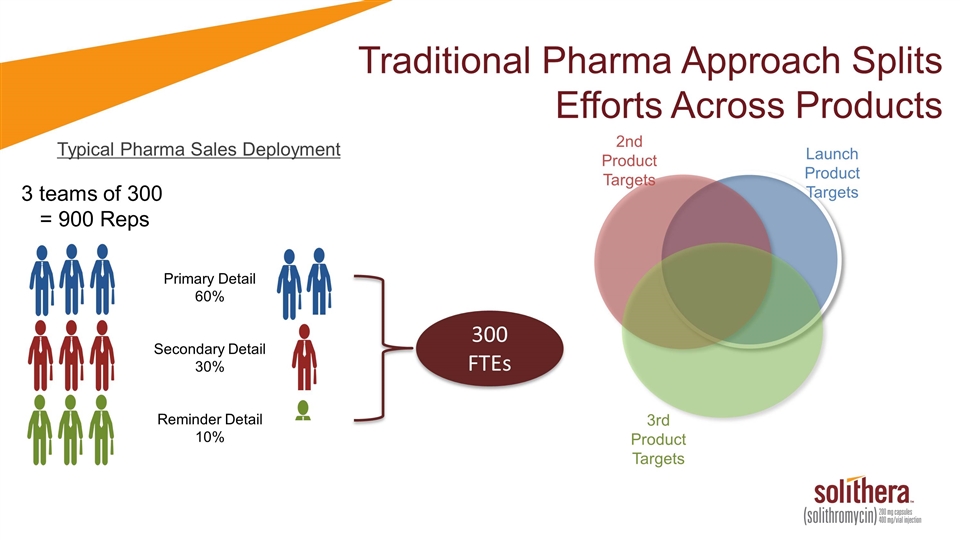

Traditional Pharma Approach Splits Efforts Across Products Typical Pharma Sales Deployment 3 teams of 300 = 900 Reps Primary Detail 60% Secondary Detail 30% Reminder Detail 10% 300 FTEs Launch Product Targets 2nd Product Targets 3rd Product Targets

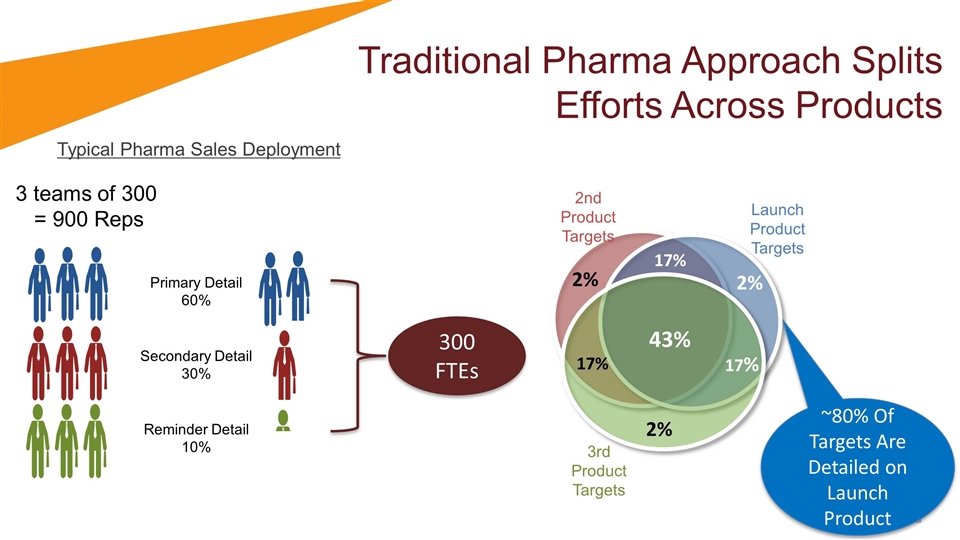

Traditional Pharma Approach Splits Efforts Across Products Typical Pharma Sales Deployment 3 teams of 300 = 900 Reps Primary Detail 60% Secondary Detail 30% Reminder Detail 10% 300 FTEs Launch Product Targets 43% 17% 17% 17% 2% 2% 2% 3rd Product Targets 2nd Product Targets ~80% Of Targets Are Detailed on Launch Product

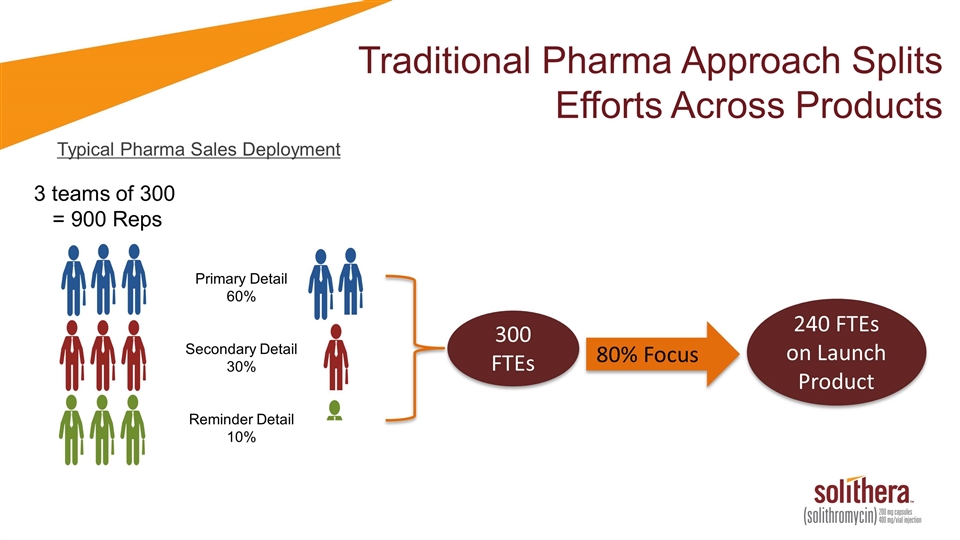

Traditional Pharma Approach Splits Efforts Across Products Typical Pharma Sales Deployment 3 teams of 300 = 900 Reps Primary Detail 60% Secondary Detail 30% Reminder Detail 10% 300 FTEs 240 FTEs on Launch Product 80% Focus

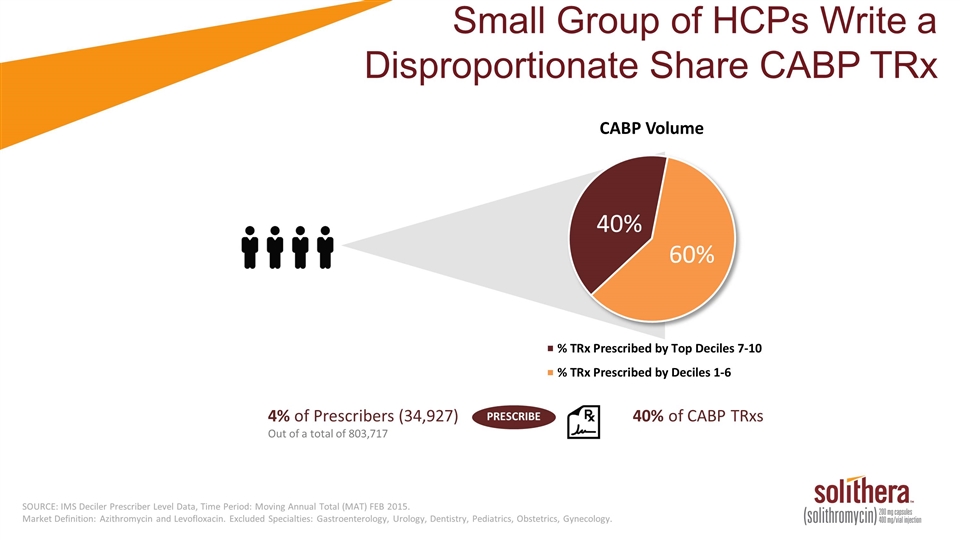

4% of Prescribers (34,927) Out of a total of 803,717 40% of CABP TRxs PRESCRIBE SOURCE: IMS Deciler Prescriber Level Data, Time Period: Moving Annual Total (MAT) FEB 2015. Market Definition: Azithromycin and Levofloxacin. Excluded Specialties: Gastroenterology, Urology, Dentistry, Pediatrics, Obstetrics, Gynecology. Small Group of HCPs Write a Disproportionate Share CABP TRx

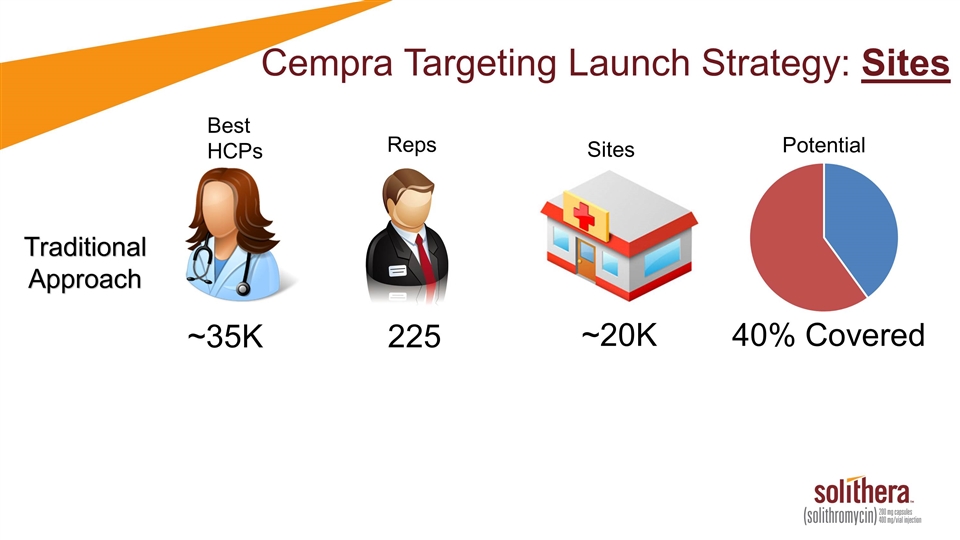

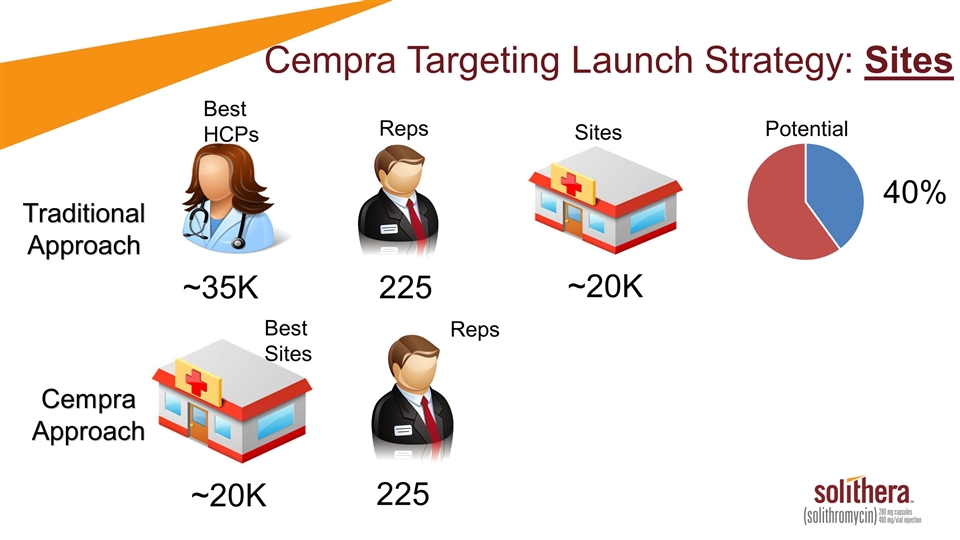

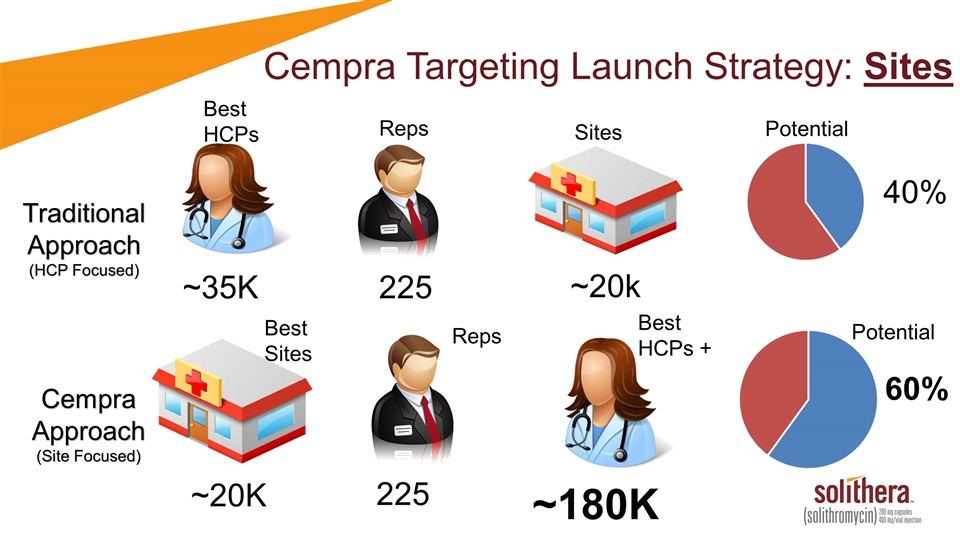

Traditional Approach ~35K 225 ~20K 40% Covered Best HCPs Reps Potential Sites Cempra Targeting Launch Strategy: Sites

Best HCPs Reps Potential Traditional Approach ~35K 225 ~20K 40% Sites Cempra Approach ~20K 225 Cempra Targeting Launch Strategy: Sites Best Sites Reps

Best HCPs Reps Potential Traditional Approach (HCP Focused) ~35K 225 ~20k 40% Sites Cempra Approach (Site Focused) ~20K 225 ~180K 60% Cempra Targeting Launch Strategy: Sites Reps Best HCPs + Potential Best Sites

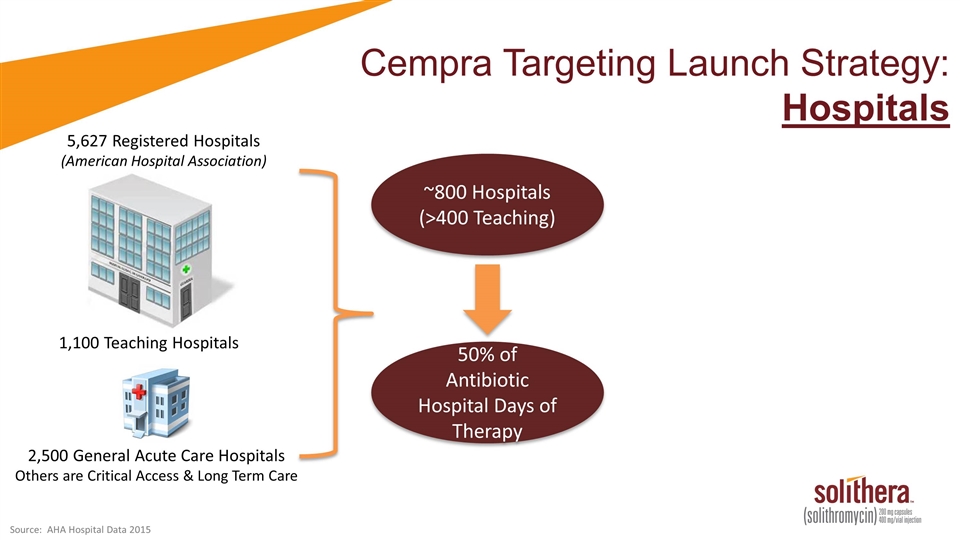

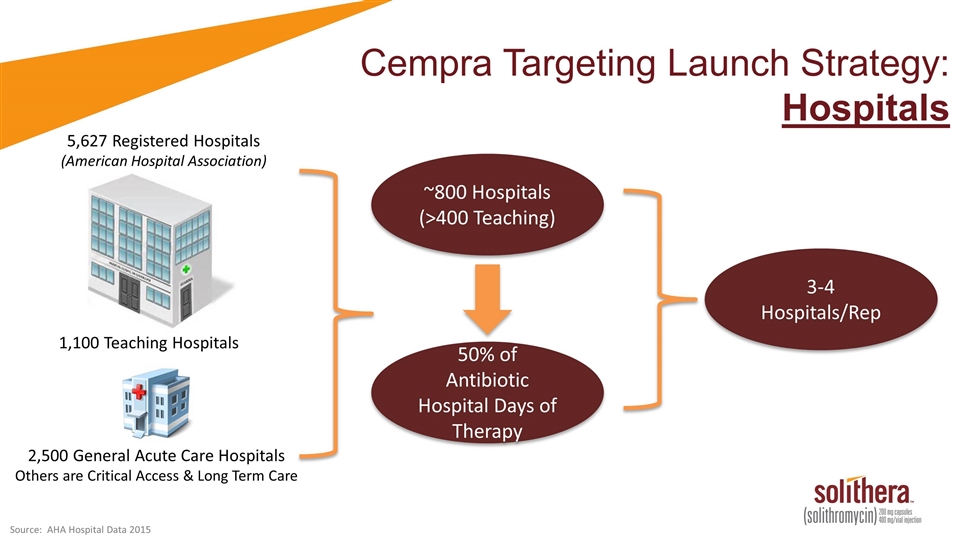

Cempra Targeting Launch Strategy: Hospitals 5,627 Registered Hospitals (American Hospital Association) 1,100 Teaching Hospitals 2,500 General Acute Care Hospitals Others are Critical Access & Long Term Care Source: AHA Hospital Data 2015

Cempra Targeting Launch Strategy: Hospitals 5,627 Registered Hospitals (American Hospital Association) 1,100 Teaching Hospitals 2,500 General Acute Care Hospitals Others are Critical Access & Long Term Care ~800 Hospitals (>400 Teaching) 50% of Antibiotic Hospital Days of Therapy Source: AHA Hospital Data 2015

Cempra Targeting Launch Strategy: Hospitals 5,627 Registered Hospitals (American Hospital Association) 1,100 Teaching Hospitals 2,500 General Acute Care Hospitals Others are Critical Access & Long Term Care ~800 Hospitals (>400 Teaching) 50% of Antibiotic Hospital Days of Therapy 3-4 Hospitals/Rep Source: AHA Hospital Data 2015

Sales Force Alignments

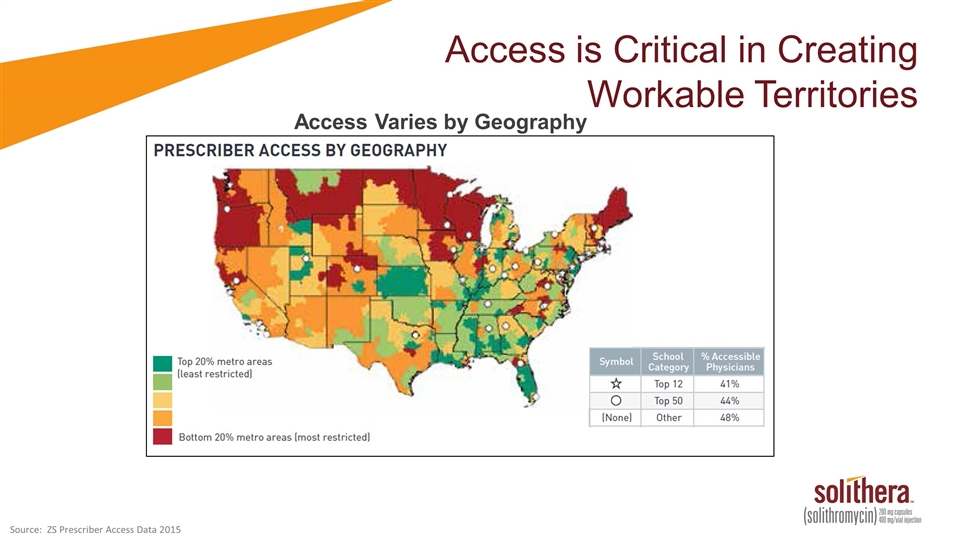

Access is Critical in Creating Workable Territories Access Varies by Geography Source: ZS Prescriber Access Data 2015

Access is Critical in Creating Workable Territories Cempra will align our capacity to geographies with better access

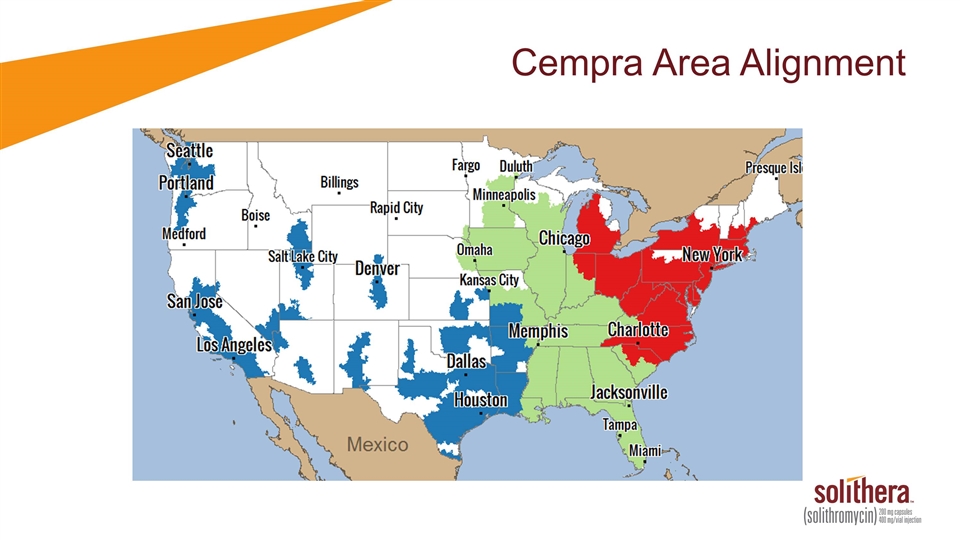

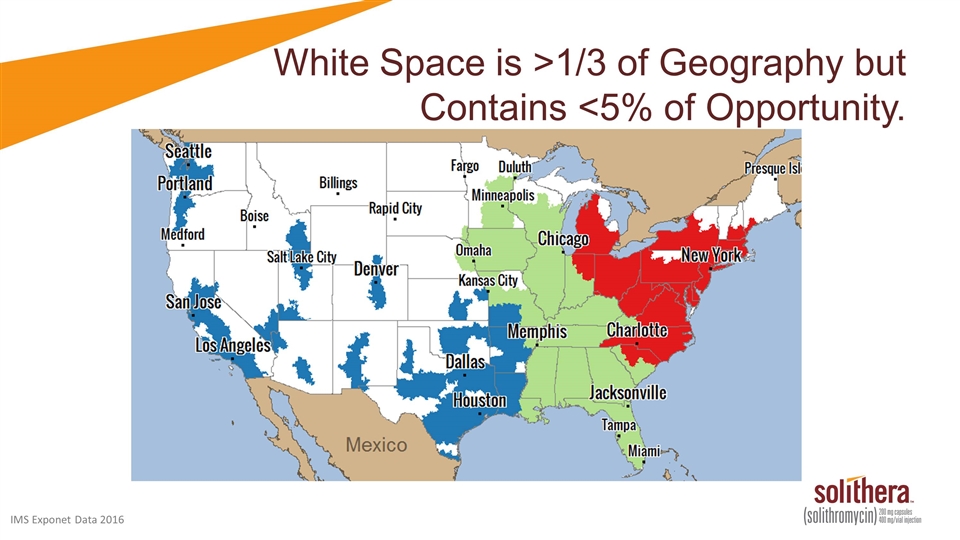

Cempra Area Alignment

White Space is >1/3 of Geography but Contains <5% of Opportunity. IMS Exponet Data 2016

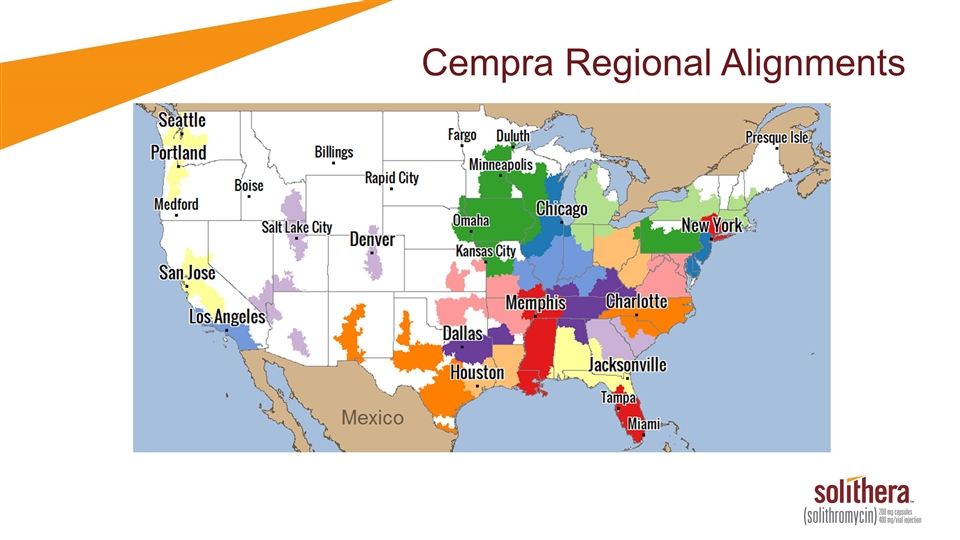

Cempra Regional Alignments

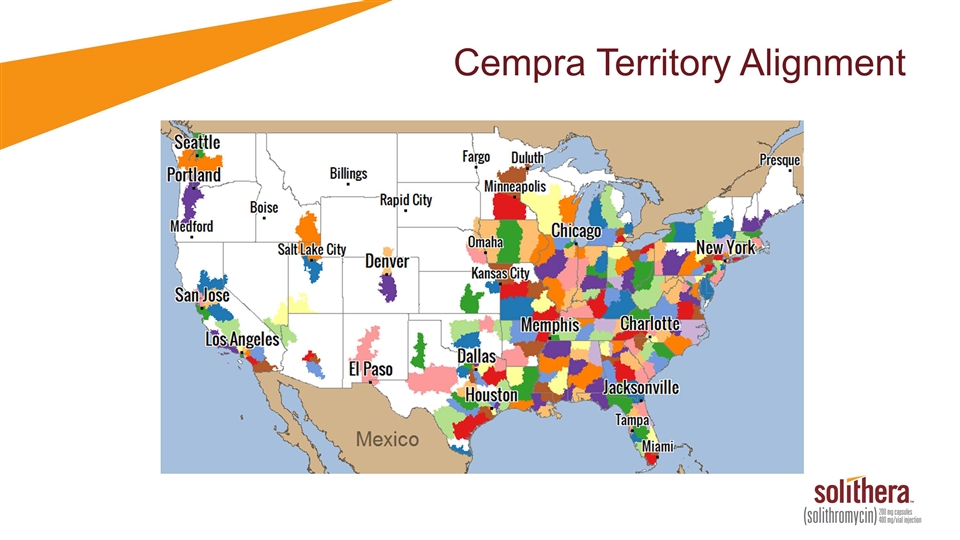

Cempra Territory Alignment

Conditions for a Successful Launch The Right Team is in Place and Growing Market Conditions are Favorable Strong Interest in Solithera from HCPs A Solid Plan is in Place

Developing Well-Differentiated Antibiotics June 23, 2016 PRABHAVATHI FERNANDES, PhD President and CEO

Highlights – Cempra, a Differentiated and Growing Company Cempra has consistently executed on plan – the leading antibacterial biotech Cempra has submitted NDAs for solithromycin and expects to launch product Q1 2017–large market potential for CABP New macrolide is urgently needed - resistance to azithromycin and serious adverse event labeling of levofloxacin. Little generic competition, no branded competition Additional indications near term- product within a product – Pediatrics, COPD, Gonorrhea Validated by license for Japan, partnerships with BARDA and NIAID Cempra has a second antibiotic in Taksta in Phase 3 - ABSSSI and refractory BJI Only oral antibiotic for long term use with large market potential Cempra owns macrolide platform technology and discovery programs for non-anti-inflammatories and motilin agonists Cempra has hired experienced staff in Commercialization, Medical Affairs, Regulatory, Clinical, Chemistry, Finance, IT – to support readiness for launch Well financed and ROW (except Japan) licensing potential is still open

Proven Management Team Prabhavathi Fernandes, PhD President & CEO Azactam (Aztreonam) Biaxin (Clarithromycin) Dificid (Fidaxomicin) Mark Hahn, CPA CFO IPO and M&A Athenix-Bayer CropScience Charles & Colvard (CTHR) E&Y David Moore, MBA CCO Levaquin (Levofloxacin) Topamax (Topiramate) Ultram (Tramadol) Nucynta (Tapentadol) Munir Abdullah, PhD EVP Regulatory Flonase (Fluticasone Propionate) Veramyst (Fluticasone Furoate) Avodart (Dutasteride) Tykerb (Lapatinib) Gary Horwith, MD EVP Pharmacovigilance & QA S. aureus vaccine Abelcet (Amphotericin B) David Oldach, MD Chief Medical Officer Viread (Tenofovir) Combinations Against HCV David Pereira, PhD EVP Chemistry Injectable Penicillins Dobutamine HCI Injection Ranitidine Injection

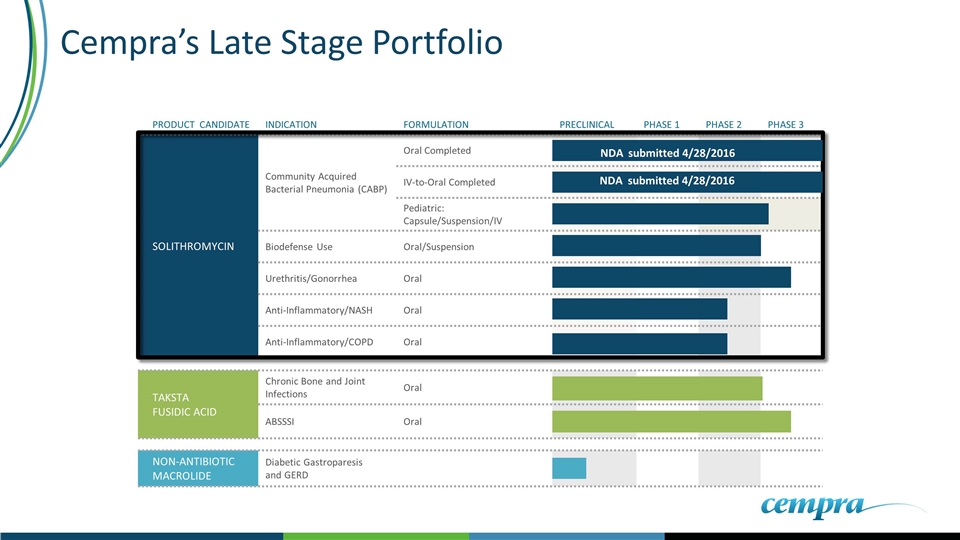

TAKSTA FUSIDIC ACID Chronic Bone and Joint Infections Oral ABSSSI Oral NON-ANTIBIOTIC MACROLIDE Diabetic Gastroparesis and GERD Cempra’s Late Stage Portfolio PRODUCT CANDIDATE INDICATION FORMULATION PRECLINICAL PHASE 1 PHASE 2 PHASE 3 SOLITHROMYCIN Community Acquired Bacterial Pneumonia (CABP) Oral Completed IV-to-Oral Completed Pediatric: Capsule/Suspension/IV Biodefense Use Oral/Suspension Urethritis/Gonorrhea Oral Anti-Inflammatory/NASH Oral Anti-Inflammatory/COPD Oral NDA submitted 4/28/2016 NDA submitted 4/28/2016

NDAs Submitted - with Potential To Be a Successful Antibiotic Solithromycin has completed 2 pivotal Phase 3 trials Positive clinical data from both trials Fast Track and Priority review (QIDPs) designations received from the FDA NDA (rolling NDA) submitted 28 April, 2016. EU submission documents preparation on track

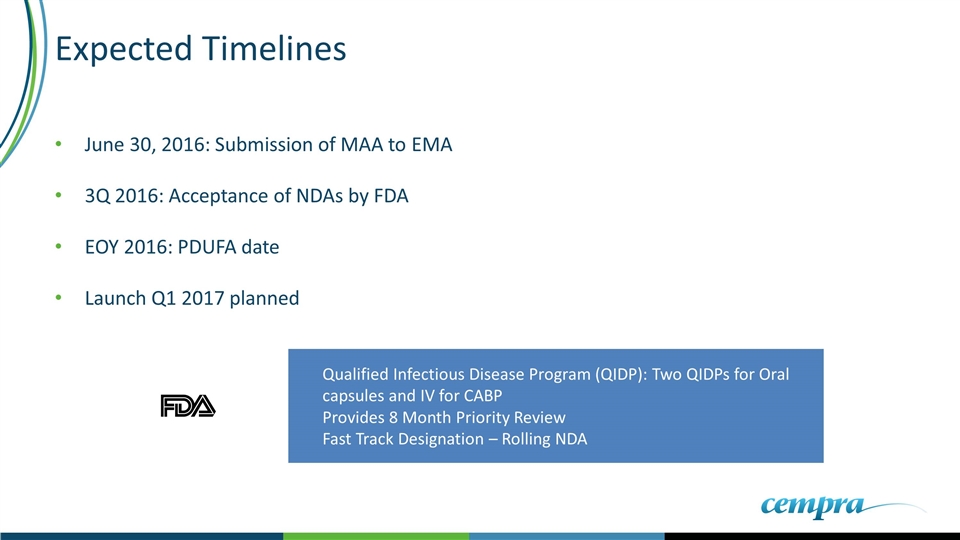

Expected Timelines June 30, 2016: Submission of MAA to EMA 3Q 2016: Acceptance of NDAs by FDA EOY 2016: PDUFA date Launch Q1 2017 planned Qualified Infectious Disease Program (QIDP): Two QIDPs for Oral capsules and IV for CABP Provides 8 Month Priority Review Fast Track Designation – Rolling NDA

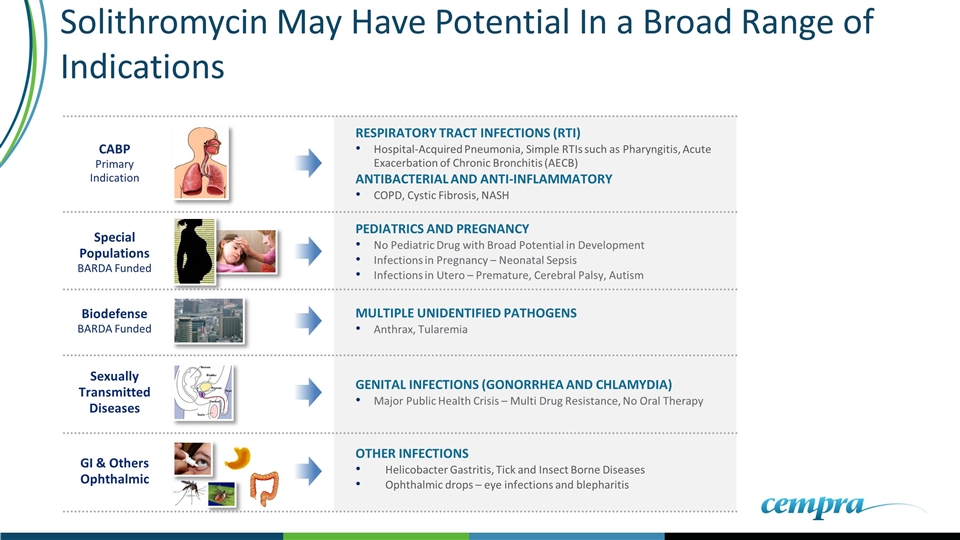

Solithromycin May Have Potential In a Broad Range of Indications Special Populations BARDA Funded Biodefense BARDA Funded Sexually Transmitted Diseases GI & Others Ophthalmic CABP Primary Indication RESPIRATORY TRACT INFECTIONS (RTI) Hospital-Acquired Pneumonia, Simple RTIs such as Pharyngitis, Acute Exacerbation of Chronic Bronchitis (AECB) ANTIBACTERIAL AND ANTI-INFLAMMATORY COPD, Cystic Fibrosis, NASH PEDIATRICS AND PREGNANCY No Pediatric Drug with Broad Potential in Development Infections in Pregnancy – Neonatal Sepsis Infections in Utero – Premature, Cerebral Palsy, Autism MULTIPLE UNIDENTIFIED PATHOGENS Anthrax, Tularemia GENITAL INFECTIONS (GONORRHEA AND CHLAMYDIA) Major Public Health Crisis – Multi Drug Resistance, No Oral Therapy OTHER INFECTIONS Helicobacter Gastritis, Tick and Insect Borne Diseases Ophthalmic drops – eye infections and blepharitis

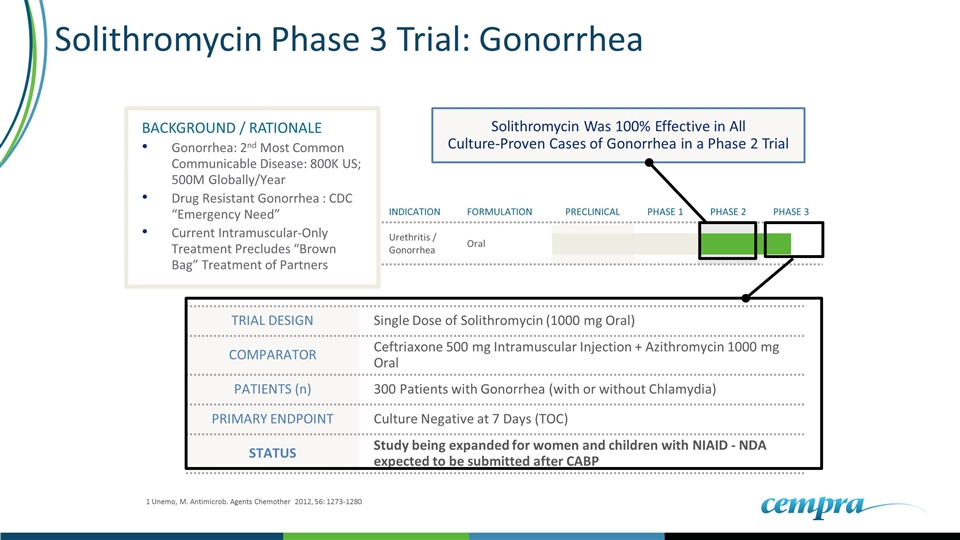

Solithromycin Phase 3 Trial: Gonorrhea TRIAL DESIGN Single Dose of Solithromycin (1000 mg Oral) COMPARATOR Ceftriaxone 500 mg Intramuscular Injection + Azithromycin 1000 mg Oral PATIENTS (n) 300 Patients with Gonorrhea (with or without Chlamydia) PRIMARY ENDPOINT Culture Negative at 7 Days (TOC) STATUS Study being expanded for women and children with NIAID - NDA expected to be submitted after CABP INDICATION FORMULATION PRECLINICAL PHASE 1 PHASE 2 PHASE 3 Urethritis / Gonorrhea Oral BACKGROUND / RATIONALE Gonorrhea: 2nd Most Common Communicable Disease: 800K US; 500M Globally/Year Drug Resistant Gonorrhea : CDC “Emergency Need” Current Intramuscular-Only Treatment Precludes “Brown Bag” Treatment of Partners Solithromycin Was 100% Effective in All Culture-Proven Cases of Gonorrhea in a Phase 2 Trial 1 Unemo, M. Antimicrob. Agents Chemother 2012, 56: 1273-1280

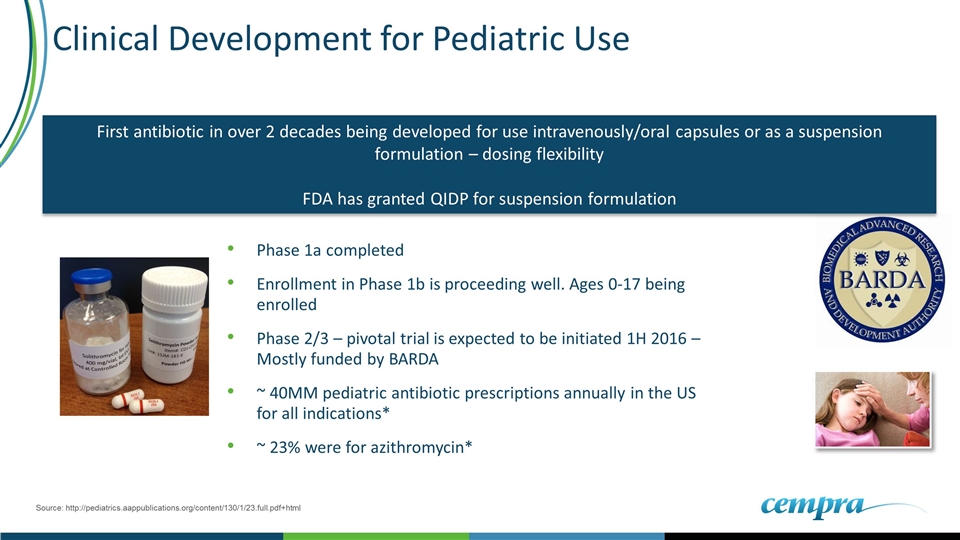

Clinical Development for Pediatric Use Phase 1a completed Enrollment in Phase 1b is proceeding well. Ages 0-17 being enrolled Phase 2/3 – pivotal trial is expected to be initiated 1H 2016 – Mostly funded by BARDA ~ 40MM pediatric antibiotic prescriptions annually in the US for all indications* ~ 23% were for azithromycin* Source: http://pediatrics.aappublications.org/content/130/1/23.full.pdf+html First antibiotic in over 2 decades being developed for use intravenously/oral capsules or as a suspension formulation – dosing flexibility FDA has granted QIDP for suspension formulation

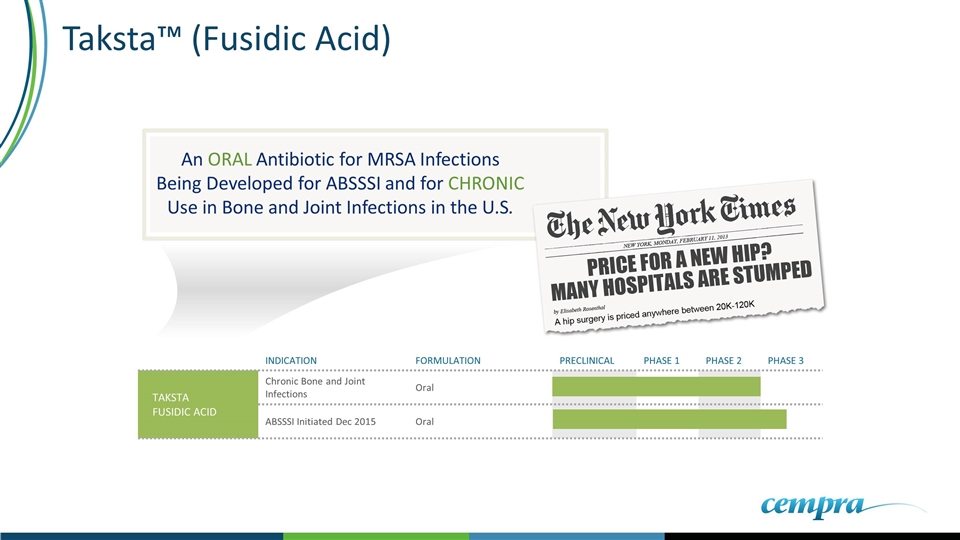

An ORAL Antibiotic for MRSA Infections Being Developed for ABSSSI and for CHRONIC Use in Bone and Joint Infections in the U.S. Taksta™ (Fusidic Acid) INDICATION FORMULATION PRECLINICAL PHASE 1 PHASE 2 PHASE 3 TAKSTA FUSIDIC ACID Chronic Bone and Joint Infections Oral ABSSSI Initiated Dec 2015 Oral

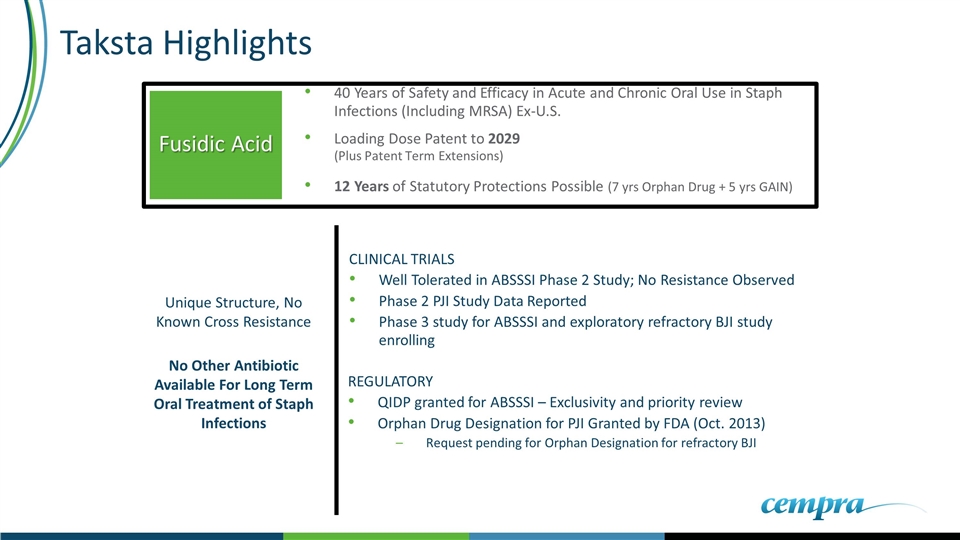

Taksta Highlights Fusidic Acid 40 Years of Safety and Efficacy in Acute and Chronic Oral Use in Staph Infections (Including MRSA) Ex-U.S. Loading Dose Patent to 2029 (Plus Patent Term Extensions) 12 Years of Statutory Protections Possible (7 yrs Orphan Drug + 5 yrs GAIN) CLINICAL TRIALS Well Tolerated in ABSSSI Phase 2 Study; No Resistance Observed Phase 2 PJI Study Data Reported Phase 3 study for ABSSSI and exploratory refractory BJI study enrolling REGULATORY QIDP granted for ABSSSI – Exclusivity and priority review Orphan Drug Designation for PJI Granted by FDA (Oct. 2013) Request pending for Orphan Designation for refractory BJI Unique Structure, No Known Cross Resistance No Other Antibiotic Available For Long Term Oral Treatment of Staph Infections

To be Available in ALL DOSE FORMULATIONS IV, Oral, Suspension v ALL AGES Newborn Through Geriatric v MONOTHERAPY Good Stewardship v MANY INDICATIONS Affecting MANY PATIENTS Community and Hospital v Solithromycin: Potential Makings of a Successful Antibiotic SAFE and EFFECTIVE