UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or (g) of the

Securities Exchange Act of 1934

MEWBOURNE ENERGY PARTNERS 09-A, L.P.

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 26-4280211 |

(State or other jurisdiction of incorporation) | | (I.R.S. Employer Identification Number) |

| |

| 3901 South Broadway, Tyler, Texas | | 75701 |

| (Address of principal executive offices) | | (Zip code) |

(903) 561-2900

(Registrant’s telephone number, including area code)

Securities to be registered pursuant to Section 12(b) of the Act: None

Securities to be registered pursuant to Section 12(g) of the Act:

Limited Partner Interests

(Title of class)

General Partner Interests

(Title of class)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | ¨ |

| | | |

| Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | | x |

TABLE OF CONTENTS

i

FORWARD-LOOKING STATEMENTS

Forward-looking statements are inherently uncertain. Some statements in this Registration Statement constitute forward-looking statements. These forward-looking statements include, but are not limited to, statements about the industry, plans, objectives, expectations, intentions and assumptions of Mewbourne Energy Partners 09-A, L.P. (the “Registrant” or the “Partnership”) and other statements contained herein that are not historical facts. When used in this Registration Statement, the words “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “estimate” and similar expressions are generally intended to identify forward-looking statements. Because these forward-looking statements involve risks and uncertainties, actual results may differ materially from those expressed or implied by these forward-looking statements. The Registrant does not intend to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

1

General

The Registrant is a limited partnership that was organized under the laws of the State of Delaware on February 26, 2009 in accordance with the laws of the State of Delaware. Mewbourne Development Corporation (“MD” or the “Managing Partner”), a Delaware corporation, has been appointed as the Registrant’s managing general partner. MD has no equity interest in the Registrant.

Limited and general partner interests in the Registrant were offered at $5,000 each to accredited investors in a private placement pursuant to Section 4(2) of the Securities Act of 1933, as amended (the “Securities Act”), and Regulation D promulgated thereunder, with a maximum offering amount of $73,000,000 (14,600 interests). On August 28, 2009, the offering of limited and general partnership interests in the Registrant was closed, with interests aggregating $66,210,000 originally being sold to accredited investors of which $62,140,000 were sold to accredited investors as general partner interests and $4,070,000 were sold to accredited investors as limited partner interests.

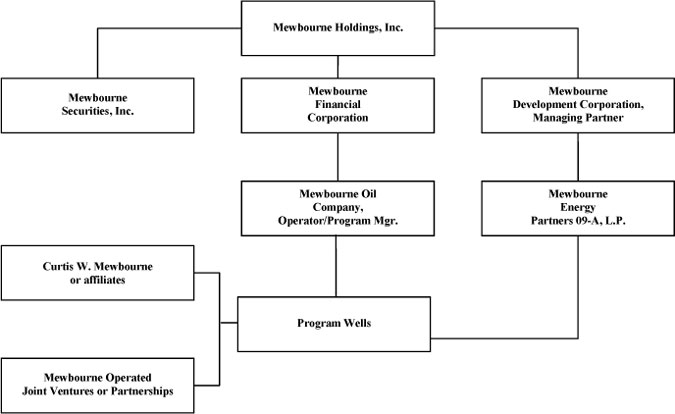

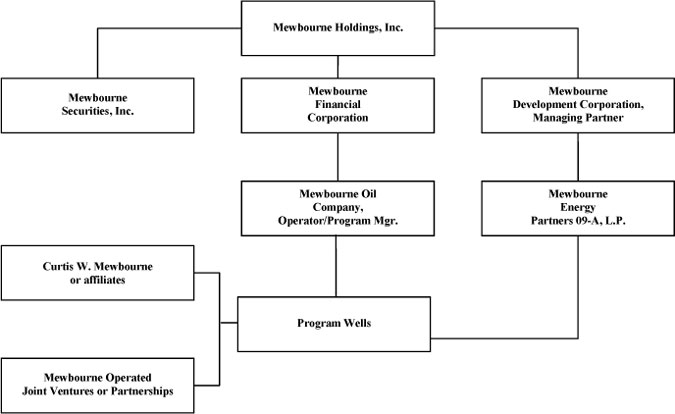

The Registrant engages primarily in oil and gas drilling and development activities with a concentration on gas under a drilling program (the “Program”), and it is not involved in any other industry segment. The Program is governed by a Drilling Program Agreement (the “Drilling Program Agreement”) between the Registrant, MD and Mewbourne Oil Company (“MOC” or the “Program Manager”), the program manager and a wholly-owned, indirect subsidiary of Mewbourne Holdings, Inc., which is also the parent of MD. MD does not make any capital contributions directly to the Registrant; rather MD makes its capital contributions directly to the Program. See the organizational structure chart of the various Mewbourne companies below. See also the financial statements in Item 13 of this Registration Statement for a summary of the Registrant’s revenue, income and identifiable assets.

OWNERSHIP STRUCTURE OF THE MEWBOURNE COMPANIES

Corporate Structure

2

Proposed Operations

Under the Drilling Program Agreement referenced above, the activities of the Partnership focus upon the acquisition of oil and gas leases covering prospects with a concentration on gas, the drilling of development wells, and the production and operation of the resulting properties. In addition to development wells, at the discretion of the Managing Partner, up to 20% of the Partnership’s capital contributions may be expended in connection with activities relating to exploratory wells. All drilling activities involve a high degree of risk, with exploratory wells presenting a higher degree of risk than development wells.

As of December 31, 2009, the Partnership had seven wells producing, five wells in drilling operations and one well that was plugged and abandoned for a total of thirteen wells in which the Partnership owns an interest. These wells are located in West Texas and Southeastern New Mexico in an area known as the Permian Basin and in Western Oklahoma and the Texas Panhandle in an area known as the Anadarko Basin.

The Managing Partner intends to cause the Partnership to engage in drilling for oil and gas, with a concentration on gas, on a number of additional prospects, none of which is yet determined. It is impossible at this time to predict with certainty the additional drilling activities that will be conducted by the Partnership.

Decisions as to the number and location of the prospects in which the Partnership will ultimately invest and as to the amounts spent on drilling are made solely by the Managing Partner for the Partnership and by the Program Manager on behalf of the Program. The Managing Partner intends to cause the Partnership to acquire an interest in as many prospects as practicable in order to best diversify the risks associated with drilling for oil and gas. However, the number and type of wells to ultimately be drilled by the Partnership will vary according to the costs of each well and the size of the fractional working interests selected in each well.

Area of Geographic Concentration

The Managing Partner anticipates that all of the Partnership’s funds available for drilling activities will be expended in the Permian Basin and also the Anadarko Basin. However, if the Managing Partner determines that it is in the best interest of the Partnership to conduct additional drilling activities in other onshore geographic areas of the United States, the Program and the Partnership may expend available funds in such areas.

The Permian Basin encompasses a large area of approximately 75,000 square miles located in West Texas and Southeastern New Mexico. Since 1921, over 30 billion barrels of oil and 100 trillion cubic feet of natural gas have been produced from the Permian Basin. Two interior basins, the Midland Basin in West Texas and the Delaware Basin in West Texas and Southeastern New Mexico, subdivide the Permian Basin. Drilling depths in the Permian Basin range from very shallow to more than 20,000 feet in the Permian Basin.

Over the past 45 years, MOC and its affiliates have drilled approximately 650 commercially productive oil and gas wells in the Permian Basin, and MOC currently operates approximately 630 wells in the Permian Basin. These historical results are not indicative of the results that may be achieved by the Partnership. In addition, a commercially productive well may not necessarily have sufficient production to recover both operating expenses and drilling and development costs. The Managing Partner and its affiliates target multiple Pennsylvanian and Permian age sandstone and carbonate reservoirs along the shelf and shelf-slope areas within the interior subbasins, which lay at depths ranging from 3,000 to 13,000 feet, and most current operations are centered on the shelf and along shelf-slope areas of the Delaware Basin located in Eddy County, Chaves County and Lea County, New Mexico. It is anticipated that the Partnership will, through the Program, conduct a portion of its oil and gas drilling and development activities in this area of the Permian Basin. Predominantly, wells drilled by MOC in this region of the Permian Basin are classified as gas wells but produce both oil and gas. However, MOC and its affiliates have drilled a number of wells in this area that have been classified as oil wells.

The Anadarko Basin of Western Oklahoma, the Texas Panhandle and Southwestern Kansas encompasses an area of approximately 60,000 square miles. First production was established in 1917, and since that time over 14 billion barrels of oil and 98 trillion cubic feet of natural gas have been produced from this geological basin. Production in the Anadarko Basin ranges from several hundred feet to over 26,000 feet in depth.

3

Over the past 35 years, MOC and its affiliates have drilled approximately 1,400 commercially productive wells that have targeted Pennsylvanian, Mississippian, Devonian, and Silurian age sandstone and carbonate reservoirs along the shelf area of Western Oklahoma and the Texas Panhandle at depths of between 6,000 and 13,000 feet. MOC currently operates approximately 750 wells in the Anadarko Basin. It is anticipated that the Partnership will, through the Program, conduct a portion of its drilling and development activities along the shelf area of Western Oklahoma, the Texas Panhandle and Southwest Kansas. A majority of the wells drilled by MOC over the past 35 years in this region of the Anadarko Basin have been classified as gas wells but produce both oil and gas. However, MOC and its affiliates have drilled a number of wells in this area that have been classified as oil wells.

Insurance

The Managing Partner expects to conduct the business of the Partnership and to cause the Program Manager to conduct the business of the Program in a manner intended to limit, to the extent practicable, the exposure of the general partners to liability in excess of their capital contributions to the Partnership. It is anticipated that drilling activities of the Partnership will be conducted in the medium depths, between 3,000 to 13,000 feet, of the Northwest Shelf, the shelf of the Delaware and Midland Basins, Central Basin Platform geological sub-regions of the Permian Basin and the shelf and the shelf-slope area of the Anadarko Basin, areas where the probability of encountering severely over-pressured formations and other hazards associated with drilling activities is less likely. The Program Manager and its affiliates will maintain extensive insurance coverage to protect, to the extent practicable, the Partnership from losses that could arise in connection with Program activities, including legal and contractual liability to third parties.

The Program Manager and its affiliates expect to retain the insurance coverage described below unless such coverage becomes unobtainable or is only available at premiums that are prohibitively more expensive than the premiums now being paid for such policies. However, the Program Manager and its affiliates will not be required to retain operator’s extra expense, including provisions for care, custody and control insurance coverage, for the Partnership after the Program has completed its drilling activities.

A brief discussion of the insurance policies that the Program Manager and its affiliates have obtained on behalf of themselves and the Partnership is set forth below. Each of these policies is subject to, including among others, customary terms, specific policy terms, conditions, exclusions, reporting provisions for certain types of claims, sub-limits, various deductibles, annual aggregates and limitations that may preclude the Partnership from recovering damages, expenses and liabilities suffered by the Partnership, including, among others, damages and liabilities arising from or caused by:

| | • | | the violation of any federal, state or local statute, ordinance or regulation, |

| | • | | fines, penalties and punitive and exemplary damages, |

| | • | | war and terrorist acts, |

| | • | | normal operation, including wear and tear, |

| | • | | the fraud, disloyalty, theft, malicious acts or other similar conduct of employees. |

Other exclusions that are customary in the insurance and oil and gas industries may also apply, including exclusions relating to claims for bodily injury or property damage arising from pollution and environmental events. The Program Manager believes that from time to time the terms, conditions, exclusions and limitations described herein may prevent the Partnership from recovering the full amount of any damages, expenses and liabilities suffered by the Partnership that arise in the event of an accident. In some cases, the Partnership may not recover any portion of such damages, expenses and liabilities.

4

The Program Manager and its affiliates maintain insurance policies that are typical of those maintained by similar operators that drill for oil and gas in the areas where the Program Manager conducts its activities, including comprehensive general liability, which provides legal liability coverage for bodily injury or property damage of others resulting from operations and ownership or use of premises, employer’s liability and commercial automobile insurance. These policies generally protect against the routine hazards encountered by the Program Manager, its affiliates and its employees and agents in the conduct of the business of the Program Manager and its affiliates.

The Program Manager and its affiliates also maintain a comprehensive energy package and an excess liability policy that together provide an additional coverage amount of $50,000,000 per occurrence. These excess umbrella liability policies generally provide legal liability coverage for bodily injury and property damage for losses in excess of the limits provided by the primary policies and protect against liabilities imposed by law or assumed under contract or agreement for damages on account of personal injuries, property damage or advertising liability such as libel, slander, defamation and invasion of privacy caused by or arising out of an occurrence happening anywhere in the world. Injury and damage arising from seepage, pollution or contamination is covered by the excess umbrella liability policies only if caused by a sudden, unintended and unexpected happening, and injury and damage arising from pollution is not covered for sites used in handling, processing, treatment, storage or disposal of waste substances or the transportation of waste substances.

In addition, the physical damage section of the oil and gas lease property policy generally protects the Program Manager against all risks of direct physical loss or damage to all personal property, except drilling rigs and related equipment, vehicles, oil and gas, and various other personal property, for which the Program Manager has liability or is legally liable, subject to a deductible.

Further, the Program Manager and its affiliates maintain an operator’s extra expense policy that has a coverage limit of $5,000,000 for land wells less than 10,000 feet in depth and a limit of $10,000,000 for wells greater than 10,000 feet in depth and that generally protects from:

| | • | | the costs to regain control of a well that goes out of control and costs to redrill or restore a well that has been lost or otherwise damaged as a result of an out of control well, |

| | • | | third-party claims for property damage relating to seepage, pollution or contamination arising from an out of control well and the cost of cleaning up such substances, |

| | • | | loss, damage or expense arising from the uncontrollable flow of oil, gas or water from one subterranean stratum to another through the bore of a well, |

| | • | | evacuation expense if ordered by a governmental agency, and |

| | • | | legal or contractual liability for oilfield equipment in the care, custody or control of the operator. |

The above policies are in effect and are renewed annually but may be canceled by the insurance underwriters upon a minimum of 30 days’ prior written notice. Each of these policies names the Partnership as a co-insured and co-beneficiary thereunder.

The Managing Partner will notify general and limited partners of any material reduction in the insurance coverage of the Program and Partnership. If possible, this notice shall be given 30 days in advance of the change in insurance coverage. In addition, if the Program or the Partnership has its insurance coverage materially reduced for any reason, the Partnership will, as soon as possible, halt all drilling activity until such time as comparable replacement coverage is obtained.

Market and Competitive Risks

The ability of the Partnership to market oil and natural gas found and produced, if any, will depend on numerous factors beyond the control of the Partnership, the effect of which factors cannot be accurately predicted or anticipated. Some of these factors include, without limitation, the availability of other domestic and foreign

5

production, the marketing of competitive fuels, the proximity and capacity of pipelines, fluctuations in supply and demand, the availability of a ready market, the effect of United States federal and state regulation of production, refining, transportation and sales, and general national and worldwide economic conditions.

While the Registrant does not have long-term contracts with purchasers of its crude oil or natural gas, MOC may enter into short-term contracts with its customers to sell the Registrant’s natural gas at specified prices. The Registrant’s natural gas may also be sold to local distribution companies, gas marketers and end users on the spot market. The spot market reflects immediate sales of natural gas without long-term contractual commitments. A substantial portion of the Program’s gas production is being sold regionally in the spot market. The future market condition for natural gas cannot be predicted with any certainty, and the Registrant may experience delays in marketing natural gas production and fluctuations in natural gas prices. The market for crude oil is such that the Registrant anticipates it will be able to sell all the crude oil it can produce.

Many aspects of the Registrant’s activities are highly competitive, including, but not limited to, the acquisition of suitable drilling prospects and the procurement of drilling and related oil field equipment. The Registrant’s ability to compete depends on its financial resources and on the Managing Partner’s staff and facilities, none of which are significant in comparison to those of the oil and gas exploration, development and production industry as a whole.

Regulation

Regulation of Production

The production of oil and gas found by the Program, if any, will be subject to federal and state laws and regulations, and orders of regulatory bodies under those laws and regulations, governing a wide variety of matters, including the drilling and spacing of wells on producing acreage, allowable rates of production, marketing, prevention of waste and pollution, and protection of the environment. Such laws, regulations and orders may restrict the rate of oil and gas production below the rate that would otherwise exist in the absence of such laws, regulations and orders and may restrict the number of wells that may be drilled on a particular oil and gas lease. For example, the Railroad Commission of Texas determines the amount of gas producers can produce and purchasers can take from oil and gas leases located within the State of Texas. Additionally, state statutory provisions relating to oil and gas generally require permits for the drilling of wells.

Natural Gas Prices

The Natural Gas Wellhead Decontrol Act of 1989 was enacted on July 26, 1989, and provides that all gas prices are decontrolled at the wellhead effective January 1, 1993. Accordingly, sales of natural gas by the Partnership generally will not be subject to the maximum lawful price ceilings set by the Natural Gas Policy Act of 1978, as amended. Thus, market conditions will determine the prices that the Partnership receives from the sale of natural gas produced from Program wells.

Oil and Liquid Hydrocarbon Prices

There are currently no federal price controls on oil production, and sales of oil, condensate and natural gas liquids by the Partnership can be made at uncontrolled market prices. However, there can be no assurance that Congress will not enact controls at any time.

Regulation of the Environment

The exploration, development and production of oil and gas is subject to various federal and state laws and regulations to protect the environment. Various states and governmental agencies are considering, and some have adopted, other laws and regulations regarding environmental control that could adversely affect the business of the Partnership. Compliance with such legislation and regulations, together with any penalties resulting from noncompliance therewith, will increase the cost of oil and gas development and production. All or a portion of these costs may ultimately be borne by the Partnership.

6

Possible Legislation

Currently, there are many legislative proposals pertaining to regulation of the oil and gas industry, which proposals may directly or indirectly affect the activities of the Partnership. No prediction can be made as to what additional energy legislation may be proposed, if any, which bills may be enacted, or when any such bills, if enacted, would become effective.

The preceding discussion of regulation of the oil and gas industry is necessarily brief and is not intended to constitute a complete discussion of the various statutes, rules, regulations or governmental orders to which the Partnership’s and the Program’s operations may be subject.

Summary of Material Contracts

Drilling Program Agreement

The Drilling Program Agreement provides that MOC, in its capacity as the Program Manager, will have the exclusive power and authority to act on behalf of the Partnership with respect to the management, control and administration of the business and affairs of the Program and the oil and gas properties subject to the Drilling Program Agreement. The Drilling Program Agreement sets out the rights, duties and obligations of the Program Manager and the other participants in the Program. For a more detailed summary of the material provisions of the Drilling Program Agreement, see “Item 11—Description of Registrant’s Securities to be Registered—Drilling Program Agreement.”

Operating Agreement

The Operating Agreement is a model form operating agreement based upon the American Association of Petroleum Landsmen Form 610-1989. The Operating Agreement includes the accounting procedure for joint operations issued by the Council of Petroleum Accountants Societies of North America. The Operating Agreement contains modifications that are customary and usual for the geographic area in which the Partnership intends to conduct operations.

Gas Marketing Agreement

In consideration for gas marketing services to be rendered by the Program Manager in connection with the marketing of natural gas from the Program’s interests, the Program will pay to the Program Manager a gas marketing fee that is currently equal to four cents per thousand cubic feet (“McF”) of natural gas that is marketed by the Program Manager on the spot gas market. The gas marketing fee may be changed from time to time, but the Program Manager may not charge the Partnership a gas marketing fee that is greater than other participants in a well. The gas marketing fee will be allocated 75% to the investor partners and 25% to the Managing Partner.

Relationship between the Partnership, MD and MOC

The Partnership does not have any employees of its own. All management functions of the Partnership are conducted by MD in its capacity as the Managing Partner, and all administration of the Program, including the origination of prospects and the supervision of drilling and completion activities with respect to those operations for which it is acting as operator, will be conducted by MOC in its capacity as the Program Manager. At December 31, 2009, MOC employed 222 persons on a full-time basis, many of whom dedicate a part of their time to conduct the Partnership’s business. For example, numerous employees of MOC provide accounting, engineering, geological, land and information technology support to the Partnership. None of such employees is subject to collective bargaining arrangements.

With respect to the executive officers of MD and MOC, such persons serve in the same capacities for both MD and MOC. It is not anticipated that the executive officers will spend a significant amount of time on the Partnership’s affairs. J. Roe Buckley, Executive Vice President and Chief Financial Officer of both MD and MOC, will spend some time managing the financial affairs of the Partnership, including working to ensure that the

7

Partnership complies with applicable reporting requirements. Mr. Buckley performs the same functions for the other partnerships managed and administered by MD and MOC. The other executive officers may from time to time tend to the affairs of the Partnership but will focus the majority of their time on the overall affairs of MD and MOC, which include overseeing the Partnership’s participation in drilling activities as discussed above.

Seasonality and Backlog

The production of oil and gas is not considered subject to seasonal factors although the price received by the Registrant for natural gas sales will generally tend to increase during the winter months. Order backlog is not pertinent to the Registrant’s business.

| Item 2. | Financial Information. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations

General

The Registrant was organized as a Delaware limited partnership on February 26, 2009. The offering of limited and general partner interests began May 1, 2009 and concluded August 28, 2009, with total investor partner contributions of $66,210,000. The Registrant commenced its business operations on the closing date of August 28, 2009.

The Registrant was formed to engage primarily in the business of drilling development wells, produce and market crude oil and natural gas produced from such properties, distribute any net proceeds from operations to the general and limited partners and, to the extent necessary, acquire leases that contain drilling prospects. The economic life of the Registrant depends on the period over which the Registrant’s oil and gas reserves are economically recoverable.

Results of Operations

Results of operations for the period from February 26, 2009 (date of inception) through December 31, 2009 are as follows:

| | | |

Oil sales | | $ | 345,134 |

Barrels produced | | | 4,806 |

Average price/barrel | | $ | 71.81 |

Gas sales | | $ | 173,899 |

Mcf produced | | | 29,284 |

Average price/Mcf | | $ | 5.94 |

Although the Partnership inception date was February 26, 2009, no income or expenses were earned or incurred prior to the August 28, 2009 closing date of the offering.

Revenues and other income for the period from February 26, 2009 (date of inception) through December 31, 2009 totaled $521,554 and consisted of oil and gas sales in the amount of $519,033 and interest income in the amount of $2,521. Oil production volume for such period amounted to approximately 4,806 barrels of oil at a corresponding average realized price of $71.81 per barrel of oil, and gas production volume during such period amounted to approximately 29,284 Mcf of gas at a corresponding average realized price of $5.94 per Mcf of gas. Expenses totaling $170,250 consisted primarily of depreciation, depletion and amortization of $130,217. Lease operating expenses totaled $7,673, and production taxes were $30,716. Administrative and general expenses were $1,299, and asset retirement obligation accretion expense was $345. At December 31, 2009, seven wells had been drilled and were productive.

Because the Registrant was formed during 2009, no trend analysis based on yearly changes in liquidity, capital resources or results of operations is available.

8

Liquidity and Capital Resources

The drivers underlying the Partnership’s cash flows consist principally of the ability of the Partnership’s wells to produce oil and gas as well as the prices of crude oil and natural gas. The Partnership expects oil and gas production and, as a result, cash flows, to increase during 2010 as additional wells are completed and oil and gas production is sold. Additionally, the Partnership will invest excess cash in short-term interest bearing securities that may also provide funds for distribution. It is anticipated that substantially all of the Partnership’s excess funds will be expended for drilling costs by the end of the fourth quarter of 2010.

Cash and cash equivalents were $48,806,858 at December 31, 2009. For the period from February 26, 2009 (date of inception) through December 31, 2009, approximately $11.6 million of the initial partners’ capital of $66,210,000 was used for drilling and completion and prepaid well costs, and $5,627,850 was utilized for sales commissions and marketing fees.

Capital requirements in the future are expected to be paid with remaining cash on hand. Management of MD believes at this point that the Partnership will have sufficient capital to complete its drilling activities and that no borrowings will be necessary. Specifically, it is anticipated that the Partnership will have begun drilling the majority of its wells by September 30, 2010, with substantially all activity completed by the end of the fourth quarter of 2010. However, due to unforeseen circumstances, it could become necessary to finance the costs of Partnership operations through Partnership borrowings, utilization of Partnership revenues obtained from production or other methods of financing. These operations may include the drilling, completing and equipping of additional wells to further develop Program prospects. The Partnership Agreement provides that outstanding Partnership borrowings may not at any time exceed 20% of its aggregate capital contributions. Furthermore, the Partnership may borrow funds only if the lender agrees that it will have no recourse against individual general partners. As a result of these provisions, obtaining sufficient debt financing on acceptable terms or at all may not be possible. If the Managing Partner deems it to be in the best interest of the Partnership to borrow funds from an unaffiliated third party, it would do so; however, it is currently anticipated that, if it became necessary to finance the costs of Partnership operations through borrowings, the Partnership would not need to borrow money from an unaffiliated third party.

Revenues that, in the sole judgment of the Managing Partner, are not required to meet the Registrant’s obligations will be distributed to the partners at least quarterly in accordance with the Partnership Agreement. The Partnership made no cash distributions to the investor partners for the period beginning February 26, 2009 (date of inception) through December 31, 2009. The Partnership expects that cash distributions will begin and continue during 2010 due to additional oil and gas revenues that are expected to be sufficient to produce cash flows from operations.

Critical Accounting Policies

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Significant estimates inherent in the Registrant’s financial statements include the estimate of oil and gas reserves and future abandonment costs. Changes in oil and gas prices, changes in production estimates and the success or failure of future development activities could have a significant effect on reserve estimates. The reserve estimates directly impact the computation of depreciation, depletion and amortization, asset retirement obligation and the ceiling test for the Registrant’s oil and gas properties.

The Registrant follows the full-cost method of accounting for its oil and gas activities. Under the full-cost method, all productive and non-productive costs incurred in the acquisition, exploration and development of oil and gas properties are capitalized. Depreciation, depletion and amortization of oil and gas properties subject to amortization are computed on the units-of-production method based on the proved reserves underlying the oil and gas properties. Oil and gas properties are subject to a quarterly ceiling test that limits such costs to the aggregate of the present value of future net cash flows of proved reserves and the lower of cost or fair value of unproved properties. The present value of future net cash flows has been prepared using the oil and gas pricing guidelines

9

established by the Securities and Exchange Commission (the “SEC”), year-end development and production costs and a 10 percent annual discount rate. There were no cost ceiling write-downs during the period from February 26, 2009 (date of inception) through December 31, 2009.

The process of estimating oil and gas reserves is complex and involves decisions and assumptions in the evaluation of available geological, geophysical, engineering and economic data. Therefore, these estimates are inherently imprecise.

Actual future production, oil and gas prices, revenues, taxes, development expenditures, operating expenses and quantities of recoverable oil and gas reserves most likely will vary from those estimated. Any significant variance could materially affect the estimated quantities and present value of reserves set forth in this Form 10. In addition, the Partnership may adjust estimates of proved reserves to reflect production history, results of exploration and development, prevailing oil and gas prices and other factors, many of which are beyond the Partnership’s control.

In December 2008, the SEC issued its final rule for Modernization of Oil and Gas Reporting. Pursuant to this rule, the SEC adopted revisions to its oil and gas reporting disclosures effective for annual reports for fiscal years ending on or after December 31, 2009. The revisions are intended to provide investors with a more meaningful and comprehensive understanding of oil and gas reserves, which should help investors evaluate the relative value of oil and gas entities. In the three decades that have passed since the original adoption of oil and gas disclosure items, there have been significant changes in the oil and gas industry. These revisions are designed to modernize and update the oil and gas disclosure requirements to align them with current practices and changes in technology.

The new rules include provisions that permit the use of new technologies to determine proved reserves, require entities to report any third party that is relied upon to prepare or audit reserve estimates, and require that oil and gas reserves be reported and the full cost ceiling value calculated using average first-of-the-month natural gas and oil prices during the twelve-month period ending in the reporting period.

Since the Partnership uses the full-cost method to account for its oil and gas operations, it is susceptible to significant non-cash charges during times of volatile commodity prices because the full cost pool may be impaired when prices are low. For instance, a 10% decline in average oil and gas prices would have resulted in a cost ceiling write-down of $232,677.

All financing activities of the Registrant are reported in the financial statements. The Registrant does not engage in any off-balance sheet financing arrangements. Additionally, the Registrant has no contractual obligations but has a financial obligation to plug and abandon non-producing properties, as discussed below.

Asset Retirement Obligations

The Partnership has recognized an estimated liability for future plugging and abandonment costs. A liability for the estimated fair value of the future plugging and abandonment costs is recorded with a corresponding increase in the full cost pool at the time a new well is drilled. Depreciation expense associated with estimated plugging and abandonment costs is recognized in accordance with the full cost methodology.

The Partnership estimates a liability for plugging and abandonment costs based on historical experience and estimated well life. The liability is discounted using the credit-adjusted risk-free rate. Revisions to the liability could occur due to changes in well plugging and abandonment costs or well useful lives or if federal or state regulators enact new well restoration requirements. The Partnership recognizes accretion expense in connection with the discounted liability over the remaining life of the well.

10

A reconciliation of the Partnership’s liability for well plugging and abandonment costs for the period beginning February 26, 2009 (date of inception) through December 31, 2009 is as follows:

| | | |

Balance, beginning of period | | $ | — |

Liabilities incurred | | $ | 69,288 |

Accretion expense | | $ | 345 |

Balance, end of period | | $ | 69,633 |

New Accounting Pronouncements

Modernization of Natural Gas and Oil Reporting. In January 2009, the SEC issued revisions to the natural gas and oil reporting disclosures, “Modernization of Oil and Gas Reporting, Final Rule” (the “Final Rule”). In January 2010, the Financial Accounting Standards Board (the “FASB”) updated its oil and gas estimation and disclosure requirements to align its requirements with the SEC’s modernized oil and gas reporting rules, which are described above. The update amends the definition of “proved reserves” to use the average of first-day-of-the-month prices during the twelve months preceding the end of the reporting period, adds definitions used in estimating and disclosing proved oil and natural gas quantities and expands the disclosures required for equity-method investments. The update must be applied prospectively as a change in accounting principle that is inseparable from a change in accounting estimate and is effective for entities with annual reporting periods ending on or after December 31, 2009. The Partnership adopted the new standards effective December 31, 2009. See the notes to the financial statements for disclosures regarding natural gas and oil reserves.

FASB Accounting Standards Codification and the Hierarchy of Generally Accepted Accounting Principles. In June 2009, the FASB issued guidance on the accounting standards codification and the hierarchy of generally accepted accounting principles (“GAAP”). The accounting standards codification is intended to be the source of authoritative GAAP and reporting standards as issued by the FASB. Its primary purpose is to improve clarity and use of existing standards by grouping authoritative literature under common topics. The accounting standards codification is effective for financial statements issued for interim and annual periods ending after September 15, 2009. The Partnership describes the authoritative guidance used within the footnotes per this standard rather than using numerical references. The accounting standards codification does not change or alter existing GAAP, and there is no expected impact on the Partnership’s financial position, results of operations or cash flows.

Organization and Related Party Transactions

The Partnership was organized on February 26, 2009 in accordance with the laws of the State of Delaware. MD, a Delaware corporation, has been appointed as the Registrant’s managing general partner. MD has no equity interest in the Registrant. MOC is operator of oil and gas properties owned by the Partnership. Mewbourne Holdings, Inc. is the parent of both MD and MOC. Substantially all transactions are with MD and MOC. Because of the common control of the Partnership, the Program, MD, MOC and other affiliates thereof, and the fact that some individuals hold positions in both MD and MOC and oversee activities in various partnerships similar to the Partnership, conflicts of interest may arise in the following situations:

| | • | | MD currently manages and in the future will sponsor and manage other partnerships similar to the Partnership; |

| | • | | MD will decide which prospects the Partnership will acquire; |

| | • | | MOC will act as the operator for Program wells under the operating agreement, the terms of which have not been negotiated by non-affiliated persons; |

| | • | | MD and its affiliates will contribute oil and gas leases and sell other property to the Program and the Partnership; |

11

| | • | | MD is a general partner of numerous other partnerships and owes duties of good faith and fair dealing to such other partnerships; |

| | • | | MD and its affiliates engage in significant drilling, operating and producing activities for other partners; and |

| | • | | Affiliates of MD may purchase interests in the Partnership, and subject to limitations, interests purchased by an affiliate have voting rights under the Partnership Agreement. |

MD is accountable to the Partnership as a fiduciary and is required to act in good faith in the best interests of the Partnership at all times. MD will attempt, in good faith, to resolve all conflicts of interest in a fair and equitable manner with respect to all persons affected by those conflicts of interest. For additional information on potential conflicts of interest and MD’s fiduciary responsibility to the Partnership, please see “Item 11. Description of Registrant’s Securities to be Registered—Partnership Agreement—Fiduciary Responsibility of the Managing Partner.”

In the ordinary course of business, MOC will incur certain costs that will be passed on to well owners of the well for which the costs were incurred. The Partnership will receive its portion of these costs based upon its ownership in each well incurring the costs. These costs are referred to as operator charges and are standard and customary in the oil and gas industry. Operator charges include recovery of gas marketing costs, fixed rate overhead, supervision, pumping and equipment furnished by the operator, some of which will be included in the full cost pool pursuant to Rule 4-10(c)(2) of Regulation S-X of the Securities Act. Reimbursement to MOC for operator charges totaled $188,152 for the period from February 26, 2009 (date of inception) through December 31, 2009. Operator charges are billed in accordance with the Program and the Partnership Agreement.

In consideration for services rendered by MD in managing the business of the Partnership, the Partnership during each of the initial three years of the Partnership will pay to MD a management fee in the amount equal to 0.75 of 1% of the subscriptions by the investor partners to the Partnership. Management fees can only be paid out of funds available for distributions. No management fees were allocated to the Partnership for the period from February 26, 2009 (date of inception) through December 31, 2009. In the periods in which management fees are paid, the Partnership includes them as part of the full cost pool pursuant to Rule 4-10(c)(2) of Regulation S-X of the Securities Act.

In general, during any particular calendar year, the total amount of administrative expenses allocated to the Partnership by MOC shall not exceed the greater of (a) 3.5% of the Partnership’s gross revenue from the sale of oil and natural gas production during each year (calculated without any deduction for operating costs or other costs and expenses) or (b) the sum of $50,000 plus 0.25% of the capital contributions of limited and general partners. Administrative expenses can only be paid out of funds available for distributions. Under this arrangement, $363 was allocated to the Partnership during the period from February 26, 2009 (date of inception) through December 31, 2009. The costs and revenues of the Program are allocated to MD and the Partnership as follows:

| | | | | | |

| | | Partnership | | | MD | |

Revenues: | | | | | | |

Interest earned on capital contributions of investor partners | | 100 | % | | 0 | % |

Proceeds from disposition of depreciable and depletable properties | | 75 | % | | 25 | % |

All other revenues | | 75 | % | | 25 | % |

| | |

Costs and expenses: | | | | | | |

Organization and offering costs(1) | | 0 | % | | 100 | % |

Lease acquisition costs(1) | | 0 | % | | 100 | % |

Tangible and intangible drilling costs(1) | | 100 | % | | 0 | % |

Operating costs, reporting and legal expenses, general and administrative expenses and all other costs | | 75 | % | | 25 | % |

| (1) | Pursuant to the Program, MD must contribute 100% of organization and offering costs and lease acquisition costs, which should approximate 17.65% of total capital costs. To the extent that organization and offering costs and lease acquisition costs are less than 17.65% of total capital costs, MD is responsible for tangible drilling costs until its share of the Program’s total capital costs reaches approximately 17.65%. |

12

The Partnership’s financial statements reflect its respective proportionate participation in the Program.

Property Interests

The Registrant’s properties consist primarily of interests in properties on which oil and gas wells are located, both producing and in progress. Such property interests are often subject to landowner royalties, overriding royalties and other oil and gas leasehold interests. MD and the Partnership are joint owners of undivided working interests in these properties.

Fractional working interests in developmental oil and gas prospects located primarily in the Anadarko Basin of Western Oklahoma, the Texas Panhandle and Southwest Kansas and the Permian Basin of Southeastern New Mexico and West Texas were acquired by the Registrant, resulting in the Registrant’s participation in the drilling of oil and gas wells. As of December 31, 2009, the Registrant had seven wells producing, five wells in drilling operations and one well that was plugged and abandoned for a total of thirteen wells in which the Partnership owns an interest.

The following table summarizes the Registrant’s drilling activity for the period beginning February 26, 2009 (date of inception) through December 31, 2009:

| | | | |

| | | Gross | | Net |

Development Wells | | | | |

Oil and natural gas wells | | 7 | | 1.395 |

Non-productive wells | | 1 | | 0.314 |

Reserves Estimate

The reserves estimate has been prepared by MOC’s Petroleum Engineering Department. MOC’s Manager of Economics and Evaluations, Bryan Montgomery, is the technical person primarily responsible for overseeing the preparation of the company’s reserve estimates. His qualifications include the following:

| | • | | Twenty-six years of practical experience in petroleum engineering with twenty-four years of this experience being in the estimation and evaluation of reserves; |

| | • | | Certified professional engineer in the State of Texas; |

| | • | | Bachelor of Science Degree in Petroleum Engineering and Master of Business Administration degree; and |

| | • | | Member in good standing of the Society of Petroleum Engineers |

Internal Controls over Reserves Estimate

MOC maintains internal controls such as the following to ensure the reliability of reserves estimation:

| | • | | No employee’s compensation is tied to the amount of reserves booked; |

| | • | | Comprehensive SEC-compliant internal policies to determine and report proved reserves are followed. Reserve estimates are made by experienced reservoir engineers; |

13

| | • | | Senior reservoir engineers review all the company’s reported proved reserves at the close of each quarter; and |

| | • | | Each quarter, the Manager of Economics and Evaluations, the Vice-President of Exploration and the Chief Operating Officer review all significant reserve changes and all new proved undeveloped reserves additions. |

| Item 4. | Security Ownership of Certain Beneficial Owners and Management |

Beneficial Owners of More than Five Percent

| | | | | | |

Title of Class | | Name of Beneficial

Owner | | Amount and Nature

of Beneficial Owner | | Percent of Class |

None | | None | | N/A | | N/A |

Security Ownership of Management

The Registrant does not have any officers or directors. The Managing Partner, MD, has the exclusive right and full authority to manage, control and administer the Registrant’s business. No officers or directors of the Managing Partner beneficially own any partnership interests of the Registrant.

Changes in Control

Under the Partnership Agreement, limited and general partners holding a majority of the outstanding limited and general partnership interests have the right to take certain actions, including the removal of the managing general partner. The Registrant is not aware of any current arrangement or activity that may lead to such removal.

| Item 5. | Directors and Executive Officers. |

As discussed in “Item 1—Business” above, the Registrant does not have any employees, officers or directors of its own. Under the Partnership Agreement, the Registrant’s managing general partner, MD, is granted the exclusive right and full authority to manage, control and administer the Registrant’s business. MD is a wholly-owned subsidiary of Mewbourne Holdings, Inc. It is not anticipated that the executive officers of MD will spend a significant amount of time on the Partnership’s affairs. J. Roe Buckley, Executive Vice President and Chief Financial Officer of MD, will spend some time managing the financial affairs of the Partnership, including working to ensure that the Partnership complies with applicable reporting requirements. Mr. Buckley performs the same functions for the other partnerships managed and administered by MD and MOC. The other executive officers may from time to time tend to the affairs of the Partnership but will focus the majority of their time on the overall affairs of MD and MOC, which include overseeing the Partnership’s participation in drilling activities.

Set forth below are the names, ages and positions of the directors and executive officers of MD, the Registrant’s managing general partner. Directors of MD are elected to serve until the next annual meeting of stockholders or until their successors are elected and qualified, and officers serve at the discretion of the Board of Directors.

14

| | | | |

Name | | Age as of

December 31,

2009 | | Position |

Curtis W. Mewbourne | | 74 | | President and Director |

J. Roe Buckley | | 47 | | Vice President and Chief Financial Officer |

Alan Clark | | 57 | | Treasurer and Controller |

Michael F. Shepard | | 63 | | Secretary and General Counsel |

Dorothy M. Cuenod | | 49 | | Assistant Secretary and Director |

Ruth M. Buckley | | 48 | | Assistant Secretary and Director |

Julie M. Greene | | 46 | | Assistant Secretary and Director |

Curtis W. Mewbourne, age 74, formed Mewbourne Holdings, Inc. in 1965 and serves as Chairman of the Board and President of Mewbourne Holdings, Inc., MD and MOC. He has operated as an independent oil and gas producer for the past 45 years. Mr. Mewbourne received a Bachelor of Science Degree in Petroleum Engineering from the University of Oklahoma in 1957. Mr. Mewbourne is the father of Dorothy M. Cuenod, Ruth M. Buckley and Julie M. Greene and the father-in-law of J. Roe Buckley.

J. Roe Buckley, age 47, joined Mewbourne Holdings, Inc. in July, 1990 and serves as Vice President and Chief Financial Officer of both MD and MOC. Mr. Buckley was employed by Mbank Dallas from 1985 to 1990 where he served as a commercial loan officer. He received a Bachelor of Arts in Economics from Sewanee in 1984. Mr. Buckley is the son-in-law of Curtis W. Mewbourne and is married to Ruth M. Buckley. He is also the brother-in-law of Dorothy M. Cuenod and Julie M. Greene.

Alan Clark, age 57, joined MOC in 1979 and serves as Treasurer and Controller of both MD and MOC. Prior to joining MOC, Mr. Clark was employed by Texas Oil and Gas Corporation as Assistant Supervisor of joint interest accounting from 1976 to 1979. Mr. Clark has served in several accounting/finance positions with MOC prior to his current assignment. Mr. Clark received a Bachelor of Business Administration from the University of Texas at Arlington.

Michael F. Shepard, age 63, joined MOC in 1986 and serves as Secretary and General Counsel of MD. He has practiced law exclusively in the oil and gas industry since 1979 and formerly was counsel with Parker Drilling Company and its Perry Gas subsidiary for seven years. Mr. Shepard holds the Juris Doctor degree from the University of Tulsa where he received the National Energy Law and Policy Institute award as the outstanding graduate in the Energy Law curriculum. He received a B.A. degree, magna cum laude, from the University of Massachusetts in 1976. Mr. Shepard is a member of the bar in Texas and Oklahoma.

Dorothy M. Cuenod, age 49, received a B.A. degree in Art History from The University of Texas and a Masters of Business Administration Degree from Southern Methodist University. Since 1984 she has served as a Director and Assistant Secretary of both MD and MOC. Ms. Cuenod is the daughter of Curtis W. Mewbourne and is the sister of Ruth M. Buckley and Julie M. Greene. She is also the sister-in-law of J. Roe Buckley.

Ruth M. Buckley, age 48, received a Bachelor of Science Degree in both Engineering and Geology from Vanderbilt University. Since 1987 she has served as a Director and Assistant Secretary of both MD and MOC. Ms. Buckley is the daughter of Curtis W. Mewbourne and is the sister of Dorothy M. Cuenod and Julie M. Greene. She is also the wife of J. Roe Buckley.

Julie M. Greene, age 46, received a B.A. degree in Business Administration from The University of Oklahoma. Since 1988 she has served as a Director and Assistant Secretary of both MD and MOC. Prior to that time she was employed by Rauscher, Pierce, Refsnes, Inc. Ms. Greene is the daughter of Curtis W. Mewbourne and is the sister of Dorothy M. Cuenod and Ruth M. Buckley. She is also the sister-in-law of J. Roe Buckley.

15

| Item 6. | Executive Compensation. |

The Registrant does not have any officers or directors. Management of the Registrant is vested in the Managing Partner. None of the officers or directors of MD or MOC receive remuneration directly from the Registrant but continue to be compensated by their present employers. The Registrant reimburses MD and MOC and affiliates thereof for certain costs of overhead falling within the definition of Administrative Costs (as provided in the Drilling Program Agreement and the Partnership Agreement), including, without limitation, salaries of the officers and employees of MD and MOC; provided that no portion of the salaries of the directors or of the executive officers of MOC or MD may be reimbursed as Administrative Costs.

| Item 7. | Certain Relationships and Related Transactions, and Director Independence. |

Pursuant to the Partnership Agreement and the Drilling Program Agreement, the Registrant had the following related party transactions with MD and its affiliates during the year ended December 31, 2009:

| | | |

Administrative and general expense, management fees (if applicable) and payment of well charges and supervision charges in accordance with standard industry operating agreements | | $ | 188,515 |

The Registrant participates in oil and gas activities through the Program. Pursuant to the Program, MD pays approximately 25% of the Program’s operating costs. The Registrant believes that these transactions were on terms no less favorable than could have been obtained from non-affiliated third parties.

Administrative Costs. MD, as the managing partner of the Partnership, and MOC, as the program manager of the Program, will be entitled to reimbursement of administrative costs incurred by them in connection with managing and conducting the affairs relating to the Partnership’s interest in the Program or of the Partnership, as applicable. The amount of administrative costs that are reimbursed by the Partnership shall be allocated to the Partnership and the Program on a basis consistent with applicable industry standards and must be supported in writing as to the application of such costs and as to the amount charged. Regardless of the actual amount of administrative costs incurred by the Managing Partner or the Program Manager in connection with the affairs of the Partnership, during any particular calendar year the total amount of administrative costs allocable to the Partnership shall not exceed the greater of: (a) 3.5% of the Partnership’s gross revenues from the sale of oil and natural gas production during such year, calculated without any deduction for operating costs or other costs and expenses, or (b) the sum of $50,000 plus 0.25% of the subscriptions by investor partners to the Partnership. Such limitation on administrative costs shall not, however, be applicable to administrative costs otherwise allocable to the Partnership that are extraordinary and non-recurring or to the fixed overhead fee chargeable by an operator of oil and gas wells, including the fixed overhead fee chargeable under an operating agreement by MOC with respect to the oil and gas wells operated by MOC.

Administrative costs incurred by the Managing Partner and the Program Manager for managing and conducting the business and affairs of the Partnership and the Program will be allocated 75% to the investor partners and 25% to the Managing Partner. Administrative costs will not include any portion of the salaries, benefits, compensation or remuneration of directors, executive officers, those holding 5% or more of the equity interests in the Managing Partner or a person having power to direct or cause the direction of the Managing Partner, whether through the ownership of voting securities, by contract or otherwise.

Reporting and Legal Expenses.MD, as the managing partner of the Partnership, and MOC, as the program manager of the Program, will be entitled to reimbursement of reporting and legal expenses incurred by them in connection with managing and conducting the affairs relating to the Partnership’s interest in the Program or of the Partnership, as applicable. Reporting and legal expenses will be allocated 75% to the investor partners in the Partnership and 25% to the Managing Partner.

Management Fee. In consideration for services to be rendered by the Managing Partner in managing the business of the Partnership, each program during each of the initial three years of the Partnership will pay to the Managing Partner a management fee in an amount equal to 1% of the subscriptions by the investor partners to the Partnership. The management fee will be allocated 75% to the investor partners in the Partnership and 25% to the

16

Managing Partner. The portion of the management fee allocated to the investor partners payable during a particular partnership year will not be deducted from the capital contributions of the investor partners but will be paid by the Program in monthly or other periodic installments from funds that would otherwise be available for distribution to the partners in the Partnership during such partnership year and in such amounts as may be determined in the discretion of the Managing Partner. To the extent that the Partnership has insufficient distributable funds during a particular partnership year to fully pay its share of the amount of the management fee payable during the partnership year, then the amount of such unpaid management fee will be carried forward and payable in the next succeeding partnership year.

Gas Marketing Services Fee. In consideration for gas marketing services to be rendered by the Program Manager in connection with the marketing of natural gas from the Program’s interests, the Program will pay to the Program Manager a gas marketing fee that is currently equal to four cents per MCF that is marketed by the Program Manager on the spot gas market. The gas marketing fee may be changed from time to time, but the Program Manager may not charge the Partnership a gas marketing fee that is greater than other participants in a well. The gas marketing fee will be allocated 75% to the investor partners and 25% to the Managing Partner.

For additional information on these related party transactions, please see “Item 2. Financial Information—Management’s Discussion and Analysis of Financial Condition and Results of Operations—Organization and Related Party Transactions,” which is incorporated herein by reference.

As discussed above, the Registrant does not have any directors.

| Item 8. | Legal Proceedings. |

The Registrant is not aware of any pending legal proceedings to which it is a party.

| Item 9. | Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters. |

At December 31, 2009, the Registrant had 13,242 outstanding limited and general partnership interests held of record by 1,754 subscribers, 1,655 of which subscribed to general partner interests and 99 of which subscribed to limited partner interests. None of the partnership interests may be sold pursuant to Rule 144 under the Securities Act. There is no established public or organized trading market for the limited and general partner interests.

Approximately $11.6 million of the initial partners’ capital of $66,210,000 was used for drilling and completion and prepaid well costs, and $5,627,850 was utilized for sales commissions and marketing fees for the period from February 26, 2009 (date of inception) through December 31, 2009. Capital requirements in the future are expected to be paid with remaining cash on hand. Management of MD believes that funds are sufficient to complete the wells for which funds have been committed. Specifically, it is anticipated that the Partnership will have begun drilling the majority of its wells by September 30, 2010 with substantially all activity completed by the end of the fourth quarter of 2010.

Revenues that, in the sole judgment of the Managing Partner, are not required to meet the Registrant’s obligations will be distributed to the partners at least quarterly in accordance with the Registrant’s Partnership Agreement. The Partnership made no cash distributions to the investor partners for the period beginning February 26, 2009 (date of inception) through December 31, 2009. The Partnership expects that cash distributions will begin and continue during 2010 due to additional oil and gas revenues that are expected to be sufficient to produce cash flows from operations.

| Item 10. | Recent Sales of Unregistered Securities. |

The partnership interests in the Registrant were offered at $5,000 each to accredited investors in a private placement pursuant to Section 4(2) of the Securities Act and Regulation D promulgated thereunder, with a maximum offering amount of $73,000,000 (14,600 interests). Mewbourne Securities, Inc., an affiliate of MD (“MS”), served as the dealer manager for the private placement.

17

On August 28, 2009, the offering of limited and general partnership interests in the Registrant was closed, with interests aggregating $66,210,000 originally being sold to accredited investors of which $62,140,000 were sold to accredited investors as general partner interests and $4,070,000 were sold to accredited investors as limited partner interests. An amount equal to 8.5% of the proceeds realized from the sale of interests to investors was not received by the Registrant and was deducted to pay sales commissions and marketing fees to MS. The remainder of the proceeds has been or will be used for drilling and completion and prepaid well costs.

| Item 11. | Description of the Registrant’s Securities to be Registered. |

The following is a summary of the provisions of the Partnership Agreement and the Drilling Program Agreement. This summary is qualified in all respects by reference to the full text of the Partnership Agreement, which appears as Exhibit 4.1 hereto, and the Drilling Program Agreement, which appears as Exhibit 10.1 hereto.

Partnership Agreement

Term

The Partnership is organized under the Delaware Revised Uniform Limited Partnership Act (the “Delaware Limited Partnership Act”). The Partnership will continue until terminated as provided for in the Partnership Agreement. See “—Dissolution, Liquidation and Termination” below.

Rights and Powers of Partners

General and Limited Partners. Under the terms of the Partnership Agreement, general and limited partners will have the following rights and powers with respect to the Partnership:

| | (a) | to share all charges, credits and distributions in accordance with the Partnership Agreement and to share all charges, credits and distributions of the Program through the Partnership, |

| | (b) | to inspect at their expense books and records relating to the activities of the Partnership through the Program, upon adequate notice and at all reasonable times, other than geophysical, geological and other similar data and information and studies, maps, evaluations and reports derived therefrom that for a reasonable period of time may be kept confidential because the Managing Partner has agreed to keep such matters confidential or has determined in good faith that such matters should be kept confidential considering the interests of the Partnership and each of its partners, |

| | (c) | to have on demand true and full information of all activities of the Partnership, through the Program, and a formal account of affairs whenever circumstances render it just and reasonable, |

| | (d) | to have dissolution and winding up of the Partnership by decree of court as provided under Delaware law, |

| | (e) | to reconstitute the Partnership with a new managing partner upon the withdrawal or retirement of the Managing Partner from the Partnership, directly or as a result of a bankruptcy, dissolution or similar event that would dissolve the Partnership, which causes the dissolution of the Partnership upon the election of a majority in interest of the general and limited partners, |

| | (f) | to terminate any contract between the Partnership and the Managing Partner or any affiliate of the Managing Partner by a vote or written consent of a majority in interest of the general and limited partners, without penalty upon 60 days’ written notice, |

18

| | (g) | to approve the sale of all or substantially all of the assets of the Partnership, except upon liquidation of the Partnership, by the affirmative vote of a majority in interest of the general and limited partners, except in connection with a roll-up transaction that requires the affirmative vote of at least 66% in interest of the general and limited partners, |

| | (h) | to dissolve the Partnership at any time upon the election of a majority in interest of the general and limited partners, |

| | (i) | to permit the assignment by the Partnership or the Managing Partner of their obligations under the Drilling Program Agreement, if such permission is required under the Drilling Program Agreement, by the affirmative vote of a majority in interest of the general and limited partners, |

| | (j) | to agree to the termination or amendment, except for certain conformatory amendments and amendments necessary to conform to the Internal Revenue Code of 1986, as amended (the “Code”), or that do not adversely affect the general and limited partners, of the Drilling Program Agreement or the waiver of any rights of the Partnership under the Drilling Program Agreement by the affirmative vote of a majority in interest of the general and limited partners, |

| | (k) | to remove the Managing Partner and substitute a new managing partner to operate and carry on the business of the Partnership or to remove the Program Manager and substitute a successor to act in such capacity by the affirmative vote of a majority in interest of the general and limited partners, and |

| | (l) | to propose and vote on certain matters affecting the Partnership, as provided in the Partnership Agreement. |

Limited Partners. Limited partners of the Partnership will take no part in the control of the business or affairs of the Partnership or the Program and will have no voice in the management or operations of the Partnership or Program. This lack of management and control is necessary to insulate the limited partners from liability in excess of their investment in the Partnership and their share of undistributed profits from the Partnership. Notwithstanding the foregoing, limited partners shall:

| | • | | have all of the rights described under the caption “General and Limited Partners” above, and |

| | • | | have their liability for operations of the Partnership and the Program limited to the amount of their capital contributions and to their shares of Partnership capital and undistributed net revenues of the Partnership, if any; provided, however, that under Delaware law the limited partners may under certain circumstances be required to repay the Partnership amounts previously distributed to them by the Partnership if the Partnership does not have sufficient other assets to satisfy the claims of creditors. |

General Partners. The general partners will delegate to the Managing Partner the responsibility for the day-to-day operations of the Partnership. In addition, the general partners will covenant not to exercise the following rights granted to them under Delaware law:

| | • | | the right to withdraw from the Partnership, |

| | • | | the right to act as agent of the Partnership or to execute documents on behalf of the Partnership, and |

| | • | | the right to act, other than together with other general partners constituting a majority in interest of the general and limited partners, to cause the Managing Partner on behalf of the Partnership to convey Partnership property or take any other action binding on the Partnership. |

19

A general partner who violates such covenants is obligated to indemnify the Partnership and the other partners for any loss or liability caused by such violation. Furthermore, in the event of a dissolution caused by a withdrawing general partner, upon reconstitution of the Partnership, the withdrawing general partner shall remain subject as a general partner to any liabilities or obligations of the Partnership arising prior to such withdrawal. Upon withdrawal from the Partnership, a general partner is entitled to continue to receive any distributions to which he is otherwise entitled under the Partnership Agreement for the period prior to his withdrawal; however, such general partner shall not be entitled to receive the fair value of his interest in the Partnership as of the date of such withdrawal based upon his right to share in distributions from the Partnership, and neither the Partnership nor the Managing Partner has any obligation to repurchase any interest in the Partnership from the withdrawing general partner. The withdrawing general partner will no longer be entitled to receive any distributions nor shall such general partner have any rights as an investor partner under the Partnership Agreement. The sharing ratios will be recalculated among the general and limited partners without regard to the withdrawing general partner’s capital contribution. See “—Reconstitution of the Partnership” below.

The Managing Partner. The Managing Partner has full and exclusive power, except as limited by the Partnership Agreement and applicable law, to manage, control, administer and operate the properties, business and affairs of the Partnership. The Managing Partner has the authority to enter into the Drilling Program Agreement on behalf of the Partnership.

Under the Partnership Agreement, the Managing Partner is required to devote only such time and effort to the business of the Partnership as may be necessary to promote adequately the interests of the Partnership and the mutual interests of the partners. The Managing Partner is permitted to engage in any other business ventures, including the ownership and management of oil and gas properties and the organization and management of other drilling programs.

Fiduciary Responsibility of the Managing Partner

The contemplated activities of the Partnership will involve decisions by the Managing Partner, on behalf of the Partnership, and the Program Manager, on behalf of the Program, and transactions between the Partnership, the Program, the Managing Partner or affiliates thereof. Because of the common control of the Partnership, the Program, the Managing Partner, the Program Manager and other affiliates thereof, any such decisions or transactions will lack the benefits of arm’s-length bargaining and will necessarily involve conflicts of interest. The Managing Partner is accountable to the Partnership as a fiduciary and is required to act in good faith in the best interests of the Partnership at all times. The Managing Partner will attempt, in good faith, to resolve all conflicts of interest in a fair and equitable manner with respect to all persons affected by those conflicts of interest. Nevertheless, the actions of the Managing Partner may not be the most advantageous to the Partnership and could fall short of the full exercise of such fiduciary duty. No provision has been made for an independent review of conflicts of interest.

The Partnership is organized under Delaware law, and under Delaware law the general partner of a partnership owes a fiduciary duty to the partnership and to its partners. Under Delaware law, the Managing Partner will owe the general and limited partners a duty of good faith, fairness and loyalty. In this regard, the Managing Partner is required to supervise and direct the activities of the Partnership prudently and with that degree of care, including acting on an informed basis, that an ordinarily prudent person in a like position would use under similar circumstances. Moreover, the Managing Partner must act at all times in the best interests of the Partnership and the general and limited partners. The Managing Partner and its affiliates may never profit by causing the Partnership to engage in drilling in contravention of these duties.

In an effort to give the Managing Partner maximum flexibility with respect to its management of the Partnership and other partnerships, the Partnership Agreement contains provisions that modify what would otherwise be the applicable Delaware law relating to the fiduciary standards of the Managing Partner to the general and limited partners. The fiduciary standards in the Partnership Agreement could be less advantageous to the general and limited partners and more advantageous to the Managing Partner than the corresponding fiduciary standards otherwise applicable under Delaware law, specifically:

| | • | | the Partnership may indemnify and hold harmless the Managing Partner and its affiliates, |

20

| | • | | the Managing Partner is required to devote only so much of its time as is necessary to manage the affairs of the Partnership, |

| | • | | the Managing Partner and its affiliates may conduct business with the Partnership in a capacity other than as a sponsor, |

| | • | | the Managing Partner and any of its affiliates may pursue business opportunities that are consistent with the Partnership’s investment objectives for their own account, and |

| | • | | the Managing Partner may manage multiple programs simultaneously. |

As a result of these provisions in the Partnership Agreement, the general and limited partners may find it more difficult to hold the Managing Partner responsible for acting in the best interests of the Partnership and its general and limited partners than if the fiduciary standards of the otherwise applicable Delaware law governed the situation.

In addition, the Partnership Agreement contains provisions that are intended to limit the liability of the Managing Partner or any affiliate of the Managing Partner for any act or omission within the scope of authority conferred upon them under the Partnership Agreement or Drilling Program Agreement if the Managing Partner has determined in good faith, as of the time of the conduct or omission, that such conduct or omission was in the best interest of the Partnership and that it did not constitute negligence or misconduct. Further, as discussed in greater detail below under “Item 12. Indemnification of Directors and Officers,” the Partnership Agreement provides for indemnification of the Managing Partner and its affiliates against claims arising from conduct or omission on behalf of the Partnership. Such indemnification will be available if the Managing Partner determines in good faith, as of the time of the conduct or omission, that such conduct or omission was in the best interests of the Partnership and that it did not constitute negligence or misconduct. The Managing Partner would be subject to a conflict of interest in making any determination as to limitations of its liability and as to whether it and its affiliates should be indemnified, and the general and limited partners must rely upon the integrity of the Managing Partner in making such determinations.