UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-22294

Western Asset Investment Grade Defined Opportunity Trust Inc.

Exact name of registrant as specified in charter)

620 Eighth Avenue, 49th Floor, New York, NY 10018

(Address of principal executive offices) (Zip code)

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: (888)777-0102

Date of fiscal year end: November 30

Date of reporting period: November 30, 2019

| ITEM 1. | REPORT TO STOCKHOLDERS. |

TheAnnual Report to Stockholders is filed herewith.

| | |

| Annual Report | | November 30, 2019 |

WESTERN ASSET

INVESTMENT GRADE

DEFINED OPPORTUNITY

TRUST INC. (IGI)

Beginning in January 2021, as permitted by regulations adopted by the Securities and Exchange Commission, the Fund intends to no longer mail paper copies of the Fund’s shareholder reports like this one, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary (such as a broker-dealer or bank). Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you invest through a financial intermediary and you already elected to receive shareholder reports electronically(“e-delivery”), you will not be affected by this change and you need not take any action. If you have not already electede-delivery, you may elect to receive shareholder reports and other communications from the Fund electronically by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. That election will apply to all Legg Mason Funds held in your account at that financial intermediary. If you are a direct shareholder with the Fund, you can call the Fund at1-888-888-0151, or write to the Fund by regular mail at P.O. Box 505000, Louisville, KY 40233 or by overnight delivery to Computershare, 462 South 4th Street, Suite 1600, Louisville, KY 40202 to let the Fund know you wish to continue receiving paper copies of your shareholder reports. That election will apply to all Legg Mason Funds held in your account held directly with the fund complex.

|

| INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

Fund objectives

The Fund’s primary investment objective is to provide current income and then to liquidate and distribute substantially all of the Fund’s net assets to stockholders on or about December 2, 2024. As a secondary investment objective, the Fund will seek capital appreciation. There can be no assurance the Fund will achieve its investment objectives.

The Fund seeks to achieve its investment objectives by investing, under normal market conditions, at least 80% of its net assets in investment grade corporate fixed-income securities of varying maturities.

| | |

II | | Western Asset Investment Grade Defined Opportunity Trust Inc. |

Letter from the chairman

Dear Shareholder,

We are pleased to provide the annual report of Western Asset Investment Grade Defined Opportunity Trust Inc. for the twelve-month reporting period ended November 30, 2019. Please read on for a detailed look at prevailing economic and market conditions during the Fund’s reporting period and to learn how those conditions have affected Fund performance.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.lmcef.com. Here you can gain immediate access to market and investment information, including:

| • | | Fund prices and performance, |

| • | | Market insights and commentaries from our portfolio managers, and |

| • | | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

Jane Trust, CFA

Chairman, President and Chief Executive Officer

December 31, 2019

| | |

Western Asset Investment Grade Defined Opportunity Trust Inc. | | III |

(This page intentionally left blank.)

Fund overview

Q. What is the Fund’s investment strategy?

A.The Fund’s primary investment objective is to provide current income and then to liquidate and distribute substantially all of the Fund’s net assets to stockholders on or about December 2, 2024. As a secondary investment objective, the Fund will seek capital appreciation. There can be no assurance the Fund will achieve its investment objectives.

The Fund seeks to achieve its investment objectives by investing, under normal market conditions, at least 80% of its net assets in investment grade corporate fixed income securities of varying maturities. The Fund may invest up to 20% of its net assets in corporate fixed-income securities of below investment grade quality (commonly known as “high yield” or “junk” bonds) at the time of investment and other securities, including obligations of the U.S. government, its agencies or instrumentalities, common stocks, warrants and depositary receipts. While the Fund may invest up to 20% of its net assets in below investment grade securities, the Fund will, under normal market conditions, maintain a portfolio with an overall dollar-weighted average of investment grade credit quality. The Fund may invest up to 20% of its net assets in securities of foreign issuers located anywhere in the world, including issuers located in emerging market countries. Additionally, the Fund may invest up to 20% of its net assets innon-U.S. dollar denominated securities.

The Fund may invest in derivative instruments, such as options contracts, futures contracts, options on futures contracts, indexed securities, credit default swaps and other swap agreements, provided that the Fund’s exposure to derivative instruments, as measured by the total notional amount of all such instruments, will not exceed 20% of its net assets.

In purchasing securities and other investments for the Fund, we may take full advantage of the entire range of maturities and durationsi offered by corporate fixed income securities and may adjust the average maturity or duration of the Fund’s portfolio from time to time, depending on our assessment of the relative yields available on securities of different maturities and durations and our expectations of future changes in interest rates.

The Fund may take on leveraging risk by utilizing certain management techniques, whereby it will segregate liquid assets, enter into offsetting transactions or own positions covering its obligations. To the extent the Fund covers its commitment under such a portfolio management technique, such instrument will not be considered a senior security for the purposes of the Investment Company Act of 1940. However, as a fundamental policy, the Fund will not leverage its capital structure by issuing senior securities such as preferred shares or debt instruments.

At Western Asset Management Company, LLC (“Western Asset”), the Fund’s subadviser, we utilize a fixed income team approach, with decisions derived from interaction among various investment management sector specialists. The sector teams are comprised of Western Asset’s senior portfolio management personnel, research analysts and anin-house economist. Under this team approach, management of client fixed income portfolios will reflect a consensus of interdisciplinary views within the Western Asset organization. The individuals responsible for development of investment strategy,day-to-day portfolio management, oversight and coordination of the Fund are S. Kenneth Leech, Michael C. Buchanan and Ryan K. Brist.

| | |

| Western Asset Investment Grade Defined Opportunity Trust Inc. 2019 Annual Report | | 1 |

Fund overview (cont’d)

Q. What were the overall market conditions during the Fund’s reporting period?

A.Fixed income markets generally posted strong results over the twelve-month reporting period ended November 30, 2019. Spread sectors(non-Treasuries) outperformed but also experienced periods of volatility as they were impacted by a number of factors, including moderating global growth, monetary policy tightening and then a “dovish pivot” by the Federal Reserve Board (the “Fed”)ii, the ongoing trade war between the U.S. and China, uncertainties surrounding Brexit and numerous other geopolitical issues.

Both short- and long-term U.S. Treasury yields declined during the reporting period. The yield for thetwo-year Treasury note began the reporting period at 2.80% (the peak for the reporting period) and ended the period at 1.61%. The low for the reporting period was 1.39% on October 3, 2019. The yield for theten-year Treasury began the reporting period at 3.01% (the peak for the reporting period) and ended the period at 1.78%. The low for the reporting period was 1.47% on August 28, September 3 and September 4, 2019.

All told, the Bloomberg Barclays U.S. Aggregate Indexiii returned 10.79% for the twelve months ended November 30, 2019. Comparatively, the Bloomberg Barclays U.S. Credit Indexiv returned 15.18% over the same period and the Bloomberg Barclays U.S. Corporate High Yield — 2% Issuer Cap Indexv returned 9.68%.

Q. How did we respond to these changing market conditions?

A.From a sector perspective, we increased the Fund’s allocations to Financials (Banking and Brokerage) and ConsumerNon-Cyclicals1 (Health Care and Tobacco), while reducing its exposure to Communications2 (Cable-Satellite and Wirelines). From a quality standpoint, we reduced the Fund’s allocation to high-yield corporate bonds, largelyB-rated securities. Meanwhile, we increased the Fund’s exposure to investment-grade corporate bonds, mainlyA-rated securities. Elsewhere, we pared the Fund’s modest long duration positioning and ended the reporting period slightly shorter than that of the benchmark. Finally, we adjusted the Fund’s yield curvevi positioning. In particular, we rotated some exposure from the long end of the yield curve to the belly, or intermediate portion, of the yield curve.

During the reporting period, we employed U.S. Treasury futures to manage the Fund’s duration and yield curve positioning. Treasury futures modestly detracted from results.

| 1 | ConsumerNon-Cyclicals consists of the following industries: Consumer Products, Food/Beverage, Health Care, Pharmaceuticals, Supermarkets and Tobacco. |

| 2 | Communications consists of the following industries: Media — Cable, Media —Non-Cable and Telecommunications. |

| | |

2 | | Western Asset Investment Grade Defined Opportunity Trust Inc. 2019 Annual Report |

Performance review

For the twelve months ended November 30, 2019, Western Asset Investment Grade Defined Opportunity Trust Inc. returned 15.59% based on its net asset value (“NAV”)vii and 23.70% based on its New York Stock Exchange (“NYSE”) market price per share. The Fund’s unmanaged benchmark, the Bloomberg Barclays U.S. Credit Index, returned 15.18% for the same period. The Lipper Corporate DebtBBB-RatedClosed-End Funds Category Averageviii returned 13.43% over the same time frame. Please note that Lipper performance returns are based on each fund’s NAV.

During the twelve-month period, the Fund made distributions to shareholders totaling $1.02 per share.* The performance table shows the Fund’s twelve-month total return based on its NAV and market price as of November 30, 2019.Past performance is no guarantee of future results.

| | | | |

| Performance Snapshotas of November 30, 2019 | |

| Price Per Share | | 12-Month

Total Return** | |

| $21.12 (NAV) | | | 15.59 | %† |

| $21.24 (Market Price) | | | 23.70 | %‡ |

All figures represent past performance and are not a guarantee of future results.

** Total returns are based on changes in NAV or market price, respectively. Returns reflect the deduction of all Fund expenses, including management fees, operating expenses, and other Fund expenses. Returns do not reflect the deduction of brokerage commissions or taxes that investors may pay on distributions or the sale of shares.

† Total return assumes the reinvestment of all distributions at NAV.

‡ Total return assumes the reinvestment of all distributions in additional shares in accordance with the Fund’s Dividend Reinvestment Plan.

Q. What were the leading contributors to performance?

A.The largest contributor to the Fund’s relative performance during the reporting period was security selection. The Fund’s holdings in the banking industry were the most beneficial, with overweight positions in UniCredit and Intesa Sanpaolo S.p.A. adding the most value. UniCredit is an Italian global banking and financial services firm. The company reported strong third quarter 2019 results that exceeded expectations. More specifically, UniCredit’s underlying net profits were up quarter-over-quarter and year-over-year, driven by solid core revenues and positive developments in trading income. Intesa Sanpaolo S.p.A. is also an Italian banking group. The company reported results that beat consensus estimates, including its highest net income since 2008. This was driven by resilient core revenues (net fees, insurance and trading) and lower than expected impairment charges. Elsewhere, in the Industrials sector, General Electric (“GE”) contributed to returns. Our positive thesis for GE has been based on its good assets, a strong new Chief Executive Officer and a revamped Board of Directors. We continue to believe that GE is an asset-rich firm with good core businesses. In our view, GE can benefit from its scale, diversification and a bondholder-friendlyde-risking strategy to improve its cash flows, cut costs, sellnon-core assets and reduce leverage.

| * | For the tax character of distributions paid during the fiscal year ended November 30, 2019, please refer to page 41 of this report. |

| | |

| Western Asset Investment Grade Defined Opportunity Trust Inc. 2019 Annual Report | | 3 |

Fund overview (cont’d)

The Fund’s rating biases were also rewarded. In particular, a large overweight to securities rated BBB contributed to results as they outperformed higher quality investment-grade credit. Finally, from a sector allocation perspective, overweights to the outperforming Financials (specifically Banking, Finance and Insurance) and the Communication Services sectors were beneficial. An underweight to the underperforming transportation sector was also positive for results.

Q. What were the leading detractors from performance?

A.While the Fund outperformed its benchmark, the largest detractor from its relative results during the reporting period was its positioning in several sectors. More specifically, overweights to underperforming emerging market sovereigns and the Energy sector negatively impact returns.

An overweight to Argentina was a headwind for results largely due to the country’s external financing needs and heightened political uncertainty. In particular, an unexpectedly large margin of victory for the opposition party in Argentina’s presidential primaries caused debt domiciled in the country to decline considerably in August 2019. Given current valuations and International Monetary Fund (“IMF”)ix involvement, we are maintaining our positions.

Finally, an opportunistic allocation to high-yield corporate bonds was not rewarded, as they underperformed investment-grade corporate bonds during the reporting period.

Looking for additional information?

The Fund is traded under the symbol “IGI” and its closing market price is available in most newspapers under the NYSE listings. The daily NAV is availableon-line under the symbol “XIGIX” on most financial websites.Barron’sand theWall Street Journal’sMonday edition both carryclosed-end fund tables that provide additional information. In addition, the Fund issues a quarterly press release that can be found on most major financial websites as well as www.lmcef.com (click on the name of the Fund).

In a continuing effort to provide information concerning the Fund, shareholders may call1-888-777-0102 (toll free), Monday through Friday from 8:00 a.m. to 5:30 p.m. Eastern Time, for the Fund’s current NAV, market price and other information.

Thank you for your investment in Western Asset Investment Grade Defined Opportunity Trust Inc. As always, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals.

Sincerely,

Western Asset Management Company, LLC

December 20, 2019

| | |

4 | | Western Asset Investment Grade Defined Opportunity Trust Inc. 2019 Annual Report |

RISKS: The Fund is anon-diversified, limited term,closed-end management investment company designed primarily as a long-term investment and not as a trading vehicle. The Fund is not intended to be a complete investment program and, due to the uncertainty inherent in all investments, there can be no assurance that the Fund will achieve its investment objectives. The Fund’s common stock is traded on the New York Stock Exchange. Similar to stocks, the Fund’s share price will fluctuate with market conditions and, at the time of sale, may be worth more or less than the original investment. Shares ofclosed-end funds often trade at a discount to their net asset value. Because the Fund isnon-diversified, it may be more susceptible to economic, political or regulatory events than a diversified fund. The Fund’s investments are subject to a number of risks, including credit risk, inflation risk and interest rate risk. As interest rates rise, bond prices fall, reducing the value of the Fund’s holdings. The Fund may invest in lower-rated high-yield bonds or “junk bonds”, which are subject to greater liquidity and credit risk (risk of default) than higher- rated obligations. The Fund may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses and have a potentially large impact on Fund performance. The Fund may invest in securities or engage in transactions that have the economic effects of leverage which can increase the risk and volatility of the Fund.

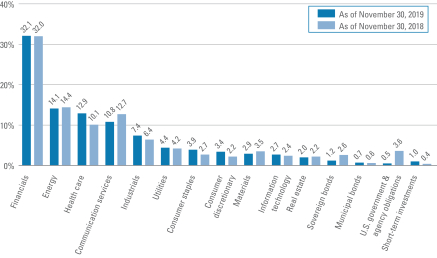

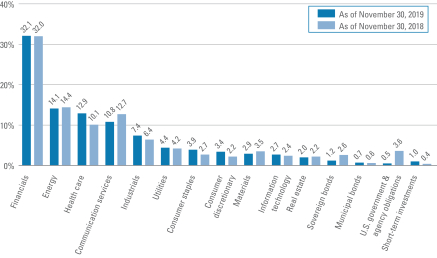

Portfolio holdings and breakdowns are as of November 30, 2019 and are subject to change and may not be representative of the portfolio managers’ current or future investments. Please refer to pages 8 through 24 for a list and percentage breakdown of the Fund’s holdings.

The mention of sector breakdowns is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. The information provided regarding such sectors is not a sufficient basis upon which to make an investment decision. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional. The Fund’s top five sector holdings (as a percentage of net assets) as of November 30, 2019 were: Financials (32.0%), Energy (14.1%), Health Care (12.9%), Communication Services (10.8%) and Industrials (7.4%). The Fund’s portfolio composition is subject to change at any time.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

| | |

| Western Asset Investment Grade Defined Opportunity Trust Inc. 2019 Annual Report | | 5 |

Fund overview (cont’d)

| i | Duration is the measure of the price sensitivity of a fixed income security to an interest rate change of 100 basis points. Calculation is based on the weighted average of the present values for all cash flows. |

| ii | The Federal Reserve Board (the “Fed”) is responsible for the formulation of U.S. policies designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments. |

| iii | The Bloomberg Barclays U.S. Aggregate Index is a broad-based bond index comprised of government, corporate, mortgage- and asset-backed issues, rated investment grade or higher, and having at least one year to maturity. |

| iv | The Bloomberg Barclays U.S. Credit Index is an index composed of corporate andnon-corporate debt issues that are investment grade (rated Baa3/BBB or higher). |

| v | The Bloomberg Barclays U.S. Corporate High Yield — 2% Issuer Cap Index is an index of the 2% Issuer Cap component of the Bloomberg Barclays U.S. Corporate High Yield Index, which covers the U.S. dollar-denominated,non-investment grade, fixed-rate, taxable corporate bond market. |

| vi | The yield curve is the graphical depiction of the relationship between the yield on bonds of the same credit quality but different maturities. |

| vii | Net asset value (“NAV”) is calculated by subtracting total liabilities, including liabilities associated with financial leverage (if any), from the closing value of all securities held by the Fund (plus all other assets) and dividing the result (total net assets) by the total number of the common shares outstanding. The NAV fluctuates with changes in the market prices of securities in which the Fund has invested. However, the price at which an investor may buy or sell shares of the Fund is the Fund’s market price as determined by supply of and demand for the Fund’s shares. |

| viii | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the twelve-month period ended November 30, 2019, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 6 funds in the Fund’s Lipper category. |

| ix | The International Monetary Fund (“IMF”) is an organization of 189 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world. |

| | |

6 | | Western Asset Investment Grade Defined Opportunity Trust Inc. 2019 Annual Report |

Fund at a glance†(unaudited)

Investment breakdown(%) as a percent of total investments

| † | The bar graph above represents the composition of the Fund’s investments as of November 30, 2019 and November 30, 2018 and does not include derivatives, such as futures contracts, forward foreign currency contracts and swap contracts. The Fund is actively managed. As a result, the composition of the Fund’s investments is subject to change at any time. |

| | |

| Western Asset Investment Grade Defined Opportunity Trust Inc. 2019 Annual Report | | 7 |

Schedule of investments

November 30, 2019

Western Asset Investment Grade Defined Opportunity Trust Inc.

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

| Corporate Bonds & Notes — 95.4% | | | | | | | | | | | | | | | | |

| Communication Services — 10.8% | | | | | | | | | | | | | | | | |

Diversified Telecommunication Services — 4.3% | | | | | | | | | | | | | | | | |

AT&T Inc., Senior Notes | | | 4.500 | % | | | 5/15/35 | | | | 370,000 | | | $ | 410,564 | |

AT&T Inc., Senior Notes | | | 4.900 | % | | | 6/15/42 | | | | 250,000 | | | | 282,340 | |

AT&T Inc., Senior Notes | | | 4.800 | % | | | 6/15/44 | | | | 290,000 | | | | 328,089 | |

AT&T Inc., Senior Notes | | | 4.500 | % | | | 3/9/48 | | | | 422,000 | | | | 460,318 | |

AT&T Inc., Senior Notes (3 mo. USD LIBOR + 1.180%) | | | 3.312 | % | | | 6/12/24 | | | | 760,000 | | | | 773,364 | (a) |

British Telecommunications PLC, Senior Notes | | | 9.625 | % | | | 12/15/30 | | | | 1,550,000 | | | | 2,371,241 | |

British Telecommunications PLC, Senior Notes | | | 4.250 | % | | | 11/8/49 | | | | 200,000 | | | | 202,687 | (b) |

Corning Inc., Senior Notes | | | 3.900 | % | | | 11/15/49 | | | | 210,000 | | | | 214,912 | |

Telefonica Emisiones SA, Senior Notes | | | 7.045 | % | | | 6/20/36 | | | | 140,000 | | | | 196,621 | |

Verizon Communications Inc., Senior Notes | | | 5.150 | % | | | 9/15/23 | | | | 2,460,000 | | | | 2,738,518 | |

Verizon Communications Inc., Senior Notes | | | 4.329 | % | | | 9/21/28 | | | | 218,000 | | | | 247,451 | |

Verizon Communications Inc., Senior Notes | | | 5.500 | % | | | 3/16/47 | | | | 1,130,000 | | | | 1,538,027 | |

Total Diversified Telecommunication Services | | | | | | | | | | | | | | | 9,764,132 | |

Media — 5.5% | | | | | | | | | | | | | | | | |

Charter Communications Operating LLC/Charter Communications Operating Capital Corp., Senior Secured Notes | | | 6.384 | % | | | 10/23/35 | | | | 180,000 | | | | 224,892 | |

Charter Communications Operating LLC/Charter Communications Operating Capital Corp., Senior Secured Notes | | | 6.484 | % | | | 10/23/45 | | | | 420,000 | | | | 521,400 | |

Charter Communications Operating LLC/Charter Communications Operating Capital Corp., Senior Secured Notes | | | 5.375 | % | | | 5/1/47 | | | | 560,000 | | | | 624,728 | |

Comcast Corp., Senior Notes | | | 6.400 | % | | | 5/15/38 | | | | 2,500,000 | | | | 3,578,198 | |

Fox Corp., Senior Notes | | | 5.476 | % | | | 1/25/39 | | | | 810,000 | | | | 998,150 | (b) |

Time Warner Cable LLC, Senior Secured Notes | | | 6.550 | % | | | 5/1/37 | | | | 370,000 | | | | 452,735 | |

Time Warner Cable LLC, Senior Secured Notes | | | 7.300 | % | | | 7/1/38 | | | | 330,000 | | | | 423,768 | |

Time Warner Cable LLC, Senior Secured Notes | | | 6.750 | % | | | 6/15/39 | | | | 20,000 | | | | 25,210 | |

Time Warner Cable LLC, Senior Secured Notes | | | 5.500 | % | | | 9/1/41 | | | | 200,000 | | | | 222,894 | |

Time Warner Entertainment Co. LP, Senior Secured Notes | | | 8.375 | % | | | 3/15/23 | | | | 1,170,000 | | | | 1,388,514 | |

Time Warner Entertainment Co. LP, Senior | | | | | | | | | | | | | | | | |

Secured Notes | | | 8.375 | % | | | 7/15/33 | | | | 370,000 | | | | 518,139 | |

Viacom Inc., Senior Notes | | | 5.250 | % | | | 4/1/44 | | | | 80,000 | | | | 91,724 | |

Walt Disney Co., Senior Notes | | | 6.650 | % | | | 11/15/37 | | | | 2,400,000 | | | | 3,566,463 | |

Total Media | | | | | | | | | | | | | | | 12,636,815 | |

See Notes to Financial Statements.

| | |

8 | | Western Asset Investment Grade Defined Opportunity Trust Inc. 2019 Annual Report |

Western Asset Investment Grade Defined Opportunity Trust Inc.

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Wireless Telecommunication Services — 1.0% | | | | | | | | | | | | | | | | |

Sprint Corp., Senior Notes | | | 7.250 | % | | | 9/15/21 | | | | 1,170,000 | | | $ | 1,243,417 | |

Sprint Corp., Senior Notes | | | 7.875 | % | | | 9/15/23 | | | | 120,000 | | | | 132,225 | |

Telefonica Europe BV, Senior Notes | | | 8.250 | % | | | 9/15/30 | | | | 390,000 | | | | 565,632 | |

Vodafone Group PLC, Senior Notes | | | 5.250 | % | | | 5/30/48 | | | | 320,000 | | | | 382,970 | |

Vodafone Group PLC, Senior Notes | | | 4.250 | % | | | 9/17/50 | | | | 20,000 | | | | 20,846 | |

Total Wireless Telecommunication Services | | | | | | | | | | | | | | | 2,345,090 | |

Total Communication Services | | | | | | | | | | | | | | | 24,746,037 | |

| Consumer Discretionary — 3.4% | | | | | | | | | | | | | | | | |

Automobiles — 0.9% | | | | | | | | | | | | | | | | |

Ford Motor Co., Senior Notes | | | 9.215 | % | | | 9/15/21 | | | | 640,000 | | | | 705,000 | |

Ford Motor Credit Co. LLC, Senior Notes | | | 5.113 | % | | | 5/3/29 | | | | 420,000 | | | | 425,427 | |

General Motors Co., Senior Notes | | | 6.600 | % | | | 4/1/36 | | | | 290,000 | | | | 337,626 | |

General Motors Co., Senior Notes | | | 6.750 | % | | | 4/1/46 | | | | 580,000 | | | | 675,814 | |

Total Automobiles | | | | | | | | | | | | | | | 2,143,867 | |

Hotels, Restaurants & Leisure — 1.3% | | | | | | | | | | | | | | | | |

Marriott International Inc., Senior Notes | | | 3.600 | % | | | 4/15/24 | | | | 320,000 | | | | 336,247 | |

McDonald’s Corp., Senior Notes | | | 4.700 | % | | | 12/9/35 | | | | 260,000 | | | | 311,416 | |

McDonald’s Corp., Senior Notes | | | 4.875 | % | | | 12/9/45 | | | | 370,000 | | | | 454,730 | |

Melco Resorts Finance Ltd., Senior Notes | | | 5.375 | % | | | 12/4/29 | | | | 590,000 | | | | 604,060 | (b)(c) |

MGM China Holdings Ltd., Senior Notes | | | 5.875 | % | | | 5/15/26 | | | | 200,000 | | | | 212,875 | (b) |

Sands China Ltd., Senior Notes | | | 5.125 | % | | | 8/8/25 | | | | 690,000 | | | | 759,887 | |

Sands China Ltd., Senior Notes | | | 5.400 | % | | | 8/8/28 | | | | 200,000 | | | | 227,832 | |

Total Hotels, Restaurants & Leisure | | | | | | | | | | | | | | | 2,907,047 | |

Household Durables — 0.3% | | | | | | | | | | | | | | | | |

Lennar Corp., Senior Notes | | | 5.000 | % | | | 6/15/27 | | | | 390,000 | | | | 422,798 | |

MDC Holdings Inc., Senior Notes | | | 6.000 | % | | | 1/15/43 | | | | 250,000 | | | | 254,900 | |

Total Household Durables | | | | | | | | | | | | | | | 677,698 | |

Internet & Direct Marketing Retail — 0.2% | | | | | | | | | | | | | | | | |

Amazon.com Inc., Senior Notes | | | 3.875 | % | | | 8/22/37 | | | | 410,000 | | | | 467,740 | |

Specialty Retail — 0.7% | | | | | | | | | | | | | | | | |

Home Depot Inc., Senior Notes | | | 3.900 | % | | | 12/6/28 | | | | 930,000 | | | | 1,049,156 | |

Target Corp., Senior Notes | | | 3.375 | % | | | 4/15/29 | | | | 540,000 | | | | 586,184 | |

Total Specialty Retail | | | | | | | | | | | | | | | 1,635,340 | |

Total Consumer Discretionary | | | | | | | | | | | | | | | 7,831,692 | |

See Notes to Financial Statements.

| | |

| Western Asset Investment Grade Defined Opportunity Trust Inc. 2019 Annual Report | | 9 |

Schedule of investments(cont’d)

November 30, 2019

Western Asset Investment Grade Defined Opportunity Trust Inc.

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

| Consumer Staples — 3.9% | | | | | | | | | | | | | | | | |

Beverages — 0.9% | | | | | | | | | | | | | | | | |

Anheuser-Busch InBev Worldwide Inc., Senior Notes | | | 4.600 | % | | | 4/15/48 | | | | 1,730,000 | | | $ | 2,010,568 | |

Constellation Brands Inc., Senior Notes | | | 4.250 | % | | | 5/1/23 | | | | 100,000 | | | | 106,641 | |

Total Beverages | | | | | | | | | | | | | | | 2,117,209 | |

Food & Staples Retailing — 0.2% | | | | | | | | | | | | | | | | |

Kroger Co., Senior Notes | | | 4.650 | % | | | 1/15/48 | | | | 50,000 | | | | 54,915 | |

Walmart Inc., Senior Notes | | | 4.050 | % | | | 6/29/48 | | | | 360,000 | | | | 431,645 | |

Total Food & Staples Retailing | | | | | | | | | | | | | | | 486,560 | |

Food Products — 0.3% | | | | | | | | | | | | | | | | |

Kraft Heinz Foods Co., Senior Notes | | | 5.000 | % | | | 6/4/42 | | | | 160,000 | | | | 170,317 | |

Mars Inc., Senior Notes | | | 2.700 | % | | | 4/1/25 | | | | 220,000 | | | | 225,997 | (b) |

Mars Inc., Senior Notes | | | 3.200 | % | | | 4/1/30 | | | | 220,000 | | | | 236,125 | (b) |

Total Food Products | | | | | | | | | | | | | | | 632,439 | |

Household Products — 0.2% | | | | | | | | | | | | | | | | |

Estee Lauder Cos. Inc., Senior Notes | | | 2.000 | % | | | 12/1/24 | | | | 180,000 | | | | 180,236 | |

Estee Lauder Cos. Inc., Senior Notes | | | 2.375 | % | | | 12/1/29 | | | | 50,000 | | | | 49,981 | |

Estee Lauder Cos. Inc., Senior Notes | | | 3.125 | % | | | 12/1/49 | | | | 110,000 | | | | 111,666 | |

Total Household Products | | | | | | | | | | | | | | | 341,883 | |

Tobacco — 2.3% | | | | | | | | | | | | | | | | |

Altria Group Inc., Senior Notes | | | 3.800 | % | | | 2/14/24 | | | | 290,000 | | | | 304,964 | |

Altria Group Inc., Senior Notes | | | 4.400 | % | | | 2/14/26 | | | | 500,000 | | | | 541,130 | |

Altria Group Inc., Senior Notes | | | 4.800 | % | | | 2/14/29 | | | | 1,360,000 | | | | 1,504,794 | |

Altria Group Inc., Senior Notes | | | 3.875 | % | | | 9/16/46 | | | | 80,000 | | | | 76,107 | |

Philip Morris International Inc., Senior Notes | | | 2.875 | % | | | 5/1/24 | | | | 1,550,000 | | | | 1,594,925 | |

Reynolds American Inc., Senior Notes | | | 8.125 | % | | | 5/1/40 | | | | 470,000 | | | | 637,490 | |

Reynolds American Inc., Senior Notes | | | 7.000 | % | | | 8/4/41 | | | | 510,000 | | | | 625,053 | |

Total Tobacco | | | | | | | | | | | | | | | 5,284,463 | |

Total Consumer Staples | | | | | | | | | | | | | | | 8,862,554 | |

| Energy — 14.1% | | | | | | | | | | | | | | | | |

Energy Equipment & Services — 0.4% | | | | | | | | | | | | | | | | |

Halliburton Co., Senior Notes | | | 5.000 | % | | | 11/15/45 | | | | 930,000 | | | | 1,039,843 | |

Oil, Gas & Consumable Fuels — 13.7% | | | | | | | | | | | | | | | | |

Apache Corp., Senior Notes | | | 6.000 | % | | | 1/15/37 | | | | 84,000 | | | | 93,480 | |

Apache Corp., Senior Notes | | | 5.100 | % | | | 9/1/40 | | | | 280,000 | | | | 273,634 | |

Apache Corp., Senior Notes | | | 5.250 | % | | | 2/1/42 | | | | 160,000 | | | | 159,311 | |

Apache Corp., Senior Notes | | | 4.750 | % | | | 4/15/43 | | | | 670,000 | | | | 624,135 | |

Cimarex Energy Co., Senior Notes | | | 4.375 | % | | | 6/1/24 | | | | 960,000 | | | | 1,006,750 | |

Cimarex Energy Co., Senior Notes | | | 3.900 | % | | | 5/15/27 | | | | 250,000 | | | | 255,003 | |

| | | | | | | | | |

See Notes to Financial Statements.

| | |

10 | | Western Asset Investment Grade Defined Opportunity Trust Inc. 2019 Annual Report |

Western Asset Investment Grade Defined Opportunity Trust Inc.

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Oil, Gas & Consumable Fuels — continued | | | | | | | | | | | | | | | | |

Concho Resources Inc., Senior Notes | | | 3.750 | % | | | 10/1/27 | | | | 110,000 | | | $ | 113,981 | |

Concho Resources Inc., Senior Notes | | | 4.300 | % | | | 8/15/28 | | | | 280,000 | | | | 300,763 | |

ConocoPhillips, Senior Notes | | | 6.500 | % | | | 2/1/39 | | | | 1,500,000 | | | | 2,184,512 | |

Continental Resources Inc., Senior Notes | | | 4.500 | % | | | 4/15/23 | | | | 880,000 | | | | 917,914 | |

Continental Resources Inc., Senior Notes | | | 4.375 | % | | | 1/15/28 | | | | 430,000 | | | | 445,048 | |

Devon Energy Corp., Senior Notes | | | 5.850 | % | | | 12/15/25 | | | | 560,000 | | | | 663,975 | |

Devon Energy Corp., Senior Notes | | | 5.600 | % | | | 7/15/41 | | | | 20,000 | | | | 24,353 | |

Devon Energy Corp., Senior Notes | | | 5.000 | % | | | 6/15/45 | | | | 210,000 | | | | 245,680 | |

Ecopetrol SA, Senior Notes | | | 5.875 | % | | | 5/28/45 | | | | 404,000 | | | | 463,968 | |

Energy Transfer Operating LP, Senior Notes | | | 7.500 | % | | | 10/15/20 | | | | 420,000 | | | | 438,517 | |

Energy Transfer Operating LP, Senior Notes | | | 4.200 | % | | | 9/15/23 | | | | 510,000 | | | | 533,683 | |

Energy Transfer Operating LP, Senior Notes | | | 5.250 | % | | | 4/15/29 | | | | 20,000 | | | | 22,091 | |

Energy Transfer Operating LP, Senior Notes | | | 6.625 | % | | | 10/15/36 | | | | 20,000 | | | | 23,667 | |

Energy Transfer Operating LP, Senior Notes | | | 5.800 | % | | | 6/15/38 | | | | 60,000 | | | | 67,831 | |

Enterprise Products Operating LLC, Senior Notes | | | 4.250 | % | | | 2/15/48 | | | | 400,000 | | | | 428,496 | |

Enterprise Products Operating LLC, Senior Notes (5.375% to 2/15/28 then

3 mo. USD LIBOR + 2.570%) | | | 5.375 | % | | | 2/15/78 | | | | 570,000 | | | | 560,891 | (a) |

Exxon Mobil Corp., Senior Notes | | | 2.440 | % | | | 8/16/29 | | | | 110,000 | | | | 110,660 | |

Exxon Mobil Corp., Senior Notes | | | 2.995 | % | | | 8/16/39 | | | | 190,000 | | | | 192,617 | |

Kinder Morgan Inc., Senior Notes | | | 7.800 | % | | | 8/1/31 | | | | 900,000 | | | | 1,226,328 | |

MEG Energy Corp., Senior Notes | | | 6.375 | % | | | 1/30/23 | | | | 280,000 | | | | 275,097 | (b) |

MEG Energy Corp., Senior Notes | | | 7.000 | % | | | 3/31/24 | | | | 620,000 | | | | 609,538 | (b) |

MPLX LP, Senior Notes | | | 5.250 | % | | | 1/15/25 | | | | 500,000 | | | | 525,066 | (b) |

MPLX LP, Senior Notes | | | 4.500 | % | | | 4/15/38 | | | | 600,000 | | | | 599,783 | |

NGPL PipeCo LLC, Senior Notes | | | 4.875 | % | | | 8/15/27 | | | | 60,000 | | | | 63,682 | (b) |

Noble Energy Inc., Senior Notes | | | 6.000 | % | | | 3/1/41 | | | | 660,000 | | | | 781,034 | |

Noble Energy Inc., Senior Notes | | | 5.250 | % | | | 11/15/43 | | | | 240,000 | | | | 260,647 | |

Occidental Petroleum Corp., Senior Notes | | | 4.850 | % | | | 3/15/21 | | | | 598,000 | | | | 616,594 | |

Occidental Petroleum Corp., Senior Notes | | | 6.950 | % | | | 7/1/24 | | | | 1,320,000 | | | | 1,541,801 | |

Occidental Petroleum Corp., Senior Notes | | | 5.550 | % | | | 3/15/26 | | | | 750,000 | | | | 850,703 | |

Occidental Petroleum Corp., Senior Notes | | | 3.200 | % | | | 8/15/26 | | | | 250,000 | | | | 251,685 | |

Occidental Petroleum Corp., Senior Notes | | | 3.500 | % | | | 8/15/29 | | | | 250,000 | | | | 252,654 | |

Occidental Petroleum Corp., Senior Notes | | | 7.875 | % | | | 9/15/31 | | | | 710,000 | | | | 946,390 | |

Occidental Petroleum Corp., Senior Notes | | | 4.400 | % | | | 4/15/46 | | | | 30,000 | | | | 29,813 | |

Petrobras Global Finance BV, Senior Notes | | | 7.375 | % | | | 1/17/27 | | | | 530,000 | | | | 637,447 | |

Petroleos Mexicanos, Senior Notes | | | 6.875 | % | | | 8/4/26 | | | | 730,000 | | | | 790,479 | |

Petroleos Mexicanos, Senior Notes | | | 6.625 | % | | | 6/15/35 | | | | 460,000 | | | | 462,730 | |

Southern Natural Gas Co. LLC, Senior Notes | | | 8.000 | % | | | 3/1/32 | | | | 1,500,000 | | | | 2,165,292 | |

| | | | | | | | | |

See Notes to Financial Statements.

| | |

| Western Asset Investment Grade Defined Opportunity Trust Inc. 2019 Annual Report | | 11 |

Schedule of investments(cont’d)

November 30, 2019

Western Asset Investment Grade Defined Opportunity Trust Inc.

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Oil, Gas & Consumable Fuels — continued | | | | | | | | | | | | | | | | |

Sunoco Logistics Partners Operations LP, Senior Notes | | | 3.900 | % | | | 7/15/26 | | | | 630,000 | | | $ | 647,174 | |

Transcontinental Gas Pipe Line Co. LLC, Senior Notes | | | 7.850 | % | | | 2/1/26 | | | | 760,000 | | | | 964,964 | |

Transcontinental Gas Pipe Line Co. LLC, Senior Notes | | | 7.250 | % | | | 12/1/26 | | | | 180,000 | | | | 223,172 | |

Transcontinental Gas Pipe Line Co. LLC, Senior Notes | | | 5.400 | % | | | 8/15/41 | | | | 10,000 | | | | 11,772 | |

Transcontinental Gas Pipe Line Co. LLC, Senior Notes | | | 4.450 | % | | | 8/1/42 | | | | 860,000 | | | | 897,671 | |

Western Midstream Operating LP, Senior Notes | | | 4.650 | % | | | 7/1/26 | | | | 1,560,000 | | | | 1,556,948 | |

Western Midstream Operating LP, Senior Notes | | | 4.750 | % | | | 8/15/28 | | | | 890,000 | | | | 863,684 | |

Western Midstream Operating LP, Senior Notes | | | 5.450 | % | | | 4/1/44 | | | | 120,000 | | | | 101,681 | |

Williams Cos. Inc., Senior Notes | | | 5.250 | % | | | 3/15/20 | | | | 460,000 | | | | 464,017 | |

Williams Cos. Inc., Senior Notes | | | 7.875 | % | | | 9/1/21 | | | | 952,000 | | | | 1,040,514 | |

Williams Cos. Inc., Senior Notes | | | 4.550 | % | | | 6/24/24 | | | | 1,130,000 | | | | 1,210,369 | |

Williams Cos. Inc., Senior Notes | | | 7.750 | % | | | 6/15/31 | | | | 62,000 | | | | 80,982 | |

Williams Cos. Inc., Senior Notes | | | 8.750 | % | | | 3/15/32 | | | | 148,000 | | | | 206,799 | |

Total Oil, Gas & Consumable Fuels | | | | | | | | | | | | | | | 31,307,470 | |

Total Energy | | | | | | | | 32,347,313 | |

| Financials — 30.9% | | | | | | | | | | | | | | | | |

Banks — 18.4% | | | | | | | | | | | | | | | | |

Banco Mercantil del Norte SA, Junior Subordinated Notes (7.500% to 6/27/29 then 10 year Treasury Constant Maturity Rate + 5.470%) | | | 7.500 | % | | | 6/27/29 | | | | 200,000 | | | | 210,500 | (a)(b)(d) |

Banco Mercantil del Norte SA, Junior Subordinated Notes (7.625% to 1/6/28 then 10 year Treasury Constant Maturity Rate + 5.353%) | | | 7.625 | % | | | 1/10/28 | | | | 400,000 | | | | 422,040 | (a)(b)(d) |

Bank of America Corp., Junior Subordinated Notes (6.100% to 3/17/25 then 3 mo. USD LIBOR + 3.898%) | | | 6.100 | % | | | 3/17/25 | | | | 590,000 | | | | 657,428 | (a)(d) |

Bank of America Corp., Junior Subordinated Notes (6.250% to 9/5/24 then 3 mo. USD LIBOR + 3.705%) | | | 6.250 | % | | | 9/5/24 | | | | 880,000 | | | | 981,671 | (a)(d) |

Bank of America Corp., Junior Subordinated Notes (6.500% to 10/23/24 then 3 mo. USD LIBOR + 4.174%) | | | 6.500 | % | | | 10/23/24 | | | | 400,000 | | | | 453,286 | (a)(d) |

Bank of America Corp., Senior Notes | | | 5.875 | % | | | 2/7/42 | | | | 1,340,000 | | | | 1,894,624 | |

Bank of America Corp., Senior Notes (3.458% to 3/15/24 then 3 mo. USD LIBOR + 0.970%) | | | 3.458 | % | | | 3/15/25 | | | | 110,000 | | | | 114,803 | (a) |

See Notes to Financial Statements.

| | |

12 | | Western Asset Investment Grade Defined Opportunity Trust Inc. 2019 Annual Report |

Western Asset Investment Grade Defined Opportunity Trust Inc.

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Banks — continued | | | | | | | | | | | | | | | | |

Bank of America Corp., Senior Notes (4.271% to 7/23/28 then 3 mo. USD LIBOR + 1.310%) | | | 4.271 | % | | | 7/23/29 | | | | 690,000 | | | $ | 768,409 | (a) |

Bank of America Corp., Subordinated Notes | | | 7.750 | % | | | 5/14/38 | | | | 670,000 | | | | 1,045,295 | |

Barclays Bank PLC, Subordinated Notes | | | 7.625 | % | | | 11/21/22 | | | | 430,000 | | | | 482,552 | |

Barclays PLC, Junior Subordinated Notes (7.750% to 9/15/23 then USD 5 year ICE Swap Rate + 4.842%) | | | 7.750 | % | | | 9/15/23 | | | | 320,000 | | | | 345,829 | (a)(d) |

Barclays PLC, Subordinated Notes (5.088% to 6/20/29 then 3 mo. USD LIBOR + 3.054%) | | | 5.088 | % | | | 6/20/30 | | | | 500,000 | | | | 545,973 | (a) |

BNP Paribas SA, Junior Subordinated Notes (7.375% to 8/19/25 then USD 5 year ICE Swap Rate + 5.150%) | | | 7.375 | % | | | 8/19/25 | | | | 1,520,000 | | | | 1,737,900 | (a)(b)(d) |

BNP Paribas SA, Junior Subordinated Notes (7.625% to 3/30/21 then USD 5 year ICE Swap Rate + 6.314%) | | | 7.625 | % | | | 3/30/21 | | | | 240,000 | | | | 253,284 | (a)(b)(d) |

Citigroup Inc., Junior Subordinated Bonds (6.250% to 8/15/26 then 3 mo. USD LIBOR + 4.517%) | | | 6.250 | % | | | 8/15/26 | | | | 1,100,000 | | | | 1,249,440 | (a)(d) |

Citigroup Inc., Junior Subordinated Notes (6.300% to 5/15/24 then 3 mo. USD LIBOR + 3.423%) | | | 6.300 | % | | | 5/15/24 | | | | 1,350,000 | | | | 1,452,215 | (a)(d) |

Citigroup Inc., Senior Notes | | | 8.125 | % | | | 7/15/39 | | | | 752,000 | | | | 1,247,304 | |

Citigroup Inc., Senior Notes | | | 4.650 | % | | | 7/23/48 | | | | 420,000 | | | | 522,206 | |

Citigroup Inc., Subordinated Notes | | | 4.600 | % | | | 3/9/26 | | | | 490,000 | | | | 539,723 | |

Citigroup Inc., Subordinated Notes | | | 4.125 | % | | | 7/25/28 | | | | 2,290,000 | | | | 2,491,089 | |

Citigroup Inc., Subordinated Notes | | | 6.675 | % | | | 9/13/43 | | | | 630,000 | | | | 918,941 | |

Cooperatieve Rabobank UA, Senior Notes | | | 5.750 | % | | | 12/1/43 | | | | 250,000 | | | | 334,012 | |

Credit Agricole SA, Junior Subordinated Notes (8.125% to 12/23/25 then USD 5 year ICE Swap Rate + 6.185%) | | | 8.125 | % | | | 12/23/25 | | | | 1,370,000 | | | | 1,656,844 | (a)(b)(d) |

Danske Bank A/S, Senior Notes | | | 5.000 | % | | | 1/12/22 | | | | 740,000 | | | | 777,138 | (b) |

Danske Bank A/S, Senior Notes | | | 5.375 | % | | | 1/12/24 | | | | 530,000 | | | | 582,383 | (b) |

Danske Bank A/S, Senior Notes (3.001% to 9/20/21 then 3 mo. USD LIBOR + 1.249%) | | | 3.001 | % | | | 9/20/22 | | | | 200,000 | | | | 201,439 | (a)(b) |

Danske Bank A/S, Senior Notes (3.244% to 12/20/24 then 3 mo. USD LIBOR + 1.591%) | | | 3.244 | % | | | 12/20/25 | | | | 200,000 | | | | 201,817 | (a)(b) |

HSBC Holdings PLC, Junior Subordinated Notes (6.375% to 9/17/24 then USD 5 year ICE Swap Rate + 3.705%) | | | 6.375 | % | | | 9/17/24 | | | | 800,000 | | | | 851,572 | (a)(d) |

See Notes to Financial Statements.

| | |

| Western Asset Investment Grade Defined Opportunity Trust Inc. 2019 Annual Report | | 13 |

Schedule of investments(cont’d)

November 30, 2019

Western Asset Investment Grade Defined Opportunity Trust Inc.

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Banks — continued | | | | | | | | | | | | | | | | |

HSBC Holdings PLC, Junior Subordinated Notes (6.500% to 3/23/28 then USD 5 year ICE Swap Rate + 3.606%) | | | 6.500 | % | | | 3/23/28 | | | | 460,000 | | | $ | 499,054 | (a)(d) |

HSBC Holdings PLC, Senior Notes (2.633% to 11/7/24 then 3 mo. USD LIBOR + 1.140%) | | | 2.633 | % | | | 11/7/25 | | | | 480,000 | | | | 478,758 | (a) |

Intesa Sanpaolo SpA, Senior Notes | | | 4.700 | % | | | 9/23/49 | | | | 200,000 | | | | 205,745 | (b) |

Intesa Sanpaolo SpA, Subordinated Notes | | | 5.710 | % | | | 1/15/26 | | | | 1,470,000 | | | | 1,570,095 | (b) |

JPMorgan Chase & Co., Junior Subordinated Notes (6.000% to 8/1/23 then 3 mo. USD

LIBOR + 3.300%) | | | 6.000 | % | | | 8/1/23 | | | | 700,000 | | | | 750,984 | (a)(d) |

JPMorgan Chase & Co., Senior Notes | | | 6.400 | % | | | 5/15/38 | | | | 1,500,000 | | | | 2,160,311 | |

JPMorgan Chase & Co., Senior Notes (2.739% to 10/15/29 then SOFR + 1.510%) | | | 2.739 | % | | | 10/15/30 | | | | 310,000 | | | | 309,682 | (a) |

JPMorgan Chase & Co., Subordinated Notes | | | 5.625 | % | | | 8/16/43 | | | | 760,000 | | | | 1,020,883 | |

Lloyds Banking Group PLC, Junior Subordinated Notes (6.750% to 6/27/26 then 5 year Treasury Constant Maturity Rate + 4.815%) | | | 6.750 | % | | | 6/27/26 | | | | 220,000 | | | | 237,875 | (a)(d) |

Lloyds Banking Group PLC, Junior Subordinated Notes (7.500% to 6/27/24 then USD 5 year ICE Swap Rate + 4.760%) | | | 7.500 | % | | | 6/27/24 | | | | 620,000 | | |

| 685,937

| (a)(d)

|

Lloyds Banking Group PLC, Junior Subordinated Notes (7.500% to 9/27/25 then USD 5 year ICE Swap Rate + 4.496%) | | | 7.500 | % | | | 9/27/25 | | | | 470,000 | | | | 523,277 | (a)(d) |

NatWest Markets NV, Subordinated Notes | | | 7.750 | % | | | 5/15/23 | | | | 820,000 | | | | 929,047 | |

PNC Bank NA, Subordinated Notes | | | 4.050 | % | | | 7/26/28 | | | | 650,000 | | | | 718,726 | |

Royal Bank of Scotland Group PLC, Junior Subordinated Notes (7.648% to 9/30/31 then 3 mo. USD LIBOR + 2.500%) | | | 7.648 | % | | | 9/30/31 | | | | 710,000 | | | | 1,018,033 | (a)(d) |

Royal Bank of Scotland Group PLC, Junior Subordinated Notes (8.625% to 8/15/21 then USD

5 year ICE Swap Rate + 7.598%) | | | 8.625 | % | | | 8/15/21 | | | | 950,000 | | | | 1,027,881 | (a)(d) |

Royal Bank of Scotland Group PLC, Subordinated Notes | | | 6.100 | % | | | 6/10/23 | | | | 840,000 | | | | 920,818 | |

Royal Bank of Scotland Group PLC, Subordinated Notes (3.754% to 11/1/24 then 5 year Treasury Constant Maturity Rate + 2.100%) | | | 3.754 | % | | | 11/1/29 | | | | 420,000 | | | | 424,018 | (a) |

U.S. Bancorp, Subordinated Notes | | | 3.000 | % | | | 7/30/29 | | | | 250,000 | | | | 258,648 | |

UniCredit SpA, Senior Notes | | | 6.572 | % | | | 1/14/22 | | | | 570,000 | | | | 611,242 | (b) |

UniCredit SpA, Subordinated Notes (7.296% to 4/2/29 then USD 5 year ICE Swap

Rate + 4.914%) | | | 7.296 | % | | | 4/2/34 | | | | 1,610,000 | | | | 1,854,320 | (a)(b) |

See Notes to Financial Statements.

| | |

14 | | Western Asset Investment Grade Defined Opportunity Trust Inc. 2019 Annual Report |

Western Asset Investment Grade Defined Opportunity Trust Inc.

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Banks — continued | | | | | | | | | | | | | | | | |

Wachovia Capital Trust III Ltd., Junior Subordi-nated Bonds (the greater of 3 mo. USD LIBOR + 0.930% or 5.570%) | | | 5.570 | % | | | 12/30/19 | | | | 410,000 | | | $ | 416,257 | (a)(d) |

Wells Fargo & Co., Senior Notes (3.196% to 6/17/26 then 3 mo. USD LIBOR + 1.170%) | | | 3.196 | % | | | 6/17/27 | | | | 1,150,000 | | | | 1,188,053 | (a) |

Wells Fargo & Co., Subordinated Notes | | | 4.400 | % | | | 6/14/46 | | | | 420,000 | | | | 485,668 | |

Wells Fargo & Co., Subordinated Notes | | | 4.750 | % | | | 12/7/46 | | | | 530,000 | | | | 648,508 | |

Westpac Banking Corp., Subordinated Notes | | | 4.421 | % | | | 7/24/39 | | | | 170,000 | | | | 184,527 | |

Total Banks | | | | | | | | | | | | | | | 42,068,064 | |

Capital Markets — 5.4% | | | | | | | | | | | | | | | | |

Charles Schwab Corp., Senior Notes | | | 3.850 | % | | | 5/21/25 | | | | 230,000 | | | | 249,172 | |

CME Group Inc., Senior Notes | | | 5.300 | % | | | 9/15/43 | | | | 750,000 | | | | 1,021,239 | |

Credit Suisse USA Inc., Senior Notes | | | 7.125 | % | | | 7/15/32 | | | | 70,000 | | | | 102,166 | |

Goldman Sachs Group Inc., Senior Notes | | | 6.250 | % | | | 2/1/41 | | | | 2,550,000 | | | | 3,580,972 | |

Goldman Sachs Group Inc., Senior Notes (2.908% to 6/5/22 then 3 mo. USD

LIBOR + 1.053%) | | | 2.908 | % | | | 6/5/23 | | | | 1,100,000 | | | | 1,116,788 | (a) |

Goldman Sachs Group Inc., Subordinated Notes | | | 5.150 | % | | | 5/22/45 | | | | 70,000 | | | | 86,225 | |

Intercontinental Exchange Inc., Senior Notes | | | 3.750 | % | | | 9/21/28 | | | | 720,000 | | | | 788,182 | |

KKR Group Finance Co. III LLC, Senior Notes | | | 5.125 | % | | | 6/1/44 | | | | 1,300,000 | | | | 1,550,011 | (b) |

KKR Group Finance Co. VI LLC, Senior Notes | | | 3.750 | % | | | 7/1/29 | | | | 110,000 | | | | 116,914 | (b) |

Morgan Stanley, Senior Notes | | | 5.500 | % | | | 1/26/20 | | | | 1,950,000 | | | | 1,959,975 | |

Morgan Stanley, Senior Notes | | | 6.375 | % | | | 7/24/42 | | | | 140,000 | | | | 207,935 | |

Raymond James Financial Inc., Senior Notes | | | 4.950 | % | | | 7/15/46 | | | | 150,000 | | | | 178,923 | |

UBS AG Stamford, CT, Subordinated Notes | | | 7.625 | % | | | 8/17/22 | | | | 330,000 | | | | 372,440 | |

UBS Group AG, Junior Subordinated Notes (7.000% to 1/31/24 then USD 5 year ICE Swap Rate + 4.344%) | | | 7.000 | % | | | 1/31/24 | | | | 920,000 | | | | 998,200 | (a)(b)(d) |

Total Capital Markets | | | | | | | | | | | | | | | 12,329,142 | |

Consumer Finance — 1.1% | | | | | | | | | | | | | | | | |

Navient Corp., Senior Notes | | | 7.250 | % | | | 1/25/22 | | | | 1,430,000 | | | | 1,555,125 | |

Navient Corp., Senior Notes | | | 6.125 | % | | | 3/25/24 | | | | 480,000 | | | | 513,595 | |

Synchrony Financial, Senior Notes | | | 2.850 | % | | | 7/25/22 | | | | 520,000 | | | | 525,233 | |

Total Consumer Finance | | | | | | | | | | | | | | | 2,593,953 | |

Diversified Financial Services — 0.9% | | | | | | | | | | | | | | | | |

Carlyle Finance LLC, Senior Notes | | | 5.650 | % | | | 9/15/48 | | | | 170,000 | | | | 202,819 | (b) |

Carlyle Finance Subsidiary LLC, Senior Notes | | | 3.500 | % | | | 9/19/29 | | | | 230,000 | | | | 228,533 | (b) |

Carlyle Holdings II Finance LLC, Senior Notes | | | 5.625 | % | | | 3/30/43 | | | | 360,000 | | | | 421,818 | (b) |

DAE Funding LLC, Senior Notes | | | 5.000 | % | | | 8/1/24 | | | | 240,000 | | | | 251,398 | (b) |

Global Aircraft Leasing Co. Ltd., Senior Notes (6.500% Cash or 7.250% PIK) | | | 6.500 | % | | | 9/15/24 | | | | 70,000 | | | | 71,771 | (b)(e) |

See Notes to Financial Statements.

| | |

| Western Asset Investment Grade Defined Opportunity Trust Inc. 2019 Annual Report | | 15 |

Schedule of investments (cont’d)

November 30, 2019

Western Asset Investment Grade Defined Opportunity Trust Inc.

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Diversified Financial Services — continued | | | | | | | | | | | | | | | | |

ILFCE-Capital Trust I, Ltd. GTD ((Highest of 3 mo. | | | | | | | | | | | | | | | | |

USD LIBOR, 10 year Treasury Constant Maturity | | | | | | | | | | | | | | | | |

Rate or 30 year Treasury Constant Maturity Rate) + 1.550%) | | | 3.770 | % | | | 12/21/65 | | | | 800,000 | | | $ | 623,216 | (a)(b) |

International Lease Finance Corp., Senior Notes | | | 8.250 | % | | | 12/15/20 | | | | 330,000 | | | | 350,385 | |

Total Diversified Financial Services | | | | | | | | | | | | | | | 2,149,940 | |

Insurance — 4.3% | | | | | | | | | | | | | | | | |

American International Group Inc., Senior Notes | | | 6.400 | % | | | 12/15/20 | | | | 1,000,000 | | | | 1,044,202 | |

American International Group Inc., Senior Notes | | | 4.750 | % | | | 4/1/48 | | | | 80,000 | | | | 95,782 | |

Delphi Financial Group Inc., Senior Notes | | | 7.875 | % | | | 1/31/20 | | | | 290,000 | | | | 292,533 | |

Fidelity & Guaranty Life Holdings Inc., Senior Notes | | | 5.500 | % | | | 5/1/25 | | | | 360,000 | | | | 382,496 | (b) |

Liberty Mutual Insurance Co., Subordinated Notes | | | 7.875 | % | | | 10/15/26 | | | | 840,000 | | | | 1,067,423 | (b) |

Massachusetts Mutual Life Insurance Co., Subordinated Notes | | | 4.900 | % | | | 4/1/77 | | | | 420,000 | | | | 527,565 | (b) |

MetLife Inc., Junior Subordinated Notes (6.400% to 12/15/36 then 3 mo. USD LIBOR + 2.205%) | | | 6.400 | % | | | 12/15/66 | | | | 1,000,000 | | | | 1,226,395 | (a) |

Nationwide Financial Services Inc., Senior Notes | | | 3.900 | % | | | 11/30/49 | | | | 260,000 | | | | 266,784 | (b) |

Nationwide Mutual Insurance Co., Subordinated Notes | | | 9.375 | % | | | 8/15/39 | | | | 520,000 | | | | 899,633 | (b) |

New York Life Insurance Co., Subordinated Notes | | | 4.450 | % | | | 5/15/69 | | | | 140,000 | | | | 166,601 | (b) |

Northwestern Mutual Life Insurance Co., Subordinated Notes | | | 3.625 | % | | | 9/30/59 | | | | 180,000 | | | | 184,262 | (b) |

Teachers Insurance & Annuity Association of America, Subordinated Notes | | | 6.850 | % | | | 12/16/39 | | | | 1,050,000 | | | | 1,561,735 | (b) |

Teachers Insurance & Annuity Association of America, Subordinated Notes | | | 4.900 | % | | | 9/15/44 | | | | 660,000 | | | | 828,514 | (b) |

Travelers Cos. Inc., Senior Notes | | | 6.250 | % | | | 6/15/37 | | | | 400,000 | | | | 571,383 | |

Trinity Acquisition PLC, Senior Notes | | | 3.500 | % | | | 9/15/21 | | | | 626,000 | | | | 638,519 | |

Total Insurance | | | | | | | | | | | | | | | 9,753,827 | |

Investment Companies — 0.5% | | | | | | | | | | | | | | | | |

MDGH - GMTN BV, Senior Notes | | | 2.500 | % | | | 11/7/24 | | | | 500,000 | | | | 502,625 | (b) |

Owl Rock Capital Corp., Senior Notes | | | 4.000 | % | | | 3/30/25 | | | | 600,000 | | | | 595,082 | |

Total Investment Companies | | | | | | | | | | | | | | | 1,097,707 | |

Thrifts & Mortgage Finance — 0.3% | | | | | | | | | | | | | | | | |

Quicken Loans Inc., Senior Notes | | | 5.750 | % | | | 5/1/25 | | | | 770,000 | | | | 801,658 | (b) |

Total Financials | | | | | | | | | | | | | | | 70,794,291 | |

See Notes to Financial Statements.

| | |

16 | | Western Asset Investment Grade Defined Opportunity Trust Inc. 2019 Annual Report |

Western Asset Investment Grade Defined Opportunity Trust Inc.

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

| Health Care — 12.9% | | | | | | | | | | | | | | | | |

Biotechnology — 1.6% | | | | | | | | | | | | | | | | |

AbbVie Inc., Senior Notes | | | 2.950 | % | | | 11/21/26 | | | | 420,000 | | | $ | 424,595 | (b) |

AbbVie Inc., Senior Notes | | | 3.200 | % | | | 11/21/29 | | | | 1,110,000 | | | | 1,127,670 | (b) |

AbbVie Inc., Senior Notes | | | 4.050 | % | | | 11/21/39 | | | | 1,160,000 | | | | 1,213,335 | (b) |

Gilead Sciences Inc., Senior Notes | | | 5.650 | % | | | 12/1/41 | | | | 100,000 | | | | 131,866 | |

Gilead Sciences Inc., Senior Notes | | | 4.500 | % | | | 2/1/45 | | | | 500,000 | | | | 580,678 | |

Gilead Sciences Inc., Senior Notes | | | 4.750 | % | | | 3/1/46 | | | | 100,000 | | | | 120,887 | |

Total Biotechnology | | | | | | | | | | | | | | | 3,599,031 | |

Health Care Equipment & Supplies — 1.2% | | | | | | | | | | | | | | | | |

Abbott Laboratories, Senior Notes | | | 4.900 | % | | | 11/30/46 | | | | 200,000 | | | | 265,993 | |

Alcon Finance Corp., Senior Notes | | | 2.750 | % | | | 9/23/26 | | | | 230,000 | | | | 234,052 | (b) |

Alcon Finance Corp., Senior Notes | | | 3.000 | % | | | 9/23/29 | | | | 360,000 | | | | 365,945 | (b) |

Becton Dickinson and Co., Senior Notes | | | 4.685 | % | | | 12/15/44 | | | | 1,110,000 | | | | 1,311,852 | |

Becton Dickinson and Co., Senior Notes | | | 4.669 | % | | | 6/6/47 | | | | 450,000 | | | | 542,571 | |

Total Health Care Equipment & Supplies | | | | | | | | | | | | | | | 2,720,413 | |

Health Care Providers & Services — 7.4% | | | | | | | | | | | | | | | | |

Anthem Inc., Senior Notes | | | 4.375 | % | | | 12/1/47 | | | | 630,000 | | | | 691,681 | |

Centene Corp., Senior Notes | | | 4.750 | % | | | 1/15/25 | | | | 370,000 | | | | 385,307 | (b)(c) |

Centene Corp., Senior Notes | | | 4.250 | % | | | 12/15/27 | | | | 160,000 | | | | 165,000 | (b)(c) |

Centene Corp., Senior Notes | | | 4.625 | % | | | 12/15/29 | | | | 420,000 | | | | 441,525 | (b)(c) |

Cigna Corp., Senior Notes | | | 4.125 | % | | | 11/15/25 | | | | 540,000 | | | | 583,424 | |

Cigna Corp., Senior Notes | | | 4.800 | % | | | 8/15/38 | | | | 540,000 | | | | 626,745 | |

CommonSpirit Health, Secured Notes | | | 4.350 | % | | | 11/1/42 | | | | 60,000 | | | | 62,636 | |

CVS Health Corp., Senior Notes | | | 2.625 | % | | | 8/15/24 | | | | 690,000 | | | | 696,302 | |

CVS Health Corp., Senior Notes | | | 4.100 | % | | | 3/25/25 | | | | 1,460,000 | | | | 1,568,787 | |

CVS Health Corp., Senior Notes | | | 4.300 | % | | | 3/25/28 | | | | 1,610,000 | | | | 1,756,421 | |

CVS Health Corp., Senior Notes | | | 4.780 | % | | | 3/25/38 | | | | 2,060,000 | | | | 2,343,674 | |

CVS Health Corp., Senior Notes | | | 5.125 | % | | | 7/20/45 | | | | 540,000 | | | | 638,984 | |

CVS Health Corp., Senior Notes | | | 5.050 | % | | | 3/25/48 | | | | 930,000 | | | | 1,102,067 | |

Dartmouth-Hitchcock Health, Secured Bonds | | | 4.178 | % | | | 8/1/48 | | | | 150,000 | | | | 171,958 | |

DH Europe Finance II Sarl, Senior Notes | | | 3.250 | % | | | 11/15/39 | | | | 290,000 | | | | 295,050 | |

DH Europe Finance II Sarl, Senior Notes | | | 3.400 | % | | | 11/15/49 | | | | 110,000 | | | | 113,791 | |

HCA Inc., Senior Secured Notes | | | 4.125 | % | | | 6/15/29 | | | | 340,000 | | | | 358,882 | |

HCA Inc., Senior Secured Notes | | | 5.125 | % | | | 6/15/39 | | | | 170,000 | | | | 188,614 | |

HCA Inc., Senior Secured Notes | | | 5.500 | % | | | 6/15/47 | | | | 350,000 | | | | 405,549 | |

HCA Inc., Senior Secured Notes | | | 5.250 | % | | | 6/15/49 | | | | 530,000 | | | | 598,264 | |

Humana Inc., Senior Notes | | | 3.125 | % | | | 8/15/29 | | | | 450,000 | | | | 457,800 | |

Humana Inc., Senior Notes | | | 4.800 | % | | | 3/15/47 | | | | 420,000 | | | | 495,275 | |

Magellan Health Inc., Senior Notes | | | 4.900 | % | | | 9/22/24 | | | | 1,140,000 | | | | 1,154,723 | |

See Notes to Financial Statements.

| | |

| Western Asset Investment Grade Defined Opportunity Trust Inc. 2019 Annual Report | | 17 |

Schedule of investments(cont’d)

November 30, 2019

Western Asset Investment Grade Defined Opportunity Trust Inc.

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Health Care Providers & Services — continued | | | | | | | | | | | | | | | | |

Orlando Health Obligated Group, Senior Notes | | | 4.089 | % | | | 10/1/48 | | | | 270,000 | | | $ | 305,706 | |

UnitedHealth Group Inc., Senior Notes | | | 3.700 | % | | | 12/15/25 | | | | 250,000 | | | | 270,328 | |

UnitedHealth Group Inc., Senior Notes | | | 3.850 | % | | | 6/15/28 | | | | 540,000 | | | | 594,885 | |

UnitedHealth Group Inc., Senior Notes | | | 3.500 | % | | | 8/15/39 | | | | 220,000 | | | | 233,643 | |

UnitedHealth Group Inc., Senior Notes | | | 4.750 | % | | | 7/15/45 | | | | 220,000 | | | | 273,156 | |

Total Health Care Providers & Services | | | | | | | | | | | | | | | 16,980,177 | |

Pharmaceuticals — 2.7% | | | | | | | | | | | | | | | | |

Allergan Funding SCS, Senior Notes | | | 4.550 | % | | | 3/15/35 | | | | 200,000 | | | | 218,187 | |

Bristol-Myers Squibb Co., Senior Notes | | | 2.750 | % | | | 2/15/23 | | | | 1,100,000 | | | | 1,122,212 | (b) |

Bristol-Myers Squibb Co., Senior Notes | | | 3.400 | % | | | 7/26/29 | | | | 1,530,000 | | | | 1,643,194 | (b) |

Bristol-Myers Squibb Co., Senior Notes | | | 5.000 | % | | | 8/15/45 | | | | 400,000 | | | | 514,177 | (b) |

Pfizer Inc., Senior Notes | | | 7.200 | % | | | 3/15/39 | | | | 560,000 | | | | 891,035 | |

Teva Pharmaceutical Finance Netherlands III BV, Senior Notes | | | 7.125 | % | | | 1/31/25 | | | | 200,000 | | | | 204,000 | (b) |

Wyeth LLC, Senior Notes | | | 5.950 | % | | | 4/1/37 | | | | 1,100,000 | | | | 1,529,744 | |

Zoetis Inc., Senior Notes | | | 4.700 | % | | | 2/1/43 | | | | 40,000 | | | | 48,126 | |

Total Pharmaceuticals | | | | | | | | | | | | | | | 6,170,675 | |

Total Health Care | | | | | | | | 29,470,296 | |

| Industrials — 7.4% | | | | | | | | | | | | | | | | |

Aerospace & Defense — 3.4% | | | | | | | | | | | | | | | | |

Avolon Holdings Funding Ltd., Senior Notes | | | 5.125 | % | | | 10/1/23 | | | | 330,000 | | | | 355,679 | (b) |

Boeing Co., Senior Notes | | | 2.800 | % | | | 3/1/24 | | | | 500,000 | | | | 513,436 | |

Boeing Co., Senior Notes | | | 3.100 | % | | | 5/1/26 | | | | 2,190,000 | | | | 2,281,903 | |

Hexcel Corp., Senior Notes | | | 3.950 | % | | | 2/15/27 | | | | 1,000,000 | | | | 1,046,915 | |

Huntington Ingalls Industries Inc., Senior Notes | | | 3.483 | % | | | 12/1/27 | | | | 320,000 | | | | 335,938 | |

L3Harris Technologies Inc., Senior Notes | | | 4.400 | % | | | 6/15/28 | | | | 700,000 | | | | 782,722 | (b) |

L3Harris Technologies Inc., Senior Notes | | | 2.900 | % | | | 12/15/29 | | | | 230,000 | | | | 233,400 | |

Lockheed Martin Corp., Senior Notes | | | 4.500 | % | | | 5/15/36 | | | | 50,000 | | | | 60,091 | |

Lockheed Martin Corp., Senior Notes | | | 4.700 | % | | | 5/15/46 | | | | 200,000 | | | | 253,110 | |

Northrop Grumman Systems Corp., Senior Notes | | | 7.875 | % | | | 3/1/26 | | | | 1,390,000 | | | | 1,788,631 | |

United Technologies Corp., Senior Notes | | | 4.625 | % | | | 11/16/48 | | | | 180,000 | | | | 225,795 | |

Total Aerospace & Defense | | | | | | | | | | | | | | | 7,877,620 | |

Air Freight & Logistics — 0.4% | | | | | | | | | | | | | | | | |

United Parcel Service Inc., Senior Notes | | | 6.200 | % | | | 1/15/38 | | | | 700,000 | | | | 987,049 | |

Airlines — 0.9% | | | | | | | | | | | | | | | | |

American Airlines Pass-Through Trust | | | 5.600 | % | | | 7/15/20 | | | | 211,592 | | | | 215,092 | (b) |

Continental Airlines Pass-Through Trust | | | 6.250 | % | | | 4/11/20 | | | | 98,950 | | | | 100,058 | |

Delta Air Lines Inc., Senior Notes | | | 2.900 | % | | | 10/28/24 | | | | 840,000 | | | | 832,507 | |

Delta Air Lines Inc., Senior Notes | | | 3.750 | % | | | 10/28/29 | | | | 230,000 | | | | 227,930 | |

| | | | | | | | | |

See Notes to Financial Statements.

| | |

18 | | Western Asset Investment Grade Defined Opportunity Trust Inc. 2019 Annual Report |

Western Asset Investment Grade Defined Opportunity Trust Inc.

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Airlines — continued | | | | | | | | | | | | | | | | |

Delta Air Lines Pass-Through Certificates Trust | | | 8.021 | % | | | 8/10/22 | | | | 68,999 | | | $ | 75,926 | |

Delta Air Lines Pass-Through Trust, Senior Secured Notes | | | 7.750 | % | | | 12/17/19 | | | | 163,170 | | | | 163,582 | |

US Airways Pass-Through Trust, Senior Secured Notes | | | 5.900 | % | | | 10/1/24 | | | | 356,863 | | | | 398,245 | |

Total Airlines | | | | | | | | | | | | | | | 2,013,340 | |

Commercial Services & Supplies — 1.2% | | | | | | | | | | | | | | | | |

California Institute of Technology, Senior Notes | | | 3.650 | % | | | 9/1/2119 | | | | 180,000 | | | | 180,649 | |

Republic Services Inc., Senior Notes | | | 2.500 | % | | | 8/15/24 | | | | 700,000 | | | | 707,387 | |

United Rentals North America Inc., Secured Notes | | | 3.875 | % | | | 11/15/27 | | | | 410,000 | | | | 414,613 | |

Waste Connections Inc., Senior Notes | | | 4.250 | % | | | 12/1/28 | | | | 750,000 | | | | 847,073 | |

Waste Management Inc., Senior Notes | | | 3.200 | % | | | 6/15/26 | | | | 40,000 | | | | 42,092 | |

Waste Management Inc., Senior Notes | | | 4.000 | % | | | 7/15/39 | | | | 550,000 | | | | 624,959 | |

Total Commercial Services & Supplies | | | | | | | | | | | | | | | 2,816,773 | |

Industrial Conglomerates — 0.8% | | | | | | | | | | | | | | | | |

General Electric Co., Senior Notes | | | 6.750 | % | | | 3/15/32 | | | | 330,000 | | | | 427,993 | |

General Electric Co., Senior Notes | | | 6.875 | % | | | 1/10/39 | | | | 1,098,000 | | | | 1,479,507 | |

Total Industrial Conglomerates | | | | | | | | | | | | | | | 1,907,500 | |

Machinery — 0.2% | | | | | | | | | | | | | | | | |

Caterpillar Inc., Senior Notes | | | 4.750 | % | | | 5/15/64 | | | | 360,000 | | | | 458,454 | |

Road & Rail — 0.3% | | | | | | | | | | | | | | | | |

Union Pacific Corp., Senior Notes | | | 4.375 | % | | | 11/15/65 | | | | 530,000 | | | | 581,963 | |

Trading Companies & Distributors — 0.2% | | | | | | | | | | | | | | | | |

Aviation Capital Group LLC, Senior Notes | | | 4.125 | % | | | 8/1/25 | | | | 340,000 | | | | 353,688 | (b) |

Total Industrials | | | | | | | | 16,996,387 | |

| Information Technology — 2.7% | | | | | | | | | | | | | | | | |

Communications Equipment — 0.4% | | | | | | | | | | | | | | | | |

Harris Corp., Senior Notes | | | 4.854 | % | | | 4/27/35 | | | | 430,000 | | | | 511,049 | |

Harris Corp., Senior Notes | | | 5.054 | % | | | 4/27/45 | | | | 340,000 | | | | 426,693 | |

Total Communications Equipment | | | | | | | | | | | | | | | 937,742 | |

IT Services — 0.6% | | | | | | | | | | | | | | | | |

International Business Machines Corp., Senior Notes | | | 3.500 | % | | | 5/15/29 | | | | 200,000 | | | | 215,832 | |

PayPal Holdings Inc., Senior Notes | | | 2.400 | % | | | 10/1/24 | | | | 720,000 | | | | 722,487 | |

S&P Global Inc., Senior Notes | | | 2.500 | % | | | 12/1/29 | | | | 220,000 | | | | 221,428 | |

S&P Global Inc., Senior Notes | | | 3.250 | % | | | 12/1/49 | | | | 110,000 | | | | 112,294 | |

Total IT Services | | | | | | | | | | | | | | | 1,272,041 | |

See Notes to Financial Statements.

| | |

| Western Asset Investment Grade Defined Opportunity Trust Inc. 2019 Annual Report | | 19 |

Schedule of investments(cont’d)

November 30, 2019

Western Asset Investment Grade Defined Opportunity Trust Inc.

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Semiconductors & Semiconductor Equipment — 0.4% | | | | | | | | | | | | | |

Intel Corp., Senior Notes | | | 4.900 | % | | | 7/29/45 | | | | 220,000 | | | $ | 281,703 | |

QUALCOMM Inc., Senior Notes | | | 4.300 | % | | | 5/20/47 | | | | 70,000 | | | | 79,212 | |

Texas Instruments Inc., Senior Notes | | | 3.875 | % | | | 3/15/39 | | | | 430,000 | | | | 491,200 | |

Total Semiconductors & Semiconductor Equipment | | | | | | | | | | | | 852,115 | |

Software — 0.9% | | | | | | | | | | | | | | | | |

Microsoft Corp., Senior Notes | | | 4.250 | % | | | 2/6/47 | | | | 1,520,000 | | | | 1,887,156 | |

salesforce.com Inc., Senior Notes | | | 3.700 | % | | | 4/11/28 | | | | 120,000 | | | | 131,636 | |

Total Software | | | | | | | | | | | | | | | 2,018,792 | |

Technology Hardware, Storage & Peripherals — 0.4% | | | | | | | | | | | | | | | | |

Dell International LLC/EMC Corp., Senior Secured Notes | | | 4.420 | % | | | 6/15/21 | | | | 1,010,000 | | | | 1,040,235 | (b) |

Total Information Technology | | | | | | | | 6,120,925 | |

| Materials — 2.9% | | | | | | | | | | | | | | | | |

Metals & Mining — 2.9% | | | | | | | | | | | | | | | | |

Alcoa Nederland Holding BV, Senior Notes | | | 6.750 | % | | | 9/30/24 | | | | 400,000 | | | | 421,996 | (b) |

ArcelorMittal, Senior Notes | | | 4.550 | % | | | 3/11/26 | | | | 330,000 | | | | 346,172 | |

Barrick Gold Corp., Senior Notes | | | 5.250 | % | | | 4/1/42 | | | | 350,000 | | | | 424,174 | |

BHP Billiton Finance USA Ltd., Senior Notes (6.750% to 10/19/25 then

USD 5 year ICE Swap Rate + 5.093% to 10/19/45 then USD 5 year ICE

Swap Rate + 5.843%) | | | 6.750 | % | | | 10/19/75 | | | | 780,000 | | | | 914,994 | (a)(b) |

First Quantum Minerals Ltd., Senior Notes | | | 7.000 | % | | | 2/15/21 | | | | 112,000 | | | | 112,630 | (b) |

First Quantum Minerals Ltd., Senior Notes | | | 7.250 | % | | | 5/15/22 | | | | 260,000 | | | | 263,170 | (b) |

Freeport-McMoRan Inc., Senior Notes | | | 3.550 | % | | | 3/1/22 | | | | 100,000 | | | | 100,750 | |

Glencore Funding LLC, Senior Notes | | | 4.125 | % | | | 3/12/24 | | | | 300,000 | | | | 315,014 | (b) |

Glencore Funding LLC, Senior Notes | | | 4.000 | % | | | 3/27/27 | | | | 590,000 | | | | 611,926 | (b) |

Hudbay Minerals Inc., Senior Notes | | | 7.250 | % | | | 1/15/23 | | | | 60,000 | | | | 61,675 | (b) |

Northwest Acquisitions ULC/Dominion Finco Inc., Secured Notes | | | 7.125 | % | | | 11/1/22 | | | | 340,000 | | | | 219,936 | (b) |

Vale Overseas Ltd., Senior Notes | | | 4.375 | % | | | 1/11/22 | | | | 2,100,000 | | | | 2,179,405 | |

Yamana Gold Inc., Senior Notes | | | 4.625 | % | | | 12/15/27 | | | | 550,000 | | | | 582,598 | |

Total Materials | | | | | | | | 6,554,440 | |

| Real Estate — 2.0% | | | | | | | | | | | | | | | | |

Equity Real Estate Investment Trusts (REITs) — 1.8% | | | | | | | | | | | | | | | | |

MPT Operating Partnership LP/MPT Finance Corp., Senior Notes | | | 5.000 | % | | | 10/15/27 | | | | 400,000 | | | | 421,010 | |

MPT Operating Partnership LP/MPT Finance Corp., Senior Notes | | | 4.625 | % | | | 8/1/29 | | | | 270,000 | | | | 283,661 | |

Ventas Realty LP, Senior Notes | | | 4.400 | % | | | 1/15/29 | | | | 540,000 | | | | 594,943 | |

Vornado Realty LP, Senior Notes | | | 3.500 | % | | | 1/15/25 | | | | 1,000,000 | | | | 1,043,470 | |

| | | | | | | | | |

See Notes to Financial Statements.

| | |

20 | | Western Asset Investment Grade Defined Opportunity Trust Inc. 2019 Annual Report |

Western Asset Investment Grade Defined Opportunity Trust Inc.

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | Value | |

Equity Real Estate Investment Trusts (REITs) — continued | | | | | | | | | | | | | |

Welltower Inc., Senior Notes | | | 3.950 | % | | | 9/1/23 | | | | 1,050,000 | | | $ | 1,111,475 | |

Welltower Inc., Senior Notes | | | 4.125 | % | | | 3/15/29 | | | | 510,000 | | | | 556,395 | |

Total Equity Real Estate Investment Trusts (REITs) | | | | | | | | | | | | 4,010,954 | |

Real Estate Management & Development — 0.2% | | | | | | | | | | | | | | | | |

Security Capital Group Inc., Senior Notes | | | 7.700 | % | | | 6/15/28 | | | | 460,000 | | | | 575,218 | |

Total Real Estate | | | | | | | | | | | | | | | 4,586,172 | |

| Utilities — 4.4% | | | | | | | | | | | | | | | | |

Electric Utilities — 4.3% | | | | | | | | | | | | | | | | |

Berkshire Hathaway Energy Co., Senior Notes | | | 6.125 | % | | | 4/1/36 | | | | 1,000,000 | | | | 1,385,087 | |

CenterPoint Energy Houston Electric LLC, Senior Secured Bonds | | | 4.500 | % | | | 4/1/44 | | | | 530,000 | | | | 647,002 | |

Commonwealth Edison Co., First Mortgage Bonds | | | 6.450 | % | | | 1/15/38 | | | | 600,000 | | | | 872,331 | |

FirstEnergy Corp., Senior Notes | | | 3.900 | % | | | 7/15/27 | | | | 480,000 | | | | 514,046 | |

FirstEnergy Corp., Senior Notes | | | 7.375 | % | | | 11/15/31 | | | | 3,040,000 | | | | 4,262,861 | |

Jersey Central Power & Light Co., Senior Notes | | | 4.300 | % | | | 1/15/26 | | | | 170,000 | | | | 185,624 | (b) |

MidAmerican Energy Co. | | | 3.650 | % | | | 4/15/29 | | | | 240,000 | | | | 263,651 | |

Oncor Electric Delivery Co. LLC, Senior Secured Notes | | | 3.100 | % | | | 9/15/49 | | | | 230,000 | | | | 230,485 | |

Southern California Edison Co., First Mortgage Bonds | | | 4.125 | % | | | 3/1/48 | | | | 480,000 | | | | 513,478 | |

Virginia Electric & Power Co., Senior Notes | | | 8.875 | % | | | 11/15/38 | | | | 500,000 | | | | 846,817 | |

Total Electric Utilities | | | | | | | | | | | | | | | 9,721,382 | |

Independent Power and Renewable Electricity Producers — 0.1% | | | | | | | | | |

NRG Energy Inc., Senior Secured Notes | | | 3.750 | % | | | 6/15/24 | | | | 320,000 | | | | 330,158 | (b) |

Total Utilities | | | | | | | | | | | | | | | 10,051,540 | |

Total Corporate Bonds & Notes (Cost — $191,685,916) | | | | | | | | | | | | 218,361,647 | |

| Sovereign Bonds — 1.2% | | | | | | | | | | | | | | | | |

Argentina — 0.6% | | | | | | | | | | | | | | | | |

Argentina POM Politica Monetaria, Bonds (Argentina Central Bank 7 Day Repo Reference Rate) | | | 70.941 | % | | | 6/21/20 | | | | 8,960,000 | ARS | | | 38,913 | (a)(f) |

Argentine Bonos del Tesoro, Bonds | | | 18.200 | % | | | 10/3/21 | | | | 650,000 | ARS | | | 2,362 | (f) |

Argentine Republic Government International Bond, Senior Notes | | | 5.875 | % | | | 1/11/28 | | | | 930,000 | | | | 371,393 | |

Argentine Republic Government International Bond, Senior Notes | | | 7.625 | % | | | 4/22/46 | | | | 150,000 | | | | 63,965 | |

Argentine Republic Government International Bond, Senior Notes | | | 6.875 | % | | | 1/11/48 | | | | 260,000 | | | | 103,856 | |

Provincia de Buenos Aires, Senior Notes | | | 9.125 | % | | | 3/16/24 | | | | 1,930,000 | | | | 743,050 | (b) |

Total Argentina | | | | | | | | | | | | | | | 1,323,539 | |

| | | | | | | | | |

See Notes to Financial Statements.

| | |

| Western Asset Investment Grade Defined Opportunity Trust Inc. 2019 Annual Report | | 21 |

Schedule of investments (cont’d)

November 30, 2019

Western Asset Investment Grade Defined Opportunity Trust Inc.

| | | | | | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount† | | | | | | Value | |

Ecuador — 0.2% | | | | | | | | | | | | | | | | | | | | |

Ecuador Government International Bond, Senior Notes | | | 10.750 | % | | | 3/28/22 | | | | 310,000 | | | $ | | | | | 273,672 | (b) |

Ecuador Government International Bond, Senior Notes | | | 10.750 | % | | | 1/31/29 | | | | 200,000 | | | | | | | | 167,571 | (b) |

Total Ecuador | | | | | | | | | | | | | | | | | | | 441,243 | |

Ghana — 0.1% | | | | | | | | | | | | | | | | | | | | |

Ghana Government International Bond, Senior Notes | | | 8.950 | % | | | 3/26/51 | | | | 300,000 | | | | | | | | 294,721 | (b) |

Nigeria — 0.1% | | | | | | | | | | | | | | | | | | | | |

Nigeria Government International Bond, Senior Notes | | | 7.696 | % | | | 2/23/38 | | | | 220,000 | | | | | | | | 215,457 | (b) |

Qatar — 0.2% | | | | | | | | | | | | | | | | | | | | |

Qatar Government International Bond, Senior Notes | | | 4.817 | % | | | 3/14/49 | | | | 410,000 | | | | | | | | 507,705 | (b) |

Total Sovereign Bonds (Cost — $5,355,860) | | | | | | | | | | | | | | | | | | | 2,782,665 | |

| | | | | |

| | | | | | | | | Shares | | | | | | | |

| Preferred Stocks — 1.1% | | | | | | | | | | | | | | | | | | | | |

| Financials — 1.1% | | | | | | | | | | | | | | | | | | | | |

Banks — 1.0% | | | | | | | | | | | | | | | | | | | | |

GMAC Capital Trust I (3 mo. USD LIBOR + 5.785%) | | | 7.695 | % | | | | | | | 85,800 | | | | | | | | 2,224,794 | (a) |