Exhibit 99.1

EMPLOYEE EQUITY FAQ

This Q&A is provided to help Jive Employees navigate how the proposed acquisition will affect any Jive equity that they hold.

Specifically, this Q&A will cover the following:

| | • | | the treatment of outstanding equity awards granted under Jive’s equity plans, |

| | • | | the treatment of purchase rights under Jive’s Employee Stock Purchase Plan (ESPP), and |

| | • | | the effects on Jive common stock you may hold. |

Important Note: The treatment described below is subject to the acquisition being completed. If the acquisition is not completed, the treatment of Jive equity awards, Jive ESPP purchase rights, and Jive common stock described below will not occur, and the Jive equity awards and Jive ESPP purchase rights will continue under their present terms and conditions.

General

| | (1) | Who is acquiring Jive? |

ESW Capital, LLC, through its affiliate, Wave Systems Corp., is acquiring Jive and Jive will become a part of the Aurea family of companies. Aurea is a technology solutions provider that delivers transformative customer experiences. The transaction is valued at $462 million.

| | (2) | When will the acquisition be finalized? |

An affiliate of ESW Capital will commence a tender offer for all the outstanding common shares of Jive at a purchase price of $5.25 per share. In order for the acquisition to be completed, a majority of Jive’s outstanding shares must be tendered by Jive stockholders in the tender offer. In addition, the acquisition is subject to obtaining regulatory approval and satisfying other customary closing conditions. The transaction is expected to close in June 2017. We are committed to maintaining open communications with all employees and will share additional information as it becomes available.

Equity Awards

| | (3) | Now that the acquisition agreement has been signed, how does this impact my vested Jive restricted stock units (“RSUs”) and vested Jive stock options? |

The signing of the agreement generally has no impact on your vested equity awards. Until the acquisition closes, these awards continue in accordance with their present terms and conditions.

Note that there may be additional restrictions on your ability to sell the underlying shares of Jive common stock you acquire under these awards. See the section entitled “Pre-Closing Trading Restrictions” below for additional details.

| | (4) | I had my RSUs vest and believe I now hold Jive common stock. Is there a difference between holding Vested RSUs and Jive common stock received from vesting of RSUs? |

‘Vested RSUs’ means RSUs that have vested but the underlying shares of Common Stock have not yet been issued to you. Most RSUs that have vested have had such RSUs settle into Jive common stock and now hold shares of Jive common stock. See the section entitled “Common Stock” below for additional details. If you have further questions on RSUs that have vested, please contact Lisa Jurinka or Nathan Aman.

-1-

| | (5) | Does the signing of the acquisition agreement have any effect on my outstanding unvested Jive RSUs or unvested Jive stock options? |

As with vested awards, the signing of the acquisition agreement generally has no impact on your unvested RSUs and unvested stock options. Until the acquisition closes, these awards will also continue in accordance with their present terms and conditions. There may be additional restrictions on your ability to sell the underlying shares of Jive common stock you acquire under these awards. See the section entitled “Pre-Closing Trading Restrictions” below for additional details.

| | (6) | What happens to my vested and unvested RSUs at the closing? |

Any vested RSUs (that have not yet settled into Jive common stock) and any unvested RSUs that are outstanding as of immediately prior to the closing will be cancelled and converted into the right to receive a cash payment, less applicable tax withholding (the “RSU Consideration”), equal to:

Total number of your outstanding RSUs x $5.25

See question (8) below for a description of when the RSU Consideration will be paid.

Note that any vested RSUs that have been previously settled and which you now hold as Jive common stock will be treated as Jive common stock in the acquisition. See the section entitled “Common Stock” below for additional details.

| | (7) | What happens to my vested and unvested Jive stock options at the closing? |

Your vested and unvested stock options that are outstanding as of immediately prior to the closing of the acquisition will be cancelled and, if the per share exercise price of those stock options is less than $5.25 per share, they will be converted into the right to receive a cash payment, less applicable tax withholding (the “Option Consideration”), equal to:

Total number shares subject to your stock option award x ($5.25 – per share exercise price)

Each of your vested and unvested stock option awards that has a per share exercise price of $5.25 or more will be cancelled for no consideration at the closing.

See question (8) below for a description of when the Option Consideration will be paid.

| | (8) | When and How will the Option Consideration and RSU Consideration be paid? |

The Options Consideration and RSU Consideration are expected to be paid via payroll as follows:

Vested Awards.

| | • | | Payments on vested RSUs (that have not settled into Jive common stock) and vested options that are outstanding as of immediately before the closing will be paid no later than the second payroll date following the closing. |

| | • | | If you hold shares of Jive common stock that you acquired through the vesting of RSUs or the exercise of stock options, these shares will be treated like all other shares of Jive common stock and be eligible to receive $5.25 per share in connection with the tender offer or closing of the merger. See the section entitled “Common Stock” below for additional details. |

Unvested Awards. Payments on RSUs and options that are unvested and outstanding as of immediately before the closing generally will be paid in accordance with the vesting schedule that applies to these

-2-

unvested awards immediately before the closing (subject to the same restrictions and other terms of such vesting schedule, e.g., continued service through the applicable vesting date(s)). The payment will be made no later than the second payroll date following the applicable vesting date.

| | (9) | What happens to the unpaid RSU Consideration and Option Consideration if I terminate before the closing? |

If your termination is for any reason other than cause between the closing and the one-year anniversary of the closing, you generally are entitled to the RSU Consideration and Option Consideration that otherwise would have been paid between the closing and the 1-year anniversary of the closing.

Except as noted above, you generally will forfeit your unpaid RSU Consideration and Option Consideration upon your termination.

| | (10) | How would the payment of the RSU Consideration and Option Consideration work in practice? |

Example (RSUs):

Assume the closing occurred on June 15, 2017 and you hold 5,000 unvested RSUs immediately prior to the closing that are scheduled to vest in equal installments over the next 10 quarters (assume vesting dates are August 15, November 15, February 15, and May 15). If your service is terminated for reasons other than cause on February 1, 2018, and you are not a party to any vesting acceleration agreement, the following table shows how your RSUs will be treated and the RSU Consideration that would be paid to you.

| | |

Total RSUs (as of closing) | | 5,000 |

Vested and Unsettled RSUs (as of closing) | | 0 |

Unvested RSUs (as of closing) | | 5,000 |

Total Vested RSU Consideration | | $0 |

Total Unvested RSU Consideration | | $26,250

(5,000 x $5.25) |

Quarterly Unvested RSU Consideration(1) | | $2,625

($26,250/10 quarters) |

Total Unvested RSU Consideration Paid as of Termination(2) (as of 2/1/18) | | $5,250

($2,625 x 2 quarters) |

Accelerated RSU Consideration(3) (as of 2/1/18) | | $5,250

($2,625 x 2 quarters) |

| (1) | In this example, the RSU Consideration is payable in quarterly installments of $2,625 no later than the second payroll date following each quarterly vesting date applicable to your RSUs (August 15, November 15, February 15, and May 15) as long as you remain in continued service. |

| (2) | Assuming a 2/1/2018 termination, this amount represents the total amount of RSU Consideration that was paid to you prior to your termination. The $5,250 represents the value of RSU Consideration you received applicable to the two quarterly vesting dates prior to 2/1/2018. Since you remained in continued service through 2/1/18, the August 15 and November 15 vest dates occurred and would have been paid. |

-3-

| (3) | Due to the acceleration benefits described above, you are entitled to the RSU Consideration that otherwise would be paid to you through June 15, 2018 (the 1-year anniversary of the closing), or 2 quarters of payments reflecting vesting for the remaining quarterly vest dates that would have occurred through June 15, 2018 (February 2018 and May 2018). |

The amounts in this example will be paid via payroll less applicable tax withholding.

Example (in-the-money options):

Assume the closing occurred on June 15, 2017, you hold 5,000 in-the-money options immediately prior to the closing. 3,000 of the options have already vested as of the closing and the remaining 2,000 options vest monthly on the 15th day of each month through December 15, 2019 (18 months following the closing) as long you remain in continuous service. The per share exercise price of these stock options is $3.00 per share. Your service is terminated for reasons other than cause on February 1, 2018, and you are not a party to any vesting acceleration agreement. The acquisition will have the following impact on your stock options.

| | |

Total Option Shares (as of closing) | | 5,000 |

Vested Option Shares (as of closing) | | 3,000 |

Unvested Option Shares (as of closing) | | 2,000 |

Option Exercise Price | | $3.00 |

Total Option Consideration | | $11,250

(5,000 x ($5.25-$3.00)) |

Total Vested Option Consideration | | $6,750

(3,000 x ($5.25-$3.00) |

Total Unvested Option Consideration(1) | | $4,500

(2,000 x ($5.25-$3.00) |

Monthly Unvested Option Consideration | | $250

($4,500/18 months) |

Total Unvested Option Consideration Paid as of Termination(2) (as of 2/1/18) | | $1,750

($250 x 7 months) |

Accelerated Option Consideration(3) (as of 2/1/18) | | $1,250

($250 x 5 months) |

| (1) | In this example, the Option Consideration is payable in monthly installments of $250 no later than the second payroll date following each monthly vesting date as long as you remain in continued service. |

| (2) | Assuming a 2/1/2018 termination, this amount represents the total amount of unvested Option Consideration that was paid to you prior to your termination. The $1,750 represents the value of Option Consideration you received applicable to seven monthly vesting dates prior to 2/1/2018. Since you remained in continued service through 2/1/18, the monthly vest dates for July through January occurred and would have been paid. |

| (3) | Due to the acceleration benefits described above, you are entitled to the Option Consideration that otherwise would be paid to you through June 15, 2018 (the 1-year anniversary of the closing), or 5 months of payments reflecting vesting for the remaining quarterly vest dates that would have occurred through June 15, 2018 (February 2018 through June 2018). |

-4-

The amounts in this example will be paid via payroll less applicable tax withholding.

| | (11) | What happens if I choose to exercise any of my vested stock options prior to closing? |

You have no obligation to exercise your stock options in connection with the acquisition. If you determine to exercise options at any time prior to closing and do not immediately sell the shares obtained on exercise (i.e. exercise and sell), any shares of Jive common stock that you continue to hold will be treated in the same way as other shares of our common stock in the transaction, as described in the “Common Stock” section below. Please consult with your financial and tax advisor if you are interested in exercising your stock options. Please note that any transactions made prior to closing must comply with Jive’s Insider Trading Policy. Additional details are provided in the “Pre-Trading Closing Restrictions” section below.

Please note that we expect to implement a pre-closing stock option exercise cut-off date in order to facilitate a smooth closing of the acquisition. Additional details will be provided as the closing approaches. We expect to have a better understanding of this cut-off date later this month.

ESPP

| | (12) | How does the signing of the acquisition agreement impact my rights under the Jive ESPP? |

If you are a current participant in the Jive ESPP, you can continue to participate in the Jive ESPP at the same contribution rate that you previously elected (or a lesser contribution rate that you elect) through the final ESPP purchase date (as discussed in question (13) below). The purchase of shares under the ESPP will continue to be made at their regularly-scheduled intervals through the final ESPP purchase date on the same terms as set forth in the Jive ESPP.

If your current ESPP offering period expires in May 2017, you will automatically be enrolled in a new offering period under the ESPP that begins on May 15, 2017 at the same contribution rate that you previously elected (or a lesser contribution rate that you elect). You may also withdraw from the ESPP at any time.

If you are not a current participant in the ESPP, you will not be able to enroll in the Jive ESPP.

| | (13) | When will the final ESPP purchase date be? |

The final purchase date under the ESPP will be within a few days prior to closing. This date has not yet been set. Purchased shares will be deposited into your brokerage account shortly after the purchase date. Jive will only buy whole shares with your current contributions. You will receive a refund of any contribution that is not enough to buy a whole share or if you reach the limitations under the ESPP.

| | (14) | How will I be paid for my ESPP shares? |

Any ESPP shares you still hold immediately before the closing, including ESPP shares purchased on the final ESPP purchase date, will be cancelled at closing and converted into the right to receive a cash payment equal to $5.25 per share.

| | (15) | Will the cash-out of my ESPP shares result in taxable income to me? |

USA-based Employees: A portion of your ESPP share proceeds will be taxable. The cash-out of your ESPP shares will be a disposition of such shares for U.S. federal tax purposes. Jive will report on your W-2 for the year of the closing an amount of ordinary income based on how long you held your ESPP shares. Please refer to the Jive prospectus for further information about the tax treatment of disposing of your ESPP shares.

-5-

Non-USA-based Employees: Please consult with your tax advisor.

| | (16) | When will the ESPP terminate? |

The ESPP will terminate immediately following the final purchase date. After the final purchase date, there will be no further ESPP contributions.

Common Stock

| | (17) | How do I tender my shares of Jive common stock? |

The tender offer will commence when the affiliate of ESW Capital files a Schedule TO, which will include an Offer to Purchase setting forth the terms of the tender offer, with the United States Securities and Exchange Commission. When the tender offer is commenced, you will receive instructions from your broker on how to tender your shares (or, in the unlikely case that you hold your shares directly, a letter of transmittal from Computershare, the depositary in the tender offer). To tender your shares, you should follow the instructions in the documents that you receive. Your shares will include any shares of Jive common stock you previously acquired through option exercises, the vesting of RSUs, or purchases under the ESPP that you continue to hold.

| | (18) | If I am an employee stockholder, can I participate in the tender offer and what happens if I do not? |

Yes, all stockholders can participate in the tender offer, whether or not they are employees. If you do not participate in the tender offer, then you will still receive consideration of $5.25 in cash per share upon the closing of the merger following the tender offer, but only if the conditions to closing are met, including that Jive stockholders tender a majority of Jive’s outstanding shares in the tender offer. If and when the closing of the merger occurs, you do not have to take any action and your brokerage account will be credited with the consideration to which you are entitled as soon as possible following the closing (or, in the unlikely case that you hold your shares directly, you will receive a letter of transmittal from Computershare and you should follow the instructions provided in order to receive the payment for your shares).

Pre-Closing Trading Restrictions

| | (19) | Can I trade Jive stock prior to the closing of the acquisition? |

All employees remain subject to Jive’s insider trading policy. The regular trading blackout window, which is currently in effect, applies to you. The regular trading blackout window will end at the beginning of the third business day following the public disclosure of Jive’s earnings for the quarter ended March 31, 2017, which is expected to be May 15, 2017. Any additional restrictions will be communicated to you by Jive’s legal department.

The quarterly blackout period for Q2 will begin at the close of trading on June 16th and end at the beginning of the third business day following the public disclosure of Jive’s Q2 earnings. If the acquisition closes before that time, the open window that is expected to begin on May 15, 2017 will be the last opportunity to sell shares before the closing.

| | (20) | Am I always permitted to trade outside of a quarterly blackout period? |

Not necessarily. In addition to quarterly blackouts, Jive may impose special blackout periods on board members, officers and employees and consultants due to the existence of a material unannounced transaction or other development. The implementation of special blackout periods may result in additional periods in which you are not permitted to engage in any trading in Jive’s securities. Any special blackout period applicable to you will be communicated to you by Jive’s legal department.

-6-

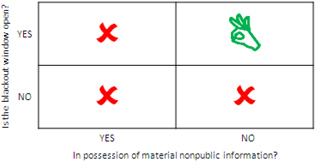

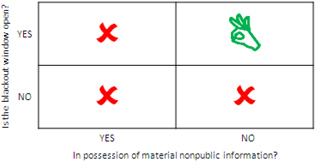

In addition, regardless of whether a blackout is in effect, you may never trade Jive’s securities if you are aware of material nonpublic information about Jive. For a summary, please consult the chart below.

| | (21) | What is material non-public information? |

Information is “material” if a reasonable investor would consider it to be important in deciding whether or not to buy, sell or hold stock. Information is “nonpublic” until it has been widely disseminated to the public market. For example, Jive’s quarterly financial results are considered to be material and such results are considered to be nonpublic until the beginning of the third full trading day after the earnings release. If you had knowledge of Jive’s quarterly financial results before the beginning of the third full trading day after the earnings release, and decided to buy or sell Jive stock based upon that knowledge, you could be liable for insider trading violations. Examples of other types of material information are listed in the Jive Insider Trading Policy.

| | (22) | What if I am subject to the pre-clearance requirements under the Insider Trading Policy? |

You remain subject to the pre-clearance requirements and must comply with them prior to engaging in any transaction involving Jive’s securities.

Any descriptions contained in this Q&A regarding how the treatment of Jive equity awards, the Jive ESPP, and Jive common stock in connection with the acquisition will be characterized for tax purposes are provided solely for general information purposes and do not constitute tax advice. Your federal, state, local, and foreign tax consequences depend upon your unique circumstances. You should consult your own tax advisor as to the specific tax implications to you of the acquisition with respect to your Jive equity awards, Jive ESPP rights, and/or shares of Jive common stock, including the applicability and effect of federal, state, local, and foreign tax laws.

Important Additional Information and Where to Find It

In connection with the proposed acquisition of Jive Software, Inc. (“Jive”) by Wave Systems Corp. (“Parent”), Jazz MergerSub, Inc. (“Acquisition Sub”), a wholly-owned subsidiary of Parent, will commence a tender offer for all of the outstanding shares of Jive. Such tender offer has not yet commenced. This communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares of Jive, nor is it a substitute for the tender offer materials that Parent, Acquisition Sub and ESW Capital, LLC (“Guarantor”) will file with the SEC upon commencement of the tender offer. At the time that the tender offer is commenced, Parent, Acquisition Sub and Guarantor will file tender offer materials on Schedule TO with the SEC, and Jive will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the offer. THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT WILL CONTAIN IMPORTANT INFORMATION THAT SHOULD BE READ CAREFULLY AND CONSIDERED BY JIVE’S STOCKHOLDERS

-7-

BEFORE ANY DECISION IS MADE WITH RESPECT TO THE TENDER OFFER. Both the tender offer statement and the solicitation/recommendation statement will be made available to Jive’s stockholders free of charge. A free copy of the tender offer statement and the solicitation/recommendation statement will also be made available to all stockholders of Jive by contacting Jive at lisa.jurinka@jivesoftware.com or jason.khoury@jivesoftware.com by phone at (415) 580-4738 or (650) 847-8308, or by visiting Jive’s website (www.jivesoftware.com). In addition, the tender offer statement and the solicitation/recommendation statement (and all other documents filed with the SEC) will be available at no charge on the SEC’s website (www.sec.gov) upon filing with the SEC. JIVE’S STOCKHOLDERS ARE ADVISED TO READ THE TENDER OFFER STATEMENT AND THE SOLICITATION/RECOMMENDATION STATEMENT, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BEFORE THEY MAKE ANY DECISION WITH RESPECT TO THE TENDER OFFER BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE TRANSACTION.

Forward Looking Statements

This document contains certain statements that constitute forward-looking statements. These forward-looking statements include, but are not limited to, statements regarding the satisfaction of conditions to the completion of the proposed transaction and the expected completion of the proposed transaction, as well as other statements that are not historical fact. These forward-looking statements are based on currently available information, as well as Jive’s views and assumptions regarding future events as of the time such statements are being made. Such forward looking statements are subject to inherent risks and uncertainties. Accordingly, actual results may differ materially and adversely from those expressed or implied in such forward-looking statements. Such risks and uncertainties include, but are not limited to, the potential failure to satisfy conditions to the completion of the proposed transaction due to the failure to receive a sufficient number of tendered shares in the tender offer, as well as those described in cautionary statements contained elsewhere herein and in Jive’s periodic reports filed with the SEC including the statements set forth under “Risk Factors” set forth in Jive’s most recent annual report on Form 10-K, the Tender Offer Statement on Schedule TO (including the offer to purchase, the letter of transmittal and other documents relating to the tender offer) to be filed by Parent, Acquisition Sub and Guarantor, and the Solicitation/Recommendation Statement on Schedule 14D-9 to be filed by Jive. As a result of these and other risks, the proposed transaction may not be completed on the timeframe expected or at all. These forward-looking statements reflect Jive’s expectations as of the date of this report. While Jive may elect to update any such forward-looking statements at some point in the future, Jive specifically disclaims any obligation to do so, even if our expectations change, except as required by law.

-8-