| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

FORM N-CSR |

| |

CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

MANAGEMENT INVESTMENT COMPANIES |

| |

| |

| |

| Investment Company Act File Number: 811-22293 |

|

| |

| T. Rowe Price U.S. Large-Cap Core Fund, Inc. |

|

| (Exact name of registrant as specified in charter) |

| |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Address of principal executive offices) |

| |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Name and address of agent for service) |

| |

| |

| Registrant’s telephone number, including area code: (410) 345-2000 |

| |

| |

| Date of fiscal year end: December 31 |

| |

| |

| Date of reporting period: December 31, 2009 |

Item 1: Report to Shareholders| U.S. Large-Cap Core Fund | December 31, 2009 |

The views and opinions in this report were current as of December 31, 2009. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

REPORTS ON THE WEB

Sign up for our E-mail Program, and you can begin to receive updated fund reports and prospectuses online rather than through the mail. Log in to your account at troweprice.com for more information.

Manager’s Letter

Fellow Shareholders

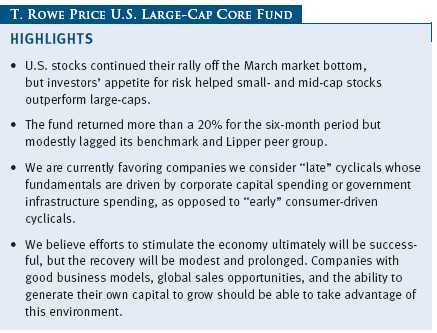

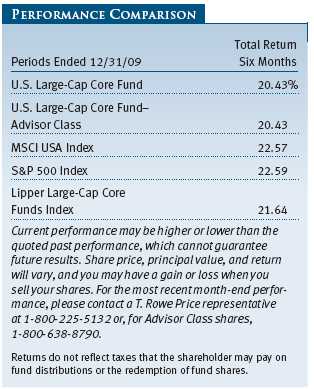

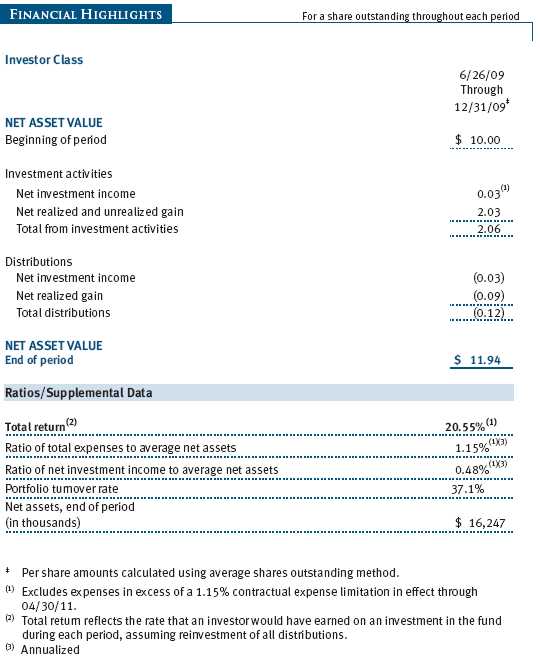

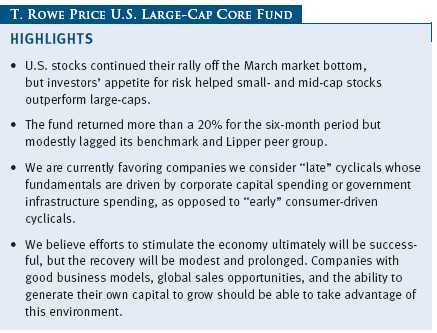

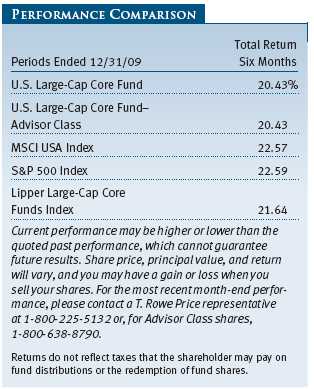

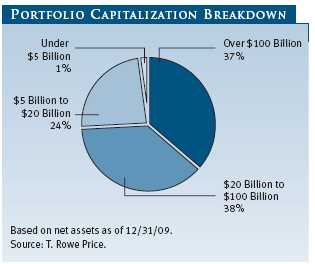

We would like to welcome shareholders to the fund, which began operations on June 26, 2009. This fund’s launch came after stocks had rallied off the market’s bottom in early March. As we progressed through the second half of 2009, U.S. economic data indicated that housing, unemployment, and consumer credit had bottomed and were improving. Encouraging global economic data increased investors’ appetite for risk and drove a greater than 22% gain in the Standard & Poor’s 500 Index in the last six months. In this environment, well-established large-cap stocks, the focus of this fund, lagged the more volatile mid- and small-cap equities.

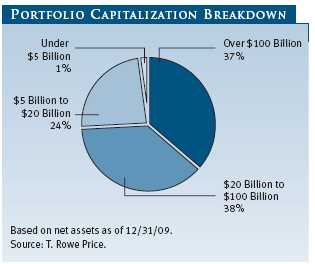

Your fund returned 20.43% during the second half of 2009 as markets rallied, modestly lagging the S&P 500 and Lipper benchmarks. Our bias for owning higher-quality equities was the primary reason for the fund’s underperformance versus the indexes. In addition, the more speculative market environment in the second half rewarded smaller-capitalization and lower-quality stocks. This pattern of small-cap and lower-quality stock outperformance is common during the early quarters of a recovery, but the magnitude of this speculative rally was significant historically.

INVESTMENT APPROACH

The U.S. Large-Cap Core Fund seeks long-term capital appreciation by investing in a concentrated portfolio of domestic large-cap growth and value stocks. The fund will use a fundamental, bottom-up analysis that also relies on a rigorous valuation assessment to find the stocks with the most potential for appreciation. Since the fund’s holdings will be limited to between 50 and 75 holdings—more concentrated than other large-cap T. Rowe Price funds—it has in place a rigorous process to moderate risk by reviewing holdings daily and ensuring they are within the portfolio’s allocation parameters.

In selecting the stocks for the portfolio, the fund generally starts with companies with more than $4 billion market capitalization and that carry “buy” ratings from T. Rowe Price analysts. In our analysis of these companies, we focus on four key elements: understanding a company’s business model and strategy, developing a relationship with the company’s management, determining the company’s standing within its industry, and assessing the company’s valuation.

The fund will focus on high-quality companies that have opportunities to increase their market share or that have barriers of entry around their business that protect them and allow them to grow organically. We will invest in well-managed companies that have great products and services within an industry that may be in a cyclical trough. Lastly, we will invest in companies that have characteristics that we believe can drive equity appreciation, such as pricing power, new product cycles, improving margins, and a strategy to earn better returns on their invested capital.

Beyond good fundamentals, we will invest in management teams that can create value by effectively operating and improving the business. We will pay close attention to free cash flow and how effective management is in redeploying its capital. We like managements that invest in their business when there is the potential for attractive returns or that return capital to shareholders if conditions warrant.

We also have in place a disciplined sell process. After stocks are added to the portfolio, they will be subject to continued scrutiny. Criteria for selling stocks are: a T. Rowe Price analyst downgrades the stock, we see a deterioration in the company’s fundamentals or management, we find a better investment idea, or a company fulfills our investment thesis and becomes fully valued.

MARKET ENVIRONMENT

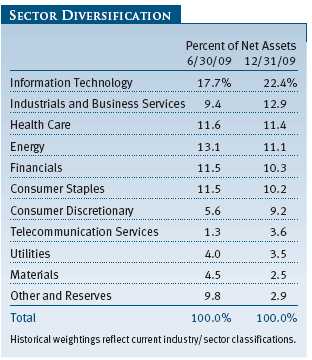

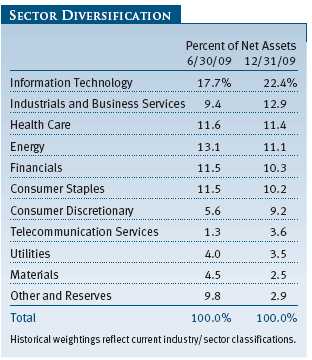

The second half of 2009 was a favorable environment for equity investors, and the S&P 500 returned more than 22%. U.S. stocks rebounded strongly from the distressed levels seen in March. Global stimulus measures helped restore confidence in the financial markets here in the U.S. and around the world. As U.S. economic data improved, investors increased their tolerance for risk and gravitated toward smaller-capitalization equities, which were often the stocks that had fallen the most during the economic downturn. Cyclical stocks in the energy and materials sectors rebounded strongly as the commodity prices surged. Information technology companies benefited from solid relative fundamentals and investor excitement about new product cycles that were poised to drive growth in 2010. Finally, consumer discretionary stocks performed very well as investors bet that U.S. consumers would increase their spending and again prove to be far more resilient than many economists have predicted.

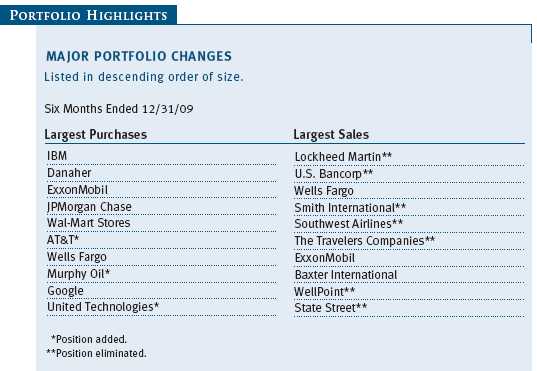

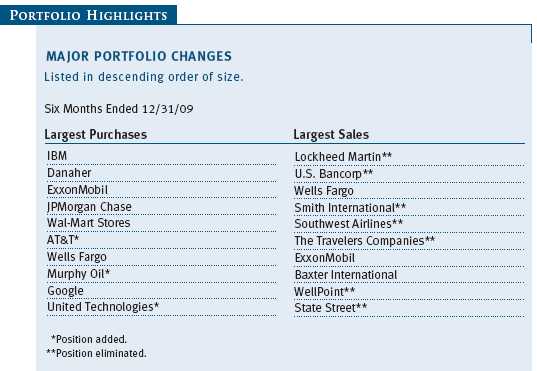

PORTFOLIO HIGHLIGHTS

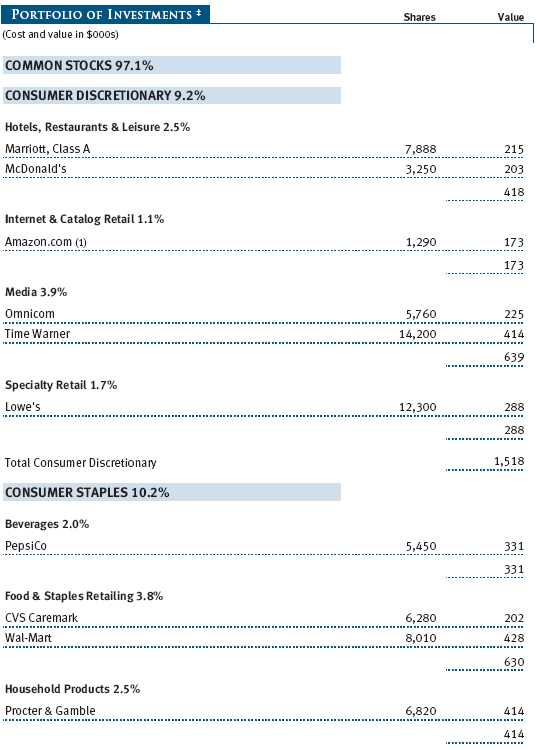

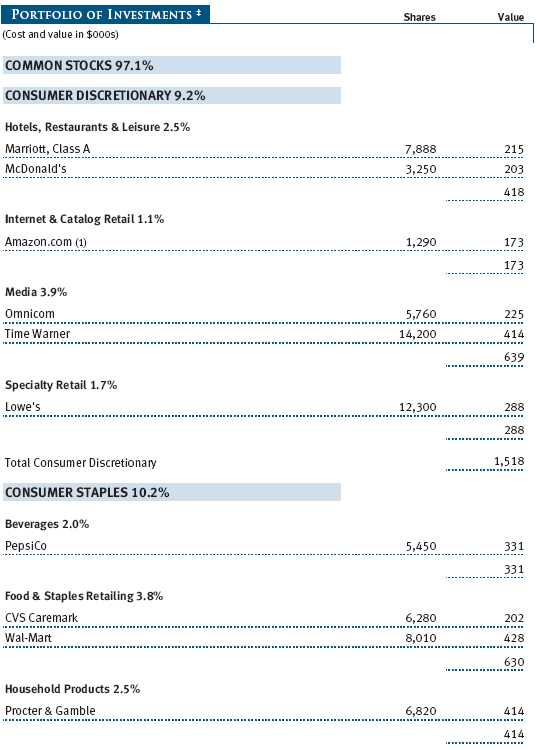

Our information technology and consumer discretionary holdings were the primary contributors to the fund’s strong absolute return. Many of the highest-quality technology and consumer discretionary stocks had sold off significantly during the recession, which provided an opportunity to own large positions in some of our favorite long-term stocks. Our top five contributors—Time Warner, Google, Amazon.com, Microsoft, and MasterCard—all came from technology and consumer sectors. The fund continues to own a large position in Time Warner because we believe that investors do not yet appreciate the improvements management has made by spinning off AOL and restructuring the core corporate infrastructure. Google and MasterCard are both leading players in markets we view as offering strong and sustainable secular growth. The fund will continue to hold meaningful positions in both stocks. Amazon.com also has a very strong secular tailwind, but the company’s valuation has become more of a challenge. We will continue to own Amazon.com, but our exposure will be smaller. Microsoft has performed very well in anticipation of the release of its new Windows 7 operating system. We believe that Windows 7 will be a strong driver of fundamentals for Microsoft in 2010 and are maintaining our holdings. (Please refer to the portfolio of investments for a complete listing of fund holdings and the amount each represents in the portfolio.)

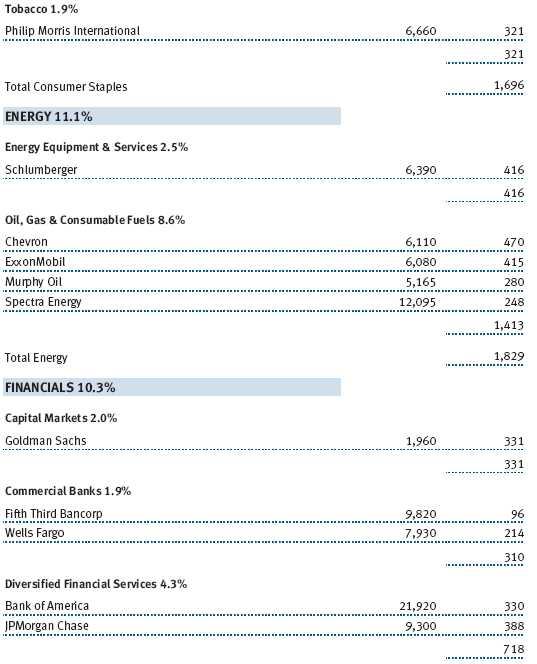

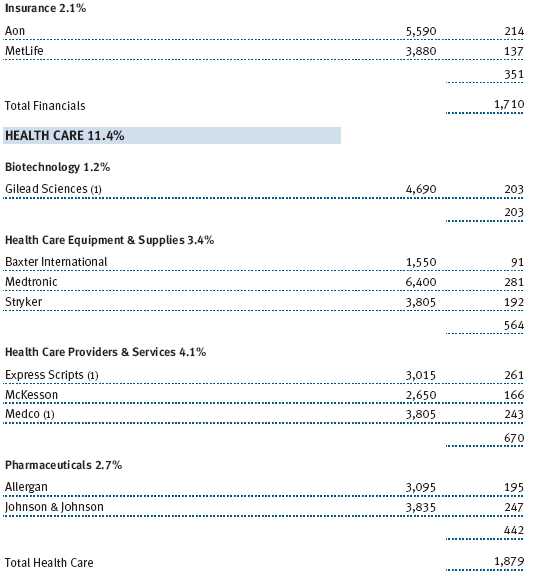

The primary detractors from fund performance came from the financials sector. While the fund’s lighter exposure to financials helped, any benefit was offset by the poor stock selection. The largest performance detractor was Bank of America, which suffered from significant consumer credit concerns as well as uncertainty over management changes and government intervention. We are pleased that late in the fourth quarter Bank of America was able to repay borrowed government funds and establish new executive leadership, which did a lot to clear the uncertainty clouding the company’s management. We believe these actions, as well as the bank’s improving credit metrics, support a strong recovery for Bank of America shares in 2010. JPMorgan Chase was also a major detractor from performance as it faced similar government and credit issues. The fund maintains a significant position in JPMorgan Chase as we view it as the highest-quality large-bank stock. Based on its earnings power in a normalized credit environment, we believe the stock is materially undervalued.

PORTFOLIO STRATEGY

The portfolio’s holdings are focused on companies that have strong brands, a worldwide presence, and less reliance on the strength of the U.S. economy to drive their revenues and earnings. Heading into 2010, the portfolio has a larger exposure to high-quality cyclicals, which will benefit from stronger fundamentals as the global economy recovers. We view many of these companies as “late” cyclicals whose fundamentals are driven by corporate capital spending or government infrastructure spending, as opposed to “early” cyclicals that are driven more by consumer spending.

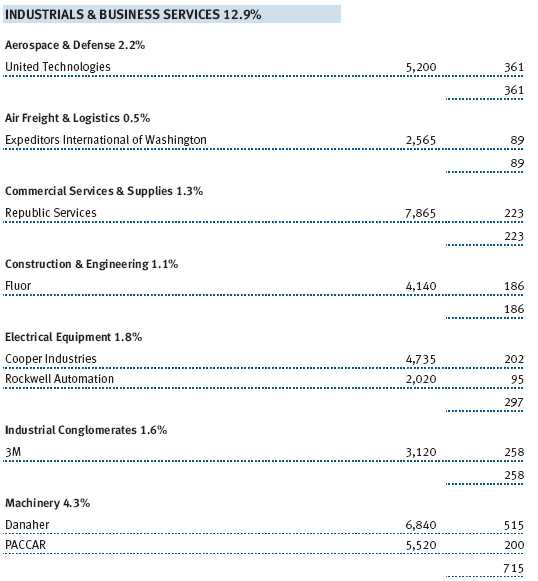

An example of a cyclical stock we expect to do well in 2010 is Danaher, an industrial tools and technology company that sells products worldwide. Danaher is a very well-managed business that historically has carried a premium multiple when compared with its industrial peers. Based on our estimate of the company’s cash flow potential over the course of the next cycle, Danaher currently looks undervalued to us. Danaher also has demonstrated an ability to create shareholder value through acquisitions, and the company has a well-capitalized balance sheet with nearly $2 billion in cash available for potential acquisitions.

Another cyclical stock we like is Schlumberger, the world’s largest oil services company, providing technology and project management services to oil and gas exploration companies around the globe. Schlumberger has a strong and defensible market position, but the stock had performed poorly due to the collapse in oil prices in the second half of 2008. We believe that many of the resource exploration projects that were put on hold when commodity prices were lower will resume. With oil prices averaging over $75 recently, Schlumberger is very well positioned to benefit from a rebound in oil and gas company capital and exploration spending.

Property and casualty insurer The Travelers Companies is an example of an undervalued stock we added to the portfolio that subsequently bounced back. The stock historically has traded in a range between a 20% discount to a 20% premium to its book value. In early 2009, the stock was trading toward the lower end of this range. Investors were concerned that Travelers had some of the same balance sheet issues that were troubling some of its competitors. Our analysis determined that Travelers’ balance sheet was much more conservatively positioned than its peers and that the company would not have similar credit-related issues. We took a position in Travelers on the expectation that the stock would eventually trade back toward the higher end of its long-term valuation range once the market realized the stability of the company’s balance sheet. Travelers did indeed appreciate toward the range’s higher end after the company reported third-quarter earnings. Once it reached that fully valued level, we realized our gains and sold our investment.

We eliminated Lockheed Martin, a large defense contractor and provider of technology services to the federal government, because it no longer met our original investment thesis. Lockheed historically has been a strong operator, but some execution issues on a couple of projects and the Defense Department’s decision to push out the time-line of some large projects have materially changed our future earnings expectations for Lockheed Martin.

OUTLOOK

Recent data confirm that the worst of the recession is over, but the economy’s strength is still open to question given the persistently high unemployment levels and volatile housing data. A replenishment of inventories that were depleted during the downturn is generating a nice snapback in economic activity. In the first half of 2010, the economy will face the challenge of diminishing government stimulus, and it will be time for the recovery to show that it is self-sustaining. We are confident that the U.S. economy can successfully grow without significant government assistance, but chastened consumers and corporate executives are likely to be much more cautious in their spending, which may temper growth rates. This environment should generate good investment opportunities in companies that have a global presence, are self-financed, and have strong brands and portfolios of products.

In the construction of our portfolio, we also are taking into account U.S. government policies. We applaud the moves by the U.S. government that have restored stability to the nation’s financial industry and credit markets. However, the government has also contemplated a number of initiatives—higher taxes and protectionist trade policies—that we believe could hinder growth. Health care reform and additional regulation of the financial services industry may crimp future returns and cash flows of companies in those sectors.

As we exit this recession, large-cap stocks have been lagging mid- and small-caps, but large-cap stocks now carry reasonable valuations that should set the stage for them to begin to outperform.

Once again, we welcome you as new shareholders and look forward to helping you achieve your long-term investment objectives.

Respectfully submitted,

Jeffrey Rottinghaus

Chairman of the fund’s Investment Advisory Committee

January 15, 2010

The committee chairman has day-to-day responsibility for managing the portfolio and works with committee members in developing and executing the fund’s investment program.

RISKS OF STOCK INVESTING

The fund’s share price can fall because of weakness in the stock markets, a particular industry, or specific holdings. Stock markets can decline for many reasons, including adverse political or economic developments, changes in investor psychology, or heavy institutional selling. The prospects for an industry or company may deteriorate because of a variety of factors, including disappointing earnings or changes in the competitive environment. In addition, the investment manager’s assessment of companies held in a fund may prove incorrect, resulting in losses or poor performance even in rising markets.

GLOSSARY

Dividend yield: The annual dividend of a stock divided by the stock’s price.

Free cash flow: The excess cash a company is generating from its operations that can be taken out of the business for the benefit of shareholders, such as dividends, share repurchases, investments, and acquisitions.

Lipper indexes: Fund benchmarks that consist of a small number of the largest mutual funds in a particular category as tracked by Lipper Inc.

MSCI USA Index: A broadly based index that is designed to measure large- and mid-cap U.S. equity market performance.

Price/book ratio: A valuation measure that compares a stock’s market price with its book value, i.e., the company’s net worth divided by the number of outstanding shares.

Price/earnings (P/E) ratio: A valuation measure calculated by dividing the price of a stock by its current or projected earnings per share. This ratio gives investors an idea of how much they are paying for current or future earnings power.

S&P 500 Index: An unmanaged index that tracks the stocks of 500 primarily large-cap U.S. companies.

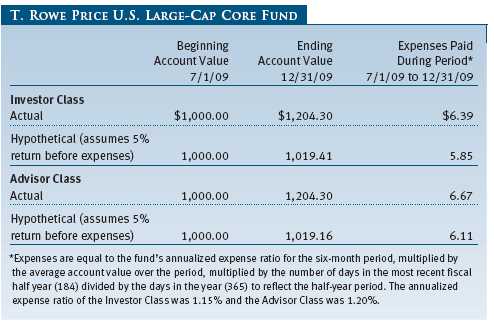

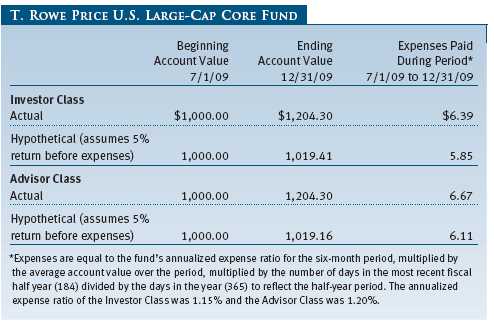

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Please note that the fund has two share classes: The original share class (“investor class”) charges no distribution and service (12b-1) fee, and the Advisor Class shares are offered only through unaffiliated brokers and other financial intermediaries and charge a 0.25% 12b-1 fee. Each share class is presented separately in the table.

Actual Expenses

The first line of the following table (“Actual”) provides information about actual account values and expenses based on the fund’s actual returns. You may use the information in this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (“Hypothetical”) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Note: T. Rowe Price charges an annual small-account maintenance fee of $10, generally for accounts with less than $2,000 ($500 for UGMA/UTMA). The fee is waived for any investor whose T. Rowe Price mutual fund accounts total $25,000 or more, accounts employing automatic investing, and IRAs and other retirement plan accounts that utilize a prototype plan sponsored by T. Rowe Price (although a separate custodial or administrative fee may apply to such accounts). This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

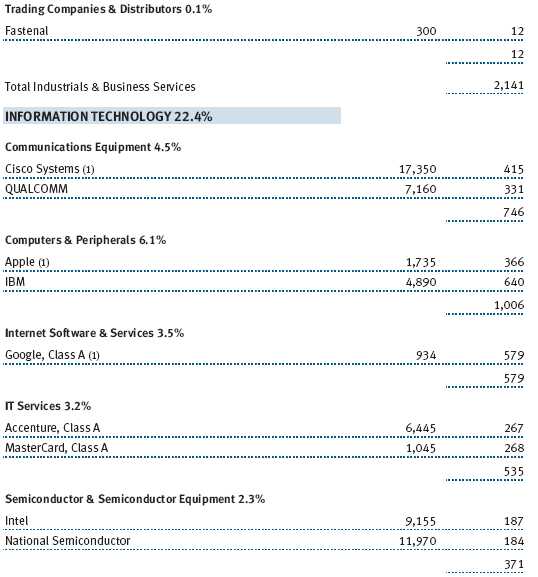

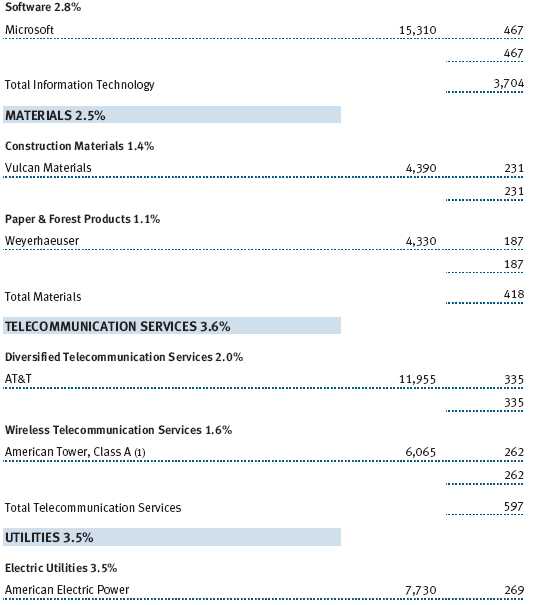

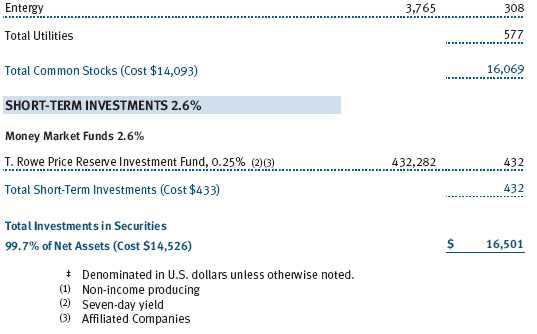

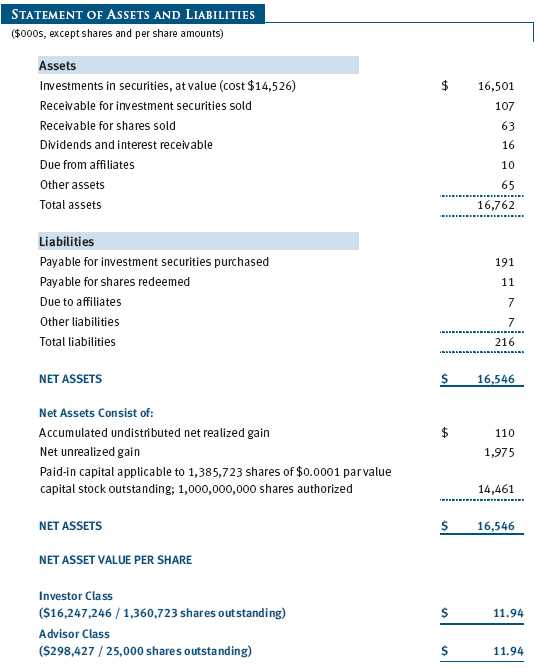

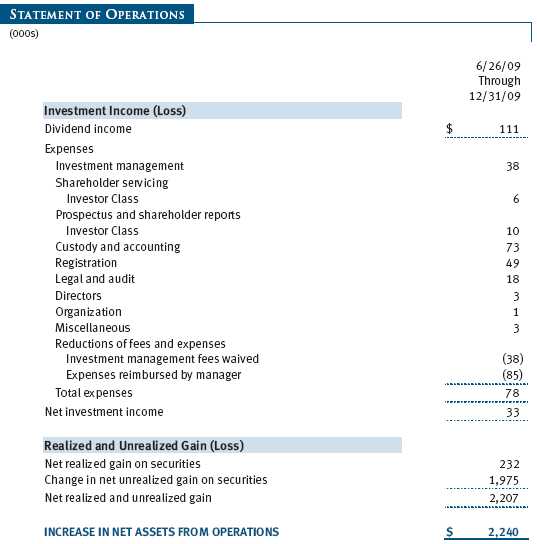

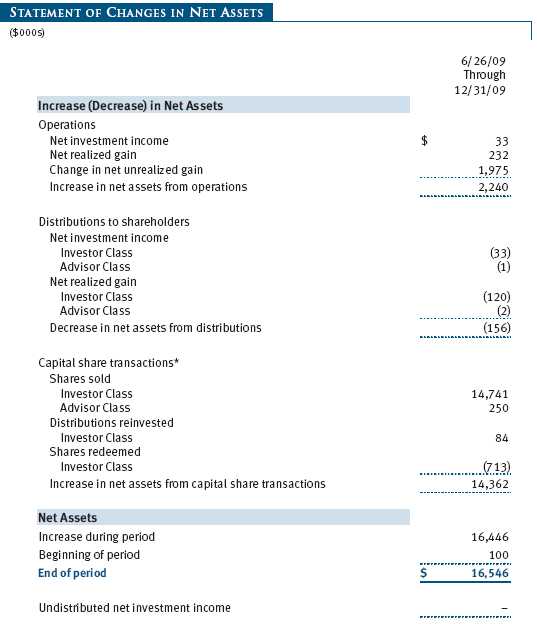

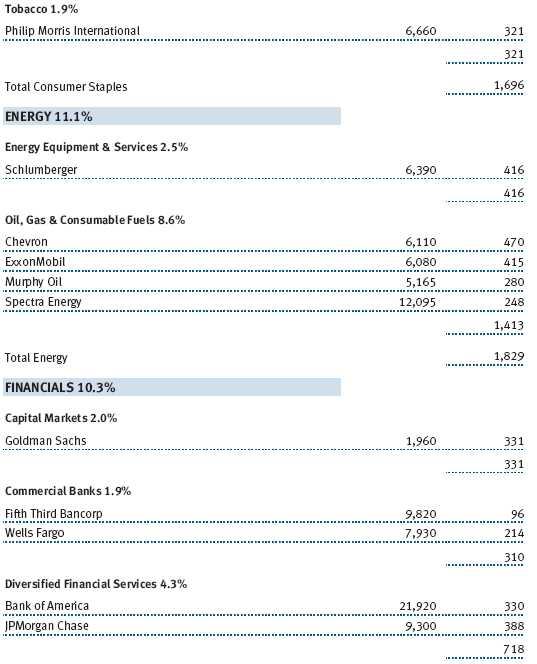

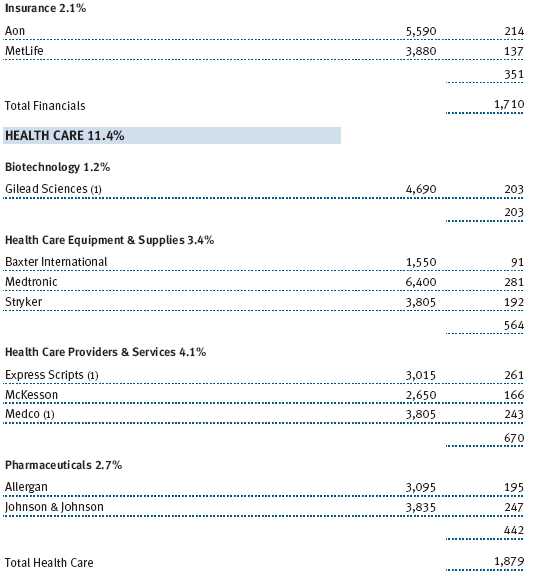

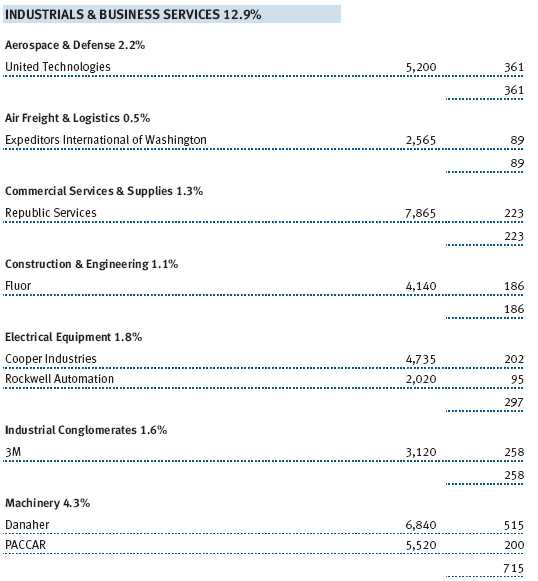

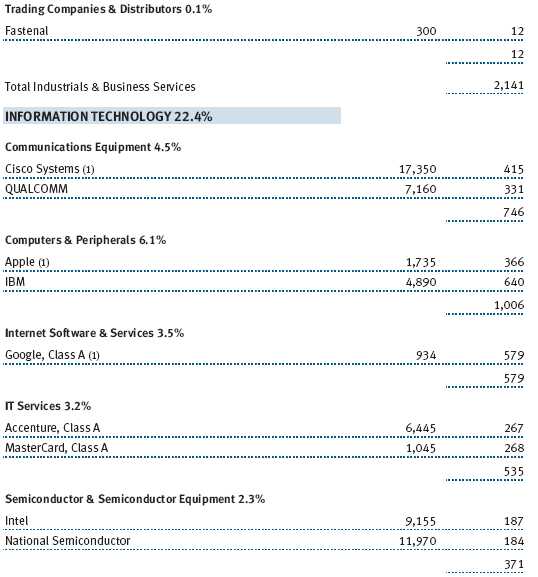

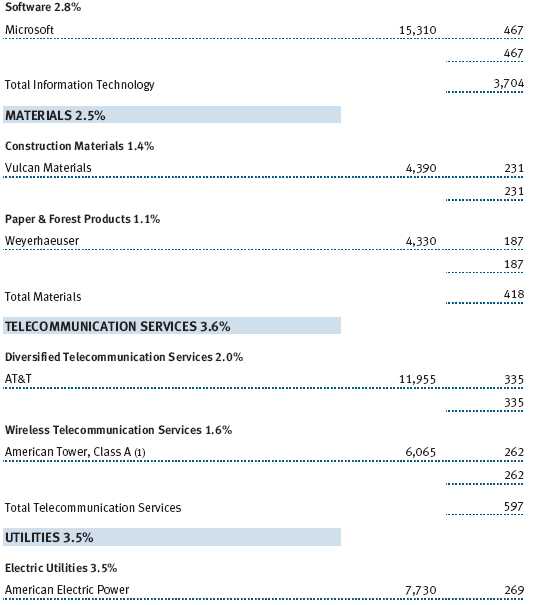

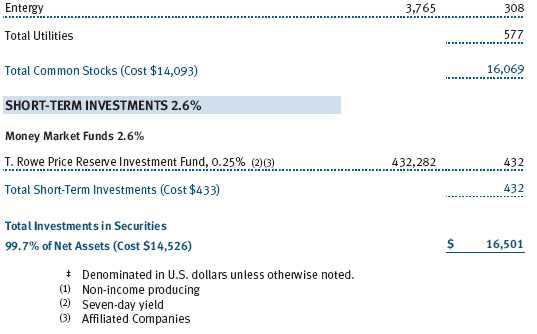

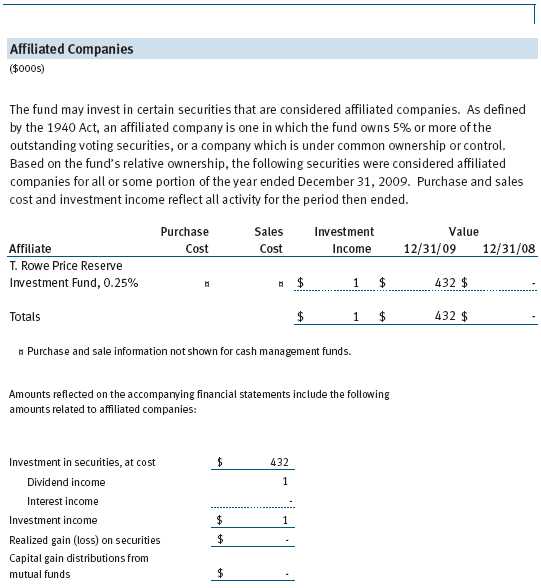

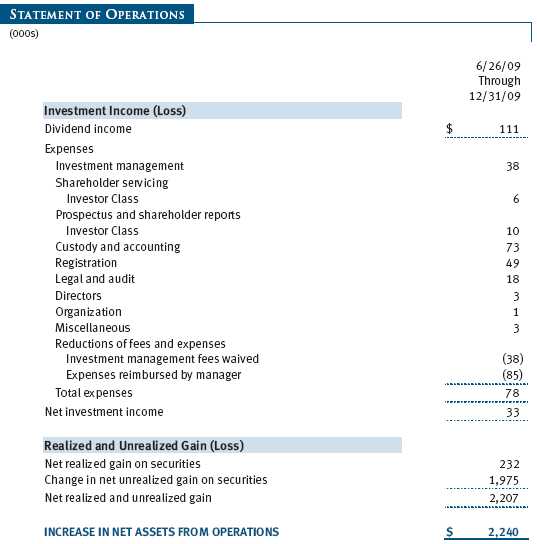

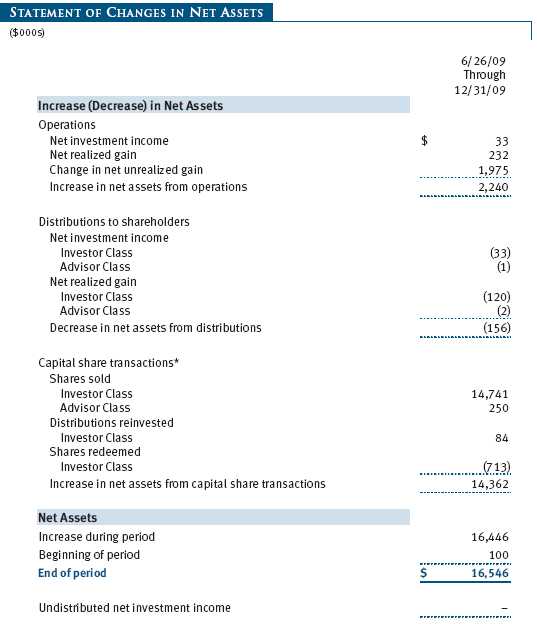

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

| NOTES TO FINANCIAL STATEMENTS |

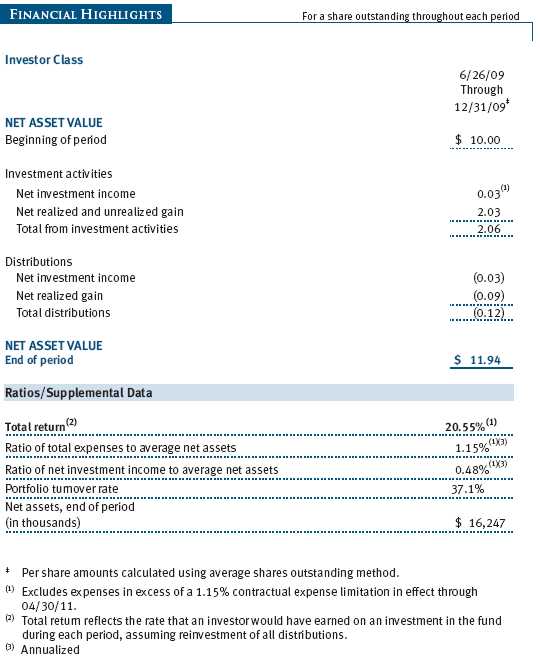

T. Rowe Price U.S. Large-Cap Core Fund (the fund), is registered under the Investment Company Act of 1940 (the 1940 Act) as a diversified, open-end management investment company. The fund seeks to provide long-term capital growth. The fund has two classes of shares: the U.S. Large-Cap Core Fund original share class, referred to in this report as the Investor Class, offered since June 26, 2009, and the U.S. Large-Cap Core Fund – Advisor Class (Advisor Class), offered since June 26, 2009. Advisor Class shares are sold only through unaffiliated brokers and other unaffiliated financial intermediaries that are compensated by the class for distribution, shareholder servicing, and/or certain administrative services under a Board-approved Rule 12b-1 plan. Each class has exclusive voting rights on matters related solely to that class; separate voting rights on matters that relate to both classes; and, in all other respects, the same rights and obligations as the other class.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), which require the use of estimates made by fund management. Fund management believes that estimates and security valuations are appropriate; however, actual results may differ from those estimates, and the security valuations reflected in the accompanying financial statements may differ from the value ultimately realized upon sale of the securities. Further, fund management believes that no events have occurred between December 31, 2009, the date of this report, and February 25, 2010, the date of issuance of the financial statements, that require adjustment of, or disclosure in, the accompanying financial statements.

Investment Transactions, Investment Income, and Distributions Income and expenses are recorded on the accrual basis. Dividends received from mutual fund investments are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Dividend income and capital gain distributions are recorded on the ex-dividend date. Income tax-related interest and penalties, if incurred, would be recorded as income tax expense. Investment transactions are accounted for on the trade date. Realized gains and losses are reported on the identified cost basis. Distributions to shareholders are recorded on the ex-dividend date. Income distributions are declared and paid by each class annually. Capital gain distributions, if any, are generally declared and paid by the fund, annually.

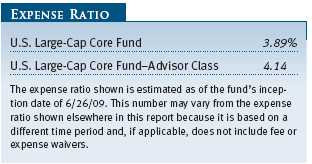

Class Accounting The Advisor Class pays distribution, shareholder servicing, and/or certain administrative expenses in the form of Rule 12b-1 fees, in an amount not exceeding 0.25% of the class’s average daily net assets; no such fees were incurred during the period ended December 31, 2009. Shareholder servicing, prospectus, and shareholder report expenses incurred by each class are charged directly to the class to which they relate. Expenses common to both classes, investment income, and realized and unrealized gains and losses are allocated to the classes based upon the relative daily net assets of each class.

Rebates and Credits Subject to best execution, the fund may direct certain security trades to brokers who have agreed to rebate a portion of the related brokerage commission to the fund in cash. Commission rebates are reflected as realized gain on securities in the accompanying financial statements. Additionally, the fund earns credits on temporarily uninvested cash balances held at the custodian, which reduce the fund’s custody charges. Custody expense in the accompanying financial statements is presented before reduction for credits.

NOTE 2 - VALUATION

The fund’s investments are reported at fair value as defined under GAAP. The fund determines the values of its assets and liabilities and computes its net asset value per share at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day that the NYSE is open for business.

Valuation Methods Equity securities listed or regularly traded on a securities exchange or in the over-the-counter (OTC) market are valued at the last quoted sale price or, for certain markets, the official closing price at the time the valuations are made, except for OTC Bulletin Board securities, which are valued at the mean of the latest bid and asked prices. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Listed securities not traded on a particular day are valued at the mean of the latest bid and asked prices for domestic securities and the last quoted sale price for international securities.

Investments in mutual funds are valued at the mutual fund’s closing net asset value per share on the day of valuation.

Other investments, including restricted securities, and those financial instruments for which the above valuation procedures are inappropriate or are deemed not to reflect fair value are stated at fair value as determined in good faith by the T. Rowe Price Valuation Committee, established by the fund’s Board of Directors.

Valuation Inputs Various inputs are used to determine the value of the fund’s financial instruments. These inputs are summarized in the three broad levels listed below:

Level 1 – quoted prices in active markets for identical securities

Level 2 – observable inputs other than Level 1 quoted prices (including, but not limited to, quoted prices for similar securities, interest rates, prepayment speeds, and credit risk)

Level 3 – unobservable inputs

Observable inputs are those based on market data obtained from sources independent of the fund, and unobservable inputs reflect the fund’s own assumptions based on the best information available. The input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level. On December 31, 2009, all of the fund’s investments were classified as Level 1, based on the inputs used to determine their values.

NOTE 3 - OTHER INVESTMENT TRANSACTIONS

Purchases and sales of portfolio securities other than short-term securities aggregated $18,506,000 and $4,644,000, respectively, for the year ended December 31, 2009.

NOTE 4 - FEDERAL INCOME TAXES

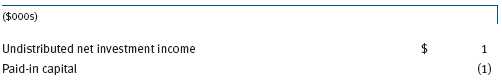

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Distributions determined in accordance with federal income tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences.

The fund files U.S. federal, state, and local tax returns as required. The fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after filing of the tax return but could be longer in certain circumstances.

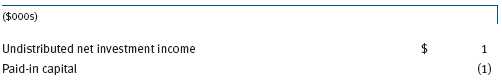

Reclassifications to paid-in capital relate primarily to nondeductible organizational expenses. For the year ended December 31, 2009, the following reclassifications were recorded to reflect tax character; there was no impact on results of operations or net assets:

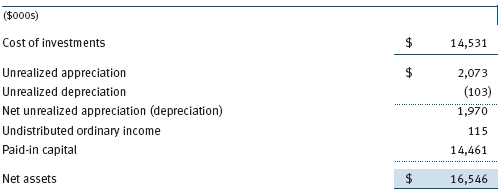

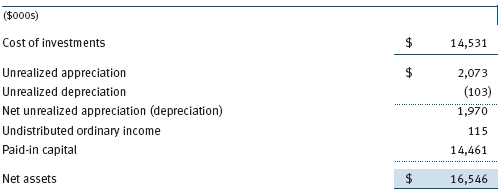

Distributions during the period ended December 31, 2009, totaled $156,000, and were characterized as ordinary income for tax purposes. At December 31, 2009, the tax-basis cost of investments and components of net assets were as follows:

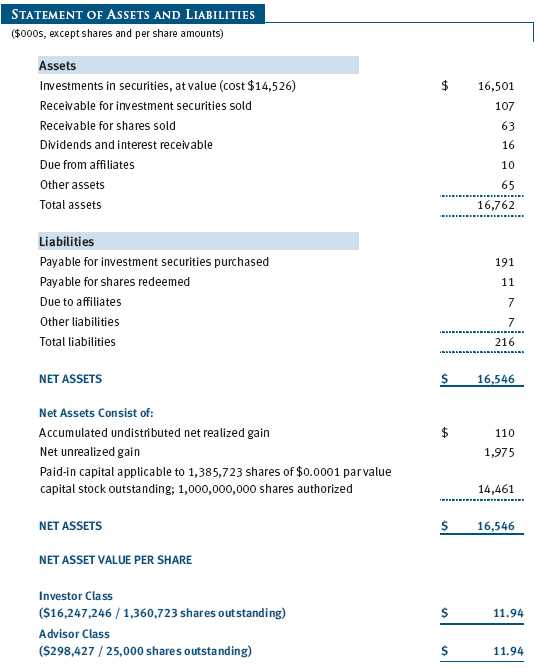

NOTE 5 - RELATED PARTY TRANSACTIONS

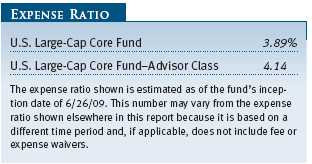

The fund is managed by T. Rowe Price Associates, Inc. (the manager or Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. The investment management agreement between the fund and the manager provides for an annual investment management fee, which is computed daily and paid monthly. The fee consists of an individual fund fee, equal to 0.25% of the fund’s average daily net assets, and a group fee. The group fee rate is calculated based on the combined net assets of certain mutual funds sponsored by Price Associates (the group) applied to a graduated fee schedule, with rates ranging from 0.48% for the first $1 billion of assets to 0.285% for assets in excess of $220 billion. The fund’s group fee is determined by applying the group fee rate to the fund’s average daily net assets. At December 31, 2009, the effective annual group fee rate was 0.30%.

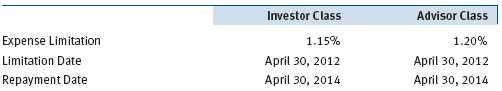

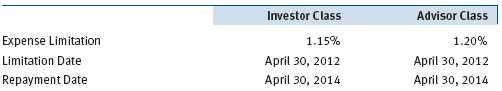

The Investor Class and Advisor Class are also subject to a contractual expense limitation through the limitation dates indicated in the table below. During the limitation period, the manager is required to waive its management fee and/or reimburse expenses, excluding interest, taxes, brokerage commissions, and extraordinary expenses, that would otherwise cause the class’s ratio of annualized total expenses to average net assets (expense ratio) to exceed its expense limitation. Each class is required to repay the manager for expenses previously reimbursed and management fees waived to the extent the class’s net assets have grown or expenses have declined sufficiently to allow repayment without causing the class’s expense ratio to exceed its expense limitation. However, no repayment will be made more than three years after the date of any reimbursement or waiver or later than the repayment dates indicated in the table below.

Pursuant to this agreement, management fees in the amount of $38,000 were waived and expenses in the amount of $85,000 were reimbursed by the manager during the year ended December 31, 2009; all of which remain subject to repayment at December 31, 2009.

In addition, the fund has entered into service agreements with Price Associates and a wholly owned subsidiary of Price Associates (collectively, Price). Price Associates computes the daily share prices and provides certain other administrative services to the fund. T. Rowe Price Services, Inc., provides shareholder and administrative services in its capacity as the fund’s transfer and dividend disbursing agent. For the year ended December 31, 2009, expenses incurred pursuant to these service agreements were $42,000 for Price Associates and $5,000 for T. Rowe Price Services, Inc. The total amount payable at period-end pursuant to these service agreements is reflected as Due to Affiliates in the accompanying financial statements.

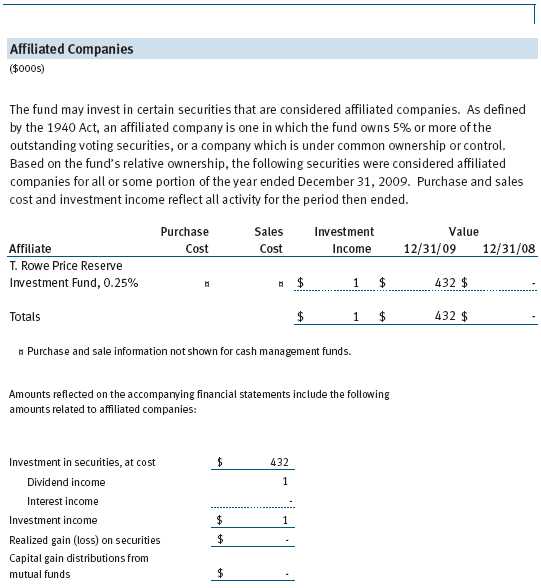

The fund may invest in the T. Rowe Price Reserve Investment Fund and the T. Rowe Price Government Reserve Investment Fund (collectively, the T. Rowe Price Reserve Investment Funds), open-end management investment companies managed by Price Associates and considered affiliates of the fund. The T. Rowe Price Reserve Investment Funds are offered as cash management options to mutual funds, trusts, and other accounts managed by Price Associates and/or its affiliates and are not available for direct purchase by members of the public. The T. Rowe Price Reserve Investment Funds pay no investment management fees.

As of December 31, 2009, T. Rowe Price Group, Inc., and/or its wholly owned subsidiaries owned 575,000 shares of the Investor Class, and 25,000 shares of the Advisor Class, aggregating 43% of the fund’s net assets.

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

To the Board of Directors and Shareholders of

T. Rowe Price U.S. Large Cap Core Fund, Inc.

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of T. Rowe Price U.S. Large Cap Core Fund, Inc. (the “Fund”) at December 31, 2009, the results of its operations, the changes in its net assets and the financial highlights for the period June 26, 2009 (commencement of operations) through December 31, 2009, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit of these statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audit, which included confirmation of securities at December 31, 2009 by correspondence with the custodian, and confirmation of the underlying fund by correspondence with the transfer agent, provides a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Baltimore, Maryland

February 25, 2010

| TAX INFORMATION (UNAUDITED) FOR THE TAX YEAR ENDED 12/31/09 |

We are providing this information as required by the Internal Revenue Code. The amounts shown may differ from those elsewhere in this report because of differences between tax and financial reporting requirements.

The fund’s distributions to shareholders included $122,000 from short-term capital gains.

For taxable non-corporate shareholders, $109,000 of the fund’s income represents qualified dividend income subject to the 15% rate category.

For corporate shareholders, $100,000 of the fund’s income qualifies for the dividends-received deduction.

| INFORMATION ON PROXY VOTING POLICIES, PROCEDURES, AND RECORDS |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information, which you may request by calling 1-800-225-5132 or by accessing the SEC’s Web site, www.sec.gov. The description of our proxy voting policies and procedures is also available on our Web site, www.troweprice.com. To access it, click on the words “Our Company” at the top of our corporate homepage. Then, when the next page appears, click on the words “Proxy Voting Policies” on the left side of the page.

Each fund’s most recent annual proxy voting record is available on our Web site and through the SEC’s Web site. To access it through our Web site, follow the directions above, then click on the words “Proxy Voting Records” on the right side of the Proxy Voting Policies page.

| HOW TO OBTAIN QUARTERLY PORTFOLIO HOLDINGS |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s Web site (www.sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 450 Fifth St. N.W., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

| ABOUT THE FUND’S DIRECTORS AND OFFICERS |

Your fund is governed by a Board of Directors (Board) that meets regularly to review a wide variety of matters affecting the fund, including performance, investment programs, compliance matters, advisory fees and expenses, service providers, and other business affairs. The Board elects the fund’s officers, who are listed in the final table. At least 75% of Board members are independent of T. Rowe Price Associates, Inc. (T. Rowe Price), and T. Rowe Price International, Inc. (T. Rowe Price International); “inside” or “interested” directors are employees or officers of T. Rowe Price. The business address of each director and officer is 100 East Pratt Street, Baltimore, Maryland 21202. The Statement of Additional Information includes additional information about the directors and is available without charge by calling a T. Rowe Price representative at 1-800-225-5132.

| Independent Directors | |

| |

| Name | |

| (Year of Birth) | Principal Occupation(s) During Past Five Years and Directorships of |

| Year Elected* | Other Public Companies |

| | |

| William R. Brody, M.D., Ph.D. | President and Trustee, Salk Institute for Biological Studies (2009 |

| (1944) | to present); Director, Novartis, Inc. (2009 to present); Director, IBM |

| 2009 | (2007 to present); President and Trustee, Johns Hopkins University |

| | (1996 to 2009); Chairman of Executive Committee and Trustee, |

| | Johns Hopkins Health System (1996 to 2009) |

| | |

| Jeremiah E. Casey | Director, National Life Insurance (2001 to 2005); Director, The Rouse |

| (1940) | Company, real estate developers (1990 to 2004) |

| 2009 | |

| | |

| Anthony W. Deering | Chairman, Exeter Capital, LLC, a private investment firm (2004 |

| (1945) | to present); Director, Under Armour (2008 to present); Director, |

| 2009 | Vornado Real Estate Investment Trust (2004 to present); Director, |

| | Mercantile Bankshares (2002 to 2007); Member, Advisory Board, |

| | Deutsche Bank North America (2004 to present); Director, Chairman |

| | of the Board, and Chief Executive Officer, The Rouse Company, real |

| | estate developers (1997 to 2004) |

| | |

| Donald W. Dick, Jr. | Principal, EuroCapital Advisors, LLC, an acquisition and management |

| (1943) | advisory firm (1995 to present) |

| 2009 | |

| | |

| Karen N. Horn | Director, Eli Lilly and Company (1987 to present); Director, Simon |

| (1943) | Property Group (2004 to present); Director, Norfolk Southern (2008 |

| 2009 | to present); Director, Georgia Pacific (2004 to 2005) |

| | |

| Theo C. Rodgers | President, A&R Development Corporation (1977 to present) |

| (1941) | |

| 2009 | |

| | |

John G. Schreiber | Owner/President, Centaur Capital Partners, Inc., a real estate invest- | | (1946) | ment company (1991 to present); Partner, Blackstone Real Estate |

| 2009 | Advisors, L.P. (1992 to present) |

| | |

| Mark R. Tercek | President and Chief Executive Officer, The Nature Conservancy (2008 |

| (1957) | to present); Managing Director, The Goldman Sachs Group, Inc. |

| 2009 | (1984 to 2008) |

| |

| *Each independent director oversees 124 T. Rowe Price portfolios and serves until retirement, resignation, |

| or election of a successor. | |

| Inside Directors | |

| |

| Name | |

| (Year of Birth) | |

| Year Elected* | |

| [Number of T. Rowe Price | Principal Occupation(s) During Past Five Years and Directorships of |

| Portfolios Overseen] | Other Public Companies |

| | |

| Edward C. Bernard | Director and Vice President, T. Rowe Price; Vice Chairman of the |

| (1956) | Board, Director, and Vice President, T. Rowe Price Group, Inc.; |

| 2009 | Chairman of the Board, Director, and President, T. Rowe |

| [124] | Price Investment Services, Inc.; Chairman of the Board and Director, |

| | T. Rowe Price Global Asset Management Limited, T. Rowe Price |

| | Global Investment Services Limited, T. Rowe Price Retirement |

| | Plan Services, Inc., T. Rowe Price Savings Bank, and T. Rowe Price |

| | Services, Inc.; Director, T. Rowe Price International, Inc.; Chief |

| | Executive Officer, Chairman of the Board, Director, and President, |

| | T. Rowe Price Trust Company; Chairman of the Board, all funds |

| | |

| Brian C. Rogers, CFA, CIC | Chief Investment Officer, Director, and Vice President, T. Rowe Price; |

| (1955) | Chairman of the Board, Chief Investment Officer, Director, and Vice |

| 2009 | President, T. Rowe Price Group, Inc.; Vice President, T. Rowe Price |

| [69] | Trust Company |

| |

| *Each inside director serves until retirement, resignation, or election of a successor. |

| Officers | |

| |

| Name (Year of Birth) | |

| Position Held With U.S. Large-Cap | |

| Core Fund | Principal Occupation(s) |

| | |

| Jeffrey W. Arricale, CPA (1971) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | Group, Inc. |

| | |

| Peter J. Bates, CFA (1974) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | Group, Inc. |

| | |

| Shawn T. Driscoll (1975) | Vice President, T. Rowe Price Group, Inc.; |

| Vice President | formerly Equity Research Analyst, MTB |

| | Investment Advisors (to 2006) |

| | |

| Joseph B. Fath, CPA (1971) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | Group, Inc. |

| | |

| Roger L. Fiery III, CPA (1959) | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | Group, Inc., T. Rowe Price International, Inc., |

| | and T. Rowe Price Trust Company |

| | |

| Mark S. Finn, CFA, CPA (1963) | Vice President, T. Rowe Price and T. Rowe Price |

| Vide President | Group, Inc. |

| | |

| John R. Gilner (1961) | Chief Compliance Officer and Vice President, |

| Chief Compliance Officer | T. Rowe Price; Vice President, T. Rowe Price |

| | Group, Inc., and T. Rowe Price Investment |

| | Services, Inc. |

| | |

| Gregory S. Golczewski (1966) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | Trust Company |

| | |

| Gregory K. Hinkle, CPA (1958) | Vice President, T. Rowe Price, T. Rowe Price |

| Treasurer | Group, Inc., and T. Rowe Price Trust Company; |

| | formerly Partner, PricewaterhouseCoopers LLP |

| | (to 2007) |

| | |

| John D. Linehan, CFA (1965) | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | Group, Inc., and T. Rowe Price Trust Company |

| | |

| Patricia B. Lippert (1953) | Assistant Vice President, T. Rowe Price and |

| Secretary | T. Rowe Price Investment Services, Inc. |

| | |

| George Marzano (1980) | Assistant Vice President, T. Rowe Price |

| Vice President | |

| | |

| Jason Nogueira, CFA (1974) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | Group, Inc. |

| | |

David Oestreicher (1967) | Director and Vice President, T. Rowe Price | | Vice President | Investment Services, Inc., T. Rowe Price Trust |

| | Company, and T. Rowe Price Services, Inc.; Vice |

| | President, T. Rowe Price, T. Rowe Price Global |

| | Asset Management Limited, T. Rowe Price Global |

| | Investment Services Limited, T. Rowe Price |

| | Group, Inc., T. Rowe Price International, Inc., and |

| | T. Rowe Price Retirement Plan Services, Inc. |

| | |

| Timothy E. Parker, CFA (1974) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | Group, Inc. |

| | |

| Robert T. Quinn, Jr. (1972) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | Group, Inc. |

| | |

| Jeffrey Rottinghaus, CPA (1970) | Vice President, T. Rowe Price, T. Rowe Price |

| President | Global Investment Services Limited, and |

| | T. Rowe Price Group, Inc. |

| | |

| Deborah D. Seidel (1962) | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | Investment Services, Inc., and T. Rowe Price |

| | Services, Inc. |

| | |

| Robert W. Sharps, CFA, CPA (1971) | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | Group, Inc., and T. Rowe Price Trust Company |

| | |

| Julie L. Waples (1970) | Vice President, T. Rowe Price |

| Vice President | |

| |

| Unless otherwise noted, officers have been employees of T. Rowe Price or T. Rowe Price International for |

| at least five years. | |

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors/Trustees has determined that Mr. Anthony W. Deering qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Deering is considered independent for purposes of Item 3 of Form N-CSR.

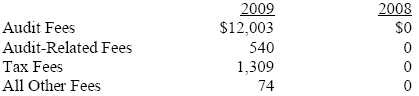

Item 4. Principal Accountant Fees and Services.

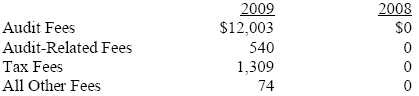

(a) – (d) Aggregate fees billed to the registrant for the last two fiscal years for professional services rendered by the registrant’s principal accountant were as follows:

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $1,879,000 and $1,922,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is attached.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

| | |

SIGNATURES |

| |

| | Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment |

| Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the |

| undersigned, thereunto duly authorized. |

| |

| T. Rowe Price U.S. Large-Cap Core Fund, Inc. |

| |

| |

| |

| By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date | February 25, 2010 |

| |

| |

| |

| | Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment |

| Company Act of 1940, this report has been signed below by the following persons on behalf of |

| the registrant and in the capacities and on the dates indicated. |

| |

| |

| By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date | February 25, 2010 |

| |

| |

| |

| By | /s/ Gregory K. Hinkle |

| | Gregory K. Hinkle |

| | Principal Financial Officer |

| |

| Date | February 25, 2010 |