SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

¨REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended August 31, 2010

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______________________ to ______________________

OR

¨ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report ____________________________

Commission File Number: 0-53646

EAGLEFORD ENERGY INC.

(Exact name of Registrant as specified in its charter)

Ontario, Canada

(Jurisdiction of incorporation or organization)

1 King Street West, Suite 1505

Toronto, Ontario, Canada, M5H 1A1

(Address of principal executive offices)

James Cassina, Telephone (416) 364-4039, Fax (416) 364-8244

1 King Street West, Suite 1505, Toronto, Ontario, Canada, M5H 1A1

(Name, telephone, e-mail and/or facsimile number and address of company contact person)

Securities registered or to be registered pursuant to section 12(b) of the Act: None

Securities registered or to be registered pursuant to Section 12(g) of the Act: Common Stock, no par value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

(Title of Class)

The number of outstanding shares of the issuer’s common stock as of August 31, 2010 was 29,751,026 shares.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

If this report is an annual or a transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ¨ | International Financial Reporting Standards by the International Accounting Standards Board ¨ | Other x |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ‘

Item 17 x Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Table of Contents

| GENERAL | 1 |

| NOTE REGARDING FORWARD-LOOKING STATEMENTS | 1 |

| PART I | | 1 |

| ITEM 1 | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS | 1 |

| A. | DIRECTORS AND SENIOR MANAGEMENT | 1 |

| B. | ADVISERS | 1 |

| C. | AUDITORS | 1 |

| ITEM 2 | OFFER STATISTICS AND EXPECTED TIMETABLE | 2 |

| A. | OFFER STATISTICS | 2 |

| B. | METHOD AND EXPECTED TIMETABLE | 2 |

| ITEM 3 | KEY INFORMATION | 2 |

| A. | SELECTED FINANCIAL DATA | 2 |

| B. | CAPITALIZATION AND INDEBTEDNESS | 5 |

| C. | REASONS FOR THE OFFER AND USE OF PROCEEDS | 5 |

| D. | RISK FACTORS | 5 |

| ITEM 4 | INFORMATION ON THE COMPANY | 12 |

| A. | HISTORY AND DEVELOPMENT OF THE COMPANY | 13 |

| B. | BUSINESS OVERVIEW | 17 |

| C. | ORGANIZATIONAL STRUCTURE | 21 |

| D. | PROPERTY, PLANTS AND EQUIPMENT | 21 |

| ITEM 4A | UNRESOLVED STAFF COMMENTS | 26 |

| ITEM 5 | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 26 |

| A. | OPERATING RESULTS | 44 |

| B. | LIQUIDITY AND CAPITAL RESOURCES | 48 |

| C. | RESEARCH AND DEVELOPMENT, PATENTS AND LICENSES | 49 |

| D. | TREND INFORMATION | 49 |

| E. | OFF-BALANCE SHEET ARRANGEMENTS | 50 |

| F. | TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS | 51 |

| G. | SAFE HARBOR | 53 |

| ITEM 6. | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | 53 |

| A. | DIRECTORS AND SENIOR MANAGEMENT | 53 |

| B. | COMPENSATION | 54 |

| C. | BOARD PRACTICES | 57 |

| D. | EMPLOYEES | 64 |

| E. | SHARE OWNERSHIP | 64 |

| ITEM 7 | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | 66 |

| A. | MAJOR SHAREHOLDERS | 66 |

| B. | RELATED PARTY TRANSACTIONS | 67 |

| C. | INTERESTS OF EXPERTS AND COUNSEL | 68 |

| ITEM 8 | FINANCIAL INFORMATION | 68 |

| A. | CONSOLIDATED STATEMENTS AND OTHER FINANCIAL INFORMATION | 68 |

| B. | SIGNIFICANT CHANGES | 68 |

| ITEM 9 | THE OFFER AND LISTING | 68 |

| A. | OFFER AND LISTING DETAILS | 68 |

| B. | PLAN OF DISTRIBUTION | 69 |

| C. | MARKETS | 69 |

| D. | SELLING SHAREHOLDERS | 69 |

| E. | DILUTION | 69 |

| F. | EXPENSES OF THE ISSUE | 69 |

| ITEM 10 | ADDITIONAL INFORMATION | 69 |

| A. | SHARE CAPITAL | 69 |

| B. | MEMORANDUM AND ARTICLES OF ASSOCIATION | 69 |

| C. | MATERIAL CONTRACTS | 71 |

| D. | EXCHANGE CONTROLS | 72 |

| E. | TAXATION | 73 |

| F. | DIVIDENDS AND PAYING AGENTS | 76 |

| G. | STATEMENT BY EXPERTS | 76 |

| H. | DOCUMENTS ON DISPLAY | 76 |

| I. | SUBSIDIARY INFORMATION | 76 |

| ITEM 11 | QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISK | 76 |

| ITEM 12 | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 78 |

| A. | DEBT SECURITIES | 78 |

| B. | WARRANTS AND RIGHTS | 78 |

| C. | OTHER SECURITIES | 78 |

| D. | AMERICAN DEPOSITORY SHARES | 78 |

| PART II | | 78 |

| ITEM 13 | DEFAULTS, DIVIDENDS ARREARAGES AND DELINQUENCIES | 78 |

| ITEM 14 | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 78 |

| ITEM 15 | CONTROLS AND PROCEDURES | 79 |

| ITEM 16 | [RESERVED] | 80 |

| A. | AUDIT COMMITTEE FINANCIAL EXPERT | 80 |

| B. | CODE OF ETHICS | 80 |

| C. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | 81 |

| D. | EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | 81 |

| E. | PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | 82 |

| F. | CHANGE IN REGISTRANT’S CERTIFYING ACCOUNTANT | 82 |

| G. | CORPORATE GOVERNANCE | 82 |

| PART III | | 82 |

| ITEM 17 | FINANCIAL STATEMENTS | 82 |

| ITEM 18 | FINANCIAL STATEMENTS | 82 |

| ITEM 19 | EXHIBITS | 82 |

GENERAL

In this Annual Report, references to “we”, “us”, “our”, the “Company”, and “Eagleford” mean Eagleford Energy Inc., and its subsidiaries, unless the context requires otherwise.

We use the Canadian dollar as our reporting currency and our financial statements are prepared in accordance with Canadian generally accepted accounting principles. Note 16 to our annual consolidated financial statements provide a reconciliation of our financial statements to United States generally accepted accounting principles. All monetary references in this document are to Canadian dollars, unless otherwise indicated. All references in this document to “dollars” or “$” or “CDN$” mean Canadian dollars, unless otherwise indicated, and references to “US$” mean United States dollars.

Except as noted, the information set forth in this Annual Report is as of January 31, 2011 and all information included in this document should only be considered accurate as of such date. Our business, financial condition or results of operations may have changed since that date.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Much of the information included in this Annual Report is based upon estimates, projections or other “forward-looking statements”. Such forward-looking statements include any projections or estimates made by us and our management in connection with our business operations. These statements relate to future events or our future financial performance. In some cases you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of those terms or other comparable terminology. While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Such estimates, projections or other forward-looking statements involve various risks and uncertainties and other factors, including the risks in the section titled “Risk Factors” below, which may cause our actual results, levels of activities, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. We caution the reader that important factors in some cases have affected and, in the future, could materially affect actual results and cause actual results to differ materially from the results expressed in any such estimates, projections or other forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform those statements to actual results.

The statements contained in Item 4 – “Information on the Company”, Item 5 – “Operating and Financial Review and Prospects” and Item 11 – “Quantitative and Qualitative Disclosures About Market Risk” are inherently subject to a variety of risks and uncertainties that could cause actual results, performance or achievements to differ significantly.

PART I

| ITEM 1 | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS |

A. DIRECTORS AND SENIOR MANAGEMENT

Not applicable. This Form 20-F is being filed as an Annual Report under the Exchange Act.

B. ADVISERS

Not applicable. This Form 20-F is being filed as an Annual Report under the Exchange Act.

C. AUDITORS

Not applicable. This Form 20-F is being filed as an Annual Report under the Exchange Act.

| ITEM 2 | OFFER STATISTICS AND EXPECTED TIMETABLE |

A. OFFER STATISTICS

Not applicable. This Form 20-F is being filed as an Annual Report under the Exchange Act.

B. METHOD AND EXPECTED TIMETABLE

Not applicable. This Form 20-F is being filed as an Annual Report under the Exchange Act.

A. SELECTED FINANCIAL DATA

The following table presents selected financial data derived from our Audited Consolidated Financial Statements for the fiscal years ended August 31, 2010, 2009, 2008, 2007 and 2006. You should read this information in conjunction with our Audited Consolidated Financial Statements and related notes (Item 17), as well as Item 4: “Information on the Company” and Item 5: “Operating and Financial Review and Prospects” of this Annual Report.

Our consolidated financial statements have been prepared in accordance with Canadian generally accepted accounting principles (“Canadian GAAP”) in Canadian dollars. Note 17 to the audited annual consolidated financial statements provides descriptions of material measurement differences between Canadian GAAP and US generally accepted accounting principles (“US GAAP”) as they relate to us and a reconciliation of our consolidated financial statements to US GAAP.

The selected consolidated statement of operations data set forth below for the years ended August 31, 2010, 2009, 2008 and 2007 and the selected consolidated balance sheet data set forth below as of August 31, 2010, 2009, 2008 and 2007 is derived from our consolidated financial statements, which have been audited by Schwartz Levitsky Feldman LLP, Chartered Accountants, Toronto, Canada all of which are attached to and forming part of this Annual Report under Item 17 – Financial Statements.

The selected consolidated statement of operations data set forth below for the year ended August 31, 2006 and the selected consolidated balance sheet data set forth below as of August 31, 2006 is derived from our consolidated financial statements, which have been audited by BDO Dunwoody LLP, Chartered Accountants, Toronto, Canada.

EAGLEFORD ENERGY INC.

Presented Pursuant to Canadian Generally Accepted Accounting Principles

(STATED IN CANADIAN DOLLARS)

| | | YEARS ENDED AUGUST 31, | |

| | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

CONSOLIDATED STATEMENT OF OPERATIONS DATA | | | | | | | | | | | | | | | | | | | | |

| Revenue | | $ | 105,375 | | | $ | 56,199 | | | $ | 292 | | | $ | 637 | | | $ | 760 | |

| Income (loss) from oil and gas operations | | | (35,586 | ) | | | (53,626 | ) | | | 268 | | | | 541 | | | | 311 | |

| Administrative expenses | | | 653,153 | | | | 276,815 | | | | 50,782 | | | | 40,691 | | | | 51,463 | |

| Operating loss for the year | | | (688,739 | ) | | | (330,441 | ) | | | (50,514 | ) | | | (40,150 | ) | | | (51,152 | ) |

| Interest income | | | 30 | | | | 1,580 | | | | - | | | | 205 | | | | - | |

| Net loss and comprehensive loss for the year | | | (688,709 | ) | | | (328,861 | ) | | | (50,514 | ) | | | (39,945 | ) | | | (51,152 | ) |

| Loss per common share basic and diluted | | | (0.028 | ) | | | (0.019 | ) | | | (0.006 | ) | | | (0.006 | ) | | | (0.008 | ) |

| Weighted average common shares | | | | | | | | | | | | | | | | | | | | |

| outstanding | | | 24,687,130 | | | | 17,646,295 | | | | 7,955,482 | | | | 6,396,739 | | | | 6,396,739 | |

| BALANCE SHEET INFORMATION | | | | | | | | | | | | | | | | | | | | |

| Working capital (deficiency) | | | (744,262 | ) | | | (137,372 | ) | | | (93,634 | ) | | | (483,860 | ) | | | (444,839 | ) |

| Total assets | | | 6,107,452 | | | | 600,327 | | | | 208,486 | | | | 9,746 | | | | 8,298 | |

| Total shareholders’ equity (deficiency) | | | 4,239,777 | | | | 265,994 | | | | (93,186 | ) | | | (482,860 | ) | | | (442,915 | ) |

The following table sets forth our selected consolidated financial data as set forth in the preceding table, as reconciled pursuant to United States Generally Accepted Accounting Principles:

EAGLEFORD ENERGY INC.

Presented Pursuant to United States Generally Accepted Accounting Principles

(STATED IN CANADIAN DOLLARS)

| | | YEARS ENDED AUGUST 31, | |

| | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

CONSOLIDATED STATEMENT OF OPERATIONS DATA | | | | | | | | | | | | | | | |

| Revenue | | $ | 105,375 | | | $ | 56,199 | | | $ | 292 | | | $ | 637 | | | $ | 760 | |

| Income (loss) from operations | | | (35,586 | ) | | | (53,626 | ) | | | 268 | | | | 541 | | | | 311 | |

| Administrative expenses | | | 653,153 | | | | 276,815 | | | | 50,782 | | | | 40,691 | | | | 51,463 | |

| Operating loss for the year | | | (688,739 | ) | | | (330,441 | ) | | | (50,514 | ) | | | (40,150 | ) | | | (51,152 | ) |

| Interest income | | | 30 | | | | 1,580 | | | | - | | | | 205 | | | | - | |

| Net loss and comprehensive loss according to Canadian GAAP | | | (688,709 | ) | | | (328,861 | ) | | | (50,514 | ) | | | (39,945 | ) | | | (51,152 | ) |

| Unrealized gain on marketable securities | | | - | | | | - | | | | - | | | | - | | | | (171 | ) |

| Additional impairment of oil and gas interests | | | (50,000 | ) | | | (73,638 | ) | | | - | | | | - | | | | - | |

| Comprehensive loss according to US GAAP | | | (738,709 | ) | | | (402,499 | ) | | | (50,514 | ) | | | (39,945 | ) | | | (51,323 | ) |

| Net loss per common share basic and diluted according to US GAAP | | | (0.030 | ) | | | (0.023 | ) | | | (0.006 | ) | | | (0.006 | ) | | | (0.008 | ) |

| Shares used in the computation of basic and diluted earnings per share | | | 24,687,130 | | | | 17,646,295 | | | | 7,955,482 | | | | 6,396,739 | | | | 6,396,739 | |

| BALANCE SHEET INFORMATION | | | | | | | | | | | | | | | | | | | | |

| Working capital deficiency | | | (744,262 | ) | | | (137,372 | ) | | | (93,634 | ) | | | (483,860 | ) | | | (444,840 | ) |

| Total assets per Canadian GAAP | | | 6,107,452 | | | | 600,327 | | | | 208,486 | | | | 9,746 | | | | 8,298 | |

| Unrealized gain on marketable securities | | | - | | | | - | | | | - | | | | - | | | | - | |

| Write-down of marketable securities | | | - | | | | - | | | | - | | | | - | | | | (1 | ) |

| Additional impairment of oil and gas interests | | | (50,000 | ) | | | (73,638 | ) | | | - | | | | - | | | | - | |

| Total assets per US GAAP | | | 6,057,452 | | | | 526,689 | | | | 208,486 | | | | 9,746 | | | | 8,297 | |

Total shareholders’ equity (deficiency) per Canadian GAAP | | | 4,239,777 | | | | 265,994 | | | | (93,186 | ) | | | (482,860 | ) | | | (442,915 | ) |

| Accumulated other comprehensive income: | | | - | | | | - | | | | - | | | | - | | | | - | |

| Unrealized gain on marketable securities | | | - | | | | - | | | | - | | | | - | | | | (1 | ) |

| Additional impairment of oil and gas interests | | | (50,000 | ) | | | (73,638 | ) | | | - | | | | - | | | | - | |

Total shareholders’ equity (deficiency) per US GAAP | | | 4,189,777 | | | | 192,356 | | | | (93,186 | ) | | | (482,860 | ) | | | (442,916 | ) |

| OTHER FINANC IAL DATA | | | | | | | | | | | | | | | | | | | | |

| Cash flow provided by (used in): | | | | | | | | | | | | | | | | | | | | |

| Operating activities | | | (219,320 | ) | | | (172,333 | ) | | | (50,414 | ) | | | (268 | ) | | | (17,523 | ) |

| Investing activities | | | (21,228 | ) | | | 80,499 | | | | - | | | | - | | | | 11,512 | |

| Financing activities | | | 111,419 | | | | 62,013 | | | | 252,188 | | | | - | | | | - | |

Differences between Generally Accepted Accounting Principles (GAAP) in Canada and the United States

For the year ended August 31, 2010 the preparation of our Audited Consolidated Financial Statements in accordance with Canadian GAAP with a reconciliation to US GAAP recorded an additional impairment in oil and gas interests of $50,000 on the consolidated balance sheet and on the consolidated statement of loss, comprehensive loss and deficit. For the year ended August 31, 2009 the preparation of our Audited Consolidated Financial Statements in accordance with Canadian GAAP with a reconciliation to US GAAP recorded an additional impairment in oil and gas interests of $73,638 on the consolidated balance sheet and on the consolidated statement of loss, comprehensive loss and deficit. For the years ended August 31, 2008 and 2007 the preparation of our Audited Consolidated Financial Statements in accordance with US GAAP would not have resulted in differences to the Consolidated Balance Sheet or Consolidated Statement of Loss, Comprehensive Loss and Deficit from our Audited Consolidated Financial Statements prepared using Canadian GAAP. For the years ended August 31, 2006 the preparation of our Audited Consolidated Financial Statements in accordance with US GAAP recorded an unrealized (loss) gain on marketable securities in accumulated other comprehensive (loss) income on the consolidated balance sheet and the consolidated statement of loss, comprehensive loss and deficit of $(1).

Recently Issued United States Accounting Standards are included in Note 17 to our August 31, 2010 Audited Consolidated Financial Statements.

Exchange Rate Information

The exchange rate between the Canadian dollar and the U.S. dollar was CDN$1.00 per US$0.9989 (or US$0.9989 per CDN$1.00) as of January 31, 2011.

The average exchange rates for the periods indicated below (based on the daily noon buying rate for cable transfers in New York City certified for customs purposes by the Federal Reserve Bank of New York) are as follows:

| | | YEARS ENDED AUGUST 31, | |

| | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| Average exchange rate CDN$ per US$1.00 | | | 1.0640 | | | | 1.0967 | | | | 1.0631 | | | | 1.0560 | | | | 1.1066 | |

| | | | | | | | | | | | | | | | | | | | | |

| Average exchange rate US$ per CDN$1.00 | | | 0.9360 | | | | 0.9033 | | | | 0.9369 | | | | 0.9440 | | | | 0.8934 | |

The high and low exchange rates between the Canadian dollar and the U.S. dollar for each of the six months ended January 31, 2011are as follows:

Month | | Exchange rate CDN$ per US$1.00 | |

| | | Low | | | High | |

| January 2011 | | | 0.9864 | | | | 1.0020 | |

| December 2010 | | | 1.0004 | | | | | |

| November 2010 | | | 1.0012 | | | | 1.0266 | |

| October 2010 | | | 1.0028 | | | | 1.0298 | |

| September 2010 | | | 1.0219 | | | | 1.0520 | |

| August 2010 | | | 1.0154 | | | | 1.0640 | |

B. CAPITALIZATION AND INDEBTEDNESS

Not Applicable. This Form 20-F is being filed as an Annual Report under the Exchange Act.

C. REASONS FOR THE OFFER AND USE OF PROCEEDS

Not Applicable. This Form 20-F is being filed as an Annual Report under the Exchange Act.

D. RISK FACTORS

Our securities are highly speculative and subject to a number of risks. You should not consider an investment in our securities unless you are capable of sustaining an economic loss of the entire investment. In addition to the other information presented in this Annual Report, the following risk factors should be given special consideration when evaluating an investment in our securities.

General Risk Factors

We require additional capital which may not be available to us on acceptable terms, or at all. Both the exploration and development of oil and gas reserves can be capital-intensive businesses. We intend to satisfy any additional working capital requirements from cash flow and by raising capital through public or private sales of debt or equity securities, debt financing or short-term loans, or a combination of the foregoing. We have no current arrangements for obtaining additional capital, and may not be able to secure additional capital, or on terms which will not be objectionable to us or our shareholders. Under such circumstances, our failure or inability to obtain additional capital on acceptable terms or at all could have a material adverse effect on us.

We have a history of losses and a limited operating history as an oil and gas exploration and development company which makes it more difficult to evaluate our future prospects. To date, we have incurred significant losses. We have a limited operating history upon which any evaluation of us and our long-term prospects might be based. We are subject to the risks inherent in the oil and gas industry, as well as the more general risks inherent to the operation of an established business. We and our prospects must be considered in light of the risks, expenses and difficulties encountered by all companies engaged in the extremely volatile and competitive oil and gas markets. Any future success we might achieve will depend upon many factors, including factors, which may be beyond our control. These factors may include changes in technologies, price and product competition, developments and changes in the international oil and gas market, changes in our strategy, changes in expenses, fluctuations in foreign currency exchange rates, general economic conditions, and economic and regulatory conditions specific to the areas in which we compete. To address these risks, we must, among other things, comply with environmental regulations; expand our portfolio of proven oil and gas properties and negotiate additional working interests and prospect participations; and expand and replace depleting oil and gas reserves.

We have significant debt which may make it more difficult for us to obtain future financing or engage in business combination transactions. We have significant debt obligations. The degree to which this indebtedness could have consequences on our future prospects includes the effect of such debts on our ability to obtain financing for working capital, capital expenditures or acquisitions. The portion of available cash flow that will need to be dedicated to repayment of indebtedness will reduce funds available for expansion. If we are unable to meet our debt obligations through cash flow from operations, we may be required to refinance or adopt alternative strategies to reduce or delay capital expenditures, or seek additional equity capital.

Our future operating results are subject to fluctuation based upon factors outside of our control. Our operating results may in the future fluctuate significantly depending upon a number of factors including industry conditions, oil and gas prices, rate of drilling success, rates of production from completed wells and the timing of capital expenditures. Such variability could have a material adverse effect on our business, financial condition and results of operations. In addition, any failure or delay in the realization of expected cash flows from operating activities could limit our future ability to participate in exploration or to participate in economically attractive oil and gas projects.

Our operating results will be affected by foreign exchange rates. Since energy commodity prices are primarily priced in US dollars, a portion of our revenue stream is affected by U.S./Canadian dollar exchange rates. We do not hedge this exposure. While to date this exposure has not been material, it may become so in the future.

Our inability to manage our expected growth could have a material adverse effect on our business operations and prospects. We may be subject to growth-related risks including capacity constraints and pressure on our internal systems and controls. The ability to manage growth effectively will require us to continue to implement and improve our operational and financial systems and to expend, train and manage our employee base. The inability to deal with this growth could have a material adverse impact on our business, operations and prospects.

To compete in our industry, we must attract and retain qualified personnel. Our ability to continue our business and to develop a competitive edge in the marketplace depends, in large part, on our ability to attract and retain qualified management and personnel. Competition for such personnel is intense, and we may not be able to attract and retain such personnel which may negatively impact our share price. We do not have key-man insurance on any of our employees, directors or senior officers and we do not have written employment agreements with any of our employees, directors or senior officers.

We must continue to institute procedures designed to avoid potential conflicts involving our officers and directors. Some of our directors and officers are or may serve on the board of directors of other companies from time to time. Pursuant to the provisions of the Business Corporations Act ( Ontario ), our directors and senior officers must disclose material interests in any contract or transaction (or proposed contract or transaction) material to us. To avoid the possibility of conflicts of interest which may arise out of their fiduciary responsibilities to each of the boards, all such directors have agreed to abstain from voting with respect to a conflict of interest between the applicable companies. In appropriate cases, we will establish a special committee of independent directors to review a matter in which several directors, or members of management, may have a conflict.

We rely on the expertise of certain persons and must insure that these relationships are developed and maintained. We are dependent on the advice and project management skills of various consultants and joint venture partners contracted by us from time to time. Our failure to develop and maintain relationships with qualified consultants and joint venture partners will have a material adverse effect on our business and operating results.

We must indemnify our officers and directors against certain actions. Our articles contain provisions that state, subject to applicable law, we must indemnify every director or officer, subject to the limitations of the Business Corporations Act (Ontario), against all losses or liabilities that our directors or officers may sustain or incur in the execution of their duties. Our articles further state that no director or officer will be liable for any loss, damage or misfortune that may happen to, or be incurred by us in the execution of his duties if he acted honestly and in good faith with a view to our best interests. Such limitations on liability may reduce the likelihood of litigation against our officers and directors and may discourage or deter our shareholders from suing our officers and directors based upon breaches of their duties to us, though such an action, if successful, might otherwise benefit us and our shareholders.

We do not currently maintain a permanent place of business within the United States. A majority of our directors and officers are nationals or residents of countries other than the United States, and all or a substantial portion of such persons' assets are located outside the United States. As a result, it may be difficult for investors to enforce within the United States any judgments obtained against our company or our officers or directors, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof.

The global financial crisis is expected to cause petroleum and natural gas prices to remain volatile for the near future. Recent market events and conditions, including disruptions in the international credit markets and other financial systems and the deterioration of global economic conditions, have caused significant volatility to commodity prices. These conditions worsened in 2008 and are continuing into 2011, causing a loss of confidence in the broader U.S. and global credit and financial markets and resulting in the collapse of, and government intervention in, major banks, financial institutions and insurers and creating a climate of greater volatility, less liquidity, widening of credit spreads, a lack of price transparency, increased credit losses and tighter credit conditions. Notwithstanding various actions by governments, concerns about the general condition of the capital markets, financial instruments, banks, investment banks, insurers and other financial institutions caused the broader credit markets to further deteriorate and stock markets to decline substantially. These factors have negatively impacted company valuations and will impact the performance of the global economy going forward. Petroleum and natural gas prices are expected to remain volatile for the near future as a result of market uncertainties over the supply and demand of these commodities due to the current state of the world economies, OPEC actions and the ongoing global credit and liquidity concerns.

Since our sole executive officer does not devote his full time to the performance of his Company duties, he may engage in other work activities to our detriment. James Cassina, our sole executive officer, devotes approximately 75% of his work time to the performance of his Company duties. Although he has an obligation to perform his duties in a manner consistent with our best interests and through his stock ownership in the Company, is incentivized to do so, may encounter conflicts regarding the availability and use of his work time. Although there are no such present conflicts, the development thereof could have a material adverse effect on us.

Risks Factors Relating to Our Common Stock

Our stockholders may have difficulty selling shares of our common stock as there is a limited public trading market for such stock. There is only a limited public market for our common stock, and no assurance can be given that a broad or active public trading market will develop in the future or, if developed, that it will be sustained. Our common stock trades on the Over-the-Counter Bulletin Board. In addition, our common stock has not been qualified under any applicable state blue-sky laws, and we are under no obligation to so qualify or register our common stock, or otherwise take action to improve the public market for such securities. Our common stock could have limited marketability due to the following factors, each of which could impair the timing, value and market for such securities: (i) lack of profits, (ii) need for additional capital, (ii) limited public market for such securities; (iii) the applicability of certain resale requirements under the Securities Act; and (iv) applicable blue sky laws and the other factors discussed in this Risk Factors section.

Possible volatility of stock price. The market price for our common stock may be volatile and is subject to significant fluctuations in response to a variety of factors, including the liquidity of the market for the common stock, variations in our quarterly operating results, regulatory or other changes in the oil and gas industry generally, announcements of business developments by us or our competitors, litigation, changes in operating costs and variations in general market conditions. Because we have a limited operating history, the market price for our common stock may be more volatile than that of a seasoned issuer. Changes in the market price of our securities may have no connection with our operating results. No predictions or projections can be made as to what the prevailing market price for our common stock will be at any time.

We do not anticipate paying dividends on our common stock. We presently plan to retain all available funds for use in our business, and therefore do not plan to pay any cash dividends with respect to our securities in the foreseeable future. Hence, investors in our common stock should not expect to receive any distribution of cash dividends with respect to such securities for the foreseeable future.

Our shareholders may experience dilution of their ownership interests because of our future issuance of additional shares of common stock. Our constating documents authorize the issuance of an unlimited number of shares of common stock, without par value. In the event that we are required to issue additional shares of common stock or securities exercisable for or convertible into additional shares of common stock, enter into private placements to raise financing through the sale of equity securities or acquire additional oil and gas property interests in the future from the issuance of shares of our common stock to acquire such interests, the interests of our existing shareholders will be diluted and existing shareholders may suffer dilution in their net book value per share depending on the price at which such securities are sold. If we do issue additional shares, it will cause a reduction in the proportionate ownership and voting power of all existing shareholders.

At the Annual and Special Meeting of Shareholders to be held on February 24, 2011, shareholders will be asked to approve a resolution permitting us to issue up 30,851,026 additional shares of common stock by way of private placements, acquisitions or equity credit lines to be completed on or before February 24, 2012.

At the Annual and Special Meeting of Shareholders to be held on February 24, 2011, shareholders will be asked to approve a resolution authorizing us to consolidate our issued and outstanding common shares on an up to one (1) for four (4) basis, or divide our issued and outstanding common shares on an up to four (4) for one (1) basis.

At the Annual and Special Meeting of Shareholders to be held on February 24, 2011, shareholders will be asked to approve a resolution authorizing us to increase the maximum aggregate number of common shares reserved for issuance under our Stock Option Plan, as amended, (the “Plan”) to an amount equal to 20% of the 30,851,026 shares issued and outstanding as of January 14, 2011, the date of the Notice of Meeting and Management Information Circular (or a total of 6,107,205 shares).

As of the date of this Annual Report, no such options are issued.

Prospective investors in our Company are urged to seek independent investment advice. Independent legal, accounting or business advisors (i) have not been appointed by, and have not represented or held themselves out as representing the interests of prospective investors in connection with this Annual Report, and (ii) have not “expertized” or held themselves out as “expertizing” any portion of this Annual Report, nor is our legal counsel providing any opinion in connection with us, our business or the completeness or accuracy of this Annual Report. Neither we nor any of our respective officers, directors, employees or agents, including legal counsel, make any representation or expresses any opinion (i) with respect to the merits of an investment in our common stock, including without limitation the proposed value of our common stock; or (ii) that this Annual Report provides a complete or exhaustive description of us, our business or relevant risk factors which an investor may now or in the future deem pertinent in making his, her or its investment decision. Any prospective investor in our common stock is therefore urged to engage independent accountants, appraisers, attorneys and other advisors to (a) conduct such due diligence review as such investor may deem necessary and advisable, and (b) to provide such opinions with respect to the merits of an investment in our Company and applicable risk factors upon which such investor may deem necessary and advisable to rely. We will fully cooperate with any investor who desires to conduct such an independent analysis so long as we determine, in our sole discretion, that such cooperation is not unduly burdensome.

Applicable SEC rules governing the trading of “penny stocks” will limit the trading and liquidity of our common stock and may affect the trade price for our common stock. The Securities and Exchange Commission (“SEC”) has adopted rules which generally define "penny stock" to be any equity security that has a market price (as defined) of less than US$5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities will be covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and "accredited investors". The term "accredited investor" refers generally to institutions with assets in excess of US$5,000,000 or individuals with a net worth in excess of US$1,000,000 or annual income exceeding US$200,000 or US$300,000 jointly with their spouse.

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the shares that are subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We expect that the penny stock rules will discourage investor interest in and limit the marketability of our common shares.

In addition to the "penny stock" rules described above, The Financial Industry Regulatory Authority (“FINRA”) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, the FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The FINRA requirements will make it more difficult for broker-dealers to recommend that their customers buy our common shares, which may limit your ability to buy and sell our shares and have an adverse effect on the market for our shares.

Risks Factors Relating to Our Business

Our future success is dependent upon our ability to locate, obtain and develop commercially viable oil and gas deposits. Our future success is dependent upon our ability to economically locate commercially viable oil and gas deposits. We may not be able to consistently identify viable prospects, and such prospects, if identified, may not be commercially exploitable. Our inability to consistently identify and exploit commercially viable hydrocarbon deposits would have a material and adverse effect on our business and financial position.

Exploratory drilling activities are subject to substantial risks. Our expected revenues and cash flows will be principally dependent upon the success of any drilling and production from prospects in which we participate. The success of such prospects will be determined by the economical location, development and production of commercial quantities of hydrocarbons. Exploratory drilling is subject to numerous risks, including the risk that no commercially productive oil and gas reservoirs will be encountered. The cost of drilling, completing and operating wells is often uncertain, and drilling operations may be curtailed, delayed or canceled as a result of a variety of factors, including unexpected formation and drilling conditions, pressure or other irregularities in formations, blowouts, equipment failures or accidents, as well as weather conditions, compliance with governmental requirements or shortages or delays in the delivery of equipment. Our inability to successfully locate and drill wells that will economically produce commercial quantities of oil and gas could have a material adverse effect on our business and, financial position.

Our drilling and exploration plans will be subject to factors beyond our control. A prospect is a property that has been identified based on available geological and geophysical information that indicates the potential for hydrocarbons. Whether we ultimately drill a property may depend on a number of factors including funding; the receipt of additional seismic data or reprocessing of existing data; material changes in oil or gas prices; the costs and availability of drilling equipment; the success or failure of wells drilled in similar formations or which would use the same production facilities; changes in estimates of costs to drill or complete wells; our ability to attract industry partners to acquire a portion of our working interest to reduce exposure to drilling and completion costs; decisions of our joint working interest owners; and restrictions under provincial regulators.

Our operating results are subject to oil and natural gas price volatility. Our profitability, cash flow and future growth will be affected by changes in prevailing oil and gas prices. Oil and gas prices have been subject to wide fluctuations in recent years in response to changes in the supply and demand for oil and natural gas, market uncertainty, competition, regulatory developments and other factors which are beyond our control. It is impossible to predict future oil and natural gas price movements with any certainty. We do not engage in hedging activities. As a result, we may be more adversely affected by fluctuations in oil and gas prices than other industry participants that do engage in such activities. An extended or substantial decline in oil and gas prices would have a material adverse effect on our access to capital, and our financial position and results of operations.

Unforeseen title defects may result in a loss of entitlement to production and reserves. Although we conduct title reviews in accordance with industry practice prior to any purchase of resource assets, such reviews do not guarantee that an unforeseen defect in the chain on title will not arise and defeat our title to the purchased assets. If such a defect were to occur, our entitlement to the production from such purchased assets could be jeopardized.

Estimates of reserves and predictions of future events are subject to uncertainties. Certain statements included in this Annual Report contain estimates of our oil and gas reserves and the discounted future net revenues from those reserves, as prepared by independent petroleum engineers or us. There are numerous uncertainties inherent in such estimates including many factors beyond our control. The estimates are based on a number of assumptions including constant oil and gas prices, and assumptions regarding future production, revenues, taxes, operating expenses, development expenditures and quantities of recoverable oil and gas reserves. Such estimates are inherently imprecise indications of future net revenues, and actual results might vary substantially from the estimates based on these assumptions. Any significant variance in these assumptions could materially affect the estimated quantity and value of reserves. In addition, our reserves might be subject to revisions based upon future production, results of future exploration and development, prevailing oil and gas prices and other factors. Moreover, estimates of the economically recoverable oil and gas reserves, classifications of such reserves and estimates of future net cash flows prepared by independent engineers at different times may vary substantially. Information about reserves constitutes forward-looking statements.

The success of our business is dependent upon our ability to replace reserves. Our future success depends upon our ability to find, develop and acquire oil and gas reserves that are economically recoverable. As a result we must locate, acquire and develop new oil and gas reserves to replace those being depleted by production. Without successful funding for acquisitions and exploration and development activities, our reserves will decline. We may not be able to find and develop or acquire additional reserves at an acceptable cost.

Most of our competitors have substantially greater financial, technical, sales, marketing and other resources than we do. We engage in the exploration for and production of oil and gas, industries which are highly competitive. We compete directly and indirectly with oil and gas companies in our exploration for and development of desirable oil and gas properties. Many companies and individuals are engaged in the business of acquiring interests in and developing oil and gas properties in the United States and Canada, and the industry is not dominated by any single competitor or a small number of competitors. Many of such competitors have substantially greater financial, technical, sales, marketing and other resources, as well as greater historical market acceptance than we do. We will compete with numerous industry participants for the acquisition of land and rights to prospects, and for the equipment and labor required to operate and develop such prospects. Competition could materially and adversely affect our business, operating results and financial condition. Such competitive disadvantages could adversely affect our ability to participate in projects with favorable rates of return.

Shortages of supplies and equipment could delay our operations and result in higher operating and capital costs. Our ability to conduct operations in a timely and cost effective manner is subject to the availability of natural gas and crude oil field supplies, rigs, equipment and service crews. Although none are expected currently, any shortage of certain types of supplies and equipment could result in delays in our operations as well as in higher operating and capital costs.

Our business is subject to interruption from severe weather. Presently, our operations are conducted principally in the central region of Alberta, Canada and in Southwest Texas. The weather in these areas and other areas in which we may operate in the future can be extreme and can cause interruption or delays in our drilling and construction operations.

We are dependent on third-party pipelines and would experience a material adverse effect on our operations were our access to such pipelines be curtailed or the rates charged for use thereof materially increased. Substantially all our sales of natural gas production are effected through deliveries to local third-party gathering systems to processing plants. In addition, we rely on access to inter-provincial pipelines for the sale and distribution of substantially all of our gas. As a result, a curtailment of our sale of natural gas by pipelines or by third-party gathering systems, an impairment of our ability to transport natural gas on inter-provincial pipelines or a material increase in the rates charged to us for the transportation of natural gas by reason of a change in federal or provincial regulations or for any other reason, could have a material adverse effect upon us. In such event, we would have to obtain other transportation arrangements. We may not have economical transportation alternatives and it may not be feasible for us to construct pipelines. In the event such circumstances were to occur, our operating netbacks from the affected wells would be suspended until, and if, such circumstances could be resolved.

Our business is subject to operating hazards and uninsured risks. The oil and gas business involves a variety of operating risks, including fire, explosion, pipe failure, casing collapse, abnormally pressured formations, adverse weather conditions, governmental and political actions, premature reservoir declines, and environmental hazards such as oil spills, gas leaks and discharges of toxic gases. The occurrence of any of these events with respect to any property operated or owned (in whole or in part) by us could have a material adverse impact on us. Insurance coverage is not always economically feasible and is not obtained to cover all types of operational risks. The occurrence of a significant event that is not insured or insured fully could have a material adverse effect on our financial condition.

Our business is subject to restoration, safety and environmental risk. Our present operations are primarily in western Canada and southwest Texas and certain laws and regulations exist that require companies engaged in petroleum activities to obtain necessary safety and environmental permits to operate. Such legislation may restrict or delay us from conducting operations in certain geographical areas. Further, such laws and regulations may impose liabilities on us for remedial and clean-up costs, or for personal injuries related to safety and environmental damages, such liabilities collectively referred to as “asset retirement obligations”. While our safety and environmental activities have been prudent in managing such risks, we may not always be successful in protecting us from the impact of all such risks.

Compliance with the Kyoto Protocol may subject us to increased operating costs. Canada is a signatory to the United Nations Framework Convention on Climate Change and has ratified the Kyoto Protocol established thereunder to set legally binding targets to reduce nationwide emissions of carbon dioxide, methane, nitrous oxide and other so-called "greenhouse gases". Recently, representatives from approximately 170 countries met in Copenhagen, Denmark to attempt to negotiate a successor to the Kyoto Protocol. Pursuant to the resulting Copenhagen Accord, a non-binding political consensus rather than a binding international treaty such as the Kyoto Protocol, the Government of Canada revised its emissions reduction targets slightly. There has been much public debate with respect to Canada's ability to meet these targets and the Government's strategy or alternative strategies with respect to climate change and the control of greenhouse gases. The Corporation's exploration and production facilities and other operations and activities emit greenhouse gases and require the Corporation to comply with Alberta's greenhouse gas emissions legislation contained in the Climate Change and Emissions Management Act and the Specified Gas Emitters Regulation. The Corporation may also be required comply with the regulatory scheme for greenhouse gas emissions ultimately adopted by the federal government, which is now expected to be modified to ensure consistency with the regulatory scheme for greenhouse gas emissions adopted by the United States. The direct or indirect costs of these regulations may have a material adverse effect on the Corporation's business, financial condition, results of operations and prospects. The future implementation or modification of greenhouse gases regulations, whether to meet the limits required by the Kyoto Protocol, the Copenhagen Accord or as otherwise determined, could have a material impact on the nature of oil and natural gas operations, including those of the Corporation. Given the evolving nature of the debate related to climate change and the control of greenhouse gases and resulting requirements, it is not possible to predict the impact on the Corporation and its operations and financial condition. See "Industry Conditions – Climate Change Regulation".

Compliance with new or modified environmental laws or regulations could have a materially adverse impact on us. We are subject to various Canadian and US laws and regulations relating to the environment. We believe that we are currently in compliance with such laws and regulations. However, such laws and regulations may change in the future in a manner which will increase the burden and cost of compliance. In addition, we could incur significant liability under such laws for damages, clean-up costs and penalties in the event of certain discharges into the environment. In addition, environmental laws and regulations may impose liability on us for personal injuries, clean-up costs, environmental damage and property damage as well as administrative, civil and criminal penalties. We maintain limited insurance coverage for accidental environmental damages, but do not maintain insurance for the full potential liability that could be caused by such environmental damage. Accordingly, we may be subject to significant liability, or may be required to cease production in the event of the noted liabilities.

| ITEM 4 | INFORMATION ON THE COMPANY |

We are incorporated under the laws of the Province of Ontario, and are registered as an extra-provincial company in Alberta. Our primary activities are investment in, exploration and development and production of oil and gas.

We hold a 0.5% non-convertible gross overriding royalty in a natural gas well located in the Haynes area in the Province of Alberta, Canada.

We hold a 5.1975% working interest held in trust through a joint venture partner in a natural gas unit located in the Botha area in the Province of Alberta, Canada.

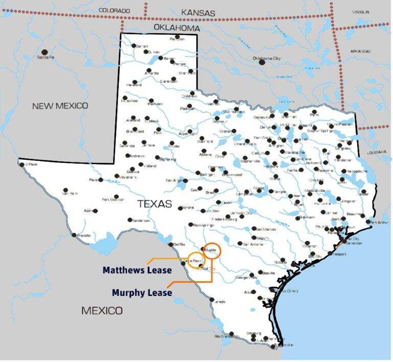

Through Dyami Energy LLC we hold a 75% working interest before payout which reduces to a 61.50% working interest after payout of $12,500,000 of production revenue in the Matthews lease. Directly, we hold a 10% working interest before payout which reduces to a 7.50% working interest after payout of $15,000,000 of production revenue in the Matthews lease. The Matthews lease comprises approximately 2,629 gross acres of land in Zavala County, Texas.

Through Dyami Energy LLC, we hold a 100% working interest in the Murphy Lease comprising approximately 2,637 acres of land in Zavala County, Texas subject to a 10% carried interest on the drilling costs from surface to base of the Austin Chalk formation, and a 3% carried interest on the drilling costs from the top of the Eagle Ford shale formation to basement on the first well drilled into a serpentine plug and for the first well drilled into a second serpentine plug, if discovered

Our registered office and management office is located at 1 King Street West, Suite 1505, Toronto, Ontario, M5H 1A1, Telephone (416) 364-4039, Facsimile (416) 364-8244. Our books and financial records are located in the registered office and management office. Our Canadian public filings can be accessed and viewed via the System for Electronic Data Analysis and Retrieval (“SEDAR”) at www.sedar.com. . Readers can also access and view our Canadian public insider trading reports via the System for Electronic Disclosure by Insiders at www.sedi.ca. Our Registrar and Transfer Agent is Equity Transfer & Trust Company located at Suite 400, 200 University Avenue, Toronto, Ontario, M5H 4H1. Our U.S. public filings are available at the public reference room of the U.S. Securities and Exchange Commission (“SEC”) located at 100 F Street, N.E., Room 1580, Washington, DC 20549 and at the website maintained by the SEC at www.sec.gov.

A. HISTORY AND DEVELOPMENT OF THE COMPANY

We were incorporated in Ontario, Canada on September 22, 1978, under the Business Corporations Act (Ontario), under the name Bonanza Red Lake Explorations Inc. (“Bonanza Red Lake”). By prospectus dated November 20, 1978 and a further amendment to the Prospectus dated January 10, 1979 we became a reporting issuer in the Province of Ontario and raised $250,000 to acquire interests in and to explore and develop certain mineral lands located near the Town of Red Lake, Ontario, Canada. In 1987, we optioned our mineral lands in Red Lake, Ontario to Pure Gold Resources Inc., who expended sufficient funds during 1988 and 1989 to earn an 85% interest in our eight patented mineral claims, and then discontinued its exploration program on the property. Bonanza Red Lake had subsequently written the carrying amount of these mineral claims down to $1.

On March 29, 2000, Bonanza Red Lake entered into a Share Exchange Agreement with 1406768 Ontario Inc. (“1406768 Ontario”). 1406768 Ontario is a company incorporated under the laws of the Province of Ontario by articles of incorporation dated effective March 13, 2000. The purpose of the transaction was to allow Bonanza Red Lake to acquire a company, 1406768 Ontario, which resulted in our owning part of an operating business. At an Annual and Special Meeting of shareholders held on May 10, 2000 we received shareholder approval for the acquisition of 1406768 Ontario; the consolidation of Bonanza Red Lake’s issued and outstanding common shares on a one new common share for every three old common shares basis; a name change from Bonanza Red Lake to Eugenic Corp; a new stock option plan (the “Plan”) authorizing 1,275,000 common shares to be set aside for issuance under the Plan; and authorizing the directors to determine or vary the number of directors of the Company from time to time which pursuant to our Articles provide for a minimum of three and a maximum of ten.

By Articles of Amendment dated August 15, 2000, Bonanza Red Lake consolidated its issued and outstanding common shares on a one new common share for every three old common shares basis and changed the name of the company to Eugenic Corp.

We completed the acquisition of 1406768 Ontario on October 12, 2000 and acquired all of the issued and outstanding shares of 1406768 Ontario for $290,000. The purchase price was satisfied by our issuance of 5,800,000 company units at $0.05 per unit. Each unit consisted of one common share and one common share purchase warrant entitling the holder to purchase one common share of ours at an exercise price of $0.25 per common share until October 12, 2003. As a result of this transaction, the original shareholders of 1406768 Ontario owned 90.7% of our issued shares. The acquisition resulted in a change in business and an introduction of new management for us. The acquisition was accounted for as a reverse take-over of us by 1406768 Ontario. Our net assets acquired at fair value as at October 12, 2000 resulted in a deficiency of assets over liabilities in the amount of $123,170 which was charged to share capital. All of the 5,800,000 outstanding warrants expired on October 12, 2003.

On November 2, 2001, we were extra-provincially registered in the Province of Alberta, Canada.

As part of an initiative to create cash flow, we commenced oil and gas operations effective August 31, 2001 and acquired a 25% working interest in one section of land (640 gross acres) in the Windfall Area of Alberta, Canada for a purchase price of $75,000. On June 25, 2003 we disposed of this property for net proceeds of $85,000.

On September 10, 2001, we entered into a Participation Agreement to acquire a 30% interest in one section of land (640 gross acres) in the St Anne area of Alberta, Canada by paying 40% of the costs to acquire approximately 7.1 kilometers of proprietary 2D seismic data. After review of the seismic data, it was determined that the joint partners would not undertake to drill a test well. Accordingly, the costs associated with acquiring this prospect were written off during fiscal 2003 - $4,806 and in fiscal 2002 - $22,781.

We entered into an Agreement dated February 28, 2002 to participate in drilling two test wells by paying 10% of the costs to drill to earn a 6% working interest before payout and a 3.6% working interest after payout. The first test well in the Haynes area of Alberta, Canada was drilled and proved to contain uneconomic hydrocarbons and was subsequently abandoned and costs of $38,855 were written off in 2002. On August 28, 2003 the joint partners farmed out their interest in the Haynes prospect for a 10% non-convertible overriding royalty (“NCOR”). The farmee drilled a test well and placed the well on production commencing December 2003. Our share of this NCOR is 0.5%. The second test well in the Mikwan area of Alberta, Canada was drilled and initially placed on production from the Glauconite formation and later shut in during 2003. The Glauconite formation was subsequently abandoned and the Belly River formation was completed and placed on production in January 2004.

Effective August 9, 2002, we entered into an agreement with Wolfden Resources Inc. (“Wolfden”) and sold our 15% interest in 8 patented mining claims located in Dome Township, Red Lake, Ontario (the “Mining Claims”) for consideration of $5,000 plus we retained a 0.3% net smelter return royalty of the net proceeds realized from the sale of recovered minerals. Wolfden also holds a right of first refusal to purchase our 0.3% net smelter return royalty. Pursuant to an arrangement dated effective August 18, 2006, Wolfden transferred certain assets including its interests in and to the Mining Claims to Premier Gold Mines Limited (“Premier”).

Effective October 28, 2005, we surrendered our 6% working interest in a gas well slated for abandonment and related expiring leases in the Mikwan area of Alberta. In exchange for the surrender of interests, we were released of our abandonment and site reclamation obligations.

On April 14, 2008, we completed a non-brokered private placement of a total of 2,575,000 units (each a "Unit") at a purchase price of $0.10 per Unit for gross proceeds of $257,500 (the "Offering"). Each Unit was comprised of one common share and one purchase warrant (each a "Warrant"). Each Warrant is exercisable until April 14, 2011 to purchase one additional share of our common stock at a purchase price of $0.20 per share.

On April 14, 2008, we also entered into an agreement (the "Debt Settlement Agreement") with our then President, Secretary and Director, Sandra J. Hall, to convert debt in the amount of $50,000 through the issuance of a total of 500,000 shares at an attributed value of $0.10 per Share. In connection with the conversion, Ms. Hall also agreed to forgive $38,000 of the debt owing to her by us.

In addition, on April 14, 2008, we also completed similar debt settlement arrangements with two other arm's length parties, in an effort to reduce the debt that we have reflected on our financial statements. In the aggregate, we entered into agreements to convert $100,000 of debt, through the issuance of a total of 1,000,000 shares at an attributed value of $0.10 per share.

On February 5, 2009, we completed a non-brokered private placement of 2,600,000 units (each a “Unit”) at a purchase price of $0.05 per Unit for gross proceeds of $130,000. Each Unit was comprised of one common share (each a “Unit Share”) and one purchase warrant (each a “Warrant”). Each Warrant is exercisable until February 5, 2014 to purchase one additional share of our common stock (each a “Warrant Share”) at a purchase price of $0.07 per share. 1407271 Ontario Inc. purchased 1,600,000 units. 1407271 Ontario Inc. is owned 100% by our former President, Ms. Sandra Hall. Ms. Hall is also the sole director and officer of 1407271.

On February 25, 2009, we completed a non-brokered private placement of 1,000,256 units (each a “Unit”) at a purchase price of $0.05 per Unit for gross proceeds of approximately $50,013. Each Unit was comprised of one common share (each a “Unit Share”) and one purchase warrant (each a “Warrant”). Each Warrant is exercisable until February 25, 2014 to purchase one additional share of our common stock (each a “Warrant Share”) at a purchase price of $0.07 per share. Sandra Hall, our former president and former director, and Milton Klyman, a director, purchased 600,000 Units and 50,000 Units, respectively.

On February 27, 2009, we purchased all of the issued and outstanding shares issued in the capital stock of 1354166 Alberta Ltd. (“1354166 Alberta”), a company incorporated on October 3, 2007 in the Province of Alberta Canada (the "Transaction") under the Business Corporations Act (Alberta). In connection therewith, we issued to the shareholders of 1354166 an aggregate of 8,910,564 units (each a "Unit") at $0.05 per unit or an aggregate of $445,528 and following the closing repaid $118,000 of shareholder loans in 1354166 by cash payment. . Each unit is comprised of one share of our common stock (each a "Share") and one purchase warrant (each a "Warrant"). Each Warrant is exercisable until February 27, 2014 to purchase one additional share of our common stock at a purchase price of $0.07 per share. 1354166 is a private company that has a 5.1975% working interest held in trust through a joint venture partner in a natural gas unit located in the Botha area of Alberta, Canada.

On February 27, 2009, we entered into an agreement with a non-related party, to convert debt in the amount of $62,500 through the issuance of a total of 1,250,000 units at an attributed value of $0.05 per unit (the "Debt Settlement"). Each Unit was comprised of one common share (each a “Unit Share”) and one purchase warrant (each a “Warrant”). Each Warrant is exercisable until February 27, 2014 to purchase one additional share of our common stock (each a “Warrant Share”) at a purchase price of $0.07 per share.

By Articles of Amendment dated November 12, 2009, 1406768 Ontario changed its name to Eagleford Energy Inc.By Articles of Amalgamation dated November 30, 2009 we amalgamated with Eagleford Energy Inc. and upon the amalgamation the amalgamated entity's name became Eagleford Energy Inc.

Effective June 10, 2010, we retained Gar Wood Securities, LLC (“Gar Wood”) to act as Investment Banker/Financial Advisor to the Company for a period of two years. Under the terms of the Gar Wood engagement, we agreed to pay a fee of 6% of the gross proceeds raised and issue 1,500,000 common share purchase warrants (the “Warrants”) as follows:

1,000,000 Warrants exercisable at US$1.00 to purchase 1,000,000 common shares expiring on December 10, 2011 and issuable in three equal tranches on June 10, 2010, December 10, 2010 and June 10, 2011; and 500,000 Warrants exercisable at US$1.50 to purchase 500,000 common shares expiring on June 10, 2012 and issuable in three equal tranches on June 10, 2010, December 10, 2010 and June 10, 2011.

On November 5, 2010 we terminated the agreement with Gar Wood dated June 10, 2010. As a result 36,430 warrants were cancelled out of the 333,333 warrants issued exercisable at $1.00 expiring December 10, 2011 and 18,215 warrants were cancelled out of the 166,667 warrants issued exercisable at $1.50 expiring June 10, 2012.During the fiscal year ended August 31, 2010, 1,100,000 of our common share purchase warrants were exercised at $0.07 expiring February 5, 2014 for proceeds of $77,000 and 1,000,000 of our common share purchase warrants were exercised at $0.07 expiring February 27, 2014 for proceeds of $70,000.

On August 31, 2010 we acquired a 10% working interest before payout and a 7.5% working interest after payout of production revenue of $15 million in the Matthews lease comprising approximately 2,629 gross acres of land in Zavala County, Texas (the “Lease Interest”). As consideration for the Lease Interest we paid on closing $212,780 (US$200,000), satisfied by US$25,000 in cash and $186,183 (US$175,000) satisfied by the issuance of a 5% secured promissory note.US$100,000 of principal together with accrued interest is due and payable on February 28, 2011 and US$75,000 of principal together with accrued interest is due and payable on August 31, 2011. The Company may, in its sole discretion, prepay any portion of the principal amount. The note is secured by the Lease Interest.

On August 31, 2010, we acquired 100% the issued and outstanding membership interests of Dyami Energy LLC, a Texas limited liability corporation for consideration of $4,218,812. (US$3,965,422) satisfied by (i) the issuance of 3,418,467 units of the Company. Each unit is comprised of one common share and one-half a purchase warrant. Each full warrant is exercisable into one additional common share at US$1.00 per share on or before August 31, 2014 (the “Units’) and (ii) the assumption of $1,021,344 (US$960,000) of Dyami Energy debt by way of a secured promissory note.The note bears interest at 6% per annum, is secured by Dyami’s interest in the Matthews and Murphy leases and is payable on December 31, 2011 or upon the Company closing a financing or series of financings in excess of US$4,500,000.

Dyami Energy holds a 75% working interest before payout and a 61.50% working interest after payout of production revenue of $12.5 million in the Matthews Lease comprising approximately 2,629 gross acres of land in Zavala County, Texas and a 100% working interest in a mineral lease comprising approximately 2,637 acres of land in Zavala County, Texas (the “Murphy Lease”) subject to a 10% carried interest on the drilling costs from surface to base of the Austin Chalk formation, and a 3% carried interest on the drilling costs from the top of the Eagle Ford shale formation to basement on the first well drilled into a serpentine plug and for the first well drilled into a second serpentine plug, if discovered (collectively the “Leases”).

The Members of Dyami entered into lock up agreements on closing and placed 50% of the Units in escrow (1,709,234 common shares and 854,617 purchase warrants) until such time that we receive a National Instrument 51-101 compliant report from an independent engineering firm indicating at least 100,000 boe of proven reserves on either the Murphy Lease or any formation below the San Miguel on the Matthews Lease (the “Report”). In the event the Report is not received by Dyami Energy within two years of the closing date of the acquisition, the escrow units are to be returned to us for cancellation. In addition without our prior written consent, the Members may not offer, sell, contract to sell, grant any option to purchase, hypothecate, pledge, transfer title to or otherwise dispose of any of the Units during the period commencing on August 31, 2010 and ending on August 31, 2011 (the “Lock-Up Period”). During the Lock-Up Period, the Members may not effect or agree to effect any short sale or certain related transactions with respect to the our common shares.

In connection with the Dyami Energy acquisition, we entered into a one year employment agreement with Eric Johnson and reserved 850,000 common share purchase warrants, exercisable on an earn-out basis, for the purchase of 850,000 common shares of our stock at a price of US$1.00 per share during a period of five years from the date of issuance.

During August 2010, Dyami Energy commenced operations to drill its Initial Test Well on the Matthews Lease, Zavala County, Texas. On October 15, 2010 the well was spud in and drilled to a measured depth of 8,563, feet including a 3,300 foot “in section” lateral into the Eagle Ford shale formation. A shot point sleeve was installed in the Eagle Ford shale formation to protect the well bore and facilitate a multi stage frac completion.

The well was logged extensively and 36 sidewall cores were taken from 4 key formations in descending order, the San Miguel, the Austin Chalk, the Eagle Ford and the Buda. The logs were interpreted by Weatherford International Ltd and the sidewall cores were analyzed by Core Laboratories and Weatherford and based on those results the Company is formulating a detailed frac design and completion plan for the Dyami/Matthews #1 H well.

During the fiscal year ended August 31, 2010 we spent $10,046 on exploration expenditures related to the Matthews Lease.

The following table summarizes the costs incurred in our oil and gas interests for acquisition, exploration, and development activities for the years ended August 31, 2010, 2009 and 2008.

| Oil and Gas Interests | | 2010 | | | 2009 | | | 2008 | |

| Developed-Alberta, Canada | | | | | | | | | |

| Net book value at September 1 | | $ | 407,000 | | | $ | 448 | | | $ | 448 | |

| Acquisition of 1354166 Alberta | | | - | | | | 538,995 | | | | - | |

| Depletion | | | (38,370 | ) | | | (26,638 | ) | | | (24 | ) |

| Write down of oil and gas interests | | | (54,630 | ) | | | (105,805 | ) | | | (528 | ) |

| Total developed, Alberta Canada | | | 314,000 | | | | 407,000 | | | | 448 | |

| Undeveloped-Texas USA | | | | | | | | | | | | |

| Acquisition of oil and gas interests | | | 212,780 | | | | - | | | | - | |

| Exploration expenditures | | | 10,046 | | | | - | | | | - | |

| Acquisition of Dyami Energy | | | 5,472,464 | | | | - | | | | - | |

| Total undeveloped, Texas, USA | | | 5,695,290 | | | | - | | | | - | |

| Total developed and undeveloped | | $ | 6,009,290 | | | $ | 407,000 | | | $ | 448 | |

On September 17, 2010, 500,000 of our common share purchase warrants were exercised at $0.07 expiring February 5, 2014 for proceeds of $35,000.

On September 24, 2010 600,000 of our common share purchase warrants were exercised at $0.07 expiring February 27, 2014 for proceeds of $42,000.

On January 26, 2011, 25,247 of our common share purchase warrants were exercised at $0.07 expiring February 27, 2014 for proceeds of $1,767.

Subsequent to the year-end August 31, 2010 and through to January 31, 2011, we received US$1,760,000 and CDN$149,000 and issued promissory notes to five of our shareholders. The notes are due on demand and bear interest at 10% per annum. Interest is payable annually on the anniversary date of the notes.

Subsequent to the year-end August 31, 2010 we received US $300,000 from our President and issued a promissory note to him. The note is due on demand and bears interest at 10% per annum, Interest is payable annually on the anniversary date of the note.

For the three months ended November 30, 2010 we incurred $1,627,606 in expenditures related to the Matthews/Dyami #1H well.

On January 20, 2011 we spud our initial well, the Murphy/Dyami 1-H, on our 100% working interest Murphy Lease comprising 2,637 acres of land in Zavala County, Texas. The well was drilled vertically to a depth of 4,588 feet through the Eagle Ford shale to the Buda formation and logged by Weatherford International. Core samples were recovered from the Georgetown, Buda, Eagle Ford Shale, Serpentine and the Escondido formations for interpretation and analysis.

We intend to apply additional capital to further enhance our property interests. As part of our oil and gas development program, management of the Company anticipates further expenditures to expand its existing portfolio of proved reserves. Amounts expended on future exploration and development are dependent on the nature of future opportunities evaluated by us. These expenditures could be funded through cash held by the Company or through cash flow from operations. Any expenditure which exceeds available cash will be required to be funded by additional share capital or debt issued by us, or by other means. Our long-term profitability will depend upon our ability to successfully implement our business plan.