UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a – 16 OR 15d – 16 UNDER THE

THE SECURITIES EXCHANGE ACT OF 1934

For the month of May, 2017

Commission File No. 0-53646

Intelligent Content Enterprises Inc.

(Translation of Registrant’s name into English) 1 King Street West, Suite 1505 Toronto, Ontario, Canada M5H 1A1 |

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-Fx Form 40-F¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes¨ Nox

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes¨ Nox

TABLE OF CONTENTS

1. Intelligent Content Enterprises Inc. Notice of Meeting and Management Information Circular dated as of April 26, 2017 as filed on SEDAR on May 1, 2017.

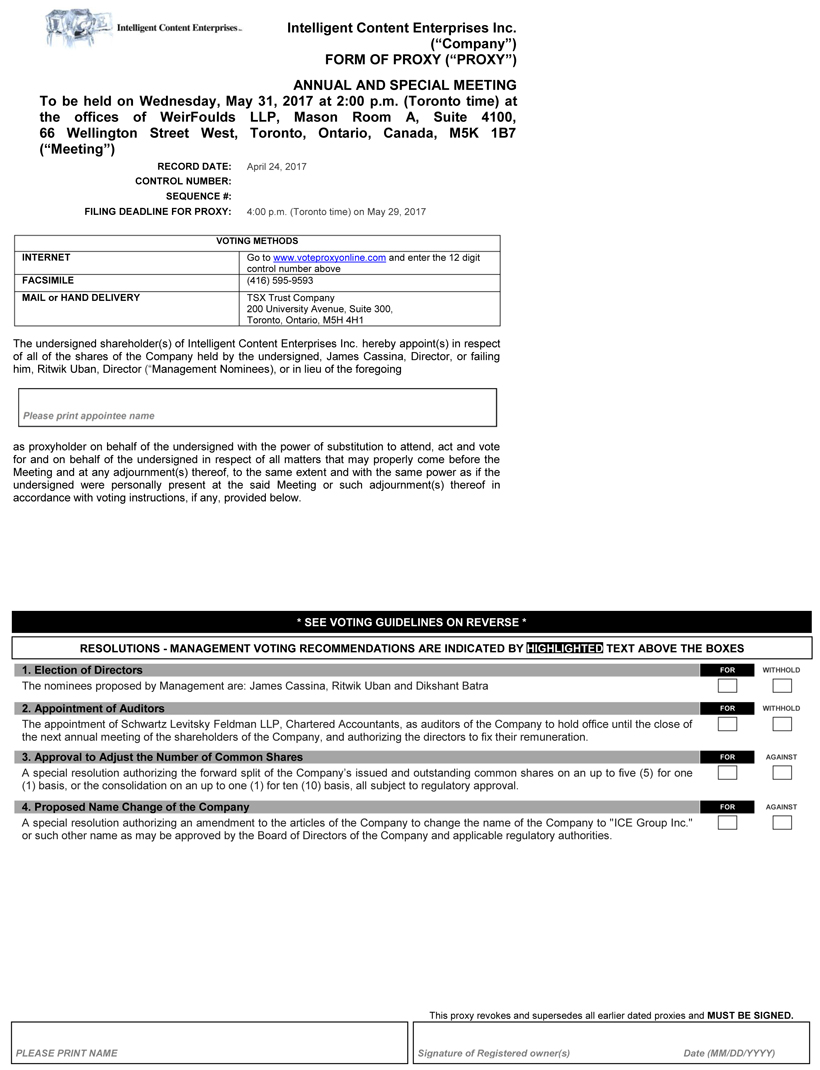

2. Intelligent Content Enterprises Inc. Supplemental Mail Card and Form of Proxy for use at Annual and Special Meeting of Shareholders to be held on May 31, 2017 as filed on SEDAR on May 1, 2017.

3. Intelligent Content Enterprises Inc. Letter of Transmittal relating to the name change of Intelligent Content Enterprises Inc. to Novicius Corp. and the consolidation of the Common Shares of Intelligent Content Enterprises Inc. as filed on SEDAR on May 1, 2017.

4. Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| May 1, 2017 | INTELLIGENT CONTENT ENTERPRISES INC. |

| | |

| | |

| | By: | /s/ James Cassina |

| | Name: | James Cassina |

| | Title: | Chief Financial Officer |

ITEM1

NOTICE OF MEETING

AND

MANAGEMENT INFORMATION CIRCULAR

in respect of the

ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

to be held on Wednesday, May 31, 2017

Dated as of April 26, 2017

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

to be held on Wednesday, May 31, 2017

TO THE SHAREHOLDERS OF INTELLIGENT CONTENT ENTERPRISES INC.:

NOTICE IS HEREBY GIVEN that an annual and special meeting (the “Meeting”) of shareholders (“Shareholders”) of common shares (“Common Shares”) of Intelligent Content Enterprises Inc. (the “Company”) will be held at the offices of WeirFoulds LLP, Mason Room A, Suite 4100, 66 Wellington Street West, Toronto, Ontario, Canada, M5K 1B7, at 2:00 p.m. (Toronto time) on Wednesday, May 31, 2017 for the following purposes:

| 1. | to receive the audited financial statements of the Company for the year ended August 31, 2016 and the report of the auditors thereon; |

| 2. | to elect the directors of the Company for the ensuing year; |

| 3. | to appoint the auditors of the Company for the ensuing year, and to authorize the directors to fix the auditors’ remuneration; |

| 4. | to consider and, if thought advisable, to approve a special resolution, in the form of the proposed special resolution set forth in the Information Circular, the text of which is incorporated herein by reference, authorizing the forward split of the Company’s issued and outstanding Common Shares on an up to five (5) for one (1) basis, or the consolidation of the Company’s issued and outstanding Common Shares on an up to one (1) new for ten (10) old shares basis, all subject to required regulatory approval; |

| 5. | to consider and, if thought advisable in conjunction with a determination to proceed with a consolidation or share split as described in the Information Circular, to approve a special resolution in the form of the proposed special resolution set forth in the Information Circular, the text of which in incorporated herein by reference, authorizing an amendment to the articles of the Company to change the name of the Company to “Novicius Enterprises Inc.” or such other name as may be approved by the board of directors of the Company and applicable regulatory and exchange authorities; and |

| 6. | to transact such other business as may properly be brought before the Meeting or any adjournment or adjournments thereof. |

Shareholders should refer to the accompanying management information circular for more detailed information with respect to the matters to be considered at the Meeting.

If you are a registered shareholderof the Company and are unable to attend the Meeting in person, please date and execute the accompanying form of proxy and return it in the envelope provided to TSX Trust Company, the registrar and transfer agent of the Company, at 200 University Avenue, Suite 300, Toronto, Ontario M5H 4H1 by no later than 4:00 p.m. (Toronto time) on Monday, May 29, 2017.

If you are not a registered shareholderof the Company and receive these materials through your broker or through another intermediary, please complete and return the form of proxy in accordance with the instructions provided to you by your broker or by the other intermediary.

DATED this 26th day of April, 2017.

BY ORDER OF THE BOARD OF DIRECTORS

| “Ritwik Uban” |

RITWIK UBAN President and Director |

Registered shareholders unable to attend the Meeting are requested to date, sign and return their form of proxy in the enclosed envelope. If you are a non-registered shareholder of the Company and receive these materials through your broker or through another intermediary, please complete and return the materials in accordance with the instructions provided to you by your broker or by the other intermediary. Failure to do so may result in your shares not being eligible to be voted by proxy at the Meeting.

PROXY STATEMENT AND MANAGEMENT INFORMATION CIRCULAR FOR THE ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 31, 2017

PURPOSE OF SOLICITATION

THIS INFORMATION CIRCULAR IS FURNISHED IN CONNECTION WITH THE SOLICITATION OF PROXIES BY THE MANAGEMENT OF EAGLEFORD ENERGY CORP. (“EAGLEFORD” OR THE “COMPANY”) FOR USE AT THE ANNUAL AND SPECIAL MEETING (THE “MEETING”) OF THE HOLDERS OF COMMON SHARES (“COMMON SHARES”) OF THE COMPANY.

The Meeting will be held at the offices of WeirFoulds LLP, Mason Room A, Suite 4100, 66 Wellington Street West, Toronto, Ontario, Canada, M5K 1B7 at 2:00 p.m. (Toronto time) on Monday, May 31, 2017, and at any adjournments thereof for the purposes set forth in the Notice of Annual and Special Meeting of Shareholders accompanying this management information circular (“Information Circular”).

Although it is expected that the solicitation of proxies will be primarily by mail, proxies may also be solicited personally or by telephone, facsimile or personal interview by regular employees of the Company, or by other proxy solicitation services retained by the Company. The costs thereof will be borne by the Company. In accordance with National Instrument 54-101 –Communication with Beneficial Owners of Securities of a Reporting Issuer, arrangements have been made with brokerage houses and other intermediaries to forward solicitation materials to the beneficial owners of Common Shares of the Company held of record by such persons and the Company may reimburse such persons for reasonable fees and disbursements incurred by them in doing so.

Unless otherwise specified, information contained in this Information Circular is given as April 26, 2017 and, unless otherwise specified, all amounts shown represent Canadian dollars. The record date for the Meeting has been set as April 24, 2017 (the “Record Date”).

APPOINTMENT AND REVOCATION OF PROXIES

Enclosed herewith is a form of proxy for use at the Meeting. The persons named in the form of proxy are directors and officers of the Company.

A SHAREHOLDER HAS THE RIGHT TO DESIGNATE OR APPOINT A PERSON OR COMPANY (WHO NEED NOT BE A SHAREHOLDER) TO ATTEND AND ACT FOR HIM AND ON HIS BEHALF AT THE MEETING OTHER THAN THE PERSONS DESIGNATED IN THE ENCLOSED INSTRUMENT OF PROXY.

Such right may be exercised by striking out the names of the two persons designated in the instrument of proxy and by inserting in the blank space provided for that purpose the name of the desired person or company or by completing another proper instrument of proxy and, in either case, depositing the completed and executed proxy with the registrar and transfer agent of the Company, TSX Trust Company at 200 University Avenue, Suite 300, Toronto, Ontario M5H 4H1 at any time prior to 4:00 p.m. (Toronto time) on Monday, May 29, 2017.

A Shareholder forwarding the enclosed form of proxy may indicate the manner in which the appointee is to vote with respect to any specific item by checking the appropriate space. If the Shareholder giving the proxy wishes to confer a discretionary authority with respect to any item of business, then the space opposite the item is to be left blank. The shares represented by the proxy submitted by a Shareholder will be voted in accordance with the directions, if any, given in the proxy.

A Shareholder who has given a proxy may revoke it at any time in so far as it has not been exercised. A proxy may be revoked, as to any matter on which a vote shall not already have been cast pursuant to the authority conferred by such proxy, by instrument in writing executed by the Shareholder or by his attorney authorized in writing or, if the Shareholder is a body corporate, by a duly authorized officer, attorney or representative thereof and deposited at the registered office of the Company at any time prior to 4:00 p.m. (Toronto time) on the last business day preceding the day of the Meeting, or any adjournment thereof, or with the Chairman of the Meeting on the day of the Meeting or any adjournment thereof, and upon either of such deposits the proxy is revoked. A proxy may also be revoked in any other manner permitted by law. The Company’s registered office is located at Suite 1505, 1 King Street West, Toronto, Ontario, M5H 1A1.

ADVICE TO BENEFICIAL HOLDERS OF COMMON SHARES

The information set forth in this section is of significant importance to many shareholders of the Company as a substantial number of shareholders do not hold shares in their own name. Shareholders who do not hold their shares in their own name (referred to in this Information Circular as“Beneficial Shareholders”) should note that only proxies deposited by shareholders whose names appear on the records of the Company as the registered holders of Common Shares can be recognized and acted upon at the Meeting. If Common Shares are listed in an account statement provided to a shareholder by a broker, then in almost all cases those Common Shares will not be registered in the shareholder’s name on the records of the Company. Such Common Shares will more likely be registered under the names of the shareholder’s broker or an agent of that broker. In Canada, the vast majority of such shares are registered under the names of CDS & Co. (the registration name for CDS Depository and Clearing Services Inc., which acts as nominee for many Canadian brokerage firms). Common Shares held by brokers or their agents or nominees can only be voted (for or against resolutions) upon the instructions of the Beneficial Shareholder. Without specific instructions, brokers and their agents and nominees are prohibited from voting shares for the broker’s clients.

THEREFORE, BENEFICIAL SHAREHOLDERS SHOULD ENSURE THAT INSTRUCTIONS RESPECTING THE VOTING OF THEIR COMMON SHARES ARE COMMUNICATED TO THE APPROPRIATE PERSON.

Applicable regulatory policy requires intermediaries/brokers to seek voting instructions from Beneficial Shareholders in advance of shareholders’ meetings. Every intermediary/broker has its own mailing procedures and provides its own return instructions which should be carefully followed by Beneficial Shareholders in order to ensure that their Common Shares are voted at the Meeting. Often, the form of proxy supplied to a Beneficial Shareholder by its broker is identical to the form of proxy provided to registered shareholders; however, its purpose is limited to instructing the registered shareholder how to vote on behalf of the Beneficial Shareholder. The majority of brokers now delegate responsibility for obtaining instructions from clients to Broadridge Financial Services, Inc. (“Broadridge”). Broadridge typically mails a scanable voting instruction form in lieu of the form of proxy. The Beneficial Shareholder is requested to complete and return the voting instruction form to them by mail or facsimile. Alternatively, the Beneficial Shareholder can call a toll-free telephone number to vote the Common Shares held by the Beneficial Shareholder. Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of Common Shares to be represented at the Meeting. A Beneficial Shareholder receiving a voting instruction form cannot use that voting instruction form to vote Common Shares directly at the Meeting as the voting instruction form must be returned as directed by Broadridge well in advance of the Meeting in order to have the Common Shares voted.

Although a Beneficial Shareholder may not be recognized directly at the Meeting for the purposes of voting Common Shares registered in the name of his broker (or agent of the broker), a Beneficial Shareholder may attend at the Meeting as proxyholder for a registered shareholder and vote the Common Shares in that capacity. Beneficial Shareholders who wish to attend at the Meeting and indirectly vote their Common Shares as proxyholder for a registered shareholder should enter their own names in the blank space on the instrument of proxy provided to them and return the same to their broker (or the broker’s agent) in accordance with the instructions provided by such broker (or agent), well in advance of the Meeting.

This Information Circular and enclosed Shareholder materials are being sent to both registered and non-registered owners of Shareholders. If you are a non-registered Shareholder, and the Company or its agent has sent these materials directly to you, your name and address and information about your holdings of Common Shares, have been obtained in accordance with applicable securities regulatory requirements from the intermediary holding on your behalf.

By choosing to send these materials to you directly, the Company (and not the intermediary holding on your behalf) has assumed responsibility for (i) delivering these materials to you, and (ii) executing your proper voting instructions. Please return your voting instructions as specified in the request for voting instructions.

MANNER OF VOTING AND EXERCISE OF DISCRETION BY PROXIES

The persons named in the enclosed instrument of proxy will vote or withhold from voting the Common Shares in respect of which they are appointed in accordance with the direction of the Shareholder appointing them and if the Shareholder specifies a choice with respect to any matter to be acted upon, the Common Shares shall be voted accordingly.

WHERE NO CHOICE IS SPECIFIED, THE PROXY WILL CONFER DISCRETIONARY AUTHORITY AND WILL BE VOTED FOR EACH OF THE MATTERS IDENTIFIED IN THE NOTICE AND DESCRIBED IN THIS INFORMATION CIRCULAR. THE ENCLOSED FORM OF PROXY ALSO CONFERS DISCRETIONARY AUTHORITY UPON THE PERSONS NAMED THEREIN TO VOTE WITH RESPECT TO ANY AMENDMENTS OR VARIATIONS TO THE MATTERS IDENTIFIED IN THE NOTICE OF MEETING AND WITH RESPECT TO OTHER MATTERS WHICH MAY PROPERLY COME BEFORE THE MEETING IN SUCH MANNER AS SUCH NOMINEE IN HIS JUDGMENT MAY DETERMINE. AS OF THE DATE OF THIS INFORMATION CIRCULAR, MANAGEMENT OF THE COMPANY KNOWS OF NO SUCH AMENDMENTS, VARIATIONS OR OTHER MATTERS TO COME BEFORE THE MEETING OTHER THAN THE MATTERS REFERRED TO IN THE NOTICE.

APPROVAL OF MATTERS

Unless otherwise noted, approval of matters to be placed before the Meeting is by “ordinary resolution”, which is a resolution passed by a simple majority (50% plus 1) of the votes cast by Shareholders of the Company entitled to vote and present in person or represented by proxy.

interests of certain persons or companies in matters to be acted upon

No person who has been a director or officer of the Company at any time since the beginning of its last completed financial year, no proposed nominee for election as a director, and no associate or affiliate of any of the foregoing persons has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter to be acted upon at the Meeting, other than the election of directors or the appointment of auditors.

VOTING SECURITiES AND PRINCIPAL HOLDERS THEREOF

The authorized capital of the Company consists of an unlimited number of Common Shares and an unlimited number of preference shares of which, as of the date of this Information Circular, an aggregate of 26,577,890 Common Shares of the Company are issued and outstanding and no preference shares are issued. Each common share entitles the holder thereof to one vote at all meetings of Shareholders.

All holders of Common Shares of the Company of record at the close of business on the Record Date will be entitled either to attend and vote at the Meeting in person the shares held by them or, provided a completed and executed proxy shall have been delivered to the Company as described above, to attend and vote thereat by proxy the shares held by them. However, if a holder of Common Shares of the Company has transferred any shares after the Record Date and the transferee of such shares establishes ownership thereof and makes a written demand, not later than ten (10) days before the Meeting, to be included in the list of Shareholders entitled to vote at the Meeting, the transferee will be entitled to vote such shares.

As of the date of this Information Circular, the only persons or companies who, to the knowledge of the directors and executive officers of the Company, beneficially own, or control or direct, directly or indirectly, voting securities carrying ten percent (10%) or more of the issued and outstanding voting shares of the Company are as follows:

| Name | | Number of Shares | | Percentage of Outstanding Common

Shares | |

| James Cassina(1) | | 4,360,769 Common Shares | | | 16.41 | % |

Notes:

| (1) | Of the 4,360,769 Common Shares held by Mr. Cassina, 2,783,162 are held indirectly through Core Energy Enterprises Inc. and a further 1,577,607 are held directly by Mr. Cassina. |

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The following table sets forth the number of Common Shares to be issued upon exercise of outstanding incentive stock options (“Options”) issued pursuant to compensation plans under which equity securities of the Company are authorized for issuance, the weighted average exercise price of such outstanding Options and the number of Common Shares remaining available for future issuance under such compensation plans as at August 31, 2016.

| Plan Category | | Number of securities to be

issued upon exercise of

outstanding Options(1) | | | Weighted-average exercise

price of outstanding Options | | | Number of securities remaining

available for future issuance

under equity compensation plans

(excluding securities reflected in

the first column)(1) | |

| Equity compensation plans approved by securityholders(1) | | | 383,000 | | | $ | 0.66 | | | | 4,917,193 | |

| Equity compensation plans not approved by securityholders | | | N/A | | | | N/A | | | | N/A | |

| TOTAL | | | 383,000 | | | $ | 0.66 | | | | 4,917,193 | |

Note:

| (1) | Represents Options to purchase Common Shares granted pursuant to the Company’s option plan which at August 31, 2016 was a rolling 20% stock option plan. |

STATEMENT OF EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

The Company’s Statement of Executive Compensation, in accordance with the requirements of Form 51-102F6V –Statement of Executive Compensation - Venture Issuers, is set forth below, which contains information about the compensation paid to, or earned by, the Company’s Chief Executive Officer and Chief Financial Officer and each of the other three most highly compensated executive officers of the Company earning more than CDN$150,000 in total compensation (the “Named Executive Officers” or “NEOs”)during the Company’s last two most recently completed financial years. Based on the foregoing, James Cassina, the Company’s President and Chief Executive Officer was the Company’s only Named Executive Officer as at August 31, 2016.

Objectives of the Compensation Program

The objectives of the Company’s compensation program are to attract, hold and inspire performance of its NEOs of a quality and nature that will enhance the sustainable profitability and growth of the Company. The Company views it as an important objective of the Company’s compensation program to ensure staff retention.

The Compensation Review Process

To determine compensation payable, the compensation committee of the Company (the “Compensation Committee”) determines an appropriate compensation reflecting the need to provide incentive and compensation for the time and effort expended by the Named Executive Officers of the Company while taking into account the financial and other resources of the Company.

The Company’s Compensation Committee is comprised of James Cassina (Chair) and Dikshant Batra.Compensation is determined in the context of our strategic plan, our growth, shareholder returns and other achievements and considered in the context of position descriptions, goals and the performance of each NEO. With respect to directors’ compensation, the Compensation Committee reviews the level and form of compensation received by the directors, members of each committee, the chair of the board of directors (the“Board”) of the Company and the chair of each Board committee, considering the duties and responsibilities of each director, his or her past service and continuing duties in service to us. The compensation of directors, the CEO and executive officers of competitors are considered, to the extent publicly available, in determining compensation and the Compensation Committee has the power to engage a compensation consultant or advisor to assist in determining appropriate compensation. Although the Compensation Committee may take into account executive compensation paid by companies comparable with the Company, no specific benchmarking policy is in place for determining compensation or any element of compensation.

In performing its duties, the Compensation Committee has the authority to engage such advisors, including executive compensation consultants, as it considers necessary. The Company does not currently have any contractual arrangement with any executive compensation consultant who has a role in determining or recommending the amount or form of senior officer or director compensation.

The Company does not have a policy that would prohibit a NEO or director from purchasing financial instruments, including prepaid variable forward contracts, equity swaps, collars or units of exchange funds, that are designed to hedge or offset a decrease in market value of equity securities granted as compensation or held, directly or indirectly, by the NEO or director. However, management is not aware of any NEO or director purchasing such an instrument.

Compensation Risk

The Company has not adopted a formal policy on compensation risk management nor has it engaged an independent compensation consultant. The Company recognizes that there may be risks in its current processes but given the size and number of executives dedicated on a full-time basis, the Company does not believe the risks to be significant.

The Company has a Compensation Committee, consisting of two members of the Board, to assist the Board in discharging its duties relating to compensation of the Company’s directors and senior officers. The Board believes that the executive compensation program of the Company should not raise its overall risk profile. Accordingly, the Company’s executive compensation programs include safeguards designed to mitigate compensation risks. The following measures impose appropriate limits to avoid excessive or inappropriate risk taking or payments:

| · | discretionary bonus payments, if any, are recommended to the Board by the Compensation Committee based on annual performance reviews, among other factors; |

| · | the Compensation Committee consisting of a minimum of two members; |

| · | stock option vesting and option terms of 5 years discourages excessive risk taking to achieve short-term goals; and |

| · | implementation of trading black-outs limit the ability of senior officers to trade in securities of the Company. |

Inappropriate and excessive risks by executives are also mitigated by regular meetings of the Board, at which, activity by the executives must be approved by the Board if such activity is outside previously Board-approved actions and/or as set out in a Board-approved budget. Given the current composition of the Company’s executive management team, the Board and the Compensation Committee are able to closely monitor and consider any risks which may be associated with the Company’s compensation practices. Risks, if any, may be identified and mitigated through regular Board meetings during which financial and other information of the Company are reviewed, including executive compensation.

Elements of Executive Compensation

The Company’sNEOcompensation program is based on the objectives of: (a) recruiting and retaining the executives critical to the success of the Company; (b) providing fair and competitive compensation; (c) balancing the interests of management and shareholders of the Company; and (d) rewarding performance, on the basis of both individual and corporate performance.

For the financial year ended August 31, 2016, the Company’s NEO compensation program consisted of the following elements:

| (a) | a management fee (the “Short-Term Incentive”) |

| (b) | a long-term equity compensation consisting of stock options granted under the Company’s stock incentive plan (“Long-Term Incentive”). |

The specific rationale and design of each of these elements are outlined in detail below.

Short-Term Incentive

Salaries form an essential element of the Company’s compensation mix as they are the first base measure to compare and remain competitive relative to peer groups. Base salaries are fixed and therefore not subject to uncertainty and are used as the base to determine other elements of compensation and benefits. The base salary provides an immediate cash incentive for theNamed Executive Officers.TheCompensationCommittee and the Board review salaries at least annually.

Base salary/management fees of the Named Executive Officer is set by the Compensation Committee on the basis of the applicable officer’s responsibilities, experience and past performance.In determining the base salary to be paid to a particularNamed Executive Officer, the Compensation Committee considers the particular responsibilities related to the position, the experience level of the officer, and his or her past performance at the Company and the current financial position of the Company.

Long-Term Incentive

The granting of stock options is a variable component of compensation intended to reward the Company’sNamed Executive Officers for their success in achieving sustained, long-term profitability and increases in stock value. Stock options ensure that theNamed Executive Officers are motivated to achieve long-term growth of the Company and continuing increases in shareholder value. In terms of relative emphasis, the Company places more importance on stock options.

The Company provides long-term incentive compensation through its stock option plan. The Compensation Committee recommends the granting of stock options from time to time based on its assessment of the appropriateness of doing so in light of the long-term strategic objectives of the Company, its current stage of development, the need to retain or attract particular key personnel, the number of stock options already outstanding and overall market conditions. The Compensation Committee views the granting of stock options as a means of promoting the success of the Company and higher returns to its shareholders. The Board grants stock options after reviewing recommendations made by the Compensation Committee.

As of our fiscal year end August 31, 2016, we had 354,000 option/stock appreciation rights or grants outstanding to our Named Executive Officers and directors.

Stock Option Plan

The Company’s Stock Option Plan (the “Option Plan”) was adopted by the Board on December 21, 2010 and approved by a majority of our shareholders voting at the Annual and Special Meeting held on February 24, 2011. Amendments to the Option Plan were approved by the Board on January 25, 2012 and were approved and ratified by the shareholders of the Company on February 24, 2012.

The Company had 26,577,890 issued and outstanding Common Shares on April 24, 2017 and the aggregate maximum number of Common Shares that may be reserved for issuance under the Option Plan is 20% of the issued and outstanding Common Shares of the Company, which as at April 24, 2017 was equal to 5,315,578 Common Shares.

As of April 24, 2017, there were 2,050,000 Options outstanding under the Option Plan. Accordingly, as of April 24, 2017 there were 3,265,578 unallocated Options available for issuance under the Option Plan, representing approximately 12.28%of the Company’s issued and outstanding Common Shares.

Description of the Option Plan

The Option Plan was adopted in order that we may be able to provide incentives for directors, officers, employees, consultants and other persons (an “Eligible Individual”) to participate in our growth and development by providing us with the opportunity through share options to acquire an ownership interest in us. Directors and officers currently are not remunerated for their services except as stated in “Executive Compensation” above.

Under the Option Plan:

| 1. | options may be granted in such numbers and with such vesting provisions as the Board may determine; |

| 2. | the exercise price of Options shall be at the discretion of the Board; |

| 3. | the term and expiry date of the Options granted shall be determined in the discretion of the Board at the time of granting of the Options; |

| 4. | the maximum term for Options is five (5) years; |

| 5. | the Options are not assignable or transferable, with the exception of an assignment made to a personal representative of a deceased Participant; |

| 6. | the vesting period or periods within the five (5) year maximum term during which an Option or a portion thereof may be exercised by a Participant shall be determined by the Board. Further, the Board may, in its sole discretion at any time or in the Option agreement in respect of any Options granted, accelerate or provide for the acceleration of, vesting of Options previously granted; |

| 7. | in the event of the resignation or retirement of a Participant, or the termination of the employment of a Participant, whether with or without cause or reasonable notice, prior to the expiry time of an Option, such Option shall cease and terminate on the ninetieth day following the effective date of such resignation, retirement or termination, and in the event of the death of a holder of Options, such Options shall be exercisable until the earlier of one year following the death of the holder, or the expiry time of such Option, whichever occurs first, and thereafter shall be of no further force or effect whatsoever as to the Common Shares in respect of which such Option has not previously been exercised; |

| 8. | in the event of a sale of the Company or all or substantially all of its property and assets or a change of control of the Company, holders of Options, whether such Options have vested or not in accordance with their terms, may exercise such options until the earlier of the expiry of the Options and the thirtieth day following the sale of the Company or all or substantially all of its property and assets or a change of control of the Company; |

| 9. | the aggregate number of Common Shares that may be reserved for issuance under the Option Plan, together with any Common Shares reserved for issuance under any other share compensation arrangement, must not exceed 20% of the number of Common Shares, on a non-diluted basis, outstanding at the time; and |

| 10. | the Board retains the right to suspend, terminate, or discontinue the terms and conditions of the Option Plan by resolution of the Board. |

The Company does not have any other long-term incentive plans, including any supplemental executive retirementplans.

Overview of How the Compensation Program Fits with Compensation Goals

The compensation package is designed to meet the goal of attracting, holding and motivating key talent in a highly competitive oil and gas exploration environment through salary and providing an opportunity to participate in the Company’s growth through stock options. Through the grant of stock options, if the price of the Company shares increases over time, both the Named Executive Officer and shareholders will benefit.

Director and Named Executive Officer Compensation

The following table (presented in accordance with National Instrument Form 51-102F6V –Statement of Executive Compensation–Venture Issuers)sets forth all annual and long term compensation for services paid to or earned by each NEO and director for the two most recently completed financial years ended August 31, 2016.

Table of Compensation excluding Compensation Securities

| Name and position | | Year | | | Salary, consulting

fee, retainer or

commission ($) | | | Bonus

($) | | Committee or

meeting fees

($) | | | Value of

perquisites ($) | | Value of all

other

compen-

sation

($)(1) | | | Total

compen-

sation

($) | |

| James Cassina | | 2016 | | | | 60,000 | | | nil | | | 600 | | | nil | | | 600 | | | | 60,600 | |

| President, Chief | | 2015 | | | | 150,000 | | | nil | | | 1,000 | | | nil | | | 1,000 | | | | 151,000 | |

| Executive Officer, Chief Financial Officer and Director(2) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Milton Klyman | | 2016 | | | | nil | | | nil | | | 600 | | | nil | | | 600 | | | | 600 | |

| Director | | 2015 | | | | nil | | | nil | | | 1,100 | | | nil | | | 1,100 | | | | 1,100 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Colin McNeil | | 2016 | | | | nil | | | nil | | | 600 | | | nil | | | 600- | | | | 600 | |

| Director | | 2015 | | | | nil | | | nil | | | 1,100 | | | nil | | | 1,1,100 | | | | 1,100 | |

Notes:

| 1. | Accrued on account of directors fees at a rate of $100 per meeting. |

| 2. | James Cassina has been the acting Chief Financial Officer for the years ended August 31, 2016, 2015, 2014 and 2013, and was appointed President of the Company on June 18, 2010. James Cassina resigned as President of the Company on September 9, 2016 upon the appointment of Ritwik Uban as President. |

Stock Options and Other Compensation Securities

The following table sets forth all compensation securities granted or issued to each NEO and directors by the Company in the financial year ended August 31, 2016 for services provided or to be provided, directly or indirectly, to the Company.

Compensation Securities

Name and

position | | Type of

compen-

sation

security(1)(2)(3) | | Number of

compen-

sation

securities,

number of

underlying

securities, and

percentage of

class

(#) | | | Date of

issue or

grant | | Issue,

conversion

or exercise price ($) | | | Closing

price of

security or

underlying

security on

date of

grant

($) | | | Closing

price of

security or

underlying

security at

year end ($) | | | Expiry Date |

| James Cassina | | Stock | | | 25,000 | | | November 12, 2014 | | | 1.20 | | | | 1.11 | | | | 1.34 | | | November 11, 2019 |

| President, Chief | | Options | | | 2,000 | | | March 1, 2012 | | | 16.00 | | | | 16.00 | | | | 1.34 | | | February 28, 2017 |

| Executive Officer and Director | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Milton Klyman | | Stock | | | 25,000 | | | November 12, 2014 | | | 1.20 | | | | 1.11 | | | | 1.34 | | | December 8, 2016 |

| Director(4) | | Options | | | 2,000 | | | March 1, 2012 | | | 16.00 | | | | 16.00 | | | | 1.34 | | | December 8, 2016 |

| | | | | | | | | | | | | | | | | | | | | | | |

| John Budden | | Stock | | | 300,000 | | | November 12, 2014 | | | 2.19 | | | | 2.19 | | | | 1.34 | | | December 8, 2016 |

| Director(4) | | Options | | | | | | | | | | | | | | | | | | | | |

Notes:

| 1. | On March 1, 2012, the Company granted options to purchase 4,000 common shares to directors. These options are exercisable at $16.00 per share, and 2,000 expired December 8, 2016 and 2,000 expired on February 28, 2017. |

| 2. | On November 12, 2014, the Company granted options to purchase 50,000 common shares to directors. These options are exercisable at $1.20 per share and 25,000 expired on December 8, 2016 and 25,000 expire on November 11, 2019. |

| 3. | On April 1, 2016, the Company granted options to purchase 300,000 common shares to a director. These options are exercisable at $2.19 per share and expired on December 8, 2016. |

| 4. | Mr. Klyman and Mr. Budden resigned as directors of the Company on September 9, 2016. |

Exercise of Compensation Securities by Directors and NEOs

The following table discloses each exercise by a director or NEO of compensation securities during the financial year ended August 31, 2016:

Name and

position | | Type of

compen-

sation

security | | Number of underlying securities exercised (#) | | Exercise

price per

security ($) | | Date of

Exercise | | Closing

price per

security on

date of

exercise ($) | | Difference

between

exercise

price and

closing price

on date of

exercise

($) | | Total value

on exercise

date ($) |

James Cassina President, Chief Executive Officer and Director | | nil | | nil | | nil | | nil | | nil | | nil | | nil |

Milton Klyman Director | | nil | | nil | | nil | | nil | | nil | | nil | | nil |

John Budden Director | | nil | | nil | | nil | | nil | | nil | | nil | | nil |

Pension Plan Benefits

The Company does not currently provide pension plan benefits to its Named Executive Officers.

Termination and Change of Control Benefits

The Company does not currently have executive employment agreements in place with any of its Named Executive Officers.

The Company has no compensatory plan, contract or arrangement where a named executive officer or director is entitled to receive compensation in the event of resignation, retirement, termination, change of control or a change in responsibilities following a change in control.

Director Compensation

Each director of the Company is entitled to receive the sum of $100 for each meeting of the directors, meeting of a committee of the directors (of which the director is a member) or meeting of the shareholders attended. No such directors’ fees were paid for the year ended August 31, 2016 other than $7,400 of outstanding director fees payable to former director Milton Klyman were converted into 24,667 units of the Company.

Retirement Policy for Directors

The Company does not have a retirement policy for its directors.

Directors’ and Officers’ Liability Insurance

The Company does not maintain directors’ and officers’ liability insurance.

CORPORATE GOVERNANCE

The Canadian Securities Administrators in National Instrument 58-101 (“NI 58-101”) have adopted guidelines for effective corporate governance which address the constitution and independence of boards, the functions to be performed by boards and their committees and the recruitment, effectiveness and education of board members. A description of our corporate governance practices is set out below, including a discussion of the principal matters relating to corporate governance practices discussed in NI 58-101.

Corporate governance refers to the manner in which a board of directors oversees the management and direction of a corporation. Governance is not a static issue, and must be judged from time-to-time based on the evolution of a corporation with respect to its size and the nature or its business, and upon the changing standards of the community. Not all corporate governance systems are alike. The Company’s approach has been developed with respect to the Company’s growth and current status. The composition of the Board is reviewed on an annual basis by the full Board and management of the Company.

In reviewing the issue of corporate governance, the Board has determined to perform the function as an entire Board. Their mandate was to consider corporate governance matters and make recommendations consistent with the Company’s position and size as a junior oil and gas Company. The resulting approach to corporate governance adopted by the Company’s Board reflects these recommendations and recognizes the responsibility of the Board for the stewardship of the Company. Through regular review at quarterly meetings, the Company’s Board will continue to examine these issues in light of the Company’s development in the oil and gas exploration and exploitation business.

Most matters requiring approval of the Board of the Company were approved by written resolutions signed by all members of the Board, with detailed information being circulated to all members of the Board beforehand. Any member of the Board may request a formal meeting of the Board in the event that such director considers that the subject matter of a particular resolution requires full Board discussion. While it is standard practice for the Company’s Board to pass written resolutions in lieu of holding formal meetings in person, the Board of Directors held three (3) formal meetings during fiscal 2016.

The information required to be disclosed by NI 58-101 is set out inSchedule “A” attached to this Information Circular.

AUDIT COMMITTEE

The mandate of the audit committee of the Board (the “Audit Committee”) is formalized in a written charter. The members of the Audit Committee of the Board are James Cassina, Ritwik Uban and Dikshant Batra (Chair). Based on his professional certification and experience, the Board has determined that Dikshant Batra is an Audit Committee Financial Expert and that James Cassina and Ritwik Uban are financially literate. The Audit Committee’s primary duties and responsibilities are to serve as an independent and objective party to monitor our financial reporting process and control systems, review and appraise the audit activities of our independent auditors, financial and senior management, and the lines of communication among the independent auditors, financial and senior management, and the Board for financial reporting and control matters including investigating fraud, illegal acts or conflicts of interest.

The Audit Committee held three (3) formal meetings in person or via conference call during fiscal 2016.

All information required to be disclosed by Multilateral Instrument 52-110 – Audit Committees is attached to this Information Circular asSchedule “B”.

PARTICULARS OF MATTERS TO BE ACTED UPON

Election of Directors

The Board of the Company is currently comprised of three (3) directors.

UNLESS OTHERWISE SPECIFIED, THE PERSONS NAMED IN THE ACCOMPANYING PROXY INTEND TO VOTE FOR THE ELECTION OF ALL THREE (3) NOMINEES. MANAGEMENT OF THE COMPANY DOES NOT CONTEMPLATE THAT ANY OF THE NOMINEES WILL BE UNABLE TO SERVE AS A DIRECTOR, BUT IF THAT SHOULD OCCUR FOR ANY REASON PRIOR TO THE MEETING, IT IS INTENDED THAT DISCRETIONARY AUTHORITY SHALL BE EXERCISED BY THE PERSONS NAMED IN THE ENCLOSED FORM OF PROXY TO VOTE THE PROXY FOR THE ELECTION OF ANY OTHER PERSON OR PERSONS IN PLACE OF ANY NOMINEE(S) UNABLE TO SERVE. EACH DIRECTOR ELECTED WILL HOLD OFFICE UNTIL THE CLOSE OF THE FIRST ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS OF THE COMPANY FOLLOWING HIS ELECTION UNLESS HIS OFFICE IS EARLIER VACATED IN ACCORDANCE WITH THE BY-LAWS OF THE COMPANY.

Management has been informed that each of the proposed nominees listed below is willing to serve as a director if elected. The following table and the notes thereto set out the name as well as the country and province and/or state of residence of each person proposed to be nominated for election as a director, his or her current position and office with the Company, his or her present principal occupation, business or employment, the date on which he or she was first elected or appointed a director of the Company and the approximate number of Common Shares beneficially owned, or controlled or directed, directly or indirectly, which is in each instance based on information furnished by the person concerned as of the date of this Information Circular.

| Name and Residence | | Present Position(s) with

the Company | | Director Since | | Principal Occupation | | Common Shares

Beneficially Owned

Directly or Indirectly(1) | |

James Cassina(2)(3)

Nassau, Bahamas | | Chief Financial Officer and Director | | February 2009 | | Business Consultant | | | 4,360,769 | (4) |

Ritwik Uban(2)

Toronto, Ontario | | President and Director | | September 2016 | | President of the Company | | | Nil | |

Dikshant Batra(2)(3)

Toronto, Ontario | | Director | | September 2016 | | President of Torinit Technologies Inc. | | | Nil | |

Notes:

| (1) | The information as to shares beneficially owned, directly or indirectly, not being within the knowledge of the Company, has been furnished by the respective proposed directors individually. |

| (2) | Member of the Audit Committee of the Company. |

| (3) | Member of the Compensation Committee of the Company. |

| (4) | Mr. Cassina holds directly 1,577,607 Common Shares and 778,942 Common Share purchase warrants. Each warrant is exercisable until August 30, 2017 to purchase one Common Share at a purchase price of $1.00 per share. Mr. Cassina holds indirectly through Core Energy Enterprises Inc., 2,783,162 Common Shares. Mr. Cassina has voting and investment power with respect to the shares owned by Core Energy Enterprises Inc. |

Corporate Cease Trade Orders, Bankruptcies, Penalties or Sanctions

Except as disclosed below, to the best knowledge of the Company, no proposed director of the Company is, as at the date hereof, or has been within the last ten years prior to the date hereof: (a) subject to a cease trade order, an order similar to a cease trade order or an order that denied a company access to any exemption under securities legislation that was in effect for a period of more than 30 consecutive days that was issued while the proposed director of the Company was acting in the capacity as director, chief executive officer or chief financial officer of that company; (b) subject to a cease trade order, an order similar to a cease trade order or an order that denied a company access to any exemption under securities legislation that was in effect for a period of more than 30 consecutive days that was issued after the proposed director of the Company ceased to be a director, chief executive officer or chief financial officer of that company and which resulted from an event that occurred while that person was acting in such capacity; or (c) a director or executive officer of any company that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets.

(a) James Cassina, Ritwik Uban and Dikshant Batra were directors of the Company when it was the subject of a failure-to-file cease trade order (“FFCTO”) issued by the Ontario Securities Commission (“OSC”) on January 9, 2017 for failure to file financial statements and related documents (“Disclosure Documents”), which FFCTO was revoked by the OSC on March 20, 2017, after the Company filed its Disclosure Documents. To the knowledge of the Company, no proposed director of the Company: (a) has been subject to any penalties or sanctions imposed by a court relating to securities or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or (b) has been subject to any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable Shareholder in deciding whether to vote for a proposed director of the Company.

To the knowledge of the Company, no proposed director of the Company is, or has within the ten years prior to the date hereof, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold the assets of that individual.

Appointment of Auditors

Schwartz Levitsky Feldman LLP, Chartered Accountants, of Toronto, Ontario are the current auditors of the Company and were first appointed auditors of the Company in 2007. Shareholders of the Company will be asked at the Meeting to reappoint Schwartz Levitsky Feldman LLP, Chartered Accountants, of Toronto, Ontario, as the Company’s auditors to hold office until the close of the next annual meeting of Shareholders of the Company, and to authorize the directors of the Company to fix the auditors’ remuneration.

UNLESS OTHERWISE SPECIFIED, THE PERSONS NAMED IN THE ACCOMPANYING PROXY INTEND TO VOTE FOR THE APPOINTMENT OF SCHWARTZ LEVITSKY FELDMAN LLP, CHARTERED ACCOUNTANTS AS AUDITORS OF THE COMPANY UNTIL THE CLOSE OF THE NEXT ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS AND FOR THE AUTHORIZATION OF THE DIRECTORS TO FIX THEIR REMUNERATION.

Financial Statements

Accompanying these materials is a copy of the audited consolidated financial statements of the Company for the financial period ended August 31, 2016, together with the auditors’ report thereon. The directors will lay before the Meeting the said audited financial statements and auditors’ report, receipt of which by the Meeting will not constitute approval or disapproval of any matters referred to therein.

Approval to Adjust the Number of Common Shares

Each year over the past few years, the Company has requested blanket shareholder approval to split or consolidate the Common Shares and if deemed fit to change the Company’s name to potentially provide greater flexibility to the Company’s directors in pursuing corporate funding and business opportunities for the Company and its shareholders. At the last annual and special meeting of shareholders held February 29 2016, the shareholders approved resolutions giving the Company’s board such authority, and to use it at any time at its discretion up to the following annual meeting of shareholders. The Company is currently exploring different business and transaction opportunities and strategic alternatives and seeking corporate funding. In connection with such pursuits the Company’s board acted on its shareholder approval and has filed articles of amendment to be effective May 26, 2017, to effect a consolidation of the Company’s shares on a one (1) new share for ten (10) old shares basis and to change the name of the Company from “Intelligent Content Enterprises Inc.” to “Novicius Corp.” The Company is asking for another approval in this year’s Annual and Special Meeting of Shareholders for the Company’s shareholders to provide that same authority and if obtained to be valid until the next annual shareholders meeting expected in 2018.

As indicated above, management of the Company is continuing to evaluate potential acquisitions and opportunities, corporate funding, and strategic alternatives to enhance future growth. In furtherance of these various initiatives that may be available to the Company, it may be prudent for the Company to adjust the existing capital structure, by changing the number of common shares issued and outstanding and changing its name. A capital structure change of this nature could require an increase in the number of issued common shares by share split (a “Split”) or a reduction in the number of issued common shares by share consolidation (a “Consolidation”). In either event, if acted upon by the Company, a Split or Consolidation would impact each shareholder identically in respect of the resulting number of common shares outstanding.

The Company will be seeking at the Meeting advance shareholder approval for any proposed Split or Consolidation that may be required, within the parameters contained in the special resolution set out below. The Company proposes that the advance approval being sought be restricted under the Split to a maximum of up to 5 times the number of common shares issued and outstanding at the date of implementing any Split and under any Consolidation to a maximum of up to 1/10 of the number of common shares issued and outstanding at the date of implementing any Consolidation.

To split or consolidate the common shares of the Company, the articles of the Company must be amended. Such an amendment must be authorized by a special resolution of shareholders. Shareholders of the Company will therefore be asked at the Meeting to consider and, if thought advisable, to authorize by means of a special resolution, an amendment to the articles of the Company: (i) in the case of a Split to split the issued and outstanding common shares of the Company resulting in each one (1) issued and outstanding common share being split for up to five (5) post split shares; and (ii) in the case of a Consolidation to consolidate the issued and outstanding common shares of the Company resulting in up to ten (10) issued and outstanding common shares being consolidated for one (1) post consolidated share. No fractional common shares of the Company will be issued in connection with the Consolidation or the Split and, in the event that a shareholder would otherwise be entitled to receive a fractional share upon such Split or Consolidation, the number of common shares of the Company to be received by such shareholder shall be rounded up to the nearest whole number of common shares.

The text of the special resolution shareholders will be asked to approve is as follows:

BE IT RESOLVED as a special resolution of the Company that:

| 1. | In the event the Company proceeds with a Split, the articles of the Company be amended to split the issued and outstanding common shares of the Company by changing each one of the issued and outstanding common shares of the Company to up to five (5) common shares of the Company. |

| 2. | In the event the Company proceeds with a Consolidation, the articles of the Company be amended to consolidate the issued and outstanding common shares of the Company by changing each one of the issued and outstanding common shares of the Company to up to one-tenth (1/10) of a common share of the Company. |

| 3. | No fractional common shares of the Company shall be issued in connection with the Split or the Consolidation and, in the event that a shareholder would otherwise be entitled to receive a fractional share upon such Split or Consolidation, the number of common shares of the Company to be received by such shareholder shall be rounded up to the nearest whole number of common shares. |

| 4. | Any one director or officer of the Company be and is hereby authorized, for and on behalf of the Company, to execute and deliver, or cause to be delivered, articles of amendment of the Company, as required pursuant to theBusiness Corporations Act (Ontario), and to do all such other acts or things necessary or desirable to implement, carry out and give effect to the aforesaid amendment to the articles of the Company. |

| 5. | The directors of the Company are hereby authorized, in their discretion, to amend this resolution so that if the Split is implemented the Split shall be less than one common share split into five (5) common shares, or if Consolidation is implemented the Consolidation shall be less than one common share consolidated into one-tenth of a common share, or otherwise to revoke this special resolution or any portion thereof before it is acted upon without further approval or authorization of the shareholders of the Company. |

To be approved, the special resolution must be passed by at least two-thirds of the votes cast by shareholders at the Meeting in respect of this special resolution, and approved by applicable regulatory and exchange authorities.

Unless otherwise specified, the persons named in the enclosed form of proxy will vote FOR the special resolution.

Proposed Name Change of the Company

As disclosed above, the Company is currently exploring different business and transaction opportunities and seeking corporate funding. In connection with its pursuit of potential opportunities the Company’s board acted on its shareholder approval and has filed articles of amendment to be effective May 26, 2017, to effect a consolidation of the Company’s shares on a one (1) new share for ten (10) old shares basis and to change the name of the Company to “Novicius Corp.”

In the event the Company determines that it is in the best interests of the Company to implement either the Split or a Consolidation of its capital stock and its Board receives such authority at the Meeting, the Company may need to change its name. In such a case the proposed name for the Company is “Novicius Enterprises Inc.” or such other name as may be approved by the Board of the Company and applicable regulatory and exchange authorities.

To change the name, the articles of the Company must be amended. Such an amendment must be authorized by a special resolution of shareholders. Shareholders of the Company will therefore be asked at the Meeting to consider and, if thought advisable, to authorize by means of a special resolution, an amendment to the articles of the Company to change the name of the Company to “Novicius Enterprises Inc.” or such other name as may be approved by the Board of the Company and applicable regulatory and exchange authorities.

Accordingly, management is seeking the approval of the shareholders to change the name of the Company. Such name change requires the approval of the shareholders, and applicable regulatory and exchange authorities of the Company by way of a special resolution, being a resolution passed by a majority of not less than 2/3 of the votes cast by shareholders at the Meeting. The following is the text of the proposed special resolution to be put forth by management at the Meeting:

BE IT RESOLVED as a special resolution of the Company that:

| 1. | The articles of the Company be amended to change the name of the Company from “Novicius Corp.” to “Novicius Enterprises Inc.” or such other name as approved by the Board of the Company and applicable regulatory and exchange authorities. |

| 2. | Any one director or officer of the Company be and is hereby authorized, for and on behalf of the Company, to execute and deliver, or cause to be delivered, articles of amendment of the Company, as required pursuant to theBusiness Corporations Act (Ontario), and to do all such other acts or things necessary or desirable to implement, carry out and give effect to the said change of name. |

| 3. | The directors of the Company are hereby authorized, in their discretion, to delay or revoke this special resolution or any portion thereof before it is acted upon without further approval or authorization of the shareholders of the Company. |

To be approved, the special resolution must be passed by at least two-thirds of the votes cast by shareholders at the Meeting in respect of this special resolution, and approved by applicable regulatory and exchange authorities.

Unless otherwise specified, the persons named in the enclosed form of proxy will vote FOR the special resolution.

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS

During the fiscal year ended August 31, 2016, no loans were made by the Company to any senior officer, director or proposed nominee for election as a director or any key employee of the Company, or any of their respective associates, for any reason whatsoever.

MANAGEMENT CONTRACTS

Management functions of the Company and its subsidiaries are not to any substantial degree performed by those other than by the directors or executive officers of the Company or subsidiary.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

Except as disclosed herein, no informed person of the Company, proposed director of the Company nor any associate or affiliate of any informed person or proposed director has any material interest, direct or indirect, in any transaction since the commencement of the Company’s financial year-ended August 31, 2016 or in any proposed transaction which has materially affected or would materially affect the Company or any of its subsidiaries.

Other matters which may come before the meeting

Management is not aware of any other business to come before the Meeting other than as set forth in the Notice of Meeting of Shareholders. If any other business properly comes before the Meeting, it is the intention of the persons named in the Instrument of Proxy to vote the Common Shares represented thereby in accordance with their best judgment on such matter.

ADDITIONAL INFORMATION

Additional information relating to the Company may be obtained or viewed from the System for Electronic Data Analysis and Retrieval (sedar) atwww.sedar.com. Readers can also access and view the public insider trading reports via the System for Electronic Disclosure by Insiders atwww.sedi.ca. The Company’s United States Securities and Exchange Commission filings can be viewed through the Electronic Data Gathering Analysis and Retrieval System (edgar) atwww.sec.gov.

Shareholders may also contact the Company at Suite 1505, 1 King Street West, Toronto, Ontario M5H 1A1 or by telephone (416) 364-4039 to request copies of the Company’s financial statements and management’s discussion and analysis (“MD&A”). Financial information is provided in the Company’s comparative financial statements and MD&A for its most recently completed financial year.

APPROVAL OF INFORMATION CIRCULAR

The contents and the sending of this Information Circular to the shareholders of the Company have been approved by the Board of Directors of the Company. Unless otherwise specified, information contained in this Information Circular is given as of April 26, 2017.

DATEDat Toronto, Ontario this 26th day of April, 2017.

| | BY ORDER OF THE BOARD OF DIRECTORS OF INTELLIGENT CONTENT ENTERPRISES INC. |

| | |

| | “Ritwik Uban” |

| | RITWIK UBAN |

| | President and Director |

SCHEDULE “A”

INTELLIGENT CONTENT ENTERPRISES INC.

(the“Company”)

FORM 58-101F1

CORPORATE GOVERNANCE DISCLOSURE

Pursuant to National Instrument 58-101Disclosure of Corporate Governance Practices(“NI 58-101”), the Company is required and hereby discloses its corporate governance practices as of the date of this Information Circular.

Board of Directors

The mandate of our Board, prescribed by theBusiness Corporations Act (Ontario), is to manage or supervise the management of our business and affairs and to act with a view to our best interests. In doing so, the Board oversees the management of our affairs directly and through its committees.

Mr. Cassina was appointed to the Board on February 9, 2010 and Mr. Batra and Mr. Uban were appointed on September 9, 2016. Our directors’ serve until our next Annual General Meeting or until a successor is duly elected, unless the office is vacated in accordance with our Articles or Bylaws. Our sole executive officer was appointed by our Board to serve until the earlier his resignation or removal, with or without cause by the directors. There was no compensation paid by us to our directors during the fiscal year ended August 31, 2015, for their services in their capacity as directors or any compensation paid to committee members other than $7,400 of outstanding director fees payable to Milton Klyman were converted into 24,667 units of the Company subsequent to his retirement from the Board. As of April 24, 2017 our Board consists of three directors, none of which are “independent directors” in that they are “independent from management and free from any interest and any business or other relationship which could, or could reasonably be perceived to, materially interfere with the directors ability to act with a view to our best interests, other than interests and relationships arising from shareholding”. It is our practice to attempt to maintain a diversity of professional and personal experience among our directors.

The Company holds meetings as required, at which the opinions of all directors are sought and duly acted upon for all material matters relating to the Company.

Directorships

None of our directors are directors of other Canadian or United States reporting issuers.

Board and Committee Meetings

The Board has met at least once annually or otherwise as circumstances warrant to review our business operations, corporate governance and financial results. The table below reflects the attendance of each director of ours at each Board and committee meeting of the Board during the fiscal year ended August 31, 2016.

| Name | | Board of

Directors

Meetings | | Audit

Committee

Meetings | | Compensation

Committee

Meetings | | Disclosure

Committee

Meetings |

| | | | | | | | | |

| Milton Klyman(1) | | 3 | | 3 | | Nil | | Nil |

| James Cassina | | 3 | | 3 | | Nil | | Nil |

| John Budden(1) | | 3 | | 3 | | Nil | | Nil |

| (1) | Mr. Klyman and Mr. Budden resigned from the board of directors on September 9, 2016. |

Board Mandate

The Board assumes responsibility for stewardship of the Company, including overseeing all of the operation of the business, supervising management and setting milestones for the Company. The Board reviews the statements of responsibilities for the Company including, but not limited to, the code of ethics and expectations for business conduct.

The Board approves all significant decisions that affect the Company and its subsidiaries and sets specific milestones towards which management directs their efforts.

The Board ensures, at least annually, that there are long-term goals and a strategic planning process in place for the Company and participates with management directly or through its committees in developing and approving the mission of the business of the Company and the strategic plan by which it proposes to achieve its goals, which strategic plan takes into account, among other things, the opportunities and risks of the Company’s business. The strategic planning process is carried out at each Board meeting where there are regularly reviewed specific milestones for the Company.

The strategic planning process incorporates identifying the main risks to the Company’s objectives and ensuring that mitigation plans are in place to manage and minimize these risks. The Board also takes responsibility for identifying the principal risks of the Company’s business and for ensuring these risks are effectively monitored and mitigated to the extent practicable. The Board appoints senior management.

The Company adheres to regulatory requirements with respect to the timeliness and content of its disclosure. The Board approves all of the Company’s major communications, including annual and quarterly reports and press releases. The Chief Executive Officer authorizes the issuance of news releases. The Chief Executive Officer is generally the only individual authorized to communicate with analysts, the news media and investors about information concerning the Company.

The Board and the Audit Committee examine the effectiveness of the Company’s internal control processes and information systems.

The Board as a whole, given its small size, is involved in developing the Company’s approach to corporate governance. The number of scheduled Board meetings varies with circumstances. In addition, special meetings are called as necessary. The Chief Executive Officer establishes the agenda at each Board meeting and submits a draft to each director for their review and recommendation for items for inclusion on the agenda. Each director has the ability to raise subjects that are not on the agenda at any Board meeting. Meeting agendas and other materials to be reviewed and/or discussed for action by the Board are distributed to directors in time for review prior to each meeting. Board members have full and free access to senior management and employees of the Company.

Position Descriptions

The Board has not developed written position descriptions for the Chairman of the Board or the Chief Executive Officer. The Board is currently of the view that the respective corporate governance roles of the Board and management, as represented by the Chief Executive Officer, are clear and that the limits to management’s responsibility and authority are well-defined.

Each of the Audit Committee, Compensation Committee, Disclosure Committee and a Petroleum and Natural Gas Committee has a chair and a mandate.

Orientation and Continuing Education

We have developed an orientation program for new directors including a director’s manual (“Director’s Manual”) which contains information regarding the roles and responsibilities of the Board, each Board committee, the Board chair, the chair of each Board committee and our president. The Director’s Manual contains information regarding its organizational structure, governance policies including the Board Mandate and each Board committee charter, and our code of business conduct and ethics. The Director’s Manual is updated as our business, governance documents and policies change. We update and inform the Board regarding corporate developments and changes in legal, regulatory and industry requirements affecting us.

Ethical Business Conduct

We have adopted a written code of business conduct and ethics (the “Code”) for our directors, officers and employees. The Board encourages following the Code by making it widely available. It is distributed to directors in the Director’s Manual and to officers, employees and consultants at the commencement of their employment or consultancy. The Code reminds those engaged in service to us that they are required to report perceived or actual violations of the law, violations of our policies, dangers to health, safety and the environment, risks to our property, and accounting or auditing irregularities to the chair of the Audit Committee who is a director of ours. In addition, to requiring directors, officers and employees to abide by the Code, we encourage consultants, service providers and all parties who engage in business with us to contact the chair of the Audit Committee regarding any perceived and all actual breaches by our directors, officers and employees of the Code. The chair of our Audit Committee is responsible for investigating complaints, presenting complaints to the applicable Board committee or the Board as a whole, and developing a plan for promptly and fairly resolving complaints. Upon conclusion of the investigation and resolution of a complaint, the chair of our Audit Committee will advise the complainant of the corrective action measures that have been taken or advise the complainant that the complaint has not been substantiated. The Code prohibits retaliation by us, our directors and management, against complainants who raise concerns in good faith and requires us to maintain the confidentiality of complainants to the greatest extent practical. Complainants may also submit their concerns anonymously in writing. In addition to the Code, we have an Audit Committee Charter and a Policy of Procedures for Disclosure Concerning Financial/Accounting Irregularities.

Since the beginning of our most recently completed financial year, no material change reports have been filed that pertain to any conduct of a director or executive officer that constitutes a departure from the Code. The Board encourages and promotes a culture of ethical business conduct by appointing directors who demonstrate integrity and high ethical standards in their business dealings and personal affairs. Directors are required to abide by the Code and expected to make responsible and ethical decisions in discharging their duties, thereby setting an example of the standard to which management and employees should adhere. The Board is required by the Board Mandate to satisfy our CEO and other executive officers are acting with integrity and fostering a culture of integrity throughout the Company. The Board is responsible for reviewing departures from the Code, reviewing and either providing or denying waivers from the Code, and disclosing any waivers that are granted in accordance with applicable law. In addition, the Board is responsible for responding to potential conflict of interest situations, particularly with respect to considering existing or proposed transactions and agreements in respect of which directors or executive officers advise they have a material interest. The Board Mandate requires that directors and executive officers disclose any interest and the extent, no matter how small, of their interest in any transaction or agreement with us, and that directors excuse themselves from both Board deliberations and voting in respect of transactions in which they have an interest. By taking these steps the Board strives to ensure that directors exercise independent judgment, unclouded by the relationships of the directors and executive officers to each other and us, in considering transactions and agreements in respect of which directors and executive officers have an interest.

Nomination of Directors

The Board has not appointed a nominating committee and does not believe that such a committee is warranted at the present time. The entire Board determines new nominees to the Board, although a formal process has not been adopted. The nominees are generally the result of recruitment efforts by the Board members, including both formal and informal discussions among Board members and officers. The Board generally looks for the nominee to have direct experience in the oil and gas business and significant public company experience. The nominee must not have a significant conflicting public company association.

Compensation

The Board determines director and executive officer compensation by recommendation of the Compensation Committee. The Company’s Compensation Committee reviews the amounts and effectiveness of compensation. Each of the members of the Compensation Committee are independent. The Board reviews the adequacy and form of compensation and compares it to other companies of similar size and stage of development. There is no minimum share ownership requirement of directors.

The Compensation Committee convenes to review director and officer compensation and status of stock options. The Compensation Committee also responds to requests from management and the Board to review recommendations of management for new senior employees and their compensation. The Compensation Committee has the power to approve and/or amend these recommendations.

The Company has felt no need to retain any compensation consultants or advisors at any time since the beginning of the Company’s most recently completed financial year.

Committees of the Board

Our Board discharges its responsibilities directly and through committees of the Board, currently consisting of the Audit Committee, a compensation committee (the “Compensation Committee”), and a disclosure committee (the “Disclosure Committee”). Each Committee has a specific mandate and responsibilities, as reflected in the charters for each committee.

Audit Committee

The mandate of the Audit Committee is formalized in a written charter. The members of the Audit Committee are James Cassina, Dikshant Batra (Chair) and Ritwik Uban. Based on his professional certification and experience, the Board has determined that Dikshant Batra is an Audit Committee Financial Expert and that James Cassina and Ritwik Uban are financially literate. The Audit Committee’s primary duties and responsibilities are to serve as an objective party to monitor our financial reporting process and control systems, review and appraise the audit activities of our independent auditors, financial and senior management, and the lines of communication among the independent auditors, financial and senior management, and the Board for financial reporting and control matters including investigating fraud, illegal acts or conflicts of interest.

Compensation Committee