SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

_____________________________________________________

Filed by the Registrant ý Filed by a Party other than the Registrant ¨

Check the appropriate box:

|

| | |

| ¨ | | Preliminary Proxy Statement |

| | |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| ý | | Definitive Proxy Statement |

| | |

| ¨ | | Definitive Additional Materials |

| | |

| ¨ | | Soliciting Material Pursuant to § 240.14a-11(c) or § 240.14a-12 |

RENEWABLE ENERGY GROUP, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| | | | | |

| ý | | No fee required. |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | (1 | ) | | Title of each class of securities to which transaction applies: |

| | | (2 | ) | | Aggregate number of securities to which transaction applies: |

| | | (3 | ) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-1 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | (4 | ) | | Proposed maximum aggregate value of transaction: |

| | | (5 | ) | | Total fee paid |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1 | ) | | Amount Previously Paid: |

| | | (2 | ) | | Form, Schedule or Registration Statement No.: |

| | | (3 | ) | | Filing Party: |

| | | (4 | ) | | Date Filed: |

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

RENEWABLE ENERGY GROUP, INC.

416 South Bell Avenue

Ames, Iowa 50010

Notice of Annual Meeting of Stockholders

To Be Held May 13, 2015

The 2015 Annual Meeting of Stockholders of Renewable Energy Group, Inc. will be held at our principal executive offices located at 416 South Bell Avenue, Ames, Iowa, 50010, on May 13, 2015, at 10:00 a.m., Central Time. We are holding the Annual Meeting to:

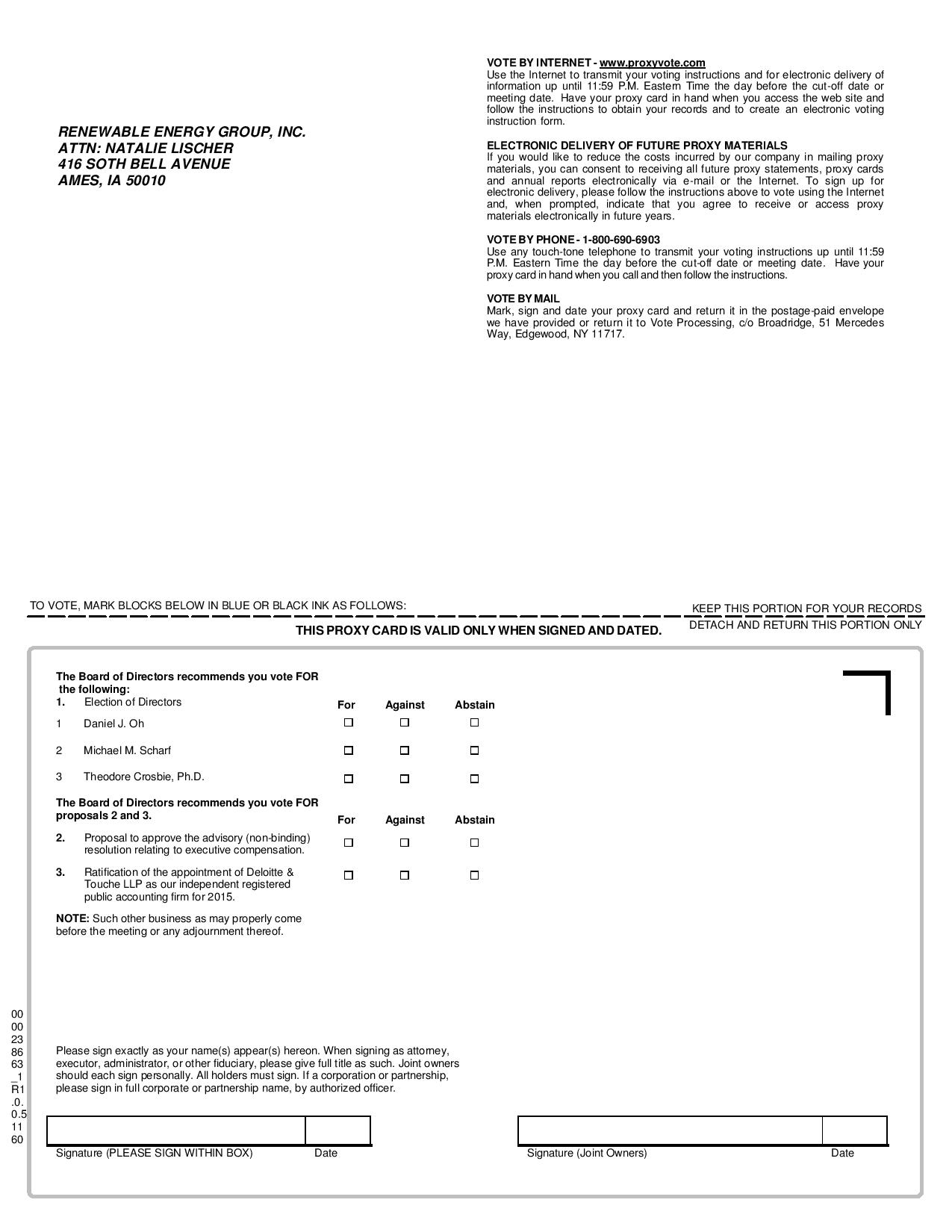

|

| |

| 1 | Elect three Class I directors to serve until the 2018 Annual Meeting of Stockholders or until their successors are elected and qualified; |

|

| |

| 2 | Hold an advisory “say-on-pay” vote to approve the compensation of our named executive officers; and |

|

| |

| 3 | Ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2015. |

We also will transact any other business that may properly come before the Annual Meeting or at any adjournments or postponements of the Annual Meeting.

We have selected March 26, 2015, as the record date for determining the stockholders entitled to notice of the Annual Meeting and to vote at the Annual Meeting and at any adjournments or postponements of the Annual Meeting.

Whether or not you plan to attend the Annual Meeting of Stockholders, we urge you to vote and submit your proxy. You may vote over the internet, by telephone or by mail. Please review the instructions under the section entitled “How do I vote my shares?” of the attached proxy statement regarding each of these voting options.

|

|

| |

| By Order of the Board of Directors, |

| |

| /s/ Natalie A. Merrill |

| |

Natalie A. Merrill Secretary |

Table of Contents

RENEWABLE ENERGY GROUP, INC.

PROXY STATEMENT

Annual Meeting of Stockholders

This proxy statement is being furnished to stockholders of Renewable Energy Group, Inc. in connection with the solicitation of proxies by our Board of Directors for use at our 2015 Annual Meeting of Stockholders, which is described below.

References to “the Company,” “we,” “us” or “our” throughout this proxy statement mean Renewable Energy Group, Inc.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

When and where will the Annual Meeting be held?

The 2015 Annual Meeting of Stockholders will be held on May 13, 2015, at 10:00 a.m., Central time, at our principal executive offices, which are located at 416 South Bell Avenue, Ames, Iowa.

What items will be voted on at the Annual Meeting?

As to all holders of our Common Stock, the purpose of the Annual Meeting is to:

| |

| • | Elect three Class I directors to serve until the 2018 Annual Meeting of Stockholders or until their successors are elected and qualified; |

| |

| • | Hold an advisory “say-on-pay” vote to approve the compensation of our named executive officers; and |

| |

| • | Ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2015. |

We will also transact any other business that may properly come before the Annual Meeting or at any adjournments or postponements of the Annual Meeting.

How does the Board recommend that I vote?

Our Board unanimously recommends that you vote:

| |

| • | FOR each director nominee; |

| |

| • | FOR advisory approval of the compensation of our named executive officers; and |

| |

| • | FOR the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2015. |

Who is entitled to vote at the Annual Meeting?

Stockholders who owned Common Stock at the close of business on March 26, 2015, the record date for the Annual Meeting, may vote at the Annual Meeting. For each share of Common Stock held, stockholders are entitled to one vote for as many separate nominees as there are directors to be elected and one vote on any other matter presented.

Who will engage in a solicitation of proxies? Who will bear the cost of that solicitation?

Certain of our directors, officers and employees may solicit proxies on our behalf by mail, phone, fax, e-mail, or in person. We will bear the cost of the solicitation of proxies. No additional compensation will be paid to our directors, officers or employees who may be involved in the solicitation of proxies.

Who will tabulate the votes and act as inspector of election?

Natalie A. Merrill, our Secretary, will act as the inspector of election at the Annual Meeting.

How do I vote my shares?

You may vote your shares in one of several ways, depending upon how you own your shares.

Shares registered directly in your name with REG (through our transfer agent, Computershare):

| |

| • | Via Internet: Go to http://www.proxyvote.com and follow the instructions. You will need to enter the Control Number printed on the Notice you received or if you received printed proxy materials, by following the instructions provided with your proxy materials and on your proxy card or voting instruction card. |

| |

| • | By Telephone: Call toll-free 1-800-690-6903 and follow the instructions. You will need to enter the Control Number printed on the Notice you received or if you requested printed proxy materials, by following the instructions provided with your proxy materials and on your proxy card or voting instruction card. |

| |

| • | In Writing: If you received printed proxy materials in the mail and wish to vote by mail, complete, sign, date, and return the proxy card in the envelope that was provided to you, or provide it or a ballot distributed at the Annual Meeting directly to the Inspector of Election at the Annual Meeting when instructed. |

Shares of Common Stock held in “street” or “nominee” name (through a bank, broker or other nominee):

| |

| • | You may receive a separate voting instruction form from your bank, broker or other nominee holding your shares. You should follow the instructions in the Notice or voting instructions provided by your broker or nominee in order to instruct your broker or other nominee on how to vote your shares. The availability of telephone or internet voting will depend on the voting process of the broker or nominee. To vote in person at the Annual Meeting, you must obtain a proxy, executed in your favor, from the holder of record. |

| |

| • | If you own shares in “street name” through a broker and do not instruct your broker how to vote, your broker may not vote your shares on proposals determined to be “non-routine.” Of the proposals included in this proxy statement, the proposal to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2015 is considered to be “routine.” Each of the other proposals is considered to be a “non-routine” matter. Therefore, if you do not provide your bank, broker or other nominee holding your shares in “street name” with voting instructions, those shares will count for quorum purposes, but will not be counted as shares present and entitled to vote on the election of directors. Therefore, it is important that you provide voting instructions to your bank, broker or other nominee. |

Regardless of how you own your shares, if you are a stockholder of record, you may vote by attending the Annual Meeting on May 13, 2015, at 10:00 a.m., Central time, at our principal executive offices, which are located at 416 South Bell Avenue, Ames, Iowa. Even if you plan to attend the Annual Meeting, we recommend that you also submit your proxy or vote by telephone or the internet so that your vote will be counted if you later decide not to attend the Annual Meeting.

If you vote via the internet, by telephone or return a proxy card by mail, but do not select a voting preference, the persons who are authorized on the proxy card and through the internet and telephone voting facilities to vote your shares will vote:

| |

| • | FOR each director nominee; |

| |

| • | FOR advisory approval of the compensation of our named executive officers; and |

| |

| • | FOR the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2015. |

How do I change or revoke my proxy?

If you are a stockholder of record, you may revoke your proxy at any time before the Annual Meeting by giving our Secretary written notice of your revocation or by submitting a later-dated proxy, and you may revoke your proxy at the Annual Meeting by voting by ballot. Attendance at the Annual Meeting, by itself, will not revoke a proxy. You may revoke your proxy by telephone by calling 1-800-690-6903 and following the instructions or via the internet by going to http://www.proxyvote.com and following the instructions.

If you are a stockholder in “street” or “nominee” name, you may revoke your voting instructions by informing the bank, broker or other nominee in accordance with that entity’s procedures for revoking your voting instructions.

What constitutes a quorum for purposes of the Annual Meeting?

On March 26, 2015, the record date, we had 44,460,847 shares of Common Stock outstanding. Voting can only take place at the Annual Meeting if the holders of a majority of Common Stock issued and outstanding and entitled to vote on the record date are present either in person or by proxy. Abstentions will be treated as present for purposes of determining the existence of a quorum.

How many votes are required to approve the proposals?

Our bylaws provide for majority voting for directors in uncontested elections. Accordingly, each of the three nominees for director will be elected if each receives the majority of the votes cast in person or represented by proxy, with respect to each director. A majority of the votes cast means that the number of shares voted FOR a director must exceed the number of votes cast AGAINST that director. An abstention or a broker non-vote on Proposal 1 will not have any effect on the election of directors and will not be counted in determining the number of votes cast.

The say-on-pay vote presented in Proposal 2 is an advisory vote and therefore is not binding on our company, our Compensation Committee or our Board of Directors. We value, however, the opinions of our stockholders and our Compensation Committee will, as it has in the past, take into account the result of the say-on-pay vote when determining future executive compensation.

The affirmative vote of a majority of the Common Stock, present in person or by proxy at the Annual Meeting and entitled to vote is required to ratify the appointment of our independent registered public accounting firm as set forth in Proposal 3.

The inspector of election will tabulate affirmative and negative votes, abstentions and broker non-votes. For Proposal 3, withheld votes and abstentions will have the same effect as negative votes. Broker non-votes will not be counted in determining the number of shares entitled to vote.

What if a nominee for director does not receive a majority vote?

We have adopted majority voting procedures for the election of directors in uncontested elections. In an uncontested election, each nominee is elected by the vote of a majority of the votes cast in person or represented by proxy. A majority of the votes cast means that the number of shares voted FOR a director must exceed the number of votes cast AGAINST that director. As provided in our bylaws, an “uncontested election” is one in which the number of nominees equals the number of directors to be elected in such election. The election of directors at the Annual Meeting will be an “uncontested election” because no nominations other than the three directors nominated by the Board were made in accordance with the applicable provisions of our bylaws.

In accordance with our bylaws, our Board may nominate or elect as a director only persons who agree to tender, promptly following his or her election or re-election to the Board, an irrevocable resignation that will be effective upon (i) the failure of the candidate to receive the required vote at the next annual meeting at which he or she faces re-election and (ii) the acceptance by the Board of such resignation.

If an incumbent director fails to receive the required vote for re-election in an uncontested election, the nominating and governance committee determines whether such director’s resignation should be accepted and makes a recommendation to the Board, which makes the final determination whether to accept the resignation. The Board must publicly disclose its decision within 90 days from the date of certification of the election results. If a director’s resignation is accepted by the Board, then the Board may fill the resulting vacancy or may decrease the size of the Board.

Can I attend the Annual Meeting in person?

We cordially invite and encourage all of our stockholders to attend the Annual Meeting. Persons who are not stockholders may attend only if invited by us. Stockholders of record must bring a copy of the Notice or proxy card in order to be admitted to the Annual Meeting. You should also be prepared to present photo identification for admittance.

Will any other matters be presented at the Annual Meeting?

We do not expect any matters, other than those included in this proxy statement, to be presented at the Annual Meeting. If other matters are presented, the individuals named as proxies will have discretionary authority to vote your shares on those other matters.

Who can help answer my questions?

If you have any questions about the Annual Meeting, voting or your ownership of our stock, please contact our investor relations department by e-mail at investor.relations@REGI.com or by phone at (515) 239-8091.

CORPORATE GOVERNANCE

Corporate Governance Guidelines; Code of Business Conduct and Ethics

We have established a corporate governance program to help guide our company and our employees, officers and directors in carrying out their responsibilities and duties, as well as to set standards for their professional conduct. Our Board of Directors has adopted Corporate Governance Guidelines, or Governance Guidelines, which provide standards and practices of corporate governance that we have designed to help contribute to our success and to assure public confidence in our company. The company’s Corporate Governance Guidelines may be found on the company’s website at www.REGI.com under “Investor Relations,” then “Corporate Governance.” In addition, all standing committees of our Board operate under charters that describe the responsibilities and practices of each committee.

We have adopted a Code of Business Conduct and Ethics, or Ethics Code, which provides ethical standards and corporate policies that apply to all of our directors, officers and employees. Our Ethics Code requires, among other things, that our directors, officers and employees act with integrity and the highest ethical standards, comply with laws and other legal requirements, engage in fair competition, avoid conflicts of interest, and otherwise act in our best interests. We have also adopted a Code of Ethics for Senior Financial Officers that applies to senior management and provides for accurate, full, fair and timely financial reporting and the reporting of information related to significant deficiencies in internal controls, fraud and legal compliance.

Board Composition

Our Board of Directors is currently composed of nine members, all of whom are independent, except for Jeffrey Stroburg and Daniel J. Oh. Our restated certificate of incorporation provides that the authorized number of board seats, which is currently nine, shall be not less than five and not more than fifteen, with the exact number to be fixed from time to time by a resolution of the majority of our Board of Directors. Each officer serves at the discretion of the Board of Directors and holds office until his successor is duly elected and qualified or until his or her earlier resignation or removal. There are no family relationships among any of our directors or executive officers.

Our Board met a total of thirteen times in 2014. During 2014, all of our directors attended at least 75% of the meetings of our Board held during their tenure and 75% of the meetings, if any, of the Board committees upon which they served and held during their tenure. Our Board does not have a policy requiring director attendance at annual meetings of our stockholders.

Board Leadership Structure

Our Board of Directors selects the Chairman of the Board in the manner and upon the criteria that it deems best for the Company at the time of selection. The Board of Directors does not have a prescribed policy on whether the roles of the Chairman and Chief Executive Officer should be separate or combined, but recognizes the value to the Company of the separation of these positions. The Board will continue to evaluate whether this leadership structure is in the best interests of the stockholders on a regular basis.

Our Chairman, Mr. Stroburg, presides over each Board meeting. The Chairman serves as liaison between the Chief Executive Officer and the other directors, approves meeting agendas and schedules and notifies other members of the Board of Directors regarding any significant concerns of stockholders or interested parties of which he becomes aware. The Chairman presides at stockholders’ meetings and provides advice and counsel to the Chief Executive Officer.

Lead Director

The Board has appointed Michael A. Jackson to serve as the lead director of the Board of Directors. The Board of Directors believes it is in the best interest of the Company’s stockholders to have an independent director serve as the lead director of the Board of Directors to ensure a greater role for the independent directors in the oversight of the Company and active participation of the independent directors in establishing Board of Directors priorities and procedures. The primary responsibilities of the lead director include presiding at all meetings of the Board of Directors at which the Chairman of the Board is not present and serving as a liaison between the Chairman of the Board and the independent directors.

Board Committees

Audit Committee. The audit committee provides assistance to the Board of Directors in fulfilling its legal and fiduciary obligations in matters involving our accounting, auditing, financial reporting, internal control and legal compliance functions by approving the services performed by our independent registered public accounting firm and reviewing their reports regarding our accounting practices and systems of internal accounting controls. The audit committee also oversees the audit efforts of our independent registered public accounting firm and takes those actions as it deems necessary to satisfy itself that the independent registered public accounting firm is independent of management. Our audit committee is comprised of Michael Scharf (Chairman), Michael A. Jackson and Randolph L. Howard, each of whom is a non-employee member of our Board of Directors. We believe that each member of our audit committee meets the requirements for independence and financial literacy under the applicable requirements of the United States Securities and Exchange Commission, or SEC rules and regulations. Messrs. Scharf, Jackson and Howard are our audit committee financial experts as currently defined under SEC rules.

Compensation Committee. The compensation committee determines our general compensation policies and makes recommendations regarding the compensation provided to our directors and executive officers which are subject to the approval of the independent members of our board. The compensation committee also reviews and determines bonuses for our non-executive officers and other employees. In addition, the compensation committee reviews and determines non-executive equity-based compensation for our directors, officers, employees and consultants and administers our stock incentive plan. Our

compensation committee also oversees our corporate compensation programs. Our compensation committee is currently comprised of Christopher Sorrells (Chairman), Delbert Christensen and Michael A. Jackson. We believe that the composition of our compensation committee meets the criteria for independence under, and the functioning of our compensation committee complies with the applicable requirements of, the Sarbanes-Oxley Act of 2002 and SEC rules and regulations.

Nominating and Governance Committee. The nominating and governance committee is responsible for making recommendations to the Board of Directors regarding candidates for directorships and the size and composition of the board. In addition, the nominating and governance committee is responsible for overseeing our corporate governance guidelines and reporting and making recommendations to the Board of Directors concerning corporate governance matters. The members of the nominating and governance committee are Michael A. Jackson (Chairman), Delbert Christensen, Theodore M. Crosbie, Ph.D., Randolph L. Howard and Christopher Sorrells. We believe that the composition of our nominating and governance committee meets the criteria for independence under, and the functioning of our nominating and governance committee currently complies with the applicable requirements of, the Sarbanes-Oxley Act of 2002, and SEC rules and regulations.

Risk Management Committee. The risk management committee assists our Board of Directors in fulfilling its responsibility to assess and oversee management’s identification and evaluation of major strategic, operational, regulatory, information and external risks inherent in our business, including among other things, agricultural and energy commodity price risk, and environmental, health and safety risk. In addition, the risk management committee oversees the development and implementation of policies, procedures and systems to address risks. The members of the risk management committee are Randolph L. Howard (Chairman), Peter J. Harding, Delbert Christensen and Michael Scharf.

Compensation Committee Interlocks and Insider Participation

Christopher Sorrells (Chairman), Michael A. Jackson and Delbert Christensen served as members of our Compensation Committee during 2014. All are outside, independent directors, and none of our named executive officers served as a director or as a member of a compensation committee of any business entity employing any of our directors during 2014.

Securities Trading

The Board believes that short-term investment activity in our securities (such as trading in or writing options, arbitrage trading or "day trading") is not appropriate; therefore, such conduct is discouraged by our Insider Trading Policy. In addition, all employees (including our NEOs) and Board members are prohibited from taking "short" positions in our securities or engaging in hedging or other monetization transactions with respect to our securities without our prior written approval. We discourage our executives from using our shares in margin accounts or otherwise pledging shares as collateral and any actions resulting in such are subject to our prior written approval.

Director Nomination Policy

Our Nominating and Governance Committee is responsible for identifying, evaluating, recruiting and recommending qualified candidates to our Board of Directors for nomination or election. Our Board of Directors nominates directors for election at each annual meeting of stockholders, and elects new directors to fill vacancies if they occur.

Our Board of Directors strives to find directors who are experienced and dedicated individuals with diverse backgrounds, perspectives and skills. Our Governance Guidelines contain membership criteria that call for candidates to be selected for their character, judgment, diversity of experience, business acumen and ability to act on behalf of all stockholders. In addition, we expect each director to be committed to enhancing stockholder value and to have sufficient time to effectively carry out his or her duties as a director. Our Nominating and Governance Committee also seeks to ensure that a majority of our directors are independent under NASDAQ rules and that one or more of our directors is an “audit committee financial expert” under SEC rules.

Prior to our annual meeting of stockholders, our Nominating and Governance Committee identifies director nominees first by evaluating the current directors whose terms will expire at the annual meeting and who are willing to continue in service. These candidates are evaluated based on the criteria described above, the candidate’s prior service as a director, and the needs of the Board for any particular talents and experience. If a director no longer wishes to continue in service, if the Nominating and Governance Committee decides not to re-nominate a director, or if a vacancy is created on the Board because of a resignation or an increase in the size of the Board or other event, then the committee considers whether to replace such director or to decrease the size of the Board. If the decision is to replace a director, then the Nominating and Governance Committee considers various candidates for Board membership, including those suggested by committee members, by other Board members, a director search firm engaged by the committee, or our stockholders. Prospective nominees are evaluated by the Nominating and Governance Committee based on the membership criteria described above and set forth in our Governance

Guidelines.

A stockholder who wishes to recommend a prospective nominee to the Board for consideration by the Nominating and Governance Committee should notify our Corporate Secretary in writing at our principal office. Such notice must be delivered to our offices by the deadline relating to stockholder proposals to be considered for inclusion in our proxy materials, as described under “General Information - Stockholder Proposals for 2016 Annual Meeting” in this proxy.

Each notice delivered by a stockholder who wishes to recommend a prospective nominee to the Board of Directors for consideration by the Nominating Committee generally must include the following information about the prospective nominee:

| |

| • | the name, age, business address and residence address of the person; |

| |

| • | the principal occupation of the person; |

| |

| • | the number of shares of our capital stock owned by the person; |

| |

| • | a statement whether the person, if elected, intends to tender an irrevocable resignation effective upon (i) such person’s failure to receive the required vote for re-election and (ii) acceptance of such resignation by the Board of Directors; |

| |

| • | a description of all compensation and other relationships during the past three years between the stockholder and the person; |

| |

| • | any other information relating to the person required to be disclosed pursuant to Section 14 of the Exchange Act; and |

| |

| • | the person’s written consent to serve as a director if elected. |

The Nominating and Governance Committee may require any prospective nominee recommended by a stockholder to furnish such other information as the Nominating and Governance Committee may reasonably require to determine the eligibility of such person to serve as an independent director or that could be material to a stockholder’s understanding of the independence, or lack thereof, of such person. In addition, Article III of our bylaws contains a description of the procedures a stockholder must follow in order to nominate a candidate for election as a director of our annual meetings.

Communications with Directors

Stockholders and interested parties may contact our directors to provide comments, to report concerns, or to ask a question, by mail at the following address:

Secretary

Renewable Energy Group, Inc.

416 South Bell Avenue

Ames, Iowa 50010

Board Role in Risk Oversight

One of the many responsibilities of our Board of Directors is to provide oversight of our risk management practices to ensure appropriate risk management systems are employed throughout the Company.

The Risk Management Committee assists our Board of Directors in fulfilling its responsibility to assess and oversee management’s identification and evaluation of major strategic, operational, regulatory, information and external risks inherent in our business, including among other things, agricultural and energy commodity price risk, and environmental, health and safety risk. In addition, the Risk Management Committee oversees the development and implementation of policies, procedures and systems to address risks.

The Committee shall not have responsibility for matters subject to the jurisdiction of another committee of the Board of Directors pursuant to that committee’s charter.

Our Board of Directors’ other standing committees support our Board by regularly addressing various issues within their respective areas of oversight. The Audit Committee’s responsibilities include reviewing and overseeing major financial risk exposures and the steps management has taken to monitor and control these exposures. Management, on a regular basis, provides the Audit Committee with its assessment and mitigation efforts in regards to particular risks facing the Company that have been identified through the risk management process. Our Audit Committee also reviews with our independent auditors the adequacy and effectiveness of our internal controls over financial reporting.

The Compensation Committee assists our Board in fulfilling its risk management oversight responsibilities associated with risks arising from our compensation policies and programs. Each year management and the Compensation Committee review whether risks arising from our compensation policies and practices for our employees are reasonably likely to have a material adverse effect on the Company. The Nominating and Governance Committee assists our Board of Directors in fulfilling its risk

management oversight responsibilities associated with risks related to corporate governance structures and processes. Each of the committee chairs, as appropriate, reports to the full Board of Directors at regular meetings concerning the activities of the committee, the significant issues it has discussed and the actions taken by the committee.

BOARD OF DIRECTORS

Our Board of Directors is divided into three classes serving staggered three-year terms. At the Annual Meeting, our stockholders will be asked to elect three individuals to serve as directors until the 2018 Annual Meeting. See “Proposal No. 1 - Election of Directors.” Our bylaws provide for majority voting for directors in uncontested elections. Accordingly, each of the three nominees for director will be elected if each receives the majority of the votes cast in person or represented by proxy, with respect to each director. A majority of the votes cast means that the number of shares voted FOR a director must exceed the number of votes cast AGAINST that director. An abstention or a broker non-vote on Proposal 1 will not have any effect on the election of directors and will not be counted in determining the number of votes cast.

Below are the names and ages of our nine directors as of the date of this proxy statement, the year each of them became a director, each director’s principal occupation or employment for at least the past five years, and other public company directorships held by each director. Unless authority is withheld, the persons named as proxies in the voting materials made available to you or in the accompanying proxy will vote for the election of the nominees listed below. We have no reason to believe that any of these nominees will be unable to serve as a director. If any of the nominees becomes unavailable to serve, however, the persons named as proxies will have discretionary authority to vote for a substitute nominee.

Nominees for Election at this Meeting for a Term Expiring in 2018 (Class I)

Daniel J. Oh (age 50) has served as our Chief Executive Officer and as a director since September 2011 and President since April 2009. Mr. Oh served as our Chief Operating Officer from June 2007 to September 2011, our Chief Financial Officer and Executive Vice President from June 2006 to June 2007 and as Secretary from August 2006 until March 2009. From May 2004 to May 2006, Mr. Oh served at Agri Business Group, Inc., or ABG, an agribusiness management consulting firm, including as Associate Director, Director and Vice President. Prior to joining ABG, Mr. Oh served in several different positions, including Senior Financial Analyst, Financial Team Member and Manager, in the Corporate Finance and Investment Banking area of the Corporate Strategy and Business Development Group at Eli Lilly and Company, a global pharmaceutical company, from August 2001 to May 2004. From 2000 to August 2001, Mr. Oh served as a consultant with McKinsey & Company, a leading consulting firm, where he focused on the pharmaceutical industry. From 1987 to 1998, Mr. Oh served as an officer in the United States Army, earning the rank of Major. Mr. Oh holds an M.B.A. from the University of Chicago with concentrations in finance, accounting and strategic management as well as a B.S. with a concentration in economics from the United States Military Academy. Mr. Oh serves as a director on Petrotec AG's supervisory board. Mr. Oh’s employment agreement with us provides that he will serve as a director.

Our Board believes that Mr. Oh’s experience, knowledge, skills and expertise as our current President and Chief Executive Officer and his knowledge of our operations and business strategies gained over his nine years of service to us in various roles provide valuable perspective to our Board and add significant value. Additionally, extensive industry knowledge and Mr. Oh’s prior experience as a senior executive and vice president at ABG, as well as his finance experience at Eli Lilly and consulting experience at McKinsey & Company, are integral to our Board’s assessment of business opportunities and strategic options for our company.

Michael M. Scharf (age 67) has served as a member of our Board of Directors since January 2012 and previously served as a member of our board of directors from August 2006 until December 2009. Mr. Scharf served as a director of Patriot Coal Corporation from November 2007 to December 2013 and previously served as a director of Southwest Iowa Renewable Energy, LLC from 2007 to 2009. Mr. Scharf served as Executive Director, Global Financial Services from January 2010 until his retirement in July 2011 and served as Senior Vice President and Chief Financial Officer of Bunge North America, Inc., the North American operating arm of Bunge Limited an agribusiness and food company, from 1989 to 2009. Prior to joining Bunge North America, Mr. Scharf served as Senior Vice President and Chief Financial Officer at Peabody Holding Company, Inc. from 1978 to 1989 and as a Tax Manager at Arthur Andersen & Co. from 1969 to 1978. Mr. Scharf holds a B.S. in accounting from Wheeling Jesuit University and is a certified public accountant.

Our Board believes that Mr. Scharf’s experience, knowledge, skills and expertise acquired as a previous member of our board and as a Senior Vice President and Chief Financial Officer of Bunge North America, Inc., including his experience with operations, risk management and international operations, as well as his financial and accounting background, add significant value to our Board. Additionally, Mr. Scharf’s service and experience as a member of audit committees and as an independent director for another public company, including active involvement in strategy discussions and other matters, strengthen the functioning of our Board.

Theodore M. Crosbie, Ph.D. (age 64) has served as a member of our Board of Directors since January 2015. He retired from Monsanto Company in March 2014 after serving in various capacities from 1996, including Vice President of Global Plant Breeding and Director of Global Wheat Breeding. Dr. Crosbie now occupies multiple public service positions, including as a Director of the Iowa Economic Development Authority, Chair of the Iowa Innovation Council and as the Chief Technology Officer for the State of Iowa, a position he has held since 2005. In addition to his service on our Board of Directors, Dr. Crosbie serves as an independent director of Titan Machinery (TITN), a public company. Dr. Crosbie also sits as a director for various privately held companies and trusts, including Kemin Industries, The Nelson Family Trust, Blue River Technologies, Kaiima Bio-Agritech and Inocucor. Dr. Crosbie earned a B.S. in agricultural education in 1973, a M.S. in plant breeding and cytogenetics in 1976 and his Ph.D. in plant breeding and cytogenetics in 1978, all from Iowa State University.

Our Board believes that Dr. Crosbie’s experience, knowledge, skills and expertise acquired during his years in senior leadership positions at Monsanto, a large agricultural company, will add significant scientific and business knowledge to our Board. Furthermore, Dr. Crosbie’s affiliation with various relevant public organizations, such as the Iowa Economic Development Authority and the Iowa Innovation Council, position him to acquire and share with our board regional economic development and technological trends that may impact our business. Given our utilization of a wide range of feedstocks and our desire to quickly respond to changes in feedstock pricing, Dr. Crosbie’s agricultural and scientific background will help our Board efficiently assess and direct corporate strategy.

Directors Continuing in Office until 2016 (Class II)

Delbert Christensen (age 65) has served as a member of our Board of Directors since August 2006. Mr. Christensen was a director of West Central from 1993 to 2014. Mr. Christensen was the Chairman of the Board of West Central from June 2010 to June 2012. Since January 2004, he has served as the President of CHMD Pork, a hog producer. He was Chairman of the Board of Directors of the Iowa Soybean Association from October 2009 to October 2010 and was on the Board of Directors of the Iowa Soybean Association from 2003 through 2014. Mr. Christensen serves on the Soybean Promotion and Research Board including on the Audit Committee (currently Chairman) and is a member of the Oil Action Team for the United Soybean Board. Mr. Christensen holds a B.S. in Agricultural Business from Iowa State University. Mr. Christensen was nominated as a director by West Central.

Our Board believes that Mr. Christensen’s experience, knowledge, skills and expertise acquired as a director of West Central, President of a hog production operation, previous substantial board experience and commodity and market knowledge as an independent farmer, add significant value to our Board.

Randolph L. Howard (age 64) has served as a member of our Board of Directors since February 2007. From July 2004 to until his retirement in September 2005, Mr. Howard served as the Senior Vice President for the Global Gas Division of Unocal Corporation, an oil company. Prior to that role, Mr. Howard served as Regional Vice President of Unocal’s International Energy Operations - North ASEAN and President with Unocal Thailand from May 1999 to June 2004. Mr. Howard served in various managerial roles at Unocal over 17 years including Vice President, Refining and Vice President, Supply, Trading and Transportation. Mr. Howard participated in the advanced executive program at Northwestern University and holds a B.S. in chemical engineering from University of California Berkeley.

Our Board believes that Mr. Howard’s experience, knowledge, skills and expertise acquired as an executive officer at Unocal Corporation, including experience and understanding of the oil and petroleum markets and operations, as well as his experience in strategy formation and doing business in international markets, add significant value to our Board.

Michael A. Jackson (age 60) has served as a member of our Board of Directors since August 2006. Since October 2014, Mr. Jackson has served as CEO and President of Jackson and Associates Consulting, LLC. Mr. Jackson served as the Chief Marketing and Strategy Officer of Trupointe Cooperative, Inc. from September 2011 until October 2014. Mr. Jackson served as the Chief Executive Officer and President of Adayana, Inc., a human capital development and agribusiness management consulting firm, from April 2008 to May 2011 and served as Chief Operating Officer of Adayana, Inc. from February 2006 to April 2008. Mr. Jackson was Chief Executive Officer and President of Agri Business Group, Inc., an agribusiness consulting and training company, which he founded in 1979, until its merger with Adayana, Inc. in October 2005. Mr. Jackson is a member of the board of directors of Terra Nitrogen Company, L.P., a nitrogen fertilizer company and is chairman of the board of ABG Ag Services. Mr. Jackson holds a B.S. in agricultural economics from Purdue University. Mr. Jackson was nominated as a director by West Central.

Our Board believes that Mr. Jackson’s experience, knowledge, skills and expertise acquired as the Chief Executive Officer of Adayana, Inc. and Agri Business Group, Inc., including experience and understanding of business strategy formation and execution from both a board and management perspective, add significant value to the Board. Additionally, Mr. Jackson’s previous service and experience as the chair of our audit committee and as an independent director for another company, including active involvement in strategy discussions and other matters, strengthen the functioning of our Board.

Directors Continuing in Office until in 2017 (Class III)

Jeffrey Stroburg (age 64) has served as a director since June 2006. Mr. Stroburg served as our Chief Executive Officer from June 2006 to September 2011. Mr. Stroburg concurrently served as Chief Executive Officer of West Central, from October 1999 until January 2015. He has also held the position of President of West Central from July 2003 until January 2015. Prior to joining West Central, Mr. Stroburg was Vice President and Chief Operating Officer of the Eastern Ag Region of Land O’ Lakes, an agricultural cooperative, from 1998 to 1999. From 1997 to 1998, Mr. Stroburg was President and Chief Executive Officer of Countrymark Cooperative, a refiner and distributor of diesel, gasoline and other petroleum products. From 1987 to 1997, Mr. Stroburg was President and Chief Executive Officer of Hamilton Farm Bureau Cooperative and held positions within the Missouri Farmers Association. From 1997 to 1998, Mr. Stroburg also served as a director for A.C. Toepfer International, a Hamburg, Germany trading company for agricultural products, and as a director for CF Industries, a fertilizer manufacturing company. Mr. Stroburg served on the board of directors for the Associated Benefits Corporation and the Cooperative Business International. Currently, Mr. Stroburg serves on the board of directors for the National Council of Farmer Cooperatives, the Biosciences Alliance of Iowa and the Iowa State University’s Center for Crops Utilization Research Industry/Stakeholder Advisory Board. Mr. Stroburg holds a B.S. from Iowa State University. Mr. Stroburg was nominated as a director by West Central.

Our Board believes that the experience, knowledge, skills and expertise gained by Mr. Stroburg in his previous role as our Chief Executive Officer, including his knowledge of our operations and the effectiveness of our business strategies provide valuable perspective to our Board and add significant value. Additionally, Mr. Stroburg’s experience as the Chief Executive Officer of West Central and prior experience as Chief Executive Officer of Countrymark Cooperative, as well as a number of executive positions with other agriculture and refining companies, are integral to our Board’s assessment of business opportunities and strategic options for our company. Mr. Stroburg’s service and experience as a director for other companies, including active involvement in strategic planning for these companies, also strengthens the governance and functioning of our Board.

Christopher D. Sorrells (age 46) has served as a member of our Board of Directors since November 2008. Until January 2015, Mr. Sorrells served as Managing Director at NGP Energy Technology Partners, L.P., a private equity firm investing in companies that provide products and services to the energy, power and environmental industries, since its formation in September 2005. From September 2003 to September 2005, Mr. Sorrells worked at Clarity Partners, a private equity firm. Mr. Sorrells served as a principal with Banc of America Securities from June 1998 to November 2002 and as an associate with Salomon Smith Barney from August 1996 to June 1998. Mr. Sorrells is a member of the board of directors of GSE Systems, a simulation and training company for the energy and power industries. Mr. Sorrells holds an M.B.A. from the College of William and Mary, a Master of Accounting degree from the University of Southern California, and a B.A. from Washington and Lee University.

Our Board believes that Mr. Sorrells’ experience, knowledge, skills and expertise acquired as a Managing Director of NGP Energy Technology Partners, L.P., including experience and understanding of the operation and governance of public companies and knowledge of debt and equity markets, add significant value to the Board. Mr. Sorrells’ knowledge of energy, power, and renewable energy industries, including solar energy, organic waste streams and chemical products, acquired as a director of groSolar and Lehigh Technologies adds further value to the Board, particularly when it comes to assessing historical trends and strategic options for our company.

Peter J. M. Harding (age 62) has served as a member of our Board of Directors since December 2014. Most recently, he was the Chief Executive Officer and a director of Westway Group, Inc. (“Westway”), a liquid storage and liquid animal feed business, from May 2009 until his retirement in June 2010. Prior to joining Westway, Mr. Harding served in various roles at ED&F Man, including as member of the board of directors and as Managing Director, molasses and palm oil trading, feed products, third party storage and biofuels division. He also served as Chief Executive Officer of Westway Holdings Corporation from 1997 to 2006. Concurrent with his service as Chief Executive Officer, he served as President of Westway Terminal Company, Inc. from 2001 to 2004. From 1995 to 1997, Mr. Harding was Chief Executive Officer of ED&F Man’s North American Cocoa Processing Group and prior to that was Chief Executive Officer of Savannah Cocoa, Inc. from 1992 to 1995. Mr. Harding served as Vice President of Sales & Marketing of Refined Sugars, Inc. from 1985 to 1989. Additionally, Mr. Harding owned and managed an asset management firm and commodity fund during the late 1980s and early 1990s.

Our Board believes that Mr. Harding’s experience, knowledge, skills and expertise acquired as an executive in different industries relevant to our business, including storage, commodities markets and biofuels, add significant value to our Board. Mr. Harding’s experience as Managing Director of ED&F Man’s molasses and palm oil trading, feed products, third party storage and biofuels division provides him with the background necessary to help the Board identify, evaluate and mitigate the risks associated with the volatile pricing of feedstocks used in our business.

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information as of March 15, 2015 about the number of shares of Common Stock beneficially owned by:

| |

| • | each person or group of persons known to us to be the beneficial owner of more than 5% of our Common Stock; |

| |

| • | each of our named executive officers; |

| |

| • | each of our directors; and |

| |

| • | all of our directors and executive officers as a group. |

Unless otherwise noted below, the address of each beneficial owner listed in the table is: c/o Renewable Energy Group, Inc., 416 S Bell Avenue, P.O. Box 888, Ames, IA 50010-0888.

We have determined beneficial ownership in accordance with the rules of the Securities and Exchange Commission. Except as indicated by the footnotes below, we believe, based on the information furnished to us, that the persons and entities named in the table below have sole voting and investment power with respect to all shares of Common Stock that they beneficially own, subject to applicable community property laws.

Applicable percentage beneficial ownership data is based on 44,460,847 shares of our Common Stock outstanding as of March 15, 2015.

In computing the number of shares of capital stock beneficially owned by a person and the percentage beneficial ownership of that person, we deemed outstanding shares subject to options, restricted stock units, stock appreciation rights and warrants held by that person that are currently exercisable or exercisable within 60 days of March 15, 2015.

Beneficial Ownership Table

|

| | | | | |

| | Number of Shares Beneficially Owned |

| 5% Stockholders | Shares | | Percentage |

DNB Asset Management AS(1) | 2,957,211 |

| | 6.65 | % |

LS Dissolution, Inc.(2) | 2,230,559 |

| | 5.02 | % |

West Central Cooperative(3) | 3,125,457 |

| | 7.03 | % |

Carlson Capital, L.P. (4) | 3,566,680 |

| | 8.02 | % |

Sooner Holdings, Inc. (5) | 3,493,613 |

| | 7.86 | % |

Dimensional Fund Advisors LP(6) | 2,250,902 |

| | 5.06 | % |

| Total | 17,624,422 |

| | 39.64 | % |

| Named Executive Officers and Directors | | | |

| Brad Albin | 38,075 |

| | * |

|

Delbert Christensen (47) | 35,169 |

| | * |

|

Theodore M. Crosbie Ph.D. (8) | 4,134 |

| | * |

|

| David Elsenbast | 36,882 |

| | * |

|

| Gary Haer | 20,303 |

| | * |

|

Peter J.M. Harding (9) | 14,430 |

| | * |

|

Randolph L. Howard (10) | 33,739 |

| | * |

|

Michael A. Jackson (11) | 7,282 |

| | * |

|

| Daniel J. Oh | 303,316 |

| | * |

|

Michael Scharf (12) | 20,356 |

| | * |

|

| Christopher D. Sorrells | — |

| | * |

|

| Chad Stone | 45,175 |

| | * |

|

Jeffrey Stroburg (13) | 176,593 |

| | * |

|

| All executive officers and directors as a group (13 persons) | 735,454 |

| | 1.65 | % |

| |

| (1) | Based on information set forth in a Schedule 13G/A filed with the SEC on February 4, 2015 by DNB Asset Management AS. DNB disclaims beneficial ownership of these securities except to the extent of management fees, |

performance fees or other fees received from the funds and managed account for which DNB is the investment manager and has discretionary investment power over the securities held by each of these funds and managed accounts. DNB’s address is Dronning Aufemias Gate 30, Bygg M-12N 0191 Oslo, Norway.

| |

| (2) | Based on the information set forth in a Schedule 13D filed by LS Dissolution, Inc. with the SEC on February 3, 2014. LS Dissolution, Inc. is the entity to which we issued shares in connection with our acquisition of substantially all of the assets of LS9, Inc. The address of LS Dissolution, Inc. is 600 Gateway Blvd., South San Francisco, CA 94080. |

| |

| (3) | The address of West Central Cooperative is 406 First Street, Ralston, Iowa 51459. The board of directors of West Central Cooperative has voting and investment power over the securities. The board consists of Sue Tronchetti, Jim Carlson, Delbert Christensen, Glen Christensen, Daryl Doerder, Jay Drees, Craig Heinenman, Darrell Jensen, Sam Spellman, Roger Ginder and Daniel Heller. |

| |

| (4) | Based on information set forth in a Schedule 13G filed with the SEC on February 2, 2015 by Carlson Capital, L.P., which serves as the investment manager to certain private funds and managed accounts (the "Accounts"). Asgard Investment Corp. II ("Asgard II") is Carlson Capital, L.P.'s general partner and, therefore, may be deemed to share voting and investment power over the securities held in the Accounts. Asgard Investment Corp. ("Asgard") is Asgard II's sole stockholder and, therefore, may be deemed to share voting and investment power over the securities held in the Accounts. Mr. Clint D. Carlson serves as president of Asgard and Carlson Capital, L.P. and, therefore, may be deemed to share voting and investment power over securities held in the Accounts. The address of Carlson Capital, Asgard II, Asgard and Mr. Clint Carlson is 2100 McKinney Avenue, Suite 1800, Dallas, TX 75201. |

| |

| (5) | Based on information set forth in a Schedule 13G filed with the SEC on June 10, 2014 by Sooner Holdings, Inc. The address of Sooner Holdings, Inc. is 5416 South Yale Avenue, Suite 400, Tulsa, Oklahoma 74135. |

| |

| (6) | Based on information set forth in a Schedule 13G filed with the SEC on February 5, 2015 by Dimensional Fund Advisors LP. Dimensional Fund Advisors LP, an investment adviser registered under Section 203 of the Investment Advisors Act of 1940, furnishes investment advice to four investment companies registered under the Investment Company Act of 1940, and serves as investment manager or sub-adviser to certain other commingled funds, group trusts and separate accounts (such investment companies, trusts and accounts, collectively referred to as the “Funds”). In certain cases, subsidiaries of Dimensional Fund Advisors LP may act as an adviser or sub-adviser to certain Funds. In its role as investment advisor, sub-adviser and/or manager, Dimensional Fund Advisors LP or its subsidiaries (collectively, “Dimensional”) may possess voting and/or investment power over the securities that are owned by the Funds, and may be deemed to be the beneficial owner of the shares of Renewable Energy Group, Inc. held by the Funds. However, all securities reported in this table are owned by the Funds. Dimensional disclaims beneficial ownership of such securities. The address of Dimensional is Building One, 6300 Bee Cave Road, Austin, Texas 78746. |

| |

| (7) | Consists of (i) 27,887 shares of Common Stock, (ii) 7,282 shares subject to restricted stock units that will vest within 60 days of March 15, 2014 and (iii) shares of Common Stock held by West Central Cooperative, over which Mr. Christensen, a director of West Central Cooperative, may be deemed to share voting and investment control. Mr. Christiansen disclaims beneficial ownership of the West Central Cooperative shares except to the extent of his pecuniary interest therein. |

| |

| (8) | Consists of 4,134 shares subject to restricted stock units that will vest within 60 days of March 15, 2015. |

| |

| (9) | Consists of (i) 10,314 shares of Common Stock and (ii) 4,116 shares subject to restricted stock units that will vest within 60 days of March 15, 2015. |

| |

| (10) | Consists of (i) 26,457 shares of Common Stock and (ii) 7,282 shares subject to restricted stock units that will vest within 60 days of March 15, 2015. |

| |

| (11) | Consists of 7,282 shares subject to restricted stock units that will vest within 60 days of March 15, 2015. |

| |

| (12) | Consists of (i) 13,074 shares of Common Stock and (ii) 7,282 shares subject to restricted stock units that will vest within 60 days of March 15, 2015. |

| |

| (13) | Consists of (i) 164,603 shares of Common Stock and (ii) 11,990 shares subject to restricted stock units. |

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

See “Security Ownership of Certain Beneficial Owners and Management,” for a detailed listing of each owner’s holdings.

WEST CENTRAL COOPERATIVE

In 2014, West Central beneficially owned more than 5% of our outstanding securities. We have several contractual relationships and transactions with West Central, including contracts for services, supply of soybean oil feedstock, a ground lease for our Ralston facility and an extended payment terms arrangement.

Under our ground lease with West Central, West Central leases to us the real property on which our Ralston facility is located for an annual rental fee of one dollar. The ground lease has a 20-year term ending July 31, 2026 and we may elect to extend the term for six additional five-year terms. During February 2012, we renegotiated the Asset Use Agreement between us and West Central. The new agreement provides for the use of certain assets, such as buildings, equipment and utilities, which will be charged to the Company based on fixed and variable components. The expenses related to these agreements totaled $205,456 for the year ended December 31, 2014.

We purchase once-refined soybean oil from West Central to supply our Ralston facility. Until October 1, 2012, these purchases were made under a feedstock supply agreement that expired in July 2010. On October 1, 2012, we entered into a new feedstock supply agreement with West Central. The supply agreement is for a sixteen month period with the option for a one year extension. West Central agrees to supply and we agree to purchase soybean oil for the Ralston facility at a price indexed to prevailing Chicago Board of Trade, or CBOT, soybean oil market prices with a negotiated market basis agreed upon between West Central and us. We paid West Central $42,463,148 for soybean oil for the year ended December 31, 2014. We did not have any biodiesel or co-product sales to West Central during 2014.

In June 2009, we entered into an extended payment terms agreement with West Central. The agreement set forth the terms of payment that apply for soybean oil that West Central sold to us for use at our Ralston facility, as well as any other feedstock that West Central agreed to sell to us. Pursuant to the agreement, payment for feedstocks delivered to us by West Central was required to be made within 45 days after delivery by West Central of an invoice for the feedstocks. Interest accrues on amounts due for feedstocks supplied by West Central beginning on the fifth day after West Central delivered an invoice for the feedstock until paid. At no time during the term of the agreement was the amount payable to West Central permitted to exceed $3.0 million. The agreement expired in January 2015, automatically renewed and will automatically renew for one additional year unless either party provides sufficient notice of cancellation prior to the renewal. We recorded interest expense of $7,058 for the year ended December 31, 2014, related to this extended payment terms agreement with West Central. At December 31, 2014 we had a balance due to West Central of $1,101,999.

In connection with our acquisition of SoyMor , REG Albert Lea, LLC (REG Albert Lea) assumed a loan with West Central. REG Albert Lea was required to make monthly interest payments. The loan amount, $713,620, was paid off in full in May 2012.

PROCEDURES FOR APPROVAL OF RELATED PARTY TRANSACTIONS

We have adopted a formal policy that we will not enter into a transaction with any of our executive officers, directors, holders of more than 5% of any class of our voting securities, and any member of the immediate family of and any entity affiliated with any of the foregoing persons, without the prior consent of our audit committee, or other independent members of our Board of Directors in the event it is inappropriate for our audit committee to review such transaction due to a conflict of interest. Any request for us to enter into a transaction with an executive officer, director, principal stockholder, or any of their immediate family members or affiliates, in which the amount involved exceeds $120,000 must first be presented to our audit committee for review, consideration and approval. In approving or rejecting any such proposal, our audit committee is to consider the relevant facts and circumstances available and deemed relevant to our audit committee, including, but not limited to, whether the transaction is on terms no less favorable than terms generally available from an unaffiliated third party under the same or similar circumstances and the extent of the related party’s interest in the transaction. All of the transactions described above were entered into prior to the adoption of such policy.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

2014 Company Performance Highlights

| |

| • | Third consecutive year with over $1 billion total revenue. |

| |

| • | Achieved Adjusted EBITDA of $108 million on 287 million gallons sold during 2014. |

| |

| • | Nameplate production capacity increased by 75 million gallons to 332 million gallons per year. |

| |

| • | Achieved Net Income of $82.5 million. |

| |

| • | Expanded our product lines by entering the renewable hydrocarbon diesel and renewable chemical markets, including expansion of our geographic reach and asset base into Europe with our Petrotec, AG investment and improved our distribution capabilities with the establishment of our Energy Services division. |

2014 Executive Compensation Highlights

The Compensation Committee approved the following actions, as a result of outstanding Company performance during 2014:

| |

| • | We increased the base salaries of our executive officers and sought to reward performance through our incentive programs. |

| |

| • | Annual incentive plan payout of 137.8% of target based on achievement of 149% and 103% of Adjusted EBITDA and Gallons target goals, respectively, for 2014. |

| |

| • | Vesting of 25% of our Chief Executive Officer’s performance-based RSUs granted previously for 2014 based on achieving threshold Adjusted EBITDA goals. |

| |

| • | Entered into a new employment agreement with our Chief Executive Officer with a compensation structure designed to award performance. |

Executive Compensation and Governance

The following are key aspects and features of our executive compensation program:

| |

| • | Executive compensation levels and targets are measured against other similarly-sized biofuels and chemical companies. |

| |

| • | Our annual bonus program is primarily based on our Adjusted EBITDA results, a financial measure we believe ensures a self-funded bonus program and incentivizes overall operational performance. |

| |

| • | We provide conservative severance benefits to our Chief Executive Officer in connection with a change-in-control equal to 12 months of salary and accelerated equity vesting upon termination of employment. |

| |

| • | None of our executive officers has an employment agreement with us with the exception of our Chief Executive Officer. |

| |

| • | Our stock incentive plan prohibits the re-pricing of equity awards without shareholder approval. |

Overview

This Compensation Discussion and Analysis describes our executive compensation program, the role and involvement of various parties in the analysis and decisions regarding executive compensation, and the material elements of our compensation program as it relates to the five executive officers whose compensation is disclosed in the compensation tables below, who we refer to as the “named executive officers” or “executives.” Our named executive officers for 2014 were:

|

| | |

| | | |

| Name | | Executive Officer Position |

| Daniel Oh | | President and Chief Executive Officer |

| Chad Stone | | Chief Financial Officer |

| Brad Albin | | Vice President, Manufacturing |

| David Elsenbast | | Vice President, Supply Chain Management |

| Gary Haer | | Vice President, Sales and Marketing |

Results of 2014 Advisory Vote to Approve Executive Compensation

At our 2014 annual meeting of stockholders held on May 15, 2014, we submitted an advisory vote on our 2014 compensation awarded to our named executive officers (commonly known as a “say-on-pay” vote). Our stockholders approved our 2014 compensation awarded to our named executive officers with approximately 99% of the votes cast in favor of the proposal. We believe that the outcome of our say-on-pay vote signals our stockholders’ support of our compensation approach, specifically our efforts to attract, retain and motivate our named executive officers.

We were pleased with our stockholders’ support of our compensation program, and our management and Board continue to review our executive compensation practices to further align our compensation practices with our evolving pay-for-performance philosophy. We value the opinions of our stockholders and will continue to consider the outcome of future say-on-pay votes, as well as feedback received throughout the year, when making compensation decisions for our named executive officers.

Compensation Philosophy and Objectives

Our executive compensation program is intended to support the execution of our business strategy and link rewards to the achievement of short- and long-term goals. Our Compensation Committee designs our programs to reward pay-for-performance, motivate financial and operating performance that drive returns for stockholders and attract and retain talented and experienced managers.

Our executive compensation program includes base salary, annual incentives paid in the form of cash bonuses and long-term incentives consisting of grants of stock-based performance shares and stock options. The majority of our executive compensation is variable compensation or at-risk pay. Base salary is the only fixed compensation component.

Role of the Compensation Committee and Management

The Compensation Committee of our Board, or the Committee, has overall responsibility for advising the independent members of our Board regarding the compensation of our named executive officers. Members of the Compensation Committee are appointed by our Board. The Compensation Committee makes its compensation recommendations based on the judgment of its members based on their tenure and experience and after receiving input from our Chief Executive Officer and other members of management. The independent members of our Board, taking into account the recommendations of the Compensation Committee, have the ultimate responsibility for evaluating and determining the compensation of our named executive officers, including the compensation of our Chief Executive Officer.

Our Chief Executive Officer makes compensation recommendations to the Compensation Committee for all executive officers other than himself and provides input from time to time on the design of compensation plan components and other compensation-related issues as they arise. Management provides analyses regarding competitive practices and pay ranges, compensation and benefit plans, policies and procedures related to equity awards, perquisites and general compensation and benefits philosophy. Senior human resources and finance executives attend non-executive sessions of Compensation Committee meetings to provide perspective and expertise relevant to the meeting agenda.

Role of the Compensation Consultant

To assist the Compensation Committee in carrying out its duties and responsibilities, the Committee engages the services of an outside executive compensation consultant. As in prior years, during 2014, the Committee engaged Aon Hewitt as its executive compensation consultant. Aon Hewitt provides the Committee with competitive market compensation data for senior executives, information on current issues and trends on executive compensation program design and governance, assists with proxy disclosure requirements, and provides ongoing advice to the Committee on regulatory and other technical developments that may affect our executive compensation programs.

In its capacity as the executive compensation consultant to the Compensation Committee, Aon Hewitt reports directly to the Committee and the Committee retains sole authority to retain and terminate the consulting relationship. In carrying out its responsibilities, the executive compensation consultant will typically collaborate with management to obtain data, provide background on program design and operation, and clarify pertinent information.

Competitive Market Data

To determine the compensation peer group each year, we consider companies within the biofuels industry that are of similar size based on market cap and revenue and that we compete with for executive talent. Our industry peers are limited as there are relatively few publicly traded biofuel producers. The Committee reviews and makes as-needed adjustments to the compensation peer group annually to ensure that the chosen companies continue to meet the relevant criteria.

In 2014, we referenced the following peer group in making compensation decisions for 2014:

|

| | | | |

| Amyris, Inc. | | FutureFuel Corp. | | Pacific Ethanol, Inc. |

| BioFuel Energy Corp. | | Gevo, Inc. | | Rentech Inc. |

Codexis, Inc.

| | Green Plains Inc. | | REX American Resources Corporation |

Darling Ingredients, Inc.

| | Methanex Corporation | | Solazyme, Inc. |

Competitive pay benchmarking information serves as one of our reference points in establishing our executive compensation and is intended to provide a general understanding of current compensation practices rather than a formula for establishing specific pay levels.

Elements of Compensation

Our compensation program for our executives consists of a number of elements that support our compensation objectives. A brief description of each element is highlighted in the following chart:

|

| | | | | | |

| | | | | | | |

| | | Compensation Element | | Characteristics | | Primary Purpose |

| | Base Salary | | Fixed amount of compensation | | • Provide a competitive fixed amount of cash compensation based on individual performance, level of responsibility, experience, internal equity and competitive pay levels• Support attraction and retention of talented executives |

| | Annual Incentive Plan (“AIP”) | | Variable compensation opportunity contingent on achievement of corporate financial and operations goals measured over the current year | | • Motivate employees to achieve short-term corporate goals and recognize individual outperformance |

| | Long-Term Incentives | | Variable compensation opportunity contingent on stockholder returns or achievement of financial goals Historically, we have a granted a mix of stock options, SARs, restricted stock units and performance-based restricted stock units. | | • Link the interests of our executives to the interests of our shareholders through increases in share price over time• Support attraction and retention of talented executives |

| Other Benefit Plans and Programs | | • Health, dental and vision insurance• Vacation, personal holidays and sick days• Life insurance and supplemental life insurance• Short-term and long-term disability; | | • Provide basic retirement and health and welfare benefits to attract and retain employees |

Base Salary

We pay our named executive officers a base salary based on the experience, skills, knowledge and responsibilities required of each officer. We believe base salaries are an important element in our overall compensation program because base salaries provide a fixed element of compensation that reflects job responsibilities and value to the company.

Base salary is essential to allow us to compete in the employment marketplace for talent and is an important component of total compensation for our named executive officers. It is vital to our goal of recruiting and retaining executive officers with proven abilities.

In December 2014, Mr. Oh’s annual base salary was increased from $450,000 to $570,000 under a new Employment Agreement, effective as of January 1, 2015. This was the first salary increase Mr. Oh had received since 2011. In setting Mr. Oh’s salary, we considered Mr. Oh’s significant leadership role in the company’s growth over the prior three years as well as the base salaries paid to Chief Executive Officers in our peer group of companies. We also considered that Mr. Oh's new base salary level was consistent with other similarly situated executives within the company's peer group. Mr. Oh's base salary was set under the agreement for three years and sought to set his salary at a level that would incent Mr. Oh during the entire term of his agreement.

In the first half of 2014, we increased the base salaries of Messrs. Stone and Albin to $285,000, respectively, Mr. Haer to $280,000 and Mr. Elsenbast to $240,000. We determined these salary increases were necessary to motivate and retain these named executive officers, in addition to reviewing and considering local, regional and national competition.

Annual Incentive Plans

Our annual cash incentive plan promotes our pay-for-performance philosophy by providing all employees with direct financial incentives in the form of annual cash awards for achieving company performance goals. For our 2014 cash incentive plan, we believed a combination of profitability (as measured by non-GAAP Adjusted EBITDA) and operational (as measured by gallons sold) metrics was effective because these metrics are closely linked to long-term stockholder value, are easily understood by employees and allow for comparability across competitors.

Under the 2014 plan, our Chief Executive Officer was eligible for an award targeted at 75% of his base salary and our named executive officers other than our Chief Executive Officer were eligible for an award targeted at 50% of their respective base salary. Of such bonus amounts, 75% was contingent upon our achievement of non-GAAP Adjusted EBITDA as such term was defined in our Form 10-K for the year ended December 31, 2014, subject to certain exclusions, and the other 25% was contingent upon our sale of a certain number of gallons of biodiesel that were produced by us, either at one of our facilities or through tolling arrangements, and gallons procured from third-party producers. If either of these performance criteria were not

met at the threshold level of 60% of the target, no amounts would have been payable under the 2014 cash incentive plan. For performance in excess of the target performance level, our Chief Executive Officer was entitled to receive up to 150% of his base salary and our named executive officers other than our Chief Executive Officer were eligible to receive up to 100% of their respective base salary.

In March 2014, the independent members of our Board of Directors approved, based upon the recommendation of our Compensation Committee, our annual incentive plan for 2014. Plan details are describes below:

|

| | | | | |

| | | | | | |

Performance Measure | Weighting | Goal | Company Performance (as a % of Target) | Bonus Payout (as a % of Target) |

Adjusted EBITDA (in millions), earnings before interest, taxes, depreciation and amortization, adjusted for certain additional items that are not indicative of core operating performance | | | <60% | | —% |

| | $45 | 60% | (threshold) | 50% |

| 75% | $75 | 100% | (target) | 100% |

| | $150 | 200% | (maximum) | 200% |

| | | >200% | | 200% |

Gallons (in millions), defined as number of gallons of fuel sold that were produced at REG facilities, REG toll and procured from third parties | | | <60% | | —% |

| | 162 | 70% | (threshold) | 50% |

| 25% | 270 | 100% | (target) | 100% |

| | 405 | 150% | (maximum) | 200% |

| | | >150% | | 200% |

| | | | | |

Our 2014 actual performance against the Adjusted EBITDA and Gallons metrics under the 2014 cash incentive plan is illustrated in the following table:

|

| | | | | | | | | |

Performance Measure | | Actual Performance | | Actual Performance as % of Target Goal | | Weighting | | AIP Payout as % of Target |