UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| ¨ | Registration statement pursuant to Section 12(b) or 12(g) of the Securities Exchange Act of 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2013

OR

| ¨ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

OR

| ¨ | Shell company report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

Date of event requiring this shell company report ___________________

Commission file number: 001-35022

Mission NewEnergy Limited

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

Western Australia, Australia

(Jurisdiction of incorporation or organization)

Unit B2, 431 Roberts Rd,

Subiaco, Western Australia 6008, Australia

(Address of principal executive offices)

Guy Burnett

Chief Financial Officer and Company Secretary

+61 8 6313 3975; guy@missionnewenergy.com

Unit B2, 431 Roberts Rd,

Subiaco, Western Australia 6008, Australia

(Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | | Name of each exchange on which registered |

| None | | None |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Ordinary Shares, no par value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of June 30, 2013: 10,870,275 Ordinary Shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

¨Yes x No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

¨Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

SYes £ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

SYes £ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| ¨ Large accelerated filer | ¨Accelerated filer | x Non-accelerated filer |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

US GAAP¨

International Financial Reporting Standards as issued by the International Accounting Standards Boardx

Other¨

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

¨Item 17¨ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

¨Yes x No

TABLE OF CONTENTS

| | Page |

| | |

| CONVENTIONS THAT APPLY TO THIS ANNUAL REPORT | 2 |

| | |

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS | 2 |

| | |

| INDUSTRY AND MARKET DATA | 3 |

| | |

| PART I | |

| | |

| Item 1. Identity of Directors, Senior Management and Advisers | 3 |

| Item 2. Offer Statistics and Expected Timetable | 3 |

| Item 3. Key Information | 4 |

| Item 4. Information on the Company | 18 |

| Item 4A.Unresolved Staff Comments | 26 |

| Item 5. Operating and Financial Review and Prospects | 26 |

| Item 6. Directors, Senior Management and Employees | 36 |

| Item 7. Major Shareholders and Related Party Transactions | 51 |

| Item 8. Financial Information | 52 |

| Item 9. The Offer and Listing | 53 |

| Item 10.Additional Information | 55 |

| Item 11. Quantitative and Qualitative Disclosures About Market Risk | 66 |

| Item 12. Description of Securities Other than Equity Securities | 68 |

| | |

| PART II | |

| | |

| Item 13. Defaults, Dividend Arrearages and Delinquencies | 68 |

| Item 14. Material Modifications to the Rights of Security Holders and Use of Proceeds | 68 |

| Item 15. Controls and Procedures | 69 |

| Item 16. [Reserved] | 70 |

| Item 16A. Audit Committee Financial Expert | 70 |

| Item 16B. Code of Ethics | 70 |

| Item 16C. Principal Accountant Fees and Services | 70 |

| Item 16D. Exemptions from the Listing Standards for Audit Committees | 70 |

| Item 16E. Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 70 |

| Item 16F. Change in Registrant’s Certifying Accountant | 70 |

| Item 16G. Corporate Governance | 71 |

| Item 16H. Mine Safety Disclosures | 71 |

| | |

| PART III | |

| | |

| Item 17. Financial Statements | 71 |

| Item 18. Financial Statements | 71 |

| Item 19. Exhibits | 71 |

Conventions that apply to this Annual Report

Unless otherwise indicated or the context clearly implies otherwise, references to “we,” “us,” “our,”, “Mission NewEnergy”, “Mission”, "the Group" and “the Company” are to Mission NewEnergy Limited, an Australian corporation, and its subsidiaries. In this annual report “shares” or “ordinary shares” refers to our ordinary shares.

In this annual report, references to “$,” “US$” or “U.S. dollars” are to the lawful currency of the United States and references to “Australian dollars” or “A$” are to the lawful currency of Australia.

Solely for the convenience of the reader, this annual report contains translations of certain Australian dollar amounts into U.S. dollars at specified rates. Except as otherwise stated in this annual report, all translations from Australian dollars to U.S. dollars are based on the noon buying rate of the City of New York for cable transfers of Australian dollars, as certified for customs purposes by the Federal Reserve Bank of New York on the date or year indicated. No representation is made that the Australian dollar amounts referred to in this annual report could have been or could be converted into U.S. dollars at such rates or any other rates. Any discrepancies in any table between totals and sums of the amounts listed are due to rounding.

The following table sets out relevant conversion measures for Mission NewEnergy’s business:

1 Tonne = 2,204.6226 Pounds biodiesel

1 Tonne = 1.1023 Tons (short) biodiesel

1 Tonne = 298 Gallons biodiesel

1 Tonne = 7.4 Barrels biodiesel

1 Barrel = 42 Gallons biodiesel

1 Hectare = 2.4 Acres

Unless otherwise indicated, the consolidated financial statements and related notes as of and for the fiscal years ended June 30, 2011, 2012and 2013 included elsewhere in this annual report have been prepared in accordance with Australian Accounting Standards and also comply with International Financial Reporting Standards (“IFRS”) and interpretations issued by the International Accounting Standards Board.

References to a particular “fiscal year” are to our fiscal year ended June 30 of that year. References to a year other than a “fiscal” year are to the calendar year ended December 31.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements that relate to our current expectations and views of future events. All statements, other than historical fact or present financial information, may be deemed to be forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements relate to events that involve known and unknown risks, uncertainties and other factors, including those listed under “Item 3.D — Key Information — Risk Factors,” “Item 4 — Information on the Company” and “Item 5 — Operating and Financial Review and Prospects,” all of which are difficult to predict and many of which are beyond our control, which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements.

In some cases, these forward-looking statements can be identified by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “potential,” “continue,” “predict,” “forecast,” “budget,” “project,” “target,” “likely to” or other similar expressions. These forward-looking statements are subject to risks, uncertainties and assumptions, some of which are beyond our control. In addition, these forward-looking statements reflect our current views with respect to future events and are not a guarantee of future performance. Actual outcomes may differ materially from the information contained in the forward-looking statements.

We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include, among other things, statements relating to:

| • | our beliefs regarding the design, technology, operation and maintenance of our refinery; |

| • | our ability to procure a sufficient supply of raw materials, in particular, suitable and cost competitive feedstocks; |

| • | our beliefs regarding the competitiveness of our products; |

| • | our beliefs regarding the advantages of our business model; |

| • | our expectations related to our ongoing restructure; |

| • | our expectations regarding the scaling and expansion or reduction of our production capacity; |

| • | our expectations regarding our ability to procure customersand expand them; |

| • | our expectations regarding settlement of our terminated Indonesian Joint Venture ; |

| • | our expectations regarding increased revenue growth and our ability to achieve profitability resulting from increases in our production volumes; |

| • | our beliefs regarding our ability to successfully implement our strategies; |

| • | our beliefs regarding our abilities to secure sufficient funds to meet our cash needs for our operations and capacity expansion; |

| • | our future business development, results of operations and financial condition; |

| • | government regulatory and industry certification, approval and acceptance of our product and its derivatives; and |

| • | government policymaking and incentives relating to renewable fuels. |

The forward-looking statements made in this annual report relate only to events or information as of the date on which the statements are made in this annual report. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

INDUSTRY AND MARKET DATA

This annual report includes information with respect to market and industry conditions and market share from third party sources or that is based upon estimates using such sources when available. We believe that such information and estimates are reasonable and reliable. We also believe the information extracted from publications of third party sources has been accurately reproduced and, so far as we are able to ascertain from information published by the third party sources, no facts have been omitted which would render the reproduced information inaccurate or misleading. However, we have not independently verified any of the data from third party sources. Similarly, our internal research is based upon the understanding of industry conditions, and such information has not been verified by any independent sources.

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

Item 3. Key Information

| A. | Selected Financial Data. |

The following selected consolidated statements of operations and other consolidated financial data for the fiscal years 2013, 2012 and 2011 have been derived from our audited consolidated financial statements included elsewhere in this annual report. You should read the selected consolidated financial data in conjunction with our consolidated financial statements and related notes and “Item 5 — Operating and Financial Review and Prospects” included elsewhere in this annual report. Our historical results do not necessarily indicate our expected results for any future periods.

Our financial statements have been prepared in Australian dollars and in accordance with International Financial Reporting Standards, as issued by the International Accounting Standards Board.

Income statement data for the fiscal years ended June 30, 2013, 2012 and 2011 and the balance sheet data as at June 30, 2013 and 2012 have been derived from our audited financial statements that are included elsewhere in this annual report. Income statement data for the fiscal years ended June 30, 2010 and 2009 and the balance sheet data as at June 30, 2011, 2010 and 2009 have been derived from our audited financial statements that are not included in this annual report.

| | | 2013 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| | | US$(1) | | | A$ | | | A$ | | | A$ | | | A$ | | | A$ | |

| | | (in thousands, except share and per share data) | |

| | | | | | | | | | | | | | | | | | | |

| Income Statement data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Total sales revenue | | | 174 | | | | 169 | | | | 27,543 | | | | 13,629 | | | | 14,394 | | | | 43,368 | |

| Total other income | | | 8,468 | | | | 8,244 | | | | 10,659 | | | | 1,890 | | | | 2,066 | | | | 11,809 | |

| Cost of sales | | | (378 | ) | | | (368 | ) | | | (26,153 | ) | | | (13,352 | ) | | | (15,021 | ) | | | (45,709 | ) |

| Employee benefits expense | | | (1,662 | ) | | | (1,618 | ) | | | (3,221 | ) | | | (6,349 | ) | | | (5,307 | ) | | | (5,117 | ) |

| Other income (expenses) | | | 8,603 | | | | 8,375 | | | | (9,012 | ) | | | (7,965 | ) | | | (88,751 | ) | | | (19,271 | ) |

| Finance costs | | | (4,159 | ) | | | (4,048 | ) | | | (3,243 | ) | | | (4,865 | ) | | | (5,152 | ) | | | (8,401 | ) |

| Profit/(loss) from operations before income tax | | | 11,046 | | | | 10,754 | | | | (3,427 | ) | | | (17,012 | ) | | | (97,771 | ) | | | (23,321 | ) |

| Income tax (expense) benefit | | | 21 | | | | 20 | | | | (16 | ) | | | 1 | | | | (29 | ) | | | (434 | ) |

| Profit/(Loss) from continuing operationNet (loss)/profit | | | 11,067 | | | | 10,774 | | | | (3,443 | ) | | | (17,011 | ) | | | (97,800 | ) | | | (23,755 | ) |

| Loss for the year from discontinued operations | | | (736 | ) | | | (717 | ) | | | (2,755 | ) | | | (4,659 | ) | | | - | | | | - | |

| Net Profit / (Loss) | | | 10,331 | | | | 10,057 | | | | (6,198 | ) | | | (21,670 | ) | | | (97,800 | ) | | | (23,755 | ) |

| Profit/(Loss) attributable to non-controlling interests | | | (15 | ) | | | (14 | ) | | | 68 | | | | - | | | | - | | | | - | |

| Profit/(Loss) attributable to members of the parent | | | 10,316 | | | | 10,043 | | | | (6,130 | ) | | | (21,670 | ) | | | (97,800 | ) | | | (23,755 | ) |

| Basic and diluted earnings (loss) per share(2) | | | 0.98 | | | | 0.96 | | | | (0.69 | ) | | | (3.50 | ) | | | (20.76 | ) | | | (12.00 | ) |

| Weighted average ordinary number of shares outstanding(3) | | | 10,481,820 | | | | 10,481,820 | | | | 8,919,299 | | | | 6,199,265 | | | | 4,711,249 | | | | 1,979,725 | |

| Balance Sheet data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Total current assets | | | 5,028 | | | | 5,486 | | | | 7,682 | | | | 29,236 | | | | 25,007 | | | | 26,372 | |

| Total assets | | | 18,428 | | | | 20,105 | | | | 10,703 | | | | 36,598 | | | | 33,749 | | | | 118,030 | |

| Total current liabilities | | | 28,458 | | | | 31,051 | | | | 2,362 | | | | 22,059 | | | | 4,300 | | | | 9,550 | |

| Total non-current liabilities | | | 1,428 | | | | 1,558 | | | | 31,215 | | | | 44,287 | | | | 59,137 | | | | 57,441 | |

| Total liabilities | | | 29,888 | | | | 32,609 | | | | 35,144 | | | | 66,346 | | | | 63,437 | | | | 66,991 | |

| Retained earnings (accumulated losses) | | | (139,366 | ) | | | (136,188 | ) | | | (140,377 | ) | | | (135,720 | ) | | | (117,259 | ) | | | (19,475 | ) |

| Total equity | | | (11,460 | ) | | | (12,504 | ) | | | (24,441 | ) | | | (29,748 | ) | | | (29,688 | ) | | | 51,039 | |

| Other financial data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends per share | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| (1) | The balance sheet data has been translated into U.S. dollars from Australian dollars based upon the noon buying rate of the City of New York for cable transfers of Australian dollars, as certified for customs purposes by the Federal Reserve Bank of New York on June 30, 2013, which exchange rate was A$1.00 = US$0.9165. The income statement data has been translated into U.S. dollars from Australian dollars based upon the weighted average of the noon buying rate of the City of New York for cable transfers of Australian dollars, as certified for customs purposes by the Federal Reserve Bank of New York for the period from July 1, 2012 to June 30, 2013 which as A$1.00 = US$1.0272. These translations are merely for the convenience of the reader and should not be construed as representations that the Australian dollar amounts actually represent such U.S. dollar amounts or could be converted into U.S. dollars at the rate indicated. |

| (2) | Net (loss)/profit per ordinary share — basic and diluted is calculated as net loss for the period divided by adjusted weighted average number of ordinary shares outstanding for the same period, after giving effect to the 50-1 share consolidation that was effected on April 4, 2011. |

| (3) | The weighted average number of ordinary shares outstanding is shown after giving effect to the 50-1 share consolidation that was effected on April 4, 2011. |

Exchange Rate Information

The Australian dollar is convertible into U.S. dollars at freely floating rates. There are no legal restrictions on the flow of Australian dollars between Australia and the United States.

For your convenience, we have translated some Australian dollar amounts into U.S. dollar amounts at the noon buying rate in The City of New York for cable transfers in Australian dollars as certified for customs purposes by the Federal Reserve Bank of New York (the “noon buying rate”). On June 30, 2013, the noon buying rate for Australian dollars into U.S. dollars was A$1.00 = US$0.9165. On October 11, 2013, the noon buying rate for Australian dollars into U.S. dollars was A$1.00 = U.S $ 0.9473.

We make no representation that any Australian dollar or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or Australian dollars, as the case may be, at any particular rate, the rates stated below, or at all.

The following table contains information for the noon buying rate for the Australian dollar into U.S. dollars for the periods indicated.

| | | At Period

End | | | Average

Rate (1) | | | High | | | Low | |

| Fiscal year ended June 30, | | | | | | | | | | | | | | | | |

| 2009 | | | 0.8055 | | | | 0.7423 | | | | 0.9797 | | | | 0.6073 | |

| 2010 | | | 0.8480 | | | | 0.8837 | | | | 0.9369 | | | | 0.7751 | |

| 2011 | | | 1.0732 | | | | 0.9905 | | | | 1.0970 | | | | 0.838 | |

| 2012 | | | 1.0236 | | | | 1.0323 | | | | 1.1026 | | | | 0.9453 | |

| 2013 | | | 0.9165 | | | | 1.0272 | | | | 1.0591 | | | | 0.9165 | |

| Month ended | | | | | | | | | | | | | | | | |

| April 30, 2013 | | | 1.0372 | | | | 1.0380 | �� | | | 1.0564 | | | | 1.0255 | |

| May 31, 2013 | | | 0.9608 | | | | 0.9919 | | | | 1.0313 | | | | 0.9608 | |

| June 30, 2013 | | | 0.9165 | | | | 0.9440 | | | | 0.9770 | | | | 0.9165 | |

| July 31, 2013 | | | 0.8957 | | | | 0.9155 | | | | 0.9259 | | | | 0.8957 | |

| August 31, 2013 | | | 0.8901 | | | | 0.9037 | | | | 0.9193 | | | | 0.8901 | |

| September 30, 2013 | | | 0.9324 | | | | 0.9301 | | | | 0.9444 | | | | 0.9055 | |

| October 31, 2013(through October 11, 2013) | | | 0.9473 | | | | 0.9426 | | | | 0.9473 | | | | 0.9366 | |

| (1) | For the fiscal years, determined by averaging noon buying rates on the last day of each full month during the fiscal year. |

| B. | Capitalization and Indebtedness. |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds. |

Not applicable.

Set forth below are certain risks that we believe are applicable to our business. You should carefully consider the risks described below and the other information in this annual report, including our consolidated financial statements and related notes included elsewhere in this annual report, before you decide to buy, sell or hold our ordinary shares. If any of the following risks actually occurs, our business, prospects, financial condition and results of operations could be materially harmed. Additional risks not presently known to us, or risks that do not seems significant today, may also impair our business operations in the future.

Risks Related to Our Business

We may not be able to continue as a going concern.

We have a history of net losses and there is a substantial doubt about our ability to continue as a going concern. We incurred an operating profit for the year ended June 30, 2013 of A$10.1 million (2012: A$6.2 million loss), with net cash used in operating activities of A$3.7 million (2012: A$4.9 million). At balance date, the current assets less current liability deficit was A$11.0 million (2012: A$6.0million surplus) and the net asset deficiency A$12.5 million (2012: A$24.4 million). The current asset deficiency is primarily due to convertible note due and payable in May 2014. The net asset deficiency is primarily as a result of the impairment of the majority of the refinery assets during the current and previous financial years (refer to note 5a).

At June 30, 2013, the Company has a current liability for the series three convertible notes of A$32.9 million (nominal value).As of October 30, 2012 A$7.5 million of the series three convertible notes were redeemed by the Company resulting in an outstanding debt obligation of A$25.4 million.

As announced to the market on the February25, 2013, a debt funding package was signed with SLW International, LLC (SLW) a substantial convertible note holder, to provide the Group with a US$5 million line of credit facility. As of October 30, 2013 the Company had fully settled all outstanding drawn funds and fully paid the interest and charges on this Facility.

The Directors believe that at the date of this report the Group has sufficient financial resources at June 30, 2013 to meet its committed financial liabilities.

The financial statements for the fiscal year ended June 30, 2013have been prepared on a going concern basis which has been assessed based on detailed cash flow forecasts extending out twelve months from the date of this financial report. The cash flow forecasts from operations are based on the forecast cash flows required to sustain the business and cash on hand at June 30,2013. The cash flow forecasts do not take into account any capital commitments as these are not foreseen to be payable within the forthcoming twelve months.

The ability of the Group to continue as a going concern in the ordinary course of business and to achieve the business growth strategies and objectives is dependent upon the ability of the Group to do a sufficient combination of the following things to enable its commitments to be met:

| · | Generate positive cash flows from operations. |

| · | Raise cash through sale of assets and recovery of receivables. |

| · | Reduce cash outflows through cost control measures. |

| · | Renegotiate the maturity date of the convertible notes. |

| · | Raise cash through the issue of further equity. |

| · | Increase debt facilities. |

The Directors consider that there are reasonable grounds to expect that the Group will be able to meet its commitments through the measures listed above, and accordingly have prepared the financial report on a going concern basis in the belief that the Group will realize its assets and settle its liabilities and commitments in the normal course of business and for at least the amounts stated in the financial report. However, should the Group not be successful in the matters discussed above, there is material uncertainty whether the Group will be able to continue as a going concern.

If we are unable to generate sufficient alternative revenue to offset the losses from our primary business, our business and financial condition will suffer a significant adverse effect.

Revenue from our business may not exceed our expenses and thus there is substantial risk that we will not be able to generate enough revenue to reverse our pattern of historical losses and negative cash flow, which would have a significant adverse effect on our business and financial condition.

We may not be able recover any funds from intercompany loans

The head company holds security over all material assets of the group in regards to all inter company loans. The company’s subsidiary’s may not be able to repay or service these intercompany loans, which would have a significant adverse effect on our business and financial condition.

Our substantial level of current debt could impair our ability to service our indebtedness, finance our operations and compete with less leveraged players in the industry.

We have substantial current indebtedness. As of June 30, 2013, we had total current indebtedness of A$31.1 million, including approximately A$27.4 million (accounting value) outstanding under our convertible notes which is due and payable in May 2014, and A$3.7 million of other debt. Our high level of indebtedness could have important consequences. For example, it could:

| · | make it more difficult for us to satisfy our indebtedness obligations under the convertible notes, exposing us to the risk of default, which could result in a foreclosure on our assets, which, in turn, would negatively affect our ability to operate as a going concern; |

| · | make it more difficult for us to satisfy our obligations under our other indebtedness; |

| · | require us to dedicate a substantial portion of our cash flow from operations to interest and principal payments on our indebtedness, reducing the availability of our cash flow for other purposes, such as capital expenditures, acquisitions, dividends and working capital; |

| · | limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; |

| · | increase our vulnerability to general adverse economic and industry conditions; |

| · | place us at a disadvantage compared to our competitors that have less debt; |

| · | limit our ability to pursue new strategies and business opportunities; |

| · | increase our cost of borrowing; and |

| · | limit our ability to borrow additional funds. |

We may not be able to generate sufficient cash to service our indebtedness and the terms of our indebtedness, as well as economic conditions, may prevent us from successfully refinancing.

Our ability to make scheduled payments on or to refinance our debt obligations depends on our future performance, which will be affected by financial, business and economic conditions and other factors. We will not be able to control many of these factors, such as economic conditions in the industry in which we operate and competitive pressures. Our cash flow may not be sufficient to allow us to pay principal and interest on our debt and to meet our other obligations. Any limitation on our ability to pay principal of, and interest on, the convertible notes would likely reduce the value of our ordinary shares. If our cash flows and capital resources are insufficient to fund our debt service obligation, including those obligations under our convertible notes, we may be forced to reduce or delay investments and capital expenditures, or to sell assets, seek additional capital or restructure or refinance our indebtedness, including the convertible notes. These alternative measures may not be successful and may not permit us to meet our scheduled debt service obligations. In addition, the terms of existing or future debt agreements, including our convertible notes, may restrict us from pursuing any of these alternatives.

If we do not meet certain EPA requirements under Renewable Fuels Standard 2 ("RFS2"), fuels produced from palm oil may not be able to generate retroactive Renewable Identification Numbers, or RINs, which are commercially necessary to supply biodiesel produced from palm oil into the United States, which would limit our market opportunity and jeopardize our near term financial viability.

Under the National Renewable Fuel Standard.Palm based biodiesel does not qualify as an approved biodiesel generate RINs. A RIN is a 38-character numeric code that is generated by the producer or importer of renewable fuel representing gallons of renewable fuel produced/imported and assigned to batches of renewable fuel that are transferred (change of ownership) to others. RINs are then turned into the EPA each year by petroleum refiners to prove that they have blended the required amount of renewable fuel under RFS2. Therefore, biodiesel that does not generate a RIN may have a very limited market in the U.S. If we are not able to meet these requirements, we may suffer a significant adverse effect on our business, financial performance and financial condition and could cause us to cease operations.

We may not be compliant under the European Renewable Energy Directive, our ability to sell palm-based biodiesel into the European Union will be significantly constrained and the results of our operations will be adversely impacted.

Under the Renewable Energy Directive, the entire pathway for palm based biodiesel including the suppliers of raw materials and the production pathway must be certified. Failure for our production facility to meet such certification or failure by our suppliers of palm oil feedstock to satisfy the Renewable Energy Directive could affect our ability to sell palm-based biodiesel into the European Union. The European Union has been and remains a key market for us. Any limitation on our ability to sell biodiesel into the European Union could have a significant adverse effect on our business, financial performance and financial condition.

The design and technology of our refineries may be unable to meet future biodiesel specifications and further capital expenditures may be required.

The specifications for biodiesel are continually evolving and are subject to further change. Further capital expenditures may be required to ensure that our refineries meet new specifications, adversely affecting our financial performance and financial position. There is also no assurance that the equipment and technology used in our capital improvements will achieve performance specifications. The failure of utilized equipment and technology in this regard may adversely affect our business.

The operation and maintenance of our refineries involve significant risks that could result in disruptions in production or reduced output.

The operations of our refineries are exposed to significant risks, including:

| · | failure of equipment or processes; |

| · | operator or maintenance errors; |

| · | extended and unscheduled interruptions to production; |

| · | damage to equipment and disaster whether arising from the actions or omissions by us or our employees or from external factors. |

There are operational hazards inherent in chemical manufacturing industries, such as fires, explosions, abnormal pressures, blowouts, pipeline ruptures, and transportation accidents. Some of these operational hazards may cause personal injury or loss of life, severe damage to or destruction of property and equipment or environmental damage, and may result in suspension or termination of operations and the imposition of civil or criminal penalties. In addition, our insurance may not be adequate to fully cover the potential operation hazards described above, and we may not be able to renew our insurance on commercially reasonable terms or at all. See “Item 3.D — Key Information — Risk Factors — Our insurance coverage may not be sufficient to cover our liability risks.”

If we are unable to generate profitable sales this will significantly reduce our revenues and harm our results of operations.

In 2013, our biofuel revenue was NIL due to the shut down of the refining operations in the prior financial year. Our historic revenue contracts have since expired and we cannot assure you that we will be able to source new customers and establish and maintain long-term relationships with such customers. As a result of our inability to find profitable sales contracts our refining operations are currently in care and maintenance. If we are unable to source new customers our revenues will be significantly reduced and could have a material adverse effect on our results of operations.

If we cannot find suitably qualified personnel to run our refineries we may be unable to deliver into sales contracts which may result in lost revenues and incurred costs.

The operation of our refineries requires suitably qualified personnel. With the current status of the refineries being in care and maintenance, the majority of personnel have been retrenched. The ability to restart the refineries may be affected by an inability to employ suitably trained staff.

If we cannot get the refineries to run successfully after being in care and maintenance.we may be unable to deliver into sales contracts which may result in lost revenues and incurred costs.

With the refineries being under care and maintenance, suchnon-operation may result in significant costly technical and mechanical delays if the decision were made to restart production.

An increase in cost or an interruption in the supply of our feedstock may inhibit production and adversely affect our financial performance.

The operation of our refineries is dependent on our ability to procure substantial quantities of suitable quality feedstock.

At this time, our refining operation is in care and maintenance and not operating. However, should we return to operations, the failure to procure a sufficient supply of raw materials satisfying our quality, quantity and cost requirements in a timely manner could impair our ability to produce our products or could increase our costs. Any interruption to the supply of suitable quality feedstock may result in disruptions in production or reduced output, which may materially and adversely affect our financial performance.

Additionally, our financial results are substantially dependent on the prices for our feedstock. A substantial increase in feedstock price relative to the value of our end products would adversely affect our financial performance. Although we may attempt to offset the effects of fluctuations in prices by entering into arrangements with our customers on a feedstock price plus contract basis through which we receive a predetermined margin over the price of the feedstock or by engaging in transactions that involve exchange-traded futures contracts (or other contractual arrangements securing future commodity prices), the amount and duration of these hedging and risk mitigation activities may vary substantially over time. These activities also involve substantial risks.

We have experienced and may in the future experience volatile capacity utilization which may adversely affect our results of operations.

We remain reliant on palm oil as a feedstock. If the price of palm oil is greater than the value of our biodiesel, which is generally priced relative to ultra low sulphur diesel (“ULSD”), we may not be able to profitably sell biodiesel into the immediate cash payment and delivery market. Our ability to supply palm-based biodiesel profitably is based on having positive margins where our input costs are lower than the value of our refined product. We are unable to influence the price of palm oil or the price of biodiesel. Resultantly, our biodiesel profitability is reliant on the existence of a positive spread between these two commodities. As we only operate when a positive operating margin exists, currently we have not been operational at anytime during the period, we have and expect to continue to have in the future erratic capacity utilization, which may adversely affect our results of operations.

We have suffered and may continue to suffer low capacity utilization if we are unable to secure term contracts.

Given the volatility of profit margins on biodiesel production due to fluctuations in commodity pricing for palm oil and the value of our finished product, we have not converted palm oil to biodiesel unless we have a committed contract customer willing to accept pricing based on our cost of purchasing feedstock and earning a positive margin from refining. Our refineries are currently shut down and we currently have no customers and have no visibility on our ability to attract customers. As such our refining operationshave been put on care and maintenance.

We have suffered and may continue to suffer low capacity utilization if we are unable to secure material volumes of biodiesel sales under the Malaysian Biodiesel mandate.

After numerous years discussing the possible implementation of a biodiesel blending mandate in Malaysia, the Malaysian Government introduced a scheme to mandate a 5% biodiesel blend into commercial diesel sales in the Central region of Malaysia. This scheme may grow or reduce depending on Government support. In addition the scheme was for a lower volume than previously communicated to Malaysian Biodiesel producers. Accordingly we secured relatively low volumes of biodiesel sales under this scheme. If the scheme is not extended, or cancelled altogether, or commercially viable quantities are not secured by us, this may adversely affect our results of operations.Due to insufficient and unprofitable sales volumes under this mandate, we terminated the arrangements to supply biodiesel and we currently have no biodiesel sales in Malaysia and have no visibility towards further sales in Malaysia.As such, our refining operationshave been put on care and maintenance.

We may be unable to perform under offtake agreement

The company may not be able to perform under any existing or new offtake agreements, given that its refinery is currently in care and maintenance. Additionally any changes in legislation in the local jurisdiction of the offtaker may prohibit such sales including in the United States where palm based biodiesel is not compliant with governmental regulations.

Our inability to meet margin calls on hedged positions would adversely affect our financial condition.

To maximize and protect the profitability of the offtake agreement, we may enter into hedging positions to protect against commodity risk. Upon entering the hedging positions and the inherent volatility in the commodity markets, we will likely be required to make margin call payments from time to time. Inability to meet such margin calls would adversely affect our financial condition and financial performance.

We may suffer losses due to sales of competing products that infringe on our intellectual property.

We rely on a combination of patents, trademarks, domain names and contractual rights to protect our intellectual property. We cannot assure you that the measures we take to protect our intellectual property rights will be sufficient to prevent any misappropriation of our intellectual property, or that our competitors will not independently develop alternative technologies that are equivalent or superior to technologies based on our intellectual property. In the event that the steps we have taken and the protection afforded by law do not adequately safeguard our proprietary technology, we could suffer losses due to the sales of competing products that exploit our intellectual property, and our profitability would be adversely affected.

If we are subject to claims of infringement of the intellectual property of others, the defense of these claims could drain our resources and any adverse determination could adversely impact or halt our biodiesel production.

Our biodiesel refineries include contracts with Axens for the supply of our proprietary systems, over which they have intellectual property that they have licensed to us. This intellectual property includes the operating procedures and technical schematics of our biodiesel refineries, which are required to operate and maintain the plants. The unauthorized use or Axens’ or our intellectual property or the infringement by us of another person’s intellectual property right may adversely affect our financial performance..

To the best of our knowledge, our patented process does not infringe any third party’s intellectual property rights. However, intellectual property rights are complex and there exists the risk that our process may infringe, or be alleged to infringe, another party’s intellectual property rights.

The defense and prosecution of intellectual property suits, patent opposition proceedings and related legal and administrative proceedings can be both costly and time consuming and may significantly divert the efforts and resources of our technical and management personnel. An adverse determination in any such litigation or proceedings to which we may become a party could subject us to significant liability to third parties, require us to seek licenses from third parties, to pay ongoing royalties, or to redesign our products or manufacturing processes or subject us to injunctions prohibiting the manufacture and sale of our products or the use of our technologies.

Any inability to obtain and maintain all the required licenses and permits related to our business and the resulting increased compliance costs may adversely affect our financial performance.

We are required to hold or obtain a number of licenses and permits, including environmental and those related to materials handling, in various jurisdictions in order to implement and operate our business. In particular our biodiesel refining operation in Malaysia holds a LembagaMinyakSawit Malaysia license (which allows for the buying, selling, movement and importation of palm oil products) and a Kementerian Perusahaan Perladangan&Komoditi license (which allows the production of biodiesel). The LembagaMinyakSawit Malaysia license is renewed annually and is currently valid. We have no reason to believe that this license will not be renewed, although renewal is not assured. The Kementerian Perusahaan Perladangan&Komoditi license is renewed every three years and is currently valid and we have no reason to believe that this license will not be renewed yearly, although renewal is not assured.

We are subject to environmental regulations, the compliance with which imposes substantial costs on us and the violation of which could result in penalties and other liabilities.

Laws dealing with protection of the environment provide for penalties and other liabilities for the violation of such laws and establish, in certain circumstances, obligations to remediate facilities and locations where operations are conducted. We may incur substantial costs in the future as part of our continued efforts to comply with these environmental laws and to avoid violations of them.

We may experience a significant chemical or biodiesel spill at our refineries or we may experience a chemical spill. If any of these events occur or if we otherwise fail to comply with the applicable environmental or other regulations, we could be subject to significant monetary damages and fines or suspensions of our operations, and our business reputation and profitability could be adversely affected.

Any amendments to the environmental laws could impose substantial pollution control measures that could require us to make significant expenditures to modify our production process or change the design of our products to limit actual or potential impact to the environment. Moreover, new laws, new interpretations of existing laws, increased governmental enforcement of environmental laws or other developments could require us to make significant additional expenditures, which may adversely affect our business, results of operations and financial condition.

Our insurance coverage may not be sufficient to cover our liability risks.

Our insurance arrangements may not adequately protect us against liability for all losses, including but not limited to environmental losses, property damage, public liability or losses arising from business interruption and product liability risk. Additionally, we may be unable to renew our existing insurance arrangements on commercially reasonable terms or at all. Should we be unable to maintain sufficient insurance coverage in the future or experience losses in excess of the scope of our insurance coverage, our financial performance could be adversely affected.

Changes in government policy could adversely affect our business.

Our refineries are located in Malaysia and possible sales of biodiesel sales may be in the United States and Europe. In addition, the equipment for our plants is imported from, and our products are sold in, various other countries. There is a risk that actions of a government in any of these countries may adversely affect our ability to implement and operate our business.

Government action or policy change in relation to access to lands and infrastructure, import and export regulations, environmental regulations, taxation, royalties and subsidies could adversely affect our operations and financial performance. In particular, upon significant changes in U.S. legislation, the renewable fuels standard or the biodiesel blenders excise tax credit, where palm based biodiesel is not compliant. Generally, however, a policy change in any of the jurisdictions in which we operate, or intend to operate, may inhibit our ability or the financial viability of our operations to export feedstock oil or the refined products that we market. This, in turn, could adversely affect our operations and financial performance.

Our financial performance may be adversely affected by fluctuations in exchange rates.

Our revenues and expenditures are potentially denominated in a number of currencies, including U.S. dollars, euros, Australian dollars, Indonesian rupiah,and Malaysian ringgit. Historically, we have experienced losses due to unhedged negative changes in exchange rate. Additionally, we have experienced foreign currency translation differences (which are held on our balance sheet in the foreign currency translation reserve) as a result of reporting consolidation of non-Australian subsidies. We have limited foreign currency hedging arrangements in place. As a result, our financial performance may be adversely affected by fluctuations in exchange rates.

We may be unable to recover our investment in our Indonesian palm oleochemical joint venture project.

We terminated our Indonesian joint venture project given material breaches in obligations by the joint venture partner. Under the terms of our Joint Venture Agreement upon termination for breach of obligations the breaching party must acquire all shares of the non-breaching party at the greater value of the initial investment being US$2.8 million of the market value of the shares. The valuation of the shares is in dispute and the matter has been referred to Indonesian Arbitration. The company can provide no assurances that it will be able to recover the original investment amount or an amount greater than our invested capital nor the timing thereof.

Risks Related to Our Strategy

We may not be able to restart refining operations.

The refining operations are currently held in care and maintenance. Should profitable opportunities present themselves there can be no assurance that theCompany would be able to restart refining operations. Further the Company can make no assurances as to its ability or cost thereof to attract necessary staff, obtain working capital lines and re-commission the equipment.

We may be unable to settle the loan raised to fund our operations in India

In April 2013, the Company announced that it had secured a short term financing facility to meet operating costs in India. The lenders required that the equity in the Indian Subsidiary, Mission Biofuels India PL, be held as security in the event that the group does not repay the facility. As at the date of this report the loan is in default and we are working with the lender on a settlement arrangement.If we are unable to negotiate a settlement the lender has the right to enforce their collateral position being security held over all shares in the Indian subsidiary. If this right is enforced we would have no further business interests in India.

We have terminated our joint venture in Indonesia following our joint venture partners breach of material obligations. If we are unable to resolve the dispute we may suffer substantial financial loss.

The Indonesian Joint Venture settlement is in Indonesian arbitration following the breach by the joint venture partner to perform material obligations. If the joint venture partners are unable to determine a way forward the Company may be materially adversely financially effected. The Company can provide no assurances that it will receive adequate compensation following the termination.

We may be unable to sell our assets for fair market value or sell them at all.

If the Company sells its assets, it may not be able to realize its original investment, nor an amount greater than the current debt obligations of the Company and as such upon the sale of its assets can provide no assurance as to the realization of proceeds for the Company or shareholders. Under the sale agreement of the 100,000 tpa refinery the company entered into a right of first refusal with Felda Global Ventures (FGV) to purchase the second biodiesel refinery that expires on 7 Jan 2014. During this time the presence of such a right of first refusal may inhibit the companies efforts to sell its refinery to a third party. The existence of the right of first refusal can provide no assurance as to the intent of FGV to acquire the second refinery.

We may be unable to continue our business in renewable energy or any other Industry.

If the Company sells all its assets, the company may not be able to find suitable projects to continue business in the renewable sector. If this is the case the company may require shareholder approval to change the Groups strategic direction, may not qualify for ASX listing and may not have sufficient capital beyond settling its obligations to launch any new business activities.

Our future growth will depend on our ability to establish and maintain strategic relationships with distributors and feedstock suppliers.

Our future growth depends on our ability to establish and maintain relationships with third parties, including distributors and feedstock suppliers. We may not be able to establish strategic relationships with third parties on terms satisfactory to us or at all, and any arrangements that we enter into may not result in the type of collaborative relationship with the third party that we are seeking. Further, these third parties may not place sufficient importance on their relationship with us and may not perform their obligations as agreed. Any failure to develop and maintain satisfactory relationships with distributors and feedstock suppliers would have a material adverse effect on our business.

We currently are not generating revenue from operations and thus we may be unable to fund our operational and capital requirements and service our existing indebtedness and we may be unable to obtain adequate financing on favorable terms to meet these needs.

We currently expect that our cash flow will be used to fund operating losses and capital expenditures. Should we become operational we would also require substantial working capital. Additionally, as of the date of this annual report we are required to repay approximately A$25.4million to redeem our outstanding convertible notes in May 2014. We cannot assure you that we will be successful in generating sufficient revenue and we may require financing to meet our needs.

Our ability to access to equity and debt capital and trade financing on favorable terms may be limited by factors such as:

| · | general economic and market conditions; |

| · | conditions in energy markets; |

| · | credit availability from banks or other lenders for us and our industry peers; |

| · | investor confidence in the industry; |

| · | the operation of our refineries; |

| · | our financial performance; and |

| · | our levels of indebtedness. |

Our ability to access equity capital is limited without shareholder approval and we may be unable to obtain the required shareholder approval to obtain financing in future equity offerings.

Our ability to access equity capital is also limited by ASX Listing Rule 7.1, which provides that a company must not, subject to specified exceptions (including approval by shareholders), issue or agree to issue during any 12-month period any equity securities, or other securities with rights to conversion to equity, if the number of those securities exceeds 25% of the number of securities in the same class on issue at the commencement of that 12-month period. Our ability to issue shares in certain subsequent offerings will be restricted by this 25% annual placement capacity to the extent that we are unable to obtain shareholder approval of the offerings.

Risks Related to Our Industry

A decline in the price of diesel or other fuel sources or an increase in their supply could constrain the selling price of our biodiesel.

Biodiesel prices are influenced by market prices for petroleum diesel, the pricing of which is affected by global and domestic market prices for crude oil. The pricing of petroleum diesel is also subject to typical market movements and decreases when there is an increase in supply in the face of unchanged or decreased demand. To remain competitive, the price of biodiesel tends to decrease as the price of petroleum diesel decreases. As a result, any decline in petroleum prices will likely lead to lower prices for biodiesel. If the price of our inputs, such as palm oil feedstock, is greater than the price of our biodiesel in the market, we will be unable to make profitable sales and we would halt production. We did not operate our refinery for twelve months in fiscal 2013,six months in fiscal 2012, nine months infiscal 2011, nine months in fiscal 2010 and five months in fiscal 2009 due to negative spreads that existed between the potential sales price of biodiesel and the input costs to produce the biodiesel. Declines in the pricing of our biodiesel relative to the cost of the inputs for production may cause us to continue the halt in production in the future which may materially and adversely affect our performance.

The biodiesel industry is a new industry and its continued development is subject to a number of risks and obstacles.

Our primary product is biodiesel. The global biodiesel industry is at an early stage of development and acceptance as compared to petroleum-based fuels. Biodiesel has experienced significant fluctuations in growth during that last five years and demand for biodiesel as our primary product may not grow as rapidly as expected or at all. Biodiesel and the global biodiesel industry, as a whole, also face a number of obstacles and drawbacks, including:

| · | gelling at lower temperatures than petroleum diesel, which can require the use of low percentage biodiesel blends in colder climates or the use of heated fuel tanks; |

| · | potential water contamination that can complicate handling and long-term storage; |

| · | reluctance on the part of some auto manufacturers and industry groups to endorse biodiesel and their recommendations against the use of biodiesel or high percentage biodiesel blends; |

| · | potentially reduced fuel economy due to the lower energy content of biodiesel as compared with petroleum diesel; and |

| · | potentially impaired growth due to a lack of infrastructure such as dedicated rail tanker cars and truck fleets, sufficient storage facilities, and refining and blending facilities. |

Delayed market acceptance of our products may adversely affect our pricing and profitability. The lack of infrastructure to store, ship and distribute our products may also increase our logistical costs and diminish our profitability.

We may be subjected to new or amended standards for biodiesel from time to time and required to modify our production process or procure alternate or additional feedstock.

New standards may be introduced and existing standards may be amended or repealed from time to time. The production of biodiesel that meets stringent quality standards is complex. Concerns about fuel quality may impact our ability to successfully market and sell our biodiesel. If we are unable to produce biodiesel that meets the industry quality standard, our credibility and the market acceptance and sales of our biodiesel could be negatively affected. In addition, actual or perceived problems with quality control in the industry generally may lead to a lack of consumer confidence in biodiesel. This could result in a decrease in demand or mandates for biodiesel, with a resulting decrease in revenue.

A change to the quality standards for biodiesel in any market in which we sell biodiesel may require us to modify our production process or procure alternate or additional feedstock, which may affect our revenue and expenditure and adversely affect our results of operations..

We face significant competition from existing and new competitors as well as competing technologies and other clean energy sources.

Our primary product is a substitute for mineral diesel and a global commodity and as such is highly cost competitive. There are already many global producers of biodiesel with which we currently compete. While these existing competitors are limited by installed refining capacity, we would expect further new entrants into the market if economic opportunities present themselves thereby increasing competition. In addition to existing and new direct competitors, as a relatively new industry with distribution channels still in the development stage, market forces may limit our access to end markets or make our costs of delivering product to end-users uncompetitive. Our future financial performance and earnings growth may be adversely affected if either of the above occurs.

In addition, new technologies may be developed or implemented for alternative energy sources and products that use such energy sources. Advances in the development of fuels other than biodiesel, or the development of products that use energy sources other than diesel, such as gasoline hybrid vehicles and plug-in electric vehicles, could significantly reduce demand for biodiesel and thus affect our sales. Biodiesel also faces competition from fuel additives that help petroleum diesel burn cleaner and therefore reduce the comparative environmental benefits of biodiesel in relation to petroleum diesel.

Other clean energy sources such as liquefied petroleum gas, hydrogen and electricity from clean sources may be more cost-effective to produce, store, distribute or use, more environmentally friendly, or otherwise more successfully developed for commercial production than our products. These other energy sources may also receive greater government support than our products in the form of subsidies, incentives or minimum use requirements. As a result, demand for our products may decline and our business model may no longer be viable and our results of operations and financial condition may be materially adversely affected. The introduction, increase in the availability or reduction in costs of alternative energy sources may materially and adversely affect the demand for our products and our financial performance.

Any increase in competition arising from an increase in the number or size of competitors or from competing technologies or other clean energy sources may result in price reductions, reduced gross profit margins, loss of our market share and departure of key management, any of which could adversely affect our financial condition and profitability.

Risks Related to Our Ordinary Shares

Unless an active trading market develops for our securities, you may not be able to sell your ordinary shares.

Our ordinary shares were delisted from trading on The NASDAQ Global Market effective July 9, 2012 and currently trade on the OTC Bulletin Board under the symbol “MNELF” and on the Australian Stock Exchange under the symbol “MBT.” Although we are a reporting company, currently there is only a limited trading market for our ordinary shares and a more active trading market may never develop or, if it does develop, may not be maintained. Failure to develop or maintain an active trading market will have a generally negative effect on the price of our ordinary shares, and you may be unable to sell your ordinary shares or any attempted sale of such ordinary shares may have the effect of lowering the market price and therefore your investment could be a partial or complete loss.

As a foreign private issuer, we follow certain home country corporate governance practices which may afford less protection to holders of our ordinary shares.

As a foreign private issuer, we are permitted to follow certain home country corporate governance practices. As a company incorporated in Australia and listed on the Australian Securities Exchange, or ASX, we expect to follow our home country practice with respect to the composition of our board of directors and nominations committee and executive sessions. The corporate governance practice and requirements in Australia do not require us as to have a majority of our board of directors to be independent, do not require us to establish a nominations committee, and do not require us to hold regular executive sessions where only independent directors shall be present. Such Australian home country practices may afford less protection to holders of our ordinary shares.

We may be classified as a passive foreign investment company, which could result in adverse U.S. federal income tax consequences to U.S. holders of our ordinary shares.

We do not expect to be a passive foreign investment company, or PFIC, for U.S. federal income tax purposes for our current fiscal year ending June 30, 2013. However, we must make a separate determination each fiscal year as to whether we are a PFIC (after the close of each taxable year). Accordingly, we cannot assure you that we will not be a PFIC for our current taxable year ending June 30, 2013or any future fiscal year. A non-U.S. corporation will be considered a PFIC for any fiscal year if either (1) at least 75% of its gross income is passive income or (2) at least 50% of the value of its assets (based on an average of the quarterly values of the assets during the fiscal year) is attributable to assets that produce or are held for the production of passive income. Because the value of our assets for purposes of the PFIC test will generally be determined by reference to the market price of our ordinary shares, fluctuations in the market price of the ordinary shares may cause us to become a PFIC. In addition, changes in the composition of our income or assets may cause us to become a PFIC. If we are a PFIC for any fiscal year during which a U.S. holder (as defined in “Item 10.E - Additional Information Taxation — U.S. Federal Income Tax Considerations”) holds an ordinary share, certain adverse U.S. federal income tax consequences could apply to such U.S. holder. See “Item 10.E - Additional Information Taxation — U.S. Federal Income Tax Considerations — Passive Foreign Investment Company Considerations.”

Currency fluctuations may adversely affect the price of our ordinary shares.

Our ordinary shares are quoted in Australian dollars on the ASX and in U.S. dollars on the OTC Bulletin Board. Movements in the Australian dollar/U.S. dollar exchange rate may adversely affect the U.S. dollar price of our ordinary shares. In the past year the Australian dollar has generally appreciated against the U.S. dollar. Any continuation of this trend may positively affect the U.S. dollar price of our ordinary shares, even if the price of our ordinary shares in Australian dollars increases or remains unchanged. However, this trend may not continue and may be reversed. If the Australian dollar weakens against the U.S. dollar, the U.S. dollar price of the ordinary shares could decline, even if the price of our ordinary shares in Australian dollars increases or remains unchanged.

Risks Relating to Takeovers

Australian takeovers laws may discourage takeover offers being made for us or may discourage the acquisition of large numbers of our ordinary shares.

We are incorporated in Australia and are subject to the takeovers laws of Australia. Among other things, we are subject to the Australian Corporations Act 2001, or the Corporations Act. Subject to a range of exceptions, the Corporations Act prohibits the acquisition of a direct or indirect interest in our issued voting shares if the acquisition of that interest will lead to a person’s voting power in us increasing from 20% or below to more than 20%, or increasing from a starting point that is above 20% and below 90%. Australian takeovers laws may discourage takeover offers being made for us or may discourage the acquisition of large numbers of our ordinary shares. This may have the ancillary effect of entrenching our board of directors and may deprive or limit our shareholders’ strategic opportunities to sell their ordinary shares and may restrict the ability of our shareholders to obtain a premium from such transactions.

Our Constitution and other Australian laws and regulations applicable to us may adversely affect our ability to take actions that could be beneficial to our shareholders.

As an Australian company we are subject to different corporate requirements than a corporation organized under the laws of the United States. Our Constitution, as well as the Corporations Act, set forth various rights and obligations that are unique to us as an Australian company. These requirements operate differently than from many U.S. companies and may limit or otherwise adversely affect our ability to take actions that could be beneficial to our shareholders. For more information, you should carefully review the summary of these matters set forth under the section entitled, “Item 10.B — Additional Information — Memorandum and Articles of Association” as well as our Constitution.

Item 4. Information on the Company

| A. | History and Development of the Company. |

Our legal and commercial name is Mission NewEnergy Limited, which was incorporated in Western Australia under the laws of Australia (specifically, the Australian Corporations Act) in November 2005. We are an Australian public company, limited by shares.

In May 2006, we conducted an initial public offering in Australia, raising A$27.0 million, and listed on the Australian Securities Exchange.

In August 2006, we commenced construction of our first biodiesel refinery with a 100,000 tonnes (30 million gallons) per year nameplate capacity at an industrial hub in Port Kuantan, Malaysia along the eastern coast of Malaysia.

In early calendar 2007, we commenced non-food biodiesel feedstock cultivation operations in India. We focused on the cultivation of JatrophaCurcas, or Jatropha, an inedible, low cost dedicated energy crop with the intention to become self-sufficient with respect to our feedstock supply and not in competition with the food supply.

In April 2007, recognizing the need to scale up both our feedstock cultivation and biodiesel production operations, we completed a convertible note offering and raised A$65.0 million in new capital. These funds were raised to fund the expansion of our feedstock cultivation operations in India and the construction of a second larger biodiesel refinery in Port Kuantan with a 250,000 tonnes (75 million gallons) per year nameplate capacity.

In mid-2008, we commenced commercial operations of our first biodiesel refinery, using locally sourced palm oil as feedstock.

Since January 2009, we have raised approximately A$35.1 million in equity capital from institutional investors in private placements to complete the funding requirement for our second biodiesel refinery and provide working capital.

In December 2009, we entered into a long term biodiesel offtake agreement with Valero.

In mid-2010, we received our first commercial quantities of Jatropha oil from our feedstock cultivation operations.

Also in mid-2010, we commissioned our second biodiesel trans-esterification refinery with a 250,000 tonnes (75 million gallons) per year nameplate capacity.

In April 2011, we conducted our initial public offering in the U.S., raising U.S. $25.1 million, and listed on the NASDAQ Global Market.

On January 27, 2012, the Company launched a major re-structure including a reduction in operating expenditure on all fronts, divestment of non-core assets and efforts to raise additional capital. At the same time,the Company announced that it would cease planting further Jatropha acreage and dramatically downscale its field operations.

On February20, 2012, the Company announced a major initiative with the acquisition of 85% of Oleovest, a special purpose company with a 70% interest in a Joint Venture with PTPN111 (a state owned major palm oil plantation company) to set up a downstream palm oil and oleo-chemical complex in Indonesia.

On May4, 2012, the Company announced the final production runs in its Malaysian refining operation. The refining assets have been put in care and maintenance.

On the July4, 2012, the Company’s ordinary shares were formally delisted from trading on the NASDAQ Global Market.

On July11, 2012, the Company announced that due to failure of material obligations by PTPN111, it had terminated its Joint Venture in Indonesia.

On October 8, 2012, the Company announced that a placement of approximately 15% of its outstanding equity raising approximately US$100,000 before placement costs.

On October 19, 2012, the Company announced that its Indian operations had been significantly downsized and that the Company was focused on divesting its remaining Indian assets.

On November23, 2012, the Company announced that it had successfully completed a substantial restructuring of the convertible notes, with the key changes being the elimination of the 4% pa cash coupon and a change in the conversion ratio from 1:4 to 1:433 ordinary shares.

On February25, 2013, the Company announced that it had secured a US$5million working capital facility, which is to be used to fund the business through the completion of the Company re-structure.

On 17 April 2013, the Company secured a short term financing facility to meet operating costs in India.

On October 11, 2013, the Company completed the sale of its 100,000 tpa refinery to Felda Global Group for US$11.5 million.

As at the date of this report the India working capital loan is in default and we are working with the lender on a settlement arrangement. If we are unable to negotiate a settlement the lender has the right to enforce their collateral position being security held over all shares in the Indian subsidiary.

We have incurred the following capital expenditures over the last three fiscal years:

| | | 2013

A$’000 | | | 2012

A$'000 | | | 2011

A$'000 | |

| Biodiesel refineries | | | 45 | | | | 765 | | | | 2,981 | |

| Land & buildings | | | - | | | | - | | | | - | |

| IT systems & office equipment | | | 5 | | | | 68 | | | | 182 | |

| Vehicles & sundry equipment | | | - | | | | - | | | | - | |

During the 2013 financial year, Mission’s principle capital expenditure primarily relatedto minor capital expenditures at Mission’s refineries.

Our principal office is located at Unit B2, 431 Roberts Rd, Subiaco, Western Australia 6008 Australia. Our telephone number is +61-8-6313-3975. Our website address is www.missionnewenergy.com. Information on our website and websites linked to it do not constitute part of this annual report.

Recent Developments

The Company is not operating its biodiesel refining segment. The 250,000 tpa refinery is being held in care and maintenance either awaiting a return to positive operating conditions or sale.As part of the ongoing overall Company restructure the Company has sold the 100,000 tpa refinery. As at the date of this report the company’s Indian subsidiary working capital loan is in default and we are working with the lender on a settlement arrangement, if we are unable to negotiate a settlement the lender has the right to enforce their collateral position being security held over all shares in the Indian subsidiary resulting in us having no further business interests in India.

Settlement of the Company’s terminated Indonesian Joint Venture project has been referred to arbitration in Indonesia following a dispute between the former Joint Venture partners over the settlement following the Joint Venture termination. Failing mediation as at the date of this report the arbitration proceedings have moved from mediation to formal hearing.

Overview

Mission NewEnergy is a producer of biodiesel and wholesale biodiesel distribution focused on the government mandated markets of the United States, Europe and Malaysia.

We own atransesterificationrefinery that converts feedstock oil to biodiesel located at Port Kuantan, Malaysia, which has a nameplate capacity of 75 million gallons-per-year. The transesterification process utilized at this facility incorporates leading proprietary technology that allows us to produce biodiesel simultaneously from multiple feedstocks, allowing us to shift in and out of different feedstocks based on feedstock supply, customer demand and market cost dynamics..The transesterification and pre-treatment unit is yet to be handed over to us by the EPCC contractor. As further discussed below, our refinery uses highly efficient second-generation transesterification technology. Our production facility in Kuantan is connected by two-way pipelines to a dedicated jetty 200 meters away at an all-weather, deep sea, international port.Our refinery iscurrently non-operational and being held in care and maintenance.

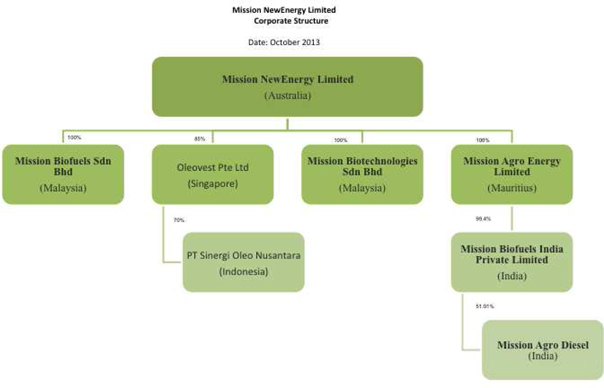

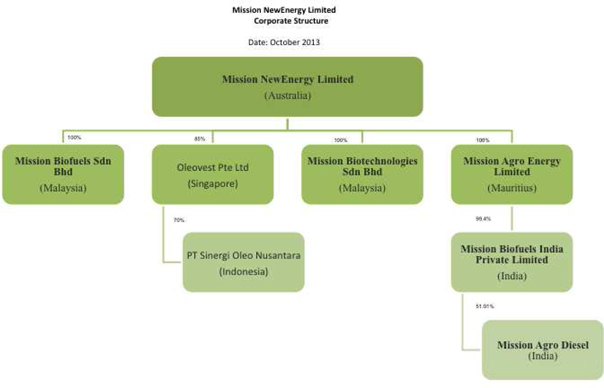

The Company also owns an 85% stake in OleovestPte Ltd, a company incorporated in Singapore.Oleovest is a special purpose company which has a 70% equity stake in PT Sinergi Oleo Nusantara (“PTSON”), a newly formed joint venture company in Indonesia which is 30% owned by PT Perkebunan Nusantara III (“PTPN III”).Under the Joint Venture Agreement, PTSON was toestablish a new downstream palm oil and oleo-chemical complex at the PTPN III owned SeiMangkei Industrial Zone in North Sumatra, which in the first stage wasexpected to consist of a 600,000 tpa edible oil refinery, a 250,000 tpa Methyl Ester (“biodiesel”) plant and a 100,000 tpa Fatty Alcohol plant. The project had anan estimated cost of US$200 million cost of construction.

Due to failure of material obligations by PTPN111, the Joint Venture in Indonesia was terminated in July 2012. The Company has taken this matter to Arbitration in Indonesia and expects that this will result in the sale of its equity interests, which are to valued at the greater of the invested value US$2.8 million or the market value of the equity interest in the Joint Venture.

Our Competitive Strengths

We believe that the following strengths enable us to compete successfully in the biofuels industry:

Established Refining Operations

Should the market condition for biodiesel production become profitable, we believe our established operations will allow the Company to react faster than competitors that either need to build or acquire refining assets..

Second Generation Transesterification Technology

Our refinery based on Axen’s technology makes it potentially an attractive technology for certain retrofit bolt on technology providers. Should such technology providers emerge the Company may be well positioned as partner thereby enabling it to operate its refining asset in a beneficial manor.

Our Strategies

The Company is focused on maximizing shareholder value through operation or divestment of assets.

Malaysian Asset