As filed with the Securities and Exchange Commission on June 7, 2012

Registration No. 333-_______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

Mercedes-Benz Auto Receivables Trusts

(Issuing Entities)

Daimler Retail Receivables LLC

(Depositor for the Issuing Entities described herein)

(Exact name of registrant as specified in its charter)

Delaware | 95-3477910 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

36455 Corporate Drive

Farmington Hills, Michigan 48331

(248) 991-6700

(Address of registrant’s principal executive office)

Steven C. Poling, Esq.

Daimler Retail Receivables LLC

36455 Corporate Drive

Farmington Hills, Michigan 48331

(248) 991-6632

(Name and address of agent for service)

Copy to:

Dale W. Lum, Esq.

Sidley Austin llp

555 California Street

San Francisco, California 94104

(415) 772-1200

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement as determined by market conditions.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.o

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. o

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer x | Smaller reporting company o |

(Do not check if a smaller reporting company)

CALCULATION OF REGISTRATION FEE

| Title of Securities to be Registered | Amount to be Registered | Proposed Maximum Aggregate Price Per Unit(1) | Proposed Maximum Aggregate Offering Price(1) | Amount of Registration Fee |

| Asset Backed Notes | $1,000,000 | 100% | $1,000,000 | $114.60 |

| (1) | Estimated solely for the purpose of calculating the registration fee. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant files a further amendment that specifically states that this Registration Statement will thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement becomes effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus supplement is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus supplement and the attached prospectus are not an offer to sell these securities and they are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION

PRELIMINARY PROSPECTUS SUPPLEMENT, DATED [______]

PROSPECTUS SUPPLEMENT

(To Prospectus dated [____] [__], 201[_])

$[______________]

Mercedes-Benz Auto Receivables Trust 201[_]-[_]

Issuing Entity

$[_________] [______%] Class A-1 Asset Backed Notes

$[_________] [Floating Rate] Class A-2 Asset Backed Notes

$[_________] [______%] Class A-3 Asset Backed Notes

$[_________] [______%] Class A-4 Asset Backed Notes

$[_________] [______%] Class B Asset Backed Notes

Daimler Retail Receivables LLC Depositor | Mercedes-Benz Financial Services USA LLC Sponsor and Servicer |

The underwriters are offering the following classes of Notes pursuant to this prospectus supplement:

Price to Public | Underwriting Discounts and Commissions | Net Proceeds to the Depositor(1) | ||||||

| Class A-1 Asset Backed Notes | $_________ | (___%) | $_________ | (___%) | $_________ | (___%) | ||

| Class A-2 Asset Backed Notes | $_________ | (___%) | $_________ | (___%) | $_________ | (___%) | ||

| Class A-3 Asset Backed Notes | $_________ | (___%) | $_________ | (___%) | $_________ | (___%) | ||

| Class A-4 Asset Backed Notes | $_________ | (___%) | $_________ | (___%) | $_________ | (___%) | ||

| Class B Asset Backed Notes | $_________ | (___%) | $_________ | (___%) | $_________ | (___%) | ||

| Total | $_________ | $_________ | $_________ | |||||

| (1) | The net proceeds to the Depositor exclude expenses, estimated at $_______. |

The price of the Notes will also include accrued interest, if any, from the date of initial issuance. Distributions on the Notes will generally be made monthly on the [__]th day of each month or, if not a business day, on the next business day, beginning [____] [__], 201[_]. The main sources for payment of the Notes are a pool of motor vehicle receivables, certain payments under the receivables[, payments under an interest rate hedge agreement] and monies on deposit in a reserve fund as described herein. Credit enhancement will consist of overcollateralization, excess interest collections on the receivables, a reserve fund and, in the case of the Class A Notes, the subordination of the Class B Notes.

The Notes will represent obligations of the Issuing Entity only and will not represent obligations of Daimler Retail Receivables LLC, Mercedes-Benz Financial Services USA LLC or any of their respective affiliates.

Consider carefully the Risk Factors beginning on page S-13 of this prospectus supplement and on page 8 of the prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS SUPPLEMENT OR THE PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Delivery of the Notes, in book-entry form only, will be made through The Depository Trust Company against payment in immediately available funds, on or about [____] [__], 201[_].

Joint Bookrunners

| [______] | [______] | [______] |

Co-Managers

| [______] | [______] |

The date of this Prospectus Supplement is [____] , 201[_].

Table of Contents

Page

S-2

We provide information on the Notes in two documents that offer varying levels of detail:

Prospectus—provides general information, some of which may not apply to the Notes.

Prospectus Supplement—provides a summary of the specific terms of the Notes.

We suggest you read this prospectus supplement and the prospectus in their entirety. The prospectus supplement pages begin with “S-”.

We include cross-references to sections in these documents where you can find further related discussions. Refer to the Table of Contents in this prospectus supplement and in the prospectus to locate the referenced sections.

You should rely only on information on the Notes provided in this prospectus supplement and the prospectus. Neither we nor the underwriters have authorized anyone to provide you with different information. We and the underwriters are making offers to sell the Notes only in places where offers and sales are permitted.

Capitalized terms used in this prospectus supplement are defined in the “Glossary of Terms” in this prospectus supplement and, if not defined therein, in the “Glossary of Terms” in the prospectus.

S-3

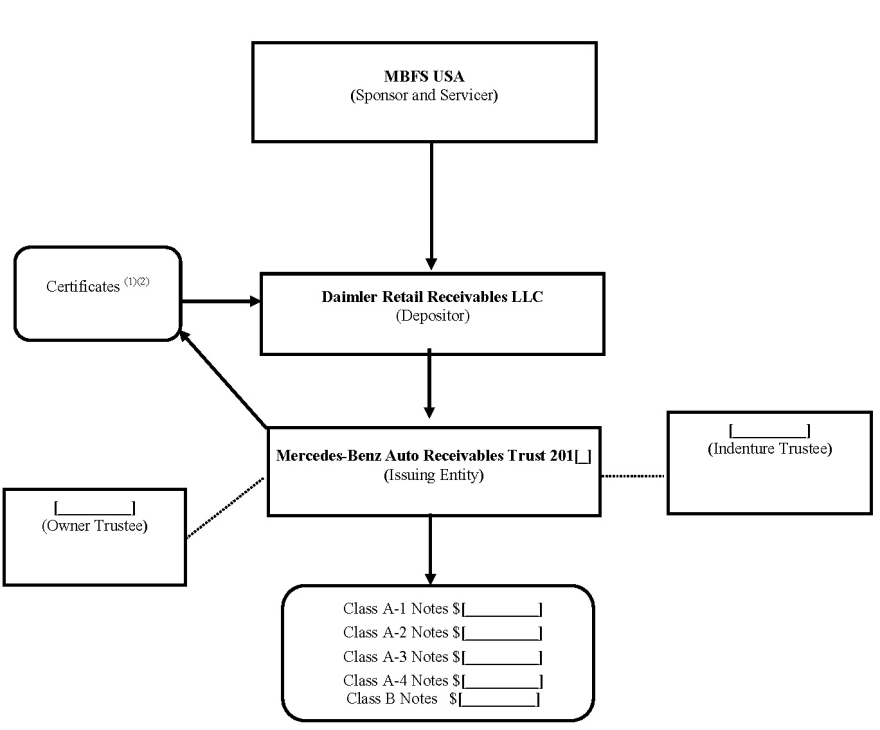

| (1) | The certificates do not have a principal balance. |

| (2) | Not being offered by this prospectus supplement. |

S-4

This summary describes the main terms of the offering of the notes. This summary does not contain all of the information that may be important to you. To fully understand the terms of the offering of the notes, you will need to read both this prospectus supplement and the prospectus in their entirety.

Principal Parties

Issuing Entity

Mercedes-Benz Auto Receivables Trust 201[_]-[_] will be governed by an amended and restated trust agreement, dated as of [____] [__], 201[_], between the depositor and the owner trustee. The issuing entity will issue the notes and the certificates to the depositor as consideration for the transfer by the depositor to the issuing entity of a pool of receivables consisting of motor vehicle installment sales contracts and installment loans that the depositor purchased from Mercedes-Benz Financial Services USA LLC. The issuing entity will rely upon collections on the receivables and the funds on deposit in certain accounts to make payments on the notes. The issuing entity will be solely liable for the payment of the notes.

The notes will be obligations of the issuing entity secured by the assets of the issuing entity. The notes will not represent obligations of Daimler Retail Receivables LLC, Mercedes-Benz Financial Services USA LLC or any of their respective affiliates.

Sponsor, Servicer and Administrator

Mercedes-Benz Financial Services USA LLC

Depositor

Daimler Retail Receivables LLC, a wholly owned subsidiary of Mercedes-Benz Financial Services USA LLC.

Owner Trustee

[______________] will act as owner trustee of the issuing entity.

Indenture Trustee

[______________] will act as indenture trustee with respect to the notes.

[Interest Rate Hedge Provider]

[______________].

Terms of the Securities

The Notes

The following classes of notes, sometimes referred to herein as the class A notes, are being offered pursuant to this prospectus supplement:

Note Class | Aggregate Principal Amount | Interest Rate Per Annum | Final Scheduled Distribution Date | |||

A-1 | $[_________] | [______%] | [_________] | |||

A-2 | $[_________] | [One- Month LIBOR] [plus __%] | [_________] | |||

A-3 | $[_________] | [______%] | [_________] | |||

A-4 | $[_________] | [______%] | [_________] | |||

B | $[_________] | [______%] | [_________] |

The notes will bear interest at the rates set forth above and interest will be calculated in the manner described below under “Interest Accrual”. The class A-1, class A-2, class A-3 and class A-4 notes are sometimes referred to herein as the “class A notes”.

The notes will be issued in book-entry form in minimum denominations of $[________] and integral multiples of $[________] in excess thereof.

The Certificates

The issuing entity will issue Mercedes-Benz Auto Receivables Trust 201[_]-[_] certificates to the depositor. The certificates are not being offered by this prospectus supplement. The certificates will not have a principal balance and will not bear interest. All distributions in respect of the certificates will be subordinated to payments on the notes.

Important Dates

Cutoff Date

The cutoff date with respect to the receivables transferred to the issuing entity on the closing date will be the close of business on [____] [__], 201[_].

Unless otherwise indicated, the statistical information presented in this prospectus supplement is presented as of the cutoff date.

S-5

Closing Date

The closing date will be on or about [____] [__], 201[_].

Distribution Dates

The [___]th day of each month (or, if the [___]th day is not a business day, the next succeeding business day). The first distribution date will be [____] [__], 201[_].

Record Dates

On each distribution date, the issuing entity will make payments to the holders of the notes as of the related record date. The record date will be the business day immediately preceding such distribution date or, if the notes have been issued in fully registered, certificated form, the last business day of the preceding month.

Interest Rates

The issuing entity will pay interest on each class of notes at the respective fixed or floating per annum rate specified above under “Terms of the Securities—The Notes”. [The Class A-1 notes, Class A-3 notes, Class A-4 notes and Class B notes] will be “fixed rate notes” and the [Class A-2 notes] will be “floating rate notes”.

Interest Accrual

[Class A-1 Notes and Class A-2 Notes]

“Actual/360”, accrued from and including the prior distribution date (or from and including the closing date, in the case of the first distribution date) to but excluding the current distribution date.

[Class A-3 Notes, Class A-4 Notes and Class B notes]

“30/360”, accrued from and including the [___]th day of the prior calendar month (or from and including the closing date, in the case of the first distribution date) to but excluding the [___]th day of the current calendar month (assuming each month has 30 days).

Interest Payments

On each distribution date, to the extent that funds are available, the noteholders of each class will receive accrued interest at the interest rate for that class. Interest payments on each class of notes will have the same priority. Interest accrued but not paid on any distribution date will be due on the immediately succeeding distribution date, together with, to the extent permitted by applicable law, interest on that unpaid interest at the related interest rate.

If the notes are accelerated following the occurrence of an event of default under the indenture, trustees’ fees and expenses will be payable in an unlimited amount prior to the payment of interest on the notes as described under “Description of the Notes—Priority of Distributions Will Change if the Notes Are Accelerated Following an Event of Default”.

For a more detailed description of the payment of interest, see “Description of the Notes—Payments of Interest” and “—Priority of Distributions Will Change if the Notes Are Accelerated Following an Event of Default”.

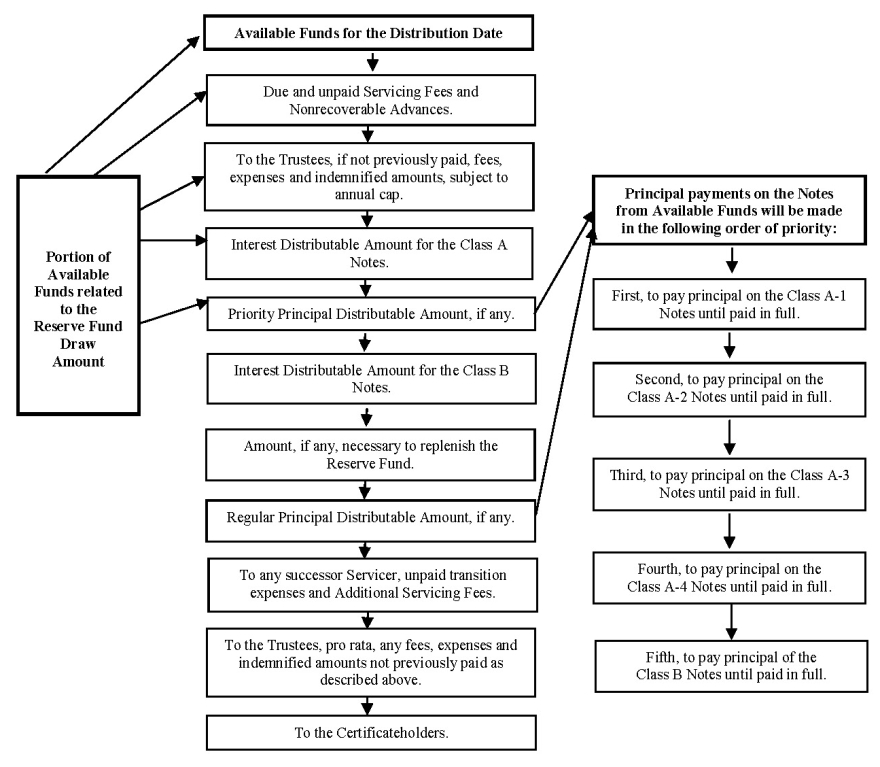

Principal Payments

On each distribution date, from the amounts allocated to the holders of the notes to pay principal described in clauses (4) and (7) under “Priority of Distributions”, the issuing entity will pay principal of the notes in the following order of priority:

| (1) | to the class A-1 notes until they have been paid in full; |

| (2) | to the class A-2 notes until they have been paid in full; |

| (3) | to the class A-3 notes until they have been paid in full; |

| (4) | to the class A-4 notes until they have been paid in full; and |

| (5) | to the class B notes until they have been paid in full. |

If a distribution date is a final scheduled distribution date for one or more classes of notes, as specified above under “Terms of the Securities—The Notes”, all principal and interest with respect to such class of notes will be payable in full (if not previously paid).

If the notes are accelerated following the occurrence of an event of default under the indenture, the issuing entity will pay principal of the notes in the following order of priority:

S-6

| (2) | to the class A-2 notes, the class A-3 notes and the class A-4 notes, pro rata, until all such classes of notes have been paid in full; and |

| (3) | to the class B notes until they have been paid in full. |

For a more detailed description of the payment of principal, see “Description of the Notes—Payments of Principal”, “—Priority of Distributions Will Change if the Notes Are Accelerated Following an Event of Default”, “Application of Available Funds” and “Description of the Indenture—Rights Upon Event of Default”.

Priority of Distributions

On each distribution date prior to the occurrence of an event of default under the indenture and acceleration of the maturity of the notes, from available collections received on or in respect of the receivables during the related collection period, the issuing entity will distribute the following amounts in the following order of priority:

| (1) | the servicing fee for the related collection period plus any overdue servicing fees for one or more prior collection periods plus an amount equal to any nonrecoverable advances to the servicer; |

| (2) | if not previously paid, the fees, expenses and indemnified amounts of the trustees for the related collection period plus any overdue fees, expenses or indemnified amounts for one or more prior collection periods will be paid to the trustees pro rata; provided, however, that such fees, expenses and indemnified amounts may not exceed, in the aggregate, $[__________] per annum; |

| (3) | the interest distributable amount for the class A notes, ratably to the holders of the class A notes; |

| (4) | principal of the notes in an amount equal to the excess, if any, of (a) the aggregate principal amount of the class A notes (before giving effect to any payments made to the holders of the class A notes on that distribution date) over (b) the adjusted pool balance (which equals the aggregate principal balance of the receivables as of the last day of the related collection period, less the yield supplement overcollateralization amount, described under “Credit Enhancement—Overcollateralization”), to the holders of the class A notes; |

| (5) | the interest distributable amount for the class B notes, ratably to the holders of the class B notes; |

| (6) | the amount, if any, necessary to fund the reserve fund up to the required amount, into the reserve fund; |

| (7) | principal of the notes in an amount equal to (i) the excess, if any, of (a) the aggregate principal amount of the notes (before giving effect to any payments made to the holders of the notes on that distribution date) over (b) the adjusted pool balance minus the target overcollateralization amount, described under “Credit Enhancement—Overcollateralization”, less (ii) any amounts allocated to pay principal as described in clause (4), to the holders of the notes; |

| (8) | if a successor servicer has replaced Mercedes-Benz Financial Services USA LLC as servicer, any unpaid transition expenses due in respect of the transfer of servicing and any additional servicing fees for the related collection period to the successor servicer; |

| (9) | any fees, expenses and indemnified amounts due to the trustees, pro rata, that have not been paid as described in clause (2); and |

| (10) | any remaining amounts to the certificateholders. |

For purposes of these distributions, on any distribution date the principal amount of a class of notes will be calculated as of the immediately preceding distribution date after giving effect to all payments made on such preceding distribution date, or, in the case of the first distribution date, as of the closing date.

All amounts distributed in respect of principal of the notes will be paid in the manner and priority described under “Principal Payments”.

In addition, if the sum of the amounts on deposit in the collection account and the reserve fund on any distribution date equals or exceeds the aggregate principal amount of the notes, accrued and unpaid interest thereon and certain amounts due to the servicer and the trustees, all such amounts will be applied up to the amounts necessary to retire the notes and pay all amounts due to the servicer and the trustees.

If the notes are accelerated following the occurrence of an event of default under the indenture, the issuing entity will pay principal of and interest on the notes

S-7

and fees of the trustees and the servicer as described under “Description of the Notes—Priority of Distributions Will Change if the Notes Are Accelerated Following an Event of Default”.

For a more detailed description of the priority of distributions and the allocation of funds on each distribution date, see “Description of the Notes” and “Application of Available Funds—Priority of Distributions”.

Credit Enhancement

Credit enhancement for the notes generally will include the following:

Subordination of the Class B Notes

The class B notes will be subordinated to each class of class A notes. On each distribution date:

| ● | no interest will be paid on the class B notes until all interest due, and certain principal payments due, on each class of class A notes has been paid in full; and |

| ● | no principal will be paid on the class B notes until all principal due on each class of class A notes has been paid in full. |

The subordination of the class B notes is intended to decrease the risk of default by the issuing entity with respect to payments due to the more senior classes of notes.

Overcollateralization

Overcollateralization represents the amount by which the aggregate principal balance of the receivables minus the yield supplement overcollateralization amount exceeds the aggregate principal amount of the notes. Overcollateralization will be available to absorb losses on the receivables that are not otherwise covered by excess collections on or in respect of the receivables, if any.

The initial amount of overcollateralization will be $[__________] (based upon an initial adjusted pool balance of $[____________________], which is subject to upward or downward revision based on the size of the final pool of receivables), or approximately [__________]% of the adjusted pool balance as of the cutoff date. The application of funds as described in clause (7) of “Priority of Distributions” is designed to increase over time the amount of overcollateralization as of any distribution date to a target amount. The amount of target overcollateralization for each distribution date will be $[__________] (based upon an initial adjusted pool balance of $[__________], which is subject to upward or downward revision based on the size of the final pool of receivables), or [__________]% of the adjusted pool balance as of the cutoff date.

The amount of target overcollateralization will be attained by paying an amount of principal on the notes on the first several distribution dates after the closing date that is greater than the principal of the receivables paid by obligors during that time.

Yield Supplement Overcollateralization Amount

For a substantial number of receivables, the contract rate minus the [__________]% annual servicing fee rate will be less than the weighted average interest rate on the notes on each distribution date. The yield supplement overcollateralization amount for each distribution date will approximate the present value of the amount by which future scheduled payments on receivables with contract rates below a specified rate are less than future payments would be on those receivables if their contract rates were equal to the specified rate. The specified rate will be set by the depositor at a level that will result in an amount of excess spread sufficient to obtain the required ratings on the notes. Applying the yield supplement overcollateralization amount to the pool balance will have the effect of supplementing interest collections on receivables with low contract rates with principal collections. The yield supplement overcollateralization amount will not be included as part of, and will therefore be in addition to, the overcollateralization amount.

For a more detailed description of the use of the yield supplement overcollateralization amount as credit enhancement for the notes, see “Description of the Notes—Credit Enhancement—Yield Supplement Overcollateralization Amount”.

Excess Spread

Excess spread will generally equal (1) the sum of interest collections on the receivables during the related collection period plus principal collections attributable to the reduction in the yield supplement overcollateralization amount from the prior distribution date minus (2) the sum of fees and expenses of the issuing entity, including the servicing fee, nonrecoverable advances, fees and expenses of the trustees and interest payments on the notes, and the

S-8

amount, if any, required to be deposited into the reserve fund so that the reserve fund is fully funded. Any excess spread will be applied on each distribution date to make payments of principal amounts on the notes to the extent necessary to reach the targeted amount of overcollateralization.

For a more detailed description of the use of excess spread as credit enhancement for the notes, see “Description of the Notes—Credit Enhancement—Excess Collections”.

Reserve Fund

On the closing date, the servicer will establish, in the name of the indenture trustee, a reserve fund into which certain amounts on the closing date and certain excess collections on or in respect of the receivables will be deposited. The reserve fund will afford noteholders limited protection against losses on the receivables. The reserve fund will be [fully] funded on the closing date with a deposit by the depositor of an amount equal to $[__________] (based upon an initial adjusted pool balance of $[__________], which is subject to upward or downward revision based on the size of the final pool of receivables), or [__________]% of the adjusted pool balance as of the cutoff date.

The amount required to be on deposit in the reserve fund on any distribution date will be $[__________] (based upon an initial adjusted pool balance of $[__________], which is subject to upward or downward revision based on the size of the final pool of receivables), or [__________]% of the adjusted pool balance as of the cutoff date; provided, that the required amount may not be greater than the aggregate principal amount of the notes.

On each distribution date, after giving effect to the distribution of available collections for that distribution date as described above under “Priority of Distributions”, the indenture trustee will deposit in the reserve fund, from amounts collected on or in respect of the receivables during the related collection period that are not used on that distribution date to make required payments to the servicer, the trustees and the noteholders, the amount, if any, by which (i) the amount required to be on deposit in the reserve fund on that distribution date exceeds (ii) the amount on deposit in the reserve fund on that distribution date.

Amounts on deposit in the reserve fund will be available to, among other things, (i) pay shortfalls in interest and certain principal payments required to be paid on the notes and (ii) reduce the principal amount of a class of notes to zero on or after its final scheduled distribution date.

On each distribution date, the indenture trustee will withdraw (or cause to be withdrawn) funds from the reserve fund, up to the amount on deposit therein, to the extent needed to make the following payments:

| (1) | [to the servicer, the servicing fee for the related collection period plus any overdue servicing fees for one or more prior collection periods plus an amount equal to any nonrecoverable advances; |

| (2) | to the trustees, all fees, expenses and indemnified amounts for the related collection period plus any overdue fees, expenses or indemnified amounts for one or more prior collection periods, so long as no event of default has occurred and is continuing under the indenture, in an amount not to exceed $[__________] per annum; |

| (3) | to the class A noteholders, monthly interest and the amounts allocated to pay principal described in clause (4) under “Priority of Distributions”, if any, required to be paid on the notes on that distribution date plus any overdue monthly interest due to any class of class A notes for the previous distribution date; |

| (4) | to the class A noteholders, principal payments required to reduce the principal amount of a class of class A notes to zero on or after its final scheduled distribution date;] |

| (5) | to the class B noteholders, monthly interest required to be paid on the class B notes on that distribution date plus any overdue monthly interest due to the class B notes for the previous distribution date; and |

| (6) | to the class B noteholders, principal payments required to reduce the principal amount of the class B notes to zero on or after its final scheduled distribution date. |

For a more detailed description of the deposits to and withdrawals from the reserve fund, see “Description of the Notes—Credit Enhancement—Reserve Fund”.

The various forms of credit enhancement described herein are intended to reduce the risk of payment default by the issuing entity. Available collections and certain funds available from credit enhancement will be applied in accordance with the priority set forth in “Application of Available Funds—Priority of

S-9

Distributions” or following the occurrence of an event of default, set forth in “Description of the Notes—Priority of Distributions Will Change if the Notes Are Accelerated Following an Event of Default”. To the extent available collections and certain funds available from credit enhancement are insufficient to make all such distributions, such collections and amounts would be applied to the items having the then highest priority of distribution, in which case items having lower priority of distribution may not be paid, either in whole or in part.

[If applicable, disclose any other credit enhancement or cash flow support that is provided for in the base prospectus. Identify any enhancement or support provider in accordance with Items 1114(b) or 1115 of Regulation AB. Describe the protection or support provided and, if applicable, how losses not covered thereby will be allocated to the securities.]

[Prefunding]

[If applicable, insert disclosure describing (i) the term or duration of the prefunding period, (ii) the amount of proceeds to be deposited in the prefunding account, (iii) the percentage of the receivables pool and securities represented by the prefunding account, (iv) any limitation on the ability to add receivables to the receivables pool and (v) the requirements for receivables that may be added to the pool.]

Optional Purchase of Receivables

The servicer will have the option to purchase the receivables on any distribution date following the last day of a collection period as of which the aggregate principal balance of the receivables is [10]% or less of the aggregate principal balance of the receivables as of the cutoff date. The purchase price will equal the aggregate principal balance of the receivables plus accrued and unpaid interest thereon; provided, however, that the purchase price must equal or exceed the aggregate principal amount of the notes, accrued and unpaid interest thereon and amounts due to the servicer and the trustees. The issuing entity will apply the payment of such purchase price to the payment of the notes in full and to pay amounts due to the servicer and the trustees.

It is expected that at the time this purchase option becomes available to the servicer only the class [B] notes will be outstanding.

For a more detailed description of this optional purchase right, see “Description of the Receivables Transfer and Servicing Agreements—Optional Purchase of Receivables”.

Events of Default

The events of default under the indenture will consist of the following:

| · | a default in the payment of interest on any note [of the controlling class] for [five] or more days; |

| · | a default in the payment of the principal of any note on the related final scheduled distribution date; |

| · | a default in the observance or performance of any other material covenant or agreement of the issuing entity made in the indenture and such default not having been cured for a period of [60] days after written notice thereof has been given to the issuing entity by the depositor or the indenture trustee or to the issuing entity, the depositor and the indenture trustee by the holders of notes [of the controlling class] evidencing not less than 25% of the aggregate principal amount of the notes; |

| · | any representation or warranty made by the issuing entity in the indenture or in any certificate delivered pursuant thereto or in connection therewith having been incorrect in any material adverse respect as of the time made and such incorrectness not having been cured for a period of [30] days after written notice thereof has been given to the issuing entity by the depositor or the indenture trustee or to the issuing entity, the depositor and the indenture trustee by the holders of notes [of the controlling class] evidencing not less than 25% of the aggregate principal amount of the notes [of the controlling class]; and |

| · | certain events of bankruptcy, insolvency, receivership or liquidation of the issuing entity or its property as specified in the indenture. |

For a more detailed description of the events of default under the indenture, see “The Indenture” in this prospectus supplement and in the prospectus.

[The “controlling class” of notes will be the class A notes, acting as a single class, so long as any class A notes are outstanding and then will be the class B notes.]

S-10

Property of the Issuing Entity

General

The property of the issuing entity will include the following:

| · | a pool of simple interest motor vehicle installment sales contracts and installment loans purchased by Mercedes-Benz Financial Services USA LLC from motor vehicle dealers in the ordinary course of business in connection with the sale of new and pre-owned Mercedes-Benz and smart automobiles or originated by Mercedes-Benz Financial Services USA LLC in the ordinary course of business in connection with the purchase by a lessee of a leased Mercedes-Benz or smart automobile and constituting tangible chattel paper; |

| · | amounts received after the cutoff date on or in respect of the receivables transferred to the issuing entity on the closing date; |

| · | security interests in the vehicles financed under the receivables; |

| · | any proceeds from claims on insurance policies relating to the financed vehicles or the related obligors; |

| · | the receivable files; |

| · | funds on deposit in the collection account, the note payment account and the reserve fund; |

| · | [rights under the interest rate hedge agreement;] |

| · | all rights under the receivables purchase agreement with Mercedes-Benz Financial Services USA LLC, including the right to cause Mercedes-Benz Financial Services USA LLC to repurchase from the depositor receivables affected materially and adversely by breaches of its representations and warranties made in the receivables purchase agreement; |

| · | all rights under the sale and servicing agreement, including the right to cause the servicer to purchase receivables affected materially and adversely by breaches of the representations and warranties of Mercedes-Benz Financial Services USA LLC or certain servicing covenants of the servicer made in the sale and servicing agreement; and |

| · | any and all proceeds relating to the above. |

The aggregate principal balance of the receivables in the statistical pool as of the cutoff date was $[__________]. The composition of the receivables in the statistical pool as of the cutoff date was as follows:

| Number of Receivables: | [________] |

| Average Principal Balance: | $[________] |

| Average Original Principal Balance: | $[________] |

| Weighted Average Contract Rate: | [________]% |

| Contract Rate (Range): | [____]% to [_____]% |

| Weighted Average Original Term: | [________] months |

| Original Term (Range): | [__] months to [__] months |

Weighted Average Remaining Term(1): | [_____] months |

Remaining Term (Range)(1): | [__} months to [__] months |

Weighted Average FICO®(2)(3) Score: | [________] |

FICO® Scores (Range)(3): | [________] |

| (1) | Based on the number of monthly payments remaining. |

| (2) | FICO® is a registered trademark of Fair Isaac & Co. |

| (3) | The FICO® score with respect to any receivable with co-obligors is the higher of each obligor’s FICO® score at the time of application. |

For a more detailed description of the receivables, see “The Receivables Pool”.

[Statistical Information

The statistical information in this prospectus supplement is based on the receivables in a statistical pool as of the cutoff date. The actual pool of receivables sold to the issuing entity on the closing date will be selected from the statistical pool. The statistical characteristics of the receivables sold to the issuing entity on the closing date may vary somewhat from the characteristics of the receivables in the statistical pool described in this prospectus supplement, although we do not expect the characteristics, as of the cutoff date, of the receivables sold to the issuing entity on the closing date to vary materially from the characteristics, as of the cutoff date, of the receivables in the statistical pool. If the aggregate principal amount of the notes being issued by the issuing entity on the closing date is the amount set forth on the cover page of this prospectus supplement, the aggregate principal balance as of the cutoff date of the receivables sold to the issuing entity on the closing date will be approximately $[___________].]

Servicing and Servicer Compensation

Mercedes-Benz Financial Services USA LLC’s responsibilities as servicer will include, among other things, collection of payments, realization on the receivables and the financed vehicles, selling or

S-11

otherwise disposing of delinquent or defaulted receivables and monitoring the performance of the receivables. In return for its services, the issuing entity will be required to pay the servicer a servicing fee on each distribution date for the related collection period equal to the product of 1/12 of 1.00% [(or 1/6 of [_____]% in the case of the first distribution date)] and the aggregate principal balance of the receivables as of the first day of the related collection period (or as of the cutoff date in the case of the first distribution date).

The servicer will have the right to delegate any or all of its servicing duties to any of its affiliates or other third parties; provided, however, that it will remain obligated and liable for servicing the receivables as if it alone were servicing the receivables.

Ratings

The sponsor expects that the notes will receive credit ratings from two nationally recognized statistical rating organizations hired by the sponsor to rate the notes. A rating is not a recommendation to purchase, hold or sell the related notes, inasmuch as a rating does not comment as to market price or suitability for a particular investor. A rating agency rating the notes may, in its discretion, lower or withdraw its rating in the future as to any class of notes. None of the sponsor, the depositor, the indenture trustee, the owner trustee or any of their affiliates will be required to monitor any changes to the ratings on the notes.

Tax Status

Opinions of Counsel

In the opinion of Sidley Austin llp, for federal income tax purposes the notes will be characterized as debt if held by persons other than the beneficial owner of the equity in the issuing entity, and the issuing entity will not be characterized as an association (or a publicly traded partnership) taxable as a corporation.

Investor Representations

If you purchase notes, you agree by your purchase that you will treat the notes as indebtedness for federal income tax purposes.

For a more detailed description of the tax consequences of acquiring, holding and disposing of notes, see “Material Federal Income Tax Consequences” in this prospectus supplement and in the prospectus.

ERISA Considerations

The notes may generally be purchased by or with plan assets of employee benefit and other benefit plans and individual retirement accounts, subject to the considerations discussed under “Certain ERISA Considerations” in this prospectus supplement and the prospectus. Each investing employee benefit or other benefit plan subject to ERISA, and each person investing on behalf of or with plan assets of such a plan, will be deemed to make certain representations.

For a more detailed description of certain ERISA considerations applicable to a purchase of the notes, see “ERISA Considerations” in this prospectus supplement and in the prospectus.

[Eligibility for Purchase by Money Market Funds

On the closing date, the class A-1 notes will be eligible securities for purchase by money market funds under paragraph (a)(12) of Rule 2a-7 under the Investment Company Act of 1940, as amended. Rule 2a-7 includes additional criteria for investments by money market funds, some of which have recently been amended, including additional requirements relating to portfolio maturity, liquidity and risk diversification. A money market fund purchasing class A-1 notes should consult its counsel before making a purchase.]

S-12

You should consider the following risk factors (and the factors under “Risk Factors” in the prospectus) in deciding whether to purchase any of the notes. The following risk factors and those in the prospectus describe the principal risk factors of an investment in the notes.

Losses on the receivables may be affected disproportionately because of geographic concentration of receivables in [________] and [________] | As of the cutoff date, the servicer’s records indicate that [_____]% and [____]% of the aggregate principal balance of the receivables in the statistical pool are related to obligors with mailing addresses in [_______] and [_______], respectively. As of that date, no other state accounted for more than 10.00% of the aggregate principal balance of the receivables in the statistical pool. If [_______]or [_______]experiences adverse economic changes, such as an increase in the unemployment rate, an increase in interest rates or an increase in the rate of inflation, obligors in those states may be unable to make timely payments on their receivables and you may experience payment delays or losses on your notes. We cannot predict whether adverse economic changes or other adverse events will occur or to what extent those events would affect the receivables or repayment of your notes. |

[The characteristics of the receivables in the statistical pool as of the cutoff date, set forth in this prospectus supplement may differ from the characteristics as of the cutoff date of the receivables sold to the issuing entity on the closing date] | [This prospectus supplement describes the characteristics of receivables in a statistical pool as of the cutoff date. The receivables actually sold to the issuing entity on the closing date may have statistical characteristics that vary somewhat from the characteristics of the receivables in the statistical pool described in this prospectus supplement. We do not expect the statistical characteristics, as of the cutoff date, of the receivables sold to the issuing entity on the closing date to vary materially from the characteristics, as of the cutoff date, of the receivables in the statistical pool described in this prospectus supplement, and each receivable must satisfy the eligibility criteria specified in the transaction documents. If the aggregate principal amount of the notes being issued by the issuing entity on the closing date is the amount set forth on the cover page of this prospectus supplement, the aggregate principal balance as of the cutoff date of the receivables sold to the issuing entity on the closing date will be approximately $[____________]. If you purchase a note, you must not assume that the statistical characteristics of the actual pool of receivables sold to the issuing entity on the closing date will be identical or nearly identical to the characteristics of the receivables in the statistical pool disclosed in this prospectus supplement.] |

The Class B notes have greater risk because they are subordinate to the Class A |

S-13

| notes | Investors in the class B notes may suffer a loss on their investment because payments of interest on and principal of the class B notes are subordinated to the class A notes subject to the following priorities: |

| ● | no interest will be paid on the class B notes until all interest due, and certain principal payments due, on that distribution date on each class of class A notes has been paid in full; and |

| ● | no principal will be paid on the class B notes until all principal of the class A notes has been paid in full; |

In addition, for so long as the class A notes are outstanding, the class A notes will be the controlling class of notes, and will have the authority when acting in that regard to take actions that will affect, and may adversely affect, the class B notes without the consent of the class B noteholders.

You may experience losses on your investment in the class B notes if available collections and amounts on deposit in the reserve fund, after making required payments on the class A notes are insufficient to protect your notes from losses on the receivables.

Payment priorities increase

risk of loss or delay in payment

| to certain classes of notes | Classes of notes that receive principal payments before other classes will be repaid more rapidly than the other classes. In addition, because the principal of each class of notes generally will be paid sequentially, classes of notes that have higher numerical class designations generally are expected to be outstanding longer and therefore will be exposed to the risk of losses on the receivables during periods after other classes of notes have been receiving most or all amounts payable on their notes, and after which a disproportionate amount of credit enhancement may have been applied and not replenished. |

If an event of default under the indenture has occurred and the notes have been accelerated, note principal payments and amounts that would otherwise be payable to the holders of the certificates will be paid first to the class A-1 notes until they have been paid in full, then pro rata to the other classes of notes based upon the outstanding principal amount of each such class. As a result, in relation to the class A-1 notes, the yields of the class A-2 notes, the class A-3 notes and the class A-4 notes will be relatively more sensitive to losses on the receivables and the timing of such losses. If the actual rate and amount of losses exceeds historical levels, and if the available credit enhancement is insufficient to cover the resulting shortfalls, the yield to maturity on your notes may be lower than anticipated and you could suffer a loss.

For more information on interest and principal payments, see “Description of the Notes—Payments of Interest” and “—Payments of Principal”.

S-14

Prepayments, potential losses and changes in the order of priority of distributions following an indenture event of default could adversely affect your investment | If the notes have been accelerated following the occurrence of an event of default under the indenture, principal will then be paid first to the class A-1 notes until they have been paid in full, then pro rata to the other classes of class A notes based upon the outstanding principal amount of each such class and then to the class B notes. |

| If the maturity dates of the notes have been accelerated following the occurrence of an event of default arising from a payment default, the indenture trustee may, or acting at the direction of the holders of [51]% of the aggregate principal amount of the notes, shall, sell the receivables and prepay the [controlling class of] notes. In addition, the Indenture Trustee may sell the receivables and prepay the notes if (i) it obtains the consent of the holders of 100% of the aggregate principal amount of notes, (ii) it obtains the consent of the holders of 51% of the aggregate principal amount of the notes to such sale and the proceeds of such sale are sufficient to cover all outstanding principal and interest on the notes or (iii) the indenture trustee determines that the future collections on the receivables would be insufficient to make payments on the notes and obtains the consent of the holders of [66⅔]% of the aggregate principal amount of the [controlling class of] notes to the sale. If the maturity dates of the notes have been accelerated following a default in the payment of any interest on any note [of the controlling class], or a default in the payment of the principal of any note on its final scheduled distribution date, the indenture trustee may, or acting at the direction of the holders of [51]% of the aggregate principal amount of the [controlling class of] notes, shall, sell the receivables and prepay the notes. If principal is repaid to any holder of notes earlier than expected, such holder may not be able to reinvest the prepaid amount at a rate of return that is equal to or greater than the rate of return on such holder’s notes. A holder of notes also may not be paid the full principal amount of such holder’s notes if the assets of the issuing entity are insufficient to pay the principal amount of such holder’s notes. | |

| For more information on events of default, the rights of the noteholders following the occurrence of an event of default and payments after an acceleration of the notes following the occurrence of an event of default, see “The Indenture—Events of Default” in the prospectus and “Description of the Indenture—Rights Upon Event of Default” and “Description of the Notes—Priority of Distributions Will Change if the Notes Are Accelerated Following an Event of Default” in this prospectus supplement. | |

Excessive prepayments and defaults on receivables with higher annual percentage rates may adversely impact your notes | Interest collections that are in excess of the required interest payments on the notes and required servicing fees could be used to cover realized losses on defaulted receivables. Interest collections depend among other things on the annual percentage rate of a receivable. The receivables pool includes receivables which have a range of annual percentage rates. Excessive prepayments and defaults on the receivables with relatively higher annual percentage rates and/or an increase in the floating rate payable on the Class A-2 notes above the fixed rate received on the receivables may adversely |

S-15

| impact your notes by reducing such available interest collections in the future. | |

[Yields on the notes may be adversely affected if the issuing entity does not use amounts in the pre-funding account to acquire additional receivables] | [The issuing entity will purchase additional receivables during the pre-funding period using amounts on deposit in the pre-funding account. The issuing entity will purchase the additional receivables from the depositor which, in turn, will acquire these receivables from MBFS USA. Noteholders will receive as a prepayment of principal any amounts remaining in the pre-funding account that have not been used to purchase additional receivables by the end of the funding period. This prepayment of principal could have the effect of shortening the weighted average life of your notes. The inability of the depositor to obtain receivables from MBFS USA meeting the requirements for sale to the issuing entity will increase the likelihood of a prepayment of principal. In addition, you will bear the risk that you may be unable to reinvest any principal prepayment at yields at least equal to the yield on your notes.] |

[Because the issuing entity will issue floating rate notes but will not enter into any interest rate swaps, you may suffer a loss on your notes if interest rates rise] | [The receivables owned by the issuing entity bear interest at a fixed rate while the Class A-2 notes will bear interest at a floating rate based on [One-Month LIBOR] plus the applicable spread. Even though the issuing entity will issue floating rate notes, it will not enter into any interest rate swaps or other derivative transactions in connection with the issuance of the notes. |

| The issuing entity will make payments on the Class A-2 notes out of available funds. Therefore, increases in [One-Month LIBOR] would require a greater proportion of available funds to be used to pay interest on the Class A-2 notes, and would thereby result in reduced amounts being available for distribution to holders of all fixed rate classes of notes. Any such reduction will diminish the amount of excess spread that would otherwise be available as credit enhancement for all classes of notes. | |

| In addition, if the floating rate payable by the issuing entity on the Class A-2 notes is substantially greater than the fixed rate received on the receivables, the issuing entity may not have sufficient funds to make payments on the notes. If the issuing entity does not have sufficient funds, you may experience delays or reductions in the interest and principal payments on your notes.] | |

[The interest rate hedge agreement exposes you to counterparty risk of the interest rate hedge counterparty] | [The issuing entity will enter into an interest rate hedge agreement with respect to each class of floating rate notes. |

S-16

| During any periods in which [LIBOR] is substantially greater than the applicable fixed rate specified in the interest rate hedge agreement, the issuing entity will be more dependent on receiving payments from the hedge counterparty in order to make payments on the notes. If the hedge counterparty fails to pay the amounts due under the interest rate hedge agreement, the amount of funds available to make payments on the notes in the current or any future period may be reduced and you may experience delays and/or reductions in the interest and principal payments on your notes. | |

| A downgrade, suspension or withdrawal of any rating of the hedge counterparty by a rating agency may result in the downgrade, suspension or withdrawal of the ratings assigned by such rating agency to any class (or all classes) of notes. Investors should make their own determinations as to the likelihood of performance by the hedge counterparty of its obligations under the interest rate hedge agreement. | |

| If the interest rate hedge agreement were to terminate early, a termination payment may be due to the issuing entity from the hedge counterparty, or to the hedge counterparty from the issuing entity. The amount of any termination payment will generally be based on the market value of the transactions under the interest rate hedge agreement. Any termination payment could, if market interest rates and other conditions have changed materially, be substantial. If the hedge counterparty fails to make a termination payment owed to the issuing entity, the issuing entity may not be able to enter into a replacement interest rate hedge agreement. | |

Adverse economic conditions in the United States could adversely affect the market value of your notes | Recently, the United States has experienced a period of economic slowdown and a recession, and the continuing effects of this downturn, including economic uncertainty, a slowing pace of recovery or a renewed downturn, may adversely affect the performance and market value of your notes. Continued high unemployment, decreased home values and lack of availability of credit may lead to increased default rates. Periods of continued or increasing economic weakness may be accompanied by decreased consumer demand for automobiles and declining values of automobiles securing outstanding automobile loan contracts, which weakens collateral coverage and increases the amount of a loss in the event of default. Significant increases in the inventory of pre-owned automobiles during periods of economic weakness and recession may also depress the prices at which repossessed automobiles may be sold or delay the timing of these sales. |

| Any of these events could cause delinquencies and losses with respect to automobile loans generally to increase. These increases may be related to the weakness in the residential housing market where increasing numbers of individuals have defaulted on their residential mortgage loans. If economic conditions worsen, or fail to improve at a sufficient pace, delinquencies and losses on the receivables could increase, which could result in losses on your notes. | |

Federal financial regulatory reform could have an adverse impact on the sponsor, the depositor or the issuing entity | The Dodd–Frank Wall Street Reform and Consumer Protection Act (Pub.L. |

S-17

| 111-203) is extensive legislation that, among other things, provides for enhanced regulation of financial institutions and non-bank financial companies, derivatives and asset-backed securities offerings and enhanced oversight of credit rating agencies. Many of the regulations required to be adopted under the Dodd-Frank Act still remain to be finalized. It is not clear what the final form of such regulations will be, how they will be implemented, or the extent to which the issuing entity, the depositor or the servicer will be affected, or whether or when any additional legislation will be enacted. No assurance can be given that the new standards will not have an adverse impact on the marketability of asset-backed securities such as the notes, the servicing of the receivables, MBFS USA’s securitization program or the regulation or supervision of MBFS USA. In addition, when the regulations become effective, your notes, which will not be subject to the requirements included in the legislation, may be less marketable than those that are offered in compliance with the legislation. | |

| The Dodd-Frank Act also creates a liquidation framework under which the Federal Deposit Insurance Corporation, or FDIC, may be appointed as receiver following a “systemic risk determination” by the Secretary of Treasury (in consultation with the President) for the resolution of certain nonbank financial companies and other entities, defined as “covered financial companies”, and commonly referred to as “systemically important entities”, in the event such a company is in default or in danger of default and the resolution of such a company under other applicable law would have serious adverse effects on financial stability in the United States, and also for the resolution of certain of their subsidiaries. With respect to the new liquidation framework for systemically important entities, no assurances can be given that such framework would not apply to the sponsor or its subsidiaries, including the issuing entity and the depositor, although the expectation embedded in the Dodd-Frank Act is that the framework will be invoked only very rarely. Recent guidance from the FDIC indicates that such new framework will in certain cases be exercised in a manner consistent with the existing bankruptcy laws, which is the insolvency regime which would otherwise apply to the sponsor, the depositor and the issuing entity. However, the provisions of the new framework provide the FDIC with certain powers not possessed by a trustee in bankruptcy under existing bankruptcy laws. Under some applications of these and other provisions of the new framework, payments on the notes could be reduced, delayed or otherwise negatively impacted. | |

Ratings of the notes are limited and may be reduced or withdrawn | The sponsor has hired [two] rating agencies and will pay them a fee to assign ratings on the notes. The sponsor has not hired any other nationally recognized statistical rating organization, or “NRSRO,” to assign ratings on the notes and is not aware that any other NRSRO has assigned ratings on the notes. However, under recently effective SEC rules, information provided to a hired rating agency for the purpose of assigning or monitoring the ratings on the notes is required to be made available to each qualified NRSRO in order to make it possible for such non-hired NRSROs to assign unsolicited ratings on the notes. |

| An unsolicited rating could be assigned at any time, including prior to the closing date, and none of the depositor, the sponsor, the underwriters or any of their affiliates will have any obligation to inform you of any unsolicited ratings assigned on or after the date of this prospectus supplement. NRSROs, |

S-18

| including the hired rating agencies, have different methodologies, criteria, models and requirements. If any non-hired NRSRO assigns an unsolicited rating on the notes, there can be no assurance that such rating will not be lower than the ratings provided by the hired rating agencies, which could adversely affect the market value of your notes and/or limit your ability to resell your notes. Investors in the notes should consult with their legal counsel regarding the effect of the issuance of a rating by a nonhired NRSRO that is lower than the ratings assigned by the hired rating agencies. In addition, if the sponsor fails to make available to the non-hired NRSROs any information provided to any hired rating agency for the purpose of assigning or monitoring the ratings on the notes, a hired rating agency could withdraw its ratings on the notes, which could adversely affect the market value of your notes and/or limit your ability to resell your notes. | |

| None of the sponsor, the depositor, the servicer, the administrator, the indenture trustee, the owner trustee or any of their affiliates will be required to monitor any changes to the ratings on the notes. Potential investors in the notes are urged to make their own evaluation of the creditworthiness of the receivables and the credit enhancement on the notes, and not to rely solely on the ratings on the notes. Additionally, we note that it may be perceived that a rating agency has a conflict of interest where, as is the industry standard and the case with the ratings of the notes, the sponsor pays the fee charged by the rating agency for its rating services. | |

Financial market disruptions and a lack of liquidity in the secondary market could adversely affect the market value of your notes and/or limit your ability to resell your notes | Recent and continuing events in the global financial markets, including the failure, acquisition or government seizure of several major financial institutions, the establishment of government initiatives such as the government bailout programs for financial institutions and assistance programs designed to increase credit availability, support economic activity and facilitate renewed consumer lending, problems related to subprime mortgages and other financial assets, the devaluation of various assets in secondary markets, the forced sale of asset-backed and other securities as a result of the deleveraging of structured investment vehicles, hedge funds, financial institutions and other entities and the lowering of ratings on certain asset-backed securities, have caused, or may cause, a significant reduction in liquidity in the secondary market for asset-backed securities, which could adversely affect the market value of your notes and/or limit your ability to resell your notes. |

S-19

The Depositor formed Mercedes-Benz Auto Receivables Trust 201[_]-[_], a Delaware statutory trust, on [_________]. The Issuing Entity will not engage in any activity other than:

| · | acquiring, holding and managing the assets of the Issuing Entity, including the Receivables, and the proceeds of those assets; |

| · | issuing the Notes and Certificates; |

| · | using (or permitting the Depositor to use) the proceeds of the sale of the Notes to (i) fund the Reserve Fund, (ii) pay the organizational, start-up and transactional expenses of the Issuing Entity and (iii) pay the balance to the Depositor; |

| · | paying interest on and principal of the Notes to the Noteholders and any excess collections to the Certificateholders; |

| · | [entering into and performing its obligations under the interest rate hedge agreement; and] |

| · | engaging in those activities, including entering into agreements, that are necessary, suitable or convenient to accomplish the foregoing or are incidental thereto or connected therewith. |

If the various protections provided to the Noteholders by overcollateralization, the Reserve Fund and excess spread and with respect to the Class A Noteholders, by the subordination of the Class B Notes, are insufficient, the Issuing Entity will have to rely solely upon payments by obligors under the Receivables and the proceeds from the repossession and sale of Financed Vehicles that secure Defaulted Receivables to make payments on the Notes. In connection with the exercise of remedies in relation to Defaulted Receivables, various factors, such as the Issuing Entity not having perfected security interests in the Financed Vehicles in all states or state and federal laws protecting defaulting consumers from repossession of their vehicles, may affect the Servicer’s ability to repossess and sell the collateral securing such Defaulted Receivables, and thus may reduce the proceeds which the Issuing Entity can distribute to Noteholders. See “Material Legal Issues Relating to the Receivables” in the prospectus.

The Issuing Entity’s principal offices are in care of [__________], as Owner Trustee, at [__________], [__________], Delaware [__________], Attention: [__________]. The Issuing Entity’s fiscal year ends on December 31.

The following table illustrates the expected capitalization of the Issuing Entity as of the Closing Date, as if the issuance and sale of the Notes had taken place on such date:

Class A-1 Notes | $ [__________] |

Class A-2 Notes | $ [__________] |

Class A-3 Notes | $ [__________] |

Class A-4 Notes | $ [__________] |

Class B Notes | $ [__________] |

Residual Interest (initial overcollateralization)(1) | $ [__________] |

Total | $ [__________] |

| (1) | Includes initial Yield Supplement Overcollateralization Amount. |

S-20

The Issuing Entity will not issue any debt other than the Notes or issue any securities other than the Notes and the Certificates, except that the Depositor may exchange all or a portion of the Certificates for additional notes or certificates issued by the Issuing Entity upon certain conditions, as described in the Prospectus under “Description of the Receivables Transfer and Servicing Agreements—Residual Interest; Issuance of Additional Securities”.

[_____________] will be the Owner Trustee under the Trust Agreement. [Disclosure regarding the owner trustee under Item 1109 of Regulation AB.]

The Issuing Entity will own a pool of Receivables consisting of motor vehicle installment sales contracts and installment loans purchased by MBFS USA from Dealers in connection with the sale of new and pre-owned Mercedes-Benz and smart automobiles or originated by MBFS USA in connection with the purchase by lessees of leased Mercedes-Benz and smart automobiles, and secured by security interests in the automobiles financed by those contracts or loans. The automobiles financed by Receivables will include Mercedes-Benz passenger cars, crossovers and sport utility vehicles, and smart fortwo microcars. MBFS USA will sell the Receivables to the Depositor on the Closing Date pursuant to the Receivables Purchase Agreement. The Depositor will transfer the Receivables to the Issuing Entity on the Closing Date pursuant to the Sale and Servicing Agreement. The property of the Issuing Entity will include, among other things, payments on the Receivables that are made after the Cutoff Date. No expenses incurred in connection with the selection and acquisition of the Receivables are payable from the proceeds of the issuance of the Notes. All of the Receivables constitute tangible chattel paper and none of the Receivables are in electronic format.

[The statistical information in this prospectus supplement is based on the receivables in a statistical pool as of the Cutoff Date. The actual pool of Receivables sold to the Issuing Entity on the Closing Date will be selected from the statistical pool. The statistical characteristics of the Receivables sold to the Issuing Entity on the Closing Date may vary somewhat from the characteristics of the receivables in the statistical pool described in this prospectus supplement, although we do not expect the characteristics, as of the Cutoff Date, of the Receivables sold to the Issuing Entity on the Closing Date to vary materially from the characteristics of the receivables in the statistical pool as of the Cutoff Date. If the aggregate principal amount of the Notes being issued by the Issuing Entity on the Closing Date is the amount set forth on the cover page of this prospectus supplement, the aggregate principal balance as of the Cutoff Date of the Receivables sold to the Issuing Entity on the Closing Date will be approximately $[___________].]

The Receivables were originated in accordance with the underwriting criteria described in “The Sponsor and the Servicer—Underwriting” in the prospectus. [The Sponsor does not consider any of the Receivables to constitute exceptions to its underwriting criteria.][Provide disclosure regarding any deviations from disclosed criteria to the extent required in accordance with Item 1111(a)(8) of Regulation AB.]

General. The Receivables to be transferred to the Issuing Entity on the Closing Date will be selected from MBFS USA’s portfolio for inclusion in the pool by several criteria, some of which are set forth in the prospectus under “The Receivables Pools”. These criteria include the requirement that each Receivable:

S-21

| · | was originated in the United States of America; |

| · | is secured by a new or pre-owned Mercedes-Benz passenger car, crossover or sport utility vehicle or a smart fortwo microcar; |

| · | as of the Cutoff Date, had a remaining principal balance of not more than $[________] and not less than $[________]; |

| · | had an original term to maturity of not more than [__] months and not less than [__] months and, as of the Cutoff Date, a remaining term to maturity (based on number of remaining monthly payments) of not more than [__] months and not less than [__] months; |

| · | provides for the allocation of payments to interest and principal based on the simple interest method; |

| · | has a Contract Rate of at least [______]% and not more than [______]%; |

| · | provides for level scheduled monthly payments that fully amortize the amount financed over its original term to maturity (except that the period between the contract date and the first payment date may be less than or greater than one month and except for the first and last payments, which may be minimally different from the level payments); |

| · | as of the Cutoff Date, is not delinquent by more than 30 days; |

| · | as of the Cutoff Date, is not secured by a Financed Vehicle that has been repossessed; |

| · | as of the Cutoff Date, does not relate to an obligor who is the subject of a bankruptcy proceeding; |

| · | is evidenced by only one original contract; and |

| · | was not selected using selection procedures believed by MBFS USA to be adverse to the Noteholders. |

[According to Item 1107(j) of Regulation AB, if expenses incurred in connection with the selection and acquisition of the pool assets are to be payable from offering proceeds, disclose the amount of such expenses.]

Additional Information. The receivables in the statistical pool have loan-to-value ratios ranging between [______]% and [______]% and a weighted average loan-to-value ratio of [______]%. The loan-to-value ratio for receivables relating to new vehicles is calculated as the original receivable principal amount divided by the manufacturer’s suggested retail price at the time of origination. The loan-to-value ratio for receivables relating to pre-owned vehicles is calculated as the original receivable principal amount divided by the retail book value at the time of origination as set forth in [the then-current edition of the Manheim Market Report]. Such calculation for vehicles financed through a Certified Pre-Owned Program is conservative because it does not take into consideration the dollar amounts invested in such pre-owned vehicles, which increase the market value of such vehicles. Certified Pre-Owned Programs require that pre-owned vehicles be inspected by Mercedes-Benz dealers and pass a 155-point vehicle inspection. The weighted average loan-to-value ratio is dollar weighted based upon the original receivable principal.

The Servicer considers a receivable delinquent when an obligor fails to make 90% of a contractual payment by the due date. The period of delinquency is based on the number of days payments are contractually past due.

[Provide delinquency information necessary to comply with Items 1111(c) and 1100(b) of Regulation AB.] [As of the Cutoff Date, none of the Receivables was ever more than 30 days delinquent.]

S-22

[The following table provides historical delinquency information for the Receivables.]

Historical Delinquency Status | Number of Receivables | Percentage of Total Number of Receivables | Aggregate Outstanding Principal Balance | Percentage of Cutoff Date Statistical Pool Balance | ||||

Delinquent no more than [ ] for 31-60 days | $ | % | ||||||

Delinquent no more than [ ] for 31-60 days but never for 61 days or more | ||||||||

| No history of delinquency | ||||||||

| Total | $ | % |

[No Receivable has been more than [90] days delinquent in the twelve months preceding the Cutoff Date.]

[Add information, including tabular information, regarding extensions, deferrals, modifications and workouts if Receivables for which the payment schedule has been extended, deferred, modified or worked out are included in the Receivables pool.]

Number of Extensions | Number of Receivables | Percentage of Total Number of Receivables | Aggregate Outstanding Principal Balance | Percentage of Cutoff Date Statistical Pool Balance | ||||

| % | $ | % | ||||||

| Total | 100.00% | % |

The following tables set forth information with respect to the receivables in the statistical pool as of the close of business as of the Cutoff Date. The percentages below are calculated based on the outstanding Principal Balance of the receivables in the statistical pool on the Cutoff Date.

S-23

Composition of the Receivables in the Statistical Pool

as of the Cutoff Date

Pre-Owned Financed Vehicles | New Financed Vehicles | Total | |||

Aggregate Principal Balance | $[__________] | $[__________] | $[__________] | ||

| Percentage of Cutoff Date Statistical Pool Balance | [__________]% | [__________]% | 100.00% | ||

Number of Receivables | [__________] | [__________] | [__________] | ||

Percentage of Receivables | [__________]% | [__________]% | 100.00% | ||

Average Principal Balance | $[__________] | $[__________] | $[__________] | ||

Average Original Balance | $[__________] | $[__________] | $[__________] | ||

| Weighted Average Contract Rate | [__________]% | [__________]% | [__________]% | ||

Contract Rate (Range) | [____]% to [____]% | [____]% to [____]% | [____]% to [____]% | ||

| Weighted Average Original Term | [____]months | [____]months | [____]months | ||

Original Term (Range) | [__] months to [__] months | [__] months to [__] months | [__] months to [__] months | ||

Weighted Average Remaining Term(1) | [__] months | [__] months | [__] months | ||

Remaining Term (Range)(1) | [__] months to [__] months | [__] months to [__] months | [__] months to [__] months | ||

Weighted Average FICO© Score(2) | [__] | [__] | [__] | ||

Range of FICO© Scores(2) | [__] to [__] | [__] to [__] | [__] to [__] |

| (1) | Based on the number of monthly payments remaining as of the Cutoff Date. |

| (2) | The FICO® score with respect to any receivable with co-obligors is the higher of each obligor’s FICO® score at the time of application. |

All receivables in the statistical pool were assigned a FICO®* score. A FICO® score is a measurement determined by Fair Isaac Corporation using information collected by the major credit bureaus to assess credit risk. Data from an independent credit reporting agency, such as a FICO® score, is one of several factors that may be used by MBFS USA in its credit scoring system to assess the credit risk associated with each applicant. See “The Sponsor and Servicer—Underwriting” in the prospectus. FICO® scores are intended to show the likelihood that an individual might default on a debt based on past credit history. An individual’s credit history may not reliably predict his or her future creditworthiness. Additionally, the reliability of the credit scoring the FICO® scores provide is limited by the accuracy of the data contained within the credit bureau files. Accordingly, FICO® scores should not necessarily be relied upon as a meaningful predictor of the performance of the Receivables.

* FICO is a federally registered service mark of Fair Isaac Corporation.

S-24

Distribution of the Receivables in the Statistical Pool by FICO® Score

as of the Cutoff Date

FICO Score | Number of Receivables | Percentage of Total Number of Receivables(1) | Principal Balance as of the Cutoff Date | Percentage of Cutoff Date Statistical Pool Balance(1) | ||||

| 600 – 649 | ||||||||

| 650 – 699 | ||||||||