Exhibit 99.1

1 INVESTOR PRESENTATION May 2022

SAFE HARBOR STATEMENT This presentation of IDW Media Holdings, Inc. (IDWMH) contains forward - looking statements. Statements that are not historical facts are forward - looking statements, and such forward - looking statements are statements made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. Examples of forward - looking statements include statements about IDWMH’s and its divisions’ future performance, projections of IDWMH’s and its divisions’ results of operations or financial condition, and statements regarding IDWMH’s plans, objectives or goals, including those relating to its strategies, initiatives, competition, acquisitions, dispositions and/or its products and offerings. Words such as “believe,” “anticipate,” “plan,” “expect,” “intend,” “target,” “estimate,” “project,” “predict,” “forecast,” “guideline,” “aim,” “will,” “should,“ “likely,” "continue" and similar expressions are intended to identify forward - looking statements, but are not the exclusive means of identifying such statements. Readers are cautioned not to place undue reliance on these forward - looking statements and all such forward - looking statements are qualified in their entirety by reference to the following cautionary statements. Forward - looking statements are based on IDWMH’s current expectations, estimates and assumptions. Because forward - looking statements address future results, events and conditions, they, by their very nature, involve inherent risks and uncertainties, many of which are unforeseeable and beyond IDWMH’s control. Such known and unknown risks, uncertainties and other factors may cause IDWMH’s actual results, performance or other achievements to differ materially from the anticipated results, performance or achievements expressed, projected or implied by these forward - looking statements. These factors include those discussed under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition” and “Results of Operations” in IDWMH’s filings made with the Securities and Exchange Commission. IDWMH cautions that such factors are not exhaustive, and that other risks and uncertainties may cause actual results to differ materially from those in forward - looking statements. Forward - looking statements speak only as of the date they are made and are statements of IDWMH’s current expectations concerning future results, events and conditions. IDWMH is under no obligation to update any of the forward - looking statements, whether as a result of new information, future events or otherwise. 2

3

W W e e c c r r e e a a t t e e a a n n d d d d e e v v e e l l o o p p s s t t o o r r i i e e s s t t h h a a t t c c a a p p t t i i v v a a t t e e a a u u d d i i e e n n c c e e s s , , and build those stories into high - va l lue f f r r a n c h i s s es 4

IDW AT A GLANCE 5 280 5+ 50+ 80 450 40 Comics Streaming Current Employees Authors Eisner Awards + shows aired licensors and graphic novels illustrators published (2021) published

RECOGNIZED LEADER Award totals are cumulative to date 6

SELECT BOARD & EXECUTIVE LEADERSHIP A team with the experience, drive and passion to expand IDW’s market impact 7 Howard Jonas Chairman of the Board Ezra Rosensaft Chief Executive Officer 20 years at HBO and KPMG Paul Davidson EVP, IDW Entertainment EVP Film and TV, The Orchard; Microsoft Xbox Video Brooke Feinstein Chief Financial Officer CPA; Grant Thornton; Buchbinder Tunick Chris McGurk Board Member Chairman & CEO of Cinedigm Digital Cinema; Former Vice Chair & COO of MGM Nachie Marsham Publisher, IDW Publishing Executive Editor, Disney Publishing Worldwide; Editor, DC Comics Allan Grafman Board Member Former President, Archie Comics; EVP & CFO of Hallmark Entertainment

8

LEADING INDEPENDENT PUBLISHER OF COMICS AND GRAPHIC NOVELS *In the US. Source: Diamond Comic Distributors: 2020 year - end market share repor t ; Direct Market defined as r etailers bypassing existing distributors to make "direct" purchases from publishers, of which the defining characteristic of the direct market, however, is non - returnability. 9 ● “Fourth largest” direct market publisher of comics and graphic novels* ● Award - winning titles with renowned and emerging authors and illustrators ● Ramping up development of original IP - based titles ● Market leader in licensed publishing, with iconic brands including Disney, Marvel, DC Comics, SEGA, Viacom, Lucasfilm and Hasbro

HOME TO RENOWNED AND UP & COMING CREATORS George Takei Kevin Eastman McElroy Brothers Congressman John Lewis Kim Dwinell AJ Mendez Marieke Nijkamp Steve Niles Mairghread Scott Scott Snyder Matthew Klein Scott Bryan Wilson Stephen King Joe Hill Alan Moore Stan Sakai John Layman Nick Bradshaw Gale Galligan Katie Cook Sam Maggs Cavan Scott Matthew Erman Lonnie Nadler Dan Schoening Alan Robert Delilah S. Dawson Bernie Wrightson Ian Flynn Van Jensen Robbie Thompson G. Willow Wilson 10

MARKET OPPORTUNITY Addressing the Insatiable Appetite for Content Beyond Superheroes to a Wider Consumer Base ● Diversifying genres, story types, voices and formats ● Developing exciting new graphic novel offerings for young readers to meet exceptional demand ● Extending book market reach through opportunities in eCommerce and mass market ● Expanding investment in original IP with focus on high - growth genres and channels Robust $1.3 Billion Market for Comics and Graphic Novels 1 1 Source: Comichron 2020 Year North American Sales Report 8% CAGR led by children’s graphic novels and book channel sales 11

ORIGINAL CONTENT / IP Expanding adult and kids original IP titles to feed the entertainment slate Expansion of Original Titles Planned by Target Market ADULT: Drama, Horror, Sci - fi IDW titles similar to: Locke & Key by Joe Hill & Gabriel Rodriguez Wynonna Earp by Beau Smith 30 Days of Night by Steve Niles KIDS: Young Adult, Middle Grade IDW titles similar to: Johnny Boo by James Kolchalka Surfside Girls by Kim Dwinell Monster on the Hill by Rob Harrell 12

LICENSED CONTENT / IP 13 Licensed content generates stable cash flows for investment in original content development

14

BUILDING FANDOM ACROSS ENTERTAINMENT PLATFORMS Develop, produce, and distribute SURFSIDE GIRLS LOCKE & KEY WYNONNA EARP V WARS OCTOBER FACTION DIRK GENTLY 15

THE CONTENT ARMS RACE Driving Massive Investment in IP & Video Content 1 Ampere Analysis 2 Variety Intelligence Platform CONTENT SPEND BY SERVICE 2 2019 in billions. Streaming services on this list are potential customers. Netflix has streamed 4 of IDW Entertainment’s shows. Global content investment is expected to exceed $230 billion in 2022, primarily driven by subscription streaming services 1 16

ROBUST DEVELOPMENT PIPELINE AUGUST MOON D4VE INCREDIBLE CHANGE BOTS INFINITE KUNG FU DOC MACABRE JOHNNY BOO LODGER ALEISTER ARCAINE ASSASSINISTAS PINOCCHIO: VAMPIRE SLAYER PIRATE PENGUIN VS NINJA CHICKEN RADICAL SHIFT OF GRAVITY SPACEBAT & THE FUGITIVES BATS IN THE BELFRY HOMETIME 17

ON BUDGET PRODUCER FEES Fees paid on project production budget Often includes a share of back - end profits and limited merchandising rights COST PLUS Primarily offered by global OTT & streamers Covers production budget plus a percentage Producer may retain some ancillary and merchandising rights STUDIO Proceeds from one or more network sales fund production Studio generally retains control of global territories and merchandising rights DE - RISKED BUSINESS MODELS For Predictable Cash Flows 18

19

CREATOR - FOCUSED FUNNEL 20 A disciplined process for identifying rising creative talent for originals ● Developing the “machine” for franchise discovery and creation ● Focus on original pitches from current and aspiring comic creators ● Criteria - based approach allows flexibility to sign best creators, in premium genres; at win - win rates IDW Publishing reviews 500 - 1000 submissions annually 20 - 40 submissions are published each year In 2+ years, goal is to generate 4 - 6 greenlit TV projects per annum Within 3 - 5 years, goal is for studios to greenlight 1 - 2 film projects per annum

VALUE CREATION PUBLISHING: IP Machine that Pays for Itself • 100+ fully developed original titles with over 1000 characters in the IDW library • Adding 40+ fully developed titles and 400+ characters per year ENTERTAINMENT: Significant ROI on Select IDW Titles • Targeting 3 - 5 new titles per year to generate repeating high - margin revenue • Growing pipeline of entertainment projects Economics • Each title costs ~$100k to publish • 75+% of titles more than cover their costs; losses on others are de minimis Economics • IDW receives fees from distributors in the form of pure incremental profit ranging from $1M to >$3M per season Virtuous Cycle: Entertainment Drives Increased Publishing Sales The Future: Further Upside Generated by Reciprocal Use of IP in Both Divisions

SCARCITY VALUE • Most content creators have been acquired by companies such as Disney, DC Comics, Valiant, etc. • Competitor Dark Horse Comics, for example, was recently acquired by Embracer Group, a multi - billion - dollar gaming conglomerate • Consolidation is expected to continue as companies look to drive value by owning/expanding their IP libraries; the value of owned IP is further increased for consolidators in streaming, gaming, Web3, etc. as they can essentially decide which assets in their library are “winners” by having control over distribution and available spend on production IDW Value Creation Access to the best creators which have fewer trusted homes for IP Optionality as the asset continues to perform and build on library 22

2008 - 2013 IDW publishes original 37 Locke & Key comics in six story arcs 2008 - 2017 IDW publishes Standard & Master collections 2020 Netflix Premiere Netflix orders Seasons 2 and 3 2021 IDW Publishing teams with DC Comics for crossover event with Neil Gaiman’s The Sandman Universe Netflix airs Season 2 2022 Netflix scheduled to air Season 3 A Case Study Building a Successful Cross - Platform Franchise Halo effect of Season 1 and 2 on book sales. Anticipate similar halo effects after Season 3 Un - Locke - ing Value BUILD: Develop and maintain brand IP in - house with premiere creative talent. OWN: Capture all rights for potential exploitation opportunities. MONETIZE: Create marketplace leading content in publishing and media spaces and beyond. 23

POWERFUL NETWORK EFFECTS ● Creation and development of unique IP: ○ Invest $2 – 3M initially, then $1 – 2M+ each year thereafter ○ Generate 20 – 40 new IP each year ● “All rights” agreements through win - win approach with creators ● IP library feeds publishing and entertainment segments ● Additional monetization potential as network effect generates opportunities across platforms: games, films, podcasts, etc. 24

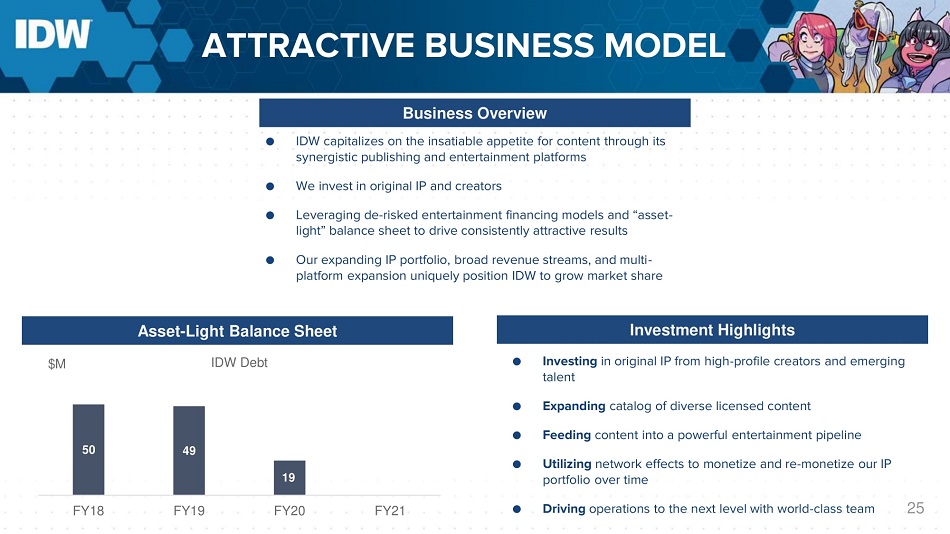

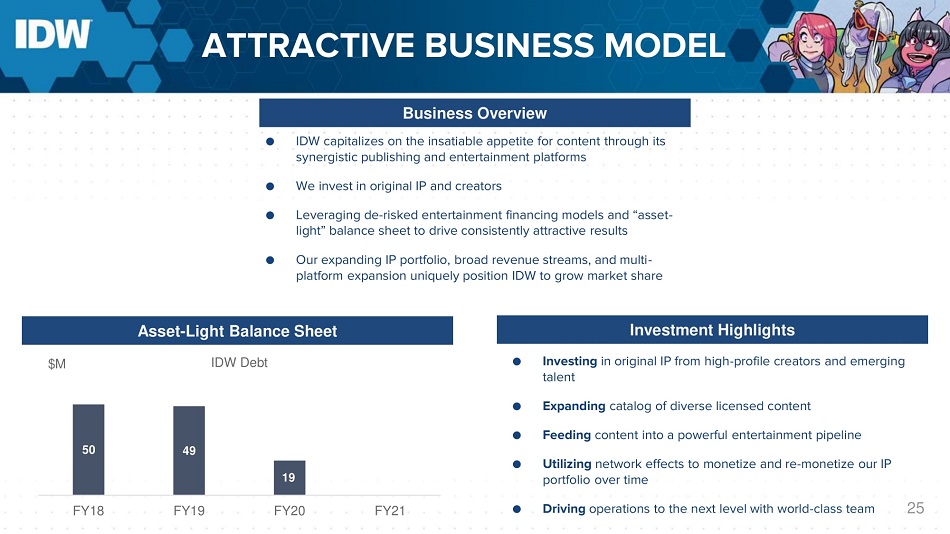

Business Overview Asset - Light Balance Sheet Investment Highlights භ ● IDW capitalizes on the insatiable appetite for content through its synergistic publishing and entertainment platforms ● We invest in original IP and creators ● Leveraging de - risked entertainment financing models and “asset - light” balance sheet to drive consistently attractive results ● Our expanding IP portfolio, broad revenue streams, and multi - platform expansion uniquely position IDW to grow market share ● Investing in original IP from high - profile creators and emerging talent ● Expanding catalog of diverse licensed content ● Feeding content into a powerful entertainment pipeline ● Utilizing network effects to monetize and re - monetize our IP portfolio over time Driving operations to the next level with world - class team 25 FY18 FY19 FY20 FY21 IDW Debt 50 49 19 $M ATTRACTIVE BUSINESS MODEL

investor.relations@idwmh.com