Exhibit 99.2

PennyMac Mortgage Investment Trust May 6, 2015 First Quarter 2015 Earnings Report

1Q15 Earnings Report 2 This presentation contains forward - looking statements within the meaning of Section 21 E of the Securities Exchange Act of 1934 , as amended, regarding management’s beliefs, estimates, projections and assumptions with respect to, among other things, the Company’s financial results, future operations, business plans and investment strategies, as well as industry and market conditions, all of which are subject to change . Words like “believe,” “expect,” “anticipate,” “promise,” “plan,” and other expressions or words of similar meanings, as well as future or conditional verbs such as “will,” “would,” “should,” “could,” or “may” are generally intended to identify forward - looking statements . Actual results and operations for any future period may vary materially from those projected herein, from past results discussed herein, or illustrative examples provided herein . Factors which could cause actual results to differ materially from historical results or those anticipated include, but are not limited to : changes in our investment objectives or investment or operational strategies ; volatility in our industry, the debt or equity markets, the general economy or the residential finance and real estate markets ; changes in general business, economic, market, employment and political conditions or in consumer confidence ; declines in residential real estate or significant changes in U . S . housing prices or activity in the U . S . housing market ; availability of, and level of competition for, attractive risk - adjusted investment opportunities in residential mortgage loans and mortgage - related assets that satisfy our investment objectives ; concentration of credit risks to which we are exposed ; the degree and nature of our competition ; our dependence on our manager and servicer, potential conflicts of interest with such entities, and the performance of such entities ; availability, terms and deployment of short - term and long - term capital ; unanticipated increases or volatility in financing and other costs ; the performance, financial condition and liquidity of borrowers ; incomplete or inaccurate information or documentation provided by customers or counterparties, or adverse changes in the financial condition of our customers and counterparties ; the quality and enforceability of the collateral documentation evidencing our ownership and rights in the assets in which we invest ; increased rates of delinquency, default and/or decreased recovery rates on our investments ; increased prepayments of the mortgages and other loans underlying our mortgage - backed securities and other investments ; the degree to which our hedging strategies may protect us from interest rate volatility ; our failure to maintain appropriate internal controls over financial reporting ; our ability to comply with various federal, state and local laws and regulations that govern our business ; changes in legislation or regulations or the occurrence of other events that impact the business, operations or prospects of government agencies, mortgage lenders and/or publicly - traded companies ; the creation of the Consumer Financial Protection Bureau, or CFPB, and enforcement of its rules ; changes in government support of homeownership ; changes in government or government - sponsored home affordability programs ; changes in governmental regulations, accounting treatment, tax rates and similar matters (including changes to laws governing the taxation of real estate investment trusts, or REITs ; limitations imposed on our business and our ability to satisfy complex rules for us to qualify as a REIT for U . S . federal income tax purposes and qualify for an exclusion from the Investment Company Act of 1940 and the ability of certain of our subsidiaries to qualify as REITs or as taxable REIT subsidiaries for U . S . federal income tax purposes and our ability and the ability of our subsidiaries to operate effectively within the limitations imposed by these rules ; and the effect of public opinion on our reputation . You should not place undue reliance on any forward - looking statement and should consider all of the uncertainties and risks described above, as well as those more fully discussed in reports and other documents filed by the Company with the Securities and Exchange Commission from time to time . The Company undertakes no obligation to publicly update or revise any forward - looking statements or any other information contained herein, and the statements made in this presentation are current as of the date of this presentation only . Forward - Looking Statements

3 First Quarter Highlights • Net income of $7.5 million on net investment income of $37.7 million – Diluted earnings per share of $0.09; return on equity of 2% – Dividend of $ 0.61 per share declared on March 24, 2015 – Book value per share declined to $20.68 at March 31, 2015 • Segment pretax results: Investment Activities: ($8.2) million; Correspondent Production: $4.4 million; tax benefit of $11.3 million – Investment Activities results driven by lower than expected performance in distressed loan investments, higher prepayments due to lower interest rates and the FHA’s unanticipated mortgage insurance premium (MIP) reduction that negatively affected ESS values, and hedge losses related to mortgage spread widening in the MBS portfolios • Continued strong cash flows from PMT’s existing investments, including $111.9 million in cash proceeds generated from the liquidation of mortgage loans and REO • New investments in mortgage servicing rights (MSRs) and excess servicing spread (ESS) – Added $27 million in new MSR investments resulting from correspondent production activities – Invested $46 million in ESS on mini - bulk and flow acquisitions of Agency MSRs by PennyMac Financial Services, Inc. (NYSE: PFSI ) related to $6.4 billion in UPB – MSR and ESS investments, related to $68 billion in UPB, grew to $581 million at March 31 1Q15 Earnings Report

4 Notable Activity After Quarter End • Entered into financing facilities for ESS and MSRs, borrowing $108 million • Completed acquisition of $136 million in ESS related to $15 billion in UPB of Agency MSRs • Expected to enter into an agreement with PFSI relating to the acquisition of approximately $74 million in ESS from bulk Ginnie Mae MSRs totaling $9.3 billion in UPB that PFSI is expected to acquire in early 3Q15 (1) • Entered into a credit risk transfer structure with Fannie Mae on PMT’s correspondent production • Granted membership in FHLB Des Moines 1Q15 Earnings Report (1) The MSR acquisition by PFSI and the Company’s purchase of excess servicing spread are subject to the negotiation and execution of definitive docu men tation, continuing due diligence and customary closing conditions, including required regulatory approvals. There can be no assurance that the committed amounts will ultimately be acquired or that the transactions will be completed at all.

3.0% 3.5% 4.0% 4.5% 5.0% 5 Current Market Environment and Outlook 1Q15 Earnings Report 140 150 160 170 180 Average 30 - year fixed rate mortgage (1) • Interest rates in 1Q15 reached their lowest levels since mid - 2013, driving higher refinancing volume – Industry forecasts now predict a $1.3 trillion mortgage origination market for 2015 • FHA’s reduction in its annual mortgage insurance premium (MIP) has boosted refinance activity • Home prices have been stagnant on a not - seasonally - adjusted basis since last summer – Housing values expected to increase, driven by underlying U.S. macroeconomic improvement and tight housing inventory in certain regions • Recent regulatory actions against large non - bank mortgage companies underscore the importance of effective governance, compliance, and operating systems (1) Freddie Mac Primary Mortgage Market Survey. 3.68% as of 04/30/15 (2) Not seasonally adjusted; Index was 100 for January 2000 (3) Moody’s Analytics Case Shiller 20 - City Home Price Index (2) 3.87 % 3.69%

1Q15 Earnings Report 6 Strong Cash Flows from Existing Investments Support Dividend Net Cash Flows from Existing Investments and Dividends (1) ($ in millions) • Substantial cash generated (income and return of capital) from PMT’s existing investments; includes: – Cash proceeds from all investments, including the liquidation of individual loans and REO, less repayment of corresponding debt – Servicing fees related to MSRs – Cash net interest income earned on distressed loans, MSRs, ESS, and MBS – Net of all operating expenses, including servicing fees, management fees, professional fees, compensation, and other expenses • Analysis excludes: – New capital raised or expansion of debt financing – Sales of investments (e.g., bulk sales of distressed whole loans, MBS ) – New investments in MSRs, ESS, MBS, or NPLs, including cash used in PMT’s Correspondent Production segment Ŷ Net cash flow from existing investments Ŷ Dividends paid during the quarter $47 $47 $46 $40 $51 $44 $44 $45 $46 $46 $0 $20 $40 $60 $80 1Q14 2Q14 3Q14 4Q14 1Q15 (1) Please see page 36 in the appendix for a reconciliation of this non - GAAP financial measure to the most directly comparable GAAP financial measure

PMT Aims to Deliver Superior Return on Equity Through Multiple Strategies 1Q15 Earnings Report 7 Correspondent Loan Aggregation MSRs and ESS Prime Non - Agency Loans (1) Commercial Real Estate Loans Distressed Residential Whole Loans • Mortgage - related investments that require specialized operational capabilities enabled by our relationship with PFSI • Multiple strategies together expected to deliver attractive returns even with shifts in the market environment (e.g., fluctuations in interest rates) • Periodic results include the impact of changes in fair value of PMT’s assets and liabilities • These strategies combined to produce a 12.5% return on equity (ROE) in 2014 and 15.4% ROE in 2013 GSE Risk Transfers on PMT’s Production Agency and Non - Agency MBS Interest rate s ensitive strategies Newer strategies (1) Includes retained interests from private - label securitizations

($ in millions) Income Contribution (2)(3) Equity Allocated (4) Return on Equity (ROE) Distressed loan investments 214.0$ 1,113$ 19.2% Interest rate sensitive strategies (1) : Correspondent production 11.4$ 59$ 19.4% MSRs 11.8$ 104$ 11.3% ESS (incl. recapture) (12.2)$ 86$ (14.3)% Agency MBS 8.2$ 14$ 58.0% Non-Agency MBS (incl. jumbo) 19.0$ 55$ 34.7% -$ Net interest rate sensitive strategies 38.2$ 318$ 12.0% Cash & short term investments 0.8$ 129$ 0.6% Management fees & corporate expenses (73.5)$ ─ ─ Benefit for income taxes 15.1$ ─ ─ Net income 194.5$ 1,560$ 12.5% 8 PMT Performance by Strategy – Full - Year 2014 1Q15 Earnings Report • Distressed loans contributed ~19% ROE before management fees and corporate expenses • Manage for net performance across all interest rate sensitive strategies, e.g., lower performance in ESS offset by outperformance in MBS strategies (1) Includes income offset by any associated hedges (2) Income contribution is net of any direct expenses associated with investments (e.g., loan fulfillment fees, loan servicing fe es) (3) MSR, ESS, and distressed loan strategies include an allocation of exchangeable senior notes and associated expense ( 4 ) Management’s internal allocation of equity. Amounts represent weighted averages during the period

($ in millions) Income Contribution (2)(3) Equity Allocated (4) Annualized Return on Equity (ROE) Distressed loan investments 13.8$ 994$ 5.5% Interest rate sensitive strategies (1) : Correspondent production 4.6$ 98$ 18.7% MSRs 0.5$ 146$ 1.4% ESS (incl. recapture) (3.8)$ 104$ (14.6)% Agency MBS 1.2$ 13$ 37.3% Non-Agency MBS (incl. jumbo) (3.4)$ 55$ (24.6)% Net interest rate sensitive strategies (0.9)$ 415$ (0.9)% Cash & short term investments 0.3$ 153$ 0.8% Management fees & corporate expenses (17.0)$ ─ ─ Benefit for income taxes 11.3$ ─ ─ Net income 7.5$ 1,563$ 1.9% 9 PMT Performance by Strategy – 1Q15 1Q15 Earnings Report • Reduced performance of distressed loans driven by lower home prices – see page 24 for details • Losses on MSR and ESS value due to decline in interest rates and FHA policy change • Hedge losses and mortgage spread widening adversely affects MBS portfolio valuations (1) Includes income offset by any associated hedges (2) Income contribution is net of any direct expenses associated with investments (e.g., loan fulfillment fees, loan servicing fe es) (3) MSR and ESS strategies include an allocation of exchangeable senior notes and associated expense (4) Management’s internal allocation of equity. Amounts represent weighted averages during the period

Correspondent loan inventory $3,827 $4,402 $4,160 $4,358 $5,279 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 $5,000 $5,500 1Q14 2Q14 3Q14 4Q14 1Q15 10 PMT's Investment Portfolio Continues to Grow and Diversify Leverage ratio (1) 1.6x 2.0x 1.8x 2.0x 2.6x (1) All borrowings, including exchangeable senior notes and asset - backed secured financing of the variable interest entity, divided by shareholders’ equity at period end Mortgage Assets ($ in millions) PMT’s L ong - Term Investments Ŷ Retained interests from private - label securitizations Ŷ MSRs and ESS Ŷ Agency and non - Agency RMBS Ŷ Distressed whole loans and REO 1Q15 Earnings Report

1Q15 Earnings Report 11 Significant New Financing Initiatives Completed • Established PMT Insurance, LLC, a wholly - owned captive insurance subsidiary of PMT in 2014 to help manage a portion of PMT’s insurance risk – Recently granted membership in the FHLB Des Moines • Diversifies PMT’s funding sources and expands term financing; helps facilitate the expansion of non - Agency lending Federal Home Loan Bank (FHLB) • Recently completed facility to finance Freddie Mac MSRs – $56 million drawn to date • Cost - effective financing expected to significantly enhance returns on equity for MSRs from PMT’s correspondent production MSR Financing • PFSI’s facility for Ginnie Mae MSR recently amended to allow the financing of related ESS owned by PMT • $150 million of new financing which is expected to enhance the returns for Ginnie Mae ESS and help facilitate future acquisitions • PFSI passes through Credit Suisse’s financing terms to PMT ESS Financing

• Have been working with Fannie Mae and J.P. Morgan to develop a credit risk transfer structure using newly originated loans aggregated by PMT – Opportunity to invest in credit risk and designed to capture the benefits of PMT’s high - quality correspondent production – Aligns with Fannie Mae’s interest in bringing in private capital via risk transfer transactions • Deal underwritten by JPMorgan will result in an M1 bond, owned by PMT, that will cover first losses on a pool of loans delivered to Fannie Mae – Structure creates an IO strip that pays the coupon on the M1 bond PMT CRT 2015 - 1 (SPV) PMT Conventional Conforming Production IO Strip Retained Fannie Mae Cash Collateral Account (CCA) Class M1 Bond 12 GSE Risk Transfers on PMT’s Correspondent Production 1Q15 Earnings Report PMT CRT 2015 - 1 delivers loans to Fannie Mae and sells loans to the market PMT CRT 2015 - 1 pays principal and interest on M1 bond over time PMT CRT 2015 - 1 issues securities and deposits proceeds in CCA Up to $1 billion in UPB filled on flow basis

Targeted Returns of PMT’s Strategies 13 MSRs and ESS Prime Non - Agency Loans (2) Agency and Non - Agency MBS Distressed Residential Whole Loans Correspondent Loan Aggregation GSE Risk Transfers on PMT’s Production Commercial Real Estate Loans 1Q15 Earnings Report Targeted Unlevered Yield Targeted Gross Pretax Return on Equity (1) 6% - 8% 10 bps - 15 bps of production 3% - 5% 2% - 6% 7.5% - 12% (incl. expected recapture contribution) 6% - 7.5% 5% - 7% Note: This slide presents examples for illustrative purposes only, using PMT’s base case assumptions (e.g., for credit perfor man ce, prepayment speeds, financing economics). Actual results may differ materially. Please refer to the disclaimers on slide 2. (1) Gross return contribution net of estimated direct expenses associated with each strategy (e.g., loan servicing fees, loan ful fi llment fees). Gross return contribution does not include an allocation of management fees, corporate operating and other administrative expenses. Certain strategies are subject to tax exp ense associated with the taxable REIT subsidiary. (2) Includes retained interests from private - label securitizations 12% - 16% 26% - 36% 8% - 13% 6% - 14% 9% - 16% 11% - 16% 16% - 20% Newer strategies

Mortgage Investment Activities

1Q15 Earnings Report 15 Distressed Loan Performance Impacted by Reduced Resolution Activity • UPB of total liquidation activities, which are comprised of payoffs, foreclosure sales to third parties, short sales and REO sales, decreased 14% from 4Q14 • Recent NPL acquisitions did not board onto PFSI’s servicing platform until late in 1Q15 – did not contribute materially to resolution activity during the quarter • Modification activity slowed 40% Q/Q, resulting in reduced interest income • Loans transitioning to REO from foreclosure increased 2% from 4Q14 – will result in future resolutions through property sale or rental $46 $16 $9 $8 $29 $23 $100 $112 $98 $58 $126 $129 4Q14 1Q15 4Q14 1Q15 4Q14 1Q15 4Q14 1Q15 4Q14 1Q15 4Q14 1Q15 Liquidation Activities Payoffs Foreclosure sale Short sale REO sales Modifications Foreclosure t o REO ($ in millions) Resolution Activity (UPB)

Illinois, $17.0 Florida, $53.0 Maryland, $35.7 California, $85.3 Other states, $126.6 1Q15 Earnings Report 16 Increased Focus on Rental Initiatives for PMT's REO Portfolio • Launched REO rental initiative leveraging local third - party property management – Tighter market yields make rental option attractive – Alternative resolution to REO sales that provides PMT a longer term investment • Selectively identifying rental targets from PMT’s portfolio of over 900 REO properties • Expect this strategy to deliver attractive returns on equity, including the potential for securitization (1) • Also launching a proprietary lease - to - own program (“PennyMac Equity Advantage Lease”) – Designed to help transition renters to homeowners by allowing them to apply a portion of their monthly rent toward a future home purchase – Meets the specific needs of first - time homebuyers – Provides a path to homeownership for qualified borrowers with steady income history who may have had a short sale or foreclosure in the past PMT’s REO Portfolio by State (2) Total = $317.5 million (1) Actual results may differ materially. Please refer to the disclaimers on slide 2. ( 2) As of 3/31/15

1Q14 2Q14 3Q14 4Q14 1Q15 End-to-end cycle time (days) 8.5 7.0 8.9 8.2 8.2 4Q14 1Q15 Correspondent production sellers 344 356 76% 60% Purchase money loans, as % of total acquisitions acquisitions Selected Operational Metrics Selected Program Metrics Correspondent Production Volume and Mix Low Rates and MIP Reduction Drive Higher Correspondent Production Volume (1) For Government loans, PMT earns a sourcing fee and interest income for its holding period and does not pay a fulfillment fee ($ in billions) UPB • Correspondent acquisitions totaled $8.0 billion, up 10% Q/Q – Conventional conforming and jumbo acquisitions were $2.9 billion; locks were $3.5 billion – Total lock volume of $9.5 billion, up 27% Q/Q • April correspondent acquisitions totaled $3.6 billion; locks totaled $4.6 billion • Growing business from previously under - represented geographies, e.g., New England • Adding sales managers to continue growth of seller relationships, targeting 480 seller relationships by year end • Building “development book” of typically smaller originators who can benefit from our operational and risk management expertise – Accounted for $1.5 billion of lock volume in 1Q15 compared to $80 million in 1Q14 • Utilizing proprietary technology to optimize margin opportunity by product and geography (1) (1) 1Q15 Earnings Report $1.9 $2.9 $3.5 $2.8 $2.8 $2.9 $4.0 $4.4 $4.4 $5.1 $5.5 $8.1 $8.4 $7.5 $9.5 $0 $2 $4 $6 $8 $10 1Q14 2Q14 3Q14 4Q14 1Q15 Govt Jumbo Conventional Conforming Total Locks 17

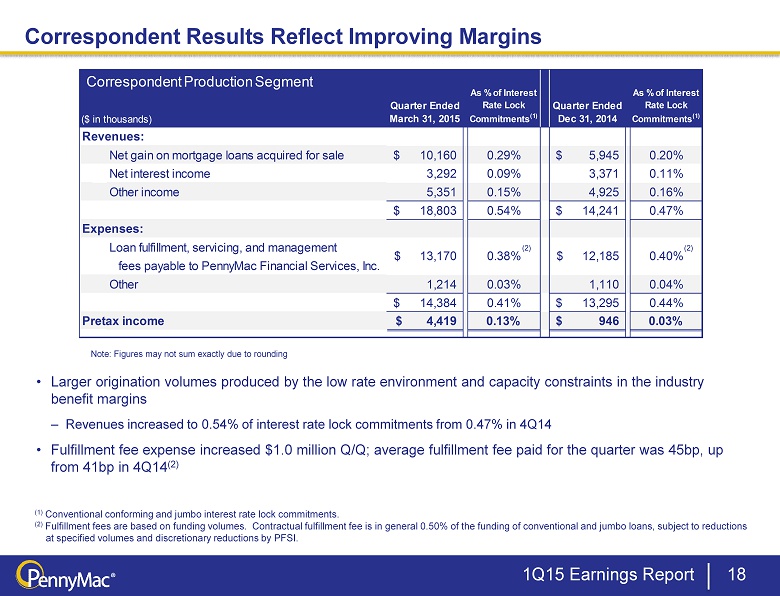

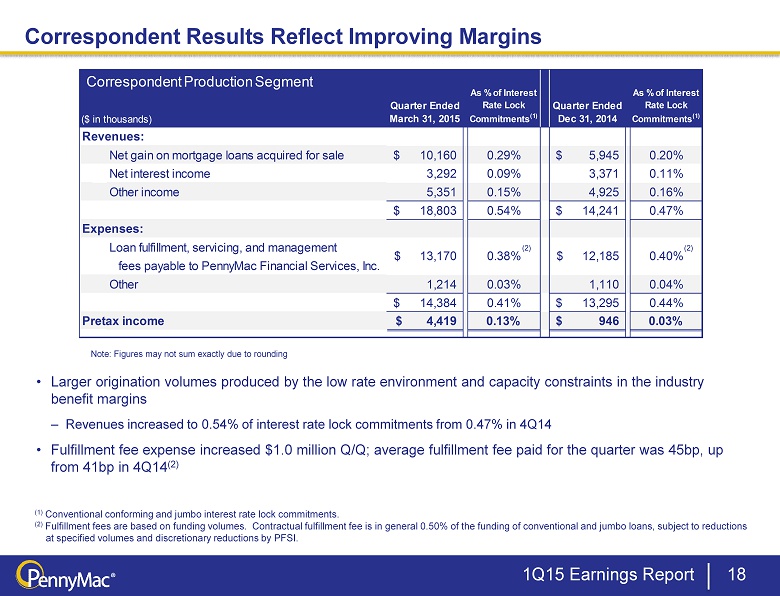

($ in thousands) Quarter Ended March 31, 2015 As % of Interest Rate Lock Commitments (1) Quarter Ended Dec 31, 2014 As % of Interest Rate Lock Commitments (1) Revenues: Net gain on mortgage loans acquired for sale 10,160$ 0.29% 5,945$ 0.20% Net interest income 3,292 0.09% 3,371 0.11% Other income 5,351 0.15% 4,925 0.16% 18,803$ 0.54% 14,241$ 0.47% Expenses: Loan fulfillment, servicing, and management fees payable to PennyMac Financial Services, Inc. Other 1,214 0.03% 1,110 0.04% 14,384$ 0.41% 13,295$ 0.44% Pretax income 4,419$ 0.13% 946$ 0.03% 13,170$ 0.38% 12,185$ 0.40% Correspondent Production Segment Correspondent Results Reflect Improving Margins 18 • Larger origination volumes produced by the low rate environment and capacity constraints in the industry benefit margins – Revenues increased to 0.54% of interest rate lock commitments from 0.47% in 4Q14 • Fulfillment fee expense increased $1.0 million Q/Q; average fulfillment fee paid for the quarter was 45bp, up from 41bp in 4Q14 (2) (1) Conventional conforming and jumbo interest rate lock commitments. (2) Fulfillment fees are based on funding volumes. Contractual fulfillment fee is in general 0.50% of the funding of conventional and jumbo loans, subject to reductions at specified volumes and discretionary reductions by PFSI . Note: Figures may not sum exactly due to rounding (2) 1Q15 Earnings Report (2)

$452 $506 $533 $549 $581 $0 $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 $80,000 $0 $100 $200 $300 $400 $500 $600 1Q14 2Q14 3Q14 4Q14 1Q15 MSR and ESS Investments Continue to Grow 19 ($ in millions) • Continued portfolio growth as investments in MSR and ESS reached $581 million, related to underlying loans with a UPB of $68 billion, at March 31, 2015 – Organic growth in MSR investments resulting from correspondent production activity – New investments in ESS totaling $46 million resulting from mini - bulk and flow MSR acquisitions by PFSI MSR and ESS Assets at Period End Fair value on balance sheet Related UPB Ŷ MSRs Ŷ Excess servicing spread (ESS) Ŷ UPB (right axis) See slides 22 and 23 in the appendix for additional information. 1Q15 Earnings Report

20 Recently Completed and New Investments in ESS Related to $25bn of Agency MSRs See slides 29 and 30 in the appendix for additional information. ▪ New pending investment in seasoned Ginnie Mae MSR portfolio – Loans with above - market average note rates – low mortgage rate environment results in refinance recapture opportunities – Relatively low delinquency rates ▪ Co - investment by PMT in the excess servicing spread cash flows (1) The MSR acquisition by PFSI and the Company’s purchase of excess servicing spread are subject to the negotiation and execution of definitive documentation, continuing due diligence and customary closing conditions, including required regulatory approvals. There can be no assurance that the committed amount will ultimately be acquired or that the transactions will be completed at all. 1Q15 Earnings Report Unpaid Principal Balance $14.9 billion Unpaid Principal Balance $9.3 billion Weighted Avg. Note Rate 3.87% Weighted Avg. Note Rate 4.73% Delinquent Loans 2.87% Delinquent Loans 5.65% Weighted Avg. Time Since Origination 24 months Weighted Avg. Time Since Origination 57 months Total Servicing Fee 34.9 bp Total Servicing Fee 35.4 bp Excess Servicing Fee 17.9 bp Excess Servicing Fee 22.9 bp Investment 136.1 million Expected Investment $74.5 million Recently Completed Acquisition ─ Previously Announced New Pending Acquisition (1)

Financial Results

22 Pretax Income (Loss) by Operating Segment Note: Figures may not sum exactly due to rounding • First quarter net income included a tax benefit of $11.3 million – Benefit related to a loss in the taxable REIT subsidiary 1Q15 Earnings Report Investment Correspondent Total Pretax ($ in millions) Activities Production Income 1Q14 33.1$ 3.1$ 36.3$ 2Q14 70.9$ 2.4$ 73.3$ 3Q14 55.1$ 2.8$ 57.9$ 4Q14 11.0$ 0.9$ 11.9$ 1Q15 (8.2)$ 4.4$ (3.8)$

Quarter Ended ($ in thousands) March 31, 2015 December 31, 2014 Revenues: Net gain on investments: Mortgage loans at fair value 17,186$ 20,676$ Mortgage loans held by variable interest entity net of asset-backed secured financing (6,642) (5,370) Mortgage-backed securities (850) 3,394 Excess spread investment (6,247) (3,000) 3,447 15,700 Net interest income Interest income 33,573 36,174 Interest expense 21,926 18,226 11,647 17,948 Net loan servicing fees 8,001 11,181 Other (4,241) (6,011) Total revenues 18,854 38,818 Expenses: Servicing and Management fees payable to PennyMac Financial Services, Inc. (1) Other 9,724 8,270 Total expenses 27,093 27,824 Pretax (loss) income (8,239)$ 10,994$ 17,369 19,554 23 1Q15 Investment Activities Segment Results • Segment revenue decreased 51% Q/Q: – Net gain on investments decreased 78% Q/Q, driven by: o Lower valuation gains on distressed loans o Losses on ESS due to higher prepayments, partially offset by $1.3 million in recapture income o Hedge losses related to mortgage spread widening in our MBS portfolios – Net interest income decreased 35% Q/Q, driven by $6.2 million decrease in capitalized interest from loan modifications (2) – Net servicing fee revenue decreased 28% Q/Q driven by: o MSR impairment and fair value changes due to higher prepayments o Partially offset by hedge gains and higher servicing fee revenue from a growing MSR portfolio • Expenses fell 3% Q/Q: – Loan servicing fees decreased 7% due to a reduction in resolution activity – Incentive fees declined 49% related to PMT’s reduced performance (1) Servicing fees include both special servicing for PMT’s distressed portfolio and subservicing for PMT’s mortgage servicing rights (2) Capitalized interest from loan modifications increases interest income and generally reduces gains from loan valuations 1Q15 Earnings Report

($ in thousands) Quarter ended March 31, 2015 Gain on Proceeds liquidation (2) Mortgage loans 44,943$ 5,807$ 2,042$ Performing loan sale 939 (186) (284) REO 65,976 962 5,568 111,858$ 6,583$ 7,326$ Accumulated gains (1) ($ in thousands) March 31, 2015 December 31, 2014 Valuation Changes: Performing loans 15,232$ 4,831$ Nonperfoming loans 195 12,653 15,427 17,484 Payoffs 2,043 3,191 Sales (284) - 17,186$ 20,675$ Quarter ended 24 Investment Gains and Cash Flows from the Distressed Loan Portfolio • Net gains on distressed loans totaled $17.2 million, a decrease from $20.7 million in 4Q14 – Valuation gains adversely affected by lower current home prices versus prior forecasts and reduced expectations for future price appreciation o Estimates of home price changes in various regions of the country were flat to slightly negative in recent months ▪ Reduction in the expected realization value of certain properties transitioning from foreclosure to REO status o Expectation for home price appreciation over the next 12 months lowered to 4.0%, versus 4.8% in 4Q14 – Fewer than expected loans transitioning from severely delinquent status to foreclosure, in addition to fewer than expected loans transitioning into reperformance – Performing loans experienced gains resulting from an increase in observed market prices for similar assets and improved performance characteristics • Cash proceeds from liquidation activity on loans and REO totaled $ 111.8 million – Accumulated gains on assets liquidated during the quarter were $6.6 million, and gains on liquidation were $7.3 million Net Gains on Mortgage Loans Cash Proceeds and Gain on Liquidation (1) Represents valuation gains and losses recognized during the period the Company held the respective asset, but excludes the gain or loss recorded upon sale or repayment of the respective asset (2) Represents the gain or loss recognized as of the date of sale or repayment of the respective asset 1Q15 Earnings Report

At 3/31/15 Under lower of amortized cost or fair value Under fair value Fair value Pool UPB $29,156 $6,001 $33,142 Pool weighted average coupon 3.81% 4.78% 4.11% Pool prepayment speed assumption (CPR) 8.9% 13.5% 11.6% Weighted average servicing fee/spread 0.26% 0.25% 0.16% Fair value $327.7 $49.4 $222.3 As multiple of servicing fee 4.38 3.26 4.20 Carrying (accounting) value $309.7 $49.4 $222.3 ($ in millions) Mortgage Servicing Rights Excess Servicing Spread 25 Valuation of MSRs and Excess Servicing Spread (ESS) • PMT carries most of its MSRs at the lower of amortized cost or fair value (“LOCOM”) – MSRs where the note rate on the underlying loan is less than or equal to 4.5% • The fair value of MSRs carried at LOCOM was $18.0 million in excess of the carrying value at March 31, 2015, compared to $ 21.8 million at December 31, 2014 1Q15 Earnings Report

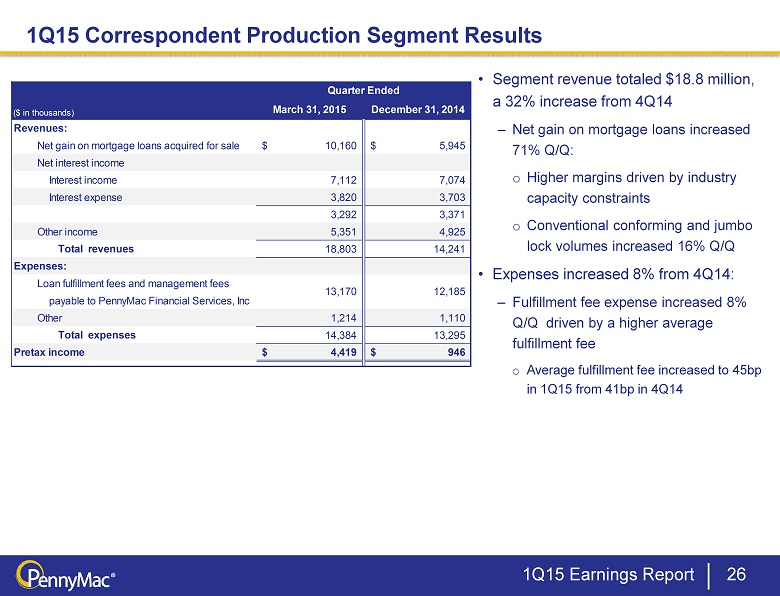

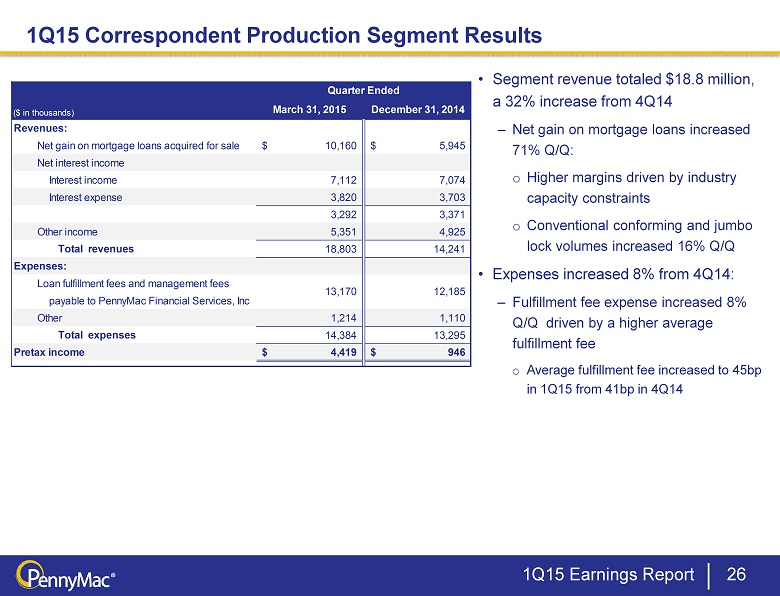

26 1Q15 Correspondent Production Segment Results • Segment revenue totaled $18.8 million, a 32% increase from 4Q14 – Net gain on mortgage loans increased 71% Q/Q: o Higher margins driven by industry capacity constraints o Conventional conforming and jumbo lock volumes increased 16% Q/Q • Expenses increased 8% from 4Q14 : – Fulfillment fee expense increased 8% Q/Q driven by a higher average fulfillment fee o Average fulfillment fee increased to 45bp in 1Q15 from 41bp in 4Q14 1Q15 Earnings Report Quarter Ended ($ in thousands) March 31, 2015 December 31, 2014 Revenues: Net gain on mortgage loans acquired for sale 10,160$ 5,945$ Net interest income Interest income 7,112 7,074 Interest expense 3,820 3,703 3,292 3,371 Other income 5,351 4,925 Total revenues 18,803 14,241 Expenses: Loan fulfillment fees and management fees payable to PennyMac Financial Services, Inc Other 1,214 1,110 Total expenses 14,384 13,295 Pretax income 4,419$ 946$ 13,170 12,185

Appendix

$0.83 $0.90 $0.86 $0.57 $0.69 $0.50 $0.93 $0.69 $0.34 $0.09 $0.57 $0.57 $0.57 $0.57 $0.59 $0.59 $0.59 $0.61 $0.61 $0.61 $20.68 $17.00 $18.00 $19.00 $20.00 $21.00 $22.00 $0.00 $0.20 $0.40 $0.60 $0.80 $1.00 4Q12 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 Diluted EPS (left axis) Dividend (left axis) Book value per share (right axis) 28 PMT Dividends and Book Value Over Time 18% 18% 11% 14% 10% 19% 14% 2% Return on Equity (2) (1) At period end. Book value per share in 4Q13 was reduced by two dividends declared in that quarter. ( 2) Return on average equity during the respective quarter; return on average equity is calculated based on annualized quarterly net income as a percentage of monthly average shareholders’ equity during the period. 7 % 17% Book value per share (1) EPS & Dividend 1Q15 Earnings Report

Opportunity for PFSI and PMT in MSR Acquisitions 29 Why Are MSR Sales Occurring? How Do MSRs Come to Market? • Large servicers are selling MSRs due to continuing operational pressures, higher regulatory capital requirements for banks (treatment under Basel III) and a re - focus on core customers/businesses • Independent mortgage banks are selling MSRs due to reduced origination volumes, operational losses, and a need for capital • Intermittent large bulk portfolio sales ($10+ billion in UPB) – Require considerable coordination with selling institutions and Agencies • Mini - bulk sales (typically $500 million to $5 billion in UPB) – Increased activity as originators sell MSRs retained in 2012 and 2013 • Flow/co - issue MSR transactions (monthly commitments, typically $ 20 - 100 million in UPB) – Alternative delivery method typically from larger independent originators Which MSR Transactions Are Attractive? • GSE and Ginnie Mae servicing in which PFSI has distinctive expertise • MSRs sold and operational servicing transferred to PFSI (not subserviced by a third party) • Measurable rep and warranty liability for PFSI PFSI is uniquely positioned be a successful acquirer of MSRs • Proven track record of complex MSR and distressed loan transfers • Operational platform that addresses the demands of the Agencies, regulators, and financing partners • Physical capacity in place to service $200 billion in UPB • Co - investment opportunity for PMT in the excess servicing spread 1Q15 Earnings Report

PMT's Excess Servicing Spread Investments in Partnership with PFSI 30 (1) The contractual servicer and MSR owner is PennyMac Loan Services, LLC, an indirect subsidiary of PennyMac Financial Services, Inc. (2) Subject and subordinate to Agency rights (under the related servicer guide); does not change the contractual servicing fee pa id by the Agency to the servicer. Excess Servicing Spread (e.g., 12.5bp) MSR Asset (e.g., 25bp servicing fee) Acquired by PFSI from Third - Party Seller (1) ▪ PMT co - invests in Agency MSRs acquired from third - party sellers by PFSI ▪ PMT acquires the right to receive the excess servicing spread cash flows over the life of the underlying loans ▪ PFSI owns the MSRs and services the loans Excess Servicing Spread (2) ▪ Interest income from a portion of the contractual servicing fee – Realized yield dependent on prepayment speeds and recapture Base MSR ▪ Income from a portion of the contractual servicing fee ▪ Also entitled to ancillary income ▪ Bears expenses of performing loan servicing activities ▪ Required to advance certain payments largely for delinquent loans Base MSR (e.g., 12.5bp) Acquired by PMT from PFSI (1) Example transaction: actual transaction details may vary materially 1Q15 Earnings Report

- 3% - 2% - 1% 0% 1% 2% 3% - 100 - 75 - 50 - 25 0 25 50 75 100 "Long" Assets MSRs/ESS and Hedges Net Exposure (2) • PMT’s interest rate risk exposure is managed on a “global” basis – Disciplined hedging – Multiple mortgage - related investment strategies with complementary interest rate sensitivities • In a hypothetical 100 bps drop in interest rates, the estimated fair value loss would be less than 1% of shareholders’ equity (1) Management of PMT’s Interest Rate Risk (1) 31 Estimated Sensitivity to Changes in Interest Rates % change in PMT shareholders’ equity At 3/31/15 (1) Analysis does not include PMT assets for which interest rates are not a key driver of values, i.e ., distressed whole loans and REO. The sensitivity analyses on the slide and the associated commentary are limited in that they are estimates as of March 31, 2015; only reflect movements in interest rates and do not contemplate other variables; do not incorporate changes in the variables in relation to other variables; are subject to the accuracy of various models and assumptions used; and do not inco rpo rate other factors that would affect the Company’s overall financial performance in such scenarios, including operational adjustments made by management to account for changing circums tan ces. For these reasons, the preceding estimates should not be viewed as an earnings forecast . ( 2) Includes loans acquired for sale and IRLCs, net of associated hedges, Agency and Non - Agency MBS assets ( 3) Includes MSRs, ESS, and hedges which include put and call options on MBS, Eurodollar futures and Treasury futures (4) Net exposure represents the net position of the “Long” Assets Position and the MSR/ESS Investments and Hedges (3) (4) Instantaneous parallel shock in interest rates (in bps) 1Q15 Earnings Report

($ in millions) 1Q14 2Q14 3Q14 4Q14 1Q15 Fundings Conventional 1,907$ 2,911$ 3,509$ 2,772$ 2,831$ Government 2,913 3,991 4,378 4,389 5,106 Jumbo 13 81 169 116 59 Total 4,833$ 6,983$ 8,056$ 7,276$ 7,996$ Locks Conventional 2,163$ 3,393$ 3,554$ 2,844$ 3,433$ Government 3,282 4,398 4,621 4,473 6,010 Jumbo 66 314 199 172 70 Total 5,512$ 8,105$ 8,373$ 7,489$ 9,512$ Fundings and Locks by Product 32 Note: Figures may not sum exactly due to rounding 1Q15 Earnings Report

Purchase 1Q15 Purchase 1Q15 Purchase 1Q15 Purchase 1Q15 Balance ($mm) 182.7$ 38.4 Balance ($mm) 195.5$ 30.8 Balance ($mm) 146.2$ 21.9 Balance ($mm) 277.8$ 57.5 Pool Factor (1) 1.00 0.21 Pool Factor (1) 1.00 0.16 Pool Factor (1) 1.00 0.15 Pool Factor (1) 1.00 0.21 Current 6.2% 26.9% Current 5.1% 27.4% Current 1.2% 21.0% Current 5.0% 31.9% 30 1.6% 7.2% 30 2.0% 13.2% 30 0.4% 11.7% 30 4.0% 8.4% 60 5.8% 4.1% 60 4.1% 2.9% 60 1.3% 3.1% 60 5.1% 4.4% 90+ 37.8% 13.8% 90+ 42.8% 15.4% 90+ 38.2% 22.2% 90+ 26.8% 17.0% FC 46.4% 31.4% FC 45.9% 30.4% FC 58.9% 28.1% FC 59.1% 23.7% REO 2.3% 16.6% REO 0.0% 10.8% REO 0.0% 13.8% REO 0.0% 14.6% Purchase 1Q15 Purchase 1Q15 Purchase 1Q15 Purchase 1Q15 Balance ($mm) 515.1$ 152.5 Balance ($mm) 259.8$ 85.7 Balance ($mm) 542.6$ 147.4 Balance ($mm) 49.0$ 25.0 Pool Factor (1) 1.00 0.30 Pool Factor (1) 1.00 0.33 Pool Factor (1) 1.00 0.27 Pool Factor (1) 1.00 0.51 Current 2.0% 24.5% Current 11.5% 29.0% Current 0.6% 25.9% Current 0.2% 26.3% 30 1.9% 6.1% 30 6.5% 7.0% 30 1.3% 5.1% 30 0.1% 6.4% 60 3.9% 2.8% 60 5.2% 4.3% 60 2.0% 1.6% 60 0.2% 4.7% 90+ 25.9% 18.1% 90+ 31.2% 24.2% 90+ 22.6% 24.8% 90+ 70.4% 30.1% FC 66.3% 33.7% FC 43.9% 21.6% FC 73.0% 29.0% FC 29.0% 20.4% REO 0.0% 14.8% REO 1.7% 13.9% REO 0.4% 13.6% REO 0.0% 12.1% Purchase 1Q15 Purchase 1Q15 Purchase 1Q15 Balance ($mm) 402.5$ 143.9 Balance ($mm) 357.2$ 180.8 Balance ($mm) 290.3$ 163.0 Pool Factor (1) 1.00 0.36 Pool Factor (1) 1.00 0.51 Pool Factor (1) 1.00 0.56 Current 45.0% 38.4% Current 0.0% 23.2% Current 3.1% 31.6% 30 4.0% 9.1% 30 0.0% 2.1% 30 1.3% 8.4% 60 4.3% 4.9% 60 0.1% 1.7% 60 5.4% 3.5% 90+ 31.3% 23.3% 90+ 49.1% 17.8% 90+ 57.8% 19.2% FC 15.3% 17.8% FC 50.8% 33.4% FC 32.4% 21.1% REO 0.1% 6.4% REO 0.0% 21.7% REO 0.0% 16.2% 1Q12 2Q12 3Q12 4Q12 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 No Pools Purchased in this Quarter. Distressed Portfolio by Acquisition Period 33 (1) Ratio of unpaid principal balance remaining to unpaid principal balance at acquisition 1Q15 Earnings Report

Distressed Portfolio by Acquisition Period (cont.) 34 (1) Ratio of unpaid principal balance remaining to unpaid principal balance at acquisition 1Q15 Earnings Report Purchase 1Q15 Purchase 1Q15 Purchase 1Q15 Purchase 1Q15 Balance ($mm) 366.2$ 216.2 Balance ($mm) 397.3$ 295.9 Balance ($mm) 929.5$ 717.8 Balance ($mm) 507.3$ 441.6 Pool Factor (1) 1.00 0.59 Pool Factor (1) 1.00 0.74 Pool Factor (1) 1.00 0.77 Pool Factor (1) 1.00 0.87 Current 1.6% 41.7% Current 4.8% 25.3% Current 0.8% 18.3% Current 1.4% 11.6% 30 1.5% 8.2% 30 7.4% 6.2% 30 0.3% 2.0% 30 0.2% 1.6% 60 3.5% 4.8% 60 7.6% 4.2% 60 0.7% 1.5% 60 0.0% 0.5% 90+ 82.2% 19.9% 90+ 45.3% 22.3% 90+ 58.6% 23.6% 90+ 38.3% 17.1% FC 11.2% 16.6% FC 34.9% 29.3% FC 39.6% 35.8% FC 60.0% 52.4% REO 0.0% 8.8% REO 0.0% 12.7% REO 0.0% 18.8% REO 0.0% 16.8% Purchase 1Q15 Purchase 1Q15 Purchase 1Q15 Balance ($mm) 439.0$ 388.6 Balance ($mm) 37.9$ 35.6 Balance ($mm) 330.8$ 327.0 Pool Factor (1) 1.00 0.89 Pool Factor (1) 1.00 0.94 Pool Factor (1) 1.00 0.99 Current 6.2% 13.7% Current 0.7% 13.5% Current 1.6% 6.9% 30 0.7% 1.8% 30 0.6% 3.6% 30 1.6% 3.1% 60 0.7% 1.5% 60 1.4% 6.1% 60 7.1% 4.7% 90+ 37.5% 15.5% 90+ 59.0% 30.0% 90+ 52.7% 38.8% FC 53.8% 53.4% FC 38.2% 40.0% FC 36.9% 45.9% REO 1.1% 14.1% REO 0.0% 6.7% REO 0.0% 0.6% 1Q14 2Q14 3Q14 4Q14 1Q13 2Q13 3Q13 4Q13 No Pools Purchased in this Quarter.

$723 $1,015 $982 $0 $500 $1,000 $1,500 $2,000 $2,500 Fair Value on Balance Sheet Collateral Value Unpaid Principal Balance $1,620 $2,275 $2,321 $0 $500 $1,000 $1,500 $2,000 $2,500 Fair Value on Balance Sheet Collateral Value Unpaid Principal Balance 35 Nonperforming Loans (at March 31, 2015) Performing Loans (at March 31, 2015) • Nonperforming loans are held on the balance sheet at fair value which is less than both the UPB and collateral value – Returns realized over time through property resolution strategies, including short sales and deeds - in - lieu of foreclosure • Performing loans are held on the balance sheet at fair value which is less than both the UPB and collateral value – Returns realized over time through interest income, restructure / refinance disposition strategies, and bulk loan sales Carrying Values for PMT’s Distressed Whole Loans (in millions) (in millions) 1Q15 Earnings Report