PennyMac Mortgage Investment Trust May 4, 2017 First Quarter 2017 Earnings Report Exhibit 99.2

1Q17 Earnings Report Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, regarding management’s beliefs, estimates, projections and assumptions with respect to, among other things, the Company’s financial results, future operations, business plans and investment strategies, as well as industry and market conditions, all of which are subject to change. Words like “believe,” “expect,” “anticipate,” “promise,” “plan,” and other expressions or words of similar meanings, as well as future or conditional verbs such as “will,” “would,” “should,” “could,” or “may” are generally intended to identify forward-looking statements. Actual results and operations for any future period may vary materially from those projected herein, from past results discussed herein, or illustrative examples provided herein. Factors which could cause actual results to differ materially from historical results or those anticipated include, but are not limited to: changes in our investment objectives or investment or operational strategies, including any new lines of business or new products and services that may subject us to additional risks; volatility in our industry, the debt or equity markets, the general economy or the real estate finance and real estate markets specifically, whether the result of market events or otherwise; events or circumstances which undermine confidence in the financial markets or otherwise have a broad impact on financial markets, such as the sudden instability or collapse of large depository institutions or other significant corporations, terrorist attacks, natural or man-made disasters, or threatened or actual armed conflicts; changes in general business, economic, market, employment and political conditions, or in consumer confidence and spending habits from those expected; declines in real estate or significant changes in U.S. housing prices or activity in the U.S. housing market; the availability of, and level of competition for, attractive risk-adjusted investment opportunities in mortgage loans and mortgage-related assets that satisfy our investment objectives; the inherent difficulty in winning bids to acquire mortgage loans, and our success in doing so; the concentration of credit risks to which we are exposed; the degree and nature of our competition; our dependence on our manager and servicer, potential conflicts of interest with such entities and their affiliates, and the performance of such entities; changes in personnel and lack of availability of qualified personnel at our manager, servicer or their affiliates; the availability, terms and deployment of short-term and long-term capital; the adequacy of our cash reserves and working capital; our ability to maintain the desired relationship between our financing and the interest rates and maturities of our assets; the timing and amount of cash flows, if any, from our investments; unanticipated increases or volatility in financing and other costs, including a rise in interest rates; the performance, financial condition and liquidity of borrowers; the ability of our servicer, which also provides us with fulfillment services, to approve and monitor correspondent sellers and underwrite loans to investor standards; incomplete or inaccurate information or documentation provided by customers or counterparties, or adverse changes in the financial condition of our customers and counterparties; our indemnification and repurchase obligations in connection with mortgage loans we purchase and later sell or securitize; the quality and enforceability of the collateral documentation evidencing our ownership and rights in the assets in which we invest; increased rates of delinquency, default and/or decreased recovery rates on our investments; our ability to foreclose on our investments in a timely manner or at all; increased prepayments of the mortgages and other loans underlying our mortgage-backed securities or relating to our mortgage servicing rights , excess servicing spread and other investments; the degree to which our hedging strategies may or may not protect us from interest rate volatility; the effect of the accuracy of or changes in the estimates we make about uncertainties, contingencies and asset and liability valuations when measuring and reporting upon our financial condition and results of income; our failure to maintain appropriate internal controls over financial reporting; technologies for loans and our ability to mitigate security risks and cyber intrusions; our ability to obtain and/or maintain licenses and other approvals in those jurisdictions where required to conduct our business; our ability to detect misconduct and fraud; our ability to comply with various federal, state and local laws and regulations that govern our business; developments in the secondary markets for our mortgage loan products; legislative and regulatory changes that impact the mortgage loan industry or housing market; changes in regulations or the occurrence of other events that impact the business, operations or prospects of government agencies or government-sponsored entities, or such changes that increase the cost of doing business with such entities; the Dodd-Frank Wall Street Reform and Consumer Protection Act and its implementing regulations and regulatory agencies, and any other legislative and regulatory changes that impact the business, operations or governance of mortgage lenders and/or publicly-traded companies; the Consumer Financial Protection Bureau and its issued and future rules and the enforcement thereof; changes in government support of homeownership; changes in government or government-sponsored home affordability programs; limitations imposed on our business and our ability to satisfy complex rules for us to qualify as a real estate investment trust (REIT) for U.S. federal income tax purposes and qualify for an exclusion from the Investment Company Act of 1940 and the ability of certain of our subsidiaries to qualify as REITs or as taxable REIT subsidiaries for U.S. federal income tax purposes, as applicable, and our ability and the ability of our subsidiaries to operate effectively within the limitations imposed by these rules; changes in governmental regulations, accounting treatment, tax rates and similar matters (including changes to laws governing the taxation of REITs, or the exclusions from registration as an investment company); the effect of public opinion on our reputation; the occurrence of natural disasters or other events or circumstances that could impact our operations; and our organizational structure and certain requirements in our charter documents. You should not place undue reliance on any forward-looking statement and should consider all of the uncertainties and risks described above, as well as those more fully discussed in reports and other documents filed by the Company with the Securities and Exchange Commission from time to time. The Company undertakes no obligation to publicly update or revise any forward-looking statements or any other information contained herein, and the statements made in this presentation are current as of the date of this presentation only.

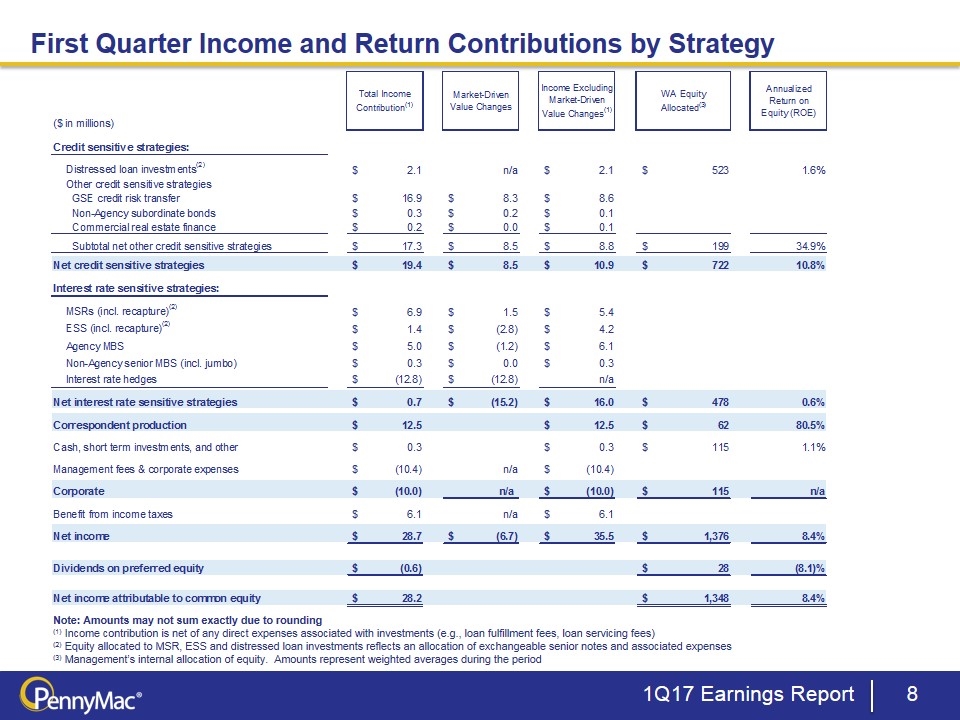

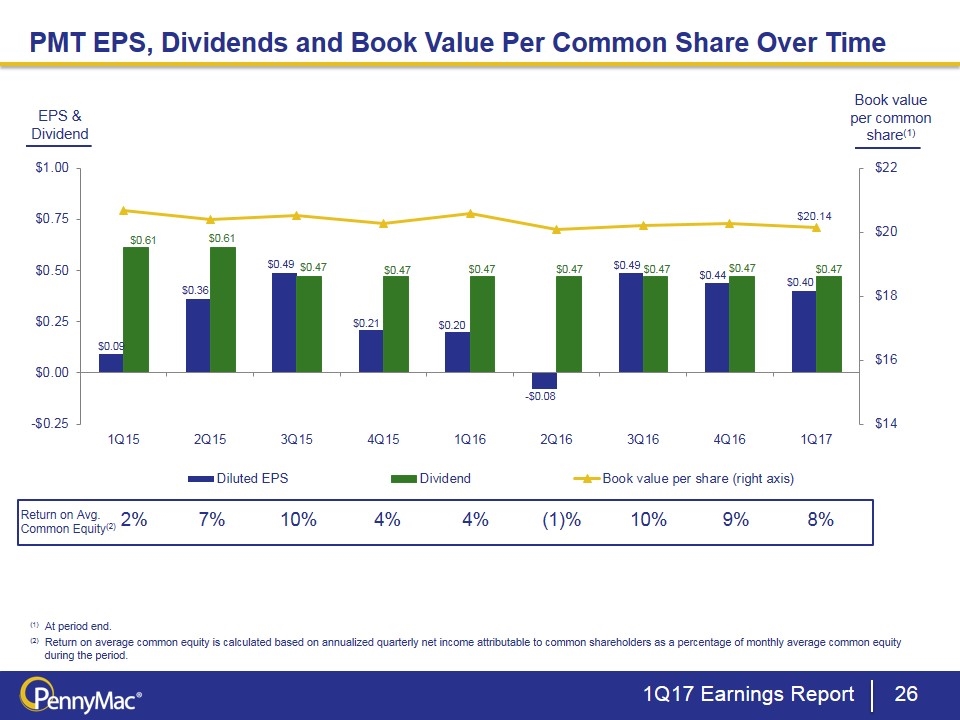

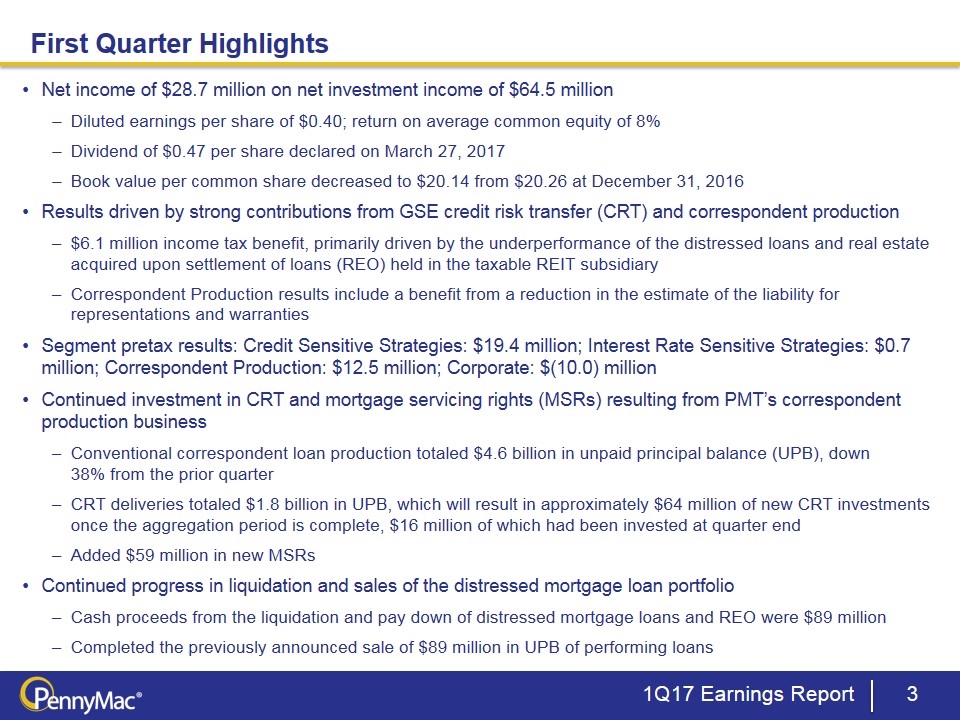

First Quarter Highlights Net income of $28.7 million on net investment income of $64.5 million Diluted earnings per share of $0.40; return on average common equity of 8% Dividend of $0.47 per share declared on March 27, 2017 Book value per common share decreased to $20.14 from $20.26 at December 31, 2016 Results driven by strong contributions from GSE credit risk transfer (CRT) and correspondent production $6.1 million income tax benefit, primarily driven by the underperformance of the distressed loans and real estate acquired upon settlement of loans (REO) held in the taxable REIT subsidiary Correspondent Production results include a benefit from a reduction in the estimate of the liability for representations and warranties Segment pretax results: Credit Sensitive Strategies: $19.4 million; Interest Rate Sensitive Strategies: $0.7 million; Correspondent Production: $12.5 million; Corporate: $(10.0) million Continued investment in CRT and mortgage servicing rights (MSRs) resulting from PMT’s correspondent production business Conventional correspondent loan production totaled $4.6 billion in unpaid principal balance (UPB), down 38% from the prior quarter CRT deliveries totaled $1.8 billion in UPB, which will result in approximately $64 million of new CRT investments once the aggregation period is complete, $16 million of which had been invested at quarter end Added $59 million in new MSRs Continued progress in liquidation and sales of the distressed mortgage loan portfolio Cash proceeds from the liquidation and pay down of distressed mortgage loans and REO were $89 million Completed the previously announced sale of $89 million in UPB of performing loans 1Q17 Earnings Report

First Quarter Highlights (continued) Issued 4.6 million of 8.125% Series A Fixed-to-Floating Rate Cumulative Redeemable Preferred Shares, for gross proceeds of $115 million Net proceeds are being used to fund PMT’s business and investment activities, pay down indebtedness, repurchase outstanding common shares pursuant to PMT’s share repurchase program, and for other general corporate purposes Repurchased approximately 139,000 of PMT’s common shares at a cost of $2.3 million 1Q17 Earnings Report

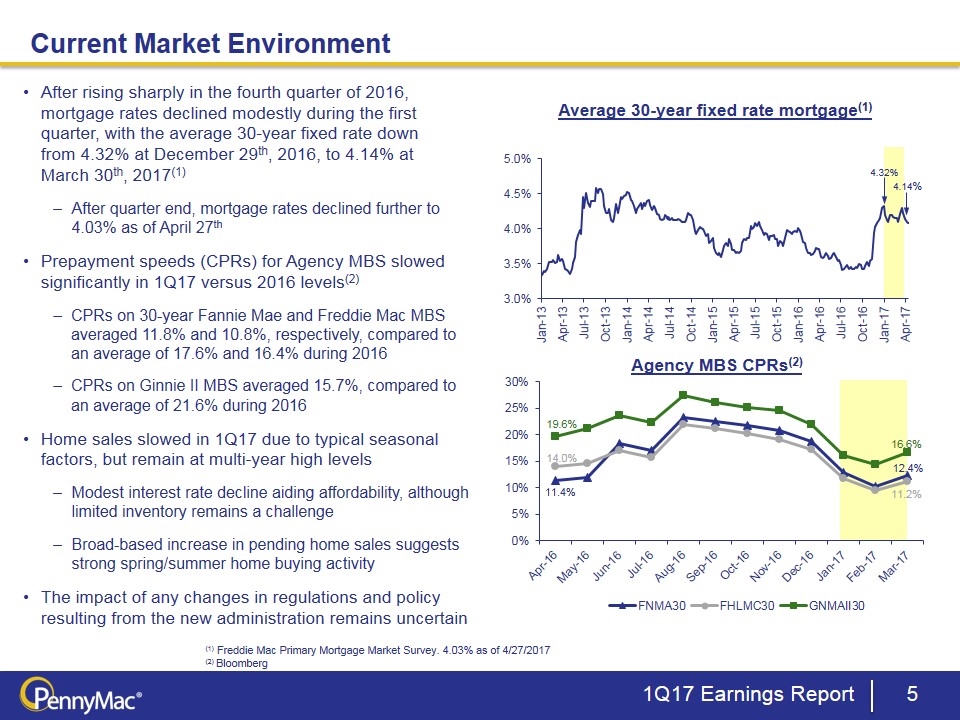

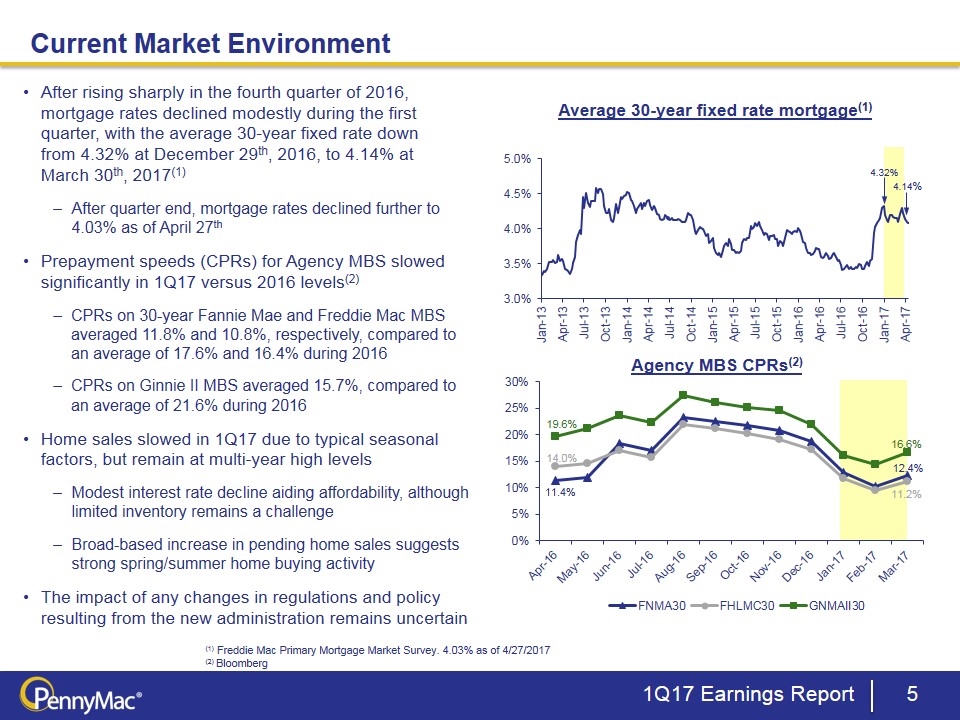

Average 30-year fixed rate mortgage(1) 4.14% 4.32% Agency MBS CPRs(2) (1) Freddie Mac Primary Mortgage Market Survey. 4.03% as of 4/27/2017 (2) Bloomberg 6 Current Market Environment 1Q17 Earnings Report 5 After rising sharply in the fourth quarter of 2016, mortgage rates declined modestly during the first quarter, with the average 30-year fixed rate down from 4.32% at December 29th, 2016, to 4.14% at March 30th, 2017(1) After quarter end, mortgage rates declined further to 4.03% as of April 27th Prepayment speeds (CPRs) for Agency MBS slowed significantly in 1Q17 versus 2016 levels(2) CPRs on 30-year Fannie Mae and Freddie Mac MBS averaged 11.8% and 10.8%, respectively, compared to an average of 17.6% and 16.4% during 2016 CPRs on Ginnie II MBS averaged 15.7%, compared to an average of 21.6% during 2016 Home sales slowed in 1Q17 due to typical seasonal factors, but remain at multi-year high levels Modest interest rate decline aiding affordability, although limited inventory remains a challenge Broad-based increase in pending home sales suggests strong spring/summer home buying activity The impact of any changes in regulations and policy resulting from the new administration remains uncertain

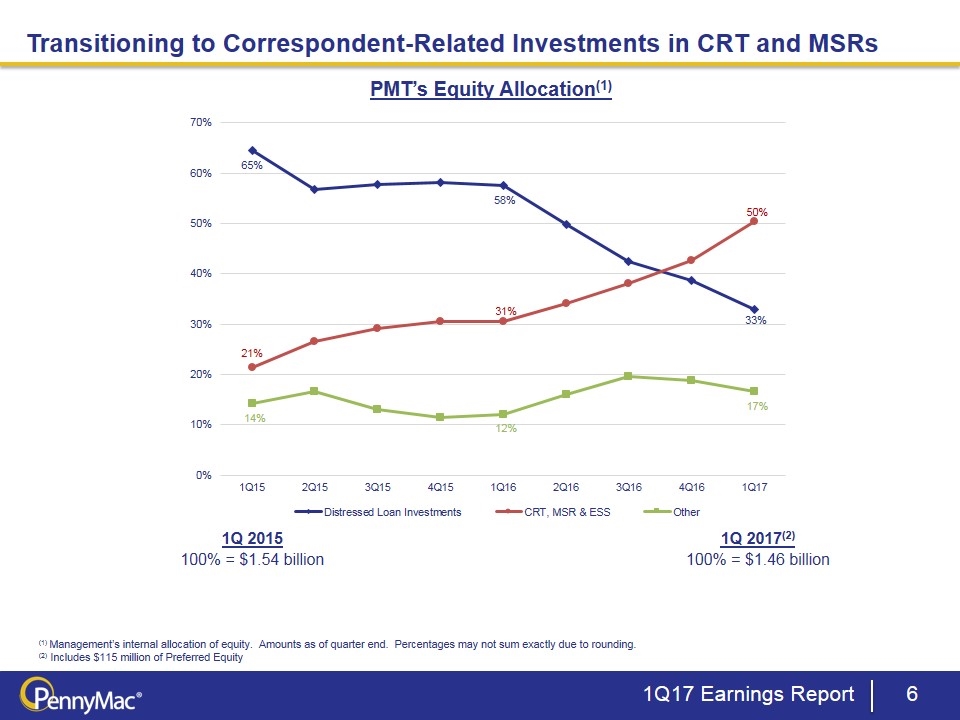

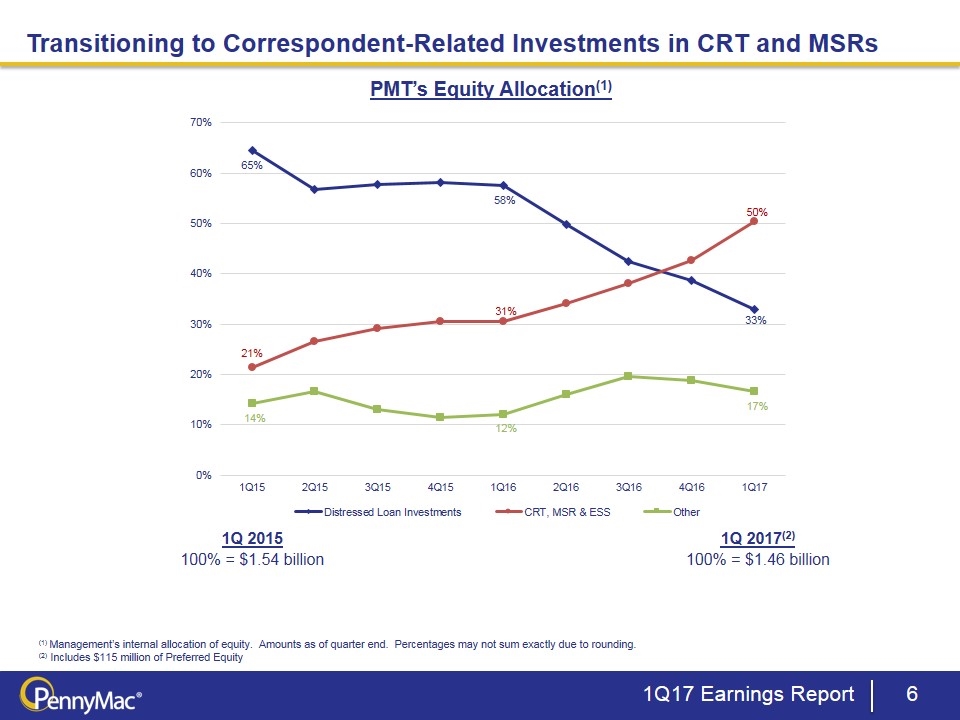

Transitioning to Correspondent-Related Investments in CRT and MSRs 1Q 2015 100% = $1.54 billion 1Q 2017(2) 100% = $1.46 billion PMT’s Equity Allocation(1) (1) Management’s internal allocation of equity. Amounts as of quarter end. Percentages may not sum exactly due to rounding. (2) Includes $115 million of Preferred Equity 1Q17 Earnings Report

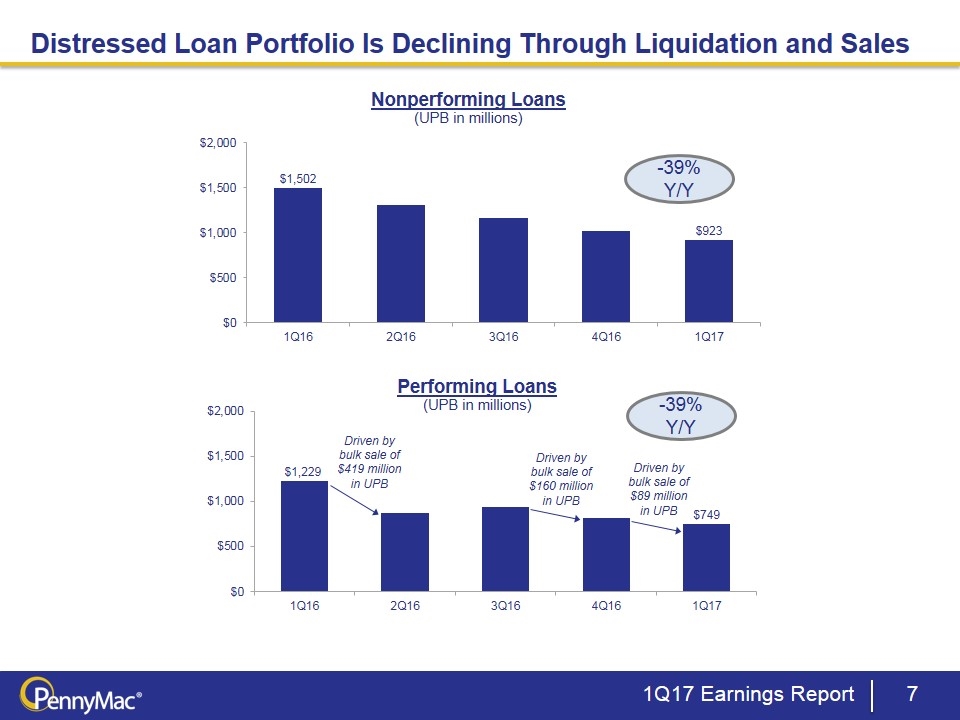

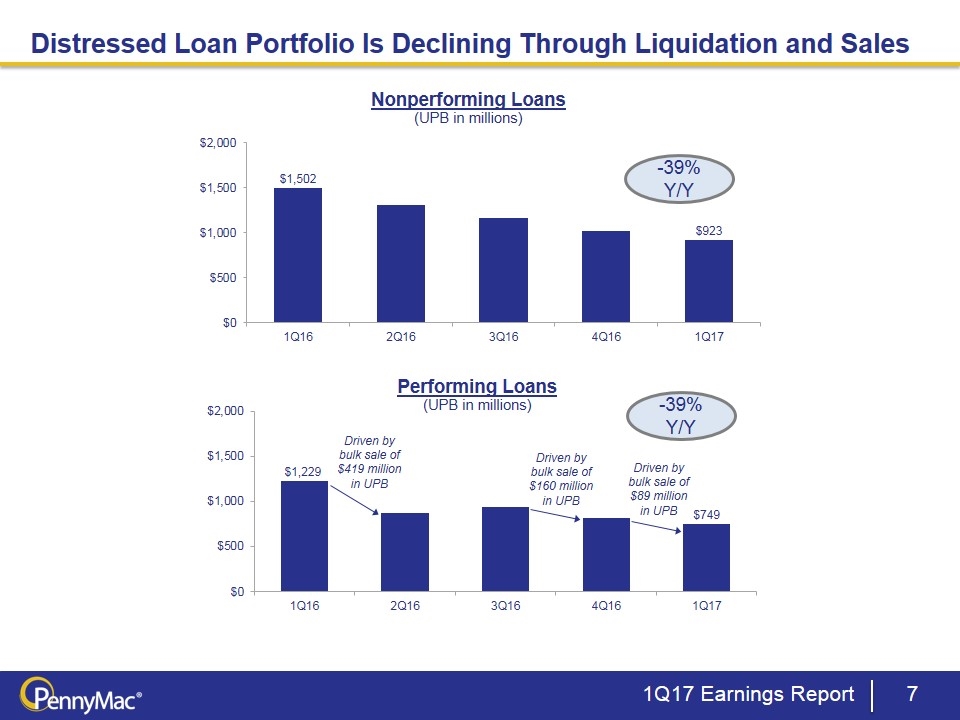

Distressed Loan Portfolio Is Declining Through Liquidation and Sales 1Q17 Earnings Report Driven by bulk sale of $419 million in UPB -39% Y/Y Driven by bulk sale of $160 million in UPB -39% Y/Y Driven by bulk sale of $89 million in UPB

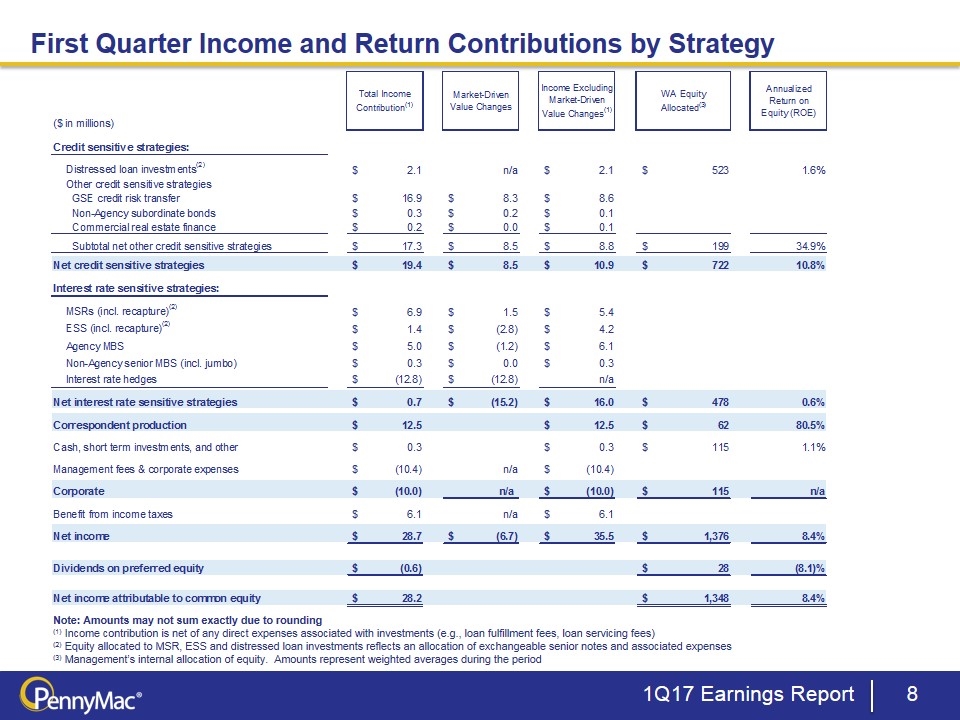

First Quarter Income and Return Contributions by Strategy 1Q17 Earnings Report Note: Amounts may not sum exactly due to rounding (1) Income contribution is net of any direct expenses associated with investments (e.g., loan fulfillment fees, loan servicing fees) (2) Equity allocated to MSR, ESS and distressed loan investments reflects an allocation of exchangeable senior notes and associated expenses (3) Management’s internal allocation of equity. Amounts represent weighted averages during the period Q1 2017 Investor Relations ($ in millions) Total Income Contribution(1) Market-Driven Value Changes Income Excluding Market-Driven Value Changes(1) WA EquityAllocated(3) Annualized Return on Equity (ROE) Credit sensitive strategies: Distressed loan investments(2) $2,085,864.4242626445 n/a $2,085,864.4242626445 $,522,732,556.68949217 1.6% Other credit sensitive strategies GSE credit risk transfer $16,908,845.460000001 $8,297,924.1675000004 $8,610,921.2925000004 Non-Agency subordinate bonds $,267,776.63219916308 $,190,669.91000000003 $77,106.722199163065 Commercial real estate finance $,164,342.24480000001 $14,462.384800000002 $,149,879.86000000002 Subtotal net other credit sensitive strategies $17,340,964.336999167 $8,503,056.4623000007 $8,837,907.8746991623 $,198,939,158.8579999 0.3486686985881427 Net credit sensitive strategies $19,426,828.76126181 $8,503,056.4623000007 $10,923,772.298961807 $,721,671,714.77529216 0.10767681960383201 Interest rate sensitive strategies: MSRs (incl. recapture)(2) $6,899,308.7210577764 $1,536,309.9600000004 $5,362,998.7610577764 ESS (incl. recapture)(2) $1,431,880.5360495774 $-2,772,775.4699999997 $4,204,656.60495771 Agency MBS $4,958,308.74 $-1,177,331.27 $6,135,640.99999998 Non-Agency senior MBS (incl. jumbo) $,296,933.89780083694 $12,750.530000000028 $,284,183.36780083692 Interest rate hedges $,-12,842,526.33 $,-12,842,526.33 n/a Net interest rate sensitive strategies $,743,905.5649081897 $,-15,243,572.58 $15,987,478.14490819 $,478,050,781.5000281 .6% Correspondent production $12,470,920.538269993 $12,470,920.538269993 $61,936,446.550864935 0.80540109953052108 Cash, short term investments, and other $,326,177.8 $,326,177.8 $,114,679,997.81257668 1.1% Management fees & corporate expenses $,-10,360,311.77 n/a $,-10,360,311.77 Corporate $,-10,034,134.689999999 n/a $,-10,034,134.689999999 $,114,679,997.81257668 n/a Benefit from income taxes $6,129,140.3399999999 n/a $6,129,140.3399999999 Net income $28,736,660.514439989 $-6,740,516.1176999994 $35,477,176.632139988 $1,376,338,940.1887364 8.4% Dividends on preferred equity $-,571,006.94444444403 $28,111,111.111111112 -8.125% Net income attributable to common equity $28,165,653.569995545 $1,348,227,829.776253 8.4% Note: Amounts may not sum exactly due to rounding (1) Income contribution is net of any direct expenses associated with investments (e.g., loan fulfillment fees, loan servicing fees) (2) Equity allocated to MSR, ESS and distressed loan investments includes an allocation of exchangeable senior notes and associated expenses (3) Management’s internal allocation of equity. Amounts represent weighted averages during the period

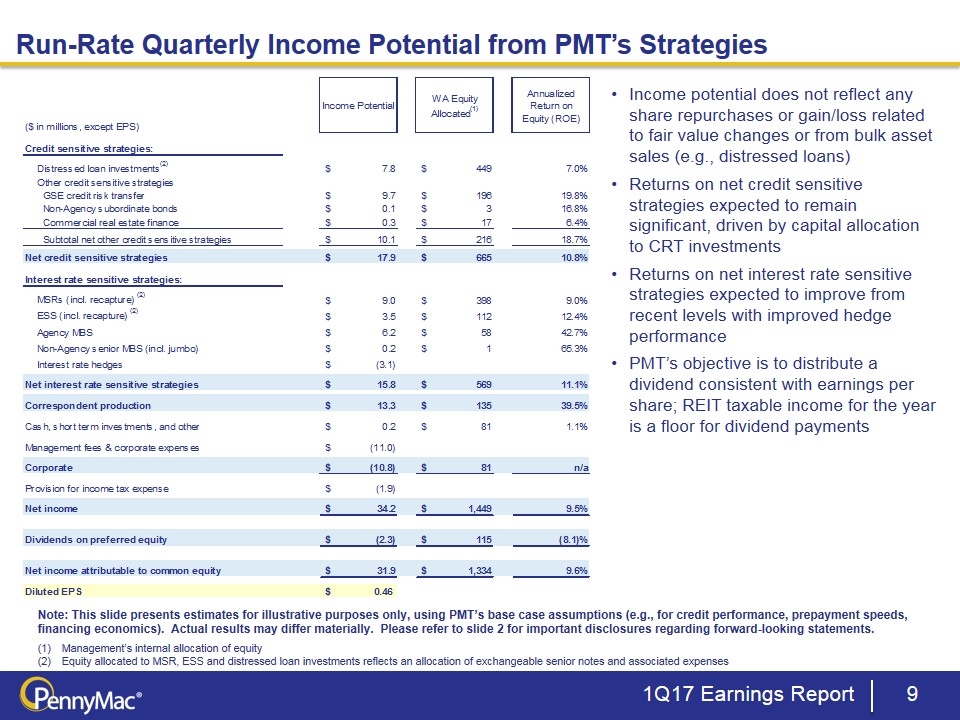

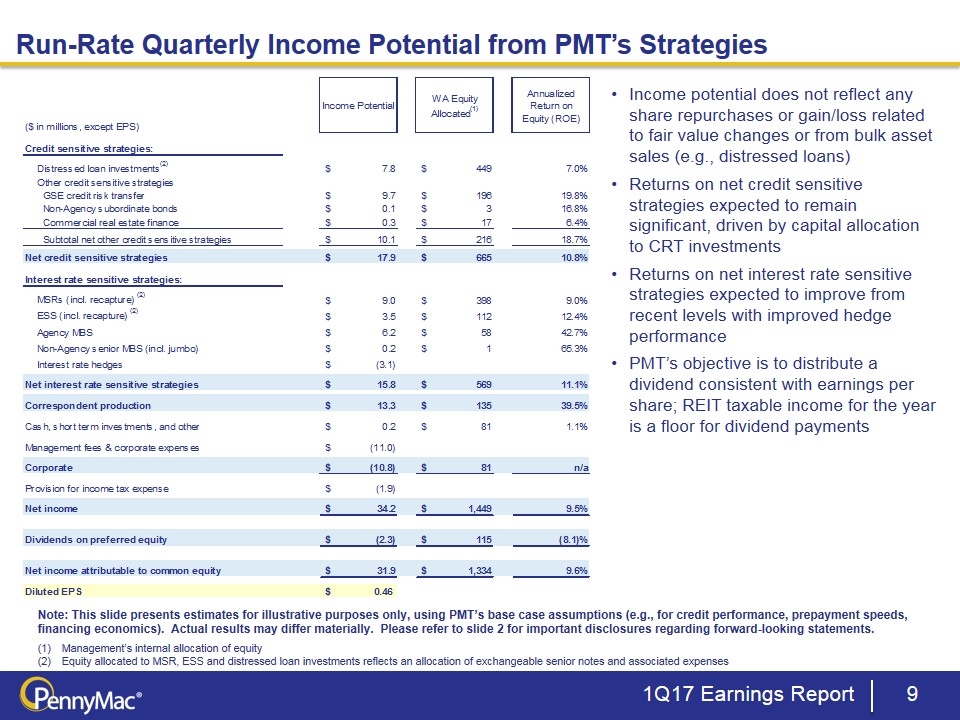

Note: This slide presents estimates for illustrative purposes only, using PMT’s base case assumptions (e.g., for credit performance, prepayment speeds, financing economics). Actual results may differ materially. Please refer to slide 2 for important disclosures regarding forward-looking statements. Management’s internal allocation of equity Equity allocated to MSR, ESS and distressed loan investments reflects an allocation of exchangeable senior notes and associated expenses Run-Rate Quarterly Income Potential from PMT’s Strategies 1Q17 Earnings Report Income potential does not reflect any share repurchases or gain/loss related to fair value changes or from bulk asset sales (e.g., distressed loans) Returns on net credit sensitive strategies expected to remain significant, driven by capital allocation to CRT investments Returns on net interest rate sensitive strategies expected to improve from recent levels with improved hedge performance PMT’s objective is to distribute a dividend consistent with earnings per share; REIT taxable income for the year is a floor for dividend payments

Mortgage Investment Activities

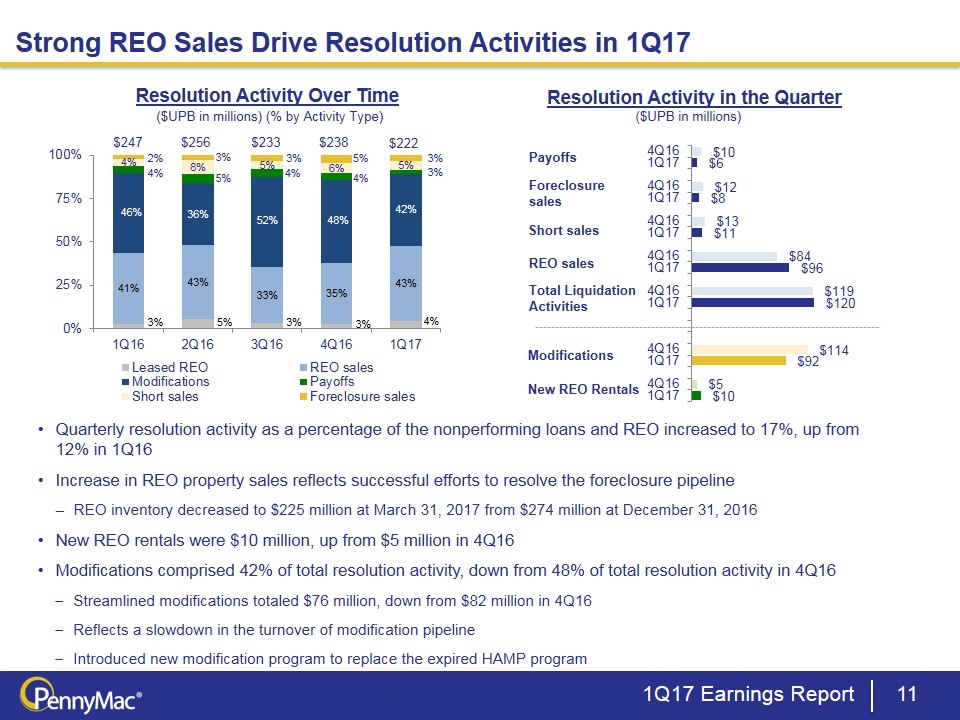

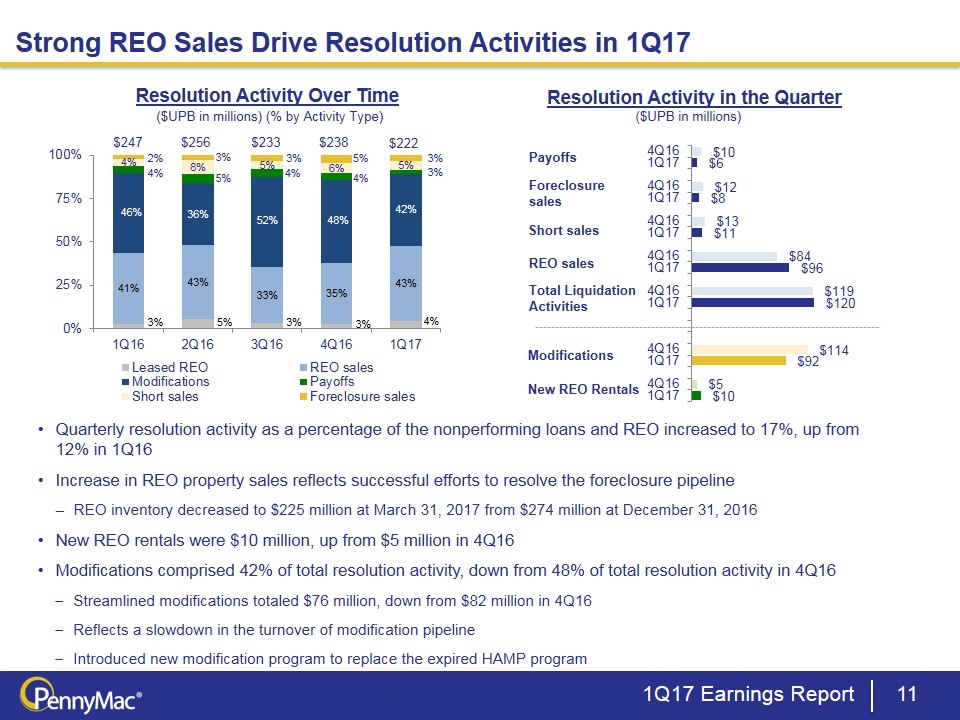

Strong REO Sales Drive Resolution Activities in 1Q17 Payoffs Foreclosure sales Short sales REO sales Modifications ($UPB in millions) Resolution Activity in the Quarter Total Liquidation Activities Resolution Activity Over Time ($UPB in millions) (% by Activity Type) $247 $256 $233 $238 Quarterly resolution activity as a percentage of the nonperforming loans and REO increased to 17%, up from 12% in 1Q16 Increase in REO property sales reflects successful efforts to resolve the foreclosure pipeline REO inventory decreased to $225 million at March 31, 2017 from $274 million at December 31, 2016 New REO rentals were $10 million, up from $5 million in 4Q16 Modifications comprised 42% of total resolution activity, down from 48% of total resolution activity in 4Q16 Streamlined modifications totaled $76 million, down from $82 million in 4Q16 Reflects a slowdown in the turnover of modification pipeline Introduced new modification program to replace the expired HAMP program $222 New REO Rentals 1Q17 Earnings Report

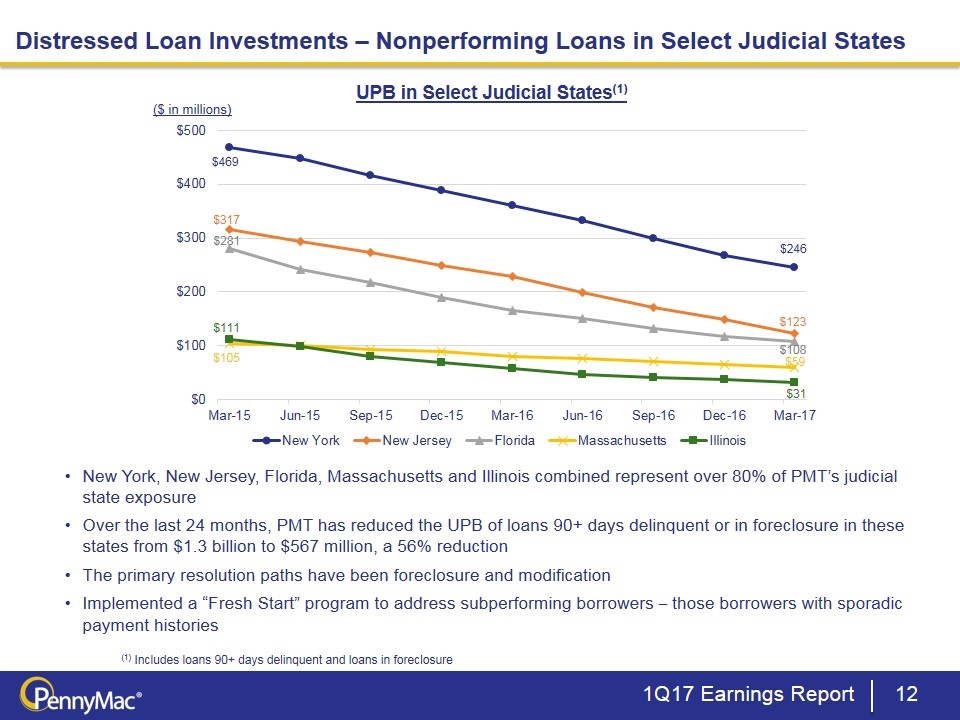

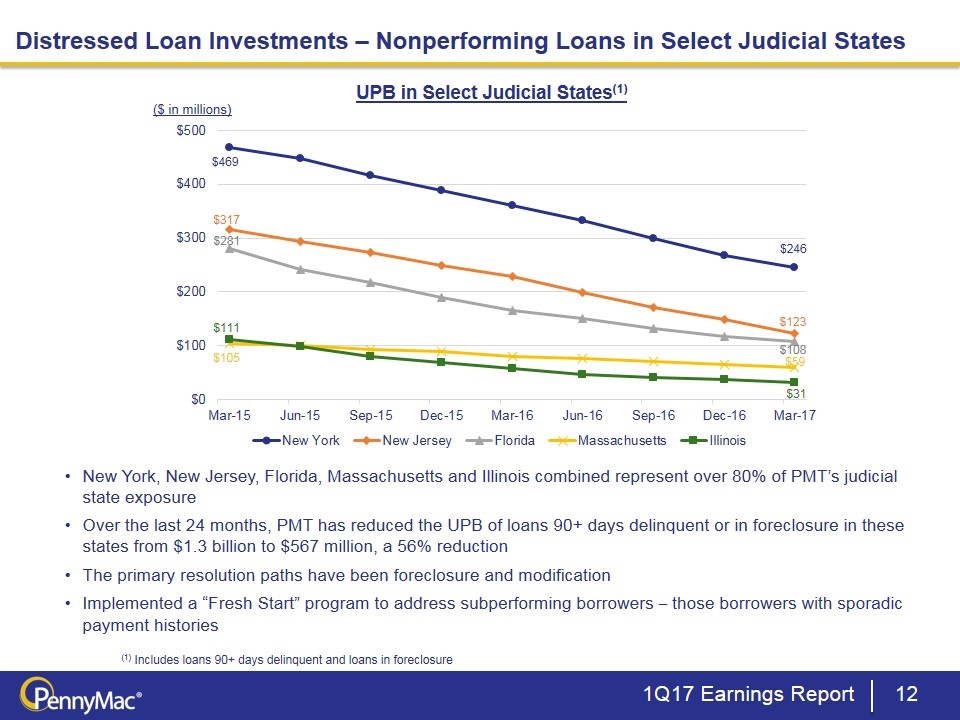

Distressed Loan Investments – Nonperforming Loans in Select Judicial States New York, New Jersey, Florida, Massachusetts and Illinois combined represent over 80% of PMT’s judicial state exposure Over the last 24 months, PMT has reduced the UPB of loans 90+ days delinquent or in foreclosure in these states from $1.3 billion to $567 million, a 56% reduction The primary resolution paths have been foreclosure and modification Implemented a “Fresh Start” program to address subperforming borrowers – those borrowers with sporadic payment histories 1Q17 Earnings Report UPB in Select Judicial States(1) ($ in millions) (1) Includes loans 90+ days delinquent and loans in foreclosure

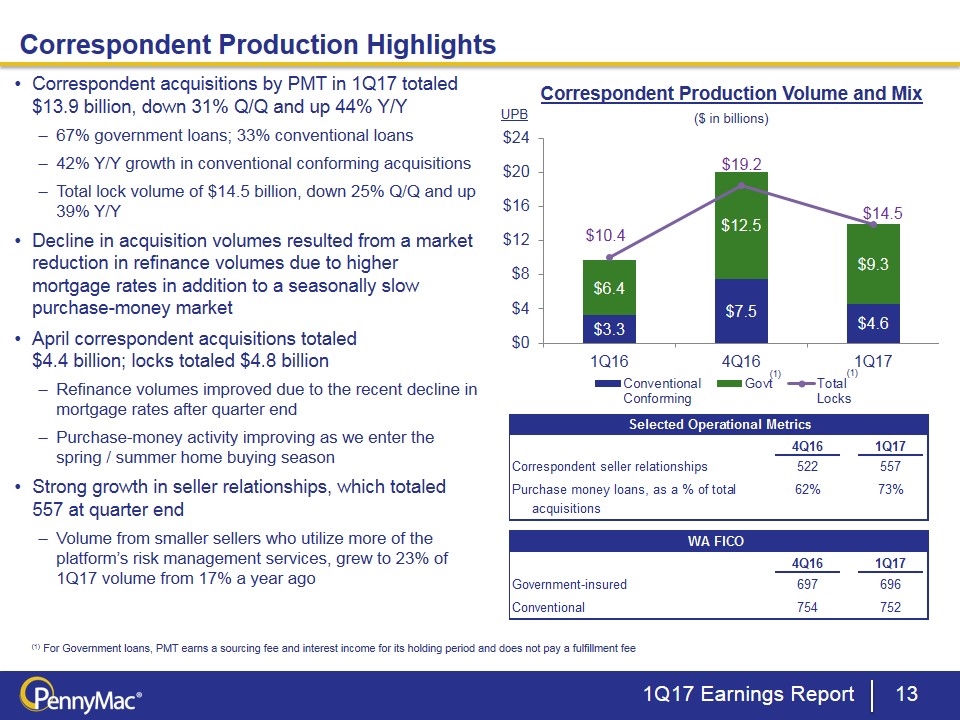

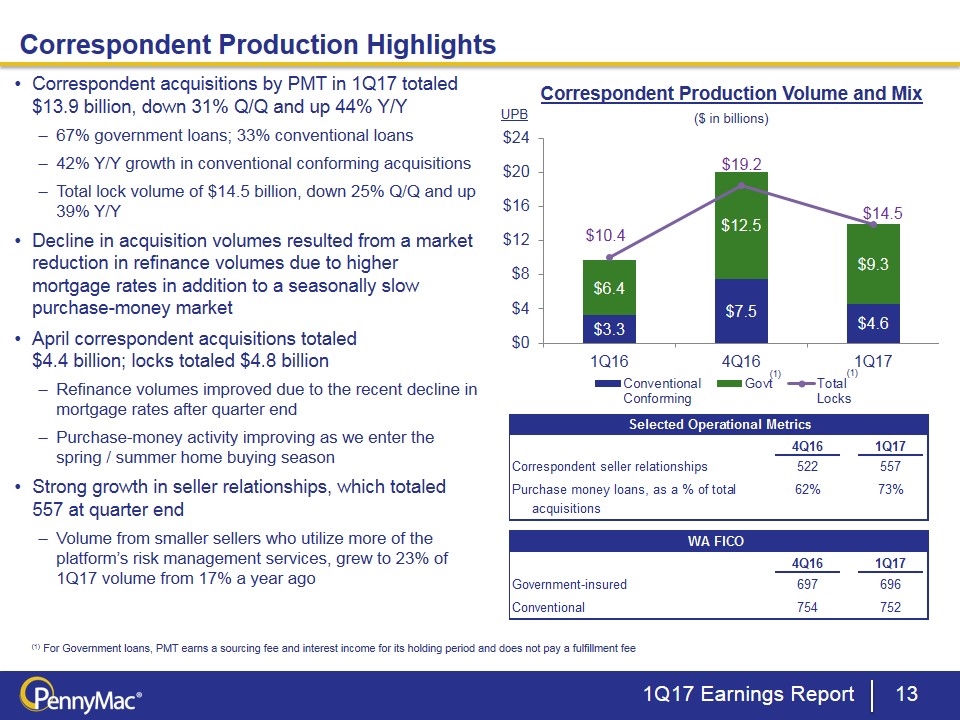

Correspondent Production Volume and Mix Correspondent Production Highlights (1) For Government loans, PMT earns a sourcing fee and interest income for its holding period and does not pay a fulfillment fee ($ in billions) UPB (1) (1) 1Q17 Earnings Report $14.5 $10.4 $19.2 Correspondent acquisitions by PMT in 1Q17 totaled $13.9 billion, down 31% Q/Q and up 44% Y/Y 67% government loans; 33% conventional loans 42% Y/Y growth in conventional conforming acquisitions Total lock volume of $14.5 billion, down 25% Q/Q and up 39% Y/Y Decline in acquisition volumes resulted from a market reduction in refinance volumes due to higher mortgage rates in addition to a seasonally slow purchase-money market April correspondent acquisitions totaled $4.4 billion; locks totaled $4.8 billion Refinance volumes improved due to the recent decline in mortgage rates after quarter end Purchase-money activity improving as we enter the spring / summer home buying season Strong growth in seller relationships, which totaled 557 at quarter end Volume from smaller sellers who utilize more of the platform’s risk management services, grew to 23% of 1Q17 volume from 17% a year ago Selected Operational Metrics $4.4000000000000004 Gov't 0.60273972602739723 4Q16 1Q17 $2.9 Fulfillment 0.39726027397260266 PCG Correspondent seller relationships 522 557 $7.3000000000000007 Purchase money loans, as a % of total 0.62 0.72570000000000001 acquisitions WA FICO 4Q16 1Q17 PCG Government-insured 697 696 Conventional 754 752 Selected Credit Metrics for 3Q15 WA FICO RETAIL Government-insured 684 Conventional(2) 734

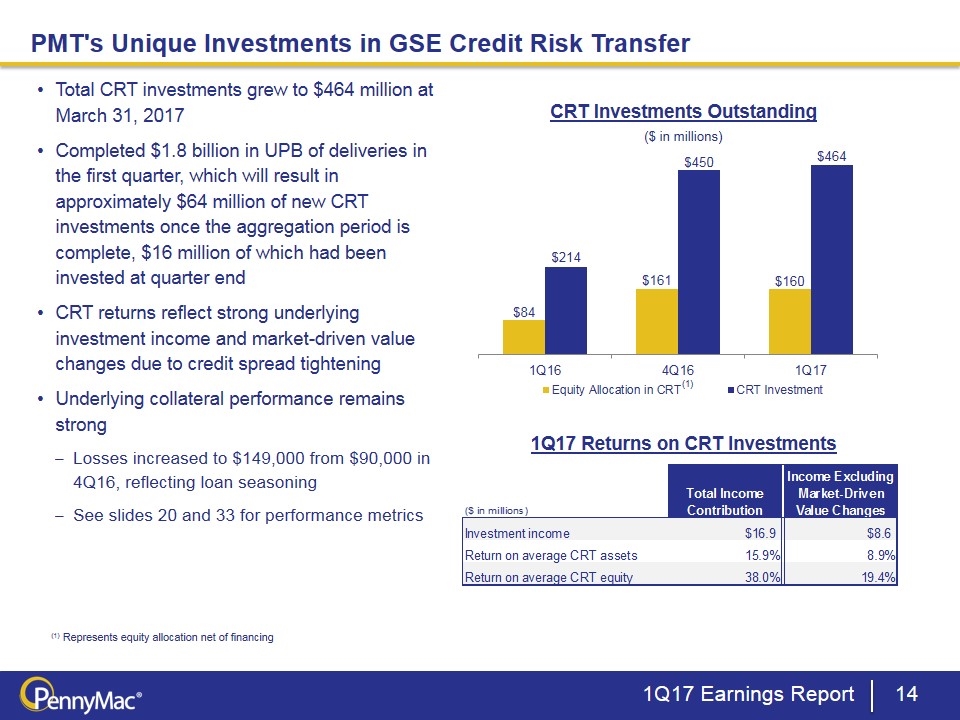

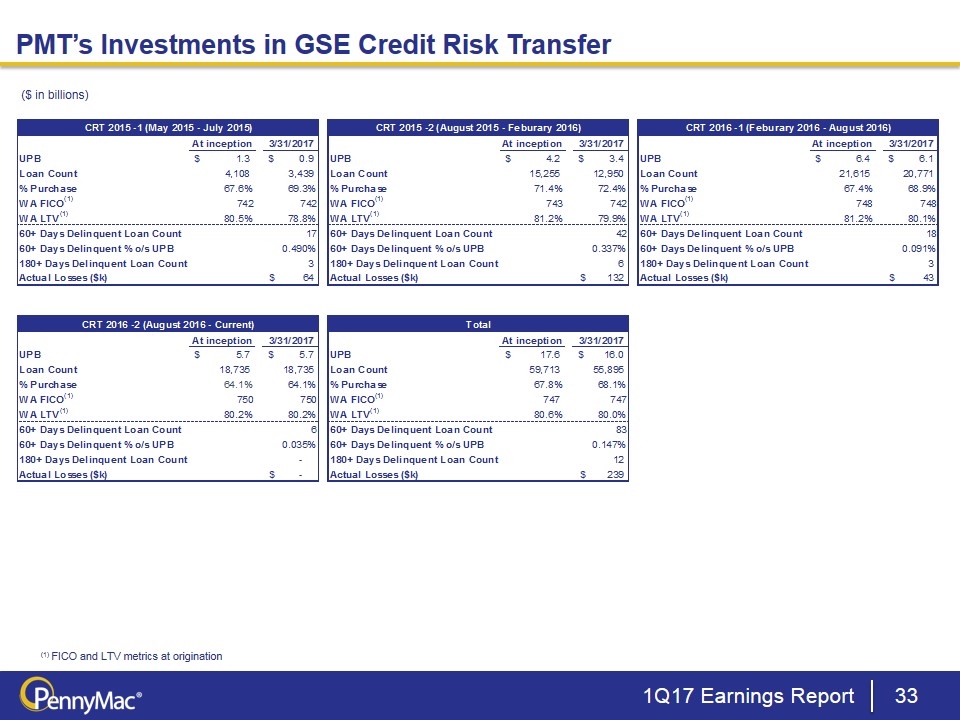

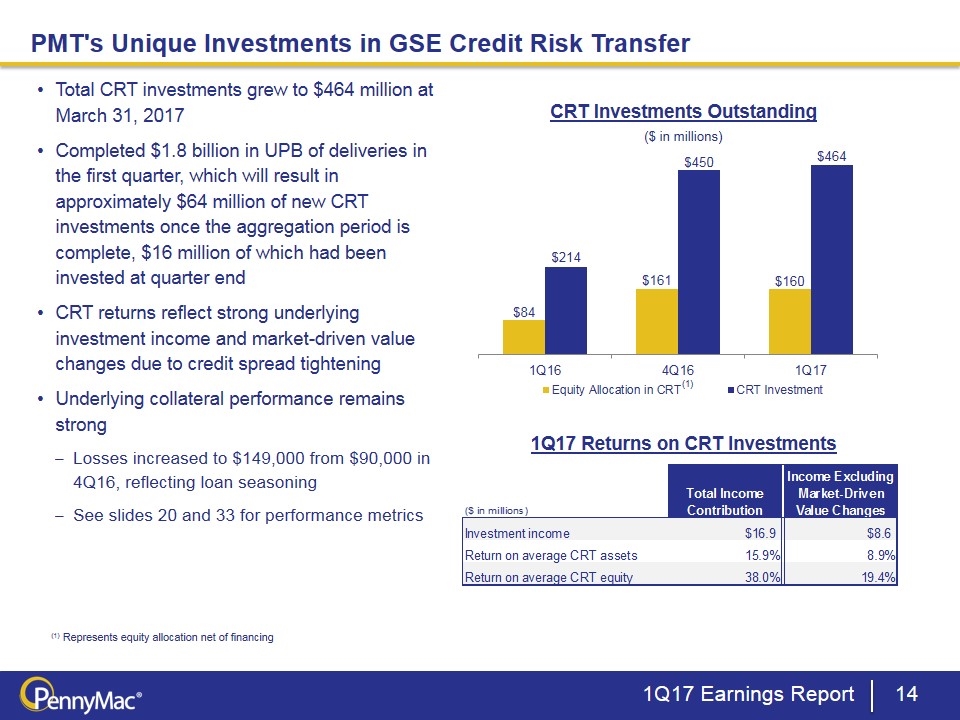

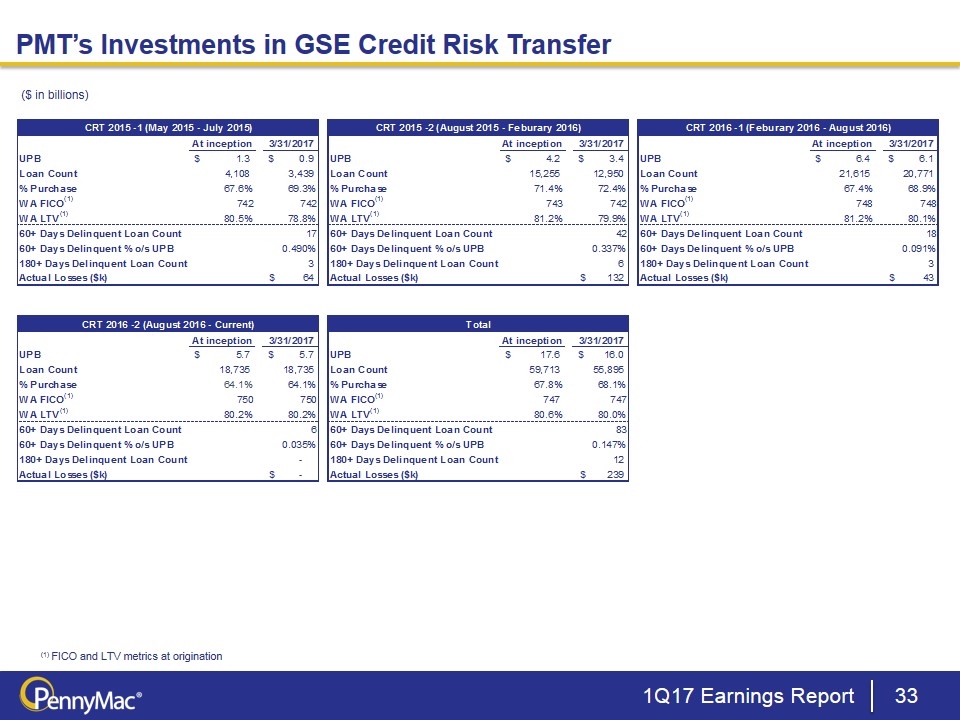

1Q17 Earnings Report CRT Investments Outstanding ($ in millions) Total CRT investments grew to $464 million at March 31, 2017 Completed $1.8 billion in UPB of deliveries in the first quarter, which will result in approximately $64 million of new CRT investments once the aggregation period is complete, $16 million of which had been invested at quarter end CRT returns reflect strong underlying investment income and market-driven value changes due to credit spread tightening Underlying collateral performance remains strong Losses increased to $149,000 from $90,000 in 4Q16, reflecting loan seasoning See slides 20 and 33 for performance metrics PMT's Unique Investments in GSE Credit Risk Transfer 1Q17 Returns on CRT Investments (1) Represents equity allocation net of financing (1) CRT ($ in millions) Total Income Contribution Income Excluding Market-Driven Value Changes Average CRT asset Investment income $16.899999999999999 $8.6 $,275,695,412 Return on average CRT assets 0.15859999999999999 8.9% Return on average CRT equity 0.38040000000000002 0.19400000000000001

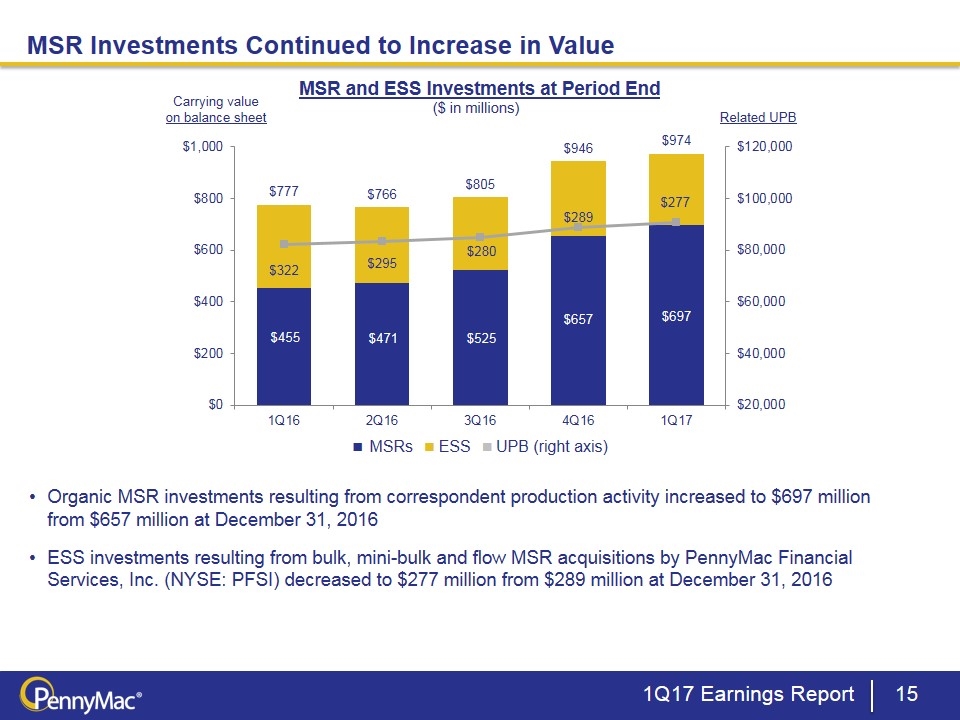

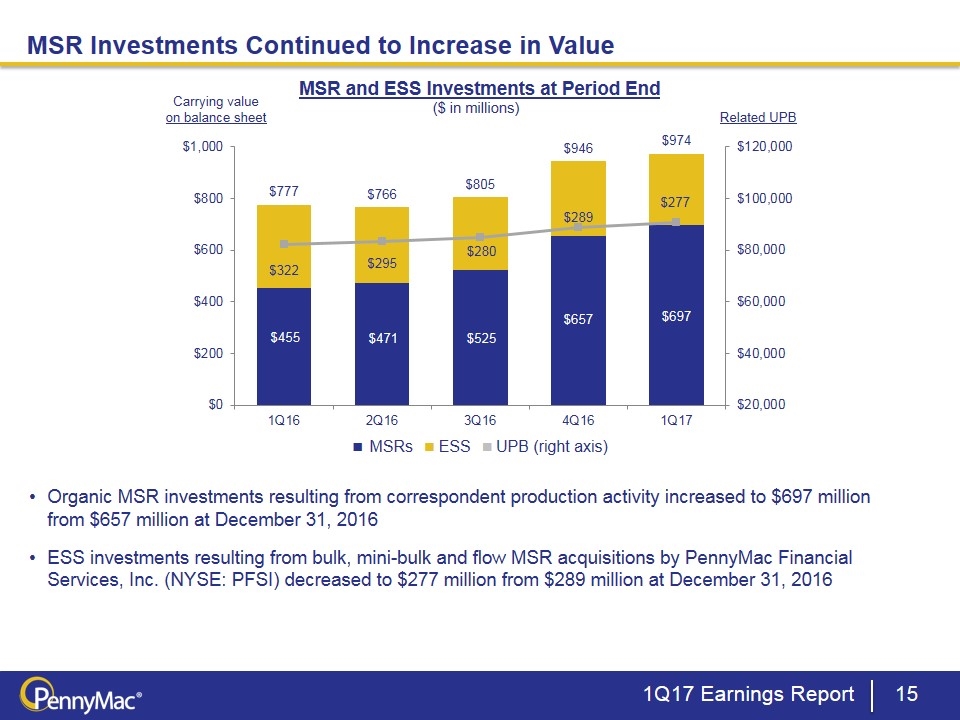

MSR Investments Continued to Increase in Value ($ in millions) Organic MSR investments resulting from correspondent production activity increased to $697 million from $657 million at December 31, 2016 ESS investments resulting from bulk, mini-bulk and flow MSR acquisitions by PennyMac Financial Services, Inc. (NYSE: PFSI) decreased to $277 million from $289 million at December 31, 2016 MSR and ESS Investments at Period End Carrying value on balance sheet Related UPB 1Q17 Earnings Report ■ MSRs ■ ESS ■ UPB (right axis)

Financial Results

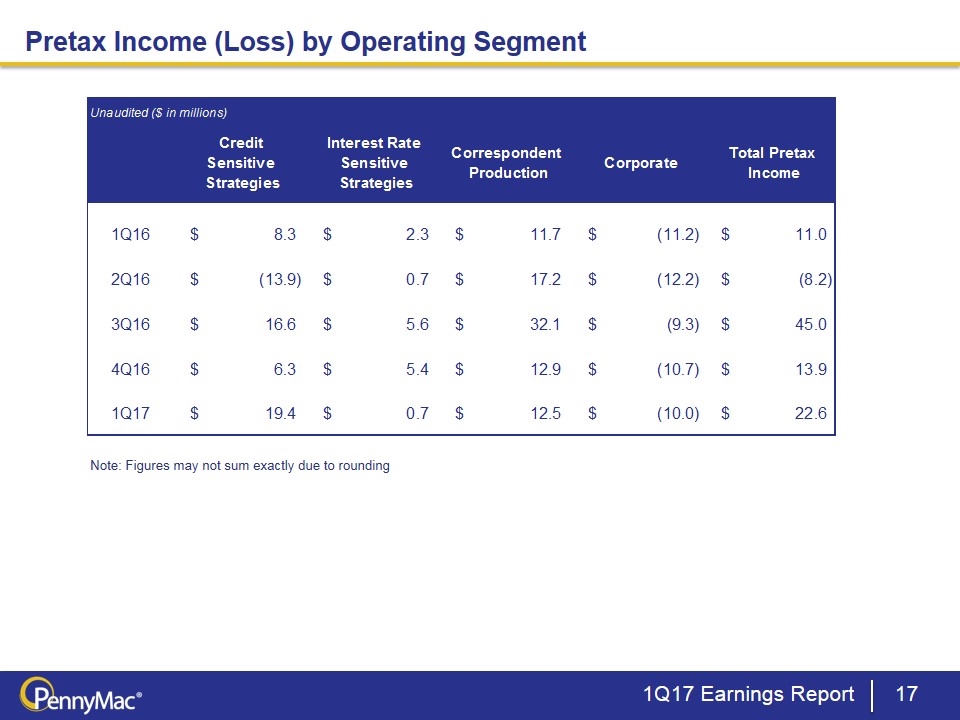

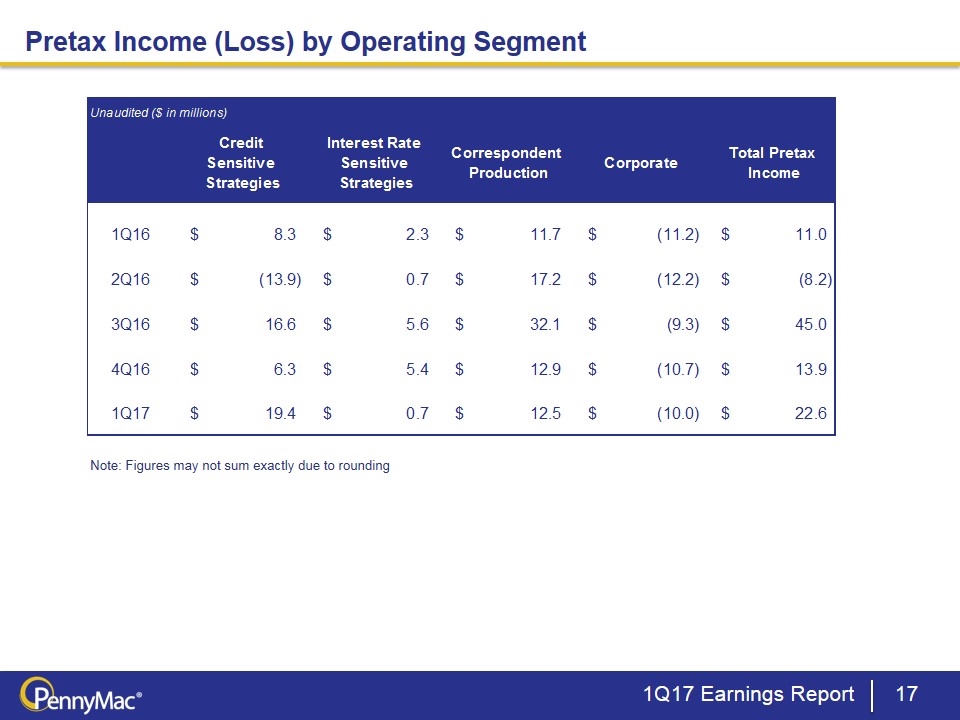

Pretax Income (Loss) by Operating Segment Note: Figures may not sum exactly due to rounding 1Q17 Earnings Report Unaudited ($ in millions) Credit Sensitive Strategies Interest Rate Sensitive Strategies Correspondent Production Corporate Total Pretax Income 1Q16 $8.2509999999999994 $2.3450000000000002 11.658234 $11.657999999999999 $-11.21 $11.043999999999997 2Q16 $-13.866256 $0.733954 $17.176976 $-12.202472 $-8.1577979999999997 3Q16 $16.614107000000001 $5.6315809999999997 $32.098768999999997 $-9.3306459999999998 $45.013810999999997 4Q16 $6.2619999999999996 $5.3579999999999997 $12.91 $-10.664999999999999 $13.865000000000002 1Q17 $19.427 $0.74399999999999999 $12.472 $-10.0345 $22.608499999999999

Credit Sensitive Strategies Segment Results The Credit Sensitive Strategies Segment includes results from distressed loans, CRT, non-Agency subordinated bonds and multifamily commercial real estate investments Segment revenue increased 82% Q/Q to $25.8 million Net gain on investments increased 144% Q/Q to $22.0 million driven by strong gains on CRT, which totaled $18.6 million Other losses decreased 58% Q/Q, primarily due to trailing recoveries on previously sold REO Total expenses decreased 19% Q/Q to $6.4 million Reflects lower liquidation fees relative to 4Q16 1Q17 Earnings Report Unaudited Credit Sensitive Stategies 4Q16 1Q17 Revenues: Net gain on investments: Mortgage loans at fair value $-1,036 $3,216 Mortgage-backed securities $-,363 $191 CRT Agreements 10,401 18,587 $9,002 $21,994 Net interest income Interest income $26,436 $20,321 Interest expense ,-15,669 ,-14,272 10,767 6,049 Net (loss) gain on mortgage loans acquired for sale -,252 14 Net mortgage loan servicing fees 5 14 Other (loss) -5,364 -2,268 14,158 25,803 Expenses: Servicing fees payable to PennyMac Financial Services, Inc. 5,738 4,348 Other 2,158 2,028 Pretax income $6,262 $19,427 Credit Sensitive Unaudited Quarter Ended ($ in thousands) December 31, 2016 March 31, 2017 Revenues: Net gain on investments: Mortgage loans at fair value $-1,036 $3,216 Mortgage-backed securities -,363 191 CRT Agreements 10,401 18,587 9,002 21,994 Net interest income: Interest income 26,436 20,321 Interest expense ,-15,669 ,-14,272 10,767 6,049 Net (loss) gain on mortgage loans acquired for sale -,252 14 Net mortgage loan servicing fees 5 14 Other (loss) -5,364 -2,268 14,158 25,803 Expenses: Servicing fees payable to PennyMac Financial Services, Inc. 5,738 4,348 Other 2,158 2,028 7896 6376 Pretax income $6,262 $19,427

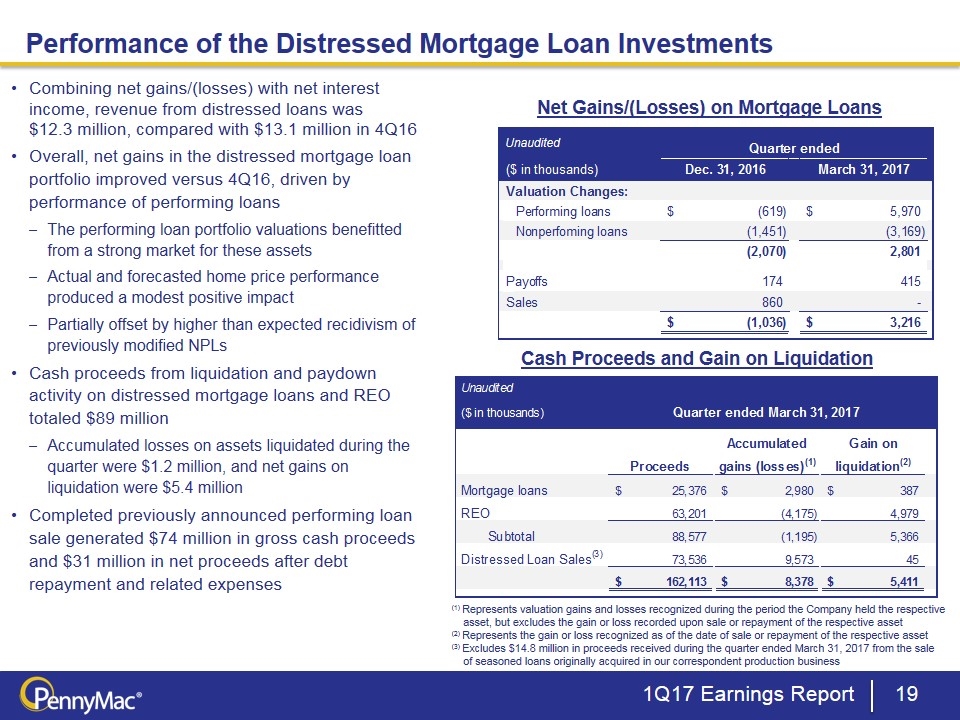

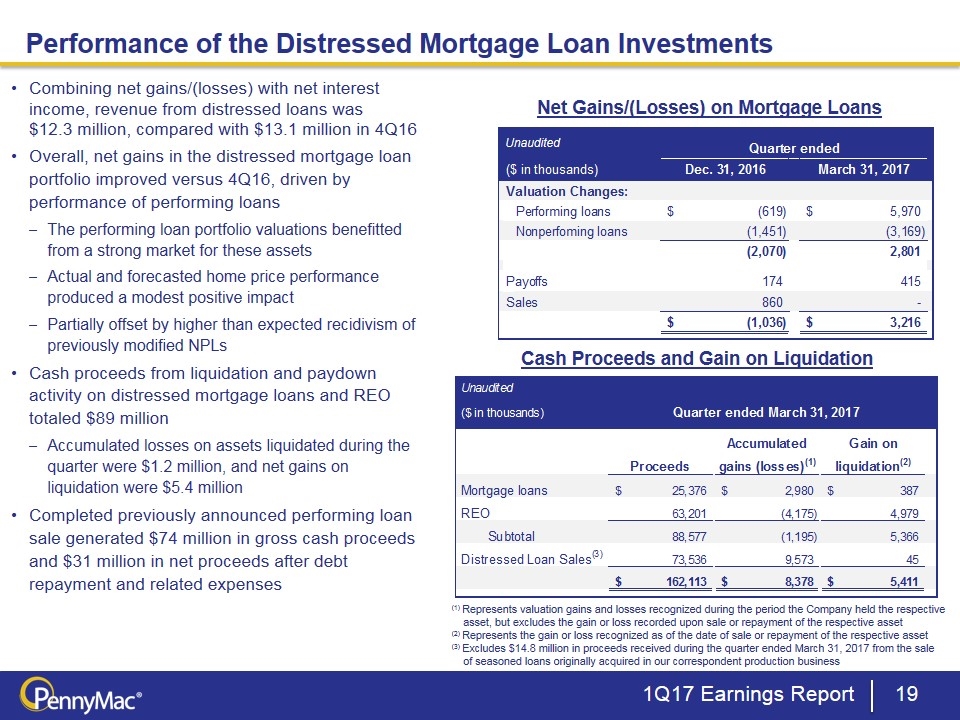

Performance of the Distressed Mortgage Loan Investments Combining net gains/(losses) with net interest income, revenue from distressed loans was $12.3 million, compared with $13.1 million in 4Q16 Overall, net gains in the distressed mortgage loan portfolio improved versus 4Q16, driven by performance of performing loans The performing loan portfolio valuations benefitted from a strong market for these assets Actual and forecasted home price performance produced a modest positive impact Partially offset by higher than expected recidivism of previously modified NPLs Cash proceeds from liquidation and paydown activity on distressed mortgage loans and REO totaled $89 million Accumulated losses on assets liquidated during the quarter were $1.2 million, and net gains on liquidation were $5.4 million Completed previously announced performing loan sale generated $74 million in gross cash proceeds and $31 million in net proceeds after debt repayment and related expenses Net Gains/(Losses) on Mortgage Loans Cash Proceeds and Gain on Liquidation (1) Represents valuation gains and losses recognized during the period the Company held the respective asset, but excludes the gain or loss recorded upon sale or repayment of the respective asset (2) Represents the gain or loss recognized as of the date of sale or repayment of the respective asset (3) Excludes $14.8 million in proceeds received during the quarter ended March 31, 2017 from the sale of seasoned loans originally acquired in our correspondent production business 1Q17 Earnings Report Unaudited Unaudited Unaudited Quarter ended ($ in thousands) Dec. 31, 2016 $42,825 Valuation Changes: Performing loans $-,619 $5,970 Nonperfoming loans -1,451 -3,169 -2,070 2,801 Payoffs 174 415 Sales 860 0 $-1,036 $3,216 Quarter ended ($ in thousands) $41,729 December 31, 2013 Q/Q Valuation Changes: Performing loans $-3,286 $9,897 1.105744680851064 Nonperfoming loans 36,459 34,793 2.5% 33,173 44,690 0.15198226529875747 Payoffs 5,620 5,888.1170000000002 -0.26764713930348261 Sales 1,125 0 $39,918 $50,578.116999999998 7.9944420719989751 Quarter ended ($ in thousands) December 31, 2013 $41,547 Valuation Changes: Performing loans $9,897 $-15 Nonperfoming loans 34,793 41,905 44,690 41,890 Payoffs 5,888.1170000000002 6,096 $50,578.116999999998 $47,986

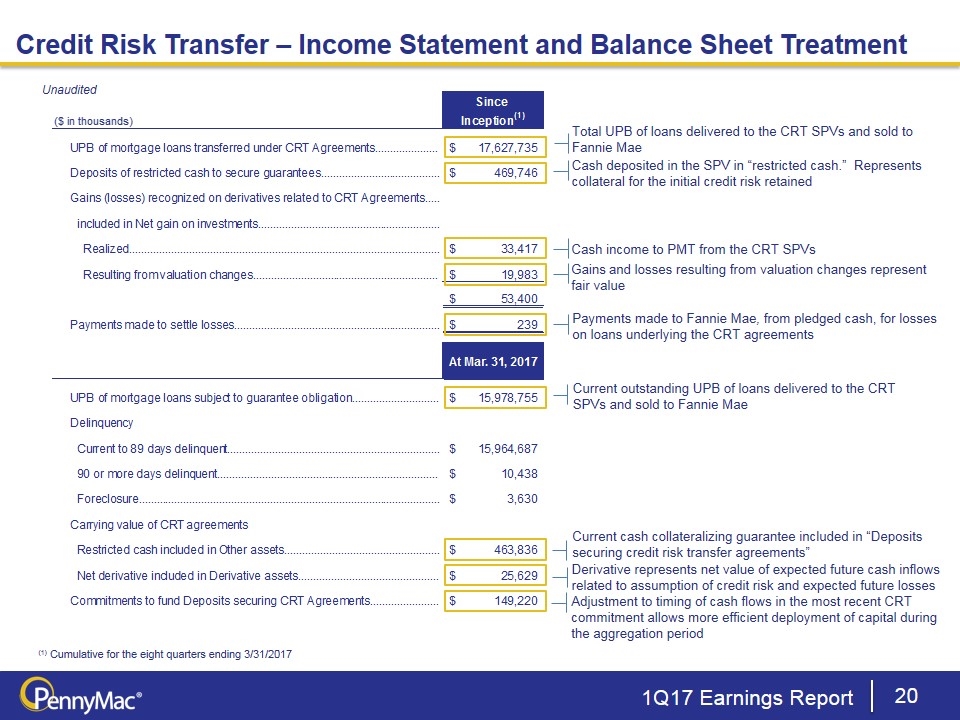

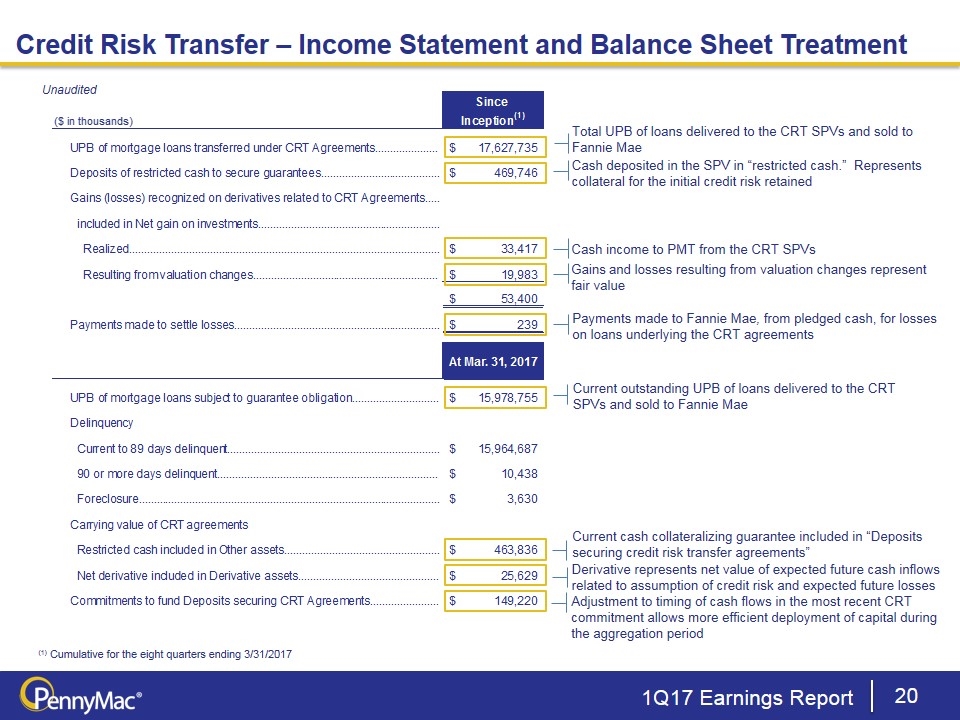

Adjustment to timing of cash flows in the most recent CRT commitment allows more efficient deployment of capital during the aggregation period Derivative represents net value of expected future cash inflows related to assumption of credit risk and expected future losses Current cash collateralizing guarantee included in “Deposits securing credit risk transfer agreements” Gains and losses resulting from valuation changes represent fair value Payments made to Fannie Mae, from pledged cash, for losses on loans underlying the CRT agreements Cash income to PMT from the CRT SPVs Total UPB of loans delivered to the CRT SPVs and sold to Fannie Mae Credit Risk Transfer – Income Statement and Balance Sheet Treatment 1Q17 Earnings Report Cash deposited in the SPV in “restricted cash.” Represents collateral for the initial credit risk retained Current outstanding UPB of loans delivered to the CRT SPVs and sold to Fannie Mae Unaudited (1) Cumulative for the eight quarters ending 3/31/2017

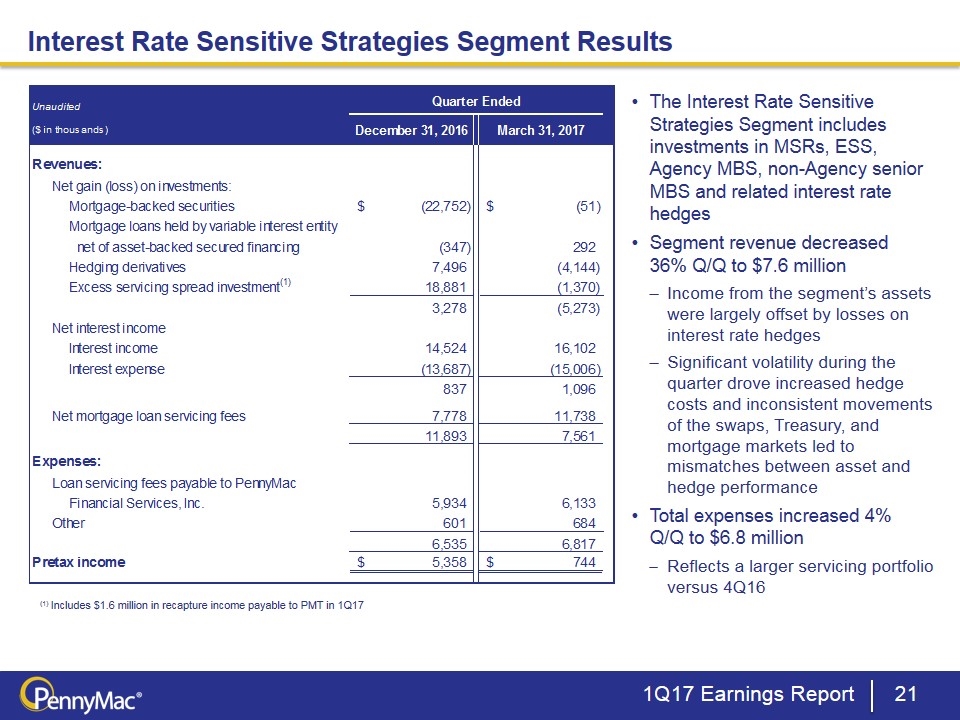

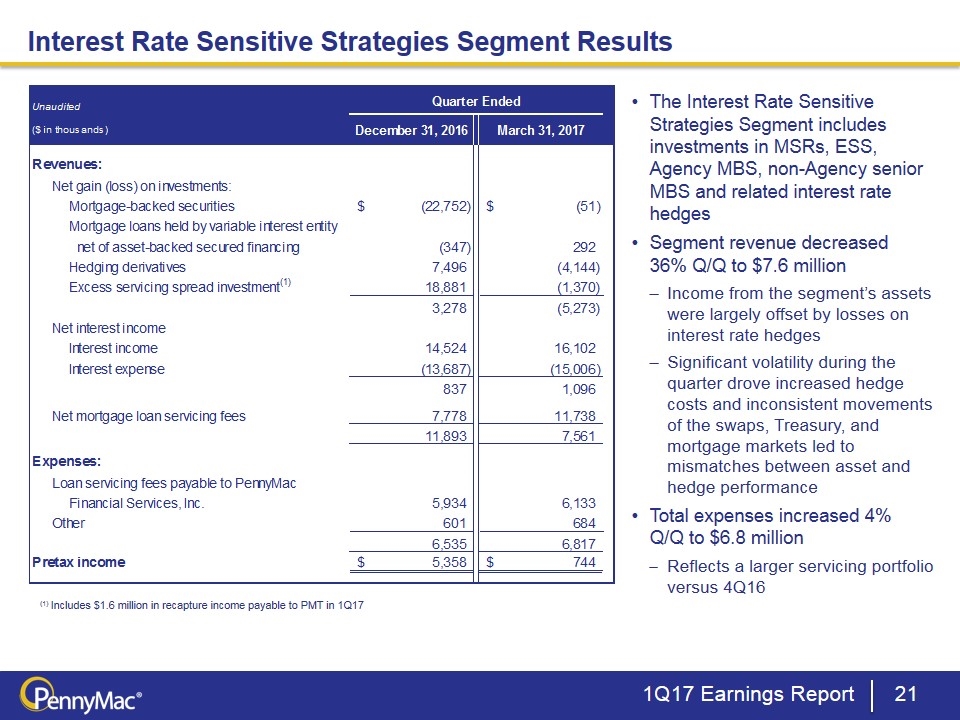

Interest Rate Sensitive Strategies Segment Results The Interest Rate Sensitive Strategies Segment includes investments in MSRs, ESS, Agency MBS, non-Agency senior MBS and related interest rate hedges Segment revenue decreased 36% Q/Q to $7.6 million Income from the segment’s assets were largely offset by losses on interest rate hedges Significant volatility during the quarter drove increased hedge costs and inconsistent movements of the swaps, Treasury, and mortgage markets led to mismatches between asset and hedge performance Total expenses increased 4% Q/Q to $6.8 million Reflects a larger servicing portfolio versus 4Q16 1Q17 Earnings Report (1) Includes $1.6 million in recapture income payable to PMT in 1Q17 Unaudited Interest Rate Sensitive Stategies 4Q16 1Q17 Revenues: Net gain (loss) on investments: Mortgage loans held by variable interest entity net of asset-backed secured financing $-,347 $292 Mortgage-backed securities ,-22,752 -51 Hedging derivatives 7,496 -4,144 Excess servicing spread investment(1) 18,881 -1,370 3,278 -5,273 Net interest income Interest income 14,524 16,102 Interest expense ,-13,687 ,-15,006 837 1,096 Net mortgage loan servicing fees 7,778 11,738 11,893 7,561 Expenses: Loan servicing fees payable to PennyMac Financial Services, Inc. 5,934 6,133 Other 601 684 Interest Rate Sensitive Pretax income $5,358 744 (1)Includes $x.x million in recapture income in 1Q17 Unaudited Quarter Ended ($ in thousands) December 31, 2016 March 31, 2017 Revenues: Net gain (loss) on investments: Mortgage-backed securities $,-22,752 $-51 Mortgage loans held by variable interest entity net of asset-backed secured financing -,347 292 Hedging derivatives 7,496 -4,144 Excess servicing spread investment(1) 18,881 -1,370 3,278 -5,273 Net interest income Interest income 14,524 16,102 Interest expense ,-13,687 ,-15,006 837 1,096 Net mortgage loan servicing fees 7,778 11,738 11,893 7,561 -4,332 Expenses: Loan servicing fees payable to PennyMac Financial Services, Inc. 5,934 6,133 Other 601 684 6535 6817 4.3152257077276206E-2 Pretax income $5,358 $744

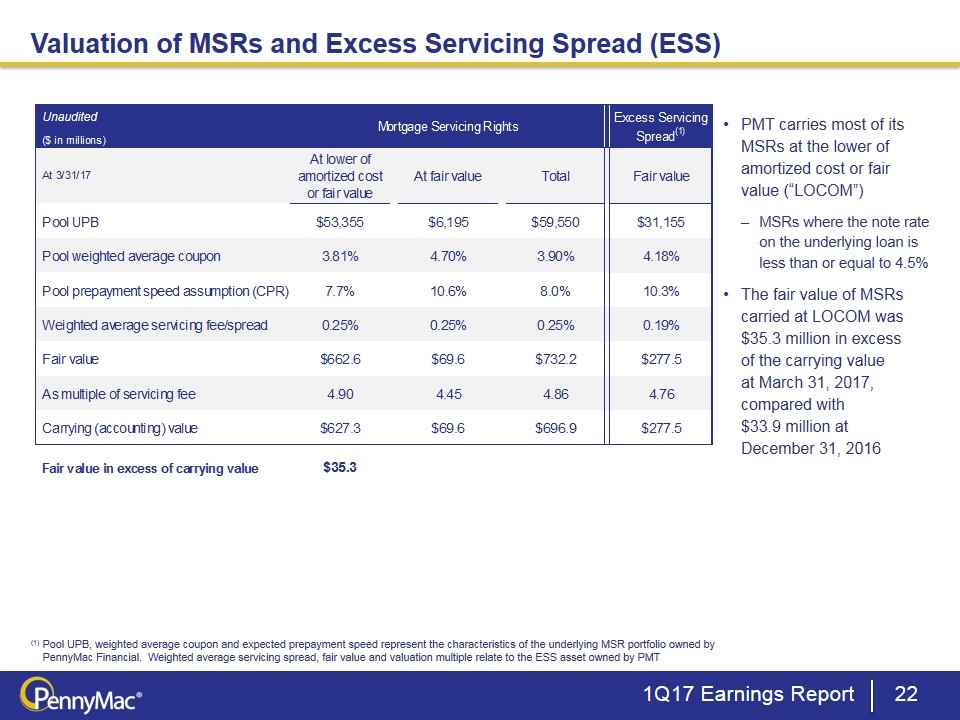

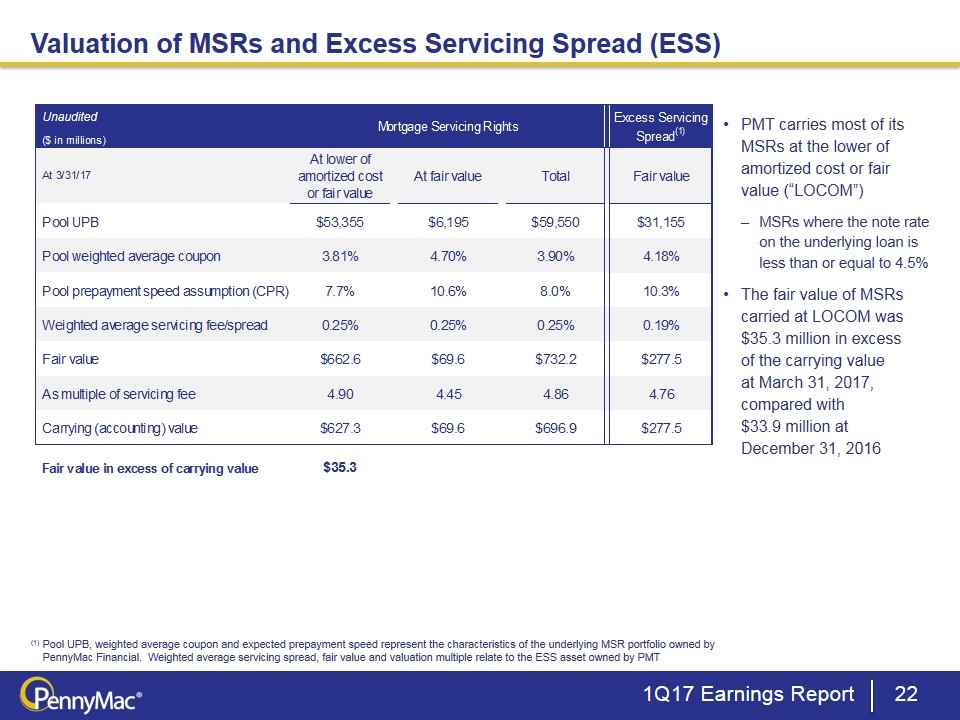

Valuation of MSRs and Excess Servicing Spread (ESS) PMT carries most of its MSRs at the lower of amortized cost or fair value (“LOCOM”) MSRs where the note rate on the underlying loan is less than or equal to 4.5% The fair value of MSRs carried at LOCOM was $35.3 million in excess of the carrying value at March 31, 2017, compared with $33.9 million at December 31, 2016 1Q17 Earnings Report Unaudited (1) Pool UPB, weighted average coupon and expected prepayment speed represent the characteristics of the underlying MSR portfolio owned by PennyMac Financial. Weighted average servicing spread, fair value and valuation multiple relate to the ESS asset owned by PMT ($ in millions) Mortgage Servicing Rights Excess Servicing Spread(1) At 3/31/17 At lower of amortized cost or fair value At fair value Total Fair value Pool UPB $53,355.108286000002 $6,195.3393300099997 $59,550.447616010002 $31,154.795793929999 150255.69102595001 Pool weighted average coupon 3.8100000000000002E-2 4.7E-2 3.9E-2 4.1799999999999997E-2 Pool prepayment speed assumption (CPR) 7.7% 0.10589999999999999 0.08 0.10340000000000001 Weighted average servicing fee/spread 2.5000000000000001E-3 2.5000000000000001E-3 2.5000000000000001E-3 1.9E-3 Fair value $662.58356498000001 $69.615916029999994 $732.19948101 $277.48426783000002 As multiple of servicing fee 4.9000000000000004 4.45 4.8600000000000003 4.76 Carrying (accounting) value $627.28757300999996 $69.615916029999994 $696.90348903999995 $277.48426783000002 Fair value in excess of carrying value $35.295991970000046 ($ in millions) Mortgage Servicing Rights Excess Servicing Spread At 6/30/2016 At lower of amortized cost or fair value At fair value Fair value Pool UPB $40,590.718999999997 $6,496.7110000000002 $36,152 83239.429999999993 Pool weighted average coupon 3.8600000000000002E-2 4.7100000000000003E-2 4.2099999999999999E-2 Pool prepayment speed assumption (CPR) 0.10780000000000001 0.1426 0.125 Weighted average servicing fee/spread 2.5000000000000001E-3 2.5000000000000001E-3 1.9E-3 Fair value $417.09399999999999 $57.975000000000001 $294.55099999999999 As multiple of servicing fee 4.03 3.53 4.3499999999999996 Carrying (accounting) value $413.48200000000003 $57.975000000000001 $294.55099999999999 Fair value in excess of carrying value $3.6119999999999663 ($ in millions) Mortgage Servicing Rights Excess Servicing Spread At 3/31/15 Under lower of amortized cost or fair value Under fair value Fair value Pool UPB $29,155.694 $6,000.7 $33,142.364999999998 68298.758999999991 Pool weighted average coupon 3.8100000000000002E-2 4.7800000000000002E-2 4.1099999999999998E-2 Pool prepayment speed assumption (CPR) 8.9% 0.1353 0.11600000000000001 Weighted average servicing fee/spread 2.5999999999999999E-3 2.5000000000000001E-3 1.6000000000000001E-3 Fair value $327.702 $49.447000000000003 $222.309 As multiple of servicing fee 4.38 3.26 4.1980000000000004 Carrying (accounting) value $309.71199999999999 $49.447000000000003 $222.309 Fair value in excess of carrying value $17.990000000000009 ($ in millions) Mortgage Servicing Rights Excess Servicing Spread At 6/30/14 Under lower of amortized cost or fair value Under fair value Fair value UPB $24,640 $4,758 $26,963.818793999999 Weighted average coupon 3.7199999999999997E-2 4.7899999999999998E-2 4.2299999999999997E-2 Prepayment speed assumption (CPR) 8.6% 0.10199999999999999 0.1024 Weighted average servicing fee/spread 2.5999999999999999E-3 2.5000000000000001E-3 1.6000000000000001E-3 Fair value $289.2 $46.8 $190.24299999999999 As multiple of servicing fee 4.5599999999999996 3.88 4.37 Carrying (accounting) value $268.7 $46.8 $190.24299999999999 Fair value in excess of carrying value $20.5 ($ in millions) Mortgage Servicing Rights Excess Servicing Spread At 3/31/14 Under lower of amortized cost or fair value Under fair value Fair value UPB $23,897 $3,426.69 $22,246 Weighted average coupon 3.6999999999999998E-2 4.7899999999999998E-2 4.3999999999999997E-2 Prepayment speed assumption (CPR) 8.3% 9.4% 0.1045 Weighted average servicing fee/spread 2.5999999999999999E-3 2.5000000000000001E-3 1.6000000000000001E-3 Fair value $289.93400000000003 $36.180999999999997 $151 As multiple of servicing fee 4.71 4.1500000000000004 4.34 Carrying (accounting) value $265.24 $36.180999999999997 $151 Fair value in excess of carrying value $24.694000000000017 Mult is acct value / UPB / wt avg svc fee ($ in millions) Mortgage Servicing Rights Excess Servicing Spread At 12/31/13 Under lower of amortized cost or fair value Under fair value Fair value UPB $23,400 $2,393 $20,512.659 Weighted average coupon 3.6799999999999999E-2 4.7800000000000002E-2 4.4400000000000002E-2 Prepayment speed assumption (CPR) 8.2% 8.9% 9.7% Weighted average servicing fee/spread 2.5999999999999999E-3 2.5999999999999999E-3 1.552E-3 Fair value $289.74 $26.452000000000002 $138.72200000000001 As multiple of servicing fee 4.8 4.32 4.3600000000000003 Carrying (accounting) value $264.12 $26.452000000000002 $138.72200000000001 Fair value in excess of carrying value $25.620000000000005

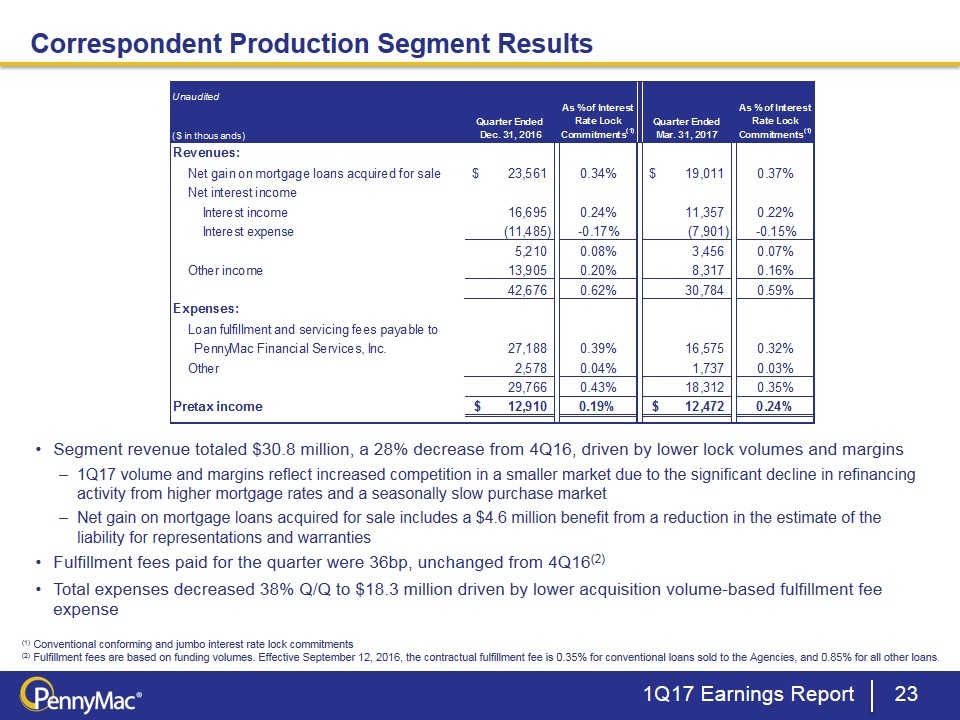

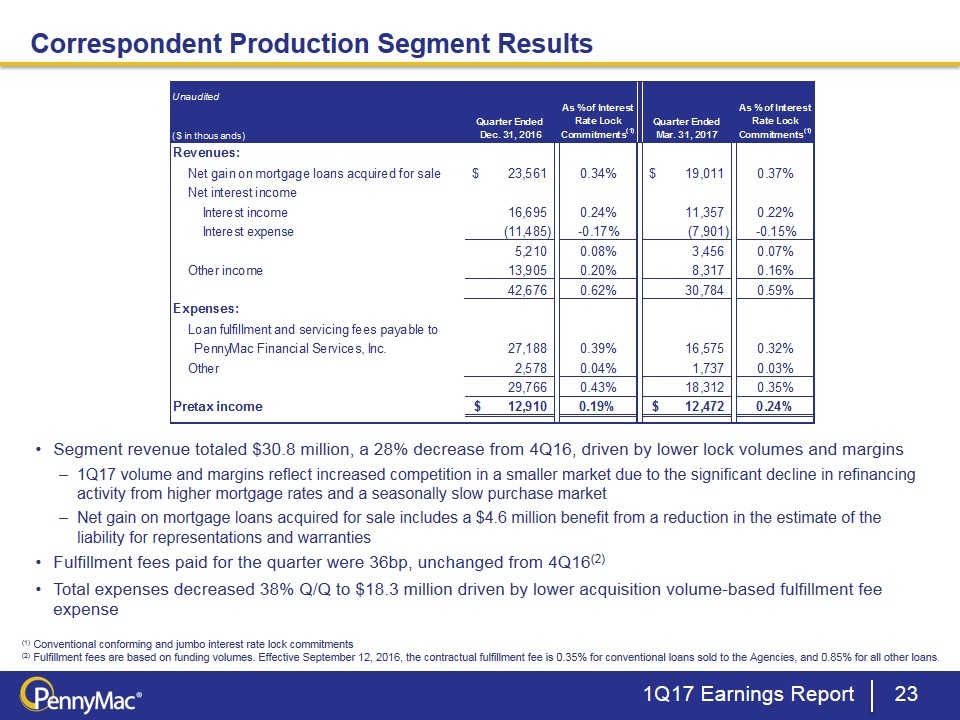

Correspondent Production Segment Results Segment revenue totaled $30.8 million, a 28% decrease from 4Q16, driven by lower lock volumes and margins 1Q17 volume and margins reflect increased competition in a smaller market due to the significant decline in refinancing activity from higher mortgage rates and a seasonally slow purchase market Net gain on mortgage loans acquired for sale includes a $4.6 million benefit from a reduction in the estimate of the liability for representations and warranties Fulfillment fees paid for the quarter were 36bp, unchanged from 4Q16(2) Total expenses decreased 38% Q/Q to $18.3 million driven by lower acquisition volume-based fulfillment fee expense (1) Conventional conforming and jumbo interest rate lock commitments (2) Fulfillment fees are based on funding volumes. Effective September 12, 2016, the contractual fulfillment fee is 0.35% for conventional loans sold to the Agencies, and 0.85% for all other loans. 1Q17 Earnings Report Unaudited($ in thousands) Quarter Ended Dec. 31, 2016 As % of Interest Rate Lock Commitments(1) Quarter Ended Mar. 31, 2017 As % of Interest Rate Lock Commitments(1) Revenues: Net gain on mortgage loans acquired for sale $23,561 3.4022139537217594E-3 $19,011 3.6669977058441804E-3 -0.19311574211620899 Net interest income Interest income 16,695 2.4107619352907251E-3 11,357 2.1906313684326106E-3 Interest expense ,-11,485 -1.6584367072065875E-3 -7,901 -1.5240097245739241E-3 5,210 7.523252280841376E-4 3,456 6.6662164385868647E-4 Other income 13,905 2.0078852776410621E-3 8,317 1.6042512187420992E-3 42,676 6.1624244594469585E-3 30,784 5.9378705684449661E-3 -0.27865779360764831 Expenses: Loan fulfillment and servicing fees payable to PennyMac Financial Services, Inc. 27,188 3.9259536086663207E-3 16,575 3.1971220332632313E-3 Other 2,578 3.722638076777172E-4 1,737 3.3504681579355855E-4 29,766 4.2982174163440382E-3 18,312 3.5321688490567897E-3 Pretax income $12,910 1.8642070431029202E-3 $12,472 2.4057017193881763E-3 ($ in thousands) 42735 42825 1000 5,957,343,983 Revenues: 7,131,150 Net gain on mortgage loans acquired for sale $23,561 3.4022139537217594E-3 $19,011 3.6669977058441804E-3 5,964,475,133 Net interest income Interest income 16,695 2.4107619352907251E-3 11,357 2.1906313684326106E-3 Interest expense ,-11,485 -1.6584367072065875E-3 -7,901 -1.5240097245739241E-3 5,210 7.523252280841376E-4 3,456 6.6662164385868647E-4 Loan origination fees & other 13,905 2.0078852776410621E-3 8,317 1.6042512187420992E-3 3.9502218509794226E-3 Total Revenues $42,676 6.1624244594469585E-3 30,784 5.9378705684449661E-3 0 Expenses: 2.3313032060552981E-3 Loan fulfillment and servicing fees $27,188 3.9259536086663207E-3 16,575 3.1971220332632313E-3 Other 2,578 3.722638076777172E-4 1,737 3.3504681579355855E-4 Total Expenses $29,766 4.2982174163440382E-3 18,312 3.5321688490567897E-3 Pretax income $12,910 1.8642070431029202E-3 $12,472 2.4057017193881763E-3 Conforming and Jumbo Locks 6925196.45163 5184350.1210000003 Revenues: Net gain on mortgage loans acquired for sale Interest income Loan origination fees Total Revenues Expenses: Loan fulfillment fees Interest Loan servicing & other Total Expenses Pre-tax net income Conforming and Jumbo Locks Conforming and Jumbo Locks (previous number)

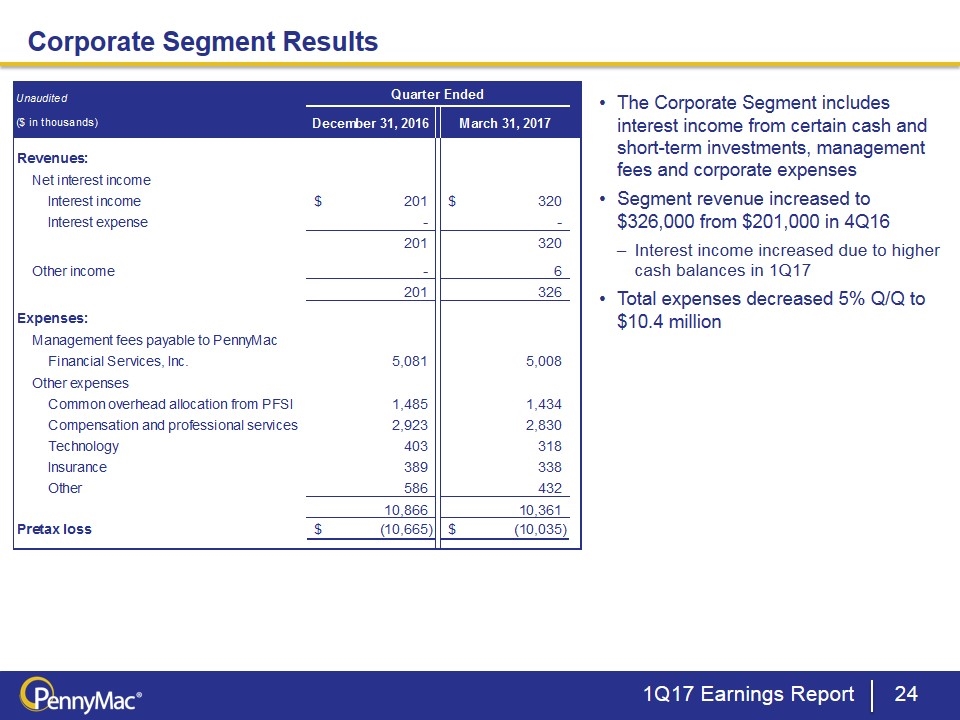

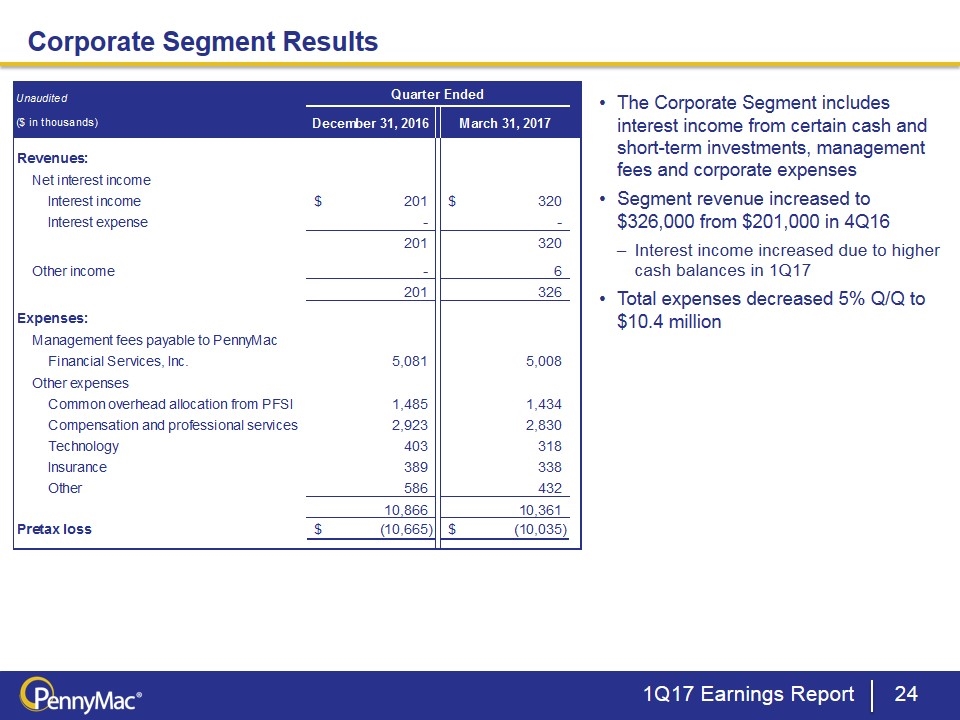

Corporate Segment Results The Corporate Segment includes interest income from certain cash and short-term investments, management fees and corporate expenses Segment revenue increased to $326,000 from $201,000 in 4Q16 Interest income increased due to higher cash balances in 1Q17 Total expenses decreased 5% Q/Q to $10.4 million 1Q17 Earnings Report Unaudited Corpoorate Expenses 4Q16 1Q17 Revenues: Net investment income: Net interest income Interest income $201 $320 Interest expense 0 0 201 320 Other income 0 6 201 326 Expenses: Management fees payable to PennyMac Financial Services, Inc. 5,081 5,008 Corporate Expenses Common overhead allocation from PFSI 1,484.904 1,434.117 Compensation and professional services 2,922.8269999999998 2,830.3599999999997 Technology 403.44 318.07100000000003 Insurance 388.62299999999999 337.91699999999997 Other 585.62900000000002 432.27699999999999 10,866.423000000001 10,360.741999999998 Pretax loss $,-10,665.423000000001 $,-10,034.741999999998 Unaudited Quarter Ended ($ in thousands) December 31, 2016 March 31, 2017 Revenues: Net interest income Interest income $201 $320 Interest expense 0 0 201 320 Other income 0 6 201 326 Expenses: Management fees payable to PennyMac Financial Services, Inc. 5,081 5,008 -1.4367250541232042E-2 Other expenses Common overhead allocation from PFSI 1,484.904 1,434.117 -3.4202211052027628E-2 Compensation and professional services 2,922.8269999999998 2,830.3599999999997 -3.1636152259439269E-2 Technology 403.44 318.07100000000003 -0.2116027166369224 Insurance 388.62299999999999 337.91699999999997 -0.1304760654927784 Other 585.62900000000002 432.27699999999999 -0.26185861697422774 10866.423000000001 10360.741999999998 -4.6536104843332739E-2 Pretax loss $,-10,665.423000000001 $,-10,034.741999999998 -5.9133238316005123E-2

Appendix

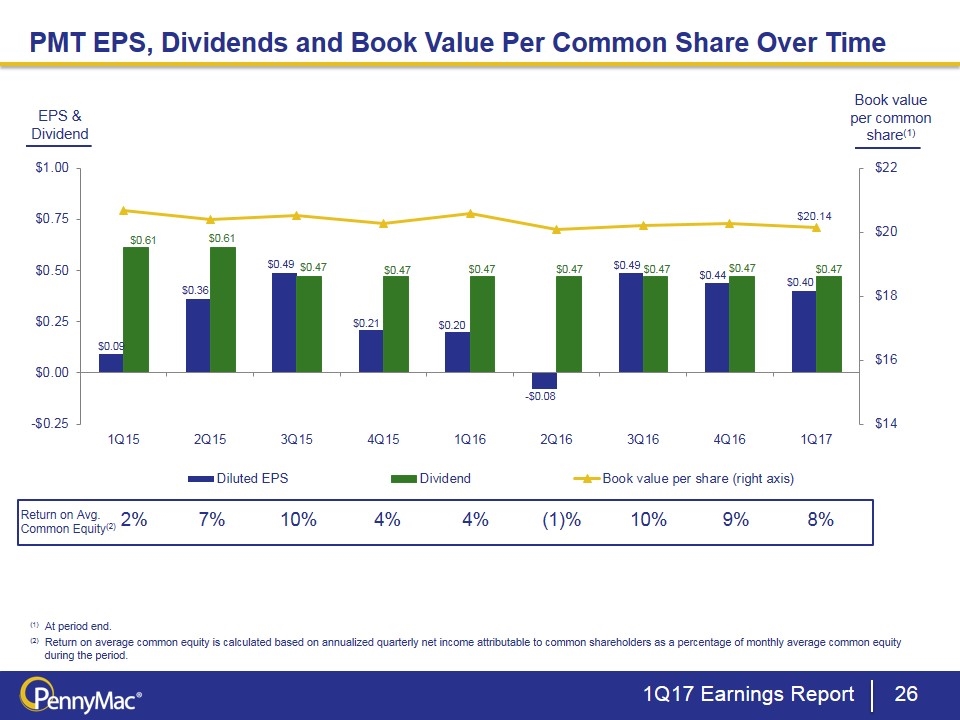

Book value per common share(1) PMT EPS, Dividends and Book Value Per Common Share Over Time 2% 10% Return on Avg. Common Equity(2) (1) At period end. (2) Return on average common equity is calculated based on annualized quarterly net income attributable to common shareholders as a percentage of monthly average common equity during the period. 7% EPS & Dividend 4% 4% 1Q17 Earnings Report (1)% 10% 9% 8%

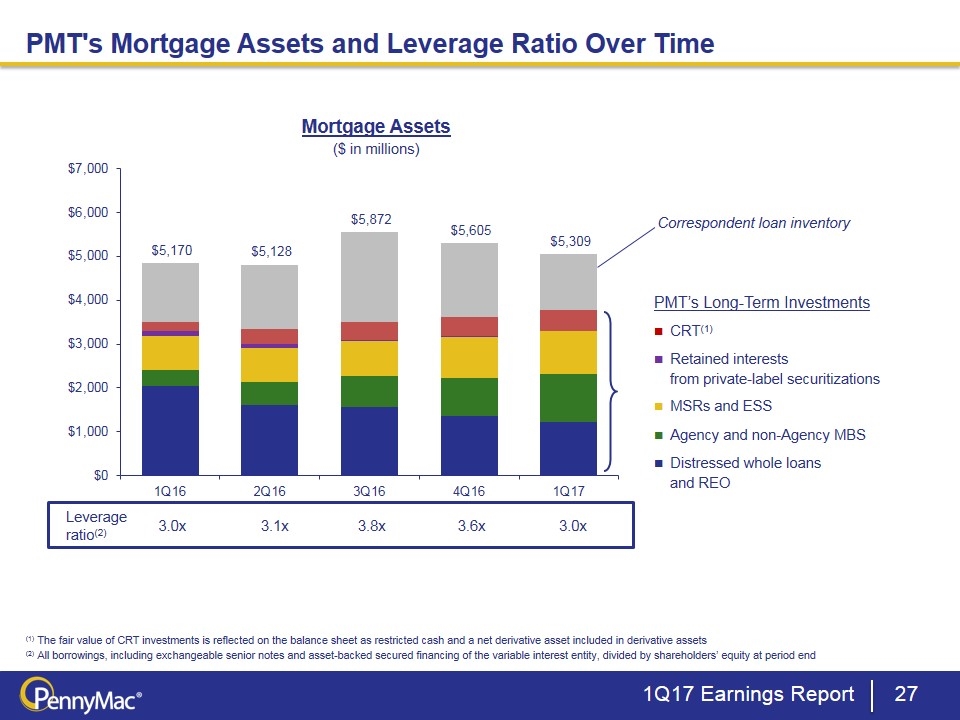

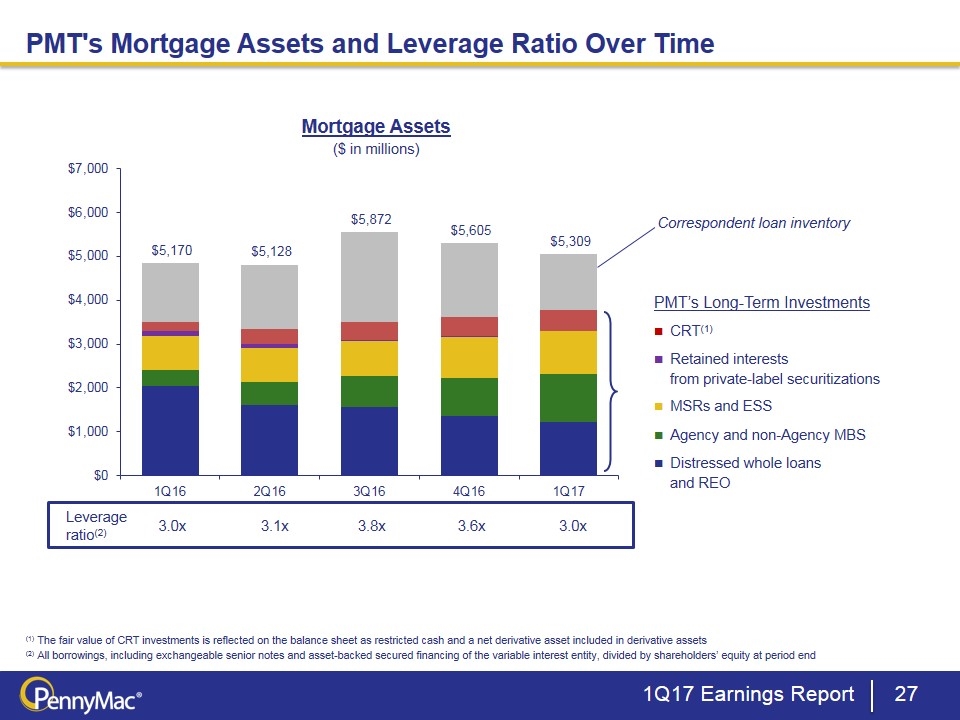

Correspondent loan inventory PMT’s Long-Term Investments ■ CRT(1) ■ Retained interests from private-label securitizations ■ MSRs and ESS ■ Agency and non-Agency MBS ■ Distressed whole loans and REO PMT's Mortgage Assets and Leverage Ratio Over Time Leverage ratio(2) (1) The fair value of CRT investments is reflected on the balance sheet as restricted cash and a net derivative asset included in derivative assets (2) All borrowings, including exchangeable senior notes and asset-backed secured financing of the variable interest entity, divided by shareholders’ equity at period end Mortgage Assets ($ in millions) 3.0x 3.1x 1Q17 Earnings Report 3.8x 3.6x 3.0x

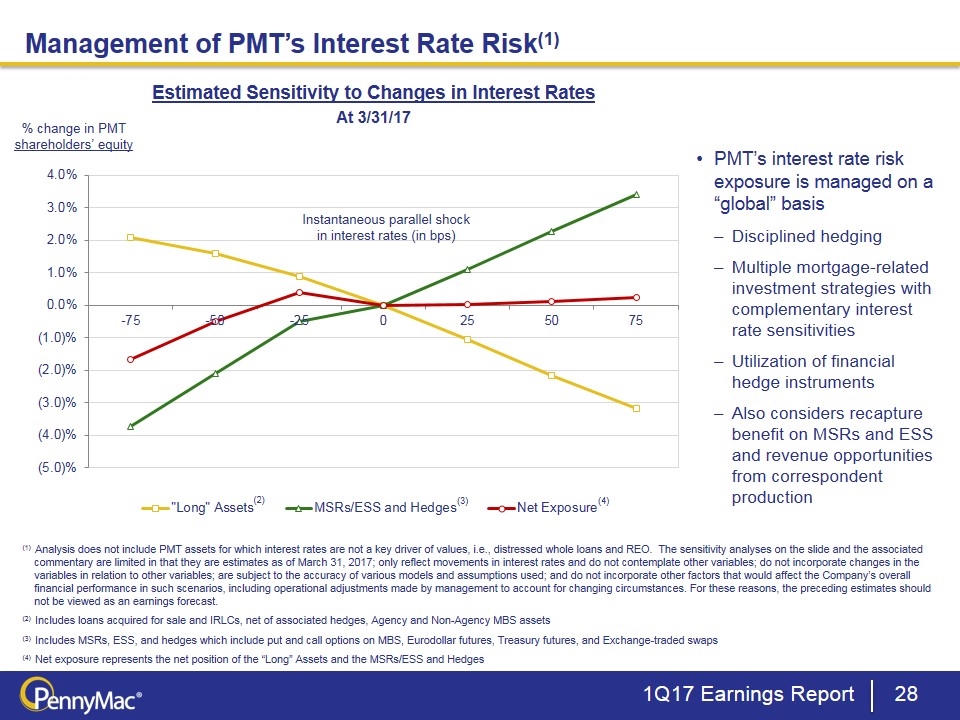

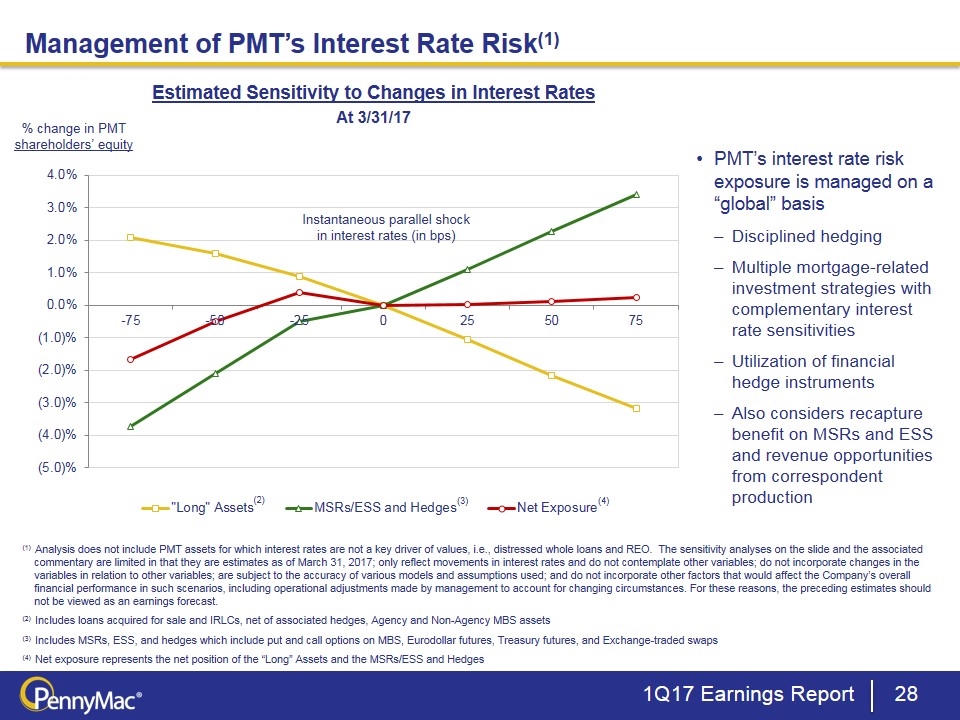

(2) PMT’s interest rate risk exposure is managed on a “global” basis Disciplined hedging Multiple mortgage-related investment strategies with complementary interest rate sensitivities Utilization of financial hedge instruments Also considers recapture benefit on MSRs and ESS and revenue opportunities from correspondent production Management of PMT’s Interest Rate Risk(1) Estimated Sensitivity to Changes in Interest Rates % change in PMT shareholders’ equity At 3/31/17 (1) Analysis does not include PMT assets for which interest rates are not a key driver of values, i.e., distressed whole loans and REO. The sensitivity analyses on the slide and the associated commentary are limited in that they are estimates as of March 31, 2017; only reflect movements in interest rates and do not contemplate other variables; do not incorporate changes in the variables in relation to other variables; are subject to the accuracy of various models and assumptions used; and do not incorporate other factors that would affect the Company’s overall financial performance in such scenarios, including operational adjustments made by management to account for changing circumstances. For these reasons, the preceding estimates should not be viewed as an earnings forecast. (2) Includes loans acquired for sale and IRLCs, net of associated hedges, Agency and Non-Agency MBS assets (3) Includes MSRs, ESS, and hedges which include put and call options on MBS, Eurodollar futures, Treasury futures, and Exchange-traded swaps (4) Net exposure represents the net position of the “Long” Assets and the MSRs/ESS and Hedges (3) (4) Instantaneous parallel shock in interest rates (in bps) 1Q17 Earnings Report

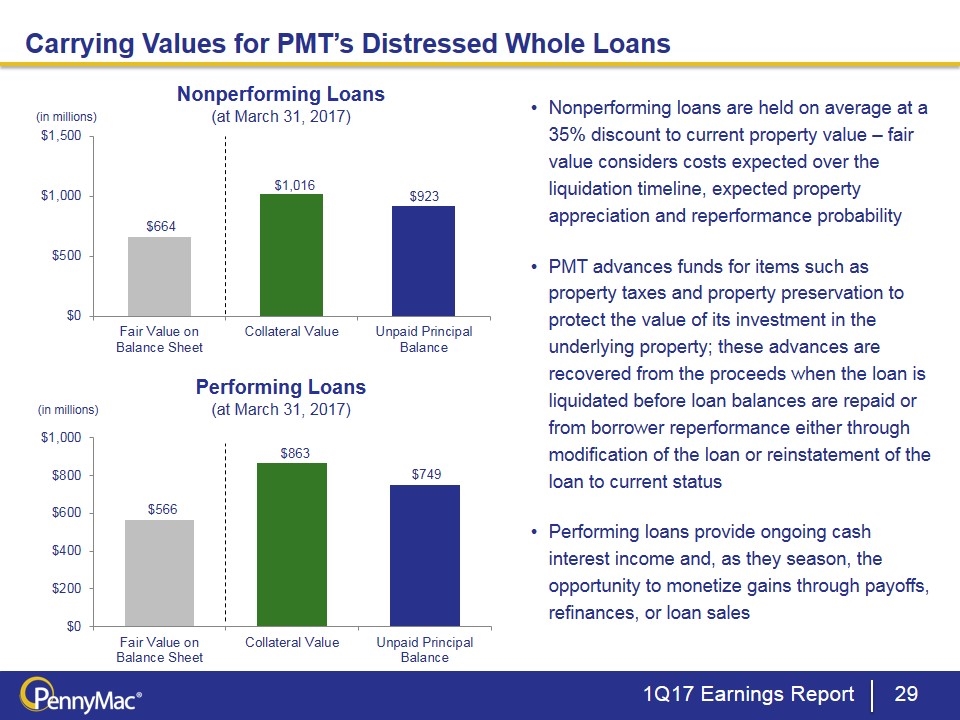

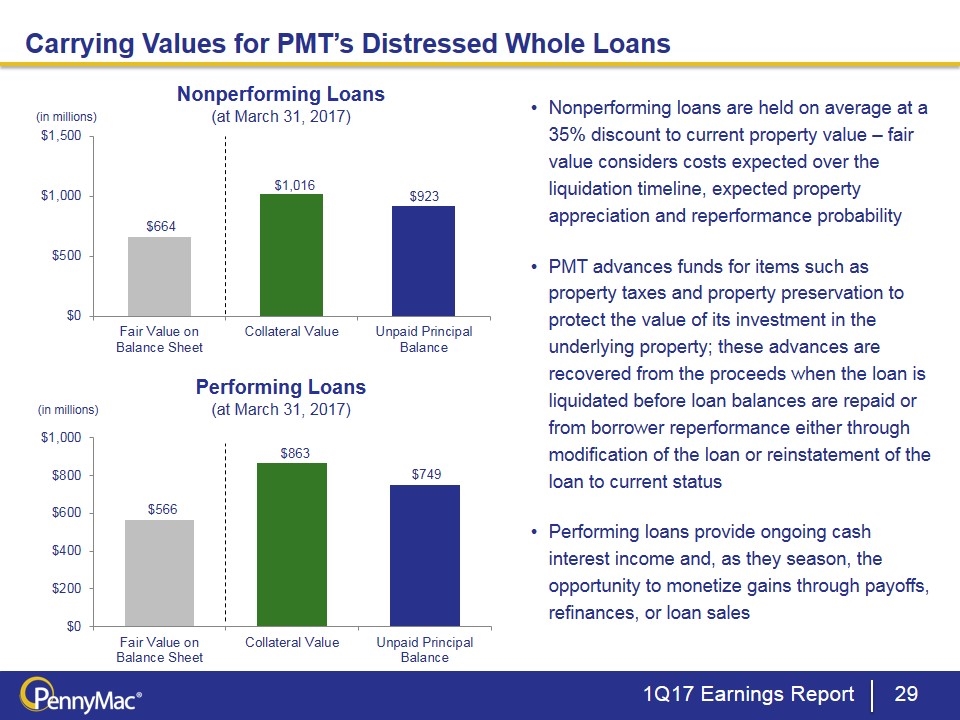

Nonperforming Loans (at March 31, 2017) Performing Loans (at March 31, 2017) Nonperforming loans are held on average at a 35% discount to current property value – fair value considers costs expected over the liquidation timeline, expected property appreciation and reperformance probability PMT advances funds for items such as property taxes and property preservation to protect the value of its investment in the underlying property; these advances are recovered from the proceeds when the loan is liquidated before loan balances are repaid or from borrower reperformance either through modification of the loan or reinstatement of the loan to current status Performing loans provide ongoing cash interest income and, as they season, the opportunity to monetize gains through payoffs, refinances, or loan sales Carrying Values for PMT’s Distressed Whole Loans (in millions) (in millions) 1Q17 Earnings Report

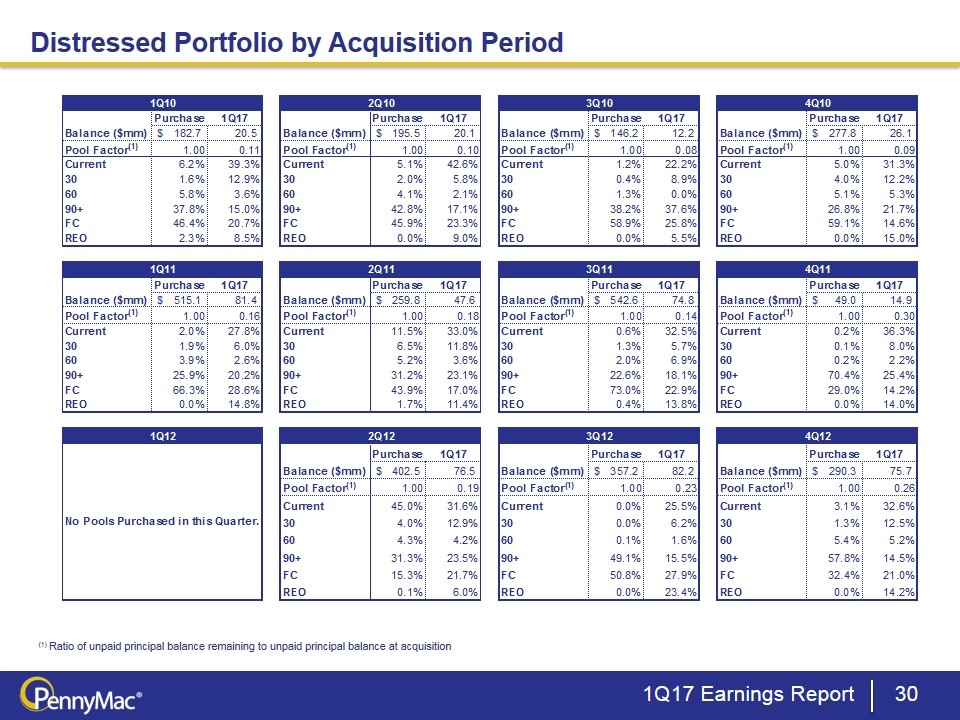

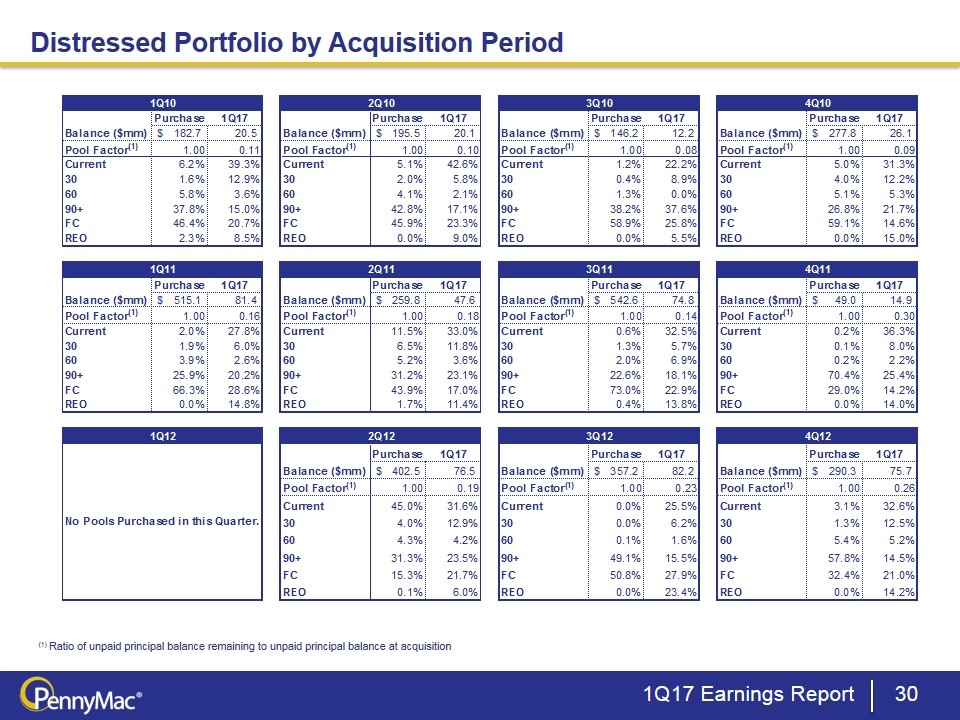

Distressed Portfolio by Acquisition Period (1) Ratio of unpaid principal balance remaining to unpaid principal balance at acquisition 1Q17 Earnings Report

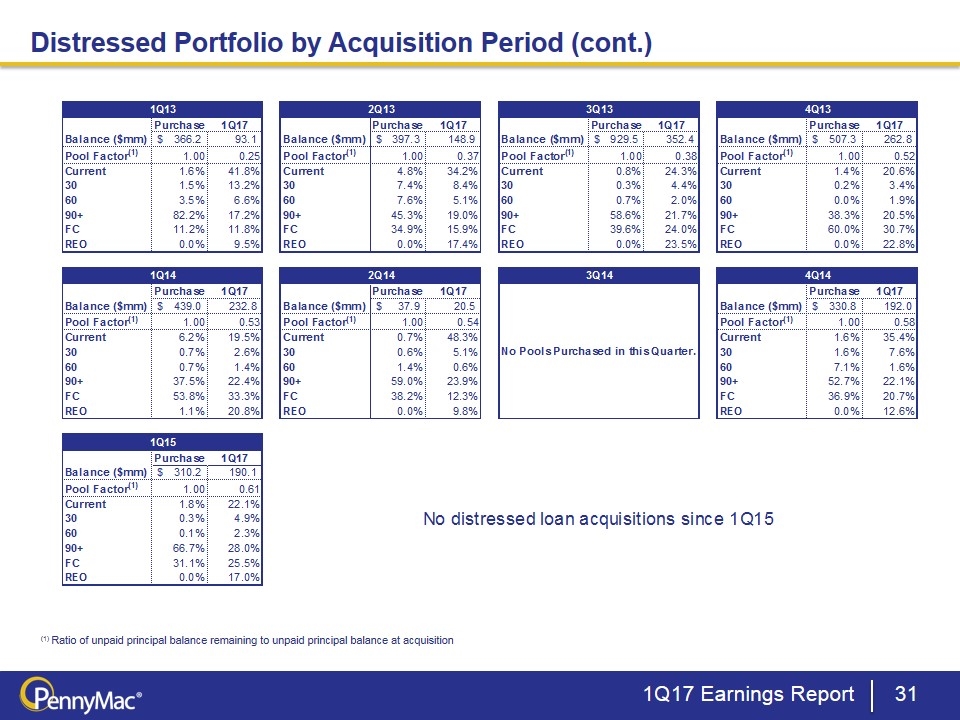

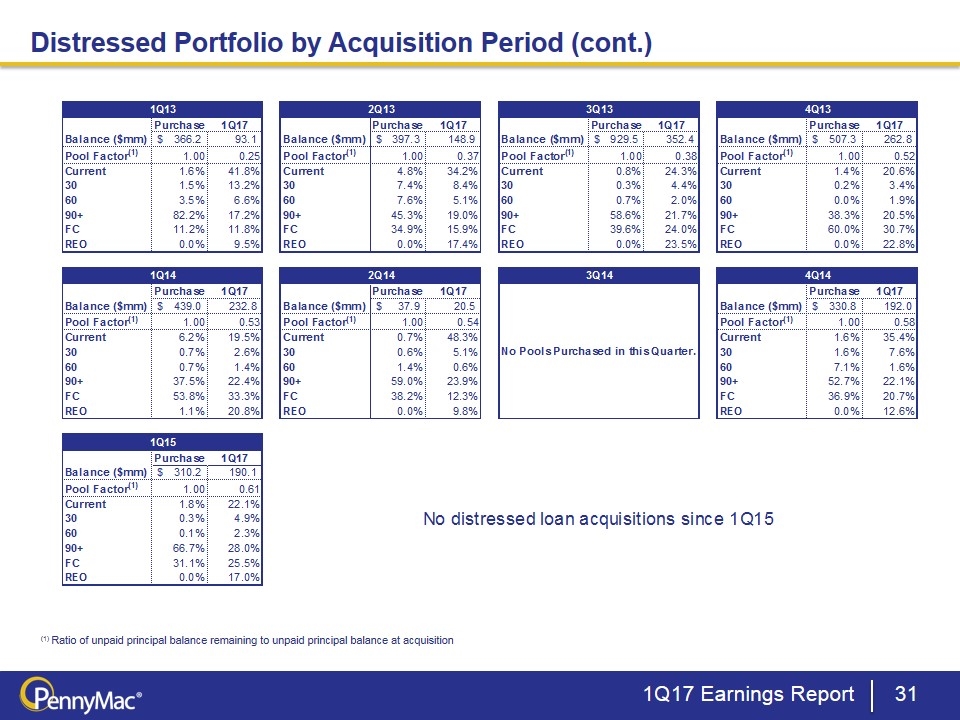

Distressed Portfolio by Acquisition Period (cont.) (1) Ratio of unpaid principal balance remaining to unpaid principal balance at acquisition 1Q17 Earnings Report

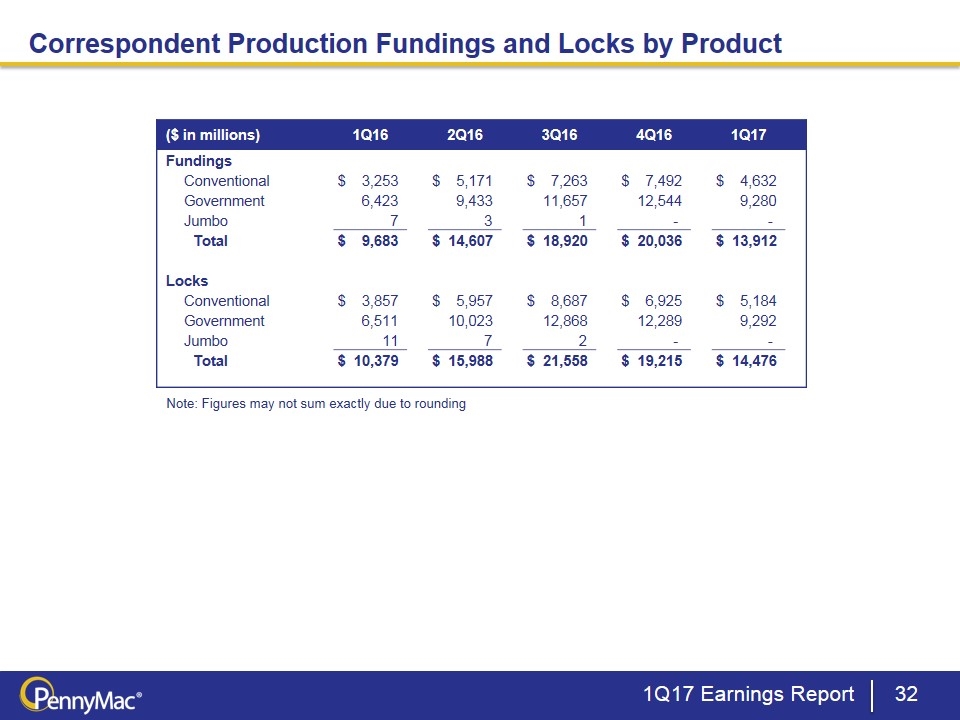

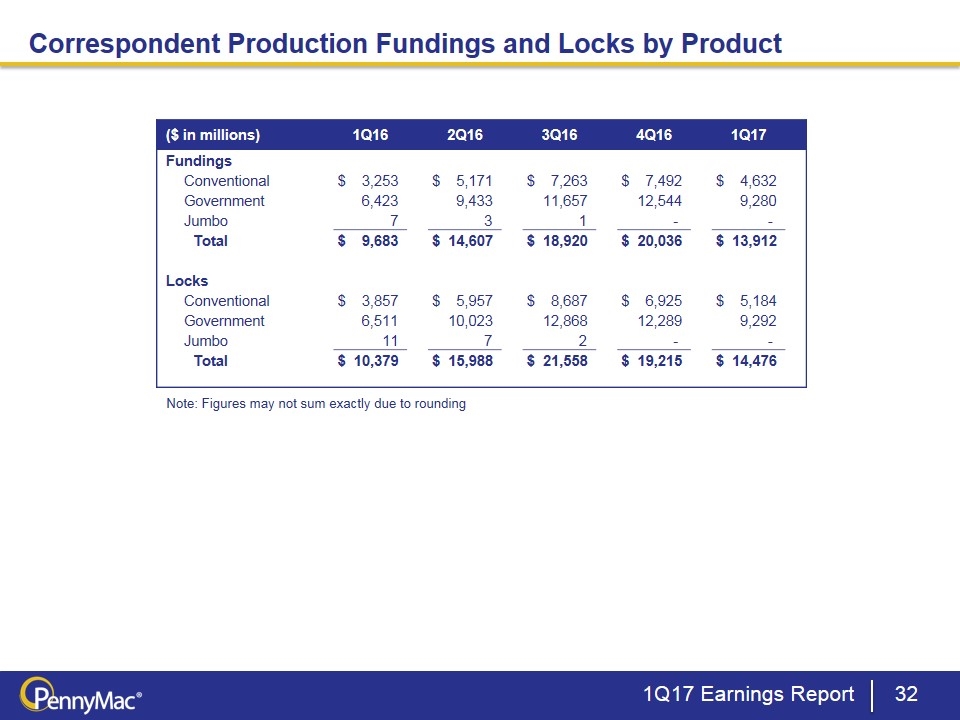

Correspondent Production Fundings and Locks by Product Note: Figures may not sum exactly due to rounding 1Q17 Earnings Report ($ in millions) 1Q16 2Q16 3Q16 4Q16 1Q17 Fundings Conventional $ 3,253 $ 5,171 $ 7,263 $ 7,492 $ 4,632 Government 6,423 9,433 11,657 12,544 9,280 Jumbo 7 3 1 - - Total $ 9,683 $ 14,607 $ 18,920 $ 20,036 $ 13,912 Locks Conventional $ 3,857 $ 5,957 $ 8,687 $ 6,925 $ 5,184 Government 6,511 10,023 12,868 12,289 9,292 Jumbo 11 7 2 - - Total $ 10,379 $ 15,988 $ 21,558 $ 19,215 $ 14,476

PMT’s Investments in GSE Credit Risk Transfer 1Q17 Earnings Report (1) FICO and LTV metrics at origination ($ in billions)

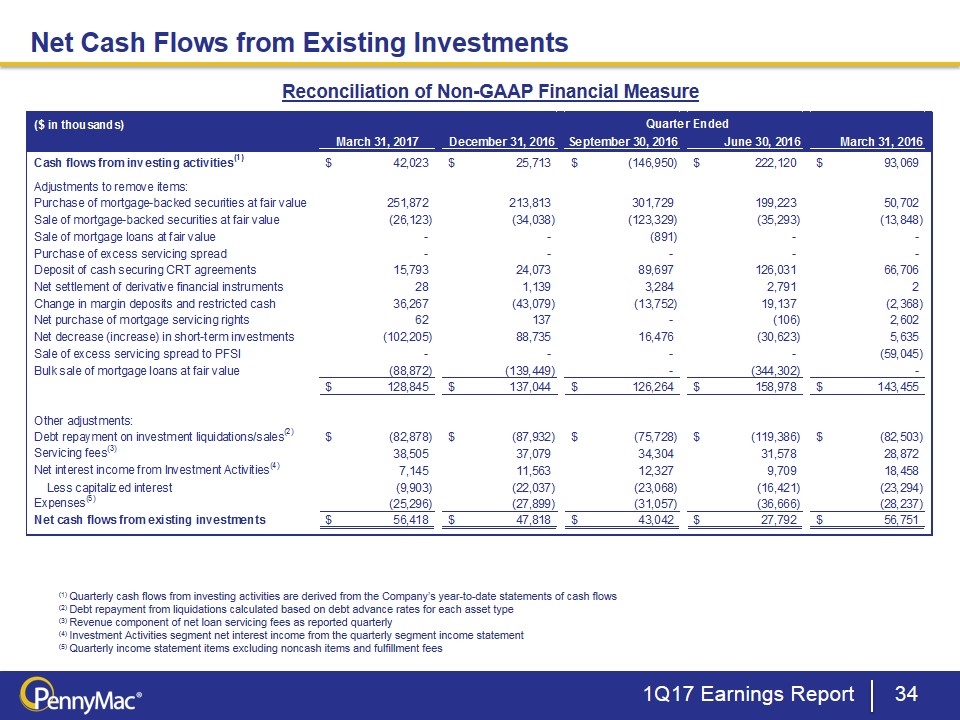

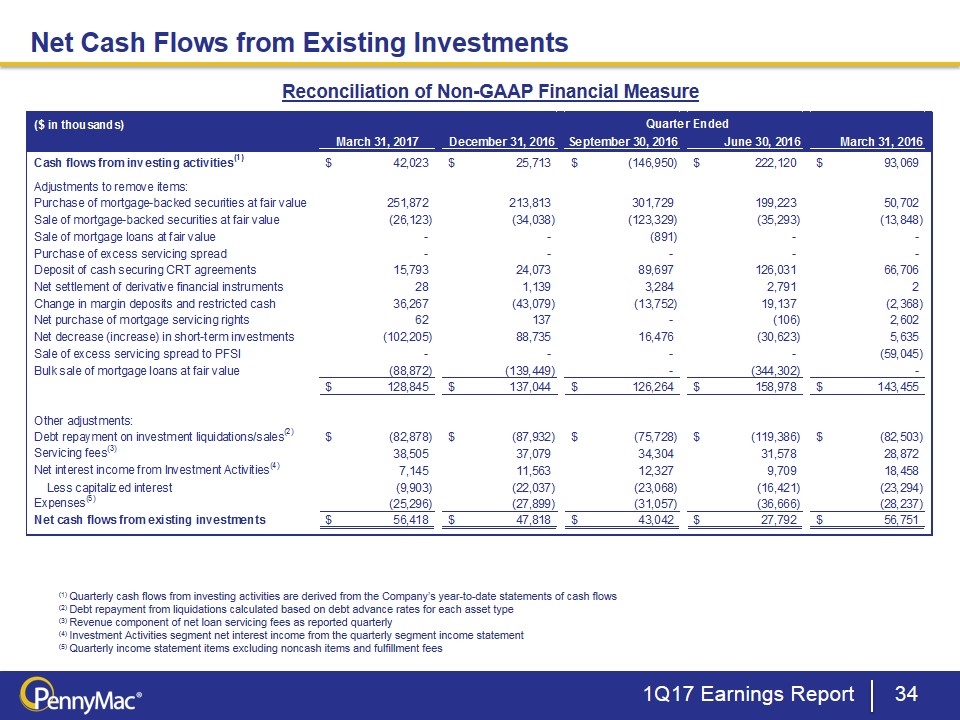

Net Cash Flows from Existing Investments (1) Quarterly cash flows from investing activities are derived from the Company’s year-to-date statements of cash flows (2) Debt repayment from liquidations calculated based on debt advance rates for each asset type (3) Revenue component of net loan servicing fees as reported quarterly (4) Investment Activities segment net interest income from the quarterly segment income statement (5) Quarterly income statement items excluding noncash items and fulfillment fees Reconciliation of Non-GAAP Financial Measure 1Q17 Earnings Report Net Cash Flows from Existing Investments and Dividends GAAP to non-GAAP reconciliation ($ in thousands) Quarter Ended $42,825 $42,735 $42,643 $42,551 $42,460 1 Cash flows from investing activities(1) $42,023 $25,713 $-,146,950 $,222,120 $93,069 0.9 $16,021.800000000001 Adjustments to remove items: Purchase of mortgage-backed securities at fair value ,251,872 ,213,813 ,301,729 ,199,223 50,702 0.69289999999999996 41,294.68399999996 Sale of mortgage-backed securities at fair value ,-26,123 ,-34,038 -,123,329 ,-35,293 ,-13,848 Sale of mortgage loans at fair value 0 - -,891 0 0 Purchase of excess servicing spread 0 - 0 0 0 Deposit of cash securing CRT agreements 15,793 24,073 89,697 ,126,031 66,706 Net settlement of derivative financial instruments 28 1,139 3,284 2,791 2 Change in margin deposits and restricted cash 36,267 ,-43,079 ,-13,752 19,137 -2,368 Net purchase of mortgage servicing rights 62 137 0 -,106 2,602 Net decrease (increase) in short-term investments -,102,205 88,735 16,476 ,-30,623 5,635 0.69289999999999996 45,714.770399999994 Sale of excess servicing spread to PFSI 0 - 0 0 ,-59,045 Bulk sale of mortgage loans at fair value ,-88,872 -,139,449 0 -,344,302 0 $,128,845 $,137,044 $,126,264 $,158,978 $,143,455 0.62729999999999997 0 Other adjustments: 0.62729999999999997 0 2 Debt repayment on investment liquidations/sales(2) $,-82,878.6999999998 $,-87,931.651040930388 $,-75,728.24000000005 $-,119,386.22 $,-82,502.693999999989 $0 3 Servicing fees(3) 38,505 37,079 34,304 31,578 28,872 0.62729999999999997 0 4 Net interest income from Investment Activities(4) 7,145 11,563 12,327 9,709 18,458 7,145 5 Less capitalized interest -9,903 ,-22,037 ,-23,068 ,-16,421 ,-23,294 6 Expenses(5) ,-25,296 ,-27,899 ,-31,057 ,-36,666 ,-28,237 Net cash flows from existing investments $56,417.993000000002 $47,818.348959069612 $43,041.975999999995 $27,791.78 $56,751.306000000011 1Q17 4Q16 3Q16 2Q16 1Q16 Expenses $41,866 $55,063 $58,312 $55,777 $41,172 Non-cash equity comp Fulfillment fees ,-16,570 ,-27,164 ,-27,255 ,-19,111 ,-12,935 Expense adjustment $25,296 $27,899 $31,057 $36,666 $28,237 1Q17 4Q16 3Q16 2Q16 1Q16 Repayment of debt related to MBS financing Repayment of debt related to NPL 37,483.175000000003 48,967.227040930389 43,530.75 68,648.75 35,898.75 Repayment of debt related to REO 45,394.831999999995 38,964.423999999999 32,197.273999999998 50,737.47 46,603.943999999996 Repayment of debt adjustment $82,878.6999999998 $87,931.651040930388 $75,728.24000000005 $,119,386.22 $82,502.693999999989 1Q17 4Q16 3Q16 2Q16 1Q16 Advance rate - repayment of MBS 0.89 0.89 0.83 0.83 0.83 Hide Advance rate - repayment of NPL 0.75 0.75 0.75 0.75 0.75 Hide Advance rate - repayment of REO 0.71799999999999997 0.71799999999999997 0.71799999999999997 0.71799999999999997 0.71799999999999997 Hide Pre-advance repayment - NPL ,127,556 ,196,468 58,041 ,410,601 47,865 Hide Pre-advance repayment - REO 63,224 54,268 44,843 70,665 64,908 Hide Re-performing loan sale (liq table) $88,872 $,139,449 $,344,302 Proceeds net of incumbrance 30,688.174999999999 41,065.227040930396 ,105,000 Repo Cost 58,183.824999999997 98,383.772959069611 ,239,302 ,113,524.84

Opportunity in MSR Acquisitions Why Are MSR Sales Occurring? How Do MSRs Come to Market? Large servicers may sell MSRs due to continuing operational pressures, higher regulatory capital requirements for banks (treatment under Basel III) and a re-focus on core customers/businesses Independent mortgage banks sell MSRs from time to time due to a need for capital Intermittent large bulk portfolio sales ($10+ billion in UPB) Require considerable coordination with selling institutions and Agencies Mini-bulk sales (typically $500 million to $5 billion in UPB) Flow/co-issue MSR transactions (monthly commitments, typically $20-100 million in UPB) Alternative delivery method typically from larger independent originators Which MSR Transactions Are Attractive? GSE and Ginnie Mae servicing in which PFSI has distinctive expertise MSRs sold and operational servicing transferred to PFSI (not subserviced by a third party) Measurable representation and warranty liability for PFSI PFSI is uniquely positioned be a successful acquirer of MSRs Proven track record of complex MSR and distressed loan transfers Operational platform that addresses the demands of the Agencies, regulators, and financing partners Physical capacity in place to sustain servicing portfolio growth plans Potential co-investment opportunity for PMT in the excess servicing spread 1Q17 Earnings Report

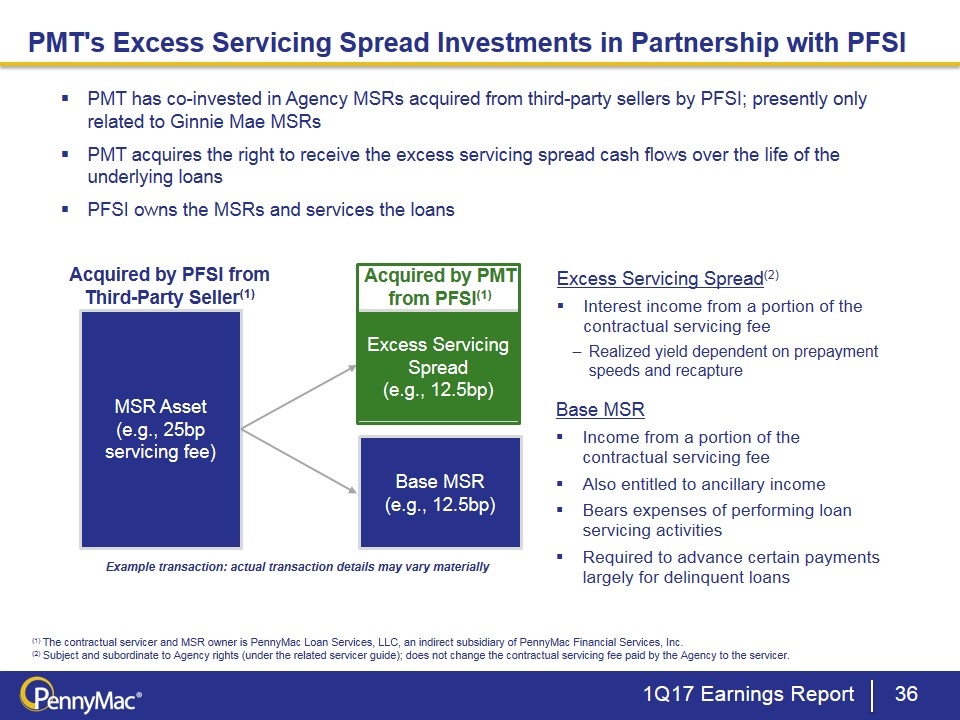

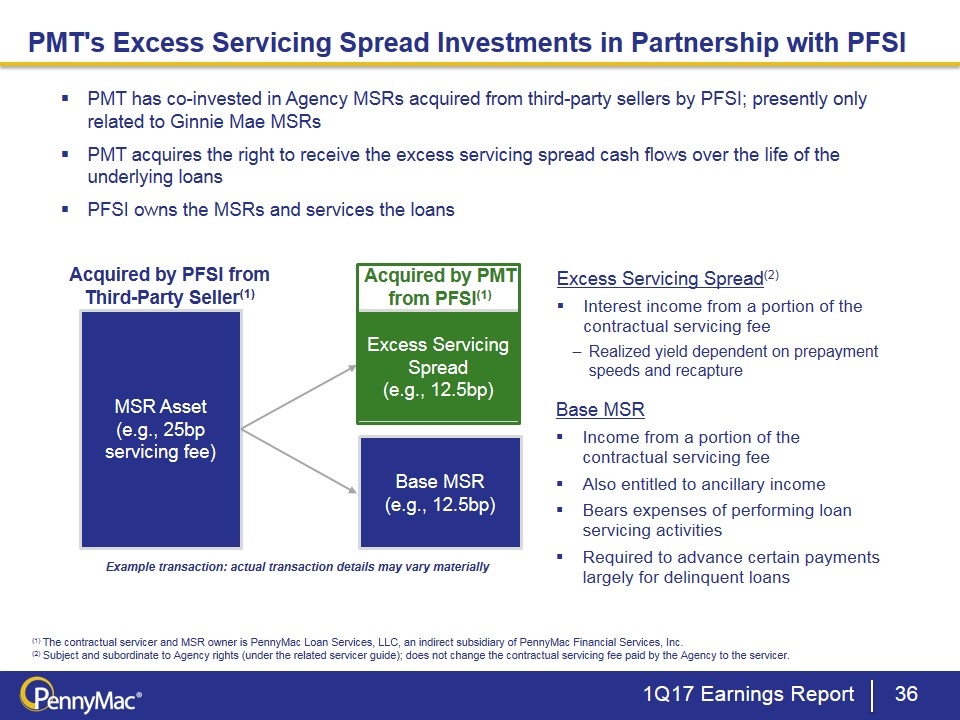

PMT's Excess Servicing Spread Investments in Partnership with PFSI (1) The contractual servicer and MSR owner is PennyMac Loan Services, LLC, an indirect subsidiary of PennyMac Financial Services, Inc. (2) Subject and subordinate to Agency rights (under the related servicer guide); does not change the contractual servicing fee paid by the Agency to the servicer. Excess Servicing Spread (e.g., 12.5bp) MSR Asset (e.g., 25bp servicing fee) Acquired by PFSI from Third-Party Seller(1) PMT has co-invested in Agency MSRs acquired from third-party sellers by PFSI; presently only related to Ginnie Mae MSRs PMT acquires the right to receive the excess servicing spread cash flows over the life of the underlying loans PFSI owns the MSRs and services the loans Excess Servicing Spread(2) Interest income from a portion of the contractual servicing fee Realized yield dependent on prepayment speeds and recapture Base MSR Income from a portion of the contractual servicing fee Also entitled to ancillary income Bears expenses of performing loan servicing activities Required to advance certain payments largely for delinquent loans Base MSR (e.g., 12.5bp) Acquired by PMT from PFSI(1) Example transaction: actual transaction details may vary materially 1Q17 Earnings Report