SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

| | o | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| | x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

for the fiscal year ended December 31, 2013

| | o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________________ to ________________

OR

| | o | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number: 001-36298

GEOPARK LIMITED

(Exact name of Registrant as specified in its charter)

Bermuda

(Jurisdiction of incorporation)

Nuestra Señora de los Ángeles 179

Las Condes, Santiago, Chile

(Address of principal executive offices)

Pedro Aylwin

Director of Legal and Governance

GeoPark Limited

Nuestra Señora de los Ángeles 179

Las Condes, Santiago, Chile

Phone: +56 (2) 2242 9600

Fax: +56 (2) 2242 9600 ext. 201

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Copies to:

Maurice Blanco, Esq.

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, NY 10017

Phone: (212) 450 4000

Fax: (212) 701 5800

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | Name of each exchange on which registered |

| Common shares, par value US$0.001 per share | | New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital stock or common stock as of the close of business covered by the annual report.

Common shares: 57,863,615

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

o Yes x No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

x Yes o No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.*

* The registrant became subject to such requirements on February 6, 2014, and it has filed all reports so required since that date.

x Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

o Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | Accelerated filer o | Non-accelerated filer x |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

US GAAP o | International Financial Reporting Standards as issued by the International Accounting Standards Board x | Other o |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow.

o Item 17 o Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

o Yes x No

TABLE OF CONTENTS

Certain definitions

Unless otherwise indicated or the context otherwise requires, all references in this annual report to:

| | · | “GeoPark Limited,” “GeoPark,” “we,” “us,” “our,” the “Company” and words of a similar effect, are to GeoPark Limited (formerly GeoPark Holdings Limited), an exempted company incorporated under the laws of Bermuda, together with its consolidated subsidiaries; |

| | · | “Agencia” are to GeoPark Latin America Limited Agencia en Chile, an established branch, under the laws of Chile, of GeoPark Latin America Limited, an exempted company incorporated under the laws of Bermuda; |

| | · | “GeoPark Latin America” are to our subsidiary GeoPark Latin America Limited, an exempted company incorporated under the laws of Bermuda; |

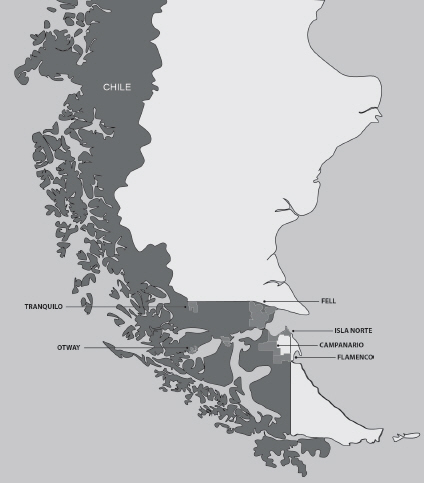

| | · | “GeoPark Fell” are to our subsidiary GeoPark Fell SpA., a sociedad por acciones incorporated under the laws of Chile; |

| | · | “GeoPark Chile” are to our subsidiary GeoPark Chile S.A., a sociedad anónima cerrada incorporated under the laws of Chile; |

| | · | “GeoPark Colombia” are prior to our internal corporate reorganization of our Colombian operations, to our subsidiary GeoPark Colombia S.A., a sociedad anónima cerrada incorporated under the laws of Chile and subsequent to such reorganization, to GeoPark Colombia Coöperatie U.A., a cooperative duly incorporated under the laws of the Netherlands; |

| | · | “GeoPark Colombia S.A.S.” are to our subsidiary GeoPark Colombia S.A.S., a sociedad anónima simplificada incorporated under the laws of Colombia, which absorbed Winchester, Luna and Cuerva and their Colombian branches by merger and assumed all rights and obligations of each; |

| | · | “Winchester” are to our subsidiary Winchester Oil and Gas S.A., now GeoPark Colombia PN S.A. Sucursal Colombia, a Colombian branch of a sociedad anónima incorporated under the laws of Panama, which merged into GeoPark Colombia S.A.S.; |

| | · | “Luna” are to our subsidiary La Luna Oil Company Limited S.A., a sociedad anónima incorporated under the laws of Panama, which merged into GeoPark Colombia S.A.S.; |

| | · | “Cuerva” are to our subsidiary GeoPark Cuerva LLC, formerly known as Hupecol Caracara LLC, a limited liability company incorporated under the laws of the state of Delaware, which merged into GeoPark Colombia S.A.S.; |

| | · | “LGI” are to LG International Corp., a company incorporated under the laws of Korea; |

| | · | “Panoro” are to Panoro Energy do Brasil Ltda., a limited liability company incorporated under the laws of Brazil and a subsidiary of Panoro Energy ASA, a company incorporated under the laws of Norway, with assets in Brazil and Africa; |

| | · | “Rio das Contas” are to Rio das Contas Produtora de Petróleo Ltda., a limited liability company incorporated under the laws of Brazil; |

| | · | our “Brazil Acquisitions” are to our Rio das Contas acquisition, which we completed on March 31, 2014, our award of two new concessions by the ANP, which are subject to confirmation of qualification requirements, and our award of seven new concessions by the ANP, in Brazil; |

| | · | “Chile” are to the Republic of Chile; |

| | · | “Colombia” are to the Republic of Colombia; |

| | · | “Brazil” are to the Federative Republic of Brazil; |

| | · | “Argentina” are to the Argentine Republic; |

| | · | “Peru” are to the Republic of Peru; |

| | · | “US$” and “U.S. dollars” are to the official currency of the United States of America; |

| | · | “Ch$” and “Chilean pesos” are to the official currency of Chile; |

| | · | “Col$” and “Colombian pesos” are to the official currency of Colombia; |

| | · | “GBP” are to the official currency of the United Kingdom; |

| | · | “AR$” and “Argentine pesos” are to the official currency of Argentina; |

| | · | “real,” “reais” and “R$” are to the official currency of Brazil; |

| | · | “IFRS” are to International Financial Reporting Standards as adopted by the International Accounting Standards Board, or IASB; |

| | · | “ANP” are to the Brazilian National Petroleum, Natural Gas and Biofuels Agency (Agência Nacional do Petróleo, Gás Natural e Biocombustíveis); |

| | · | “CNPE” are to the Brazilian National Council on Energy Policy (Conselho Nacional de Política Energética); |

| | · | “ANH” are to the Colombian National Hydrocarbons Agency (Agencia Nacional de Hidrocarburos); |

| | · | “ENAP” are to the Chilean National Petroleum Company (Empresa Nacional de Petróleo) |

| | · | “economic interest” means an indirect participation interest in the net revenues from a given block based on bilateral agreements with the concessionaires; and |

| | · | “working interest” means the right granted to the lessee of a property to explore for and to produce and own oil, gas, or other minerals. The working interest owners bear the exploration, development and operating costs on either a cash, penalty or carried basis. |

Financial statements

Our consolidated financial statements

This annual report includes our audited consolidated financial statements as of December 31, 2013 and 2012 and for each of the years ended December 31, 2013, 2012 and 2011, or our Annual Consolidated Financial Statements.

Our Consolidated Financial Statements are presented in U.S. dollars and have been prepared in accordance with IFRS, as issued by the International Accounting Standards Board (“IASB”).

Our Annual Consolidated Financial Statements have been audited by Price Waterhouse & Co. S.R.L., Argentina, a member firm of PricewaterhouseCoopers Network, or PwC, an independent registered public accounting firm, as stated in their report included elsewhere in this annual report.

Our fiscal year ends December 31. References in this annual report to a fiscal year, such as “fiscal year 2013,” relate to our fiscal year ended on December 31 of that calendar year.

Acquisition of Rio das Contas

On May 14, 2013, we agreed to acquire all of the issued and outstanding shares of Rio das Contas from Panoro, for a total cash consideration of US$140 million subject to certain purchase price and easement adjustments. The closing of the acquisition was subject to certain conditions, including approval by the ANP, among others. We closed the acquisition on March 31, 2014.

This annual report includes the consolidated financial statements prepared in accordance with IFRS of Rio das Contas as of and for the years ended December 31, 2013 and 2012, or the Rio das Contas Audited Consolidated Financial Statements, which have been audited by Ernst & Young Auditores Independentes S.S., Brazil, or Ernst & Young, as stated in their report appearing herein. References to Rio das Contas Consolidated Financial Statements are to the Rio das Contas Audited Consolidated Financial Statements. Our results as reflected in our Consolidated Financial Statements included in this annual report are not comparable to our results for any period following the future date on which we consolidate the results of Rio das Contas.

In light of our Rio das Contas acquisition that closed on March 31, 2014, we include in this annual report Unaudited Condensed Combined Pro Forma Financial Data to illustrate:

• The combined results of operations for GeoPark for the year ended December 31, 2013 to give pro forma effect to the acquisition of Rio das Contas as if such transaction had occurred as of January 1, 2013; and

• The combined statement of financial position for GeoPark as of December 31, 2013 to give pro forma effect to the acquisition of Rio das Contas as if such acquisition had occurred as of December 31, 2013.

We refer to these pro forma financial statements as our Unaudited Condensed Combined Pro Forma Financial Data. For purposes of preparing our Unaudited Condensed Combined Pro Forma Financial Data, we have made certain adjustments to the historical and pre-acquisition financial information of Rio das Contas. See “Item 3. Key Information—A. Selected financial data—Unaudited Condensed Combined Pro Forma Financial Data.” Our Unaudited Condensed Combined Pro Forma Financial Data is presented for informational purposes only and does not purport to represent our results of operations or financial condition had our acquisition of Rio das Contas occurred at the respective dates indicated above.

Our historical financial information and pro forma financial data should be read in conjunction with “Item 5. Operating and Financial Review and Prospects,” our Consolidated Financial Statements and the Rio das Contas Consolidated Financial Statements, including, in each case, the accompanying notes thereto, included elsewhere in this annual report.

Non IFRS financial measures

Adjusted EBITDA

Adjusted EBITDA is a supplemental non-IFRS financial measure that is used by management and external users of our financial statements, such as industry analysts, investors, lenders and rating agencies.

We define Adjusted EBITDA as profit for the period before net finance cost, income tax, depreciation, amortization and certain non-cash items such as impairments and write-offs of unsuccessful exploration and evaluation assets, accrual of stock options and stock awards and bargain purchase gain on acquisition of subsidiaries. Adjusted EBITDA is not a measure of profit or cash flows as determined by IFRS.

We believe Adjusted EBITDA is useful because it allows us to more effectively evaluate our operating performance and compare the results of our operations from period to period without regard to our financing methods or capital structure. We exclude the items listed above from profit for the period in arriving at Adjusted EBITDA because these amounts can vary substantially from company to company within our industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Adjusted EBITDA should not be considered as an alternative to, or more meaningful than, profit for the period or cash flows from operating activities as determined in accordance with IFRS or as an indicator of our operating performance or liquidity. Certain items excluded from Adjusted EBITDA are significant components in

understanding and assessing a company’s financial performance, such as a company’s cost of capital and tax structure and significant and/or recurring write-offs, as well as the historic costs of depreciable assets, none of which are components of Adjusted EBITDA. Our computation of Adjusted EBITDA may not be comparable to other similarly titled measures of other companies.

For a reconciliation of Adjusted EBITDA to the IFRS financial measure of profit for the year, see Note 6 to our Annual Consolidated Financial Statements as of and for the years ended 2012 and 2013, included in this annual report.

We have also included Pro Forma Adjusted EBITDA in this annual report to show our Adjusted EBITDA after giving pro forma effect to our Rio das Contas acquisition that closed on March 31, 2014. For a reconciliation of Pro Forma Adjusted EBITDA to the IFRS financial measure of pro forma profit for the year, see “Item 3. Key Information—A. Selected financial data—Unaudited Condensed Combined Pro Forma Financial Data—Note 2—Reconciliations.”

Oil and gas reserves and production information

The information included in this annual report regarding estimated quantities of proved reserves in Brazil, Chile, Colombia and Argentina is derived, in part, from estimates of the proved reserves as of December 31, 2013. The reserves estimates are derived from the report prepared by DeGolyer and MacNaughton, or D&M, independent reserves engineers, or the D&M Reserves Report, included as an exhibit to this annual report, prepared by D&M. The D&M Reserves Report was prepared by D&M for us and presents estimates as of December 31, 2013 of oil and gas reserves located in the Fell Block in Chile, the Del Mosquito, Cerro Doña Juana and Loma Cortaderal Blocks in Argentina and the La Cuerva, Llanos 32, Llanos 34, Llanos 17 and Yamú Blocks in Colombia and the interests held through Rio das Contas, which we acquired on March 31, 2014, in Brazil in BCAM-40 Concession (Manatí).

Information about our reserves only presents reserves estimates for our working interests in the blocks covered by such report as of the date of such report. These estimates are included in this annual report in reliance upon the authority of D&M as an expert in these matters.

Market share and other information

Market data, other statistical information, information regarding recent developments in Chile, Colombia, Brazil and Argentina and certain industry forecast data used in this annual report were obtained from internal reports and studies, where appropriate, as well as estimates, market research, publicly available information (including information available from the SEC website) and industry publications. Industry publications generally state that the information they include has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Similarly, internal reports and studies, estimates and market research, which we believe to be reliable and accurately extracted by us for use in this annual report, have not been independently verified. However, we believe such data is accurate and agree that we are responsible for the accurate extraction of such information from such sources and its correct reproduction in this annual report.

In addition, we have provided definitions for certain industry terms used in this annual report in the “Glossary of oil and natural gas terms” included as Appendix A to this annual report.

Rounding

We have made rounding adjustments to some of the figures included in this annual report. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that precede them.

This annual report contains statements that constitute forward-looking statements. Many of the forward-looking statements contained in this annual report can be identified by the use of forward-looking words such as “anticipate,” “believe,” “could,” “expect,” “should,” “plan,” “intend,” “will,” “estimate” and “potential,” among others.

Forward-looking statements appear in a number of places in this annual report and include, but are not limited to, statements regarding our intent, belief or current expectations. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. Such statements are subject to risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking statements due to various factors, including, but not limited to, those identified under the section “Item 3. Key Information—D. Risk factors” in this annual report. These risks and uncertainties include factors relating to:

| | · | operating risks, including equipment failures and the amounts and timing of revenues and expenses; |

| | · | termination of, or intervention in, concessions, rights or authorizations granted by the Chilean, Colombian, Brazilian and Argentine governments to us; |

| | · | uncertainties inherent in making estimates of our oil and natural gas data; |

| | · | the volatility of oil and natural gas prices; |

| | · | environmental constraints on operations and environmental liabilities arising out of past or present operations; |

| | · | discovery and development of oil and natural gas reserves; |

| | · | project delays or cancellations; |

| | · | financial market conditions and the results of financing efforts; |

| | · | political, legal, regulatory, governmental, administrative and economic conditions and developments in the countries in which we operate; |

| | · | fluctuations in inflation and exchange rates in Chile, Colombia, Brazil, Argentina and in other countries in which we may operate in the future; |

| | · | availability and cost of drilling rigs, production equipment, supplies, personnel and oil field services; |

| | · | contract counterparty risk; |

| | · | projected and targeted capital expenditures and other cost commitments and revenues; |

| | · | weather and other natural phenomena; |

| | · | the impact of recent and future regulatory proceedings and changes, changes in environmental, health and safety and other laws and regulations to which our company or operations are subject, as well as changes in the application of existing laws and regulations; |

| | · | current and future litigation; |

| | · | our ability to successfully identify, integrate and complete acquisitions |

| | · | our ability to retain key members of our senior management and key technical employees; |

| | · | competition from other similar oil and natural gas companies; |

| | · | market or business conditions and fluctuations in global and local demand for energy; |

| | · | the direct or indirect impact on our business resulting from terrorist incidents or responses to such incidents, including the effect on the availability of and premiums on insurance; and |

| | · | other factors discussed under “Item 3. Key Information—D. Risk factors” in this annual report. |

Forward-looking statements speak only as of the date they are made, and we do not undertake any obligation to update them in light of new information or future developments or to release publicly any revisions to these statements in order to reflect later events or circumstances or to reflect the occurrence of unanticipated events.

We are incorporated as an exempted company with limited liability under the laws of Bermuda, and substantially all of our assets are located in Chile, Colombia, Brazil and Argentina. In addition, most of our directors and executive officers reside outside the United States, and all or a substantial portion of the assets of such persons are located outside the United States. As a result, it may be difficult for investors to effect service of process on those persons in the United States or to enforce in the United States judgments obtained in U.S. courts against us or those persons based on the civil liability provisions of the U.S. securities laws.

There is no treaty in force between the United States and Bermuda providing for the reciprocal recognition and enforcement of judgments in civil and commercial matters. As a result, whether a U.S. judgment would be enforceable in Bermuda against us or our directors and officers depends on whether the U.S. court that entered the judgment is recognized by the Bermuda court as having jurisdiction over us or our directors and officers, as determined by reference to Bermuda conflict of law rules and the judgment is not contrary to public policy in Bermuda, has not been obtained by fraud in proceedings contrary to natural justice and is not based on an error in Bermuda law. A judgment debt from a U.S. court that is final and for a sum certain based on U.S. federal securities laws will not be enforceable in Bermuda unless the judgment debtor had submitted to the jurisdiction of the U.S. court, and the issue of submission and jurisdiction is a matter of Bermuda (not U.S.) law.

An action brought pursuant to a public or penal law, the purpose of which is the enforcement of a sanction, power or right at the instance of the state in its sovereign capacity, may not be entertained by a Bermuda court. Certain remedies available under the laws of U.S. jurisdictions, including certain remedies under U.S. federal securities laws, may not be available under Bermuda law or enforceable in a Bermuda court, as they may be contrary to Bermuda public policy. Further, no claim may be brought in Bermuda against us or our directors and officers in the first instance for violations of U.S. federal securities laws because these laws have no extraterritorial jurisdiction under Bermuda law and do not have force of law in Bermuda. A Bermuda court may, however, impose civil liability on us or our directors and officers if the facts alleged in a complaint constitute or give rise to a cause of action under Bermuda law. However, section 281 of the Bermuda Companies Act allows a Bermuda court, in certain circumstances, to relieve officers and directors of Bermuda companies of liability for acts of negligence, breach of duty or trust or other defaults.

Section 98 of the Bermuda Companies Act provides generally that a Bermuda company may indemnify its directors, officers and auditors against any liability which by virtue of any rule of law would otherwise be imposed on them in respect of any negligence, default, breach of duty or breach of trust, except in cases where such liability arises from fraud or dishonesty of which such director, officer or auditor may be guilty in relation to the company. Section 98 further provides that a Bermuda company may indemnify its directors, officers and auditors against any liability incurred by them in defending any proceedings, whether civil or criminal, in which judgment is awarded in their favor or in which they are acquitted or granted relief by the Supreme Court of Bermuda pursuant to Section 281 of the Bermuda Companies Act.

Our bye-laws contain provisions whereby we and our shareholders waive any claim or right of action that we have, both individually and on our behalf, against any director or officer in relation to any action or failure to take action by such director or officer, except in respect of any fraud or dishonesty of such director or officer. We may also indemnify our directors and officers in their capacity as directors and officers for any loss arising or liability attaching to them by virtue of any rule of law in respect of any negligence, default, breach of trust of which a director or officer may be guilty in relation to the company other than in respect of his own fraud or dishonesty. We have entered into customary indemnification agreements with our directors.

No treaty exists between the United States and Chile for the reciprocal recognition and enforcement of foreign judgments. Chilean courts, however, have enforced valid and conclusive judgments for the payment of money rendered by competent U.S. courts by virtue of the legal principles of reciprocity and comity, subject to review in Chile of the U.S. judgment in order to ascertain whether certain basic principles of due process and public policy have been respected, without retrial or review of the merits of the subject matter. If a U.S. court grants a final judgment, enforceability of this judgment in Chile will be subject to obtaining the relevant exequatur (i.e., recognition and enforcement of the foreign judgment) according to Chilean civil procedure law in effect at that time, and depending on certain factors (the satisfaction or non-satisfaction of which would be determined by the Supreme Court of Chile). Currently, the most important of such factors are: the existence of reciprocity (if it can be proved

that there is no reciprocity in the recognition and enforcement of the foreign judgment between the United States and Chile, that judgment would not be enforced in Chile); the absence of any conflict between the foreign judgment and Chilean laws (excluding for this purpose the laws of civil procedure) and Chilean public policy; the absence of a conflicting judgment by a Chilean court relating to the same parties and arising from the same facts and circumstances; the Chilean court’s determination that the U.S. courts had jurisdiction, that process was appropriately served on the defendant and that the defendant was afforded a real opportunity to appear before the court and defend its case; and the judgment being final under the laws of the country in which it was rendered. Nonetheless, we have been advised by our Chilean counsel that there is doubt as to the enforceability in original actions in Chilean courts of liabilities predicated solely upon U.S. federal or state securities laws.

| Directors and senior management |

Not applicable.

Not applicable.

Not applicable.

Not applicable.

| Method and expected timetable |

Not applicable.

We have derived our selected historical statement of income, balance sheet and cash flow data as of December 31, 2013 and 2012 and for the years ended December 31, 2013, 2012 and 2011 from our Annual Consolidated Financial Statements included elsewhere in this annual report, which have been audited by PwC. We have derived our selected balance sheet data as of December 31, 2011 from our Annual Consolidated Financial Statements not included in this annual report.

We maintain our books and records in U.S. dollars and prepare our consolidated financial statements in accordance with IFRS.

This financial information should be read in conjunction with “Presentation of Financial and Other Information,” “Item 5. Operating and Financial Review and Prospects” and our Consolidated Financial Statements and the related notes thereto, included elsewhere in this annual report.

The selected historical financial data set forth in this section does not include any results or other financial information of our Colombian acquisitions prior to their incorporation into our financial statements, or our Brazil Acquisitions.

We have not included selected consolidated financial data as of and for the years ended December 31, 2009 and 2010 in the tables below. We have not presented financial data prior to this period as we qualify as an emerging growth company under the Jumpstart Our Business Startups Act of 2012 or the JOBS Act and we make use of an existing accommodation for specified reduced reporting, requiring only two years of audited financial statements at the time of our initial public offering. As a result we have not prepared financial information in IFRS prior to December 31, 2011.

| | | For the year ended December 31, | |

| | | | | | | | | | |

| | | (in thousands of US$, except per share numbers) | |

| | | | | | | | | | |

| Revenue | | | | | | | | | |

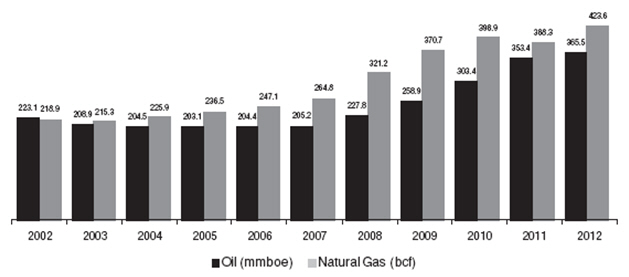

Net oil sales | | | 315,435 | | | | 221,564 | | | | 73,508 | |

Net gas sales | | | 22,918 | | | | 28,914 | | | | 38,072 | |

Net revenue | | | 338,353 | | | | 250,478 | | | | 111,580 | |

Production costs | | | (179,643 | ) | | | (129,235 | ) | | | (54,513 | ) |

Gross profit(1) | | | 158,710 | | | | 121,243 | | | | 57,067 | |

Exploration costs | | | (16,254 | ) | | | (27,890 | ) | | | (10,066 | ) |

Administrative costs | | | (46,584 | ) | | | (28,798 | ) | | | (18,169 | ) |

Selling expenses | | | (17,252 | ) | | | (24,631 | ) | | | (2,546 | ) |

Other operating income/(expense) | | | 5,344 | | | | 823 | | | | (502 | ) |

Operating profit | | | 83,964 | | | | 40,747 | | | | 25,784 | |

Financial income | | | 4,893 | | | | 892 | | | | 162 | |

Financial expenses | | | (38,769 | ) | | | (17,200 | ) | | | (13,678 | ) |

| Bargain purchase gain on acquisition of subsidiaries | | | — | | | | 8,401 | | | | — | |

Profit before tax | | | 50,088 | | | | 32,840 | | | | 12,268 | |

Income tax | | | (15,154 | ) | | | (14,394 | ) | | | (7,206 | ) |

Profit for the year | | | 34,934 | | | | 18,446 | | | | 5,062 | |

Non-controlling interest | | | 12,922 | | | | 6,567 | | | | 5,008 | |

| Profit attributable to owners of the Company | | | 22,012 | | | | 11,879 | | | | 54 | |

| Earnings per share for profit attributable to owners of the Company—Basic | | | 0.50 | | | | 0.28 | | | | 0.00 | |

| Earnings per share for profit attributable to owners of the Company—Diluted(2) | | | 0.47 | | | | 0.27 | | | | 0.00 | |

Weighted average common shares outstanding—Basic | | | 43,603,846 | | | | 42,673,981 | | | | 41,912,685 | |

Weighted average common shares outstanding—Diluted(2) | | | 46,532,049 | | | | 44,109,305 | | | | 43,917,167 | |

| (1) | Gross profit is defined as net revenue minus production costs. |

| (2) | See Note 18 to our Annual Consolidated Financial Statements. |

| | | | |

| | | | | | | | | | |

| | | (In thousands of US$) | |

| Assets | | | | | | | | | |

| Non-current assets | | | | | | | | | |

Property, plant and equipment | | | 595,446 | | | | 457,837 | | | | 224,635 | |

Prepaid taxes | | | 11,454 | | | | 10,707 | | | | 2,957 | |

Other financial assets | | | 5,168 | | | | 7,791 | | | | 5,226 | |

Deferred income tax | | | 13,358 | | | | 13,591 | | | | 450 | |

Prepayments and other receivables | | | 6,361 | | | | 510 | | | | 707 | |

Total non-current assets | | | 631,787 | | | | 490,436 | | | | 233,975 | |

| Current assets | | | | | | | | | | | | |

Other financial assets | | | — | | | | — | | | | 3,000 | |

Inventories | | | 8,122 | | | | 3,955 | | | | 584 | |

Trade receivables | | | 42,628 | | | | 32,271 | | | | 15,929 | |

Prepayments and other receivables | | | 35,764 | | | | 49,620 | | | | 24,984 | |

Prepaid taxes | | | 6,979 | | | | 3,443 | | | | 147 | |

Cash at bank and in hand | | | 121,135 | | | | 48,292 | | | | 193,650 | |

Total current assets | | | 214,628 | | | | 137,581 | | | | 238,294 | |

Total assets | | | 846,415 | | | | 628,017 | | | | 472,269 | |

| | | | | | | | | | | | | |

Share capital | | | 44 | | | | 43 | | | | 43 | |

Share premium | | | 120,426 | | | | 116,817 | | | | 112,231 | |

Other | | | 150,371 | | | | 122,561 | | | | 96,615 | |

Equity attributable to owners of the Company | | | 270,841 | | | | 239,421 | | | | 208,889 | |

Equity attributable to non-controlling interest | | | 95,116 | | | | 72,665 | | | | 41,763 | |

Total equity | | | 365,957 | | | | 312,086 | | | | 250,652 | |

Liabilities | | | | | | | | | | | | |

| Non-current liabilities | | | | | | | | | | | | |

Borrowings | | | 290,457 | | | | 165,046 | | | | 134,643 | |

Provisions for other long-term liabilities | | | 33,076 | | | | 25,991 | | | | 9,412 | |

Trade and other payables | | | 8,344 | | | | — | | | | — | |

Deferred income tax | | | 23,087 | | | | 17,502 | | | | 13,109 | |

Total non-current liabilities | | | 354,964 | | | | 208,539 | | | | 157,164 | |

| Current liabilities | | | | | | | | | | | | |

Borrowings | | | 26,630 | | | | 27,986 | | | | 30,613 | |

Current income tax | | | 7,231 | | | | 7,315 | | | | 187 | |

Trade and other payables | | | 91,633 | | | | 72,091 | | | | 33,653 | |

Total current liabilities | | | 125,494 | | | | 107,392 | | | | 64,453 | |

Total liabilities | | | 480,458 | | | | 315,931 | | | | 221,617 | |

Total equity and liabilities | | | 846,415 | | | | 628,017 | | | | 472,269 | |

| | | For the year ended December 31, | |

| | | | | | | | | | |

| | | (In thousands of US$) | |

| Cash provided by (used in) | | | | | | | | | |

Operating activities | | | 140,094 | | | | 131,802 | | | | 68,763 | |

Investing activities | | | (221,299 | ) | | | (303,507 | ) | | | (101,276 | ) |

Financing activities | | | 164,018 | | | | 26,375 | | | | 131,739 | |

Net increase (decrease) in cash | | | 82,813 | | | | (145,330 | ) | | | 99,226 | |

| | | For the year ended December 31, | |

| | | | | | | | | | |

Adjusted EBITDA(1) (US$ thousands) | | | 167,253 | | | | 121,404 | | | | 63,391 | |

Adjusted EBITDA margin(2) | | | 49.4 | % | | | 48.5 | % | | | 56.8 | % |

Adjusted EBITDA per boe(3) | | | 33.9 | | | | 31.1 | | | | 22.9 | |

| (1) | Adjusted EBITDA is a non-IFRS financial measure. For a definition of Adjusted EBITDA and other information relating to this measure, see “Presentation of Financial and Other Information—Financial statements—Non-IFRS financial measures.” For a reconciliation of Adjusted EBITDA to the IFRS financial measure of profit for the year, see Note 6 to our Annual Consolidated Financial Statements as of and for the years ended 2012 and 2013, included in this annual report. |

| (2) | Adjusted EBITDA margin is defined as Adjusted EBITDA divided by net revenue. |

| (3) | Adjusted EBITDA per boe is defined as Adjusted EBITDA divided by total production expressed in boe.” |

Unaudited Condensed Combined Pro Forma Financial Data

The following Unaudited condensed combined pro forma income statement data below is presented as if the acquisitions of Rio das Contas had occurred as of January 1, 2013. The Unaudited condensed combined pro forma statement of financial position is presented below as if our Rio das Contas acquisition had occurred on December 31, 2013.

The Unaudited Condensed Combined Pro Forma Financial Data is based on the following financial

statements included elsewhere in this annual report and should be read in conjunction with them and the notes thereto:

• our Annual Audited Consolidated Financial Statements; and

• the Rio das Contas Audited Consolidated Financial Statements;

Rio das Contas was acquired on March 31, 2014. The Rio das Contas pre-acquisition income statement data for the year ended December 31, 2013 and the pre-acquisition statement of financial position data as of December 31, 2013 have been extracted from the Rio das Contas Audited Consolidated Financial Statements.

The preparation of the Unaudited Condensed Combined Pro Forma Financial Data includes the impact of certain purchase accounting adjustments, such as estimated changes in depreciation expense on acquired proved and unproved properties that are expected to have a continuing impact on us. Accordingly, the amounts shown in our Unaudited Condensed Combined Pro Forma Financial data are not necessarily indicative of the results that would have resulted if the acquisitions had occurred on January 1, 2013 or that may result in the future.

The Unaudited Condensed Combined Pro Forma Financial Data is for informational purposes only. Because of its nature, it addresses a hypothetical situation and it is not intended to represent or to be indicative of the consolidated financial position or results of operations that we would have reported had the acquisitions been completed on the dates indicated. It should not be relied upon as representative of the historical consolidated financial position or results of operations that would have been achieved, or the future consolidated financial position or operating results that can be expected. The unaudited pro forma adjustments, described in the accompanying notes, are based on available information and certain assumptions that management believes are reasonable for purposes of this annual report.

Adjusted EBITDA is a supplemental non-IFRS financial measure that is used by management and external users of our financial statements, such as industry analysts, investors, lenders and rating agencies. We define Adjusted EBITDA as profit for the period before net finance cost, income tax, depreciation, amortization and certain non-cash items such as impairments and write-off of exploration and evaluation assets, accrual of stock options and stock awards and bargain purchase gain on acquisition of subsidiaries.

Adjusted EBITDA is not a measure of profit or cash flows as determined by IFRS and may not be comparable to other similarly-titled measures of other companies.

Unaudited condensed combined pro forma income statement

| | | | | | | | | | | | | |

| (in thousands of US$) | | GeoPark historical IFRS | | | Rio das Contas historical IFRS | | | Pro Forma adjustments Rio das Contas acquisition (1) | | | Pro Forma combined | |

| For the year ended December 31, 2013 | | | |

Net revenue | | | 338,353 | | | | 48,570 | | | | — | | | | 386,923 | |

Production costs | | | (179,643 | ) | | | (22,861 | ) | | | (12,403 | )(a) | | | (214,907 | ) |

Gross profit | | | 158,710 | | | | 25,709 | | | | (12,403 | ) | | | 172,016 | |

Exploration costs | | | (16,254 | ) | | | — | | | | — | | | | (16,254 | ) |

Administrative costs | | | (46,584 | ) | | | (2,021 | ) | | | — | | | | (48,605 | ) |

Selling expenses | | | (17,252 | ) | | | — | | | | — | | | | (17,252 | ) |

Other operating income | | | 5,344 | | | | — | | | | — | | | | 5,344 | |

Operating profit/(loss) | | | 83,964 | | | | 23,688 | | | | (12,403 | ) | | | 95,249 | |

Net financial result | | | (33,876 | ) | | | 353 | | | | (2,934 | ) (b) | | | (36,457 | ) |

Profit/(loss) before income tax | | | 50,088 | | | | 24,041 | | | | (15,337 | ) | | | 58,792 | |

Income tax | | | (15,154 | ) | | | (4,659 | ) | | | 5,214 | (c) | | | (14,599 | ) |

Profit/(loss) for the year | | | 34,934 | | | | 19,382 | | | | (10,122 | ) | | | 44,194 | |

| Attributable to: | | | | | | | | | | | | | | | | |

Owners of the Company | | | 22,012 | | | | 19,382 | | | | (10,122 | ) | | | 31,272 | |

Non-controlling interest | | | 12,922 | | | | — | | | | — | | | | 12,922 | |

| Earnings per share (in US$) for profit attributable to owners of the Company: | | | | | | | | | | | | | | | | |

Basic | | | 0.50 | | | | | | | | | | | | 0.72 | |

Diluted | | | 0.47 | | | | | | | | | | | | 0.67 | |

| Weighted average number of shares: | | | | | | | | | | | | | | | | |

Basic | | | 43,603,846 | | | | | | | | | | | | 43,603,846 | |

Diluted | | | 46,532,049 | | | | | | | | | | | | 46,532,049 | |

(1) See Notes to the Unaudited Condensed Combined Pro Forma Financial Data below.

Unaudited condensed combined pro forma statement of financial position

| | | | | | | | | | | | | |

| (In thousands of US$) | | GeoPark historical IFRS | | | Rio das Contas historical IFRS | | | Pro Forma adjustments Rio das Contas acquisition (1) | | | Pro Forma combined | |

| As of December 31, 2013 | | | |

| Assets | | | | | | | | | | | | |

Property, plant and equipment | | | 595,446 | | | | 64,754 | | | | 71,512 | (d) | | | 731,712 | |

Other | | | 36,341 | | | | 394 | | | | — | | | | 36,735 | |

Total non-current assets | | | 631,787 | | | | 65,148 | | | | 71,512 | | | | 768,447 | |

Trade receivables | | | 42,628 | | | | 9,546 | | | | — | | | | 52,174 | |

Prepayments and other receivables | | | 35,764 | | | | 142 | | | | — | | | | 35,906 | |

Cash at bank and in hand | | | 121,135 | | | | 17,015 | | | | (77,894 | )(e) | | | 60,256 | |

Other | | | 15,101 | | | | 117 | | | | — | | | | 15,218 | |

Total current assets | | | 214,628 | | | | 26,820 | | | | (77,894 | ) | | | 163,554 | |

Total assets | | | 846,415 | | | | 91,968 | | | | (6,382 | ) | | | 932,001 | |

| Equity | | | | | | | | | | | | | | | | |

Share premium | | | 120,426 | | | | 64,865 | | | | (64,865 | ) (f) | | | 120,426 | |

Reserves | | | 126,465 | | | | 5,783 | | | | (5,783 | )(f) | | | 126,465 | |

Other | | | 23,950 | | | | 6,784 | | | | (6,784 | )(f) | | | 23,950 | |

| Attributable to owners of the Company | | | 270,841 | | | | 77,432 | | | | (77,432 | ) | | | 270,841 | |

Non-controlling interest | | | 95,116 | | | | — | | | | — | | | | 95,116 | |

Total equity | | | 365,957 | | | | 77,432 | | | | (77,432 | ) | | | 365,957 | |

| Liabilities | | | | | | | | | | | | | | | | |

Borrowings | | | 290,457 | | | | — | | | | 70,450 | (g) | | | 360,907 | |

| Provisions for other long-term liabilities | | | 33,076 | | | | 6,671 | | | | — | | | | 39,747 | |

Deferred income tax | | | 23,087 | | | | 3,247 | | | | — | | | | 26,334 | |

Trade and other payables | | | 8,344 | | | | — | | | | — | | | | 8,344 | |

Contingent payment | | | — | | | | — | | | | 600 | (h) | | | 600 | |

Total non-current liabilities | | | 354,964 | | | | 9,918 | | | | 71,050 | | | | 435,932 | |

Trade and other payables | | | 91,633 | | | | 634 | | | | — | | | | 92,267 | |

Borrowings | | | 26,630 | | | | — | | | | — | | | | 26,630 | |

Other | | | 7,231 | | | | 3,984 | | | | — | | | | 11,215 | |

Total current liabilities | | | 125,494 | | | | 4,618 | | | | — | | | | 130,112 | |

Total liabilities | | | 480,458 | | | | 14,536 | | | | 71,050 | | | | 566,044 | |

Total equity and liabilities | | | 846,415 | | | | 91,968 | | | | (6,382 | ) | | | 932,001 | |

(1) See Notes to the Unaudited Condensed Combined Pro Forma Financial Data below.

Notes to the Unaudited Condensed Combined Pro Forma Financial Data

Note 1— Purchase price adjustments on Rio das Contas acquisition

The purchase price allocation of our Rio das Contas acquisition is preliminary and may be subject to change. The final purchase price may result in an adjustment to the purchase price or its allocation. Any such adjustment will be reflected as an increase or decrease by means of working capital adjustment to be determined when certain information is available.

| (in thousands of US$) | | | | | | |

| Cost of the acquisition | | | | | | |

Cash payment(i) | | | 140,100 | | | | |

Total cost of the acquisition | | | | | | | 140,100 | |

| Less: Book value of assets acquired and liabilities assumed | | | | | | | | |

Total book value of assets acquired and liabilities assumed | | | 77,432 | | | | | |

| Fair value adjustments: | | | | | | | | |

Proved and unproved properties(ii) | | | 62,668 | | | | | |

Fair value of assets acquired and liabilities assumed | | | | | | | 140,100 | |

(i) Comprised of a fixed purchase price of US$140 million, increased by a working capital adjustment of US$0.1 million calculated based on the Rio das Contas Consolidated Financial Statements. The working capital adjustment is preliminary and is subject to final agreement with the seller.

(ii) Reflects fair value adjustments of property, plant and equipment and the recognition of mineral interest.

The following pro forma adjustments were made to the unaudited condensed combined pro forma income statement for the year ended December 31, 2013 to reflect the acquisition of Rio das Contas as if it had occurred on January 1, 2013:

(a) Additional depreciation expense resulting from the increased basis of property, plant and equipment acquired of US$9.5 million for the year ended December 31, 2013. Also, the accounting policy for depreciation of oil and gas properties was adjusted to conform to our policy (which is based on commercial proved and probable reserves) resulting in additional depreciation expense of US$2.9 million for the year ended December 31, 2013.

(b) Interest expense on US$70.5 million credit facility incurred in connection with the acquisition is calculated using an effective interest rate of 4.2% for the year ended December 31, 2013. The loan, which is secured by the benefits GeoPark receives under the Purchase and Sale Agreement for Natural Gas with Petrobras, will mature five years from the date of disbursement and will bear a variable interest rate equal six-month LIBOR + 3.9%. The effect of a 1⁄8 percent variance in the interest rate on profit for the year would be US$0.3 million for the year ended December 31, 2013.

(c) Decrease in income taxes related to foregoing adjustments. The rate applied for adjustments (a) and (c) is the statutory rate in Brazil of 34%.

The following pro forma adjustments were made to the unaudited condensed combined pro forma statement of financial position to reflect the acquisition of Rio das Contas as if it had occurred on

December 31, 2013:

(d) Fair value adjustment of US$71.5 million allocated to the recognition of mineral interest.

(e) Adjustment to reflect: (i) increase in cash of US$70.5 million due to bank indebtedness issued in connection with the acquisition; and (ii) cash payment of US$140.1 million relating to the acquisition.

(f) Elimination of Rio das Contas equity items for consolidation purposes.

(g) Bank indebtedness of US$70.5 million incurred in connection with the acquisition.

(h) Contingent payment of US$0.6 million relating to the acquisition. The purchase price is adjusted for an earn-out amount equal to 45% of the net cash flows of the BCAM-40 Concession in excess of

US$25 million. The earn-out amount is calculated over a five-year period starting January 1, 2013.

Note 2—Reconciliations

Reconciliation of pro forma Adjusted EBITDA to the IFRS financial measure of pro forma profit for the year

| (In thousands of US$) | | For the year ended December 31, 2013 | |

| Pro Forma profit for the year attributable to owners of the Company | | | 31,272 | |

Pro Forma non-controlling interest | | | 12,922 | |

Pro Forma profit for the year | | | 44,194 | |

Pro Forma income tax | | | 14,599 | |

Pro Forma net finance results | | | 36,457 | |

Pro Forma others(i) | | | (7,040 | ) |

| Pro Forma impairment and write off of unsuccessful efforts | | | 10,962 | |

Pro Forma accrual of stock options and stock awards | | | 9,167 | |

Pro Forma depreciation | | | 89,724 | |

Pro Forma Adjusted EBITDA | | | 198,062 | |

(h) Includes capitalized costs for the year ended December 31, 2013.

Reconciliation of Rio das Contas historical Adjusted EBITDA to the IFRS measure of Rio das Contas historical profit for the year

| (in thousands of US$) | | For the year ended December 31, 2013 | |

Rio das Contas historical profit for the year | | | 19,382 | |

Income tax | | | 4,659 | |

Net financial result | | | (353 | ) |

Depreciation | | | 7,121 | |

Rio das Contas historical Adjusted EBITDA | | | 30,809 | |

Exchange rates

In Chile, Colombia and Argentina, our functional currency is the U.S. dollar. In Brazil, our functional currency is the real.

The Brazilian foreign exchange system allows the purchase and sale of foreign currency and the international transfer of real by any person or legal entity, regardless of the amount, subject to certain regulatory procedures.

Since 1999, the Brazilian Central Bank has allowed the U.S. dollar-real exchange rate to float freely, and, since then, the U.S. dollar-real exchange rate has fluctuated considerably.

Our operations in Brazil account for 12% of our consolidated assets and 21% of our production each on a pro forma basis, after giving effect to our Rio das Contas acquisition, which closed on March 31, 2014. This portion of our business is exposed to losses that may arise from currency fluctuation. In the past, the Brazilian Central Bank has occasionally intervened to control unstable movements in foreign exchange rates. We cannot predict whether the Brazilian Central Bank or the Brazilian government will continue to permit the real to float freely or will intervene in the exchange rate market through the return of a currency band system or otherwise. The real may depreciate or appreciate substantially against the U.S. dollar. Furthermore, Brazilian law provides that, whenever there is a serious imbalance in Brazil’s balance of payments or there are serious reasons to foresee a serious imbalance, temporary restrictions may be imposed on remittances of foreign capital abroad. We cannot assure you that such measures will not be taken by the Brazilian government in the future. See “—D. Risk factors—Risks relating to our business—Our results of operations could be materially adversely affected by fluctuations in foreign currency exchange rates.”

The following tables show the selling rate for U.S. dollars for the periods and dates indicated. The information in the “Average” column represents the average of the daily exchange rates during the periods presented. The numbers in the “Period-end” column are the quotes for the exchange rate as of the last business day of the period in question. As of April 15, 2014, the exchange rate for the purchase of U.S. dollars as reported by the Central Bank of Brazil was R$2.2257 per U.S. dollar.

The following table presents the monthly high and low representative market rate during the months indicated.

| Recent exchange rates of real per U.S. dollar | | | | | | |

| Month: | | | | | | |

October 2013 | | | 2.1611 | | | | 2.2123 | |

November 2013 | | | 2.2426 | | | | 2.3362 | |

December 2013 | | | 2.3102 | | | | 2.3817 | |

January 2014 | | | 2.3335 | | | | 2.4397 | |

February 2014 | | | 2.3334 | | | | 2.4238 | |

March 2014 | | | 2.2603 | | | | 2.3649 | |

April 2014 (through April 25, 2014) | | | 2.1974 | | | | 2.2811 | |

Source: Central Bank of Brazil.

The following table presents the average R$ per U.S. dollar representative market rate for each of the five most recent years, calculated by using the average of the exchange rates on the last day of each month during the period, and the representative year-end market rate for each of the five most recent years.

| Real per U.S. dollar | | | | | | |

| Period: | | | | | | |

2009 | | | 1.9936 | | | | 1.7412 | |

2010 | | | 1.7593 | | | | 1.6662 | |

2011 | | | 1.6746 | | | | 1.8758 | |

2012 | | | 1.9550 | | | | 2.0435 | |

First quarter 2013 | | | 1.9964 | | | | 2.0138 | |

Second quarter 2013 | | | 2.0700 | | | | 2.2156 | |

Third quarter 2013 | | | 2.2889 | | | | 2.2300 | |

Fourth quarter 2013 | | | 2.2735 | | | | 2.3426 | |

First quarter 2014 | | | 2.3409 | | | | 2.2630 | |

Second quarter 2014 (through April 25, 2014) | | | 2.2331 | | | | 2.2325 | |

Source: Central Bank of Brazil.

Exchange rate fluctuation may affect the U.S. dollar value of any distributions we make with respect to our common shares. See “—D. Risk factors—Risks relating to our business—Our results of operations could be materially adversely affected by fluctuations in foreign currency exchange rates.”

| Capitalization and indebtedness |

Not applicable.

| Reasons for the offer and use of proceeds |

Not applicable.

Our business, financial condition and results of operations could be materially and adversely affected if any of the risks described below occur. As a result, the market price of our common shares could decline, and you could lose all or part of your investment. This annual report also contains forward-looking statements that involve risks and uncertainties. See “Forward-Looking Statements.” The risks below are not the only ones facing our Company. Additional risks not currently known to us or that we currently deem immaterial may also adversely affect us.

Risks relating to our business

A substantial or extended decline in oil, natural gas and methanol prices may materially adversely affect our business, financial condition or results of operations.

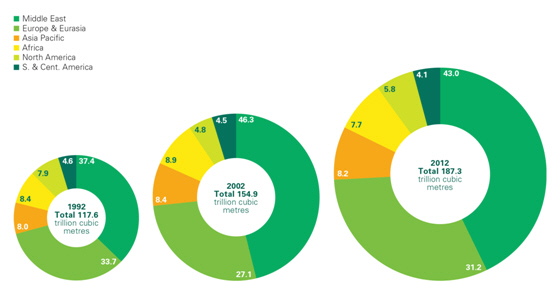

The prices that we receive for our oil and natural gas production heavily influence our revenues, profitability, access to capital and growth rate. Historically, the markets for oil, natural gas and methanol (which historically have influenced prices for almost all of our Chilean gas sales) have been volatile and will likely continue to be volatile in the future. International oil, natural gas and methanol prices have fluctuated widely in recent years and may continue to do so in the future.

The prices that we will receive for our production and the levels of our production depend on numerous factors beyond our control. These factors include, but are not limited, to the following:

| | · | global economic conditions; |

| | · | changes in global supply and demand for oil, natural gas and methanol; |

| | · | the actions of the Organization of the Petroleum Exporting Countries, or OPEC; |

| | · | political and economic conditions, including embargoes, in oil-producing countries or affecting other countries; |

| | · | the level of oil- and natural gas-producing activities, particularly in the Middle East, Africa, Russia, South America and the United States; |

| | · | the level of global oil and natural gas exploration and production activity; |

| | · | the level of global oil and natural gas inventories; |

| | · | availability of markets for natural gas; |

| | · | weather conditions and other natural disasters; |

| | · | technological advances affecting energy production or consumption; |

| | · | domestic and foreign governmental laws and regulations, including environmental, health and safety laws and regulations; |

| | · | proximity and capacity of oil and natural gas pipelines and other transportation facilities; |

| | · | the price and availability of competitors’ supplies of oil and natural gas in captive market areas; |

| | · | quality discounts for oil production based, among other things, on API and mercury content; |

| | · | taxes and royalties under relevant laws and the terms of our contracts; |

| | · | our ability to enter into oil and natural gas sales contracts at fixed prices; |

| | · | the level of global methanol demand and inventories and changes in the uses of methanol; |

| | · | the price and availability of alternative fuels; and |

| | · | future changes to our hedging policies. |

These factors and the volatility of the energy markets make it extremely difficult to predict future natural gas and oil price movements. For example, from January 1, 2010 to December 31, 2013, NYMEX West Texas International, or WTI, crude oil contracts prices ranged from a low of US$64.78 per bbl to a high of US$113.39 per bbl, Henry Hub natural gas average monthly spot prices ranged from a low of US$1.82 per mmbtu to a high of US$7.51 per mmbtu, US Gulf methanol spot barge prices ranged from a low of US$324.61 per metric ton to a high of US$530.71 per metric ton and Brent spot prices ranged from a low of US$67.18 per barrel to a high of US$128.14 per barrel. Further, oil, natural gas and methanol prices do not necessarily fluctuate in direct relationship to each other.

As of December 31, 2013, natural gas comprised 26% of our net proved reserves. On a pro forma basis, after giving effect to our Rio das Contas acquisition, which closed on March 31, 2014 natural gas comprised 47% of our net proved reserves. A decline in natural gas prices could negatively affect our future growth, particularly for future gas sales where we may not be able to secure or extend our current long-term contracts.

For the year ended December 31, 2013, 93% of our revenues, were derived from oil. Giving effect on a pro forma basis to our Rio das Contas acquisition, which closed on March 31, 2014, 81.5% of our revenues would have been derived from oil in the same period. See “Item 3. Key Information—A. Selected financial data—Unaudited Condensed Combined Pro Forma Financial Data.” Because we expect that our production mix will continue to be weighted toward oil, our financial results are more sensitive to movements in oil prices.

Lower oil and natural gas prices may not only decrease our revenues on a per unit basis, but also may reduce the amount of oil and natural gas that we can produce economically. In addition, changes in oil and gas prices can impact our valuation of reserves and, in periods of sharply lower commodity prices, we may curtail production and capital spending projects or may defer or delay drilling wells because of lower cash flows. A substantial or extended decline in oil or natural gas prices would materially adversely affect our business, financial condition and results of operations. We have historically not hedged our production to protect against fluctuations in the international oil prices. We may in the future consider adopting a hedging policy against commodity price risk, when deemed appropriate and taking into account the size of our business and market volatility.

Unless we replace our oil and natural gas reserves, our reserves and production will decline over time. Our business is dependent on our continued successful identification of productive fields and prospects and the identified locations in which we drill in the future may not yield oil or natural gas in commercial quantities.

Production from oil and gas properties declines as reserves are depleted, with the rate of decline depending on reservoir characteristics. Accordingly, our current proved reserves will decline as these reserves are produced. For instance, based on our internal projections, we estimate that the daily production in our Colombian blocks will peak

in 2015 and decline thereafter, and that the daily production in the Fell Block and the Tierra del Fuego Blocks will peak in 2016 and decline thereafter. As of December 31, 2013, our reserves-to-production (or reserve life) ratio for net proved reserves in Chile and Colombia was 3.5 years. According to estimates, if on January 1, 2014, we ceased all drilling and development and workovers, including recompletions, refracs and workovers, our proved developed producing reserves base in Chile, Colombia and Argentina would decline at an annual effective rate of 50% over the first three years, including 50% during the first year. In Brazil, we estimate that daily production in the Manatí Field, in which we acquired an interest as a result of the Rio das Contas acquisition on March 31, 2014, will peak in 2017 and decline thereafter. We estimate that, if on January 1, 2014, all drilling and development and workovers had ceased, including recompletions, refracs and workovers, then the proved developed producing reserves base attributable to the Manatí Field in Brazil would have no decline in the first year, but would decline at an annual effective rate of approximately 30% per year over the next three years.

Our future oil and natural gas reserves and production, and therefore our cash flows and income, are highly dependent on our success in efficiently developing our current reserves and using cost-effective methods to find or acquire additional recoverable reserves. While we have had success in identifying and developing commercially exploitable deposits and drilling locations in the past, we may be unable to replicate that success in the future. We may not identify any more commercially exploitable deposits or successfully drill, complete or produce more oil or gas reserves, and the wells which we have drilled and currently plan to drill within our blocks or concession areas may not discover or produce any further oil or gas or may not discover or produce additional commercially viable quantities of oil or gas to enable us to continue to operate profitably. If we are unable to replace our current and future production, the value of our reserves will decrease, and our business, financial condition and results of operations will be materially adversely affected.

We derive a significant portion of our revenues from sales to a few key customers.

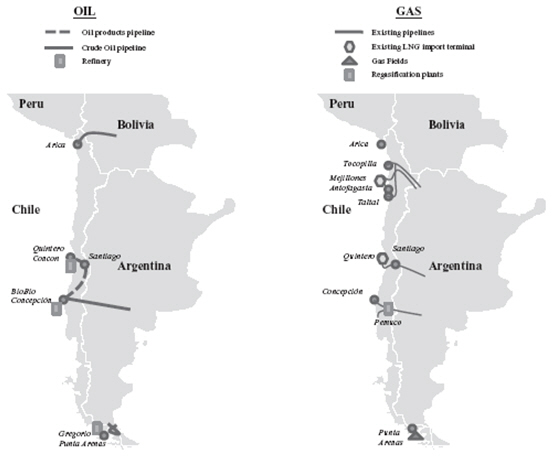

In Chile, 100% of our crude oil and condensate sales are made to ENAP. For the year ended December 31, 2013, sales to ENAP represented 42.6% of our revenues from oil and 39.8% of our total revenues. ENAP imports the majority of the oil it refines and partially supplements those imports with volumes supplied locally by its own operated fields and those operated by us. The sales contract with ENAP is commonly revised every two years to reflect changes in the global oil market and to adjust for ENAP’s logistics costs in the Gregorio oil terminal. The current agreement was recently executed and signed, with an initial term of 1 year, until March 2015, and it will be automatically extended for periods of 1 year until the expiration of the Fell Block CEOP, which is the earlier of August 24, 2032 or the date on which we cease exploitation of hydrocarbons in the Fell Block. However, if ENAP were to decrease or cease purchasing oil from us, or if we were unable to renew our contract with ENAP at a lower sales price or at all, this could have a material adverse effect on our business, financial condition and results of operations.

In Colombia, for the year ended December 31, 2013, we made 52.5% of our oil sales to Gunvor, 20.9% to Hocol S.A., or Hocol, a subsidiary of Ecopetrol, and 9.8% to Perenco, with Gunvor accounting for 27.8%, Hocol 11.1% and Perenco 5.2% of our overall revenues for the same period. Our current sales contracts with Hocol, Perenco and Gunvor are short-term agreements. If any of Hocol, Perenco or Gunvor were to decrease or cease purchasing oil from us, or if any of them were to decide not to renew their contracts with us or to renew them at a lower sales price, this could have a material adverse effect on our business, financial condition and results of operations.

In Brazil, following our Rio das Contas acquisition, which closed on March 31, 2014, we expect that all of our revenues from the sale of gas in the Manatí Field in Brazil will be generated from sales to Petrobras, the operator of the Manatí Field, pursuant to a long-term gas off-take contract. See “Item 4. Information on the Company—B. Business overview—Significant agreements—Brazil—Petrobras Natural Gas Purchase Agreement.”

There are inherent risks and uncertainties relating to the exploration and production of oil and natural gas.

Our performance depends on the success of our exploration and production activities and on the existence of the infrastructure that will allow us to take advantage of our oil and gas reserves. Oil and natural gas exploration and production activities are subject to numerous risks beyond our control, including the risk that exploration activities will not identify commercially viable quantities of oil or natural gas. Our decisions to purchase, explore, develop or otherwise exploit prospects or properties will depend in part on the evaluation of seismic and other data obtained

through geophysical, geochemical and geological analysis, production data and engineering studies, the results of which are often inconclusive or subject to varying interpretations.

Furthermore, the marketability of any oil and natural gas production from our projects may be affected by numerous factors beyond our control. These factors include, but are not limited to, proximity and capacity of pipelines and other means of transportation, the availability of upgrading and processing facilities, equipment availability and government laws and regulations (including, without limitation, laws and regulations relating to prices, sale restrictions, taxes, governmental stake, allowable production, importing and exporting of oil and natural gas, environmental protection and health and safety). The effect of these factors, individually or jointly, cannot be accurately predicted, but may have a material adverse effect on our business, financial condition and results of operations.

There can be no assurance that our drilling programs will produce oil and natural gas in the quantities or at the costs anticipated, or that our currently producing projects will not cease production, in part or entirely. Drilling programs may become uneconomic as a result of an increase in our operating costs or as a result of a decrease in market prices for oil and natural gas. Our actual operating costs or the actual prices we may receive for our oil and natural gas production may differ materially from current estimates. In addition, even if we are able to continue to produce oil and gas, there can be no assurance that we will have the ability to market our oil and gas production. See “—Our inability to access needed equipment and infrastructure in a timely manner may hinder our access to oil and natural gas markets and generate significant incremental costs or delays in our oil and natural gas production” below.

Our identified potential drilling location inventories are scheduled over many years, making them susceptible to uncertainties that could materially alter the occurrence or timing of their drilling.

Our management team has specifically identified and scheduled certain potential drilling locations as an estimation of our future multi-year drilling activities on our existing acreage. As of December 31, 2013, approximately 60 of our specifically identified potential future drilling locations were attributed to proved undeveloped reserves in Chile and Colombia. These identified potential drilling locations, including those without proved undeveloped reserves, represent a significant part of our growth strategy. In Brazil, we have not yet conducted seismic surveys in the seven new concession areas awarded to us by the ANP to allow us to identify any potential drilling locations.

Our ability to drill and develop these identified potential drilling locations depends on a number of factors, including oil and natural gas prices, the availability and cost of capital, drilling and production costs, the availability of drilling services and equipment, drilling results, lease expirations, the availability of gathering systems, marketing and transportation constraints, refining capacity, regulatory approvals and other factors. Because of the uncertainty inherent in these factors, there can be no assurance that the numerous potential drilling locations we have identified will ever be drilled or, if they are, that we will be able to produce oil or natural gas from these or any other potential drilling locations.

Our business requires significant capital investment and maintenance expenses, which we may be unable to finance on satisfactory terms or at all.

The oil and natural gas industry is capital intensive and we expect to make substantial capital expenditures in our business and operations for the exploration and production of oil and natural gas reserves. We made US$303.5 million (including US$105.3 million relating to the purchase price for our Colombian acquisitions) and US$228.0 million of capital expenditures for the years ended December 31, 2012 and 2013, respectively.

In March 2014, we invested US$140 million in Brazil, subject to certain adjustments, to acquire Rio das Contas, which we financed through the incurrence of a loan of US$70.5 million and cash on hand.

In 2014, we expect our total capital expenditures, excluding the purchase price of our Rio das Contas acquisition, to be between US$220 million to US$250 million, of which approximately 62%, 32% and 5% will be in Chile, Colombia and Brazil, respectively. We expect these capital expenditures to include the drilling of 50 to 60 new wells (approximately 40% of which we expect to be exploratory wells), as well as workovers, seismic surveys and new facility construction. In Brazil, we expect our capital expenditures will consist of between US$5 million to US$7.5 million to finance in part the construction of a gas compression plant in the Manatí Field (following our Rio

das Contas acquisition, which closed on March 31, 2014) and approximately US$0.45 million in license fee payments to the ANP relating to our Round 12 concessions, with the remainder for seismic surveys in exploration blocks in the Potiguar and Recôncavo Basins.

The actual amount and timing of our future capital expenditures may differ materially from our estimates as a result of, among other things, commodity prices, actual drilling results, the availability of drilling rigs and other equipment and services, and regulatory, technological and competitive developments. In response to improvements in commodity prices, we may increase our actual capital expenditures. We intend to finance our future capital expenditures through cash generated by our operations and potential future financing arrangements. However, our financing needs may require us to alter or increase our capitalization substantially through the issuance of debt or equity securities or the sale of assets.

If our capital requirements vary materially from our current plans, we may require further financing. In addition, we may incur significant financial indebtedness in the future, which may involve restrictions on other financing and operating activities. These changes could cause our cost of doing business to increase, limit our ability to pursue acquisition opportunities, reduce cash flow used for drilling and place us at a competitive disadvantage. A significant reduction in cash flows from operations or the availability of credit could materially adversely affect our ability to achieve our planned growth and operating results.

We are subject to complex laws common to the oil and natural gas industry, which can have a material adverse effect on our business, financial condition and results of operations.

The oil and natural gas industry is subject to extensive regulation and intervention by governments throughout the world, including extensive local, state and federal regulations, in such matters as the award of exploration and production interests, the imposition of specific exploration and drilling obligations, allocation of and restrictions on production, price controls, required divestments of assets and foreign currency controls, and the development and nationalization, expropriation or cancellation of contract rights.

We have been required in the past, and may be required in the future, to make significant expenditures to comply with governmental laws and regulations, including with respect to the following matters:

| | · | licenses, permits and other authorizations for drilling operations; |

| | · | reports concerning operations; |

| | · | compliance with environmental, health and safety laws and regulations; |

| | · | drafting and implementing emergency planning; |

| | · | plugging and abandonment costs; and |

Under these laws and regulations, we could be liable for, among other things, personal injury, property damage, environmental damage and other types of damage. Failure to comply with these laws and regulations may also result in the suspension or termination of our operations and subject us to administrative, civil and criminal penalties. Moreover, these laws and regulations could change in ways that could substantially increase our costs. Any such liabilities, obligations, penalties, suspensions, terminations or regulatory changes could have a material adverse effect on our business, financial condition or results of operations.

In addition, the terms and conditions of the agreements under which our oil and gas interests are held generally reflect negotiations with governmental authorities and can vary significantly. These agreements take the form of special contracts, concessions, licenses, associations or other types of agreements. Any suspensions, terminations or regulatory changes in respect of these special contracts, concessions, licenses, associations or other types of agreements could have a material adverse effect on our business, financial condition or results of operations.

Oil and gas operations contain a high degree of risk and we may not be fully insured against all risks we face in our business.

Oil and gas exploration and production is speculative and involves a high degree of risk and hazards. In particular, our operations may be disrupted by risks and hazards that are beyond our control and that are common among oil and gas companies, including environmental hazards, blowouts, industrial accidents, occupational safety and health hazards, technical failures, labor disputes, community protests or blockades, unusual or unexpected geological formations, flooding, earthquakes and extended interruptions due to weather conditions, explosions and other accidents. For example, in the first half of 2013 we experienced a well control incident at our Chercán 1 well in the Flamenco Block in Chile with no harm to employees or property. While we were able to bring that incident under control without injuries or environmental damage, there can be no assurance that we will not experience similar or more serious incidents in the future, which could result in damage to, or destruction of, wells or production facilities, personal injury, environmental damage, business interruption, financial losses and legal liability.

While we believe that we maintain customary insurance coverage for companies engaged in similar operations, we are not fully insured against all risks in our business. In addition, insurance that we do and may carry may contain significant exclusions from and limitations on coverage. We may elect not to obtain certain non-mandatory types of insurance if we believe that the cost of available insurance is excessive relative to the risks presented. The occurrence of a significant event or a series of events against which we are not fully insured and any losses or liabilities arising from uninsured or underinsured events could have a material adverse effect on our business, financial condition or results of operations.

The development schedule of oil and natural gas projects is subject to cost overruns and delays.

Oil and natural gas projects may experience capital cost increases and overruns due to, among other factors, the unavailability or high cost of drilling rigs and other essential equipment, supplies, personnel and oil field services. The cost to execute projects may not be properly established and remains dependent upon a number of factors, including the completion of detailed cost estimates and final engineering, contracting and procurement costs. Development of projects may be materially adversely affected by one or more of the following factors:

| | · | shortages of equipment, materials and labor; |

| | · | fluctuations in the prices of construction materials; |

| | · | delays in delivery of equipment and materials; |

| | · | obtaining easements and rights of way; |

| | · | compliance with governmental laws and regulations, including environmental, health and safety laws and regulations; |

| | · | adverse weather conditions; |

| | · | unanticipated increases in costs; |

| | · | unforeseen engineering and drilling complications; |

| | · | environmental or geological uncertainties; and |

| | · | other unforeseen circumstances. |

Any of these events or other unanticipated events could give rise to delays in development and completion of our projects and cost overruns.