- GPRK Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

6-K Filing

GeoPark Limited (GPRK) 6-KCurrent report (foreign)

Filed: 12 Feb 15, 12:00am

| Form 20-F | X | Form 40-F |

| Yes | No | X |

| Yes | No | X |

| ITEM | |

| 1. | Corporate Presentation & Outlook 2015 dated February 2015 titled “GeoPark Creating Value and Giving Back” |

[GRAPHIC OMITTED] [GRAPHIC OMITTED] Corporate Presentation and Outlook 2015 February 2015 |  |

[GRAPHIC OMITTED]

The material that follows comprises information about

GeoPark Limited ("GeoPark") and its subsidiaries, as of the

date of the presentation. It has been prepared solely for

informational purposes and should not be treated as giving

legal, tax, investment or other advice to potential

investors. The information presented or contained herein is

in summary form and does not purport to be complete.

No representations or warranties, express or implied, are

made as to, and no reliance should be placed on, the

accuracy, fairness, or completeness of this information.

Neither GeoPark nor any of its affiliates, advisers or

representatives accepts any responsibility whatsoever for

any loss or damage arising from any information presented

or contained in this presentation. The information

presented or contained in this presentation is current as

of the date hereof and is subject to change without notice,

and its accuracy is not guaranteed. Neither GeoPark nor any

of its affiliates, advisers or representatives makes any

undertaking to update any such information subsequent to

the date hereof.

This presentation contains forward -looking statements,

which are based upon GeoPark and/or its management's

current expectations and projections about future events.

When used in this presentation, the words "believe,"

"anticipate," "intend," "estimate," "expect," "should,"

"may" and similar expressions, or the negative of such

words and expressions, are intended to identify forward

-looking statements, although not all forward -looking

statements contain such words or expressions. Additionally,

all information, other than historical facts included in

this presentation, regarding strategy, future operations,

drilling plans, estimated reserves, estimated resources,

future production, estimated capital expenditures,

projected costs, the potential of drilling prospects and

other plans and objectives of management is forward

-looking information. Such statements and information are

subject to a number of risks, uncertainties and

assumptions. Forward -looking statements are not guarantees

of future performance and actual results may differ

materially from those anticipated due to many factors,

including oil and natural gas prices, industry conditions,

drilling results, uncertainties in estimating reserves and

resources, availability and cost of drilling rigs,

production equipment, supplies, personnel and oil field

services, availability of capital resources and other

factors. As for forward -looking statements that relate to

future financial results and other projections, actual

results may be different due to the inherent uncertainty of

estimates, forecasts and projections. Because of these

uncertainties, potential investors should not rely on these

forward -looking statements. Neither GeoPark nor any of its

affiliates, directors, officers, agents or employees, nor

any of the shareholders or under shall be liable, in any

event, before any third party (including investors) for any

investment or business decision made or action taken in

reliance on the information and statements contained in

this presentation or for any consequential, special or

similar damages.

Statements related to resources are deemed forward -looking

statements as they involve the implied assessment, based on

certain estimates and assumptions, that the resources will

be discovered and can be profitably produced in the future.

Specifically, forward -looking information contained herein

regarding "resources" may include: estimated volumes and

value of the Company's oil and gas resources and the

ability to finance future development; and, the conversion

of a portion of resources into reserves.

In light of our Rio das Contas acquisition, we have

included unaudited Pro forma condensed combined financial

data to illustrate the combined results of operations for

GeoPark for the year ended December 31, 2013 to give Pro

forma effect to the acquisition of Rio das Contas as if

such acquisition had occurred as of January 1, 2013.

The information included in this presentation regarding

estimated quantities of proved reserves, the future net

revenues from those reserves and their present value in

Chile, Colombia, Brazil, and Argentina as of December 31,

2013; and estimated quantities of proved reserves, the

future net revenues from those reserves and their present

value for certain new discoveries made since December 31,

2013, are derived, in part, from the reports prepared by

DeGolyer and MacNaughton, or DandM, independent reserves

engineers. Certain reserves data, such as those based on

the DandM report, were prepared under SEC standards, and

certain other data were prepared under Petroleum Resources

Management System (PRMS) standards.

Certain data in this presentation was obtained from various

external sources, and neither GeoPark nor its affiliates,

advisers or representatives has verified such data with

independent sources. Accordingly, neither GeoPark nor any

of its affiliates, advisers or representatives makes any

representations as to the accuracy or completeness of that

data, and such data involves risks and uncertainties and is

subject to change based on various factors.

This presentation contains a discussion of Adjusted EBITDA,

which is not an IFRS measure. We define Adjusted EBITDA as

profit for the period before net finance cost, income tax,

depreciation, amortization and certain non-cash items such

as impairments and write-offs of unsuccessful exploration

and evaluation assets, accrual of stock options and stock

awards and bargain purchase gain on acquisition of

subsidiaries. Adjusted EBITDA is included in this

presentation because it is a measure of our operating

performance and our management believes that Adjusted

EBITDA is useful to investors because it is frequently used

by securities analysts, investors and other interested

parties in their evaluation of the operating performance of

companies in industries similar to ours. Adjusted EBITDA

should not be considered a substitute for financial

information presented or prepared in accordance with IFRS.

Adjusted EBITDA, as determined and measured by us, should

also not be compared to similarly titled measures reported

by other companies.

Rounding amounts and percentages: Certain amounts and

percentages included in this document have been rounded for

ease of presentation. Percentage figures included in this

document have not in all cases been calculated on the basis

of such rounded figures but on the basis of such amounts

prior to rounding. For this reason, certain percentage

amounts in this document may vary from those obtained by

performing the same calculations using the figures in the

financial statements. In addition, certain other amounts

that appear in this document may not sum due to rounding.

2

|  |

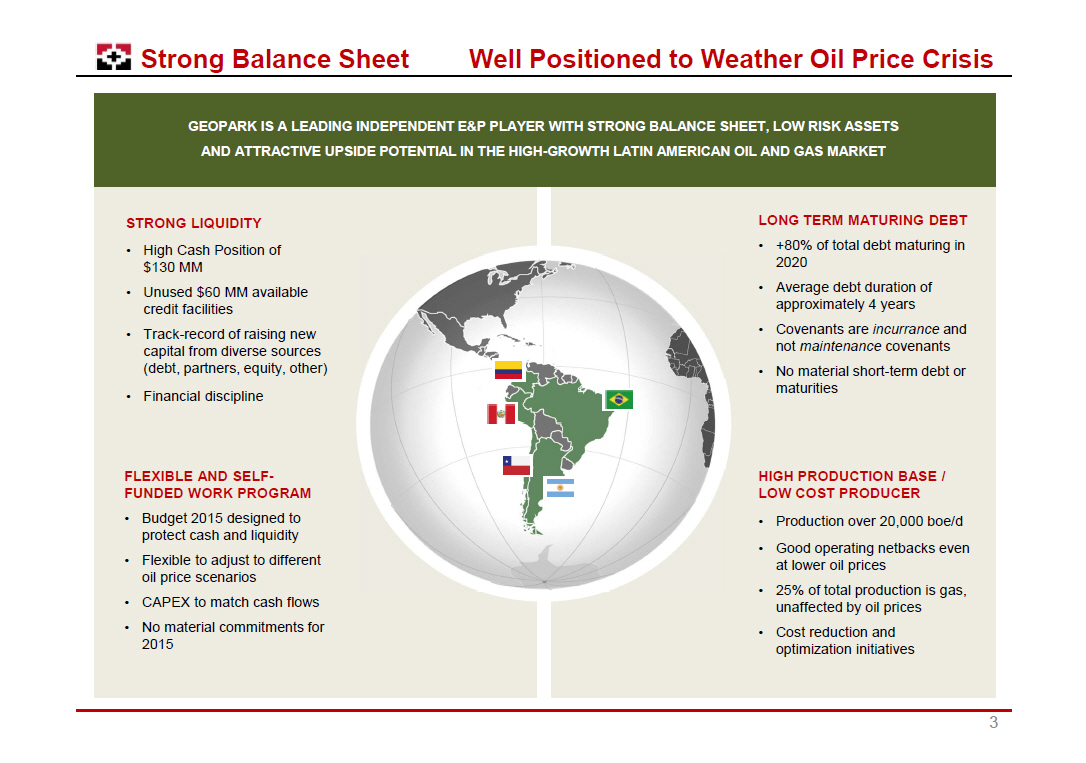

[GRAPHIC OMITTED] Strong Balance Sheet Well Positioned to Weather Oil Price Crisis GEOPARK IS A LEADING INDEPENDENT EandP PLAYER WITH STRONG BALANCE SHEET, LOW RISK ASSETS AND ATTRACTIVE UPSIDE POTENTIAL IN THE HIGH-GROWTH LATIN AMERICAN OIL AND GAS MARKET STRONG LIQUIDITY [] High Cash Position of $130 MM [] Unused $60 MM available credit facilities [] Track-record of raising new capital from diverse sources (debt, partners, equity, other) [] Financial discipline FLEXIBLE AND SELF- FUNDED WORK PROGRAM [] Budget 2015 designed to protect cash and liquidity [] Flexible to adjust to different oil price scenarios [] CAPEX to match cash flows [] No material commitments for 2015 LONG TERM MATURING DEBT [] +80% of total debt maturing in 2020 [] Average debt duration of approximately 4 years [] Covenants are incurrance and not maintenance covenants [] No material short-term debt or maturities HIGH PRODUCTION BASE / LOW COST PRODUCER [] Production over 20,000 boe/d [] Good operating netbacks even at lower oil prices [] 25% of total production is gas, unaffected by oil prices [] Cost reduction and optimization initiatives [GRAPHIC OMITTED] 3 |  |

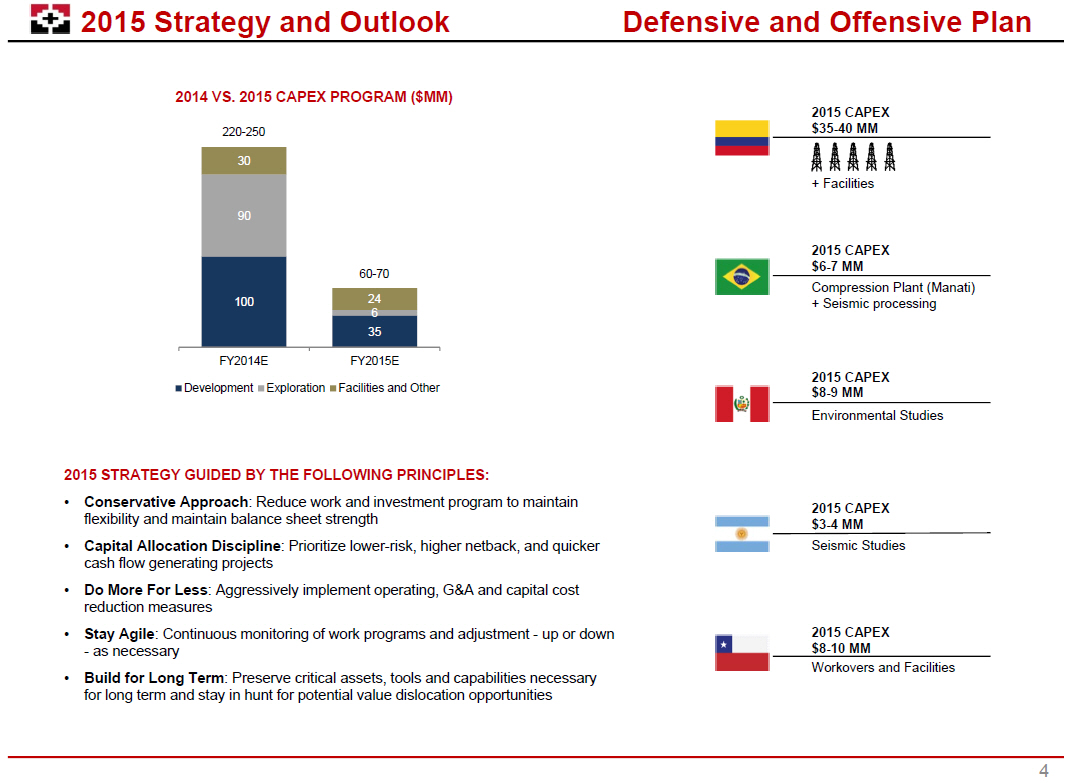

[GRAPHIC OMITTED] 2015 Strategy and Outlook Defensive and Ofensive Plan 2014 VS. 2015 CAPEX PROGRAM ($MM) [GRAPHIC OMITTED] 2015 CAPEX $35-40 MM + Facilities 2015 CAPEX $6-7 MM Compression Plant (Manati) + Seismic processing 2015 CAPEX $8-9 MM Environmental Studies 2015 CAPEX $3-4 MM Seismic Studies 2015 CAPEX $8-10 MM Workovers and Facilities 2015 STRATEGY GUIDED BY THE FOLLOWING PRINCIPLES: [] Conservative Approach : Reduce work and investment program to maintain flexibility and maintain balance sheet strength [] Capital Allocation Discipline : Prioritize lower-risk, higher netback, and quicker cash flow generating projects [] Do More For Less: Aggressively implement operating, GandA and capital cost reduction measures [] Stay Agile: Continuous monitoring of work programs and adjustment - up or down - as necessary [] Build for Long Term: Preserve critical assets, tools and capabilities necessary for long term and stay in hunt for potential value dislocation opportunities 4 |  |

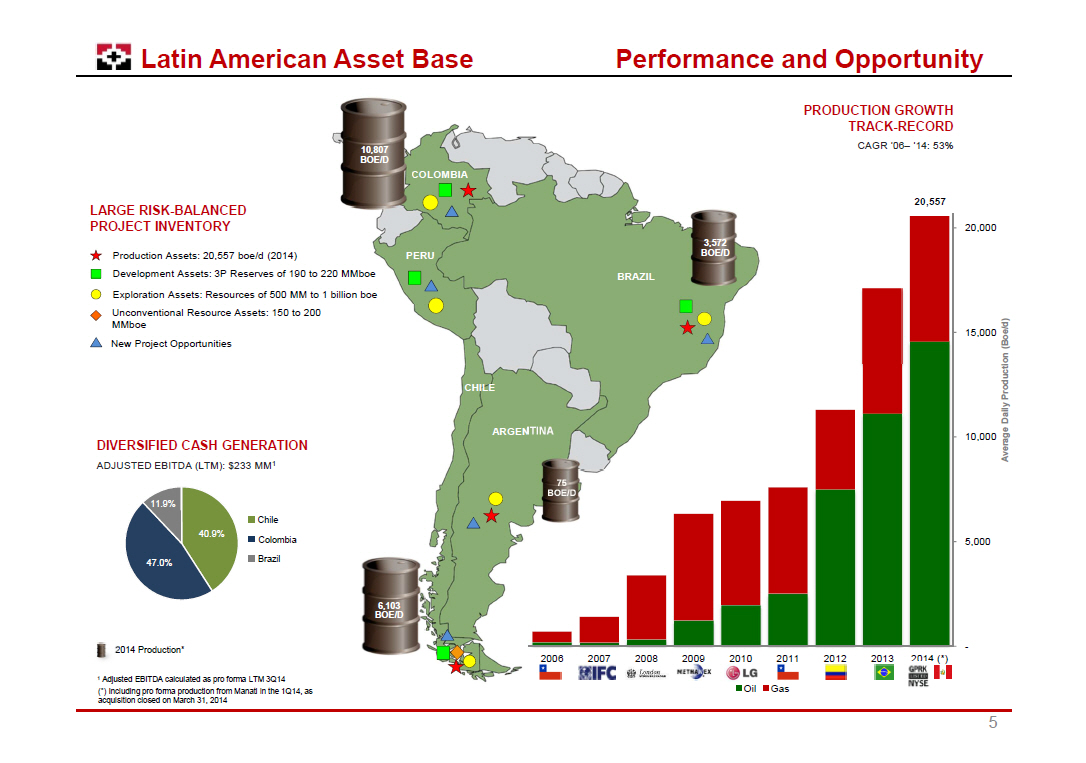

[GRAPHIC OMITTED] Latin American Asset Base Performance and Opportunity LARGE RISK-BALANCED PROJECT INVENTORY Production Assets: 20,557 boe/d (2014) Development Assets: 3P Reserves of 190 to 220 MMboe Exploration Assets: Resources of 500 MM to 1 billion boe Unconventional Resource Assets: 150 to 200 MMboe New Project Opportunities DIVERSIFIED CASH GENERATION ADJUSTED EBITDA (LTM): $233 MM(1) [GRAPHIC OMITTED] (1) Adjusted EBITDA calculated as pro forma LTM 3Q14 (*) Including pro forma production from Manati in the 1Q14, as acquisition closed on March 31, 2014 [GRAPHIC OMITTED] PRODUCTION GROWTH TRACK -RECORD CAGR '06-- '14: 53% [GRAPHIC OMITTED] 5 |  |

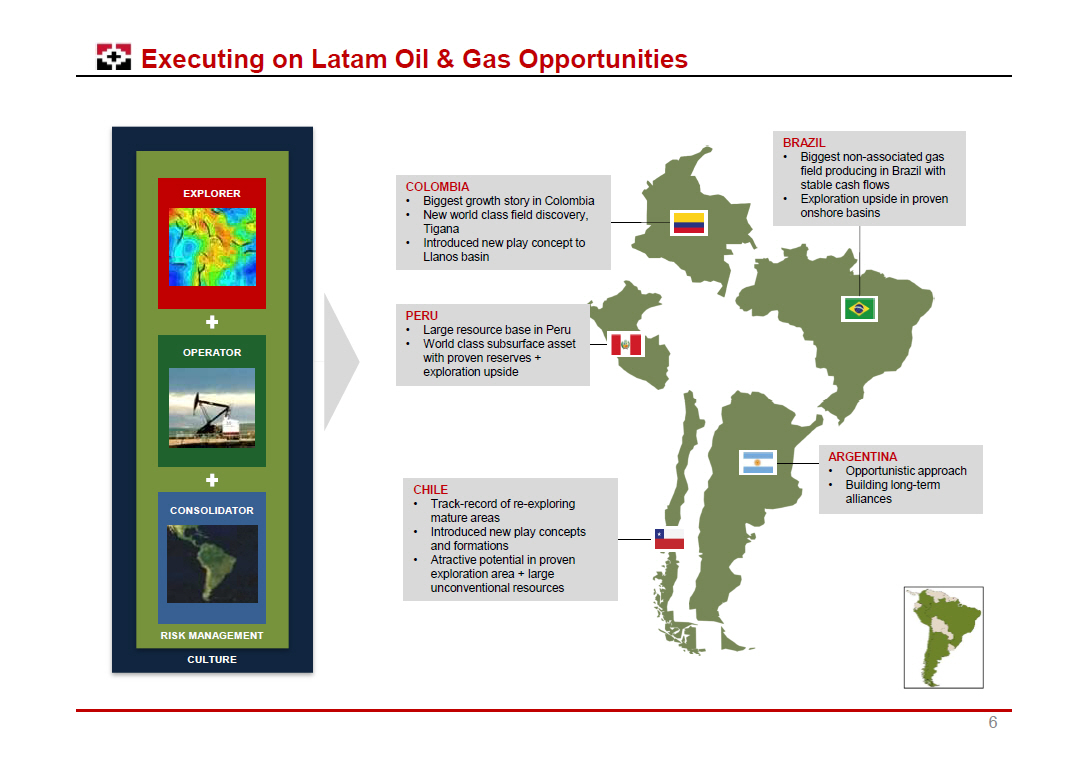

[GRAPHIC OMITTED] Executing on Latam Oil and Gas Opportunities [GRAPHIC OMITTED] COLOMBIA [] Biggest growth story in Colombia [] New world class field discovery, Tigana [] Introduced new play concept to Llanos basin PERU [] Large resource base in Peru [] World class subsurface asset with proven reserves + exploration upside CHILE [] Track-record of re-exploring mature areas [] Introduced new play concepts and formations [] Atractive potential in proven exploration area + large unconventional resources BRAZIL [] Biggest non-associated gas field producing in Brazil with stable cash flows [] Exploration upside in proven onshore basins ARGENTINA [] Opportunistic approach [] Building long-term alliances [GRAPHIC OMITTED] 6 |  |

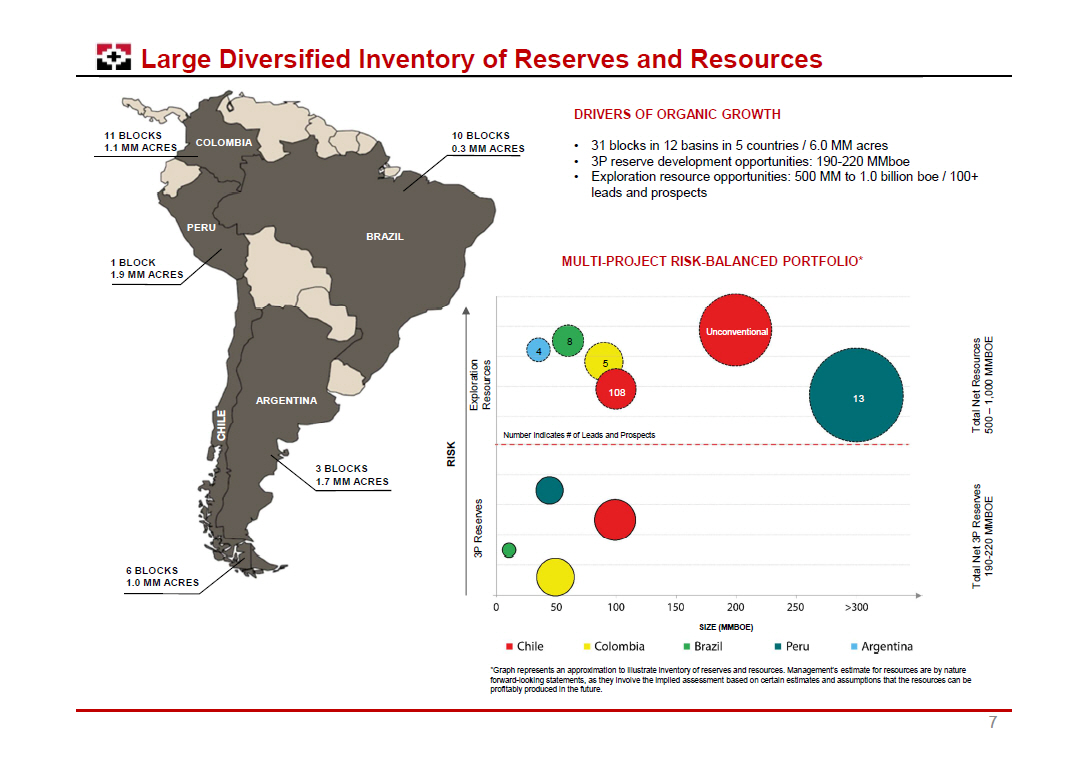

[GRAPHIC OMITTED] Large Diversified Inventory of Reserves and Resources DRIVERS OF ORGANIC GROWTH [] 31 blocks in 12 basins in 5 countries / 6.0 MM acres [] 3P reserve development opportunities: 190-220 MMboe [] Exploration resource opportunities: 500 MM to 1.0 billion boe / 100+ leads and prospects MULTI -PROJECT RISK-BALANCED PORTFOLIO* [GRAPHIC OMITTED] [GRAPHIC OMITTED] 7 |  |

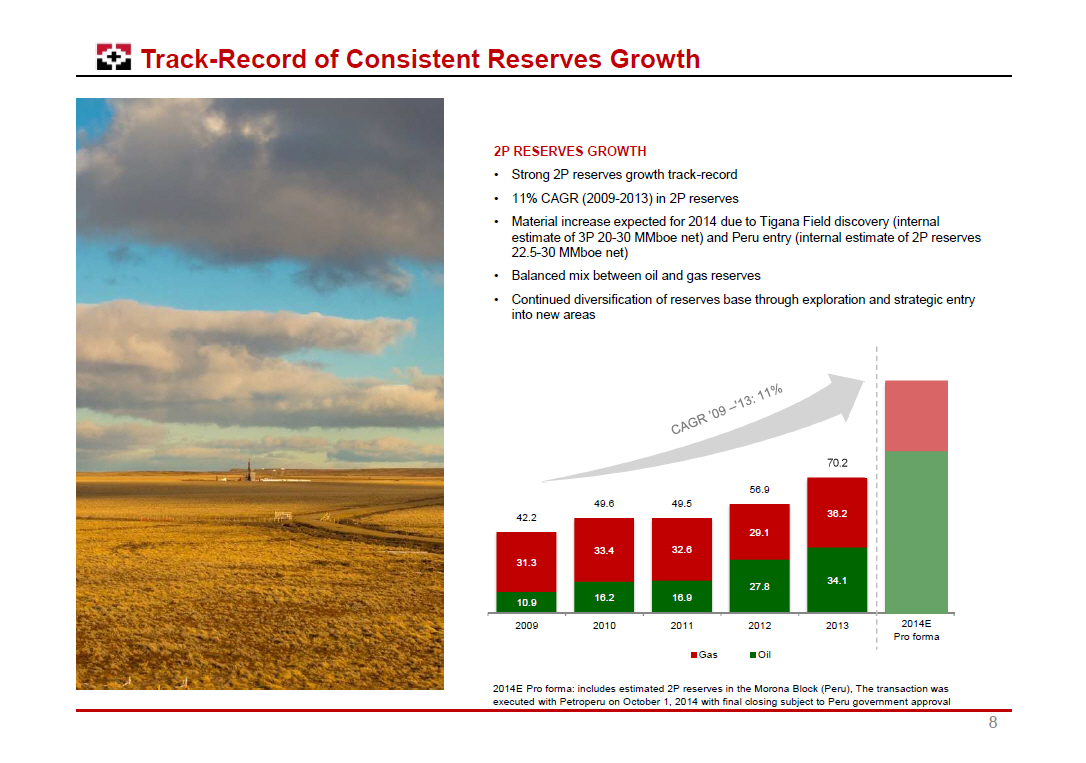

[GRAPHIC OMITTED] Track-Record of Consistent Reserves Growth 2P RESERVES GROWTH [] Strong 2P reserves growth track-record [] 11% CAGR (2009-2013) in 2P reserves [] Material increase expected for 2014 due to Tigana Field discovery (internal estimate of 3P 20-30 MMboe net) and Peru entry (internal estimate of 2P reserves 22.5 -30 MMboe net) [] Balanced mix between oil and gas reserves [] Continued diversification of reserves base through exploration and strategic entry into new areas [GRAPHIC OMITTED] 2014E Pro forma: includes estimated 2P reserves in the Morona Block (Peru), The transaction was executed with Petroperu on October 1, 2014 with final closing subject to Peru government approval 8 |  |

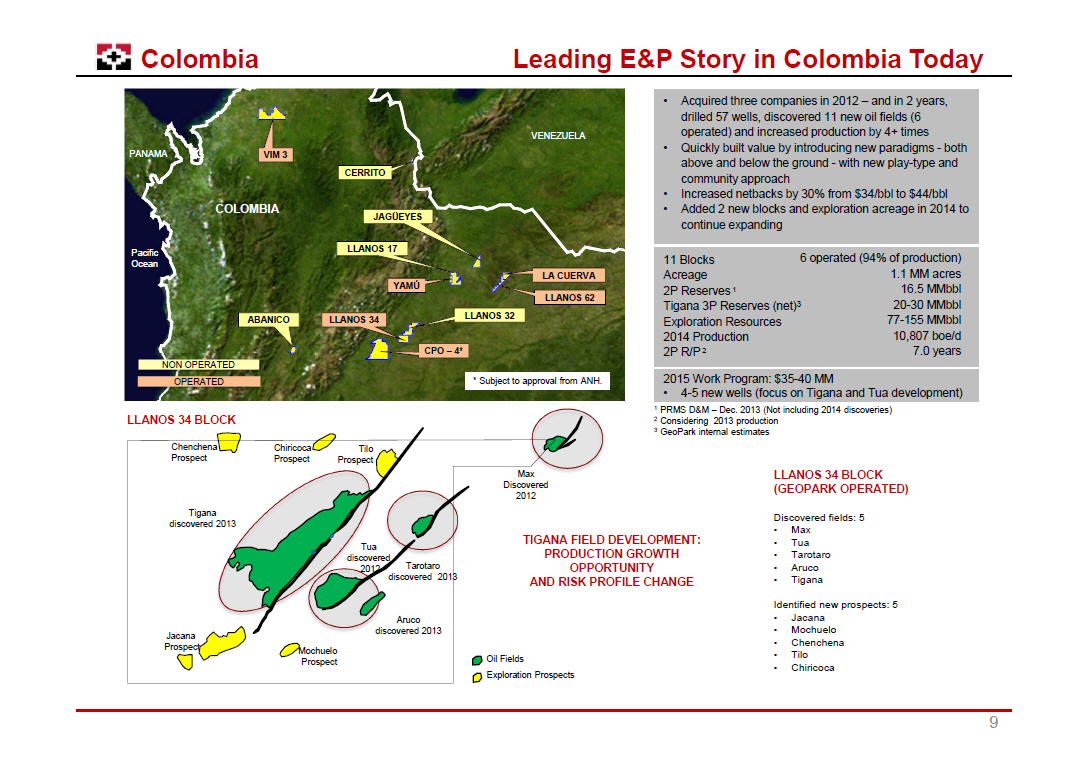

[GRAPHIC OMITTED] Colombia Leading EandP Story in Colombia Today [GRAPHIC OMITTED] [] Acquired three companies in 2012 -- and in 2 years, drilled 57 wells, discovered 11 new oil fields (6 operated) and increased production by 4+ times [] Quickly built value by introducing new paradigms - both above and below the ground - with new play-type and community approach [] Increased netbacks by 30% from $34/bbl to $44/bbl [] Added 2 new blocks and exploration acreage in 2014 to continue expanding 11 Blocks 6 operated (94% of production) Acreage 1.1 MM acres 2P Reserves (1) 16.5 MMbbl Tigana 3P Reserves (net)(3) 20-30 MMbbl Exploration Resources 77-155 MMbbl 2014 Production 10,807 boe/d 2P R/P (2) 7.0 years 2015 Work Program: $35-40 MM [] 4-5 new wells (focus on Tigana and Tua development) (1) PRMS DandM -- Dec. 2013 (Not including 2014 discoveries) (2) Considering 2013 production (3) GeoPark internal estimates LLANOS 34 BLOCK [GRAPHIC OMITTED] TIGANA FIELD DEVELOPMENT: PRODUCTION GROWTH OPPORTUNITY AND RISK PROFILE CHANGE LLANOS 34 BLOCK (GEOPARK OPERATED) Discovered fields: 5 [] Max [] Tua [] Tarotaro [] Aruco [] Tigana Identified new prospects: 5 [] Jacana [] Mochuelo [] Chenchena [] Tilo [] Chiricoca 9 |  |

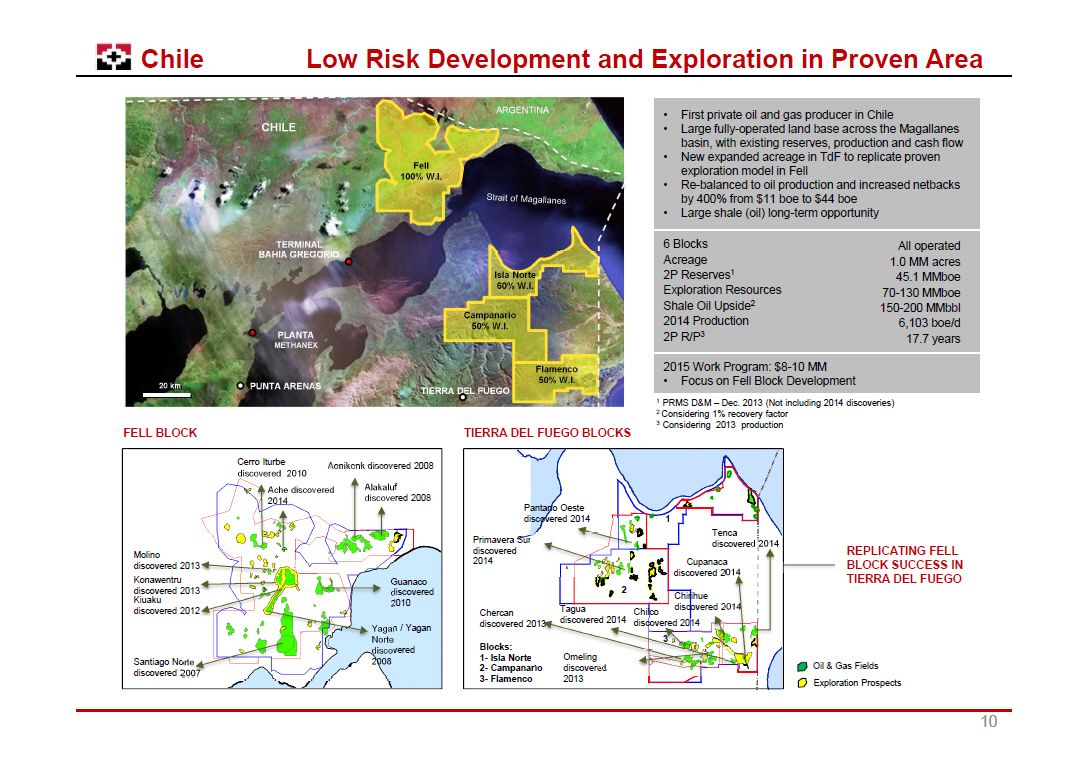

Chile Low Risk Development and Exploration in Proven Area [GRAPHIC OMITTED] FELL BLOCK [GRAPHIC OMITTED] TIERRA DEL FUEGO BLOCKS [GRAPHIC OMITTED] REPLICATING FELL BLOCK SUCCESS IN TIERRA DEL FUEGO Oil and Gas Fields Exploration Prospects [] First private oil and gas producer in Chile [] Large fully-operated land base across the Magallanes basin, with existing reserves, production and cash flow [] New expanded acreage in TdF to replicate proven exploration model in Fell [] Re-balanced to oil production and increased netbacks by 400% from $11 boe to $44 boe [] Large shale (oil) long-term opportunity 6 Blocks All operated Acreage 1.0 MM acres 2P Reserves(1) 45.1 MMboe Exploration Resources 70-130 MMboe Shale Oil Upside(2) 150-200 MMbbl 2014 Production 6,103 boe/d 2P R/P(3) 17.7 years 2015 Work Program: $8-10 MM [] Focus on Fell Block Development (1) PRMS DandM -- Dec. 2013 (Not including 2014 discoveries) (2) Considering 1% recovery factor (3) Considering 2013 production 10 |  |

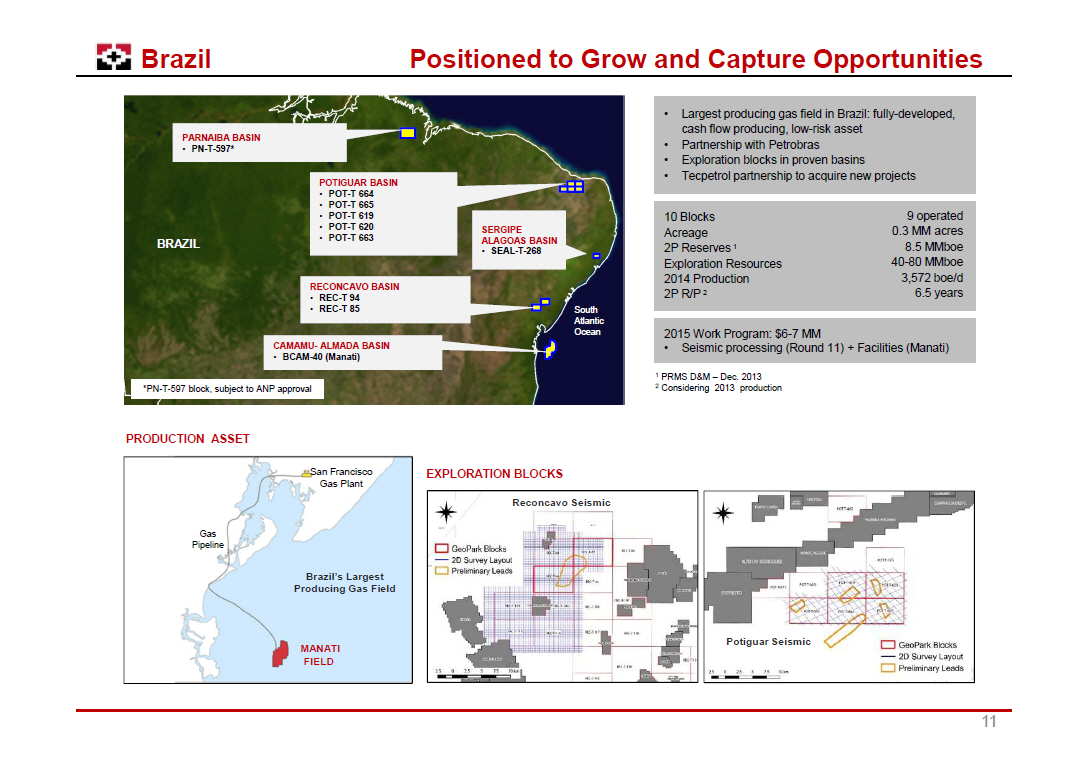

[GRAPHIC OMITTED] Brazil Positioned to Grow and Capture Opportunities [GRAPHIC OMITTED] [] Largest producing gas field in Brazil: fully-developed, cash flow producing, low-risk asset [] Partnership with Petrobras [] Exploration blocks in proven basins [] Tecpetrol partnership to acquire new projects 10 Blocks 9 operated Acreage 0.3 MM acres 2P Reserves (1) 8.5 MMboe Exploration Resources 40-80 MMboe 2014 Production 3,572 boe/d 2P R/P (2) 6.5 years 2015 Work Program: $6-7 MM [] Seismic processing (Round 11) + Facilities (Manati) (1) PRMS DandM -- Dec. 2013 (2) Considering 2013 production PRODUCTION ASSET [GRAPHIC OMITTED] EXPLORATION BLOCKS [GRAPHIC OMITTED] 11 |  |

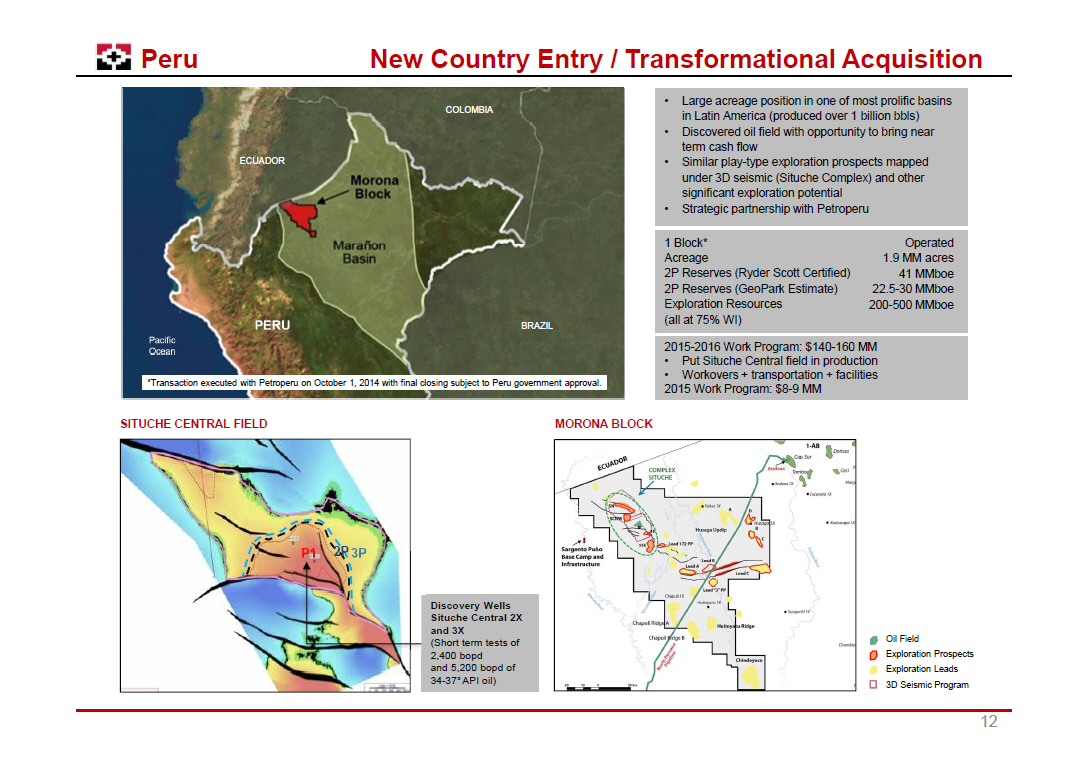

[GRAPHIC OMITTED] Peru New Country Entry / Transformational Acquisition [GRAPHIC OMITTED] [] Large acreage position in one of most prolific basins in Latin America (produced over 1 billion bbls) [] Discovered oil field with opportunity to bring near term cash flow [] Similar play-type exploration prospects mapped under 3D seismic (Situche Complex) and other significant exploration potential [] Strategic partnership with Petroperu 1 Block* Operated Acreage 1.9 MM acres 2P Reserves (Ryder Scott Certified) 41 MMboe 2P Reserves (GeoPark Estimate) 22.5-30 MMboe Exploration Resources 200-500 MMboe (all at 75% WI) 2015-2016 Work Program: $140-160 MM [] Put Situche Central field in production [] Workovers + transportation + facilities 2015 Work Program: $8-9 MM SITUCHE CENTRAL FIELD [GRAPHIC OMITTED] Discovery Wells Situche Central 2X and 3X (Short term tests of 2,400 bopd and 5,200 bopd of 34-37[] API oil) MORONA BLOCK [GRAPHIC OMITTED] Oil Field Exploration Prospects Exploration Leads 3D Seismic Program 12 |  |

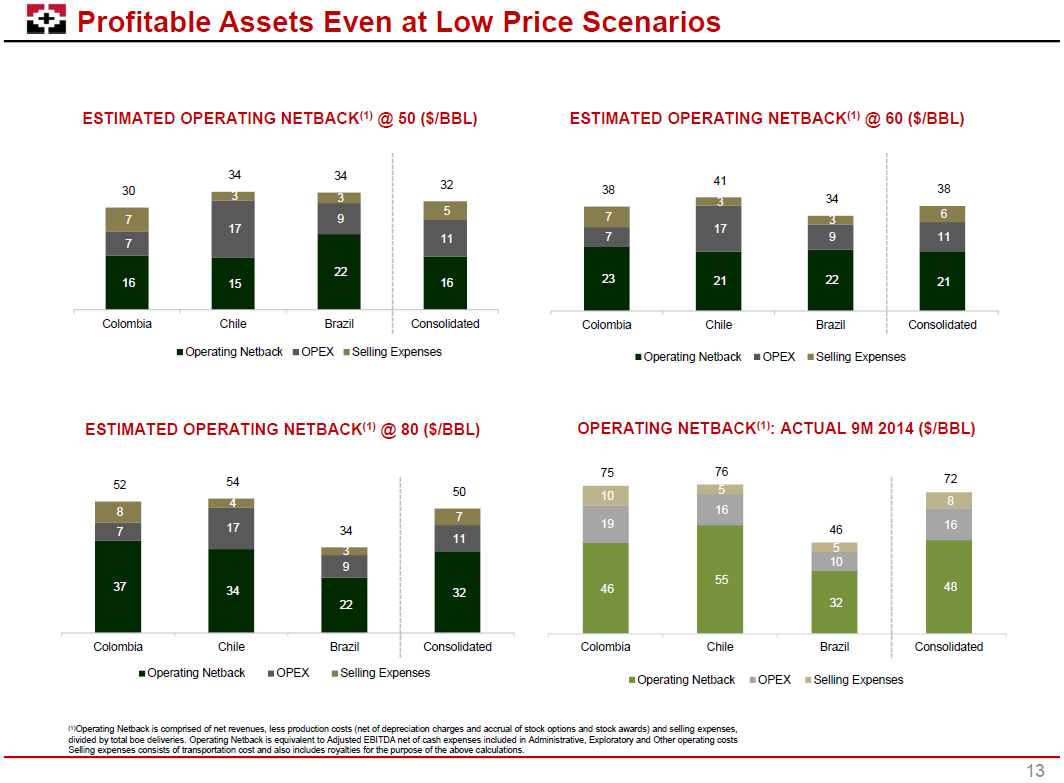

[GRAPHIC OMITTED] Profitable Assets Even at Low Price Scenarios ESTIMATED OPERATING NETBACK (1) @ 50 ($/BBL) [GRAPHIC OMITTED] ESTIMATED OPERATING NETBACK (1) @ 60 ($/BBL) [GRAPHIC OMITTED] ESTIMATED OPERATING NETBACK (1) @ 80 ($/BBL) [GRAPHIC OMITTED] OPERATING NETBACK (1): ACTUAL 9M 2014 ($/BBL) [GRAPHIC OMITTED] (1)Operating Netback is comprised of net revenues, less production costs (net of depreciation charges and accrual of stock options and stock awards) and selling expenses, divided by total boe deliveries. Operating Netback is equivalent to Adjusted EBITDA net of cash expenses included in Administrative, Exploratory and Other operating costs 13 |  |

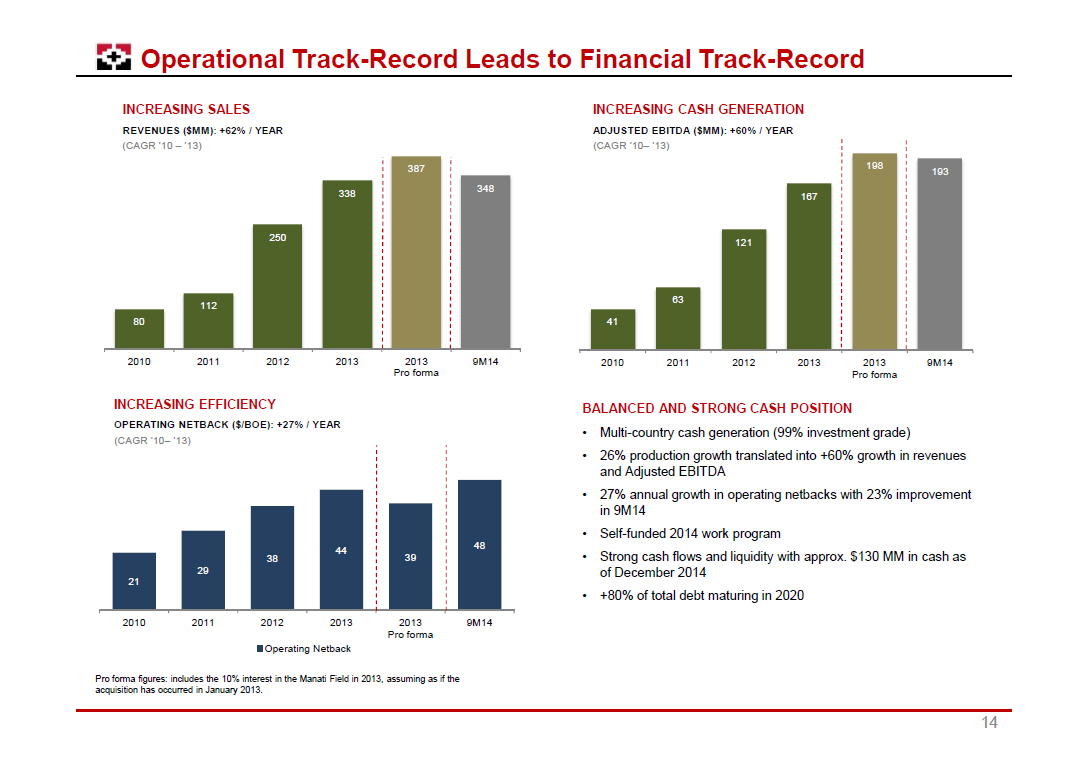

[GRAPHIC OMITTED] Operational Track-Record Leads to Financial Track-Record INCREASING SALES REVENUES ($MM): +62% / YEAR (CAGR '10 -- '13) [GRAPHIC OMITTED] INCREASING CASH GENERATION ADJUSTED EBITDA ($MM): +60% / YEAR (CAGR '10-- '13) [GRAPHIC OMITTED] INCREASING EFFICIENCY OPERATING NETBACK ($/BOE): +27% / YEAR (CAGR '10-- '13) [GRAPHIC OMITTED] BALANCED AND STRONG CASH POSITION [] Multi-country cash generation (99% investment grade) [] 26% production growth translated into +60% growth in revenues and Adjusted EBITDA [] 27% annual growth in operating netbacks with 23% improvement in 9M14 [] Self-funded 2014 work program [] Strong cash flows and liquidity with approx. $130 MM in cash as of December 2014 [] +80% of total debt maturing in 2020 Pro forma figures: includes the 10% interest in the Manati Field in 2013, assuming as if the acquisition has occurred in January 2013. 14 |  |

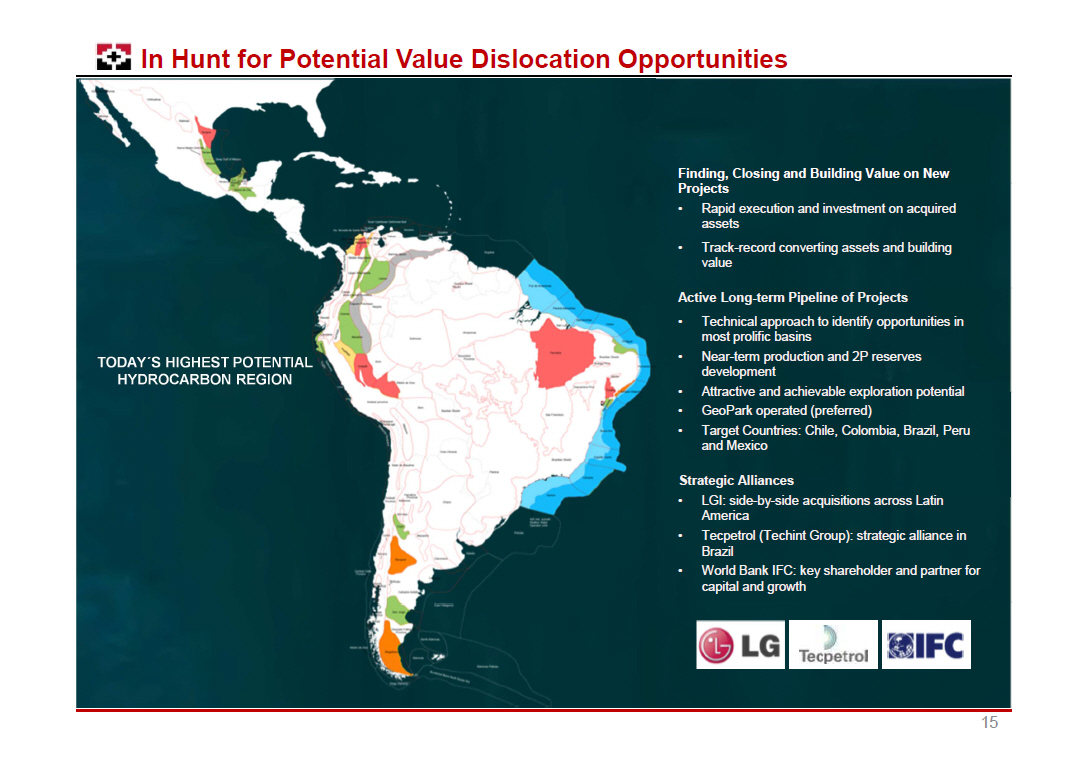

In Hunt for Potential Value Dislocation Opportunities TODAY[]S HIGHEST POTENTIAL HYDROCARBON REGION Finding, Closing and Building Value on New Projects [] Rapid execution and investment on acquired assets [] Track-record converting assets and building value Active Long-term Pipeline of Projects [] Technical approach to identify opportunities in most prolific basins [] Near-term production and 2P reserves development [] Attractive and achievable exploration potential [] GeoPark operated (preferred) [] Target Countries: Chile, Colombia, Brazil, Peru and Mexico Strategic Alliances [] LGI: side-by-side acquisitions across Latin America [] Tecpetrol (Techint Group): strategic alliance in Brazil [] World Bank IFC: key shareholder and partner for capital and growth [GRAPHIC OMITTED] [GRAPHIC OMITTED] 15 |  |

[GRAPHIC OMITTED] Uniquely -Positioned Oil and Gas Investment Vehicle [GRAPHIC OMITTED] [] Oil-Finding and Operating Know-How [] Solid Asset Base with Cash Flow and Upside [] Operational and Financial Track Record [] Access to Capital [] New Project Inventory and Alliances [] Capital Allocation and Project Efficiencies PORTFOLIO PROVIDES SECURE GROWTH WITH OPPORTUNITY FOR ACCELERATED UPSIDE 16 |  |

[GRAPHIC OMITTED]

Appendix

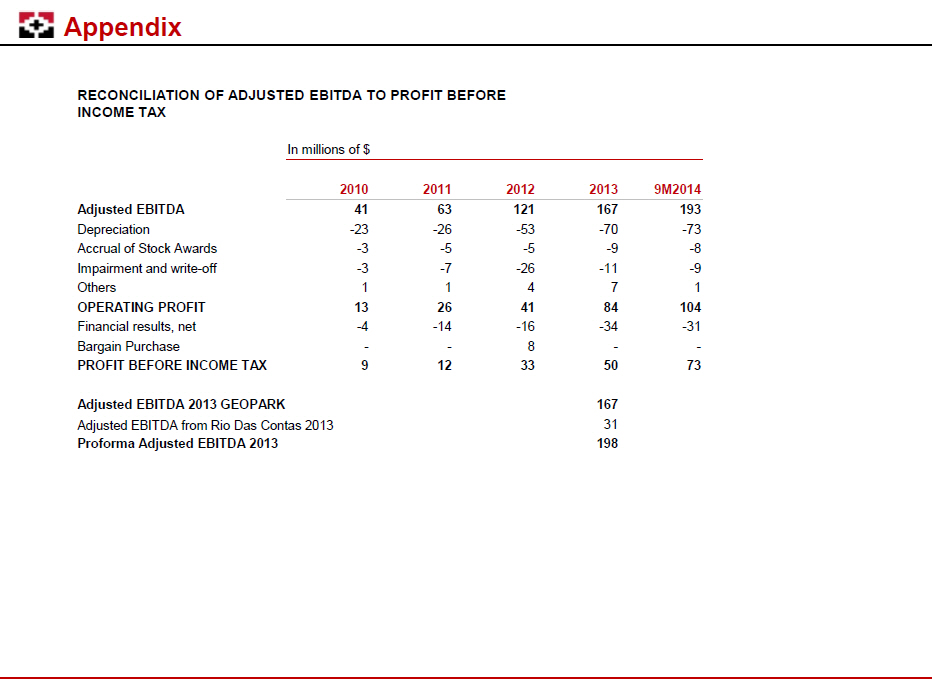

RECONCILIATION OF ADJUSTED EBITDA TO PROFIT BEFORE

INCOME TAX

In millions of $

20

10 2011 2012 2013 9M2014 Adjusted EBITDA 41 63 121 167 193

Depreciation -23 -26 -53 -70 -73 Accrual of Stock Awards -3

-5 -5 -9 -8 Impairment and write-off -3 -7 -26 -11 -9

Others 1 1 4 7 1

OPERATING PROFIT 13 26 41 84 104

Financial results, net -4 -14 -16 -34 -31 Bargain Purchase

- - 8 - -

PROFIT BEFORE INCOME TAX 9 12 33 50 73

Adjusted EBITDA 2013 GEOPARK 167

Adjusted EBITDA from Rio Das Contas 2013 31

Proforma Adjusted EBITDA 2013 198

|  |

[GRAPHIC OMITTED] [GRAPHIC OMITTED] Contacts Andr[]s Ocampo Chief Financial Officer Pablo Ducci Capital Markets Sof[]a Chellew Investor Relations Santiago, Chile Nuestra Se[]ora de los []ngeles 179, Las Condes, Santiago, Chile Phone: +(56 2) 2242 9600 Email: ir@geo -park.com [GRAPHIC OMITTED] |  |

[GRAPHIC OMITTED] [GRAPHIC OMITTED] |  |

| GeoPark Limited | |||||

| By: | /s/ Andrés Ocampo | ||||

| Name: | Andrés Ocampo | ||||

| Title: | Chief Financial Officer | ||||