- GPRK Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

6-K Filing

GeoPark Limited (GPRK) 6-KCurrent report (foreign)

Filed: 17 Aug 17, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2017

Commission File Number: 001-36298

GeoPark Limited

(Exact name of registrant as specified in its charter)

Nuestra Señora de los Ángeles 179

Las Condes, Santiago, Chile

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

| Form 20-F | X | Form 40-F |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

| Yes |

| No | X |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

| Yes |

| No | X |

GEOPARK LIMITED

TABLE OF CONTENTS

| ITEM | |

| 1. | Interim Condensed Consolidated Financial Statements and Explanatory Notes for the six-month period ended 30 June 2016 and 2017 |

GEOPARK LIMITED

Interim condensed consolidated

financial statements

AND explanatory notes

For the six-months period ended 30 June 2016 and 2017

GEOPARK LIMITED

30 JUNE 2017

CONTENTS

| Page | |

| 3 | Condensed Consolidated Statement of Income |

| 4 | Condensed Consolidated Statement of Comprehensive Income |

| 5 | Condensed Consolidated Statement of Financial Position |

| 6 | Condensed Consolidated Statement of Changes in Equity |

| 7 | Condensed Consolidated Statement of Cash Flow |

| 8 | Explanatory Notes |

2

GEOPARK LIMITED

30 JUNE 2017

CONDENSED CONSOLIDATED STATEMENT OF INCOME

| Amounts in US$ ´000 | Note | Three-months period ended 30 June 2017 (Unaudited) | Three-months period ended 30 June 2016 (Unaudited) | Six-months period ended 30 June 2017 (Unaudited) | Six-months period ended 30 June 2016 (Unaudited) |

| REVENUE | 2 | 75,227 | 45,923 | 141,935 | 82,487 |

| Commodity risk management contracts | 4 | 5,881 | - | 11,268 | - |

| Production and operating costs | 5 | (25,303) | (13,787) | (42,855) | (26,802) |

| Geological and geophysical expenses | 6 | (1,870) | (2,931) | (3,078) | (5,285) |

| Administrative expenses | 7 | (11,968) | (8,238) | (20,487) | (15,722) |

| Selling expenses | 8 | (89) | (493) | (537) | (3,164) |

| Depreciation | (19,966) | (16,614) | (35,682) | (38,136) | |

| Write-off of unsuccessful efforts | 10 | (4,602) | (447) | (4,602) | (447) |

| Other expenses | (1,468) | (637) | (1,989) | (1,377) | |

| OPERATING PROFIT (LOSS) | 15,842 | 2,776 | 43,973 | (8,446) | |

| Financial expenses | 9 | (8,098) | (8,128) | (17,630) | (17,663) |

| Financial income | 663 | 490 | 952 | 1,062 | |

| Foreign exchange (loss) gain | (4,702) | 9,558 | (1,793) | 17,015 | |

| PROFIT (LOSS) BEFORE INCOME TAX | 3,705 | 4,696 | 25,502 | (8,032) | |

| Income tax expense | (4,819) | (6,322) | (20,809) | (5,637) | |

| LOSS (PROFIT) FOR THE PERIOD | (1,114) | (1,626) | 4,693 | (13,669) | |

| Attributable to: | |||||

| Owners of the Company | (3,432) | (1,334) | 202 | (10,589) | |

| Non-controlling interest | 2,318 | (292) | 4,491 | (3,080) | |

(Losses) Earnings per share (in US$) for (loss) profit attributable to owners of the Company. Basic | (0.06) | (0.02) | 0.00 | (0.18) | |

(Losses) Earnings per share (in US$) for (loss) profit attributable to owners of the Company. Diluted | (0.06) | (0.02) | 0.00 | (0.18) |

The above condensed consolidated statement of income should be read in conjunction with the accompanying notes.

3

GEOPARK LIMITED

30 JUNE 2017

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

| Amounts in US$ ´000 | Three-months period ended 30 June 2017 (Unaudited) | Three-months period ended 30 June 2016 (Unaudited) | Six-months period ended 30 June 2017 (Unaudited) | Six-months period ended 30 June 2016 (Unaudited) | ||

| (Loss) Profit for the period | (1,114) | (1,626) | 4,693 | (13,669) | ||

| Other comprehensive income | ||||||

| Items that may be subsequently reclassified to profit or loss: | ||||||

| Currency translation differences | (779) | 3,205 | (247) | 5,620 | ||

| Total comprehensive (loss) income for the period | (1,893) | 1,579 | 4,446 | (8,049) | ||

| Attributable to: | ||||||

| Owners of the Company | (4,211) | 1,871 | (45) | (4,969) | ||

| Non-controlling interest | 2,318 | (292) | 4,491 | (3,080) | ||

The above condensed consolidated statement of comprehensive income should be read in conjunction with the accompanying notes.

4

GEOPARK LIMITED

30 JUNE 2017

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

| Amounts in US$ ´000 | Note | At 30 June 2017 (Unaudited) | Year ended 31 December 2016 |

| ASSETS | |||

| NON CURRENT ASSETS | |||

| Property, plant and equipment | 10 | 487,849 | 473,646 |

| Prepaid taxes | 2,760 | 2,852 | |

| Other financial assets | 20,594 | 19,547 | |

| Deferred income tax asset | 21,343 | 23,053 | |

| Prepayments and other receivables | 231 | 241 | |

| TOTAL NON CURRENT ASSETS | 532,777 | 519,339 | |

| CURRENT ASSETS | |||

| Inventories | 4,698 | 3,515 | |

| Trade receivables | 10,337 | 18,426 | |

| Prepayments and other receivables | 6,464 | 7,402 | |

| Prepaid taxes | 18,261 | 15,815 | |

| Derivative financial instrument assets | 7,557 | - | |

| Other financial assets | 4,967 | 2,480 | |

| Cash at bank and in hand | 76,988 | 73,563 | |

| TOTAL CURRENT ASSETS | 129,272 | 121,201 | |

| TOTAL ASSETS | 662,049 | 640,540 | |

| EQUITY | |||

| Equity attributable to owners of the Company | |||

| Share capital | 11 | 60 | 60 |

| Share premium | 236,544 | 236,046 | |

| Reserves | 129,871 | 130,118 | |

| Accumulated losses | (258,806) | (260,459) | |

| Attributable to owners of the Company | 107,669 | 105,765 | |

| Non-controlling interest | 40,406 | 35,828 | |

| TOTAL EQUITY | 148,075 | 141,593 | |

| LIABILITIES | |||

| NON CURRENT LIABILITIES | |||

| Borrowings | 12 | 314,596 | 319,389 |

| Provisions and other long-term liabilities | 13 | 43,228 | 42,509 |

| Deferred income tax liability | 7,500 | 2,770 | |

| Trade and other payables | 14 | 29,766 | 34,766 |

| TOTAL NON CURRENT LIABILITIES | 395,090 | 399,434 | |

| CURRENT LIABILITIES | |||

| Borrowings | 12 | 31,728 | 39,283 |

| Derivative financial instrument liabilities | - | 3,067 | |

| Current income tax liability | 11,623 | 5,155 | |

| Trade and other payables | 14 | 75,533 | 52,008 |

| TOTAL CURRENT LIABILITIES | 118,884 | 99,513 | |

| TOTAL LIABILITIES | 513,974 | 498,947 | |

| TOTAL EQUITY AND LIABILITIES | 662,049 | 640,540 |

The above condensed consolidated statement of financial position should be read in conjunction with the accompanying notes.

5

GEOPARK LIMITED

30 JUNE 2017

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

| Attributable to owners of the Company | |||||||

| Amount in US$ '000 | Share Capital | Share Premium | Other Reserve | Translation Reserve | Accumulated losses | Non - controlling Interest | Total |

| Equity at 1 January 2016 | 59 | 232,005 | 127,527 | (4,511) | (208,428) | 53,515 | 200,167 |

| Comprehensive income (loss): | |||||||

| Loss for the six-months period | - | - | - | - | (10,589) | (3,080) | (13,669) |

| Currency translation differences | - | - | - | 5,620 | - | - | 5,620 |

| Total comprehensive income (loss) for the period ended 30 June 2016 | - | - | - | 5,620 | (10,589) | (3,080) | (8,049) |

| Transactions with owners: | |||||||

| Repurchase of shares | - | (727) | - | - | - | - | (727) |

| Share-based payment | 1 | 1,747 | - | - | (1,108) | 83 | 723 |

| 1 | 1,020 | - | - | (1,108) | 83 | (4) | |

| Balance at 30 June 2016 (Unaudited) | 60 | 233,025 | 127,527 | 1,109 | (220,125) | 50,518 | 192,114 |

| Balance at 31 December 2016 | 60 | 236,046 | 127,527 | 2,591 | (260,459) | 35,828 | 141,593 |

| Comprehensive income (loss): | |||||||

| Profit for the six-months period | - | - | - | - | 202 | 4,491 | 4,693 |

| Currency translation differences | - | - | - | (247) | - | - | (247) |

| Total comprehensive income (loss) for the period ended 30 June 2017 | - | - | - | (247) | 202 | 4,491 | 4,446 |

| Transactions with owners: | |||||||

| Share-based payment | - | 498 | - | - | 1,451 | 87 | 2,036 |

| - | 498 | - | - | 1,451 | 87 | 2,036 | |

| Balance at 30 June 2017 (Unaudited) | 60 | 236,544 | 127,527 | 2,344 | (258,806) | 40,406 | 148,075 |

The above condensed consolidated statement of changes in equity should be read in conjunction with the accompanying notes.

6

GEOPARK LIMITED

30 JUNE 2017

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOW

| Amounts in US$ ’000 | Six-months period ended 30 June 2017 (Unaudited) | Six-months period ended 30 June 2016 (Unaudited) |

| Cash flows from operating activities | ||

| Profit (Loss) for the period | 4,693 | (13,669) |

| Adjustments for: | ||

| Income tax expense | 20,809 | 5,637 |

| Depreciation | 35,682 | 38,136 |

| Loss on disposal of property, plant and equipment | 24 | - |

| Write-off of unsuccessful efforts | 4,602 | 447 |

| Amortisation of other long-term liabilities | (216) | (869) |

| Accrual of borrowing’s interests | 12,638 | 13,948 |

| Unwinding of long-term liabilities | 1,347 | 1,242 |

| Accrual of share-based payment | 2,036 | 723 |

| Foreign exchange loss (gain) | 1,793 | (17,015) |

| Unrealized gain on commodity risk management contracts | (9,098) | - |

| Income tax paid | (6,925) | (2,012) |

| Change in working capital | 11,749 | 1,862 |

| Cash flows from operating activities – net | 79,134 | 28,430 |

| Cash flows from investing activities | ||

| Purchase of property, plant and equipment | (49,439) | (14,134) |

| Cash flows used in investing activities – net | (49,439) | (14,134) |

| Cash flows from financing activities | ||

| Proceeds from borrowings | - | 186 |

| Proceeds from loans received from related parties | - | 5,210 |

| Principal paid | (12,432) | (10,087) |

| Repurchase of shares | - | (727) |

| Interest paid | (12,555) | (12,757) |

| Cash flows used in financing activities – net | (24,987) | (18,175) |

| Net increase (decrease) in cash and cash equivalents | 4,708 | (3,879) |

| Cash and cash equivalents at 1 January | 73,563 | 82,730 |

| Currency translation differences | (1,283) | 396 |

| Cash and cash equivalents at the end of the period | 76,988 | 79,247 |

| Ending Cash and cash equivalents are specified as follows: | ||

| Cash in banks | 76,975 | 79,236 |

| Cash in hand | 13 | 11 |

| Cash and cash equivalents | 76,988 | 79,247 |

The above condensed consolidated statement of cash flow should be read in conjunction with the accompanying notes.

7

GEOPARK LIMITED

30 JUNE 2017

EXPLANATORY NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 1

General information

GeoPark Limited (the Company) is a company incorporated under the law of Bermuda. The Registered Office address is Cumberland House, 9th Floor, 1 Victoria Street, Hamilton HM11, Bermuda.

The principal activity of the Company and its subsidiaries (“the Group”) is the exploration, development and production for oil and gas reserves in Chile, Colombia, Brazil, Peru and Argentina.

This condensed consolidated interim financial report was authorised for issue by the Board of Directors on 16 August 2017.

Basis of Preparation

The condensed consolidated interim financial report of GeoPark Limited is presented in accordance with IAS 34 “Interim Financial Reporting”. It does not include all of the information required for full annual financial statements, and should be read in conjunction with the annual financial statements as at and for the years ended 31 December 2015 and 2016, which have been prepared in accordance with IFRS.

The condensed consolidated interim financial report has been prepared in accordance with the accounting policies applied in the most recent annual financial statements. For further information please refer to GeoPark Limited's consolidated financial statements for the year ended 31 December 2016.

Whenever necessary, certain comparative amounts have been reclassified to conform to changes in presentation in the current period.

Taxes on income in the interim periods are accrued using the tax rate that would be applicable to expected total annual profit or loss.

The activities of the Company are not subject to significant seasonal changes.

Estimates

The preparation of interim financial information requires the use of certain critical accounting estimates. It also requires management to exercise its judgement in the process of applying the Group’s accounting policies. Actual results may differ from these estimates.

In preparing these condensed consolidated interim financial statements, the significant judgements made by management in applying the Group’s accounting policies and the key sources of estimation uncertainty were the same as those that applied to the condensed consolidated financial statements for the year ended 31 December 2016.

8

GEOPARK LIMITED

30 JUNE 2017

Note 1 (Continued)

Financial risk management

The Company’s activities expose it to a variety of financial risks: currency risk, price risk, credit risk- concentration, funding and liquidity risk, interest risk and capital risk. The condensed consolidated interim financial statements do not include all financial risk management information and disclosures required in the annual financial statements, and should be read in conjunction with the Company’s annual financial statements as at 31 December 2016.

There have been no changes in the risk management since year end or in any risk management policies.

Subsidiary undertakings

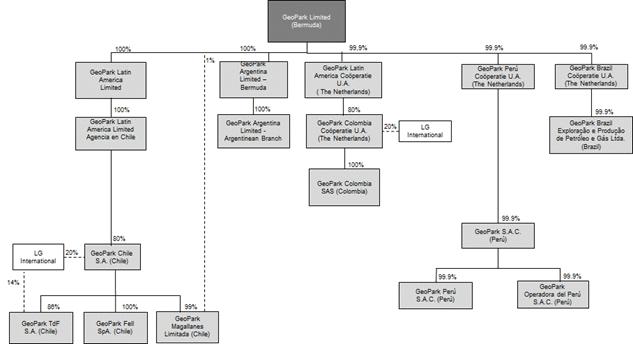

The following chart illustrates the Group structure as of 30 June 2017 (a):

(a) LG International is not a subsidiary, it is Non-controlling interest.

There have been no changes in the Group structure since December 2016.

9

GEOPARK LIMITED

30 JUNE 2017

Note 1 (Continued)

Subsidiary undertakings (Continued)

Details of the subsidiaries and joint operations of the Company are set out below:

| Name and registered office | Ownership interest | |||

| Subsidiaries | GeoPark Argentina Limited – Bermuda | 100% | ||

| GeoPark Argentina Limited – Argentinean Branch | 100% (a) | |||

| GeoPark Latin America Limited | 100% | |||

| GeoPark Latin America Limited – Agencia en Chile | 100% (a) | |||

| GeoPark S.A. (Chile) | 100% (a) (b) | |||

| GeoPark Brazil Exploração y Produção de Petróleo e Gás Ltda. (Brazil) | 100% (a) | |||

| GeoPark Chile S.A. (Chile) | 80% (a) (c) | |||

| GeoPark Fell S.p.A. (Chile) | 80% (a) (c) | |||

| GeoPark Magallanes Limitada (Chile) | 80% (a) (c) | |||

| GeoPark TdF S.A. (Chile) | 68.8% (a) (d) | |||

| GeoPark Colombia S.A. (Chile) | 100% (a) | |||

| GeoPark Colombia SAS (Colombia) | 80% (a) (c) | |||

| GeoPark Latin America Coöperatie U.A. (The Netherlands) | 100% | |||

| GeoPark Colombia Coöperatie U.A. (The Netherlands) | 80% (a) (c) | |||

| GeoPark S.A.C. (Peru) | 100% (a) | |||

| GeoPark Perú S.A.C. (Peru) | 100% (a) | |||

| GeoPark Operadora del Perú S.A.C. (Peru) | 100% (a) | |||

| GeoPark Peru Coöperatie U.A. (The Netherlands) | 100% | |||

| GeoPark Brazil Coöperatie U.A. (The Netherlands) | 100% | |||

| GeoPark Colombia E&P S.A.(Panama) | 100% (b) | |||

| GeoPark Colombia E&P Sucursal Colombia(Colombia) | 100% (b) | |||

| Joint operations | Tranquilo Block (Chile) | 50% (e) | ||

| Flamenco Block (Chile) | 50% (e) | |||

| Campanario Block (Chile) | 50% (e) | |||

| Isla Norte Block (Chile) | 60% (e) | |||

| Yamu/Carupana Block (Colombia) | 89.5%/100% (e) | |||

| Llanos 34 Block (Colombia) | 45% (e) | |||

| Llanos 32 Block (Colombia) | 10% | |||

| CPO-4 Block (Colombia) | 50% (e) | |||

| Puelen Block (Argentina) | 18% | |||

| Sierra del Nevado Block (Argentina) | 18% | |||

| CN-V Block (Argentina) | 50% (e) | |||

| Manati Field (Brazil) | 10% |

| (a) | Indirectly owned. |

| (b) | Dormant companies. |

| (c) | LG International has 20% interest. |

| (d) | LG International has 20% interest through GeoPark Chile S.A. and a 14% direct interest, totaling 31.2%. |

| (e) | GeoPark is the operator. |

10

GEOPARK LIMITED

30 JUNE 2017

Note 2

Revenue

| Amounts in US$ '000 | Three-months period ended 30 June 2017 | Three-months period ended 30 June 2016 | Six-months period ended 30 June 2017 | Six-months periodended 30 June 2016 |

| Sale of crude oil | 64,082 | 34,303 | 118,595 | 57,472 |

| Sale of gas | 11,145 | 11,620 | 23,340 | 25,015 |

| 75,227 | 45,923 | 141,935 | 82,487 |

Note 3

Segment Information

Operating segments are reported in a manner consistent with the internal reporting provided to the chief operating decision-maker. The chief operating decision-maker, who is responsible for allocating resources and assessing performance of the operating segments, has been identified as the Executive Committee. This committee is integrated by the CEO, COO, CFO and managers in charge of the Geoscience, Operations, Corporate Governance, Finance and People departments. This committee reviews the Group’s internal reporting in order to assess performance and allocate resources. Management has determined the operating segments based on these reports. The committee considers the business from a geographic perspective.

The Executive Committee assesses the performance of the operating segments based on a measure of Adjusted EBITDA. Adjusted EBITDA is defined as profit for the period before net finance cost, income tax, depreciation, amortization, certain non-cash items such as impairments and write-offs of unsuccessful efforts, accrual of share-based payment, unrealized result on commodity risk management contracts and other non recurring events. Operating Netback is equivalent to Adjusted EBITDA before cash expenses included in Administrative, Geological and Geophysical and other operating expenses. Other information provided to the Executive Committee is measured in a manner consistent with that in the financial statements.

11

GEOPARK LIMITED

30 JUNE 2017

Note 3 (Continued)

Segment Information (Continued)

Six-months period ended 30 June 2017

| Amounts in US$ '000 | Total | Colombia | Chile | Brazil | Argentina | Peru | Corporate |

| Revenue | 141,935 | 110,834 | 15,975 | 15,126 | - | - | - |

| Sale of crude oil | 118,595 | 110,511 | 7,687 | 397 | - | - | - |

| Sale of gas | 23,340 | 323 | 8,288 | 14,729 | - | - | - |

| Production and operating costs | (42,855) | (27,353) | (9,731) | (5,771) | - | - | - |

| Royalties | (10,580) | (8,625) | (641) | (1,314) | - | - | - |

| Transportation costs | (1,196) | (652) | (544) | - | - | - | - |

| Share-based payment | (228) | (123) | (86) | (19) | - | - | - |

| Other costs | (30,851) | (17,953) | (8,460) | (4,438) | - | - | - |

| Depreciation | (35,682) | (19,006) | (11,886) | (4,642) | (67) | (63) | (18) |

| Operating profit / (loss) | 43,973 | 65,169 | (9,681) | (682) | (1,987) | (2,038) | (6,808) |

| Operating netback | 100,942 | 85,676 | 5,975 | 9,374 | (83) | - | - |

| Adjusted EBITDA | 75,936 | 75,037 | 2,227 | 7,487 | (1,721) | (1,875) | (5,219) |

Six-months period ended 30 June 2016

| Amounts in US$ '000 | Total | Colombia | Chile | Brazil | Argentina | Peru | Corporate |

| Revenue | 82,487 | 47,664 | 19,006 | 15,817 | - | - | - |

| Sale of crude oil | 57,472 | 47,664 | 9,445 | 363 | - | - | - |

| Sale of gas | 25,015 | - | 9,561 | 15,454 | - | - | - |

| Production and operating costs | (26,802) | (12,135) | (10,708) | (3,959) | - | - | - |

| Royalties | (4,327) | (2,074) | (768) | (1,485) | - | - | - |

| Transportation costs | (1,262) | (604) | (658) | - | - | - | - |

| Share-based payment | (150) | (117) | (33) | - | - | - | - |

| Other costs | (21,063) | (9,340) | (9,249) | (2,474) | - | - | - |

| Depreciation | (38,136) | (14,296) | (16,529) | (7,155) | (91) | (65) | - |

| Operating (loss) / profit | (8,446) | 8,220 | (13,177) | 2,432 | 607 | (1,647) | (4,881) |

| Operating netback | 52,713 | 33,069 | 7,871 | 11,896 | (143) | 18 | 2 |

| Adjusted EBITDA | 32,017 | 23,065 | 3,524 | 9,782 | 1,793 | (1,552) | (4,595) |

| Total Assets | Total | Colombia | Chile | Brazil | Argentina | Peru | Corporate |

| 30 June 2017 | 662,049 | 213,926 | 307,817 | 96,102 | 9,741 | 7,539 | 26,924 |

| 31 December 2016 | 640,540 | 182,784 | 317,969 | 99,904 | 6,071 | 5,020 | 28,792 |

12

GEOPARK LIMITED

30 JUNE 2017

Note 3 (Continued)

Segment Information (Continued)

A reconciliation of total Operating netback to total profit (loss) before income tax is provided as follows:

Three-months period ended 30 June 2017 | Three-months period ended 30 June 2016 | Six-months period ended 30 June 2017 | Six-months period ended 30 June 2016 |

| Operating netback | 51,921 | 31,732 | 100,942 | 52,713 |

| Geological and geophysical expenses | (3,644) | (3,135) | (6,073) | (5,438) |

| Administrative expenses | (11,185) | (8,133) | (18,933) | (15,258) |

| Adjusted EBITDA for reportable segments | 37,092 | 20,464 | 75,936 | 32,017 |

| Unrealized gain on commodity risk management contracts | 3,915 | - | 9,098 | - |

| Depreciation(a) | (19,966) | (16,614) | (35,682) | (38,136) |

| Write-off of unsuccessful efforts | (4,602) | (447) | (4,602) | (447) |

| Share-based payment | (1,027) | (233) | (2,036) | (723) |

| Others(b) | 430 | (394) | 1,259 | (1,157) |

| Operating profit / (loss) | 15,842 | 2,776 | 43,973 | (8,446) |

| Financial expenses | (8,098) | (8,128) | (17,630) | (17,663) |

| Financial income | 663 | 490 | 952 | 1,062 |

| Foreign exchange (loss) gain | (4,702) | 9,558 | (1,793) | 17,015 |

| Profit / (Loss) before tax | 3,705 | 4,696 | 25,502 | (8,032) |

| (a) | Net of capitalised costs for oil stock included in Inventories. Depreciation includes US$ 1,588,000 (US$ 1,861,000 in 2016) generated by assets not related to production activities. For the three months period ended 30 June 2017 the amount included in depreciation is US$ 759,000 (US$ 906,000 in 2016). |

| (b) | Includes allocation to capitalised projects. |

The following table presents a reconciliation of Adjusted EBITDA to operating profit for the six-month periods ended 30 June 2017 and 2016:

| Six-months period ended 30 June 2017 | |||||

| Colombia | Chile | Brazil | Other(c) | Total | |

| Adjusted EBITDA for reportable segments | 75,037 | 2,227 | 7,487 | (8,815) | 75,936 |

| Depreciation | (19,006) | (11,886) | (4,642) | (148) | (35,682) |

| Unrealized gain on commodity risk management contracts | 9,098 | - | - | - | 9,098 |

| Write-off of unsuccessful efforts | (1,625) | - | (2,977) | - | (4,602) |

| Share-based payment | (259) | (177) | (93) | (1,507) | (2,036) |

| Others | 1,924 | 155 | (457) | (363) | 1,259 |

| Operating profit / (loss) | 65,169 | (9,681) | (682) | (10,833) | 43,973 |

13

GEOPARK LIMITED

30 JUNE 2017

Note 3 (Continued)

Segment Information (Continued)

| Six-months period ended 30 June 2016 | |||||

| Colombia | Chile | Brazil | Other(c) | Total | |

| Adjusted EBITDA for reportable segments | 23,065 | 3,524 | 9,782 | (4,354) | 32,017 |

| Depreciation | (14,296) | (16,529) | (7,155) | (156) | (38,136) |

| Write-off of unsuccessful efforts | - | (447) | - | - | (447) |

| Share-based payment | (263) | (153) | (20) | (287) | (723) |

| Others | (286) | 428 | (175) | (1,124) | (1,157) |

| Operating profit / (loss) | 8,220 | (13,177) | 2,432 | (5,921) | (8,446) |

(c)Includes Argentina, Peru and Corporate.

Note 4

Commodity risk management contracts

During 2016, the Group entered into derivative financial instruments to manage its exposure to oil price risk. These derivatives were zero-premium collars and were placed with major financial institutions and commodity traders. The Group entered into the derivatives under ISDA Master Agreements and Credit Support Annexes, which provide credit lines for collateral posting thus alleviating possible liquidity needs under the instruments and protect the Group from potential non-performance risk by its counterparties. The Group’s derivatives are accounted for as non-hedge derivatives as of 30 June 2017 and therefore all changes in the fair values of its derivative contracts are recognized as gains or losses in the earnings of the periods in which they occur.

| Period | Reference | Type | Volume bbl/d | Price US$/bbl |

| 1 November 2016 – 30 June 2017 | ICE BRENT | Zero Premium Collar | 4,000 | 50.0 Put 57.0 Call |

| 1 November 2016 – 30 June 2017 | ICE BRENT | Zero Premium Collar | 2,000 | 50.0 Put 57.1 Call |

| 1 January 2017 – 30 September 2017 | ICE BRENT | Zero Premium Collar | 3,000 | 54.0 Put 61.1 Call |

| 1 January 2017 – 30 September 2017 | ICE BRENT | Zero Premium Collar | 1,000 | 54.0 Put 61.0 Call |

| 1 January 2017 – 30 September 2017 | ICE BRENT | Zero Premium Collar | 2,000 | 53.0 Put 60.1 Call |

| 1 July 2017 – 31 December 2017 | ICE BRENT | Zero Premium Collar | 2,000 | 51.0 Put 57.5 Call |

| 1 July 2017 – 31 December 2017 | ICE BRENT | Zero Premium Collar | 3,000 | 51.0 Put 57.5 Call |

| 1 July 2017 – 31 December 2017 | ICE BRENT | Zero Premium Collar | 1,000 | 51.0 Put 57.5 Call |

14

GEOPARK LIMITED

30 JUNE 2017

Note 4 (Continued)

Commodity risk management contracts (Continued)

The table below summarizes the gain on the commodity risk management contracts:

Three-months period ended 30 June 2017 | Three-months period ended 30 June 2016 | Six-months period ended 30 June 2017 | Six-months period ended 30 June 2016 | |

| Realized gain on commodity risk management contracts | 1,966 | - | 2,170 | - |

| Unrealized gain on commodity risk management contracts | 3,915 | - | 9,098 | - |

| Total | 5,881 | - | 11,268 | - |

Note 5

Production and operating costs

| Amounts in US$ '000 | Three-months period ended 30 June 2017 | Three-months period ended 30 June 2016 | Six-months period ended 30 June 2017 | Six-months period ended 30 June 2016 |

| Staff costs | 3,599 | 2,383 | 6,959 | 5,424 |

| Well and facilities maintenance | 4,613 | 2,513 | 7,274 | 4,425 |

| Royalties | 5,862 | 2,571 | 10,580 | 4,327 |

| Gas plant costs | 1,514 | 1,602 | 3,052 | 3,249 |

| Consumables | 2,798 | 1,505 | 5,399 | 3,193 |

| Equipment rental | 1,281 | 813 | 2,360 | 1,729 |

| Transportation costs | 658 | 505 | 1,196 | 1,262 |

| Field camp | 585 | 183 | 1,124 | 675 |

| Non operated blocks costs | 324 | 221 | 605 | 513 |

| Crude oil stock variation | 1,846 | 48 | (100) | 308 |

| Share-based payment | 116 | 70 | 228 | 150 |

| Other costs | 2,107 | 1,373 | 4,178 | 1,547 |

| 25,303 | 13,787 | 42,855 | 26,802 |

Note 6

Geological and geophysical expenses

| Amounts in US$ '000 | Three-months period ended 30 June 2017 | Three-months period ended 30 June 2016 | Six-months period ended 30 June 2017 | Six-months period ended 30 June 2016 |

| Staff costs | 2,848 | 2,625 | 4,889 | 4,334 |

| Share-based payment | 128 | 58 | 254 | 109 |

| Other services | 796 | 510 | 1,184 | 1,104 |

| Allocation to capitalised project | (1,902) | (262) | (3,249) | (262) |

| 1,870 | 2,931 | 3,078 | 5,285 |

15

GEOPARK LIMITED

30 JUNE 2017

Note 7

Administrative expenses

| Amounts in US$ '000 | Three-months period ended 30 June 2017 | Three-months period ended 30 June 2016 | Six-months period ended 30 June 2017 | Six-months period ended 30 June 2016 |

| Staff costs | 7,327 | 5,018 | 12,675 | 9,490 |

| Consultant fees | 1,079 | 896 | 1,930 | 1,635 |

| Office expenses | 615 | 595 | 1,234 | 1,105 |

| Director fees and allowance | 1,384 | 384 | 2,030 | 758 |

| Travel expenses | 826 | 436 | 1,312 | 632 |

| Share-based payment | 783 | 105 | 1,554 | 464 |

| New projects | 298 | 157 | 441 | 261 |

| Overhead | (1,984) | (885) | (3,921) | (1,831) |

| Other administrative expenses | 1,640 | 1,532 | 3,232 | 3,208 |

| 11,968 | 8,238 | 20,487 | 15,722 |

Note 8

Selling expenses

| Amounts in US$ '000 |

period ended 30 June 2017 |

period ended 30 June 2016 |

period ended 30 June 2017 |

period ended 30 June 2016 |

| Transportation | 161 | 282 | 415 | 2,875 |

| Selling taxes and other | (72) | 211 | 122 | 289 |

| 89 | 493 | 537 | 3,164 |

Note 9

Financial expenses

| Amounts in US$ '000 | Three-months period ended 30 June 2017 | Three-months period ended 30 June 2016 | Six-months period ended 30 June 2017 | Six-months period ended 30 June 2016 |

| Bank charges and other financial costs | 1,076 | 467 | 2,054 | 1,377 |

| Unwinding of long-term liabilities | 742 | 397 | 1,347 | 1,242 |

| Interest and amortisation of debt issue costs | 5,862 | 6,899 | 13,178 | 14,410 |

| Interest with related parties | 494 | 394 | 1,207 | 789 |

| Less: amounts capitalised on qualifying assets | (76) | (29) | (156) | (155) |

| 8,098 | 8,128 | 17,630 | 17,663 |

16

GEOPARK LIMITED

30 JUNE 2017

Note 10

Property, plant and equipment

| Amounts in US$'000 | Oil & gas properties | Furniture, equipment and vehicles | Production facilities and machinery | Buildings and improve-ments | Construction in progress | Exploration and evaluation assets | TOTAL |

| Cost at 1 January 2016 | 648,992 | 13,745 | 124,832 | 10,518 | 29,823 | 87,000 | 914,910 |

| Additions | (2,906)(a) | 270 | - | - | 8,153 | 6,058 | 11,575 |

| Disposals | - | - | - | - | (300) | (35) | (335) |

| Write-off of unsuccessful efforts | - | - | - | - | - | (447)(b) | (447) |

| Transfers | 14,796 | 33 | 1,951 | - | (9,403) | (7,377) | - |

| Currency translation differences | 15,130 | 136 | 1,795 | 38 | 85 | 898 | 18,082 |

| Cost at 30 June 2016 | 676,012 | 14,184 | 128,578 | 10,556 | 28,358 | 86,097 | 943,785 |

| Cost at 1 January 2017 | 692,241 | 14,357 | 132,413 | 10,553 | 32,926 | 61,773 | 944,263 |

| Additions | 827 | 303 | - | - | 28,198 | 26,094 | 55,422 |

| Disposals | - | (24) | - | - | - | - | (24) |

| Write-off of unsuccessful efforts | - | - | - | - | - | (4,602)(c) | (4,602) |

| Transfers | 24,328 | (189) | 12,173 | - | (22,920) | (13,392) | - |

| Currency translation differences | (861) | (13) | (184) | (3) | 70 | (185) | (1,176) |

| Cost at 30 June 2017 | 716,535 | 14,434 | 144,402 | 10,550 | 38,274 | 69,688 | 993,883 |

| Depreciation and write-down at 1 January 2016 | (321,173) | (7,317) | (60,614) | (3,195) | - | - | (392,299) |

| Depreciation | (30,216) | (1,416) | (5,637) | (445) | - | - | (37,714) |

| Currency translation differences | (2,818) | (55) | 23 | (22) | - | - | (2,872) |

| Depreciation and write-down At 30 June 2016 | (354,207) | (8,788) | (66,228) | (3,662) | - | - | (432,885) |

| Depreciation and write-down at 1 January 2017 | (384,739) | (10,049) | (71,698) | (4,131) | - | - | (470,617) |

| Depreciation | (28,244) | (1,122) | (5,960) | (466) | - | - | (35,792) |

| Currency translation differences | 316 | 1 | 54 | 4 | - | - | 375 |

| Depreciation and write-down at 30 June 2017 | (412,667) | (11,170) | (77,604) | (4,593) | - | - | (506,034) |

| Carrying amount at 30 June 2016 | 321,805 | 5,396 | 62,350 | 6,894 | 28,358 | 86,097 | 510,900 |

| Carrying amount at 30 June 2017 | 303,868 | 3,264 | 66,798 | 5,957 | 38,274 | 69,688 | 487,849 |

| (a) | Corresponds to the effect of reestimation of assets retirement obligations in Colombia. |

| (b) | Corresponds to unsuccessful exploratory activities performed in 2013 in Chile (Flamenco Block). |

| (c) | Corresponds to two unsuccessful exploratory wells drilled in Colombia (Llanos 34 Block) and Brazil (REC-T-94 Block) in 2017. |

17

GEOPARK LIMITED

30 JUNE 2017

Note 11

Share capital

| Issued share capital | Six-months periodended 30 June 2017 | Year ended 31 December 2016 |

| Common stock (US$ ´000) | 60 | 60 |

| The share capital is distributed as follows: | ||

| Common shares, of nominal US$ 0.001 | 60,066,530 | 59,940,881 |

| Total common shares in issue | 60,066,530 | 59,940,881 |

Authorised share capital | ||

| US$ per share | 0.001 | 0.001 |

| Number of common shares (US$ 0.001 each) | 5,171,949,000 | 5,171,949,000 |

| Amount in US$ | 5,171,949 | 5,171,949 |

GeoPark’s share capital only consists of common shares. The authorized share capital consists of 5,171,949,000 common shares of par value US$ 0.001 per share. All of the Company issued and outstanding common shares are fully paid and nonassessable.

Note 12

Borrowings

The outstanding amounts are as follows:

| Amounts in US$ '000 | At 30 June 2017 | Year ended 31 December 2016 |

| Notes GeoPark Latin America Agencia en Chile (a) | 303,985 | 304,059 |

| Banco Itaú (b) | 39,891 | 49,763 |

| Banco de Chile (c) | 2,340 | 4,709 |

| Banco de Crédito e Inversiones (d) | 108 | 141 |

| 346,324 | 358,672 |

Classified as follows:

| Current | 31,728 | 39,283 | |

| Non-Current | 314,596 | 319,389 |

18

GEOPARK LIMITED

30 JUNE 2017

Note 12 (Continued)

Borrowings (Continued)

(a) During February 2013, the Company successfully placed US$ 300 million notes which were offered under Rule 144A and Regulation S exemptions of the United States Securities laws.

The Notes, issued by the Company's wholly-owned subsidiary GeoPark Latin America Limited Agencia en Chile ("the Issuer"), were priced at 99.332% and carry a coupon of 7.50% per annum (yield 7.625% per annum). Final maturity of the notes will be 11 February 2020. The Notes are guaranteed by GeoPark Limited and GeoPark Latin America Cooperatie U.A. and are secured with a pledge of all of the equity interests of the Issuer in GeoPark Chile S.A. and GeoPark Colombia S.A. and a pledge of certain intercompany loans. The debt issuance cost for this transaction amounted to US$ 7,637,000. The indenture governing our Notes due 2020 includes incurrence test covenants that provides among other things, that, the Debt to EBITDA ratio should not exceed 2.5 times and the EBITDA to Interest ratio should exceed 3.5 times. As of the date of these interim condensed consolidated financial statements, the Company’s Debt to EBITDA ratio was 2.8 times, primarily due to the lower oil prices that impacted the Company’s EBITDA generation. Failure to comply with the incurrence test covenants does not trigger an event of default. However, this situation may limit the Company’s capacity to incur additional indebtedness, as specified in the indenture governing the Notes. Incurrence covenants as opposed to maintenance covenants must be tested by the Company before incurring additional debt or performing certain corporate actions including but not limited to dividend payments, restricted payments and others, (other than in each case, certain specific exceptions). EBITDA to Interest ratio was 4.1 times. As of the date of these interim condensed consolidated financial statements, the Company is in compliance of all the indenture’s provisions.

(b) During March 2014, GeoPark executed a loan agreement with Itaú BBA International for US$ 70,450,000 to finance the acquisition of a 10% working interest in the Manatí field in Brazil. The interest will be paid semi-annually; principal will be cancelled semi-annually with a year grace period. The debt issuance cost for this transaction amounted to US$ 3,295,000. In March 2015, the Company reached an agreement to: (i) extend the principal payments that were due in 2015 (amounting to approximately US$ 15,000,000), which will be divided pro-rata during the remaining principal installments, starting in March 2016 and (ii) to increase the variable interest rate to six-month LIBOR + 4.0%. As a result of the above, the Company paid US$ 10.000.000 in March 2016 and 2017 and September 2016, corresponding to principal payments under the current principal amortization schedule.

The facility agreement includes customary events of default, and requires the Brazilian subsidiary to comply with customary covenants, including the maintenance of a ratio of net debt to EBITDA of up to 3.5x for the first two years and up to 3.0x thereafter. The credit facility also limits the borrower’s ability to pay dividends if the ratio of net debt to EBITDA is greater than 2.5x. As of the date of these interim condensed consolidated financial statements, the Company has complied with these covenants

19

GEOPARK LIMITED

30 JUNE 2017

Note 12 (Continued)

Borrowings (Continued)

(c) During December 2015, GeoPark executed a loan agreement with Banco de Chile for US$ 7,028,000 to finance the start-up of new Ache gas field in GeoPark-operated Fell Block. The interest rate applicable to this loan is LIBOR plus 2.35% per annum. The interest and the principal will be paid on monthly basis; with a six months grace period, with final maturity on December 2017.

(d) During February 2016, GeoPark executed a loan agreement with Banco de Crédito e Inversiones for US$ 186,000 to finance the acquisition of vehicles for the Chilean operation. The interest rate applicable to this loan is 4.14% per annum. The interest and the principal will be paid on monthly basis, with final maturity on February 2019.

As of the date of this interim condensed consolidated report, the Group has available credit lines for over US$ 40,100,000.

Note 13

Provisions and other long-term liabilities

The outstanding amounts are as follows:

| Amounts in US$ '000 | At 30 June 2017 | Year ended 31 December |

| Assets retirement obligation | 31,615 | 29,862 |

| Deferred income | 1,891 | 3,484 |

| Other | 9,722 | 9,163 |

| 43,228 | 42,509 |

20

GEOPARK LIMITED

30 JUNE 2017

Note 14

Trade and other payables

The outstanding amounts are as follows:

| Amounts in US$ '000 | At 30 June 2017 | Year ended 31 December |

| Trade payables | 47,671 | 23,650 |

| Payables to related parties(a) | 29,008 | 27,801 |

| Customer advance payments(b) | 15,000 | 20,000 |

| Taxes and other debts to be paid | 3,147 | 3,355 |

| Staff costs to be paid | 5,702 | 7,749 |

| V.A.T. | 415 | 1,102 |

| To be paid to co-venturers | 2,307 | 1,614 |

| Royalties to be paid | 2,049 | 1,503 |

| 105,299 | 86,774 |

Classified as follows:

| Current | 75,533 | 52,008 | |

| Non-Current | 29,766 | 34,766 |

| (a) | The outstanding amount corresponds to advanced cash call payments granted by LGI to GeoPark Chile S.A. for financing Chilean operations in TdF’s blocks. The expected maturity of these balances is July 2020 and the applicable interest rate is 8% per annum. |

| (b) | In December 2015, the Company entered into a prepayment agreement with Trafigura under which the Company sells and deliver a portion of its Colombian crude oil production. Funds committed are available upon request and will be repaid by the Company on a monthly basis through future oil deliveries over the period of the contract. |

Note 15

Capital commitments

Capital commitments are detailed in Note 31 (b) to the audited Consolidated Financial Statements as of 31 December 2016. The following updates have taken place during the six-month period ended 30 June 2017:

Colombia

As of the date of these Interim Condensed Consolidated Financial Statements, GeoPark is awaiting the ANH’s approval of the wells already drilled in Llanos 34 Block, that were presented as fulfilment of the commitments to be performed before 15 March 2017 and 14 September 2019.

On 21 June 2017, ANH approved GeoPark’s relinquishment of 79.15% of the VIM 3 Block area. The remaining area will cover 46,881 acres and the commitments are not affected by this resolution. There is no impact in the Condensed Consolidated Statement of Income since there are no investments associated with the relinquished area.

21

GEOPARK LIMITED

30 JUNE 2017

Note 15 (Continued)

Capital commitments (Continued)

Argentina

One exploratory well was drilled in the CN-V Block, with testing expected for the third quarter of the year. As a subsequent event, on 10 July 2017, the Ministry of Mendoza notified the extension of the exploratory period to fulfil the commitments in the block until 27 November 2017.

Chile

On 30 June 2017, the Chilean Ministry accepted the Company’s proposal to extend the second exploratory phase in the Flamenco Block for an additional period of 18 months, ending on 7 May 2019. The remaining commitment amounts to US$ 2,100,000.

On 29 May 2017, the Chilean Ministry accepted the Company’s proposal to update the value of the commitments in both the Campanario and Isla Norte Blocks as well as the guarantees related to those commitments. Consequently, the investment commitments assumed by GeoPark are:

| · | Campanario Block: 3 exploratory wells before 10 July 2019 (US$ 4,758,000) |

| · | Isla Norte Block: 2 exploratory wells before 7 May 2019 (US$ 2,855,000) |

As of the date of these interim condensed consolidated financial statements, the Company has established a guarantee for its commitments that amounts to US$ 6,403,200.

Brazil

On 12 May 2017, the BrazilianNational Agency of Petroleum, Natural Gas and Biofuels (“ANP”) notified the suspension of the exploratory period to fulfill the commitments in the SEAL-T-268 Block.

In the REC-T-94 Block, an exploratory well was drilled and completed in April 2017. As a subsequent event, on 12 July 2017, theANP notified the suspension of the exploratory period to fulfill the commitments in the block.

Note 16

Fair value measurement of financial instruments

Accounting policies for financial instruments have been applied to classify as either: loans and receivables, held-to-maturity, available-for-sale, or fair value through profit and loss. For financial instruments that are measured in the statement of financial position at fair value, IFRS 13 requires a disclosure of fair value measurements by level according to the following fair value measurement hierarchy:

Level 1 - Quoted prices (unadjusted) in active markets for identical assets or liabilities.

22

GEOPARK LIMITED

30 JUNE 2017

Note 16 (Continued)

Fair value measurement of financial instruments (Continued)

Level 2 - Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly (that is, as prices) or indirectly (that is, derived from prices).

Level 3 - Inputs for the asset or liability that are not based on observable market data (that is, unobservable inputs).

This note provides an update on the judgements and estimates made by the Group in determining the fair values of the financial instruments since the last annual financial report.

(a) Fair value hierarchy

The following table presents the Group’s financial assets and financial liabilities measured and recognised at fair value at 30 June 2017 and 31 December 2016 on a recurring basis:

| Amounts in US$ '000 | Level 2 | At 30 June 2017 |

| Assets | ||

| Derivative financial instrument assets | ||

| Commodity risk management contracts | 7,557 | 7,557 |

| Total Assets | 7,557 | 7,557 |

| Amounts in US$ '000 | Level 2 | Year ended 31 December |

| Liabilities | ||

| Derivative financial instrument liabilities | ||

| Commodity risk management contracts | 3,067 | 3,067 |

| Total Liabilities | 3,067 | 3,067 |

There were no transfers between Level 2 and 3 during the period.

The Group did not measure any financial assets or financial liabilities at fair value on a non-recurring basis as at 30 June 2017.

(b) Valuation techniques used to determine fair values

Specific valuation techniques used to value financial instruments include:

| · | The use of quoted market prices or dealer quotes for similar instruments. |

| · | The market-to-market fair value of the Company's outstanding derivative instruments is based on independently provided market rates and determined using standard valuation techniques, including the impact of counterparty credit risk and are within level 2 of the fair value hierarchy. |

| · | The fair value of the remaining financial instruments is determined using discounted cash flow analysis. All of the resulting fair value estimates are included in level 2. |

23

GEOPARK LIMITED

30 JUNE 2017

Note 16 (Continued)

Fair value measurement of financial instruments (Continued)

(c) Fair values of other financial instruments (unrecognised)

The Group also has a number of financial instruments which are not measured at fair value in the balance sheet. For the majority of these instruments, the fair values are not materially different to their carrying amounts, since the interest receivable/payable is either close to current market rates or the instruments are short-term in nature.

Borrowings are comprised primarily of fixed rate debt and variable rate debt with a short term portion where interest has already been fixed. They are classified under other financial liabilities and measured at their amortized cost. The Group estimates that the fair value of its main financial liabilities is approximately 95% of its carrying amount including interests accrued as of 31 March 2017 and as of 31 December 2016. Fair values were calculated using discounted cash flow analysis.

Note 17

Subsequent Events

Commodity risk management contracts

On 28 July 2017, the Group entered into new derivative financial instruments to manage its exposure to oil price risk. These derivatives were zero-premium collars and were placed with major financial institutions and commodity traders. The Group entered into the derivatives under ISDA Master Agreements and Credit Support Annexes, which provide credit lines for collateral posting thus alleviating possible liquidity needs under the instruments and protect the Group from potential non-performance risk by its counterparties. The following table includes the detail information:

| Period | Reference | Type | Volume bbl/d | Price US$/bbl |

| 1 October 2017 – 31 March 2018 | ICE BRENT | Zero Premium Collar | 4,000 | 50.0 Put 54.90 Call |

| 1 October 2017 – 31 March 2018 | ICE BRENT | Zero Premium Collar | 2,000 | 50.0 Put 54.95 Call |

Capital commitments

Subsequent events related to capital commitments are detailed in Note 15.

24

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| GeoPark Limited | |||||

| By: | /s/ Andrés Ocampo | ||||

| Name: | Andrés Ocampo | ||||

| Title: | Chief Financial Officer | ||||

Date: August 17, 2017