- GPRK Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

6-K Filing

GeoPark Limited (GPRK) 6-KCurrent report (foreign)

Filed: 1 Jul 21, 8:47am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2021

Commission File Number: 001-36298

GeoPark Limited

(Exact name of registrant as specified in its charter)

Calle 94 N° 11-30 8° piso

Bogota, Colombia

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

| Form 20-F | ☒ | Form 40-F | ☐ |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

| Yes | ☐ | No | ☒ |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

| Yes | ☐ | No | ☒ |

GEOPARK LIMITED

TABLE OF CONTENTS

| ITEM | |

| 1. | GeoPark’s Letter to Shareholders dated July 1, 2021. |

| 2. | Presentation dated June 2021 titled “Consistent Performance and Value Delivery.” |

Item 1

July 1, 2021

Dear Fellow GeoPark Shareholder,

Over nearly two decades, GeoPark’s management team and Board have built the Company into one of the leading independent E&P companies in Latin America, with an unparalleled track record of more than 18 years of steady annual production growth, despite external volatility. Today, GeoPark is flexible and disciplined, and our proven leadership team is successfully executing on our strategy focused on low-cost, high-margin assets. Overseeing this strategy is a highly experienced, independent and accountable Board of Directors.

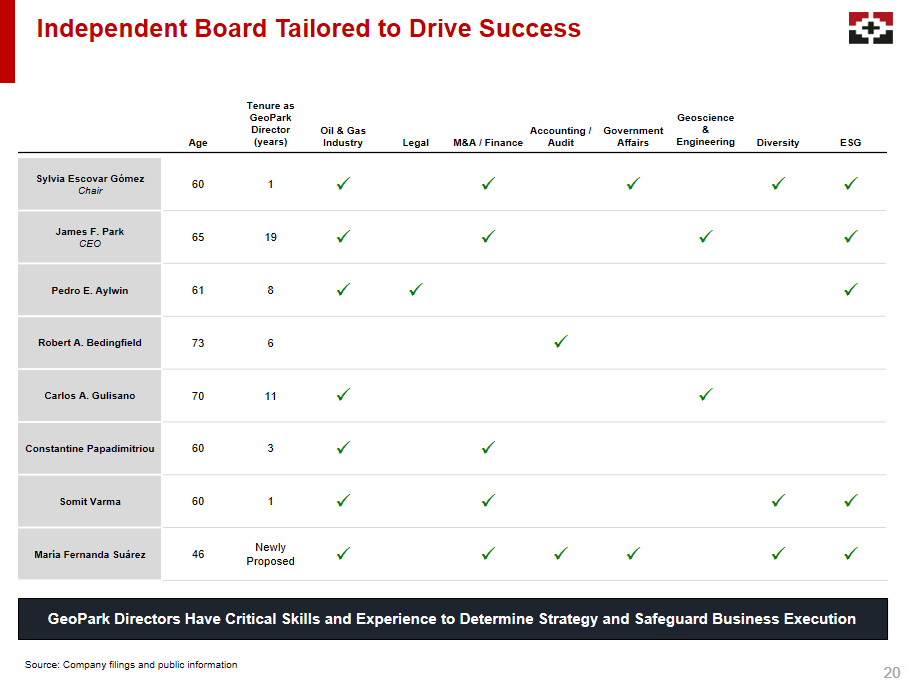

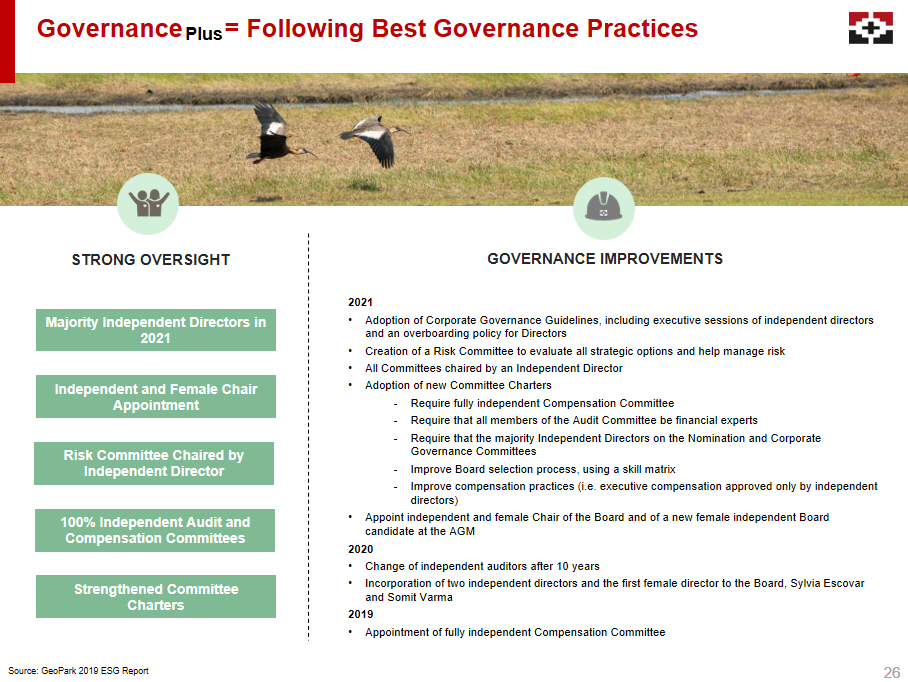

For the past several years, GeoPark has engaged in deliberate efforts to strengthen the Company’s governance by refreshing our Board to align it with best practices, including adding two new independent directors in the past 12 months, nominating a third independent director at this year’s Annual General Meeting of Shareholders, and appointing a new independent Chair. Our majority independent Board has the right experience to support our evolving strategy, including significant experience in Colombia, where more than 90% of our business is currently located.

Today, our Board contains more diversity of thought, encourages a free and open expression of ideas and opinions, and carefully and objectively evaluates all value creation opportunities for shareholders. We continue to make changes to improve our governance, regularly review the mix of skills and experience on our Board and are committed to continuous refreshment.

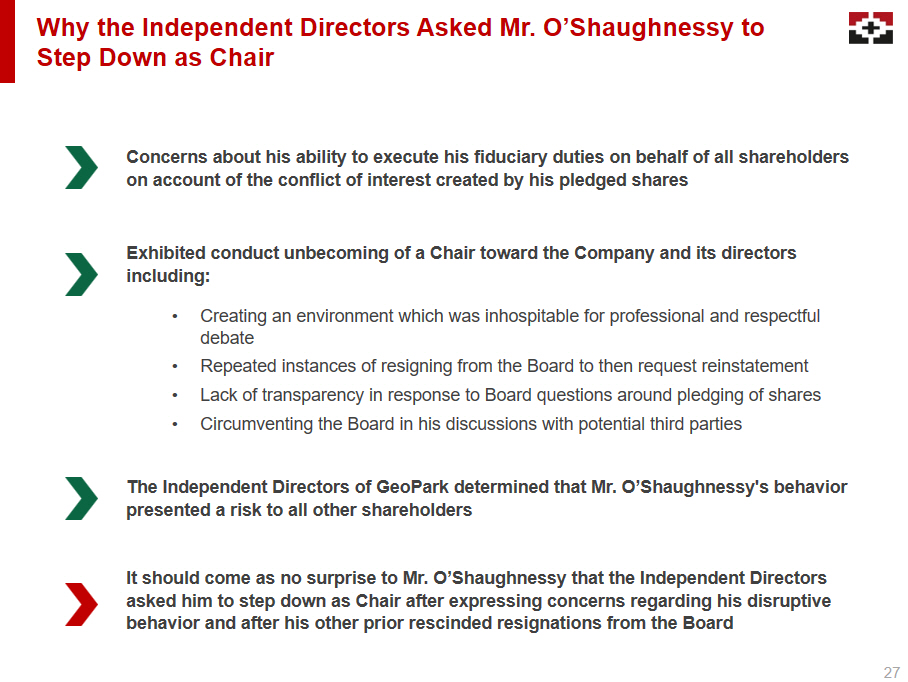

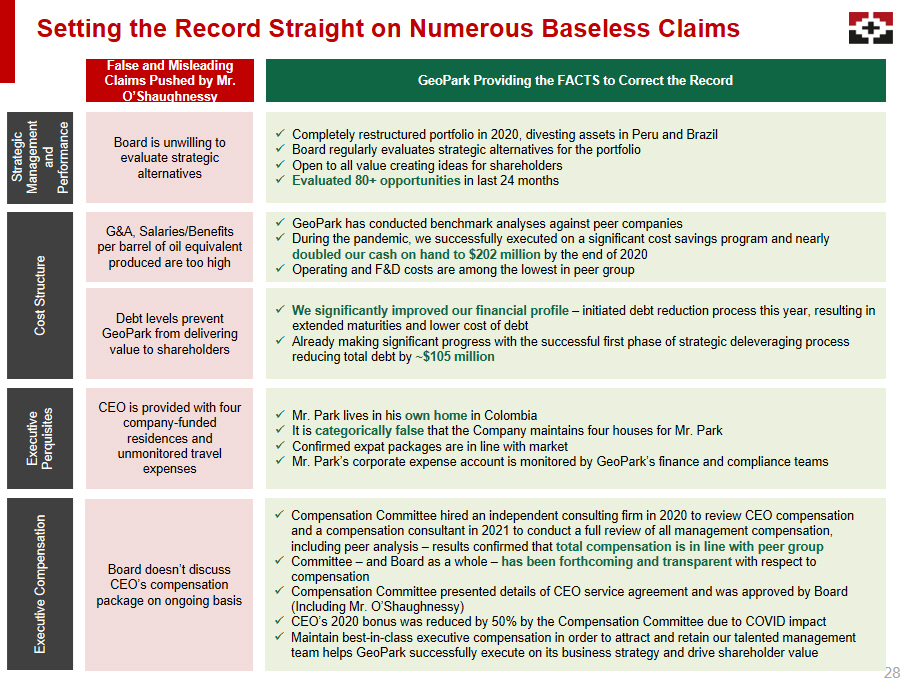

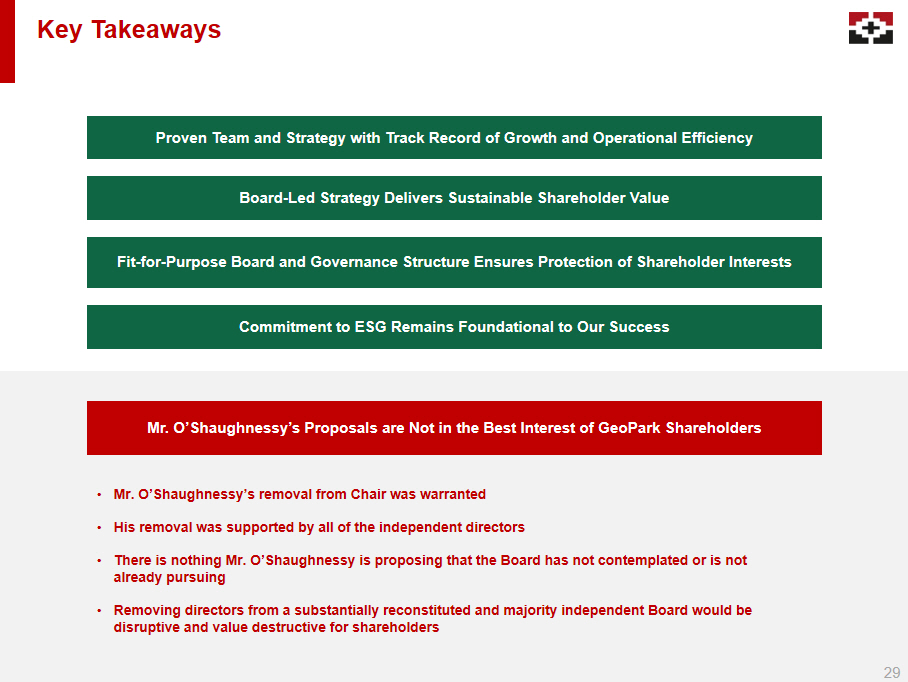

GeoPark’s Co-Founder and former Chairman, Gerry O’Shaughnessy, recently launched a “withhold” campaign in which he is soliciting votes against four of GeoPark’s incumbent directors on a separate proxy card at our upcoming Annual General Meeting. Gerry’s disruptive behavior on the Board, coupled with the fact that the majority of his shares in GeoPark are pledged as collateral, raises serious concerns about his ability to act in the best interests of all shareholders. Gerry is not an agent of change – in fact, historically he has been an impediment to positive change and corporate governance improvements. Gerry’s presentation and letters to shareholders contain false and misleading information. There is nothing he is suggesting that the Board has not contemplated or is not already pursuing. To protect your investment in GeoPark, it is important that you dismiss Gerry’s baseless claims against the Company and discard any blue proxy card you may receive.

Your vote at our Annual General Meeting of Shareholders, scheduled for July 15, 2021, is important. We strongly urge you to vote the WHITE proxy card FOR all 8 of GeoPark’s highly qualified directors and discard any materials with the blue proxy card you may receive from Gerry O’Shaughnessy.

|

We recently released an investor presentation detailing the Company's Board-led strategy that is delivering consistent growth, operational efficiency and sustainable shareholder value. The presentation also details the Company’s fit-for-purpose Board of Directors and governance structure that is protecting shareholder interests. The presentation can be found at https://www.geo-park.com/en/investor-support/.

Highlights from the presentation include:

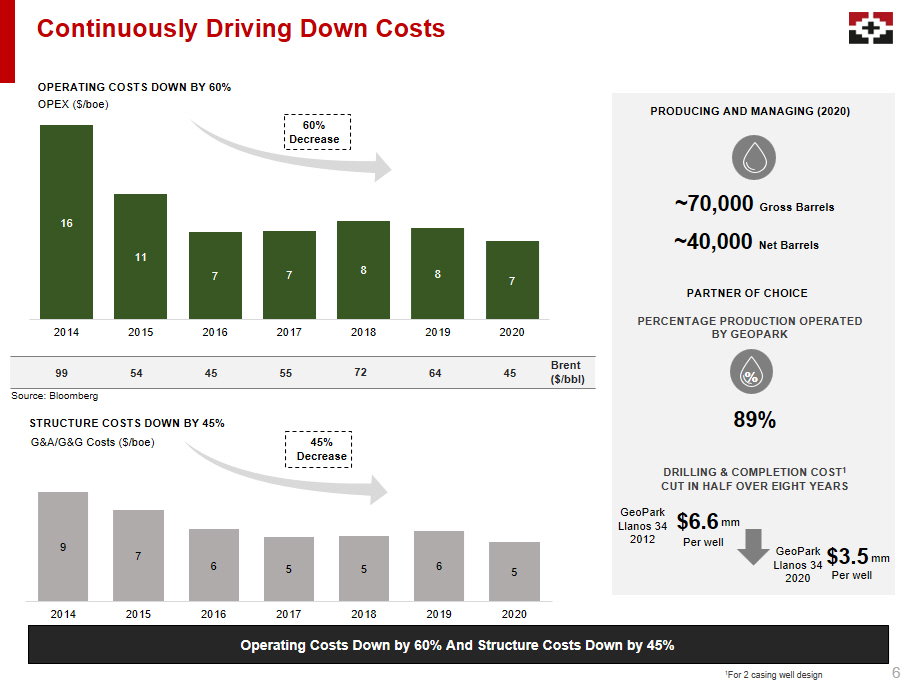

| · | GeoPark has a proven team and strategy with a more than 18-year track record of growth and operational efficiency, which supports high margins even during times of fluctuating oil prices. Over the past six years, we’ve decreased operating costs by 60% and decreased structure costs by 45%, while steadily growing annual production. Our operational expertise, technical know-how, and ability to operate and drill at a lower cost has earned us a strong reputation in the region and makes us the operating partner of choice. |

| · | Our Board-led strategy delivers sustainable shareholder value, including Total Shareholder Returns of 371% over the past 5 years1, which is well in excess of GeoPark’s peers. Our entire Board is focused on the best interests of the Company and our shareholders. We are always open to – and have a track record of pursuing – opportunities that will create value. |

| · | Our fit-for-purpose Board and governance structure ensure the protection of shareholder interests. We continue to make changes to improve our governance, and our directors have the appropriate mix of independence, skills and experience to hold management accountable and objectively pursue strategies that maximize shareholder value. |

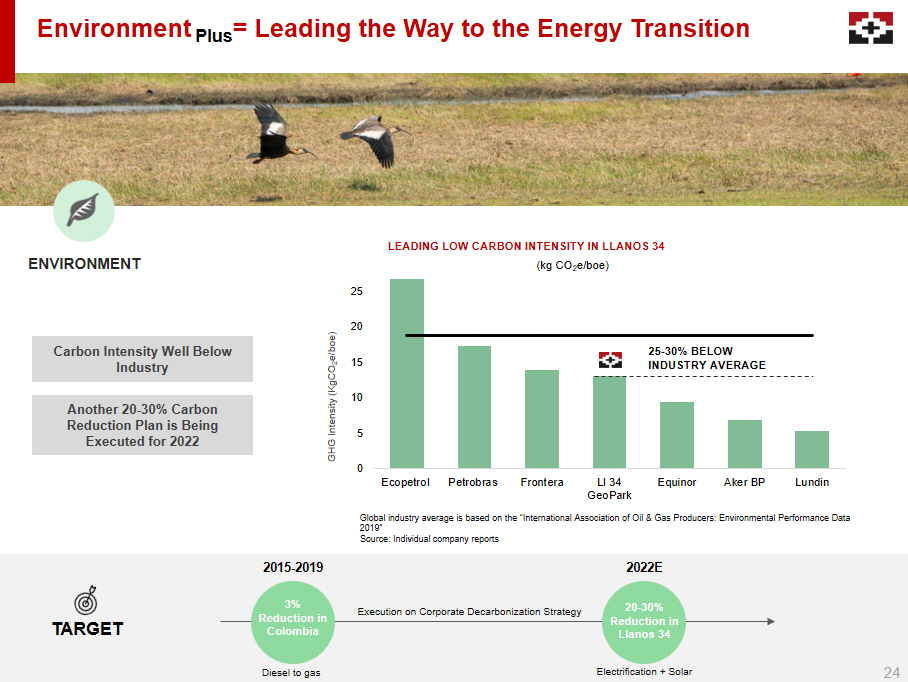

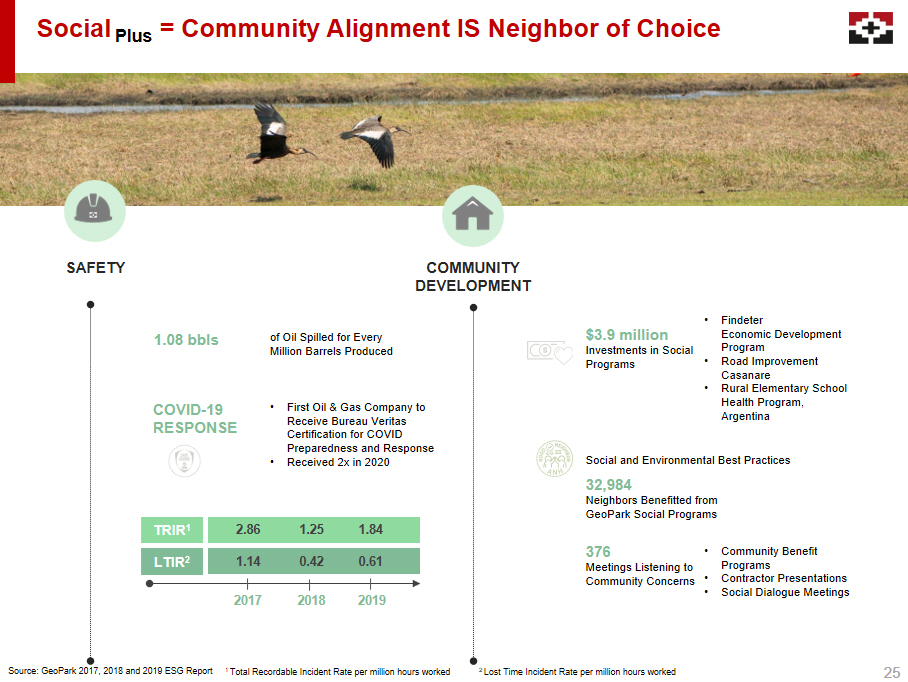

| · | Our commitment to ESG remains foundational to our success. We continue to prioritize SPEED (Safety, Prosperity, Employees, Environment and Community Development), our integrated value system that is integral to our strategy. We are focused on reducing our carbon footprint and minimizing social and environmental impacts with clear and defined goals. Our culture of diversity has resulted in 42% of our leadership team being gender diverse, which is almost twice the industry average. |

| · | Mr. O’Shaughnessy proved unable to serve as an effective Chair and change was needed. As Chair, Mr. O’Shaughnessy created a Boardroom environment that was inhospitable for professional and respectful debate, and 88.7% of his shares were pledged as collateral as of December 31, 2020, which raised concerns that he was acting out of self-interest as opposed to what was in the best interests of all shareholders. The decision to ask him to step down as Chair was initiated by GeoPark’s Independent Directors, with no involvement of the non-independent directors or Company management – and was unanimously approved by the entire Board. It is unfortunate that after resigning from the Board, he continues to make false claims about GeoPark’s strategy, leadership and oversight. |

Your Board and management team are continuing to drive growth and deliver consistent, sustainable value, while also maintaining GeoPark as one of the safest, lowest cost operators in the region. Don’t risk derailing that process by voting in line with an individual whose interests are not aligned with those of all shareholders.

Sincerely,

The GeoPark Board of Directors

WE STRONGLY URGE YOU TO VOTE “FOR” ALL 8 OF OUR BOARD NOMINEES

TO PROTECT THE VALUE OF YOUR INVESTMENT

VOTE USING THE WHITE CARD TODAY

1 Capital IQ as of 17-Jun-21

Your vote is important. Please discard any blue proxy cards you may receive from Gerry O’Shaughnessy. If you have already returned a blue proxy card, you can change your vote simply by voting by telephone or via the Internet by following the instructions on the enclosed WHITE proxy card or by signing, dating and returning a WHITE proxy card today. Only your latest-dated proxy card will be counted.

If you have questions about how to vote your shares, please contact:

INNISFREE M&A INCORPORATED

Shareholders, Call Toll-Free: (877) 750-8166

Banks and Brokers, Call Collect: (212) 750-5833

NOTICE

A copy of GeoPark’s proxy statement and related materials as furnished to the SEC is available at no charge on the SEC website at www.sec.gov. In addition, copies of the proxy statement and other documents may be obtained free of charge by accessing the Company’s website at www.geo-park.com or at www.envisionreports.com/GPRK/2021/1B327AP21E/default.htm?voting=true.

CAUTIONARY STATEMENTS RELEVANT TO FORWARD-LOOKING INFORMATION

This press release contains statements that constitute forward-looking statements. Many of the forward- looking statements contained in this press release can be identified by the use of forward-looking words such as ‘‘anticipate,’’ ‘‘believe,’’ ‘‘could,’’ ‘‘expect,’’ ‘‘should,’’ ‘‘plan,’’ ‘‘intend,’’ ‘‘will,’’ ‘‘estimate’’ and ‘‘potential,’’ among others.

Forward-looking statements that appear in a number of places in this press release include, but are not limited to, statements regarding the intent, belief or current expectations, regarding various matters, including the composition of the Board of Directors, the Board’s evolution and diversification, GeoPark’s focus on value creation for shareholders and its focus on reducing our carbon footprint and minimizing social and environmental impacts. Forward-looking statements are based on management’s beliefs and assumptions, and on information currently available to the management. Such statements are subject to risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking statements due to various factors.

Forward-looking statements speak only as of the date they are made, and the Company does not undertake any obligation to update them in light of new information or future developments or to release publicly any revisions to these statements in order to reflect later events or circumstances, or to reflect the occurrence of unanticipated events. For a discussion of the risks facing the Company which could affect whether these forward-looking statements are realized, see filings with the U.S. Securities and Exchange Commission (SEC).

Item 2

Consistent Performance and Value Delivery June 2021

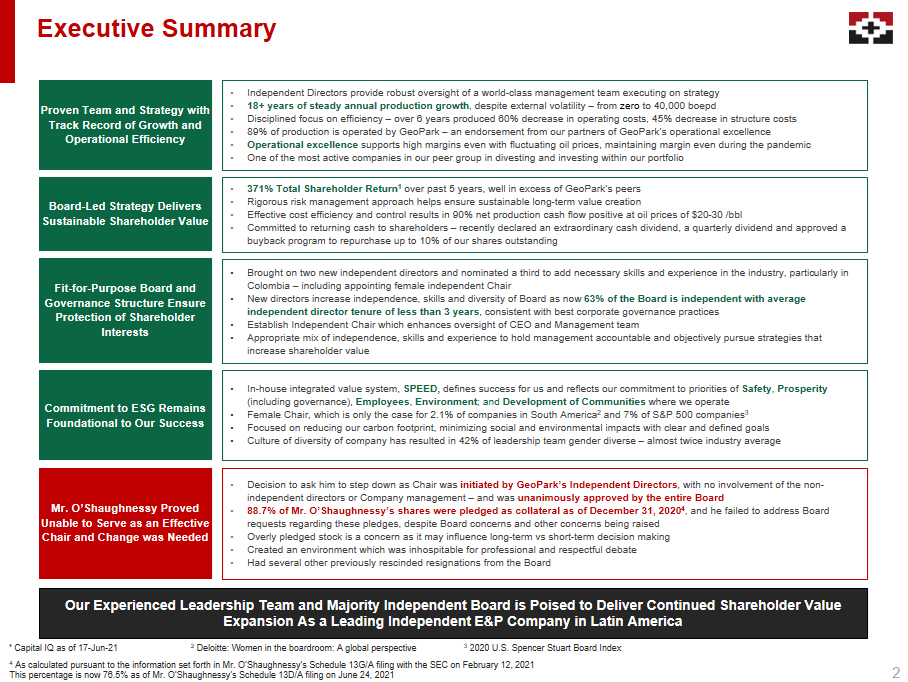

2 Executive Summary Our Experienced Leadership Team and Majority Independent Board is Poised to Deliver Continued Shareholder Value Expansion As a Leading Independent E&P Company in Latin America Proven Team and Strategy with Track Record of Growth and Operational Efficiency • Independent Directors provide robust oversight of a world - class management team executing on strategy • 18+ years of steady annual production growth , despite external volatility – from zero to 40,000 boepd • Disciplined focus on efficiency – over 6 years produced 60% decrease in operating costs, 45% decrease in structure costs • 89% of production is operated by GeoPark – an endorsement from our partners of GeoPark’s operational excellence • Operational excellence supports high margins even with fluctuating oil prices, maintaining margin even during the pandemic • One of the most active companies in our peer group in divesting and investing within our portfolio Commitment to ESG Remains Foundational to Our Success • In - house integrated value system, SPEED, defines success for us and reflects our commitment to priorities of Safety , Prosperity (including governance), Employees , Environment ; and Development of Communities where we operate • Female Chair, which is only the case for 2.1% of companies in South America 2 and 7% of S&P 500 companies 3 • Focused on reducing our carbon footprint, minimizing social and environmental impacts with clear and defined goals • Culture of diversity of company has resulted in 42% of leadership team gender diverse – almost twice industry average Mr. O’Shaughnessy Proved Unable to Serve as an Effective Chair and Change was Needed • Decision to ask him to step down as Chair was initiated by GeoPark’s Independent Directors , with no involvement of the non - independent directors or Company management – and was unanimously approved by the entire Board • 88.7% of Mr. O’Shaughnessy’s shares were pledged as collateral as of December 31, 2020 4 , and he failed to address Board requests regarding these pledges, despite Board concerns and other concerns being raised • Overly pledged stock is a concern as it may influence long - term vs short - term decision making • Created an environment which was inhospitable for professional and respectful debate • Had several other previously rescinded resignations from the Board Board - Led Strategy Delivers Sustainable Shareholder Value • 371% Total Shareholder Return 1 over past 5 years, well in excess of GeoPark’s peers • Rigorous risk management approach helps ensure sustainable long - term value creation • Effective cost efficiency and control results in 90% net production cash flow positive at oil prices of $20 - 30 / bbl • Committed to returning cash to shareholders – recently declared an extraordinary cash dividend, a quarterly dividend and approve d a buyback program to repurchase up to 10% of our shares outstanding Fit - for - Purpose Board and Governance Structure Ensure Protection of Shareholder Interests • Brought on two new independent directors and nominated a third to add necessary skills and experience in the industry, partic ula rly in Colombia – including appointing female independent Chair • New directors increase independence, skills and diversity of Board as now 63% of the Board is independent with average independent director tenure of less than 3 years , consistent with best corporate governance practices • Establish Independent Chair which enhances oversight of CEO and Management team • Appropriate mix of independence, skills and experience to hold management accountable and objectively pursue strategies that increase shareholder value ¹ Capital IQ as of 17 - Jun - 21 2 Deloitte: Women in the boardroom: A global perspective 3 2020 U.S. Spencer Stuart Board Index 4 As calculated pursuant to the information set forth in Mr. O’Shaughnessy’s Schedule 13G/A filing with the SEC on February 12, 2 021 This percentage is now 76.5% as of Mr. O’Shaughnessy’s Schedule 13D/A filing on June 24, 2021

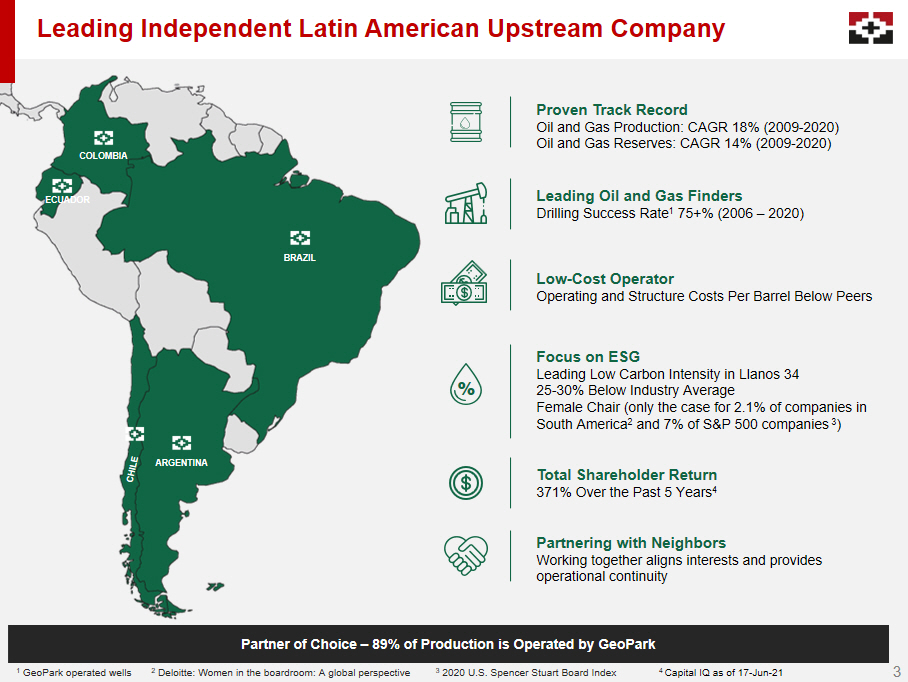

3 ARGENTINA COLOMBIA ECUADOR BRAZIL Leading Independent Latin American Upstream Company Partner of Choice – 89% of Production is Operated by GeoPark Proven Track Record Oil and Gas Production: CAGR 18% (2009 - 2020) Oil and Gas Reserves: CAGR 14% (2009 - 2020) Leading Oil and Gas Finders Drilling Success Rate 1 75+% (2006 – 2020) Low - Cost Operator Operating and Structure Costs Per Barrel Below Peers Focus on ESG Leading Low Carbon Intensity in Llanos 34 25 - 30% Below Industry Average Female Chair (only the case for 2.1% of companies in South America 2 and 7% of S&P 500 companies 3 ) Total Shareholder Return 371% Over the Past 5 Years 4 Partnering with Neighbors Working together aligns interests and provides operational continuity % 1 GeoPark operated wells 2 Deloitte: Women in the boardroom: A global perspective 3 2020 U.S. Spencer Stuart Board Index 4 Capital IQ as of 17 - Jun - 21 3

4 Proven and Diverse Leadership Team James F. Park Co - founder / CEO / Board Director • Basic Resources International S.A. • GoodRock LLC Andrés Ocampo CFO 11 years at GeoPark Augusto Zubillaga COO 15 years at GeoPark Pedro E. Aylwin Director of Legal and Governance 18 years at GeoPark Experience Marcela Vaca Asset Managing Director 9 years at GeoPark Martín Terrado Director of Operations 3 years at GeoPark Adriana La Rotta Director of Connections 3 years at GeoPark Salvador Minniti Director of Exploration 14 years at GeoPark Norma Sanchez Director of Nature and Neighbors 9 years at GeoPark Agustina Wisky Director of Capacities and Culture 19 years at GeoPark Stacy Steimel Director of Shareholder Value 4 years at GeoPark Ignacio Mazariegos Director of New Business 11 years at GeoPark Experience Successful Management Strategy – Agile Decision - Making Team with High Degree of Autonomy and Delegation

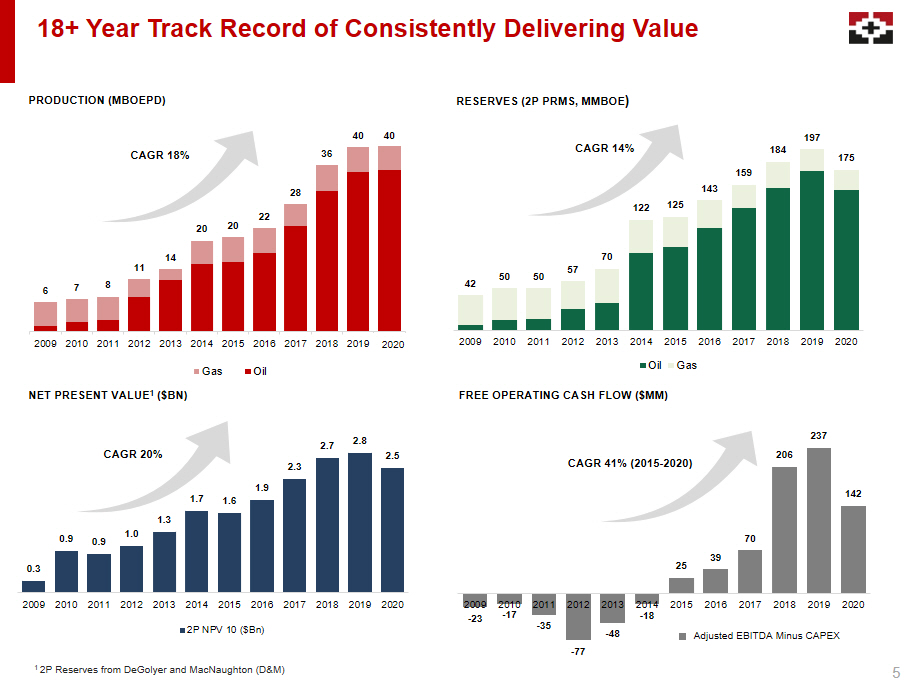

5 6 7 8 11 14 20 20 22 28 36 40 40 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Gas Oil 0.3 0.9 0.9 1.0 1.3 1.7 1.6 1.9 2.3 2.7 2.8 2.5 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2P NPV 10 ($Bn) 42 50 50 57 70 122 125 143 159 184 197 175 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Oil Gas CAGR 20% PRODUCTION (MBOEPD) RESERVES (2P PRMS, MMBOE ) NET PRESENT VALUE 1 ($BN) CAGR 14% CAGR 18% - 23 - 17 - 35 - 77 - 48 - 18 25 39 70 206 237 142 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Adjusted EBITDA Minus CAPEX CAGR 41% (2015 - 2020) FREE OPERATING CASH FLOW ($MM) 1 2P Reserves from DeGolyer and MacNaughton (D&M ) 2020 18+ Year Track Record of Consistently Delivering Value

6 Continuously Driving Down Costs PRODUCING AND MANAGING (2020) ~ 70,000 Gross Barrels PERCENTAGE PRODUCTION OPERATED BY GEOPARK 89% % 45% Decrease G&A/G&G Costs ($/ boe ) STRUCTURE COSTS DOWN BY 45% 60% Decrease OPERATING COSTS DOWN BY 60 % OPEX ($/ boe ) 54 45 55 7 2 64 45 Brent ($/ bbl ) 99 Operating Costs Down by 60% And Structure Costs Down by 45% DRILLING & COMPLETION COST 1 CUT IN HALF OVER EIGHT YEARS GeoPark Llanos 34 2012 $6.6 GeoPark Llanos 34 2020 $3.5 PARTNER OF CHOICE ~ 40,000 Net Barrels Per well Per well Source: Bloomberg mm mm 16 11 7 7 8 8 7 2014 2015 2016 2017 2018 2019 2020 9 7 6 5 5 6 5 2014 2015 2016 2017 2018 2019 2020 1 For 2 casing well design

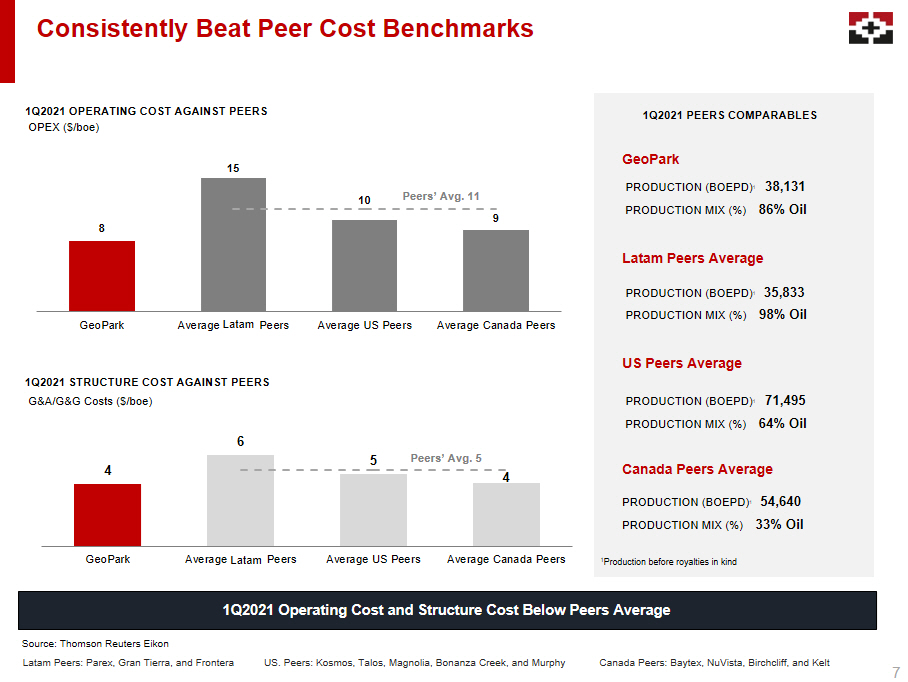

7 4 6 5 4 GeoPark Average LatAm Peers Average US Peers Average Canada Peers 8 15 10 9 GeoPark Average LatAm Peers Average US Peers Average Canada Peers Consistently Beat Peer Cost Benchmarks 1Q2021 OPERATING COST AGAINST PEERS OPEX ($/boe) 1Q2021 STRUCTURE COST AGAINST PEERS G&A/G&G Costs ($/boe) GeoPark 1Q2021 PEERS COMPARABLES Latam Peers Average PRODUCTION (BOEPD) 1 38,131 PRODUCTION MIX (%) 86% Oil PRODUCTION (BOEPD) 1 35,833 PRODUCTION MIX (%) 98% Oil PRODUCTION (BOEPD) 1 71,495 PRODUCTION MIX (%) 64% Oil PRODUCTION (BOEPD) 1 54,640 PRODUCTION MIX (%) 33% Oil 1Q2021 Operating Cost and Structure Cost Below Peers Average 1 Production before royalties in kind US Peers Average Canada Peers Average Peers ’ Avg . 11 Latam Peers: Parex , Gran Tierra, and Frontera US. Peers: Kosmos , Talos, Magnolia, Bonanza Creek, and Murphy Canada Peers: Baytex , NuVista , Birchcliff , and Kelt Source: Thomson Reuters Eikon Peers ’ Avg . 5 Latam Latam

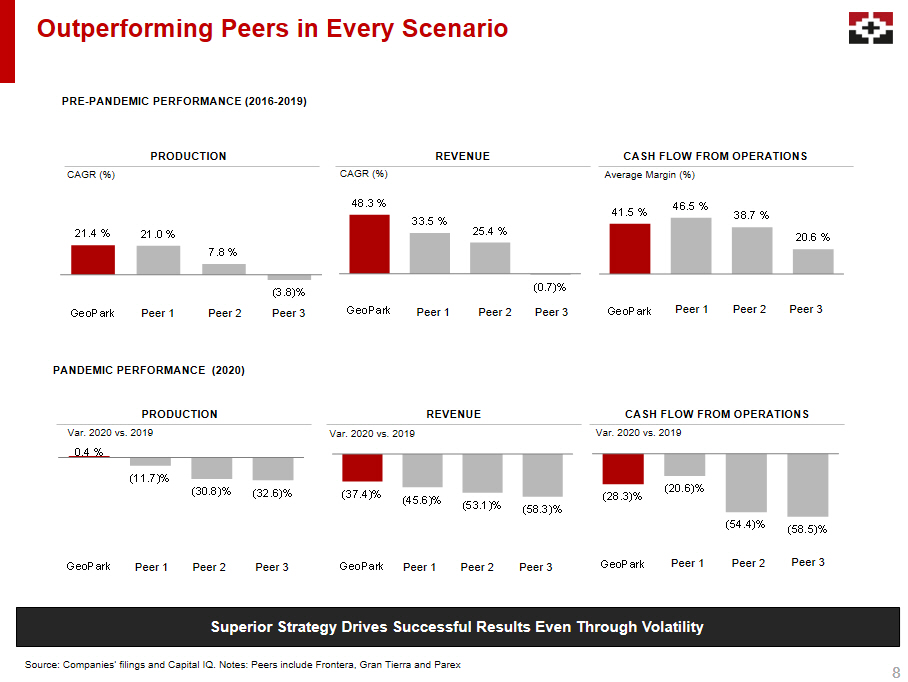

8 (28.3)% (20.6)% (54.4)% (58.5)% GeoPark Parex Gran Tierra Frontera 41.5 % 46.5 % 38.7 % 20.6 % GeoPark Parex Gran Tierra Frontera Outperforming Peers in Every Scenario 8 Source : Companies’ filings and Capital IQ. Notes: Peers include Frontera, Gran Tierra and Parex PRE - PANDEMIC PERFORMANCE (2016 - 2019) PRODUCTION REVENUE CASH FLOW FROM OPERATIONS PANDEMIC PERFORMANCE (2020) PRODUCTION REVENUE CASH FLOW FROM OPERATIONS 21.4 % 21.0 % 7.8 % (3.8)% GeoPark Parex Gran Tierra Frontera 48.3 % 33.5 % 25.4 % (0.7)% GeoPark Parex Gran Tierra Frontera 0.4 % (11.7)% (30.8)% (32.6)% GeoPark Parex Gran Tierra Frontera (37.4)% (45.6)% (53.1)% (58.3)% GeoPark Parex Frontera Gran Tierra Superior Strategy Drives Successful Results Even Through Volatility Peer 1 Peer 2 Peer 3 Peer 1 Peer 2 Peer 3 Peer 1 Peer 2 Peer 3 Peer 1 Peer 2 Peer 3 Peer 1 Peer 2 Peer 3 Peer 1 Peer 2 Peer 3 CAGR (%) CAGR (%) Average Margin (%) Var. 2020 vs. 2019 Var. 2020 vs. 2019 Var. 2020 vs. 2019

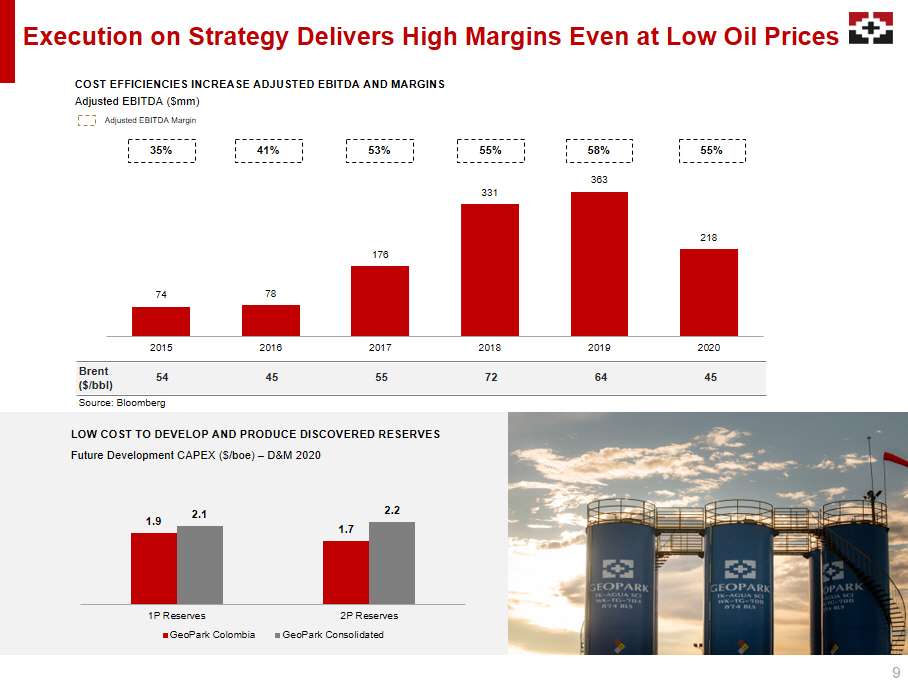

9 74 78 176 331 363 218 2015 2016 2017 2018 2019 2020 Execution on Strategy Delivers High Margins Even at Low Oil Prices COST EFFICIENCIES INCREASE ADJUSTED EBITDA AND MARGINS Adjusted EBITDA ($mm) Adjusted EBITDA Margin 54 45 55 72 64 45 Brent ($/bbl) LOW COST TO DEVELOP AND PRODUCE DISCOVERED RESERVES Future Development CAPEX ($/boe) – D&M 2020 1.9 1.7 2.1 2.2 1P Reserves 2P Reserves GeoPark Colombia GeoPark Consolidated 53% 55% 55% 41% 35% 58% Source: Bloomberg

10 Board - Led Strategy Delivers Sustainable Shareholder Value

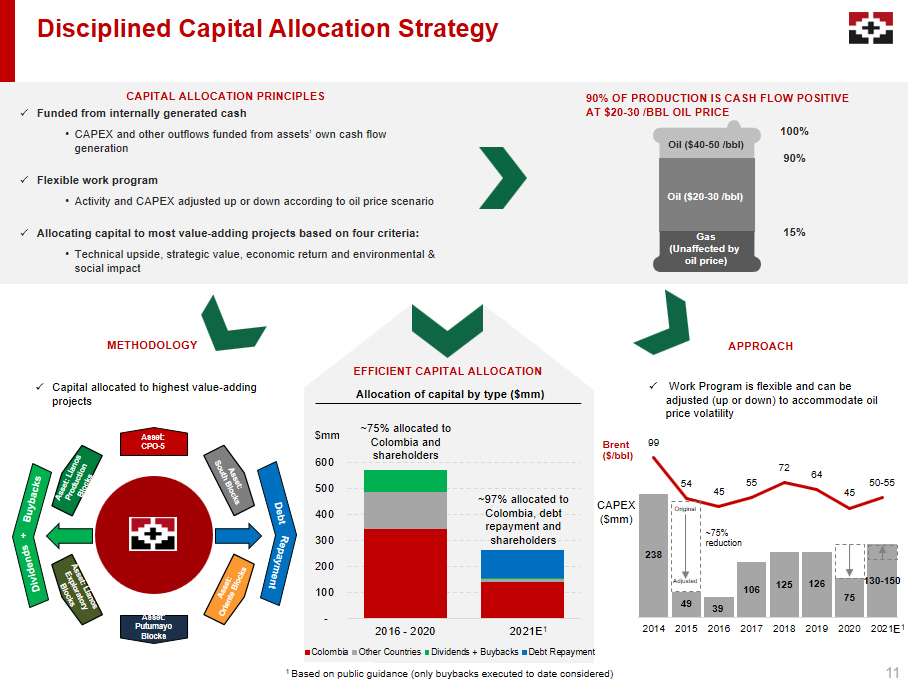

11 Disciplined Capital Allocation Strategy METHODOLOGY APPROACH x Work Program is flexible and can be adjusted (up or down) to accommodate oil price volatility EFFICIENT CAPITAL ALLOCATION x Capital allocated to highest value - adding projects 238 49 39 106 125 126 75 130 - 150 99 54 45 55 72 64 45 50 - 55 -80 -30 20 70 120 0 50 100 150 200 250 300 350 2014 2015 2016 2017 2018 2019 2020 2021 Brent ($/bbl) CAPEX ($ mm ) x Funded from internally generated cash • CAPEX and other outflows funded from assets’ own cash flow generation x Flexible work program • Activity and CAPEX adjusted up or down according to oil price scenario x Allocating capital to most value - adding projects based on four criteria: • Technical upside, strategic value, economic return and environmental & social impact CAPITAL ALLOCATION PRINCIPLES $mm Original Adjusted ~75% reduction Allocation of capital by type ($mm) Asset: CPO - 5 Asset: Putumayo Blocks 90% OF PRODUCTION IS CASH FLOW POSITIVE AT $20 - 30 /BBL OIL PRICE 15% 90% 100% Oil ($40 - 50 / bbl ) Gas (Unaffected by oil price) Oil ($20 - 30 / bbl ) + - 100 200 300 400 500 600 2016 - 2020 2021 Colombia Other Countries Dividends + Buybacks Debt Repayment ~ 97% allocated to Colombia, debt repayment and shareholders ~ 75% allocated to Colombia and shareholders 1 Based on public guidance (only buybacks executed to date considered) E 1 E 1

12 16.9 15.9 23.9 31.9 32.5 19.9 4.5 4.5 4.5 4.5 4.5 4.5 2015 2016 2017 2018 2019 2020 Operating Netback ($ /boe) Average 2P F&D (2015-2020) ($ /boe) 118 122 228 398 447 276 49 39 106 125 126 75 2015 2016 2017 2018 2019 2020 Operating Netback 2.4x Board - Led Strategy Results in Superior Returns on Capital Invested EVERY $1 INVESTED GENERATES $2 TO $3 OF TOTAL OPERATING RETURNS (in $mm) EVERY $1 INVESTED GENERATES $3 TO $7 PER BARREL (in $/ boe ) 3.1x 2.2x 3.2x 3.5x 3.7x 3x+ 3x+ 5x+ 7x+ 7x+ 4x+ 54 45 55 72 6 4 45 Brent ($/ bbl ) Peers : 1.3x Peers : 2.0x Peers : 1.9x Peers : 1.6x Peers : 2.2x Peers : 2.2x Notes: Peers include Frontera, Gran Tierra and Parex . 2P F&D is calculated as CAPEX divided by reserves added in 2015 - 2020 and does not include acquisitions Operating netback as reported by peers Source: Bloomberg CAPEX

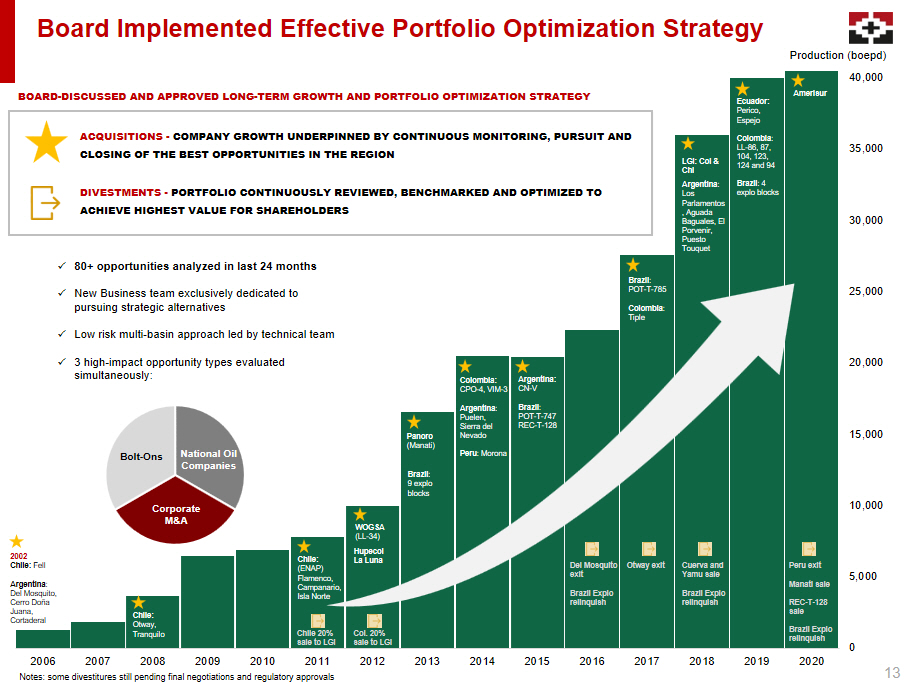

13 0 5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Board Implemented Effective Portfolio Optimization Strategy National Oil Companies Bolt - Ons Corporate M&A Chile: Otway, Tranquilo Chile: (ENAP) Flamenco, Campanario, Isla Norte WOGSA (LL - 34) Hupecol La Luna Brazil : 9 explo blocks Panoro ( Manati ) Colombia: CPO - 4, VIM - 3 Argentina : Puelen , Sierra del Nevado Peru : Morona Argentina: CN - V Brazil : POT - T - 747 REC - T - 128 Brazil : POT - T - 785 Colombia : Tiple Argentina : Los Parlamentos , Aguada Baguales, El Porvenir, Puesto Touquet LGI: Col & Chi Ecuador: Perico, Espejo Colombia : LL - 86, 87, 104, 123, 124 and 94 Brazil : 4 explo blocks Amerisur 2002 Chile: Fell Argentina : Del Mosquito, Cerro Doña Juana, Cortaderal ACQUISITIONS - COMPANY GROWTH UNDERPINNED BY CONTINUOUS MONITORING, PURSUIT AND CLOSING OF THE BEST OPPORTUNITIES IN THE REGION Production ( boepd ) Peru exit Manati sale REC - T - 128 sale Brazil Explo relinquish Cuerva and Yamu sale Brazil Explo relinquish Del Mosquito exit Brazil Explo relinquish Otway exit Chile 20% sale to LGI Col. 20% sale to LGI Notes: some divestitures still pending final negotiations and regulatory approvals DIVESTMENTS - PORTFOLIO CONTINUOUSLY REVIEWED, BENCHMARKED AND OPTIMIZED TO ACHIEVE HIGHEST VALUE FOR SHAREHOLDERS BOARD - DISCUSSED AND APPROVED LONG - TERM GROWTH AND PORTFOLIO OPTIMIZATION STRATEGY x 80+ opportunities analyzed in last 24 months x New Business team exclusively dedicated to pursuing strategic alternatives x Low risk multi - basin approach led by technical team x 3 high - impact opportunity types evaluated simultaneously:

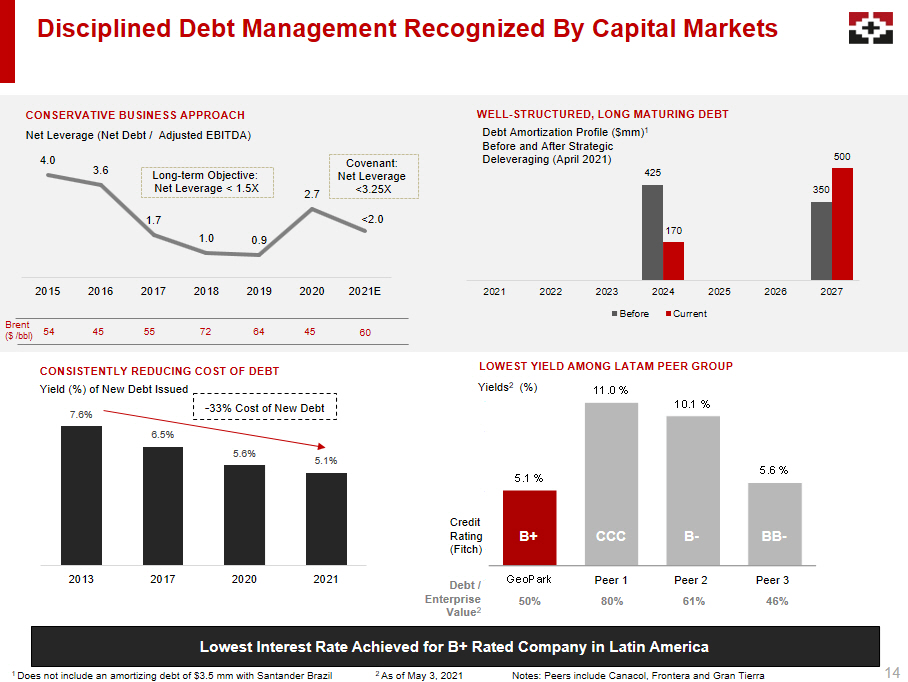

14 Covenant: Net Leverage <3.25X CONSISTENTLY REDUCING COST OF DEBT Yield (%) of New D ebt Issued WELL - STRUCTURED, LONG MATURING DEBT 54 45 55 72 64 45 Brent ($ / bbl ) Long - term Objective: Net Leverage < 1.5X 425 350 170 500 2021 2022 2023 2024 2025 2026 2027 Before Current Debt Amortization Profile ($mm) 1 Before and After Strategic Deleveraging (April 2021) 7.6 % 6.5 % 5.6% 5.1 % 2013 2017 2020 2021 - 33% Cost of New Debt 60 1 Does not include an amortizing debt of $3.5 mm with Santander Brazil 2 As of May 3, 2021 Notes: Peers include Canacol, Frontera and Gran Tierra CONSERVATIVE BUSINESS APPROACH Net Leverage (Net Debt / Adjusted EBITDA) Lowest Interest R ate A chieved for B+ Rated C ompany in Latin America 4.0 3.6 1.7 1.0 0.9 2.7 <2.0 2015 2016 2017 2018 2019 2020 2021E Disciplined Debt Management Recognized By Capital Markets 5.1 % 11.0 % 10.1 % 5.6 % (1.0)% 1.0 % 3.0 % 5.0 % 7.0 % 9.0 % 11.0 % 13.0 % GeoPark Gran Tierra Frontera Canacol LOWEST YIELD AMONG LATAM PEER GROUP Yields 2 (%) B+ B - Credit Rating (Fitch) CCC BB - Peer 1 Peer 2 Peer 3 Debt / Enterprise Value 2 50 % 80 % 61 % 46 %

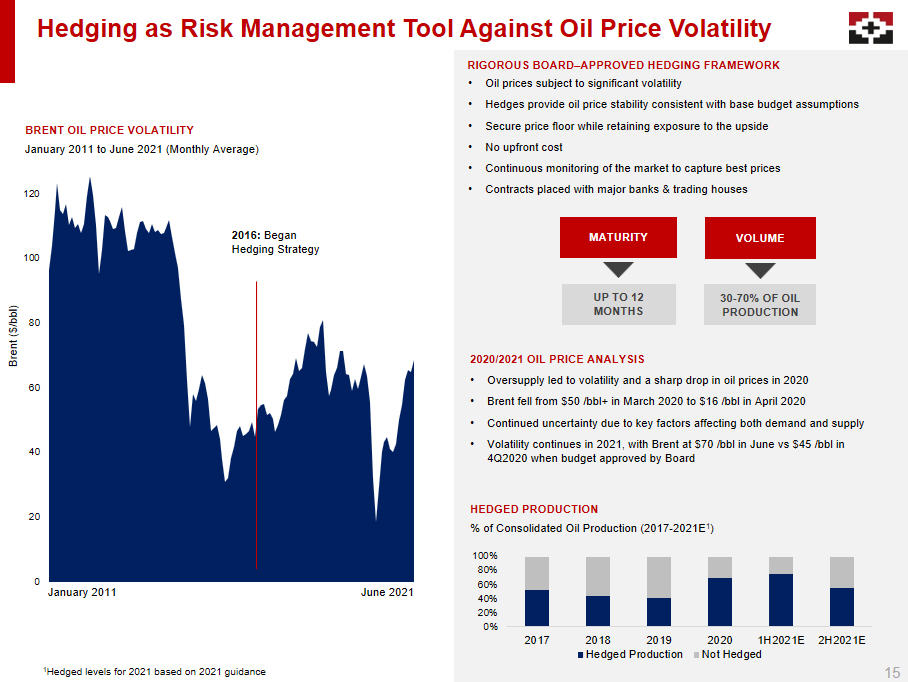

15 Hedging as Risk Management Tool Against Oil Price Volatility HEDGED PRODUCTION % of Consolidated Oil Production (2017 - 2021E 1 ) 2020/2021 OIL PRICE ANALYSIS • Oversupply led to volatility and a sharp drop in oil prices in 2020 • Brent fell from $50 / bbl + in March 2020 to $16 / bbl in April 2020 • Continued uncertainty due to key factors affecting both demand and supply • Volatility continues in 2021, with Brent at $70 / bbl in June vs $45 / bbl in 4Q2020 when budget approved by Board Brent ($/ bbl ) BRENT OIL PRICE VOLATILITY January 2011 to June 2021 (Monthly Average) 0 20 40 60 80 100 120 January 2011 June 2021 RIGOROUS BOARD – APPROVED HEDGING FRAMEWORK • Oil prices subject to significant volatility • Hedges provide oil price stability consistent with base budget assumptions • Secure price floor while retaining exposure to the upside • No upfront cost • Continuous monitoring of the market to capture best prices • Contracts placed with major banks & trading houses MATURITY UP TO 12 MONTHS VOLUME 30 - 70% OF OIL PRODUCTION 2016: Began Hedging Strategy 0% 20% 40% 60% 80% 100% 2017 2018 2019 2020 1H2021E 2H2021E Hedged Production Not Hedged 15 1 Hedged levels for 2021 based on 2021 guidance

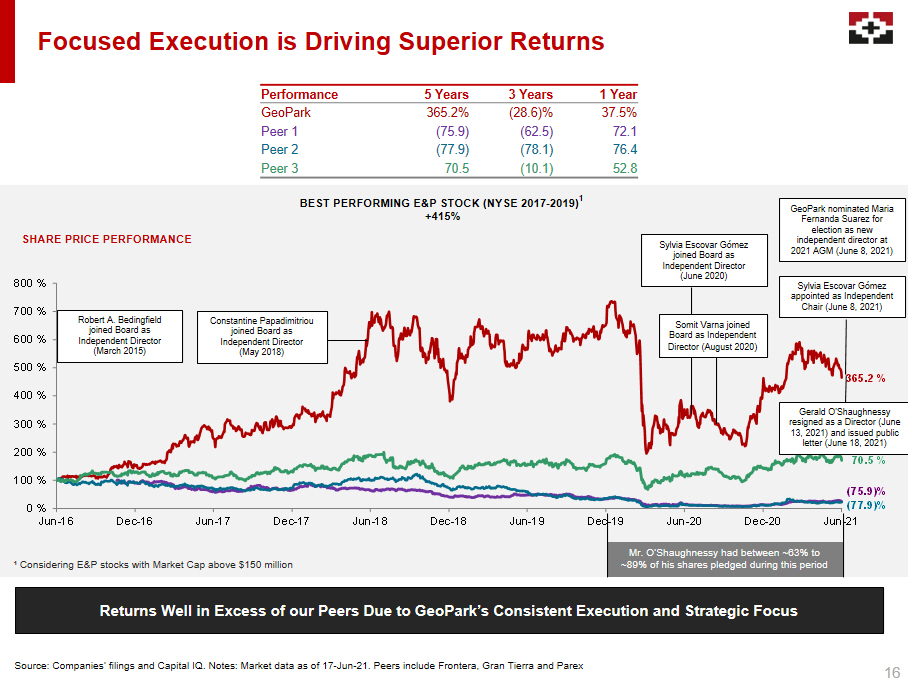

16 365.2 % (75.9)% (77.9)% 70.5 % 0 % 100 % 200 % 300 % 400 % 500 % 600 % 700 % 800 % Jun-16 Dec-16 Jun-17 Dec-17 Jun-18 Dec-18 Jun-19 Dec-19 Jun-20 Dec-20 Jun-21 SHARE PRICE PERFORMANCE Source: Companies’ filings and Capital IQ. Notes : Market data as of 17 - Jun - 21. Peers include Frontera, Gran Tierra and Parex Returns Well in Excess of our Peers Due to GeoPark’s Consistent Execution and Strategic Focus Focused Execution is Driving Superior Returns Performance 5 Years 3 Years 1 Year GeoPark 365.2% (28.6)% 37.5% Peer 1 (75.9) (62.5) 72.1 Peer 2 (77.9) (78.1) 76.4 Peer 3 70.5 (10.1) 52.8 Constantine Papadimitriou joined Board as Independent Director (May 2018) Sylvia Escovar Gómez joined Board as Independent Director (June 2020) Somit Varna joined Board as Independent Director (August 2020 ) GeoPark nominated Maria Fernanda Suarez for election as new independent director at 2021 AGM (June 8, 2021) Sylvia Escovar Gómez appointed as Independent Chair (June 8, 2021) Gerald O'Shaughnessy resigned as a Director (June 13, 2021) and issued public letter (June 18, 2021) Mr. O’Shaughnessy had between ~63% to ~89% of his shares pledged during this period BEST PERFORMING E&P STOCK (NYSE 2017 - 2019) 1 +415% ¹ Considering E&P stocks with Market Cap above $150 million Robert A. Bedingfield joined Board as Independent Director (March 2015)

17 Fit - for - Purpose Board and Governance Structure Ensure Protection of Shareholder Interests

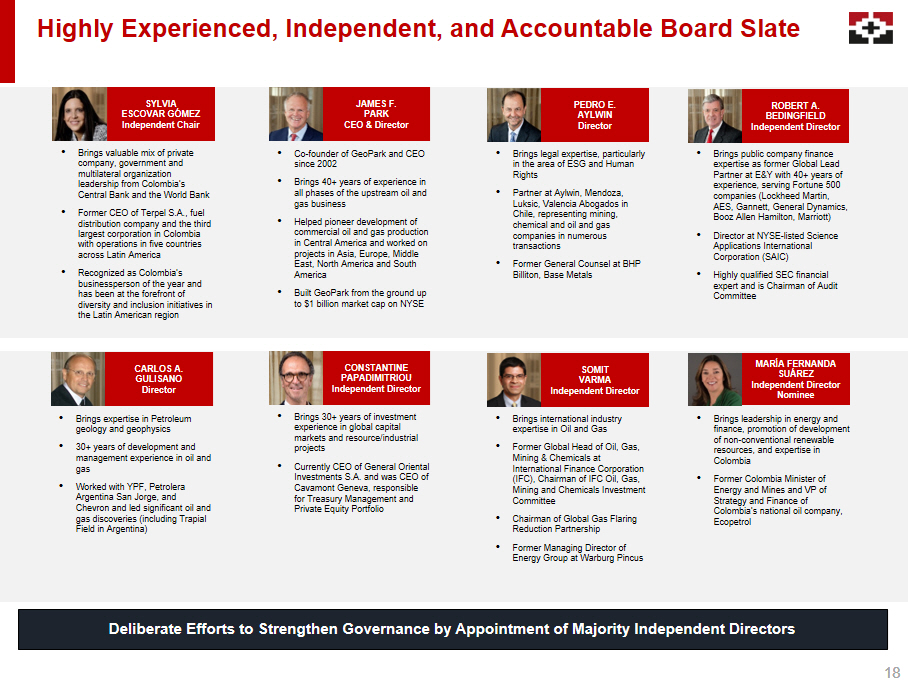

18 Highly Experienced, Independent, and Accountable Board Slate 18 • Brings valuable mix of private company, government and multilateral organization leadership from Colombia’s Central Bank and the World Bank • Former CEO of Terpel S.A., fuel distribution company and the third largest corporation in Colombia with operations in five countries across Latin America • R ecognized as Colombia’s businessperson of the year and has been at the forefront of diversity and inclusion initiatives in the Latin American region • Brings public company finance expertise as former Global Lead Partner at E&Y with 40+ years of experience, serving Fortune 500 companies (Lockheed Martin, AES, Gannett, General Dynamics, Booz Allen Hamilton, Marriott) • Director at NYSE - listed Science Applications International Corporation (SAIC) • Highly qualified SEC financial expert and is Chairman of Audit Committee • Co - founder of GeoPark and CEO since 2002 • Brings 40+ years of experience in all phases of the upstream oil and gas business • Helped pioneer development of commercial oil and gas production in Central America and worked on projects in Asia, Europe, Middle East, North America and South America • Built GeoPark from the ground up to $1 billion market cap on NYSE • Brings leadership in energy and finance, promotion of development of non - conventional renewable resources, and expertise in Colombia • Former Colombia Minister of Energy and Mines and VP of Strategy and Finance of Colombia’s national oil company, Ecopetrol ROBERT A. BEDINGFIELD Independent Director SYLVIA ESCOVAR GÓMEZ Independent Chair JAMES F. PARK CEO & Director MARÍA FERNANDA SUÁREZ Independent Director Nominee • Brings legal expertise, particularly in the area of ESG and Human Rights • Partner at Aylwin , Mendoza, Luksic , Valencia Abogados in Chile, representing mining, chemical and oil and gas companies in numerous transactions • Former General Counsel at BHP Billiton, Base Metals PEDRO E. AYLWIN Director • Brings expertise in P etroleum geology and geophysics • 30+ years of development and management experience in oil and gas • Worked with YPF, Petrolera Argentina San Jorge, and Chevron and led significant oil and gas discoveries (including Trapial Field in Argentina) CARLOS A. GULISANO Director Deliberate Efforts to Strengthen Governance by Appointment of Majority Independent Directors • Brings international industry expertise in Oil and Gas • Former Global Head of Oil, Gas, Mining & Chemicals at International Finance Corporation (IFC), Chairman of IFC Oil, Gas, Mining and Chemicals Investment Committee • Chairman of Global Gas Flaring Reduction Partnership • F ormer Managing Director of Energy Group at Warburg Pincus SOMIT VARMA Independent Director • Brings 30+ years of investment experience in global capital markets and resource/industrial projects • Currently CEO of General Oriental Investments S.A. and was CEO of Cavamont Geneva, responsible for Treasury Management and Private Equity Portfolio CONSTANTINE PAPADIMITRIOU Independent Director

19 New Independent Board Members Added to Support Colombia Strategy 19 PROACTIVE REFRESHMENT AND GOVERNANCE IMPROVEMENT • GeoPark has put itself on a clear path to achieve best corporate governance practices with an independent chair and a majority of independent directors • Rigorous process led by the Nomination and Corporate Governance Committee and fully supported by the Board • Committee identified and vetted director candidates, prioritizing certain criteria including: x Independence x Match of skills and experience with GeoPark’s evolving needs, including in Colombia – where more than 90% of our business is located today x Ability to add value through: • Business/industry acumen • Diversity of background and experience • Personal and professional accomplishment • High ethical standards x Diversity • Instituted new Risk Committee led by two independent members to bolster risk management approach and help unlock consistent long - term value creation for shareholders • Board today contains more diversity of thought, encourages a free and open expression of ideas and opinions, and works constructively towards achieving consensus on all major decisions that impact the business INDEPENDENT CHAIR AND 2 NEW INDEPENDENT DIRECTORS SYLVIA ESCOVAR GÓMEZ • Appointed Independent Chair in 2021 • Named top businessperson of the year by Portafolio , Colombia’s leading financial daily • Voted one of the 10 executives with the best reputation in Colombia • Select skills/capabilities: x Enhancing oil & gas businesses models x Expanding range/quality of services MARÍA FERNANDA SUÁREZ • Nominated for election as new independent director at 2021 AGM • Former Colombia Minister of Energy and Mines and VP of Strategy and Finance of Colombia’s national oil company, Ecopetrol • Select skills/capabilities: x Leadership in energy and finance x Promoting development of non - conventional renewable sources SOMIT VARMA • Joined as independent director in August 2020 • Head of Energy Teams at IFC and Partner at Warburg Pincus focusing on energy investments • Select skills/capabilities: x Investments in oil, gas and mining x Scaling business x Improving ESG standards Directors Best Suited to Support Evolving Needs of Business and in Line with Corporate Governance Best Practices

20 Independent Board Tailored to Drive Success 20 Source : Company filings and public information GeoPark Directors Have Critical Skills and Experience to Determine Strategy and Safeguard Business Execution Age Tenure as GeoPark Director (years) Oil & Gas Industry Legal M&A / Finance Accounting / Audit Government Affairs Geoscience & Engineering Diversity ESG 1 Sylvia Escovar Gómez Chair 60 1 x x x x x James F. Park CEO 65 19 x x x x Pedro E. Aylwin 61 8 x x x Robert A. Bedingfield 73 6 x Carlos A. Gulisano 70 11 x x Constantine Papadimitriou 60 3 x x Somit Varma 60 1 x x x x María Fernanda Suárez 46 Newly Proposed x x x x x x

21 Commitment to ESG Remains Foundational to Our Success

22 Culture Based on Trust and Mutual Respect 22 Horizontal and Bottom - Up Approach with Autonomy to Propose, Innovate and Execute Company Plan All Employees Share in Company Success

23 S PEED = ESG FOUNDING PRINCIPLES SINCE DAY ONE IN 2002 23 23 STRONG COMMUNITY SUPPORT 371% TOTAL SHAREHOLDER RETURNS OVER PAST 5 YEARS 100% EMPLOYEES ARE SHAREHOLDERS ZERO SANCTIONS Plus ZERO VEHICLE ACCIDENTS IN 10 MM KM 1 1 Apr. to Dec . 2020

24 Environment = Leading the Way to the Energy Transition ENVIRONMENT 2015 - 2019 2022E 3% Reduction in Colombia Execution on Corporate Decarbonization Strategy Diesel to gas Electrification + Solar Global industry average is based on the “International Association of Oil & Gas Producers : Environmental Performance Data 2019 ” Source: Individual company reports GHG Intensity (KgCO 2 e/ boe ) LEADING LOW CARBON INTENSITY IN LLANOS 34 (kg CO 2 e/ boe ) TARGET 20 - 30% Reduction in Llanos 34 24 Plus 0 5 10 15 20 25 Ecopetrol Petrobras Frontera Ll 34 GeoPark Equinor Aker BP Lundin Carbon Intensity Well Below Industry Another 20 - 30% Carbon R eduction P lan is Being E xecuted for 2022 25 - 30% BELOW INDUSTRY AVERAGE

25 SAFETY COVID - 19 RESPONSE $3.9 million Investments in Social Programs 32,984 Neighbors Benefitted from GeoPark Social Programs 376 Meetings Listening to Community Concerns Social and Environmental Best Practices 1.08 b bls of Oil S pilled for Every M illion Barrels P roduced COMMUNITY DEVELOPMENT Source: GeoPark 2017, 2018 and 2019 ESG Report 25 • First Oil & Gas Company to Receive Bureau Veritas Certification for COVID Preparedness and Response • R eceived 2x in 2020 • Findeter Economic Development Program • Road Improvement Casanare • Rural Elementary S chool Health Program, Argentina • Community Benefit Programs • Contractor Presentations • Social Dialogue Meetings LTIR 2 TRIR 1 1.14 0.42 0.61 2.86 1.25 1.84 2017 2018 2019 Social = Community Alignment IS Neighbor of Choice Plus 1 Total Recordable Incident Rate per million hours worked 2 Lost Time Incident Rate per million hours worked

26 Majority Independent Directors in 2021 GOVERNANCE IMPROVEMENTS STRONG OVERSIGHT Source: GeoPark 2019 ESG Report 26 Governance = Following Best Governance Practices 100% Independent Audit and Compensation Committees Independent and Female Chair Appointment 2021 • Adoption of Corporate Governance Guidelines, including executive sessions of independent directors and an overboarding policy for Directors • Creation of a Risk Committee to evaluate all strategic options and help manage risk • All Committees chaired by an Independent Director • Adoption of new Committee Charters - Require fully independent Compensation Committee - Require that all members of the Audit Committee be financial experts - Require that the majority Independent Directors on the Nomination and Corporate Governance Committees - Improve Board selection process, using a skill matrix - Improve compensation practices (i.e. executive compensation approved only by independent directors) • Appoint independent and female Chair of the Board and of a new female independent Board candidate at the AGM 2020 • Change of independent auditors after 10 years • Incorporation of two independent directors and the first female director to the Board, Sylvia Escovar and Somit Varma 2019 • Appointment of fully independent Compensation Committee Strengthened Committee Charters Risk Committee Chaired by Independent Director Plus

27 Why the Independent Directors Asked Mr. O’Shaughnessy to Step Down as Chair Concerns about his ability to execute his fiduciary duties on behalf of all shareholders on account of the conflict of interest created by his pledged shares Exhibited conduct unbecoming of a Chair toward the Company and its directors including: • Creating an environment which was inhospitable for professional and respectful debate • Repeated instances of resigning from the Board to then request reinstatement • Lack of transparency in response to Board questions around pledging of shares • Circumventing the Board in his discussions with potential third parties The Independent Directors of GeoPark determined that Mr. O’Shaughnessy's behavior presented a risk to all other shareholders It should come as no surprise to Mr. O’Shaughnessy that the Independent Directors asked him to step down as Chair after expressing concerns regarding his disruptive behavior and after his other prior rescinded resignations from the Board

28 Setting the Record Straight on Numerous Baseless Claims False and Misleading Claims Pushed by Mr. O’Shaughnessy G&A, Salaries/Benefits per barrel of oil equivalent produced are too high GeoPark Providing the FACTS to Correct the Record x GeoPark has conducted benchmark analyses against peer companies x During the pandemic, we successfully executed on a significant cost savings program and nearly doubled our cash on hand to $202 million by the end of 2020 x Operating and F&D costs are among the lowest in peer group Debt levels prevent GeoPark from delivering value to shareholders x We significantly improved our financial profile – initiated debt reduction process this year, resulting in extended maturities and lower cost of debt x Already making significant progress with the successful first phase of strategic deleveraging process reducing total debt by ~$105 million CEO is provided with four company - funded residences and unmonitored travel expenses x Mr. Park lives in his own home in Colombia x It is categorically false that the Company maintains four houses for Mr. Park x Confirmed expat packages are in line with market x Mr. Park’s corporate expense account is monitored by GeoPark’s finance and compliance teams Board doesn’t discuss CEO’s compensation package on ongoing basis x Compensation Committee hired an independent consulting firm in 2020 to review CEO compensation and a compensation consultant in 2021 to conduct a full review of all management compensation, including peer analysis – results confirmed that total compensation is in line with peer group x Committee – and Board as a whole – has been forthcoming and transparent with respect to compensation x Compensation Committee presented details of CEO service agreement and was approved by Board (Including Mr. O’Shaughnessy) x CEO’s 2020 bonus was reduced by 50% by the Compensation Committee due to COVID impact x Maintain best - in - class executive compensation in order to attract and retain our talented management team helps GeoPark successfully execute on its business strategy and drive shareholder value Cost Structure Executive Perquisites Executive Compensation Board is unwilling to evaluate strategic alternatives x Completely restructured portfolio in 2020, divesting assets in Peru and Brazil x Board regularly evaluates strategic alternatives for the portfolio x Open to all value creating ideas for shareholders x Evaluated 80+ opportunities in last 24 months Strategic Management and Performance

29 Key Takeaways • Mr. O’Shaughnessy’s removal from Chair was warranted • His removal was supported by all of the independent directors • There is nothing Mr. O’Shaughnessy is proposing that the Board has not contemplated or is not already pursuing • Removing directors from a substantially reconstituted and majority independent Board would be disruptive and value destructive for shareholders Proven Team and Strategy with Track Record of Growth and Operational Efficiency Commitment to ESG Remains Foundational to Our Success Mr. O’Shaughnessy’s Proposals are Not in the Best Interest of GeoPark Shareholders Board - Led Strategy Delivers Sustainable Shareholder Value Fit - for - Purpose Board and Governance Structure Ensures Protection of Shareholder Interests 29

30 If you have any questions, please call our proxy solicitor: Innisfree M&A Incorporated 501 Madison Avenue, 20th Floor New York, NY 10022 Stockholders may call: (877) 750 - 8166 Banks and Brokers may call: (212) 750 - 5833 Vote FOR Your Highly Qualified Board Nominees Today!

31 APPENDIX

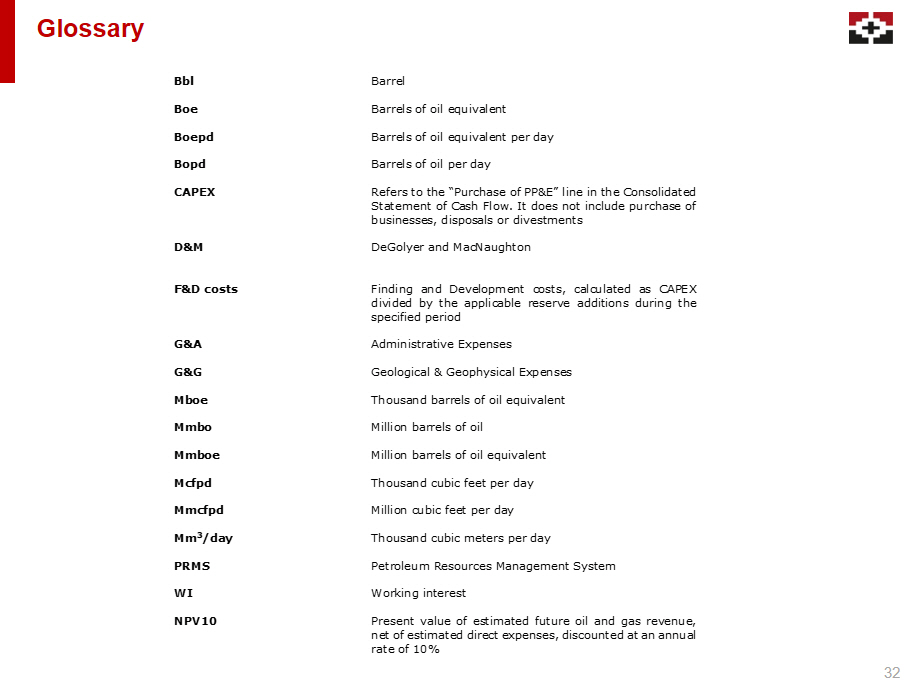

32 Glossary Bbl Barrel Boe Barrels of oil equivalent Boepd Barrels of oil equivalent per day Bopd Barrels of oil per day CAPEX Refers to the “Purchase of PP&E” line in the Consolidated Statement of Cash Flow. It does not include purchase of businesses, disposals or divestments D&M DeGolyer and MacNaughton F&D costs Finding and Development costs, calculated as CAPEX divided by the applicable reserve additions during the specified period G&A Administrative Expenses G&G Geological & Geophysical Expenses Mboe Thousand barrels of oil equivalent Mmbo Million barrels of oil Mmboe Million barrels of oil equivalent Mcfpd Thousand cubic feet per day Mmcfpd Million cubic feet per day Mm 3 /day Thousand cubic meters per day PRMS Petroleum Resources Management System WI Working interest NPV10 Present value of estimated future oil and gas revenue, net of estimated direct expenses, discounted at an annual rate of 10%

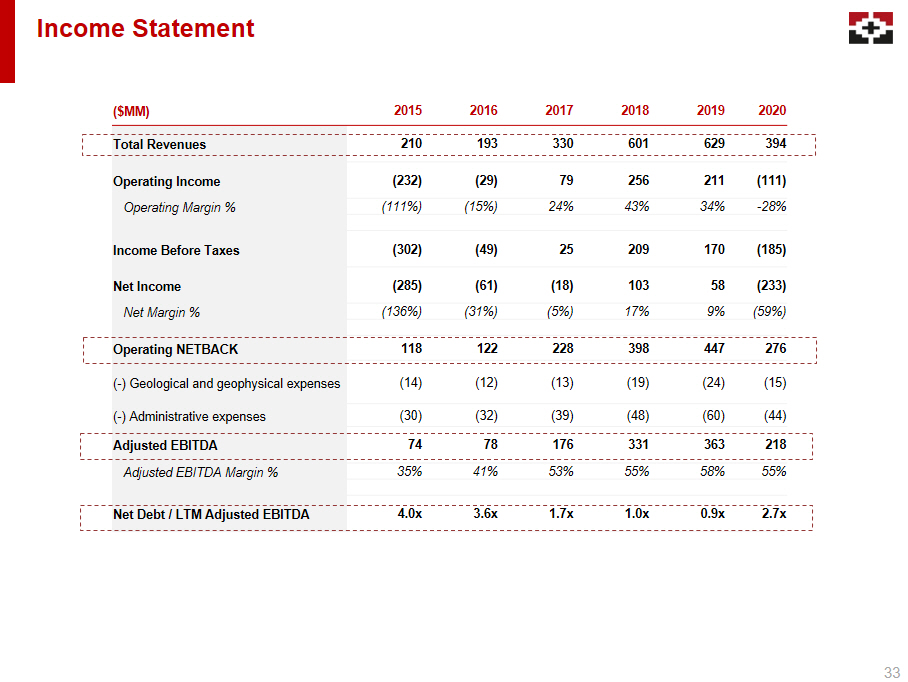

33 ($MM) 2015 2016 2017 2018 2019 2020 Total Revenues 210 193 330 601 629 394 Operating Income (232) (29) 79 256 211 (111) Operating Margin % (111%) (15%) 24% 43% 34% - 28% Income Before Taxes (302) (49) 25 209 170 (185) Net Income (285) (61) (18) 103 58 (233) Net Margin % (136%) (31%) (5%) 17% 9% (59%) Operating NETBACK 118 122 228 398 447 276 ( - ) Geological and geophysical expenses (14) (12) (13) (19) (24) (15) ( - ) Administrative expenses (30) (32) (39) (48) (60) (44) Adjusted EBITDA 74 78 176 331 363 218 Adjusted EBITDA Margin % 35% 41% 53% 55% 58% 55% Net Debt / LTM Adjusted EBITDA 4.0x 3.6x 1.7x 1.0x 0.9x 2.7x Income Statement

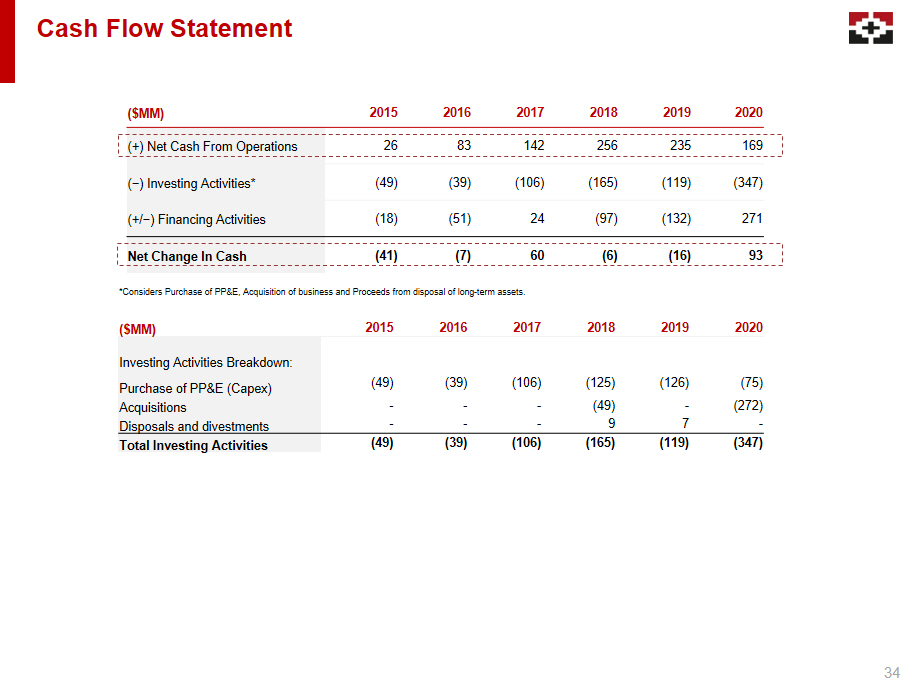

34 Cash Flow Statement ($MM) 2015 2016 2017 2018 2019 2020 (+) Net Cash From Operations 26 83 142 256 235 169 (−) Investing Activities* (49) (39) (106) (165) (119) (347) (+/−) Financing Activities (18) (51) 24 (97) (132) 271 Net Change In Cash (41) (7) 60 (6) (16) 93 *Considers Purchase of PP&E, Acquisition of business and Proceeds from disposal of long - term assets. ($MM) 2015 2016 2017 2018 2019 2020 Investing Activities Breakdown: Purchase of PP&E (Capex) (49) (39) (106) (125) (126) (75) Acquisitions - - - (49) - (272) Disposals and divestments - - - 9 7 - Total Investing Activities (49) (39) (106) (165) (119) (347)

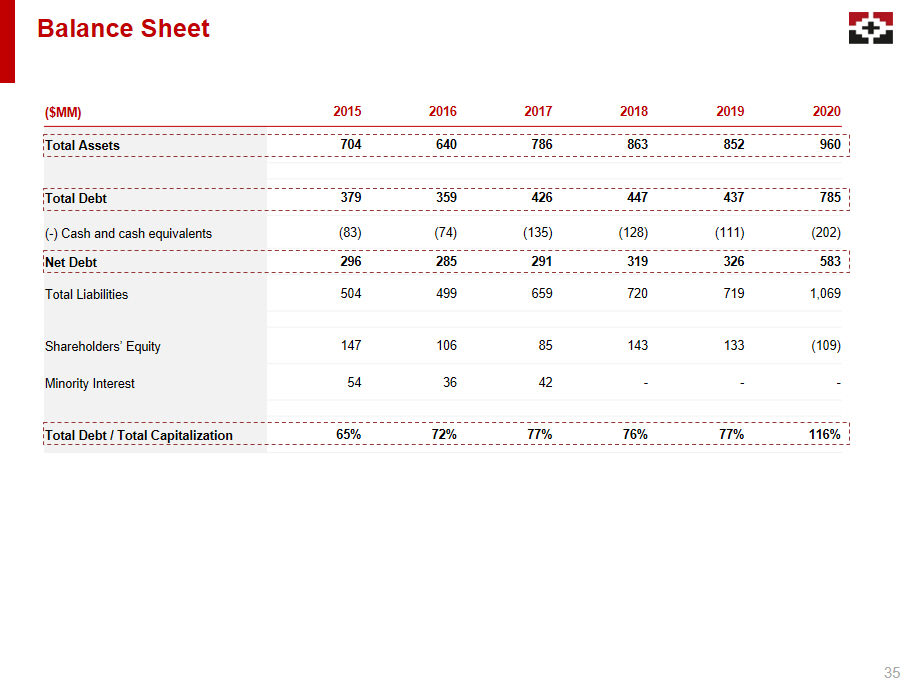

35 ($MM) 2015 2016 2017 2018 2019 2020 Total Assets 704 640 786 863 852 960 Total Debt 379 359 426 447 437 785 ( - ) Cash and cash equivalents (83) (74) (135) (128) (111) (202) Net Debt 296 285 291 319 326 583 Total Liabilities 504 499 659 720 719 1,069 Shareholders’ Equity 147 106 85 143 133 (109) Minority Interest 54 36 42 - - - Total Debt / Total Capitalization 65% 72% 77% 76% 77% 116% Balance Sheet

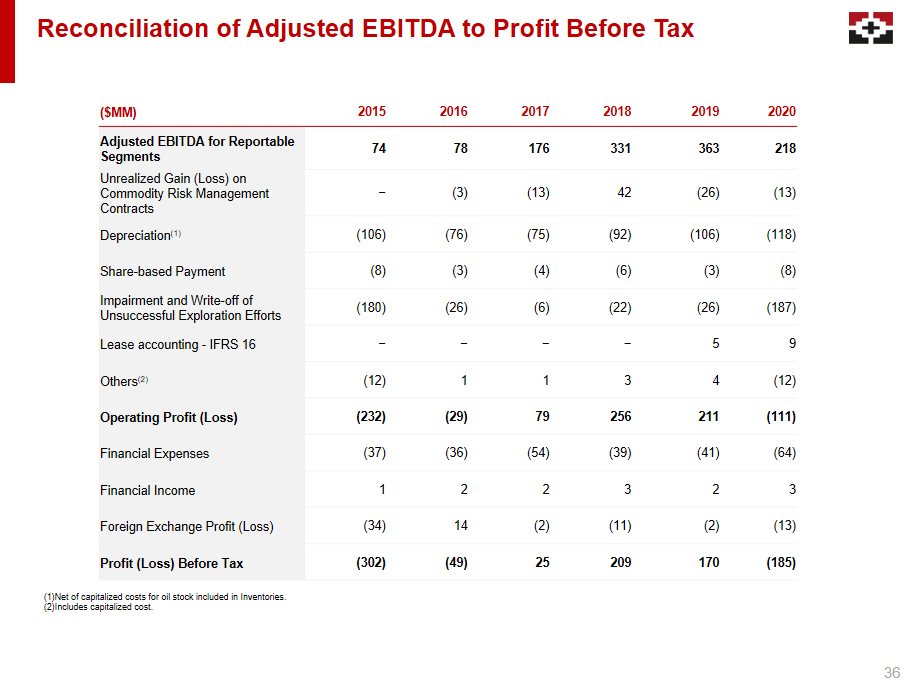

36 ($MM) 2015 2016 2017 2018 2019 2020 Adjusted EBITDA for Reportable Segments 74 78 176 331 363 218 Unrealized Gain (Loss) on Commodity Risk Management Contracts − (3) (13) 42 (26) (13) Depreciation (1) (106) (76) (75) (92) (106) (118) Share - based Payment (8) (3) (4) (6) (3) (8) Impairment and Write - off of Unsuccessful Exploration Efforts (180) (26) (6) (22) (26) (187) Lease accounting - IFRS 16 − − − − 5 9 Others (2) (12) 1 1 3 4 (12) Operating Profit (Loss) (232) (29) 79 256 211 (111) Financial Expenses (37) (36) (54) (39) (41) (64) Financial Income 1 2 2 3 2 3 Foreign Exchange Profit (Loss) (34) 14 (2) (11) (2) (13) Profit (Loss) Before Tax (302) (49) 25 209 170 (185) (1)Net of capitalized costs for oil stock included in Inventories. (2)Includes capitalized cost. Reconciliation of Adjusted EBITDA to Profit Before Tax

37 Operating Netback Definitions Operating netbacks used in the presentation taken from company filings. Definitions may differ between companies: GeoPark: • Revenue, less production and operating costs (net of depreciation charges and accrual of stock options and stock awards, the eff ect of IFRS 16), selling expenses, and realized results on commodity risk management contracts. Parex : • Oil and natural gas sales (determined by sales revenue excluding risk management contracts) less royalty expense, production exp ense and transportation expense. Frontera: • Net sales (including oil and gas sales net of purchases, realized gains and losses from risk management contracts less royalt ies and diluent costs) less production costs and transportation costs. Gran Tierra: • Operating netback, as presented, is defined as oil sales less operating and transportation expenses.

38 The information contained herein has been prepared by GeoPark Limited (“GeoPark“, “we” or “us”) solely for informational purposes . Nothing contained herein should be relied upon as a promise or representation as to performance of any investment or otherwise . The information in this presentation is current only as of the date on its cover . For any time after the cover date of this presentation, the information, including information concerning our business, financial condition, results of operations and prospects may have changed . The delivery of this presentation shall not, under any circumstances, create any implication that there have been no changes in our affairs after the date of this presentation . This presentation includes forward - looking statements . Forward - looking statements can be identified by the use of forward - looking words such as “anticipate”, “believe”, “could”, “expect”, “should”, “plan”, “intend”, “will”, “estimate” and “potential,” among others . Forward - looking statements appear in a number of places in this presentation and include, but are not limited to, statements regarding our intent, belief or current expectations . Forward - looking statements are based on our management’s beliefs and assumptions and on information currently available to our management . Such statements are subject to risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward - looking statements due to various factors, including, but not limited to, those identified in the “Forward - Looking Statements” and “Risk Factors” sections of our Annual Report on Form 20 - F filed on March 31 , 2021 for further information . Forward - looking statements speak only as of the date they are made, and GeoPark does not undertake any obligation to update them in light of new information or future developments or to release publicly any revisions to these statements in order to reflect later events or circumstances or to reflect the occurrence of unanticipated events . The information included in this presentation regarding GeoPark’s estimated quantities of reserves as of December 31 , 2020 is derived, in part, from the reports prepared by DeGolyer and MacNaughton , or D&M, independent reserves engineers . The reserves estimates in the reports prepared by D&M were prepared in accordance with the definitions and guidelines set forth in the 2007 Petroleum Resource Management System Methodology (the “PRMS”) approved by the Society of Petroleum Engineers, the World Petroleum Council, the American Association of Petroleum Geologists and the Society of Petroleum Evaluation Engineers . PRMS proved ( 1 P) reserves are estimated quantities of oil, condensate and natural gas from which there is geological and engineering data that demonstrate with reasonable certainty that they are recoverable in future years from known reservoirs under existing economic and operating conditions . PRMS probable reserves ( 2 P) are those additional reserves which analysis of geoscience and engineering data indicate are less likely to be recovered than proved reserves but more certain to be recovered than possible reserves . PRMS possible reserves ( 3 P) are those additional reserves that analysis of geoscience and engineering data indicates are less likely to be recoverable than probable reserves . Reserves estimates prepared in accordance with SEC rules and regulations may differ significantly from reserves estimates prepared in accordance with PRMS guidelines . Therefore, the reserves estimates presented in this presentation may differ significantly from the reserves estimates presented in our annual report for the year ended December 31 , 2020 . This presentation includes Adjusted EBITDA, which is a supplemental non - IFRS financial measure that is used by management and external users of our financial statements, such as industry analysts, investors, lenders and rating agencies, to assess the performance of our Company and the operating segments . We define Adjusted EBITDA as profit (loss) for the period before net finance cost (determined in accordance with the indentures governing our senior notes, which do not give effect to the adoption of IFRS 16 Leases), income tax, depreciation, amortization, certain non - cash items such as impairments and write - offs of unsuccessful exploration efforts, accrual of share - based payment, unrealized result in commodity risk management contracts, geological and geophysical expenses allocated to capitalized projects and other events defined therein . Adjusted EBITDA is not a measure of profit or cash flows as determined by IFRS . We believe Adjusted EBITDA is useful because it allows us to more effectively evaluate our operating performance and compare the results of our operations from period to period without regard to our financing methods or capital structure . Our computation of Adjusted EBITDA may not be comparable to other similarly titled measures of other companies . For a reconciliation of Adjusted EBITDA to the IFRS financial measure of profit, see the Appendix of this presentation . This presentation contains several oil and gas metrics, including F&D costs, recycle ratio, reserve replacement, NPV, RLI, Operating Netback to CAPEX ratio, etc . These metrics have been prepared by management and do not have standardized meanings or standard methods of calculation and therefore such measures may not be comparable to similar measures used by other companies and should not be used to make comparisons . Readers are cautioned that the information provided by these metrics, or that can be derived from the metrics presented in this presentation, should not be relied upon for investment or other purposes . Disclaimer

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| GeoPark Limited | |||

| By: | /s/ Andrés Ocampo | ||

| Name: | Andrés Ocampo | ||

| Title: | Chief Financial Officer | ||

Date: July 1, 2021