Exhibit 99.1

Gerald O’Shaughnessy Issues Letter to GeoPark Shareholders

Company’s Board Has Failed to Address Pressing Strategic Challenges that Will Impede Future Value Creation

GeoPark’s Public Materials Contain Numerous Outright Lies – Including About Mr. O’Shaughnessy’s Departure from the Board – and Shareholders Deserve the Truth

Jim Park’s Lack of Transparency and Insistence on Control at All Costs Have Derailed Potential Strategic Options for Creating Value

Shareholders Should Vote AGAINST Four Company Nominees at Upcoming Annual Meeting to Signal that GeoPark Must be Run in the Best Interests of All Shareholders – Not for the Benefit of Jim Park

WICHITA, Kan. – July 8, 2021 – Gerald O’Shaughnessy, the co-founder, former Chairman and second largest shareholder of GeoPark Limited (“GeoPark” or the “Company”) (NYSE: GPRK) today issued the following letter to the Company’s shareholders.

July 8, 2021

Dear Fellow Shareholders,

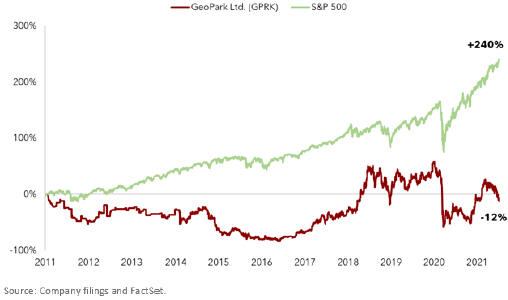

You face an important decision at the upcoming GeoPark Annual General Meeting (“the Meeting”). How you vote will determine whether the current GeoPark Board seriously considers options to improve the value of your investment, or whether the incumbent directors simply continue with the status quo that has resulted in suboptimal economic results compared to our closest peer and our partner in Llanos 34, Parex Resources. Put simply, voting against four of the Company’s director nominees sends a message that GeoPark must be run in the best interests of all shareholders, not just to benefit CEO Jim Park.

As the Company’s second largest shareholder, my interests are wholly aligned with yours. Unlike you, I unfortunately have had to witness the dysfunction in GeoPark’s boardroom and the extreme deference of most directors to Mr. Park. What has occurred at the Company is a classic failure of corporate governance – Mr. Park has been allowed to operate without real oversight from the Board. That is why I strongly urge you to vote against directors most responsible – Jim Park, Constantin Papadimitriou, Robert Bedingfield and Pedro Aylwin.

Please consider the following points:

The Board Has Failed to Address the Critical Strategic Issues Facing GeoPark

GeoPark’s conduct during this campaign has been highly telling. Despite its voluminous public materials, the GeoPark Board has not addressed many of the urgent issues I have raised – instead, and perhaps unwittingly, since Jim Park has undoubtedly dictated the Company’s response to my points, it has sought to distract shareholders from what really matters.

For example, the Board has still not unequivocally stated that it will consider potential strategic combinations or partnerships to enhance shareholder value where Mr. Park and his team would not occupy leadership roles in any resulting entity. These issues are core to GeoPark’s future, and the Board cannot leave shareholders in the dark on these matters.

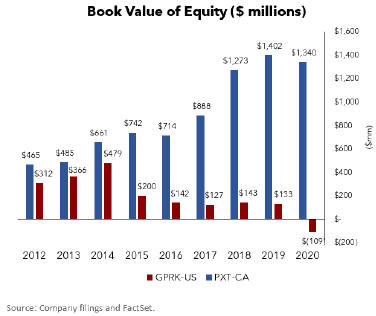

In terms of the economic case, the facts on the surface mask a deeper issue. GeoPark’s performance in the last five years has been good, largely as a result of discovering one asset – Llanos 34 in Colombia – that has been a game changer for two companies sharing the same asset. This good fortune has been weakened, however, by the Company’s money-losing non-Colombian assets.