- GPRK Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

6-K Filing

GeoPark Limited (GPRK) 6-KCurrent report (foreign)

Filed: 14 May 20, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2020

Commission File Number: 001-36298

GeoPark Limited

(Exact name of registrant as specified in its charter)

Nuestra Señora de los Ángeles 179

Las Condes, Santiago, Chile

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F | X |

| Form 40-F |

|

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

|

|

|

|

|

Yes |

|

| No | X |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes |

|

| No | X |

GEOPARK LIMITED

TABLE OF CONTENTS

ITEM

|

|

1. | Interim Condensed Consolidated Financial Statements and Explanatory Notes for the three-months period ended March 31, 2019 and 2020. |

Item 1

GEOPARK LIMITED

INTERIM CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS

AND EXPLANATORY NOTES

For the three-months period ended March 31, 2019 and 2020

|

|

Page |

|

|

|

3 | |

4 | |

5 | |

6 | |

7 | |

8 |

2

CONDENSED CONSOLIDATED STATEMENT OF INCOME

|

|

|

|

|

|

|

|

|

|

| Three-months |

| Three-months |

|

|

|

| period ended |

| period ended |

|

|

|

| March 31, 2020 |

| March 31, 2019 |

Amounts in US$ ´000 |

| Note |

| (Unaudited) |

| (Unaudited) |

REVENUE |

| 3 |

| 133,239 |

| 150,139 |

Commodity risk management contracts |

| 4 |

| 32,011 |

| (21,268) |

Production and operating costs |

| 5 |

| (41,075) |

| (38,919) |

Geological and geophysical expenses |

| 6 |

| (4,458) |

| (4,296) |

Administrative expenses |

| 7 |

| (12,685) |

| (11,721) |

Selling expenses |

| 8 |

| (1,962) |

| (3,534) |

Depreciation |

|

|

| (39,301) |

| (25,450) |

Write-off of unsuccessful exploration efforts |

| 10 |

| (3,205) |

| (303) |

Impairment loss recognized for non-financial assets |

| 19 |

| (97,481) |

| — |

Other (expenses) income |

|

|

| (232) |

| 1,332 |

OPERATING (LOSS) PROFIT |

|

|

| (35,149) |

| 45,980 |

Financial expenses |

| 9 |

| (14,754) |

| (9,689) |

Financial income |

| 9 |

| 1,423 |

| 864 |

Foreign exchange (loss) gain |

| 9 |

| (10,787) |

| 994 |

(LOSS) PROFIT BEFORE INCOME TAX |

|

|

| (59,267) |

| 38,149 |

Income tax expense |

|

|

| (30,275) |

| (18,460) |

(LOSS) PROFIT FOR THE PERIOD |

|

|

| (89,542) |

| 19,689 |

(Losses) Earnings per share (in US$) for (loss) profit attributable to owners of the Company. Basic |

|

|

| (1.48) |

| 0.32 |

(Losses) Earnings per share (in US$) for (loss) profit attributable to owners of the Company. Diluted |

|

|

| (1.48) |

| 0.30 |

The above condensed consolidated statement of income should be read in conjunction with the accompanying notes.

3

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

|

|

|

|

|

|

| Three-months |

| Three-months |

|

| period ended |

| period ended |

|

| March 31, 2020 |

| March 31, 2019 |

Amounts in US$ ´000 |

| (Unaudited) |

| (Unaudited) |

(Loss) Profit for the period |

| (89,542) |

| 19,689 |

Other comprehensive income |

|

|

|

|

Items that may be subsequently reclassified to profit or loss: |

|

|

|

|

Currency translation differences |

| (8,500) |

| (48) |

Losses on cash flow hedges |

| (6,770) |

| — |

Income tax relating to losses on cash flow hedges |

| 2,166 |

| — |

Other comprehensive loss for the period |

| (13,104) |

| (48) |

Total comprehensive (loss) profit for the period |

| (102,646) |

| 19,641 |

The above condensed consolidated statement of comprehensive income should be read in conjunction with the accompanying notes.

4

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

|

|

|

|

|

|

|

|

| Note |

| At March 31, 2020 |

| Year ended |

Amounts in US$ ´000 |

|

|

| (Unaudited) |

| December 31, 2019 |

ASSETS |

|

|

|

|

|

|

NON CURRENT ASSETS |

|

|

|

|

|

|

Property, plant and equipment |

| 10 |

| 742,124 |

| 567,788 |

Right-of-use assets |

|

|

| 24,440 |

| 13,462 |

Prepayments and other receivables |

|

|

| 7,193 |

| 7,031 |

Other financial assets |

|

|

| 14,122 |

| 10,985 |

Deferred income tax asset |

|

|

| 31,003 |

| 26,934 |

TOTAL NON CURRENT ASSETS |

|

|

| 818,882 |

| 626,200 |

CURRENT ASSETS |

|

|

|

|

|

|

Inventories |

|

|

| 12,614 |

| 11,447 |

Trade receivables |

|

|

| 32,746 |

| 44,178 |

Prepayments and other receivables |

|

|

| 64,057 |

| 51,016 |

Derivative financial instrument assets |

| 15 |

| 31,503 |

| 8,097 |

Other financial assets |

|

|

| 2,804 |

| 14 |

Cash and cash equivalents |

|

|

| 165,548 |

| 111,180 |

TOTAL CURRENT ASSETS |

|

|

| 309,272 |

| 225,932 |

TOTAL ASSETS |

|

|

| 1,128,154 |

| 852,132 |

EQUITY |

|

|

|

|

|

|

Equity attributable to owners of the Company |

|

|

|

|

|

|

Share capital |

| 11 |

| 61 |

| 59 |

Share premium |

|

|

| 175,941 |

| 173,716 |

Reserves |

|

|

| 94,475 |

| 112,471 |

Accumulated losses |

|

|

| (243,443) |

| (153,361) |

TOTAL EQUITY |

|

|

| 27,034 |

| 132,885 |

LIABILITIES |

|

|

|

|

|

|

NON CURRENT LIABILITIES |

|

|

|

|

|

|

Borrowings |

| 12 |

| 763,058 |

| 420,138 |

Lease liabilities |

|

|

| 16,990 |

| 5,801 |

Provisions and other long-term liabilities |

| 13 |

| 73,708 |

| 62,062 |

Deferred income tax liability |

|

|

| 18,494 |

| 10,850 |

Trade and other payables |

| 14 |

| 8,482 |

| 5,475 |

TOTAL NON CURRENT LIABILITIES |

|

|

| 880,732 |

| 504,326 |

CURRENT LIABILITIES |

|

|

|

|

|

|

Borrowings |

| 12 |

| 12,273 |

| 17,281 |

Lease liabilities |

|

|

| 12,000 |

| 7,442 |

Derivative financial instrument liabilities |

| 15 |

| 12,360 |

| 952 |

Current income tax liability |

|

|

| 50,136 |

| 57,901 |

Trade and other payables |

| 14 |

| 133,619 |

| 131,345 |

TOTAL CURRENT LIABILITIES |

|

|

| 220,388 |

| 214,921 |

TOTAL LIABILITIES |

|

|

| 1,101,120 |

| 719,247 |

TOTAL EQUITY AND LIABILITIES |

|

|

| 1,128,154 |

| 852,132 |

The above condensed consolidated statement of financial position should be read in conjunction with the accompanying notes.

5

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Attributable to owners of the Company | ||||||||||

|

| Share |

| Share |

| Other |

| Translation |

| Accumulated |

|

|

Amount in US$ '000 |

| Capital |

| Premium |

| Reserve |

| Reserve |

| losses |

| Total |

Equity at January 1, 2019 |

| 60 |

| 237,840 |

| 114,131 |

| (2,322) |

| (206,688) |

| 143,021 |

Comprehensive income: |

|

|

|

|

|

|

|

|

|

|

|

|

Profit for the three-months period |

| — |

| — |

| — |

| — |

| 19,689 |

| 19,689 |

Other comprehensive loss for the period |

| — |

| — |

| — |

| (48) |

| — |

| (48) |

Total comprehensive income for the period ended March 31, 2019 |

| — |

| — |

| — |

| (48) |

| 19,689 |

| 19,641 |

Transactions with owners: |

|

|

|

|

|

|

|

|

|

|

|

|

Share-based payment |

| 2 |

| 2,457 |

| — |

| — |

| (1,204) |

| 1,255 |

Repurchase of shares |

| (1) |

| (10,195) |

| — |

| — |

| — |

| (10,196) |

Total transactions with owners for the period ended March 31, 2019 |

| 1 |

| (7,738) |

| — |

| — |

| (1,204) |

| (8,941) |

Balance at March 31, 2019 (Unaudited) |

| 61 |

| 230,102 |

| 114,131 |

| (2,370) |

| (188,203) |

| 153,721 |

Balance at January 1, 2020 |

| 59 |

| 173,716 |

| 116,291 |

| (3,820) |

| (153,361) |

| 132,885 |

Comprehensive income: |

|

|

|

|

|

|

|

|

|

|

|

|

Loss for the three-months period |

| — |

| — |

| — |

| — |

| (89,542) |

| (89,542) |

Other comprehensive loss for the period |

| — |

| — |

| (4,604) |

| (8,500) |

| — |

| (13,104) |

Total comprehensive income for the period ended March 31, 2020 |

| — |

| — |

| (4,604) |

| (8,500) |

| (89,542) |

| (102,646) |

Transactions with owners: |

|

|

|

|

|

|

|

|

|

|

|

|

Share-based payment |

| 2 |

| 2,458 |

| — |

| — |

| (540) |

| 1,920 |

Repurchase of shares |

| — |

| (2,678) |

| — |

| — |

| — |

| (2,678) |

Stock distribution |

| — |

| 2,445 |

| (2,445) |

| — |

| — |

| — |

Cash distribution |

| — |

| — |

| (2,447) |

| — |

| — |

| (2,447) |

Total transactions with owners for the period ended March 31, 2020 |

| 2 |

| 2,225 |

| (4,892) |

| — |

| (540) |

| (3,205) |

Balance at March 31, 2020 (Unaudited) |

| 61 |

| 175,941 |

| 106,795 |

| (12,320) |

| (243,443) |

| 27,034 |

The above condensed consolidated statement of changes in equity should be read in conjunction with the accompanying notes.

6

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOW

|

|

|

|

|

|

| Three-months |

| Three-months |

|

| period ended |

| period ended |

|

| March 31, 2020 |

| March 31, 2019 |

Amounts in US$ ’000 |

| (Unaudited) |

| (Unaudited) |

Cash flows from operating activities |

|

|

|

|

(Loss) Profit for the period |

| (89,542) |

| 19,689 |

Adjustments for: |

|

|

|

|

Income tax expense |

| 30,275 |

| 18,460 |

Depreciation |

| 39,301 |

| 25,450 |

Write-off of unsuccessful exploration efforts |

| 3,205 |

| 303 |

Impairment loss for non-financial assets |

| 97,481 |

| — |

Amortization of other long-term liabilities |

| — |

| (428) |

Accrual of borrowing interests |

| 11,419 |

| 7,573 |

Unwinding of long-term liabilities |

| 1,540 |

| 1,240 |

Accrual of share-based payment |

| 1,920 |

| 1,255 |

Foreign exchange loss (gain) |

| 10,787 |

| (994) |

Unrealized (gain) loss on commodity risk management contracts |

| (26,431) |

| 23,078 |

Income tax paid |

| (16,970) |

| (11,947) |

Change in working capital |

| (24,976) |

| (2,366) |

Cash flows from operating activities – net |

| 38,009 |

| 81,313 |

Cash flows from investing activities |

|

|

|

|

Purchase of property, plant and equipment |

| (33,673) |

| (37,266) |

Acquisition of business, net of cash acquired (Note 17) |

| (272,335) |

| — |

Cash flows used in investing activities – net |

| (306,008) |

| (37,266) |

Cash flows from financing activities |

|

|

|

|

Proceeds from borrowings |

| 350,000 |

| — |

Debt issuance costs paid |

| (7,506) |

| — |

Principal paid |

| — |

| (3) |

Interest paid |

| (13,813) |

| (13,787) |

Lease payments |

| (2,784) |

| (1,341) |

Repurchase of shares |

| (2,678) |

| (10,196) |

Cash flows from (used in) financing activities - net |

| 323,219 |

| (25,327) |

Net increase in cash and cash equivalents |

| 55,220 |

| 18,720 |

|

|

|

|

|

Cash and cash equivalents at January 1 |

| 111,180 |

| 127,727 |

Currency translation differences |

| (852) |

| 188 |

Cash and cash equivalents at the end of the period |

| 165,548 |

| 146,635 |

|

|

|

|

|

Ending Cash and cash equivalents are specified as follows: |

|

|

|

|

Cash at bank and bank deposits |

| 165,525 |

| 146,611 |

Cash in hand |

| 23 |

| 24 |

Cash and cash equivalents |

| 165,548 |

| 146,635 |

The above condensed consolidated statement of cash flow should be read in conjunction with the accompanying notes.

7

EXPLANATORY NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 1

General information

GeoPark Limited (the “Company”) is a company incorporated under the law of Bermuda. The Registered Office address is Clarendon House, 2 Church Street, Hamilton HM11, Bermuda.

The principal activity of the Company and its subsidiaries (the “Group” or “GeoPark”) is the exploration, development and production for oil and gas reserves in Colombia, Chile, Brazil, Argentina, Peru and Ecuador.

This condensed consolidated interim financial report was authorized for issue by the Board of Directors on May 13, 2020.

Basis of Preparation

The condensed consolidated interim financial report of GeoPark Limited is presented in accordance with IAS 34 “Interim Financial Reporting”. It does not include all of the information required for full annual financial statements, and should be read in conjunction with the annual financial statements as at and for the years ended December 31, 2018 and 2019, which have been prepared in accordance with IFRS.

The condensed consolidated interim financial report has been prepared in accordance with the accounting policies applied in the most recent annual financial statements.

Whenever necessary, certain comparative amounts have been reclassified to conform to changes in presentation in the current period.

Taxes on income in the interim periods are accrued using the tax rate that would be applicable to expected total annual profit or loss.

The activities of the Group are not subject to significant seasonal changes.

New and amended standards adopted by the Group

A number of new or amended standards became applicable for the current reporting period. The Group did not have to change its accounting policies or make retrospective adjustments as a result of adopting these standards.

Estimates

The preparation of interim financial information requires the use of certain critical accounting estimates. It also requires management to exercise its judgement in the process of applying the Group’s accounting policies. Actual results may differ from these estimates.

In preparing these condensed consolidated interim financial statements, the significant judgements made by management in applying the Group’s accounting policies and the key sources of estimation uncertainty were the same as those that applied to the consolidated financial statements for the year ended December 31, 2019.

8

Note 1 (Continued)

Financial risk management

The Group’s activities expose it to a variety of financial risks: currency risk, price risk, credit risk- concentration, funding and liquidity risk, interest risk and capital risk. The condensed consolidated interim financial statements do not include all financial risk management information and disclosures required in the annual financial statements, and should be read in conjunction with the Group’s annual financial statements as at December 31, 2019.

The 2019 coronavirus (“COVID 19”) outbreak is currently having an indeterminable adverse impact on the world economy. While the COVID 19 has begun to have numerous worldwide effects on general commercial activity, one such effect is that the price of crude oil dropped. At this time, given the uncertainty of the lasting effect of the COVID 19 outbreak, its impact on the Group’s business cannot be determined.

The Group is continually reviewing its exposure to the current market conditions and effective immediately, adjusted the 2020 capital expenditures program but remains flexible, quickly adaptable and expanded if prices recover. The Group recently added new oil hedges increasing its price risk protection within the next six months. GeoPark maintained a strong cash position, with US$ 165,548,000 of cash and over US$ 130,700,000 in uncommitted credit lines as of March 31, 2020. For more detailed information, see Note 18.

Subsidiary undertakings

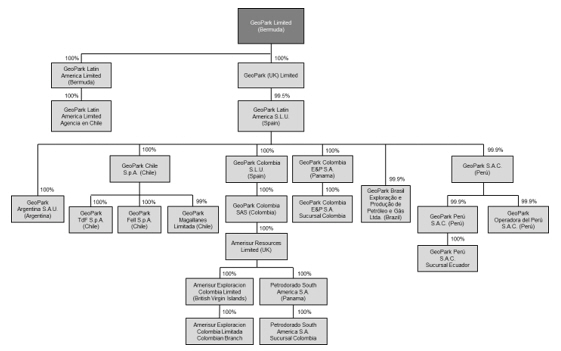

The following chart illustrates the main companies of the Group structure as of March 31, 2020:

In January 2020, Amerisur Resources Limited and its subsidiaries were acquired by GeoPark Colombia S.A.S. Also during 2020, GeoPark Chile S.p.A. and GeoPark Argentina S.A.U. were contributed to GeoPark Latin America S.L.U.

9

Note 1 (Continued)

Subsidiary undertakings (Continued)

Details of the subsidiaries and joint operations of the Group are set out below:

|

|

|

|

|

|

| Name and registered office |

| Ownership interest |

Subsidiaries |

| GeoPark Argentina S.A.U. (Argentina) |

| 100% (a) |

|

| GeoPark Latin America Limited (Bermuda) |

| 100% |

|

| GeoPark Latin America Limited – Agencia en Chile (Chile) |

| 100% (a) |

|

| GeoPark Brasil Exploração y Produção de Petróleo e Gás Ltda. (Brazil) |

| 100% (a) |

|

| GeoPark Chile S.p.A. (Chile) |

| 100% (a) |

|

| GeoPark Fell S.p.A. (Chile) |

| 100% (a) |

|

| GeoPark Magallanes Limitada (Chile) |

| 100% (a) |

|

| GeoPark TdF S.p.A. (Chile) |

| 100% (a) |

|

| GeoPark Colombia S.A.S. (Colombia) |

| 100% (a) |

|

| GeoPark Latin America S.L.U. (Spain) |

| 100% (a) |

|

| GeoPark Colombia S.L.U. (Spain) |

| 100% (a) |

|

| GeoPark S.A.C. (Peru) |

| 100% (a) |

|

| GeoPark Perú S.A.C. (Peru) |

| 100% (a) |

|

| GeoPark Operadora del Perú S.A.C. (Peru) |

| 100% (a) |

|

| GeoPark Colombia E&P S.A. (Panama) |

| 100% (a) |

|

| GeoPark Colombia E&P Sucursal Colombia (Colombia) |

| 100% (a) |

|

| GeoPark Mexico S.A.P.I. de C.V. (Mexico) |

| 100% (a) (b) |

|

| GeoPark E&P S.A.P.I. de C.V. (Mexico) |

| 100% (a) (b) |

|

| GeoPark (UK) Limited (United Kingdom) |

| 100% |

|

| GeoPark Perú S.A.C. Sucursal Ecuador (Ecuador) |

| 100% (a) |

|

| Amerisur Resources Limited (United Kingdom) |

| 100% (a) |

|

| Amerisur Exploración Colombia Limited (British Virgin Islands) |

| 100% (a) |

|

| Amerisur Exploración Colombia Limited Colombian Branch (Colombia) |

| 100% (a) |

|

| Yarumal S.A.S. (Colombia) |

| 100% (a) (b) |

|

| Petrodorado South America S.A. (Panama) |

| 100% (a) |

|

| Petrodorado South America S.A. Sucursal Colombia (Colombia) |

| 100% (a) |

|

| Fenix Oil & Gas Limited (British Virgin Islands) |

| 100% (a) (b) |

|

| Fenix Oil & Gas Limited Sucursal Colombia (Colombia) |

| 100% (a) (b) |

|

| Amerisurexplor Ecuador S.A. (Ecuador) |

| 100% (a) (b) |

|

| Amerisur S.A. (Paraguay) |

| 100% (a) (b) |

(a) | Indirectly owned. |

(b) | Dormant companies. |

10

Note 1 (Continued)

Subsidiary undertakings (Continued)

|

|

|

|

|

|

| Name and registered office |

| Ownership interest |

Joint operations |

| Flamenco Block (Chile) |

| 50% (a) |

|

| Campanario Block (Chile) |

| 50% (a) |

|

| Isla Norte Block (Chile) |

| 60% (a) |

|

| Llanos 34 Block (Colombia) |

| 45% (a) |

|

| Llanos 32 Block (Colombia) |

| 12.5% |

|

| Puelen Block (Argentina) |

| 18% (b) |

|

| Sierra del Nevado Block (Argentina) |

| 18% (b) |

|

| CN-V Block (Argentina) |

| 50% |

|

| Los Parlamentos (Argentina) |

| 50% |

|

| Manati Field (Brazil) |

| 10% |

|

| REC-T-128 Block (Brazil) |

| 70% (a) |

|

| POT-T-785 Block (Brazil) |

| 70% (a) |

|

| Morona Block (Peru) |

| 75% (a) |

|

| Espejo Block (Ecuador) |

| 50% (a) |

|

| Perico Block (Ecuador) |

| 50% |

|

| Llanos 86 Block (Colombia) |

| 50% (a) |

|

| Llanos 87 Block (Colombia) |

| 50% (a) |

|

| Llanos 104 Block (Colombia) |

| 50% (a) |

|

| Llanos 123 Block (Colombia) |

| 50% (a) |

|

| Llanos 124 Block (Colombia) |

| 50% (a) |

|

| CPO-5 Block (Colombia) |

| 30% |

|

| Coati Block (Colombia) |

| 60% |

|

| Mecaya Block (Colombia) |

| 50% |

|

| PUT-8 Block (Colombia) |

| 50% |

|

| PUT-9 Block (Colombia) |

| 50% |

|

| PUT-12 Block (Colombia) |

| 60% |

|

| Tacacho Block (Colombia) |

| 50% |

|

| Terecay Block (Colombia) |

| 50% |

(a) | GeoPark is the operator. |

(b) | In process of relinquishment. |

Note 2

Segment Information

Operating segments are reported in a manner consistent with the internal reporting provided to the chief operating decision-maker. The chief operating decision-maker, who is responsible for allocating resources and assessing performance of the operating segments, has been identified as the Executive Committee. This committee is integrated by the CEO, COO, CFO and managers in charge of the Geoscience, Operations, Legal and Corporate Governance, People and Sustainability departments. This committee reviews the Group’s internal reporting in order to assess performance and allocate resources. Management has determined the operating segments based on these reports. The committee considers the business from a geographic perspective.

11

Note 2 (Continued)

Segment Information (Continued)

The Executive Committee assesses the performance of the operating segments based on a measure of Adjusted EBITDA. Adjusted EBITDA is defined as profit for the period (determined as if IFRS 16 Leases has not been adopted), before net finance cost, income tax, depreciation, amortization, certain non-cash items such as impairments and write-offs of unsuccessful exploration efforts, accrual of share-based payment, unrealized result on commodity risk management contracts and other items (such as geological and geophysical expenses allocated to capitalized projects and other expenses). Operating Netback is equivalent to Adjusted EBITDA before cash expenses included in Administrative, Geological and Geophysical and Other operating expenses. Other information provided to the Executive Committee is measured in a manner consistent with that in the financial statements.

Three-months period ended March 31, 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amounts in US$ '000 |

| Total |

| Colombia |

| Chile |

| Brazil |

| Argentina |

| Peru |

| Ecuador |

| Corporate |

Revenue |

| 133,239 |

| 114,076 |

| 6,996 |

| 3,260 |

| 8,907 |

| — |

| — |

| — |

Sale of crude oil |

| 123,835 |

| 113,476 |

| 2,106 |

| 488 |

| 7,765 | �� | — |

| — |

| — |

Sale of gas |

| 9,404 |

| 600 |

| 4,890 |

| 2,772 |

| 1,142 |

| — |

| — |

| — |

Production and operating costs |

| (41,075) |

| (29,263) |

| (3,583) |

| (1,271) |

| (6,958) |

| — |

| — |

| — |

Royalties |

| (12,709) |

| (10,926) |

| (252) |

| (325) |

| (1,206) |

| — |

| — |

| — |

Share-based payment |

| (68) |

| (43) |

| (14) |

| (1) |

| (10) |

| — |

| — |

| — |

Operating costs |

| (28,298) |

| (18,294) |

| (3,317) |

| (945) |

| (5,742) |

| — |

| — |

| — |

Depreciation |

| (39,301) |

| (24,064) |

| (8,797) |

| (994) |

| (5,279) |

| (136) |

| — |

| (31) |

Operating profit (loss) |

| (35,149) |

| 80,490 |

| (59,402) |

| 367 |

| (19,209) |

| (32,016) |

| (241) |

| (5,138) |

Operating Netback |

| 93,422 |

| 87,021 |

| 3,346 |

| 1,469 |

| 1,584 |

| 2 |

| — |

| — |

Adjusted EBITDA |

| 77,702 |

| 76,316 |

| 2,928 |

| 828 |

| 2,106 |

| (987) |

| (227) |

| (3,262) |

Three-months period ended March 31, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amounts in US$ '000 |

| Total |

| Colombia |

| Chile |

| Brazil |

| Argentina |

| Peru |

| Corporate |

Revenue |

| 150,139 |

| 126,594 |

| 8,762 |

| 5,453 |

| 9,330 |

| — |

| — |

Sale of crude oil |

| 137,608 |

| 126,161 |

| 3,306 |

| 190 |

| 7,951 |

| — |

| — |

Sale of gas |

| 12,531 |

| 433 |

| 5,456 |

| 5,263 |

| 1,379 |

| — |

| — |

Production and operating costs |

| (38,919) |

| (26,289) |

| (4,914) |

| (1,456) |

| (6,260) |

| — |

| — |

Royalties |

| (13,264) |

| (11,138) |

| (329) |

| (406) |

| (1,391) |

| — |

| — |

Share-based payment |

| (316) |

| (168) |

| (71) |

| (15) |

| (62) |

| — |

| — |

Operating costs |

| (25,339) |

| (14,983) |

| (4,514) |

| (1,035) |

| (4,807) |

| — |

| — |

Depreciation |

| (25,450) |

| (11,429) |

| (8,342) |

| (1,725) |

| (3,773) |

| (142) |

| (39) |

Operating profit (loss) |

| 45,980 |

| 54,660 |

| (5,312) |

| 2,462 |

| (704) |

| (975) |

| (4,151) |

Operating Netback |

| 108,987 |

| 99,081 |

| 3,818 |

| 3,497 |

| 2,591 |

| — |

| — |

Adjusted EBITDA |

| 92,253 |

| 88,989 |

| 2,924 |

| 2,755 |

| 2,646 |

| (1,390) |

| (3,671) |

12

Note 2 (Continued)

Segment Information (Continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets |

| Total |

| Colombia |

| Chile |

| Brazil |

| Argentina |

| Peru |

| Ecuador |

| Corporate |

March 31, 2020 |

| 1,128,154 |

| 754,788 |

| 196,126 |

| 54,586 |

| 62,843 |

| 23,284 |

| 1,094 |

| 35,433 |

December 31, 2019 |

| 852,132 |

| 357,125 |

| 249,207 |

| 68,480 |

| 79,062 |

| 53,993 |

| 1,119 |

| 43,146 |

A reconciliation of total Operating Netback to total profit before income tax is provided as follows:

|

|

|

|

|

|

| Three-months |

| Three-months |

|

| period ended |

| period ended |

|

| March 31, 2020 |

| March 31, 2019 |

Operating Netback |

| 93,422 |

| 108,987 |

Geological and geophysical expenses |

| (4,551) |

| (5,285) |

Administrative expenses |

| (11,169) |

| (11,449) |

Adjusted EBITDA for reportable segments |

| 77,702 |

| 92,253 |

Unrealized gain (loss) on commodity risk management contracts |

| 26,431 |

| (23,078) |

Depreciation (a) |

| (39,301) |

| (25,450) |

Write-off of unsuccessful exploration efforts |

| (3,205) |

| (303) |

Impairment loss recognized for non-financial assets |

| (97,481) |

| — |

Share-based payment |

| (1,920) |

| (1,255) |

Lease accounting - IFRS 16 |

| 2,784 |

| 1,342 |

Others (b) |

| (159) |

| 2,471 |

Operating (loss) profit |

| (35,149) |

| 45,980 |

Financial expenses |

| (14,754) |

| (9,689) |

Financial income |

| 1,423 |

| 864 |

Foreign exchange (loss) gain |

| (10,787) |

| 994 |

(Loss) Profit before tax |

| (59,267) |

| 38,149 |

(a) | Net of capitalized costs for oil stock included in Inventories. Depreciation includes US$ 700,000 (US$ 701,000 in 2019) generated by assets not related to production activities. |

(b) | Includes allocation to capitalized projects. |

13

Note 2 (Continued)

Segment Information (Continued)

The following table presents a reconciliation of Adjusted EBITDA to operating profit (loss) for the three-month periods ended March 31, 2020 and 2019:

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

| Three-months period ended March 31, 2020 | |||||||||||

|

| Colombia |

| Chile |

| Brazil |

| Argentina |

| Other (a) |

| Total | |

Adjusted EBITDA for reportable segments |

| 76,316 |

| 2,928 |

| 828 |

| 2,106 |

| (4,476) |

| 77,702 | |

Depreciation |

| (24,064) |

| (8,797) |

| (994) |

| (5,279) |

| (167) |

| (39,301) | |

Unrealized gain on commodity risk management contracts |

| 26,431 |

| — |

| — |

| — |

| — |

| 26,431 | |

Write-off of unsuccessful exploration efforts |

| — |

| (3,205) |

| — |

| — |

| — |

| (3,205) | |

Impairment loss recognized for non-financial assets |

| — |

| (50,281) |

| — |

| (16,205) |

| (30,995) |

| (97,481) | |

Share-based payment |

| (87) |

| (23) |

| (6) |

| (43) |

| (1,761) |

| (1,920) | |

Lease accounting - IFRS 16 |

| 1,799 |

| 35 |

| 566 |

| 251 |

| 133 |

| 2,784 | |

Others |

| 95 |

| (59) |

| (27) |

| (39) |

| (129) |

| (159) | |

Operating profit / (loss) |

| 80,490 |

| (59,402) |

| 367 |

| (19,209) |

| (37,395) |

| (35,149) | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Three-months period ended March 31, 2019 | ||||||||||

|

| Colombia |

| Chile |

| Brazil |

| Argentina |

| Other (a) |

| Total |

Adjusted EBITDA for reportable segments |

| 88,989 |

| 2,924 |

| 2,755 |

| 2,646 |

| (5,061) |

| 92,253 |

Depreciation |

| (11,429) |

| (8,342) |

| (1,725) |

| (3,773) |

| (181) |

| (25,450) |

Unrealized loss on commodity risk management contracts |

| (23,078) |

| — |

| — |

| — |

| — |

| (23,078) |

Write-off of unsuccessful exploration efforts |

| (230) |

| — |

| — |

| (73) |

| — |

| (303) |

Share-based payment |

| (315) |

| (137) |

| (33) |

| (279) |

| (491) |

| (1,255) |

Lease accounting - IFRS 16 |

| 387 |

| 44 |

| 548 |

| 237 |

| 126 |

| 1,342 |

Others |

| 336 |

| 199 |

| 917 |

| 538 |

| 481 |

| 2,471 |

Operating profit / (loss) |

| 54,660 |

| (5,312) |

| 2,462 |

| (704) |

| (5,126) |

| 45,980 |

(a) | Includes Peru, Ecuador and Corporate. |

Note 3

Revenue

|

|

|

|

|

|

| Three-months |

| Three-months |

|

| period ended |

| period ended |

Amounts in US$ '000 |

| March 31, 2020 |

| March 31, 2019 |

Sale of crude oil |

| 123,835 |

| 137,608 |

Sale of gas |

| 9,404 |

| 12,531 |

|

| 133,239 |

| 150,139 |

14

Note 4

Commodity risk management contracts

The Group entered into derivative financial instruments to manage its exposure to oil price risk. These derivatives are zero-premium collars, fixed price or zero-premium 3 ways (put spread plus call), and were placed with major financial institutions and commodity traders. The Group entered into the derivatives under ISDA Master Agreements and Credit Support Annexes, which provide credit lines for collateral posting thus alleviating possible liquidity needs under the instruments and protect the Group from potential non-performance risk by its counterparties. The Group’s derivatives are accounted for as non-hedge derivatives and therefore all changes in the fair values of its derivative contracts are recognized as gains or losses in the results of the periods in which they occur.

The following table presents the Group’s derivative contracts in force as of March 31, 2020:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Volume |

|

|

Period |

| Reference |

| Type |

| bbl/d |

| Price US$/bbl |

April 1, 2019 - March 31, 2020 |

| ICE BRENT |

| Zero Premium 3 Way |

| 2,000 |

| 45.00-55.00 Put 79.02 Call |

April 1, 2019 - March 31, 2020 |

| ICE BRENT |

| Zero Premium 3 Way |

| 2,000 |

| 45.00-55.00 Put 79.00 Call |

July 1, 2019 - March 31, 2020 |

| ICE BRENT |

| Zero Premium 3 Way |

| 4,000 |

| 45.00-55.00 Put 81.50 Call |

October 1, 2019 - December 31, 2020 |

| ICE BRENT |

| Zero Premium 3 Way |

| 2,000 |

| 45.00-55.00 Put 71.00 Call |

October 1, 2019 - December 31, 2020 |

| ICE BRENT |

| Zero Premium 3 Way |

| 2,000 |

| 45.00-55.00 Put 73.80 Call |

November 1, 2019 - December 31, 2020 |

| ICE BRENT |

| Zero Premium 3 Way |

| 2,000 |

| 45.00-55.00 Put 65.20 Call |

January 1, 2020 - December 31, 2020 |

| ICE BRENT |

| Zero Premium 3 Way |

| 2,000 |

| 45.00-55.00 Put 69.00 Call |

January 1, 2020 - December 31, 2020 |

| ICE BRENT |

| Zero Premium 3 Way |

| 2,000 |

| 45.00-55.00 Put 70.00 Call |

April 1, 2020 - December 31, 2020 |

| ICE BRENT |

| Zero Premium 3 Way |

| 1,000 |

| 45.00-55.00 Put 71.95 Call |

The table below summarizes the gain (loss) on the commodity risk management contracts:

|

|

|

|

|

|

| Three-months |

| Three-months |

|

| period ended |

| period ended |

|

| March 31, 2020 |

| March 31, 2019 |

Realized gain on commodity risk management contracts |

| 5,580 |

| 1,810 |

Unrealized gain (loss) on commodity risk management contracts |

| 26,431 |

| (23,078) |

Total |

| 32,011 |

| (21,268) |

During the three-months period ending March 31, 2020, the Group hedged 18,000 bbl/d via zero-premium collars and zero-premium 3 ways (US$ 10/bbl wide put spread and call), with a minimum average Brent price of US$ 55/bbl and a maximum average price of US$ 81.50/bbl.

The following table presents the Group’s derivative contracts agreed after the balance sheet date:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Volume |

|

|

Period |

| Reference |

| Type |

| bbl/d |

| Price US$/bbl |

April 1, 2020 - September 30, 2020 |

| ICE BRENT |

| Zero Premium Collar |

| 2,500 |

| 30.00 Put 32.15 Call |

April 2, 2020 - June 30, 2020 |

| ICE BRENT |

| Fixed Price |

| 2,000 |

| 31.10 |

April 2, 2020 - June 30, 2020 |

| ICE BRENT |

| Fixed Price |

| 3,500 |

| 31.80 |

April 2, 2020 - September 30, 2020 |

| ICE BRENT |

| Fixed Price |

| 2,000 |

| 32.00 |

April 3, 2020 - June 30, 2020 |

| ICE BRENT |

| Zero Premium Collar |

| 2,500 |

| 33.00 Put 35.10 Call |

April 7, 2020 - June 30, 2020 |

| ICE BRENT |

| Zero Premium Collar |

| 1,000 |

| 34.00 Put 36.10 Call |

April 9, 2020 - June 30, 2020 |

| ICE BRENT |

| Zero Premium Collar |

| 1,500 |

| 34.00 Put 36.55 Call |

July 1, 2020 - September 30, 2020 |

| ICE BRENT |

| Zero Premium Collar |

| 2,000 |

| 30.00 Put 34.60 Call |

15

Note 5

Production and operating costs

|

|

|

|

|

|

| Three-months period |

| Three-months period |

Amounts in US$ '000 |

| ended March 31, 2020 |

| ended March 31, 2019 |

Staff costs |

| 3,699 |

| 4,861 |

Share-based payment |

| 68 |

| 316 |

Royalties |

| 12,709 |

| 13,264 |

Well and facilities maintenance |

| 5,397 |

| 5,810 |

Operation and maintenance |

| 1,896 |

| 2,031 |

Consumables |

| 5,105 |

| 4,774 |

Equipment rental |

| 2,415 |

| 2,259 |

Transportation costs |

| 1,080 |

| 710 |

Gas plant costs |

| 568 |

| 757 |

Safety and insurance costs |

| 1,118 |

| 914 |

Field camp |

| 760 |

| 756 |

Non operated blocks costs |

| 364 |

| 355 |

Crude oil stock variation |

| 3,142 |

| (313) |

Other costs |

| 2,754 |

| 2,425 |

|

| 41,075 |

| 38,919 |

Note 6

Geological and geophysical expenses

|

|

|

|

|

|

| Three-months period |

| Three-months period |

Amounts in US$ '000 |

| ended March 31, 2020 |

| ended March 31, 2019 |

Staff costs |

| 3,335 |

| 4,090 |

Share-based payment |

| 69 |

| 187 |

Other services |

| 1,127 |

| 1,158 |

Allocation to capitalized project |

| (73) |

| (1,139) |

|

| 4,458 |

| 4,296 |

Note 7

Administrative expenses

|

|

|

|

|

|

| Three-months period |

| Three-months period |

Amounts in US$ '000 |

| ended March 31, 2020 |

| ended March 31, 2019 |

Staff costs |

| 5,890 |

| 5,931 |

Share-based payment |

| 1,783 |

| 752 |

Consultant fees |

| 2,209 |

| 2,692 |

Travel expenses |

| 807 |

| 1,083 |

Director fees and allowance |

| 653 |

| 893 |

Communication and IT costs |

| 606 |

| 901 |

Allocation to joint operations |

| (2,504) |

| (1,944) |

Other administrative expenses |

| 3,241 |

| 1,413 |

|

| 12,685 |

| 11,721 |

16

Note 8

Selling expenses

|

|

|

|

|

|

| Three-months |

| Three-months |

|

| period ended |

| period ended |

Amounts in US$ '000 |

| March 31, 2020 |

| March 31, 2019 |

Transportation |

| 1,653 |

| 3,214 |

Selling taxes and other |

| 309 |

| 320 |

|

| 1,962 |

| 3,534 |

Note 9

Financial results

|

|

|

|

|

|

| Three-months |

| Three-months |

|

| period ended |

| period ended |

Amounts in US$ '000 |

| March 31, 2020 |

| March 31, 2019 |

Financial expenses |

|

|

|

|

Bank charges and other financial costs |

| (1,862) |

| (965) |

Interest and amortization of debt issue costs |

| (11,352) |

| (7,565) |

Unwinding of long-term liabilities |

| (1,540) |

| (1,240) |

Less: amounts capitalized on qualifying assets |

| — |

| 81 |

|

| (14,754) |

| (9,689) |

Financial income |

|

|

|

|

Interest received |

| 1,423 |

| 864 |

|

| 1,423 |

| 864 |

Foreign exchange gains and losses |

|

|

|

|

Foreign exchange gain (loss) |

| 2,919 |

| (1,656) |

Realized (loss) gain on currency risk management contracts (a) |

| (472) |

| 431 |

Unrealized (loss) gain on currency risk management contracts (a) |

| (13,234) |

| 2,219 |

|

| (10,787) |

| 994 |

Total financial results |

| (24,118) |

| (7,831) |

(a) | GeoPark manages its exposure to local currency fluctuation with respect to income tax balances in Colombia by entering into derivative financial instruments with local banks in Colombia, for an amount equivalent to US$ 83,700,000 as of December 31, 2019 (US$ 92,050,000 as of December 31, 2018), in order to anticipate any currency fluctuation with respect to income taxes payable in February, April and June 2020 and 2019, respectively. |

17

Note 10

Property, plant and equipment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Furniture, |

|

|

|

|

|

|

| Exploration |

|

|

|

|

|

| equipment |

| Production |

| Buildings |

|

|

| and |

|

|

|

| Oil & gas |

| and |

| facilities and |

| and |

| Construction |

| evaluation |

|

|

Amounts in US$'000 |

| properties |

| vehicles |

| machinery |

| improvements |

| in progress |

| assets |

| TOTAL |

Cost at January 1, 2019 |

| 717,510 |

| 17,748 |

| 172,094 |

| 11,554 |

| 60,597 |

| 59,992 |

| 1,039,495 |

Additions |

| 994 |

| 117 |

| 359 |

| 27 |

| 35,730 |

| 4,665 |

| 41,892 |

Write-off of unsuccessful exploration efforts |

| — |

| — |

| — |

| — |

| — |

| (303) |

| (303) |

Transfers |

| 13,981 |

| 257 |

| 2,633 |

| 65 |

| (13,458) |

| (3,478) |

| — |

Currency translation differences |

| (454) |

| (5) |

| (82) |

| (1) |

| — |

| (55) |

| (597) |

Cost at March 31, 2019 |

| 732,031 |

| 18,117 |

| 175,004 |

| 11,645 |

| 82,869 |

| 60,821 |

| 1,080,487 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost at January 1, 2020 |

| 830,937 |

| 19,549 |

| 172,507 |

| 11,770 |

| 69,587 |

| 48,036 |

| 1,152,386 |

Additions |

| (654) |

| 520 |

| 4 |

| 423 |

| 23,215 |

| 9,555 |

| 33,063 |

Acquisitions |

| 165,954 |

| 616 |

| 37,073 |

| — |

| 1,221 |

| 78,773 |

| 283,637 |

Write-off / Impairment |

| (66,486) | (a) | — |

| — |

| — |

| (30,995) | (a) | (3,205) | (b) | (100,686) |

Transfers |

| 22,626 |

| — |

| 2,239 |

| 78 |

| (19,976) |

| (4,967) |

| — |

Currency translation differences |

| (17,480) |

| (176) |

| (3,141) |

| (68) |

| (47) |

| (511) |

| (21,423) |

Cost at March 31, 2020 |

| 934,897 |

| 20,509 |

| 208,682 |

| 12,203 |

| 43,005 |

| 127,681 |

| 1,346,977 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and write-down at January 1, 2019 |

| (359,358) |

| (13,361) |

| (103,704) |

| (5,902) |

| — |

| — |

| (482,325) |

Depreciation |

| (19,526) |

| (466) |

| (4,265) |

| (235) |

| — |

| — |

| (24,492) |

Currency translation differences |

| 322 |

| 1 |

| 118 |

| 1 |

| — |

| — |

| 442 |

Depreciation and write-down at March 31, 2019 |

| (378,562) |

| (13,826) |

| (107,851) |

| (6,136) |

| — |

| — |

| (506,375) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and write-down at January 1, 2020 |

| (467,806) |

| (15,149) |

| (95,047) |

| (6,596) |

| — |

| — |

| (584,598) |

Depreciation |

| (30,181) |

| (572) |

| (5,345) |

| (128) |

| — |

| — |

| (36,226) |

Currency translation differences |

| 12,461 |

| 155 |

| 3,317 |

| 38 |

| — |

| — |

| 15,971 |

Depreciation and write-down at March 31, 2020 |

| (485,526) |

| (15,566) |

| (97,075) |

| (6,686) |

| — |

| — |

| (604,853) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Carrying amount at March 31, 2019 |

| 353,469 |

| 4,291 |

| 67,153 |

| 5,509 |

| 82,869 |

| 60,821 |

| 574,112 |

Carrying amount at March 31, 2020 |

| 449,371 |

| 4,943 |

| 111,607 |

| 5,517 |

| 43,005 |

| 127,681 |

| 742,124 |

(a) | See Note 19. |

(b) | Corresponds to an unsuccessful exploratory well drilled in the Isla Norte Block (Chile). |

18

Note 11

Equity

Share capital

|

|

|

|

|

|

| At |

| Year ended |

Issued share capital |

| March 31, 2020 |

| December 31, 2019 |

Common stock (US$ ´000) |

| 61 |

| 59 |

The share capital is distributed as follows: |

|

|

|

|

Common shares, of nominal US$ 0.001 |

| 60,649,149 |

| 59,167,584 |

Total common shares in issue |

| 60,649,149 |

| 59,167,584 |

|

|

|

|

|

Authorized share capital |

|

|

|

|

US$ per share |

| 0.001 |

| 0.001 |

|

|

|

|

|

Number of common shares (US$ 0.001 each) |

| 5,171,949,000 |

| 5,171,949,000 |

Amount in US$ |

| 5,171,949 |

| 5,171,949 |

GeoPark’s share capital only consists of common shares. The authorized share capital consists of 5,171,949,000 common shares of par value US$ 0.001 per share. All of the Company issued and outstanding common shares are fully paid and nonassessable.

Cash distribution

On November 6, 2019, the Company’s Board of Directors declared the initiation of a quarterly cash distribution of US$ 0.0413 per share that was paid on December 10, 2019. On March 4, 2020, declared a quarterly cash distribution of US$ 0.0413 per share that was paid on April 8, 2020.

Buyback Program

On February 10, 2020, the Company’s Board of Directors approved a program to repurchase up to 10% of its shares outstanding or approximately 5,930,000 shares. The repurchase program begun on February 11, 2020 and will expire on December 31, 2020. These transactions have no impact on the Group’s results.

However, both the quarterly cash distribution and the share buyback program were suspended after the April 8, 2020 distribution, as part of the revised work program for 2020 to help address the recent decline in oil prices.

Stock distribution

On February 10, 2020, the Company’s Board of Directors declared a special stock distribution of 0.004 shares per share. Consequently, on March 11, 2020, 242,650 common shares were distributed to the shareholders of record at the close of business on February 25, 2020.

19

Note 12

Borrowings

The outstanding amounts are as follows:

|

|

|

|

|

|

| At |

| Year ended |

Amounts in US$ '000 |

| March 31, 2020 |

| December 31, 2019 |

2024 Notes (a) |

| 421,149 |

| 427,812 |

2027 Notes (b) |

| 346,580 |

| — |

Banco Santander (c) |

| 7,602 |

| 9,607 |

|

| 775,331 |

| 437,419 |

Classified as follows:

|

|

|

|

|

Current |

| 12,273 |

| 17,281 |

Non-Current |

| 763,058 |

| 420,138 |

(a) | On September 21, 2017, the Company successfully placed US$ 425,000,000 notes which were offered to qualified institutional buyers in accordance with Rule 144A under the United States Securities Act, and outside the United States to non-U.S. persons in accordance with Regulation S under the United States Securities Act. |

The Notes carry a coupon of 6.50% per annum. Final maturity of the Notes will be September 21, 2024. The Notes are secured with a guarantee granted by GeoPark Colombia S.L.U. and GeoPark Chile S.p.A. The debt issuance cost for this transaction amounted to US$ 6,683,000 (debt issuance effective rate: 6.90%). The indenture governing the Notes due 2024 includes incurrence test covenants that provide, among other things, that during the two-years period between September 22, 2019 and September 21, 2021, the Net Debt to Adjusted EBITDA ratio should not exceed 3.25 times and the Adjusted EBITDA to Interest ratio should exceed 2.25 times. Failure to comply with the incurrence test covenants does not trigger an event of default. However, this situation may limit the Company’s capacity to incur additional indebtedness, as specified in the indenture governing the Notes. Incurrence covenants as opposed to maintenance covenants must be tested by the Company before incurring additional debt or performing certain corporate actions including but not limited to dividend payments, restricted payments and others. As of the date of these interim condensed consolidated financial statements, the Company is in compliance of all the indenture’s provisions and covenants.

(b) | On January 17, 2020, the Company successfully placed US$ 350,000,000 Notes which were offered in a private placement to qualified institutional buyers in accordance with Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”), and outside the United States to non U.S. persons in accordance with Regulation S under the Securities Act. The Notes will be fully and unconditionally guaranteed jointly and severally by GeoPark Chile S.p.A. and GeoPark Colombia S.L.U. |

20

Note 12 (Continued)

Borrowings (Continued)

The Notes were priced at 99.285% and carry a coupon of 5.50% per annum (yield 5.625% per annum). The debt issuance cost for this transaction amounted to US$ 5,004,000 (debt issuance effective rate: 5.88%). Final maturity of the Notes will be January 17, 2027. The indenture governing the Notes due 2027 includes incurrence test covenants that provides among other things, that, the Net Debt to Adjusted EBITDA ratio should not exceed 3.25 times and the Adjusted EBITDA to Interest ratio should exceed 2.5 times. Failure to comply with the incurrence test covenants does not trigger an event of default. However, this situation may limit the Company’s capacity to incur additional indebtedness, as specified in the indenture governing the Notes. Incurrence covenants as opposed to maintenance covenants must be tested by the Company before incurring additional debt or performing certain corporate actions including but not limited to dividend payments, restricted payments and others.

The net proceeds from the Notes were used by the Company (i) to make an intercompany loan to its wholly-owned subsidiary, GeoPark Colombia S.A.S., providing it with sufficient funds to pay the total consideration for the acquisition of Amerisur (see Note 17) and to pay any related fees and expenses, and (ii) for general corporate purposes.

(c) | During October 2018, GeoPark Brazil Exploração y Produção de Petróleo e Gás Ltda. executed a loan agreement with Banco Santander for Brazilian Real 77,640,000 (equivalent to US$ 20,000,000 at the moment of the loan execution) to repay an existing US$-denominated intercompany loan to GeoPark Latin America Limited - Agencia en Chile. The interest rate applicable to this loan is CDI plus 2.25% per annum. “CDI” (Interbank certificate of deposit) represents the average rate of all inter-bank overnight transactions in Brazil. The principal and the interest are paid semi-annually, with final maturity in October 2020. |

As of the date of these interim condensed consolidated financial statements, the Group has available credit lines for over US$ 130,700,000.

Note 13

Provisions and other long-term liabilities

The outstanding amounts are as follows:

|

|

|

|

|

|

| At |

| Year ended |

Amounts in US$ '000 |

| March 31, 2020 |

| December 31, 2019 |

Assets retirement obligation |

| 60,291 |

| 56,113 |

Deferred income |

| 4,167 |

| 2,267 |

Other |

| 9,250 |

| 3,682 |

|

| 73,708 |

| 62,062 |

21

Note 14

Trade and other payables

The outstanding amounts are as follows:

|

|

|

|

|

|

| At |

| Year ended |

Amounts in US$ '000 |

| March 31, 2020 |

| December 31, 2019 |

Trade payables |

| 77,633 |

| 83,991 |

To be paid to co-venturers |

| 10,702 |

| 4,803 |

Payables to LGI (a) |

| 15,000 |

| 15,000 |

Customer advance payments (b) |

| 7,554 |

| — |

Staff costs to be paid |

| 12,785 |

| 13,219 |

Cash distribution to be paid |

| 2,447 |

| — |

Royalties to be paid |

| 4,918 |

| 6,294 |

V.A.T |

| 2,260 |

| 6,718 |

Taxes and other debts to be paid |

| 8,802 |

| 6,795 |

|

| 142,101 |

| 136,820 |

Classified as follows:

|

|

|

|

|

Current |

| 133,619 |

| 131,345 |

Non-Current |

| 8,482 |

| 5,475 |

(a) | Payables related to the acquisition of Non-controlling interest in Colombia and Chile’s business from LG International in November 2018 (see Note 36.1 to the audited Consolidated Financial Statements as of December 31, 2019). |

(b) | In April 2018, Amerisur entered into a prepayment agreement with Shell Western Supply & Trading Limited under which Amerisur sells and deliver a portion of its Colombian crude oil production. Funds committed were available upon request until June 2019 and will be repaid by the Group on a quarterly basis through future oil deliveries until June 2020. |

Note 15

Fair value measurement of financial instruments

Fair value hierarchy

The following table presents the Group’s financial assets and financial liabilities measured and recognized at fair value at March 31, 2020 and December 31, 2019 on a recurring basis:

|

|

|

|

|

|

|

|

|

|

|

|

| At |

Amounts in US$ '000 |

| Level 1 |

| Level 2 |

| March 31, 2020 |

Assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

|

|

|

|

|

Money market funds |

| 25,134 |

| — |

| 25,134 |

Derivative financial instrument assets |

|

|

|

|

|

|

Commodity risk management contracts |

| — |

| 31,503 |

| 31,503 |

Total Assets |

| 25,134 |

| 31,503 |

| 56,637 |

22

Note 15 (Continued)

Fair value measurement of financial instruments (Continued)

Fair value hierarchy (Continued)

|

|

|

|

|

|

|

|

|

|

|

|

| At |

Amounts in US$ '000 |

| Level 1 |

| Level 2 |

| March 31, 2020 |

Liabilities |

|

|

|

|

|

|

Derivative financial instrument liabilities |

|

|

|

|

|

|

Currency risk management contracts |

| — |

| 12,360 |

| 12,360 |

Total Liabilities |

| — |

| 12,360 |

| 12,360 |

|

|

|

|

|

|

|

|

|

|

|

|

| Year ended |

Amounts in US$ '000 |

| Level 1 |

| Level 2 |

| December 31, 2019 |

Assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

|

|

|

|

|

Money market funds |

| 42,212 |

| — |

| 42,212 |

Derivative financial instrument assets |

|

|

|

|

|

|

Commodity risk management contracts |

| — |

| 444 |

| 444 |

Currency risk management contracts |

| — |

| 874 |

| 874 |

Forward contracts relating to forecast transactions |

| — |

| 6,779 |

| 6,779 |

Total Assets |

| 42,212 |

| 8,097 |

| 50,309 |

Liabilities |

|

|

|

|

|

|

Derivative financial instrument liabilities |

|

|

|

|

|

|

Commodity risk management contracts |

| — |

| 952 |

| 952 |

Total Liabilities |

| — |

| 952 |

| 952 |

There were no transfers between Level 2 and 3 during the period.

The Group did not measure any financial assets or financial liabilities at fair value on a non-recurring basis as at March 31, 2020.

Fair values of other financial instruments (unrecognized)

The Group also has a number of financial instruments which are not measured at fair value in the balance sheet. For the majority of these instruments, the fair values are not materially different to their carrying amounts, since the interest receivable/payable is either close to current market rates or the instruments are short-term in nature.

Borrowings are comprised primarily of fixed rate debt and variable rate debt with a short term portion where interest has already been fixed. They are measured at their amortized cost. The Group estimates that the fair value of its main financial liabilities is approximately 54% of its carrying amount including interests accrued as of March 31, 2020. Fair values were calculated based on market price for the Notes and cash flows discounted for other borrowings using a rate based on the borrowing rate and are within Level 1 and Level 2 of the fair value hierarchy, respectively.

23

Note 16

Capital commitments

Capital commitments are detailed in Note 33.2 to the audited Consolidated Financial Statements as of December 31, 2019. The following updates have taken place during the three-month period ended March 31, 2020:

Colombia

The Colombian National Hydrocarbons Agency (“ANH”) approved the termination of the E&P Contract related to the VIM-3 Block requested by GeoPark in 2018, with a remaining commitment for an amount of US$ 9,290,800, which can be transferred as investment to another block in Colombia.

The Llanos 32 Block has committed to drill 2 exploratory wells, which amount to US$ 3,350,000 at GeoPark’s working interest, before February 20, 2022.

The future investment commitments were assumed by the Group, at its working interest, as a consequence of the acquisition of Amerisur (see Note 17):

· | CPO-5 Block: 3D seismic acquisition, processing and interpretation (US$ 2,542,000) before July 9, 2021. |

· | Coati Block: 3D seismic and 2D seismic acquisition (US$ 4,500,000). The exploratory period is currently under suspension. |

· | PUT-8 Block: 3D seismic acquisition and 3 exploratory wells (US$ 13,107,000) before March 1, 2022. |

· | PUT-9 Block: 3D seismic acquisition and 2 exploratory wells (US$ 4,365,000) before October 14, 2020. On March 18, 2020, GeoPark requested ANH to suspend the exploratory period. |

· | PUT-12 Block: 2D seismic acquisition, reprocessing and interpretation, geochemistry and 1 exploratory well (US$ 17,920,000) before December 29, 2021. On April 7, 2020, GeoPark requested ANH to suspend the exploratory period. |

· | PUT-30 Block: 2D seismic acquisition and 1 exploratory well (US$ 26,929,000) before May 2, 2022. |

· | Terecay Block: 3D seismic acquisition, processing and interpretation (US$ 2,856,000). The exploratory period is currently under suspension. |

· | The PUT-14 and PUT-36 Blocks are in Preliminary Phase as of the date of these interim condensed consolidated financial statements. During this Preliminary Phase, GeoPark must request the Ministry of Interior for the certificate that indicates presence or no presence of indigenous communities and develop previous consultation, if applicable. Only when this process has been completed and the corresponding regulatory approvals has been obtained, the blocks will enter into Phase 1, where the exploratory commitments are mandatory. The investment commitments for the blocks over the three-years term of Phase 1 would be up to US$ 16,122,000 and US$ 20,584,000, respectively. |

Chile

On March 17, 2020, the Chilean Ministry approved the GeoPark’s proposal of modifying the outstanding commitments in the Campanario Block to 2 deeper exploratory wells, for an amount of US$ 5,002,000.

Brazil

GeoPark fulfilled the commitments that were remaining as of 31 December 2019 in the REC-T-128 Block.

24

Note 17

Business transactions

Acquisition of Amerisur Resources Plc

On January 16, 2020, GeoPark acquired the 100% share capital of Amerisur Resources Plc, a company listed on the Alternative Investment Market (“AIM”) of the London Stock Exchange. After the acquisition the company was delisted and the name changed to Amerisur Resources Limited. The principal activities of Amerisur Resources Limited and its subsidiaries (“Amerisur”) are exploration, development and production for oil and gas reserves in Latin America. Amerisur owns thirteen production, development and exploration blocks in Colombia (twelve operated blocks in the Putumayo basin and one non-operated block in the Llanos basin) and an export oil pipeline from Colombia to Ecuador named Oleoducto Binacional Amerisur (“OBA”).

GeoPark paid a cash consideration of British Pound Sterling (”GBP”) 241,682,496 (equivalent to US$ 314,163,077) at closing date.

Before closing the transaction, the Group decided to manage its exposure to GBP fluctuation with respect to the abovementioned cash consideration. Consequently, on November 25, 2019, GeoPark entered into a “Deal Contingent Forward” (DCF) with a UK Bank, in order to anticipate any currency fluctuation in respect to the cash consideration payable in GBP. This forward contract was accounted for as a cash flow hedge and therefore all changes in its fair value until closing date were recognized in Other Reserve within Equity. At closing date, GeoPark removed that amount from the cash flow hedge reserve and included it directly in the initial cost of the acquired business.

On January 8, 2020, Amerisur announced that it had received a copy of a claim form issued in the High Court of England and Wales (the “Court”) by Leigh Day solicitors on behalf of a group of claimants (the “Claimants”) described as members of a farming community in the department of Putumayo in Colombia. The claim states that the Claimants seek compensation for economic and non-economic damages said to be caused by alleged environmental contamination and pollution caused by Amerisur’s operations in Colombia. Amerisur stated that the accusations of environmental damage referenced in the claim are being investigated by Colombian authorities and to-date have been deemed to be without merit. Amerisur further stated that it viewed the substance of the claim to be without merit. Following court hearings held in January and February 2020, an interim freezing order was imposed on Amerisur in respect to GBP 4,465,600 (equivalent to US$ 5,560,000 as of March 31, 2020) of its assets located in the United Kingdom. Amerisur has been negotiating with the Claimants in order to file a bank guarantee that will enable the Court to lift the freezing order. The Court must now schedule the case management conference, where it will decide on the timetable, disclosure and costs for the proceedings.

In accordance with the acquisition method of accounting, the acquisition cost was allocated to the underlying assets acquired and liabilities assumed based primarily upon their estimated fair values at the date of acquisition. An income approach (being the net present value of expected future cash flows) was adopted to determine the fair values of the mineral interest. Estimates of expected future cash flows reflect estimates of projected future revenues, production costs and capital expenditures based on our business model. The excess of acquisition cost, if any, over the net identifiable assets acquired represents goodwill.

25

Note 17 (Continued)

Business transactions (Continued)

Acquisition of Amerisur Resources Plc (Continued)

The following table summarises the combined consideration paid for the acquired business, and a preliminary allocation of fair value of the assets acquired and liabilities assumed for this transaction:

|

|

|

Amounts in US$ '000 |

| Total |

Cash |

| 314,163 |

Total consideration |

| 314,163 |

Property, plant and equipment (including mineral interest) |

| 283,637 |

Right-of-use assets |

| 17,360 |

Prepayments and other receivables |

| 23,629 |

Trade receivables |

| 11,502 |

Other assets |

| 16,324 |

Cash and cash equivalents |

| 41,828 |

Lease liabilities |

| (17,851) |

Provision for other long-term liabilities |

| (14,284) |

Deferred income tax liabilities |

| (16,343) |

Trade and other payables |

| (31,639) |

Total identifiable net assets |

| 314,163 |

Considering that Amerisur issues financial information on a monthly basis, the Group has considered the identified assets and liabilities as of December 31, 2019. If the purchase price allocation exercise had been carried out as of January 16, 2020, it would not have deferred significantly.

The purchase price allocation detailed above is preliminary, since the valuation process is ongoing. This process will be completed during 2020.

Note 18

Coronavirus and oil price crisis

The oil market is undergoing a significant over-supply condition that has resulted in a sharp drop in prices, with Brent falling by 50% year to date. There are two key drivers for the current market scenario. On the demand side, the sustained impact of the COVID-19 pandemic across the world and the associated containment measures (border closures, flight cancellations, social distancing, self-isolation and quarantine, large gathering restrictions and bar/restaurant closures, among others), have resulted in a sharp and sudden drop in fuel demand and hence on crude demand as well. This impact has been felt since early 2020 but has accelerated significantly in March and April. The full extent and duration of such containment measures, and their impact on the World economy are yet uncertain. The oil demand recovery hinges on the exact timing of the normalization of activity levels around the globe.

Concurrently, on the supply side, during the first week of March 2020, OPEC and non-OPEC producers (sometimes referred to as OPEC+) met in Vienna, Austria, to discuss the prospect of extending or increasing oil production cuts that had been first put in place in late 2016 and had been renewed and expanded ever since. No consensus was reached among the 24 participating countries, effectively eliminating output reduction targets as of April 1, 2020. As a consequence, Saudi Arabia announced plans to increase production to 12 million barrels per day. Other OPEC+ members and Russia also announced production increases.

26

Note 18 (Continued)

Coronavirus and oil price crisis (Continued)

The combined impact of sharply lower demand and growing supply have led the market into an oil significant surplus with inventories building around the world and prices dropping to levels last seen in the early 2000s.

In mid April, in the midst of significant demand destruction, OPEC+ agreed to a historical 9.7 MMbbl/d output cut. They were joined by other G-20 countries which indicated they would add 3 to 5 MMbbl/d production reductions. The compliance with these output reduction measures, alongside demand recovery, will be the key elements to balance the crude oil market in the coming months.

Although there are not specific tax benefits granted to the oil and gas sector in the jurisdictions where the Company has its business, in response to the Covid-19 crisis, many governments have granted extensions to file and pay tax duties. The Group has applied and used any extension granted, specifically in Colombia, Brazil, Argentina, Peru and Spain. Likewise, certain social security charges on payroll have been also allowed to be reduced. Tax audits and procedures before fiscal authorities have been suspended until further governmental notice.

Specifically, GeoPark’s program and strategy are guided by the following principles and priorities:

· | Keep Team Healthy: Protect workforce and families from the pandemic and its interruptions |

· | Continuity of Field Operations: Ensure backup plans and teams in place to guarantee continuity of operations and business |

· | Preserve Cash: Adjust the work program to maintain flexibility and balance sheet strength |

· | Capital Allocation Discipline: Prioritize lower-risk, higher netback, and quick cash flow generating projects |

· | Do More for Less: Implement operating, administrative and capital cost reduction measures |

· | Stay Agile: Continuous monitoring of work programs and adjustment, up or down, as necessary |

· | Build for the Long-Term: Protect critical tools and capabilities necessary for the long-term |

Examples of the ongoing cost-cutting initiatives already implemented and providing results include:

· | Renegotiation of all service contracts, as well as any other type of contract |

· | Improvements in operational efficiency |

· | Temporary suspension of certain marginal fields |

· | Overall reduction of administrative and structure costs, starting with a voluntary salary and bonus reduction by our management team and Board of Directors, as well as general renegotiation of fees and expenses |

· | Temporary suspension of quarterly cash dividends and share buybacks |

Effective immediately, GeoPark adjusted the 2020 capital expenditures program to US$ 70‑80 million, approximately a 60% reduction from prior preliminary estimates (approximately US$ 180‑200 million including capital expenditures for Amerisur assets). For the whole year 2020, GeoPark has continued to secure oil production, with a minimum price of US$30 per barrel. Also, the current scenario has not impacted the approved credit lines and both Fitch and Standard & Poor’s maintained their credit ratings on our outstanding series of Notes due 2024 and 2027.

27

Note 19

Impairment test on Property, plant and equipment

Considering the scenario described in Note 18, the Group has addressed the process of evaluating the recoverability of its fixed assets affected by oil price drop. From an accounting point of view, this price drop constitutes an impairment indicator according to IAS 36 and, consequently, it triggers the need of assessing fair value of the assets involved against their carrying amount.

Group’s management considers as Cash Generating Unit (CGU) each of the blocks or group of blocks in which the Group has working or economic interests. The blocks with no material investment on fixed assets or with operations that are not linked to oil prices were not subject to the impairment test.

The main assumptions taken into account for the impairment tests are the ones described in Note 37 of the annual financial statements as at and for the years ended December 31, 2018 and 2019. Only the following assumption were revised: i) the future oil prices have been calculated taking into consideration the updated oil price curves available in the market, provided by international advisory companies, weighted through internal estimations; and ii) the production and structure costs were estimated considering the adjusted 2020 approved budget.

The oil price curves considered Brent of prices of US$ 34.8, US$ 46.0, US$ 53.8 and US$ 59.5 per barrel for 2020 to 2023, respectively.

The following table summarizes the impairment tests performed by the Group as of March 31, 2020:

|

|

|

|

|

|

|

|