- GPRK Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

6-K Filing

GeoPark Limited (GPRK) 6-KCurrent report (foreign)

Filed: 5 Aug 21, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2021

Commission File Number: 001-36298

GeoPark Limited

(Exact name of registrant as specified in its charter)

Calle 94 N° 11-30 8° piso

Bogota, Colombia

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F | X |

| Form 40-F |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes |

| No | X |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes |

| No | X |

GEOPARK LIMITED

TABLE OF CONTENTS

ITEM

| |

1. | Interim Condensed Consolidated Financial Statements and Explanatory Notes for the three-months and six-months periods ended June 30, 2020 and 2021. |

Item 1

GEOPARK LIMITED

INTERIM CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS

AND EXPLANATORY NOTES

For the three-months and six-months periods ended June 30, 2020 and 2021

2

CONDENSED CONSOLIDATED STATEMENT OF INCOME

| | | | | | | | | | |

|

| |

| Three-months |

| Three-months | | Six-months | | Six-months |

| | |

| period ended |

| period ended | | period ended | | period ended |

| | | | June 30, 2021 |

| June 30, 2020 | | June 30, 2021 | | June 30, 2020 |

Amounts in US$ ´000 | | Note |

| (Unaudited) |

| (Unaudited) | | (Unaudited) | | (Unaudited) |

REVENUE |

| 3 |

| 165,598 |

| 55,650 | | 312,193 | | 188,889 |

Commodity risk management contracts |

| 4 |

| (47,669) |

| (9,131) | | (94,960) | | 22,880 |

Production and operating costs |

| 5 |

| (53,020) |

| (20,714) | | (95,972) | | (61,789) |

Geological and geophysical expenses |

| 6 |

| (2,128) |

| (2,951) | | (5,203) | | (7,409) |

Administrative expenses |

| 7 |

| (12,694) |

| (11,318) | �� | (24,027) | | (24,003) |

Selling expenses |

| 8 |

| (1,829) |

| (1,638) | | (3,552) | | (3,600) |

Depreciation |

|

|

| (20,594) |

| (23,322) | | (43,161) | | (62,623) |

Write-off of unsuccessful exploration efforts |

| 10 |

| (8,061) |

| — | | (8,061) | | (3,205) |

Impairment loss recognized for non-financial assets | | 19 | | — | | — | | — | | (97,481) |

Other expenses |

|

|

| (394) |

| (7,429) | | (2,148) | | (7,661) |

OPERATING PROFIT (LOSS) |

|

|

| 19,209 |

| (20,853) | | 35,109 | | (56,002) |

Financial expenses |

| 9 |

| (20,735) |

| (16,545) | | (36,709) | | (31,299) |

Financial income |

| 9 |

| 135 |

| 674 | | 598 | | 2,097 |

Foreign exchange gain (loss) |

| 9 |

| 1,810 |

| 4,726 | | 4,504 | | (6,061) |

PROFIT (LOSS) BEFORE INCOME TAX |

|

|

| 419 |

| (31,998) | | 3,502 | | (91,265) |

Income tax (expense) benefit |

|

|

| (2,887) |

| 12,144 | | (16,307) | | (18,131) |

LOSS FOR THE PERIOD |

|

|

| (2,468) |

| (19,854) | | (12,805) | | (109,396) |

Losses per share (in US$) for loss attributable to owners of the Company. Basic |

|

|

| (0.04) |

| (0.33) | | (0.21) | | (1.81) |

Losses per share (in US$) for loss attributable to owners of the Company. Diluted |

|

|

| (0.04) |

| (0.33) | | (0.21) | | (1.81) |

The above condensed consolidated statement of income should be read in conjunction with the accompanying notes.

3

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

| | | | | | | | |

|

| Three-months |

| Three-months | | Six-months |

| Six-months |

|

| period ended |

| period ended | | period ended |

| period ended |

|

| June 30, 2021 |

| June 30, 2020 | | June 30, 2021 |

| June 30, 2020 |

Amounts in US$ ´000 |

| (Unaudited) |

| (Unaudited) | | (Unaudited) |

| (Unaudited) |

Loss for the period |

| (2,468) |

| (19,854) | | (12,805) |

| (109,396) |

Other comprehensive income |

|

|

|

| |

|

|

|

Items that may be subsequently reclassified to profit or loss: |

|

|

|

| |

|

|

|

Currency translation differences |

| 2,461 |

| (1,682) | | 1,812 |

| (10,182) |

Losses on cash flow hedges |

| — |

| — | | — |

| (6,770) |

Income tax relating to losses on cash flow hedges |

| — |

| — | | — |

| 2,166 |

Other comprehensive profit (loss) for the period |

| 2,461 |

| (1,682) | | 1,812 |

| (14,786) |

Total comprehensive loss for the period |

| (7) |

| (21,536) | | (10,993) |

| (124,182) |

The above condensed consolidated statement of comprehensive income should be read in conjunction with the accompanying notes.

4

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

| | | | | | |

|

| Note |

| At June 30, 2021 |

| Year ended |

Amounts in US$ ´000 | | |

| (Unaudited) |

| December 31, 2020 |

ASSETS |

|

|

|

|

|

|

NON CURRENT ASSETS |

|

|

|

|

|

|

Property, plant and equipment |

| 10 |

| 615,084 |

| 614,665 |

Right-of-use assets |

|

|

| 18,728 |

| 21,402 |

Prepayments and other receivables |

|

|

| 1,071 |

| 1,060 |

Other financial assets |

|

|

| 13,923 |

| 13,364 |

Deferred income tax asset |

|

|

| 22,404 |

| 18,168 |

TOTAL NON CURRENT ASSETS |

|

|

| 671,210 |

| 668,659 |

CURRENT ASSETS |

|

|

|

|

|

|

Inventories |

|

|

| 9,154 |

| 13,326 |

Trade receivables |

|

|

| 47,391 |

| 46,918 |

Prepayments and other receivables |

|

|

| 19,346 |

| 27,263 |

Derivative financial instrument assets |

| 15 |

| — |

| 1,013 |

Other financial assets |

|

|

| 13 |

| 28 |

Cash and cash equivalents |

|

|

| 85,023 |

| 201,907 |

Assets held for sale | | | | — |

| 1,152 |

TOTAL CURRENT ASSETS |

|

|

| 160,927 |

| 291,607 |

TOTAL ASSETS |

|

|

| 832,137 |

| 960,266 |

EQUITY |

|

|

|

|

|

|

Equity attributable to owners of the Company |

|

|

|

|

|

|

Share capital |

| 11 |

| 61 |

| 61 |

Share premium |

|

|

| 179,339 |

| 179,399 |

Reserves |

|

|

| 91,675 |

| 92,216 |

Accumulated losses |

|

|

| (391,197) |

| (380,866) |

TOTAL EQUITY |

|

|

| (120,122) |

| (109,190) |

LIABILITIES |

|

|

|

|

|

|

NON CURRENT LIABILITIES |

|

|

|

|

|

|

Borrowings |

| 12 |

| 656,172 |

| 766,897 |

Lease liabilities |

|

|

| 10,293 |

| 11,457 |

Provisions and other long-term liabilities |

| 13 |

| 81,627 |

| 82,370 |

Deferred income tax liability |

|

|

| 1,550 |

| 7,190 |

Trade and other payables |

| 14 |

| 1,330 |

| 4,886 |

TOTAL NON CURRENT LIABILITIES |

|

|

| 750,972 |

| 872,800 |

CURRENT LIABILITIES |

|

|

|

|

|

|

Borrowings |

| 12 |

| 27,527 |

| 17,689 |

Lease liabilities |

|

|

| 7,596 |

| 10,890 |

Derivative financial instrument liabilities |

| 15 |

| 67,247 |

| 15,094 |

Current income tax liability |

|

|

| 4,549 |

| 52,775 |

Trade and other payables |

| 14 |

| 94,368 |

| 100,156 |

Liabilities associated with assets held for sale | | | | — |

| 52 |

TOTAL CURRENT LIABILITIES |

|

|

| 201,287 |

| 196,656 |

TOTAL LIABILITIES |

|

|

| 952,259 |

| 1,069,456 |

TOTAL EQUITY AND LIABILITIES |

|

|

| 832,137 |

| 960,266 |

The above condensed consolidated statement of financial position should be read in conjunction with the accompanying notes.

5

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

| | | | | | | | | | | | |

|

| Attributable to owners of the Company | ||||||||||

|

| Share |

| Share |

| Other |

| Translation |

| Accumulated |

| |

Amount in US$ '000 |

| Capital |

| Premium |

| Reserve |

| Reserve |

| losses | | Total |

Equity at January 1, 2020 |

| 59 |

| 173,716 |

| 116,291 |

| (3,820) |

| (153,361) |

| 132,885 |

Comprehensive loss: |

|

|

|

|

|

|

|

|

|

|

|

|

Loss for the six-months period |

| — |

| — |

| — |

| — |

| (109,396) |

| (109,396) |

Other comprehensive loss for the period |

| — |

| — |

| (4,604) |

| (10,182) |

| — |

| (14,786) |

Total comprehensive loss for the period ended June 30, 2020 |

| — |

| — |

| (4,604) |

| (10,182) |

| (109,396) |

| (124,182) |

Transactions with owners: |

|

|

|

|

|

|

|

|

|

|

|

|

Share-based payment |

| 2 |

| 2,679 |

| — |

| — |

| 1,254 |

| 3,935 |

Repurchase of shares |

| (1) |

| (3,070) |

| — |

| — |

| — |

| (3,071) |

Stock distribution | | 1 |

| 2,342 |

| (2,343) |

| — |

| — |

| — |

Cash distribution | | — | | — | | (2,343) | | — | | — | | (2,343) |

Total transactions with owners for the period ended June 30, 2020 |

| 2 |

| 1,951 |

| (4,686) |

| — |

| 1,254 |

| (1,479) |

Balance at June 30, 2020 (Unaudited) |

| 61 |

| 175,667 |

| 107,001 |

| (14,002) |

| (261,503) |

| 7,224 |

| | | | | | | | | | | | |

Balance at January 1, 2021 |

| 61 |

| 179,399 |

| 104,485 |

| (12,269) |

| (380,866) |

| (109,190) |

Comprehensive profit (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

Loss for the six-months period |

| — |

| — |

| — |

| — |

| (12,805) |

| (12,805) |

Other comprehensive profit for the period |

| — |

| — |

| — |

| 1,812 |

| — |

| 1,812 |

Total comprehensive profit (loss) for the period ended June 30, 2021 |

| — |

| — |

| — |

| 1,812 |

| (12,805) |

| (10,993) |

Transactions with owners: |

|

|

|

|

|

|

|

|

|

|

|

|

Share-based payment |

| 1 |

| 1,295 |

| — |

| — |

| 2,474 |

| 3,770 |

Repurchase of shares |

| (1) |

| (1,355) |

| — |

| — |

| — |

| (1,356) |

Cash distribution | | — |

| — |

| (2,353) |

| — |

| — |

| (2,353) |

Total transactions with owners for the period ended June 30, 2021 |

| — |

| (60) |

| (2,353) |

| — |

| 2,474 |

| 61 |

Balance at June 30, 2021 (Unaudited) |

| 61 | | 179,339 |

| 102,132 |

| (10,457) |

| (391,197) |

| (120,122) |

The above condensed consolidated statement of changes in equity should be read in conjunction with the accompanying notes.

6

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOW

| | | | |

|

| Six-months |

| Six-months |

|

| period ended |

| period ended |

|

| June 30, 2021 |

| June 30, 2020 |

Amounts in US$ ’000 |

| (Unaudited) |

| (Unaudited) |

Cash flows from operating activities |

|

|

|

|

Loss for the period |

| (12,805) |

| (109,396) |

Adjustments for: |

|

|

|

|

Income tax expense |

| 16,307 |

| 18,131 |

Depreciation |

| 43,161 |

| 62,623 |

Loss on disposal of property, plant and equipment | | 293 | | 15 |

Write-off of unsuccessful exploration efforts |

| 8,061 |

| 3,205 |

Impairment loss for non-financial assets | | — | | 97,481 |

Amortization of other long-term liabilities |

| (118) |

| — |

Accrual of borrowing interests |

| 23,470 |

| 23,692 |

Borrowings cancellation costs | | 6,308 | | — |

Unwinding of long-term liabilities |

| 2,451 |

| 2,873 |

Accrual of share-based payment |

| 3,770 |

| 3,935 |

Foreign exchange gain |

| (4,504) |

| (3,353) |

Unrealized loss (gain) on commodity risk management contracts |

| 38,619 |

| (8,572) |

Income tax paid |

| (61,267) |

| (16,970) |

Change in working capital |

| 15,184 |

| (27,743) |

Cash flows from operating activities – net |

| 78,930 |

| 45,921 |

Cash flows from investing activities |

|

|

|

|

Purchase of property, plant and equipment |

| (54,738) |

| (39,508) |

Acquisition of business, net of cash acquired |

| — |

| (272,335) |

Proceeds from disposal of long-term assets (Note 17) | | 1,100 | | — |

Cash flows used in investing activities – net |

| (53,638) |

| (311,843) |

Cash flows from financing activities |

|

|

|

|

Proceeds from borrowings |

| 162,201 |

| 350,000 |

Debt issuance costs paid |

| (2,019) |

| (7,507) |

Principal paid |

| (255,000) |

| (3,575) |

Interest paid |

| (22,957) |

| (14,046) |

Borrowings cancellation costs paid | | (12,908) |

| — |

Lease payments |

| (3,948) |

| (4,775) |

Repurchase of shares |

| (1,356) |

| (3,071) |

Cash distribution | | (2,353) | | (2,343) |

Payments for transactions with former non-controlling interest | | (3,580) | | (1,000) |

Cash flows (used in) from financing activities - net |

| (141,920) |

| 313,683 |

Net (decrease) increase in cash and cash equivalents |

| (116,628) |

| 47,761 |

Cash and cash equivalents at January 1 |

| 201,907 |

| 111,180 |

Currency translation differences |

| (256) |

| (1,431) |

Cash and cash equivalents at the end of the period |

| 85,023 |

| 157,510 |

Ending Cash and cash equivalents are specified as follows: |

|

|

|

|

Cash at bank and bank deposits |

| 85,003 |

| 157,487 |

Cash in hand |

| 20 |

| 23 |

Cash and cash equivalents |

| 85,023 |

| 157,510 |

The above condensed consolidated statement of cash flow should be read in conjunction with the accompanying notes.

7

EXPLANATORY NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Note 1

General information

GeoPark Limited (the “Company”) is a company incorporated under the laws of Bermuda. The Registered Office address is Clarendon House, 2 Church Street, Hamilton HM11, Bermuda.

The principal activity of the Company and its subsidiaries (the “Group” or “GeoPark”) is the exploration, development and production for oil and gas reserves in Colombia, Chile, Brazil, Argentina and Ecuador.

This condensed consolidated interim financial statements were authorized for issue by the Board of Directors on August 4, 2021.

Basis of Preparation

The condensed consolidated interim financial statements of GeoPark Limited are presented in accordance with IAS 34 “Interim Financial Reporting”. They do not include all of the information required for full annual financial statements, and should be read in conjunction with the annual consolidated financial statements as of and for the year ended December 31, 2020, which have been prepared in accordance with IFRS.

The condensed consolidated interim financial statements have been prepared in accordance with the accounting policies applied in the most recent annual consolidated financial statements. The Group has not early adopted any standard, interpretation or amendment that has been issued but is not yet effective. Several amendments and interpretations apply for the first time in 2021, but do not have an impact on the condensed consolidated interim financial statements of the Group.

Whenever necessary, certain comparative amounts have been reclassified to conform to changes in presentation in the current period.

Taxes on income in the interim periods are accrued using the tax rate that would be applicable to expected total annual profit or loss.

The activities of the Group are not subject to significant seasonal changes.

Estimates

The preparation of interim financial information requires the use of certain critical accounting estimates. It also requires management to exercise its judgement in the process of applying the Group’s accounting policies. Actual results may differ from these estimates.

In preparing these condensed consolidated interim financial statements, the significant judgements made by management in applying the Group’s accounting policies and the key sources of estimation uncertainty were the same as those that applied to the annual consolidated financial statements as of and for the year ended December 31, 2020.

Financial risk management

The Group’s activities expose it to a variety of financial risks: currency risk, price risk, credit risk- concentration, funding and liquidity risk, interest risk and capital risk. The condensed consolidated interim financial statements do not include all financial risk management information and disclosures required in the annual consolidated financial statements, and should be read in conjunction with the Group’s annual consolidated financial statements as of and for the year ended December 31, 2020.

8

Note 1 (Continued)

Financial risk management (Continued)

The 2019 coronavirus (“COVID-19”) outbreak has had numerous worldwide effects on general commercial activity, including that the price of crude oil dropped dramatically during 2020. By the end of 2020 and the beginning of 2021, the crude demand recovery resulted in improvements in the market conditions. At this time, given the uncertainty of the lasting effect of the COVID-19 outbreak, its impact on the Group’s business cannot be completely determined.

During May and June 2021, extensive protests and demonstrations across Colombia affected overall logistics and supply chains, restricting GeoPark’s crude oil transportation, drilling and the mobilization of personnel, equipment, and supplies. These events caused GeoPark to manage production curtailments that started in early May 2021 and normalized towards the end of June 2021.

The Group is continually reviewing its exposure to the current market conditions and adjusting the 2021 capital expenditures program which remains flexible, quickly adaptable and expandable as prices recover. The Group also continues to add new oil hedges, increasing its price risk protection within the next twelve months. GeoPark maintained a cash position of US$ 85,023,000 and has available US$ 108,029,000 in uncommitted credit lines as of June 30, 2021.

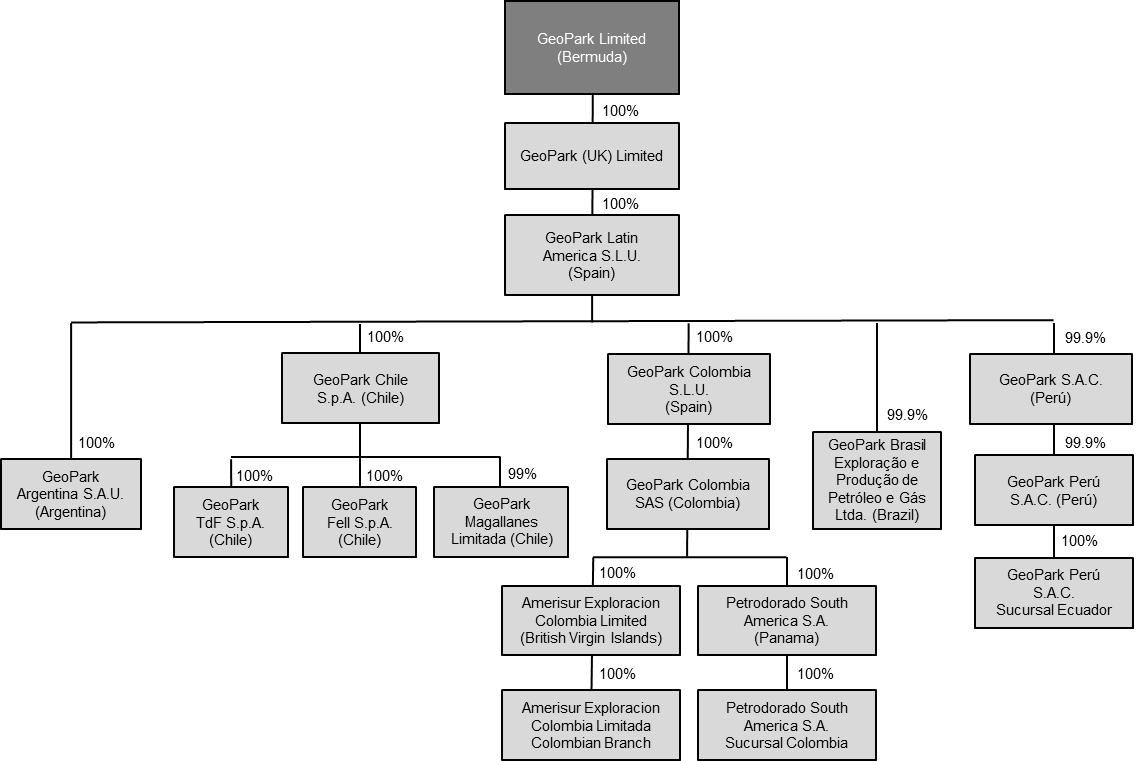

Subsidiary undertakings

The following chart illustrates the main companies of the Group structure as of June 30, 2021:

Details of the subsidiaries and joint operations of the Group are set out in Note 21 to the annual consolidated financial statements as of and for the year ended December 31, 2020.

On March 13, 2021, the Company incorporated a subsidiary in the United States named Market Access LLP (ownership interest: 9%), which is in start-up phase.

The Chilean branch GeoPark Latin America Limited - Agencia en Chile was voluntary dissolved and liquidated. In May 2021, the Register of Commerce registered the dissolution with an effective date March 31, 2021.

9

Note 2

Segment Information

Operating segments are reported in a manner consistent with the internal reporting provided to the chief operating decision-maker. The chief operating decision-maker, who is responsible for allocating resources and assessing performance of the operating segments, has been identified as the Executive Committee. This committee is integrated by the CEO, COO, CFO and managers in charge of the Geoscience, Operations, Legal and Corporate Governance, People and Sustainability departments. This committee reviews the Group’s internal reporting in order to assess performance and allocate resources. Management has determined the operating segments based on these reports. The committee considers the business from a geographic perspective.

The Executive Committee assesses the performance of the operating segments based on a measure of Adjusted EBITDA. Adjusted EBITDA is defined as profit (loss) for the period (determined as if IFRS 16 Leases had not been adopted), before net finance cost, income tax, depreciation, amortization, certain non-cash items such as impairments and write-offs of unsuccessful exploration efforts, accrual of share-based payment, unrealized result on commodity risk management contracts, geological and geophysical expenses allocated to capitalized projects and other items. Operating Netback is equivalent to Adjusted EBITDA before cash expenses included in Administrative and Geological and Geophysical expenses. Other information provided to the Executive Committee is measured in a manner consistent with that in the financial statements.

Six-months period ended June 30, 2021:

| | | | | | | | | | | | | | |

Amounts in US$ '000 |

| Total |

| Colombia |

| Chile |

| Brazil |

| Argentina |

| Ecuador |

| Corporate |

Revenue |

| 312,193 |

| 277,008 |

| 10,186 |

| 10,618 |

| 14,381 |

| — |

| — |

Sale of crude oil |

| 291,167 |

| 275,941 |

| 2,525 |

| 319 |

| 12,382 |

| — |

| — |

Sale of gas |

| 21,026 |

| 1,067 |

| 7,661 |

| 10,299 |

| 1,999 |

| — |

| — |

Production and operating costs |

| (95,972) |

| (79,580) |

| (5,608) |

| (2,286) |

| (8,498) |

| — |

| — |

Royalties |

| (44,429) |

| (41,044) |

| (356) |

| (905) |

| (2,124) |

| — |

| — |

Share-based payment |

| (133) |

| (111) |

| (23) |

| — |

| 1 |

| — |

| — |

Operating costs |

| (51,410) |

| (38,425) |

| (5,229) |

| (1,381) |

| (6,375) |

| — |

| — |

Depreciation |

| (43,161) |

| (27,010) |

| (7,182) |

| (2,091) |

| (6,760) |

| (116) |

| (2) |

Operating profit (loss) |

| 35,109 |

| 52,846 |

| (8,286) |

| 5,451 |

| (3,543) |

| (972) |

| (10,387) |

Operating Netback |

| 153,561 |

| 136,554 |

| 4,441 |

| 7,509 |

| 5,057 |

| — |

| — |

Adjusted EBITDA |

| 126,920 |

| 121,580 |

| 3,113 |

| 6,842 |

| 2,695 |

| (1,009) |

| (6,301) |

Six-months period ended June 30, 2020:

| | | | | | | | | | | | | | | | |

Amounts in US$ '000 |

| Total |

| Colombia |

| Chile |

| Brazil |

| Argentina |

| Peru (a) | | Ecuador |

| Corporate |

Revenue |

| 188,889 |

| 159,097 |

| 11,556 |

| 4,823 |

| 13,413 |

| — | | — |

| — |

Sale of crude oil |

| 172,837 |

| 158,067 |

| 2,609 |

| 698 |

| 11,463 |

| — | | — |

| — |

Sale of gas |

| 16,052 |

| 1,030 |

| 8,947 |

| 4,125 |

| 1,950 |

| — | | — |

| — |

Production and operating costs |

| (61,789) |

| (43,311) |

| (5,486) |

| (2,075) |

| (10,917) |

| — | | — |

| — |

Royalties |

| (15,914) |

| (13,268) |

| (399) |

| (380) |

| (1,867) |

| — | | — |

| — |

Share-based payment |

| (132) |

| (83) |

| (27) |

| (2) |

| (20) |

| — | | — |

| — |

Operating costs |

| (45,743) |

| (29,960) |

| (5,060) |

| (1,693) |

| (9,030) |

| — | | — |

| — |

Depreciation |

| (62,623) |

| (35,629) |

| (16,077) |

| (1,598) |

| (9,000) |

| (250) | | (11) |

| (58) |

Operating profit (loss) |

| (56,002) |

| 79,166 |

| (64,259) |

| 90 |

| (22,605) |

| (38,622) | | (392) |

| (9,380) |

Operating Netback |

| 134,076 |

| 124,538 |

| 5,947 |

| 1,711 |

| 1,880 |

| — | | — |

| — |

Adjusted EBITDA |

| 105,454 |

| 104,714 |

| 5,201 |

| 633 |

| 2,516 |

| (1,577) | | (368) |

| (5,665) |

| (a) | As of the date of these interim condensed consolidated financial statements, Peru is no longer an operating segment due to the decision to retire from the Morona Block. |

10

Note 2 (Continued)

Segment Information (Continued)

| | | | | | | | | | | | | | | | |

Total Assets |

| Total |

| Colombia |

| Chile |

| Brazil |

| Argentina |

| Peru |

| Ecuador |

| Corporate |

June 30, 2021 |

| 832,137 |

| 658,423 |

| 95,189 |

| 37,721 |

| 33,220 |

| 939 |

| 1,319 |

| 5,326 |

December 31, 2020 |

| 960,266 |

| 680,828 | | 101,742 | | 38,172 | | 36,803 | | 4,656 | | 1,127 | | 96,938 |

A reconciliation of total Operating Netback to total profit (loss) before income tax is provided as follows:

| | | | | | | | |

|

| Three-months |

| Three-months | | Six-months |

| Six-months |

|

| period ended |

| period ended | | period ended |

| period ended |

|

| June 30, 2021 |

| June 30, 2020 | | June 30, 2021 |

| June 30, 2020 |

Operating Netback |

| 74,189 |

| 40,654 | | 153,561 |

| 134,076 |

Geological and geophysical expenses |

| (2,151) |

| (3,065) | | (5,259) |

| (7,616) |

Administrative expenses |

| (11,587) |

| (9,837) | | (21,382) |

| (21,006) |

Adjusted EBITDA for reportable segments |

| 60,451 |

| 27,752 | | 126,920 |

| 105,454 |

Unrealized (loss) gain on commodity risk management contracts |

| (11,964) |

| (17,859) | | (38,619) |

| 8,572 |

Depreciation (a) |

| (20,594) |

| (23,322) | | (43,161) |

| (62,623) |

Write-off of unsuccessful exploration efforts |

| (8,061) |

| — | | (8,061) |

| (3,205) |

Impairment loss recognized for non-financial assets | | — | | — | | — | | (97,481) |

Share-based payment |

| (1,716) |

| (2,015) | | (3,770) |

| (3,935) |

Lease accounting - IFRS 16 |

| 1,487 |

| 1,991 | | 3,948 |

| 4,775 |

Others (b) |

| (394) |

| (7,400) | | (2,148) |

| (7,559) |

Operating profit (loss) |

| 19,209 |

| (20,853) | | 35,109 |

| (56,002) |

Financial expenses |

| (20,735) |

| (16,545) | | (36,709) |

| (31,299) |

Financial income |

| 135 |

| 674 | | 598 |

| 2,097 |

Foreign exchange gain (loss) |

| 1,810 |

| 4,726 | | 4,504 |

| (6,061) |

Profit (Loss) before tax |

| 419 |

| (31,998) | | 3,502 |

| (91,265) |

| (a) | Net of capitalized costs for oil stock included in Inventories. Depreciation for the six-months period ended June 30, 2021 includes US$ 1,424,000 (US$ 1,406,000 in 2020) generated by assets not related to production activities. For the three-months period ended June 30, 2021 the amount included in depreciation is US$ 724,000 (US$ 706,000 in 2020). |

| (b) | Includes allocation to capitalized projects. |

11

Note 2 (Continued)

Segment Information (Continued)

The following table presents a reconciliation of Adjusted EBITDA to operating profit (loss) for the six-months period ended June 30, 2021 and 2020:

| | | | | | | | | | | | |

|

| Six-months period ended June 30, 2021 | ||||||||||

|

| Colombia |

| Chile |

| Brazil |

| Argentina |

| Other (a) |

| Total |

Adjusted EBITDA for reportable segments |

| 121,580 | | 3,113 | | 6,842 | | 2,695 | | (7,310) | | 126,920 |

Depreciation |

| (27,010) | | (7,182) | | (2,091) | | (6,760) | | (118) | | (43,161) |

Unrealized gain on commodity risk management contracts |

| (38,619) | | — | | — | | — | | — | | (38,619) |

Write-off of unsuccessful exploration efforts | | (3,626) | | (4,435) | | — | | — | | — | | (8,061) |

Share-based payment |

| (371) | | (48) | | (6) | | (70) | | (3,275) | | (3,770) |

Lease accounting - IFRS 16 |

| 2,164 | | 311 | | 890 | | 471 | | 112 | | 3,948 |

Others |

| (1,272) | | (45) | | (184) | | 121 | | (768) | | (2,148) |

Operating profit / (loss) |

| 52,846 |

| (8,286) |

| 5,451 |

| (3,543) |

| (11,359) |

| 35,109 |

| (a) | Includes Ecuador and Corporate. |

| | | | | | | | | | | | |

|

| Six-months period ended June 30, 2020 | ||||||||||

|

| Colombia |

| Chile |

| Brazil |

| Argentina |

| Other (a) |

| Total |

Adjusted EBITDA for reportable segments |

| 104,714 | | 5,201 | | 633 | | 2,516 | | (7,610) |

| 105,454 |

Depreciation |

| (35,629) | | (16,077) | | (1,598) | | (9,000) | | (319) |

| (62,623) |

Unrealized gain on commodity risk management contracts |

| 8,572 | | — | | — | | — | | — |

| 8,572 |

Write-off of unsuccessful exploration efforts |

| — | | (3,205) | | — | | — | | — |

| (3,205) |

Impairment loss recognized for non-financial assets | | — | | (50,281) | | — | | (16,205) | | (30,995) | | (97,481) |

Share-based payment |

| (173) | | (47) | | (12) | | (87) | | (3,616) |

| (3,935) |

Lease accounting - IFRS 16 |

| 2,870 | | 70 | | 1,106 | | 469 | | 260 |

| 4,775 |

Others |

| (1,188) | | 80 | | (39) | | (298) | | (6,114) |

| (7,559) |

Operating profit / (loss) |

| 79,166 |

| (64,259) |

| 90 |

| (22,605) |

| (48,394) |

| (56,002) |

| (a) | Includes Peru, Ecuador and Corporate. |

Note 3

Revenue

| | | | | | | | |

|

| Three-months |

| Three-months | | Six-months |

| Six-months |

|

| period ended |

| period ended | | period ended |

| period ended |

Amounts in US$ '000 |

| June 30, 2021 |

| June 30, 2020 | | June 30, 2021 |

| June 30, 2020 |

Sale of crude oil |

| 153,849 |

| 49,002 | | 291,167 |

| 172,837 |

Sale of gas |

| 11,749 |

| 6,648 | | 21,026 |

| 16,052 |

| | 165,598 |

| 55,650 | | 312,193 |

| 188,889 |

12

Note 4

Commodity risk management contracts

The Group entered into derivative financial instruments to manage its exposure to oil price risk. These derivatives are zero-premium collars, fixed price or zero-premium 3 ways (put spread plus call), and were placed with major financial institutions and commodity traders. The Group entered into the derivatives under ISDA Master Agreements and Credit Support Annexes, which provide credit lines for collateral posting thus alleviating possible liquidity needs under the instruments and protect the Group from potential non-performance risk by its counterparties. The Group’s derivatives are accounted for as non-hedge derivatives and therefore all changes in the fair values of its derivative contracts are recognized as gains or losses in the results of the periods in which they occur.

The following table summarizes the Group’s production hedged during the six-months period ended June 30, 2021 and for the following periods as a consequence of the derivative contracts in force as of June 30, 2021:

| | | | | | | | |

|

| |

| |

| Volume |

| Average |

Period | | Reference | | Type | | bbl/d | | price US$/bbl |

January 1, 2021 - March 31, 2021 | | ICE BRENT | | Zero Premium Collars | | 23,500 | | 38.91 Put 52.72 Call |

January 1, 2021 - March 31, 2021 | | VASCONIA(a) | | Zero Premium Collars | | 2,000 | | 35.00 Put 43.01 Call |

| | | | | | 25,500 | | |

April 1, 2021 - June 30, 2021 | | ICE BRENT | | Zero Premium Collars | | 25,500 | | 40.61 Put 53.59 Call |

| | | | | | 25,500 | | |

July 1, 2021 - September 30, 2021 | | ICE BRENT | | Zero Premium Collars | | 18,000 | | 43.19 Put 60.64 Call |

July 1, 2021 - September 30, 2021 | | VASCONIA(a) | | Zero Premium Collars | | 2,000 | | 41.50 Put 68.57 Call |

| | | | | | 20,000 | | |

October 1, 2021 - December 31, 2021 | | ICE BRENT | | Zero Premium Collars | | 19,500 | | 43.72 Put 62.65 Call |

| | | | | | 19,500 | | |

January 1, 2022 - March 31, 2022 | | ICE BRENT | | Zero Premium Collars | | 14,500 | | 49.10 Put 74.81 Call |

| | | | | | 14,500 | | |

April 1, 2022 - June 30, 2022 | | ICE BRENT | | Zero Premium Collars | | 8,000 | | 50.55 Put 77.28 Call |

| | | | | | 8,000 | | |

| (a) | Vasconia Crude (ICE Brent minus Vasconia Differential). |

The table below summarizes the (loss) gain on the commodity risk management contracts:

| | | | | | | | |

|

| Three-months |

| Three-months | | Six-months |

| Six-months |

|

| period ended |

| period ended | | period ended |

| period ended |

|

| June 30, 2021 |

| June 30, 2020 | | June 30, 2021 |

| June 30, 2020 |

Realized (loss) gain on commodity risk management contracts |

| (35,705) |

| 8,728 | | (56,341) |

| 14,308 |

Unrealized (loss) gain on commodity risk management contracts |

| (11,964) |

| (17,859) | | (38,619) |

| 8,572 |

Total |

| (47,669) |

| (9,131) | | (94,960) |

| 22,880 |

The following table presents the Group’s derivative contracts agreed after the balance sheet date:

| | | | | | | | |

| | | | | | Volume | | |

Period |

| Reference |

| Type |

| bbl/d |

| Price US$/bbl |

July 1, 2022 - September 30, 2022 | | ICE BRENT | | Zero Premium Collars | | 1,000 | | 52.00 Put 80.00 Call |

13

Note 5

Production and operating costs

| | | | | | | | |

|

| Three-months |

| Three-months |

| Six-months |

| Six-months |

| | period ended | | period ended | | period ended | | period ended |

Amounts in US$ '000 |

| June 30, 2021 |

| June 30, 2020 | | June 30, 2021 |

| June 30, 2020 |

Staff costs |

| 4,016 |

| 3,571 |

| 8,025 |

| 7,270 |

Share-based payment |

| 115 |

| 64 |

| 133 |

| 132 |

Royalties |

| 24,625 |

| 3,205 |

| 44,429 |

| 15,914 |

Well and facilities maintenance |

| 4,602 |

| 2,498 |

| 9,544 |

| 7,895 |

Operation and maintenance |

| 1,636 |

| 1,689 |

| 3,565 |

| 3,585 |

Consumables |

| 4,131 |

| 3,630 |

| 8,795 |

| 8,735 |

Equipment rental |

| 1,787 |

| 2,010 |

| 3,577 |

| 4,425 |

Transportation costs |

| 300 |

| 2,445 |

| 1,550 |

| 3,525 |

Gas plant costs |

| 708 |

| 426 |

| 1,266 |

| 994 |

Safety and insurance costs |

| 1,070 |

| 803 |

| 2,017 |

| 1,921 |

Field camp |

| 794 |

| 587 |

| 2,104 |

| 1,347 |

Non-operated blocks costs |

| 1,436 |

| 976 |

| 2,377 |

| 1,340 |

Crude oil stock variation |

| 5,104 |

| (3,074) |

| 4,723 |

| 68 |

Other costs |

| 2,696 |

| 1,884 |

| 3,867 |

| 4,638 |

| | 53,020 |

| 20,714 | | 95,972 |

| 61,789 |

Note 6

Geological and geophysical expenses

| | | | | | | | |

|

| Three-months |

| Three-months |

| Six-months |

| Six-months |

| | period ended | | period ended | | period ended | | period ended |

Amounts in US$ '000 |

| June 30, 2021 |

| June 30, 2020 | | June 30, 2021 |

| June 30, 2020 |

Staff costs |

| 1,788 |

| 2,746 |

| 3,745 |

| 6,081 |

Share-based payment |

| 53 |

| (3) |

| 100 |

| 66 |

Other services |

| 287 |

| 237 |

| 1,358 |

| 1,364 |

Allocation to capitalized project |

| — |

| (29) |

| — |

| (102) |

| | 2,128 |

| 2,951 | | 5,203 |

| 7,409 |

Note 7

Administrative expenses

| | | | | | | | |

|

| Three-months |

| Three-months |

| Six-months |

| Six-months |

| | period ended | | period ended | | period ended | | period ended |

Amounts in US$ '000 |

| June 30, 2021 |

| June 30, 2020 | | June 30, 2021 |

| June 30, 2020 |

Staff costs |

| 6,368 |

| 5,356 |

| 12,637 |

| 11,246 |

Share-based payment |

| 1,548 |

| 1,954 |

| 3,537 |

| 3,737 |

Consultant fees |

| 3,011 |

| 2,428 |

| 4,574 |

| 4,637 |

Travel expenses |

| 59 |

| 60 |

| 114 |

| 867 |

Director fees and allowance |

| 672 |

| 431 |

| 1,566 |

| 1,084 |

Communication and IT costs |

| 1,050 |

| 832 |

| 1,929 |

| 1,438 |

Allocation to joint operations |

| (1,950) |

| (759) |

| (3,925) |

| (3,263) |

Other administrative expenses |

| 1,936 |

| 1,016 |

| 3,595 |

| 4,257 |

| | 12,694 |

| 11,318 | | 24,027 |

| 24,003 |

14

Note 8

Selling expenses

| | | | | | | | |

|

| Three-months |

| Three-months |

| Six-months |

| Six-months |

|

| period ended |

| period ended |

| period ended |

| period ended |

Amounts in US$ '000 |

| June 30, 2021 |

| June 30, 2020 |

| June 30, 2021 |

| June 30, 2020 |

Transportation |

| 833 |

| 1,274 |

| 1,766 |

| 2,927 |

Selling taxes and other |

| 996 |

| 364 |

| 1,786 |

| 673 |

| | 1,829 |

| 1,638 | | 3,552 |

| 3,600 |

Note 9

Financial results

| | | | | | | | |

|

| Three-months |

| Three-months |

| Six-months |

| Six-months |

|

| period ended |

| period ended |

| period ended |

| period ended |

Amounts in US$ '000 |

| June 30, 2021 |

| June 30, 2020 |

| June 30, 2021 |

| June 30, 2020 |

Financial expenses |

|

|

|

|

|

|

|

|

Bank charges and other financial costs |

| (1,852) |

| (2,902) |

| (4,310) |

| (4,764) |

Interest and amortization of debt issue costs |

| (11,309) |

| (12,310) |

| (23,640) |

| (23,662) |

Borrowings cancellation costs | | (6,308) |

| — | | (6,308) |

| — |

Unwinding of long-term liabilities |

| (1,266) |

| (1,333) |

| (2,451) |

| (2,873) |

| | (20,735) |

| (16,545) | | (36,709) |

| (31,299) |

Financial income |

|

|

|

|

|

|

|

|

Interest received |

| 135 |

| 674 |

| 598 |

| 2,097 |

| | 135 |

| 674 | | 598 |

| 2,097 |

Foreign exchange gains and losses |

|

|

|

|

|

|

|

|

Foreign exchange gain |

| 1,810 |

| 1,308 |

| 4,504 |

| 4,227 |

Result on currency risk management contracts (a) |

| — |

| 3,418 |

| — |

| (10,288) |

| | 1,810 |

| 4,726 | | 4,504 |

| (6,061) |

Total financial results |

| (18,790) |

| (11,145) |

| (31,607) |

| (35,263) |

| (a) | GeoPark manages its exposure to local currency fluctuation with respect to income tax balances in Colombia. As of December 31, 2019, the Group entered into derivative financial instruments with local banks in Colombia for an amount equivalent to US$ 83,700,000 in order to anticipate any currency fluctuation with respect to income taxes payable in February, April and June 2020. The realized result on these contracts for the six-months period ended June 30, 2020 was a loss of US$ 9,414,000. No currency risk management contracts were in place during 2021. |

15

Note 10

Property, plant and equipment

| | | | | | | | | | | | | | |

|

| |

| Furniture, |

| |

| |

| |

| Exploration |

| |

| | | | equipment | | Production | | Buildings | | | | and | | |

| | Oil & gas | | and | | facilities and | | and | | Construction | | evaluation | | |

Amounts in US$'000 | | properties |

| vehicles | | machinery | | improvements | | in progress |

| assets | | Total |

Cost at January 1, 2020 |

| 830,937 |

| 19,549 |

| 172,507 |

| 11,770 |

| 69,587 |

| 48,036 |

| 1,152,386 |

Additions |

| (875) | (a) | 811 | | 4 | | 423 | | 28,394 | | 10,019 | | 38,776 |

Disposals | | — | | (24) | | — | | — | | — | | — | | (24) |

Acquisitions |

| 174,962 | | 617 | | 34,613 | | — | | 1,221 | | 79,693 | | 291,106 |

Write-off / Impairment |

| (66,486) | (b) | — | | — | | — | | (30,995) | (b) | (3,205) | (c) | (100,686) |

Transfers |

| 23,186 | | — | | 3,447 | | 78 | | (21,619) | | (5,092) | | — |

Currency translation differences |

| (19,846) | | (310) | | (3,587) | | (79) | | (81) | | (1,187) | | (25,090) |

Cost at June 30, 2020 |

| 941,878 | | 20,643 | | 206,984 | | 12,192 | | 46,507 | | 128,264 | | 1,356,468 |

| | | | | | | | | | | | | | |

Cost at January 1, 2021 |

| 968,617 |

| 20,707 |

| 197,829 |

| 12,442 |

| 18,848 |

| 78,614 |

| 1,297,057 |

Additions |

| (1,480) | (a) | 572 | | — | | — | | 31,845 | | 22,323 | | 53,260 |

Disposals | | — | | (789) | | (900) | | (543) | | (3,371) | (d) | — | | (5,603) |

Write-off | | — | | — | | — | | — | | — | | (8,061) | (e) | (8,061) |

Transfers |

| 20,741 | | — | | 8,578 | | 64 | | (29,625) | | 242 | | — |

Currency translation differences |

| (2,030) | | (26) | | (139) | | (9) | | (10) | | (82) | | (2,296) |

Cost at June 30, 2021 |

| 985,848 | | 20,464 | | 205,368 | | 11,954 | | 17,687 | | 93,036 | | 1,334,357 |

| | | | | | | | | | | | | | |

Depreciation and write-down at January 1, 2020 |

| (467,806) |

| (15,149) |

| (95,047) |

| (6,596) |

| — |

| — |

| (584,598) |

Depreciation |

| (47,155) | | (1,153) | | (8,013) | | (253) | | — | | — |

| (56,574) |

Disposals | | — | | 9 | | — | | — | | — | | — | | 9 |

Currency translation differences |

| 14,675 | | 182 | | 3,858 | | 45 | | — | | — |

| 18,760 |

Depreciation and write-down at June 30, 2020 |

| (500,286) |

| (16,111) |

| (99,202) |

| (6,804) |

| — |

| — |

| (622,403) |

| | | | | | | | | | | | | | |

Depreciation and write-down at January 1, 2021 |

| (548,445) | | (16,985) | | (109,987) | | (6,975) | | — | | — |

| (682,392) |

Depreciation |

| (33,417) | | (1,076) | | (6,279) | | (348) | | — | | — | | (41,120) |

Disposals | | — | | 474 | | 900 | | 436 | | — | | — | | 1,810 |

Currency translation differences |

| 2,260 | | 21 | | 139 | | 9 | | — | | — | | 2,429 |

Depreciation and write-down at June 30, 2021 |

| (579,602) |

| (17,566) |

| (115,227) |

| (6,878) |

| — |

| — |

| (719,273) |

| | | | | | | | | | | | | | |

Carrying amount at June 30, 2020 |

| 441,592 |

| 4,532 |

| 107,782 |

| 5,388 |

| 46,507 |

| 128,264 |

| 734,065 |

Carrying amount at June 30, 2021 |

| 406,246 |

| 2,898 |

| 90,141 |

| 5,076 |

| 17,687 |

| 93,036 |

| 615,084 |

| (a) | Corresponds to the effect of the change in the estimate of assets retirement obligations. |

| (b) | Corresponds to impairment losses recognized in the Fell Block (Chile), the Aguada Baguales and El Porvenir Blocks (Argentina) and the Morona Block (Peru) for US$ 50,281,000, US$ 16,205,000 and US$ 30,995,000, respectively. |

| (c) | Corresponds to an unsuccessful exploratory well drilled in the Isla Norte Block (Chile). |

| (d) | Corresponds to assets related to the operationship of the non-producing Morona Block (Block 64) in Peru, that were transferred to Petroperu in May 2021. See Note 17. |

| (e) | Corresponds to two unsuccessful exploratory wells drilled in the Llanos 32 Block (Colombia) and other exploration costs incurred in the Fell Block (Chile). |

16

Note 11

Equity

Share capital

| | | | |

|

| At |

| Year ended |

Issued share capital |

| June 30, 2021 |

| December 31, 2020 |

Common stock (US$ ´000) |

| 61 |

| 61 |

The share capital is distributed as follows: |

|

|

| |

Common shares, of nominal US$ 0.001 |

| 61,077,168 |

| 61,029,772 |

Total common shares in issue |

| 61,077,168 |

| 61,029,772 |

| | | | |

Authorized share capital |

|

|

|

|

US$ per share |

| 0.001 |

| 0.001 |

| | | | |

Number of common shares (US$ 0.001 each) |

| 5,171,949,000 |

| 5,171,949,000 |

Amount in US$ |

| 5,171,949 |

| 5,171,949 |

GeoPark’s share capital only consists of common shares. The authorized share capital consists of 5,171,949,000 common shares of par value US$ 0.001 per share. All of the Company issued and outstanding common shares are fully paid and nonassessable.

Cash distributions

On March 10, 2021, and on May 5, 2021, the Company’s Board of Directors declared a quarterly cash distribution of US$ 0.0205 per share that was paid on April 13, 2021, and on May 28, 2021, respectively.

Buyback Program

On November 4, 2020, the Company’s Board of Directors approved a program to repurchase up to 10% of its shares outstanding or approximately 6,062,000 shares. The repurchase program began on November 5, 2020 and will expire on November 15, 2021. During the six-months period ended June 30, 2021, the Company purchased 94,005 common shares for a total amount of US$ 1,356,000. These transactions have no impact on the Group’s results.

Note 12

Borrowings

The outstanding amounts are as follows:

| | | | |

|

| At |

| Year ended |

Amounts in US$ '000 |

| June 30, 2021 |

| December 31, 2020 |

2024 Notes (a) (c) |

| 171,685 |

| 428,737 |

2027 Notes (b) (c) |

| 498,792 |

| 352,113 |

Banco Santander | | 3,880 | | 3,736 |

Bancolombia (d) |

| 9,342 |

| — |

| | 683,699 |

| 784,586 |

Classified as follows:

| | | | |

Current |

| 27,527 |

| 17,689 |

Non-Current |

| 656,172 |

| 766,897 |

17

Note 12 (Continued)

Borrowings (Continued)

The tender total consideration included the tender offer consideration of US$ 1,000 for each US$ 1,000 principal amount of the 2024 Notes plus the early tender payment of US$ 50 for each US$ 1,000 principal amount of the 2024 Notes. The tender also included a consent solicitation to align the covenants of the 2024 Notes to those of the 2027 Notes.

The reopening of the 2027 Notes was priced above par at 101.875%, representing a yield to maturity of 5.117%. The debt issuance cost for this transaction amounted to US$ 2,019,000. The Notes were offered in a private placement to qualified institutional buyers in accordance with Rule 144A under the Securities Act, and outside the United States to non-U.S. persons in accordance with Regulation S under the Securities Act. The Notes are fully and unconditionally guaranteed jointly and severally by GeoPark Chile SpA and GeoPark Colombia S.L.U.

After these transactions, the Company reduced its total indebtedness nominal amount in US$ 105,000,000 and improved its financial profile by extending its debt maturities. The current outstanding nominal amount of the 2024 Notes and 2027 Notes is US$ 170,000,000 and US$ 500,000,000, respectively. The Company recorded a loss of US$ 6,308,000 within Financial expenses for the three-months period ended June 30, 2021 as a consequence of these transactions.

The indentures governing the 2024 Notes and the 2027 Notes include incurrence test covenants that provide among other things, that, the Net Debt to Adjusted EBITDA ratio should not exceed 3.25 times and the Adjusted EBITDA to Interest ratio should exceed 2.5 times. Failure to comply with the incurrence test covenants does not trigger an event of default. However, this situation may limit the Company’s capacity to incur additional indebtedness, as specified in the indentures governing the Notes. Incurrence covenants as opposed to maintenance covenants must be tested by the Company before incurring additional debt or performing certain corporate actions including but not limited to dividend payments, restricted payments and others. As of the date of these interim condensed consolidated financial statements, the Company is in compliance of all the indentures’ provisions and covenants.

18

Note 12 (Continued)

Borrowings (Continued)

This note should be read in conjunction with Note 27 to the annual consolidated financial statements as of and for the year ended December 31, 2020.

As of the date of these interim condensed consolidated financial statements, the Group has credit lines available for US$ 108,029,000.

Note 13

Provisions and other long-term liabilities

The outstanding amounts are as follows:

| | | | |

|

| At |

| Year ended |

Amounts in US$ '000 |

| June 30, 2021 |

| December 31, 2020 |

Assets retirement obligation |

| 64,125 |

| 64,040 |

Deferred income |

| 3,553 |

| 3,828 |

Other |

| 13,949 |

| 14,502 |

| | 81,627 |

| 82,370 |

Note 14

Trade and other payables

The outstanding amounts are as follows:

| | | | |

|

| At |

| Year ended |

Amounts in US$ '000 |

| June 30, 2021 |

| December 31, 2020 |

Trade payables |

| 70,824 |

| 63,528 |

To be paid to co-venturers |

| 205 |

| 5,760 |

Payables to LGI |

| — |

| 3,528 |

Staff costs to be paid |

| 8,967 |

| 13,752 |

Royalties to be paid |

| 7,042 |

| 5,287 |

V.A.T. |

| 4,185 |

| 3,453 |

Taxes and other debts to be paid |

| 4,475 |

| 9,734 |

| | 95,698 |

| 105,042 |

Classified as follows:

| | | | |

Current |

| 94,368 | | 100,156 |

Non-Current |

| 1,330 | | 4,886 |

19

Note 15

Fair value measurement of financial instruments

Fair value hierarchy

The following table presents the Group’s financial assets and financial liabilities measured and recognized at fair value at June 30, 2021 and December 31, 2020 on a recurring basis:

| | | | | | |

|

| |

| |

| At |

Amounts in US$ '000 | | Level 1 | | Level 2 |

| June 30, 2021 |

Assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

|

|

|

| |

Money market funds |

| 270 |

| — |

| 270 |

Total Assets | | 270 | | — | | 270 |

Liabilities |

|

|

|

|

|

|

Derivative financial instrument liabilities |

|

|

|

|

| |

Commodity risk management contracts |

| — |

| 67,247 |

| 67,247 |

Total Liabilities |

| — |

| 67,247 |

| 67,247 |

| | | | | | |

|

| |

| |

| At |

Amounts in US$ '000 | | Level 1 | | Level 2 |

| December 31, 2020 |

Assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

|

|

|

|

|

Money market funds |

| 823 |

| — |

| 823 |

Derivative financial instrument assets |

|

|

|

|

|

|

Commodity risk management contracts |

| — |

| 1,013 |

| 1,013 |

Total Assets |

| 823 |

| 1,013 |

| 1,836 |

Liabilities |

|

|

|

|

|

|

Derivative financial instrument liabilities |

|

|

|

|

|

|

Commodity risk management contracts |

| — |

| 15,094 |

| 15,094 |

Total Liabilities |

| — |

| 15,094 |

| 15,094 |

There were no transfers between Level 2 and 3 during the period. The Group did not measure any financial assets or financial liabilities at fair value on a non-recurring basis as of June 30, 2021.

Fair values of other financial instruments (unrecognized)

The Group also has a number of financial instruments which are not measured at fair value in the balance sheet. For the majority of these instruments, the fair values are not materially different to their carrying amounts, since the interest receivable/payable is either close to current market rates or the instruments are short-term in nature.

Borrowings are comprised primarily of fixed rate debt and variable rate debt with a short term portion where interest has already been fixed. They are measured at their amortized cost. The Group estimates that the fair value of its main financial liabilities is approximately 101% of its carrying amount including interests accrued as of June 30, 2021. Fair values were calculated based on market price for the Notes and cash flows discounted for other borrowings using a rate based on the borrowing rate and are within Level 1 and Level 2 of the fair value hierarchy, respectively.

20

Note 16

Capital commitments

Capital commitments are detailed in Note 33.2 to the audited Consolidated Financial Statements as of December 31, 2020. The following updates have taken place during the six-months period ended June 30, 2021:

Colombia

The Colombian National Hydrocarbons Agency (“ANH”) approved GeoPark’s proposal to transfer part of its capital commitments in the PUT-30 Block to the Llanos 34 Block. Consequently, GeoPark has committed to drill 3 exploratory wells in the Llanos 34 Block for a total amount of US$ 17,381,000, before November 10, 2021. Due to a private agreement with the partner in the block, the investment commitment to be incurred by GeoPark amounts only to US$ 12,840,000. As of the date of these interim condensed consolidated financial statements, one of the three committed exploratory wells has already been drilled.

Ecuador

On April 27, 2021 and May 7, 2021, the Ecuadorian Ministry of Energy and Non-Renewable Resources approved the requests to extend the exploratory period in the Espejo and Perico Blocks until June 17, 2025 and June 16, 2025, respectively.

Note 17

Business transactions

REC-T-128 Block (Brazil)

In July 2020, GeoPark initiated a farm-out process to sell its 70% interest in the currently non-producing REC-T-128 Block in Brazil. On March 1, 2021, the farm-out agreement was signed. The total consideration is US$ 1,100,000, plus a contingent payment of up to US$ 710,000. Closing of the transaction took place in May 2021, after the corresponding customary regulatory approvals.

Morona Block (Peru)

On July 15, 2020, GeoPark notified its irrevocable decision to retire from the non-producing Morona Block (Block 64) in Peru, due to extended force majeure, which allows for the termination of the license contract. On April 6, 2021, the final agreement with Petroperu was signed and, on May 31, 2021, the joint operation agreement was ended. From such date on, GeoPark only acts as operator of the Morona Block on behalf of Petroperu until the supreme decree approving the assignment is issued by the Peruvian Government.

Note 18

Subsequent events

In July 2021, GeoPark Colombia S.A.S. extended the availability period for its offtake and prepayment agreement with Trafigura, one of its customers, until August 10, 2021. The prepayment agreement provides GeoPark with access to up to US$ 75,000,000 in the form of prepaid future oil sales. As of the date of these Consolidated Financial Statements, GeoPark did not withdrawn any amount from this prepayment agreement.

21

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | |

| GeoPark Limited | |

| | |

| | |

| By: | /s/ Andrés Ocampo |

| | Name: Andrés Ocampo |

| | Title: Chief Financial Officer |

Date: August 4, 2021

22