Exhibit 99.1

The following supplements Industrial Income Trust Inc.’s Annual Report on Form 10-K for the year ended December 31, 2014, as filed with the Securities and Exchange Commission (the “SEC”) on February 27, 2015, which is available atwww.industrialincome.com. As used herein, the terms “IIT,” the “Company,” “we,” “our,” or “us” refer to Industrial Income Trust Inc.

| | | | |

| |

Overview | | | 2 | |

| |

Quarterly Highlights | | | 3 | |

| |

Consolidated Statements of Operations | | | 4 | |

| |

Consolidated Balance Sheets | | | 5 | |

| |

Consolidated Statements of Cash Flows | | | 6 | |

| |

Funds from Operations | | | 7 | |

| |

Selected Financial Data | | | 8 | |

| |

Portfolio Overview | | | 9 | |

| |

Lease Expirations & Top Customers | | | 11 | |

| |

Development Overview | | | 12 | |

| |

Debt | | | 13 | |

| |

Definitions | | | 14 | |

This supplemental information contains forward-looking statements that are based on IIT’s current expectations, plans, estimates, assumptions and beliefs that involve numerous risks and uncertainties, including, without limitation, the failure of acquisitions to perform as IIT expects, IIT’s ability to successfully integrate acquired properties and operations and otherwise execute on its investment strategy, the availability of affordable financing, the availability of cash flows from operating activities for distributions and capital expenditures and those risks set forth in the “Risk Factors” section of IIT’s Annual Report on Form 10-K for the year ended December 31, 2014, as amended or supplemented by the Company’s other filings with the SEC. Any of these statements could prove to be inaccurate, and actual events or IIT’s investments and results of operations could differ materially from those expressed or implied. To the extent that IIT’s assumptions differ from actual results, IIT’s ability to meet such forward-looking statements, including its ability to consummate additional acquisitions and financings, to invest in a diversified portfolio of quality real estate investments, and to generate attractive returns for investors, may be significantly hindered. You are cautioned not to place undue reliance on any forward-looking statements. IIT cannot assure you that it will attain its investment objectives.

The large photo on the cover page is of Miami Distribution Center, which consists of one building totaling 186,000 square feet located in the South Florida market.

| | | | |

Fourth Quarter 2014 Supplemental Reporting Package | |

| | Page 1 |

IIT is a leading, national industrial real estate investment trust that selectively acquires, develops, and operates high-quality distribution warehouses located in key U.S. logistics centers serving corporate customers. IIT’s core strategy has been to build a national platform of institutional quality industrial properties by targeting markets that have high barriers to entry, proximity to a large demographic base, and/or access to major distribution infrastructure. IIT acquired its first building in June 2010.

As of December 31, 2014, IIT owned and managed a consolidated real estate portfolio that included 283 industrial buildings totaling approximately 57.6 million square feet in 19 markets throughout the U.S. with 551 customers having a weighted-average remaining lease term (based on square feet) of 5.3 years. Of the 283 industrial buildings we owned and managed as of December 31, 2014:

| | • | | 278 industrial buildings totaling approximately 55.8 million square feet comprised our operating portfolio, which was 91% occupied (93% leased). |

| | • | | 5 industrial buildings totaling approximately 1.8 million square feet comprised our development and value-add portfolio. |

As of December 31, 2014, we had six buildings under construction totaling approximately 0.6 million square feet and two buildings in the pre-construction phase totaling an additional 0.6 million square feet.

Public Earnings Call

We will host a public conference call on Tuesday, March 24, 2015 to review quarterly operating and financial results for the quarter ended December 31, 2014. Dwight Merriman, Chief Executive Officer, and Tom McGonagle, Chief Financial Officer, will present operating and financial data and discuss the Company’s corporate strategy and acquisition and development activity. The conference call will take place at 2:15 p.m. MDT and can be accessed by dialing (877) 742-5590; conference ID 61738564. To access a replay of the call, contact Dividend Capital at (866) 324-7348.

Contact Information

Industrial Income Trust Inc.

518 Seventeenth Street, 17th Floor

Denver, Colorado 80202

Telephone: (303) 228-2200

Attn: Thomas G. McGonagle, Chief Financial Officer

| (1) | See “Definitions” for a description of certain terms used in this supplemental reporting package. |

| | | | |

Fourth Quarter 2014 Supplemental Reporting Package | |

| | Page 2 |

The following is an overview of our financial and operating results for the quarter ended December 31, 2014:

| | • | | As of December 31, 2014, we had 283 consolidated buildings aggregating 57.6 million square feet, as compared to 296 consolidated buildings aggregating 57.2 million square feet as of December 31, 2013. |

| | • | | As of December 31, 2014, we had six buildings under construction totaling approximately 0.6 million square feet and two buildings in the pre-construction phase totaling an additional 0.6 million square feet. |

| | • | | As of December 31, 2014, our aggregate gross investment in properties was approximately $3.9 billion. |

| | • | | During the quarter ended December 31, 2014, we leased approximately 1.9 million square feet, which included 1.0 million square feet of new leases and expansions, and 0.9 million square feet of renewals and future leases. Future leases represent new leases for units that are entered into while the units are occupied by the current customer. Since January 2013, we have leased over 16 million square feet in approximately 295 transactions. |

| | • | | Our net operating income(1) was $57.6 million for the quarter ended December 31, 2014, a decrease of 0.4% as compared to net operating income of $57.8 million for the same period in 2013. |

| | • | | Our same store net operating income(1) was $55.4 million for the quarter ended December 31, 2014, an increase of 1.7% over same store net operating income of $54.4 million for the same period in 2013. |

| | • | | Our net loss was $3.5 million, or $0.02 per share, for the quarter ended December 31, 2014, as compared to net loss of $4.2 million, or $0.02 per share, for the same period in 2013. These results include non-recurring acquisition and strategic transaction expenses of $0.8 million for the quarter ended December 31, 2014, and $1.1 million for the same period in 2013. |

| | • | | We had Company-defined Funds from Operations (“Company-Defined FFO”)(2) of $32.4 million, or $0.15 per share, for the quarter ended December 31, 2014, as compared to $33.4 million, or $0.16 per share, for the same period in 2013. |

Our operating results for the quarters ended December 31, 2014 and 2013 are not directly comparable, as we sold 20 industrial buildings aggregating 2.8 million square feet for net proceeds of $125.3 million in April 2014.

| (1) | See “Selected Financial Data” for additional information regarding net operating income and same store net operating income, as well as “Definitions” for a reconciliation of net operating income to GAAP net income (loss). |

| (2) | See “Funds from Operations” for a reconciliation of GAAP net income (loss) to Company-defined FFO, as well as “Definitions” for additional information. |

| | | | |

Fourth Quarter 2014 Supplemental Reporting Package | |

| | Page 3 |

|

Consolidated Statements of Operations |

| | | | | | | | | | | | | | | | |

| | | For the Quarter | | | For the Year | |

| | | Ended December 31, | | | Ended December 31, | |

(in thousands, except per share data) | | 2014 | | | 2013 | | | 2014 | | | 2013 | |

Revenues: | | | | | | | | | | | | | | | | |

Rental revenues | | $ | 77,524 | | | $ | 78,198 | | | $ | 312,457 | | | $ | 249,852 | |

| | | | | | | | | | | | | | | | |

Total revenues | | | 77,524 | | | | 78,198 | | | | 312,457 | | | | 249,852 | |

| | | | | | | | | | | | | | | | |

| | | | |

Operating expenses: | | | | | | | | | | | | | | | | |

Rental expenses | | | 19,954 | | | | 20,380 | | | | 82,100 | | | | 64,021 | |

Real estate-related depreciation and amortization | | | 35,066 | | | | 36,430 | | | | 141,794 | | | | 121,339 | |

General and administrative expenses | | | 1,406 | | | | 1,768 | | | | 6,557 | | | | 6,882 | |

Asset management fees, related party | | | 7,519 | | | | 7,232 | | | | 29,548 | | | | 23,063 | |

Acquisition expenses, related party | | | - | | | | 516 | | | | 3,432 | | | | 11,477 | |

Acquisition and strategic transaction expenses | | | 795 | | | | 597 | | | | 1,614 | | | | 12,912 | |

| | | | | | | | | | | | | | | | |

Total operating expenses | | | 64,740 | | | | 66,923 | | | | 265,045 | | | | 239,694 | |

| | | | | | | | | | | | | | | | |

| | | | |

Operating income | | | 12,784 | | | | 11,275 | | | | 47,412 | | | | 10,158 | |

| | | | |

Other (expenses) income: | | | | | | | | | | | | | | | | |

Equity in loss of unconsolidated joint ventures | | | (36) | | | | (61) | | | | (75) | | | | (2,866) | |

Interest expense and other | | | (16,240) | | | | (15,372) | | | | (62,869) | | | | (50,898) | |

Gain on disposition of real estate properties | | | - | | | | - | | | | 24,471 | | | | - | |

Gain on acquisition of joint venture | | | - | | | | - | | | | - | | | | 26,481 | |

Incentive fee from acquisition of joint venture | | | - | | | | - | | | | - | | | | 1,985 | |

| | | | | | | | | | | | | | | | |

Total other (expenses) income | | | (16,276) | | | | (15,433) | | | | (38,473) | | | | (25,298) | |

| | | | |

Net (loss) income | | | (3,492) | | | | (4,158) | | | | 8,939 | | | | (15,140) | |

Net (loss) income attributable to noncontrolling interests | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | |

Net (loss) income attributable to common stockholders | | $ | (3,492) | | | $ | (4,158) | | | $ | 8,939 | | | $ | (15,140) | |

| | | | | | | | | | | | | | | | |

Weighted-average shares outstanding | | | 211,692 | | | | 206,753 | | | | 209,958 | | | | 179,619 | |

| | | | | | | | | | | | | | | | |

Net (loss) income per common share - basic and diluted | | $ | (0.02) | | | $ | (0.02) | | | $ | 0.04 | | | $ | (0.08) | |

| | | | | | | | | | | | | | | | |

| | | | |

Fourth Quarter 2014 Supplemental Reporting Package | |

| | Page 4 |

|

Consolidated Balance Sheets |

| | | | | | | | |

| | | As of December 31, | |

(in thousands) | | 2014 | | | 2013 | |

ASSETS | | | | | |

Net investment in real estate properties | | $ | 3,519,151 | | | $ | 3,499,570 | |

Investment in unconsolidated joint ventures | | | 8,208 | | | | 8,066 | |

Cash and cash equivalents | | | 8,053 | | | | 18,358 | |

Restricted cash | | | 5,941 | | | | 2,813 | |

Straight-line rent receivable | | | 42,759 | | | | 28,614 | |

Tenant receivables, net | | | 3,278 | | | | 5,497 | |

Notes receivable | | | 3,612 | | | | 3,612 | |

Deferred financing costs, net | | | 9,094 | | | | 11,543 | |

Deferred acquisition costs | | | 20,492 | | | | 25,390 | |

Other assets | | | 7,062 | | | | 10,601 | |

| | | | | | | | |

Total assets | | $ | 3,627,650 | | | $ | 3,614,064 | |

| | | | | | | | |

LIABILITIES AND EQUITY | | | | | | | | |

Accounts payable and accrued expenses | | $ | 26,873 | | | $ | 29,092 | |

Tenant prepaids and security deposits | | | 41,108 | | | | 44,719 | |

Accrued capital | | | 8,460 | | | | 6,697 | |

Intangible lease liability, net | | | 25,865 | | | | 31,858 | |

Debt | | | 1,978,625 | | | | 1,876,631 | |

Distributions payable | | | 33,072 | | | | 32,301 | |

Other liabilities | | | 4,701 | | | | 684 | |

| | | | | | | | |

Total liabilities | | | 2,118,704 | | | | 2,021,982 | |

Total stockholders’ equity | | | 1,508,945 | | | | 1,592,081 | |

Noncontrolling interests | | | 1 | | | | 1 | |

| | | | | | | | |

Total liabilities and equity | | $ | 3,627,650 | | | $ | 3,614,064 | |

| | | | | | | | |

Shares outstanding | | | 211,573 | | | | 206,743 | |

| | | | | | | | |

| | | | |

Fourth Quarter 2014 Supplemental Reporting Package | |

| | Page 5 |

|

Consolidated Statements of Cash Flows |

| | | | | | | | |

| | | For the Year | |

| | | Ended December 31, | |

($ in thousands) | | 2014 | | | 2013 | |

Operating activities: | |

Net income (loss) | | $ | 8,939 | | | $ | (15,140) | |

Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | | | | | | |

Real estate-related depreciation and amortization | | | 141,794 | | | | 121,339 | |

Equity in loss of unconsolidated joint ventures | | | 75 | | | | 2,866 | |

Gain on disposition of real estate properties | | | (24,471) | | | | - | |

Gain on acquisition of joint venture | | | - | | | | (26,481) | |

Incentive fee from acquisition of joint venture | | | - | | | | (1,985) | |

Straight-line rent and amortization of above- and below-market leases | | | (12,540) | | | | (14,108) | |

Other | | | 2,261 | | | | 714 | |

Changes in operating assets and liabilities | | | (5,313) | | | | 19,683 | |

| | | | | | | | |

Net cash provided by operating activities | | | 110,745 | | | | 86,888 | |

| | | | | | | | |

Investing activities: | | | | | | | | |

Real estate acquisitions | | | (121,834) | | | | (857,618) | |

Acquisition of joint venture | | | - | | | | (126,010) | |

Acquisition deposits | | | (19,992) | | | | (20,716) | |

Capital expenditures and development activities | | | (122,721) | | | | (86,388) | |

Investment in unconsolidated joint ventures | | | (217) | | | | (19,804) | |

Distributions from unconsolidated joint ventures | | | - | | | | 3,754 | |

Proceeds from disposition of real estate properties | | | 125,310 | | | | - | |

Other | | | - | | | | (494) | |

| | | | | | | | |

Net cash used in investing activities | | | (139,454) | | | | (1,107,276) | |

| | | | | | | | |

Financing activities: | | | | | | | | |

Proceeds from issuance of mortgage notes | | | 17,500 | | | | 91,000 | |

Repayments of mortgage notes | | | (6,818) | | | | (11,305) | |

Proceeds from issuance of term loan | | | - | | | | 300,000 | |

Proceeds from lines of credit | | | 200,000 | | | | 775,000 | |

Repayments of lines of credit | | | (107,000) | | | | (725,225) | |

Proceeds from issuance of common stock | | | - | | | | 721,768 | |

Offering costs for issuance of common stock | | | (1,082) | | | | (69,640) | |

Distributions paid to common stockholders | | | (65,562) | | | | (51,732) | |

Redemptions of common stock | | | (18,050) | | | | (11,890) | |

Other | | | (584) | | | | (3,780) | |

| | | | | | | | |

Net cash provided by financing activities | | | 18,404 | | | | 1,014,196 | |

| | | | | | | | |

Net decrease in cash and cash equivalents | | | (10,305) | | | | (6,192) | |

Cash and cash equivalents, at beginning of period | | | 18,358 | | | | 24,550 | |

| | | | | | | | |

Cash and cash equivalents, at end of period | | $ | 8,053 | | | $ | 18,358 | |

| | | | | | | | |

| | | | |

Fourth Quarter 2014 Supplemental Reporting Package | |

| | Page 6 |

Our fourth quarter 2014 Company-defined FFO was $0.15 per share, as compared to $0.16 per share for the fourth quarter 2013. There can be no assurances that the current level of Company-defined FFO will be maintained.

| | | | | | | | | | | | | | | | |

| | | For the Quarter | | | For the Year | |

| | | Ended December 31, | | | Ended December 31, | |

(in thousands, except per share data) | | 2014 | | | 2013 | | | 2014 | | | 2013 | |

Net (loss) income | | $ | (3,492) | | | $ | (4,158) | | | $ | 8,939 | | | $ | (15,140) | |

| | | | | | | | | | | | | | | | |

Net (loss) income per common share | | $ | (0.02) | | | $ | (0.02) | | | $ | 0.04 | | | $ | (0.08) | |

| | | | | | | | | | | | | | | | |

Reconciliation of net (loss) income to FFO: | | | | | | | | | | | | | | | | |

Net (loss) income | | $ | (3,492) | | | $ | (4,158) | | | $ | 8,939 | | | $ | (15,140) | |

Add (deduct) NAREIT-defined adjustments: | | | | | | | | | | | | | | | | |

Real estate-related depreciation and amortization | | | 35,066 | | | | 36,430 | | | | 141,794 | | | | 121,339 | |

Real estate-related depreciation and amortization of unconsolidated joint ventures | | | - | | | | 19 | | | | 9 | | | | 4,487 | |

Gain on acquisition of joint venture | | | - | | | | - | | | | - | | | | (26,481) | |

Gain on disposition of real estate properties | | | - | | | | - | | | | (24,471) | | | | - | |

| | | | | | | | | | | | | | | | |

FFO | | $ | 31,574 | | | $ | 32,291 | | | $ | 126,271 | | | $ | 84,205 | |

| | | | | | | | | | | | | | | | |

FFO per common share | | $ | 0.15 | | | $ | 0.16 | | | $ | 0.60 | | | $ | 0.47 | |

| | | | | | | | | | | | | | | | |

Reconciliation of FFO to Company-defined FFO: | | | | | | | | | | | | | | | | |

FFO | | $ | 31,574 | | | $ | 32,291 | | | $ | 126,271 | | | $ | 84,205 | |

Add (deduct) Company-defined adjustments: | | | | | | | | | | | | | | | | |

Acquisition and strategic transaction costs | | | 795 | | | | 1,113 | | | | 5,046 | | | | 24,389 | |

Acquisition costs of unconsolidated joint ventures | | | - | | | | - | | | | - | | | | 863 | |

| | | | | | | | | | | | | | | | |

Company-defined FFO | | $ | 32,369 | | | $ | 33,404 | | | $ | 131,317 | | | $ | 109,457 | |

| | | | | | | | | | | | | | | | |

Company-defined FFO per common share | | $ | 0.15 | | | $ | 0.16 | | | $ | 0.63 | | | $ | 0.61 | |

| | | | | | | | | | | | | | | | |

Weighted-average shares outstanding | | | 211,692 | | | | 206,753 | | | | 209,958 | | | | 179,619 | |

| | | | | | | | | | | | | | | | |

| (1) | See “Definitions” for additional information regarding Funds from Operations and Company-defined FFO. |

| | | | |

Fourth Quarter 2014 Supplemental Reporting Package | |

| | Page 7 |

The following table presents selected consolidated financial information, which has been derived from our consolidated financial statements. The information presented below is only a summary and does not provide all of the information contained in our historical consolidated financial statements, including the related notes thereto, and as such, you should read it in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2014. The same store operating portfolio for the three months ended December 31, 2014 and 2013 included 270 buildings owned as of October 1, 2013, and represented 93% of total rentable square feet or 96% of total revenues as of December 31, 2014. The same store operating portfolio for the year ended December 31, 2014 and 2013 included 171 buildings owned as of January 1, 2013, and represented 58% of total rentable square feet or 62% of total revenues as of December 31, 2014.

| | | | | | | | | | | | | | | | |

| | | For the Quarter | | | For the Year | |

| | | Ended December 31, | | | Ended December 31, | |

($ in thousands, except per share data) | | 2014 | | | 2013 | | | 2014 | | | 2013 | |

Operating data: | | | | | | | | | | | | | | | | |

Rental revenues from same store operating properties(1) | | $ | 74,614 | | | $ | 73,848 | | | $ | 192,805 | | | $ | 189,590 | |

Rental revenues from other properties(1) | | | 2,910 | | | | 4,350 | | | | 119,652 | | | | 60,262 | |

| | | | | | | | | | | | | | | | |

Total rental revenues | | | 77,524 | | | | 78,198 | | | | 312,457 | | | | 249,852 | |

| | | | | | | | | | | | | | | | |

Rental expenses from same store operating properties(1) | | | 19,217 | | | | 19,399 | | | | 50,741 | | | | 49,235 | |

Rental expenses from other properties(1) | | | 737 | | | | 981 | | | | 31,359 | | | | 14,786 | |

| | | | | | | | | | | | | | | | |

Total rental expenses | | | 19,954 | | | | 20,380 | | | | 82,100 | | | | 64,021 | |

| | | | | | | | | | | | | | | | |

NOI from same store operating properties | | | 55,397 | | | | 54,449 | | | | 142,064 | | | | 140,355 | |

NOI from other properties | | | 2,173 | | | | 3,369 | | | | 88,293 | | | | 45,476 | |

| | | | | | | | | | | | | | | | |

Total NOI(2) | | $ | 57,570 | | | $ | 57,818 | | | $ | 230,357 | | | $ | 185,831 | |

| | | | | | | | | | | | | | | | |

Less straight-line rents | | $ | (3,290) | | | $ | (6,327) | | | $ | (15,537) | | | $ | (17,634) | |

Plus amortization of above market leases, net | | | 465 | | | | 781 | | | | 2,997 | | | | 3,526 | |

| | | | | | | | | | | | | | | | |

Cash NOI(2) | | $ | 54,745 | | | $ | 52,272 | | | $ | 217,817 | | | $ | 171,723 | |

| | | | | | | | | | | | | | | | |

Adjusted EBITDA(3) | | $ | 48,717 | | | $ | 48,810 | | | $ | 194,762 | | | $ | 163,381 | |

| | | | | | | | | | | | | | | | |

| | | | |

Distributions: | | | | | | | | | | | | | | | | |

Total distributions declared | | $ | 33,072 | | | $ | 32,301 | | | $ | 131,203 | | | $ | 112,104 | |

Distributions declared per common share | | $ | 0.15625 | | | $ | 0.15625 | | | $ | 0.62500 | | | $ | 0.62500 | |

| | | | |

Cash flow data: | | | | | | | | | | | | | | | | |

Net cash provided by operating activities | | $ | 29,619 | | | $ | 32,161 | | | $ | 110,745 | | | $ | 86,888 | |

Net cash used in by investing activities | | $ | (45,840) | | | $ | (65,872) | | | $ | (139,454) | | | $ | (1,107,276) | |

Net cash provided by financing activities | | $ | 13,113 | | | $ | 24,418 | | | $ | 18,404 | | | $ | 1,014,196 | |

| | | | |

Capital expenditures: | | | | | | | | | | | | | | | | |

Development activity | | $ | 10,103 | | | $ | 6,503 | | | $ | 61,050 | | | $ | 47,737 | |

Tenant improvements and leasing commissions | | | 19,924 | | | | 18,447 | | | | 44,567 | | | | 30,219 | |

Property maintenance and improvements | | | 7,997 | | | | 6,340 | | | | 17,104 | | | | 8,432 | |

| | | | | | | | | | | | | | | | |

Total capital expenditures | | $ | 38,024 | | | $ | 31,290 | | | $ | 122,721 | | | $ | 86,388 | |

| | | | | | | | | | | | | | | | |

| (1) | See “Definitions” for additional information regarding “same store operating properties” and “other properties.” |

| (2) | See “Definitions” for a reconciliation of net operating income to GAAP net income (loss) and for a reconciliation of cash net operating income to GAAP net income (loss). |

| (3) | See “Definitions” for a reconciliation of adjusted EBITDA to GAAP net income (loss). |

| | | | |

Fourth Quarter 2014 Supplemental Reporting Package | |

| | Page 8 |

Our portfolio consists primarily of institutional quality, functional industrial buildings with generic features designed for operating flexibility and for high acceptance by a wide range of customers. As of December 31, 2014, the weighted-average age of our buildings (based on square feet) was 13.8 years.

Portfolio Data

| | | | | | | | | | | | |

| | | As of December 31, | |

(square feet in thousands) | | 2014 | | | 2013 | | | 2012 | |

Number of consolidated buildings | | | 283 | | | | 296 | | | | 190 | |

Number of unconsolidated buildings | | | 2 | | | | 1 | | | | 29 | |

| | | | | | | | | | | | |

Total number of buildings | | | 285 | | | | 297 | | | | 219 | |

| | | | | | | | | | | | |

Rentable square feet of consolidated buildings | | | 57,640 | | | | 57,230 | | | | 36,898 | |

Rentable square feet of unconsolidated buildings | | | 710 | | | | 180 | | | | 6,181 | |

| | | | | | | | | | | | |

Total rentable square feet | | | 58,350 | | | | 57,410 | | | | 43,079 | |

| | | | | | | | | | | | |

| | | |

Total number of customers(1) | | | 551 | | | | 553 | | | | 414 | |

| | | |

Percent occupied of operating portfolio(1) | | | 91% | | | | 94% | | | | 95% | |

Percent occupied of total portfolio(1) | | | 88% | | | | 91% | | | | 90% | |

| | | |

Percent leased of operating portfolio(1) | | | 93% | | | | 95% | | | | 96% | |

Percent leased of total portfolio(1) | | | 90% | | | | 93% | | | | 92% | |

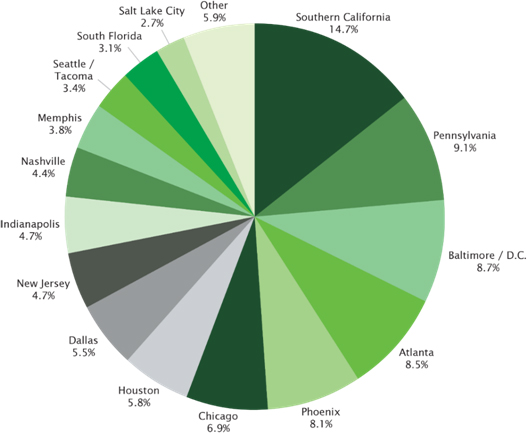

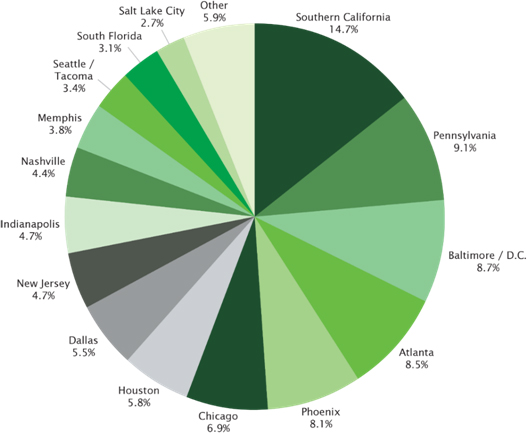

Markets by Total Rentable Square Feet

as of December 31, 2014

| (1) | Represents our consolidated portfolio. |

| | | | |

Fourth Quarter 2014 Supplemental Reporting Package | |

| | Page 9 |

As of December 31, 2014, we owned and managed a well-diversified industrial portfolio located in 19 major industrial markets throughout the U.S. Approximately 72% (based on square feet) and 73% (based on annual base rent) of our total portfolio was located in our top-tier markets(1).

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | Percent | |

| | | Number | | Rentable | | | | | | | | | | | | of Total | |

| | | of | | Square | | | Occupied | | | Leased | | | Annualized | | | Annualized | |

($ and square feet in thousands) | | Buildings | | Feet | | | Rate | | | Rate | | | Base Rent | | | Base Rent | |

Operating Properties: | | | | | | | | | | | | | | | | | | | | | | |

Atlanta | | 19 | | | 4,905 | | | | 88.7 % | | | | 88.7 % | | | $ | 14,437 | | | | 6.1 % | |

Austin | | 7 | | | 748 | | | | 100.0 | | | | 100.0 | | | | 4,644 | | | | 1.9 | |

Baltimore / D.C. | | 25 | | | 4,999 | | | | 91.5 | | | | 95.2 | | | | 24,136 | | | | 10.1 | |

Chicago | | 19 | | | 3,967 | | | | 99.6 | | | | 99.6 | | | | 16,565 | | | | 7.0 | |

Dallas | | 23 | | | 3,218 | | | | 94.2 | | | | 94.2 | | | | 14,164 | | | | 6.0 | |

Denver | | 1 | | | 554 | | | | 100.0 | | | | 100.0 | | | | 3,348 | | | | 1.4 | |

Houston | | 27 | | | 2,803 | | | | 90.3 | | | | 90.3 | | | | 13,324 | | | | 5.6 | |

Indianapolis | | 7 | | | 2,698 | | | | 84.7 | | | | 84.7 | | | | 10,916 | | | | 4.6 | |

Memphis | | 6 | | | 2,176 | | | | 93.9 | | | | 98.5 | | | | 5,845 | | | | 2.5 | |

Nashville | | 6 | | | 2,531 | | | | 100.0 | | | | 100.0 | | | | 9,142 | | | | 3.8 | |

New Jersey | | 17 | | | 2,728 | | | | 84.7 | | | | 85.3 | | | | 11,501 | | | | 4.8 | |

Pennsylvania | | 29 | | | 5,248 | | | | 96.4 | | | | 97.0 | | | | 22,819 | | | | 9.6 | |

Phoenix | | 17 | | | 4,646 | | | | 83.2 | | | | 83.2 | | | | 20,726 | | | | 8.7 | |

Portland | | 8 | | | 948 | | | | 90.5 | | | | 90.5 | | | | 3,932 | | | | 1.6 | |

Salt Lake City | | 4 | | | 1,140 | | | | 100.0 | | | | 100.0 | | | | 5,615 | | | | 2.4 | |

San Francisco Bay Area | | 8 | | | 1,171 | | | | 97.1 | | | | 97.1 | | | | 6,889 | | | | 2.9 | |

Seattle / Tacoma | | 10 | | | 1,950 | | | | 97.2 | | | | 99.0 | | | | 10,171 | | | | 4.3 | |

South Florida | | 21 | | | 1,793 | | | | 97.9 | | | | 97.9 | | | | 12,441 | | | | 5.2 | |

Southern California | | 24 | | | 7,633 | | | | 82.6 | | | | 89.5 | | | | 27,175 | | | | 11.4 | |

| | | | | | | | | | | | | | | | | | | | | | |

Total Operating | | 278 | | | 55,856 | | | | 91.2 | | | | 92.8 | | | | 237,790 | | | | 99.9 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Development and Value-Add Properties: | | | | | | | | | | | | | | | | | | | | | | |

Houston | | 3 | | | 537 | | | | 7.1 | | | | 7.1 | | | | 207 | | | | 0.1 | |

Salt Lake City | | 1 | | | 416 | | | | - | | | | - | | | | - | | | | - | |

Southern California | | 1 | | | 831 | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | |

Total Development and Value-Add | | 5 | | | 1,784 | | | | 2.1 | | | | 2.1 | | | | 207 | | | | 0.1 | |

| | | | | | | | | | | | | | | | | | | | | | |

Total Portfolio | | 283 | | | 57,640 | | | | 88.4 % | | | | 90.0 % | | | $ | 237,997 | | | | 100.0 % | |

| | | | | | | | | | | | | | | | | | | | | | |

| (1) | Our top-tier markets include: Atlanta, Baltimore / D.C., Chicago, Dallas, Houston, New Jersey, Pennsylvania, San Francisco Bay Area, Seattle / Tacoma, South Florida and Southern California. |

| | | | |

Fourth Quarter 2014 Supplemental Reporting Package | |

| | Page 10 |

|

Lease Expirations & Top Customers |

As of December 31, 2014, our consolidated real estate portfolio consisted of 283 industrial buildings occupied by 551 customers with 591 leases and a weighted-average remaining lease term (based on square feet) of 5.3 years.

Lease Expirations

During the fourth quarter of 2014, we leased approximately 1.9 million square feet, which included 1.0 million square feet of new leases and expansions, and 0.9 million square feet of renewals and future leases. Future leases represent new leases for units that are entered into while the units are occupied by the current customer. Approximately 78% of our total occupied square feet is scheduled to expire in 2017 or later.

| | | | | | | | | | | | | | | | | | |

| | | | | | | | Percent | | | | | | Percent | |

| | | Number | | | | | of Total | | | | | | of Total | |

| | | of | | Occupied | | | Occupied | | | Annualized | | | Annualized | |

($ and square feet in thousands) | | Leases | | Square Feet | | | Square Feet | | | Base Rent | | | Base Rent | |

2015(1) | | 103 | | | 5,207 | | | | 10.2 % | | | $ | 26,553 | | | | 11.2 % | |

2016 | | 101 | | | 5,879 | | | | 11.6 | | | | 27,988 | | | | 11.8 | |

2017 | | 109 | | | 5,700 | | | | 11.2 | | | | 26,784 | | | | 11.3 | |

2018 | | 77 | | | 8,207 | | | | 16.1 | | | | 36,837 | | | | 15.5 | |

2019 | | 66 | | | 5,873 | | | | 11.5 | | | | 29,854 | | | | 12.4 | |

2020 | | 39 | | | 3,402 | | | | 6.7 | | | | 15,920 | | | | 6.7 | |

2021 | | 24 | | | 3,172 | | | | 6.2 | | | | 17,250 | | | | 7.2 | |

2022 | | 22 | | | 4,250 | | | | 8.3 | | | | 17,983 | | | | 7.6 | |

2023 | | 12 | | | 1,226 | | | | 2.4 | | | | 4,768 | | | | 2.0 | |

2024 | | 18 | | | 2,591 | | | | 5.1 | | | | 11,609 | | | | 4.9 | |

Thereafter | | 20 | | | 5,467 | | | | 10.7 | | | | 22,451 | | | | 9.4 | |

| | | | | | | | | | | | | | | | | | |

Total occupied | | 591 | | | 50,974 | | | | 100.0 % | | | $ | 237,997 | | | | 100.0 % | |

| | | | | | | | | | | | | | | | | | |

Customers

Of the 551 customers as of December 31, 2014, there were no customers that individually represented more than 10% of total annualized base rent or total occupied square feet. The following table reflects our 10 largest customers, based on annualized base rent, which occupied a combined 11.5 million square feet as of December 31, 2014:

| | | | | | | | |

| | | Percent of Total | | | Percent of Total | |

| | | Annualized | | | Occupied | |

Customer | | Base Rent | | | Square Feet | |

Amazon.com, LLC | | | 5.8 % | | | | 4.8 % | |

Home Depot USA INC. | | | 3.6 | | | | 3.8 | |

Hanesbrands, Inc. | | | 2.6 | | | | 2.6 | |

Belkin International | | | 2.3 | | | | 1.6 | |

CEVA Logistics U.S. | | | 2.3 | | | | 2.8 | |

Harbor Freight Tools | | | 2.1 | | | | 2.5 | |

GlaxoSmithKlein | | | 1.4 | | | | 1.2 | |

United Natural Foods, Inc. | | | 1.4 | | | | 1.1 | |

Samsung Electronics | | | 1.2 | | | | 1.2 | |

U.S. Government | | | 1.1 | | | | 0.9 | |

| | | | | | | | |

Total | | | 23.8 % | | | | 22.5 % | |

| | | | | | | | |

| (1) | Includes month-to-month leases. |

| | | | |

Fourth Quarter 2014 Supplemental Reporting Package | |

| | Page 11 |

Development Overview

The following summarizes our development and value-add portfolio and projects under development as of December 31, 2014:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Number | | Rentable | | | | | | Cumulative | | | | | | | | | | | |

| ($ and square | | | | of | | Square | | | Percent | | | Costs | | | Projected | | | Completion | | | Percent | | Percent |

feet in thousands) | | Market | | Buildings | | Feet(1) | | | Owned | | | Incurred(2) | | | Investment | | | Date(3) | | | Occupied | | Leased |

Development and Value-Add Portfolio(4) | | | | | | | | | | | | | | | | | | | | | | | | |

Imperial DC | | Houston | | 1 | | | 328 | | | | 100% | | | $ | 20,365 | | | $ | 22,382 | | | | Q1-2014 | | | - % | | - % |

Westport DC Bldg C | | Salt Lake City | | 1 | | | 416 | | | | 100% | | | | 22,645 | | | | 25,560 | | | | Q2-2014 | | | - % | | - % |

Beltway Crossing DC | | Houston | | 2 | | | 209 | | | | 100% | | | | 14,035 | | | | 15,287 | | | | Q2-2014 | | | 18% | | 18% |

Cajon DC | | So. California | | 1 | | | 831 | | | | 100% | | | | 56,594 | | | | 62,747 | | | | Q3-2014 | | | - % | | - % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Development and Value-Add | | 5 | | | 1,784 | | | | 100% | | | $ | 113,639 | | | $ | 125,976 | | | | | | | 2% | | 2% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Projects Under Development | | | | | | | | | | | | | | | | | | | | | | | | | | |

Under Construction | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Franklin Square II | | Baltimore / D.C. | | 1 | | | 192 | | | | 100% | | | $ | 9,489 | | | $ | 13,972 | | | | Q1-2015 | | | | | - % |

Tamarac II | | South Florida | | 1 | | | 104 | | | | 100% | | | | 3,522 | | | | 11,265 | | | | Q2-2015 | | | | | 26% |

Tamarac III | | South Florida | | 1 | | | 42 | | | | 100% | | | | 2,315 | | | | 4,968 | | | | Q2-2015 | | | | | - % |

Miami III | | South Florida | | 1 | | | 102 | | | | 100% | | | | 3,303 | | | | 9,274 | | | | Q2-2015 | | | | | - % |

Miami IV | | South Florida | | 1 | | | 88 | | | | 100% | | | | 2,844 | | | | 8,201 | | | | Q2-2015 | | | | | - % |

Leigh Valley III | | Pennsylvania | | 1 | | | 106 | | | | 100% | | | | 1,594 | | | | 9,397 | | | | Q4-2015 | | | | | - % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Under Construction | | 6 | | | 634 | | | | 100% | | | | 23,067 | | | | 57,077 | | | | | | | | | 4% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Pre-Construction | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Lehigh Valley I | | Pennsylvania | | 1 | | | 400 | | | | 100% | | | | 4,197 | | | | 25,484 | | | | Q4-2015 | | | | | - % |

Lehigh Valley II | | Pennsylvania | | 1 | | | 210 | | | | 100% | | | | 1,465 | | | | 13,619 | | | | Q1-2016 | | | | | - % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Pre-Construction | | 2 | | | 610 | | | | 100% | | | | 5,662 | | | | 39,103 | | | | | | | | | - % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Projects Under Development | | 8 | | | 1,244 | | | | 100% | | | $ | 28,729 | | | $ | 96,180 | | | | | | | | | 2% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Development Properties Transferred to Operating Portfolio During the Period | | | | | | | | | | | | | |

Chino DC | | So. California | | 1 | | | 410 | | | | 100% | | | | 33,521 | | | | 39,043 | | | | Q2-2014 | | | 100% | | 100% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | 1 | | | 410 | | | | 100% | | | $ | 33,521 | | | $ | 39,043 | | | | | | | 100% | | 100% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Rentable square feet for pre-construction projects is projected and cannot be assured. |

| (2) | As of December 31, 2014. |

| (3) | The completion date represents the acquisition date, date of building shell completion or estimated date of shell completion. |

| (4) | The development and value-add portfolio includes buildings acquired with the intention to reposition or redevelop, or buildings recently completed which have not yet stabilized. We generally consider a building to be stabilized on the earlier to occur of the first anniversary of a building’s completion or a building achieving 90% occupancy. |

| | | | |

Fourth Quarter 2014 Supplemental Reporting Package | |

| | Page 12 |

Summary of Consolidated Debt

As of December 31, 2014, we had approximately $2.0 billion of consolidated indebtedness, which was comprised of borrowings under our lines of credit and unsecured term loans, and our mortgage note financings. Our consolidated debt had a weighted-average remaining term of approximately 4.7 years. Assuming the effects of the forward-starting interest rate swap agreements relating to the $300.0 million term loan, approximately 82% of our total debt was fixed and 18% of our total debt was variable as of December 31, 2014. The following is a summary of our consolidated debt as of December 31, 2014:

| | | | | | | | |

| | | Weighted-Average | | | | | |

| | | Stated Interest Rate as | | | | Balance as of | |

($ in thousands) | | of December 31, 2014 | | Maturity Date | | December 31, 2014 | |

Lines of credit | | 2.20% | | August 2015 - January 2017 | | $ | 343,000 | |

| | | |

Term loans(1) | | 2.35% | | January 2018 - January 2019 | | | 500,000 | |

| | | |

Fixed-rate mortgage notes | | 4.25% | | June 2015 - November 2024 | | | 1,126,545 | |

Variable-rate mortgage note | | 2.17% | | May 2015 | | | 9,080 | |

| | | | | | | | |

Total / weighted-average mortgage notes | | 4.23% | | | | | 1,135,625 | |

| | | | | | | | |

Total / weighted-average consolidated debt | | 3.40% | | | | $ | 1,978,625 | |

| | | | | | | | |

Fixed-rate debt | | 4.05% | | | | | 67% | |

Variable-rate debt | | 2.09% | | | | | 33% | |

| | | | | | | | |

Total / weighted-average(2) | | 3.40% | | | | | 100% | |

| | | | | | | | |

Scheduled Principal Payments of Debt

As of December 31, 2014, the principal payments due on our consolidated debt during each of the next five years and thereafter were as follows:

| | | | | | | | | | | | | | | | |

($ in thousands) | | Lines of Credit (3) | | | Term Loans | | | Mortgage Notes | | | Total | |

2015 | | $ | 258,000 | | | $ | - | | | $ | 53,445 | | | $ | 311,445 | |

2016 | | | - | | | | - | | | | 20,515 | | | | 20,515 | |

2017 | | | 85,000 | | | | - | | | | 62,666 | | | | 147,666 | |

2018 | | | - | | | | 200,000 | | | | 167,954 | | | | 367,954 | |

2019 | | | - | | | | 300,000 | | | | 71,475 | | | | 371,475 | |

Thereafter | | | - | | | | - | | | | 755,069 | | | | 755,069 | |

| | | | | | | | | | | | | | | | |

Total principal payments | | | 343,000 | | | | 500,000 | | | | 1,131,124 | | | | 1,974,124 | |

Unamortized premium on assumed debt | | | - | | | | - | | | | 4,501 | | | | 4,501 | |

| | | | | | | | | | | | | | | | |

Total | | $ | 343,000 | | | $ | 500,000 | | | $ | 1,135,625 | | | $ | 1,978,625 | |

| | | | | | | | | | | | | | | | |

| (1) | Effective January 14, 2014, the interest rate for the $200.0 million term loan was fixed through the use of interest rate swaps at an all-in interest rate of 2.93% as of December 31, 2014. The forward-starting interest rate swap agreements relating to the $300.0 million term loan has an effective date of January 20, 2015 and will have an all-in interest rate ranging from 3.31% to 4.16%, depending on our consolidated leverage ratio at that time. |

| (2) | Assuming the effects of the forward-starting interest rate swap agreements relating to the $300.0 million term loan, our weighted-average interest rate would have been 3.64% as of December 31, 2014. |

| (3) | Both lines of credit may be extended pursuant to two one-year extension options, subject to certain conditions. |

| | | | |

Fourth Quarter 2014 Supplemental Reporting Package | |

| | Page 13 |

Annualized Base Rent.Annualized base rent is calculated as monthly base rent including the impact of any contractual tenant concessions (cash basis) per the terms of a lease as of December 31, 2014, multiplied by 12.

Adjusted EBITDA.Adjusted EBITDA represents net income (loss) attributable to common stockholders before interest, taxes, depreciation, amortization, stock-based compensation expense, acquisition and strategic transaction costs, gains on business combinations, and proportionate share of interest, depreciation and amortization from unconsolidated joint ventures. We use Adjusted EBITDA to measure our operating performance to provide investors relevant and useful information because it allows fixed income investors to view income from our operations on an unleveraged basis before the effects of non-cash items, such as depreciation and amortization.

| | | | | | | | | | | | | | | | |

| | | For the Quarter | | | For the Year | |

| | | Ended December 31, | | | Ended December 31, | |

($ in thousands) | | 2014 | | | 2013 | | | 2014 | | | 2013 | |

Reconciliation of net (loss) income to adjusted EBITDA: | | | | | | | | | | | | | | | | |

Net (loss) income | | $ | (3,492) | | | $ | (4,158) | | | $ | 8,939 | | | $ | (15,140) | |

Interest expense | | | 16,240 | | | | 15,372 | | | | 62,869 | | | | 50,898 | |

Proportionate share of interest expense from unconsolidated joint venture | | | 19 | | | | - | | | | 45 | | | | 2,848 | |

Real estate-related depreciation and amortization | | | 35,066 | | | | 36,430 | | | | 141,794 | | | | 121,339 | |

Proportionate share of real estate-related depreciation and amortization from unconsolidated joint ventures | | | - | | | | 19 | | | | 9 | | | | 4,487 | |

Acquisition and strategic transaction costs | | | 795 | | | | 1,113 | | | | 5,046 | | | | 24,389 | |

Gain on disposition of real estate properties | | | - | | | | - | | | | (24,471) | | | | - | |

Gain on acquisition of joint venture | | | - | | | | - | | | | - | | | | (26,481) | |

Proportionate share of acquisition costs from unconsolidated joint ventures | | | - | | | | - | | | | - | | | | 863 | |

Share-based compensation expense | | | 89 | | | | 34 | | | | 531 | | | | 178 | |

| | | | | | | | | | | | | | | | |

Adjusted EBITDA | | $ | 48,717 | | | $ | 48,810 | | | $ | 194,762 | | | $ | 163,381 | |

| | | | | | | | | | | | | | | | |

Consolidated Portfolio.The consolidated portfolio excludes properties owned through our unconsolidated joint ventures.

Development and Value-Add Portfolio.The development and value-add portfolio includes buildings acquired with the intention to reposition or redevelop, or buildings recently completed which have not yet reached stabilization. We generally consider a building to be stabilized on the earlier to occur of the first anniversary of a building’s completion or a building achieving 90% occupancy.

Funds from Operations (“FFO”) and Company-Defined FFO.We believe that FFO and Company-defined FFO, in addition to net income (loss) and cash flows from operating activities as defined by GAAP, are useful supplemental performance measures that our management uses to evaluate our consolidated operating performance. However, these supplemental, non-GAAP measures should not be considered as an alternative to net income (loss) or to cash flows from operating activities as an indication of our performance and are not intended to be used as a liquidity measure indicative of cash flow available to fund our cash needs, including our ability to make distributions to our stockholders. No single measure can provide users of financial information with sufficient information and only our disclosures read as a whole can be relied upon to adequately portray our financial position, liquidity, and results of operations. In addition, other REITs may define FFO and similar measures differently and choose to treat acquisition and strategic transaction costs and potentially other accounting line items in a manner different from us due to specific differences in investment and operating strategy or for other reasons.

FFO. As defined by the National Association of Real Estate Investment Trusts (“NAREIT”), FFO is a non-GAAP measure that excludes certain items such as real estate-related depreciation and amortization and gains or losses on sales of assets. We believe FFO is a meaningful supplemental measure of our operating performance that is useful to investors because depreciation and amortization in accordance with GAAP implicitly assumes that the value of real estate assets diminishes predictably over time. In addition, FFO adjusts for non-recurring gains or losses on the acquisition of certain joint venture properties. We use FFO as an indication of our consolidated operating performance and as a guide to making decisions about future investments.

| | | | |

Fourth Quarter 2014 Supplemental Reporting Package | |

| | Page 14 |

Company-defined FFO. Similar to FFO, Company-defined FFO is a non-GAAP measure that excludes real estate-related depreciation and amortization and gains or losses on sales of assets, and also excludes non-recurring acquisition and strategic transaction costs (including acquisition fees paid to the Advisor), each of which are characterized as expenses in determining net loss under GAAP. Strategic transaction costs, which are costs incurred in connection with our exploration of potential strategic alternatives, represent non-recurring costs that make our operating results on an on-going basis less comparable and, as such, are excluded from Company-defined FFO. Acquisition and strategic transaction costs are paid in cash out of operational cash flow, additional debt, net proceeds from the sale of properties, or ancillary cash flows, and, as a result, such costs negatively impact our operating performance and cash flows from operating activities during the period they are incurred. As such, Company-defined FFO may not be a complete indicator of our operating performance, especially during periods in which properties are being acquired or strategic transaction costs are being incurred, and may not be a useful measure of the long-term operating performance of our properties if we do not continue to operate our business plan as disclosed.

Management does not include historical acquisition costs in its evaluation of future operating performance, as such costs are one-time costs related to the acquisition. In addition, management does not include strategic transaction costs in its evaluation of future operating performance as they represent one-time costs. We use Company-defined FFO to, among other things: (i) evaluate and compare the potential performance of the portfolio after the acquisition phase is complete, and (ii) evaluate potential performance to determine liquidity event strategies. We believe Company-defined FFO facilitates a comparison to other REITs that are not engaged in significant acquisition activity and have similar operating characteristics as us. We believe investors are best served if the information that is made available to them allows them to align their analyses and evaluation with the same performance metrics used by management in planning and executing our business strategy. We believe that these performance metrics will assist investors in evaluating the potential performance of the portfolio. However, these supplemental, non-GAAP measures are not necessarily indicative of future performance and should not be considered as an alternative to net income (loss) or to cash flows from operating activities and are not intended to be used as a liquidity measure indicative of cash flow available to fund our cash needs. Neither the SEC, NAREIT, nor any regulatory body has passed judgment on the acceptability of the adjustments used to calculate Company-defined FFO. In the future, the SEC, NAREIT, or a regulatory body may decide to standardize the allowable adjustments across the non-traded REIT industry at which point we may adjust our calculation and characterization of Company-defined FFO.

GAAP.Generally accepted accounting principles used in the United States.

Net Operating Income (“NOI”) and Cash NOI.We define (i) NOI as GAAP rental revenues less GAAP rental expenses and (ii) cash NOI as NOI (as previously defined), excluding non-cash amounts recorded for straight-line rents and the amortization of above and below market leases. We consider NOI and cash NOI to be appropriate supplemental performance measures. We believe NOI and cash NOI provide useful information to our investors regarding our financial condition and results of operations because NOI and cash NOI reflect the operating performance of our properties and exclude certain items that are not considered to be controllable in connection with the management of the properties, such as real estate-related depreciation and amortization, acquisition-related expenses, general and administrative expenses, and interest expense. However, NOI and cash NOI should not be viewed as alternative measures of our financial performance since NOI and cash NOI excludes such expenses, which could materially impact our results of operations. Further, our NOI and cash NOI may not be comparable to that of other real estate companies as they may use different methodologies for calculating NOI and cash NOI. Therefore, we believe net income (loss), as defined by GAAP, to be the most appropriate GAAP measure to evaluate our overall performance. Refer to the reconciliation below of our GAAP net income (loss) to NOI and cash NOI.

| | | | | | | | | | | | | | | | |

| | | For the Quarter | | | For the Year | |

| | | Ended December 31, | | | Ended December 31, | |

($ in thousands) | | 2014 | | | 2013 | | | 2014 | | | 2013 | |

GAAP net (loss) income | | $ | (3,492) | | | $ | (4,158) | | | $ | 8,939 | | | $ | (15,140) | |

Real estate-related depreciation and amortization | | | 35,066 | | | | 36,430 | | | | 141,794 | | | | 121,339 | |

General and administrative expenses | | | 1,406 | | | | 1,768 | | | | 6,557 | | | | 6,882 | |

Asset management fees | | | 7,519 | | | | 7,232 | | | | 29,548 | | | | 23,063 | |

Acquisition and strategic transaction costs | | | 795 | | | | 1,113 | | | | 5,046 | | | | 24,389 | |

Other (income) expenses | | | 16,276 | | | | 15,433 | | | | 38,473 | | | | 25,298 | |

| | | | | | | | | | | | | | | | |

NOI | | $ | 57,570 | | | $ | 57,818 | | | $ | 230,357 | | | $ | 185,831 | |

| | | | | | | | | | | | | | | | |

Straight-line rents | | | (3,290) | | | | (6,327) | | | | (15,537) | | | | (17,634) | |

Amortization of above market leases, net | | | 465 | | | | 781 | | | | 2,997 | | | | 3,526 | |

| | | | | | | | | | | | | | | | |

Cash NOI | | $ | 54,745 | | | $ | 52,272 | | | $ | 217,817 | | | $ | 171,723 | |

| | | | | | | | | | | | | | | | |

| | | | |

Fourth Quarter 2014 Supplemental Reporting Package | |

| | Page 15 |

Occupied Rate / Leased Rate.The occupied rate reflects the square footage with a paying customer in place. The leased rate includes the occupied square footage and additional square footage with leases in place that have not yet commenced.

Operating Portfolio.The operating portfolio includes stabilized properties.

Same Store Operating Properties.The same store portfolio includes operating properties owned for the entirety of both the current year period and prior year period for which the operations have been stabilized. Properties that do not meet the same store criteria are included in “other properties” in “Selected Financial Data” above. The same store operating portfolio for the three months ended December 31, 2014 and 2013 included 270 buildings owned as of October 1, 2013. The same store operating portfolio for the year ended December 31, 2014 and 2013 included 171 buildings owned as of January 1, 2013.

| | | | |

Fourth Quarter 2014 Supplemental Reporting Package | |

| | Page 16 |