UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Industrial Income Trust Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11:

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| x | Fee paid previously with preliminary materials: $256,805 | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

INDUSTRIAL INCOME TRUST INC.

518 SEVENTEENTH STREET, 17TH FLOOR

DENVER, COLORADO 80202

SEPTEMBER 4, 2015

YOUR VOTE IS IMPORTANT

Dear Fellow Stockholders:

On behalf of the board of directors, I cordially invite you to attend the special meeting of stockholders of Industrial Income Trust Inc., a Maryland corporation (the “Company”), to be held at the Grand Hyatt Denver, 1750 Welton Street, Denver, CO 80202, on October 21, 2015 at 10:00 am Mountain Daylight Time. At the special meeting, we will ask common stockholders of the Company to approve the merger of the Company with and into Western Logistics II LLC (“Merger Sub”), an entity indirectly controlled by Global Logistic Properties Limited, pursuant to the Agreement and Plan of Merger, dated as of July 28, 2015, among the Company, Western Logistics LLC (“Parent”), and Merger Sub (the “Merger Agreement”), and the other transactions contemplated by the Merger Agreement. In addition, we will ask common stockholders to approve an amendment to our Second Articles of Amendment and Restatement, which we refer to as our “Charter,” to facilitate the distribution to our common stockholders of units of beneficial interest in a liquidating trust that will be established to own 11 properties that are under development or in the lease-up stage, which are not being acquired by Parent and Merger Sub in the merger (the “Excluded Properties”), sell them over time and distribute the net proceeds of such sales to our common stockholders.

If the merger is completed, all holders of our common stock (other than any wholly owned subsidiary of the Company) will be entitled to receive $10.30 per share in cash of merger consideration, without interest and less applicable withholding taxes, as more fully described in the proxy statement.

As a condition to the completion of the merger under the Merger Agreement, all holders of our common stock will be entitled to receive a distribution of one liquidating trust unit for each share of our common stock held immediately prior to the merger. Under the terms of the Merger Agreement, we also will be permitted to make a cash distribution to holders of our common stock of net proceeds from a loan to be secured by the Excluded Properties and other available cash of the liquidating company immediately prior to completion of the merger, if we are able to obtain such a loan. We currently expect to value the liquidating trust units for tax purposes at $0.82 per unit, including the amount of any net cash proceeds distributed to stockholders as described above. There can be no assurance that we will be able to obtain a loan secured by the Excluded Properties on terms consistent with the commitment letter we have entered into for this loan, and the amount of net proceeds from the sale of Excluded Properties available to be distributed to trust beneficiaries is subject to significant uncertainties, many of which are beyond our control, and that could cause actual results to differ materially from our expectations. These uncertainties include the risk that changes in the real estate markets or other factors may cause the liquidating trust to sell properties for less than expected.You may receive less than expected or nothing from the liquidating trust, and you should consider this risk in evaluating the merger.

After careful consideration, our board of directors has unanimously approved the merger, the Merger Agreement and the other transactions contemplated by the Merger Agreement, and has declared the merger and the other transactions contemplated by the Merger Agreement advisable, fair to and in the best interests of the Company and our stockholders.ACCORDINGLY, OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE APPROVAL OF THE MERGER AND THE OTHER TRANSACTIONS CONTEMPLATED BY THE MERGER AGREEMENT, “FOR” THE AMENDMENT OF OUR CHARTER AND “FOR” THE APPROVAL OF ANY ADJOURNMENTS OF THE SPECIAL MEETING FOR THE PURPOSE OF SOLICITING ADDITIONAL PROXIES IF THERE ARE NOTSUFFICIENT VOTES AT THE SPECIAL MEETING TO APPROVE THE MERGER AND THEOTHER TRANSACTIONS CONTEMPLATED BY THE MERGER AGREEMENT AND THE CHARTER AMENDMENT.

The approval of the merger and the other transactions contemplated by the Merger Agreement and the approval of the amendment to our Charter requires the affirmative vote of the holders of at least a majority of the shares of our outstanding stock entitled to vote on such matter. The proxy statement accompanying this letter provides you with more specific information concerning the special meeting, the merger, the Merger Agreement and the other transactions contemplated by the Merger Agreement.

IT IS IMPORTANT THAT YOU BE REPRESENTED AT THE SPECIAL MEETING REGARDLESS OF THE NUMBER OF SHARES YOU OWN OR WHETHER YOU ARE ABLE TO ATTEND THE SPECIAL MEETING IN PERSON. Unlike most public companies, no large brokerage houses or affiliated groups of stockholders own substantial blocks of our shares. As a result, in order to achieve a quorum and to avoid delays and additional costs, we need substantial stockholder voting participation by proxy or in person at the special meeting. I urge you to vote as soon as possible. You may vote by authorizing a proxy over the Internet, by telephone or by completing, signing, and returning your proxy card. Thank you in advance for your participation.

Sincerely,

Evan H. Zucker

Chairman of the Board of Directors

For the Board of Directors of Industrial Income Trust Inc.

This proxy statement is dated September 4, 2015 and is first being mailed to our stockholders on or about September 10, 2015.

INDUSTRIAL INCOME TRUST INC.

518 SEVENTEENTH STREET, 17TH FLOOR

DENVER, COLORADO 80202

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON OCTOBER 21, 2015

Dear Stockholder:

You are cordially invited to attend a special meeting of the stockholders of Industrial Income Trust Inc. to be held at the Grand Hyatt Denver, 1750 Welton Street, Denver, CO 80202, on October 21, 2015 at 10:00 am Mountain Daylight Time. The matters to be considered by stockholders at the special meeting, which are described in detail in the accompanying materials, are:

| 1. | to consider and vote on a proposal to approve the merger of Industrial Income Trust Inc. with and into Western Logistics II LLC or its assignee, pursuant to the Agreement and Plan of Merger, dated as of July 28, 2015, by and among Industrial Income Trust Inc., Western Logistics LLC and Western Logistics II LLC, and the other transactions contemplated by the Merger Agreement, all as more fully described in the enclosed proxy statement; |

| 2. | to consider and vote on a proposal to approve an amendment to our Second Articles of Amendment and Restatement, which we refer to as our “Charter,” to permit distributions in kind of beneficial interests in a liquidating trust that is established to own and liquidate the remaining assets of Industrial Income Trust Inc. in connection with a merger of Industrial Income Trust Inc. approved by our stockholders in accordance with our Charter; and |

| 3. | to consider and vote on a proposal to approve any adjournments of the special meeting for the purpose of soliciting additional proxies if there are not sufficient votes at the special meeting to approve the merger and the other transactions contemplated by the Merger Agreement and the amendment to our Charter. |

OUR BOARD OF DIRECTORS HAS UNANIMOUSLY APPROVED THE MERGER, THE MERGER AGREEMENT AND THE OTHER TRANSACTIONS CONTEMPLATED BY THE MERGER AGREEMENT, AND HAS DECLARED THE MERGER AND THE OTHER TRANSACTIONS CONTEMPLATED BY THE MERGER AGREEMENT ADVISABLE, FAIR TO AND IN THE BEST INTERESTS OF INDUSTRIAL INCOME TRUST INC. AND OUR STOCKHOLDERS. OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE APPROVAL OF THE MERGER AND THE OTHER TRANSACTIONS CONTEMPLATED BY THE MERGER AGREEMENT, “FOR” THE APPROVAL OF THE CHARTER AMENDMENT AND “FOR” THE APPROVAL OF ANY ADJOURNMENTS OF THE SPECIAL MEETING FOR THE PURPOSE OF SOLICITING ADDITIONAL PROXIES IF THERE ARE NOT SUFFICIENT VOTES AT THE SPECIAL MEETING TO APPROVE THE MERGER AND THE OTHER TRANSACTIONS CONTEMPLATED BY THE MERGER AGREEMENT AND THE CHARTER AMENDMENT.

Holders of record of our common stock at the close of business on August 19, 2015 will be entitled to notice of, and to vote at, the special meeting or any adjournments or postponements thereof. It is important that your shares be represented at the special meeting regardless of the size of your holdings.

The affirmative vote of the holders of at least a majority of the shares of our outstanding stock entitled to vote on the proposal is required to approve the merger and the other transactions contemplated by the Merger Agreement and to approve the amendment to our Charter, and approval of both of these proposals is required in

order for us to complete the merger.Our common stockholders must approve the merger and thetransactions contemplated by the Merger Agreement and the Charter Amendment for the merger tooccur. Accordingly, regardless of the number of shares that you own, your vote is important. EVEN IF YOU PLAN TO ATTEND THE SPECIAL MEETING IN PERSON, WE REQUEST THAT YOUAUTHORIZE YOUR PROXY TO VOTE YOUR SHARES BY EITHER MARKING, SIGNING, DATING AND PROMPTLY RETURNING THE PROXY CARD OR SUBMITTING YOUR PROXY OR VOTING INSTRUCTIONS BY TELEPHONE OR INTERNET. If you fail to vote in person or by proxy, the effect will be that the shares of common stock that you own will not be counted for purposes of determining whether a quorum is present and will have the same effect as a vote “AGAINST” the proposal to approve the merger and the other transactions contemplated by the Merger Agreement and “AGAINST” the proposal to approve the amendment to our Charter.

The affirmative vote of a majority of the total number of votes cast at a meeting at which a quorum is present is required to approve the adjournment of the special meeting. For purposes of the vote on the proposal to approve the adjournment of the special meeting, abstentions and other shares not voted will not be counted as votes cast and will have no effect on the result of the vote, although abstentions will be considered present for the purpose of determining the presence of a quorum.

Any proxy may be revoked at any time prior to its exercise by delivery of a properly executed, later-dated proxy card, by submitting your proxy or voting instructions by telephone or Internet at a later date than your previously authorized proxy, by submitting a written revocation of your proxy to our secretary, or by voting in person at the special meeting.

We encourage you to read the enclosed proxy statement and accompanying annexes carefully and to submit a proxy or voting instructions so that your shares of our common stock will be represented and voted even if you do not attend the special meeting. If you have any questions or need assistance in submitting a proxy or voting instructions, please call our proxy solicitor, Broadridge Financial Solutions, Inc., toll-free at 855-742-8273.

By Order of the Board of Directors,

Joshua J. Widoff

Executive Vice President,

General Counsel and Secretary

September 4, 2015

TABLE OF CONTENTS

| Page | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

Estimated Amounts that May Be Distributed by the Liquidating Trust | 5 | |||

| 6 | ||||

| 6 | ||||

| 6 | ||||

| 7 | ||||

Interests of Our Directors and Executive Officers in the Merger | 7 | |||

| 8 | ||||

| 8 | ||||

| 9 | ||||

| 10 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING AND THE MERGER | 13 | |||

| 20 | ||||

| 22 | ||||

| 23 | ||||

| 23 | ||||

| 23 | ||||

| 23 | ||||

| 24 | ||||

| 25 | ||||

| 26 | ||||

PROPOSAL 2—PROPOSAL TO APPROVE CERTAIN AMENDMENT TO OUR CHARTER | 27 | |||

PROPOSAL 3—PROPOSAL TO APPROVE ADJOURNMENTS OF THE SPECIAL MEETING | 29 | |||

| 30 | ||||

| 30 | ||||

| 30 | ||||

| 30 | ||||

Estimated Amounts that May Be Distributed by the Liquidating Trust | 30 | |||

| 31 | ||||

| 47 | ||||

| 50 | ||||

Certain Unaudited Prospective Financial Information of Industrial Income | 56 | |||

| 58 | ||||

Interests of Our Directors and Executive Officers in the Merger | 58 | |||

| 63 | ||||

| 63 | ||||

| 63 | ||||

| 64 | ||||

i

| Page | ||||

| 72 | ||||

| 73 | ||||

| 81 | ||||

| 81 | ||||

| 82 | ||||

| 82 | ||||

| 82 | ||||

| 83 | ||||

| 85 | ||||

| 86 | ||||

| 88 | ||||

| 103 | ||||

| 105 | ||||

| 109 | ||||

| 110 | ||||

| 110 | ||||

| 110 | ||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 111 | |||

| 112 | ||||

ADVANCE NOTICE FOR STOCKHOLDER NOMINATIONS AND PROPOSALS FOR THE 2016 ANNUAL MEETING | 112 | |||

| 112 | ||||

| 112 | ||||

| A-1 | ||||

| B-1 | ||||

Annex C—Opinion of Merrill Lynch, Pierce, Fenner & Smith Incorporated | C-1 | |||

| D-1 | ||||

ii

This summary highlights only selected information from this proxy statement relating to the merger of Industrial Income Trust Inc., which we refer to as “we,” “us,” “our,” the “Company” or “Industrial Income,” with and into Western Logistics II LLC or its assignee, which we refer to as the “merger” and the transfer of 11 of the Company’s properties currently under development or in the lease-up stage into a liquidating company, the membership interests in which will be contributed to a liquidating trust for the benefit of our current stockholders. This summary does not contain all of the information about the merger and the related transactions contemplated by the Merger Agreement including the transfer of properties to the liquidating company that is important to you. As a result, to understand more fully the merger and the related transactions including the transfer of 11 properties to the liquidating company and the transfer of membership interests in the liquidating company to a liquidating trust, and for a more complete description of the legal terms of these transactions, you should read carefully this proxy statement in its entirety, including the annexes and the other documents to which we have referred you, including the Merger Agreement, attached asAnnex A, and the form of liquidating trust agreement, attached asAnnex B. Each item in this summary includes a page reference directing you to a more complete description of that item in this proxy statement.

The Parties to the Merger (page 22)

Industrial Income Trust Inc.

518 Seventeenth Street, 17th Floor

Denver, Colorado 80202

(303) 228-2200

Industrial Income is a Maryland corporation formed in May 2009 to make investments in income-producing real estate assets consisting primarily of high-quality distribution warehouses and other industrial properties that are leased to creditworthy corporate customers. As of June 30, 2015, Industrial Income’s consolidated real estate portfolio, which is indirectly owned through Industrial Income Operating Partnership LP, which we refer to as the “Operating Partnership,” consisted of 285 industrial buildings totaling approximately 58.4 million square feet located in 19 markets throughout the United States. In addition, as of June 30, 2015, we had six buildings under construction totaling approximately 0.8 million square feet and one building in pre-construction phase totaling an additional 0.2 million square feet. We are sponsored by Industrial Income Advisors Group LLC, which we refer to as our “Sponsor,” and our advisor is IIT Advisor LLC, which we refer to as our “Advisor”. Our Sponsor is an affiliate of our Advisor. We rely on our Advisor to manage our day-to-day activities and to implement our investment strategy. We, our Advisor, and the Operating Partnership are parties to an eighth amended and restated advisory agreement, dated as of July 27, 2015, which we refer to herein as the “Advisory Agreement.” We refer to the advisory agreement dated February 21, 2015 that was in effect prior to July 27, 2015 among Industrial Income Advisors LLC (the “Prior Advisor”), the Operating Partnership and us as the “Prior Advisory Agreement.” For additional information about us and our business, see “Additional Information” beginning on page 112.

1

Western Logistics LLC

c/o Global Logistic Properties Limited

501 Orchard Road #08-01 Wheelock Place

Singapore 238880

c/o GLP US Management LLC

Two North Riverside Plaza, Suite 2350

Chicago, IL 60606

(312) 940-5300

Western Logistics LLC, which we refer to as “Parent,” is a Delaware limited liability company formed by Global Logistic Properties Limited, which we refer to as “Global Logistic Properties” or “GLP,” in connection with the merger.

Global Logistic Properties is a leading provider of modern logistics facilities. As of June 30, 2015, GLP’s property portfolio encompassed 452 million square feet (42 million square meters) of logistics facilities across China, Japan, Brazil and the United States. Upon closing of the proposed acquisition of Industrial Income, GLP’s U.S. footprint would expand to 173 million square feet (16.1 million square meters). After this merger transaction, GLP’s global portfolio would encompass more than 500 million square feet (47 million square meters) and approximately $33 billion of assets under management worldwide. Global Logistic Properties was listed on the mainboard of the Singapore Exchange Securities Trading Limited in October 2010 and had an equity market capitalization of US$9 billion as of July 1, 2015. Global Logistic Properties’ principal executive offices are located at 501 Orchard Road #08-01 Wheelock Place, Singapore 238880.

Western Logistics II LLC

c/o Global Logistic Properties Limited

501 Orchard Road #08-01 Wheelock Place

Singapore 238880

c/o GLP US Management LLC

Two North Riverside Plaza, Suite 2350

Chicago, IL 60606

(312) 940-5300

Western Logistics II LLC, which we refer to as “Merger Sub,” is a newly formed Delaware limited liability company and wholly owned subsidiary of Parent. Merger Sub was formed by Parent in connection with the merger.

The Proposals

The special meeting will be held at the Grand Hyatt Denver, 1750 Welton Street, Denver, CO 80202, on October 21, 2015 at 10:00 am Mountain Daylight Time. At the special meeting, you will be asked to approve the merger and the other transactions contemplated by the Merger Agreement, to approve an amendment to our Charter to facilitate the distribution to our common stockholders of units of beneficial interest in a liquidating trust that will be established to hold the Excluded Properties, sell them over time and distribute the net proceeds of such sales to our common stockholders (the “Charter Amendment”) and to approve any adjournments of the special meeting for the purpose of soliciting additional proxies if there are not sufficient votes at the special meeting to approve the merger and the other transactions contemplated by the Merger Agreement.

The persons named in the proxy card also will have discretionary authority to vote upon other business, if any, that properly comes before the special meeting and any adjournments or postponements of the special meeting.

2

Record Date, Notice and Quorum

Only holders of record of our shares of common stock as of the close of business on the record date, which was August 19, 2015, or their duly appointed proxies, are entitled to receive notice of, to attend and to vote the shares of Industrial Income common stock that they held on the record date at the special meeting or any adjournments or postponements of the special meeting. The only class of shares that can be voted at the Industrial Income special meeting is Industrial Income common stock. On the record date of August 19, 2015, 214,271,401 shares of our common stock were outstanding and entitled to vote at the special meeting or any adjournments or postponements of the special meeting.

You will have one vote for each share of our common stock that you owned as of the record date.

The holders of a majority of the shares of our common stock that were outstanding as of the close of business on the record date, present in person or represented by proxy, will constitute a quorum for purposes of the special meeting. A quorum is necessary to transact business at the special meeting. If a quorum is not present, the special meeting may be adjourned by the chairman of the meeting until a quorum has been obtained.

Required Vote for the Proposals

The affirmative vote of the holders of at least a majority of the shares of our outstanding stock entitled to vote on such proposal is required to approve the merger and the other transactions contemplated by the Merger Agreement and to approve the Charter Amendment.Because the required vote to approve the merger and the other transactions contemplated by the Merger Agreement and to approve the Charter Amendment is based on the number of shares of common stock outstanding and entitled to vote rather than on the number of votes cast by holders of shares of common stock present in person or represented by proxy at the special meeting and entitled to vote, failure to vote your shares and abstentions will have the same effect as voting against approval of the merger and the other transactions contemplated by the Merger Agreement and the Charter Amendment.

Pursuant to our bylaws, the affirmative vote of a majority of the total number of votes cast at a meeting at which a quorum is present is required to approve the adjournment of the special meeting. For purposes of the vote on the proposal to approve the adjournment of the special meeting, abstentions and other shares not voted will not be counted as votes cast and will have no effect on the result of the vote, although abstentions will be considered present for the purpose of determining the presence of a quorum.

Voting by Our Directors and Executive Officers

As of the record date, our directors owned, either directly or indirectly, an aggregate of 54,229 shares of our common stock and restricted stock (including unvested restricted stock), entitling them to exercise, in the aggregate, less than one percent of the voting power of our shares of common stock entitled to vote at the special meeting. Our directors have informed us that they intend to vote the shares of common stock that they beneficially own “FOR” the approval of the merger and the other transactions contemplated by the Merger Agreement, “FOR” the approval of the Charter Amendment and “FOR” the approval of any adjournments of the special meeting for the purpose of soliciting additional proxies. Our executive officers do not have voting power over any shares of common stock or restricted stock as of the record date.

Proxies and Revocation

Any of our common stockholders of record entitled to vote at the special meeting may vote by signing, dating and returning the enclosed proxy card, by Internet, as provided in the proxy card and this proxy statement,

3

by touch-tone telephone at the toll-free number, as provided in the proxy card, or by telephone at855-742-8273, or by appearing and voting at the special meeting in person. If your shares of our common stock are held on your behalf by a broker, dealer, commercial bank, trust company, custodian or other nominee, you will receive instructions from them that you must follow to have your shares voted at the special meeting.

You may revoke your proxy at any time prior to its exercise by delivering a written notice of revocation, prior to the special meeting, to our Executive Vice President, General Counsel and Secretary, Mr. Joshua J. Widoff, at 518 Seventeenth Street, 17th Floor, Denver, Colorado 80202, properly signing, dating and mailing a new proxy card to our Secretary, dialing the toll-free number provided in the proxy card and in this proxy statement to authorize your proxy again, logging on to the Internet site provided in the proxy card and in this proxy statement to authorize your proxy again, or by attending the special meeting to vote your shares in person.

Attendance at the special meeting will not by itself revoke a previously granted proxy. Also, if you elect to vote in person at the special meeting and your shares are held by a broker, dealer, commercial bank, trust company, custodian or other nominee, you must bring to the special meeting a legal proxy from the broker, dealer, commercial bank, trust company, custodian or other nominee authorizing you to vote your shares of common stock.

The Merger and the Related Transactions (page 30)

The merger will become effective upon the date and at the time set forth in the articles of merger filed with the Maryland State Department of Assessments and Taxation and the certificate of merger filed with the Delaware Secretary of State, or such later time as may be agreed by the parties. We refer to this time as the “merger effective time.” It currently is anticipated that the merger will be completed by October 30, 2015, and no later than November 16, 2015.

Pursuant to the Merger Agreement, on the closing date of the merger, the following transactions will occur:

| • | prior to the merger effective time, each special partnership unit of the Operating Partnership, which we refer to as “special partnership units,” will automatically be redeemed by the Operating Partnership for the receipt by the holder of such special partnership units, which holder is our Sponsor, of partnership units of the Operating Partnership, which we refer to as “OP Units,” in accordance with the Operating Partnership’s partnership agreement, which we refer to as the “special partnership unit redemption.” We estimate that the aggregate number of OP Units that will be issued in exchange for the special partnership units will be 294,110, assuming that the merger closes on October 30, 2015; |

| • | immediately after the special partnership unit redemption described above, each OP Unit received as part of the special partnership unit redemption will automatically be converted into one share of common stock of Industrial Income, which we refer to as the “OP Unit conversion.” |

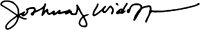

| • | immediately prior to the merger effective time, we will transfer 11 of our properties that are under development or in the lease-up stage, which we refer to as the “Excluded Properties,” into a new holding company, which we refer to as the “liquidating company,” in which we and our Sponsor will be the initial members, and we will then transfer our interests in the liquidating company to a liquidating trust, the units of beneficial interest in which will be distributed to our current stockholders on a one unit for one share basis. We sometimes refer to the liquidating company and the liquidating trust collectively as the “liquidating trust;” |

| • | immediately prior to the merger effective time, the contribution and the other transactions described below under “The Merger and the Related Transactions—Interests of Our Directors and Executive Officers in the Merger—Contribution Transactions and OP Unit Purchase Agreement” will be consummated, after which time the owners of our Advisor will receive an aggregate of approximately 8.8 million OP Units from the Operating Partnership in exchange for the contribution of a new |

4

Industrial Income advisor entity (the “Replacement Advisor”), which will be a subsidiary of our Advisor, to the Operating Partnership (the “OP Unit Purchase”); and |

| • | immediately after the foregoing transactions, we will merge with and into Merger Sub, with Merger Sub continuing as the “surviving entity.” |

Immediately after the consummation of the merger and the OP Unit Purchase, Parent will own, directly or indirectly, all of the assets previously owned by the Company, the Operating Partnership and all other subsidiaries of Industrial Income (other than the Excluded Properties, which will have been transferred to the liquidating trust as described above).

Merger Consideration (page 30)

Each share of our common stock issued and outstanding immediately prior to the merger effective time (other than shares held by us, our subsidiaries or Merger Sub) will be converted into, and canceled in exchange for, the right to receive an amount in cash of $10.30 per share, without interest and less applicable withholding taxes, which we refer to as the “merger consideration.”

Estimated Amounts that May Be Distributed by the Liquidating Trust (page 30)

On the merger closing date, but before the closing of the merger, we currently expect that we will make a distribution to our stockholders of net proceeds from a loan to be secured by the Excluded Properties and other available cash of the liquidating company, which we currently expect will result in an estimated additional $0.26 per share of cash being distributed to our stockholders if such loan transaction occurs. In addition, immediately prior to the closing, we also will distribute to each of our stockholders units of beneficial interest in the liquidating trust, which we currently expect to assign a value for tax purposes of approximately $0.56 per unit of the liquidating trust, although the ultimate value of such interest will depend on the net proceeds realized from future sales of the Excluded Properties. We do not expect the liquidating trust to make distributions to unitholders, other than the distribution of net loan proceeds and other available cash on the merger closing date and distributions of net proceeds from the sales, financings and refinancings of the Excluded Properties.

We currently estimate that the total value of the consideration that may be received by stockholders as a result of all of the transactions described under “—Merger Consideration” and “—Estimated Amounts that May Be Distributed by the Liquidating Trust” to be approximately $11.12 per share (inclusive of expected future distributions in respect of units of the liquidating trust that may be received by our stockholders). If the liquidating trust is unable to make the expected cash distribution of $0.26 per share on the merger closing date, we would expect to assign a value for tax purposes to each unit in the liquidating trust of approximately $0.82 per unit, which would still result in a total value that may be received by stockholders of $11.12 per share, inclusive of the merger consideration.

There can be no assurance that we will be able to obtain the loan on the Excluded Properties consistent with the commitment letter we have entered into and make the planned distributions, and the amount of the distributions at closing may be less or more than $0.26 per share. The actual amount of net proceeds from the sale of Excluded Properties and the amount to be distributed to trust beneficiaries are subject to various and significant uncertainties, many of which are beyond our control, and that could cause actual results to differ materially from our expectations. These uncertainties include the risk that changes in the real estate markets or other factors may cause the liquidating trust to sell properties for less than expected.

You may receive less than expected or nothing from the liquidating trust, and you should consider this risk in evaluating the merger.

5

The Liquidating Trust (page 73)

Immediately prior to the merger effective time, we will transfer 11 of our properties that are under development or in the lease-up stage, which we refer to as the “Excluded Properties,” to a liquidating company that we will form. We then will contribute our interests in the liquidating company to a trust for the benefit of our stockholders. Our stockholders will receive one non-transferable unit representing a proportionate beneficial interest in the liquidating trust for each share of common stock that they hold at the time of the merger. In addition, an affiliate of our Sponsor will be a member of the liquidating company and will hold special units comparable to the special partnership units it currently holds in our Operating Partnership which will entitle it to a 15% distribution of the aggregate net sales, financing or refinancing proceeds and certain other amounts received with respect to the Excluded Properties by the liquidating trust, because our common stockholders will have received the full return of their capital contributions and a 6.5% cumulative, non-compounded pre-tax return, as provided in the limited partnership agreement of our Operating Partnership, as a result of prior dividend distributions and the amounts to be received in the merger. The trustees of the liquidating trust will oversee the continuing development and leasing of the Excluded Properties, will have the right to approve the disposition of the assets transferred to the liquidating trust, and will approve the distribution of proceeds from the sale of those assets to the holders of common and special units in the liquidating trust, after payment of expenses and liabilities (including fees payable to the advisor to the liquidating trust (the “Trust Advisor”)) and the making of reasonable provision for claims and contingent liabilities. It is expected that the compensation payable to the Trust Advisor under a management services agreement will be comparable to certain of the fees that would have been payable to our Prior Advisor under the Prior Advisory Agreement, as discussed in more detail under “The Merger and the Related Transactions—Interests of Our Directors and Executive Officers in the Merger—Liquidating Trust” on page 60.

Although we believe that the sales of these assets ultimately will lead to additional distributions to you, we cannot assure you that the liquidating trust will be able to sell or otherwise dispose of its assets for value or that any sales proceeds will be sufficient to discharge its liabilities. The liquidating trust will be governed by a trust agreement, which will be in the form attached to this proxy statement asAnnex B, with such changes as will not be adverse in any material respect to the beneficiaries thereunder.

Recommendation of Our Board of Directors (page 47)

Our board of directors has unanimously approved the merger, the Merger Agreement and the other transactions contemplated by the Merger Agreement, and has declared the merger and the other transactions contemplated by the Merger Agreement advisable, fair to and in the best interests of Industrial Income Trust Inc. and our stockholders. Our board of directors recommends that you vote “FOR” the approval of the merger and the other transactions contemplated by the Merger Agreement, “FOR” the approval of the Charter Amendment and “FOR” the approval of any adjournments of the special meeting for the purpose of soliciting additional proxies.

Opinion of Our Financial Advisor (page 50)

In connection with the merger, Industrial Income’s financial advisor, Merrill Lynch, Pierce, Fenner & Smith Incorporated, which we refer to as “BofA Merrill Lynch,” delivered a written opinion, dated July 28, 2015, to the Industrial Income board of directors as to the fairness, from a financial point of view and as of such date, to holders of Industrial Income common stock (other than IIA, as defined below, and its affiliates) of the $10.30 per share merger consideration to be received by such holders pursuant to the Merger Agreement. For purposes of BofA Merrill Lynch’s opinion, “IIA” was defined, collectively, as IIT Advisor LLC, Industrial Income Advisors LLC, Industrial Income Advisors Group LLC, and their respective affiliates. The full text of BofA Merrill Lynch’s written opinion, dated July 28, 2015, is attached asAnnex C to this proxy statement and sets forth,

6

among other things, the assumptions made, procedures followed, factors considered and limitations on the review undertaken by BofA Merrill Lynch in rendering its opinion.BofA Merrill Lynch delivered its opinion to the Industrial Income board of directors for the benefit and use of the Industrial Income board of directors (in its capacity as such) in connection with and for purposes of its evaluation of the per share merger consideration from a financial point of view. BofA Merrill Lynch’s opinion did not address any other aspect of the merger or any related transaction and no opinion or view was expressed as to the relative merits of the merger or any related transaction in comparison to other strategies or transactions that might be available to Industrial Income or in which Industrial Income might engage or as to the underlying business decision of Industrial Income to proceed with or effect the merger or any related transaction. BofA Merrill Lynch also expressed no opinion or recommendation as to how any stockholder should vote or act in connection with the merger, any related transaction or any other matter. For more information regarding our financial advisor, see “The Merger and the Related Transactions—Opinion of Our Financial Advisor.”

In order to close the merger, Parent will need funds to (i) pay our stockholders, our Sponsor as holder of our special partnership interests, and the owners of our Advisor the amounts due to them, (ii) pay off our existing consolidated indebtedness as contemplated by the Merger Agreement, and (iii) pay all fees and expenses related to the merger and the financing of the merger.

Parent anticipates that the funds needed to close the merger will be funded through a combination of (a) equity financing in an amount up to $1.9 billion to be provided by Parent’s sponsor, (b) debt financing in an amount up to approximately $2.9 billion to be provided by Column Financial, Inc. and Morgan Stanley Bank, N.A. pursuant to the debt commitment letter described herein, and (c) our cash on hand.

The Merger Agreement does not contain a financing condition to the closing of the merger. Parent may, however, elect to postpone the closing of the merger by providing written notice, no later than one business day prior to the date the closing would otherwise be required to occur, to a date no later than October 31, 2015, in order to finalize its debt financing. We have agreed to provide, and to cause our subsidiaries and use our reasonable best efforts to cause our and our subsidiaries’ representatives to provide, all cooperation reasonably requested by Parent in connection with Parent’s efforts to arrange any financing. For more information, see “The Merger Agreement—Covenants and Agreements—Financing Cooperation.”

Interests of Our Directors and Executive Officers in the Merger (page 58)

Our executive officers and members of our board of directors may be deemed to have interests in the merger that are in addition to or different from yours, including the following:

| • | immediately prior to the merger effective time, 9,510 outstanding and unvested shares of restricted stock held by our independent directors as of the record date will automatically become fully vested and free of any forfeiture restrictions, entitled to receive the merger consideration; |

| • | our directors and officers are entitled to continued indemnification arrangements and directors’ and officers’ insurance coverage for a period of six years following the merger effective time; |

| • | the owners of our Advisor will receive approximately 8.8 million OP Units in exchange for the contribution of the Replacement Advisor to our Operating Partnership immediately prior to the merger effective time, and such OP Units will be purchased by Merger Sub concurrently with closing at the merger effective time for an aggregate price of approximately $91.0 million, in each case as described below under “The Merger Agreement and Related Transactions—Interests of Our Directors and Executive Officers in the Merger—Contribution Transactions and OP Unit Purchase Agreement.” The |

7

consideration received by the owners of our Advisor in the contribution transaction is the same amount our Advisor would have received as a disposition fee under the Prior Advisory Agreement, with no net impact on our stockholders; |

| • | at closing, our Sponsor will receive an aggregate of approximately $3.0 million in total merger consideration in exchange for the special units in our Operating Partnership and an affiliate of our Sponsor will receive a distribution, immediately prior to closing, of approximately $9.8 million from the net proceeds of the loan that we expect to obtain that will be secured by the Excluded Properties and other available cash of the liquidating company, as well as future distributions of 15% of the net sales, financing or refinancing proceeds and certain other amounts received with respect to the Excluded Properties by the liquidating trust after the merger effective time, which 15% currently is expected to total approximately $21.1 million; |

| • | the liquidating trust will enter into a management services agreement for the duration of the liquidating trust with the Trust Advisor, an affiliate of our Advisor, to provide asset, development, and operating management services for the Excluded Properties, to assist in the sale of such properties, and to provide administrative services to the liquidating trust and its subsidiaries following consummation of the transactions contemplated by the Merger Agreement. It is expected that the compensation payable to the Trust Advisor under a management services agreement will be comparable to certain of the fees that would have been payable to our Prior Advisor under the Prior Advisory Agreement; |

| • | an affiliate of our Advisor will enter into a contract for transition services to provide certain accounting, asset management, lease management, risk management, treasury and other services to Parent and the surviving entity in the merger on a transition basis, which we refer to as the “transition services agreement.” |

Our board of directors is aware of these interests and considered them among other matters in approving the Merger Agreement, the merger and the other transactions contemplated by the Merger Agreement. (See “The Merger and the Related Transactions—Interests of Our Directors and Executive Officers in the Merger,” beginning on page 58.)

No Solicitation of Transactions (page 94)

The Merger Agreement contains restrictions on our ability to solicit or engage in discussions or negotiations with a third party regarding specified transactions involving us or our subsidiaries. Notwithstanding these restrictions, under certain circumstances and subject to certain conditions, our board of directors may respond to an unsolicited written acquisition proposal or terminate the Merger Agreement and enter into an acquisition agreement with respect to a superior proposal. Upon entering into an agreement for a transaction that constitutes a superior proposal, we will be obligated to pay a termination fee to Parent as described below under “—Termination Fee and Expenses.”

Conditions to the Merger (page 103)

The completion of the merger is subject to certain conditions, including, among others: (i) receipt of the approval of the merger by the affirmative vote of the holders of at least a majority of the shares of our outstanding stock entitled to vote at the special meeting; (ii) completion of the formation of the liquidating trust and distribution of the units of the liquidating trust to our stockholders; (iii) completion of the contribution transaction relating to our Advisor; (iv) the receipt of Committee on Foreign Investment in the United States (“CFIUS”) clearance by GLP related to notices filed with CFIUS prior to the date of the Merger Agreement in connection with GLP’s syndication of interests in the completed acquisition of the logistics platform portfolio of IndCor Properties, Inc. (the “IndCor CFIUS Condition”); and (v) other customary closing conditions set forth in the Merger Agreement. While it currently is anticipated that the merger will be completed by October 30, 2015,

8

and no later than November 16, 2015, there can be no assurance that such conditions will be satisfied in a timely manner or at all, or that an effect, event, development or change will not transpire that could delay or prevent these conditions from being satisfied.

Termination of the Merger Agreement (page 105)

The Merger Agreement may be terminated and the merger may be abandoned at any time prior to the merger effective time, as follows:

| 1. | By mutual written consent of the parties; |

| 2. | By either Parent or us if: |

| • | the merger has not been consummated on or before November 16, 2015, provided that a breach of the Merger Agreement by the party terminating the Merger Agreement is not the cause for the failure of the merger to be consummated by such date; |

| • | any governmental authority of competent jurisdiction has issued an order or taken any other action permanently restraining or otherwise prohibiting the merger, and such order or other action shall have become final and non-appealable (provided that this termination right will not be available to a party if the issuance of such final, non-appealable order or taking of such other action was primarily due to the failure of such party to comply with any provision of the Merger Agreement); or |

| • | the requisite vote of our stockholders to approve the merger and the other transactions contemplated by the Merger Agreement and the Charter Amendment is not obtained after the special meeting has been duly convened, provided that the party terminating the Merger Agreement is not in breach of its obligations thereunder. |

| 3. | By Parent if: |

| • | we have breached any of our representations, warranties, covenants or agreements set forth in the Merger Agreement, and such breach results in the applicable closing condition regarding representations and warranties or covenants and agreements being incapable of being satisfied by November 16, 2015, provided that Parent is not in breach of its obligations under the Merger Agreement; or |

| • | prior to the special meeting, if we or our board of directors breach certain covenants related to the non-solicitation of alternative acquisition transactions, change the recommendation with respect to the merger or fail to reaffirm the recommendation as required under the Merger Agreement, or approve, adopt, publicly endorse or recommend entry into, or enter into a definitive agreement for, an alternative acquisition transaction. |

| 4. | By us if: |

| • | Parent has breached any of its representations, warranties, covenants or agreements set forth in the Merger Agreement, and such breach results in the applicable closing condition regarding representations and warranties or covenants and agreements being incapable of being satisfied by November 16, 2015, provided that we are not in breach of our obligations under the Merger Agreement; |

| • | prior to obtaining the approval of our stockholders for the merger, our board of directors authorizes us to enter into a definitive agreement to implement a superior proposal in accordance with the terms of the Merger Agreement and we pay the $110.0 million termination fee (described below); or |

9

| • | if we learn that GLP will not satisfy the IndCor CFIUS Condition prior to November 16, 2015 and we provide notice to Parent of our intent to terminate the Merger Agreement, and Parent does not waive the related closing condition within three business days after receiving such notice. |

Termination Fee and Expenses (page 107)

We have agreed to reimburse Parent up to $25.0 million for Parent’s reasonable transaction expenses and pay Parent a termination fee of $110.0 million, minus any amount previously reimbursed for expenses, under certain circumstances. Parent has also agreed to pay us a termination fee of $250.0 million or reimburse us for up to $7.5 million of our reasonable transaction expenses under certain circumstances.

Termination Fee Payable by Parent to Industrial Income

Parent has agreed to pay a termination fee of $250.0 million to Industrial Income if the Merger Agreement is terminated by Industrial Income upon a breach, violation or failure by Parent of its representations, warranties, covenants or agreements set forth in the Merger Agreement that is unable to be cured or that remains uncured by November 16, 2015.

Termination Fee Payable by Industrial Income to Parent

We have agreed to pay Parent a termination fee of $110.0 million if the Merger Agreement is terminated under certain circumstances described in detail under “The Merger Agreement—Termination of the Merger Agreement—Termination Fee and Expenses Payable by Industrial Income to Parent” on page 107.

Payment of Expenses to Industrial Income

Parent has agreed to pay to us all reasonable, actual and documented out-of-pockets costs and expenses incurred up to an aggregate maximum amount of $7.5 million if the Merger Agreement is terminated by us because we learn that GLP will not satisfy the Indcor CFIUS Condition prior to November 16, 2015 and we provide notice to Parent of our intent to terminate the Merger Agreement, and Parent does not waive the related closing condition within three business days of receiving such notice (subject to certain limitations).

Payment of Expenses to Parent

We have agreed to pay to Parent all reasonable, actual and documented out-of-pockets costs and expenses incurred up to an aggregate maximum amount of $25.0 million if the Merger Agreement is terminated by (i) either Parent or us because (x) the Industrial Income stockholders fail to approve the merger and the other transactions contemplated by the Merger Agreement at a duly convened meeting of stockholders or (y) the Special Meeting has not been held prior to November 16, 2015 (subject to certain limitations) or (ii) Parent, subject to limitations, because we have breached any of our representations, warranties, covenants or agreements set forth in the Merger Agreement, and such breach results in the applicable closing condition regarding representations and warranties or covenants and agreements being incapable of being satisfied or, if capable of being satisfied, not being satisfied, by November 16, 2015. In the event that the $110.0 million termination fee later becomes payable as described above, any expense reimbursement amount previously paid will be credited against the amount of the termination fee then payable by Industrial Income.

Guarantee and Remedies (page 63)

In connection with the Merger Agreement, Global Logistic Properties has agreed to absolutely, unconditionally and irrevocably guarantee to Industrial Income, as primary obligor, the full and punctual payment, observance, performance and satisfaction of certain obligations of Parent and Merger Sub, including

10

with respect to: (1) indemnification for increased taxes of Industrial Income in connection with actions taken by Industrial Income at the request of Parent prior to the merger effective time, including the creation or change of corporate form of Industrial Income’s subsidiaries and the disposition of assets or capital stock of Industrial Income’s subsidiaries, and indemnification for any losses suffered by Industrial Income in connection with the arrangement of the debt financing by Parent, including as a result of cooperation by Industrial Income in the arrangement of the debt financing; (2) the payment of the $250.0 million termination fee in accordance with the terms of the Merger Agreement; and (3) the payment up to $7.5 million expense reimbursement in accordance with the Merger Agreement, in each case, as, when and to the extent due under the Merger Agreement. The guarantee will terminate on the earlier of (a) the merger effective time and (b) 180 days following a termination in accordance with the terms of the Merger Agreement (except as to payments for which a claim has been made under the applicable guarantee).

We cannot seek specific performance to require the buyer parties to complete the merger, and our exclusive remedy for the failure of the buyer parties to complete the merger is to seek payment of the $250.0 million termination fee or up to $7.5 million expense reimbursement from Parent, as supported by the guarantee of Global Logistic Properties described above. See “—Termination Fee and Expenses—Termination Fee Payable by Parent to Industrial Income.”

Regulatory Approvals (page 63)

Section 721 of the Defense Production Act, as well as related executive orders and regulations, authorize the President or the Committee on Foreign Investment in the United States, a U.S. Government interagency committee, which we refer to as “CFIUS,” to review transactions that could result in control of a U.S. business by a foreign person. The merger transaction is subject to CFIUS review, but obtaining CFIUS approval for Parent and Merger Sub to acquire Industrial Income is not a condition to Parent’s or Merger Sub’s obligations under the Merger Agreement. Parent may, however, elect to postpone the closing of the merger by providing written notice, no later than one business day prior to the date the closing would otherwise be required to occur, to a date no later than October 31, 2015, in order to obtain clearance from CFIUS in connection with the transactions contemplated by the Merger Agreement.

Pursuant to the New Jersey Industrial Site Remediation Act and corresponding regulations, which we refer to as “ISRA,” the Company and its subsidiaries are required to use their reasonable best efforts to take certain steps and file certain documents with the New Jersey Department of Environmental Protection, which we refer to as the “NJDEP,” in respect of certain of Industrial Income’s New Jersey properties prior to the consummation of the merger. In furtherance of the foregoing, the parties to the Merger Agreement will assist and cooperate with each other in doing all things reasonably necessary, proper and advisable to comply with such requirements under ISRA with respect to each property owned by the Company subject to the requirements of ISRA, including reasonably cooperating with representatives of the other parties in connection with actions related to ISRA and completing compliance with ISRA prior to the closing of the merger. The Company has drafted and delivered to Parent certain ISRA-related notices for approval by Parent, Parent has approved such notices, and Company has submitted such notices to the NJDEP. The Company will provide other documents required to be filed in connection with ISRA, including any remediation certifications, remediation funding sources and annual surcharge payments, to Parent for its review, comment and approval prior to submitting such notices, filings or other documents to the NJDEP. The Company will provide Parent with reasonable advance notice for any inspections or other activities related to the properties subject to the requirements of ISRA, and Parent and its representatives will have the opportunity to attend and participate in any such inspections.

Dissenters’ Rights of Appraisal (page 112)

Holders of our common stock are not entitled to dissenters’ or appraisal rights and may not exercise the rights of objecting stockholders to receive the fair value of their shares in connection with the merger because, as

11

permitted by the Maryland General Corporation Law, which we refer to as the “MGCL,” our Charter provides that stockholders shall not be entitled to exercise any appraisal rights unless the board of directors, upon the affirmative vote of a majority of the board of directors, shall determine that such rights apply.

Material United States Federal Income Tax Consequences (page 64)

The receipt of the cash merger consideration, the distribution of the units in the liquidating trust, and the cash distribution of net loan proceeds and other available cash, taken together, will be treated as a sale of your stock in the Company for an amount, per share, equal to the sum of: (i) the cash merger consideration per share of $10.30 per share; (ii) the amount of the per share cash distribution of net loan proceeds, currently estimated to be $0.26 per share; and (iii) the fair market value of a unit in the liquidating trust, currently estimated to be $0.56 per unit, which value will be determined by the Company at the time of the distribution and the merger. The aggregate amount of this consideration currently is estimated to be $11.12 per share of Industrial Income stock, as previously announced. Generally, for federal income tax purposes, you will recognize gain (or loss) to the extent such value is greater than (or less than) your basis in your stock in the Company. For such purposes, your basis in your stock in the Company will generally be equal to the price at which you purchased such stock less any distributions received that constituted a return of capital prior to the closing of the merger. In addition, under certain circumstances, we may be required to withhold a portion of your merger consideration under applicable tax laws, including pursuant to the Foreign Investment in Real Property Tax Act of 1980, or FIRPTA. Tax matters can be complicated, and the tax consequences of the merger to you will depend on your particular tax situation. We encourage you to consult your tax advisor regarding the tax consequences of the merger to you.

Deregistration of Our Common Stock (page 72)

Our shares of common stock are not listed on a national security exchange and there is no public trading market for our common stock. If the merger is completed, our common stock will be deregistered under the Exchange Act.

12

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING AND THE MERGER

The following questions and answers address briefly some questions you may have regarding the special meeting, the proposed merger and the liquidating trust. These questions and answers may not address all questions that may be important to you as a stockholder. Please refer to the more detailed information contained elsewhere in this proxy statement, including the Merger Agreement, a copy of which is attached asAnnex A, and the form of trust agreement, a copy of which is attached asAnnex B.

Q: What is the proposed transaction?

A: The proposed transaction is a merger, pursuant to the Merger Agreement, of Industrial Income with a wholly-owned subsidiary of Parent in exchange for cash in the amount of $10.30 for each share of our common stock, including shares of our common stock issued upon redemption of the special partnership units held by our Sponsor. Additionally, immediately prior to the merger, we will distribute to our stockholders units of beneficial interest in a liquidating trust, on a one unit for one share basis, that will hold interests in a liquidating company that will own 11 Excluded Properties that are under development or in the lease-up stage that are not being acquired by GLP. For additional information about the merger and the related transactions, please review the Merger Agreement attached to this proxy statement asAnnex A and incorporated by reference into this proxy statement. We encourage you to read the Merger Agreement carefully and in its entirety, as it is the principal document governing the merger. By voting to approve the merger and the other transactions contemplated by the Merger Agreement, stockholders also are approving the OP Unit Purchase and the transactions contemplated by the Contribution Agreement, each as discussed more fully in this proxy statement.

Q: As a common stockholder of Industrial Income, what will I receive as a result of the merger?

A: Holders of our shares of common stock at the merger effective time will receive, for each of our shares of common stock that they own, the merger consideration, which is $10.30 per share in cash, without interest and less applicable withholdings and taxes.

Q: What will stockholders potentially receive from the liquidating trust and the sales of the Excluded Properties?

A: We currently estimate that our stockholders will receive an estimated value of $0.82 per share, in one or more distributions, from the net proceeds of the sales, financings and refinancings of the Excluded Properties by the liquidating trust, based on the stabilized values of the Excluded Properties, through a combination of transactions. On the closing date of the merger, we currently expect that we will make a distribution to our stockholders from the net proceeds of a loan to be secured by the Excluded Properties and other available cash of the liquidating company, which we currently expect will result in an estimated additional $0.26 per share of cash being distributed to our stockholders if such loan transaction occurs. Stockholders will receive the remainder of the value of the Excluded Properties in the form of units of beneficial interest of the liquidating trust, to which we currently expect to assign a value for tax purposes of approximately $0.56 per unit, although the ultimate value of such interests will depend on the net proceeds realized from future sales, financings, or refinancings of the Excluded Properties. There can be no assurance that we will be able to obtain the loan secured by the Excluded Properties on terms consistent with the commitment letter we have entered into, and make the planned distributions, and the amount of the distributions at closing may be less or more than $0.26 per share. If this loan transaction is not completed, then we do not anticipate that stockholders would receive any cash distributions with respect to the Excluded Properties on the closing date of the merger. In that case, we would expect that stockholders would receive an estimated value of approximately $0.82 per unit of beneficial interest from the sale, financing, or refinancing of the Excluded Properties by the liquidating trust, subject to the qualifications noted above, which would still result in a total value that may be received by stockholders of $11.12 per share, inclusive of the merger consideration. Statements about the future value or distributions to be received by stockholders with respect to the Excluded Properties and the liquidating trust units involve known and unknown

13

risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of liquidating trust to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements, including the actual amounts to potentially be received from the liquidating trust, if any, the timing of such distributions and the market prices for the Excluded Properties at the time of any sales by the liquidating trust, including costs related thereto.

There can be no assurance that we will be able to obtain the loan on the Excluded Properties on terms consistent with the commitment letter we have entered into and make the planned distributions, and the amount of the distributions at closing may be less or more than $0.26 per share. The actual amount of net proceeds from the sale of Excluded Properties and the amount to be distributed to trust beneficiaries are subject to various and significant uncertainties, many of which are beyond our control, and that could cause actual results to differ materially from our expectations.

You may receive less than expected or nothing from the liquidating trust, and you should consider this risk in evaluating the merger.

We do not expect the liquidating trust to make distributions to unitholders, other than the distribution of net loan proceeds and other available cash on the merger closing date and distributions of net proceeds from the sales, financings and refinancings of the Excluded Properties. The liquidating trust will have a term of three years, which may be extended under certain circumstances. We expect that the liquidating trust will complete the disposition of all of the Excluded Properties, satisfy its liabilities and distribute the net proceeds within 12 to 24 months after the closing of the merger and prior to expiration of this three year term, although we cannot say with certainty at this time how long this will take before a final distribution is made. Although we believe that the sales of these assets will ultimately lead to additional distributions to you, we cannot assure you that the liquidating trust will be able to sell or otherwise dispose of its assets for value or that any sales proceeds will be sufficient to discharge its liabilities. The actual amount of net proceeds from the sale of Excluded Properties and the amount to be distributed to trust beneficiaries are subject to various and significant uncertainties, many of which are beyond our control, and that could cause actual results to differ materially from our expectations. These uncertainties include the risk that changes in the real estate markets or other factors may cause the liquidating trust to sell properties for less than expected.

Q: Will Industrial Income continue to pay distributions prior to the effective time of the merger?

A: As permitted by the Merger Agreement, we currently expect to continue to pay regular daily dividends, aggregated and paid quarterly, consistent with past practice, subject to the approval of our board of directors, at a daily rate that equates to a quarterly rate not to exceed $0.15625 per common share through the business day immediately preceding the closing of the merger.

Q: When do you expect the merger to be completed?

A: We are working toward completing the merger as quickly as possible and we currently anticipate that it will be completed by October 30, 2015, and no later than November 16, 2015. Completion of the merger is subject to, and may be delayed by, certain conditions to closing described elsewhere in this proxy statement.

Q: If the merger is completed, when can I expect to receive the $10.30 per share cash merger consideration for my shares?

A: Promptly after the completion of the merger, the transfer agent will be instructed to pay the $10.30 per share cash merger consideration with respect to the holders of record of shares of our common stock within five business days after the closing of the merger.

14

Q: What is the liquidating trust?

A: Immediately before the completion of the merger, we will transfer 11 Excluded Properties that are under development or in the lease-up stage and are not being acquired by GLP to a liquidating company that will complete the development and lease-up of these properties, and ultimately sell them and distribute the proceeds. Industrial Income will own all of the common membership interests in the liquidating company, and an affiliate of our Sponsor will own special interests comparable to the special partnership units it holds in our Operating Partnership. Following this contribution of the Excluded Properties, we will contribute our interests in the liquidating company to the liquidating trust, which will be a trust formed under Maryland law for the benefit of our stockholders as beneficiaries. In connection with the merger, our stockholders will receive, in addition to the merger consideration, one non-transferable unit representing a proportionate beneficial interest in the liquidating trust for each share of common stock that they hold.

Q: Who will manage and oversee the liquidating trust?

A: The liquidating trust will be governed by a board of trustees. A majority of the trustees will be independent of our Advisor. The liquidating trust will enter into a management agreement with the Trust Advisor to provide asset, development, and operating management services for the 11 properties to be owned by the liquidating trust, to assist in the sale of such properties, and to provide administrative services to the liquidating trust and its subsidiaries. It is expected that the compensation payable to the Trust Advisor under a management services agreement will be comparable to certain of the fees that would have been payable to our Prior Advisor under the Prior Advisory Agreement, as described in more detail under detail under “The Merger and the Related Transactions—Interests of Our Directors and Executive Officers in the Merger—Liquidating Trust.”

Q: When and where is the special meeting?

A: The special meeting will be held at the Grand Hyatt Denver, 1750 Welton Street, Denver, CO 80202, on October 21, 2015 at 10:00 am Mountain Daylight Time.

Q: Who can vote and attend the special meeting?

A: All of our stockholders as of the close of business on August 19, 2015, the record date for the special meeting, are entitled to receive notice of, attend and vote the shares of Industrial Income common stock that they held on the record date at the special meeting or any adjournments or postponements of the special meeting. Each share of common stock entitles a holder to one vote on each matter properly brought before the special meeting.

Q: What vote of stockholders is required to approve the merger and the other transactions contemplated by the Merger Agreement and the Charter Amendment?

A: The approval of the merger and the other transactions contemplated by the Merger Agreement and the Charter Amendment requires the affirmative vote of the holders of at least a majority of the shares of our outstanding stock entitled to vote on each such proposal. Because the required vote is based on the number of shares of common stock that are outstanding rather than on the number of votes cast by holders of our shares of common stock present in person or represented by proxy at the special meeting and entitled to vote, failure to vote your shares and abstentions will have the same effect as voting against the approval of the merger and the other transactions contemplated by the Merger Agreement and the approval of the Charter Amendment.

Q: What vote of stockholders is required to adjourn the special meeting?

A: Pursuant to our bylaws, the affirmative vote of a majority of the total number of votes cast at a meeting at which a quorum is present is required to approve the adjournment of the special meeting. For purposes of the vote on the proposal to approve the adjournment of the special meeting, abstentions and other shares not voted will not be counted as votes cast and will have no effect on the result of the vote, although abstentions will be considered present for the purpose of determining the presence of a quorum. If a quorum is not present, the chairman of the meeting will be entitled to adjourn the meeting without further notice.

15

Q: Is my vote required to postpone the special meeting?

A: No. Unlike an adjournment of the special meeting, at any time prior to convening the special meeting, our board of directors may postpone the special meeting for any reason without the approval of our stockholders. If the special meeting is postponed, as required by our bylaws, we will provide at least ten days’ notice of the new date of the special meeting.

Q: How does our board of directors recommend that I vote?

A: Our board of directors recommends that our common stockholders vote“FOR” the approval of the merger and the other transactions contemplated by the Merger Agreement, “FOR” the approval of the Charter Amendment and“FOR” the approval of any adjournments of the special meeting for the purpose of soliciting additional proxies if there are not sufficient votes at the special meeting to approve the merger and the other transactions contemplated by the Merger Agreement.

Q: Why is my vote important?

A: If you do not submit a proxy or voting instructions or vote in person at the special meeting, it will be more difficult for us to obtain the necessary quorum to hold the special meeting. In addition, because the proposal to approve the merger and the other transactions contemplated by the Merger Agreement and the proposal to approve the Charter Amendment must be approved by the affirmative vote of the holders of at least a majority of the shares of our outstanding stock entitled to vote as of the record date for the special meeting, your failure to submit a proxy or voting instructions or to vote in person at the special meeting will have the same effect as a vote “AGAINST” the approval of the merger and “AGAINST” the approval of the Charter Amendment.

Q: Do any of the Company’s executive officers and directors or any other persons have any interest in the merger or other transactions that is different than mine?

A: Yes. Our executive officers and directors may have interests in the merger that are different from, or in addition to, yours, including the following:

| • | Certain directors hold shares of unvested restricted stock, which will vest immediately prior to the merger and receive the same cash consideration per share as other stockholders. |

| • | Our directors and officers are also entitled to continued indemnification arrangements and directors’ and officers’ insurance coverage for a period of six years following the merger effective time. |

| • | The owners of our Advisor will receive approximately 8.8 million OP Units in exchange for the contribution of the Replacement Advisor to our Operating Partnership immediately prior to the merger effective time, and such OP Units will be purchased by Merger Sub concurrently with closing at the merger effective time for an aggregate price of approximately $91.0 million, in each case as described below under “The Merger and the Related Transactions—Interests of Our Directors and Executive Officers in the Merger—Contribution Transactions and OP Unit Purchase Agreement.” The consideration received by the owners of our Advisor in the contribution transaction is the same amount our Advisor would have received as a disposition fee under the Prior Advisory Agreement, with no net impact on our stockholders. |

| • | At closing, our Sponsor will receive an aggregate of approximately $3.0 million in total merger consideration in exchange for the special units in our Operating Partnership, and an affiliate of our Sponsor will receive a distribution of approximately $9.8 million from the net proceeds of the loan that we expect to obtain immediately prior to the closing that will be secured by the Excluded Properties and other available cash of the liquidating company, as well as future distributions of 15% of the net sales, financing or refinancing proceeds and certain other amounts received with respect to sales of the Excluded Properties by the liquidating trust after the merger effective time, which 15% currently is expected to total approximately $21.1 million. |

16

| • | The liquidating trust will enter into a management services agreement for the duration of the liquidating trust with the Trust Advisor, an affiliate of our Advisor, to provide asset, development, and operating management services for the Excluded Properties, to assist in the sale of such properties, and to provide administrative services to the liquidating trust and its subsidiaries following consummation of the transactions contemplated by the Merger Agreement. It is expected that the compensation payable to the Trust Advisor under a management services agreement will be comparable to certain of the fees that would have been payable to our Prior Advisor under the Prior Advisory Agreement. |

| • | An affiliate of our Advisor will enter into a contract for transition services to provide certain accounting, asset management, lease management, risk management, treasury and other services to the Parent and the surviving entity in the merger on a transition basis. |

Each of the above interests is discussed under “The Merger and the Related Transactions—Interests of Our Directors and Executive Officers in the Merger,” beginning on page 58.

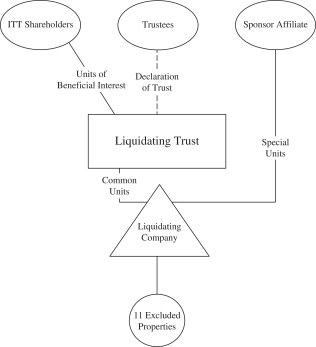

Q: How do I cast my vote if I am a record holder?

A: You can vote in person at the special meeting or by proxy. If you hold your shares of our common stock in your own name as a holder of record, you have the following four options for submitting your vote by proxy:

| • | by signing, dating, and mailing the proxy card in the postage-paid envelope provided; |

| • | via the Internet at www.proxyvote.com; |

| • | by touch-tone telephone at the toll-free number, as provided in the proxy card; or |

| • | by telephone at 855-742-8273. |