UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| x | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

INDUSTRIAL INCOME TRUST INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing: |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

On September 15, 2015, in connection with the previously announced merger among Industrial Income Trust Inc. (the “Company”), Western Logistics LLC and Western Logistics II LLC, the Company released the following Q&A to stockholders regarding the proposed liquidating trust.

INDUSTRIAL INCOME TRUST INC.

Q&A REGARDING PROPOSED LIQUIDATING TRUST

| | 1. | How will my initial distributions from the REIT be taxed? |

| | • | | The distribution of the units in the Liquidating Trust, the receipt of the cash merger consideration and the cash distribution of net loan proceeds, taken together, will be treated as a sale of your stock in the Company for an amount, per share, equal to the estimated sum of: (i) the cash merger consideration per share of US$10.30 per share; (ii) the amount of the per share cash distribution of net loan proceeds, currently estimated to be US$0.26 per share; and (iii) the fair market value of a unit in the Liquidating Trust, currently estimated to be US$0.56 per unit, which value will be determined by the Company at the time of the distribution and the Merger. The aggregate amount of this consideration is currently estimated to be US$11.12 per share of IIT stock, as previously announced. You will recognize gain (or loss) to the extent such value is greater than (or less than) your basis in your stock in the Company. For such purposes, your basis in your stock in the Company will generally be equal to the price at which you purchased such stock less any distributions received that constituted a return of capital prior to the closing of the Merger. |

| | 2. | What is the Liquidating Trust (include legal entity description)? |

| | • | | The Liquidating Trust will be a trust created under Maryland law pursuant to an Agreement and Declaration of Trust that will be entered into by Industrial Income Trust Inc. and the initial Trustees of the Liquidating Trust prior to the closing of the Merger. |

| | 3. | Will the Liquidating Trust be treated as a REIT for federal income tax purposes? |

| | • | | No. The Liquidating Trust is intended to be treated as a “grantor trust” for federal income tax purposes. See Q&A 10 below. |

| | 4. | What will I receive to evidence my ownership? |

| | • | | Your ownership in the Liquidating Trust will be reflected in the records of the Liquidating Trust and you will receive a statement reflecting the number of units of beneficial interest you own and the estimated fair market value of such units. The Liquidating Trust will not issue certificates evidencing ownership of units of beneficial interest in the Liquidating Trust. |

| | 5. | How will my ownership interest in the Liquidating trust be determined? |

| | • | | One unit of beneficial interest in the Liquidating Trust will be distributed for each share of IIT common stock or restricted stock owned immediately prior to the Merger. |

| | 6. | What is the value of my ownership interests in the Liquidating Trust? |

| | • | | We currently estimate that the net value of units of beneficial interest in the Liquidating Trust will be US$0.56 per unit. This is in addition to the US$0.26 per IIT share that we currently estimate we will distribute from the net proceeds of a loan secured by the Liquidating Trust’s properties immediately prior to or concurrently with the closing of the Merger. The actual amount realized upon liquidation of the Liquidating Trust and ultimately distributed by the Liquidating Trust will likely differ, perhaps materially, from the estimate, based on, among other things, obtaining the loan, market conditions for sales of the Excluded Properties, the amount of time it takes to complete the liquidation and the potential costs associated with the liquidation. There can be no assurance regarding the amount of cash that ultimately will be distributed to IIT shareholders in connection with the liquidation of the Liquidating Trust or the timing of the liquidation of the Liquidating Trust. As a result, we cannot assure that you will receive a specific value. |

| | 7. | Will more details about the 11 assets including locations/markets and a description of what stage each asset is in the development process and an estimated completion date be included in the IIT proxy so that shareholders are fully informed in order to cast their vote? |

| | • | | Page 75 of the proxy provides name, location/market, rentable square footage, cost to date, cost to complete and estimated completion date. |

| | 8. | Does IIT intend to market the 11 assets prior to their completion? |

| | • | | Pursuant to the Merger Agreement, the Liquidating Trust cannot undertake any marketing activity prior to the merger closing. After the closing of the merger, the Liquidating Trust is likely to consider all options in marketing the assets for sale whether any or all projects are completed or not. |

| | 9. | Does IIT intend to market the 11 assets individually or as a portfolio? |

| | • | | The Liquidating Trust is likely to consider all options in marketing the assets for sale, including whether it makes sense to sell individually or to group as multiple or single portfolios. |

2

| | 10. | Who oversees the Liquidating Trust/what is the corporate governance? |

| | • | | The Liquidating Trust will be governed by a Board of Trustees. A majority of the Trustees will be independent of our advisor. |

| | 11. | Who will manage and administer the Liquidating Trust? |

| | • | | The Liquidating Trust will enter into a management agreement with an affiliate of our existing advisor to provide asset, development, and operating management services for the 11 properties owned by the Liquidating Trust, to assist in the sale of such properties, and to provide administrative services to the Liquidating Trust and its subsidiaries. It is expected that the compensation payable to the advisor under the management services agreement will be comparable to the compensation payable to our existing advisor under the existing advisory agreement, including the retention of special units in the Liquidating Trust comparable to the special partnership units that our existing advisor holds in our current Operating Partnership. |

| | 12. | Will the annual management fee still be charged against the 11 assets? And if yes, how is the value determined in which the fee is charged against? |

| | • | | The advisor to the Liquidating Trust will continue to charge asset management fees consistent with the IIT advisory agreement. These fees will be based on original costs. |

| | 13. | How will any future management conflicts be addressed? |

| | • | | Any future conflicts between the Liquidating Trust and the advisor to the Liquidating Trust will be resolved by the independent Trustees. |

| | 14. | How will the Liquidating Trust and Holders of its Units be taxed? |

| | • | | Under the Internal Revenue Code of 1986, as amended (the “Code”), a trust will be treated as a “liquidating trust” if it is organized for the primary purpose of liquidating and distributing the assets transferred to it, and if its activities are all reasonably necessary to and consistent with the accomplishment of that purpose. However, if the liquidation is prolonged or if the liquidation purpose becomes so obscured by business activities that the declared purpose of the liquidation can be said to be lost or abandoned, there is a risk that the Liquidating Trust would no longer be considered a “liquidating trust” for federal income tax purposes. Although neither the Internal Revenue Code nor the regulations thereunder provide any specific guidance as to the length of time a liquidating trust may last, the Internal Revenue Service’s guidelines for issuing rulings with respect to liquidating trust status call for a term not to exceed three years, which period may be extended to cover the collection of installment obligations. The following discussion assumes that the Liquidating Trust will be treated as a “liquidating trust” for U.S. federal income tax purposes. |

3

| | • | | The Liquidating Trust is intended to be treated as a “grantor trust” for federal income tax purposes. Accordingly, each unit in the trust will represent ownership of an undivided proportionate interest in all of the assets and liabilities of the trust and you will be treated for federal income tax purposes as receiving or paying directly a pro rata portion of all income, gain, loss deduction and credit of the Liquidating Trust. The long-term or short- term character of any capital gain or loss recognized in connection with the sale of the Liquidating Trust’s assets will be determined based upon a holding period commencing at the time of the acquisition by you of your beneficial interest in the Liquidating Trust. If you are an individual taxpayer who itemizes deductions, you generally will be entitled to deduct the amount of any miscellaneous itemized deductions attributed to you from the Liquidating Trust only to the extent that such amount, together with your other miscellaneous itemized deductions, exceeds two percent (2%) of your adjusted gross income. |

| | • | | The Liquidating Trust will not be treated as a partnership for federal income tax purposes, but the tax consequences to you generally will be similar to those that you would experience if the trust were a partnership. As with a partnership, income derived from the Liquidating Trust will only be taxed at the unitholder level, and the Liquidating Trust will not be taxed (i.e., no “double taxation”). However, you will receive an itemized statement, referred to as a grantor letter, that reports to you your allocable share of all of the various categories of revenues and expenses of the Liquidating Trust, and you will not receive a Schedule K-1, which is the form used to provide tax information for partnership investments. |

| | • | | If the Liquidating Trust fails to qualify as such, its treatment will depend, among other things, upon the reasons for its failure to so qualify. In such case, the Liquidating Trust could be taxable as a corporation, which would mean that any income generated by the Liquidating Trust would be subject to double taxation (i.e., taxed first at the Liquidating Trust level and then a second time at the unitholder level upon any distribution by the Liquidating Trust). |

| | 15. | What is my basis in the Liquidating Trust? |

| | • | | Your basis in a unit in the Liquidating Trust (and indirectly in the pro rata portion of assets in the Liquidating Trust attributable to one unit) will be equal to the fair market value of a unit (and those net assets) on the date of the distribution and the Merger, which value will be determined by the Company and reported to you. We currently estimate, subject to the assumptions set forth above, that this will be US$0.56 per unit. |

| | 16. | Will IIT provide cost basis estimates for investors? |

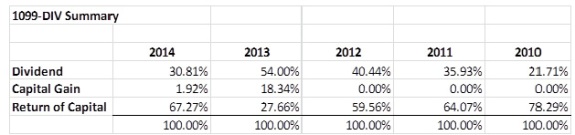

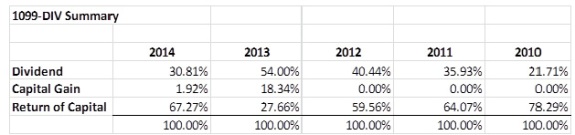

| | • | | The tax reporting of the merger transaction does not require cost basis to be reported by IIT. To assist investors in determining their individual tax liability in connection with the merger, IIT is providing the following historical information regarding the tax characterization of IIT’s distributions for 2010 to 2014. The percentages represent the portion of the amount of each full year’s distributions, as shown on an investor’s 1099 DIV for that year, that represented ordinary income (dividend), capital gain, or return of capital. |

4

| | An investor can estimate the cost basis in his or her IIT shares by subtracting the portion of each year’s distributions that represented a return of capital from the original cost basis of the shares. |

The percentages for each year apply only to distributions reported on each respective year’s 1099-DIV regardless of the date actually paid.

| | 17. | When will I receive my tax documents each year? |

| | • | | The goal of the Liquidating Trust will be to provide to you as soon as possible after each year end the detailed itemized statement that reports to you your allocable share of all of the various categories of revenue and expense of the Liquidating Trust for the year. This statement will likely be distributed later than we historically have delivered tax information to our shareholders. |

| | 18. | Will the Liquidating Trust client statement reflect a 56 cent value per unit and total value of account? |

| | • | | We anticipate that the statement initially would reflect approximately 56 cents per unit, if the loan is obtained and 26 cents of net proceeds are distributed prior to closing of the Merger. Otherwise, if the loan is not closed prior to the closing of the Merger, we anticipate that the statement initially would reflect approximately 82 cents per unit. |

| | 19. | Will I owe tax whether I have received cash distributions or not? |

| | • | | Yes, you will be taxed each year on your share of revenues from the Liquidating Trust, net of your share of the expenses of the Liquidating Trust (including interest and depreciation) whether or not you receive a distribution of cash from the Liquidating Trust that year. |

| | 20. | Do we expect any taxable income/liability in 2015? |

| | • | | Based on current estimates, we do not expect taxable income. However, this is subject to change to the extent that an asset is sold or an asset is leased upon completion. |

5

| | 21. | What is the tax impact to qualified accounts/IRAs? |

| | • | | Generally, a qualified account’s or IRA’s allocable share of all of the various categories of revenue and expense of the liquidating trust will be exempt from taxes. However, under the Code, tax exempt investors, including pension funds and IRAs, are taxed on any “unrelated business taxable income”, or UBTI, that they recognize in a year if that UBTI exceeds US$1,000 for the year. |

| | • | | Because the Liquidating Trust will have incurred debt, a portion of its income and gain will be considered to be UBTI. Under the Code, tax exempt investors who incur debt to finance an investment are subject to tax on the portion of the income attributable to that investment that is debt financed. Given the treatment of the Liquidating Trust as a “grantor trust” for federal income tax purposes, each unitholder, including IRAs and other tax exempt investors, will be treated as owning an interest in an allocable portion of each asset in the Liquidating Trust and as having incurred an allocable portion of all debt financing of the Liquidating Trust. Thus, a portion of the income of the Liquidating Trust will be considered to be “debt financed” and, therefore, will constitute UBTI for IRAs and other tax exempt investors. |

| | • | | In addition, the Liquidating Trust may have other sources of income that are also considered to be UBTI for federal income tax purposes, depending upon the nature of its operations and the sources of its income. |

| | 22. | Why is financing being obtained on the Liquidating Trust’s properties, thus potentially causing UBTI to be generated? |

| | • | | Financing is being obtained on the Liquidating Trust’s properties for two primary reasons: (i) to expedite return of cash to the Company’s shareholders, and (ii) to create access to additional liquidity for development, construction and stabilization costs associated with the Liquidating Trust’s properties. |

| | • | | There can be no assurance regarding the amount of financing, if any, that the Liquidating Trust will be able to obtain. As a result, we cannot assure shareholders that the Liquidating Trust will be able to make a cash distribution upon closing of the merger or obtain additional liquidity to fund development, construction and stabilization costs. |

| | 23. | How will UBTI be reported? |

| | • | | The detailed itemized statement that reports to you your allocable share of all of the various categories of revenue and expense of the Liquidating Trust for the year will include information as to the amount of any UBTI for the year (as would be the case with a Schedule K-1 from a partnership). |

6

| | • | | Any IRA or other tax exempt investor that has more than US$1,000 of UBTI for the year from all sources, including the interest in the Liquidating Trust, will need to file a federal income tax return for the year (on IRS Form 990-T) reporting that income and paying tax on the UBTI in excess of US$1,000. The applicable federal income tax rate on that income would be the highest rate applicable to individuals – currently 39.6%. |

| | • | | For many tax exempt IIT shareholders, we do not currently anticipate that the amount of UBTI recognized in any year will exceed this threshold. |

| | • | | In the case of an IRA, it is the custodian for the IRA that is obligated to make that filing. |

| | 24. | Do I have to pay tax on UBTI whether I have received cash distributions or not? |

| | • | | Yes, you will be taxed each year on your share of the UBTI from the Liquidating Trust whether or not you receive a distribution of cash from the Liquidating Trust that year. |

| | 25. | Can I sell my ownership interests in the Liquidating Trust? |

| | • | | No. The units of beneficial interest in the Liquidating Trust arenot transferable with the following exceptions: |

| | • | | Upon your death, the units may be transferred to the persons specified in your will. If you die without having a will, the units may be transferred in accordance to applicable state law. |

| | • | | The units may also be transferred in the unlikely event that transfer is required by operation of law. |

| | 26. | Will I receive regular distributions (dividends)? |

| | • | | No. The Trustees will decide whether and when to make distributions from the Liquidating Trust, based on the availability of funds, the amounts needed to pay the liabilities and expenses of the Liquidating Trust, and any applicable restrictions under the debt agreements of the Liquidating Trust. |

| | 27. | Will there be a redemption plan? |

| | • | | No. The Liquidating Trust will not be permitted to redeem or purchase the units of beneficial interest. |

7

| | 28. | How long until I receive all my proceeds? |

| | • | | We currently expect that all of the properties of the Liquidating Trust will be sold and the proceeds distributed to unitholders within 12 to 24 months after the closing of the Merger, but there can be no assurance that the liquidation of the trust will occur within this estimated time frame. |

| | 29. | Who bears the expenses of the Liquidating Trust? |

| | • | | The expenses of the Liquidating Trust will be paid from the revenues of the Liquidating Trust before distributions are paid to unitholders. |

***********

IMPORTANT ADDITIONAL INFORMATION

The descriptions of federal income tax matters contained in this Q&A are for general informational purposes only and do not address all possible tax considerations that may be material to an IIT shareholder regarding distributions received upon closing of the Merger or ownership of units of the Liquidating Trust and do not constitute legal or tax advice. Moreover, this Q&A does not deal with all tax matters that might be relevant to an IIT shareholder, in light of its personal circumstances, nor does it deal with particular types of IIT shareholders that are subject to special treatment under the federal income tax laws. The state, local and foreign tax consequences of any items of income, gain, loss, deduction or credit of the Liquidating Trust may be treated differently for state, local and foreign tax purposes than for federal income tax purposes. To ensure compliance with requirements imposed by the Internal Revenue Service, any descriptions of income tax matters contained in this Q&A are not intended or written to be used, and cannot be used, for the purpose of (i) avoiding penalties under the Code or (ii) promoting, marketing or recommending to another party any transaction or matter addressed herein.

IIT cannot and does not provide income tax advice or guidance. IIT shareholders are urged to consult with their tax advisers as to their individual tax consequences.

***********

ADDITIONAL INFORMATIONABOUTTHE PROPOSED TRANSACTIONAND WHERETO FIND IT

In connection with the proposed transaction, IIT has filed with the Securities and Exchange Commission (the “SEC”) and has mailed or otherwise provided to its shareholders a proxy statement and other relevant materials, and will hold a special meeting of its shareholders to obtain the requisite shareholder approval. Before making any voting or investment decisions, IIT’s shareholders are urged to read the proxy statement in its entirety and any other relevant documents filed with the SEC because they will contain important information about the proposed merger. The proxy statement and other relevant materials containing information about the proposed transactions, and any other documents filed by IIT with the SEC, may be obtained free of charge at the SEC’s web site atwww.sec.gov and IIT’s website at www.industrialincome.com. In addition, shareholders may obtain free copies of the proxy statement and other documents filed by IIT with the SEC by directing a written request to the following address: Industrial Income Trust Inc., Attention: Eric Paul, 518 17th street, Denver, CO 80202.

IIT and its executive officers and directors may be deemed to be participants in the solicitation of proxies from the shareholders of IIT in connection with the merger. Information about those executive officers and directors of IIT and their ownership of common stock is set forth in the proxy statement for IIT’s 2015 annual meeting of shareholders, which was filed with the SEC on April 17, 2015. Shareholders may obtain additional information regarding the direct and indirect interests of IIT and its executive officers and directors in the merger by reading the proxy statement regarding the merger when it becomes available.

***********

8

FORWARD-LOOKING STATEMENTS

This communication contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform of 1995. These forward-looking statements generally can be identified by use of statements that include words such as “intend,” “plan,” “may,” “should,” “could,” “will,” “project,” “estimate,” “anticipate,” “believe,” “expect,” “continue,” “potential,” “opportunity” and similar expressions. Such statements involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of IIT to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. Such factors may include, but are not limited to, the following: (i) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; (ii) the failure of IIT to obtain the requisite vote of shareholders required to consummate the proposed merger or the failure to satisfy the other closing conditions to the merger or any of the other transactions contemplated by the merger agreement; (iii) risks related to disruption of management’s attention from IIT’s ongoing business operations due to the transaction; (iv) the effect of the announcement of the merger on the ability of IIT to retain key personnel, maintain relationships with its customers and suppliers, and maintain its operating results and business generally; (v) the ability of third parties to fulfill their obligations relating to the proposed transaction, including providing financing under current financial market conditions; (vi) the tax impact of the transactions contemplated with respect to the Liquidating Trust and resultant tax treatment relating to, arising or resulting from or incurred in connection with such transactions; (vii) the actual distributions to be received by shareholders from the Liquidating Entity, if any, the timing of such distributions and the market prices for the Excluded Properties at the time of any sales by the Liquidating Entity, including costs related thereto; (viii) the outcome of any legal proceedings that may be instituted against IIT and others related to the merger agreement; (ix) the ability of IIT to implement its operating strategy; (x) IIT’s ability to manage planned growth; (xi) changes in economic cycles; and (xii) competition within the real estate industry.

In addition, these forward-looking statements reflect IIT’s views as of the date on which such statements were made. IIT anticipates that subsequent events and developments may cause its views to change. These forward-looking statements should not be relied upon as representing IIT’s views as of any date subsequent to the date hereof. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by IIT or any other person that the results or conditions described in such statements or the objectives and plans of IIT will be achieved. Additional factors that could cause actual results to differ materially from these forward-looking statements are listed from time to time in IIT’s SEC reports, including, but not limited to, the “Risk Factors” section of IIT’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014, which was filed with the SEC on February 27, 2015 and subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. IIT expressly disclaims a duty to provide updates to forward-looking statements, whether as a result of new information, future events or other occurrences.

9