EXHIBIT 10.6

CONSTRUCTION LOAN AGREEMENT

among

REDLANDS DC LP, a Delaware limited partnership, formerly known as IIT Redlands DC LP

CAJON DC LP, a Delaware limited partnership, formerly known as IIT Cajon DC LP

MIAMI DC III LLC, a Delaware limited liability company, formerly known as IIT Miami DC III LLC

MIAMI DC IV LLC, a Delaware limited liability company, formerly known as IIT Miami DC IV LLC

MIAMI DC III LAND LLC, a Delaware limited liability company, formerly known as IIT Miami DC III Land LLC

TAMARAC COMMERCE CENTER DC II LLC, a Delaware limited liability company, formerly known as IIT Tamarac Commerce Center II LLC

TAMARAC COMMERCE CENTER DC III LLC, a Delaware limited liability company, formerly known as IIT Tamarac Commerce Center III LLC

LEHIGH VALLEY CROSSING DC I LLC, a Delaware limited liability company, formerly known as IIT Lehigh Valley Crossing DC I LLC

LEHIGH VALLEY CROSSING DC II LLC, a Delaware limited liability company, formerly known as IIT Lehigh Valley Crossing DC II LLC

LEHIGH VALLEY CROSSING DC III LLC, a Delaware limited liability company, formerly known as IIT Lehigh Valley Crossing DC III LLC

BLUEGRASS DC II LLC, a Delaware limited liability company, formerly known as IIT Bluegrass DC II LLC

and

WELLS FARGO BANK, NATIONAL ASSOCIATION

Dated as of November 4, 2015,

Loan No. 1015003

TABLE OF CONTENTS

| | | | | | | | |

| | | | | | | Page | |

ARTICLE 1. | | DEFINITIONS | | | 1 | |

| | |

1.1 | | DEFINED TERMS | | | 1 | |

| | |

ARTICLE 2. | | LOAN | | | 13 | |

| | |

2.1 | | LOAN | | | 13 | |

| | |

2.2 | | PURPOSE | | | 13 | |

| | |

2.3 | | GRANT OF SECURITY INTEREST IN REAL PROPERTY | | | 13 | |

| | |

2.4 | | GRANT OF SECURITY INTEREST IN ACCOUNTS; APPLICATION OF FUNDS | | | 13 | |

| | |

2.5 | | ADDITIONAL SECURITY INTEREST | | | 14 | |

| | |

2.6 | | LOAN FEE | | | 14 | |

| | |

2.7 | | LOAN DOCUMENTS | | | 14 | |

| | |

2.8 | | EFFECTIVE DATE | | | 14 | |

| | |

2.9 | | MATURITY DATE | | | 14 | |

| | |

2.10 | | PREPAYMENT | | | 14 | |

| | |

2.11 | | FULL REPAYMENT AND RECONVEYANCE, SATISFACTION OR RELEASE | | | 14 | |

| | |

2.12 | | PARTIAL RELEASES | | | 14 | |

| | |

2.13 | | OPTION TO EXTEND | | | 16 | |

| | |

2.14 | | RECOURSE | | | 17 | |

| | |

ARTICLE 3. | | DISBURSEMENT | | | 17 | |

| | |

3.1 | | CONDITIONS PRECEDENT | | | 17 | |

| | |

3.2 | | ACCOUNT AND DISBURSEMENT AUTHORIZATION | | | 21 | |

| | |

3.3 | | FUNDS TRANSFER DISBURSEMENTS | | | 22 | |

| | |

3.4 | | LOAN DISBURSEMENTS | | | 22 | |

| | |

3.5 | | REALLOCATIONS | | | 23 | |

| | |

3.6 | | WITHHOLDING OF ADVANCES; RETENTION | | | 24 | |

| | |

3.7 | | TENANT IMPROVEMENTS / LEASING COMMISSIONS | | | 24 | |

| | |

3.8 | | INTEREST RESERVE ADVANCES | | | 25 | |

| | |

3.9 | | LENDER’S OPTIONAL DISBURSEMENTS | | | 25 | |

| | |

ARTICLE 4. | | CONSTRUCTION | | | 25 | |

| | |

4.1 | | COMMENCEMENT OF CONSTRUCTION | | | 25 | |

| | |

4.2 | | COMPLETION OF CONSTRUCTION | | | 25 | |

| | |

4.3 | | FORCE MAJEURE | | | 25 | |

| | |

4.4 | | CONSTRUCTION AGREEMENT | | | 25 | |

| | |

4.5 | | ARCHITECT’S AND DESIGN PROFESSIONAL’S AGREEMENT | | | 26 | |

| | |

4.6 | | PLANS AND SPECIFICATIONS | | | 26 | |

TABLE OF CONTENTS

(Continued)

| | | | | | | | |

| | | | | | | Page | |

| | |

4.7 | | CONTRACTOR/CONSTRUCTION INFORMATION | | | 27 | |

| | |

4.8 | | PROHIBITED CONTRACTS | | | 27 | |

| | |

4.9 | | LIENS AND NOTICES | | | 27 | |

| | |

4.10 | | CONSTRUCTION RESPONSIBILITIES | | | 28 | |

| | |

4.11 | | ASSESSMENTS AND COMMUNITY FACILITIES DISTRICTS | | | 28 | |

| | |

4.12 | | DELAY | | | 28 | |

| | |

4.13 | | INSPECTIONS | | | 28 | |

| | |

4.14 | | SURVEYS | | | 29 | |

| | |

4.15 | | IN BALANCE PAYMENTS | | | 29 | |

| | |

ARTICLE 5. | | INSURANCE | | | 29 | |

| | |

5.1 | | TITLE INSURANCE | | | 29 | |

| | |

5.2 | | PROPERTY INSURANCE | | | 29 | |

| | |

5.3 | | FLOOD HAZARD INSURANCE | | | 29 | |

| | |

5.4 | | LIABILITY INSURANCE | | | 29 | |

| | |

5.5 | | OTHER COVERAGE | | | 30 | |

| | |

5.6 | | GENERAL | | | 30 | |

| | |

5.7 | | COLLATERAL PROTECTION INSURANCE NOTICE | | | 30 | |

| | |

ARTICLE 6. | | REPRESENTATIONS AND WARRANTIES | | | 30 | |

| | |

6.1 | | AUTHORITY/ENFORCEABILITY | | | 30 | |

| | |

6.2 | | BINDING OBLIGATIONS | | | 30 | |

| | |

6.3 | | FORMATION AND ORGANIZATIONAL DOCUMENTS | | | 30 | |

| | |

6.4 | | NO VIOLATION | | | 31 | |

| | |

6.5 | | COMPLIANCE WITH LAWS; USE | | | 31 | |

| | |

6.6 | | LITIGATION | | | 31 | |

| | |

6.7 | | FINANCIAL CONDITION | | | 31 | |

| | |

6.8 | | NO MATERIAL ADVERSE CHANGE | | | 31 | |

| | |

6.9 | | LOAN PROCEEDS AND ADEQUACY | | | 32 | |

| | |

6.10 | | ACCURACY | | | 32 | |

| | |

6.11 | | TAX LIABILITY | | | 32 | |

| | |

6.12 | | UTILITIES | | | 32 | |

| | |

6.13 | | COMPLIANCE | | | 32 | |

| | |

6.14 | | AMERICANS WITH DISABILITIES ACT COMPLIANCE | | | 32 | |

| | |

6.15 | | BUSINESS LOAN | | | 32 | |

| | |

6.16 | | TAX SHELTER REGULATIONS | | | 32 | |

| | |

6.17 | | FULL FORCE AND EFFECT | | | 32 | |

TABLE OF CONTENTS

(Continued)

| | | | | | | | |

| | | | | | | Page | |

| | |

6.18 | | NO SUBORDINATION | | | 32 | |

| | |

6.19 | | PERMITS; FRANCHISES | | | 33 | |

| | |

6.20 | | OTHER OBLIGATIONS | | | 33 | |

| | |

6.21 | | LEASES | | | 33 | |

| | |

6.22 | | MATERIAL CONTRACTS | | | 33 | |

| | |

6.23 | | SANCTIONS | | | 33 | |

| | |

6.24 | | PROJECT INFORMATION | | | 33 | |

| | |

6.25 | | REAFFIRMATION AND SURVIVAL OF REPRESENTATIONS AND WARRANTIES | | | 33 | |

| | |

ARTICLE 7. | | REPRESENTATIONS, WARRANTIES AND COVENANTS REGARDING SPECIAL PURPOSE ENTITY STATUS | | | 34 | |

| | |

7.1 | | REPRESENTATIONS, WARRANTIES AND COVENANTS REGARDING SPECIAL PURPOSE ENTITY (“SPE”) STATUS | | | 34 | |

| | |

ARTICLE 8. | | HAZARDOUS MATERIALS | | | 35 | |

| | |

8.1 | | HAZARDOUS MATERIALS INDEMNITY AGREEMENT | | | 35 | |

| | |

ARTICLE 9. | | COVENANTS OF BORROWERs | | | 35 | |

| | |

9.1 | | EXPENSES | | | 35 | |

| | |

9.2 | | ERISA COMPLIANCE | | | 36 | |

| | |

9.3 | | LEASING | | | 36 | |

| | |

9.4 | | APPROVAL OF LEASES | | | 36 | |

| | |

9.5 | | SNDA Delivery | | | 37 | |

| | |

9.6 | | DISTRIBUTIONS | | | 37 | |

| | |

9.7 | | SUBDIVISION MAPS | | | 37 | |

| | |

9.8 | | SECURITY DEPOSITS | | | 37 | |

| | |

9.9 | | GOVERNMENTAL COMPLIANCE | | | 38 | |

| | |

9.10 | | ASSIGNMENT | | | 38 | |

| | |

9.11 | | MANAGEMENT AND LEASING OF PROPERTIES | | | 38 | |

| | |

9.12 | | SUBORDINATION OF MANAGEMENT AGREEMENT | | | 38 | |

| | |

9.13 | | SUBORDINATION OF LISTING AGREEMENT | | | 38 | |

| | |

9.14 | | MANAGER | | | 38 | |

| | |

9.15 | | DEVELOPMENT OF PROPERTIES | | | 39 | |

| | |

9.16 | | SWAP AGREEMENTS | | | 39 | |

| | |

9.17 | | SUBORDINATION OF DEVELOPMENT AGREEMENT | | | 39 | |

| | |

9.18 | | PROPERTY TRANSFERS | | | 39 | |

| | |

9.19 | | EQUITY TRANSFERS | | | 39 | |

| | |

9.20 | | CERTIFICATES OF OWNERSHIP | | | 40 | |

TABLE OF CONTENTS

(Continued)

| | | | | | | | |

| | | | | | | Page | |

| | |

9.21 | | ACCOUNTS AND CASH FLOW | | | 40 | |

| | |

9.22 | | ADDITIONAL DEBT AND SEPARATE GUARANTY | | | 41 | |

| | |

9.23 | | EXISTENCE | | | 41 | |

| | |

9.24 | | TAXES AND OTHER LIABILITIES | | | 41 | |

| | |

9.25 | | NOTICE | | | 41 | |

| | |

9.26 | | ACTIONS TO MAINTAIN PROPERTY | | | 42 | |

| | |

9.27 | | MATERIAL CONTRACTS | | | 42 | |

| | |

9.28 | | INSURANCE | | | 42 | |

| | |

9.29 | | FURTHER ASSURANCES | | | 42 | |

| | |

ARTICLE 10. | | REPORTING COVENANTS | | | 42 | |

| | |

10.1 | | FINANCIAL INFORMATION | | | 42 | |

| | |

10.2 | | TAX RETURNS | | | 43 | |

| | |

10.3 | | BOOKS AND RECORDS | | | 43 | |

| | |

10.4 | | REPORTS | | | 43 | |

| | |

10.5 | | LEASING REPORTS | | | 43 | |

| | |

10.6 | | OPERATING STATEMENTS FOR PROPERTIES | | | 43 | |

| | |

10.7 | | PROJECTED FINANCIAL STATEMENTS AND OTHER INFORMATION | | | 43 | |

| | |

ARTICLE 11. | | DEFAULTS AND REMEDIES | | | 43 | |

| | |

11.1 | | DEFAULT | | | 43 | |

| | |

11.2 | | ACCELERATION UPON DEFAULT; REMEDIES | | | 46 | |

| | |

11.3 | | DISBURSEMENTS TO THIRD PARTIES | | | 46 | |

| | |

11.4 | | LENDER’S COMPLETION OF CONSTRUCTION | | | 46 | |

| | |

11.5 | | LENDER’S RIGHT TO STOP CONSTRUCTION | | | 47 | |

| | |

11.6 | | SET OFF | | | 47 | |

| | |

11.7 | | RIGHTS CUMULATIVE, NO WAIVER | | | 47 | |

| | |

ARTICLE 12. | | MISCELLANEOUS PROVISIONS | | | 47 | |

| | |

12.1 | | INDEMNITY | | | 47 | |

| | |

12.2 | | FORM OF DOCUMENTS | | | 48 | |

| | |

12.3 | | NO THIRD PARTIES BENEFITED | | | 48 | |

| | |

12.4 | | NOTICES | | | 48 | |

| | |

12.5 | | ATTORNEY-IN-FACT | | | 49 | |

| | |

12.6 | | ACTIONS | | | 49 | |

| | |

12.7 | | RIGHT OF CONTEST | | | 49 | |

| | |

12.8 | | RELATIONSHIP OF PARTIES | | | 49 | |

| | |

12.9 | | DELAY OUTSIDE LENDER’S CONTROL | | | 49 | |

TABLE OF CONTENTS

(Continued)

| | | | | | | | |

| | | | | | | Page | |

| | |

12.10 | | ATTORNEYS’ FEES AND EXPENSES; ENFORCEMENT | | | 49 | |

| | |

12.11 | | IMMEDIATELY AVAILABLE FUNDS | | | 50 | |

| | |

12.12 | | LENDER’S CONSENT | | | 50 | |

| | |

12.13 | | LOAN SALES AND PARTICIPATION; DISCLOSURE OF INFORMATION | | | 50 | |

| | |

12.14 | | CAPITAL ADEQUACY | | | 50 | |

| | |

12.15 | | LENDER’S AGENTS | | | 51 | |

| | |

12.16 | | TAX SERVICE | | | 51 | |

| | |

12.17 | | WAIVER OF RIGHT TO TRIAL BY JURY | | | 51 | |

| | |

12.18 | | SEVERABILITY | | | 51 | |

| | |

12.19 | | HEIRS, SUCCESSORS AND ASSIGNS | | | 51 | |

| | |

12.20 | | TIME | | | 51 | |

| | |

12.21 | | HEADINGS | | | 51 | |

| | |

12.22 | | GOVERNING LAW AND CONSENT TO JURISDICTION | | | 52 | |

| | |

12.23 | | GOVERNMENTAL COMPLIANCE | | | 52 | |

| | |

12.24 | | INTENTIONALLY DELETED | | | 52 | |

| | |

12.25 | | COUNTERPARTS | | | 52 | |

| | |

12.26 | | IIT | | | 52 | |

| | |

12.27 | | INTEGRATION; INTERPRETATION | | | 52 | |

| | |

12.28 | | TAX SHELTER MATTERS | | | 52 | |

| | |

12.29 | | NO WAIVER | | | 53 | |

| | |

12.30 | | JOINT AND SEVERAL LIABILITY | | | 53 | |

| | |

12.31 | | ELECTRONIC TRANSMISSION OF DATA | | | 53 | |

| | |

12.32 | | POWERS OF ATTORNEY | | | 53 | |

| | |

12.33 | | RULES OF CONSTRUCTION | | | 53 | |

| | |

12.34 | | USE OF SINGULAR AND PLURAL; GENDER | | | 54 | |

| | |

12.35 | | EXHIBITS, SCHEDULES AND RIDERS | | | 54 | |

| | |

12.36 | | INCONSISTENCIES | | | 54 | |

| | |

12.37 | | ADVERTISING; SIGNS | | | 54 | |

| | |

12.38 | | SPECIAL REPRESENTATIONS, CONSENTS AND WAIVERS CONCERNING CO-BORROWERS | | | 54 | |

| | | |

| SCHEDULE 1 | | - | | BORROWERS AND PROPERTIES | | | | |

| SCHEDULE 2 | | - | | BANK OF AMERICA LETTERS OF CREDIT | | | | |

| SCHEDULE 2.10 | | - | | ALLOCATED LOAN AMOUNTS | | | | |

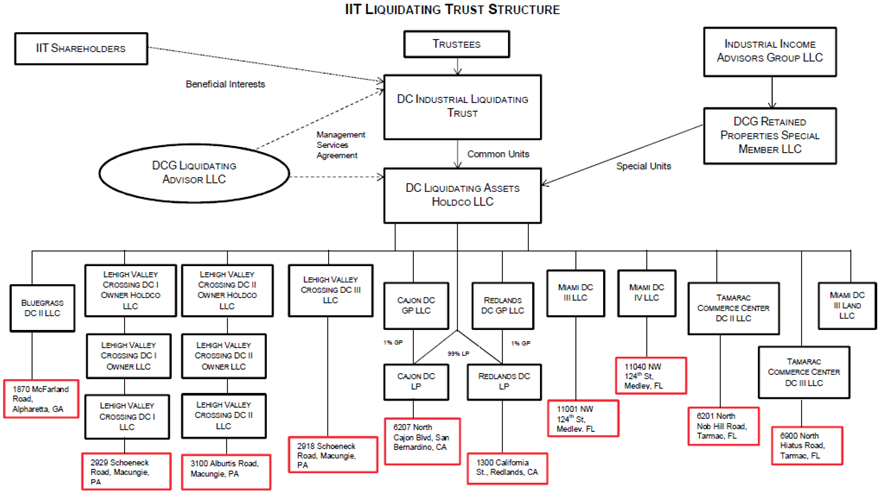

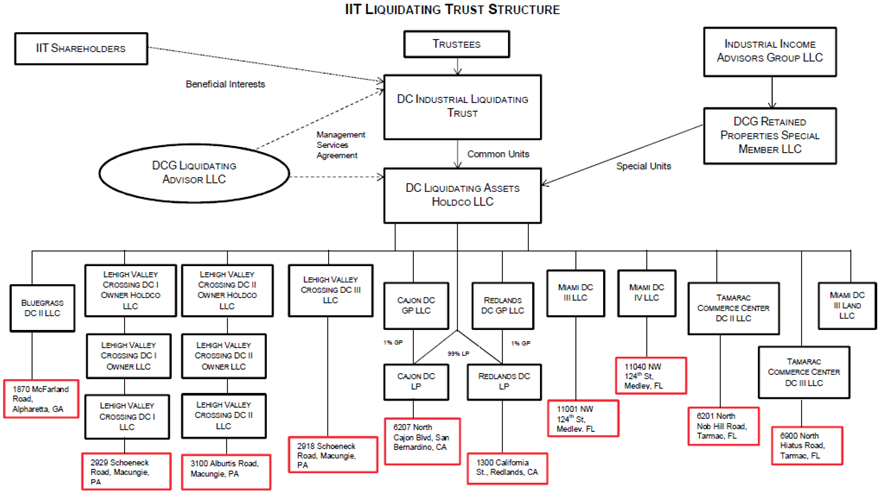

| SCHEDULE 6.3 | | - | | ORGANIZATIONAL CHART | | | | |

| SCHEDULE 6.6 | | - | | LITIGATION | | | | |

| SCHEDULE 6.22 | | - | | LEASES | | | | |

| EXHIBIT A | | - | | PROPERTIES | | | | |

TABLE OF CONTENTS

(Continued)

| | | | | | |

| | | | | | | Page |

| EXHIBIT A-1 | | - | | REDLANDS PROPERTY | | |

| EXHIBIT A-2 | | - | | CAJON PROPERTY | | |

| EXHIBIT A-3 | | - | | MIAMI III PROPERTY | | |

| EXHIBIT A-4 | | - | | MIAMI IV PROPERTY | | |

| EXHIBIT A-5 | | - | | MIAMI III LAND PROPERTY | | |

| EXHIBIT A-6 | | - | | TAMARAC COMMERCE CENTER II PROPERTY | | |

| EXHIBIT A-7 | | - | | TAMARAC COMMERCE CENTER III PROPERTY | | |

| EXHIBIT A-8 | | - | | LEHIGH VALLEY I PROPERTY | | |

| EXHIBIT A-9 | | - | | LEHIGH VALLEY II PROPERTY | | |

| EXHIBIT A-10 | | - | | LEHIGH VALLEY III PROPERTY | | |

| EXHIBIT A-11 | | - | | BLUEGRASS II PROPERTY | | |

| EXHIBIT B | | - | | DOCUMENTS | | |

| EXHIBIT C | | - | | LOAN BUDGET | | |

| EXHIBIT D | | - | | DISBURSEMENT PLAN | | |

| EXHIBIT E | | - | | DISBURSEMENT INSTRUCTION AGREEMENT | | |

| EXHIBIT F | | - | | DESIGN PROFESSIONAL’S CONSENT FORM | | |

| EXHIBIT G | | - | | CONTRACTOR’S CONSENT FORM | | |

| EXHIBIT H | | - | | OPTION TO EXTEND REQUEST LETTER FROM BORROWER | | |

| EXHIBIT I | | - | | PROPERTY LEVEL BUDGET | | |

CONSTRUCTION LOAN AGREEMENT

This CONSTRUCTION LOAN AGREEMENT (“Agreement”) is dated as of November 4, 2015, by and amongREDLANDS DC LP, a Delaware limited partnership, formerly known as IIT Redlands DC LP, CAJON DC LP, a Delaware limited partnership, formerly known as IIT Cajon DC LP,MIAMI DC III LLC, a Delaware limited liability company, formerly known as IIT Miami DC III LLC,MIAMI DC IV LLC, a Delaware limited liability company, formerly known as IIT Miami DC IV LLC,MIAMI DC III LAND LLC, a Delaware limited liability company, formerly known as IIT Miami DC III Land LLC,TAMARAC COMMERCE CENTER DC II LLC, a Delaware limited liability company, formerly known as IIT Tamarac Commerce Center II LLC,TAMARAC COMMERCE CENTER DC III LLC, a Delaware limited liability company, formerly known as IIT Tamarac Commerce Center III LLC,LEHIGH VALLEY CROSSING DC I LLC, a Delaware limited liability company, formerly known as IIT Lehigh Valley Crossing DC I LLC,LEHIGH VALLEY CROSSING DC II LLC, a Delaware limited liability company, formerly known as IIT Lehigh Valley Crossing DC II LLC,LEHIGH VALLEY CROSSING DC III LLC, a Delaware limited liability company, formerly known as IIT Lehigh Valley Crossing DC III LLC,BLUEGRASS DC II LLC, a Delaware limited liability company, formerly known as IIT Bluegrass DC II LLC (each, a “Borrower” and collectively, the “Borrowers”), jointly and severally, andWELLS FARGO BANK, NATIONAL ASSOCIATION (“Lender”).

R E C I T A L S

| | A. | Borrowers desire to borrow from Lender, and Lender agrees to loan to Borrowers, the extension of credit for which provision is made herein. |

| | B. | Borrowers collectively own that certain portfolio of real property listed on Schedule 1 and described more particularly inExhibit A attached hereto, together with all buildings, appurtenances, fixtures, and improvements now or hereafter located thereon, including, without limitation, the Construction Improvements defined herein (each, a “Property” and collectively, the “Properties”). |

| | C. | Borrowers have requested that proceeds of the loan be used for, among other things, (i) completing the construction of Bluegrass Valley II Property and the Lehigh Valley II Property (collectively, the “Construction Improvements”), (ii) the General Uses (as hereinafter defined) and (iii) the Closing Date Uses (as hereinafter defined). |

NOW, THEREFORE, Borrower and Lender agree as follows:

ARTICLE 1. DEFINITIONS

| 1.1 | DEFINED TERMS. The following capitalized terms generally used in this Agreement shall have the meanings defined or referenced below. Certain other capitalized terms used only in specific sections of this Agreement are defined in such sections. |

“Account Funds” – means all sums now or hereafter on deposit in or payable or withdrawable from any of the Accounts.

“Accounts” – means the Collection Account, Lockbox Account, Operating Account, Security Deposit Account, any subaccounts created thereunder and all other accounts with Lender created hereunder and under the other Loan Documents from time to time.

“ADA”- means the Americans with Disabilities Act, 42 U.S.C. §§ 12101,et.seq., as now or hereafter amended or modified.

“Advisory Agreement” – mean that certain Management Services Agreement dated November 4, 2015, by and among Holdco, the Trust and DC Liquidating Trust Advisor LLC.

“Affiliate” or “affiliate”- means, as to any specified Person, (a) any Person that directly or indirectly through one or more intermediaries Controls or is Controlled by or is under common Control with such Person, (b) any Person owning or Controlling forty nine percent (49%) or more of the outstanding voting securities of or other ownership interests in such Person, (c) if such Person is an individual, an entity for which such Person directly or indirectly acts as an officer, director, partner, owner or member, (d) any entity in which such Person (together with the members of his family if the Person in question is an individual) owns, directly or indirectly through one or more intermediaries an interest in any class of stock (or other beneficial interest in such entity) of forty-nine percent (49%) or more, or (e) with respect to any Obligor, any other Obligor.

“Agreement”- has the meaning ascribed to such term in the preamble hereto.

“Allocated Loan Amount” – means the amount of the Loan allocated to each Property as set forth onSchedule 2.10. Upon any partial prepayment of the principal amount of the Loan pursuant to the terms of this Agreement, such prepaid amounts shall thereafter be allocated by Lender among the Properties pro rata (based on the Allocated Loan Amounts set forth for each Property) and shall reduce the same accordingly; provided that, upon a Partial Release pursuant toSection 2.12 or in connection with the application of insurance or condemnation proceeds, such prepaid amount shall first be applied to reduce in its entirety the Allocated Loan Amount with respect to the applicable Property released or subject to such insurance or condemnation proceeds, and then allocated pro rata among the remaining Properties.

“Applicable Law” – means all constitutions, statutes, rules, regulations and orders of any Governmental Authority, including all orders and decrees of all courts, tribunals and arbitrators applicable to each Borrower, Guarantor, each Property, or Lender, as the context requires.

“Appraisal” – means a written appraisal regarding a Property prepared in conformance with the requirements of FIRREA, as well as any other applicable rules and/or regulations from any and all applicable Governmental Authorities.

“Approved Lease Form” – means, subject toSection 9.4, the standard lease form approved by Lender prior to the Effective Date, as amended and approved by Lender from time to time thereafter.

“Approved Leases”- means any Lease that has been approved by Lender, such approval not to be unreasonably withheld, conditioned or delayed. A Lease shall be deemed, without Lender’s express approval thereof, to be an Approved Lease (a “Deemed Approved Lease”) if it is either: (i) a Lease existing as of the Effective Date, or (ii) satisfies the following requirements: (A) (1) it is on the Approved Lease Form without any material changes, including, without limitation, any material changes to the form estoppel, subordination, attornment and mortgagee protection provisions contained within the Approved Lease Form, or (2) it is on a lease form required by a national or other credit tenant provided that such form does not include any purchase option or expansion option rights in favor of the applicable tenant; (B) the tenant subject to such Lease is not an Affiliate of any Borrower or Guarantor; (C) the leased premises under such Lease is less than the greater of (1) 25,000 net rentable square feet and (2) twenty-five percent (25%) of the net rentable square feet of the building in which such premises is located; (D) such Lease has a lease term of at least thirty-six (36) months; and (E) such Lease has a Net Effective Rent at ninety percent (90%) or more of the Net Effective Rent used in the financial proforma contained in the Appraisal used by Lender in approving this Loan. Notwithstanding the foregoing, any Lease (including any renewals or material modifications or amendments) for all or any part of the Redlands Property and/or Cajon Property shall in all cases require the consent of Lender.

“Architect” – means, collectively, the Bluegrass Valley II Architect and the Lehigh Valley II Architect.

“Architect’s Agreement” – means, collectively, (i) with respect to the Bluegrass Valley II Property, the agreement for architectural services, dated February 10, 2015, by and between the Bluegrass Valley II Borrower and the Bluegrass Valley II Architect and (ii) with respect to the Lehigh Valley II Property, the agreement for architectural services to be entered into by and between the Lehigh Valley II Borrower and the Lehigh Valley II Architect.

“Bank of America Letters of Credit” – means one or more letters of credits or similar instructions currently issued by Bank of America, N.A. upon the application of a Borrower, upon which a Borrower is an account party or for which a Borrower is in any way liable, which letters of credit are more particularly set forth onSchedule 2.

“Bankruptcy Code”- means the Bankruptcy Reform Act of 1978 (11 U.S.C.§ 101-1330) as now or hereafter amended or recodified.

“Bluegrass Valley II Architect” – Randall-Paulson Architects, Incorporated.

“Bluegrass Valley II Borrower” – the Borrower that owns the Bluegrass Valley II Property.

“Bluegrass Valley II General Contractor” – The Conlan Company.

“Bluegrass Valley II Property” – means the Property more particularly described onExhibit A-11 attached hereto as being the “Bluegrass Valley II Property.”

“Borrower” – has the meaning ascribed to such term in the preamble hereto.

“Borrowers Cash Management Agreement” – means the Cash Management Agreement between Borrowers and Lender, dated as of the date hereof (as the same may be amended, restated, supplemented or modified from time to time).

“Borrowing Group” - means, individually and collectively: (a) each Borrower, (b) the Guarantor, and (c) any officer, director or other person or entity acting on behalf of any Borrower or Guarantor with respect to the Loan.

“Borrowers’ Equity Requirement”- means the equity contribution by Borrowers in an amount no less than One Hundred Four Million and No/100ths Dollars ($104,000,000.00).

“Borrowers’ Funds”- means all funds of Borrower deposited in the Borrowers’ Funds subaccount of the Guarantor Reserve Account pursuant to the terms of this Agreement.

“Business Day”- means any day, except a Saturday, Sunday or any other day on which commercial banks in New York, New York are authorized or required by law to close. Unless specifically referenced in this Agreement as a Business Day, all references to “days” shall be to calendar days.

“Cajon Property” – means the Property more particularly described onExhibit A-2 attached hereto as being the “Cajon Property.”

“Close-Out Agreements” – means any construction related agreements entered into by any Borrower (other than the Construction Borrowers) for which the work has been completed but for which all payments have not been made as of the Effective Date.

“Closing Date Uses” – shall mean the following purposes for which the Loan proceeds may be used in connection with the closing of the Loan: (i) the Spin-Off, (ii) certain fees, costs and expenses agreed to by Lender in connection with the closing of the Loan, (iii) the Special Distribution, (iv) funding the Guarantor Reserve Account and Master Operating Account in accordance with the terms of this Agreement, and (v) funding the L/C Cash Collateral Amount into the L/C Cash Collateral Account.

“Collateral” – has the meaning ascribed to such term in the applicable Security Instrument.

“Collection Account” – shall have the meaning given to such term in the Borrowers Cash Management Agreement.

“Commitment Amount” – has the meaning ascribed to such term inSection 2.1, as adjusted pursuant to the terms of this Agreement.

“Complete”, “Completed” or “Completion” - means completion of the Construction Improvements, which shall be deemed to have occurred, with respect to such portion thereof upon: (i) Lender’s receipt of a written statement or certificate executed by the applicable Architect designated or shown on the applicable Plans and Specifications approved by Lender certifying, without qualification or exception (other than punchlist items), that the applicable portion of the shell Construction Improvements are completed; (ii) Lender’s receipt of all temporary or permanent certificates of occupancy or other comparable governmental approvals which are required for the applicable portion of the Construction Improvements by the local government agency having jurisdiction and authority to issue such certificates of occupancy or other approvals; and (iii) the expiration of the statutory period(s) within which valid mechanic’s liens, materialman’s liens affidavits or notices may be recorded and/or served by reason of the construction or renovation of the applicable portion of the Construction Improvements, or, alternatively, Lender’s receipt of valid, unconditional releases thereof from the applicable General Contractor and all Material Subcontractors.

“Constituent Entity” – means any (i) member of any Borrower or Guarantor, and (ii) corporation, limited liability company, partnership, trust, or other type of business organization included in the signature for any Borrower or Guarantor that is contained in any of the Loan Documents or where consent, approval or other authorization is required for any Borrower’s or Guarantor’s execution of any Loan Documents.

“Construction Agreement” – means, as applicable: (i) with respect to the Bluegrass Valley II Property, the agreement for construction services, dated August 18, 2015, by and between the Bluegrass Valley II Borrower and the Bluegrass Valley II General Contractor, (ii) and with respect to the Lehigh Valley II Property, the agreement for construction services to be entered into by and between the Lehigh Valley II Borrower and the Lehigh Valley II General Contractor and (iii) any other construction agreements related to the construction of Tenant Improvements between Borrower, as the owner, and any Contractor.

“Construction Borrowers” – means the applicable Borrower that owns each of the Bluegrass Valley II Property and Lehigh Valley II Property.

“Construction Improvements” – has the meaning ascribed to such term in the Recitals.

“Construction Property” – shall mean each of the Bluegrass Valley II Property and the Lehigh Valley II Property.

“Construction Properties” – shall mean, collectively, the Bluegrass Valley II Property and the Lehigh Valley II Property.

“Contractor”- means a contractor, acceptable to Lender, who will construct all or any portion of the Tenant Improvements.

“Control” – means, with respect to any Person, (i) the ownership, directly or indirectly, of at least ten percent (10%) of the common equity interests in such Person and (ii) the possession, directly or indirectly, of the power to direct or cause the direction of the management (including the day-to-day management decisions) and policies of such Person whether through the ability to exercise voting power, by contract or otherwise.

“Deemed Approved Lease”- has the meaning ascribed to such term in the definition of “Approved Leases” inSection 1.1.

“Default”- has the meaning ascribed to such term inSection 11.1.

“DERM”- has the meaning ascribed to such term inSection 2.13(k).

“Design Professional”- means any architect or engineer which prepares any of the Plans and Specifications for any portion of the Construction Improvements or Tenant Improvements.

“Design Professional’s Agreement”- means each and every agreement by and between Borrower and each Design Professional.

“Determination Date” - means the last day of each calendar month during the term of the Loan.

“Developer”- means the Person engaged by each applicable Borrower, and who shall be acceptable to Lender, for the development of each Property.

“Development Agreement” – means each development agreement by and between each applicable Borrower and a Developer, the form and substance of which shall be acceptable to Lender.

“Development Agreement Subordination” – means a document or documents, in form and substance satisfactory to Lender, pursuant to which Developer acknowledges and agrees to the collateral assignment of the applicable Development Agreement to Lender and subordinates the Development Agreement to the applicable Security Instrument on terms and conditions reasonably satisfactory to Lender.

“Disbursement Instruction Agreement” – means a Disbursement Instruction Agreement in the form attached hereto asExhibit E, or on such other form as Lender and Borrower may agree upon from time to time.

“Dollars” or “$” – means the lawful currency of the United States of America.

“Effective Date”- means the earlier of (i) the date that the Loan proceeds are first released to, or for the benefit of, Borrowers, and (ii) the date the Security Instruments are recorded in each of the real property records of the counties where the Properties is located.

“Embargoed Person” - means any person, entity or country which is a sanctioned person, entity or country under U.S. law, including but not limited to, the International Emergency Economic Powers Act, 50 U.S.C. §§ 1701 et seq., The Trading with the Enemy Act, 50 U.S.C. App. 1 et seq., and any Executive Orders or regulations promulgated thereunder (including regulations administered by OFAC and the Specially Designated Nationals List maintained by OFAC) with the result that the investment in Borrower (whether directly or indirectly), is prohibited by, or the Loan made by Lender is in violation of, any applicable federal, state, county, municipal and other governmental statutes, laws, rules, orders, regulations, ordinances, judgments, decrees and injunctions affecting Borrower, the Property, or any part thereof, whether now or hereafter enacted and in force.

“Estimated Loan Amount Outstanding” – means if (i) the Projected Net Operating Income used in calculating the Outstanding Amount Debt Yield contains the rental income from tenants under Approved Leases who are not yet in occupancy of the leased premises and (ii) the Loan Budget contains unfunded allocations of tenant allowance and leasing commissions attributable to such Approved Leases which, in Lender’s discretion is anticipated to be disbursed pursuant to this Agreement, then Estimated Loan Amount Outstanding shall be calculated by (i) adding an amount equal to the unfunded allocations of tenant allowance and leasing commissions attributable to such Approved Leases for further disbursements in accordance with the Loan Budget to (ii) the then actual outstanding principal balance of the Note.

“ERISA” – has the meaning ascribed thereto inSection 9.2.

“Extended Maturity Date”- means November 3, 2018.

“Fee Letter” – means that certain letter agreement between DC Liquidating Assets Holdco LLC and Lender, dated August 24, 2015.

“FIRREA” – means the Financial Institutions Reform, Recovery, and Enforcement Act of 1989, as amended from time to time.

“GAAP”- means generally accepted accounting principles in the United States set forth in the statements and interpretations, as codified, of the Financial Accounting Standards Board or such other principles as may be approved by a significant segment of the accounting profession in the United States, that are applicable to the circumstances as of the date of determination, subject, however, to the matters addressed inSection 6.7.

“General Contractor” – means, collectively, the Bluegrass Valley II General Contractor and the Lehigh Valley II General Contractor.

“General Uses” – shall mean the following purposes for which the Loan proceeds may be used from and after the occurrence of the Spin-Off: financing the construction of the Construction Improvements, payment of any finishing costs with respect to the Properties (including, without limitation, amounts due under any Close-Out Agreements), general working capital, debt service, operating and carrying costs for the Properties, payment of Leasing Commissions for Approved Leases, construction of the Tenant Improvements and payment of fees due under the Management Agreements, the Development Agreements, or the Advisory Agreement.

“Gross Operating Income” – means the sum of any and all amounts, payments, fees, rentals, additional rentals, expense reimbursements (including, without limitation, all reimbursements by tenants, lessees, licensees and other users of the Properties), income, interest and other monies directly or indirectly received by or on behalf of or credited to Borrowers from any person with respect to Borrowers’ ownership, use, development, operation, leasing, franchising, marketing or licensing of the Properties, including, without limitation, from parking operations. Gross Operating Income shall be computed on a cash basis and shall include for each quarterly statement all amounts actually received in such quarter whether or not such amounts are attributable to a charge arising in such quarter.

“Governmental Authority” – means any nation or government, any federal, state, local, municipal or other political subdivision thereof or any entity exercising executive, legislative, judicial, regulatory or administrative functions of or pertaining to government.

“Guarantor” – means Holdco, a replacement guarantor as may be requested by Borrowers, subject to the approval of Lender in Lender’s sole and absolute discretion, and any other Person who, or

which, in any manner, is or becomes obligated to Lender under any guaranty now or hereafter executed in connection with respect to the Loan (collectively or severally as the context thereof may suggest or require).

“Guarantor Account Funds” – means all sums now or hereafter on deposit in or payable or withdrawable from any of the Master Operating Account or the Guarantor Reserve Account.

“Guarantor Cash Management Agreement” – means the Cash Management Agreement between Guarantor and Lender, dated as of the date hereof (as the same may be amended, restated, supplemented or modified from time to time).

“Guarantor Reserve Account” – shall have the meaning given to such term in the Guarantor Cash Management Agreement.

“Guaranty” – shall have the meaning given such term inExhibit B hereto.

“Hazardous Materials Indemnity Agreement” or“Indemnity – means that certain Hazardous Materials Indemnity Agreement (Unsecured) of even date herewith executed by and among Borrowers and Guarantor, each as Indemnitor, and Lender.

“Holdco”- means DC Liquidating Assets Holdco LLC, a Delaware limited liability company.

“IPT”- means Industrial Property Trust Inc., a Maryland corporation.

“In-Balance” – means, with respect to the Loan and each Construction Property, Lender’s determination from time to time that any undisbursed Loan funds together with all sums, if any, to be provided by Borrowers as shown in the Loan Budget for such Construction Property, shall be at all times equal to or greater than the amount which Lender from time to time reasonably determines necessary to: (i) pay, through Completion, all costs of development, construction, marketing and leasing of such Construction Property in accordance with the Loan Documents; (ii) pay all sums scheduled to accrue under the Loan Documents prior to repayment of the Loan; and (iii) perform and satisfy all of the covenants of Borrowers contained in the Loan Documents prior to repayment of the Loan.

“In-Balance Payments” – means all payments required from time to time underSection 4.15 hereof.

“Indemnitees” – means Lender, Lender’s parents, subsidiaries and affiliates, any holder of or participant in the Loan and all directors, officers, agents, successors and assigns of any of the foregoing.

“Indemnitor”- means the Borrowers and the Guarantor, and any other Person who, or which, in any manner, is or becomes obligated to Lender under any indemnity now or hereafter executed in connection with respect to the Loan (collectively or severally as the context thereof may suggest or require).

“Initial Disbursement” – means a disbursement of the proceeds in an amount equal to the aggregate amount of the Closing Date Uses.

“L/C Cash Collateral Account” – means the account held at Bank of America, N.A. into which the L/C Cash Collateral Amount will be deposited until the expiration of all Bank of America Letters of Credit.

“L/C Cash Collateral Amount” – means a maximum amount equal to ONE MILLION SIX HUNDRED FIFTY SIX THOUSAND FIVE HUNDRED THIRTY AND NO/100 DOLLARS ($1,656,530).

“Leases”- means all lease agreements of any Property, or any portion thereof, and all other agreements of any kind relating to the use or occupancy of any Property, or any portion thereof, and every renewal, modification or amendment thereof, whether now existing or entered into after the date hereof.

“Leasing Commissions”- means any and all commissions payable to independent third party real estate brokers who were involved in the execution of each Approved Lease after the Effective Date.

“Lehigh Valley II Architect” – means Ware Malcolm, the architect retained by the Lehigh Valley II Borrower with respect to the Construction Improvements relating to the Lehigh Valley II Property.

“Lehigh Valley II Borrower” – the Borrower that owns the Lehigh Valley II Property.

“Lehigh Valley II General Contractor” – means R.S. Mowery & Sons, Inc., the general contractor retained by the Lehigh Valley II Borrower with respect to the Construction Improvements relating to the Lehigh Valley II Property.

“Lehigh Valley I Property” – means the Property more particularly described onExhibit A-8 attached hereto as being the “Lehigh Valley I Property.”

“Lehigh Valley II Property” – means the Property more particularly described onExhibit A-9 attached hereto as being the “Lehigh Valley II Property.”

“Lender”- has the meaning ascribed to such term in the preamble hereto.

“Listing Agent”- means the Person engaged by each applicable Borrower, and who shall be acceptable to Lender (subject to the last sentence ofSection 9.11 herein), for the leasing of each Property.

“Listing Agreement” – means each listing agreement by and between each applicable Borrower and a Listing Agent, the form and substance of which shall be acceptable to Lender (subject to the last sentence ofSection 9.11 herein).

“Listing Agreement Subordination” – means a document or documents, in form and substance satisfactory to Lender, pursuant to which Listing Agent acknowledges and agrees to the collateral assignment of the applicable Listing Agreement to Lender and subordinates the Listing Agreement to the applicable Security Instrument on terms and conditions reasonably satisfactory to Lender.

“Loan”- means the principal sum that Lender agrees to lend and Borrowers agree to borrow pursuant to the terms and conditions of this Agreement, being ONE HUNDRED TWENTY MILLION AND NO/100 DOLLARS ($120,000,000.00).

“Loan Budget” – means the Loan Budget attached hereto asExhibit C, as the same may be amended, modified, supplemented or replaced from time to time.

“Loan Documents”- means those documents, as hereafter amended, supplemented, replaced or modified from time to time, properly executed and in recordable form, if necessary, listed inExhibit B as Loan Documents.

“Loan-to-Value Percentage”- has the meaning ascribed to such term inSection 2.13(f).

“Lockbox Account” – shall have the meaning given to such term in the Borrowers Cash Management Agreement.

“Major Subcontractor” – means any subcontractor or materialman having a contract value for any portion of the Construction Improvements in an amount of $500,000 or more.

“Management Agreement”- means each management agreement by and between each applicable Borrower and a Manager, the form and substance of which shall be acceptable to Lender.

“Management Agreement Subordination” – means a document or documents, in form and substance satisfactory to Lender, pursuant to which Manager acknowledges and agrees to the collateral assignment of a Management Agreement to Lender and subordinates the Management Agreement to the applicable Security Instrument on terms and conditions reasonably satisfactory to Lender.

“Manager”- means the Person or Persons engaged by each applicable Borrower, and who shall be acceptable to Lender, for the management, leasing and operation of each Property.

“Master Operating Account” – shall have the meaning given to such term in the Guarantor Cash Management Agreement.

“Material Contract” – means any contract (other than a Construction Contract, Development Agreement, Management Agreement, Advisory Agreement, and Leases) entered into by or on behalf of any Borrower relating to the leasing, ownership, management, use, operation, maintenance or repair of any Property with a duration of more than twelve (12) months (unless terminable on thirty (30) or fewer days notice) or with annual payments in excess of One Hundred Thousand Dollars ($100,000).

“Material Adverse Effect”- means a material adverse effect upon (i) the business or financial position or results of operation of the Borrowers taken as a whole, (ii) the ability of the Borrowers to perform, or of Lender to enforce, the Loan Documents taken as a whole, (iii) the Properties taken as a whole or the aggregate values thereof, or (iv) the ability of the Guarantor to perform under the guaranties taken as a whole given in connection with the Loan; provided, however, that for purposes of Section 2.13(i) only, the foregoing (i) through (iv) shall be determined on the basis of the results and status of each Borrower, Property and/or guaranty (as applicable) individually and not on an aggregate basis.

“Maturity Date”- means the Original Maturity Date or the Extended Maturity Date, as applicable.

“Miami III Borrower” – the Borrower that owns the Miami III Property.

“Miami III Property” – means the Property more particularly described onExhibit A-3 attached hereto as being the “Miami III Property.”

“Net Effective Rent”- means, as for any Lease on a square foot basis, the annualized base rent payable under such Lease, as reduced for any amounts paid by Borrower directly to or on behalf of the tenant for the purpose of inducing the tenant to enter into such Lease, including, without limitation, an excessive tenant improvement allowance (for purposes of tenant improvements, any amount in excess of 110% of the budgeted tenant improvements allowance in the most recent Appraisal delivered to Lender shall be deemed excessive), moving expenses, free rent periods or abatements or lease buyouts, as amortized over the life of the Lease.

“Net Sales Proceeds” – means, in the case of a Transfer of a Property, the gross sales price of such Property net of the amount of any disposition fees payable under the Advisory Agreement, good faith estimated tax distributions to the beneficial owners of the Holdco or Trust, out-of-pocket legal fees, title and recording tax expenses, commissions and other customary fees and expenses actually incurred by or on behalf of a Person in connection therewith and paid or payable to any Person other than an Affiliate of any Borrower (except in the case of disposition

fees under the Advisory Agreement and good faith estimated tax distributions);provided, that the aggregate amount of such fees, expenses, and distributions shall not exceed 6% of the gross sales price of such Property.

“NFA”- has the meaning ascribed to such term inSection 2.13(k).

“Note”- means that certain Promissory Note of even date herewith, in the original principal amount of the Loan, executed by each Borrower and payable to the order of Lender, as hereafter amended, supplemented, replaced or modified.

“Obligor” means any Borrower or Guarantor.

“OFAC” – means the United States Treasury Department Office of Foreign Assets Control and any successor thereto.

“Operating Account” – shall have the meaning given to such term in the Borrowers Cash Management Agreement.

“Option to Extend”- means Borrowers’ option, subject to the terms and conditions ofSection 2.13, to extend the term of the Loan from the Original Maturity Date to the Extended Maturity Date.

“Original Maturity Date”- means November 3, 2017.

“Other Related Documents”- means those documents, as hereafter amended, supplemented, replaced or modified from time to time, properly executed and in recordable form, if necessary, listed inExhibit B as Other Related Documents.

“Outstanding Amount Debt Yield” - means as of the applicable Determination Date, the Projected Net Operating Income of the Properties for the applicable six (6) month period commencing from the date immediately succeeding such applicable Determination Date, which amount shall be annualized by multiplying by two (2), divided by the Estimated Loan Amount Outstanding, with such fraction expressed as a percentage.

“Permitted Debt” means (a) unsecured non-interest bearing ordinary course obligations, including trade payables or other accruals, incurred in connection with Borrowers’ ordinary course of business that: (i) do not exceed two percent (2%) of the outstanding balance of the Loan; (ii) are not evidenced by a note; (iii) must be paid within sixty (60) days; and (iv) are otherwise expressly permitted under the Loan Documents, (b) the Bank of America Letters of Credit, and (c) deferred payment of fees due under the Management Agreements, the Development Agreements, or the Advisory Agreement.

“Permitted Transfer” – means a Transfer permitted underSection 9.18(b) orSection 9.19(b).

“Person” – means any individual, sole proprietorship, corporation, general partnership, limited partnership, limited liability company, joint venture, association, joint-stock company, bank, trust, land trust, estate, association, joint stock company, unincorporated organization, any federal, state, county or municipal government (or any agency or political subdivision thereof), endowment fund or any other form of entity. With respect to any Sanctioned Person, “Person” shall also include any group, sector, territory or country.

“Plans and Specifications”- means any and all plans and specifications prepared by each applicable Architect for the construction of the Construction Improvements and by each of the other Design Professionals for the construction of the Tenant Improvements heretofore or hereafter delivered to and approved by Lender, as amended in order to comply with the terms and conditions of this Agreement.

“Prohibited Equity Transfer”- has the meaning ascribed to such term inSection 9.14(a).

“Prohibited Property Transfer”- has the meaning ascribed to such term inSection 9.13(a).

“Projected Net Operating Income” – means the in-place, forward net operating income for the applicable future periods of determination based on executed Approved Leases that are executed as of or prior to such date of determination and are or will be effective during such future projected period of determination. Net operating income shall be (a) the actual rental payments to be received from Approved Leases in each Property in accordance with GAAP, including any rental loss insurance proceeds, if applicable, (but modified to exclude the straight line recognition of rents and mark to market adjustments);plus (b) the estimated expense reimbursements to be received;plus (c) any and all other normal and recurring income from each Property to be received;minus (d) projected operating expenses (no less than the then current appraisal estimates, subject to reasonable adjustment by Lender to conform to Lender’s standard practices) of each Property determined in accordance with GAAP (excluding any interest or principal payments on the Loan, any allowance for depreciation, any similar non-cash accrual expenses, leasing costs and expenses, and any actual capital expenditures or tenant improvement costs or allowances) payable in the ordinary course of business;provided,however, that such operating expenses shall include (i) property management fees equal to the greater of (A) the property management fees used in the financial proforma in the then most recent Appraisal approved by Lender, (B) the actual amount of property management fees, and (C) the amount equal to three percent (3%) (prorated on an annual basis) of the amounts set forth inclauses (a),(b) and(c) above for such applicable period; (ii) annual project reserves equal to the greater of (A) the reserves used in the financial proforma in the then most recent Appraisal obtained and approved by Lender, and (B) the sum of $0.05 per rentable square feet per year in the Properties and (iii) normalized customary expenses that are typically paid once or twice per calendar year, including, without limitation real property taxes and insurance premiums. For the avoidance of doubt, revenue set forth above inclauses (a),(b) and(c) shall exclude any concessions provided to a tenant under an Approved Lease for the purpose of inducing such tenant to enter into such Approved Lease (including, without limitation, an excessive tenant improvement allowance, moving expenses, free rent periods or abatements or lease buyouts). For purposes of determining Projected Net Operating Income, the following shall not be, or shall cease to be, an Approved Lease: (1) a Lease where the tenant is or becomes insolvent or seeks bankruptcy protection; (2) a Lease where a material default has occurred and is continuing; or (3) a Lease that has been terminated prior to or is scheduled to be terminated or expires during the applicable six (6) month period immediately following an applicable Determination Date for calculating such Projected Net Operating Income.

“Property” or “Properties”- has the meaning ascribed to such term in the Recitals.

“Property Level Budget” - means each of the Property specific loan budgets attached hereto asExhibit I, as the same may be amended, modified, supplemented or replaced from time to time.

“Recourse Guaranty” – shall have the meaning given such term inExhibit B hereto.

“Redlands Property” – means the Property more particularly described onExhibit A-1 attached hereto as being the “Redlands Property.”

“Restricted Party” - shall mean each of (i) Borrower, (ii) Guarantor and (iii) any Constituent Entity of Borrower owning twenty percent (20%) or more of the ownership interests of Borrower.

“Sanction” or “Sanctions” - means individually and collectively, respectively, any and all economic or financial sanctions, sectoral sanctions, secondary sanctions, trade embargoes and anti-terrorism laws, including but not limited to those imposed, administered or enforced from time to time by: (a) the United States of America, including those administered by the OFAC, the U.S. State Department, the U.S. Department of Commerce, or through any existing or future Executive Order, (b) the United Nations Security Council, (c) the European Union, (d) the United Kingdom, or (e) any other governmental authorities with jurisdiction over any Person within the Borrowing Group.

“Sanctioned Person” - means any Person that is a target of Sanctions, including without limitation, a Person that is: (a) listed on OFAC’s Specially Designated Nationals and Blocked Persons List; (b) listed on OFAC’s Consolidated Non-Specially Designated Nationals List; (c) a legal entity that is deemed by OFAC to be a Sanctions target based on the ownership of such legal entity by Sanctioned Peron(s); or (d) a Person that is a Sanctions target pursuant to any territorial or country-based Sanctions program.

“Security Deposit Account”- has the meaning ascribed to such term inSection 9.8.

“Security Instruments” – mean each mortgage, deed to secure debt, deed of trust or other security instrument executed by a Borrower in favor, and for the benefit, of Lender, relating to each Property, as the same may be amended, modified, supplemented or replaced from time to time.

“Separateness Provisions” - has the meaning ascribed to such term inSection 7.1(c).

“Special Distribution” – means a special distribution of a portion of the Loan proceeds by Borrowers to Holdco and its direct and indirect owners, including, without limitation, the beneficial owners of the Trust.

“Spin-Off” – means the spin-off of Holdco from IIT Real Estate Holdco LLC, a Delaware limited liability company substantially concurrently with the Effective Date, resulting in (a) one hundred percent (100%) of the common membership interests in Holdco being owned by the Trust, (b) one hundred percent (100%) of the special membership interests being owned by DCG Retained Properties Special Member LLC, a Delaware limited liability company and (c) the direct or indirect interests in the Properties being contributed to Holdco.

“Subdivision Map”- shall have the meaning ascribed to such term inSection 9.6.

“Swap Agreement” – means a “swap agreement” as defined in Section 101 of the Bankruptcy Code, entered into by Borrowers and Lender (or with another financial institution which is reasonably acceptable to Lender), together with all modifications, extensions, renewals and replacements thereof.

“Tenant Improvements”- means each Lender approved tenant improvements requested by a Borrower with respect to such Borrower’s obligations therefor under an Approved Lease;providedhowever, that no tenant improvements in connection with a Deemed Approved Lease shall require Lender approval.

“TI/LC Expenses”- has the meaning ascribed to such term inSection 3.7.

“Title Company”- means (i) with respect to the Lehigh Valley I Property and the Lehigh Valley II Property, First American Title Insurance Company and (ii) with respect to all other Properties, Stewart Title Guaranty Company.

“Title Policy”- means the standard ALTA promulgated form of Loan Policy of Title Insurance as issued by the applicable Title Company.

“Transfer”- means any sale, installment sale, exchange, mortgage, pledge, hypothecation, assignment, encumbrance or other transfer, conveyance or disposition, whether voluntarily, involuntarily or by operation of law or otherwise (excluding Leases permitted under this Agreement).

“Trust”- means DC Industrial Liquidating Trust, a Maryland statutory trust.

“UCC” - means the Uniform Commercial Code in effect from time to time in the state where a Borrower is organized and where a Property is located, as applicable, as now or hereafter amended or modified.

“Unpaid Advisory Fees”- has the meaning ascribed to such term inSection 9.6.

ARTICLE 2. LOAN

| 2.1 | LOAN. Subject to the terms of this Agreement, Lender agrees to lend to Borrowers and Borrowers agree to borrow from Lender the principal sum of up to One Hundred Twenty Million and No/100ths Dollars ($120,000,000.00) (the “Commitment Amount”); said sum to be evidenced by the Note. This Loan is not a revolving credit line, and no payments or credits shall increase the maximum amount of advances available from the Loan. The Loan shall bear interest and be repaid in accordance with the provisions of the Note. |

| 2.2 | PURPOSE. Amounts disbursed to or on behalf of Borrower pursuant to the Note shall be used (i) in connection with the closing of the Loan, the Closing Date Uses and (ii) from and after the occurrence of the Spin-Off, the General Uses, and for such other purposes and uses as may be permitted under this Agreement and the other Loan Documents. |

| 2.3 | GRANT OF SECURITY INTEREST IN REAL PROPERTY. The Note shall be secured, in part, by the Security Instruments encumbering certain real property and improvements as described therein. |

| 2.4 | GRANT OF SECURITY INTEREST IN ACCOUNTS; APPLICATION OF FUNDS. As security for payment of the Loan and the performance by Borrowers of all other terms, conditions and provisions of the Loan Documents, each Borrower, as debtor, hereby pledges and assigns to Lender, and grants to Lender a security interest in, all of such Borrower’s right, title and interest in and to all Accounts. No Borrower shall, without obtaining the prior written consent of Lender, further pledge, assign or grant any security interest in any of the Accounts, or permit any lien to attach thereto, or any levy to be made thereon, or any UCC Financing Statements to be filed thereon, except those naming Lender as the secured party, to be filed with respect thereto. This Agreement is, among other things, intended by the parties to be a security agreement for purposes of the UCC. Upon the occurrence and during the continuance of a Default, Lender may apply all or any part of the Account Funds against the amounts outstanding under the Loan in any order and in any manner as Lender shall elect in Lender’s sole discretion without seeking the appointment of a receiver and without adversely affecting the rights of Lender to foreclose the liens and security interests securing the Loan or exercise its other rights under the Loan Documents. The Account Funds shall not constitute trust funds and may be commingled with other monies held by Lender. All interest, if any, which accrues on the Account Funds and Guarantor Account Funds shall be at a rate established by Lender, which may or may not be the highest rate then available, shall accrue for the benefit of Borrowers or Guarantor, as applicable, and shall be taxable to Borrowers and shall be added to and disbursed in the same manner and under the same conditions as the principal sum on which said interest accrued. Upon repayment in full of Borrowers’ obligations under the Loan Documents, all remaining Account Funds, if any, shall be disbursed to Borrowers within ten (10) Business Days. |

| 2.5 | ADDITIONAL SECURITY INTEREST. Each Borrower hereby grants and assigns to Lender a security interest, to secure payment and performance of all obligations, in all of such Borrower’s right, title and interest, now or hereafter acquired, to the payment of money from Lender to such Borrower under any Swap Agreement. |

| 2.6 | LOAN FEE. Borrowers shall pay to Lender a loan fee as set forth in, and in accordance with, the Fee Letter. |

| 2.7 | LOAN DOCUMENTS. Borrowers shall deliver to Lender concurrently with this Agreement each of the documents, each properly executed and in recordable form, as applicable, described inExhibit B as Loan Documents, together with those documents described inExhibit B as Other Related Documents. |

| 2.8 | EFFECTIVE DATE. The effective date of the Loan Documents shall be the Effective Date. |

| 2.9 | MATURITY DATE. All sums due and owing under this Agreement and the other Loan Documents shall be repaid in full on the Maturity Date. All payments due to Lender under this Agreement, whether at the Maturity Date or otherwise, shall be paid in Dollars, in immediately available funds. |

| 2.10 | PREPAYMENT. The Loan is prepayable in full or in part at any time, without a prepayment penalty;providedhowever, that any partial or full repayment of the Loan will be subject to payment of termination fees on any outstanding Swap Agreement or LIBOR contract. If the outstanding principal balance of the Loan ever exceeds the maximum amount of the Loan, then all such amounts shall nonetheless be evidenced by the Note, guaranteed by any applicable guaranty granted in connection with the Loan and secured by the Security Instrument;provided,however, Borrowers shall, within five (5) Business Days after Lender’s demand or any Borrower’s earlier discovery of such advance, pay to Lender an amount equal to such excess principal amount and accrued but unpaid interest thereon. |

| 2.11 | FULL REPAYMENT AND RECONVEYANCE, SATISFACTION OR RELEASE. Upon receipt of all sums owing and outstanding under the Loan Documents, and the full performance of all other obligations secured by the Security Instrument, Lender shall reconvey, satisfy or release the Properties from the lien of the Security Instruments and terminate any assignment of leases and rents and UCC Financing Statements related to the Collateral;provided,however, that all of the following conditions shall be satisfied at the time of, and with respect to, such reconveyance, satisfaction or release: (a) Lender shall have received all escrow, closing and recording costs, the costs of preparing and delivering such reconveyance, satisfaction or release, the payment of any and all sums then due and payable under the Loan Documents, and the full payment and performance of all other obligations secured by the Security Instrument, including, without limitation, those set forth in the Note and the Security Instrument; and (b) Lender shall have received a written release satisfactory to Lender of any set aside letter, letter of credit or other form of undertaking which Lender has issued to any surety, governmental agency or any other party in connection with the Loan and/or the Properties. Lender’s obligation to make further disbursements under the Loan shall terminate as to any portion of the Loan undisbursed as of the date of issuance of such reconveyance, satisfaction or release, and any commitment of Lender to lend any undisbursed portion of the Loan shall be cancelled. Any repayment shall be without prejudice to Borrowers’ obligations under any Swap Agreement between any Borrower and Lender, which shall remain in full force and effect subject to the terms of such Swap Agreement (including provisions that may require a reduction, modification or early termination of a swap transaction, in whole or in part, in the event of such repayment, and may require Borrowers to pay any fees or other amounts for such reduction, modification or early termination), and no such fees or amounts shall be deemed a penalty hereunder or otherwise. |

| 2.12 | PARTIAL RELEASES. At any time prior to the Maturity Date, upon Borrowers’ request, Lender shall issue a partial release (the “Partial Release”) from the lien of a Security Instrument with respect to any Property;provided,however, that prior to or simultaneously with any such partial release all of the following conditions shall be satisfied: |

| | (a) | Borrower shall have provided Lender with not less than twenty (20) days prior written notice (for the avoidance of doubt, any such notice is revocable by written notice to Lender from the Borrowers given at any time prior to a Partial Release provided Borrower reimburses Lender for its reasonable costs and expenses (if any) actually incurred in connection with the consummation of such partial release (e.g. costs or preparing release documents)) of the consummation of a refinancing, sale or transfer with respect to such Property; |

| | (b) | No Default shall exist (unless such Default shall be cured by the Partial Release requested); |

| | (c) | Borrower shall have executed, or caused the execution of, all such documents and instruments as reasonably requested by Lender in connection with the Partial Release; |

| | (d) | Lender shall have received any and all sums then due and payable under the Loan Documents, and the full payment and performance of all other obligations then due and secured by the applicable Security Instrument, including, without limitation, those set forth in the Note and such Security Instrument, together with all escrow, closing and recording costs, the costs of preparing and delivering such partial reconveyance, satisfaction or release and the cost of any title insurance endorsements required by Lender, including, without limitation, a partial reconveyance or release endorsement; |

| | (e) | For each Property to be released, Lender shall have received a release price (the “Release Price”) for such Property either (a) the greater of an amount equal to (1) one hundred percent (100%) of the Net Sales Proceeds received by Borrower upon any sale or transfer of such Property, and (2) one hundred sixty-five percent (165%) of the Allocated Loan Amount for such Property, or (b) such other amount agreed to in writing by Lender prior such release; |

| | (f) | Any Release Price shall be applied to the principal of the Loan and may not be reborrowed. If, after such application, any portion of the Release Price exceeds the outstanding principal balance of the Loan and Borrower has not otherwise satisfied the outstanding obligations under the Loan Documents and terminated all undisbursed commitments, such excess shall be deposited into the Guarantor Reserve Account; and |

| | (g) | Following Lender’s receipt of a certification from Borrowers affirming that the conditions set forth in this Section have been satisfied (including, without limitation, attached calculations demonstrating compliance withsubsection (e)) and the release of a Property in accordance with this Section, Lender will release the Borrower who owns or owned such released Property from its obligations under this Agreement, the Loan Documents and the Other Related Documents. Notwithstanding the release of any Borrower pursuant to thisSection 2.12(g), such Borrower shall continue to be liable for all obligations which expressly survive the release, satisfaction or cancellation of the Note or any obligations under the Loan Documents. |

Neither the acceptance of any payment nor the issuance of any Partial Release by Lender shall affect Borrowers’ (other than any Borrower released in accordance with thisSection 2.12) obligation to repay all amounts owing under the Loan Documents or under the lien of any Security Instrument on the remainder of the Properties which are not reconveyed, satisfied or released. Any partial prepayment shall be without prejudice to Borrower’s obligations under any Swap Agreement between Borrowers and Lender which shall remain in full force and effect subject to the terms of such Swap Agreement (including provisions that may require a reduction, modification or early termination of a swap transaction, in whole or in part, in the event of such

prepayment, and may require Borrowers to pay any fees or other amounts for such reduction, modification or early termination), and no such fees or amounts shall be deemed a penalty hereunder or otherwise;

| 2.13 | OPTION TO EXTEND. Borrowers shall have the option to extend the term of the Loan from the Original Maturity Date, to the Extended Maturity Date, upon satisfaction (or waiver by Lender in writing) of each and every one of the following conditions precedent: |

| | (a) | Borrowers shall provide Lender with written notice of Borrowers’ request to exercise the Option to Extend in the form attached hereto asExhibit H not more than one hundred twenty (120) days but not less than forty-five (45) days prior to the Original Maturity Date. |

| | (b) | As of the date of Borrowers’ delivery of notice of request to exercise the Option to Extend, and as of the Original Maturity Date, no Default shall have occurred and be continuing, and Borrowers shall so certify in writing. |

| | (c) | Section 4.2 hereunder shall be satisfied as of the Original Maturity Date. |

| | (d) | Borrowers shall execute or cause the execution of all documents reasonably required by Lender to exercise the Option to Extend (including, without limitation, a certification by Borrowers that all conditions precedent for the extension have been satisfied) and shall deliver to Lender, at Borrowers’ sole cost and expense, such title insurance endorsements required underSection 2.13(g) below. |

| | (e) | Borrowers shall pay to Lender an extension fee in the amount of twenty-five one-hundredths of one percent (0.25%) of the Commitment Amount, less any unfunded amounts being cancelled and/or principal payments previously made or concurrently made in order to satisfy the Loan-to-Value Percentage requirement and the Outstanding Amount Debt Yield minimum requirement, pursuant toSection 2.13(h), for the extension, payable in full concurrently with the execution of all documents contemplated inSection 2.13(d) above. |

| | (f) | If required by Lender, at least twenty (20) days prior to the Original Maturity Date, Lender shall have received, at Borrowers’ sole expense, an Appraisal (subject to review and reasonable adjustment by Lender to conform to Lender’s standard practices), confirming to the satisfaction of Lender that (i) (x) the then outstanding principal balance of the Note plus (y) the amount of any unfunded TI/LC Expenses to be funded from the Loan proceeds in connection with Leases taken into account when determining the “as-is” market value In the Appraisalasapercentageof (ii) the applicable appraised value of the Properties and Improvements then subject to Security Instruments, in the aggregate, does not exceed fifty percent (50%) of the “as-is” market value (“Loan-to-Value Percentage”) as of the Original Maturity Date;provided,however, in the event such as-is market value is not adequate to meet the requiredLoan-to-Value Percentage, then Borrower shall pay down the outstanding principal balance of the Loan such that said requiredLoan-to-Value Percentage shall be met on or before the the Original Maturity Date. The valuation date of each Appraisal shall be within sixty (60) days of each applicable reference date specified above. Any principal balance reduction shall reduce the Commitment Amount by a like amount and may not be reborrowed. |

| | (g) | Lender shall have received a date-down endorsement and other endorsements amending the mechanic’s and materialmen’s lien coverage and, if applicable, deleting the pending disbursements clause and such other endorsements reasonably required by Lender, in form and content satisfactory to Lender. |

| | (h) | As of the Determination Date immediately prior to the Original Maturity Date, Lender shall have received and approved projected financial statements and supporting documents demonstrating that the Outstanding Amount Debt Yield for the Properties then subject to Security Instruments equals or exceeds ten percent (10%). If the Outstanding Amount Debt Yield as so calculated for such Properties does not equal or exceed such minimum percent threshold, then Borrowers shall pay down the outstanding principal balance of the Loan such that the recalculated Outstanding Amount Debt Yield shall equal or exceed ten percent (10%) on or before the Original Maturity Date. Any principal balance reduction shall reduce the Commitment Amount by a like amount and may not be reborrowed. |

| | (i) | Borrowers shall have commenced construction of the Construction Improvements on the Lehigh Valley II Property or the Lehigh Valley II Property shall have been subject to a Partial Release and no longer subject to a Security Instrument. |

| | (j) | There shall have occurred no Material Adverse Effect in the financial condition of any Borrower or Guarantor from that which existed as of the later of: (A) the Effective Date or (B) the date upon which the financial condition of such party was first represented to Lender. |

| | (k) | If the Miami III Property has not otherwise been released in accordance withSection 2.12 prior to the Original Maturity Date, Borrowers shall have either (i) (x) delivered to Lender evidence of the satisfaction of all requirements set forth in the letter dated January 30, 2015 from Miami-Dade County Department of Regulatory and Economic Resources (“DERM”) to the Miami III Borrower,and (y) obtained a no further action letter (or such reasonably similar letter actually provided by DERM (as hereinafter defined), the “NFA”) with respect to the Miami III Property,or (ii) obtained the release of the Miami III Property by delivering to Lender a release price for the Miami III Property equal to one hundred sixty-five percent (165%) of the Allocated Loan Amount for the Miami III Property (for avoidance of doubt, the Miami III Property may be released in accordance withSection 2.12 at any time prior to the Original Maturity Date, and the foregoing clause (ii) shall only apply if the Miami III Property has not otherwise been released prior to the Original Maturity Date in accordance withSection 2.12). |

Except as modified by this Option to Extend, the terms and conditions of this Agreement and the other Loan Documents as modified and approved by Lender shall remain unmodified and in full force and effect.

| 2.14 | RECOURSE. The Loan shall be full recourse to each Borrower and all of its assets, whether now owned or hereafter acquired or in which any Borrower otherwise has an interest, and all proceeds thereof. |

ARTICLE 3. DISBURSEMENT

| | (a) | Lender’s obligation to close the Loan transaction contemplated by this Agreement shall be subject to Borrowers’ compliance with and/or satisfaction (as the context so requires) of (or waiver by the Lender thereof in writing), each of the following conditions precedent, in each case, to the satisfaction of Lender in its reasonable discretion: |

| | (i) | Receipt and approval by Lender of an executed original of this Agreement, each of the Loan Documents, the Other Related Documents and any and all other documents, instruments, policies and forms of evidence or other materials which are required pursuant to this Agreement, each in form and content acceptable to Lender; |

| | (ii) | There shall exist no Default, as defined in this Agreement, or Default as defined in any of the other Loan Documents or in the Other Related Documents; |

| | (iii) | Each Security Instrument shall constitute a valid lien upon the respective Property covered by such Security Instrument, and shall be prior and superior to all other liens and encumbrances thereon except those approved by Lender in writing (including, without limitation, all exceptions under any Lender’s Title Policy approved by Lender in connection with closing); |

| | (iv) | Lender has received and approved in form and substance satisfactory to Lender: |

| | 1. | UCC, judgment lien and federal tax lien searches with respect to each Borrower and Guarantor, in the state/county in which each such party is organized; |

| | 2. | all authorizations and permits which are then procurable and required by any Applicable Laws in connection with the zoning and use of each Property; |

| | 3. | a current survey of each Property meeting American Land Title Association (“ALTA”) standards, certified to Lender, and the Title Company, showing the boundaries of such Property by courses and distances, together with a corresponding metes and bounds description, the actual or proposed location of all improvements, encroachments and restrictions, the location and width of all easements, utility lines, rights-of-way and building set-back lines, and notes referencing book and page numbers for the instruments granting the same; |

| | 4. | Borrowers shall have fulfilled the insurance requirements underArticle 5 of this Agreement and Lender and its consultants shall have approved the same; |

| | 5. | Title Policies, together with any endorsements which Lender may require, insuring the principal amount of the Loan and the validity and the priority of the lien of the Security Instruments upon each Property, subject only to matters approved by Lender in writing; |

| | 6. | evidence satisfactory to Lender that no Property is located within the 100-year flood plain or identified as a special flood hazard area as defined by the Federal Insurance Administration, or if any portion of a Property is so located within the 100-year flood plain or identified as a special flood hazard area, evidence that flood insurance is in effect; |

| | 7. | opinions of counsel for Borrowers and Guarantor satisfactory to Lender, dated as of the date of the first advance hereunder and relating to such matters with respect to this Agreement and the transaction contemplated hereby as Lender may request; |

| | 8. | with respect to each Borrower and Guarantor: (A) copies certified as true and complete of the following documents from the applicable Governmental Authority: (1) the articles or certificate of incorporation, certificate of formation, certificates of trust, or certificate of limited |

| | partnership, as applicable; and (2) good standing certificates or certificates of existence from the jurisdictions in which each Borrower and Guarantor is organized and/or qualified to do business dated not more than thirty (30) days prior to the date of this Agreement and (B) true and complete copies of the by-laws, partnership agreement, trust agreement or operating agreement, as applicable, of each Borrower and Guarantor, certified as of the date of this Agreement as complete and correct copies thereof by the Secretary or an Assistant Secretary, general partner, manager or other authorized representative reasonably acceptable to Lender, of each Borrower and Guarantor; |

| | 9. | resolutions, in form and substance satisfactory to Lender, of each Borrower, Guarantor and such other Persons as Lender may request, authorizing the execution, delivery and performance of the Loan Documents and Other Related Documents to which such Person is a party and the transactions contemplated thereby, certified as of the date of this agreement by the Secretary or an Assistant Secretary, general partner, manager or other authorized representative reasonably acceptable to Lender, of such Person, which certificates shall state that the resolutions thereby certified have not been amended, modified, revoked or rescinded; |

| | 10. | a copy of any existing leases, management agreement, development agreement, maintenance agreement or brokerage agreement; |