Exhibit 99.2

B RILEY FINANCIAL FBR -&Co.- Merger Announcement February 21, 2017

Forward-Looking Statements Forward-Looking Statements This communication may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause B. Riley Financial’s or FBR’s performance or achievements to be materially different from any expected future results, performance, or achievements. Forward-looking statements speak only as of the date they are made and neither B. Riley Financial nor FBR assume any duty to update forward looking statements. We caution readers that a number of important factors could cause actual results to differ materially from those expressed in, or implied or projected by, such forward-looking statements. Such forward-looking statements include, but are not limited to, statements about the benefits of the merger involving B. Riley Financial and FBR, including future financial and operating results, the combined company’s plans, objectives, expectations and intentions and other statements that are not historical facts. The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: (i) the possibility that the merger does not close when expected or at all because required regulatory, stockholder or other approvals and other conditions to closing are not received or satisfied on a timely basis or at all; (ii) changes in B. Riley’s share price before closing; (iii) lower FBR earnings and/or higher FBR transaction and other expenses that result in a shortfall in the funds available for distribution by FBR in the special dividend; (iv) the risk that the benefits from the transaction may not be fully realized or may take longer to realize than expected, including as a result of changes in general economic and market conditions, interest and exchange rates, monetary policy, laws and regulations and their enforcement, and the degree of competition in the geographic and business areas in which B. Riley Financial and FBR operate; (v) the ability to promptly and effectively integrate the businesses of B. Riley Financial and FBR; (vi) the reaction to the transaction of the companies’ customers, employees and counterparties; (vii) diversion of management time on merger-related issues; and (viii) other risks that are described in B. Riley’s and FBR’s public filings with the SEC. For more information, see the risk factors described in each of B. Riley’s and FBR’s Annual Reports on Form10-K, Quarterly Reports on Form10-Q and other filings with the SEC. No Offer or Solicitation This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. B RILEY FINANCIAL FBR -&Co.- 1

Important Additional Information Additional Information about the Merger and Where to Find It Stockholders are urged to carefully review and consider each of B. Riley Financial’s and FBR’s public filings with the SEC, including but not limited to their Annual Reports on Form10-K, their proxy statements, their Current Reports on Form8-K and their Quarterly Reports on Form10-Q. In connection with the proposed transaction, B. Riley Financial will file with the SEC a Registration Statement on FormS-4 that will include a Joint Proxy Statement of B. Riley Financial and FBR and a Prospectus of B. Riley Financial (the “Joint Proxy/Prospectus”), as well as other relevant documents concerning the proposed transaction. Stockholders of B. Riley Financial and FBR are urged to carefully read the Registration Statement and the Joint Proxy/Prospectus regarding the transaction in their entirety when they become available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. A definitive Joint Proxy/Prospectus will be sent to the stockholders of B. Riley Financial and FBR. The Joint Proxy/Prospectus and other relevant materials (when they become available) filed with the SEC may be obtained free of charge at the SEC’s Website at http://www.sec.gov. FBR AND B. RILEY FINANCIAL STOCKHOLDERS ARE URGED TO READ THE JOINT PROXY/PROSPECTUS AND THE OTHER RELEVANT MATERIALS BEFORE VOTING ON THE TRANSACTION. Investors will also be able to obtain these documents, free of charge, from FBR by accessing FBR’s website at www.fbr.com under the tab “Investor Relations” or from B. Riley Financial at www.brileyfin.com under the tab “Investor Relations.” Copies can also be obtained, free of charge, by directing a written request to B. Riley Financial, Attention: Corporate Secretary, 21255 Burbank Boulevard, Suite 400, Woodland Hills, California 91367 or to FBR, Attention: Corporate Secretary, 1300 North Seventeenth Street, Arlington, Virginia 22209. Participants in Solicitation B. Riley Financial and FBR and their directors and executive officers and certain other persons may be deemed to be participants in the solicitation of proxies from the stockholders of FBR or B. Riley Financial in connection with the merger. Information about the directors and executive officers of B. Riley Financial and their ownership of B. Riley Financial’s common stock, par value $0.0001 per share is set forth in the proxy statement for B. Riley Financial’s 2016 annual meeting of stockholders, as filed with the SEC on a Schedule 14A on April 19, 2016. Information about the directors and executive officers of FBR and their ownership of FBR’s common stock, par value $0.001 per share is set forth in the proxy statement for FBR’s 2016 annual meeting of shareholders, as filed with the SEC on a Schedule 14A on April 9, 2016. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the Joint Proxy/Prospectus regarding the merger when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph. B RILEY FINANCIAL FBR -&Co.- 2

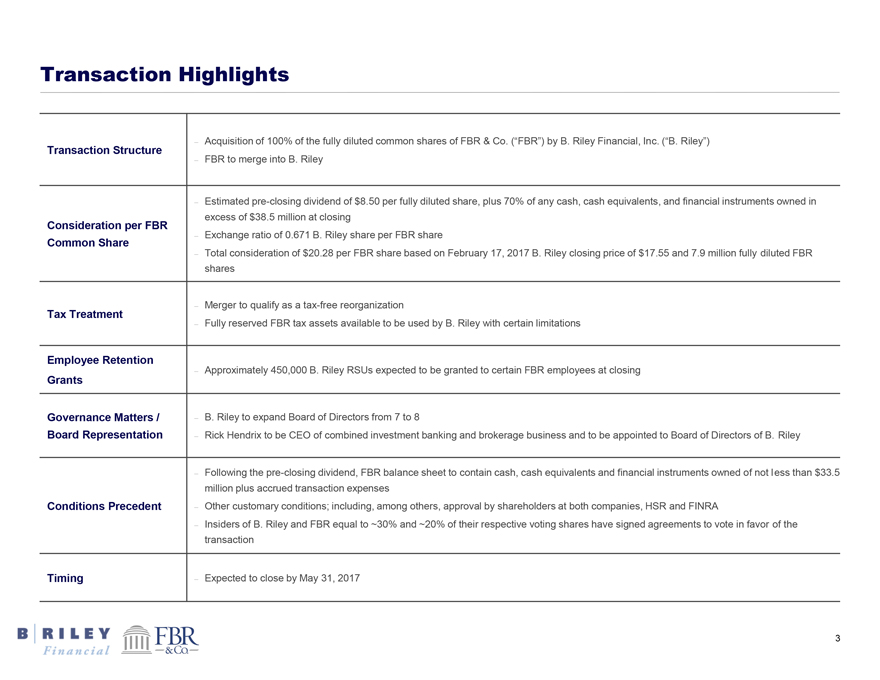

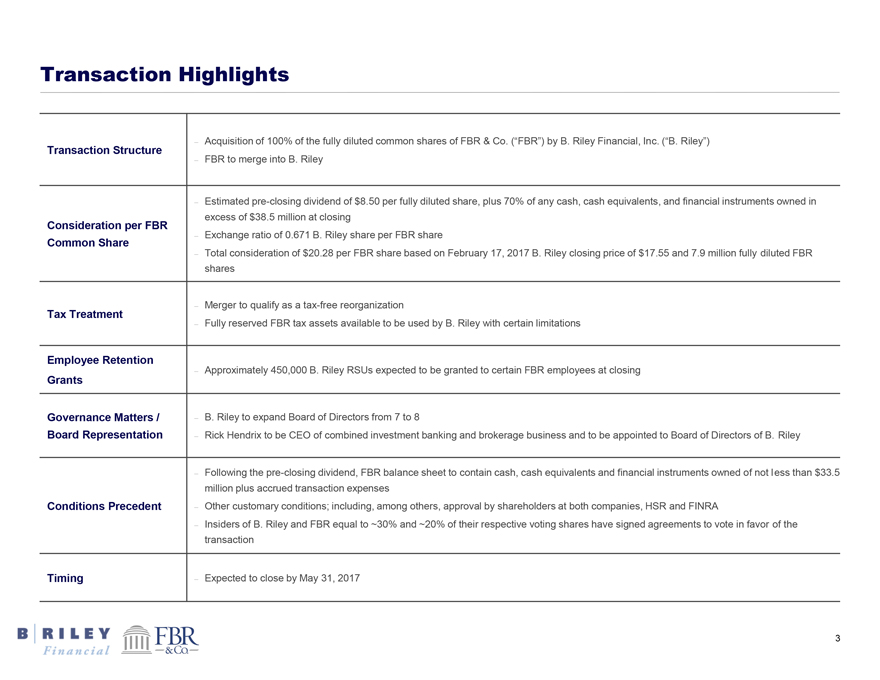

Transaction Highlights

– Acquisition of 100% of the fully diluted common shares of FBR & Co. (“FBR”) by B. Riley Financial, Inc. (“B. Riley”)

Transaction Structure

– FBR to merge into B. Riley

– Estimatedpre-closing dividend of $8.50 per fully diluted share, plus 70% of any cash, cash equivalents, and financial instruments owned in excess of $38.5 million at closing

Consideration per FBR – Exchange ratio of 0.671 B. Riley share per FBR share

Common Share – Total consideration of $20.28 per FBR share based on February 17, 2017 B. Riley closing price of $17.55 and 7.9 million fully diluted FBR shares

– Merger to qualify as atax-free reorganization

Tax Treatment

– Fully reserved FBR tax assets available to be used by B. Riley with certain limitations

Employee Retention

– Approximately 450,000 B. Riley RSUs expected to be granted to certain FBR employees at closing

Grants

Governance Matters / – B. Riley to expand Board of Directors from 7 to 8

Board Representation – Rick Hendrix to be CEO of combined investment banking and brokerage business and to be appointed to Board of Directors of B. Riley

– Following thepre-closing dividend, FBR balance sheet to contain cash, cash equivalents and financial instruments owned of not less than $33.5 million plus accrued transaction expenses

Conditions Precedent

– Other customary conditions; including, among others, approval by shareholders at both companies, HSR and FINRA

– Insiders of B. Riley and FBR equal to

30% and 20% of their respective voting shares have signed agreements to vote in favor of the transaction Timing

– Expected to close by May 31, 2017

B RILEY FINANCIAL FBR —&Co.—3

Compelling and Highly Complementary Strategic Combination

The merger of B. Riley and FBR creates a global leader in business services, financial advisory and investment banking

Diversified business mix producing steady, predictable results through market cycles with multiplebig-ticket, high-margin revenue streams

Leading small cap focused investment banking and advisory platform

One of the world’s largest ABL appraisal practices provides steady cash flow; auction and liquidation business provides meaningful upside opportunities

Principal investments business focused on attaining high IRRs in areas aligned with core expertise

Strong cultural fit combining two entrepreneurial financial services firms

Clearly realizable revenue and cost synergies

Strong pro forma financial profile with increased capital base

Pro forma 2016E Revenue of $325mm(1)

(1) Pro forma revenue includes combined results of FBR & Co. and estimate for B. Riley Financial, Inc. including pro forma United Online Communications segment for full calendar year 2016.

B RILEY FINANCIAL FBR —&Co.—4

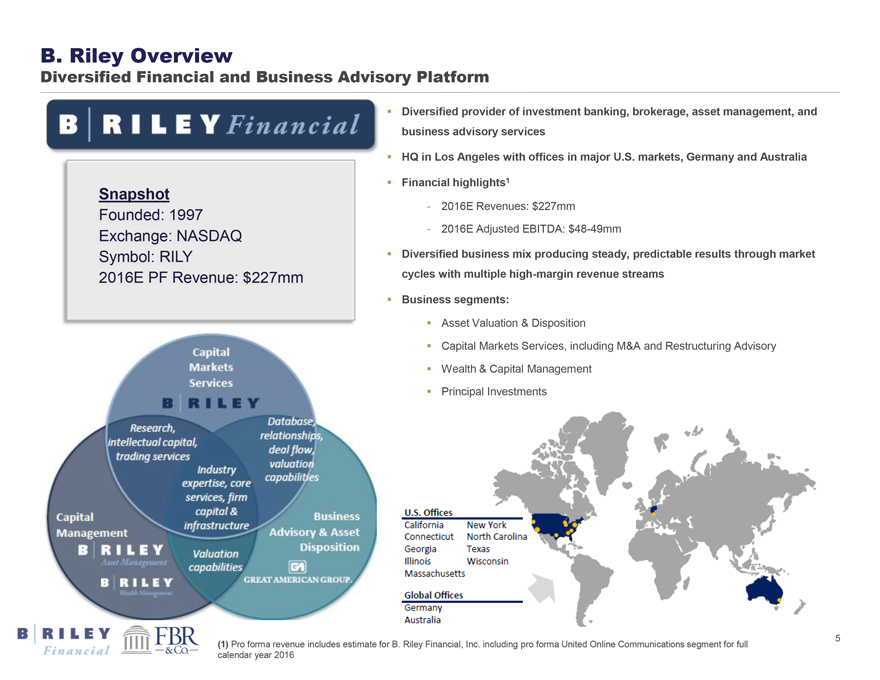

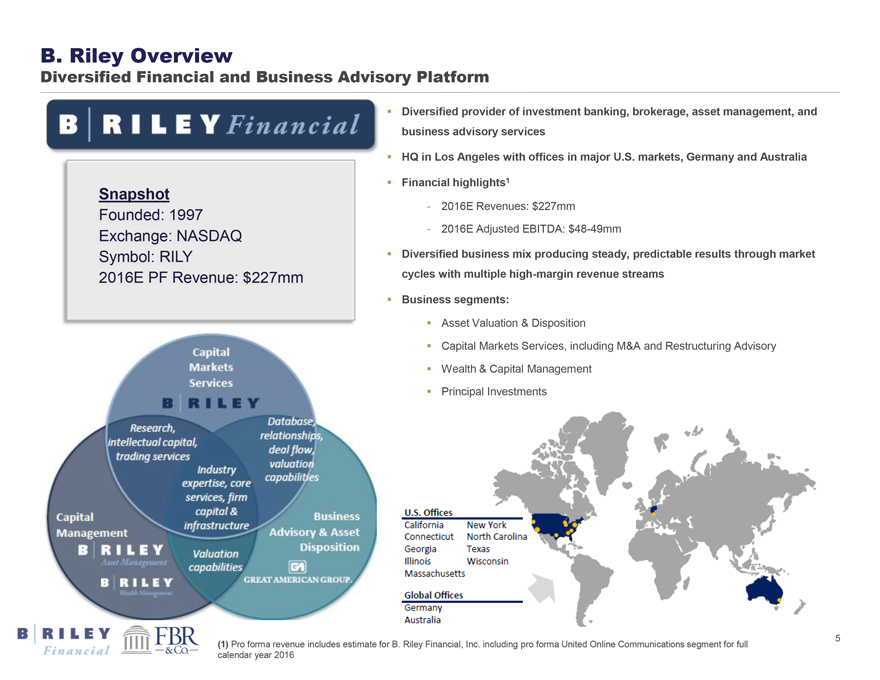

B. Riley Overview Diversified Financial and Business Advisory Platform

B RILEY FINANCIAL Snapshot Founded: 1997 Exchange: NASDAQ Symbol: RILY 2016E PF Revenue: $227mm

Capital markets services B RILEY Research, intellectual capital trading services

Database relationships deal flow, valuation capabilities Industry expertise, core services, firm capital & infrastructure

Capital management B RILEY Asset Management B RILEY Valuation capabilities

Business Advisory & asset disposition GREAT AMERICAN GROUP.

Diversified provider of investment banking, brokerage, asset management, and business advisory services

HQ in Los Angeles with offices in major U.S. markets, Germany and Australia

Financial highlights1

- 2016E Revenues: $227mm

- 2016E Adjusted EBITDA:$48-49mm

Diversified business mix producing steady, predictable results through market cycles with multiple high-margin revenue streams

Business segments: Asset Valuation & Disposition

Capital Markets Services, including M&A and Restructuring Advisory

Wealth & Capital Management Principal Investments

(1) Pro forma revenue includes estimate for B. Riley Financial, Inc. including pro forma United Online Communications segment for full calendar year 2016 U.S. Offices California Connecticut Georgia Illinois Massachusetts New York North Carolina Texas Wisconsin Global Offices Germany Australia B RILEY FINANCIAL FBR —&Co.—5

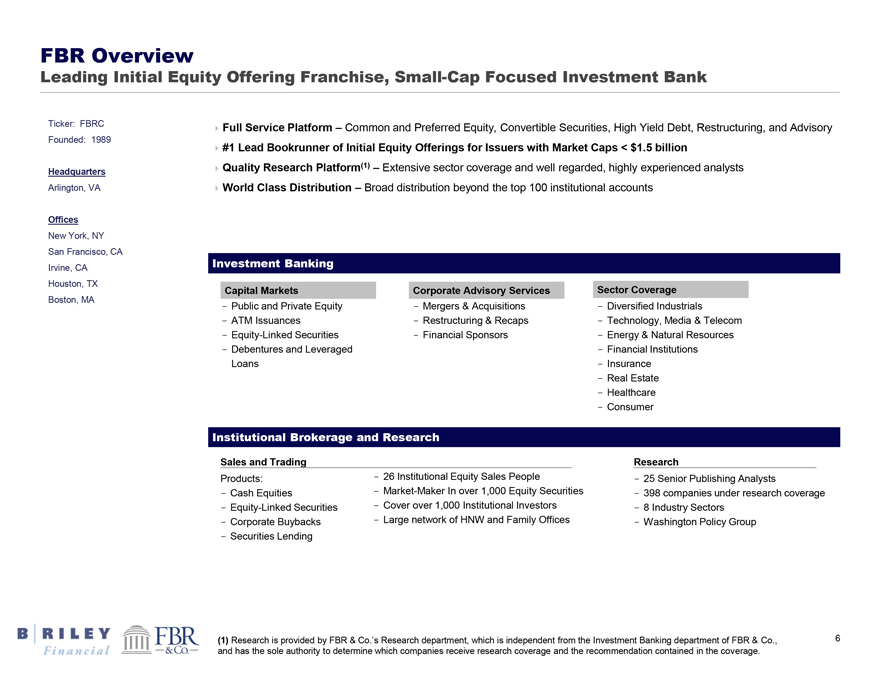

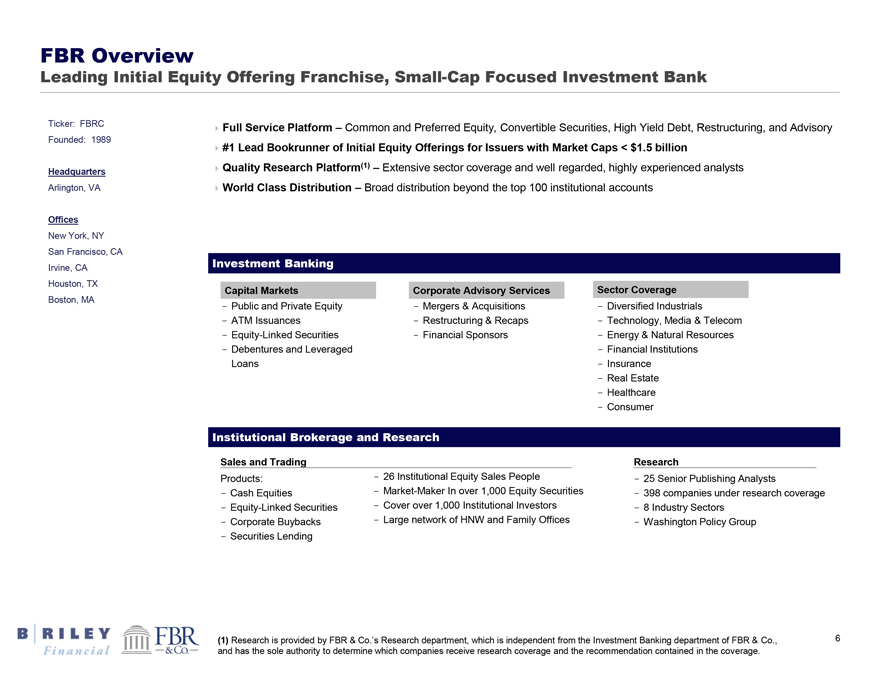

FBR Overview

Leading Initial Equity Offering Franchise,Small-Cap Focused Investment Bank

Ticker: FBRC

Founded: 1989 Headquarters Arlington, VA

Offices New York, NY San Francisco, CA Irvine, CA Houston, TX Boston, MA

Full Service Platform – Common and Preferred Equity, Convertible Securities, High Yield Debt, Restructuring, and Advisory

#1 Lead Bookrunner of Initial Equity Offerings for Issuers with Market Caps < $1.5 billion

Quality Research Platform(1) – Extensive sector coverage and well regarded, highly experienced analysts

World Class Distribution – Broad distribution beyond the top 100 institutional accounts

Investment Banking Capital Markets

- Public and Private Equity - ATM Issuances - Equity-Linked Securities - Debentures and Leveraged Loans

Corporate Advisory Services - Mergers & Acquisitions - Restructuring & Recaps - Financial Sponsors

Sector Coverage - Diversified Industrials - Technology, Media & Telecom - Energy & Natural Resources - Financial Institutions

- Insurance - Real Estate - Healthcare - Consumer

Institutional Brokerage and Research

Sales and Trading

Products: - Cash Equities - Equity-Linked Securities - Corporate Buybacks - Securities Lending - 26 Institutional Equity Sales People - Market-Maker In over 1,000 Equity Securities - Cover over 1,000 Institutional Investors

- Large network of HNW and Family Offices Research - 25 Senior Publishing Analysts

- 398 companies under research coverage - 8 Industry Sectors - Washington Policy Group

(1) Research is provided by FBR & Co.’s Research department, which is independent from the Investment Banking department of FBR & Co., and has the sole authority to determine which companies receive research coverage and the recommendation contained in the coverage.

B RILEY FINANCIAL FBR —&Co.—6

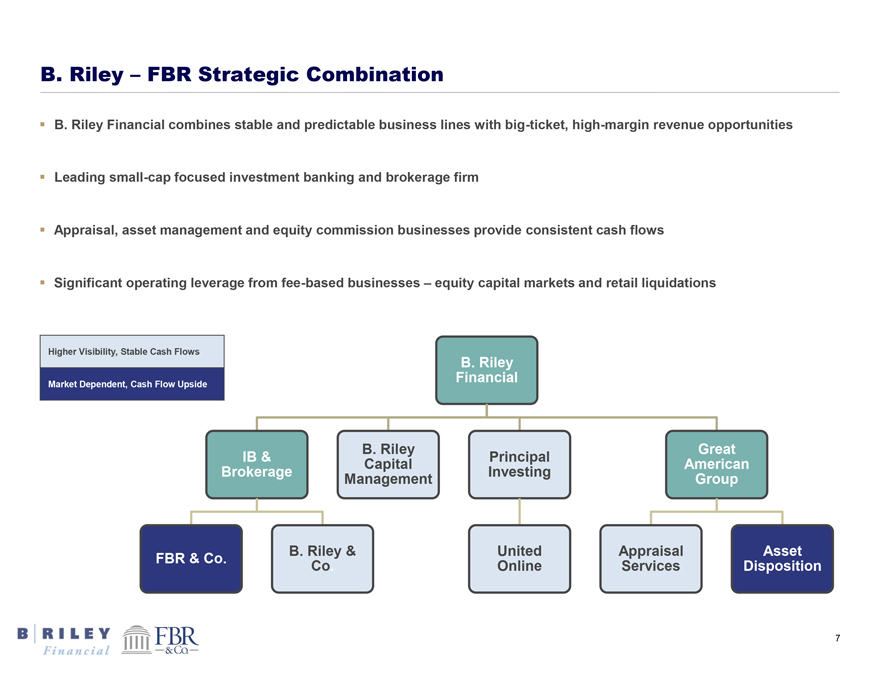

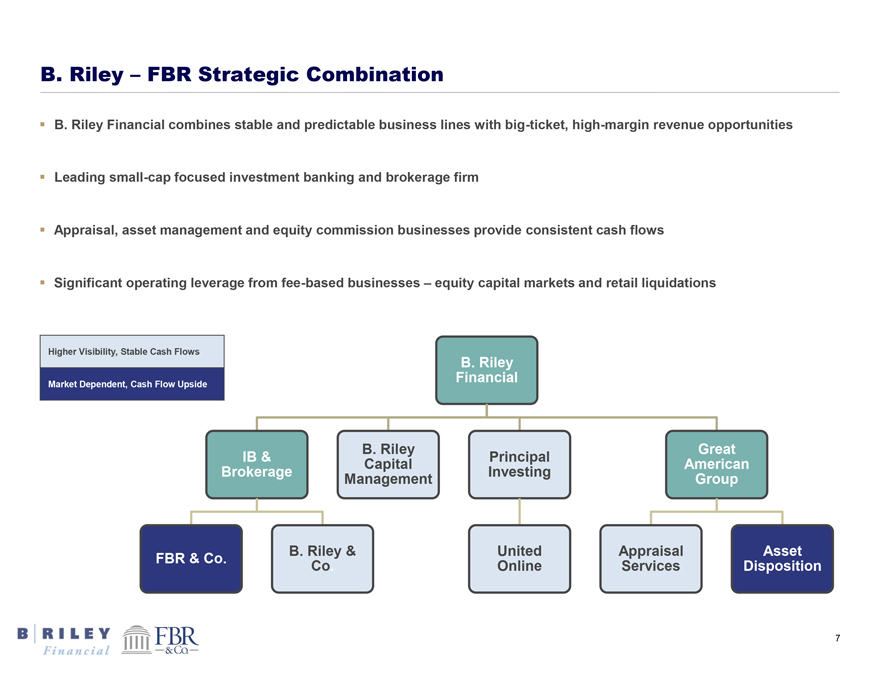

B. Riley – FBR Strategic Combination

B. Riley Financial combines stable and predictable business lines with big-ticket, high-margin revenue opportunities

Leading small-cap focused investment banking and brokerage firm

Appraisal, asset management and equity commission businesses provide consistent cash flows

Significant operating leverage from fee-based businesses – equity capital markets and retail liquidations

Higher Visibility, Stable Cash Flows

Market Dependent, Cash Flow Upside

B. Riley Financial

IB & Brokerage

B. Riley Capital Management

Principal Investing

Great American Group

FBR & Co.

B. Riley & Co.

United Online

Appraisal Services

Asset Disposition

B RILEY FINANCIAL FBR & Co. 7

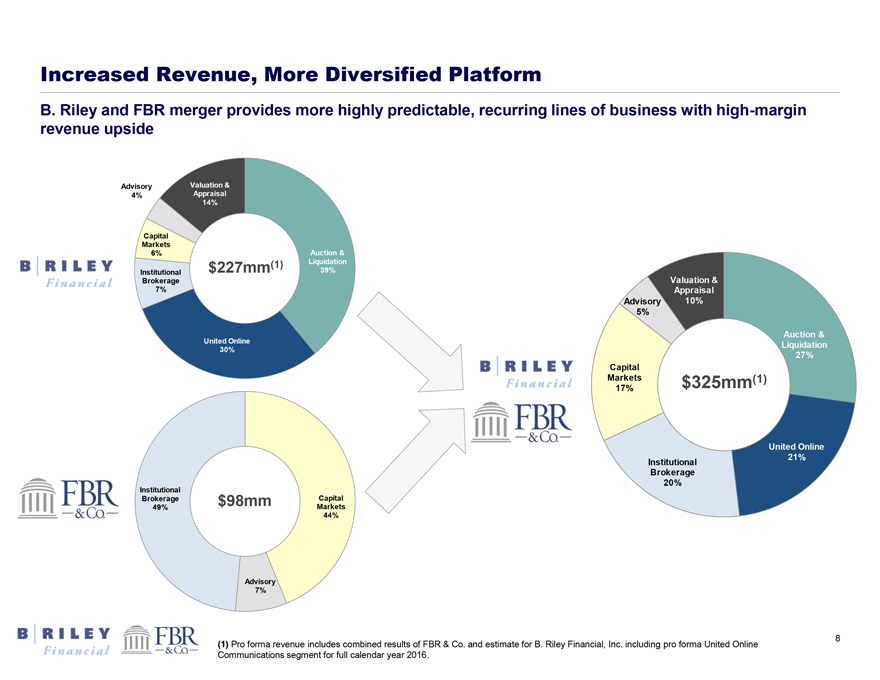

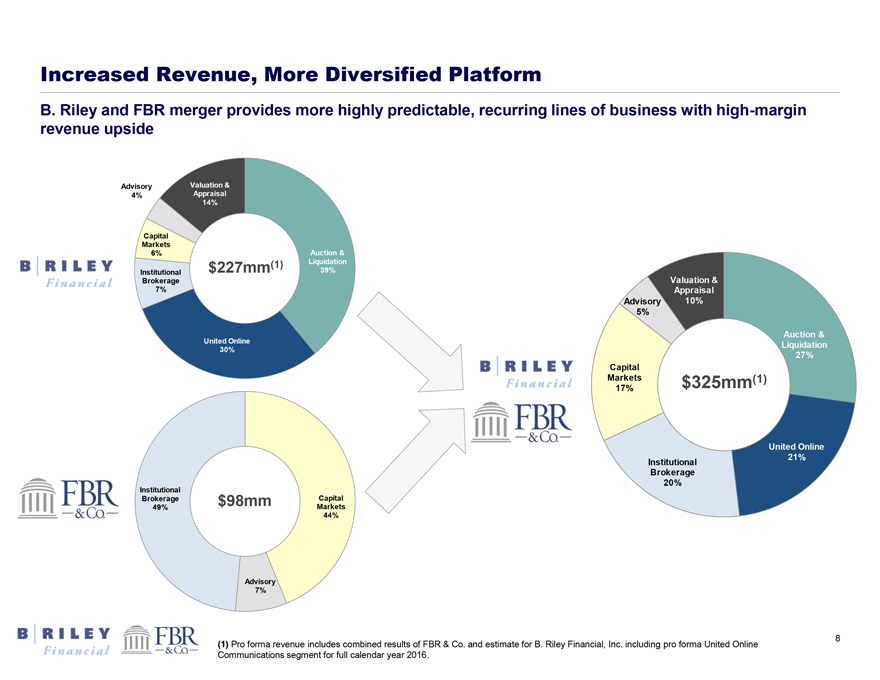

Increased Revenue, More Diversified Platform

B. Riley and FBR merger provides more highly predictable, recurring lines of business with high-margin revenue upside

B RILEY FINANCIAL

Advisory 4%

Valuation & Appraisal 14%

Capital Markets 6%

$227mm(1)

Auction & Liquidation 39%

Institutional Brokerage 7%

United Online 30%

B RILEY FINANCIAL FBR & Co.

Advisory 5%

Valuation & Appraisal 10%

Auction & Liquidation 27%

Capital Markets 17%

$325mm(1)

Institutional Brokerage 20%

United Online 21%

FBR & Co.

Institutional Brokerage 49%

$98mm

Capital Markets 44%

Advisory 7%

(1) Pro forma revenue includes combined results of FBR & Co. and estimate for B. Riley Financial, Inc. including pro forma United Online Communications segment for full calendar year 2016.

B RILEY FINANCIAL FBR & Co. 8

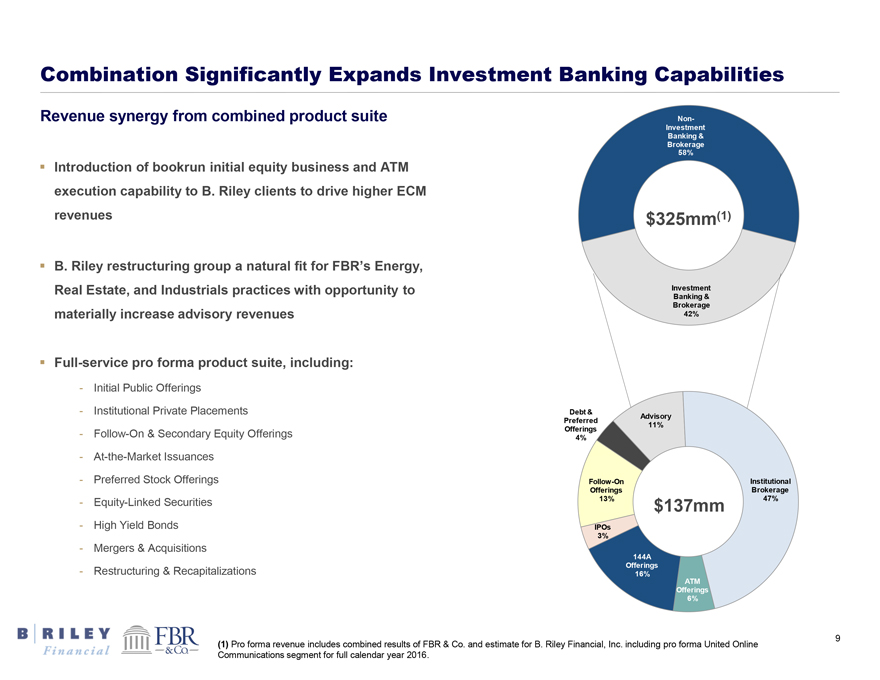

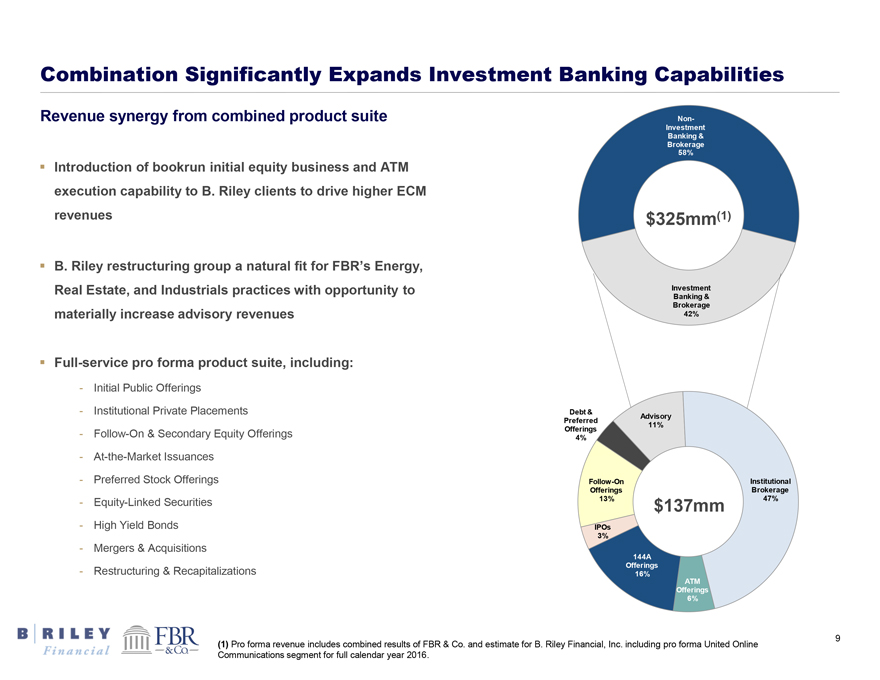

Combination Significantly Expands Investment Banking Capabilities

Revenue synergy from combined product suite

Introduction of bookrun initial equity business and ATM execution capability to B. Riley clients to drive higher ECM revenues

B. Riley restructuring group a natural fit for FBR’s Energy,

Real Estate, and Industrials practices with opportunity to materially increase advisory revenues

Full-service pro forma product suite, including:

- Initial Public Offerings

- Institutional Private Placements

-Follow-On & Secondary Equity Offerings

-At-the-Market Issuances

- Preferred Stock Offerings

- Equity-Linked Securities

- High Yield Bonds

- Mergers & Acquisitions

- Restructuring & Recapitalizations

Non- Investment Banking & Brokerage 58%

$325mm(1)

Investment Banking & Brokerage 42%

Debt & Preferred Offerings 4% Advisory 11%

Follow-On Offerings 13% IPOs 3% $137mm Institutional Brokerage 47%

144A Offerings 16%

ATM Offerings 6%

(1) Pro forma revenue includes combined results of FBR & Co. and estimate for B. Riley Financial, Inc. including pro forma United Online Communications segment for full calendar year 2016.

B RILEY FINANCIAL FBR & Co. 9

Complementary Institutional Brokerage Platforms The combined Company will be a top provider ofsmall-cap research coverage B RILEY Financial FBR -& Co.- 210 Consumer 32% Diversified Industrials 6% Healthcare 7% TMT 55% 398 Energy & Natural Resources 20% Financial Services & RealEstate 31% Insurance 5% Consumer 11% Diversified Industrials 13% Healthcare 12% TMT 8% 591 Energy & Natural Resources 13% Financial Services & RealEstate 20% Insurance 3% Consumer 18% Diversified Industrials 11% Healthcare 10% TMT 25% 591 combined companies under coverage - 210 covered by B. Riley’s 20 publishing analysts - 398 covered by FBR’s 25 publishing analysts - 17 overlapping names, representing 3% overlap Both firms specialize in small andmid-cap coverage - Median market cap in B. Riley’s coverage: $663mm - Median market cap in FBR’s coverage: $1.7b Branded B. Riley Discovery and FBR Washington Policy Groups further differentiate a tightly focusedsmall-cap platform Expanded geographic distribution reach with significant operations on the East and West coasts Minimal institutional client overlap to broaden distribution - 883 aggregate clients with only 11% overlap - $53mm in pro forma commissions with ~7% overlap B RILEY Financial FBR -& Co.- Notes: 17 overlapping companies. Motor Vehicle Components and Medical Technology classified as Diversified Industrials and Healthcare, respectively. 10

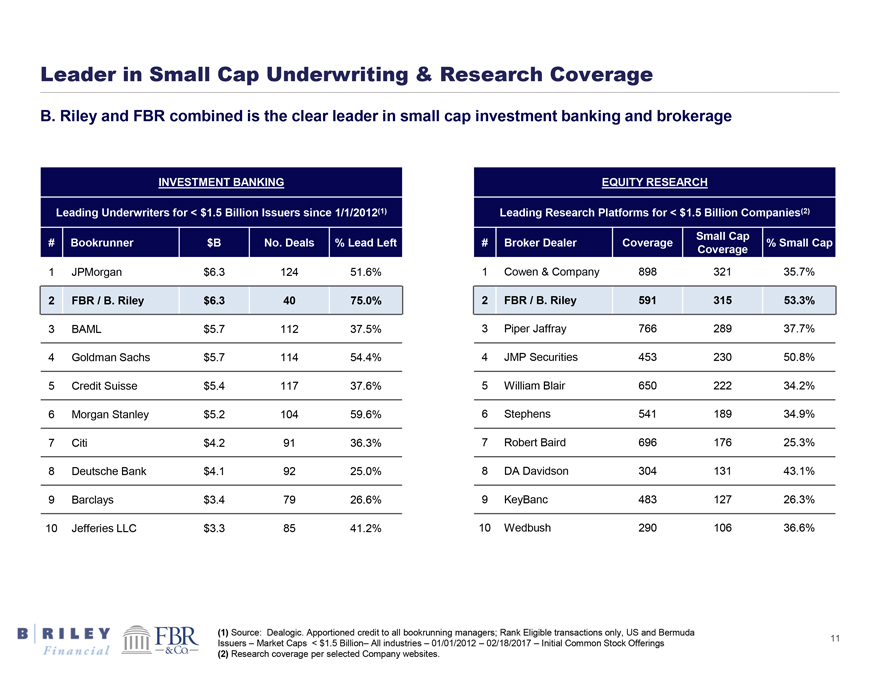

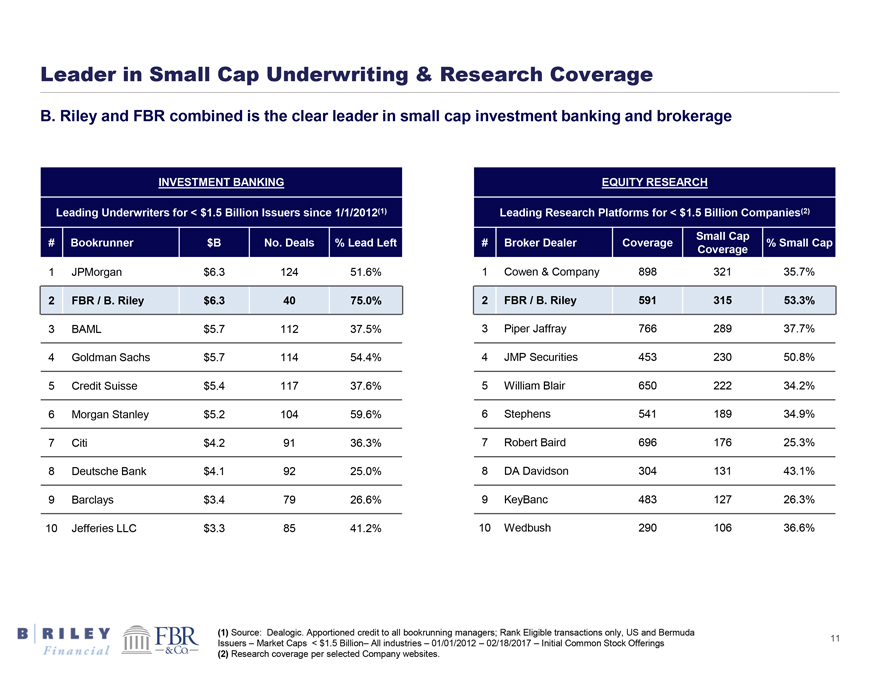

Leader in Small Cap Underwriting & Research Coverage

B. Riley and FBR combined is the clear leader in small cap investment banking and brokerage

INVESTMENT BANKING

EQUITY RESEARCH

Leading Underwriters for < $1.5 Billion Issuers since 1/1/2012(1)

Leading Research Platforms for < $1.5 Billion Companies(2)

Small Cap # Bookrunner $B No. Deals % Lead Left # Broker Dealer Coverage % Small Cap Coverage 1

JPMorgan $6.3 124 51.6% 1 Cowen & Company 898 321 35.7% 2 FBR / B. Riley $6.3 40 75.0% 2 FBR / B. Riley 591 315 53.3% 3 BAML $5.7 112 37.5% 3 Piper Jaffray 766 289 37.7% 4 Goldman Sachs $5.7 114 54.4% 4 JMP Securities 453 230 50.8% 5 Credit Suisse $5.4 117 37.6% 5 William Blair 650 222 34.2% 6 Morgan Stanley $5.2 104 59.6% 6 Stephens 541 189 34.9% 7 Citi $4.2 91 36.3% 7 Robert Baird 696 176 25.3% 8 Deutsche Bank $4.1 92 25.0% 8 DA Davidson 304 131 43.1% 9 Barclays $3.4 79 26.6% 9 KeyBanc 483 127 26.3% 10 Jefferies LLC $3.3 85 41.2% 10 Wedbush 290 106 36.6% B RILEY Financial FBR -& Co.- (1) Source: Dealogic. Apportioned credit to all bookrunning managers; Rank Eligible transactions only, US and Bermuda Issuers – Market Caps < $1.5 Billion– All industries – 01/01/2012 – 02/18/2017 – Initial Common Stock Offerings (2) Research coverage per selected Company websites. 11

B. Riley Business Segments

Great American – Retail Liquidations and Industrial Auctions

Retail Liquidations

Four decades of experience helping clients liquidate and realize returns from excess inventories & underperforming assets Network of 150+ consultants deployed on aproject-by-project basis to execute liquidations

Participated in liquidations involving $25b+ in aggregate asset value since 1995

Industrial Auctions

Great American provides auction services to help clients dispose of assets quickly and efficiently at the best market prices

Serving a full range of industries: construction, manufacturing and aerospace, healthcare, food & beverage, and consumer products

B RILEY Financial

FBR -& Co.-

Source: B. Riley materials.

12

B. Riley Business Segments

Great American – Advisory & Valuation

As one of the world’s largest asset based loans (ABLs) appraisal practices, Great American provides appraisals to financial institutions and corporations to support ABLs

Valuation services: financial reporting, corporate tax & risk management and fairness opinions High touch-point team of over 100 appraisers, project managers and business developers 900+ unique company visits per year

Business model: recurring revenue from quarterly appraisals and fixed fees from valuation & advisory services

Steady topline growth and adjusted EBITDA

Source: B. Riley materials.

13

B. Riley Business Segments

B. Riley Capital Management and Principal Investments

Great American Capital Partners

In April 2015, launched GA Capital Partners, a direct lending business to provide senior secured loans to middle market public and private U.S. companies

- Closed Fund I with $155mm+ in commitments; closed ten financings totaling $100mm+

B. Riley Wealth Management

Registered investment advisor that provides comprehensive advisory services and customized portfolios; advising client assets of $700mm+

Traditional asset management, alternative asset management (hedge funds, private equity) and trust and estate planning

B. Riley Asset Management

B. Riley Asset Management (BRAM) provides investment management and financial advisory services

- Manages funds and offers traditional and alternative investment products

Principal Investments

United Online acquired in July 2016

Source: B. Riley materials.

14

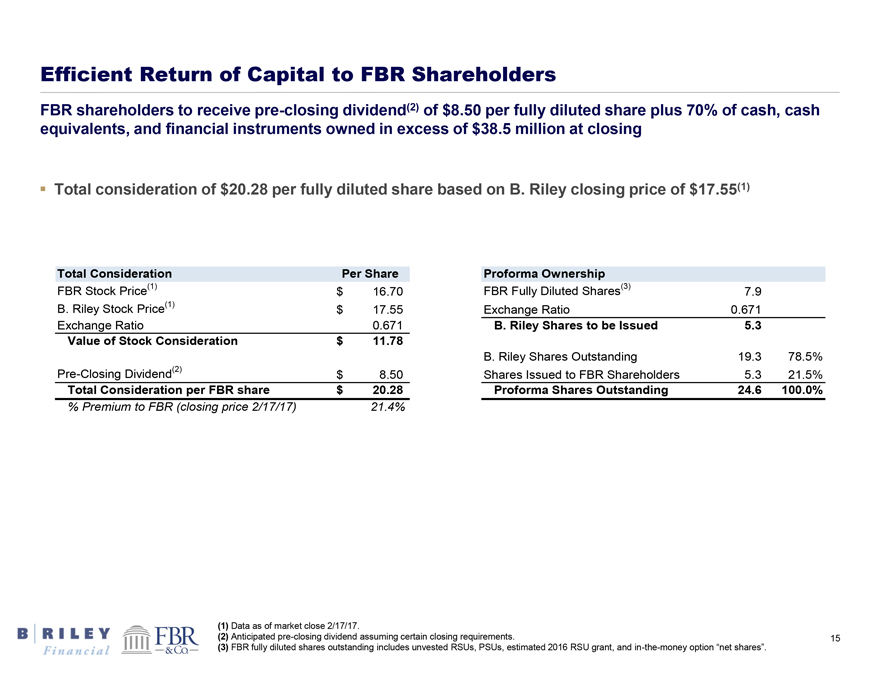

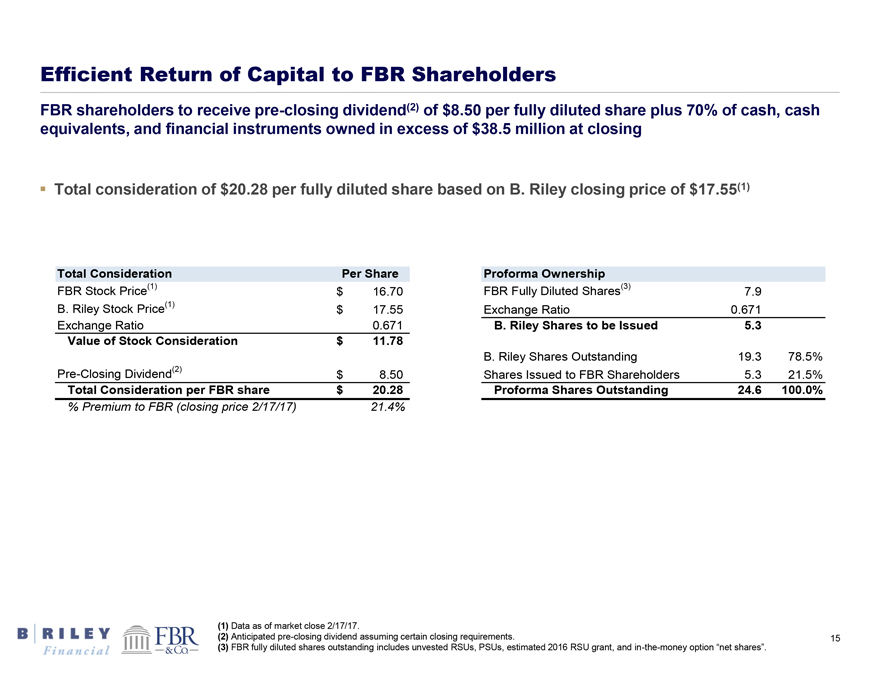

Efficient Return of Capital to FBR Shareholders

FBR shareholders to receivepre-closing dividend(2) of $8.50 per fully diluted share plus 70% of cash, cash equivalents, and financial instruments owned in excess of $38.5 million at closing Total consideration of $20.28 per fully diluted share based on B. Riley closing price of $17.55(1) Total Consideration Per Share Proforma Ownership FBR Stock Price(1) $16.70 FBR Fully Diluted Shares(3) 7.9 B. Riley Stock Price(1) $17.55 Exchange Ratio 0.671 Exchange Ratio 0.671 B. Riley Shares to be Issued 5.3

Value of Stock Consideration $11.78 B. Riley Shares Outstanding 19.3 78.5%Pre-Closing Dividend(2) $8.50 Shares Issued to FBR Shareholders 5.3 21.5% Total Consideration per FBR share $20.28 Proforma Shares Outstanding 24.6 100.0% % Premium to FBR (closing price 2/17/17) 21.4% (1) Data as of market close 2/17/17. (2) Anticipatedpre-closing dividend assuming certain closing requirements. (3) FBR fully diluted shares outstanding includes unvested RSUs, PSUs, estimated 2016 RSU grant, andin-the-money option “net shares”. 15

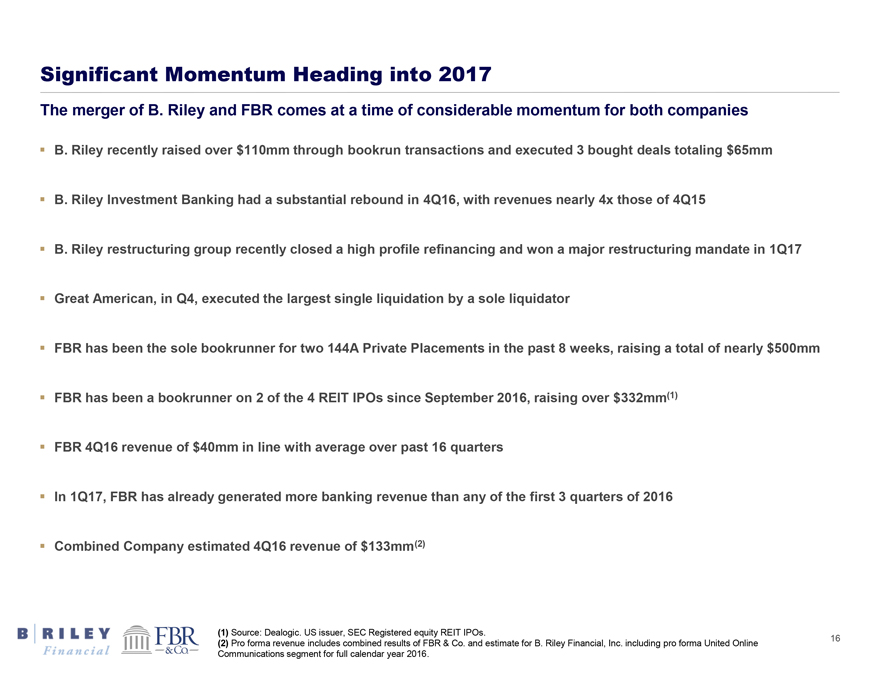

Significant Momentum Heading into 2017

The merger of B. Riley and FBR comes at a time of considerable momentum for both companies

B. Riley recently raised over $110mm through bookrun transactions and executed 3 bought deals totaling $65mm B. Riley Investment Banking had a substantial rebound in 4Q16, with revenues nearly 4x those of 4Q15 B. Riley restructuring group recently closed a high profile refinancing and won a major restructuring mandate in 1Q17 Great American, in Q4, executed the largest single liquidation by a sole liquidator FBR has been the sole bookrunner for two 144A Private Placements in the past 8 weeks, raising a total of nearly $500mm FBR has been a bookrunner on 2 of the 4 REIT IPOs since September 2016, raising over $332mm(1) FBR 4Q16 revenue of $40mm in line with average over past 16 quarters In 1Q17, FBR has already generated more banking revenue than any of the first 3 quarters of 2016 Combined Company estimated 4Q16 revenue of $133mm(2)

(1) Source: Dealogic. US issuer, SEC Registered equity REIT IPOs.

(2) Pro forma revenue includes combined results of FBR & Co. and estimate for B. Riley Financial, Inc. including pro forma United Online Communications segment for full calendar year 2016.

16