UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ¨ Filed by a Party other than the Registrant x

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| x | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

Ultratech, Inc.

(Name of Registrant as Specified In Its Charter)

Neuberger Berman LLC

Neuberger Berman Fixed Income Holdings LLC

Neuberger Berman Investment Advisers LLC

Neuberger Berman Group LLC

Mr. Benjamin Nahum

Mr. James F. McAree

Mr. Amit Solomon

Dr. Ronald Black

Ms. Beatriz V. Infante

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: N/A |

| | (2) | | Aggregate number of securities to which transaction applies: N/A |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): N/A |

| | (4) | | Proposed maximum aggregate value of transaction: N/A |

| | (5) | | Total fee paid: N/A |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: N/A |

| | (2) | | Form, Schedule or Registration Statement No.: N/A |

| | (3) | | Filing Party: N/A |

| | (4) | | Date Filed: N/A |

| | |

Neuberger Berman LLC 605 Third Avenue New York, NY 10158-3698 Tel. 212.476.9000 | |  |

June 13, 2016

To Our Fellow Ultratech Stockholders:

I am writing on behalf of Neuberger Berman LLC (“Neuberger Berman”) to request your support at the upcoming annual meeting of stockholders of Ultratech, Inc. (“Ultratech” or the “Company”) for our two highly qualified, independent nominees to the board of directors, Ms. Beatriz V. Infante and Dr. Ronald Black.

Neuberger Berman and certain of its affiliates manage investment funds and client accounts that collectively own more than two million shares of Ultratech, constituting approximately 7.6% of the outstanding stock. We have been an investor in Ultratech for more than ten years.

Neuberger Berman takes great pride in its long-term investment horizon and its supportive relationships with executives who are committed to creating sustainable shareholder value. Our firm has a history of successfully investing in companies led by entrepreneurial founders whose financial prosperity is tied to the stock price appreciation of the companies they run. We are patient, long-term investors.

But even our extraordinary patience has its limits.

Ultratech’s Stock Price Performance Has Been Dismal

Ultratech stockholders have nothing to show by way of stock price appreciation for their investment in the Company over the last three years. Or five years. Or for the lasttwenty years.*

Indeed, while the stock market and semiconductor equipment sector have risen significantly in value, Ultratech’s stock traded23% lower at the end of 2015 than it did at the end of 1995.

| | | | |

20 Year Total Returns December 29, 1995 – December 31, 2015 | |

| |

| | | % Return | |

S&P 500 | | | +383 | % |

Russell 2000 | | | +368 | % |

UTEK | | | -23 | % |

For the three years ended December 31, 2015, Ultratech’s stockdeclined 47% while the S&P 500, Russell 2000 and S&P Composite 1500 Semiconductor Equipment Index rose 53%, 39% and 63% respectively.

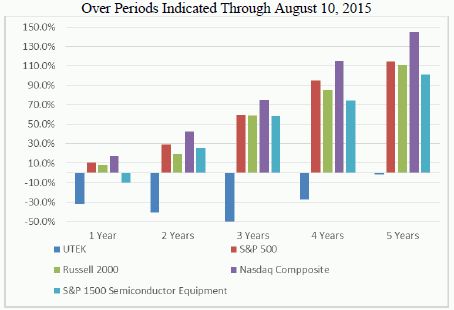

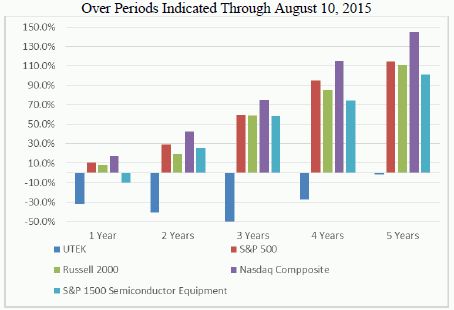

As shown in the chart below, the Company’s total return to stockholders compared to relevant indexes, prior to our public involvement with the Company, which commenced last August, is dismal.

Total Shareholder Return of UTEK Compared with Key Indexes

The Company’s stock price underperformance is a direct reflection of its poor financial results. The Company generatedmore revenue in 1995 than it did in 2015. The Company generated more net income in 1996 alone than it hascumulatively generated since 2001.

The Ultratech Board Has Failed to Hold Management Accountable

We believe the executive team at Ultratech has shown itself unable and unwilling to address two decades of subpar financial and stock price performance. The mindset of Company management is, in our view, epitomized by comments made during the Second Quarter 2015 earnings call by Ultratech’s founder, Chairman and Chief Executive Officer, Mr. Art Zafiropoulo:

“We have a number of long term shareholders of our stock at Ultratech and many new

ones. And I can tell you that we’re expecting to provide the kind of returns we have

provided in the past in the near future. Your patience will be rewarded.”

2

But there have been no returns “provided in the past.” Of what returns does Mr. Zafiropoulo speak?

The Board of Directors is supposed to act as the shareowners’ representatives, challenging the status quo, asking hard questions, and ultimately holding management accountable for performance. There have been no returns; there should be tough questions; and there should be accountability.

Ultratech’s incumbent directors, who have an average tenure of more than 13 years, have had ample time to demand better results and implement change for the benefit of owners. Yet Mr. Zafiropoulo retains the positions of Chairman and CEO despite twenty years in that role with no return for stockholders – and despite him being 77 years old – with no signs of a credible succession plan.

The Board has also indulged Mr. Zafiropoulo with significant compensation, including equity awards and option grants, and extraordinary perquisites. In the last ten years alone, Mr. Zafiropoulo has been paid more than $25 million, according to the Company’s proxy statements. That is more than the profit generated for stockholderssince 2001. As if that compensation was insufficient for Mr. Zafiropoulo to afford a car, the Company provides its CEO a car for personal use, at an extraordinary cost of more than $76,000 per year. The Company’s CEO and CFO (and their wives) were also awarded lifetime health benefits.

Moreover, while Mr. Zafiropoulo has asked stockholders to wait patiently for improved results, he has shown very little confidence in his own ability to improve the Company’s future. We estimate that Mr. Zafiropoulo has liquidated three-quarters of his ownership interest in the Company. Ten years ago, according to the Company’s proxy statements, he held more than 2.3 million shares. Today, despite years of additional stock and options grants totaling more than 1.8 million shares, Mr. Zafiropoulo’s stake in the Company is a mereone million shares.

The Board has also, in our view, inappropriately allowed Mr. Zafiropoulo to blur the lines between Ultratech and Mr. Zafiropoulo’s personal and family interests. Stockholders should be told how their investment in Ultratech is enhanced by the Company’s sponsorship of a race car team affiliated with Mr. Zafiropoulo’s car dealership, and why Mr. Zafiropoulo’s son, who was paid more than half a million dollars last year, is the best qualified executive to hold a senior leadership position in the Company’s marketing department.

Significant Board Changes Are Overdue

Several months ago, we concluded that the Ultratech Board would benefit from stockholder-nominated, technology industry professionals with substantial public company board experience, not only to address the performance and governance issues noted above, but also to help steer the Company through a leadership transition. We were mindful that Mr. Zafiropoulo is 77 years old, his CFO is 68 years old and several of Ultratech’s board members are in their 70s. Moreover, given the performance of the business, every avenue of value creation should be thoroughly examined, objectively, with no preconceived conclusions.

3

We are pleased that the Board has belatedly agreed to add one new director to the Board, but we firmly believe that this modest change is insufficient to transform the tone and character of the Board. We are also aware that the new director was hand-picked by the existing Board.

We believe more change is called for. Accordingly, at this year’s annual meeting, we are nominating Ms. Beatriz V. Infante and Dr. Ronald Black, two exceptional technology executives, to the Board.

Our nominees bring impressive backgrounds and are independent of Neuberger Berman. Ms. Infante has extensive technology leadership experience and has served on three public company boards. Dr. Black is currently the CEO of Rambus, Inc., a $1.3 billion public technology company that provides cutting-edge semiconductor and IP products, and has served on numerous public and privately-held company boards worldwide.

We believe that Ms. Infante and Dr. Black will provide stockholders with the comfort of knowing that new, experienced, objective and independent directors are reviewing the strategy, operations, performance, executive compensation and leadership of the business. They and we believe that aligning the fortunes of the executive team with stockholders is a critical function of good corporate governance and appropriate executive compensation practices.

We believe our nominees will make a difference at Ultratech. We are confident that they bring the focus, financial discipline and commitment to stockholder interests that Ultratech badly needs. If elected, these directors will constitute two of the Company’s seven Board members. With their addition, stockholders have nothing to lose, but much to gain. We therefore encourage you to support our two nominees for the Board.

Please carefully review the enclosed proxy materials. In them, we describe further the reasons we believe change at Ultratech is urgently needed and provide biographies and information about our two exceptional nominees.Please use the enclosed GOLD proxy card to vote for them and for change.

4

For additional information please visitwww.HelpFixUTEK.com.

If you have any questions about how to vote, our proxy solicitor, Okapi Partners, can be reached at info@okapipartners.com or (855) 208-8902.

Best regards,

Benjamin Nahum

Senior Portfolio Manager and Managing Director

Neuberger Berman Investment Advisers LLC and Neuberger Berman LLC

5

IMPORTANT INFORMATION

On June 13, 2016, Neuberger Berman LLC, Neuberger Berman Fixed Income Holdings LLC, Neuberger Berman Investment Advisers LLC, Neuberger Berman Group LLC, Mr. Benjamin Nahum, Mr. James F. McAree and Mr. Amit Solomon (collectively, the “Neuberger Berman Participants”) and Dr. Ronald Black and Ms. Beatriz V. Infante (collectively, with the Neuberger Berman Participants, the “Participants”) filed a definitive proxy statement on Schedule 14A (the “Neuberger Berman Proxy Statement”) with the Securities and Exchange Commission (“SEC”), along with an accompanying GOLD proxy card, to be used in connection with the Participants’ solicitation of proxies from the stockholders of Ultratech, Inc. (the “Company”) for use at the Company’s 2016 Annual Meeting of Stockholders (the “Proxy Solicitation”).All stockholders of the Company are advised to read the Neuberger Berman Proxy Statement and the accompanying GOLD proxy card because they contain important information. The Neuberger Berman Proxy Statement and the accompanying GOLD proxy card will be furnished to some or all of the Company’s stockholders and are, along with other relevant soliciting material of the Participants, available at no charge at the SEC’s website at www.sec.gov, from the Neuberger Berman Participants’ proxy solicitor, Okapi Partners LLC (Call Toll-Free: (855) 208-8902) and at www.HelpFixUTEK.com.

Information about the Participants and a description of their direct and indirect interests by security holdings and otherwise are contained in the Neuberger Berman Proxy Statement.

To the extent that independent researchers or financial analysts are quoted in this document, it is the policy of the Neuberger Berman Participants to use reasonable efforts to verify the source and accuracy of the quote. The Participants have not, however, sought or obtained the consent of the quoted source to the use of such quote as soliciting material. This document may contain expressions of opinion and belief. Except as otherwise expressly attributed to another individual or entity, these opinions and beliefs are the opinions and beliefs of the Neuberger Berman Participants.

6

Tell the Board what you think! Your vote is important.

No matter how many shares of Common Stock you own, please give Neuberger Berman your proxy FOR the election of the Nominees by taking three steps:

| | • | | SIGNING the enclosedGOLD proxy card, |

| | • | | DATING the enclosedGOLD proxy card, and |

| | • | | MAILING the enclosedGOLD proxy card TODAY in the envelope provided (no postage is required if mailed in the United States). |

If any of your shares of Common Stock are held in the name of a brokerage firm, bank, bank nominee or other institution, only it can vote such shares of Common Stock and only upon receipt of your specific instructions. Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosedGOLD voting form.

If you have any questions or require any additional information concerning this Proxy Statement, please contact Okapi Partners at the address set forth below.

1212 Avenue of the Americas, 24th Floor

New York, NY 10036

(212) 297-0720

Call Toll-Free at: (855) 208-8902

E-mail: info@okapipartners.com

| * | Stock price and index returns in this letter are calculated through December 31, 2015, except as otherwise indicated. |

7