Use these links to rapidly review the document

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | |

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material under §240.14a-12

|

| | | | |

| DIRECTV |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

Table of Contents

|

Notice of 2012 Annual Meeting of Stockholders |

|

| | | | | | | | |

| | | Time and Date | | 1:00 p.m. Eastern time on May 3, 2012

| | |

| |

| | | Place | | Hilton Hotel New York

1335 Avenue of the Americas

New York, New York

| | |

| |

| | | Items of Business | | 1. | | Elect nominees to the Board of Directors, named and for the terms described in the attached Proxy Statement. | | |

| | | | | 2. | | Ratify the appointment of Deloitte & Touche LLP as independent registered public accounting firm for DIRECTV for the fiscal year ending December 31, 2012. | | |

| | | | | 3. | | Amend and restate Certificate of Incorporation to reclassify all issued and outstanding Class A and Class B stock as "Common Stock," eliminate Class A and Class B Common Stock, and increase authorized Common Stock from 3,947,000,000 to 3,950,000,000 shares. | | |

| | | | | 4. | | Advisory vote to approve compensation of our named executives. | | |

| | | | | 5. | | Consider and act upon a shareholder proposal regarding a prohibition on the accelerated vesting of performance-based equity awards upon a change in control. | | |

| | | | | 6. | | Transact such other business as may properly come before the meeting.

| | |

| |

| | | Record Date | | You can vote if you were a stockholder of record of DIRECTV Class A Common Stock at the close of business on March 9, 2012. Each share of Common Stock is entitled to one vote for each nominated director and one vote for each of the proposals to be voted on.

| | |

| |

| | | Materials to Review | | Our proxy solicitation materials include: | | |

| | | | | • | | The Proxy Statement | | |

| | | | | • | | Your proxy card | | |

| | | | | • | | The Annual Report of DIRECTV to Stockholders for the Fiscal Year ended December 31, 2011.

| | |

| |

| | | Proxy Voting | | It is important that your shares be represented and voted at the meeting. You can vote your shares by: | | |

| | | | | • | | Completing and returning your proxy card, or | | |

| | | | | • | | Voting online or by telephone (described in "How do I vote?" under "Proxy Statement—Questions and Answers").

| | |

| |

| | |

| | | By order of the Board of Directors |

|

|

|

|

|

Jan Williamson

Corporate Secretary |

March 16, 2012

El Segundo, CA |

|

|

i

Table of Contents

DIRECTV

| | |

Notice of 2012 Annual Meeting of Stockholders | | i |

Table of Contents | | ii |

Proxy Statement For the Annual Meeting of Stockholders To Be Held May 3, 2012 | | 1 |

Proxy Summary | | 1 |

Questions and Answers About the Annual Meeting and Voting | | 5 |

Corporate Governance | | 10 |

Composition of the Board | | 12 |

2011 Director Compensation | | 23 |

Executive Officers | | 26 |

Security Ownership of Directors, Named Executive Officers, and Certain Other Beneficial Owners | | 28 |

Section 16(a) Beneficial Ownership Reporting Compliance | | 29 |

Audit Committee Report | | 30 |

Proposals for Stockholder Vote | | |

Proposal 1—Election of Directors | | 32 |

Proposal 2—Ratification of Appointment of Auditors | | 40 |

Proposal 3—Amend and Restate Certificate of Incorporation | | 40 |

Proposal 4—Advisory Vote to Approve Executive Compensation | | 42 |

Proposal 5—Shareholder Proposal Regarding Prohibition on Accelerated Vesting of Equity Awards | | 43 |

Executive Compensation | | |

Compensation Discussion and Analysis | | 48 |

No Material Inappropriate Risks in Executive and Employee Compensation Programs | | 70 |

2011 Summary Compensation Table and Related Tables | | 72 |

2011 Grants of Plan-Based Awards | | 76 |

Agreements with Executive Officers | | 78 |

2011 Outstanding Equity Awards at Fiscal Year-End | | 80 |

2011 Option Exercises and Stock Vested | | 82 |

2011 Pension Benefits Table | | 83 |

2011 Non-Qualified Deferred Compensation Table | | 86 |

Potential Payments upon Termination or Change in Control | | 89 |

Compensation Committee Report | | 96 |

Equity Compensation Plan Information | | 97 |

Submission of Stockholder Proposals | | 98 |

Annex A: Third Amended and Restated Certificate of Incorporation of DIRECTV | | 100 |

Annex B: DIRECTV Non-GAAP Financial Measure Reconciliation Schedules

(Unaudited) | | 115 |

ii

Table of Contents

Proxy Summary

DIRECTV

2230 East Imperial Highway

El Segundo, California 90245

(310) 964-5000

|

Proxy Statement

For the Annual Meeting of Stockholders

To Be Held May 3, 2012

|

The accompanying proxy is solicited by the Board of Directors of DIRECTV for use at our Annual Meeting of Stockholders (Annual Meeting) to be held at 1:00 p.m. Eastern time, on May 3, 2012, at the Hilton Hotel New York, 1335 Avenue of the Americas, New York, New York, and any adjournment or postponement thereof.

On or after March 16, 2012 we expect that this Proxy Statement and accompanying proxy card will be mailed or will be available through the Internet to stockholders of record of DIRECTV at the close of business on March 9, 2012.

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information you should consider before you decide how to vote your shares. You should read the entire Proxy Statement carefully before voting.

Annual Meeting of Stockholders

Voting

Stockholders of record of DIRECTV Class A Common Stock (Common Stock) as of the record date are entitled to vote. Each share of Common Stock is entitled to one vote for each nominated director and one vote for each of the proposals to be voted on.

Admission

Please detach and retain the admission ticket attached to your proxy card. As capacity is limited, you may bring only one guest to the meeting.

If you hold your stock through a broker, bank or other record holder, please bring evidence that you own Common Stock to the Annual Meeting and we will provide you with admission tickets.

If you receive your Annual Meeting materials electronically and wish to attend the meeting, please follow the instructions provided for attendance. A form of government-issued photo ID will be required to enter the Annual Meeting.

1

Table of Contents

DIRECTV

Meeting Agenda

- 1.

- Elect nominees to the Board of Directors, named and for the term described in the attached Proxy Statement.

- 2.

- Ratify the appointment of Deloitte & Touche LLP as independent registered public accounting firm for DIRECTV for the fiscal year ending December 31, 2012.

- 3.

- Amend and restate Certificate of Incorporation to reclassify all issued and outstanding Class A and Class B stock as "Common Stock," eliminate Class A and Class B Common Stock, and increase authorized Common Stock from 3,947,000,000 to 3,950,000,000 shares.

- 4.

- Advisory vote to approve compensation of our named executives.

- 5.

- Consider and act upon a shareholder proposal regarding a prohibition on the accelerated vesting of performance-based equity awards upon a change in control.

- 6.

- Transact such other business as may properly come before the meeting.

Voting Matters and Vote Recommendation

For detailed information, refer to "Proposals for Stockholder Vote" beginning on page 32.

| | | | |

| |

| Matter | | Board's Vote Recommendation |

| Management Proposals | | |

| |

1. | | Election of Directors | | FOR each nominated director |

2. | | Ratification of Deloitte & Touche LLP appointment | | FOR |

3. | | Amend and Restate Certificate of Incorporation | | FOR |

4. | | Advisory vote to approve executive compensation | | FOR |

| |

| Shareholder Proposal | | |

| |

5. | | Prohibition on accelerated vesting of stock awards | | AGAINST |

| |

Our Nominated Directors

For detailed information, refer to "Director Biographical Information and Business Experience (Nominated for Election at This Annual Meeting)" beginning on page 32.

| | | | | | | | | | | | |

| |

| |

| |

| |

| | Committee

Membership

|

|---|

| |

| | Director

Since

| |

|

|---|

Name

| | Age

| | Occupation

| | NCGC

| | A

| | C

|

|---|

| Ralph Boyd, Jr. | | 55 | | 2003 | | Strategic Consultant | | ü | | ü | | |

| David Dillon | | 60 | | 2011 | | Chairman of the Board and CEO, The Kroger Co. | | ü | | ü | | |

| Samuel DiPiazza, Jr. | | 61 | | 2010 | | Vice Chairman, Institutional Clients Group, Citibank | | ü | | ü | | |

| Dixon Doll | | 69 | | 2011 | | Co-Founder and General Partner, DCM | | ü | | | | ü |

| Peter Lund | | 71 | | 2000 | | Private Investor and Media Consultant | | ü | | ü | | ü |

| Nancy Newcomb | | 66 | | 2006 | | Retired Sr. Corporate Officer, Citigroup, Inc. | | ü | | ü | | |

| Lorrie Norrington | | 52 | | 2011 | | Former President, eBay Marketplace, eBay, Inc. | | ü | | | | ü |

| |

| | |

| Key: | | NCGC=Nominating and Corporate Governance

A= Audit

C=Compensation

|

2

Table of Contents

Proxy Summary

Director Attendance

For 2011, each incumbent director attended more than 75% of the aggregate of Board meetings and committee meetings for committees on which the director served.

Business Highlights

For details, please refer to "2011 Performance and Bonuses" beginning on page 49.

In fiscal year 2011 we delivered strong financial and operating results. Highlights include:

- •

- Consolidated revenue increased 13% to $27.2 billion, including revenue of $5.1 billion from our Latin America operations representing an increase of 42% over 2010

- •

- Record breaking subscriber growth with 662,000 net new subscribers in the U.S. and 2.1 million net new subscribers in Latin America for 2011

- •

- Operating profit before depreciation and amortization (OPBDA) increased 9.4% on a consolidated basis with Latin America OPBDA increasing by 42.9%

- •

- Net income increased 19% to $2.6 billion

- •

- Earnings per share of Class A Common Stock grew 38.8% to $3.47

- •

- We returned over $5.4 billion to our stockholders through our share repurchase program.

Executive Compensation Matters

For details, please refer to "Executive Compensation" beginning on page 48.

Pay for Performance

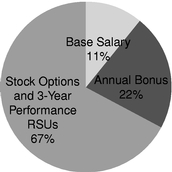

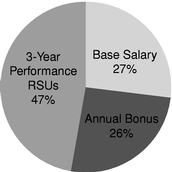

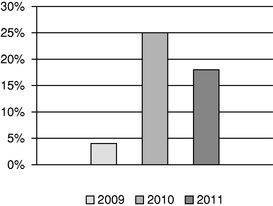

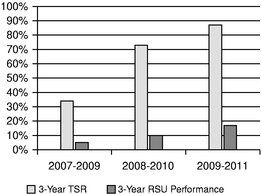

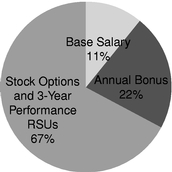

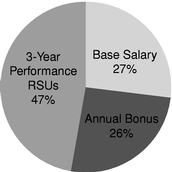

Our compensation program allows our Compensation Committee and Board to determine pay based on a comprehensive review of quantitative and qualitative factors intended to produce long-term business success. For our CEO, Michael White, almost 90% of his total direct compensation opportunity is performance-based and for our other named executive officers it is over 70%. The positive alignment between our financial results over multiple years, including total shareholder return, and the executive officer compensation earned for those results, demonstrates the success of this approach, as described in the Compensation Discussion and Analysis beginning on page 48. Details of executive compensation are shown in the 2011 Summary Compensation Table on page 72.

Sound Program Design

We believe that well-designed compensation programs allow us to attract, develop and retain executives who have the experience, business judgment, vision and personal integrity to work well as a team to achieve results. We believe that compensation that reflects performance and is aligned with the interests of long-term stockholders contributes to our success.

Consequently, we developed compensation programs to:

- •

- Recruit and retain top executives

- •

- Balance short-term and long-term goals and risk-to-reward relationships that encourage increasing long-term stockholder value, and

- •

- Pay for performance.

3

Table of Contents

DIRECTV

We achieve our objectives through compensation that:

- •

- Provides a competitive total pay opportunity

- •

- Links a significant portion of total compensation to performance that we believe will create long-term stockholder value

- •

- Consists of a substantial portion of stock-based compensation with appropriate long-term stock ownership guidelines to further align the executives' financial interests with stockholders

- •

- Enhances retention by linking total compensation to multi-year performance, and

- •

- Does not encourage unnecessary or excessive risk taking.

Our compensation programs emphasize a long-term view and team effort. We believe they:

- •

- Foster rapid adjustment and adaptation to fast-changing business conditions

- •

- Help achieve our short-term and long-term goals

- •

- Align the interests of our executives with those of our stockholders, and

- •

- Provide a balanced and stable foundation for increasing stockholder value.

Our Board of Directors recommends that stockholders vote to approve, on an advisory basis, the compensation of the named executive officers.

4

Table of Contents

Questions and Answers

|

Questions and Answers About the

Annual Meeting and Voting

|

Annual Meeting and Voting

Do I need a ticket to attend the Annual Meeting?

Yes. If you plan to attend the Annual Meeting, please detach and retain the admission ticket attached to your proxy card. As capacity is limited, you may bring only one guest to the meeting.

If you hold your stock through a broker, bank or other record holder, please bring evidence that you own DIRECTV Class A Common Stock (Common Stock) to the Annual Meeting and we will provide you with admission tickets.

If you receive your Annual Meeting materials electronically and wish to attend the meeting, please follow the online instructions provided for attendance. A form of government-issued photo ID will be required to enter the Annual Meeting.

Who is entitled to vote at the Annual Meeting?

The record date for the Annual Meeting is March 9, 2012. Stockholders of record and beneficial owners as of that date are entitled to vote at the Annual Meeting. You are considered a stockholder of record if you hold Common Stock in your name in an account with DIRECTV's stock transfer agent, Broadridge Corporate Issuer Solutions, Inc. (Broadridge). You are a beneficial owner if you hold Common Stock indirectly through a nominee, such as a broker, bank or similar organization.

Is there a list of stockholders entitled to vote at the Annual Meeting?

A complete list of stockholders entitled to notice of, and to vote at, the Annual Meeting will be open for examination by the stockholders beginning 10 days prior to the

meeting. In addition, for any purpose germane to the meeting, the list will be available during normal business hours at:

Office of the Corporate Secretary

2230 East Imperial Highway

El Segundo, CA 90245

AND

One Rockefeller Plaza

New York, NY 10020

What kinds of securities are eligible to vote at the Annual Meeting?

DIRECTV has one class of outstanding stock entitled to vote at the Annual Meeting. Holders of Class A Common Stock of DIRECTV, par value $0.01, are entitled to one vote per share. At the close of business on February 28, 2012, there were 676,608,719 shares of Common Stock outstanding and eligible for voting at the Annual Meeting.

Will my vote be kept private?

Yes. DIRECTV believes your vote should be private and we use an independent specialist to receive, inspect, count and tabulate proxies. DIRECTV has retained Broadridge for this purpose. A representative of Broadridge also acts as inspector of elections at the Annual Meeting.

How can I vote my proxy?

The Proxy Committee will vote the shares represented by a proxy unless the proxy card is received late or in a form that cannot be voted.

Except in the case of stock held by one of the employee stock plans described below, by signing and returning the proxy card or by voting through the Internet or by telephone, you will authorize the Proxy Committee to vote your shares of Common Stock on any matters that the Company does not know about now

5

Table of Contents

DIRECTV

but that may be presented properly at the Annual Meeting. The members of the Proxy Committee are Patrick Doyle and Larry Hunter.

Shares you hold as a stockholder of record

The form of proxy solicited by the Board of Directors allows you to:

- •

- Vote for or against or abstain in the vote for each nominated director in Proposal 1

- •

- Approve, disapprove or abstain on each of Proposals 2, 3, 4 and 5.

For any choice you indicate about any of these matters, your shares will be voted as specified. If you sign and return your proxy card without specifying a choice, the Proxy Committee will vote your shares as the Board of Directors recommends in this Proxy Statement.

If you receive more than one proxy card (which means you have shares in more than one account), you must mark, sign and date each of them or, alternatively, submit a proxy for all these shares through the Internet or by telephone, as described below.

If you are a stockholder of record you can vote in any one of the following ways.

- •

- Internet: Go to the Web site shown on your proxy card (www.proxyvote.com). You will need to enter your voter control number that appears on your proxy card.

- •

- Telephone: Call the toll-free number listed on your proxy card, (1-800-690-6903). You will need to provide your voter control number that appears on your proxy card. Please follow the instructions on your proxy card and the voice prompts on the telephone.

- •

- Mail: Mark your vote on the various matters, sign your name exactly as it appears on your proxy card, date your proxy card and return it in the enclosed envelope.

- •

- Ballot: If you prefer, you may vote by ballot at the Annual Meeting instead of using one of the above methods.

Shares held by a broker, bank or other record holder

If you are a beneficial owner, that is a broker, bank or other record holder (referred to as a nominee) holds your shares, please refer to the instructions the nominee provides for your shares to be voted.

If your shares are held by a broker, your broker must vote those shares in accordance with your instructions. If you do not give voting instructions to your broker, your broker may vote your shares for you on any routine items of business voted upon at the Annual Meeting but may not vote on matters that are considered non-routine. Consequently, if you do not give voting instructions to your broker, they will not vote your shares on non-routine matters.

See "What is a broker non-vote?" and "What is a quorum for the Annual Meeting?" on page 7 for more information on how shares held by brokers or other nominees are voted.

Shares held In the DIRECTV 401(k) Stock Plan

If you participate in the DIRECTV 401(k) Stock Plan (Stock Plan), your proxy card will serve to instruct the Trustee of the Stock Plan how to vote those shares. If you do not provide instructions on how to vote your shares held in the Stock Plan, those shares may be voted in the same proportion as the shares for which the Trustee receives instructions from all other Participants, unless not otherwise permitted by law.

For stock held through the Stock Plan, whether you submit a proxy for your stock by telephone, through the mail or by Internet, your directions must be received by Broadridge no later than 11:59 p.m., Eastern time on April 30, 2012. Please note that while you may attend the Annual Meeting, you may not vote stock held through the Stock Plan at the meeting.

6

Table of Contents

Questions and Answers

Can I change my vote?

You may revoke your proxy at any time until it is voted at the Annual Meeting by:

- •

- Sending a written notice of revocation to Broadridge, or

- •

- Executing a subsequent proxy card, or

- •

- Submitting a subsequent proxy through the Internet or by telephone, or by voting in person at the Annual Meeting.

What is a broker non-vote?

A broker non-vote occurs when a broker or other nominee does not receive voting instructions from the beneficial owner and does not have the discretion to direct the voting of the shares.

If you are a beneficial owner and do not provide voting instructions to your broker or other nominee, your broker or other nominee may exercise discretion in voting on routine matters but may not exercise discretion and therefore will not vote on non-routine matters.

See "What are the voting requirements for each of the Proposals discussed in this Proxy Statement?" below, for more information about matters considered routine and non-routine.

What is a quorum for the Annual Meeting?

A quorum consists of a majority of all of the outstanding shares of Common Stock entitled to vote at the meeting, present in person or represented by proxy.

What are the voting requirements for each of the Proposals discussed in this Proxy Statement?

If there is a quorum present, each of Proposals 1, 2, 4 and 5 will be approved if it receives an affirmative vote of a majority of the shares present, either in person or by proxy, that are eligible to vote. Proposal 3 will be approved if a majority of the shares outstanding are voted in favor of the proposal.

Abstentions and broker non-votes are counted differently, depending on the proposal, as described below.

| | |

| Proposal 1:Election of Directors | | • Non-routine • If you do not provide voting instructions, your broker may not vote on this matter. |

Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm | | • Routine • If you do not provide voting instructions, your broker is permitted to exercise their discretion in voting |

Proposal 3: Amend and Restate Certificate of Incorporation to eliminate Class A and Class B Common Stock | | • Non-routine • If you do not provide voting instructions, your broker may not vote on this matter |

Proposal 4: Advisory Vote to Approve Executive Compensation | | • Non-routine • If you do not provide voting instructions, your broker may not vote on this matter |

Proposal 5: Shareholder Proposal Regarding a Prohibition on the Accelerated Vesting of Performance-Based Equity Awards upon a Change in Control | | • Non-routine • If you do not provide voting instructions, your broker may not vote on this matter |

|

|

|

Proposal 1: Election of Directors

The Company's Amended and Restated By-Laws (By-Laws), require that in uncontested elections each director must be elected by a majority of votes cast for that director. For this Annual Meeting, the election of directors standing for election is uncontested. Therefore, the number of shares voted "for" a nominated director must exceed the number of votes cast "against" that nominated director in order for

7

Table of Contents

DIRECTV

that nominated director to be elected. Only votes "for" or "against" are counted as votes cast. Abstentions and broker non-votes are not considered votes cast.

If a nominated director who currently is serving as a director does not receive the affirmative vote of at least a majority of the votes cast, the Company's By-Laws provide that the director must promptly tender his or her resignation to the Board after the stockholder vote has been certified. Pursuant to the By-Laws, within 120 days the independent directors (excluding the director who tendered the resignation) will decide whether to accept the resignation or whether other action should be taken, and publicly disclose their decision and rationale.

Proposals 2, 3, 4 and 5

Each of Proposal 2, Proposal 4 and Proposal 5 will be approved if the proposal receives the affirmative vote of a majority of the shares present and entitled to vote. Proposal 3 will be approved if the proposal receives votes in favor by a majority of the outstanding shares entitled to vote. Abstentions are effectively treated as a vote against each of Proposal 2, Proposal 3, Proposal 4 and Proposal 5.

Although the vote on compensation of our named executive officers is advisory only, the Board will consider the results of the vote in its consideration of compensation of our named executive officers. The Board has adopted a policy to hold advisory votes on the compensation of named executive officers every year.

Other Business Matters

The Board of Directors does not intend to present any business at the Annual Meeting other than the proposals described in this Proxy Statement.

However, if any other matter properly comes before the Annual Meeting, your proxies will act on such matter in their discretion as permitted.

Materials Related to the Annual Meeting

What materials will stockholders receive related to the Annual Meeting?

If you are a stockholder of record, the Annual Meeting materials you are entitled to receive are:

- •

- This Proxy Statement

- •

- Your proxy card

- •

- The Annual Report of DIRECTV to Stockholders (Annual Report) for the Fiscal Year ended December 31, 2011.

Other governance materials are available as described in "How can I get copies of governance materials?"below.

What is meant by householding of Annual Meeting materials?

The SEC permits corporations to send a single copy of the Annual Report and Proxy Statement to any household at which two or more stockholders reside if it appears they are members of the same family. Each stockholder will continue to receive a separate proxy card. By use of this procedure, referred to as householding, we can reduce the volume of duplicate information stockholders receive and can reduce waste and expenses for the Company. DIRECTV has instituted this procedure for all stockholders of record.

If we sent only one set of these documents to your household and one or more of you would prefer to receive your own set, please contact Broadridge.

| | |

| Telephone: | | 1-800-542-1061 |

| | | |

| U.S. Mail: | | Broadridge Financial Solutions, Inc.

Householding Department

51 Mercedes Way

Edgewood, NY 11717 |

| | | |

If you are a beneficial owner, please contact your nominee directly if you have questions, require additional copies of the Proxy

8

Table of Contents

Questions and Answers

Statement or Annual Report, or wish to receive multiple sets of materials by revoking your consent to householding.

Can I get my Annual Meeting materials electronically?

Yes. At your request, you will be sent an email when DIRECTV's Annual Report and proxy materials become available on the Internet. If you are a stockholder of record, you may sign up for electronic delivery of these materials atenroll.icsdelivery.com/dtv.

How can I get copies of governance materials?

Our governance materials are posted on our website atwww.directv.com/investor. In addition, stockholders may obtain paper copies of the following materials by sending a written request by first-class mail to:

DIRECTV

Attn: Corporate Secretary

2230 E. Imperial Highway

El Segundo, CA 90245.

Please indicate specifically which documents you are requesting:

- •

- Annual Report

- •

- Second Amended and Restated Certificate of Incorporation (Certificate)

- •

- Amended and Restated By-Laws (By-Laws)

- •

- Charters of the Audit, Nominating and Corporate Governance and Compensation Committees

- •

- Corporate Governance Guidelines

- •

- Code of Ethics and Business Conduct

- •

- Code of Ethics Applicable to the Chief Executive Officer and Senior Financial Officers

- •

- DIRECTV's Employee Benefit Plans.

Who will pay for the cost of this proxy solicitation?

DIRECTV will bear the expenses of printing and mailing this Proxy Statement and the costs for the solicitation of proxies. DIRECTV will also request nominees holding Common Stock to send this Proxy Statement to, and obtain proxies from, the beneficial holders. If requested, DIRECTV will reimburse the record holders for their reasonable out-of-pocket expenses. Solicitation of proxies by mail may be supplemented by telephone and Internet, advertisements and personal solicitation by the directors, officers or employees of DIRECTV. No additional compensation will be paid to our directors, officers or employees for solicitation.

9

Table of Contents

DIRECTV

Corporate Governance Guidelines

DIRECTV's Corporate Governance Guidelines discuss, among other things, the responsibilities of the Board, director qualification standards and Board independence criteria. Copies are available through the sources listed under "How can I get copies of governance materials?" on page 9.

Code of Ethics

DIRECTV has adopted a Code of Ethics and Business Conduct, which complies with the requirements of the NASDAQ Stock Market (NASDAQ) and a Code of Ethics applicable to the Chief Executive Officer and Senior Financial Officers, which complies with the requirements of Section 406 of the Sarbanes-Oxley Act of 2002. Required information regarding any amendment or waiver to the Code of Ethics that would otherwise require DIRECTV to file a Current Report on Form 8-K pursuant to Item 5.05 shall instead be disclosed on DIRECTV's website within four business days following the date of the amendment or waiver. You may access DIRECTV's Code of Ethics through the sources listed under "How can I get copies of governance materials?" on page 9.

Directors

Selection of Directors

The Nominating and Corporate Governance Committee (NCGC) is responsible for reviewing with the Board, on an annual basis, the appropriate skills and characteristics required of directors. While the NCGC has not established any specific minimum qualifications that a potential candidate must meet for nomination by the NCGC, important qualifying factors are:

- •

- Level of education, and

- •

- Business or public service experience.

The assessment process by the NCGC also includes consideration of the ability to bring:

- •

- Unique and fresh perspectives

- •

- Diversity

- •

- Specific technical or business knowledge and expertise that might be beneficial to the Board, and

- •

- Experience on the boards or management of other major corporations.

The NCGC also takes into account the need to have candidates with the required financial sophistication and expertise to satisfy the requirements to serve on DIRECTV's Audit Committee.

While the Board and NCGC do not have a specific policy regarding the consideration of diversity in identifying director nominees, both the NCGC and the entire Board appreciate the value of diversity among Board members. Though done on an informal basis, diversity is an important element for the members of the NCGC in the identification and consideration of and deliberations regarding potential candidates for service on the Company's Board. That consideration relates not only to race, gender and ethnic origin but also to diversity in education, business and life experience, and industry knowledge. The NCGC believes that such diversity improves the quality of the Board's discussions and deliberations, brings fresh and differing perspectives that are valuable to DIRECTV's senior management, and helps assure that diversity is a focus for the entire company. The NCGC conducts a formal diversity review of the Company every year and improving diversity within the Board and Company-wide will continue to be an important goal for the NCGC.

Recommendations for potential candidates may come from members of the Board of Directors or management of DIRECTV or stockholders, as discussed below. The

10

Table of Contents

Corporate Governance

Company also has retained, and may retain in the future, an independent consultant that specializes in executive and director searches for major corporations. The NCGC typically bases its review on any written materials provided on any candidate. The NCGC determines whether the candidate meets DIRECTV's general qualifications, assesses specific qualities and skills and determines whether it is appropriate to request additional information or an interview. The independent consultant may assist in the review process by facilitating communications with candidates concerning their interest in serving as a director and may help the NCGC to assess the fit of the individual with DIRECTV and its needs.

The NCGC considers recommendations for Board candidates submitted by stockholders using the same criteria it applies to recommendations from directors and members

of management. Subject to limitations in the Company's Certificate and By-Laws, as each may be amended from time to time, and applicable law, stockholders may submit recommendations in writing by:

| | |

| Mail | | Nominating and Corporate Governance Committee

c/o DIRECTV

Attention: Corporate Secretary

2230 East Imperial Highway

El Segundo, CA 90245 |

|

|

|

| Fax | | 1-310-964-0843 |

To be considered by the NCGC for the 2013 Annual Meeting, recommendations for director nominees must comply with the requirements described in "Submission of Stockholder Proposals" on page 98, unless otherwise required by law.

11

Table of Contents

DIRECTV

The Board currently consists of 10 members. In 2011, average attendance at Board and meetings of the committees of the Board including the NCGC, the Audit Committee and the Compensation Committee was 98%. For 2011, each incumbent director attended more than 75% of the aggregate of Board meetings and committee meetings for committees on which the director served.

In addition to being members of the Board, independent directors may serve on one or more of three standing committees of the Board. Please refer to "Committees of the Board of Directors" beginning on page 20 for information about committee responsibilities and current membership. Directors spend a considerable amount of time preparing for Board and committee meetings and, from time to time, may be called upon between meetings. The Board, and each committee, can retain outside advisors at the expense of the Company.

Independence of Directors

The Company's Certificate requires that at least a majority of the Board of Directors be comprised of independent directors.

For a director to be considered independent, he or she must qualify as an "independent director" under the rules and regulations of the NASDAQ in effect from time to time. The Board annually makes a determination as to the independence of each of its members based on the NASDAQ criteria and any relationship that may exist between the Company or its suppliers and the director.

The review by the Board to determine independence of its members includes consideration of, among other things, employment history, information publicly available from third party filings and responses to questionnaires completed by each director on commercial, banking, professional, charitable, familial and other relationships. Each director has the opportunity to ask questions of any member and to consider all relevant information. The Board conducts the review with the guidance of legal counsel on applicable standards and other relevant considerations.

Based on a review by the Board of all relevant information, the Board has determined that there is no material relationship between the Company and each of Neil Austrian, Ralph Boyd, Jr., David Dillon, Samuel DiPiazza, Jr., Dixon Doll, Charles Lee, Peter Lund, Nancy Newcomb and Lorrie Norrington and that each is an independent director as defined by the Securities Exchange Act of 1934 as amended (Exchange Act) and the Corporate Governance Standards established by the NASDAQ.

Executive Session

At each scheduled meeting of the Board, unless otherwise determined at the meeting, the independent directors meet in executive session without members of management present.

The agendas and procedures for the executive sessions of the independent directors are determined by the Chairman of the NCGC, Neil Austrian, who presides at the executive sessions of the independent directors.

12

Table of Contents

Composition of the Board

Board Leadership

The Board of Directors does not have a policy regarding the separation of the roles of Chairman of the Board and Chief Executive Officer and believes it is in the best interests of the Company to make that determination based on the position and direction of the Company and the membership of the Board. Currently, Michael White serves as Chief Executive Officer (CEO), President and Chairman of the Board. The Board believes that this arrangement facilitates the organization and efficiency of the Board meetings over the calendar year by permitting the CEO to:

- •

- Develop a thoughtful and comprehensive agenda of the issues and matters most critical to the Company for review by the Board, and

- •

- Guide the review process in a manner that will assure efficient use of the time available to the Board.

The Company believes that this structure also makes the best use of the CEO's knowledge of the Company and the industry, as well as fostering greater communication between the Company's management and the Board.

The Board also believes that the composition of the Board, with nine of 10 current members qualifying as independent directors, together with the strength and experience of the individual Board members, will assure that the Board continues to:

- •

- Fully perform its duties and independently identify and assess the most important areas concerning the business, and

- •

- Assess the performance of the Company's senior management, including the CEO.

In Neil Austrian, the Board has a strong lead director who, among other things, chairs meetings of the Board in the absence of the Chairman or when it is deemed appropriate in light of the Chairman's management role. Further, Mr. Austrian chairs and sets the

agenda for executive sessions of the independent directors, confers with the Chairman on the agenda, information flow and schedule of meetings, provides feedback to the Chairman on corporate and Board strategies and, together with the Chairman of the Compensation Committee, oversees the evaluation of the CEO. The Board will revisit the Board leadership arrangement on an annual basis.

Role of the Board in Risk Management

Risk management is primarily the responsibility of the Company's management. However, the Board provides risk oversight to help assure that management has implemented processes to identify and manage the most significant risks associated with the business of the Company. The Board uses various means to fulfill this oversight responsibility. The Board reviews the annual business plan and receives updates on the results not less frequently than quarterly, which include the relevant risks, such as strategic, financial, operational and reputation risks, and the plans to address these risks. The Board does not believe that its role in risk oversight has any meaningful impact on how the leadership of the Board should be structured.

Additionally, an Enterprise Risk Management (ERM) program is in place that identifies significant risks, assigns executive management responsible for mitigating the risks, and provides regular reporting to the Audit Committee and to the Board. The ERM program also assigns oversight for the risks to either the full Board or the appropriate Board committee depending on the nature of the risk. Each committee monitors management in evaluating risks that fall within that committee's areas of responsibility. In performing this function, each committee has full access to management, as well as the ability to engage advisors at the Company's expense.

13

Table of Contents

DIRECTV

For information regarding the management of risk in connection with the compensation policies of the Company, please refer to "No Material Inappropriate Risks in Executive and Employee Compensation Programs" on page 70.

In addition, as part of the Corporate Audit and Assurance Annual Risk Assessment, the Audit Committee is provided with annual reports on key risk areas. The Company's Vice President, Corporate Audit and Assurance, who functionally reports directly to the Audit Committee, performs this assessment and assists the Company to identify and assess risks as part of the ERM program. In connection with its risk oversight role, at each of its meetings, the Audit Committee meets privately with representatives from the Company's independent public accounting firm and separately with the Company's Vice President, Corporate Audit and Assurance.

Finally, the Audit Committee provides oversight of the Company's culture and tone at the top through reports received on the Ethics/Whistleblower program as well as reports on the results of Sarbanes-Oxley testing of Entity Level Controls. The Audit Committee provides periodic reports to the Board that include these activities.

Stockholder Communications with the Board

Stockholders wishing to communicate with the directors may send a letter by regular or express mail addressed to the Corporate Secretary, DIRECTV, 2230 E. Imperial Highway, El Segundo, CA 90245, Attention: Board of Directors. The Corporate Secretary will deliver all correspondence sent to that address to the directors on a quarterly basis, unless management determines in an individual case that it should be sent more promptly. All correspondence to directors may also be forwarded within DIRECTV to an appropriate

subject matter expert for review. Stockholder concerns relating to accounting, internal controls or auditing matters are immediately brought to the attention of DIRECTV's Corporate Audit and Assurance function and handled in accordance with procedures established by the Audit Committee with respect to such matters, which include an anonymous toll-free hotline to report such matters,1-800-860-4031.

Special procedures have been established for stockholders and other interested parties wishing to communicate directly with Mr. Austrian as Chairman of the NCGC and as the lead director of the independent directors or to the independent directors as a group. Such communications should be sent as provided above and addressed to the attention of the Corporate Secretary. DIRECTV will adhere to the following procedures.

- 1.

- Upon receipt, the Corporate Secretary shall consult with the General Counsel to determine if the communication should be directed to DIRECTV's Chief Ethics Officer for disposition in accordance with DIRECTV's Procedure for Handling Ethics Complaints (Ethics Procedure) or should be provided to the Chairman of the NCGC for disposition as provided below.

- 2.

- Based on the outcome of the above, the Corporate Secretary shall:

- •

- Provide the communication to DIRECTV's Chief Ethics Officer for processing in accordance with the Company's Ethics Procedure and notify Mr. Austrian that she has done so, or

- •

- Provide the actual communication, or a summary thereof (as approved by the General Counsel), to Mr. Austrian.

- 3.

- Following receipt of any communication or summary, Mr. Austrian, in consultation with the General Counsel or independent legal counsel, as he deems appropriate, will determine whether the communication or summary shall be given to all independent directors.

14

Table of Contents

Composition of the Board

- 4.

- In any case, the Corporate Secretary shall retain copies of all such communications and make such communications available to independent directors, or to all directors, as directed by Mr. Austrian.

Annual Meeting Attendance

DIRECTV does not require the attendance of directors at the Company's Annual Meeting. All the members of the Board of Directors of DIRECTV, as constituted at that time, attended the 2011 Annual Meeting. The directors attending were Messrs. Austrian, Boyd, Dillon, DiPIazza, Lee, Lund, White and Mses. Newcomb and Norrington.

15

Table of Contents

DIRECTV

Director Information

The current members of the Board of Directors of DIRECTV are set out in the table below (information as to age, position and committee membership is as of March 16, 2012, unless otherwise noted).

| | | | | | |

Name

| | Age

| | Position

| | Committee Memberships

|

|---|

Neil Austrian | | 72 | | Chairman and Chief Executive Officer, Office Depot, Inc. | | • Nominating and Corporate Governance (Chair) • Compensation |

Ralph Boyd, Jr. | | 55 | | Strategic Consultant | | • Audit (Chair) • Nominating and Corporate Governance |

David Dillon | | 60 | | Chairman and Chief Executive Officer, The Kroger Co. | | • Audit • Nominating and Corporate Governance |

Samuel DiPiazza, Jr. | | 61 | | Vice Chairman, Institutional Clients Group, Citibank | | • Audit • Nominating and Corporate Governance |

Dixon Doll | | 69 | | Co-Founder and General Partner, DCM | | • Compensation • Nominating and Corporate Governance |

Charles Lee | | 72 | | Retired Chairman and Co-Chief Executive Officer, Verizon Communications, Inc. | | • Compensation (Chair) • Nominating and Corporate Governance |

Peter Lund | | 71 | | Private Investor and Media Consultant | | • Audit • Compensation • Nominating and Corporate Governance |

Nancy Newcomb | | 66 | | Retired Senior Corporate Officer, Citigroup, Inc. | | • Audit • Nominating and Corporate Governance |

Lorrie Norrington | | 52 | | Former President, eBay Marketplaces, eBay, Inc. | | • Compensation • Nominating and Corporate Governance |

Michael White, Chairman | | 60 | | Chairman, President and Chief Executive Officer | | None |

| | | | | | | |

Directors who have been nominated and are standing for election at the Annual Meeting are Messrs. Boyd, Dillon, DiPiazza, Doll and Lund and Mses. Newcomb and Norrington.

At last year's Annual Meeting, the stockholders approved a proposal to declassify the Board of Directors. The declassification process is described in the Certificate and is implemented in a way that does not attempt to shorten the terms to which Board members were elected prior to the proposal. Consequently, only seven

nominees are being presented for election by the stockholders because the terms of Messrs. Austrian, Lee and White do not expire until the Annual Meeting of stockholders in 2013.

Your proxy entitles you to vote only for the number of nominees who are standing for election at the Annual Meeting. That is, you are limited to voting for seven nominees to the Board of Directors. You cannot vote for a greater number of persons.

16

Table of Contents

Composition of the Board

Director Biographies and Business Experience (Term Expires at 2013 Annual Meeting)

Set forth below are brief biographies of the current members of the Board of Directors other than the directors nominated for election at this year's Annual Meeting. We have also provided the particular experience, qualifications, attributes or skills that led the Board to conclude that the person should serve as a director of the Company. Comparable information for the current members of the Board of Directors that have been nominated and have agreed to stand for re-election at the Annual Meeting is provided as part of Proposal 1, beginning on page 32.

| | | | | | |

| |

|

|

Neil Austrian

Class I

Term expires 2013 |

|

•

Director (December 2003 to present) • Chair of the Nominating and Corporate Governance Committee (December 2003 to present) • Compensation Committee (February 2008 to present) • Audit Committee (February 2009 to February 2011)

Professional Experience • Chairman and Chief Executive Officer, Office Depot, Inc. (May 2011 to present) • Interim Chairman and Chief Executive Officer, Office Depot, Inc. (October 2010 to May 2011 and October 2004 to March 2005) • President and Chief Operating Officer of the National Football League (1991 to 1999) • Managing Director of Dillon, Read & Co., Inc. (1987 to 1991)

Service on Other Boards of Directors • Director, Office Depot, Inc. (1998 to present)

Qualifications, Attributes and Skills • Extensive business accomplishments and long and varied business career provide a significant resource to the Board and to the Company • Experience with the business of professional sports is particularly valuable to the Company given our focus on sports as a significant component of our differentiated product offering • Business career and service on the boards of other major businesses, along with his commitment to service and the community as evidenced by his service as a board member of Community Anti-Drug Coalitions of America, provide a well-rounded personal and professional viewpoint • Experience with and exposure to governance issues make him the right choice to chair the Board's Nominating and Corporate Governance Committee and to serve as lead independent director • Financial background and diverse business background have provided an excellent base for his service on the Board's Compensation Committee |

|

|

| | | | | | | |

17

Table of Contents

DIRECTV

| | | | | | |

| |

|

|

Charles Lee

Class I

Term expires 2013 |

|

•

Director (December 2003 to present) • Compensation Committee (December 2003 to present; Chair, February 2006 to present) • Nominating and Corporate Governance Committee (December 2003 to present)

Professional Experience • Non-executive Chairman, Verizon Communications, Inc. (Verizon) (April 2002 to December 2003) • Chairman and Co-Chief Executive Officer, Verizon (2000 to 2002) • Chairman of the Board of Directors and Chief Executive Officer, GTE Corporation (Prior to 2000)

Service on Other Boards of Directors • United Technologies Corporation (current) • United States Steel Corporation (current) • Marathon Petroleum Corporation (current) • Proctor & Gamble (until 2010) • Trustee Emeritus and Presidential Councilor, Cornell University • Board of Overseers for The Weill Cornell Medical College

Education • Bachelor's degree, Metallurgical Engineering, Cornell University • Master's degree in business administration with distinction, Harvard Graduate School of Business Administration

Qualifications, Attributes and Skills • Long and successful business career with a depth of experience in executive leadership and corporate finance • Service on boards of other major corporations • Experience with a major telecommunications company and consumer products company are particularly helpful to the Board in understanding the communications and media businesses as it relates to the business and strategy of the Company • Commitment to public service • Executive and director experience and breadth of understanding of U.S. business provide an excellent background for his role as Chair of the Compensation Committee and as a member of the Nominating and Corporate Governance Committee |

|

|

| | | | | | | |

18

Table of Contents

Composition of the Board

| | | | | | |

| |

|

|

Michael White

Class I

Term expires 2013 |

|

•

President and Chief Executive Officer (January 2010 to present) • Chairman of the Board (June 2010 to present) • Director (November 2009 to present) • Management's voice on the Board of Directors

Professional Experience • Member Board of Directors and Vice Chairman, PepsiCo (March 2006 to November 2009) • Chairman and Chief Executive Officer, PepsiCo International (February 2003 to November 2009) • President and Chief Executive Officer, Frito-Lay's Europe/Africa/Middle East division (2000 to 2003) • Senior Vice President and Chief Financial Officer, PepsiCo (1998 to 2000) • Executive Vice President and Chief Financial Officer, PepsiCo Foods International • Chief Financial Officer, Frito-Lay North America • Vice President of Planning, Frito-Lay (1990)

Service on Other Boards of Directors • Whirlpool Corporation (Chair, Human Resources Committee; member, Corporate Governance and Nominating Committee) (current)

Education • BA, Boston College • Master's degree, International Relations, Johns Hopkins University

Qualifications, Attributes and Skills

Broad business experience and responsibilities, including: • Twenty-year stint with PepsiCo, consisting of significant senior executive experience in finance and international operations, leading a transformation of PepsiCo's international business and helping engineer numerous acquisitions • Executive positions at Avon Products, Inc., Bain & Company and Arthur Andersen & Co. • Selected by the Board of Directors of DIRECTV to serve as CEO, President and Chairman not only based on his business experience but also based on the Board's assessment of his ability to work proactively with the Board to develop and implement a strategy for success for the Company in the coming years |

|

|

| | | | | | | |

19

Table of Contents

DIRECTV

Committees of the Board of Directors

The current charter of each of the committees described below is available through the sources listed under "How can I get copies of governance materials?" on page 9.

Nominating and Corporate Governance Committee

| | |

| |

|

|---|

| | | |

| NCGC Membership |

Neil Austrian, Chair |

• Ralph Boyd, Jr. | | • Charles Lee |

• David Dillon | | • Peter Lund |

• Samuel DiPiazza, Jr. | | • Nancy Newcomb |

• Dixon Doll | | • Lorrie Norrington |

| | | |

The Nominating and Corporate Governance Committee (NCGC) currently has nine members, all of whom are independent directors as defined by NASDAQ. The NCGC met four times in 2011. Mr. Lund and Ms. Norrington were named to NCGC in February 2011 and participated in all meetings of the NCGC. Mr. Dillon was appointed in April 2011 and participated in two meetings. Mr. Doll was appointed in July 2011 and participated in one meeting.

The NCGC is responsible for taking a leadership role in shaping the corporate governance of DIRECTV and is responsible for developing and recommending to the Board a set of corporate governance guidelines applicable to DIRECTV and to periodically review and recommend changes to those guidelines.

The NCGC also conducts an annual review of the Company's Code of Ethics and Business Conduct and the Company's Code of Ethics applicable to the Chief Executive Officer and Senior Financial Officers. It also researches and recommends candidates for membership on the Board, considers whether to nominate incumbent members for re-election, makes recommendations to the Board as to the

determination of director independence and recommends to the Board retirement policies for directors. The NCGC also makes recommendations concerning committee memberships, chairs and rotation, and sets the agendas for the executive sessions of the independent directors.

Audit Committee

| | |

| |

|

|---|

| | | |

| Audit Committee Membership |

Ralph Boyd, Jr., Chair |

• David Dillon | | • Peter Lund |

• Samuel DiPiazza, Jr. | | • Nancy Newcomb |

| | | |

The Audit Committee currently has five members all of whom are independent directors as defined by the NASDAQ. The Audit Committee met five times in 2011. Mr. Austrian resigned from the Audit Committee in February 2011 and attended one meeting. Mr. Dillon was appointed to the Audit Committee in April 2011 and attended two meetings.

The primary function of the Audit Committee is to assist the Board in:

- •

- Fulfilling its oversight responsibilities for the financial reports and other financial information provided by DIRECTV to the stockholders and others

- •

- Evaluating DIRECTV's system of internal controls

- •

- Overseeing the Company's compliance procedures for the employee code of ethics and standards of business conduct

- •

- Overseeing DIRECTV's audit, accounting and financial reporting processes generally, and

- •

- Reviewing and deciding upon proposed transactions with related parties.

Based on the education, experience and offices held as described in more detail in the biographical information provided on each on pages 33, 34, 35, 37 and 38, the Board has determined that each of Messrs. Boyd, Dillon, DiPiazza and Lund and Ms. Newcomb are qualified to serve as the Audit Committee's financial experts and each satisfies the

20

Table of Contents

Composition of the Board

standard for "audit committee financial expert" under the Sarbanes-Oxley Act of 2002.

Compensation Committee

| | |

| |

|

|---|

| | | |

| Compensation Committee Membership |

Charles Lee, Chair |

• Neil Austrian | | • Peter Lund |

• Dixon Doll | | • Lorrie Norrington |

| | | |

The Compensation Committee currently has five members. The Compensation Committee met four times in 2011. Ms. Norrington was named to the Compensation Committee in February 2011 and attended three meetings. Mr. Doll was named to the Compensation Committee in September 2011 and attended two meetings.

The Board has determined that each member is an independent, non-employee or outside director under applicable NASDAQ rules, Rule 16b-3 under the Exchange Act and Section 162(m) of the Internal Revenue Code of 1986, as amended from time to time (the Code). Executive sessions without members of management present are held when appropriate and at least once each year. The members of the Compensation Committee are not eligible to participate in any of the compensation plans or programs that the Committee administers, except for the standard compensation received in connection with service on the Board and its committees.

The Compensation Committee:

- •

- Sets the level of compensation of the CEO, and the other elected officers of the Company, reviews and approves corporate goals and objectives relevant to the compensation of the CEO and the other elected officers, and evaluates performance in light of those goals and objectives

- •

- Approves, amends and administers all plans, programs and other arrangements, designed and intended to provide compensation primarily for executive officers

- •

- Recommends all equity-based plans for approval by stockholders and oversees their administration

- •

- Monitors compliance by executives with the Company's stock ownership policy as approved by the Compensation Committee

- •

- Reviews the compensation levels and program designs for directors for service on the Board and its committees and recommends changes in such compensation

- •

- Evaluates the Compensation Committee's performance at least annually, and

- •

- Reviews and approves the Compensation Discussion and Analysis and prepares the Committee's report to be included in the Company's annual Proxy Statement.

The Committee has engaged an independent compensation consultant. For more information, see "Independent Compensation Consultant" on page 65.

The Compensation Committee may delegate its authority to subcommittees or the Chairman of the Compensation Committee with the authority to act on the Compensation Committee's behalf. The Compensation Committee has delegated authority over the granting and administration of stock-based awards, other than awards to elected officers, to the Special 2010 Stock Plan Committee, which consists solely of the CEO. As successor administrator of the previous Hughes Electronics Incentive Plan, The DIRECTV Group, Inc. 2004 Stock Plan and The Liberty Entertainment, Inc. Transitional Stock Adjustment Plan, the Compensation Committee has delegated certain administrative authority over outstanding stock awards to employees other than elected officers to a committee consisting of the CEO and the senior executive for Human Resources. As administrator of the employee and executive benefit plans and programs, the Committee has delegated certain design and administrative authority to two management committees, the Administrative Committee and the Investment Review Committee.

21

Table of Contents

DIRECTV

Compensation Committee Interlocks and Insider Participation

During 2011, three persons, Charles Lee, Chair, Neil Austrian and Peter Lund, served as members of the Compensation Committee for the entire year; Dixon Doll and Lorrie Norrington served for a portion of the year.

Each member of the Compensation Committee has been determined by the Board to be an independent director as defined in the By-Laws and the applicable rules of NASDAQ and none of them is or has been a current or former officer or employee of the Company.

22

Table of Contents

Director Compensation

|

2011 Director Compensation

|

Summary of Changes in 2011

There were no changes in the Board's compensation programs during 2011.

The following directors joined the Board in 2011 and the 2011 Director Compensation Table on page 24 reflects their compensation for a partial year of Board service:

| | |

Director

| | Date Joined

|

|---|

| Lorrie Norrington | | February 11, 2011 |

| David Dillon | | March 10, 2011 |

| Dixon Doll | | July 27, 2011 |

| |

Compensation

The two principal components of compensation for directors are (i) annual cash compensation for service on the Board and its committees and (ii) annual stock compensation for service on the Board. Mr. White, who is an employee director, is not compensated as a member of the Board.

Many aspects of compensation for the Company's directors are similar to those of the executives:

- •

- Directors' compensation is evaluated annually and against the same peer group of companies as the named executive officers (the peer group of companies is discussed further at page 63)

- •

- Target levels of Board and committee compensation are approximately at the median for the peer group

- •

- Stock-based compensation is approximately 50% of total compensation

- •

- The directors are subject to a stock ownership guideline.

To assist in determining the forms and levels of director compensation, the Compensation Committee engaged the same independent consultant it uses for executive compensation. As part of the Compensation Committee's regular review of Board compensation, the

Consultant prepared an assessment of Board compensation among the peer group and in other industries. Based on this assessment, the Compensation Committee determined that there would be no changes in Board compensation for 2011. The 2011 cash and stock compensation for the independent directors is as follows:

Supplementary Chart 1—Annual Board of Directors Compensation

| | | |

| |

Cash Board Compensation | | $ | 80,000 |

Stock Board Compensation | | $ | 120,000 |

Audit Committee Chair | | $ | 30,000 |

Other Committee Chair | | $ | 20,000 |

Audit Committee Member | | $ | 15,000 |

Other Committee Member | | $ | 10,000 |

| |

The Company does not pay any compensation on a "per meeting" basis.

Independent directors are reimbursed for related travel and director education expenses and all directors are eligible for complimentary DIRECTV programming and matching of charitable gifts consistent with the Company's policies for employees. There are no separate benefit plans for directors, other than the savings plan described in this section. Directors are not eligible to participate in any other compensation or benefit program provided for the Company's employees. Our Certificate and By-Laws provide for indemnification of the Company's directors and officers and we maintain director and officer liability insurance. In 2011, the Company entered into an indemnification agreement with each of the independent directors. The form of agreement is the same for all independent directors and was attached as Exhibit 10.1 to the Form 8-K filed by DIRECTV with the SEC on August 4, 2011.

The 2011 Director Compensation Table and the notes following the table provide more information regarding director compensation.

23

Table of Contents

DIRECTV

2011 Director Compensation

| | | | | | | | | | | | | |

Name

(a)

| | Fees earned or

paid in cash

($)

(b)

| | Stock Awards

($)

(c)

| | All Other

Compensation

($)

(d)

| | Total

($)

(e)

| |

|---|

Neil Austrian | | | 112,516 | | | 120,138 | | | 13,893 | | | 246,547 | |

Ralph Boyd, Jr. | | | 120,012 | | | 120,138 | | | 24,131 | | | 264,281 | |

David Dillon | | | 83,342 | | | 120,384 | | | 2,935 | | | 206,661 | |

Samuel DiPiazza, Jr. | | | 105,012 | | | 120,138 | | | 23,432 | | | 248,582 | |

Dixon Doll | | | 47,508 | | | 60,510 | | | 24,025 | | | 132,043 | |

Charles Lee | | | 110,016 | | | 120,138 | | | 24,264 | | | 254,418 | |

Peter Lund | | | 114,186 | | | 120,138 | | | 3,874 | | | 238,198 | |

Nancy Newcomb | | | 105,012 | | | 120,138 | | | 23,410 | | | 248,560 | |

Lorrie Norrington | | | 91,685 | | | 120,138 | | | 3,957 | | | 215,780 | |

| | | | | | | | | | | | | | |

Cash Compensation

The amounts shown in column (b) represent the cash compensation paid to the directors or contributed to the savings plan described in this section by the directors during 2011. The compensation shown for Messrs. Dillon and Doll and Ms. Norrington reflects each director's partial year of service on the Board.

Stock Compensation

The amounts shown in column (c) are the grant date fair value of stock compensation paid during 2011. The fair value on the February 25, 2011 grant date was $46.03 per share, which is the closing price of the Common Stock on that date. The number of shares provided as stock compensation for the year was determined as $120,000 in target value divided by the closing stock price, and rounded up to the next higher 10 shares. This calculation resulted in a 2011 payment of 2,610 shares worth $120,138 on the grant date to each director, except for Messrs. Dillon and Doll. Mr. Dillon joined the Board on March 10, 2011 and received 2,640 shares as stock compensation for 2011 based on the $45.60 closing stock price on that date. Mr. Doll joined the Board on July 28, 2011 and received 1,180 shares as stock compensation for 2011 based on the $51.28 closing stock price on that date.

The Board's stock compensation program provides that a director, such as Mr. Doll, who joins the Board after the Annual Meeting of stockholders will receive a prorated stock payment for the first year of service on the Board. As of December 31, 2011, no director had an outstanding stock or stock option award.

Savings Plan

The independent directors are eligible to participate in a savings plan called the DIRECTV Deferred Compensation Plan for Non-Employee Directors, which is a pre-tax savings plan subject to Section 409A of the Code. A director may elect to contribute any combination of cash compensation up to 100% and stock compensation up to 100% or not to participate at all. Cash contributions are credited at the director's election either to an interest bearing account or converted to Restricted Stock Units (RSUs). Interest on cash contributions is fixed annually and approximates 10-year Treasury Note rates and no portion of the interest is above market rates. Stock contributions are converted to RSUs. The RSU values increase and decrease with the market value of the Common Stock. Directors elect to have account balances paid as a lump sum or in up to 10 annual

24

Table of Contents

Director Compensation

installments, beginning in the year following the year a director ceases to serve on the Board.

All Other Compensation

All other benefits earned or given to or on behalf of the directors (as shown in column (d) of the 2011 Director Compensation Table above) are identified in Supplementary Chart 2 and the discussion following.

Supplementary Chart 2—Board Of Directors—All Other Compensation

| | | | | | | | | | |

Name

(a)

| | Payments and Promises of

Payments Pursuant to

Director Legacy Programs

and Similar Charitable

Award Programs

($)

(b)

| | Other

($)

(c)

| | Total

($)

(d)

| |

|---|

Neil Austrian | | | 10,000 | | | 3,893 | | | 13,893 | |

Ralph Boyd, Jr. | | | 20,000 | | | 4,131 | | | 24,131 | |

David Dillon | | | 0 | | | 2,935 | | | 2,935 | |

Samuel DiPiazza, Jr. | | | 20,000 | | | 3,432 | | | 23,432 | |

Dixon Doll | | | 20,000 | | | 4,025 | | | 24,025 | |

Charles Lee | | | 20,000 | | | 4,264 | | | 24,264 | |

Peter Lund | | | 0 | | | 3,874 | | | 3,874 | |

Nancy Newcomb | | | 20,000 | | | 3,410 | | | 23,410 | |

Lorrie Norrington | | | 250 | | | 3,707 | | | 3,957 | |

| | | | | | | | | | | |

Payments and Promises of Payments Pursuant to Director Legacy Programs and Similar Charitable Award Programs

Members of the Board of Directors are eligible for DIRECTV's Gift Matching Program in which the Company matches dollar-for-dollar qualified gifts to non-profit organizations, up to $20,000 per employee and director per year. Eligible recipient organizations must operate on a not-for-profit basis and must conduct their giving in a country served by DIRECTV U.S. or DIRECTV Latin America. In the United States, they must be certified for tax-exempt status under Section 501(c)(3) of the Code. Organizations based solely outside of the U.S. must clear both the Patriot Act and OFAC terror watch lists to be eligible. We will not match contributions to institutions that restrict admission or aid due to race or religious beliefs. We will match gifts to qualified institutions affiliated with religious

organizations, but will not match gifts made directly to religious organizations. For 2011, we exempted contributions to the Japan Disaster Relief from the $20,000 limit on matching gifts. Charitable contributions are shown in Supplementary Chart 2, column (b). Matching gifts on behalf of Mr. White are reported in column (h) of the 2011 Summary Compensation Table on page 72.

Other

Column (c) entitled "Other" represents the value of complimentary DIRECTV programming, a benefit that is provided to all employees, managers, executives and directors. Each director is given complimentary DIRECTV service, which we report as a perquisite in the same manner as we report it for the named executive officers, as described beginning on page 74.

25

Table of Contents

DIRECTV

The names and ages of the executive officers of DIRECTV as of March 16, 2012, and their positions with DIRECTV are as follows:

| | | | |

Executive Officer

| | Age

| | Position

|

|---|

Michael White | | 60 | | Chairman, President and Chief Executive Officer |

Joseph Bosch | | 53 | | Executive Vice President and Chief Human Resources Officer |

Bruce Churchill | | 54 | | Executive Vice President, President of DIRECTV Latin America, LLC and President—New Enterprises |

Patrick Doyle | | 56 | | Executive Vice President, Treasurer and Chief Financial Officer |

Larry Hunter | | 61 | | Executive Vice President and General Counsel |

Romulo Pontual | | 52 | | Executive Vice President and Chief Technology Officer |

John Murphy | | 43 | | Senior Vice President, Controller and Chief Accounting Officer |

| | | | | |

The Board of Directors elected each of the above executive officers. Executive officers of DIRECTV serve at the discretion of the Board of Directors and may be removed at any time by the Board with or without cause.

A brief biography of each of the executive officers, except Michael White, follows. Mr. White's biography is under "Director Biographies and Business Experience (Term Expires at 2013 Annual Meeting)" on page 17.

| | |

| Biographies of Executive Officers |

| Joseph Bosch | | Mr. Bosch has served as Executive Vice President and Chief Human Resources Officer of the Company since August 2010. Prior to joining the Company, Mr. Bosch served as Senior Vice President of Human Resources for Centex Corporation from July 2006 to August 2009. Previously, Mr. Bosch served as Senior Vice President of Human Resources for Tenet Healthcare Corporation from August 2004 to June 2006. He served in a variety of senior human resources management positions with Pizza Hut, Pizza Hut International and other Pepsi-Cola North America operations. |

Bruce Churchill |

|

Mr. Churchill has served as the Executive Vice President of the Company, President of DIRECTV Latin America LLC and as President—New Enterprises since January 2004. He served as Chief Financial Officer of the Company from January 2004 to March 2005. Prior to joining the Company, Mr. Churchill served as President and Chief Operating Officer of STAR, a position he held beginning in May 2000. Previously, he served as the Deputy Chief Executive Officer of STAR since 1996. Prior to joining STAR, Mr. Churchill served as Senior Vice President, Finance at Fox Television. |

|

|

|

| Patrick Doyle | | Mr. Doyle has served as Executive Vice President since October 2008 and has served as Treasurer of the Company since February 2012 and as Chief Financial Officer since October 2007 when he was also appointed as Senior Vice President. He served as Treasurer, Controller and Chief Accounting Officer of the Company from June 2001 to October 2007. He was appointed Corporate Vice President and Controller in July 2000 and Treasurer in June 2001. Previously, Mr. Doyle served as Vice President, Taxes from October 1996 to July 2000 and was given the additional responsibility of Corporate Development in June 1997. |

26

Table of Contents

Executive Officers

| | |

Larry Hunter |

|

Mr. Hunter has served as Executive Vice President and General Counsel of the Company since January 2004. He also served as Interim Chief Executive Officer from July 1, 2009 until December 31, 2009. Mr. Hunter served as Senior Vice President from June 2001 to January 2004 and as General Counsel since December 2002. He was named Associate General Counsel in June 2001 and was named Corporate Vice President in August 1998. Mr. Hunter served as Chairman and Chief Executive Officer of DIRECTV Japan from 1998 to 2001. Mr. Hunter was assigned responsibility for overseeing the Human Resources and Corporate Communications departments in 2007, and the Administration department in 2008, and retained those responsibilities until July 2010. |

|

|

|

| Romulo Pontual | | Mr. Pontual has served as Executive Vice President and Chief Technology Officer of the Company since January 2004. Prior to joining the Company, Mr. Pontual served as Executive Vice President, Television Platforms at News Corporation since 1996. |

John Murphy |

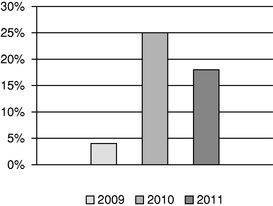

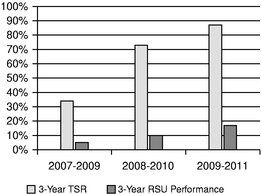

|