December 20, 2022

VIA EDGAR

Division of Corporation Finance

Office of Real Estate & Construction

Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

Attention: Shannon Menjivar, Accounting Branch Chief

William Demarest, Staff Accountant

| | | | | |

| |

| Re: | STARWOOD PROPERTY TRUST, INC. |

| Form 10-K for the year ended December 31, 2021 |

| Filed February 25, 2022 |

| File No. 001-34436 |

Ladies and Gentlemen:

Starwood Property Trust, Inc. (“Starwood”, the “Company” or “we”) hereby responds to the follow-up comment of the staff (the “Staff”) of the Division of Corporation Finance of the U.S. Securities and Exchange Commission (the “SEC”) contained in your letter dated December 6, 2022 (the “Comment Letter”) regarding Starwood’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021 (the “2021 Form 10-K”). For the convenience of the Staff, we have set forth the comment below followed by Starwood’s response to the comment.

Non-GAAP Financial Measures, page 76

COMMENT:

1.We note your response to comment 1 and that the presentation of Distributable Earnings

(DE) is intended to eliminate differences between DE and taxable income. Please provide

a comparison of DE to taxable income for the years ended December 2020 and 2021 and a

comparison of DE to estimated taxable income for the period ended September 30, 2022.

To the extent historical and estimated taxable income differs from DE please explain to us

the material differences.

U.S. Securities and Exchange Commission

December 20, 2022

Page 2

STARWOOD RESPONSE:

The disclosures in our periodic filings indicate that over time Distributable Earnings (“DE”) has been a strong indicator of our dividends, but our disclosures also caution that DE does not represent a measure of our taxable income. While DE is not intended to entirely eliminate the differences between GAAP net income and taxable income, DE does have a stronger correlation to our dividend than GAAP net income, which is the primary reason this non-GAAP measure was created.

As noted in our prior communications, one of the principal reasons investors invest in commercial mortgage REITs is to earn a dividend. Given the low correlation between GAAP earnings and our dividend, DE was designed by commercial mortgage REITs to provide stakeholders with the means to assess our ability to pay dividends while simultaneously attempting to keep this non-GAAP measure as simple, understandable and verifiable as possible. As the dividend coverage data below illustrates, there is a very strong and consistent correlation between DE and our dividend.

While DE is a strong indicator of dividends, it was not designed to equal, and generally will not equal, taxable income. The reasons for this are multifold: (i) the rules under the Internal Revenue Code (the “Code”) are incredibly complex and not generally well-understood by typical REIT investors; (ii) the tax rules are often very different from GAAP; and (iii) taxable income cannot be reliably estimated on an interim basis because it is, by definition, an annual calculation under the Code.

In contrast, the DE construct was designed to be as simple as possible, with adjustments grounded in GAAP. The adjustments in our GAAP to DE reconciliation either equal an amount in our GAAP income statement or are derived by using a GAAP based formulation. Doing so allows such adjustments to be easily understood by readers of the financial statements who are more likely to be familiar with GAAP than the intricate tax rules. As a result, DE is not designed to, and will never, replicate taxable income. In addition, computing taxable income on an interim basis is simply not possible given that the underlying framework is annual.

Further, there is a distinction between taxable income (i.e., the amount that must be distributed) and DE (i.e., the amount of earnings available to be distributed). The former effectively sets a floor on dividends because to comply with the REIT rules, a REIT needs to distribute each year substantially all taxable income to its shareholders. The latter provides a critical measure by which management, boards of directors, analysts and investors can assess the degree to which a commercial mortgage REIT’s dividends are sustainably covered by distributable earnings. Together, these two measures serve as key indicators of the dividends that are paid. Some

U.S. Securities and Exchange Commission

December 20, 2022

Page 3

REITs, like us, generally set their dividend at levels close to the amount of taxable income and retain the excess available distributable earnings to reinvest in the business. Other REITs distribute a higher percentage of their DE in order to maintain dividends at levels they deem in the company’s best interests, and some REITs pay dividends in excess of DE, presumably in the hopes that future DE will increase and cover the dividend. Investors rely on DE coverage ratios to understand these different practices and assess the long-term viability of the current dividend level.

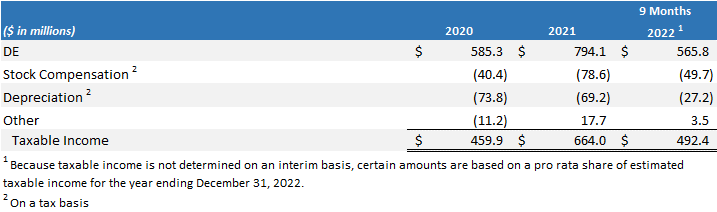

As reflected in the tables below, the significant differences between taxable income and DE for the periods presented have generally been stock compensation and depreciation. While each of these items represent a deduction in computing taxable income, both of these non-cash amounts have traditionally been added back to GAAP net income to calculate DE.

As discussed above, although taxable income effectively establishes the amount a REIT is required to distribute, large non-cash deductions like depreciation mean that taxable income is not always an accurate measure of earnings that a REIT is able to distribute. This helps explain why DE is not intended to be a measure of taxable income, but rather of distributable income.

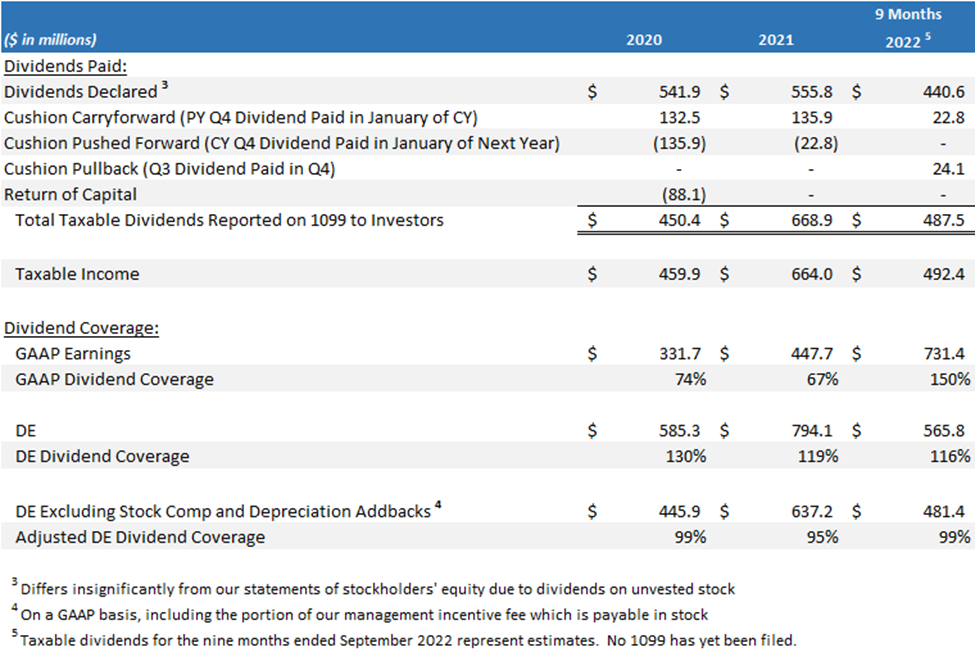

As illustrated in the following table, DE, taxable income and dividends paid are highly correlated, while there is traditionally a low correlation between GAAP earnings, taxable income and our dividends paid. Not surprisingly, neither our management, our board, our analysts, nor to our knowledge our investors, consider GAAP net income as an indicator of our dividend or use it to assess dividend sustainability.

U.S. Securities and Exchange Commission

December 20, 2022

Page 4

In sum, the above illustrates that our GAAP net income is not correlated to our dividend, with coverage ranging from 67% to 150% over the periods presented. In contrast, DE provides a much more consistent and highly correlated metric to the dividend and to taxable income, with coverage ranging from 116% to 130% before adjusting for non-cash tax deductions such as stock compensation and depreciation, which brings the coverage range to 95% to 99%. These non-cash tax deductions effectively permit us to distribute less than our full DE and retain the excess to reinvest in our business. To the extent our peer commercial mortgage REITs were consistently not covering the dividend with DE, this would be a crucial signal to investors that the dividend rate may not be sustainable.

Given this relationship between taxable income (an effective floor), DE (an effective ceiling over the long-term) and dividends paid, it is important to monitor whether material differences between the calculations of DE and taxable income exist. It is for this reason that our definition of DE provides for special adjustments which require approval of our independent directors. It is likewise the reason we determined that the Woodstar gain needed to be included in DE. Without this adjustment, the relationship between these three metrics would be materially disconnected.

U.S. Securities and Exchange Commission

December 20, 2022

Page 5

The Importance of Taxable Deductions to REITs

As a REIT, we are required to distribute at least 90% of our taxable income to shareholders each year to maintain our REIT status under the Code and pay corporate income tax on any undistributed portion between 90% and 100% of earnings. Because of these requirements, REITs have significant constraints on their ability to retain earnings. By acquiring depreciable assets, REITs are able to retain earnings that can be redeployed into additional investments. This is a clear example of how the depreciation adjustment made in computing DE helps arrive at the amount of earnings that are distributable, even if that amount does not represent the amount of earnings required to be distributed pursuant to the Code, which amount is reduced by the deduction for depreciation.

Regarding the addback of stock compensation, it is important to note that while the GAAP expense is added back in arriving at DE, the shares related to this compensation are considered in the fully diluted denominator of DE per weighted average diluted share.

Proposed Enhanced Disclosure

As a result of our engagement with the Staff through this comment letter process, we intend to enhance our future disclosures regarding DE in order to further assist readers in understanding the purpose and utility of DE, and specifically the correlation to our dividend. We propose enhancing our disclosures on the usefulness of DE as follows:

Existing Disclosure Excerpt: We believe that Distributable Earnings (“DE”) provides meaningful information to consider in addition to our net income (loss) and cash flow from operating activities determined in accordance with GAAP. We believe DE is a useful financial metric for existing and potential future holders of our common stock as historically, over time, DE has been a strong indicator of our dividends per share. As a REIT, we generally must distribute annually at least 90% of our net taxable income, subject to certain adjustments, and therefore we believe our dividends are one of the principal reasons stockholders may invest in our common stock.

Proposed Additional Disclosure: DE was designed to provide stakeholders with a relatively simple, understandable, and verifiable way to assess our ability to pay dividends. The nature of the adjustments made to our GAAP net income in order to arrive at DE are similar to those made in arriving at taxable income, although the amounts may differ due to differences between GAAP and tax rules. For purposes of reconciling GAAP to DE, the adjustments are either already

U.S. Securities and Exchange Commission

December 20, 2022

Page 6

included in our GAAP income statement or are determined by reference to the overall GAAP framework.

However, there is a distinction between taxable income (i.e., the amount which determines what we are required to distribute) and DE (i.e., the amount of earnings available to be distributed). DE is not intended to entirely eliminate the differences between GAAP net income and taxable income, but instead is intended to provide investors with a more highly correlated metric to our dividend than GAAP net income. Taxable income cannot be reliably estimated on an interim basis because it is, by definition, an annual calculation under the Internal Revenue Code. In addition, the computation of taxable income is complex and subject to an entirely different set of rules than those prescribed by GAAP. As a result, DE will not, and cannot, equal taxable income. However, given that it has traditionally proven to be a stronger indicator of our dividend than GAAP, DE provides a critical measure which management and our board of directors utilize to determine our ability to pay our dividend and decide whether changes to our existing dividend levels are warranted.

* * * * *

If you should have any questions regarding the above or require further information, please do not hesitate to contact me by phone at 305-695-5470 or by email at rpaniry@starwood.com.

| | | | | |

| Very truly yours, |

| |

| /s/ RINA PANIRY |

| |

| Rina Paniry |

| Chief Financial Officer |