Use these links to rapidly review the document

TABLE OF CONTENTS1

TABLE OF CONTENTS2

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | |

| (Mark One) | | |

ý |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended February 3, 2013 |

or |

o |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

|

Commission file number 333-159809

HD SUPPLY, INC.

(Exact name of registrant as specified in its charter)

| | |

Delaware

(State or other jurisdiction of

incorporation or organization) | | 75-2007383

(IRS Employer Identification No.) |

3100 Cumberland Boulevard, Suite 1480,

Atlanta, Georgia

(Address of principal executive offices) |

|

30339

(Zip Code) |

(770) 852-9000

(Registrant's telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | |

| Title of Class | | Name of each exchange on which registered |

|---|

| None | | |

Securities registered pursuant to section 12(g) of the Act:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes o No ý

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer o | | Accelerated filer o | | Non-accelerated filer ý

(Do not check if a

smaller reporting company) | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).o Yes ý No

The registrant is a privately held corporation and its equity shares are not publicly traded. As of April 15, 2013, there were 1,000 shares of common stock of HD Supply, Inc. outstanding, all of which were owned by HDS Holding Corporation.

Table of Contents

INDEX TO FORM 10-K

| | | | | | |

| |

| | Page | |

|---|

| | Background Information and Glossary of Certain Defined Terms | | | 1 | |

| | Forward-looking statements and information | | | 3 | |

Part I | | | | | | |

Item 1. | | BUSINESS | | | 6 | |

Item 1A. | | RISK FACTORS | | | 16 | |

Item 2. | | PROPERTIES | | | 39 | |

Item 3. | | LEGAL PROCEEDINGS | | | 40 | |

Part II | | | | | | |

Item 5. | | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | | | 40 | |

Item 6. | | SELECTED FINANCIAL DATA | | | 41 | |

Item 7. | | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | | 44 | |

Item 7A. | | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | | | 79 | |

Item 8. | | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | | | 80 | |

Item 9A. | | CONTROLS AND PROCEDURES | | | 141 | |

Part III | | | | | | |

Item 10. | | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | | | 142 | |

Item 11. | | EXECUTIVE COMPENSATION | | | 148 | |

Item 12. | | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | | | 162 | |

Item 13. | | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | | | 167 | |

Item 14. | | PRINCIPAL ACCOUNTANT FEES AND SERVICES | | | 169 | |

Part IV | | | | | | |

Item 15. | | EXHIBITS AND FINANCIAL STATEMENT SCHEDULES | | | 170 | |

Signatures | | |

178 | |

Table of Contents

Background Information and Glossary of Certain Defined Terms

The Transactions

On August 30, 2007, investment funds associated with Bain Capital Partners, LLC ("Bain"), The Carlyle Group ("Carlyle") and Clayton, Dubilier & Rice, Inc. ("CD&R") (collectively, the "Equity Sponsors") formed HD Supply Holdings, Inc. (formerly known as HDS Investment Holding, Inc., "Holding") and entered into a stock purchase agreement with The Home Depot, Inc. ("Home Depot" or "THD") pursuant to which Home Depot agreed to sell to Holding, or to a wholly owned subsidiary of Holding, certain intellectual property and all the outstanding common stock of HD Supply, Inc. and the Canadian subsidiary CND Holdings, Inc. On August 30, 2007, through a series of transactions, Holding's direct wholly owned subsidiary, HDS Holding Corporation, acquired direct control of HD Supply through the merger of its wholly owned subsidiary, HDS Acquisition Corp., with and into HD Supply, Inc. (the "Company") and the Canadian subsidiary CND Holdings, Inc. Through these transactions (the "Transactions"), Home Depot was paid cash of $8.2 billion and 12.5% of Holding's common stock worth $325 million.

Defined Terms for Indebtedness

In this annual report on Form 10-K, unless otherwise indicated or the context otherwise requires:

- •

- "7.5% Senior Notes" refers to the Company's 7.50% Senior Notes due 2020 issued on February 1, 2013 in an aggregate principal amount of $1,275 million.

- •

- "11.5% Senior Notes" refers to the Company's 11.50% Senior Notes due 2020 issued on October 15, 2012 in an aggregate principal amount of $1,000 million.

- •

- "14.875% Senior Notes" refers to the Company's 14.875% Senior Notes due 2020 issued on April 12, 2012 in an aggregate principal amount of $757 million.

- •

- "ABL Facility" refers to the Company's asset based lending facility issued on April 12, 2012, providing for senior secured revolving loans and letters of credit of up to a maximum aggregate principal amount of $1,500 million (subject to availability under the borrowing base).

- •

- "April 2012 First Priority Notes" refers to the Company's 81/8% Senior Secured First Priority Notes due 2019 issued on April 12, 2012 in an aggregate principal amount of $950 million.

- •

- "August 2012 First Priority Notes" refers to the Company's 81/8% Senior Secured First Priority Notes due 2019 issued on August 2, 2012 in an aggregate principal amount of $300 million.

- •

- "First Priority Notes" refers collectively to the April 2012 First Priority Notes and the August 2012 First Priority Notes.

- •

- "Old ABL Credit Facility" refers to the senior asset based revolving credit facility entered into by HD Supply (as successor by merger to HDS Acquisition Subsidiary, Inc.) on August 30, 2007 (as amended by Amendment No. 1, dated as of October 3, 2007, Amendment No. 2, dated as of November 1, 2007, and Limited Consent and Amendment No. 3, dated as of March 19, 2010), in an aggregate principal amount of $2,100 million, a portion of which may be used for letters of credit or swing-line loans.

- •

- "Old Senior Notes" refers to the Company's 12.0% Senior Cash Pay Notes due 2014.

- •

- "Old Senior Secured Credit Facility" refers to the senior secured credit facility entered into by HD Supply (as successor by merger to HDS Acquisition Subsidiary, Inc.) on August 30, 2007, as amended on October 2, 2007, November 1, 2007, and March 19, 2010, which consists of a $1,000 million term loan facility and a $300 million revolving credit facility.

1

Table of Contents

- •

- "Old Senior Subordinated Notes" refers to the Company's 13.5% Senior Subordinated Notes due 2015.

- •

- "Old Term Loan" refers to the $1,000 million term loan facility under the Old Senior Secured Credit Facility.

- •

- "Priority Notes" refers collectively to the First Priority Notes and the Second Priority Notes.

- •

- "Refinancing Transactions" refers to the transactions described below in "Description of Indebtedness."

- •

- "Second Priority Notes" refers to the Company's 11.0% Senior Secured Second Priority Notes due 2020 issued on April 12, 2012 in an aggregate principal amount of $675 million.

- •

- "Senior Credit Facilities" refers collectively to the ABL Facility and the Term Loan Facility.

- •

- "Senior Notes" refers collectively to the 11.5% Senior Notes and 7.5% Senior Notes.

- •

- "Senior Subordinated Notes" refers to the Company's 10.5% Senior Subordinated Notes due 2021 issued on January 16, 2013 in an aggregate principal amount of $950 million.

- •

- "Term Loan Facility" refers to the Company's senior secured credit facility issued on April 12, 2012, providing for Term Loans in an aggregate principal amount of $1,000 million.

- •

- "Term Loan" refers to the term loans issued under the Term Loan Facility.

- •

- "THD Guarantee" refers to Home Depot's guarantee of our payment obligations for principal and interest of the Old Term Loan under the Old Senior Secured Credit Facility.

Description of Indebtedness

The following transactions (the "Refinancing Transactions") occurred on April 12, 2012:

- •

- Entry into a new Term Loan Facility and the repayment of all amounts outstanding under our Old Senior Secured Credit Facility.

- •

- Entry into a new ABL Facility and the repayment of all amounts outstanding under our Old ABL Credit Facility.

- •

- Bain and Carlyle exchanged certain of the Old Senior Notes held by them prior to the redemption of the Old Senior Notes for a portion of the 14.875% Senior Notes (the "Sponsor Exchange").

- •

- CD&R purchased a portion of the 14.875% Senior Notes (the "CD&R Purchase" and together with the Sponsor Exchange, the "14.875% Senior Notes Issuance").

- •

- The issuance of the April 2012 First Priority Notes.

- •

- The issuance of the Second Priority Notes.

- •

- The redemption of the remaining Old Senior Notes.

- •

- The termination of the THD Guarantee.

On August 2, 2012, we issued the August 2012 First Priority Notes. The net proceeds from the August 2012 First Priority Notes issuance were used to reduce outstanding borrowings under the Company's ABL Facility.

On October 15, 2012, we issued the 11.5% Senior Notes. On November 8, 2012, the net proceeds from the 11.5% Senior Notes issuance were used to redeem $930 million aggregate principal amount of Old Senior Subordinated Notes at a price of 103.375%.

2

Table of Contents

On January 16, 2013, we issued 10.5% Senior Subordinated Notes. On February 8, 2013, the net proceeds from the Senior Subordinated Notes issuance were used to redeem all of the remaining outstanding principal amount of Old Senior Subordinated Notes at a price of 103.375%.

On February 1, 2013, we issued the 7.5% Senior Notes due 2020. The net proceeds from the 7.5% Senior Notes issuance were used to repurchase all of the outstanding principal amount of 14.875% Senior Notes at a price equal to the principal amount of the 14.875% Senior Notes repurchased plus a make-whole premium (calculated pursuant to the formula set forth in the indenture governing the 14.875% Senior Notes to a repurchase date of February 1, 2013). Also on February 1, 2013, the trustee for the 14.875% Senior Notes cancelled all of the outstanding 14.875% Senior Notes.

On February 15, 2013, we modified the Term Loan Facility to lower the applicable borrowing margins and replace the hard call provision applicable to optional prepayment of term loans thereunder with a soft call option.

Our Senior Credit Facilities, First Priority Notes, Second Priority Notes, Senior Notes, Senior Subordinated Notes, and Old Senior Subordinated Notes are discussed in greater detail in "Item 8. Financial Statements and Supplementary Data—Notes to the Consolidated Financial Statements—Note 6, Debt" within this annual report on Form 10-K.

Glossary of Certain Other Terms

| | |

| ASC | | Accounting Standards Codification |

| HDS Canada | | HD Supply Canada |

| CTI | | Creative Touch Interiors |

| DCF | | Discounted cash flow |

| DOT | | U.S. Department of Transportation |

| Exchange Act | | Securities Exchange Act of 1934 |

| Fiscal 2010 | | Fiscal year ended January 30, 2011 |

| Fiscal 2011 | | Fiscal year ended January 29, 2012 |

| Fiscal 2012 | | Fiscal year ended February 3, 2013 |

| GAAP | | Generally accepted accounting principles in the United States of America |

| Gross margin | | Gross profit as a percentage of net sales |

| HD Supply | | HD Supply, Inc. |

| HDPE | | High-density polyethylene |

| Holding | | HD Supply Holdings, Inc. |

| HVAC | | Heating, ventilating, and air conditioning |

| IPVF | | Industrial Pipes, Valves and Fittings |

| MRO | | Maintenance, repair and operations |

| NOLs | | Net operating losses |

| Peachtree | | Peachtree Business Products LLC |

| PIK | | Paid-in-kind |

| PVC | | Polyvinyl chlorides |

| RAMSCO | | Rexford Albany Municipal Supply Company, Inc. |

| SKU | | Stock-keeping unit |

| SEC | | U.S. Securities and Exchange Commission |

| Vendor rebates | | Vendors providing for inventory purchase rebates |

Forward-looking statements and information

This annual report on Form 10-K includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Some of the forward-looking statements can be

3

Table of Contents

identified by the use of forward-looking terms such as "believes," "expects," "may," "will," "should," "could," "seeks," "intends," "plans," "estimates," "anticipates" or other comparable terms. These forward-looking statements include all matters that are not historical facts. They appear in a number of places throughout this report and include statements regarding our intentions, beliefs or current expectations concerning, among other things, our results of operations, financial condition, liquidity, prospects, growth strategies and the industries in which we operate.

Forward-looking statements are subject to known and unknown risks and uncertainties, many of which may be beyond our control. We caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and the development of the industries in which we operate may differ materially from those made in or suggested by the forward-looking statements contained in this report. In addition, even if our results of operations, financial condition and liquidity, and the development of the industries in which we operate are consistent with the forward-looking statements contained in this report, those results or developments may not be indicative of results or developments in subsequent periods. A number of important factors could cause actual results to differ materially from those contained in or implied by the forward-looking statements, including those reflected in forward-looking statements relating to our operations and business, the risks and uncertainties discussed in this annual report on Form 10-K (See "Risk Factors") and those described from time to time in our other filings with the SEC. Factors that could cause actual results to differ from those reflected in forward-looking statements relating to our operations and business include:

- •

- inherent risks of the maintenance, repair and operations market, infrastructure spending and the non-residential and residential construction markets;

- •

- our ability to achieve profitability;

- •

- our ability to service our debt and to refinance all or a portion of our indebtedness;

- •

- limitations and restrictions in the agreements governing our indebtedness;

- •

- the competitive environment in which we operate and demand for our products and services in highly competitive and fragmented industries;

- •

- the loss of any of our significant customers;

- •

- competitive pricing pressure from our customers;

- •

- our ability to identify and acquire suitable acquisition candidates on favorable terms;

- •

- cyclicality and seasonality of the maintenance, repair and operations market, infrastructure spending and the non-residential and residential construction markets;

- •

- our ability to identify and develop relationships with a sufficient number of qualified suppliers and to maintain our supply chains;

- •

- our ability to manage fixed costs;

- •

- the development of alternatives to distributors in the supply chain;

- •

- our ability to manage our working capital through product purchasing and customer credit policies;

- •

- potential material liabilities under our self-insured programs;

- •

- our ability to attract, train and retain highly qualified associates and key personnel;

- •

- limitations on our income tax net operating loss carryforwards in the event of an ownership change;

4

Table of Contents

- •

- our ability to identify and integrate new products; and

- •

- the significant influence our sponsors have over corporate decisions.

You should read this annual report on Form 10-K completely and with the understanding that actual future results may be materially different from expectations. All forward-looking statements made in this report are qualified by these cautionary statements. These forward-looking statements are made only as of the date of this annual report on Form 10-K, and we do not undertake any obligation, other than as may be required by law, to update or revise any forward-looking statements to reflect changes in assumptions, the occurrence of unanticipated events, changes in future operating results over time or otherwise. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data.

5

Table of Contents

PART I

ITEM 1. BUSINESS

Our Company

We are one of the largest industrial distributors in North America. We believe we have leading positions in the three distinct market sectors in which we specialize: Maintenance, Repair & Operations; Infrastructure & Power; and Specialty Construction. These market sectors are large and fragmented, and we believe they present opportunities for significant growth. We aspire to be the "First Choice" of customers, associates, suppliers and the communities in which we operate. This aspiration drives our relentless focus and is reflected in the customer and market centricity, speed and precision, intense teamwork, process excellence and trusted relationships that define our culture. We believe this aspiration distinguishes us from other distributors and has created value for our shareholders, driven above-market growth and delivered attractive returns on invested capital.

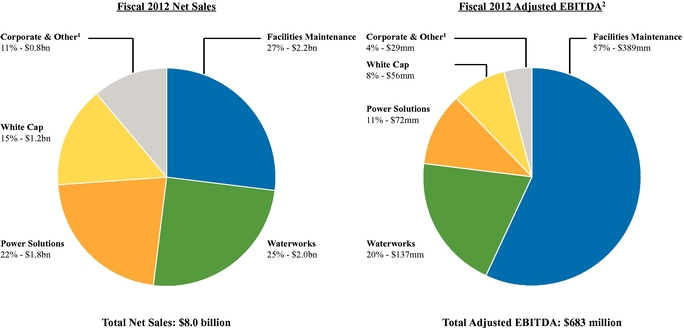

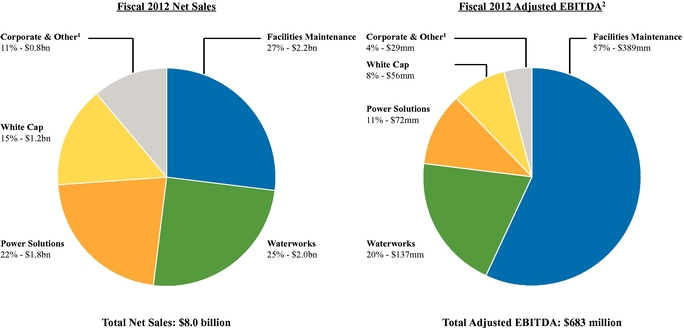

We serve our markets with an integrated go-to-market strategy. We operate through over 600 locations across 46 U.S. states and nine Canadian provinces. We have approximately 15,000 associates delivering localized, customer-tailored products, services and expertise. We serve approximately 500,000 customers, which include contractors, government entities, maintenance professionals, home builders and industrial businesses. Our broad range of end-to-end product lines and services include over one million SKUs of quality, name-brand and proprietary-brand products as well as value-add services supporting the entire lifecycle of a project from infrastructure and construction to maintenance, repair and operations. For the fiscal year ended February 3, 2013, or fiscal 2012, we generated $8.0 billion in Net sales, representing 14.3% growth over the fiscal year ended January 29, 2012, or fiscal 2011, or 12.2% excluding the 53rd week of fiscal 2012; $683 million of Adjusted EBITDA, representing 34.4% growth over fiscal 2011, or 31.7% excluding the 53rd week of fiscal 2012; and incurred a Net loss of $1,179 million. For a reconciliation of Net income (loss), the most directly comparable financial measure under GAAP, to Adjusted EBITDA, see "Part II, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations—Key Business Metrics—Cash interest expense and Adjusted EBITDA."

We believe our long-standing customer relationships and competitive advantage stem from our knowledgeable associates, extensive product and service offerings, national footprint, integrated best-in-class technology, broad purchasing scale and strategic supplier relationships. We believe that our comprehensive supply chain solutions improve the effectiveness and efficiency of our customers' businesses. Our value-add services include customer training, material and product fabrication, kitting, jobsite delivery, will call pick up options, as well as onsite managed inventory, online material management and emergency response capabilities. Furthermore, we believe our product application knowledge, comprehensive product assortment, and sourcing expertise allow our customers to perform reliably and give them the tools to enhance profitability. We reach our customers through a variety of sales channels, including professional outside and inside sales forces, call centers and branch supported direct marketing programs utilizing market-specific product catalogs, and business unit websites. Our distribution network allows us to provide rapid, reliable, on-time delivery and customer pickup throughout the U.S. and Canada. Additionally, we believe our highly integrated, best-in-class technology provides leading e-commerce and integrated workflow capabilities for our customers, while providing us unparalleled pricing, budgeting, reporting and analytical capabilities across our Company. We believe customers view us as an integral part of the value chain due to our extensive product knowledge, expansive product availability and the ability to directly integrate with their systems and workflows.

Since 2007 we have undertaken significant operating and growth initiatives at all levels. We developed and are implementing a multi-year strategy to optimize our business mix. This strategy includes entering new markets and product lines, streamlining and upgrading our process and technology capabilities, acquiring new capabilities and selling non-core business units. At the same time,

6

Table of Contents

we attracted what we believe to be "best of the best" talent capitalizing on relevant experience, teamwork and change navigation. With this transformational execution behind us, we believe our Company is well-positioned to continue to grow in excess of the markets in which we operate.

We operate our Company through four reportable segments: Facilities Maintenance, Waterworks, Power Solutions and White Cap. The charts below summarize the breakdown of the results for our reportable segments and Corporate & Other in fiscal 2012.

- (1)

- Crown Bolt, CTI, Repair & Remodel and HD Supply Canada, in addition to Corporate and Eliminations, comprise "Corporate & Other."

- (2)

- Adjusted EBITDA is our measure of profitability for our reportable segments and Corporate & Other as presented within our audited consolidated financial statements in accordance with GAAP. See Note 14 to our consolidated financial statements.

Facilities Maintenance. Facilities Maintenance distributes MRO products, provides value-add services and fabricates custom products. Our Facilities Maintenance business unit serves multifamily, hospitality, healthcare and institutional facilities. Products include electrical and lighting items, plumbing, HVAC products, appliances, janitorial supplies, hardware, kitchen and bath cabinets, window coverings, textiles and guest amenities, healthcare maintenance and water and wastewater treatment products. Facilities Maintenance operates a distribution center-based model that sells its products primarily through a professional sales force, print catalogs and e-commerce.

Waterworks. Waterworks distributes complete lines of water and wastewater transmission products, serving contractors and municipalities in the water and waste-water industries for residential and non-residential uses. Our Waterworks business unit serves non-residential, residential, water systems, sewage systems and other markets. Products include pipes, fittings, valves, hydrants and meters for use in the construction, maintenance and repair of water and waste-water systems as well as fire-protection systems. Waterworks has complemented its core products through additional offerings, including smart meters (AMR/AMI), HDPE pipes and specific engineered treatment plant products and services.

Power Solutions. Power Solutions distributes electrical transmission and distribution products, power plant MRO supplies and smart-grid products, and arranges materials management and procurement outsourcing for the power generation and distribution industries. Our Power Solutions business unit serves the utilities and electrical markets. Products include conductors such as wire and

7

Table of Contents

cable, transformers, overhead transmission and distribution hardware, switches, protective devices and underground distribution, connectors used in the construction or maintenance and repair of electricity transmission and substation distribution infrastructure, and electrical wire and cable, switchgear, supplies, lighting and conduit used in non-residential and residential construction.

White Cap. White Cap distributes specialized hardware, tools, engineered materials and safety products to non-residential and residential contractors. Products include tilt-up brace systems, forming and shoring systems, concrete chemicals, hand and power tools, rebar, ladders, safety and fall arrest equipment, specialty screws and fasteners, sealants and adhesives, drainage pipe, geo-synthetics, erosion and sediment control equipment and other engineered materials used broadly across all types of non-residential and residential construction.

Corporate & Other. Corporate & Other is comprised of the following business units: Crown Bolt, CTI, Repair & Remodel and HD Supply Canada. Crown Bolt is a retail distribution operator providing program and packaging solutions, sourcing, distribution, and in-store service, fasteners, builders' hardware, rope and chain and plumbing accessories, primarily serving Home Depot and other hardware stores. CTI offers turnkey supply and installation services for multiple interior finish options, including flooring, cabinets, countertops, and window coverings, along with comprehensive design center services for non-residential, residential and senior living projects. Our Repair & Remodel business unit offers light remodeling and construction supplies, kitchen and bath cabinets, windows, plumbing materials, electrical equipment and other products, primarily to small remodeling contractors and trade professionals. HD Supply Canada is an industrial distributor that primarily focuses on servicing fasteners/industrial supplies and specialty lighting markets which operates across nine provinces. Corporate & Other also includes costs related to our centralized support functions, which include finance, information technology, human resources, legal, supply chain and other support services and removes inter-segment transactions.

8

Table of Contents

Summary of Reportable Segments

The table below is a summary of our four reportable segments. Although our reportable segments are distinct and specialized to reflect the needs of their customers, we operate our Company with an integrated go-to-market strategy.

| | | | | | | | | |

| | | |

| |

| |

| |

|

| | Overview | | Catalog Based Distributor of MRO Products to Maintenance Professionals | | Distributor of Water, Sewer, Storm and Fire Protection Products | | Distributor of Utilities and Electrical Construction and Industrial Products | | Distributor of Specialty Construction and Safety Supplies |

| | Fiscal 2012 Net Sales | | $2.2 billion | | $2.0 billion | | $1.8 billion | | $1.2 billion |

| | Fiscal 2012 Adjusted EBITDA(1) | | $389 million | | $137 million | | $72 million | | $56 million |

| | Adjusted EBITDA Margin(2) | | 18% | | 7% | | 4% | | 5% |

| | Growth(3) | | 20% | | 21% | | 40% | | 224% |

| | Locations | | 40 Distribution Centers in U.S.; 2 in Canada | | 238 Branches in 44 U.S. States | | 97 Branches in 26 U.S. States; 4 in Canada | | 137 Branches in 31 U.S. States |

| | Approx. SKUs | | 175,000 | | 300,000 | | 220,000 | | 230,000 |

| | Select Products | | Electrical and Lighting Items; Plumbing; HVAC Products; Appliances; Janitorial Supplies; Hardware; Kitchen and Bath Cabinets; Window Coverings; Textiles and Guest Amenities; Healthcare Maintenance; Water and Wastewater Treatment Products | | Water and Wastewater Transmission Products Including Pipe (PVC, Ductile Iron, HDPE); Fittings; Valves; Fire Protection; Metering Systems; Storm Drain; Hydrants; Fusion Machine Rental; Valve Testing and Repair | | Pole Line Hardware; Wire and Cable; Gear and Controls; Power Equipment; Fixtures and Lightning; Meters | | Concrete Accessories and Chemicals; Tools; Engineered Materials and Fasteners; Safety; Erosion and Waterproofing |

|

|

|

|

|

|

|

|

|

|

| | Value-add Services | | Next Day Delivery; Customized and Fabricated Products; Renovations and Installation Services; Technical Support; Customer Training; e-Commerce Solutions | | Proprietary PC-based Estimating Software; Job Management Reports; Electronic Billing; On-demand Customer Reports; Part Number Interchange; Material Management Online ("MMO"); Database Depot; Distributor Managed Inventory ("DMI") | | Emergency Response Solutions; Integrated Inventory and Sourcing Solutions; IT Solutions (Virtual Warehouse, EDI, Online Ordering, Custom Online Catalog); SmartGrid; Project Services (Material Take Offs and Laydown Yards); Tool Repair | | Pre-Bid Assistance; Product Submittals; Value Engineering; Change Order Support; Rentals (Tilt-Up Braces, Forming/Shoring, Equipment); Fabrication Including Detailing and Engineering; Tool Repair; Electronic Billing |

| | Customer Examples | | Residential Property Owners and Managers; Hotels and Lodging Facilities; Assisted Living Facilities Institutions; Water and Wastewater Treatment Facilities | | Professional Contractors Serving Municipalities, Non-residential and Residential Construction | | Municipalities and Co-ops; Investor Owned Utilities; Non-residential, Residential and Mechanical Contractors; Industrial (Industrial Manufactures, MRO, Oil and Gas Contractors) | | Professional Contractors Serving Non-residential, Residential and Industrial Construction |

|

|

|

|

- (1)

- Adjusted EBITDA is our measure of profitability for our reportable segments as presented within our consolidated financial statements in accordance with GAAP. See Note 14 to our consolidated financial statements.

- (2)

- Adjusted EBITDA Margin is equal to Adjusted EBITDA divided by Net sales.

- (3)

- Growth is equal to growth in Adjusted EBITDA over fiscal 2011 and excludes the 53rd week of fiscal 2012.

- (4)

- Management estimates based on market data and industry knowledge.

- (5)

- Unless stated otherwise, market position refers to management's estimate of our market position in North America within the estimated addressable markets we serve.

9

Table of Contents

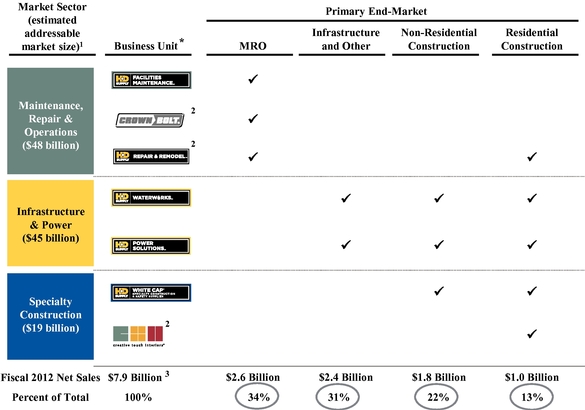

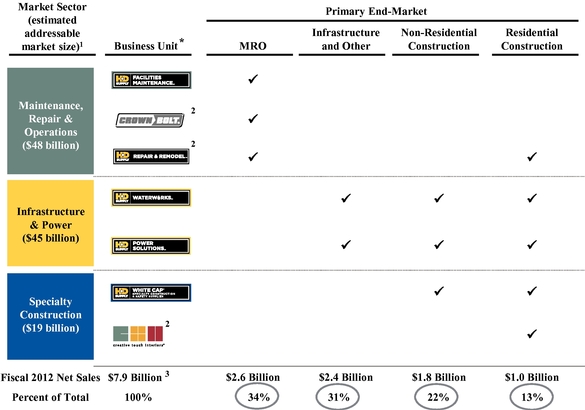

Our Market Sectors

We offer a diverse range of products and services to the Maintenance, Repair & Operations, Infrastructure & Power and Specialty Construction market sectors in the U.S. and Canada. The markets in which we operate have a high degree of customer and supplier fragmentation, with customers that typically demand a high level of service and availability of a broad set of complex products from a large number of suppliers. These market dynamics make the distributor a critical element within the value chain.

The table below summarizes our market sectors, business units and end-markets, including our net sales by end-market.

- *

- Excludes HD Supply Canada.

- (1)

- Management estimates based on market data and industry knowledge.

- (2)

- Crown Bolt, Creative Touch Interiors, Repair & Remodel and HD Supply Canada, in addition to Corporate and Eliminations, comprise "Corporate & Other."

- (3)

- Figures do not foot due to rounding. Excludes HD Supply Canada.

Maintenance, Repair & Operations

In the Maintenance, Repair & Operations market sector, our Facilities Maintenance, Crown Bolt and Repair & Remodel business units serve customers across multiple industries by primarily delivering supplies and services needed to maintain and upgrade multifamily, hospitality, healthcare and institutional facilities. Facilities Maintenance and Crown Bolt are distribution center based models, while Repair & Remodel operates through retail outlets primarily serving cash and carry customers. We estimate that this market sector currently represents an addressable market in excess of $48 billion annually with demand driven primarily by ongoing maintenance requirements of a broad range of existing structures and traditional repair and remodeling construction activity across multiple industries.

10

Table of Contents

We believe Facilities Maintenance customers value speed and product availability over price. In addition, we believe that our leadership position in this sector positions us to capitalize on improving business conditions across our addressable market. For example, we expect to benefit from the relative stability of demand for MRO materials during periods of lower vacancy rates within multifamily housing and higher occupancy rates within hospitality.

Infrastructure & Power

In the Infrastructure & Power market sector, Waterworks and Power Solutions support both established infrastructure and new projects by meeting demand for critical supplies and services used to build and maintain water systems and electrical power generation, transmission and distribution infrastructure. We estimate that this market sector currently represents an addressable market in excess of $45 billion annually with demand in the U.S. driven primarily by an aging and overburdened national infrastructure, general population growth trends and the need for cost-effective energy distribution. The broad geographic presence of our business units, through a regionally organized branch distribution network, reduces our exposure to economic factors in any single region. We believe we have the potential to capitalize on a substantial backlog of deferred projects that will need to be addressed in the coming years as a result of our customers delaying much needed upgrades or repairs during the recent economic downturn as well as a recovery in the non-residential and residential construction markets.

Specialty Construction

In the Specialty Construction market sector, White Cap and CTI serve professional contractors and trades by meeting their distinct and customized supply needs in non-residential, residential and industrial applications. We estimate that this market sector currently represents an addressable market in excess of $19 billion annually with demand driven primarily by residential construction, non-residential construction, industrial and repair and remodeling construction spending. White Cap is our primary business unit serving this sector through the broad national presence of its regionally organized branch distribution network. CTI serves its market through a network of branches and design centers. We believe we are well-positioned to benefit from the recovery from historical lows within the non-residential and residential construction end-markets.

Our History

In March 1997, Home Depot, the former parent of our operating subsidiaries, acquired Maintenance Warehouse / America Corp., a Texas corporation organized on January 26, 1985, and a leading direct marketer of MRO products to the hospitality and multifamily housing markets. Since 1997, our business has grown rapidly, primarily through the acquisition of more than 40 businesses.

From fiscal 2000 to fiscal 2004, we extended our presence into new categories while growing existing businesses through 10 acquisitions. New businesses included plumbing and HVAC (through the acquisition of Apex Supply), flooring products and installation (Floors, Inc., Floorworks, Inc., Arvada Hardwood Floor Company) and specialty hardware, tools and materials for construction contractors (White Cap). Growth at existing businesses was driven organically and through "tuck-in" acquisitions, expanding our presence in the Maintenance, Repair & Operations market sector (N-E Thing Supply, Economy Maintenance Supply) and flooring and design services for professional homebuilders (Creative Touch Interiors).

In fiscal 2005, we accelerated the pace of consolidation by acquiring 18 businesses, the largest of which was National Waterworks, a leading distributor of products used to build, repair and maintain water and wastewater transmission systems. In fiscal 2006, we transformed our business with the acquisition of Hughes Supply, which doubled our Net sales and further established our market leadership in a number of our largest business units, which we supplemented with 11 other strategic acquisitions.

11

Table of Contents

In 2007, investment funds associated with the Equity Sponsors formed Holding and purchased HD Supply from Home Depot. In connection with the 2007 Acquisition, Home Depot obtained a 12.5% interest in the common stock of Holding.

Since 2007, we have focused on extending our presence in key growth sectors and exiting less attractive sectors. In February 2008, we sold our Lumber and Building Materials operations to ProBuild Holdings. In June 2009, we purchased substantially all of the assets of ORCO Construction Supply, the second largest construction materials distributor in the U.S., through White Cap. In February 2011, we sold all of the assets of SESCO/QUESCO, an electrical products division of HD Supply Canada, to Sonepar Canada. In May 2011, we purchased all of the assets of RAMSCO, expanding Waterworks in upstate New York. In September 2011, we sold our Plumbing/HVAC operations to Hajoca Corporation. In March 2012, we sold our IPVF business to Shale-Inland Holdings LLC. In June 2012, we acquired Peachtree, which specializes in customizable business and property marketing supplies, to enhance Facilities Maintenance. In December 2012, we purchased substantially all of the assets of Water Products, expanding the geographic footprint of Waterworks.

Customers and Suppliers

We maintain a customer base of approximately 500,000 customers, many of which represent long-term relationships. Home Depot is our largest customer, accounting for approximately 4% of fiscal 2012 Net sales. We are subject to very low customer concentration with no customer, other than Home Depot, representing more than 1% of fiscal 2012 Net sales, reducing our exposure to any single customer.

We have developed relationships with approximately 15,000 strategic suppliers, many of which are long-standing. These supplier relationships provide us with reliable access to inventory, volume purchasing benefits and the ability to deliver a diverse product offering on a cost-effective basis. We maintain multiple suppliers for a substantial number of our products, thereby limiting the risk of product shortage for customers.

Competition

We operate in a highly fragmented industry and hold leading positions in multiple market sectors. Competition, including our competitors and specific competitive factors, varies for each market sector. The majority of our competition comes from mid-size regional distributors and small, local distributors; however, we also face competition from a number of national competitors, including Fastenal, Grainger, MSC Industrial, Rexel, Watsco, WESCO and Wolseley plc (Ferguson division).

We believe the principal competitive factors for our market sectors include local selling capabilities, availability, breadth and cost of materials and supplies, technical knowledge and expertise, value-add service capabilities, customer and supplier relationships, reliability and accuracy of service, effective use of technology, delivery capabilities and timeliness, pricing of products, and the provision of credit. We believe that our competitive strengths and strategy allow us to compete effectively in our market sectors.

Seasonality

In a typical year, our operating results are impacted by seasonality. Historically, sales of our products have been higher in the second and third quarters of each fiscal year due to favorable weather and longer daylight conditions during these periods. Seasonal variations in operating results may also be significantly impacted by inclement weather conditions, such as cold or wet weather, which can delay construction projects.

12

Table of Contents

Products

Maintenance, Repair & Operations:

Facilities Maintenance: Electrical and lighting items, plumbing, HVAC products, appliances, janitorial supplies, hardware, kitchen and bath cabinets, window coverings, textiles and guest amenities, healthcare maintenance and water and wastewater treatment products.

Crown Bolt: Fasteners, builders hardware, rope and chain, and plumbing accessories primarily consumed in home improvement, do-it-yourself projects and residential construction.

Repair & Remodel: Kitchen cabinets, windows, plumbing materials, masonry, electrical equipment, lumber, flooring and tools and tool rentals for small remodeling, home improvement and do-it-yourself residential projects.

Infrastructure & Power:

Waterworks: Water and wastewater transmission products including pipe (PVC, Ductile Iron, HDPE), fittings, valves, fire protection, metering systems, storm drain, hydrants, fusion machine rental, valve testing and repair.

Power Solutions: Pole line hardware, wire and cable, gear and controls, power equipment, fixtures and lightning, meters

Specialty Construction:

White Cap: Concrete accessories and chemicals, tools, engineered materials and fasteners, safety, erosion and waterproofing.

CTI: Flooring, cabinets, countertops and window coverings, along with comprehensive design center services, for the interior finish of non-residential, residential and senior living projects.?

Intellectual property

Our trademarks and those of our subsidiaries, certain of which are material to our business, are registered or otherwise legally protected in the United States, Canada and elsewhere. We, together with our subsidiaries, own approximately 160 trademarks registered worldwide. We also rely upon trade secrets and know-how to develop and maintain our competitive position. We protect intellectual property rights through a variety of methods, including trademark, patent, copyright and trade secret laws, in addition to confidentiality agreements with suppliers, employees, consultants and others who have access to our proprietary information. Generally, registered trademarks have a perpetual life,provided that they are renewed on a timely basis and continue to be used properly as trademarks. We intend to maintain our material trademark registrations so long as they remain valuable to our business. Other than the trademarksHD Supply (and design),USABluebook,Creative Touch Interiors andWhite Cap, we do not believe our business is dependent to a material degree on trademarks, patents, copyrights or trade secrets. Other than commercially available software licenses, we do not believe that any of our licenses for third-party intellectual property are material to our business, taken as a whole. See "Risk Factors—If we are unable to protect our intellectual property rights, or we infringe on the intellectual property rights of others, our ability to compete could be negatively impacted."

13

Table of Contents

Employees

In domestic and international operations, we had approximately 15,000 employees as of February 3, 2013, consisting of approximately 9,000 hourly personnel and approximately 6,000 salaried employees.

As of February 3, 2013, less than one percent of our hourly workforce was covered by collective bargaining agreements.

Regulation

Our operations are affected by various statutes, regulations and laws in the markets in which we operate, which historically have not had a material effect on our business. While we are not engaged in a regulated industry, we are subject to various laws applicable to businesses generally, including laws affecting land usage, zoning, the environment, health and safety, transportation, labor and employment practices (including pensions), competition, immigration and other matters. Additionally, building codes may affect the products our customers are allowed to use, and consequently, changes in building codes may affect the saleability of our products. The transportation and disposal of many of our products are also subject to federal regulations. The DOT regulates our operations in domestic interstate commerce. We are subject to safety requirements governing interstate operations prescribed by the DOT. Vehicle dimensions and driver hours of service also remain subject to both federal and state regulation. See "Risk Factors—Risks Relating to Our Business—Our costs of doing business could increase as a result of changes in U.S. federal, state or local regulations."

Environmental, Health and Safety Matters

We are subject to a broad range of foreign, federal, state and local environmental, health and safety laws and regulations, including those pertaining to air emissions, water discharges, the handling, disposal and transport of solid and hazardous materials and wastes, the investigation and remediation of contamination and otherwise relating to health and safety and the protection of the environment and natural resources. As our operations, and those of many of the companies we have acquired, to a limited extent involve and have involved the handling, transport and distribution of materials that are, or could be classified as, toxic or hazardous, there is some risk of contamination and environmental damage inherent in our operations and the products we handle, transport and distribute. Our environmental, health and safety liabilities and obligations may result in significant capital expenditures and other costs, which could negatively impact our business, financial condition and results of operations. We may be fined or penalized by regulators for failing to comply with environmental, health and safety laws and regulations, or we may be held responsible for such failures by companies we have acquired. In addition, contamination resulting from our current or past operations, and those of many of the companies we have acquired, may trigger investigation or remediation obligations, which may have a material adverse effect on our business, financial condition and results of operations.

Available Information

We are subject to the reporting and information requirements of the Exchange Act and, as a result, we file periodic reports and other information with the SEC.

The public may read and copy any such reports or other information that we file with the SEC. Such filings are available to the public over the internet at the SEC's website at http://www.sec.gov. The SEC's website is included in this annual report on Form 10-K as an inactive textual reference only. In addition, the Company's annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports are available free of charge to the public through the "Investor Relations" portion of the Company's website, www.hdsupply.com, as soon as reasonably practical after they are filed with the SEC. We include our website address in this filing only as a

14

Table of Contents

textual reference. The information contained on our website is not incorporated by reference into this report. You may also obtain a copy of any information that we file with the SEC at no cost by calling us, or writing to us, at the following address:

HD Supply, Inc.

3100 Cumberland Boulevard, Suite 1480

Atlanta, Georgia 30339

Attn: General Counsel

(770) 852-9000

15

Table of Contents

ITEM 1A. RISK FACTORS

Risks Relating to Our Business

We are subject to inherent risks of the maintenance, repair and operations market, infrastructure spending and the non-residential and residential construction markets, including risks related to general economic conditions.

Demand for our products and services depends to a significant degree on spending in our markets. The level of activity in our markets depends on a variety of factors that we cannot control.

Historically, both new housing starts and residential remodeling have decreased in slow economic periods. In addition, residential construction activity can impact the level of non-residential construction activity. Other factors impacting the level of activity in the non-residential and residential construction markets include:

- •

- changes in interest rates;

- •

- unemployment rates;

- •

- high foreclosure rates and unsold/foreclosure inventory;

- •

- unsold new housing inventory;

- •

- availability of financing (including the impact of disruption in the mortgage markets);

- •

- adverse changes in industrial economic outlook;

- •

- a decrease in the affordability of homes;

- •

- vacancy rates;

- •

- capacity utilization;

- •

- capital spending;

- •

- commercial investment;

- •

- corporate profitability;

- •

- local, state and federal government regulation; and

- •

- shifts in populations away from the markets that we serve.

Infrastructure spending depends largely on interest rates, availability and commitment of public funds for municipal spending, capacity utilization and general economic conditions. In the maintenance, repair and operations market, the level of activity depends largely on the number of units and occupancy rates within multifamily, hospitality, healthcare and institutional facilities markets. Because all of our markets are sensitive to changes in the economy, downturns (or lack of substantial improvement) in the economy in any region in which we operate have adversely affected and could continue to adversely affect our business, financial condition and results of operations. For example, we distribute many of our products to waterworks contractors in connection with non-residential, residential and industrial construction projects. The water and wastewater transmission products industry is affected by changes in economic conditions, including national, regional and local standards in construction activity, and the amount spent by municipalities on waterworks infrastructure. While we operate in many markets in the United States and Canada, our business is particularly impacted by changes in the economies of California, Texas and Florida, which represented approximately 15%, 13% and 9%, respectively, in net sales for fiscal 2012.

In addition, the markets in which we compete are sensitive to general business and economic conditions in the United States and worldwide, including availability of credit, interest rates,

16

Table of Contents

fluctuations in capital, credit and mortgage markets, and business and consumer confidence. Adverse developments in global financial markets and general business and economic conditions, including through recession, downturn or otherwise, could have a material adverse effect on our business, financial condition, results of operations and cash flows, including our ability and the ability of our customers and suppliers to access capital. There was a significant decline in economic growth, both in the United States and worldwide, that began in the second half of 2007 and continued through 2009. In addition, volatility and disruption in the capital markets during that period reached unprecedented levels, with stock markets falling dramatically and credit becoming very expensive or unavailable to many companies without regard to those companies' underlying financial strength. As a result of these developments, many lenders and institutional investors reduced, and in some cases, ceased to provide funding to borrowers. Although there have been some indications of stabilization in the general economy and certain industries and markets in which we operate, there can be no guarantee that any improvement in these areas will continue or be sustained.

We have been, and may continue to be, adversely impacted by the decline in the new residential construction market since its peak in 2005.

Most of our business units are dependent to varying degrees upon the new residential construction market. The homebuilding industry has undergone a significant decline from its peak in 2005. According to the U.S. Census Bureau, actual single family housing starts in the U.S. during 2012 increased 24% from 2011 levels, but remain 69% below their peak in 2005. The multi-year downturn in the homebuilding industry has resulted in a substantial reduction in demand for our products and services, which in turn had a significant adverse effect on our business and operating results during fiscal years 2008 to 2012, as compared to peak levels. In addition, the mortgage markets continue to experience disruption and reduced availability of mortgages for potential homebuyers due to more restrictive standards to qualify for mortgages, including with respect to new home construction loans.

We cannot predict the duration of the current housing industry market conditions, or the timing or strength of any future recovery of housing activity in our markets. We also cannot provide any assurances that the homebuilding industry will recover to historical levels, or that the operational strategies we have implemented to address the current market conditions will be successful. Continued weakness in the new residential construction market would have a significant adverse effect on our business, financial condition and operating results. In addition, because of these factors, there may be fluctuations in our operating results, and the results for any historical period may not be indicative of results for any future period.

The non-residential construction market continues to experience a downturn which could materially and adversely affect our business, liquidity and results of operations.

Many of our business units are dependent on the non-residential construction market and the slowdown and volatility of the United States economy in general is having an adverse effect on our business units that serve this industry. According to the U.S. Census Bureau, actual non-residential construction put-in-place in the U.S. during 2012 increased 8% from 2011 levels, but remains 12% lower than 2009 levels. From time to time, our business units that serve the non-residential construction market have also been adversely affected in various parts of the country by declines in non-residential construction starts due to, among other things, changes in tax laws affecting the real estate industry, high interest rates and the level of residential construction activity. Continued uncertainty about current economic conditions will continue to pose a risk to our business units that serve the non-residential construction market as participants in this industry may postpone spending in response to tighter credit, negative financial news and/or declines in income or asset values, which could have a continued material negative effect on the demand for our products and services.

17

Table of Contents

We cannot predict the duration of the current market conditions, or the timing or strength of any future recovery of non-residential construction activity in our markets. Continued weakness in the non-residential construction market would have a significant adverse effect on our business, financial condition and operating results. In addition, because of these factors, there may be fluctuations in our operating results, and the results for any historical period may not be indicative of results for any future period.

Residential renovation and improvement activity levels may not return to historic levels which may negatively impact our business, liquidity and results of operations.

Certain of our business units rely on residential renovation and improvement (including repair and remodeling) activity levels. Unlike most previous cyclical declines in new home construction in which we did not experience comparable declines in our home improvement business units, the recent economic decline adversely affected our home improvement business units as well. According to Moody's Economy.com, residential improvement project spending in the United States increased 10% in 2012, but remains 14% below its peak in 2006. Continued high unemployment levels, high mortgage delinquency and foreclosure rates, limitations in the availability of mortgage and home improvement financing and significantly lower housing turnover, may continue to limit consumers' spending, particularly on discretionary items, and affect their confidence level leading to continued reduced spending on home improvement projects.

We cannot predict the timing or strength of a significant recovery in these markets. Continued depressed activity levels in consumer spending for home improvement and new home construction will continue to adversely affect our results of operations and our financial position. Furthermore, continued economic weakness may cause unanticipated shifts in consumer preferences and purchasing practices and in the business models and strategies of our customers. Such shifts may alter the nature and prices of products demanded by the end consumer and our customers and could adversely affect our operating performance.

We may be unable to achieve or maintain profitability.

We have set goals to progressively improve our profitability over time by growing our sales, increasing our gross margin and reducing our expenses as a percentage of sales. For the fiscal years 2012 and 2011 we had net losses of $1,179 million and $543 million, respectively. There can be no assurance that we will achieve our enhanced profitability goals. Factors that could significantly adversely affect our efforts to achieve these goals include, but are not limited to, the failure to:

- •

- grow our revenue through organic growth or through acquisitions;

- •

- improve our revenue mix by investing (including through acquisitions) in businesses that provide higher margins than we have been able to generate historically;

- •

- achieve improvements in purchasing or to maintain or increase our rebates from vendors through our vendor consolidation and/or low-cost country initiatives;

- •

- improve our gross margins through the utilization of improved pricing practices and technology and sourcing savings;

- •

- maintain or reduce our overhead and support expenses as we grow;

- •

- effectively evaluate future inventory reserves;

- •

- collect monies owed from customers;

- •

- maintain relationships with our significant customers; and

- •

- integrate any businesses acquired.

18

Table of Contents

Any of these failures or delays may adversely affect our ability to increase our profitability.

We may be required to take impairment charges relating to our operations which could impact our future operating results.

As of February 3, 2013, goodwill represented approximately 43% of our total assets. Goodwill is not amortized and is subject to impairment testing at least annually using a fair value based approach. The identification and measurement of impairment involves the estimation of the fair value of reporting units. The estimates of fair value of reporting units are based on the best information available as of the date of the assessment and incorporate management assumptions about expected future cash flows and other valuation techniques. Future cash flows can be affected by changes in industry or market conditions among other things.

The recoverability of goodwill is evaluated at least annually and when events or changes in circumstances indicate that the fair value of a reporting unit has more likely than not declined below its carrying value. The annual impairment test resulted in no impairment of goodwill during fiscal 2012, fiscal 2011 or fiscal 2010. However, during the fourth quarter of fiscal 2012, our Crown Bolt business reached an agreement to amend and extend its strategic purchase agreement with Home Depot. While the amendment extends the agreement five years through fiscal 2019, retaining Crown Bolt as the exclusive supplier of certain products to Home Depot, it eliminates the minimum purchase requirement and adjusted future pricing. These changes resulted in a reduction of expected future cash proceeds from Home Depot. We, therefore, considered this amendment a triggering event and, as such, we performed an additional goodwill impairment analysis for Crown Bolt. As a result of the analysis, we recorded a non-cash, pre-tax goodwill impairment charge of $150 million during the fourth quarter of fiscal 2012.

We cannot accurately predict the amount and timing of any impairment of assets. In addition to the goodwill impairment charge we recorded in fiscal 2012, we may be required to take additional goodwill or other asset impairment charges relating to certain of our reporting units and asset groups, if weakness in the non-residential and/or residential construction markets and/or the general U.S. economy continues. Similarly, certain company transactions, such as the amendment to the Crown Bolt strategic purchase agreement with Home Depot, could result in additional goodwill impairment charges being recorded. Any such non-cash charges would have an adverse effect on our financial results.

In view of the general economic downturn in the United States, we may be required to close under-performing locations.

We may have to close under-performing branches from time to time as warranted by general economic conditions and/or weakness in the industries in which we operate. For example, during the economic downturn from 2007 through fiscal 2010, we closed branches and terminated employees as part of our restructuring plans during that timeframe. Any future facility closures could have a significant adverse effect on our financial condition, operating results and cash flows.

We occupy most of our facilities under long-term non-cancelable leases. We may be unable to renew leases on favorable terms or at all. Also, if we close a facility, we remain obligated under the applicable lease.

Most of our facilities are located in leased premises. Many of our current leases are non-cancelable and typically have terms ranging from 3 to 5 years, with options to renew for specified periods of time. We believe that leases we enter into in the future will likely be long-term and non-cancelable and have similar renewal options. However, there can be no assurance that we will be able to renew our current or future leases on favorable terms or at all which could have an adverse effect on our ability to operate our business and on our results of operations. In addition, if we close or idle a facility, we generally remain committed to perform our obligations under the applicable lease,

19

Table of Contents

which include, among other things, payment of the base rent for the balance of the lease term. Over the course of the last three fiscal years, we closed or idled facilities for which we remain liable on the lease obligations. Our obligation to continue making rental payments in respect of leases for closed or idled facilities could have a material adverse effect on our business and results of operations.

The industries in which we operate are highly competitive and fragmented, and demand for our products and services could decrease if we are not able to compete effectively.

The markets in which we operate are fragmented and highly competitive. Our competition includes other distributors and manufacturers that sell products directly to their respective customer base and some of our customers that resell our products. To a limited extent, retailers of electrical fixtures and supplies, building materials, maintenance, repair and operations supplies and contractors' tools also compete with us. We also expect that new competitors may develop over time as internet-based enterprises become more established and reliable and refine their service capabilities. Competition varies depending on product line, customer classification and geographic area.

We compete with many local, regional and, in several markets and product categories, other national distributors. Several of our competitors in one or more of our business units have substantially greater financial and other resources than us. No assurance can be given that we will be able to respond effectively to such competitive pressures. Increased competition by existing and future competitors could result in reductions in sales, prices, volumes and gross margins that could materially adversely affect our business, financial condition and results of operations. Furthermore, our success will depend, in part, on our ability to maintain our market share and gain market share from competitors.

In addition, contracts with municipalities are often awarded and renewed through periodic competitive bidding. We may not be successful in obtaining or renewing these contracts, which could be harmful to our business and financial performance.

Our competitors continue to consolidate, which could cause markets to become more competitive and could negatively impact our business.

Our competitors in the United States and Canada are consolidating. This consolidation is being driven by customer needs and supplier capabilities, which could cause markets to become more competitive as greater economies of scale are achieved by distributors. Customers are increasingly aware of the total costs of fulfillment and of the need to have consistent sources of supply at multiple locations. We believe these customer needs could result in fewer distributors as the remaining distributors become larger and capable of being a consistent source of supply.

There can be no assurance that we will be able to take advantage effectively of this trend toward consolidation. The trend in our industry toward consolidation could make it more difficult for us to maintain operating margins and could also increase competition for our acquisition targets and result in higher purchase price multiples. Furthermore, as our industrial and construction customers face increased foreign competition and potentially lose business to foreign competitors or shift their operations overseas in an effort to reduce expenses, we may face increased difficulty in growing and maintaining our market share and growth prospects in these markets.

The loss of any of our significant customers could adversely affect our financial condition.

Our ten largest customers generated approximately 8% of our Net sales in fiscal 2012, and our largest customer, Home Depot, accounted for approximately 4% of our Net sales in that same period. We cannot guarantee that we will maintain or improve our relationships with these customers or that we will continue to supply these customers at historical levels. During the economic downturn, some of our customers reduced their operations. For example, some homebuilder customers exited or severely

20

Table of Contents

curtailed building activity in certain of our markets. There is no assurance that our customers will determine to increase their operations or return to historic levels. Slow economic recovery could continue to have a significant adverse effect on our financial condition, operating results and cash flows.

In addition, consolidation among customers could also result in a loss of some of our present customers to our competitors. The loss of one or more of our significant customers, a significant customer's decision to purchase our products in significantly lower quantities than they have in the past, or deterioration in our relationship with any of them could significantly affect our financial condition, operating results and cash flows. For example, during fiscal 2012 our Crown Bolt business agreed to an amendment of its strategic purchase agreement with Home Depot. While the amendment extends the agreement five years through fiscal 2019, it eliminates the minimum purchase requirement and adjusts future pricing. These changes resulted in a reduction of expected future cash proceeds from Home Depot. We, therefore, considered this amendment a triggering event and, as such, we performed an additional goodwill impairment analysis for Crown Bolt. As a result of the analysis, we recorded a non-cash, pre-tax goodwill impairment charge of $150 million during the fourth quarter of fiscal 2012.

Generally, our customers are not required to purchase any minimum amount of products from us. The contracts into which we have entered with most of our customers typically provide that we supply particular products or services for a certain period of time when and if ordered by the customer. Should our customers purchase our products in significantly lower quantities than they have in the past, such decreased purchases could have a material adverse effect on our financial condition, operating results and cash flows.

The majority of our net sales are credit sales which are made primarily to customers whose ability to pay is dependent, in part, upon the economic strength of the industry and geographic areas in which they operate, and the failure to collect monies owed from customers could adversely affect our financial condition.

The majority of our Net sales volume in fiscal 2012 was facilitated through the extension of credit to our customers whose ability to pay is dependent, in part, upon the economic strength of the industry in the areas where they operate. Our business units offer credit to customers, either through unsecured credit that is based solely upon the creditworthiness of the customer, or secured credit for materials sold for a specific job where the security lies in lien rights associated with the material going into the job. The type of credit offered depends both on the financial strength of the customer and the nature of the business in which the customer is involved. End users, resellers and other non-contractor customers generally purchase more on unsecured credit than secured credit. The inability of our customers to pay off their credit lines in a timely manner, or at all, would adversely affect our financial condition, operating results and cash flows. Furthermore, our collections efforts with respect to non-paying or slow-paying customers could negatively impact our customer relations going forward.

Because we depend on the creditworthiness of certain of our customers, if the financial condition of our customers declines, our credit risk could increase. Significant contraction in our markets, coupled with tightened credit availability and financial institution underwriting standards, could adversely affect certain of our customers. Should one or more of our larger customers declare bankruptcy, it could adversely affect the collectability of our accounts receivable, bad debt reserves and net income.

21

Table of Contents

We are subject to competitive pricing pressure from our customers.

Certain of our largest customers historically have exerted significant pressure on their outside suppliers to keep prices low because of their market share and their ability to leverage such market share in the highly fragmented building products supply industry. The economic downturn has resulted in increased pricing pressures from our customers. If we are unable to generate sufficient cost savings to offset any price reductions, our financial condition, operating results and cash flows may be adversely affected.

We may not achieve the acquisition component of our growth strategy.

Acquisitions may continue to be an important component of our growth strategy; however, there can be no assurance that we will be able to continue to grow our business through acquisitions as we have done historically or that any businesses acquired will perform in accordance with expectations or that business judgments concerning the value, strengths and weaknesses of businesses acquired will prove to be correct. Future acquisitions may result in the incurrence of debt and contingent liabilities, an increase in interest expense and amortization expense and significant charges relative to integration costs. Our strategy could be impeded if we do not identify suitable acquisition candidates and our financial condition and results of operations will be adversely affected if we overpay for acquisitions.

Acquisitions involve a number of special risks, including:

- •

- problems implementing disclosure controls and procedures for the newly acquired business;

- •

- unforeseen difficulties extending internal control over financial reporting and performing the required assessment at the newly acquired business;

- •

- potential adverse short-term effects on operating results through increased costs or otherwise;

- •

- diversion of management's attention and failure to recruit new, and retain existing, key personnel of the acquired business;

- •

- failure to successfully implement infrastructure, logistics and systems integration;

- •

- our business growth could outpace the capability of our systems; and

- •

- the risks inherent in the systems of the acquired business and risks associated with unanticipated events or liabilities, any of which could have a material adverse effect on our business, financial condition and results of operations.

In addition, we may not be able to obtain financing necessary to complete acquisitions on attractive terms or at all.

A range of factors may make our quarterly revenues and earnings variable.

We have historically experienced, and in the future expect to continue to experience, variability in revenues and earnings on a quarterly basis. The factors expected to contribute to this variability include, among others: (i) the cyclical nature of some of the markets in which we compete, including the non-residential and residential construction markets, (ii) general economic conditions in the various local markets in which we compete, (iii) the pricing policies of our competitors, (iv) the production schedules of our customers and (v) the effects of the weather. These factors, among others, make it difficult to project our operating results on a consistent basis.

22

Table of Contents

The maintenance, repair and operations market, infrastructure spending and the non-residential and residential construction markets are seasonal and cyclical.

Although weather patterns affect our operating results throughout the year, adverse weather historically has reduced construction and maintenance and repair activity in our first and fourth fiscal quarters. In contrast, our highest volume of Net sales historically has occurred in our second fiscal quarter. To the extent that hurricanes, severe storms, floods, other natural disasters or similar events occur in the geographic regions in which we operate, our business may be adversely affected. In addition, most of our business units experience seasonal variation as a result of the dependence of our customers on suitable weather to engage in construction, maintenance and renovation and improvement projects. For example, White Cap sells products used primarily in the non-residential and residential construction industry. Generally, during the winter months, construction activity declines due to inclement weather and shorter daylight hours. As a result, operating results for the business units that experience such seasonality may vary significantly from period to period. We anticipate that fluctuations from period to period will continue in the future.

Disruptions at distribution centers or shipping ports, due to events such as work stoppages, the flooding from Hurricane Sandy in 2012, as well as disruptions caused by tornadoes, blizzards and other storms from time to time, may affect our ability to both maintain key products in inventory and deliver products to our customers on a timely basis, which may in turn adversely affect our results of operations.