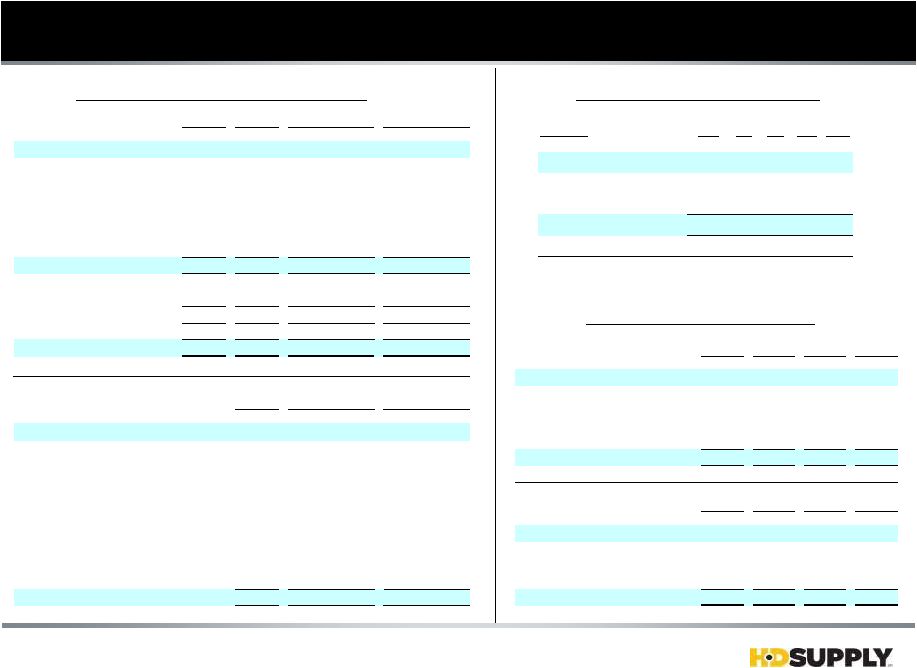

28 Description of EBITDA & Adjusted EBITDA EBITDA, a measure used by management to evaluate operating performance, is defined as net income (loss) less income (loss) from discontinued operations, net of tax, plus (i) interest expense and interest income, net, (ii) provision (benefit) for income taxes, and (iii) depreciation and amortization. EBITDA is not a recognized term under GAAP and does not purport to be an alternative to net income as a measure of operating performance or to cash flows from operating activities as a measure of liquidity. Additionally, EBITDA is not intended to be a measure of free cash flow available for management’s discretionary use, as it does not consider certain cash requirements such as interest payments, tax payments and other debt service requirements. We believe EBITDA is helpful in highlighting trends because EBITDA excludes the results of decisions that are outside the control of operating management and that can differ significantly from company to company depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which companies operate, age and book depreciation of facilities and capital investments. In addition, EBITDA provides more comparability between the historical results of HD Supply prior to the acquisition by HDS Holding Corporation of all the outstanding capital stock of each of HD Supply, Inc. and CND Holdings, Inc. as well as certain intellectual property from the Home Depot, Inc. (the “Acquisition”) and results that reflect the new capital structure after the Acquisition. We further believe that EBITDA is frequently used by securities analysts, investors and other interested parties in their evaluation of companies, many of which present an EBITDA measure when reporting their results. We compensate for the limitations of using non-GAAP financial measures by using them to supplement GAAP results to provide a more complete understanding of the factors and trends affecting the business than GAAP results alone. Because not all companies use identical calculations, our presentation of EBITDA may not be comparable to other similarly titled measures of other companies. |