As filed with the Securities and Exchange Commission on June 5, 2009

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

HD SUPPLY, INC.

(Exact name of registrant as specified in its charter)

(See table of additional guarantor registrants on following page)

| | | | |

| Delaware | | 5000 | | 75-2007383 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

3100 Cumberland Boulevard,

Suite 1480

Atlanta, Georgia 30339

(770) 852-9000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Ricardo Nunez, Esq.

Senior Vice President, General Counsel and Corporate Secretary

HD Supply, Inc.

3100 Cumberland Boulevard, Suite 1480

Atlanta, Georgia 30339

(770) 852-9000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

Steven J. Slutzky, Esq.

Debevoise & Plimpton LLP

919 Third Avenue

New York, New York 10022

(212) 909-6000

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after this Registration Statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, as amended, or the “Securities Act,” check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | |

| Large accelerated filer ¨ | | Accelerated filer ¨ |

| Non-accelerated filer x (Do not check if a smaller reporting company) | | Smaller reporting company ¨ |

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross-Border Third Party Tender Offer) ¨

CALCULATION OF REGISTRATION FEE

| | | | | | | | |

| |

Title of each class of

securities to be registered | | Amount to be

registered | | Proposed maximum

offering price per

unit(1) | | Proposed maximum

aggregate offering price | | Amount of registration fee(2) |

12% Senior Notes due 2014 | | $2,500,000,000 | | 100% | | $2,500,000,000 | | $139,500 |

13.5% Senior Subordinated Notes due 2015(3) | | $2,193,001,646 | | 100% | | $2,193,001,646 | | $122,370 |

Guarantees of 12% Senior Notes due 2014(4) | | — | | — | | — | | None(5) |

Guarantees of 13.5% Senior Subordinated Notes due 2015(4) | | — | | — | | — | | None(5) |

Total | | $4,693,001,646 | | 100% | | $4,693,001,646 | | $261,870 |

| |

| |

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(f) promulgated under the Securities Act. |

| (2) | The registration fee has been calculated under Rule 457(f)(2) of the Securities Act. |

| (3) | Includes $611,026,926 principal amount of such notes expected to be issued in lieu of cash interest payments thereon. Such additional principal amount constitutes the registrants’ reasonable good faith estimate of the amount of such notes to be paid as interest in lieu of cash. |

| (4) | See the following page for a table of guarantor registrants. |

| (5) | Pursuant to Rule 457(n) promulgated under the Securities Act, no separate filing fee is required for the guarantees. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

TABLE OF GUARANTOR REGISTRANTS

| | | | |

Exact name of guarantor registrant as specified in its charter* | | State or other

jurisdiction of

formation | | I.R.S. employer

identification number |

Brafasco Holdings II, Inc. | | Delaware | | 54-2167751 |

Brafasco Holdings, Inc. | | Delaware | | 36-4392444 |

Cox Lumber Co. | | Florida | | 59-0999516 |

Creative Touch Interiors, Inc. | | Maryland | | 52-1009987 |

HD Builder Solutions Group, LLC | | Delaware | | 02-0647515 |

HD Supply Construction Supply Group, Inc. | | Delaware | | 84-1380403 |

HD Supply Construction Supply, Ltd. | | Florida | | 26-0100647 |

HD Supply Distribution Services, LLC | | Delaware | | 20-2860740 |

HD Supply Electrical, Ltd. | | Florida | | 26-0100654 |

HD Supply Facilities Maintenance Group, Inc. | | Delaware | | 14-1900568 |

HD Supply Facilities Maintenance, Ltd. | | Florida | | 52-2418852 |

HD Supply Fasteners & Tools, Inc. | | Michigan | | 38-1992495 |

HD Supply GP & Management, Inc. | | Delaware | | 51-0374238 |

HD Supply Holdings, LLC | | Florida | | 42-1651863 |

HD Supply Management, Inc. | | Florida | | 43-2080574 |

HD Supply Plumbing/HVAC Group, Inc. | | Delaware | | 58-2510145 |

HD Supply Plumbing/HVAC, Ltd. | | Florida | | 26-0100650 |

HD Supply Repair & Remodel, LLC | | Delaware | | 20-2749043 |

HD Supply Support Services, Inc. | | Delaware | | 59-3758965 |

HD Supply Utilities Group, Inc. | | Delaware | | 52-2048968 |

HD Supply Utilities, Ltd. | | Florida | | 26-0100651 |

HD Supply Waterworks Group, Inc. | | Delaware | | 05-0532711 |

HD Supply Waterworks, Ltd. | | Florida | | 05-0550887 |

HDS IP Holding, LLC | | Nevada | | 61-1540596 |

HSI IP, Inc. | | Delaware | | 66-0620064 |

Madison Corner, LLC | | Florida | | 20-3548192 |

Park-Emp, LLC | | Florida | | 30-0501912 |

ProValue, LLC | | Delaware | | 55-0872477 |

Southwest Stainless, L.P. | | Delaware | | 51-0374240 |

Sunbelt Supply Canada, Inc. | | Delaware | | 41-2148226 |

Utility Supply of America, Inc. | | Illinois | | 36-3645787 |

White Cap Construction Supply, Inc. | | Delaware | | 95-3043400 |

Williams Bros. Lumber Company, LLC | | Delaware | | 20-2920464 |

World-Wide Travel Network, Inc. | | Florida | | 59-2571159 |

| * | The address for each of the additional registrants is c/o HD Supply, Inc., 3100 Cumberland Boulevard, Suite 1480, Atlanta, Georgia, 30339, telephone: (770) 852-9000. The name and address, including zip code, of the agent for service for each additional registrant is Ricardo Nunez, Senior Vice President, General Counsel and Corporate Secretary, HD Supply, Inc., 3100 Cumberland Boulevard, Suite 1480, Atlanta, Georgia, 30339, telephone: (770) 852-9000. |

The information in this prospectus is not complete and may be changed. We may not complete this exchange offer or issue these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED , 2009

PROSPECTUS

HD SUPPLY, INC.

Offer to Exchange

$2,500,000,000 Outstanding 12% Senior Notes due 2014

for $2,500,000,000 Registered 12% Senior Notes due 2014

and

$1,581,974,720 Outstanding 13.5% Senior Subordinated PIK Notes due 2015

for $1,581,974,720 Registered 13.5% Senior Subordinated PIK Notes due 2015

The new notes:

| | • | | The terms of the new notes offered in the exchange offer are substantially identical to the terms of the old notes, except that the new notes will be registered under the Securities Act of 1933, as amended, or the “Securities Act,” and will not be subject to restrictions on transfer or provisions relating to additional interest, will bear a different CUSIP number from the old notes and will not entitle their holders to registration rights. |

Investing in the new notes involves risks. You should carefully review therisk factors beginning on page 19 of this prospectus.

The exchange offer:

| | • | | Our offer to exchange old notes for new notes will be open until 5:00 p.m., New York City time, on , 2009, unless extended. |

| | • | | No public market currently exists for the old notes or the new notes. |

The guarantees:

| | • | | The new notes will be fully and unconditionally guaranteed on an unsecured basis by each of our domestic subsidiaries that guarantees the obligations under our senior secured credit facilities. |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2009.

Table of contents

We have not authorized anyone to give you any information or to make any representations about the transactions we discuss in this prospectus other than those contained in this prospectus. If you are given any information or representation about these matters that is not discussed in this prospectus, you must not rely on that information. This prospectus is not an offer to sell or a solicitation of an offer to buy securities anywhere or to anyone where or to whom we are not permitted to offer to sell securities under applicable law.

In making an investment decision, investors must rely on their own examination of the issuer and the terms of the offering, including the merits and risks involved. These securities have not been recommended by any federal or state securities commission or regulatory authority. Furthermore, the foregoing authorities have not confirmed the accuracy or determined the adequacy of this document. Any representation to the contrary is a criminal offense.

In connection with the exchange offer, we have filed with the U.S. Securities and Exchange Commission, or the “SEC,” a registration statement on Form S-4, under the Securities Act, relating to the new notes to be issued in the exchange offer. As permitted by SEC rules, this prospectus omits information included in the registration statement. For a more complete understanding of the exchange offer, you should refer to the registration statement, including its exhibits.

The public may read and copy any reports or other information that we file with the SEC. Such filings are available to the public over the Internet at the SEC’s website at http://www.sec.gov. The SEC’s website is included in this prospectus as an inactive textual reference only. You may also read and copy any document that we file with the SEC at its public reference room at 100 F Street, N.E., Washington D.C. 20549. You may obtain information on the operation of the public reference room by calling the SEC at 1-800-SEC-0330. You may also obtain a copy of the registration statement relating to the exchange offer and other information that we file with the SEC at no cost by calling us or writing to us at the following address:

HD Supply, Inc.

3100 Cumberland Boulevard,

Suite 1480

Atlanta, Georgia 30339

Attn: General Counsel

(770) 852-9000

In order to obtain timely delivery of such materials, you must request documents from us no later than five business days before you make your investment decision or at the latest by , 2009.

i

Forward-looking statements

This prospectus includes forward-looking statements and cautionary statements within the meaning of the Private Securities Litigation Reform Act of 1995. Some of the forward-looking statements can be identified by the use of forward-looking terms such as “believes,” “expects,” “may,” “will,” “should,” “could,” “seeks,” “intends,” “plans,” “estimates,” “anticipates” or other comparable terms. These forward-looking statements include all matters that are not historical facts. They appear in a number of places throughout this prospectus and include statements regarding our intentions, beliefs or current expectations concerning, among other things, our results of operations, financial condition, liquidity, prospects, growth strategies and the industries in which we operate.

Forward-looking statements are subject to known and unknown risks and uncertainties, many of which may be beyond our control. We caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and the development of the industries in which we operate may differ materially from those made in or suggested by the forward-looking statements contained in this prospectus. In addition, even if our results of operations, financial condition and liquidity, and the development of the industries in which we operate are consistent with the forward-looking statements contained in this prospectus, those results or developments may not be indicative of results or developments in subsequent periods. A number of important factors could cause actual results to differ materially from those in the forward-looking statements, including those factors discussed in “Risk factors.” Factors that could cause actual results to differ from those reflected in forward-looking statements relating to our operations and business include:

| | • | | Our substantial indebtedness; |

| | • | | Our ability to incur additional indebtedness; |

| | • | | Limitations and restrictions in the agreements governing our indebtedness; |

| | • | | Our ability to service our debt and to refinance all or a portion of our indebtedness; |

| | • | | Our ability to obtain additional financing on acceptable terms; |

| | • | | Increases in interest rates; |

| | • | | Rating agency actions with respect to our indebtedness; |

| | • | | Our combined financial information as of and for the periods prior to the Acquisition is not representative of our future financial position, results of operations or cash flows; |

| | • | | Since the Acquisition, we no longer benefit from the combination of a consumer products business and our business; |

| | • | | The interests of the Equity Sponsors; |

| | • | | Decreases in activity in the residential, non-residential and public infrastructure construction and facility maintenance and repair markets; |

| | • | | The decline in the new residential construction market; |

| | • | | The downturn in the non-residential construction industry; |

| | • | | The downturn in residential repair and improvement activity; |

| | • | | Our ability to increase or maintain our profitability; |

| | • | | Goodwill impairment charges; |

| | • | | Impairment charges as a result of closing underperforming locations; |

| | • | | Our obligations under long-term, non-cancelable leases; |

| | • | | Demand for our products and services in highly competitive and fragmented industries; |

| | • | | Consolidation among our competitors; |

ii

| | • | | The loss of any of our significant customers; |

| | • | | Failure to collect monies owed from customers, including on credit sales; |

| | • | | Competitive pricing pressure from our customers; |

| | • | | Our ability to continue to achieve the acquisition component of our growth strategy; |

| | • | | Variability in our revenues and earnings; |

| | • | | Cyclicality and seasonality of the residential, non-residential and infrastructure construction and facility maintenance and repair markets; |

| | • | | Fluctuations in commodity prices; |

| | • | | Increases in petroleum prices; |

| | • | | Product shortages and cyclicality in the residential, non-residential and infrastructure construction and facility maintenance and repair markets; |

| | • | | Our ability to identify and develop relationships with a sufficient number of qualified suppliers and to maintain our supply chains; |

| | • | | Our ability to manage fixed costs; |

| | • | | Changes in our product mix; |

| | • | | The impairment of financial institutions; |

| | • | | The development of alternatives to distributors in the supply chain; |

| | • | | Our ability to manage our product purchasing and customer credit policies; |

| | • | | Inclement weather, anti-terrorism measures and other disruptions to the transportation network; |

| | • | | Interruptions in the proper functioning of IT systems; |

| | • | | Our ability to implement our technology initiatives; |

| | • | | Changes in U.S. federal, state or local regulations; |

| | • | | Exposure to construction defect and product liability claims; |

| | • | | Outcomes of legal proceedings; |

| | • | | Potential material liabilities under our self-insured programs; |

| | • | | Our ability to attract, retain and retrain highly qualified associates and key personnel; |

| | • | | Fluctuations in foreign currency exchange rates; |

| | • | | Inability to protect our intellectual property rights; |

| | • | | Significant costs related to compliance with environmental, health and safety regulations; |

| | • | | Our ability to achieve and maintain effective disclosure controls and internal control over our financial reporting; and |

| | • | | Increased costs related to our becoming a reporting company. |

You should read this prospectus completely and with the understanding that actual future results may be materially different from expectations. All forward-looking statements made in this prospectus are qualified by these cautionary statements. These forward-looking statements are made only as of the date of this prospectus, and we do not undertake any obligation, other than as may be required by law, to update or revise any forward-looking statements to reflect changes in assumptions, the occurrence of unanticipated events, changes in future operating results over time or otherwise. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data.

iii

Industry and market data

This prospectus includes estimates regarding market and industry data and forecasts, which are based on publicly available information, industry publications and surveys, reports from government agencies, reports by market research firms and our own estimates based on our management’s knowledge of and experience in the markets and businesses in which we operate. We believe these estimates are reasonable as of the date of this prospectus. However, we have not independently verified market and industry data from third-party sources. This information may prove to be inaccurate because of the method by which we obtained some of the data for our estimates or because this information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in a survey of market size. In addition, consumer preferences and the competitive landscape can and do change. As a result, you should be aware that the market and industry data included in this prospectus, and our estimates and beliefs based on such data, may not be reliable. We do not make any representations as to the accuracy of such industry and market data.

We categorize our businesses based on the market sectors they predominantly serve: (1) Infrastructure & Energy, (2) Maintenance, Repair & Improvement and (3) Specialty Construction, including residential and non-residential construction. Generally, each of our businesses serve customers in markets other than their predominant market sector. The allocations of our customers by market sector are estimates and are made by the heads of each of our businesses based on different methodologies. For example, to determine public and private mix (which we use in determining our exposure to the new residential construction market), our Waterworks business generally assigns each customer an identifying code and tracks shipments at the job level based on job type. In other businesses, customers may be assigned a “customer type” for the life of their relationship with us. Other businesses estimate end-market type percentages based on other factors such as the type of products sold or based on information from our sales force and customers. We compile the estimates received from the heads of each of our businesses into a consolidated estimate of the percentage of our net sales derived from each of our customer market sectors.

These estimated market sector percentages are based on a number of assumptions and judgments by our management. There can be no assurance that these percentages would not be materially different had they been estimated utilizing a different methodology or assumptions or that they will not change materially over time. More recent information, some of which may be less favorable for the markets served by our company, may have been published or otherwise been made available.

Trademarks

We use various trademarks, service marks and brand names, such asHD Supply(and design),Crown Bolt, National Waterworks(and design),USABluebookandWhite Capthat we deem particularly important to the advertising activities and operation of our various businesses and some of these marks are registered in the United States and, in some cases, other jurisdictions. This prospectus also refers to the brand names, trademarks or service marks of other companies. All brand names and other trademarks or service marks cited in this prospectus are the property of their respective holders.

Certain terms used in this prospectus

Unless otherwise noted or indicated by the context, in this prospectus:

| | • | | the term “Acquisition” means the acquisition by subsidiaries of HDS Investment Holding, Inc. of all of the outstanding capital stock of each of HD Supply, Inc. and CND Holdings, Inc. as well as certain related intellectual property, from Home Depot or its subsidiaries in connection with the Transactions; |

iv

| | • | | the term “CND Holdings” refers to CND Holdings, Inc. (which has been dissolved as of February 2, 2009); |

| | • | | the term “Equity Sponsors” refers to Bain Capital Partners, LLC, The Carlyle Group, Clayton, Dubilier & Rice, Inc. and/or, as the context requires, Bain Capital Integral Investors 2006, LLC, Carlyle Partners V, L.P. and Clayton, Dubilier & Rice Fund VII, L.P.; |

| | • | | the terms, “fiscal 2006,” “fiscal 2007,” “fiscal 2008,” and “fiscal 2009” mean our fiscal years ended January 28, 2007, February 3, 2008, February 1, 2009, and January 31, 2010, respectively; |

| | • | | the term “Home Depot” refers to The Home Depot, Inc., a Delaware corporation, and the indirect parent of HD Supply prior to the consummation of the Acquisition; |

| | • | | the terms “HD Supply,” the “Company,” “we,” “us” and “our” each refer to HD Supply, Inc., a Delaware corporation, and its subsidiaries, and the other assets acquired by subsidiaries of HDS Investment Holding, Inc. in the Acquisition; |

| | • | | the term “Holding” refers to HDS Investment Holding, Inc., the indirect parent of HD Supply, formerly named Pro Acquisition Corporation; |

| | • | | the term “initial purchasers” refers to J.P. Morgan Securities Inc., Merrill Lynch, Pierce, Fenner & Smith Incorporated and Lehman Brothers Inc., collectively; and |

| | • | | the term “Transactions” refers to the transactions described in the section “The Transactions.” |

v

Summary

This summary highlights certain information contained elsewhere in this prospectus. Because this is only a summary, it does not contain all of the information that may be important to you. For a more complete understanding of this offering, we encourage you to read this entire prospectus, including HD Supply’s consolidated and combined financial statements and the related notes and the section entitled “Risk factors” included elsewhere in this prospectus.

Our company

We are one of the largest wholesale distributors based on sales serving the highly fragmented U.S. and Canadian Infrastructure & Energy, Maintenance, Repair & Improvement and Specialty Construction market sectors. Through approximately 790 locations across the United States and Canada, we operate a diverse portfolio of distribution businesses that provide approximately 1 million SKUs to over 450,000 professional customers, including contractors, government entities, maintenance professionals, home builders and industrial businesses. Our company is organized in three distinct market sectors, each of which offers different products and services to the end customer.

We believe that the diversity of our product portfolio, vendor relationships and customer base reduces our exposure to any single end market, customer or product and positions us to benefit from investment across all construction end markets—new residential, non-residential and infrastructure construction; residential renovation and improvement; the ongoing maintenance of existing facilities; and the upgrade of water, wastewater, oil and gas, and electric utility infrastructure. We believe that our size and scale, coupled with our experienced sales force, extensive distribution infrastructure and information technology systems allow us to provide competitive pricing, product breadth, availability and delivery and customer service. For fiscal 2008, we generated net sales of $9,768 million, an operating loss of $789 million, and operating income excluding goodwill impairment of $134 million.

The following table presents net sales, operating income (loss), and operating income (loss) excluding goodwill impairment for fiscal 2008 (dollars in millions):

| | | | | | | | | | | | | | | |

| | | Fiscal year ended February 1, 2009 | |

| | | Net sales | | Operating

income (loss) | | | Goodwill

impairment | | | Operating income

(loss) excluding

goodwill

impairment | |

Infrastructure & Energy | | $ | 5,011 | | $ | (453 | ) | | $ | (690 | ) | | $ | 237 | |

Maintenance, Repair & Improvement | | | 2,070 | | | 162 | | | | — | | | | 162 | |

Specialty Construction | | | 2,460 | | | (346 | ) | | | (233 | ) | | | (113 | ) |

Other | | | 227 | | | (152 | ) | | | — | | | | (152 | ) |

| | | | | | | | | | | | | | | |

Total | | $ | 9,768 | | $ | (789 | ) | | $ | (923 | ) | | $ | 134 | |

| | | | | | | | | | | | | | | |

Operating income (loss) excluding goodwill impairment is not a recognized measure under accounting principles generally accepted in the United States (“GAAP”). Management believes that operating income (loss) excluding goodwill impairment is a meaningful measurement of the ongoing results of the business since it reflects operating results without the impact of this non-cash charge which is not expected to recur.

1

Our three market sectors are presented below:

| | • | | Infrastructure & Energy—To support established infrastructure and economic growth, our Infrastructure & Energy businesses serve customers in the Infrastructure & Energy market sector by meeting their demand for the critical supplies and services used to build and maintain water systems, oil refineries, and petrochemical plants, and for the generation, transmission, distribution and application of electrical power. This market sector is made up of the following businesses: |

| | • | | Waterworks—Distributes complete lines of water and wastewater transmission products, serving contractors and municipalities in all aspects of the water and wastewater industries. |

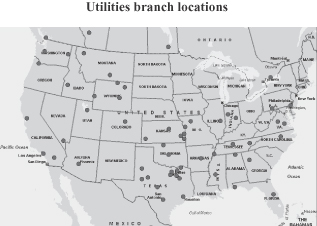

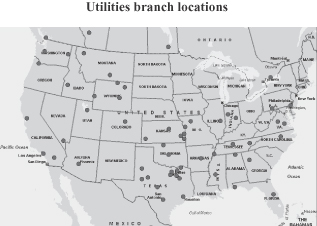

| | • | | Utilities—Distributes electrical transmission and distribution products, power plant maintenance, repair and operations supplies and smart-grid technologies and provides materials management and procurement outsourcing arrangements to investor-owned utilities, municipal and provincial power authorities, rural electric cooperatives and utility contractors. |

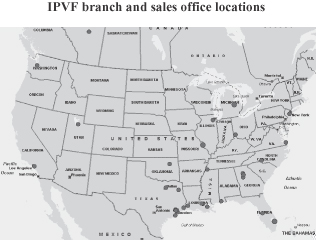

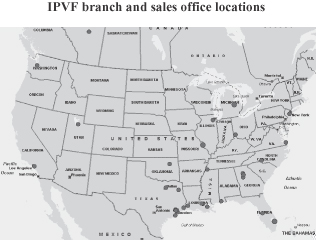

| | • | | Industrial Pipe, Valves and Fittings (“IPVF”)—Distributes stainless steel and special alloy pipes, plates, sheets, flanges and fittings, as well as high performance valves, actuation services and high-density polyethylene pipes and fittings for oil and gas, petrochemical, power, food and beverage, pulp and paper, mining, and marine industries; IPVF also serves pharmaceutical customers, industrial and mechanical contractors, fabricators, wholesale distributors, exporters and original equipment manufacturers. |

| | • | | Electrical—Supplies electrical products such as wire and cable, switch gear supplies, lighting and conduit to residential and commercial contractors. |

| | • | | Maintenance, Repair & Improvement—Our Maintenance, Repair & Improvement businesses serve customers in the Maintenance, Repair & Improvement market sector by meeting their continual demand for supplies needed to fix and upgrade facilities across multiple industries. This market sector is made up of the following businesses: |

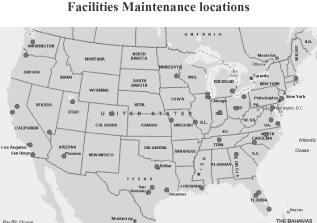

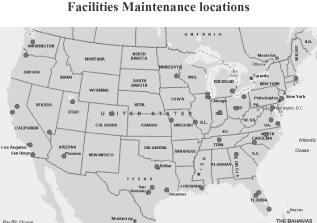

| | • | | Facilities Maintenance—Supplies maintenance, repair and operations products and upgrade and renovation services largely to the multifamily, healthcare and hospitality markets. |

| | • | | Crown Bolt—A retail distribution operator, providing program and packaging solutions, sourcing, distribution, and in-store service, primarily serving Home Depot. |

| | • | | Repair & Remodel—Offers light remodeling and construction supplies primarily to small remodeling contractors and trade professionals. |

| | • | | Specialty Construction—Our Specialty Construction businesses serve customers in the Specialty Construction market sector by meeting their very distinct, customized supply needs in commercial, residential and industrial applications. This market sector is made up of the following businesses: |

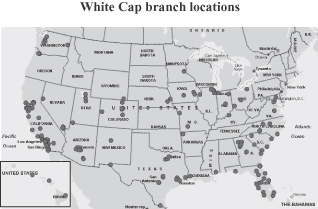

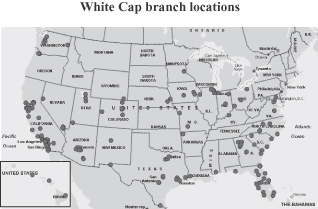

| | • | | White Cap—Distributes specialized hardware, tools and building materials to professional contractors. |

| | • | | Plumbing—Distributes plumbing fixtures, faucets and finishes, Heating Ventilation and Air Conditioning (“HVAC”) equipment, pipes, valves, fittings and water heaters, as well as related services, to residential and commercial contractors. |

| | • | | Creative Touch Interiors (“CTI”)—Offers turnkey flooring installation services and countertop, cabinet and window covering installation services to homebuilders. |

In addition to our three market sectors, we operate an HD Supply Canada business. This business is an industrial wholesale distributor and primarily focuses on servicing the electrical and fastener markets within Canada.

2

Industry overview

Our markets

We operate in the wholesale distribution industry largely serving Infrastructure & Energy, Maintenance, Repair & Improvement and Specialty Construction market sectors. These markets are characterized by a fragmented customer base consisting of contractors, government entities, maintenance professionals, home builders and industrial businesses, which typically demand a high level of service and availability of a broad set of complex products from a large number of suppliers. These factors drive the importance of the distributor within the value chain and create barriers to entry for suppliers to sell directly to customers.

The markets we serve are highly fragmented, with the majority of our competitors being specialized, local or regional companies focused primarily on a narrow range of product categories. We believe that our national footprint, diverse product and service offerings across our businesses, and leading market positions throughout multiple markets distinguish us from our competitors.

Our scale provides us with numerous competitive advantages in a consolidating market, including:

| | • | | Significant product purchasing power, which we leverage across our broad and diverse vendor base; |

| | • | | Ability to service increasingly diverse, multi-state and national customers; |

| | • | | Broad product and service offering with cross-selling and adjacent market opportunities across our businesses; and |

| | • | | Extensive product selection and reliable customer service supported by our distribution infrastructure and systems capability. |

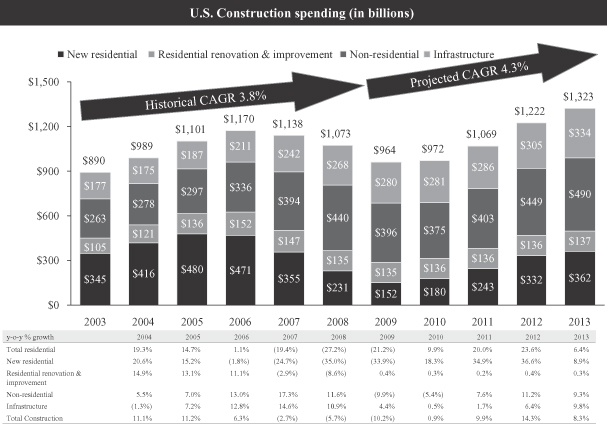

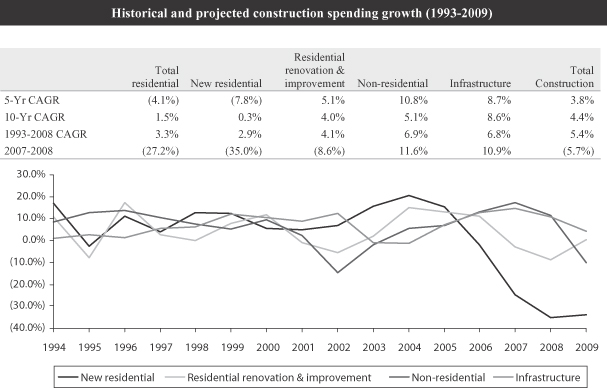

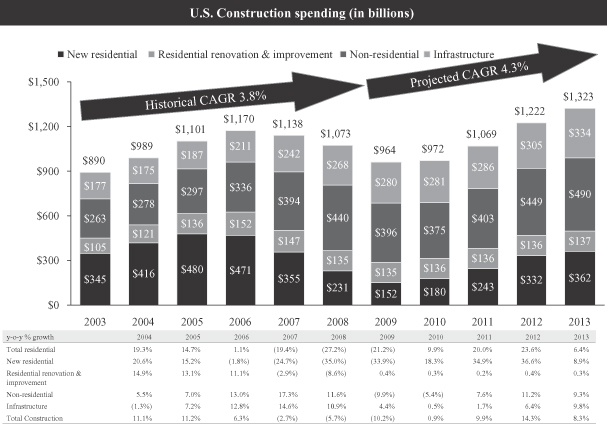

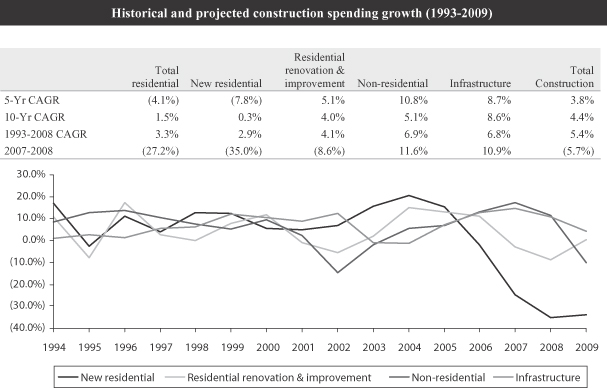

While certain macroeconomic factors (which may include GDP growth, population growth, migration, interest rates, employment and consumer sentiment) underpin growth across our industry, we serve a diverse set of end markets that also have a number of different growth drivers and trends. End-market demand for products within the industries we serve is principally driven by residential construction, non-residential construction, infrastructure construction, and maintenance, repair and operations (“MRO”) activity.

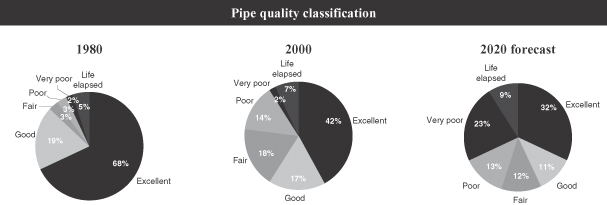

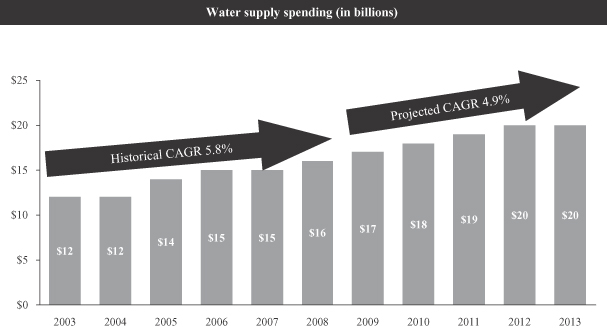

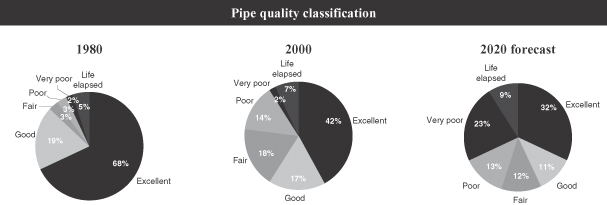

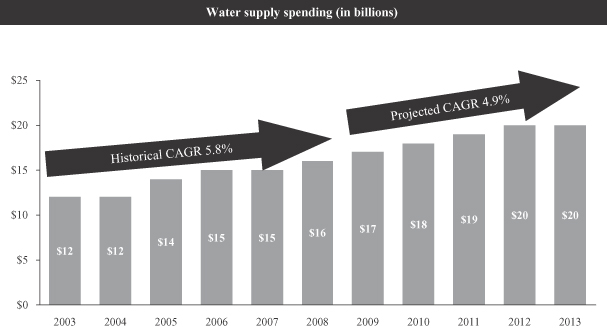

Certain other industry-specific growth drivers impact our largest market sector, Infrastructure & Energy. Growth in our Waterworks business, for example, is linked to private and public expenditures that are driven by upgrade requirements for an aging water infrastructure as well as federal and state regulation. Growth in our Utilities business is supported by transmission and distribution infrastructure spending that we expect to accelerate in response to growing electricity consumption, an inadequate national electric grid and regulatory pressure from the Energy Policy Act of 2005. Finally, our IPVF business is driven by growing maintenance and capital spending in the oil and gas and petrochemical industries. Recent U.S. government stimulus legislation includes more than $300 billion of infrastructure and construction projects that we believe will create significant demand for materials through our customer base.

Our strengths

We believe that our company has the following competitive strengths:

| | • | | Broad end-market exposure and diverse revenue mix: Overall, our broad end-market and geographic exposure, low customer concentration and diverse product and service offerings across our businesses help reduce the risks related to a single end market. |

| | • | | Broad end-market and geographic exposure: We serve a broad array of end markets with favorable long-term growth prospects, driven by many different factors. |

3

| | Further, we operate approximately 790 branches strategically located across the United States and Canada. Our broad business mix reduces our exposure to the seasonality and cyclicality of any individual end market or region. |

| | • | | Diversified customer base and product and service offering: We offer approximately 1 million SKUs to over 450,000 active client accounts. Our large, highly fragmented customer base has low account concentration with our largest customer representing only 2.8% of our fiscal 2008 net sales and our top 10 customers comprising only 6.1% of our fiscal 2008 net sales. |

| | • | | Attractive industry fundamentals: We operate in the large, fragmented U.S. and Canadian residential, non-residential and infrastructure construction and renovation and improvement markets. Many competitors lack the resources and scale to compete with our product depth, strong customer service, global sourcing capability, broad geographic coverage, and sophisticated information technology, or “IT,” systems. As a result, we have developed leading market positions and believe that we are poised to capture additional market share and capitalize on continued consolidation in the industry. Despite the downturn in the residential and nonresidential construction markets, the long-term forecast for our markets is favorable, driven by projected economic and population growth. Moreover, we believe certain of our businesses will also benefit from specific incremental growth drivers, including a need to upgrade our country’s aging water and wastewater systems and power transmission and distribution grid, and demand for capital equipment in the oil and gas and petrochemical industries. Additionally, recent U.S. government stimulus legislation has appropriated more than $100 billion toward transportation, Housing & Urban Development (“HUD”), energy and water projects. |

| | • | | Significant profitability improvement opportunities: We have grown rapidly through acquisitions and have historically focused on top-line growth. We believe that we are well positioned to capitalize on opportunities to improve profitability by further integrating acquisitions, leveraging our scale and driving best practices throughout the organization. We currently have a series of margin improvement initiatives underway, including: |

| | • | | leveraging preferred supplier contract terms across our businesses; |

| | • | | consolidating suppliers within and among our businesses; |

| | • | | utilizing scale to drive low-cost country sourcing and proprietary brand penetration; |

| | • | | reducing corporate overhead costs; |

| | • | | analyzing and optimizing pricing; and |

| | • | | improving business and branch-level operating performance. |

| | • | | Experienced management team and strong equity sponsorship: Our senior management team has an average of 18 years of distribution, construction and diversified industry experience. Our CEO, Joseph DeAngelo, has over 25 years of global operating experience including 17 years at General Electric Company, where he gained extensive operational, sourcing and financial experience across numerous General Electric business units. Our business heads have significant experience across industries with our company and at other leading industrial companies such as General Electric Company, Arrow Electronics, Inc., Honeywell International Inc. and The Stanley Works. The presidents of our businesses have an average 21 years of industry experience, the majority of which has been accrued in service at our legacy companies. Further, each of our Equity Sponsors, Bain Capital Partners, LLC, The Carlyle Group and Clayton, Dubilier & Rice, Inc., brings a strong track record of creating value through their ownership of large distribution businesses, including Rexel S.A., Brenntag Holding GmbH & Co. KG and Wesco Aircraft Hardware Corp. |

4

Our strategy

We are focused on driving strong performance and ongoing operational improvements at our businesses and corporate through the following initiatives:

| | • | | Maintain and build upon strong market positions: Our Waterworks, White Cap and Utilities businesses currently enjoy leading positions in their markets in the United States, and our Facilities Maintenance business has the leading position in the U.S. multifamily MRO segment of the facilities MRO market. We expect that our scale and local-market presence position us to gain further share, as we believe our suppliers and customers continue to seek relationships with fewer, larger distributors. Our ongoing focus will be to continue to develop our businesses with a focus on leveraging our strong market positions and investing locally to grow market share and increase local branch density. |

| | • | | Continue to implement margin enhancement initiatives: Our current market positions have been established following the strategic combination of National Waterworks, Hughes Supply, White Cap and other businesses. While the integration of these businesses is largely complete, we believe that we have not yet realized the full opportunity resulting from the acquisitions. We have identified opportunities to realize additional profitability improvements in our businesses. In addition to in-progress corporate and divisional cost reductions, we are focused on further implementing our sourcing and pricing initiatives and expanding our existing proprietary branded product lines. |

| | • | | Identified sourcing initiatives: These initiatives include the consolidation of our vendor base to aggregate total product spend, reduction of vendor overlap resulting from historical acquisitions and increased sourcing from low cost countries. |

| | • | | Pricing initiatives: These initiatives include the implementation of our analytical pricing optimization tools, which enables more sophisticated and disciplined product pricing at the individual customer level. |

| | • | | Proprietary branded products: We intend to grow sales of proprietary branded products, which typically generate higher gross margins than leading third-party brands sold by our businesses, and provide an opportunity to increase customer loyalty. We currently offer a limited number of proprietary branded products, and we believe that the potential for growth in sales of such products is significant. |

| | • | | Corporate and divisional cost reductions: We have initiated a corporate office restructuring, which we expect will generate savings over the next several years. In addition, in the fourth quarter of fiscal 2008 we implemented several cost reduction programs within several of our businesses, which we expect to result in additional savings. |

| | • | | Additional opportunities: In addition to the opportunities described above, we expect to realize profitability improvements from branch consolidation and local best practice sharing. |

| | • | | Increase operational efficiency through optimal asset management: During fiscal 2007 and the first half of fiscal 2008, our primary focus was on the separation of our business from Home Depot. With that effort largely complete, we intend to accelerate plans to improve our business and asset-management practices that are expected to yield substantial operational efficiencies and incremental cash flow generation. |

| | • | | Capital expenditure management: In connection with the Hughes Supply integration in fiscal 2006, we made capital expenditures on IT and infrastructure investment. With these investments largely complete, we intend to improve capital expenditure management by using our greenfield branch analysis tool and a renewed focus on consistent application of investment metrics. |

5

| | • | | Working capital management and return on capital: We intend to build on near-term asset management successes through the implementation of enterprise resource planning system enhancements to improve receivables and inventory management. We intend to modify manager compensation across our businesses to encourage efficient usage of operating working capital. We also anticipate utilizing our scale and ongoing supplier consolidation initiatives to drive more favorable payment terms from our suppliers. |

| | • | | Drive organic growth through greenfield sites and market share gains: We believe that local market penetration is a key driver of operational and financial performance. Under appropriate market conditions, we intend to continue to selectively open new branches in attractive markets to capture additional market share, improve customer service levels, increase profitability and increase local market density. We have also recently launched a series of additional initiatives within some of our businesses, which we believe will result in additional market share gains. These include entering new product and market adjacencies, offering additional value-added services such as full-suite outsourcing solutions, improved sales force effectiveness and facilitating the hiring and retention of top sales staff through improved incentives. |

| | • | | Supplement organic growth with an active potential acquisition pipeline: We will continue to identify and evaluate potential “tuck-in” acquisition targets to further grow and enhance our business. For example, on June 1, 2009, we acquired substantially all of the assets of Orco Construction Supply, a former competitor of our White Cap business, out of bankruptcy. Our acquisition strategy builds on our significant experience with integrating over 40 strategic and “tuck-in” acquisitions since 1997, where we have typically realized significant synergies during the first two years of ownership. We currently have a number of potential acquisition targets of various sizes under review. |

The Transactions

The following transactions were consummated in connection with the issuance of the old notes:

On June 19, 2007, Holding, which was formed by investment funds affiliated with the Equity Sponsors, entered into a purchase and sale agreement with Home Depot, THD Holdings, LLC, a wholly owned subsidiary of Home Depot, The Home Depot International, Inc., a wholly owned subsidiary of Home Depot, and Homer TLC, Inc., a wholly owned subsidiary of Home Depot. The purchase and sale agreement was amended on August 14, 2007, August 23, 2007 and August 27, 2007.

On August 30, 2007, HDS Acquisition Subsidiary, Inc. and certain of its subsidiaries, each a wholly owned indirect subsidiary of HDS Investment Holding, Inc., acquired all of the capital stock of HD Supply, Inc. and CND Holdings, Inc. and certain related intellectual property assets, which we refer to as the Acquisition. The following transactions occurred in connection with the Acquisition:

| | • | | We acquired all of the outstanding capital stock of HD Supply, Inc. from THD Holdings, LLC, all of the outstanding capital stock of CND Holdings, Inc. from Home Depot International, Inc. and certain related intellectual property assets from Homer TLC, Inc., for a purchase price equal to $8.5 billion. $8.175 billion, less $8 million due to the working capital deficit as described below, of the purchase price was in the form of cash consideration and the remainder was in the form of shares of capital stock of HDS Investment Holding, Inc. with a value of $325 million issued to THD Holdings, LLC, a wholly-owned subsidiary of Home Depot. |

| | • | | In connection with our funding the purchase price of the Acquisition, we received at the closing of the Acquisition and certain post-closing transactions $2,275 million or the “Equity Financing,” from one or more affiliates of, or funds managed or advised by, the Equity Sponsors and/or any of their respective affiliates as well as certain minority investors in exchange for equity securities of HDS Investment Holding, Inc. |

6

| | • | | We entered into a senior secured credit facility, amended on October 2, 2007 and November 1, 2007, which consists of a $1,000 million term loan facility (the “Term Loan Facility”) and a $300 million revolving credit facility (the “Revolving Credit Facility,” and collectively with the Term Loan Facility, the “Senior Secured Credit Facility”). |

| | • | | We entered into a senior asset-based revolving credit facility, or the “Senior ABL Credit Facility,” in an aggregate principal amount of $2,100 million, a portion of which may be used for letters of credit or swing-line loans (collectively with the “Senior Secured Credit Facility,” the “Senior Credit Facilities”). |

| | • | | We entered into an indenture pursuant to which we issued to the selling noteholders, acting in their capacity as initial purchasers, $2,500 million in aggregate principal amount of 12% senior cash pay notes due 2014 and an indenture pursuant to which we issued $1,300 million in aggregate principal amount of 13.5% senior subordinated payment-in-kind (“PIK”) notes due 2015. |

| | • | | We became a party to the THD Guarantee (“THD Guarantee”) pursuant to which Home Depot guarantees our payment obligations for principal and interest under the Term Loan Facility and which, among other things, restricts our ability to incur secured debt and pay dividends. The fair value of the THD Guarantee, estimated at $106 million at the time of the Transaction, is recorded as an other non-current asset on our balance sheet and is being amortized to interest expense over the five-year life of the Term Loan Facility on a straight-line basis which approximates the effective interest method. |

| | • | | The net proceeds from the notes issued to the selling noteholders, together with (i) borrowings under the Term Loan Facility and the Senior ABL Credit Facility and (ii) the Equity Financing, were used, among other things, to pay Home Depot (on behalf of THD Holdings, LLC, Home Depot International, Inc. and Homer TLC, Inc.) the cash consideration for the Acquisition and to pay related transaction fees and expenses. In addition, Home Depot paid $100 million of such fees and expenses on our behalf pursuant to the purchase and sale agreement, as amended. |

| | • | | Holding and Home Depot agreed that HD Supply must deliver working capital (as defined in the purchase and sale agreement) of at least $2,145 million at the closing of the Acquisition. At closing, the amount of working capital delivered on the preliminary statement was $2,137 million, resulting in an $8 million deficit paid by Home Depot. During fiscal 2008, Holding and Home Depot agreed to a final settlement for working capital and other items resulting in a net payment from Home Depot to Holding of $22 million received in fiscal 2009. |

| | • | | Immediately following the completion of the Acquisition, we entered into a series of internal reorganizations which resulted in: |

| | • | | The Equity Sponsors and/or any of their respective affiliates as well as certain minority investors and Home Depot owning 87.5% and 12.5%, respectively, of HDS Investment Holding, Inc.; |

| | • | | Holding indirectly owning 100% of the common stock of HD Supply, Inc.; and |

| | • | | HD Supply, Inc. indirectly owning 100% of the common stock and other ownership interests of its operating subsidiaries, including CND Holdings. |

In connection with the Acquisition, the rights and obligations of HDS Acquisition Subsidiary, Inc. under the notes, the indentures, the Credit Facilities and related agreements were assumed by us.

Upon the closing of the Acquisition, we entered into a number of agreements with Home Depot and/or its affiliates. See “Certain relationships and related party transactions—Agreements with Home Depot.”

* * * *

We are incorporated under the laws of the state of Delaware. Our principal executive offices are located at 3100 Cumberland Boulevard, Suite 1480, Atlanta, Georgia 30339. Our telephone number is (770) 852-9000.

7

Summary of the terms of the exchange offer

In this prospectus, we refer to (1) the old senior cash pay notes and old senior subordinated PIK notes as the “old notes,” (2) the new senior cash pay notes and new senior subordinated PIK notes as the “new notes,” and (3) the old notes and the new notes together as the “notes.” The offering of old notes was made only to qualified institutional buyers under Rule 144A and to persons outside the United States under Regulation S, and accordingly was exempt from registration under the Securities Act.

Securities offered | Up to $2,500,000,000 aggregate principal amount of new 12% senior cash pay notes due 2014, which have been registered under the Securities Act. |

Up to $1,581,974,720 aggregate principal amount of new 13.5% senior subordinated PIK notes due 2015, which have been registered under the Securities Act.

The terms of the new notes offered in the exchange offer are substantially identical to those of the old notes, except that the new notes are registered under the Securities Act and will not contain restrictions on transfer or provisions relating to additional interest, will bear a different CUSIP number from the old notes and will not entitle their holders to registration rights.

The exchange offer | You may exchange old notes for new notes. |

Resale of the new notes | We believe the new notes that will be issued in the exchange offer may be resold by most investors without compliance with the registration and prospectus delivery provisions of the Securities Act, subject to certain conditions. You should read the discussion under the heading “The exchange offer” for further information regarding the exchange offer and resale of the new notes. |

Registration rights agreements | We have undertaken the exchange offer pursuant to the terms of the registration rights agreement entered into with the initial purchasers with respect to each series of the old notes. See “The exchange offer” and “Description of notes—Registration covenant; Exchange Offer.” |

Consequences of failure to exchange the old notes | You will continue to hold old notes that remain subject to their existing transfer restrictions if: |

| | • | | you do not tender your old notes; or |

| | • | | you tender your old notes and they are not accepted for exchange. |

With some limited exceptions, we will have no obligation to register the old notes after we consummate the exchange offer. See “The exchange offer—Terms of the exchange offer” and “The exchange offer—Consequences of failure to exchange.”

8

Expiration date | The exchange offer will expire at 5:00 p.m., New York City time, on , 2009, or the expiration date, unless we extend it, in which case expiration date means the latest date and time to which the exchange offer is extended. |

Interest on the new notes | The new notes of each series will accrue interest from the most recent date to which interest has been paid or provided for on the old notes of such series or, if no interest has been paid on the old notes of such series, from the date of original issue of the old notes of such series. |

Conditions to the exchange offer | The exchange offer is subject to several customary conditions. We will not be required to accept for exchange, or to issue new notes in exchange for, any old notes and may terminate or amend the exchange offer if we determine in our reasonable judgment that the exchange offer violates applicable law, any applicable interpretation of the SEC or its staff or any order of any governmental agency or court of competent jurisdiction. The foregoing conditions are for our sole benefit and may be waived by us. In addition, we will not accept for exchange any old notes tendered, and no new notes will be issued in exchange for any such old notes if: |

| | • | | at any time any stop order is threatened or in effect with respect to the registration statement of which this prospectus constitutes a part; or |

| | • | | at any time any stop order is threatened or in effect with respect to the qualification of the indentures governing the relevant notes under the Trust Indenture Act of 1939, as amended. |

See “The exchange offer—Conditions.” We reserve the right to terminate or amend the exchange offer at any time prior to the expiration date upon the occurrence of any of the foregoing events.

Procedures for tendering old notes | If you wish to accept the exchange offer, you must submit required documentation and effect a tender of old notes pursuant to the procedures for book-entry transfer (or other applicable procedures), all in accordance with the instructions described in this prospectus and in the relevant letter of transmittal. See “The exchange offer—Procedures for tendering,” “The exchange offer—Book entry transfer” and “The exchange offer—Guaranteed delivery procedures.” |

Guaranteed delivery procedures | If you wish to tender your old notes, but cannot properly do so prior to the expiration date, you may tender your old notes according to the guaranteed delivery procedures set forth in “The exchange offer—Guaranteed delivery procedures.” |

Withdrawal rights | Tenders of old notes may be withdrawn at any time prior to 5:00 p.m., New York City time, on the expiration date. To withdraw a tender of old notes, a written or facsimile transmission notice of withdrawal must be received by the exchange agent at its address set forth in “The exchange offer—Exchange agent” prior to 5:00 p.m. on the expiration date. |

9

Acceptance of old notes and delivery of new notes | Except in some circumstances, any and all old notes that are validly tendered in an exchange offer prior to 5:00 p.m., New York City time, on the expiration date will be accepted for exchange. The new notes issued pursuant to the exchange offer will be delivered promptly following the expiration date. See “The exchange offer—Terms of the exchange offer.” |

Certain U.S. federal tax consequences | We believe that the exchange of the old notes for the new notes will not constitute a taxable exchange for U.S. federal income tax purposes. See “Certain U.S. federal tax considerations.” |

Exchange agent | Wells Fargo Bank, National Association is serving as the exchange agent. |

10

Summary of the terms of the new notes

The terms of each series of new notes offered in the exchange offer are identical in all material respects to the terms of the respective series of old notes, except that the new notes will:

| | • | | be registered under the Securities Act and therefore will not be subject to restrictions on transfer; |

| | • | | not be subject to provisions relating to additional interest; |

| | • | | bear a different CUSIP or ISIN number from the old notes; |

| | • | | not entitle their holders to registration rights; and |

| | • | | be subject to terms relating to book-entry procedures and administrative terms relating to transfers that differ from those of the old notes. |

Securities | $2,500,000,000 aggregate principal amount of 12% senior cash pay notes due 2014. |

$1,581,974,720 aggregate principal amount of 13.5% senior subordinated PIK notes due 2015.

Maturity | The senior cash pay notes will mature on September 1, 2014. The senior subordinated PIK notes will mature on September 1, 2015. |

Interest payment dates | Interest on the senior cash pay notes and senior subordinated PIK notes is payable on March 1 and September 1, commencing on March 1, 2008, and accrues from August 30, 2007. |

Interest on the senior cash pay notes | Interest on the senior cash pay notes accrues at a rate per annum equal to 12% and is payable in cash. |

Interest on the senior subordinated PIK notes | For any interest period through September 1, 2011, interest on the outstanding principal amount of the senior subordinated PIK notes is payable entirely in PIK Interest. After September 1, 2011, all interest on the senior subordinated PIK notes will be payable in cash. Interest on the senior subordinated PIK notes accrues at a rate per annum equal to 13.5%. |

Guarantees | The senior cash pay notes are guaranteed on an unsecured senior basis, and the senior subordinated PIK notes are guaranteed on an unsecured senior subordinated basis, by each domestic subsidiary of HD Supply that (i) is a borrower under the Senior ABL Credit Facility, (ii) guarantees payment of our indebtedness or that of any Subsidiary Guarantor under any Credit Facility and that is a Wholly Owned Domestic Subsidiary, or (iii) guarantees Capital Markets Securities (each as defined herein). These guarantees are subject to termination under specified circumstances. See “Description of notes—Subsidiary Guarantees.” |

11

As of and for the fiscal year ended February 1, 2009, our subsidiaries that do not guarantee the notes represented approximately 4.0% of our net sales, approximately 0.0% of our operating income, approximately 2.2% of our assets and approximately 0.9% of our liabilities.

Optional redemption | We may redeem the senior cash pay notes or senior subordinated PIK notes, in each case in whole or in part, at our option, at any time (1) before September 1, 2011, at a redemption price equal to 100% of the principal amount thereof, plus accrued and unpaid interest, if any, to the redemption date plus the applicable make-whole premium described under “Description of notes—Redemption” and (2) on or after September 1, 2011 at the redemption prices listed under “Description of notes—Redemption.” |

Optional redemption after certain equity offerings | On or prior to September 1, 2010, we may on one or more occasions, at our option, apply funds in an amount not exceeding the net proceeds of one or more equity offerings to redeem up to 35% of the senior cash pay notes and the senior subordinated PIK notes, respectively, at the applicable redemption prices listed under “Description of notes—Redemption.” |

Change of control | If we experience a change of control, as described under “Description of notes—Change of Control,” we must offer to repurchase all of the notes (unless otherwise redeemed) at a price equal to 101% of their principal amount, plus accrued and unpaid interest to the repurchase date. |

Ranking of notes and guarantees | The senior cash pay notes and the guarantees thereof are our and the guarantors’ unsecured senior obligations and: |

| | • | | rank equally in right of payment to all existing and future senior indebtedness of HD Supply and the guarantors; |

| | • | | rank senior in right of payment to all existing and future subordinated obligations of HD Supply and the guarantors; and |

| | • | | are effectively subordinated to all of our and the guarantors’ secured indebtedness (including under our Senior Credit Facilities) to the extent of the value of the assets securing such indebtedness and to all indebtedness and other liabilities of our subsidiaries that do not guarantee the notes. |

The senior subordinated PIK notes and the guarantees thereof are our and the guarantors’ unsecured senior subordinated obligations and:

| | • | | are subordinated in right of payment to all existing and future senior indebtedness of HD Supply and the guarantors (including under our Senior Credit Facilities and the senior cash pay notes); |

| | • | | rank equally in right of payment to all existing and future senior subordinated obligations of HD Supply and the guarantors; and |

12

| | • | | rank senior in right of payment to all of our and the guarantors’ future debt that is by its terms subordinated to the senior subordinated PIK notes. |

As of February 1, 2009, we had debt on our consolidated balance sheet of $6,056 million. Of this debt, $2,074 million was secured debt and senior to the notes. In addition, we had $2,500 million of debt on our consolidated balance sheet that was senior to the senior subordinated PIK notes. We may incur additional debt, including secured debt, under the Senior Credit Facilities or otherwise. As of February 1, 2009, we had no additional availability under the Revolving Credit Facility and $472 million of availability under the Senior ABL Credit Facility (after giving effect to the borrowing base limitations and approximately $60 million of letters of credit issued). If we so elect, certain of our subsidiaries, which, if domestic, will also be guarantors of the notes, may be borrowers under the Senior ABL Credit Facility. See “Capitalization.”

Covenants | The indentures governing the notes contain covenants that, among other things, limit our ability and the ability of our restricted subsidiaries to: |

| | • | | pay dividends, redeem stock or make other distributions; |

| | • | | make certain investments; |

| | • | | transfer or sell assets; |

| | • | | merge or consolidate with another company; and |

| | • | | enter into certain transactions with our affiliates. |

These covenants are subject to important exceptions and qualifications, which are described under “Description of notes—Certain covenants” and “Description of notes—Merger and Consolidation.”

Risk factors

You should consider carefully all of the information set forth in this prospectus and, in particular, the information under the heading “Risk factors” beginning on page 19 in evaluating the exchange offer and making an investment in the new notes.

13

Summary financial and other information

The following table presents our summary financial and other information, as of and for the periods indicated. The summary financial information as of and for the fiscal year ended February 1, 2009 has been derived from our consolidated financial statements included elsewhere in this prospectus, which have been audited by PricewaterhouseCoopers LLP. The summary financial information as of February 3, 2008 and for the period from August 30, 2007 to February 3, 2008 (Successor period) and for the period from January 29, 2007 to August 29, 2007 and for fiscal year ended January 28, 2007 (Predecessor periods) has been derived from our consolidated and combined financial statements included elsewhere in this prospectus, which have been audited by KPMG LLP. The summary financial information as of January 28, 2007 has been derived from our combined financial statements not included in this prospectus, which have been audited by KPMG LLP.

The “Summary financial and other information” should be read in conjunction with “Selected consolidated and combined financial information,” “Management’s discussion and analysis of financial condition and results of operations” and our audited consolidated and combined financial statements and related notes appearing elsewhere in this prospectus. Our consolidated and combined financial information may not be indicative of our future performance and our combined financial information does not reflect what our financial position and results of operations would have been had we operated as a separate stand-alone entity during the periods presented prior to the Acquisition. In addition, we note that due to the significant size and number of acquisitions we completed in fiscal 2006 and the first six months of fiscal 2007, our historical data are not directly comparable on a period-over-period basis.

Amounts in the following table and related notes may not add due to rounding.

14

Summary financial and other information

| | | | | | | | | | | | | | | | | | |

| | | Successor | | | | | Predecessor | |

| (Dollars in millions) | | Fiscal year

ended

February 1,

2009 | | | Period from

August 30,

2007 to

February 3,

2008 | | | | | Period from

January 29,

2007 to

August 29,

2007 | | | Fiscal year

ended

January 28,

2007 | |

Statement of income data: | | | | | | | | | | | | | | | | | | |

Net sales | | $ | 9,768 | | | $ | 4,599 | | | | | $ | 7,121 | | | $ | 11,254 | |

Cost of sales | | | 7,134 | | | | 3,372 | | | | | | 5,220 | | | | 8,220 | |

| | | | | | | | | | | | | | | | | | |

Gross profit | | | 2,634 | | | | 1,227 | | | | | | 1,901 | | | | 3,034 | |

Operating expenses: | | | | | | | | | | | | | | | | | | |

Selling, general and administrative | | | 2,063 | | | | 1,001 | | | | | | 1,424 | | | | 2,094 | |

Depreciation and amortization | | | 403 | | | | 168 | | | | | | 115 | | | | 184 | |

Restructuring charge | | | 34 | | | | — | | | | | | — | | | | — | |

Goodwill impairment | | | 923 | | | | — | | | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | |

Total operating expenses | | | 3,423 | | | | 1,169 | | | | | | 1,539 | | | | 2,278 | |

Operating income (loss) | | | (789 | ) | | | 58 | | | | | | 362 | | | | 756 | |

Interest expense | | | 644 | | | | 289 | | | | | | 221 | | | | 321 | |

Interest (income) | | | (2 | ) | | | — | | | | | | — | | | | — | |

Unrealized derivative loss | | | 11 | | | | — | | | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | |

Income (loss) before provision for income taxes and discontinued operations | | | (1,442 | ) | | | (231 | ) | | | | | 141 | | | | 435 | |

Provision (benefit) for income taxes | | | (301 | ) | | | (83 | ) | | | | | 58 | | | | 169 | |

| | | | | | | | | | | | | | | | | | |

Income (loss) from continuing operations | | | (1,141 | ) | | | (148 | ) | | | | | 83 | | | | 266 | |

Income (loss) from discontinued operations, net of tax | | | (1 | ) | | | (15 | ) | | | | | (27 | ) | | | 7 | |

| | | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | (1,142 | ) | | $ | (163 | ) | | | | $ | 56 | | | $ | 273 | |

| | | | | | | | | | | | | | | | | | |

Balance sheet data (end of period): | | | | | | | | | | | | | | | | | | |

Working capital(1) (unaudited) | | $ | 2,071 | | | $ | 2,009 | | | | | | | | | $ | 1,984 | |

Cash and cash equivalents | | | 771 | | | | 108 | | | | | | | | | | 22 | |

Total assets | | | 9,218 | | | | 10,593 | | | | | | | | | | 11,365 | |

Total debt(2) | | | 6,056 | | | | 5,800 | | | | | | | | | | 6,408 | |

Total stockholders’ and owner’s equity | | | 1,288 | | | | 2,433 | | | | | | | | | | 2,970 | |

Other financial data (unaudited): | | | | | | | | | | | | | | | | | | |

Cash interest expense(3) | | $ | 397 | | | $ | 191 | | | | | $ | 221 | | | $ | 321 | |

EBITDA(4) | | | (389 | ) | | | 230 | | | | | | 481 | | | | 947 | |

Adjusted EBITDA(4) | | | 601 | | | | 233 | | | | | | 514 | | | | 964 | |

Capital expenditures | | | 77 | | | | 75 | | | | | | 176 | | | | 243 | |

Statement of cash flows data: | | | | | | | | | | | | | | | | | | |

Cash flows provided by (used in) operating activities (net) | | $ | 548 | | | $ | 364 | | | | | $ | 408 | | | $ | 248 | |

Cash flows provided by (used in) investing activities (net) | | | 37 | | | | (8,255 | ) | | | | | (140 | ) | | | (4,185 | ) |

Cash flows provided by (used in) financing activities (net) | | | 86 | | | | 7,977 | | | | | | (269 | ) | | | 3,958 | |

| (1) | We define working capital as current assets (including cash) minus current liabilities, which include the current portion of long-term debt and accrued interest thereon. |

| (2) | Total debt includes current and non-current installments of interest-bearing financial obligations and capital leases. |

| (3) | Cash interest expense represents total interest expense in continuing operations less (i) amortization of deferred financing costs, (ii) amortization of the asset related to the estimated fair value of the THD Guarantee, (iii) PIK interest expense on the senior subordinated PIK notes and (iv) amortization of amounts in accumulated other comprehensive income related to derivatives. |

15

The following table provides a reconciliation of interest expense, the most directly comparable financial measure under GAAP, to cash interest expense for the periods presented (amounts in millions):

| | | | | | | | | | | | | | | | |

| | | Successor | | | | | Predecessor |

| | | Fiscal year

ended

February 1,

2009 | | | Period from

August 30,

2007 to

February 3,

2008 | | | | | Period from

January 29,

2007 to

August 29,

2007 | | Fiscal year

ended

January 28,

2007 |

Interest expense | | $ | 644 | | | $ | 289 | | | | | $ | 221 | | $ | 321 |

Amortization of deferred financing costs | | | (33 | ) | | | (14 | ) | | | | | — | | | — |

Amortization of THD Guarantee | | | (21 | ) | | | (9 | ) | | | | | — | | | — |

PIK interest expense on the senior subordinated PIK notes | | | (192 | ) | | | (75 | ) | | | | | — | | | — |

Amortization of amounts in accumulated other comprehensive income related to derivatives | | | (1 | ) | | | — | | | | | | — | | | — |

| | | | | | | | | | | | | | | | |

Cash interest expense | | $ | 397 | | | $ | 191 | | | | | $ | 221 | | $ | 321 |

| | | | | | | | | | | | | | | | |

Cash interest expense is not a recognized term under GAAP and does not purport to be an alternative to interest expense. Management believes that cash interest expense is useful for analyzing the cash flow needs and debt service requirements of the Company.

| (4) | EBITDA, a measure used by management to evaluate operating performance, is defined as net income (loss) less income (loss) from discontinued operations, net of tax, plus (i) interest expense and interest income, net, (ii) provision (benefit) for income taxes, and (iii) depreciation and amortization. EBITDA is not a recognized term under GAAP and does not purport to be an alternative to net income as a measure of operating performance or to cash flows from operating activities as a measure of liquidity. Additionally, EBITDA is not intended to be a measure of free cash flow available for management’s discretionary use, as it does not consider certain cash requirements such as interest payments, tax payments and other debt service requirements. We believe EBITDA is helpful in highlighting trends because EBITDA excludes the results of decisions that are outside the control of operating management and that can differ significantly from company to company depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which companies operate, age and book depreciation of facilities and capital investments. In addition, EBITDA provides more comparability between the historical results of HD Supply prior to the Acquisition and results that reflect the new capital structure after the Acquisition. We further believe that EBITDA is frequently used by securities analysts, investors and other interested parties in their evaluation of companies, many of which present an EBITDA measure when reporting their results. We compensate for the limitations of using non-GAAP financial measures by using them to supplement GAAP results to provide a more complete understanding of the factors and trends affecting the business than GAAP results alone. Because not all companies use identical calculations, our presentation of EBITDA may not be comparable to other similarly titled measures of other companies. |

In addition, we present Adjusted EBITDA because it is based on “Consolidated EBITDA,” a measure which is used in calculating financial ratios in several material debt covenants in our Senior Credit Facilities. Borrowings under the Senior Credit Facilities are a key source of liquidity and our ability to borrow under the Senior Credit Facilities depends upon, among other things, our compliance with such financial ratio covenants. Adjusted EBITDA is defined as EBITDA adjusted to exclude non-cash items, unusual items and certain other adjustments to Consolidated Net Income permitted in calculating Consolidated EBITDA under the Senior Credit Facilities. We believe that inclusion of supplementary adjustments to EBITDA applied in presenting Adjusted EBITDA is appropriate to provide additional information to investors about how the covenants in those agreements operate and about certain non-cash items, unusual items that we do not expect to continue at the same level and other items. The Senior Credit Facilities permit us to make certain

16

adjustments to Consolidated Net Income in calculating Consolidated EBITDA, such as projected net cost savings, which are not reflected in the Adjusted EBITDA data presented in this prospectus. We may in the future reflect such permitted adjustments in our calculations of Adjusted EBITDA.

EBITDA and Adjusted EBITDA have limitations as analytical tools and should not be considered in isolation or as substitutes for analyzing our results as reported under GAAP. Some of these limitations are:

| | • | | EBITDA and Adjusted EBITDA do not reflect changes in, or cash requirements for, our working capital needs; |

| | • | | EBITDA and Adjusted EBITDA do not reflect our interest expense, or the requirements necessary to service interest or principal payments on our debt; |

| | • | | EBITDA and Adjusted EBITDA do not reflect our income tax expenses or the cash requirements to pay our taxes; |

| | • | | EBITDA and Adjusted EBITDA do not reflect historical cash expenditures or future requirements for capital expenditures or contractual commitments; and |

| | • | | although depreciation and amortization charges are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and EBITDA and Adjusted EBITDA do not reflect any cash requirements for such replacements. |

The following table presents a reconciliation of net income (loss), the most directly comparable financial measure under GAAP, to EBITDA and Adjusted EBITDA for the periods presented.

| | | | | | | | | | | | | | | | | |

| | | Successor | | | | | Predecessor | |

| (Dollars in millions) | | Fiscal year

ended

February 1,

2009 | | | Period from

August 30,

2007 to

February 3,

2008 | | | | | Period from

January 29,

2007 to

August 29,

2007 | | Fiscal year

ended

January 28,

2007 | |

Net income (loss) | | $ | (1,142 | ) | | $ | (163 | ) | | | | $ | 56 | | $ | 273 | |

Less income (loss) from discontinued operations, net of tax | | | 1 | | | | 15 | | | | | | 27 | | | (7 | ) |

| | | | | | | | | | | | | | | | | |

Income (loss) from continuing operations | | | (1,141 | ) | | | (148 | ) | | | �� | | 83 | | | 266 | |

| | | | | | | | | | | | | | | | | |

Interest expense, net | | | 642 | | | | 289 | | | | | | 221 | | | 321 | |

Provision (benefit) from income taxes | | | (301 | ) | | | (83 | ) | | | | | 58 | | | 169 | |

Depreciation and amortization | | | 411 | | | | 172 | | | | | | 119 | | | 191 | |

| | | | | | | | | | | | | | | | | |

EBITDA | | $ | (389 | ) | | $ | 230 | | | | | $ | 481 | | $ | 947 | |

| | | | | | | | | | | | | | | | | |

| | | | | |

Adjustments to EBITDA: | | | | | | | | | | | | | | | | | |

Unrealized derivative loss(i) | | | 11 | | | | — | | | | | | — | | | — | |