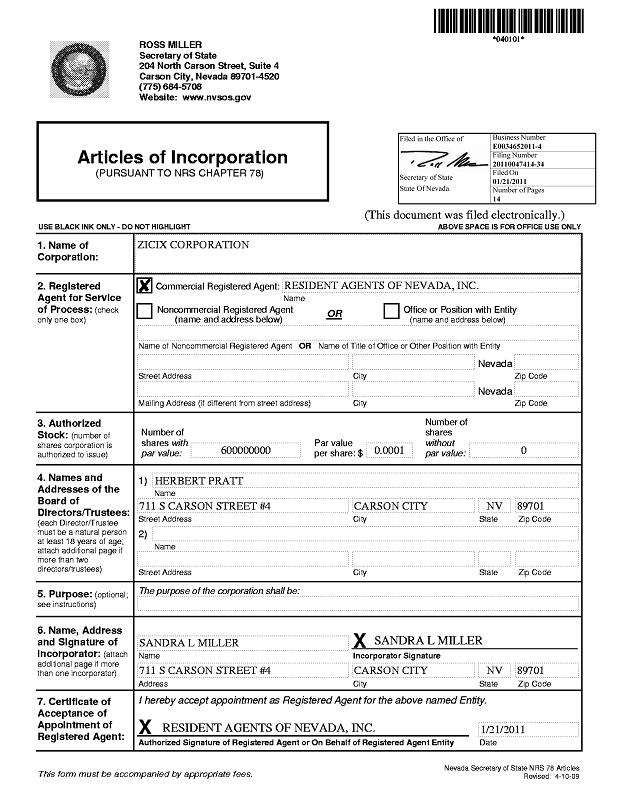

Exhibit 2.1

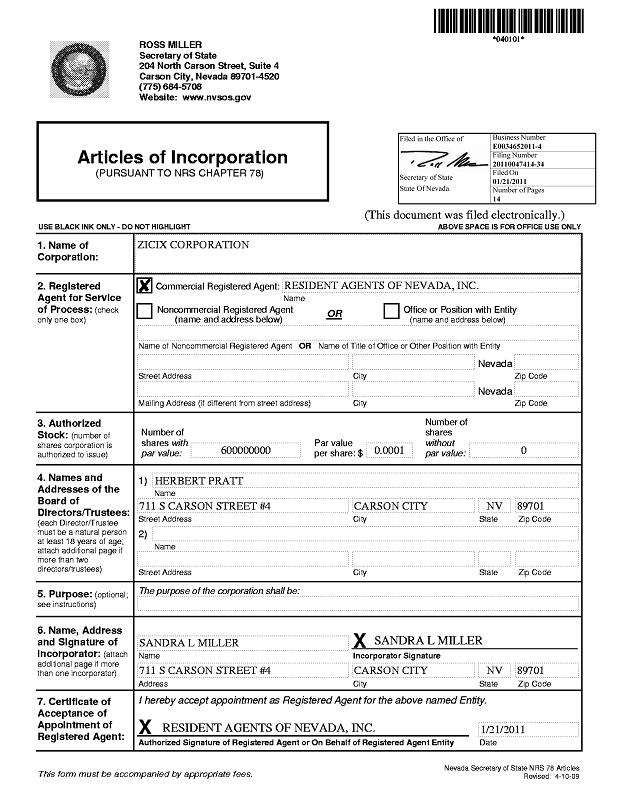

Filed in the Office of Secretary of State State Of Nevada Business Number E0034652011 - 4 Filing Number 20110047414 - 34 Filed On 01/21/2011 Number of Pages 14

ARTICLES OF INCORPORATION OF ZICIX CORPORATION For the purpose of associating to establish a corporation under the provisions and subject to the requirements of Title 7, Chapter 78 of Nevada Revised Statutes, and the acts amendatory thereof, and hereinafter sometimes referred to as the General Corporation Law of the State of Nevada, the undersigned incorporator does hereby adopt and make the following Articles of Incorporation: ARTICLE I NAME The name of the Corporation is ZICIX Corporation (hereinafter, the "Corporation"). ARTICLE II REGISTERED OFFICE AND AGENT The name of the Corporation's resident agent in the State of Nevada is Resident Agents of Nevada, Inc., and the street address of the said resident agent where process may be served on the Corporation is 711 So. Carson St., Suite 4, Carson City, Nevada 89701. The mailing address and the street address of the said resident agent are identical. ARTICLE III POWERS The purpose for which the Corporation is organized is to transact all lawful business for which corporations may be incorporated pursuant to the laws of the State of Nevada. The Corporation shall have all the powers of a corporation organized under the General Corporation Law of the State of Nevada. ARTICLE IV TERM The Corporation is to have perpetual existence.

2 ARTICLEV CAPITAL STOCK A. Number and Designation . The total number of shares of all classes that this Corporation shall have authority to issue shall be SIX HUNDRED MILLION (600,000,000), of which FIVE HUNDRED MIU.ION (500,000,000) shall be shares of common stock, par value $0.001per share ("Common StocK'), and ONE HUNDRED MIU.ION (100,000,000) shall be shares of preferred stock, par value $0.0001per share ("Preferred Stock''). The shares may be issued by the Corporation from time to time as approved by the board of directors of the Corporation without the approval of the stockholders except as otherwise provided in this Article V or the rules of a national securities exchange if applicable. The consideration for subscriptions to, or the purchase of, the capital stock to be issued by a corporation shall be paid in such form and in such manner as the board of directors shall determine. The board of directors may authorize capital stock to be issued for consideration consisting of cash, any tangible or intangible property or any benefit to the corporation, or any combination thereof. In the absence of actual fraud in the transaction, the judgment of the directors as to the value of such consideration shall be conclusive. The capital stock so issued shall be deemed to be fully paid and non - assessable stock upon receipt by the corporation of such consideration. In the case of a stock dividend, the part of the surplus of the Corporation which is transferred to stated capital upon the issuance of shares as a stock dividend shall be deemed to be the consideration for their issuance. A description of the different classes and series (if any) of the Corporation's capital stock, and a statement of the relative powers, designations, preferences and rights of the shares of each class and series (if any) of capital stock, and the qualifications, limitations or restrictions thereof, are as follows: B. Undesignated Common Stock . Shares of Common Stock not at the time designated as shares of a particular series pursuant to this Article (V)(B) or any other provision of these Articles of Incorporation may be issued from time to time in one or more additional series or without any distinctive designation. The board of directors may determine, in whole or in part, the preferences, voting powers, qualifications and special or relative rights or privileges of any such series before the issuance of any shares of that series. The board of directors shall determine the number of shares constituting each series of Common Stock and each series shall have a distinguishingdesignation. C. Common Stock . Except as provided in these Articles or the designation of any series or class of capital stock, the holders of the Common Stock shall exclusively possess all voting power. Subject to the provisions of these Articles, each holder of shares of Common Stock shall be entitled to one vote for each share held by such holders. Whenever there shall have been paid, or declared and set aside for payment, to the holders

3 of the outstanding shares of any class or series of stock having preference over the Common Stock as to the payment of dividends, the full amount of dividends and sinking fund or retirement fund or other retirement payments, if any, to which such holders are respectively entitled in preference to the Common Stock, then dividends may be paid on the Common Stock, and on any class or series of stock entitled to participate therewith as to dividends, out of any assets legally available for the payment of dividends, but only when and as declared by the board of directors of the Corporation. In the event of any liquidation, dissolution or winding up of the Corporation, after there shall have been paid, or declared and set aside for payment, to the holders of the outstandingshares of any class having preference over the Common Stock in any such event, the full preferential amounts to which they are respectively entitled, the holders of the Common Stock and of any class or series of stock entitled to participate therewith, in whole or in part, as to distribution of assets shall be entitled, after payment or provision for payment of all debts and liabilities of the Corporation, to receive the remaining assets of the Corporation available for distribution, in cash or in kind. Each share of Common Stock shall have the same relative powers, preferences and rights as, and shall be identical in all respects with, allthe other shares of Common Stock of the Corporation. D. Serial Preferred Stock . Shares of Preferred Stock not at the time designated as shares of a particular series pursuant to this Article (V)(D) or any other provision of these Articles of Incorporation may be issued from time to time in one or more additional series. The board of directors may determine, in whole or in part, the preferences, voting powers, qualifications and special or relative rights or privileges of any such series before the issuance of any shares of that series. The board of directors shall determine the number of shares constituting each series of Preferred Stock and each series shall have a distinguishing designation. Each share of each series of serial preferred stock shall have the same relative powers, preferences and rights as, and shall be identical in all respects with, allthe other shares of the Corporation of the same series, except the times from which dividends on shares which may be issued from time to time of any such series may begin to accrue. E. Series A Preferred Stock . There shall be a series of the voting preferred stock of the Corporation which shall be designated as the "Series A Preferred Stock," $.0001par value, and the number of shares constituting such series shall be ONE HUNDRED MILLION (100,000,000). Such number of shares may be increased or decreased by resolution of the board of directors; provided, however, that no decrease shall reduce the number of shares of Series A Preferred Stock to a number less than that of the shares then outstanding plus the number of shares issuable upon exercise of outstanding rights, options or warrants or upon conversion of outstanding securities issued by the Corporation.

4 1. Dividends and Distributions . a) Subject to the rights of the holders of any shares of any series of preferred stock of the Corporation ranking prior and superior to the Series A Preferred Stock with respect to dividends, the holders of shares of Series A Preferred Stock, in preference to the holders of shares of Common Stock, $0.001par value (the "Common StocK'), of the Corporation and of any other junior stock, shall be entitled to receive, when, as and if declared by the board of directors out of funds legally available for the purpose, quarterly dividends payable in cash on or about the first day of January, April, July and October in each year (each such date beingreferred to herein as a "Quarterly Dividend Payment Date''), commencing on the first Quarterly Dividend Payment Date after the first issuance of a share or fraction of a share of Series A Preferred Stock, in an amount per share (subject to the provision for adjustment hereinafter set forth) 1 times the aggregate per share amount of all cash dividends and 1 times the aggregate per share amount (payable in kind) of all non - cash dividends or other distributions,other than a dividend payable in shares of Common Stock or a subdivision of the outstanding shares of Common Stock (by reclassification or otherwise), declared on the Common Stock since the immediately preceding Quarterly Dividend Payment Date or, with respect to the first Quarterly Dividend Payment Date, since the first issuance of any share or fraction of a share of Series A Preferred Stock. In the event the Corporation shall at any time after July 1, 2010 (the "Rights Declaration Date") declare or pay any dividend on the Common Stock, stock payable on the Common Stock, or effect a subdivision or combination or consolidation of the outstanding shares of Common Stock (by reclassification or otherwise than by payment of a dividend in shares of Common Stock) into a greater or lesser number of shares of Common Stock, then in each such case the amount to which holders of shares of Series A Preferred Stock were entitled immediately prior to such event under clause (b) of the preceding sentence shall be adjusted by multiplying such amount by a fraction, the numerator of which is the number of shares of Common Stock outstanding immediately after such event and the denominator of which is the number of shares of Common Stock that were outstanding immediately prior to such event. b) The Corporation shall declare a dividend or distribution on the Series A Preferred Stock as provided in paragraph (a) of this Section immediately after it declares a dividend or distribution on the Common Stock (other than a dividend payable in shares of Common Stock); provided, however, that in the event no dividend or distribution shall have been declared on the Common Stock during the period between any Quarterly Dividend Payment Date and the next subsequent Quarterly Dividend Payment Date, a dividend of $.01per share on the Series A Preferred Stock shall nevertheless be payable on such subsequent Quarterly Dividend Payment Date.

5 c) Dividends shall begin to accrue and be cumulative on outstanding shares of Series A Preferred Stock from the Quarterly Dividend Payment Date next preceding the date of issue of such shares, unless the date of issue of such shares is prior to the record date for the first Quarterly Dividend Payment Date, in which case dividends on such shares shall begin to accrue from the date of issue of such shares, or unless the date of issue is a Quarterly Dividend Payment Date or is a date after the record date for the determination of holders of shares of Series A Preferred Stock entitled to receive a quarterly dividend and before such Quarterly Dividend Payment Date, in either of which events such dividends shall begin to accrue and be cumulative from such Quarterly Dividend Payment Date. Accrued but unpaid dividends shall not bear interest. Dividends paid on the shares of Series A Preferred Stock in an amount less than the total amount of such dividends at the time accrued and payable on such shares shall be allocated pro rata on a share - by - share basis among all such shares at the time outstanding. The board of directors may fix a record date for the determination of holders of shares of Series A Preferred Stock entitled to receive payment of a dividend or distribution declared thereon, which record date shall be not more than 60 days prior to the date fixed for the payment thereof. 2. Voting Rights . The holders of shares of Series A Preferred Stock shall have the following votingrights: a) Each share of Series A Preferred Stock shall entitle the holder thereof to 100 votes on all matters submitted to a vote of the stockholders of the Corporation. b) Except as otherwise provided herein, the holders of shares of Series A c) Preferred Stock, the holders of shares of Common Stock, and the holders of shares of any other capital stock of the Company having general voting rights shall vote together as one class on all matters submitted to a vote of stockholders of the Corporation. Except as otherwise set forth herein and except as otherwise provided by law, holders of Series A Preferred Stock shall have no special voting rights and their consent shall not be required (except to the extent they are entitled to vote with holders of Common Stock as set forth herein) for taking any corporate action. 3. Certain Restrictions . a) Whenever dividends or distributions payable on the Series A Preferred Stock as provided in Section 2 are in arrears, thereafter and until all accrued and unpaid dividends and distributions, whether or not declared, on shares of Series A Preferred Stock outstanding shall have been paid in full, the Corporation shall not : i. declare or pay dividends on, make any other distributions on, or redeem or purchase or otherwise acquire for consideration any shares of stock

6 iii. b ) ranking junior (either as to dividends or upon liquidation, dissolution or winding up) to the Series A Preferred Stock; ii. (ii) declare or pay dividends on or make any other distributions on any shares of stock ranking on a parity (either as to dividends or upon liquidation, dissolution or winding up) with theSeries A Preferred Stock, except dividends paid ratably on the Series A Preferred Stock and all such parity stock on which dividends are payable or in arrears in proportion to the total amounts to which the holders of all such shares are then entitled; except as permitted in Section 3(A)(iv) below, redeem or purchase or otherwise acquire for consideration shares of any stock ranking on a parity (either as to dividends or upon liquidation, dissolution or winding up) with theSeries A Preferred Stock, provided, however, that the Corporation may at any time redeem, purchase or otherwise acquire shares of any such parity stock in exchange for shares of any stock of the Corporation ranking junior (either as to dividends or upon dissolution, liquidation or winding up) to the Series A Preferred Stock; and iv. purchase or otherwise acquire for consideration any shares of Series A Preferred Stock, or any shares of stock ranking on a parity with the Series A Preferred Stock, except in accordance with a purchase offer made in writing or by publication (as determined by the board of directors) to all holders of such shares upon such terms as the board of directors, after consideration of the respective annual dividend rates and other relative rights and preferences of the respective Series and classes, shall determine in good faith will result in fair and equitable treatment among the respective series or classes. The Corporation shall not permit any subsidiary of the Corporation to purchase or otherwise acquire for consideration any shares of stock of the Corporation unless the Corporation could, under paragraph (A) of this Section 3, purchase or otherwise acquire such shares at such time and in such manner. 4. Reacquired Shares . Any shares of Series A Preferred Stock purchased or otherwise acquired by the Corporation in any manner whatsoever shall be retired and canceled promptly after the acquisition thereof. The Corporation shall cause all such shares upon their cancellation to be authorized but unissued shares of Preferred Stock which may be reissued aspart of a new series of Preferred Stock, subject to the conditions and restrictions on issuance set forth herein. 5. Liquidation, Dissolution or Winding Up . a) Upon any liquidation (voluntary or otherwise), dissolution or winding up of the Corporation, no distribution shall be made to the holders of shares of stock ranking junior (either as to dividends or upon liquidation, dissolution or winding up) to the Series A Preferred Stock unless, prior thereto, the holders of

7 shares of Series A Preferred Stock shall have received $1.00 per share, plus an amount equal to accrued and unpaid dividends and distributions thereon, whether or not declared, to the date of such payment (the "Series A Uquidation Preference''). Following the payment of the full amount of the Series A Liquidation Preference, no additional distributions shall be made to the holders of shares of Series A Preferred Stock, unless, prior thereto, the holders of shares of Common Stock shall have received an amount per share (the "Common Adjustment'') equal to the quotient obtained by dividing (i) the Series A Liquidation Preference by (ii) 100 (as appropriately adjusted as set forthin paragraph (C) of this Section 5 to reflect such events as stock dividends, and subdivisions, combinations and consolidationswith respect to the Common Stock) (such number in clause (ii) being referred to as the "Adjustment Number"). Following the payment of the full amount of the Series A Liquidation Preference and the Common Adjustment in respect of all outstanding shares of Series A Preferred Stock and Common Stock, respectively, holders of Series A Preferred Stock and holders of shares of Common Stock shall receive their ratable and proportionate share of the remaining assets to be distributed in the ratio of the Adjustment Number to 1 with respect to such Series A Preferred Stock and Common Stock, on a per share basis, respectively. b) In the event there are not sufficient assets available to permit payment c) in full of the Series A Liquidation Preference and the liquidation preferences of all other series of preferred stock, if any, which rank on a parity with the Series A Preferred Stock, then such remaining assets shall be distributed ratably to the holders of such parity shares in proportion to their respective liquidation preferences. In the event there are not sufficient assets available to permit payment in full of the Common Adjustment, then such remaining assets shall be distributed ratably to the holders of Common Stock. In the event the Corporation shall at any time after the Rights Declaration Date declare or pay any dividend on Common Stock payable in shares of Common Stock, or effect a subdivision or combination or consolidation of the outstanding shares of Common Stock (by reclassification or otherwise than by payment of a dividend in shares of Common Stock) into a greater or lesser number of shares of Common Stock, then in each such case the Adjustment Number in effect immediately prior to such event shall be adjusted by multiplying such Adjustment Number by a fraction the numerator of which is the number of shares of Common Stock outstanding immediately after such event and the denominator of which is the number of shares of Common Stock that are outstanding immediately prior to such event. 6. Consolidation, Merger, etc . In case the Corporation shall enter into any consolidation, merger, combination or other transaction in which the shares of Common Stock are exchanged for or changed into other stock or securities, cash and/or any other property, then in any such case the shares of Series A Preferred Stock shall at the same time be

8 similarly exchanged or changed in an amount per share (subject to the provision for adjustment hereinafter set forth) equal to 100 times the aggregate amount of stock, securities, cash and/or any other property (payable in kind), as the case may be, into which or for which each share of Common Stock is exchanged or changed. In the event the Corporation shall at any time after the Rights Declaration Date declare or pay any dividend on Common Stock payable in shares of Common Stock, or effect a subdivision or combination or consolidation of the outstanding shares of Common Stock (by reclassification or otherwise than by payment of a dividend in shares of Common Stock) into a greater or lesser number of shares of Common Stock, then in each such case the amount set forth in the preceding sentence with respect to the exchange or change of shares of Series A Preferred Stock shall be adjusted by multiplying such amount by a fraction the numerator of which is the number of shares of Common Stock outstanding immediately after such event and the denominator of which is the number of shares of Common Stock that are outstanding immediately prior to such event. 7. Redemption . The shares of Series A Preferred Stock shall not be redeemable. 8. Ranking . The Series A Preferred Stock shall rank junior to all other series of the Company's Preferred Stock as to the payment of dividends and the distribution of assets, unless the terms of any such series shall provide otherwise. 9. Conversion . At any time after a holding period of one day from the date of issuance, the Series A Preferred Stock may be converted to shares of Common Stock at a ratio of one (1) share of Series A Preferred Stock to 100 common shares by the Company's transfer agent. At such time of voluntary conversion, the Holder shall submit the certificate representing the Series A Preferred shares to the company's transfer agent together with an opinion letter of qualified counsel and release of restriction resolution from the Corporation. Upon the release of restriction of the certificate(s), the Corporation's transfer agent shall issue new Common Stock in the appropriate amount per conversion and cancel the relinquished preferred shares. 10. Fractional Shares . Series A Preferred Stock may be issued in fractions which are integral multiples of one one - hundredth of a share. Fractions of shares of Series A Preferred Stock may, at the election of the Corporation, be evidenced by depositary receipts, pursuant to an appropriate agreement between the Corporation and a depositary selected by the Corporation. The holders of such depositary receipts shall have all the rights, privileges and preferences to which they are entitled as beneficial owners of the Series A Preferred Stock represented by such depositary receipts. ARTICLE VI PREEMPTIVE RIGHTS No holder of any of the shares of any class or series of stock or of options, warrants or other rights to purchase shares of any class or series of stock or of other securities of the Corporation shall have any

9 preemptive right to purchase or subscribe for any unissued stock of any class or series, or any unissued bonds, certificates of indebtedness, debentures or other securities convertible into or exchangeable for stock or carrying any right to purchase stock may be issued pursuant to resolution of the board of directors of the Corporation to such persons, firms, corporations or associations, whether or not holders thereof, and upon such terms as may be deemed advisable by the board of directors in the exercise of its sole discretion. ARTICLE VII REPURCHASE OF SHARES The Corporation may from time to time, pursuant to authorization by the board of directors of the Corporation and without action by the stockholders, purchase or otherwise acquire shares of any class, bonds, debentures, notes, scrip, warrants, obligations, evidences or indebtedness, or other securities of the Corporation in such manner, upon such terms, and in such amounts as the board of directors shall determine; subject, however, to such limitations or restrictions, if any, as are contained in the express terms of any class of shares of the Corporation outstanding at the time of the purchase or acquisition in question or as are imposed by law. ARTICLE VIII MEETINGS OF STOCKHOLDERS; CUMULATIVE VOTING No action that isrequired or permitted to be taken by the stockholders of the Corporation at any annual or special meeting of stockholders may be effected by written consent of stockholders in lieu of a meeting of stockholders, unless the action to be effected by written consent of stockholders and the taking of such action by such written consent have expressly been approved in advance by the board of directors of the Corporation. Special meeting of the stockholders of the Corporation for any purpose or purposes may be called at any time by the board of directors of the Corporation, or by a committee of the board of directors which has been duly designated by the board of directors and whose powers and authorities, as provided in a resolution of the board of directors or in the bylaws of the Corporation, include the power and authority to call such meetings but such special meetings may not be called by another person or persons. There shall be no cumulative voting by stockholders of any class or series in the election of directors of the Corporation. Meetings of stockholders may be held at such place as the bylaws may provide.

10 ARTICLE IX NOTICE FOR NOMINATIONS AND PROPOSAIS Nominations for the election of directors and proposals for any new business to be taken up at any annual or special meeting of stockholders may be made by the board of directors of the Corporation or by any stockholder of the Corporation entitled to vote generally in the election of directors. In order for a stockholder of the Corporation to make any such nominations and/or proposals at an annual meeting or such proposals at a special meeting, he or she shall give notice thereof in writing, delivered or mailed by first class United States mail, postage prepaid, to the Secretary of the Corporation of not less than thirty days or more than sixty days prior to any such meeting; provided, however, that if less than forty days' notice of the meeting isgiven to stockholders, such written notice shall be delivered or mailed, as prescribed, to the Secretary of the Corporation not later than the close of the tenth day following the day on which notice of the meeting was mailed to stockholders. Each such notice given by a stockholder with respect to nominations for the election of directors shall set forth (1) the name, age, business address and, if known, residence address of each nominee proposed in such notice, (2) the principal occupation or employment of each such nominee, and (3) the number of shares of stock of the Corporation which are beneficially owned by each such nominee. In addition, the stockholder making such nomination shall promptly provide any other information reasonably requested by the Corporation. Each such notice given by a stockholder to the Secretary with respect to business proposals to bring before a meeting shall set forth in writing as to each matter: (1) a brief description of the business desired to be brought before the meeting and the reasons for conducting such business at the meeting; (2) the name and address, as they appear on the Corporation's books, of the stockholder proposing such business; (3) the class and number of shares of the Corporation which are beneficially owned by the stockholder; and (4) any material interest of the stockholder in such business. Notwithstandinganything in these Articles to the contrary, no business shall be conducted at the meeting except in accordance with the procedures set forth in this Article. The Chairman of the annual or special meeting of stockholders may, if the facts warrant, determine and declare to such meeting that a nomination or proposal was not made in accordance with the foregoing procedure, and, if he should so determine, he shall so declare to the meeting and the defective nomination or proposal shall be disregarded and laid over for action at the next succeeding adjourned, special or annual meeting of the stockholders taking place thirty days or more thereafter. This provision shall not require the holding of any adjourned or special meeting of stockholders for the purpose of considering such defective nomination or proposal.

11 ARTICIE X DIRECTORS The number of directors of the Corporation shall be such number, not less than one nor more than 15 (exclusive of directors, if any, to be elected by holders of preferred stock of the Corporation), asshall be provided from time to time in a resolution adopted by the board of directors, provided that no decrease in the number of directors shall have the effect of shortening the term of any incumbent director, and provided further that no action shall be taken to decrease or increase the number of directors from time to time unless at least two - thirds of the directors then in office shall concur in said action. Exclusive of directors, if any, elected by holders of preferred stock, vacancies in the board of directors of the Corporation, however caused, and newly created directorships shall be filled by a vote of two - thirds of the directors then in office, whether or not a quorum, and any director so chosen shall hold office for a term expiring at the annual meeting of stockholders at which the term of the class to which the director has been chosen expires and when the director's successor is elected and qualified. Whenever the holders of any one or more series of preferred stock of the Corporation shall have the right, voting separately as a class, to elect one or more directors of the Corporation, the board of directors shall include said directors so elected in addition to the number of directors fixed as provided in this Article X. Notwithstandingthe foregoing, and except as otherwise may be required by law, whenever the holders of any one or more series of preferred stock of the Corporation elect one or more directors of the Corporation, the terms of the director or directors elected by such holders shall expire at the next succeeding annual meeting of stockholders. In furtherance, but not in limitation of the powers conferred by statute, the board of directors is expressly authorized to do the following: Designate one (1) or more committees, each committee to consist of one or more of the directors of the Corporation and such number of natural persons who are not directors as the board of directors shall designate, which to the extent provided in the Resolution, or in the by - laws of the Corporation, shall have and may exercise the powers of the board of directors in the management of the business and affairs of the Corporation. As provided by Nevada Revised Statutes 78.140, without repeating the section in full here, the same is adopted and no contract or other transaction between this Corporation and any of its officers, agents or directors shall be deemed void or voidable solely for that reason. The balance of the provisions of the code section cited, as it now exists, allowing such transactions, is hereby incorporated into this Article as though more fully set forth, and such Article shall be read and interpreted to provide the greatest latitude in its application. As provided by Nevada Revised Statutes 78.207, without repeating the section in full here, the board of directors shall have the authority to change the number of shares of any class or series, if any, of authorized stock by increasing or decreasing the number of authorized shares of the class or series and correspondingly increasing or decreasing the number of issued and outstanding shares of the same class

12 or series held by each stockholder of record at the effective date and time of the change by a resolution adopted by the board of directors, without obtaining the approval of the stockholders. If a proposed increase or decrease in the number of issued and outstanding shares of any class or series would adversely alter or change any preference or any relative or other right given to any other class or series of outstanding shares, then the decrease must be approved by the vote, in addition to any vote required, of the holders of shares representing a majority of the voting power of each class or series whose preference or rights are adversely affected by the increase or decrease, regardless of limitations or restrictions on the voting power thereof. The increase or decrease does not have to be approved by the vote of the holders of shares representing a majority of the voting power in each class or series whose preference or rights are not adversely affected by the increase or decrease. Special meetings of the stockholders may be called only by the board of directors or a committee of the board of directors that is delegated the power to call special meetings by the board of directors. Change the name of the Corporation at any time and from time to time to any name authorized by Nevada Revised Statutes 78.039. ARTICLE XI REMOVAL OF DIRECTORS Notwithstanding any other provision of these Articles or the bylaws of the Corporation, any director or all the directors of a single class (but not the entire board of directors) of the Corporation may be removed, at any time, but only for cause and only by the affirmative vote of the holders of at least a majority of the voting power of the outstanding shares of capital stock of the Corporation entitled to vote generally in the election of directors (considered for this purpose as one class) without the necessity of a meeting of the stockholders called for that or any other purpose. Notwithstanding the foregoing, whenever the holders of any one or more series of preferred stock of the Corporation shall have the right, voting separately as a class, to elect one or more directors of the Corporation, the preceding provisions of this Article XI shall not apply with respect to the director or directors elected by such holders of preferred stock. ARTICLE XII INDEMNIFICATION Any person who was or is a party or is or is threatened to be made a party to any threatened, pending, or completed action, suit, or proceeding, whether civil, criminal, administrative, or investigative (whether or not by or in the right of the Corporation) by reason of the fact that he is or was a director, officer, incorporator, employee, or agent of the Corporation, or is or wasserving at the request of the Corporation as a director, officer, incorporator, employee, partner, trustee, or agent of another

13 corporation, partnership,joint venture, trust, or other enterprise (including an employee benefit plan), shall be entitled to be indemnified by the Corporation to the full extent then permitted by law against expenses (including counsel fees and disbursements), judgments, fines (including excise taxes assessed on a person with respect to an employee benefit plan), and amounts paid in settlement incurred by him in connection with such action, suit, or proceeding and, if so requested, the Corporation shall advance (within two business days of such request) any and all such expenses to the person indemnified; provided, however, that (i) the foregoing obligation of the Company shall not apply to a claim that was commenced by the person indemnified without the prior approval of the Board of Directors. Such right of indemnificationshall inure whether or not the claim asserted is based on matters which antedate the adoption of this Article XII. Such right of indemnificationshall continue as to a person who has ceased to be a director, officer, incorporator, employee, partner, trustee, or agent and shall inure to the benefit of the heirs and personal representatives of such a person. The indemnification provided by this Article XII shall not be deemed exclusive of any other rights which may be provided now or in the future under any provision currently in effect or hereafter adopted of the bylaws, by any agreement, by vote of stockholders, by resolution of disinterested directors, by provisions of law, or otherwise. ARTICLE XIII LIMITATIONS ON DIRECTORS' LIABILITY No director or officer of the Corporation shall be personally liable to the Corporation or its stockholders for damages for breach of fiduciary duty as a director or officer, except: (A) for acts or omissions that involve intentional misconduct, fraud or a knowingviolation of law; or (B) the payment of distributions in violation of Nevada Revised Statutes Sec.78.300. If the General Corporation law of the State of Nevada is amended after the date of filingof these Articles to further eliminate or limit the personal liability of directors, then the liability of a director of the Corporation shall be eliminated or limited to the fullest extent permitted by the General Corporation Law of the State of Nevada, as so amended. Any repeal or modification of the foregoing paragraph by the stockholders of the Corporation shall not adversely affect any right or protection of a director of the Corporation existing at the time of such repeal or modification.