Two Harbors Investment Corp. February 8, 2012 2011 Fourth Quarter Earnings Call

2 Forward-Looking Statements This presentation includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ from expectations, estimates and projections and, consequently, readers should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “target,” “assume,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believe,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward- looking statements involve significant risks and uncertainties that could cause actual results to differ materially from expected results. Factors that could cause actual results to differ include, but are not limited to, higher than expected operating costs, changes in prepayment speeds of mortgages underlying our RMBS, the rates of default or decreased recovery on the mortgages underlying our non-Agency securities, failure to recover certain losses that are expected to be temporary, changes in interest rates or the availability of financing, the impact of new legislation or regulatory changes on our operations, the impact of any deficiencies in the servicing or foreclosure practices of third parties and related delays in the foreclosure process, the inability to acquire mortgage loans or securitize the mortgage loans we acquire, the inability to acquire single family residential properties at attractive prices or lease such properties on a profitable basis, the impact of new or modified government mortgage refinance or principal reduction programs, and unanticipated changes in overall market and economic conditions. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Two Harbors does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statement to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Additional information concerning these and other risk factors is contained in Two Harbors’ most recent filings with the Securities and Exchange Commission. All subsequent written and oral forward looking statements concerning Two Harbors or matters attributable to Two Harbors or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. Safe Harbor Statement

Our Mission Guides Us Return on book value of 12.6%1 in 2011 Our mission is to be recognized as the “best in class” mortgage REIT We’ll accomplish this goal through the following: ― Superior portfolio construction ― Unparalleled risk management ― Leading governance and disclosure practices Anticipated change in industry creates opportunity: ― Agency: Well positioned to capitalize on reduced competition for Agency assets ― Non-Agency: Attractive on both an absolute and relative basis 3 (1) See Appendix, page 13 for calculation of 2011 return on book value.

Strategic Priorities Focus on Diversification We look for opportunities to put capital to work where the greatest value can be derived. We are taking a measured approach to diversify our business, keeping true to our strategic long-term plans and our core strengths. ▪ Asset securitization ― Leverages our strength of credit expertise ― Purchased first loans in late 2011 ▪ Single family residential properties ― Leverages our strengths of data analysis and housing market expertise ― Hold properties for investment and rent for income 4

Diversification into Single Family Residential Properties Recent dynamics in the housing and mortgage markets have created an attractive entry point for us to deploy capital in a dislocated residential market to acquire single family homes and rent them at attractive yields. ▪ Single family real estate is an attractive asset class due to long duration, ability to leverage and potential for home price appreciation and increased rents. ▪ We intend to hold properties for investment and rent them for income. ▪ We will leverage on our core strengths, including data analysis in the housing finance markets, and utilize service providers to deliver property acquisition and management services. ▪ We are taking a measured approach to this strategy and do not expect this business to represent a significant portion of our assets or to have a material impact on our results in the first quarter of 2012. 5

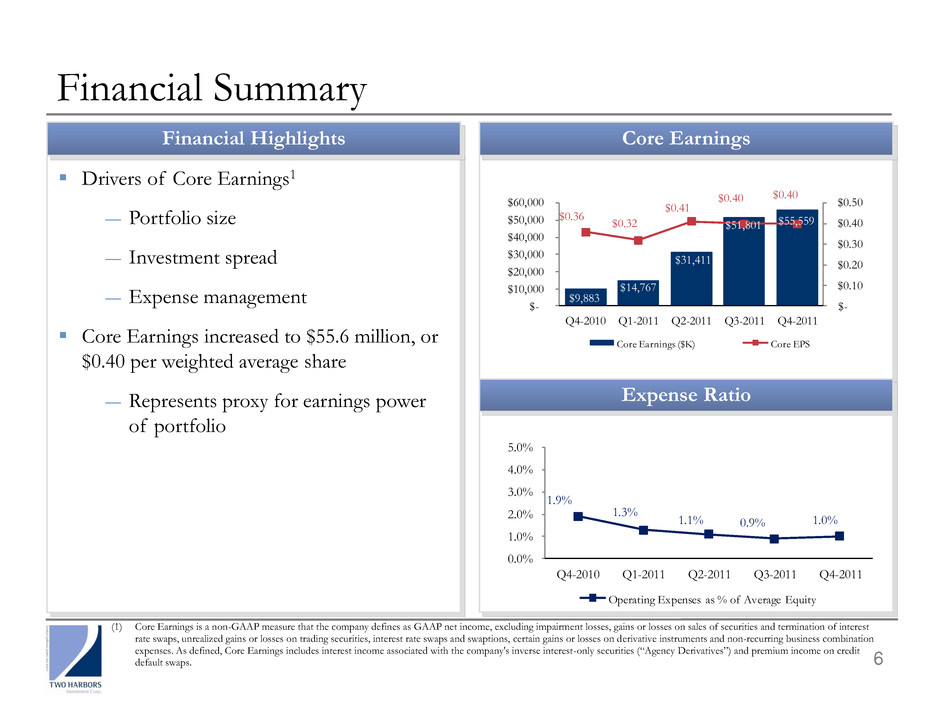

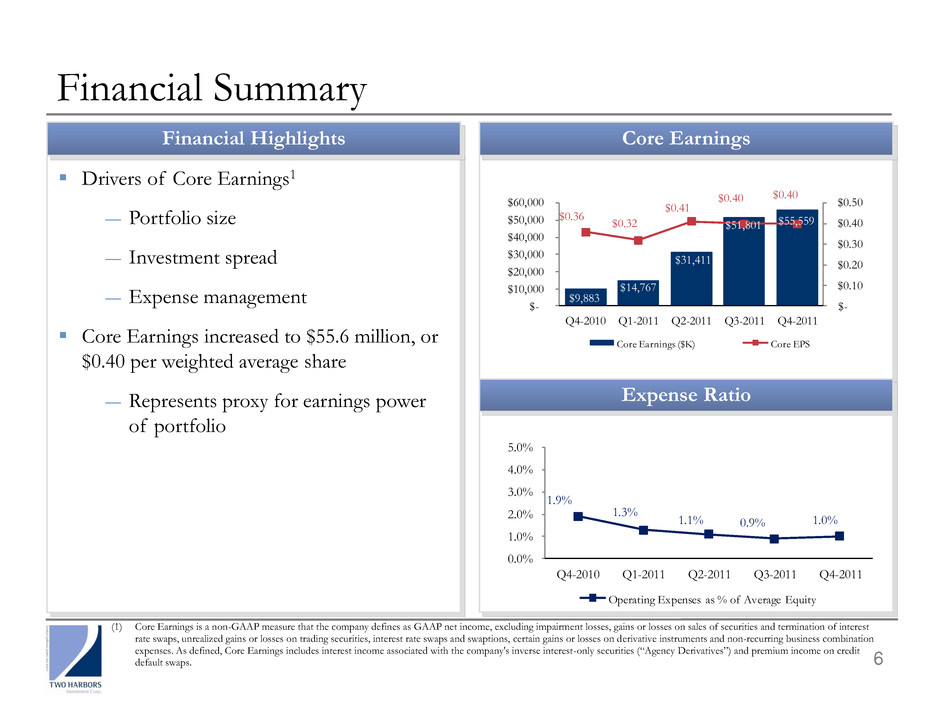

6 110 Financial Summary 110 Drivers of Core Earnings1 ― Portfolio size ― Investment spread ― Expense management Core Earnings increased to $55.6 million, or $0.40 per weighted average share ― Represents proxy for earnings power of portfolio $9,883 $14,767 $31,411 $51,801 $55,559 $0.36 $0.32 $0.41 $0.40 $0.40 $- $0.10 $0.20 $0.30 $0.40 $0.50 $- $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 Q4-2010 Q1-2011 Q2-2011 Q3-2011 Q4-2011 Core Earnings ($K) Core EPS (1) Core Earnings is a non-GAAP measure that the company defines as GAAP net income, excluding impairment losses, gains or losses on sales of securities and termination of interest rate swaps, unrealized gains or losses on trading securities, interest rate swaps and swaptions, certain gains or losses on derivative instruments and non-recurring business combination expenses. As defined, Core Earnings includes interest income associated with the company's inverse interest-only securities (“Agency Derivatives”) and premium income on credit default swaps. Financial Highlights Core Earnings Expense Ratio 1.9% 1.3% 1.1% 0.9% 1.0% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% Q4-2010 Q1-2011 Q2-2011 Q3-2011 Q4-2011 Operating Expenses as % of Average Equity

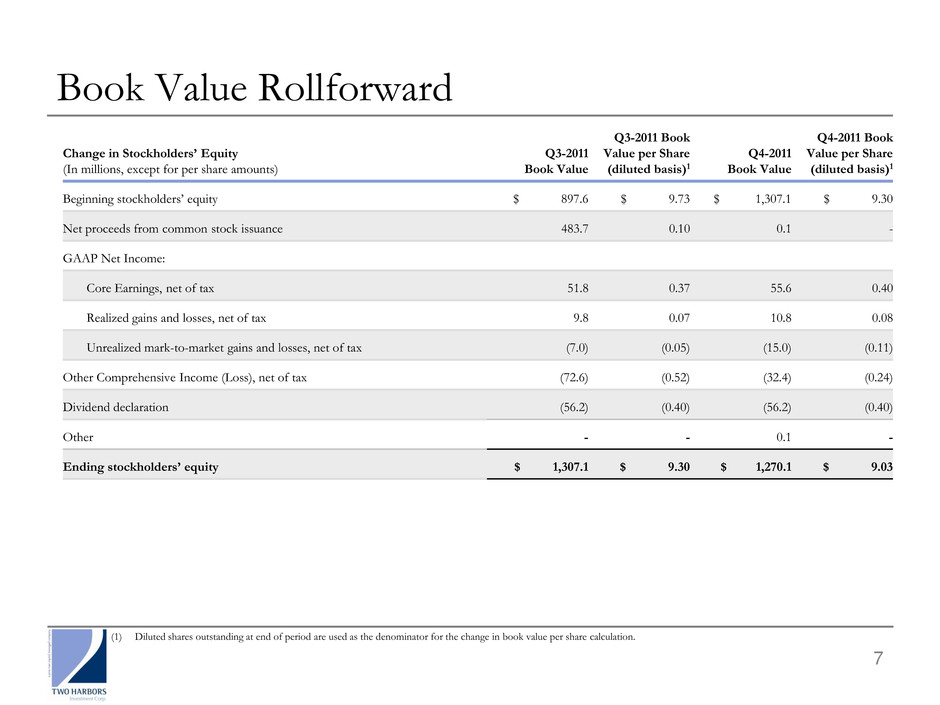

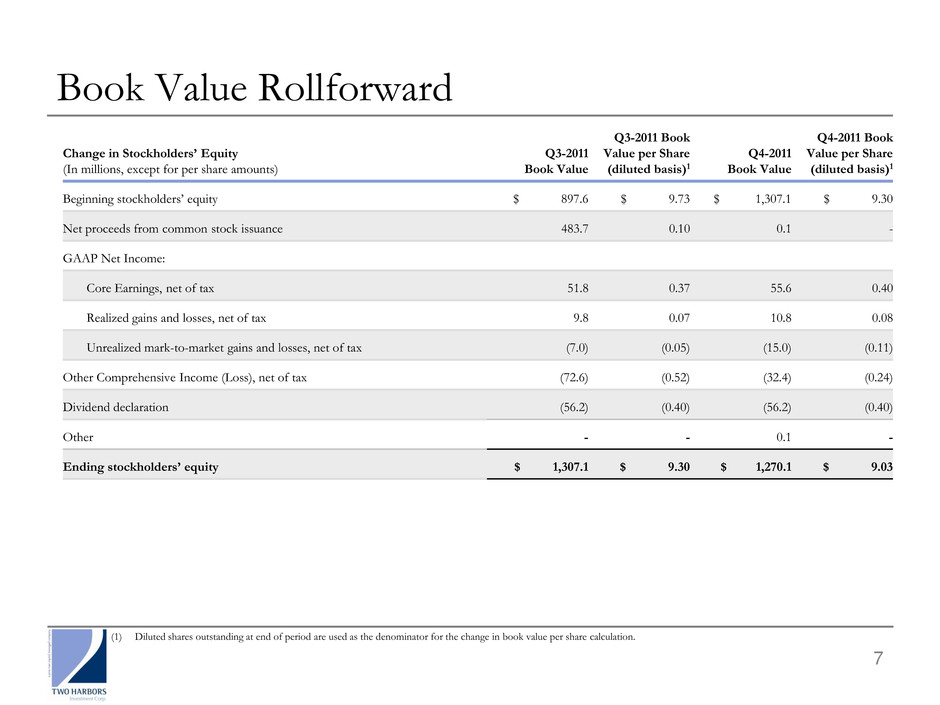

7 Book Value Rollforward Change in Stockholders’ Equity (In millions, except for per share amounts) Q3-2011 Book Value Q3-2011 Book Value per Share (diluted basis)1 Q4-2011 Book Value Q4-2011 Book Value per Share (diluted basis)1 Beginning stockholders’ equity $ 897.6 $ 9.73 $ 1,307.1 $ 9.30 Net proceeds from common stock issuance 483.7 0.10 0.1 - GAAP Net Income: Core Earnings, net of tax 51.8 0.37 55.6 0.40 Realized gains and losses, net of tax 9.8 0.07 10.8 0.08 Unrealized mark-to-market gains and losses, net of tax (7.0) (0.05) (15.0) (0.11) Other Comprehensive Income (Loss), net of tax (72.6) (0.52) (32.4) (0.24) Dividend declaration (56.2) (0.40) (56.2) (0.40) Other - - 0.1 - Ending stockholders’ equity $ 1,307.1 $ 9.30 $ 1,270.1 $ 9.03 (1) Diluted shares outstanding at end of period are used as the denominator for the change in book value per share calculation.

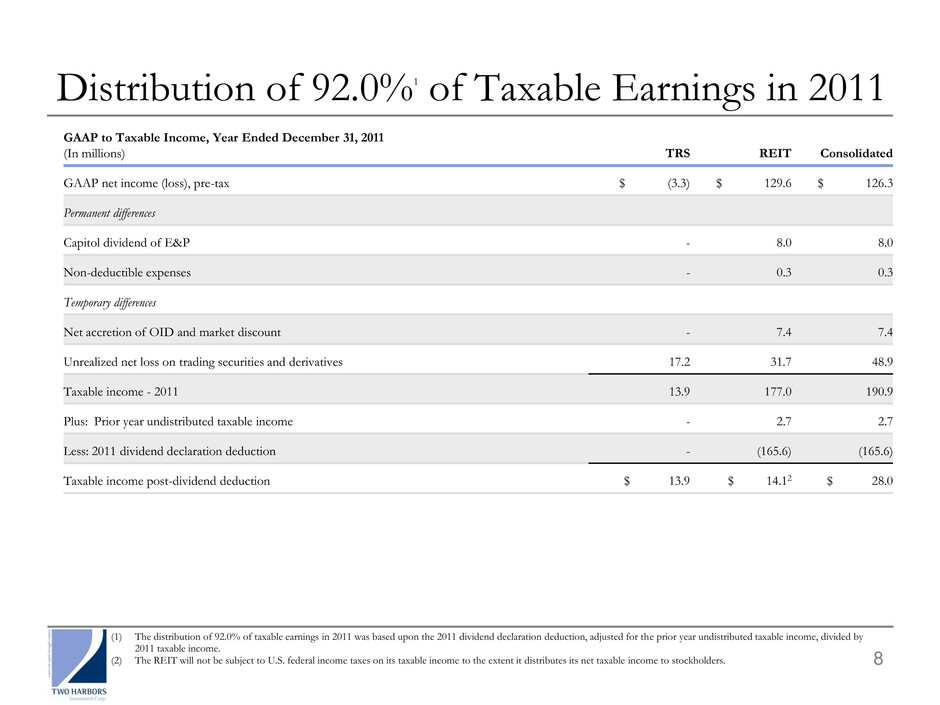

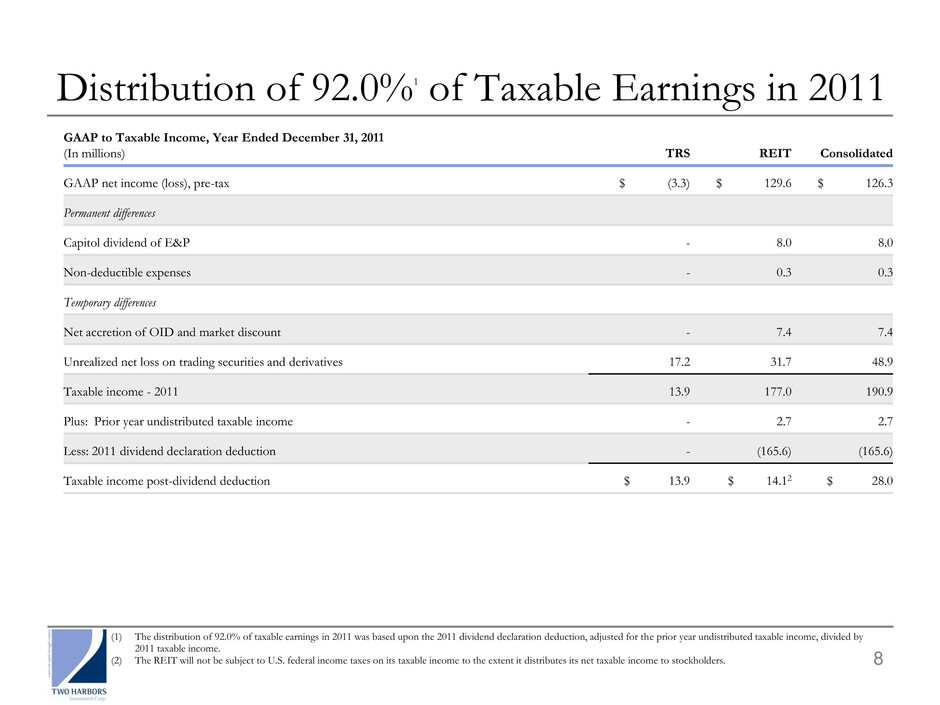

8 Distribution of 92.0%1 of Taxable Earnings in 2011 GAAP to Taxable Income, Year Ended December 31, 2011 (In millions) TRS REIT Consolidated GAAP net income (loss), pre-tax $ (3.3) $ 129.6 $ 126.3 Permanent differences Capitol dividend of E&P - 8.0 8.0 Non-deductible expenses - 0.3 0.3 Temporary differences Net accretion of OID and market discount - 7.4 7.4 Unrealized net loss on trading securities and derivatives 17.2 31.7 48.9 Taxable income - 2011 13.9 177.0 190.9 Plus: Prior year undistributed taxable income - 2.7 2.7 Less: 2011 dividend declaration deduction - (165.6) (165.6) Taxable income post-dividend deduction $ 13.9 $ 14.12 $ 28.0 (1) The distribution of 92.0% of taxable earnings in 2011 was based upon the 2011 dividend declaration deduction, adjusted for the prior year undistributed taxable income, divided by 2011 taxable income. (2) The REIT will not be subject to U.S. federal income taxes on its taxable income to the extent it distributes its net taxable income to stockholders.

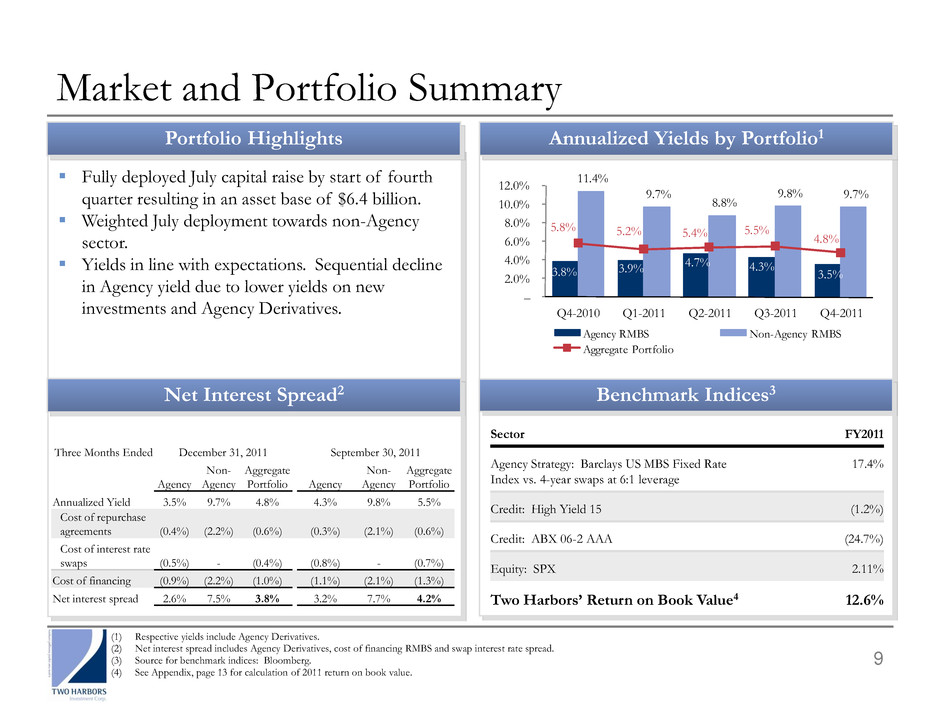

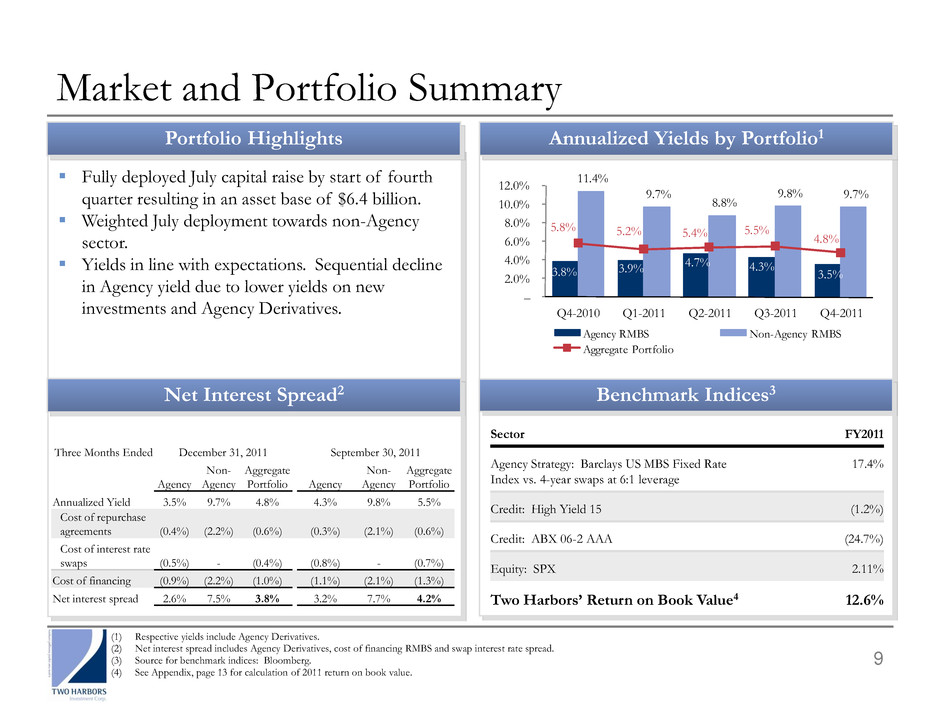

Market and Portfolio Summary 9 110 110 Fully deployed July capital raise by start of fourth quarter resulting in an asset base of $6.4 billion. Weighted July deployment towards non-Agency sector. Yields in line with expectations. Sequential decline in Agency yield due to lower yields on new investments and Agency Derivatives. 3.8% 3.9% 4.7% 4.3% 3.5% 11.4% 9.7% 8.8% 9.8% 9.7% 5.8% 5.2% 5.4% 5.5% 4.8% – 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% Q4-2010 Q1-2011 Q2-2011 Q3-2011 Q4-2011 Agency RMBS Non-Agency RMBS Aggregate Portfolio (1) Respective yields include Agency Derivatives. (2) Net interest spread includes Agency Derivatives, cost of financing RMBS and swap interest rate spread. (3) Source for benchmark indices: Bloomberg. (4) See Appendix, page 13 for calculation of 2011 return on book value. Sector FY2011 Agency Strategy: Barclays US MBS Fixed Rate Index vs. 4-year swaps at 6:1 leverage 17.4% Credit: High Yield 15 (1.2%) Credit: ABX 06-2 AAA (24.7%) Equity: SPX 2.11% Two Harbors’ Return on Book Value4 12.6% Three Months Ended December 31, 2011 September 30, 2011 Agency Non- Agency Aggregate Portfolio Agency Non- Agency Aggregate Portfolio Annualized Yield 3.5% 9.7% 4.8% 4.3% 9.8% 5.5% Cost of repurchase agreements (0.4%) (2.2%) (0.6%) (0.3%) (2.1%) (0.6%) Cost of interest rate swaps (0.5%) - (0.4%) (0.8%) - (0.7%) Cost of financing (0.9%) (2.2%) (1.0%) (1.1%) (2.1%) (1.3%) Net interest spread 2.6% 7.5% 3.8% 3.2% 7.7% 4.2% Portfolio Highlights Annualized Yields by Portfolio1 Net Interest Spread2 Benchmark Indices3

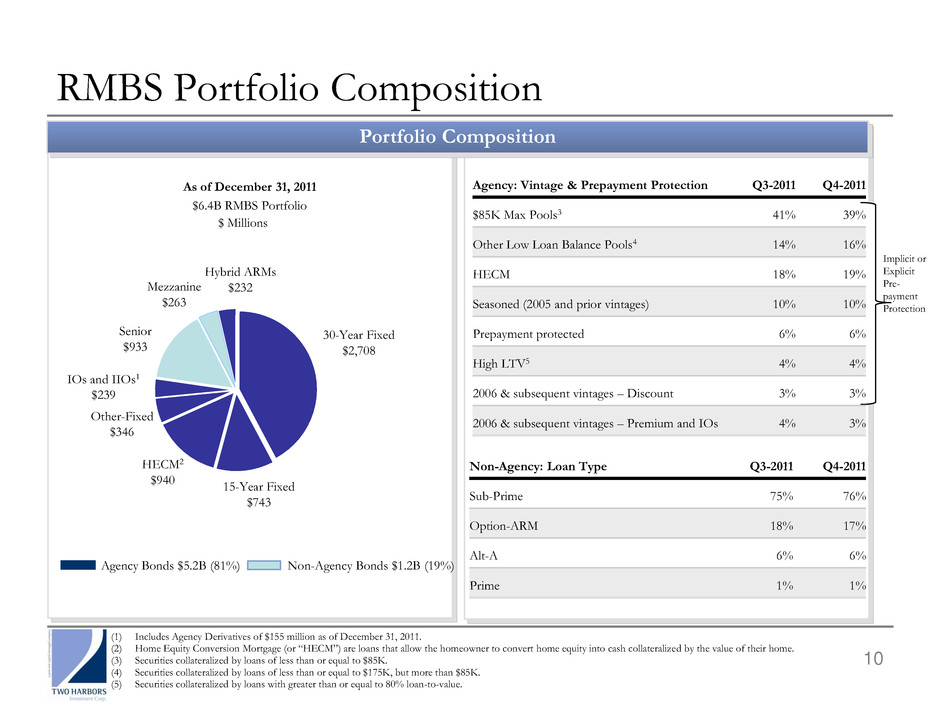

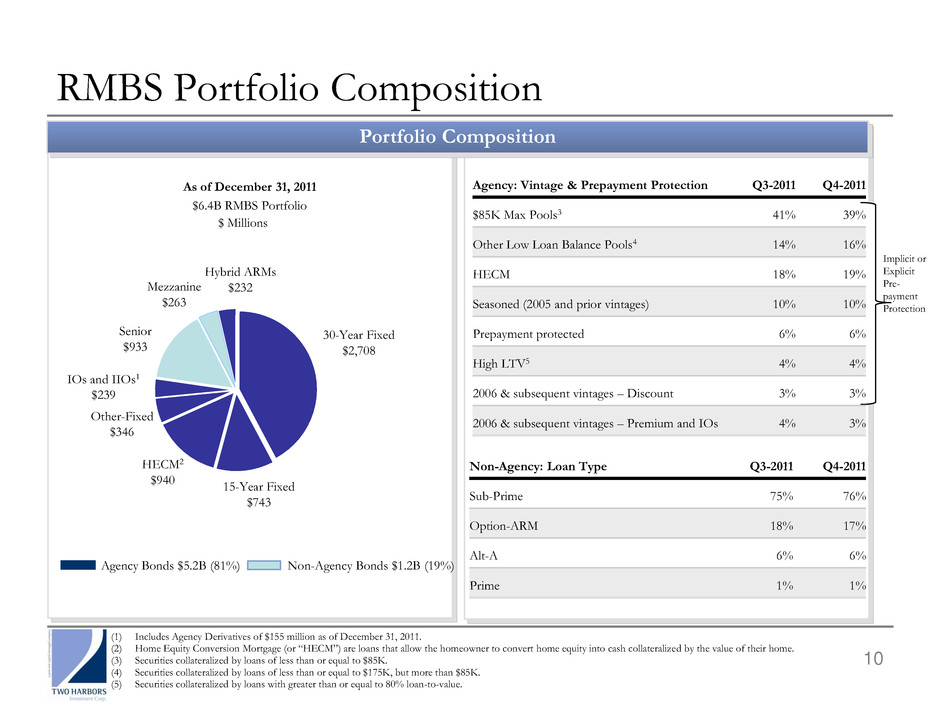

Implicit or Explicit Pre- payment Protection RMBS Portfolio Composition 10 Portfolio Composition (1) Includes Agency Derivatives of $155 million as of December 31, 2011. (2) Home Equity Conversion Mortgage (or “HECM”) are loans that allow the homeowner to convert home equity into cash collateralized by the value of their home. (3) Securities collateralized by loans of less than or equal to $85K. (4) Securities collateralized by loans of less than or equal to $175K, but more than $85K. (5) Securities collateralized by loans with greater than or equal to 80% loan-to-value. Non-Agency: Loan Type Q3-2011 Q4-2011 Sub-Prime 75% 76% Option-ARM 18% 17% Alt-A 6% 6% Prime 1% 1% 30-Year Fixed $2,708 Hybrid ARMs $232 Senior $933 Mezzanine $263 IOs and IIOs1 $239 As of December 31, 2011 $6.4B RMBS Portfolio 15-Year Fixed $743 HECM2 $940 Other-Fixed $346 $ Millions Agency Bonds $5.2B (81%) Non-Agency Bonds $1.2B (19%) Agency: Vintage & Prepayment Protection Q3-2011 Q4-2011 $85K Max Pools3 41% 39% Other Low Loan Balance Pools4 14% 16% HECM 18% 19% Seasoned (2005 and prior vintages) 10% 10% Prepayment protected 6% 6% High LTV5 4% 4% 2006 & subsequent vintages – Discount 3% 3% 2006 & subsequent vintages – Premium and IOs 4% 3%

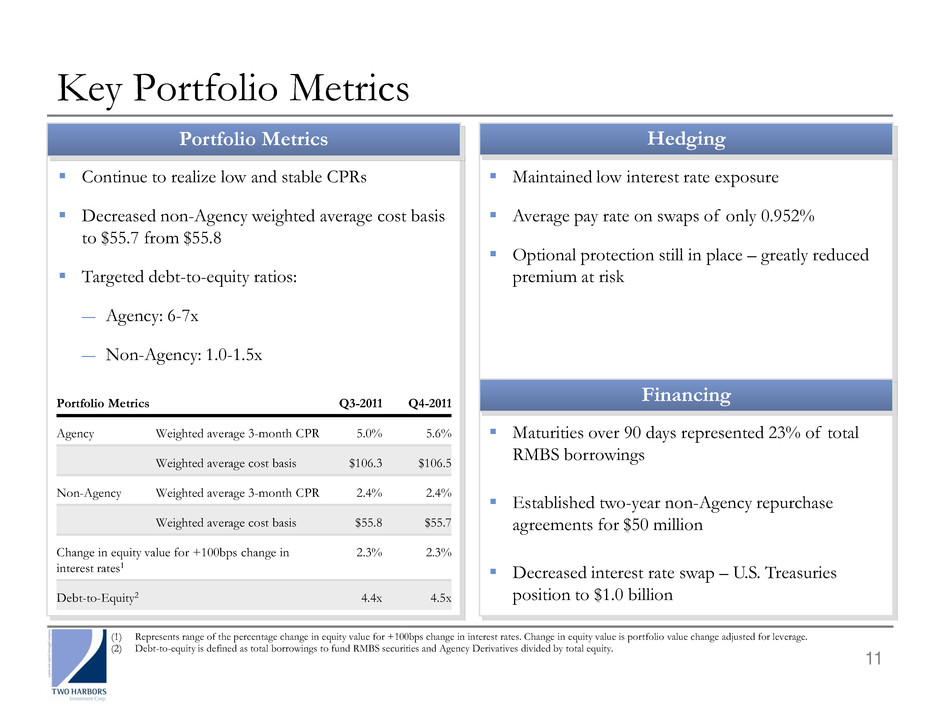

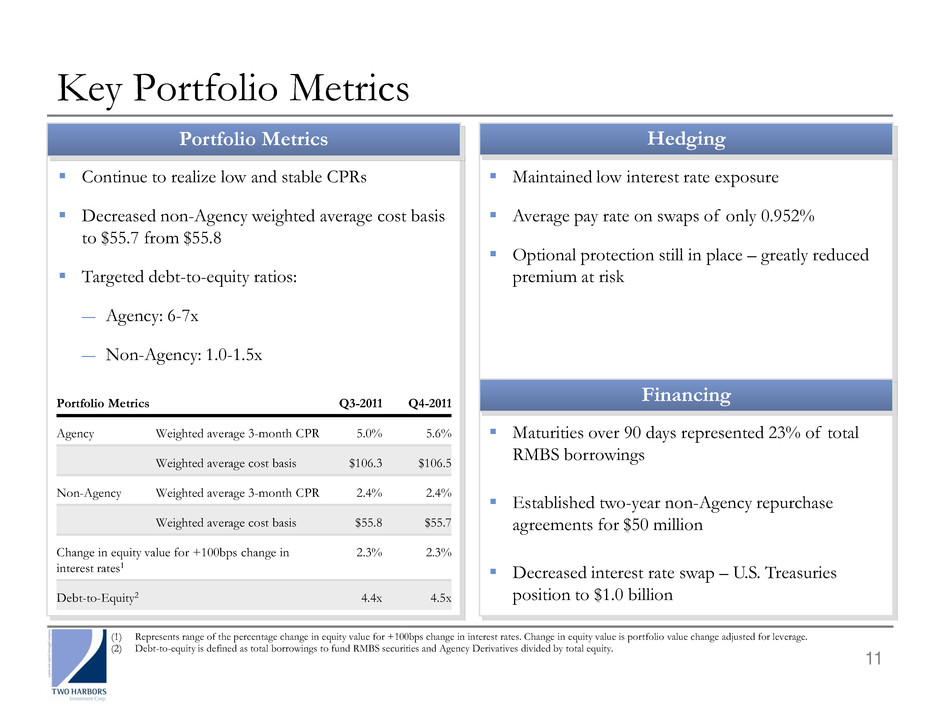

11 110 Key Portfolio Metrics 110 Continue to realize low and stable CPRs Decreased non-Agency weighted average cost basis to $55.7 from $55.8 Targeted debt-to-equity ratios: ― Agency: 6-7x ― Non-Agency: 1.0-1.5x (1) Represents range of the percentage change in equity value for +100bps change in interest rates. Change in equity value is portfolio value change adjusted for leverage. (2) Debt-to-equity is defined as total borrowings to fund RMBS securities and Agency Derivatives divided by total equity. Maintained low interest rate exposure Average pay rate on swaps of only 0.952% Optional protection still in place – greatly reduced premium at risk Maturities over 90 days represented 23% of total RMBS borrowings Established two-year non-Agency repurchase agreements for $50 million Decreased interest rate swap – U.S. Treasuries position to $1.0 billion Portfolio Metrics Q3-2011 Q4-2011 Agency Weighted average 3-month CPR 5.0% 5.6% Weighted average cost basis $106.3 $106.5 Non-Agency Weighted average 3-month CPR 2.4% 2.4% Weighted average cost basis $55.8 $55.7 Change in equity value for +100bps change in interest rates1 2.3% 2.3% Debt-to-Equity2 4.4x 4.5x Portfolio Metrics Financing Hedging

12 Appendix

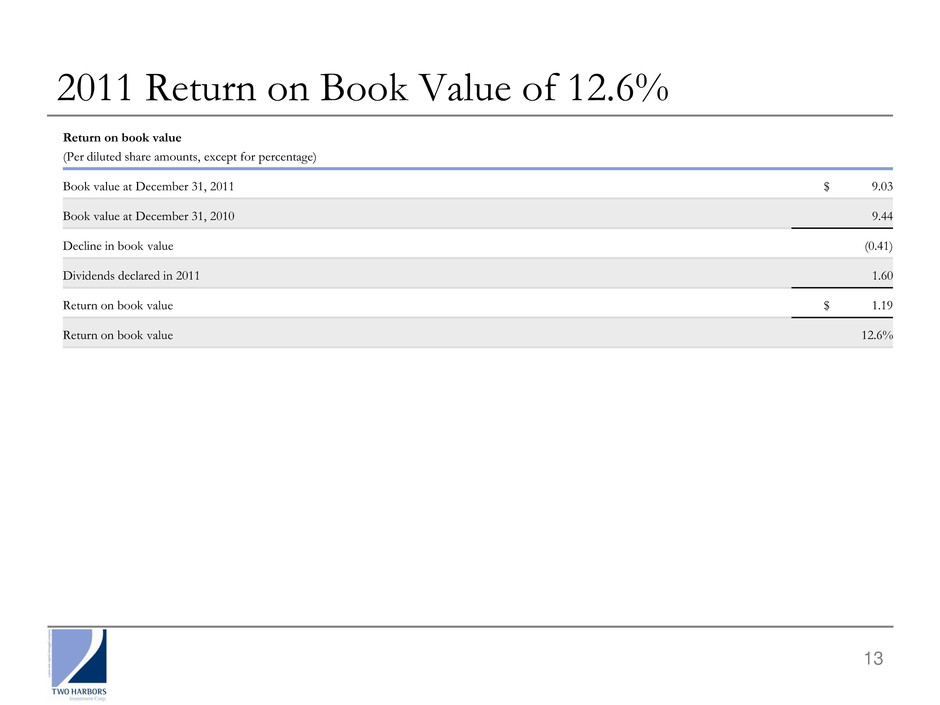

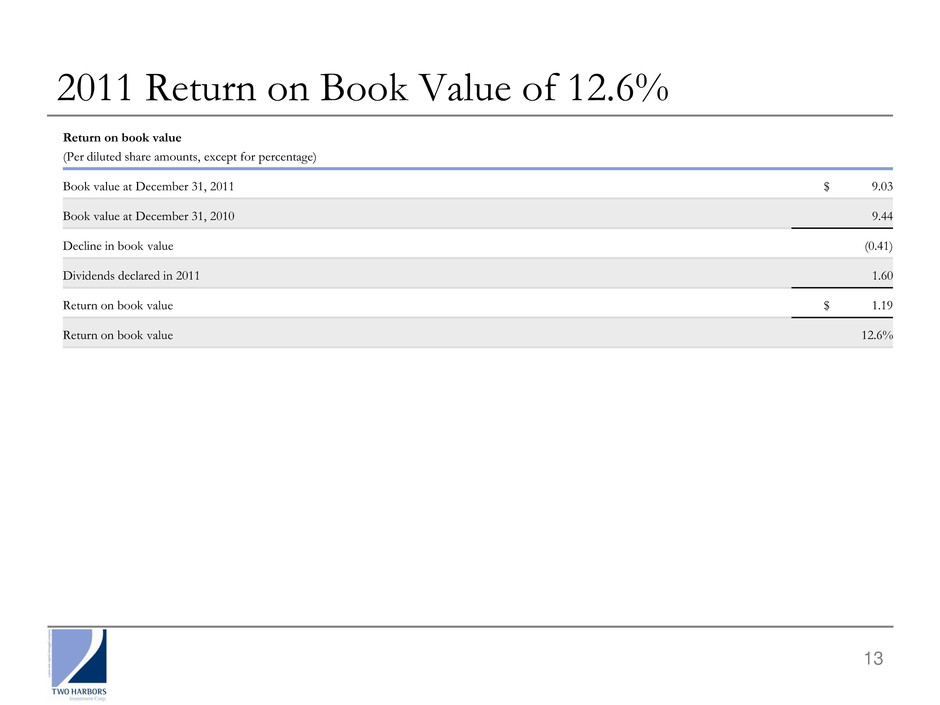

13 2011 Return on Book Value of 12.6% Return on book value (Per diluted share amounts, except for percentage) Book value at December 31, 2011 $ 9.03 Book value at December 31, 2010 9.44 Decline in book value (0.41) Dividends declared in 2011 1.60 Return on book value $ 1.19 Return on book value 12.6%

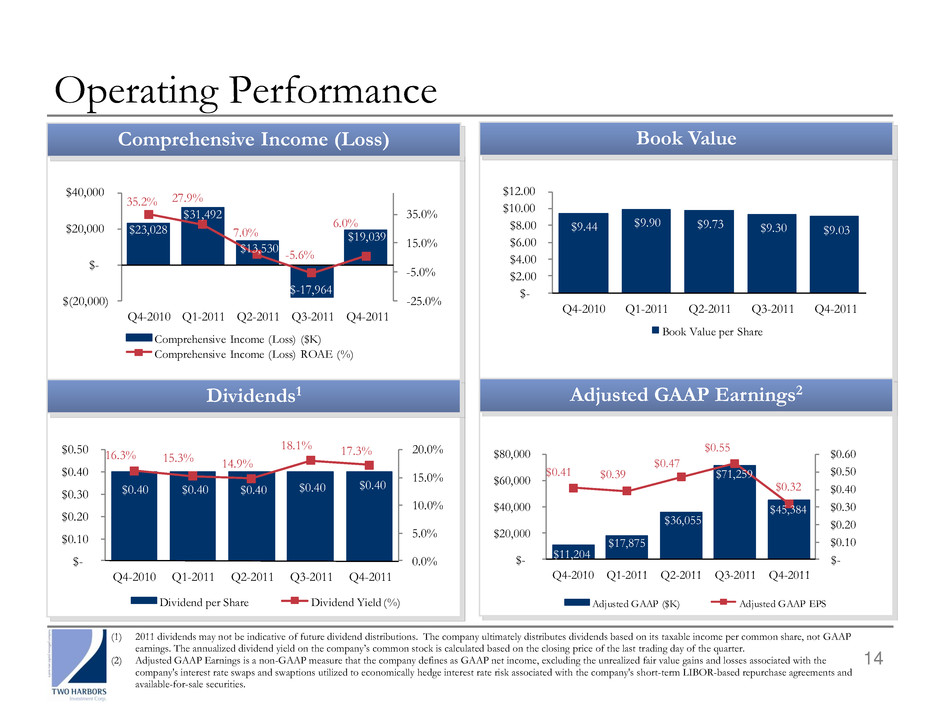

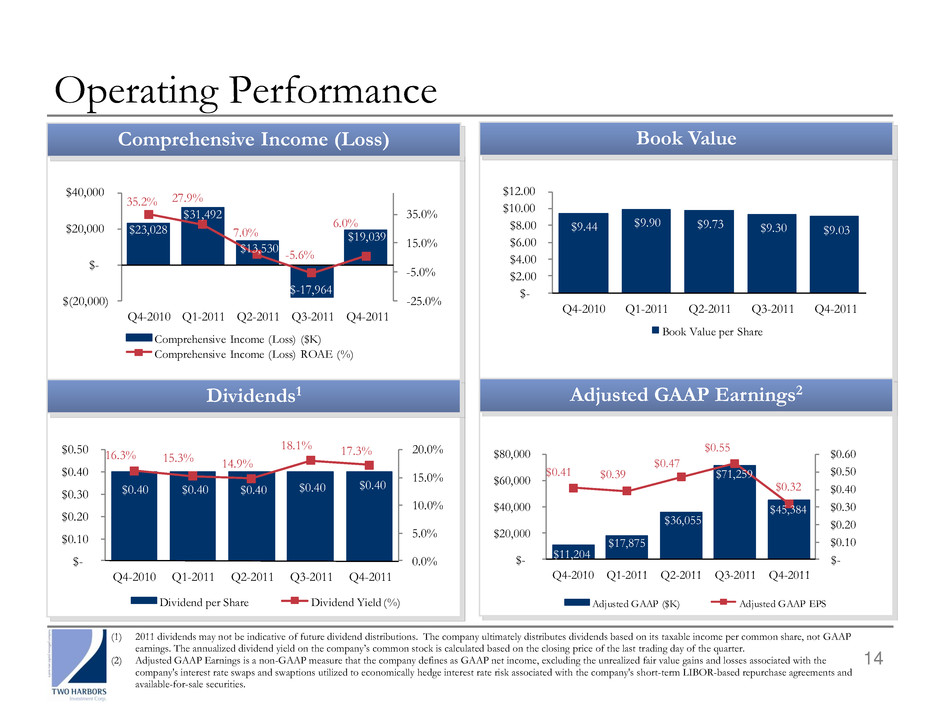

110 Operating Performance 110 $9.44 $9.90 $9.73 $9.30 $9.03 $- $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 Q4-2010 Q1-2011 Q2-2011 Q3-2011 Q4-2011 Book Value per Share $23,028 $31,492 $13,530 $-17,964 19,039 35.2% 27.9% 7.0% -5.6% 6.0% -25.0% -5.0% 15.0% 35.0% $(20,000) $- $20,000 $40,000 Q4-2010 Q1-2011 Q2-2011 Q3-2011 Q4-20 1 Comprehensive Income (Loss) ($K) Comprehensive Income (Loss) ROAE (%)$0.40 $0.40 $0.40 $0.40 $0.40 16.3% 15.3% 14.9% 18.1% 17.3% 0.0% 5.0% 10.0% 15.0% 20.0 $- $0.10 $0.20 $0.30 $0.40 $0.50 Q4-2010 Q1-2011 Q2-2011 Q3-2011 Q4-2011 Dividend per Share Dividend Yield (%) (1) 2011 dividends may not be indicative of future dividend distributions. The company ultimately distributes dividends based on its taxable income per common share, not GAAP earnings. The annualized dividend yield on the company’s common stock is calculated based on the closing price of the last trading day of the quarter. (2) Adjusted GAAP Earnings is a non-GAAP measure that the company defines as GAAP net income, excluding the unrealized fair value gains and losses associated with the company's interest rate swaps and swaptions utilized to economically hedge interest rate risk associated with the company's short-term LIBOR-based repurchase agreements and available-for-sale securities. 14 Book Value Adjusted GAAP Earnings2 Comprehensive Income (Loss) Dividends1 $11,204 $17,875 $36,055 $71,259 $45,384 $0.41 $0.39 $0.47 $0.55 $0.32 $- $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 $- $20,000 $40,000 $60,000 $80,000 Q4-201 Q1-2011 Q2-2011 Q3-2011 Q4-2011 Adjusted GAAP ($K) Adjusted GAAP EPS

15 Operating Performance Operating Performance (In millions, except for per share amounts) Core Earnings Realized Gains Unrealized MTM Q3-2011 Financials Core Earnings Realized Gains Unrealized MTM Q4-2011 Financials Interest income $ 67.7 $ - $ - $ 67.7 $ 73.2 $ - $ - $ 73.2 Interest expense 7.2 - - 7.2 9.1 - - 9.1 Net interest income 60.5 - - 60.5 64.1 - - 64.1 Net other-than-temporary impairment losses - - (3.4) (3.4) - - (1.4) (1.4) Gain on sale of investment securities, net - 27.7 3.7 31.4 - 2.8 (2.5) 0.3 Gain (loss) on interest rate swap and swaptions1 (8.3) (17.8) (13.2) (39.3) (6.3) 1.1 6.6 1.4 Gain (loss) on other derivative instruments 7.0 1.1 14.3 22.4 6.0 10.9 (27.7) (10.8) Total other income (expense) (1.3) 11.0 4.8 14.5 (0.3) 14.8 (23.6) (9.1) Management fees & Other operating expenses 7.6 - - 7.6 8.4 - - 8.4 Net income (loss) before income taxes 51.6 11.0 1.4 64.0 55.4 14.8 (25.0) 45.2 Income tax (expense) benefit 0.2 (1.2) (8.4) (9.4) 0.2 (4.0) 10.0 6.2 Net income (loss) $ 51.8 $ 9.8 $ (7.0) $ 54.6 $ 55.6 $ 10.8 $ (15.0) $ 51.4 Basic and diluted weighted average EPS $ 0.40 $ 0.07 $ (0.05) $ 0.42 $ 0.40 $ 0.08 $ (0.11) $ 0.37 Supplemental data: Unrealized gains/(losses) on interest rate swaps and swaptions economically hedging repurchase agreements and available-for-sale securities $ (20.2) $ 5.5 Income benefit 3.6 0.5 Total $ (16.6) $ 6.0 (1) Fourth quarter 2011 loss on interest rate swap agreements of $6.3 million includes $0.2 million in interest costs for swaps associated with U.S. Treasuries and TBA contracts.

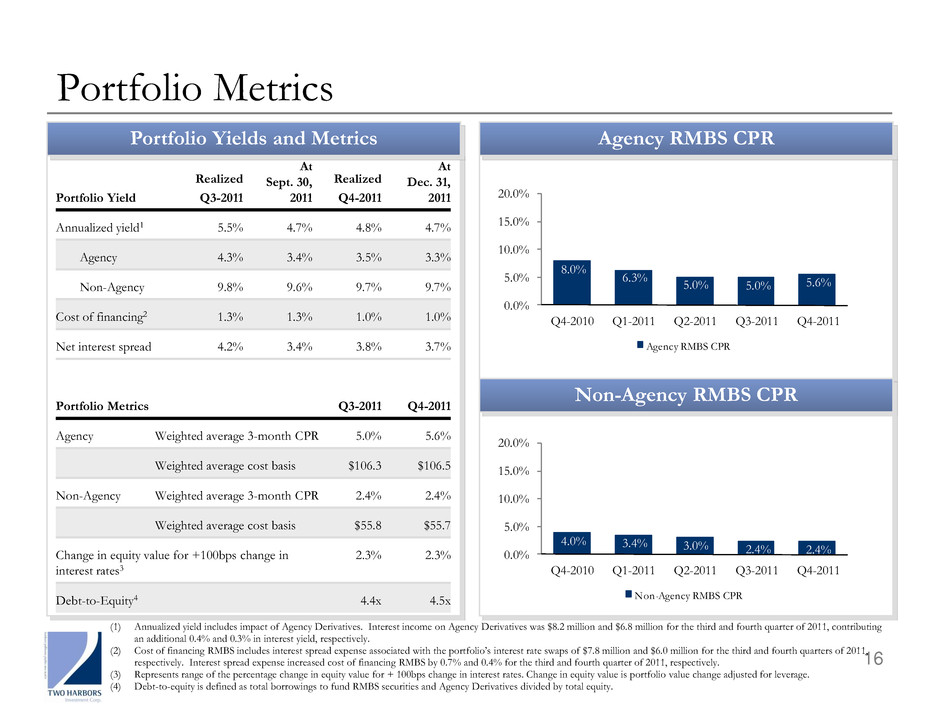

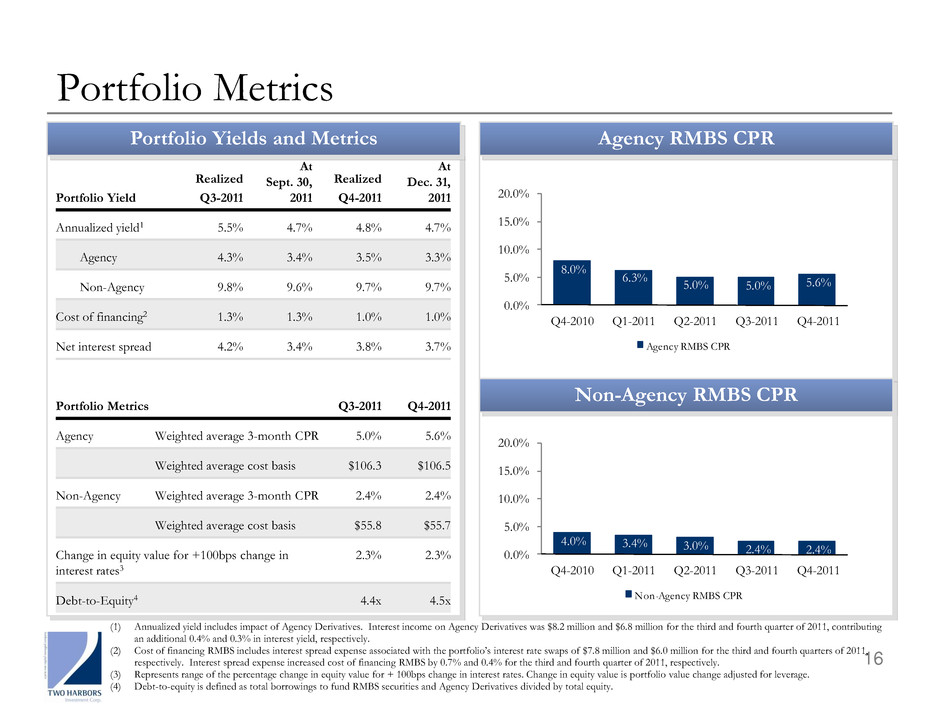

16 110 Portfolio Metrics Portfolio Yield Realized Q3-2011 At Sept. 30, 2011 Realized Q4-2011 At Dec. 31, 2011 Annualized yield1 5.5% 4.7% 4.8% 4.7% Agency 4.3% 3.4% 3.5% 3.3% Non-Agency 9.8% 9.6% 9.7% 9.7% Cost of financing2 1.3% 1.3% 1.0% 1.0% Net interest spread 4.2% 3.4% 3.8% 3.7% Portfolio Metrics Q3-2011 Q4-2011 Agency Weighted average 3-month CPR 5.0% 5.6% Weighted average cost basis $106.3 $106.5 Non-Agency Weighted average 3-month CPR 2.4% 2.4% Weighted average cost basis $55.8 $55.7 Change in equity value for +100bps change in interest rates3 2.3% 2.3% Debt-to-Equity4 4.4x 4.5x (1) Annualized yield includes impact of Agency Derivatives. Interest income on Agency Derivatives was $8.2 million and $6.8 million for the third and fourth quarter of 2011, contributing an additional 0.4% and 0.3% in interest yield, respectively. (2) Cost of financing RMBS includes interest spread expense associated with the portfolio’s interest rate swaps of $7.8 million and $6.0 million for the third and fourth quarters of 2011, respectively. Interest spread expense increased cost of financing RMBS by 0.7% and 0.4% for the third and fourth quarter of 2011, respectively. (3) Represents range of the percentage change in equity value for + 100bps change in interest rates. Change in equity value is portfolio value change adjusted for leverage. (4) Debt-to-equity is defined as total borrowings to fund RMBS securities and Agency Derivatives divided by total equity. 110 8.0% 6.3% 5.0% 5.0% 5.6% 0.0% 5.0% 10.0% 15.0% 20.0% Q4-2010 Q1-2011 Q2-2011 Q3-2011 Q4-2011 Agency RMBS CPR Portfolio Yields and Metrics Agency RMBS CPR Non-Agency RMBS CPR 4.0% 3.4% 3.0% 2.4% 2.4%0.0% 5.0% 10.0% 15.0% 2 . Q4-2010 Q1-2011 Q2-2011 Q3-2011 Q4-2011 Non-Agency RMBS CPR

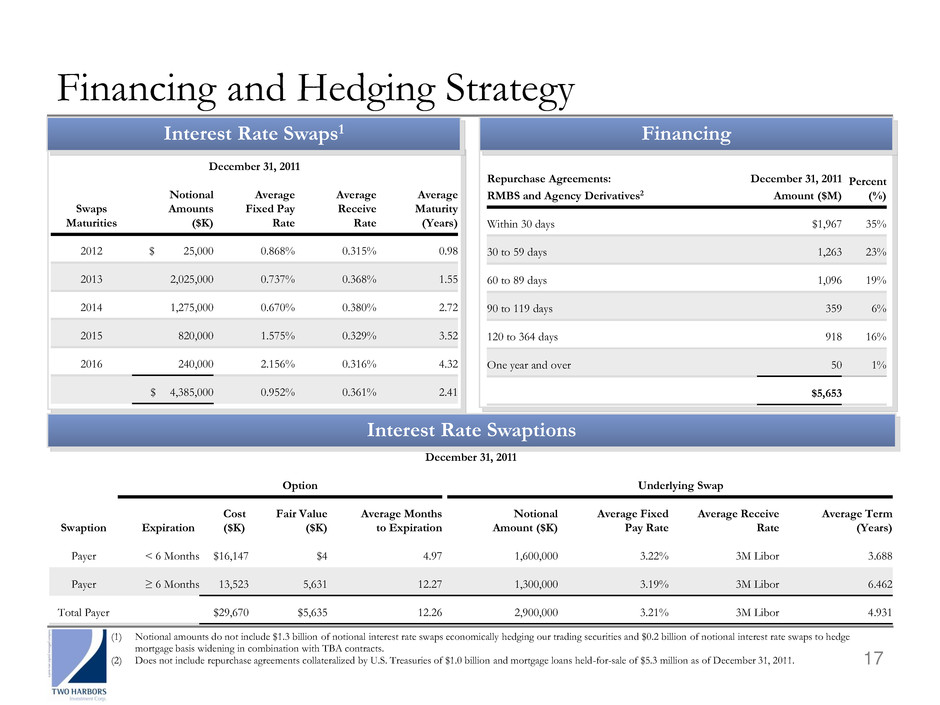

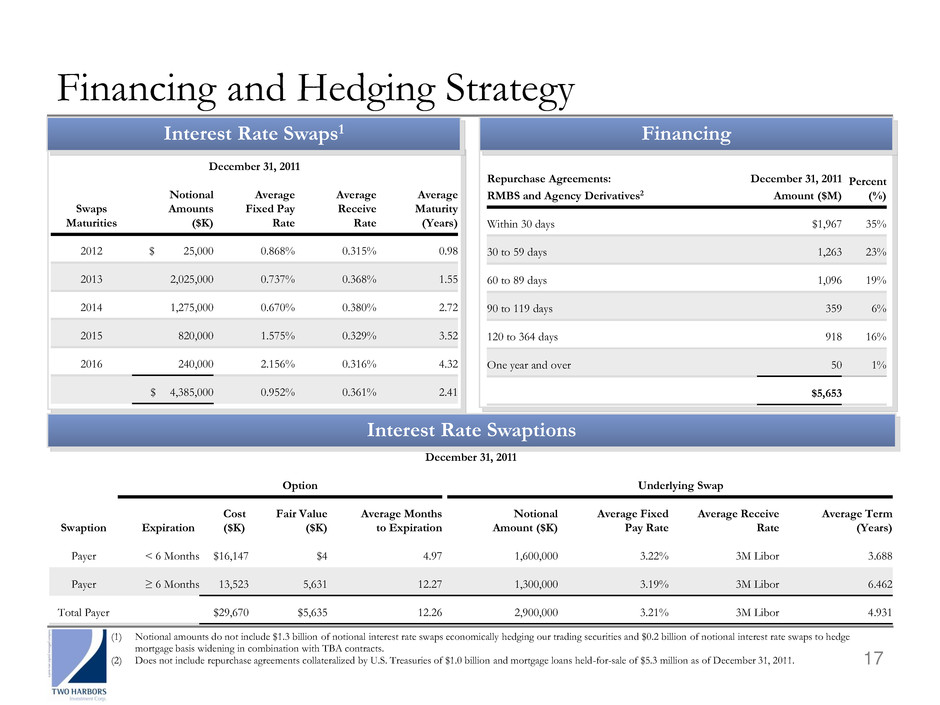

December 31, 2011 Option Underlying Swap Swaption Expiration Cost ($K) Fair Value ($K) Average Months to Expiration Notional Amount ($K) Average Fixed Pay Rate Average Receive Rate Average Term (Years) Payer < 6 Months $16,147 $4 4.97 1,600,000 3.22% 3M Libor 3.688 Payer ≥ 6 Months 13,523 5,631 12.27 1,300,000 3.19% 3M Libor 6.462 Total Payer $29,670 $5,635 12.26 2,900,000 3.21% 3M Libor 4.931 110 110 December 31, 2011 Swaps Maturities Notional Amounts ($K) Average Fixed Pay Rate Average Receive Rate Average Maturity (Years) 2012 $ 25,000 0.868% 0.315% 0.98 2013 2,025,000 0.737% 0.368% 1.55 2014 1,275,000 0.670% 0.380% 2.72 2015 820,000 1.575% 0.329% 3.52 2016 240,000 2.156% 0.316% 4.32 $ 4,385,000 0.952% 0.361% 2.41 17 Financing and Hedging Strategy (1) Notional amounts do not include $1.3 billion of notional interest rate swaps economically hedging our trading securities and $0.2 billion of notional interest rate swaps to hedge mortgage basis widening in combination with TBA contracts. (2) Does not include repurchase agreements collateralized by U.S. Treasuries of $1.0 billion and mortgage loans held-for-sale of $5.3 million as of December 31, 2011. Repurchase Agreements: RMBS and Agency Derivatives2 December 31, 2011 Amount ($M) Percent (%) Within 30 days $1,967 35% 30 to 59 days 1,263 23% 60 to 89 days 1,096 19% 90 to 119 days 359 6% 120 to 364 days 918 16% One year and over 50 1% $5,653 Interest Rate Swaps1 Financing Interest Rate Swaptions

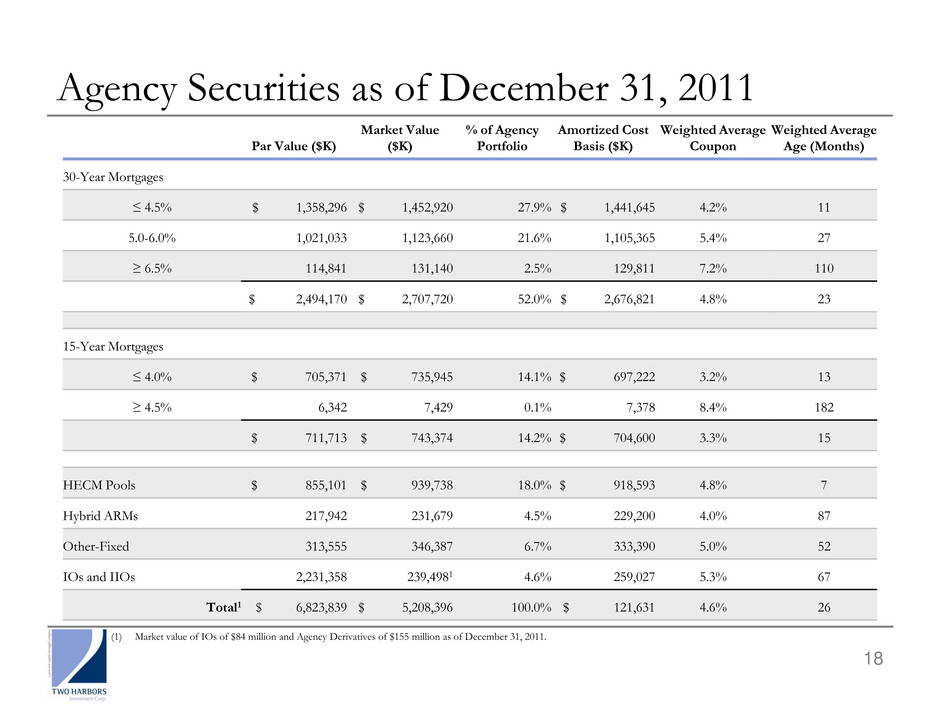

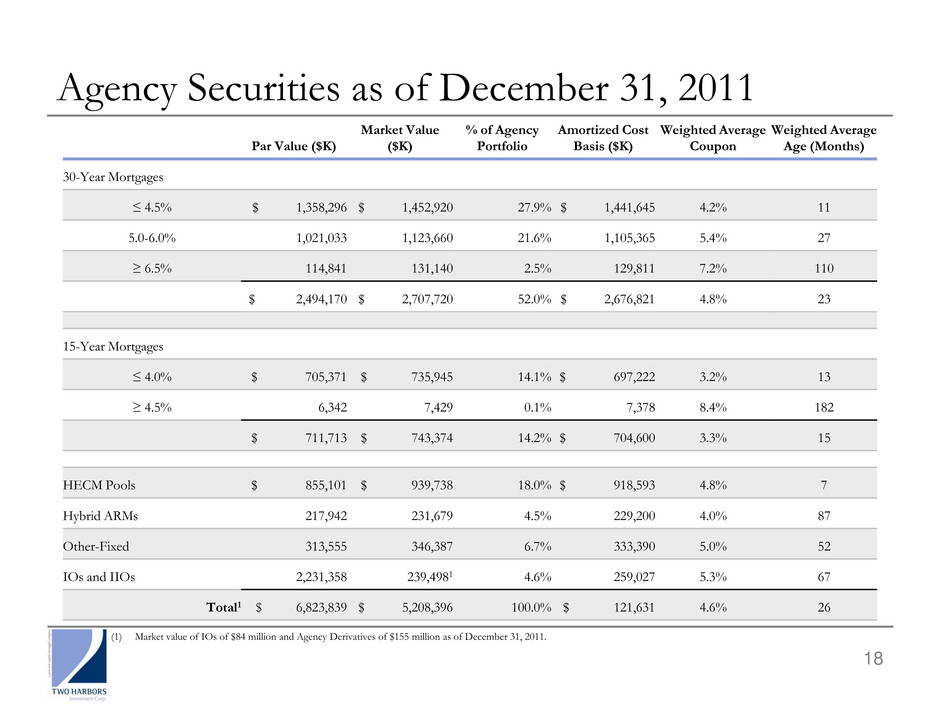

18 Agency Securities as of December 31, 2011 Par Value ($K) Market Value ($K) % of Agency Portfolio Amortized Cost Basis ($K) Weighted Average Coupon Weighted Average Age (Months) 30-Year Mortgages ≤ 4.5% $ 1,358,296 $ 1,452,920 27.9% $ 1,441,645 4.2% 11 5.0-6.0% 1,021,033 1,123,660 21.6% 1,105,365 5.4% 27 ≥ 6.5% 114,841 131,140 2.5% 129,811 7.2% 110 $ 2,494,170 $ 2,707,720 52.0% $ 2,676,821 4.8% 23 15-Year Mortgages ≤ 4.0% $ 705,371 $ 735,945 14.1% $ 697,222 3.2% 13 ≥ 4.5% 6,342 7,429 0.1% 7,378 8.4% 182 $ 711,713 $ 743,374 14.2% $ 704,600 3.3% 15 HECM Pools $ 855,101 $ 939,738 18.0% $ 918,593 4.8% 7 Hybrid ARMs 217,942 231,679 4.5% 229,200 4.0% 87 Other-Fixed 313,555 346,387 6.7% 333,390 5.0% 52 IOs and IIOs 2,231,358 239,4981 4.6% 259,027 5.3% 67 Total1 $ 6,823,839 $ 5,208,396 100.0% $ 121,631 4.6% 26 (1) Market value of IOs of $84 million and Agency Derivatives of $155 million as of December 31, 2011.

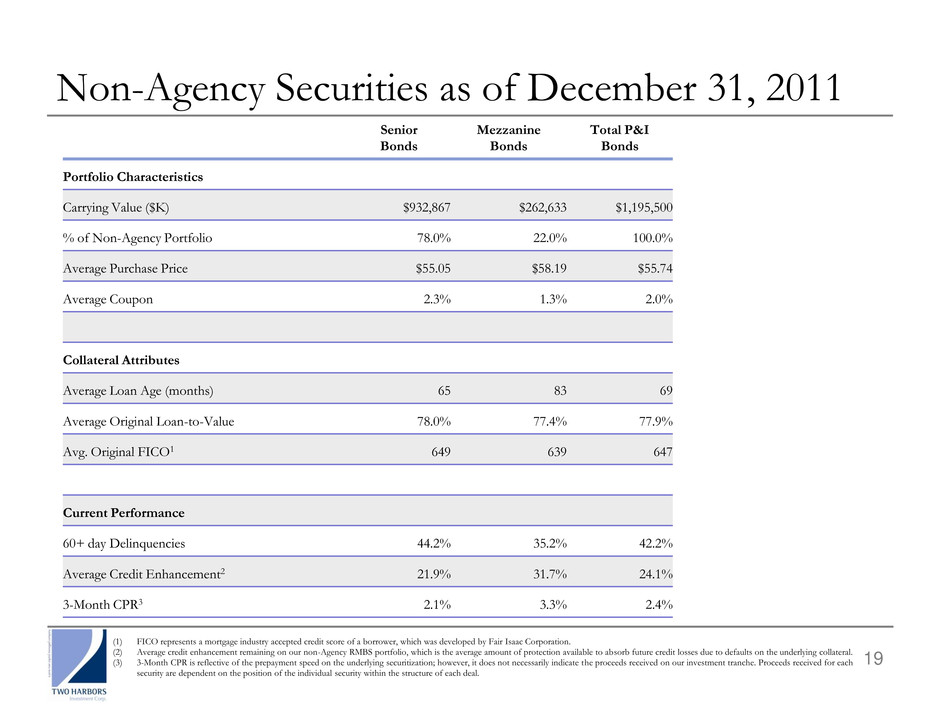

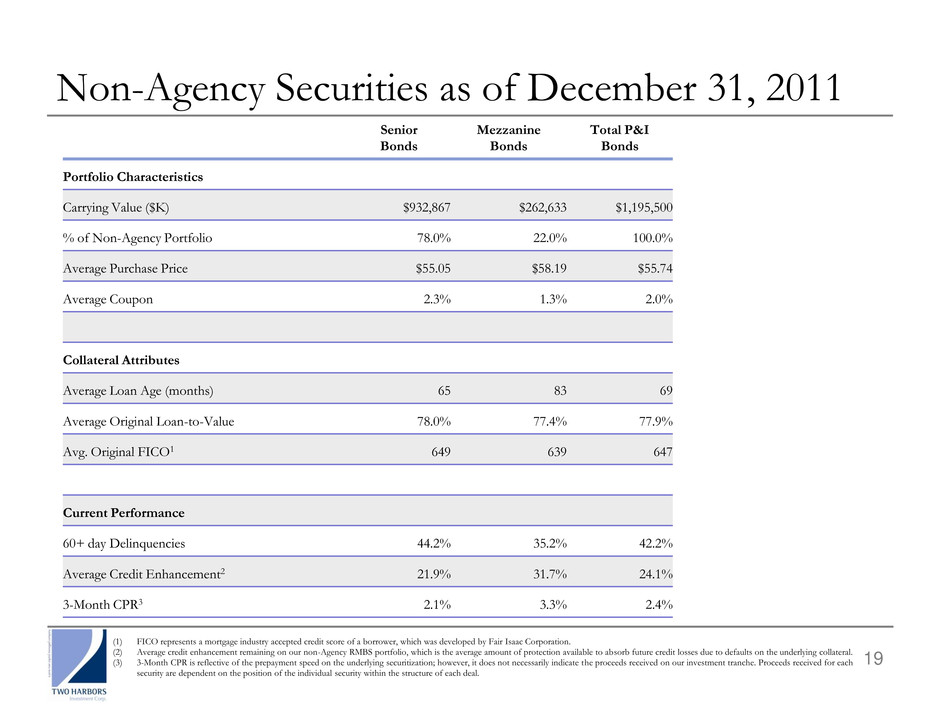

19 Non-Agency Securities as of December 31, 2011 Senior Bonds Mezzanine Bonds Total P&I Bonds Portfolio Characteristics Carrying Value ($K) $932,867 $262,633 $1,195,500 % of Non-Agency Portfolio 78.0% 22.0% 100.0% Average Purchase Price $55.05 $58.19 $55.74 Average Coupon 2.3% 1.3% 2.0% Collateral Attributes Average Loan Age (months) 65 83 69 Average Original Loan-to-Value 78.0% 77.4% 77.9% Avg. Original FICO1 649 639 647 Current Performance 60+ day Delinquencies 44.2% 35.2% 42.2% Average Credit Enhancement2 21.9% 31.7% 24.1% 3-Month CPR3 2.1% 3.3% 2.4% (1) FICO represents a mortgage industry accepted credit score of a borrower, which was developed by Fair Isaac Corporation. (2) Average credit enhancement remaining on our non-Agency RMBS portfolio, which is the average amount of protection available to absorb future credit losses due to defaults on the underlying collateral. (3) 3-Month CPR is reflective of the prepayment speed on the underlying securitization; however, it does not necessarily indicate the proceeds received on our investment tranche. Proceeds received for each security are dependent on the position of the individual security within the structure of each deal.