MAY 4, 2017 First Quarter 2017 Earnings Call

Safe Harbor Statement FORWARD-LOOKING STATEMENTS This presentation includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ from expectations, estimates and projections and, consequently, readers should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “target,” “assume,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believe,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from expected results, including, among other things, those described in our Annual Report on Form 10-K for the year ended December 31, 2016, and any subsequent Quarterly Reports on Form 10-Q, under the caption “Risk Factors.” Factors that could cause actual results to differ include, but are not limited to: the state of credit markets and general economic conditions; changes in interest rates and the market value of our assets; changes in prepayment rates of mortgages underlying our target assets; the rates of default or decreased recovery on the mortgages underlying our target assets; the occurrence, extent and timing of credit losses within our portfolio; the concentration of credit risks we are exposed to; declines in home prices; our ability to establish, adjust and maintain appropriate hedges for the risks in our portfolio; the availability and cost of our target assets; the availability and cost of financing; changes in the competitive landscape within our industry; our ability to effectively execute and to realize the benefits of strategic transactions and initiatives we have pursued or may in the future pursue; our ability to manage various operational risks and costs associated with our business; interruptions in or impairments to our communications and information technology systems; our ability to acquire mortgage servicing rights (MSR) and successfully operate our seller-servicer subsidiary and oversee our subservicers; the impact of any deficiencies in the servicing or foreclosure practices of third parties and related delays in the foreclosure process; the state of commercial real estate markets and our ability to acquire or originate commercial real estate loans or related assets; our exposure to legal and regulatory claims; legislative and regulatory actions affecting our business; the impact of new or modified government mortgage refinance or principal reduction programs; our ability to maintain our REIT qualification; and limitations imposed on our business due to our REIT status and our exempt status under the Investment Company Act of 1940. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Two Harbors does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statement to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Additional information concerning these and other risk factors is contained in Two Harbors’ most recent filings with the Securities and Exchange Commission (SEC). All subsequent written and oral forward-looking statements concerning Two Harbors or matters attributable to Two Harbors or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. This presentation may include industry and market data obtained through research, surveys, and studies conducted by third parties and industry publications. We have not independently verified any such market and industry data from third-party sources. This presentation is provided for discussion purposes only and may not be relied upon as legal or investment advice, nor is it intended to be inclusive of all the risks and uncertainties that should be considered. This presentation does not constitute an offer to purchase or sell any securities, nor shall it be construed to be indicative of the terms of an offer that the parties or their respective affiliates would accept. Readers are advised that the financial information in this presentation is based on company data available at the time of this presentation and, in certain circumstances, may not have been audited by the company’s independent auditors. 2

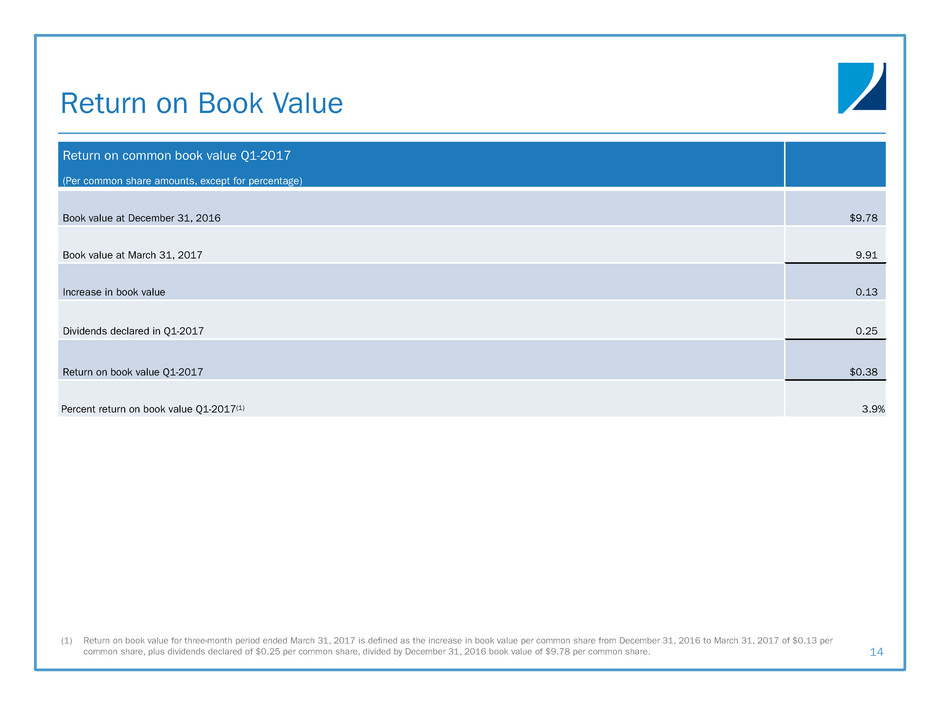

Financial Summary(1) • Total return on book value of 3.9%(2) – Book value of $9.91 per common share and cash dividend of $0.25 per common share • Comprehensive Income of $145.7 million, or $0.42 per common share • GAAP net income of $72.0 million, or $0.21 per common share • Core Earnings (revised)(3) of $95.0 million, or $0.27 per common share • Completed underwritten public offering of $287.5 million aggregate principal amount of 6.25% convertible senior notes due 2022 • Issued 5,750,000 shares of 8.125% Series A fixed-to-floating rate cumulative redeemable preferred stock for proceeds, net of offering costs, of $138.9 million 3 (1) Except as otherwise indicated in this presentation, reported data is as of or for the period ended March 31, 2017. (2) See Appendix slide 14 for calculation of Q1-2017 return on book value. (3) Core Earnings is a non-GAAP measure. Please see slide 17 for a discussion of an update to the company’s Core Earnings calculation as of March 31, 2017. Please see Appendix slide 17 of this presentation for a definition of Core Earnings and a reconciliation of GAAP to non-GAAP financial information. ON TRACK TO DELIVER STRONGER EARNINGS IN 2017 QUARTERLY HIGHLIGHTS

Strategic Overview 4 • Attractive investment opportunities in target assets • More efficient business model • Sophisticated approach to risk management • Opportunistic expansion of capital structure INCREASING EARNINGS POTENTIAL WHILE MAINTAINING RISK MANAGEMENT APPROACH

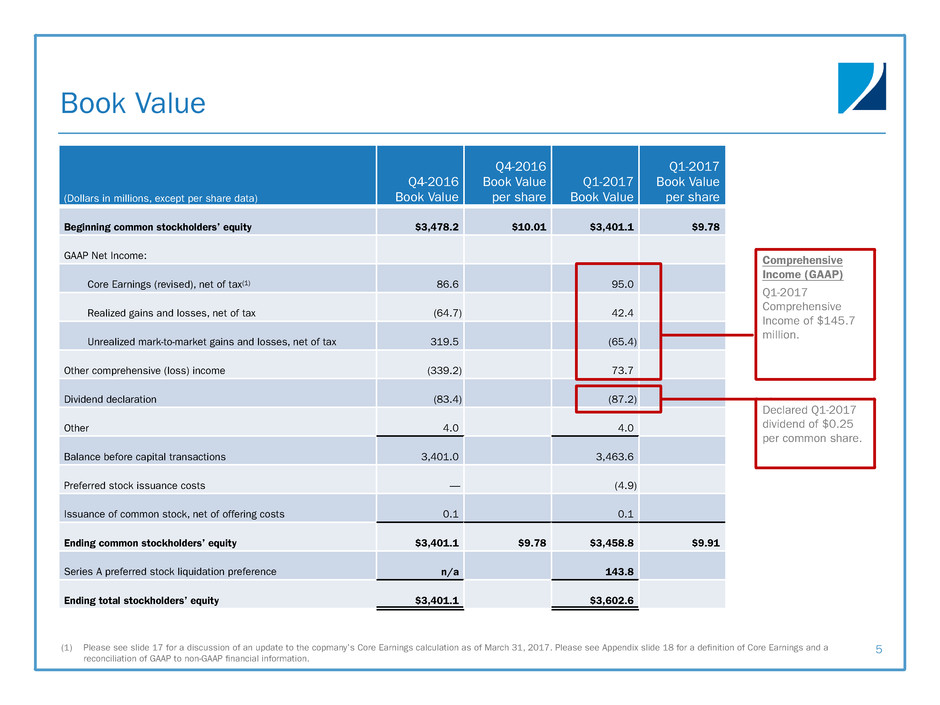

(Dollars in millions, except per share data) Q4-2016 Book Value Q4-2016 Book Value per share Q1-2017 Book Value Q1-2017 Book Value per share Beginning common stockholders’ equity $3,478.2 $10.01 $3,401.1 $9.78 GAAP Net Income: Core Earnings (revised), net of tax(1) 86.6 95.0 Realized gains and losses, net of tax (64.7) 42.4 Unrealized mark-to-market gains and losses, net of tax 319.5 (65.4) Other comprehensive (loss) income (339.2) 73.7 Dividend declaration (83.4) (87.2) Other 4.0 4.0 Balance before capital transactions 3,401.0 3,463.6 Preferred stock issuance costs — (4.9) Issuance of common stock, net of offering costs 0.1 0.1 Ending common stockholders’ equity $3,401.1 $9.78 $3,458.8 $9.91 Series A preferred stock liquidation preference n/a 143.8 Ending total stockholders’ equity $3,401.1 $3,602.6 Book Value 5 Comprehensive Income (GAAP) Q1-2017 Comprehensive Income of $145.7 million. Declared Q1-2017 dividend of $0.25 per common share. (1) Please see slide 17 for a discussion of an update to the copmany’s Core Earnings calculation as of March 31, 2017. Please see Appendix slide 18 for a definition of Core Earnings and a reconciliation of GAAP to non-GAAP financial information.

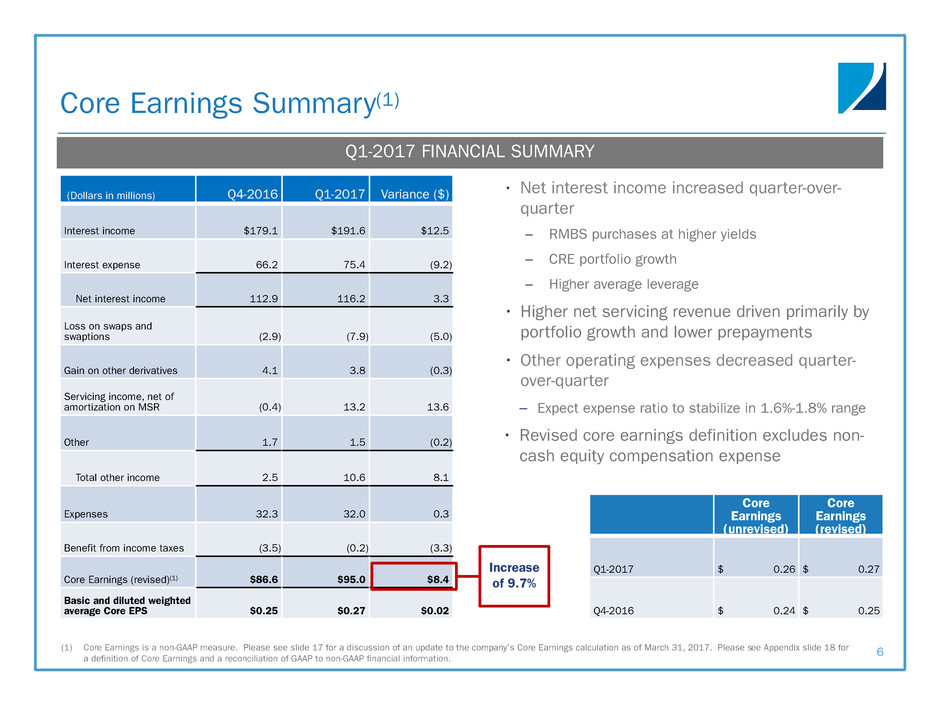

(Dollars in millions) Q4-2016 Q1-2017 Variance ($) Interest income $179.1 $191.6 $12.5 Interest expense 66.2 75.4 (9.2) Net interest income 112.9 116.2 3.3 Loss on swaps and swaptions (2.9) (7.9) (5.0) Gain on other derivatives 4.1 3.8 (0.3) Servicing income, net of amortization on MSR (0.4) 13.2 13.6 Other 1.7 1.5 (0.2) Total other income 2.5 10.6 8.1 Expenses 32.3 32.0 0.3 Benefit from income taxes (3.5) (0.2) (3.3) Core Earnings (revised)(1) $86.6 $95.0 $8.4 Basic and diluted weighted average Core EPS $0.25 $0.27 $0.02 Core Earnings Summary(1) 6 Q1-2017 FINANCIAL SUMMARY (1) Core Earnings is a non-GAAP measure. Please see slide 17 for a discussion of an update to the company’s Core Earnings calculation as of March 31, 2017. Please see Appendix slide 18 for a definition of Core Earnings and a reconciliation of GAAP to non-GAAP financial information. • Net interest income increased quarter-over- quarter – RMBS purchases at higher yields – CRE portfolio growth – Higher average leverage • Higher net servicing revenue driven primarily by portfolio growth and lower prepayments • Other operating expenses decreased quarter- over-quarter – Expect expense ratio to stabilize in 1.6%-1.8% range • Revised core earnings definition excludes non- cash equity compensation expense Increase of 9.7% Core Earnings (unrevised) Core Earnings (revised) Q1-2017 $ 0.26 $ 0.27 Q4-2016 $ 0.24 $ 0.25

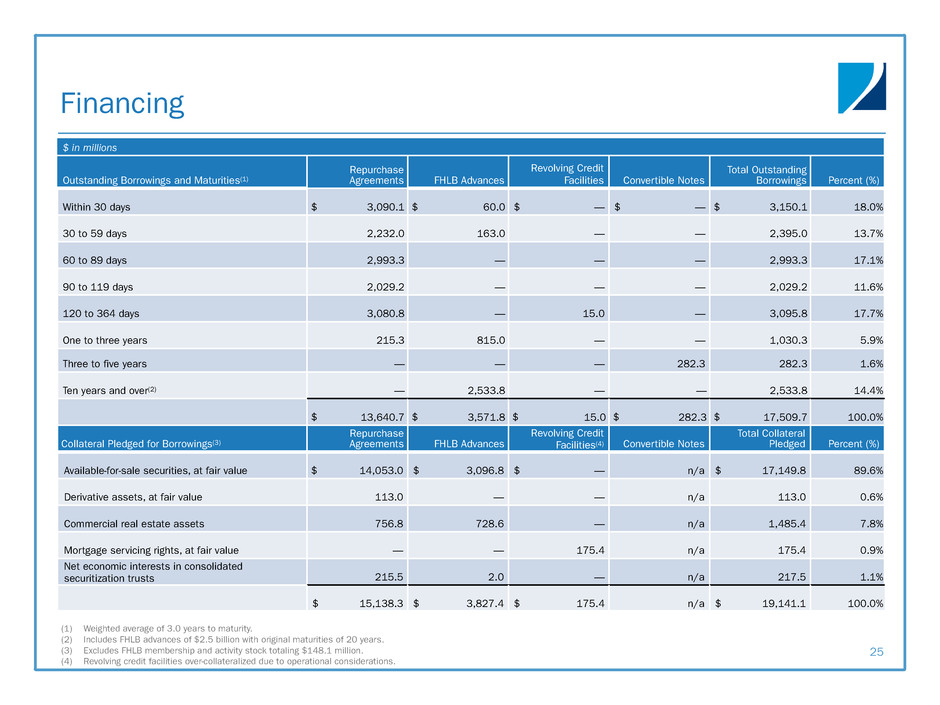

Diversified Financing Profile 7 REPURCHASE AGREEMENTS • Outstanding borrowings of $13.6 billion with 24 active counterparties; 31 total counterparties • Repo markets functioning efficiently for RMBS FEDERAL HOME LOAN BANK OF DES MOINES • Outstanding secured advances of $3.6 billion • Weighted average borrowing rate of 1.04% FINANCING FOR MSR • Outstanding borrowings of $15.0 million under revolving credit facilities • Additional available capacity of $55.0 million as of March 31, 2017 • Post quarter-end, additional $20.0 million of capacity added FINANCING FOR COMMERCIAL REAL ESTATE ASSETS • Outstanding borrowings under repurchase agreements of $478.8 million with three financing facilities – Expanded the maximum borrowing capacity of one facility from $250 million to $400 million – Subsequent to quarter-end, closed on additional financing facility CONVERTIBLE DEBT ISSUANCE • $287.5 million principal amount of unsecured senior convertible notes due 2022 • Majority of proceeds used to help fund MSR

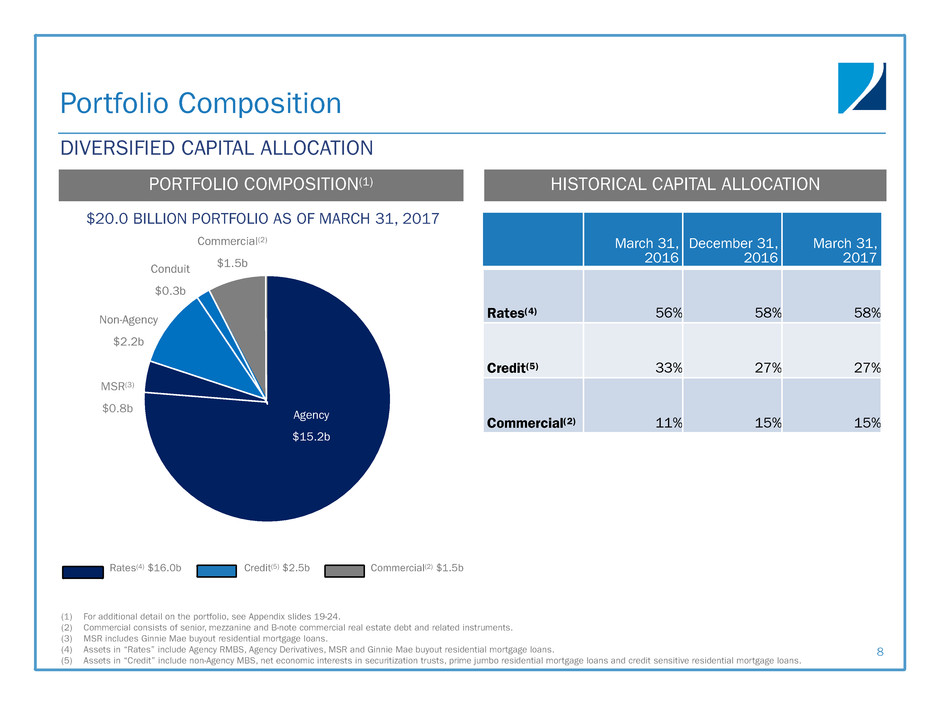

HISTORICAL CAPITAL ALLOCATIONPORTFOLIO COMPOSITION(1) Portfolio Composition 8 $20.0 BILLION PORTFOLIO AS OF MARCH 31, 2017 (1) For additional detail on the portfolio, see Appendix slides 19-24. (2) Commercial consists of senior, mezzanine and B-note commercial real estate debt and related instruments. (3) MSR includes Ginnie Mae buyout residential mortgage loans. (4) Assets in “Rates” include Agency RMBS, Agency Derivatives, MSR and Ginnie Mae buyout residential mortgage loans. (5) Assets in “Credit” include non-Agency MBS, net economic interests in securitization trusts, prime jumbo residential mortgage loans and credit sensitive residential mortgage loans. Rates(3) $10,766 Commercial(2) $1.5b March 31, 2016 December 31, 2016 March 31, 2017 Rates(4) 56% 58% 58% Credit(5) 33% 27% 27% Commercial(2) 11% 15% 15% DIVERSIFIED CAPITAL ALLOCATION Agency $15.2b MSR(3) $0.8b Non-Agency $2.2b Conduit $0.3b Rates(4) $16.0b Credit(5) $2.5b Commercial(2) $1.5b

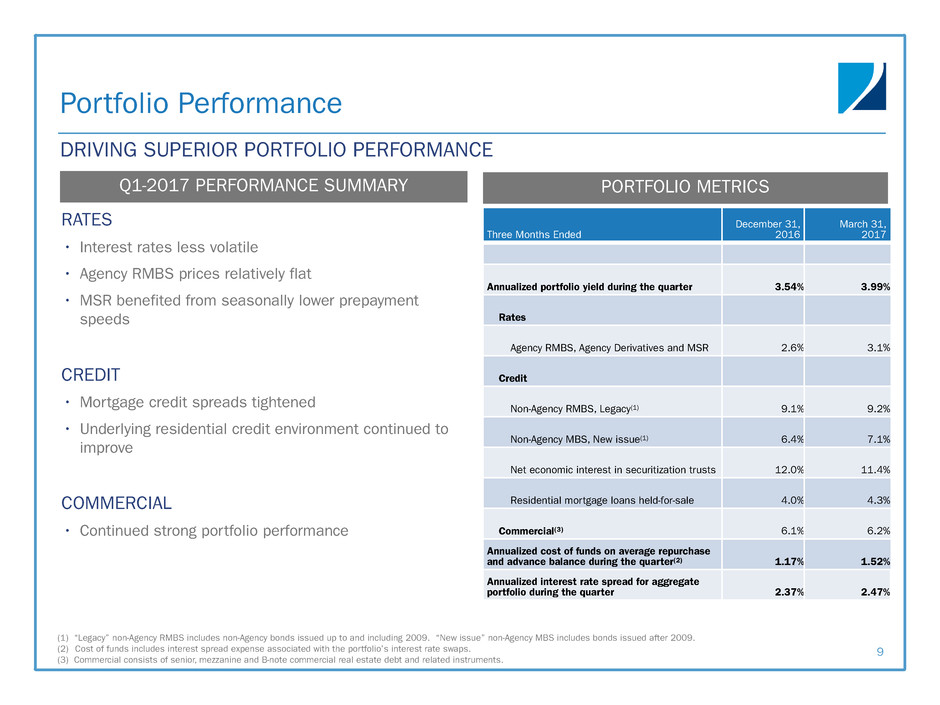

Portfolio Performance 9 Q1-2017 PERFORMANCE SUMMARY (1) “Legacy” non-Agency RMBS includes non-Agency bonds issued up to and including 2009. “New issue” non-Agency MBS includes bonds issued after 2009. (2) Cost of funds includes interest spread expense associated with the portfolio’s interest rate swaps. (3) Commercial consists of senior, mezzanine and B-note commercial real estate debt and related instruments. RATES • Interest rates less volatile • Agency RMBS prices relatively flat • MSR benefited from seasonally lower prepayment speeds CREDIT • Mortgage credit spreads tightened • Underlying residential credit environment continued to improve COMMERCIAL • Continued strong portfolio performance PORTFOLIO METRICS Three Months Ended December 31, 2016 March 31, 2017 Annualized portfolio yield during the quarter 3.54% 3.99% Rates Agency RMBS, Agency Derivatives and MSR 2.6% 3.1% Credit Non-Agency RMBS, Legacy(1) 9.1% 9.2% Non-Agency MBS, New issue(1) 6.4% 7.1% Net economic interest in securitization trusts 12.0% 11.4% Residential mortgage loans held-for-sale 4.0% 4.3% Commercial(3) 6.1% 6.2% Annualized cost of funds on average repurchase and advance balance during the quarter(2) 1.17% 1.52% Annualized interest rate spread for aggregate portfolio during the quarter 2.37% 2.47% DRIVING SUPERIOR PORTFOLIO PERFORMANCE

Rates Update 10 PORTFOLIO SUMMARY MSR INTEGRAL COMPONENT OF RATES STRATEGY SENSIBLE APPROACH TO RISK MANAGEMENT • Low interest rate exposure • Utilize a combination of hedging tools • MSR is a key component of hedging strategy • Agency RMBS holdings of $15.2 billion – Increase in Agency RMBS from initially deploying proceeds from the capital raises in the first quarter; plan to redeploy those proceeds into MSR and commercial real estate assets • MSR portfolio of approximately $750 million in fair market value – Added $7.4 billion UPB of new issue, high quality MSR from flow-sale arrangements in the first quarter – Expect near-term flow MSR volume of approximately $2.0-2.5 billion UPB per month – Subsequent to quarter-end, agreed to purchase approximately $12 billion UPB of new issue, conventional MSR subject to GSE transfer approval

Credit Update 11 • Legacy RMBS prices increased in the first quarter but significant opportunity remains • Home prices continue to improve; CoreLogic Home Price Index up 7.0% on a rolling 12-month basis(1) • Prepayments higher year-over-year – TWO’s 1Q-17 three month CPR of 6.7%, compared to 1Q-16 three month CPR of 5.3% • Future upside driven by increasing prepays, lower delinquencies/defaults and severities (1) Source: CoreLogic Home Price Index rolling 12-month change as of February 2017. (2) Weighted average market price utilized current face for weighting purposes. Please see slide 23 in the Appendix for more information on our non-Agency RMBS portfolio. RESIDENTIAL CREDIT TAILWINDS CONTINUED IMPROVEMENT OF UNDERLYING RESIDENTIAL CREDIT ENVIRONMENT • Legacy non-Agency RMBS holdings of $2.2 billion • Opportunistically purchased approximately $340 million of legacy non-Agency RMBS • Average market price of $75.38 allows ability to capture upside opportunity(2) PORTFOLIO SUMMARY

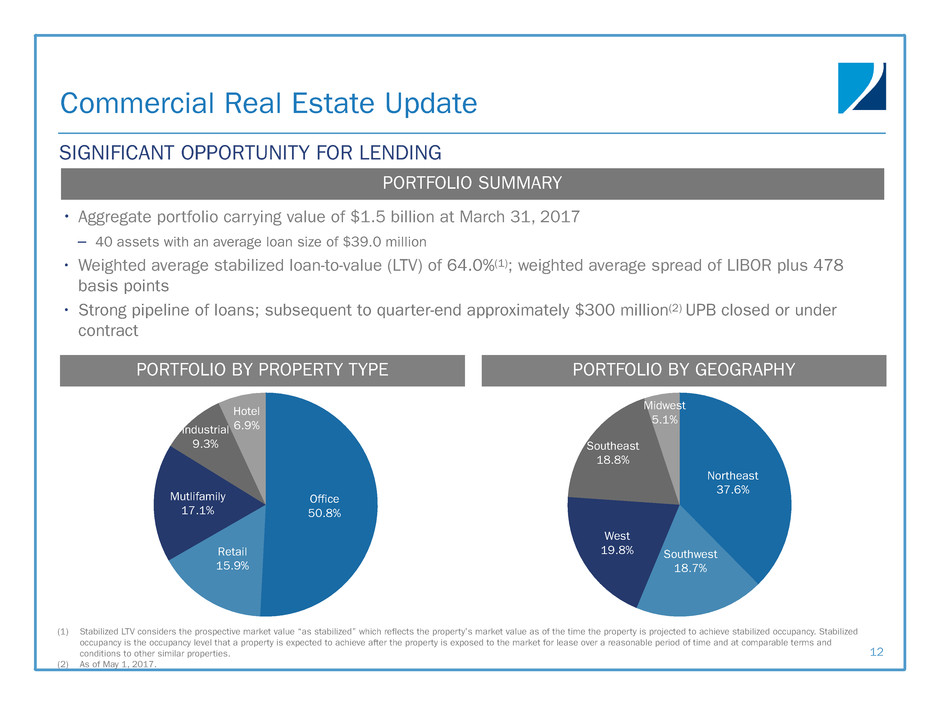

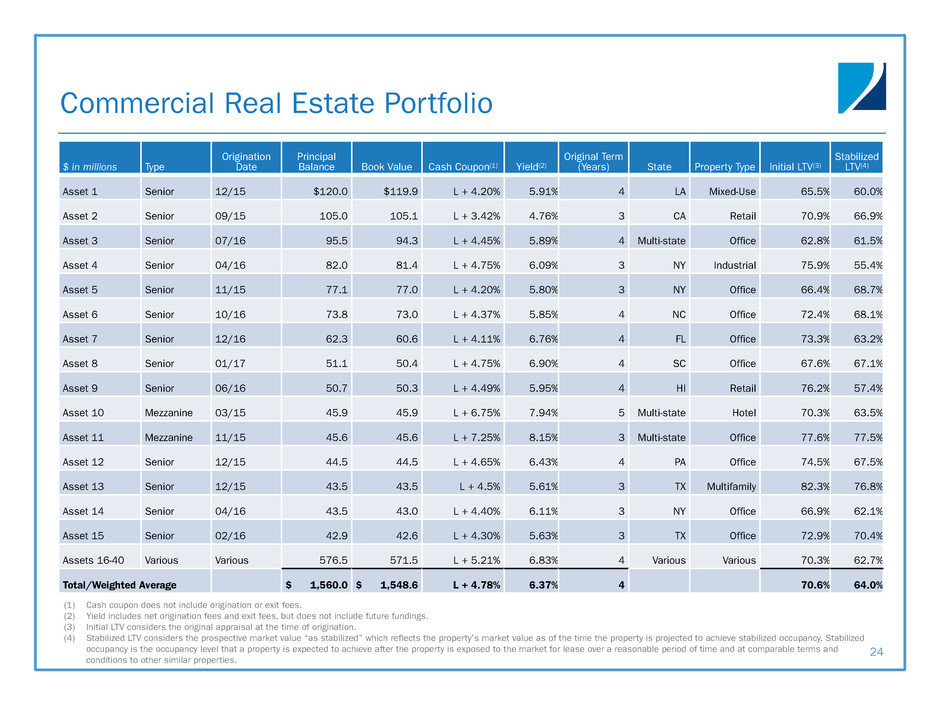

Commercial Real Estate Update 12 PORTFOLIO BY PROPERTY TYPE PORTFOLIO BY GEOGRAPHY (1) Stabilized LTV considers the prospective market value “as stabilized” which reflects the property’s market value as of the time the property is projected to achieve stabilized occupancy. Stabilized occupancy is the occupancy level that a property is expected to achieve after the property is exposed to the market for lease over a reasonable period of time and at comparable terms and conditions to other similar properties. (2) As of May 1, 2017. Office 50.8% Retail 15.9% Mutlifamily 17.1% Industrial 9.3% Hotel 6.9% Northeast 37.6% Southwest 18.7% West 19.8% Southeast 18.8% Midwest 5.1% SIGNIFICANT OPPORTUNITY FOR LENDING • Aggregate portfolio carrying value of $1.5 billion at March 31, 2017 – 40 assets with an average loan size of $39.0 million • Weighted average stabilized loan-to-value (LTV) of 64.0%(1); weighted average spread of LIBOR plus 478 basis points • Strong pipeline of loans; subsequent to quarter-end approximately $300 million(2) UPB closed or under contract PORTFOLIO SUMMARY

Appendix

Return on Book Value 14 (1) Return on book value for three-month period ended March 31, 2017 is defined as the increase in book value per common share from December 31, 2016 to March 31, 2017 of $0.13 per common share, plus dividends declared of $0.25 per common share, divided by December 31, 2016 book value of $9.78 per common share. Return on common book value Q1-2017 (Per common share amounts, except for percentage) Book value at December 31, 2016 $9.78 Book value at March 31, 2017 9.91 Increase in book value 0.13 Dividends declared in Q1-2017 0.25 Return on book value Q1-2017 $0.38 Percent return on book value Q1-2017(1) 3.9%

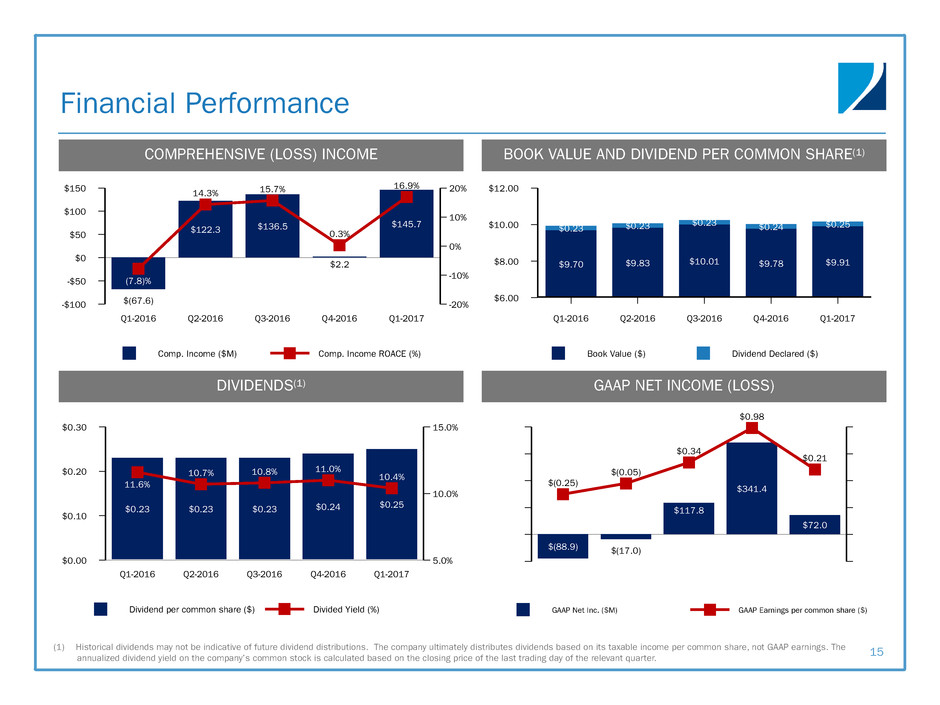

Book Value ($) Dividend Declared ($) $12.00 $10.00 $8.00 $6.00 Q1-2016 Q2-2016 Q3-2016 Q4-2016 Q1-2017 $9.70 $9.83 $10.01 $9.78 $9.91 $0.23 $0.23 $0.23 $0.24 $0.25 Comp. Income ($M) Comp. Income ROACE (%) $150 $100 $50 $0 -$50 -$100 20% 10% 0% -10% -20% Q1-2016 Q2-2016 Q3-2016 Q4-2016 Q1-2017 $(67.6) $122.3 $136.5 $2.2 $145.7 (7.8)% 14.3% 15.7% 0.3% 16.9% DIVIDENDS(1) Financial Performance 15 COMPREHENSIVE (LOSS) INCOME BOOK VALUE AND DIVIDEND PER COMMON SHARE(1) GAAP NET INCOME (LOSS) (1) Historical dividends may not be indicative of future dividend distributions. The company ultimately distributes dividends based on its taxable income per common share, not GAAP earnings. The annualized dividend yield on the company’s common stock is calculated based on the closing price of the last trading day of the relevant quarter. Dividend per common share ($) Divided Yield (%) $0.30 $0.20 $0.10 $0.00 15.0% 10.0% 5.0% Q1-2016 Q2-2016 Q3-2016 Q4-2016 Q1-2017 $0.23 $0.23 $0.23 $0.24 $0.25 11.6% 10.7% 10.8% 11.0% 10.4% GAAP Net Inc. ($M) GAAP Earnings per common share ($) $400 $300 $200 $100 $0 -$100 $1.00 $0.50 $0.00 -$0.50 -$1.00 -$1.50 Q1-2016 Q2-2016 Q3-2016 Q4-2016 Q1-2017 $(88.9) $(17.0) $117.8 $341.4 $72.0 $(0.25) $(0.05) $0.34 $0.98 $0.21

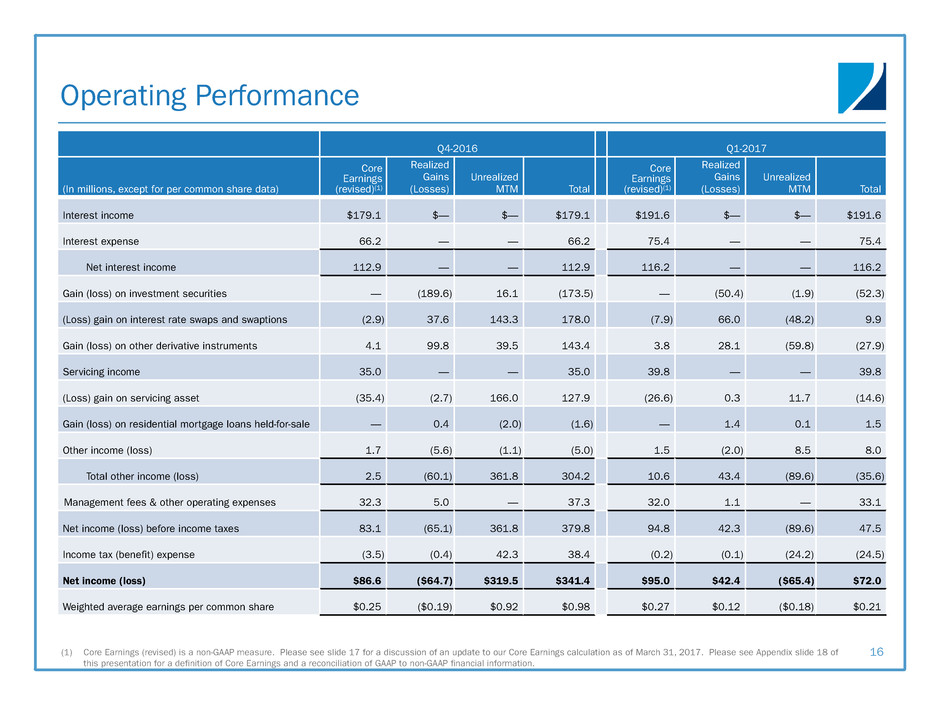

Operating Performance Q4-2016 Q1-2017 (In millions, except for per common share data) Core Earnings (revised)(1) Realized Gains (Losses) Unrealized MTM Total Core Earnings (revised)(1) Realized Gains (Losses) Unrealized MTM Total Interest income $179.1 $— $— $179.1 $191.6 $— $— $191.6 Interest expense 66.2 — — 66.2 75.4 — — 75.4 Net interest income 112.9 — — 112.9 116.2 — — 116.2 Gain (loss) on investment securities — (189.6) 16.1 (173.5) — (50.4) (1.9) (52.3) (Loss) gain on interest rate swaps and swaptions (2.9) 37.6 143.3 178.0 (7.9) 66.0 (48.2) 9.9 Gain (loss) on other derivative instruments 4.1 99.8 39.5 143.4 3.8 28.1 (59.8) (27.9) Servicing income 35.0 — — 35.0 39.8 — — 39.8 (Loss) gain on servicing asset (35.4) (2.7) 166.0 127.9 (26.6) 0.3 11.7 (14.6) Gain (loss) on residential mortgage loans held-for-sale — 0.4 (2.0) (1.6) — 1.4 0.1 1.5 Other income (loss) 1.7 (5.6) (1.1) (5.0) 1.5 (2.0) 8.5 8.0 Total other income (loss) 2.5 (60.1) 361.8 304.2 10.6 43.4 (89.6) (35.6) Management fees & other operating expenses 32.3 5.0 — 37.3 32.0 1.1 — 33.1 Net income (loss) before income taxes 83.1 (65.1) 361.8 379.8 94.8 42.3 (89.6) 47.5 Income tax (benefit) expense (3.5) (0.4) 42.3 38.4 (0.2) (0.1) (24.2) (24.5) Net income (loss) $86.6 ($64.7) $319.5 $341.4 $95.0 $42.4 ($65.4) $72.0 Weighted average earnings per common share $0.25 ($0.19) $0.92 $0.98 $0.27 $0.12 ($0.18) $0.21 16(1) Core Earnings (revised) is a non-GAAP measure. Please see slide 17 for a discussion of an update to our Core Earnings calculation as of March 31, 2017. Please see Appendix slide 18 of this presentation for a definition of Core Earnings and a reconciliation of GAAP to non-GAAP financial information.

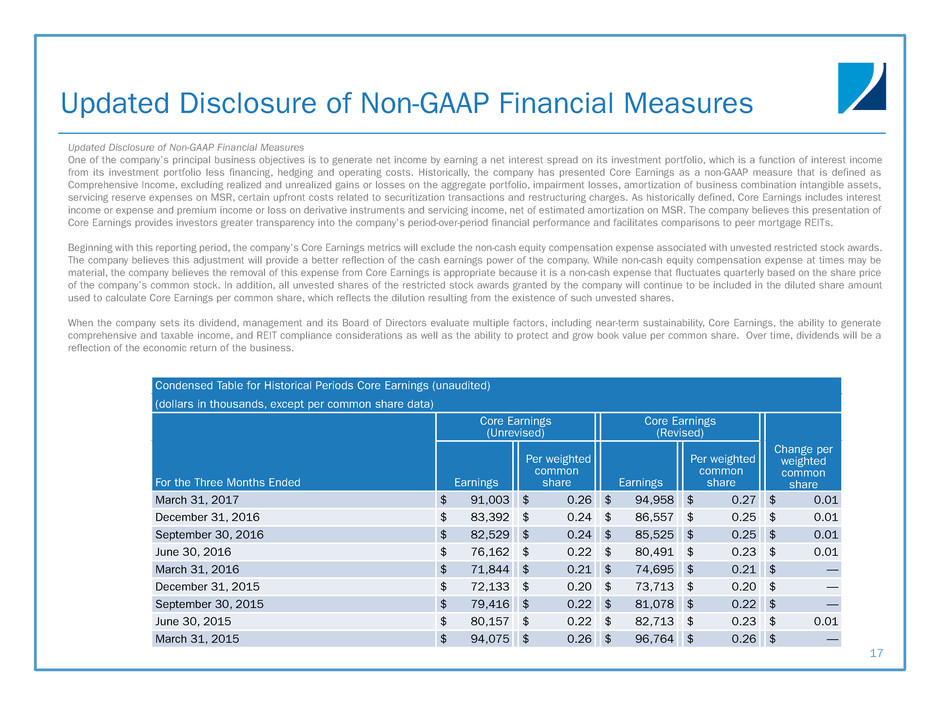

Updated Disclosure of Non-GAAP Financial Measures One of the company’s principal business objectives is to generate net income by earning a net interest spread on its investment portfolio, which is a function of interest income from its investment portfolio less financing, hedging and operating costs. Historically, the company has presented Core Earnings as a non-GAAP measure that is defined as Comprehensive Income, excluding realized and unrealized gains or losses on the aggregate portfolio, impairment losses, amortization of business combination intangible assets, servicing reserve expenses on MSR, certain upfront costs related to securitization transactions and restructuring charges. As historically defined, Core Earnings includes interest income or expense and premium income or loss on derivative instruments and servicing income, net of estimated amortization on MSR. The company believes this presentation of Core Earnings provides investors greater transparency into the company’s period-over-period financial performance and facilitates comparisons to peer mortgage REITs. Beginning with this reporting period, the company’s Core Earnings metrics will exclude the non-cash equity compensation expense associated with unvested restricted stock awards. The company believes this adjustment will provide a better reflection of the cash earnings power of the company. While non-cash equity compensation expense at times may be material, the company believes the removal of this expense from Core Earnings is appropriate because it is a non-cash expense that fluctuates quarterly based on the share price of the company’s common stock. In addition, all unvested shares of the restricted stock awards granted by the company will continue to be included in the diluted share amount used to calculate Core Earnings per common share, which reflects the dilution resulting from the existence of such unvested shares. When the company sets its dividend, management and its Board of Directors evaluate multiple factors, including near-term sustainability, Core Earnings, the ability to generate comprehensive and taxable income, and REIT compliance considerations as well as the ability to protect and grow book value per common share. Over time, dividends will be a reflection of the economic return of the business. Condensed Table for Historical Periods Core Earnings (unaudited) (dollars in thousands, except per common share data) Core Earnings (Unrevised) Core Earnings (Revised) For the Three Months Ended Earnings Per weighted common share Earnings Per weighted common share Change per weighted common share March 31, 2017 $ 91,003 $ 0.26 $ 94,958 $ 0.27 $ 0.01 December 31, 2016 $ 83,392 $ 0.24 $ 86,557 $ 0.25 $ 0.01 September 30, 2016 $ 82,529 $ 0.24 $ 85,525 $ 0.25 $ 0.01 June 30, 2016 $ 76,162 $ 0.22 $ 80,491 $ 0.23 $ 0.01 March 31, 2016 $ 71,844 $ 0.21 $ 74,695 $ 0.21 $ — December 31, 2015 $ 72,133 $ 0.20 $ 73,713 $ 0.20 $ — September 30, 2015 $ 79,416 $ 0.22 $ 81,078 $ 0.22 $ — June 30, 2015 $ 80,157 $ 0.22 $ 82,713 $ 0.23 $ 0.01 March 31, 2015 $ 94,075 $ 0.26 $ 96,764 $ 0.26 $ — Updated Disclosure of Non-GAAP Financial Measures 17

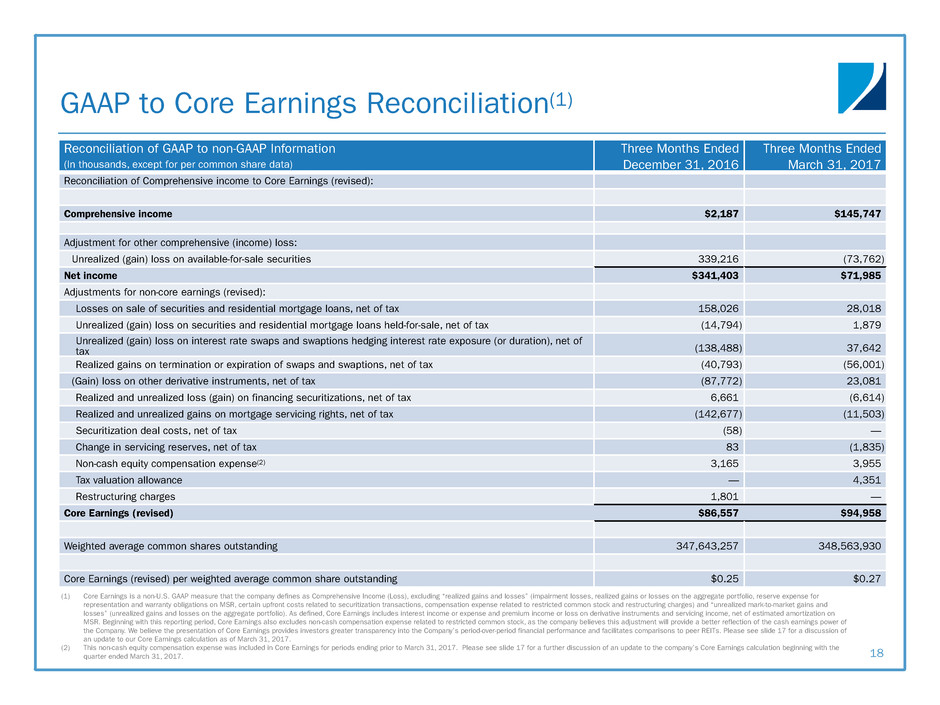

GAAP to Core Earnings Reconciliation(1) Reconciliation of GAAP to non-GAAP Information Three Months Ended Three Months Ended (In thousands, except for per common share data) December 31, 2016 March 31, 2017 Reconciliation of Comprehensive income to Core Earnings (revised): Comprehensive income $2,187 $145,747 Adjustment for other comprehensive (income) loss: Unrealized (gain) loss on available-for-sale securities 339,216 (73,762) Net income $341,403 $71,985 Adjustments for non-core earnings (revised): Losses on sale of securities and residential mortgage loans, net of tax 158,026 28,018 Unrealized (gain) loss on securities and residential mortgage loans held-for-sale, net of tax (14,794) 1,879 Unrealized (gain) loss on interest rate swaps and swaptions hedging interest rate exposure (or duration), net of tax (138,488) 37,642 Realized gains on termination or expiration of swaps and swaptions, net of tax (40,793) (56,001) (Gain) loss on other derivative instruments, net of tax (87,772) 23,081 Realized and unrealized loss (gain) on financing securitizations, net of tax 6,661 (6,614) Realized and unrealized gains on mortgage servicing rights, net of tax (142,677) (11,503) Securitization deal costs, net of tax (58) — Change in servicing reserves, net of tax 83 (1,835) Non-cash equity compensation expense(2) 3,165 3,955 Tax valuation allowance — 4,351 Restructuring charges 1,801 — Core Earnings (revised) $86,557 $94,958 Weighted average common shares outstanding 347,643,257 348,563,930 Core Earnings (revised) per weighted average common share outstanding $0.25 $0.27 18 (1) Core Earnings is a non-U.S. GAAP measure that the company defines as Comprehensive Income (Loss), excluding “realized gains and losses” (impairment losses, realized gains or losses on the aggregate portfolio, reserve expense for representation and warranty obligations on MSR, certain upfront costs related to securitization transactions, compensation expense related to restricted common stock and restructuring charges) and “unrealized mark-to-market gains and losses” (unrealized gains and losses on the aggregate portfolio). As defined, Core Earnings includes interest income or expense and premium income or loss on derivative instruments and servicing income, net of estimated amortization on MSR. Beginning with this reporting period, Core Earnings also excludes non-cash compensation expense related to restricted common stock, as the company believes this adjustment will provide a better reflection of the cash earnings power of the Company. We believe the presentation of Core Earnings provides investors greater transparency into the Company’s period-over-period financial performance and facilitates comparisons to peer REITs. Please see slide 17 for a discussion of an update to our Core Earnings calculation as of March 31, 2017. (2) This non-cash equity compensation expense was included in Core Earnings for periods ending prior to March 31, 2017. Please see slide 17 for a further discussion of an update to the company’s Core Earnings calculation beginning with the quarter ended March 31, 2017.

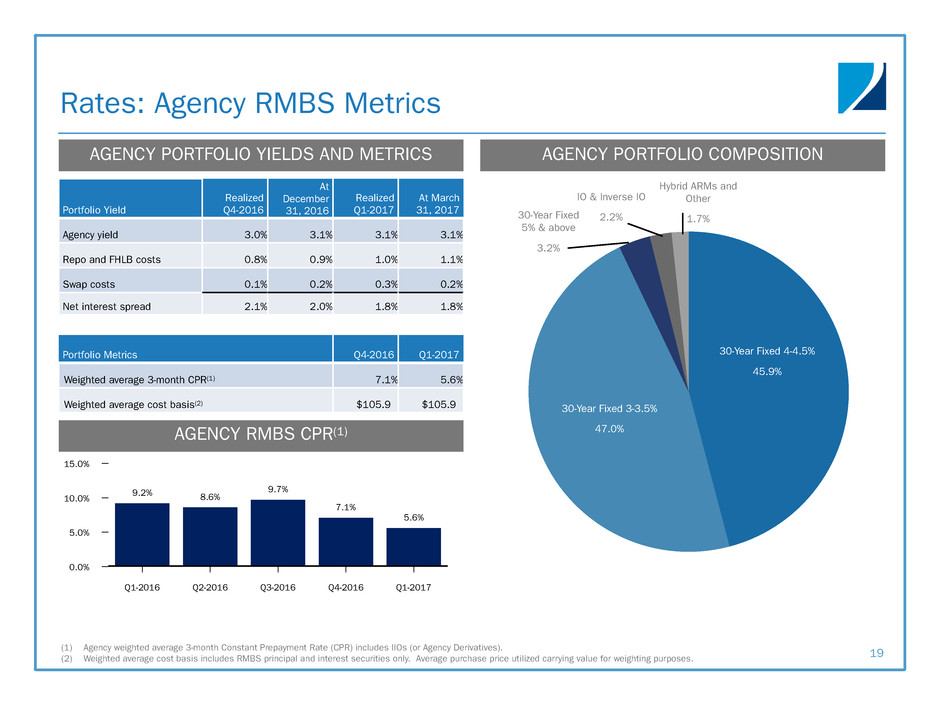

Rates: Agency RMBS Metrics 19 AGENCY PORTFOLIO YIELDS AND METRICS AGENCY RMBS CPR(1) (1) Agency weighted average 3-month Constant Prepayment Rate (CPR) includes IIOs (or Agency Derivatives). (2) Weighted average cost basis includes RMBS principal and interest securities only. Average purchase price utilized carrying value for weighting purposes. Portfolio Yield Realized Q4-2016 At December 31, 2016 Realized Q1-2017 At March 31, 2017 Agency yield 3.0% 3.1% 3.1% 3.1% Repo and FHLB costs 0.8% 0.9% 1.0% 1.1% Swap costs 0.1% 0.2% 0.3% 0.2% Net interest spread 2.1% 2.0% 1.8% 1.8% Portfolio Metrics Q4-2016 Q1-2017 Weighted average 3-month CPR(1) 7.1% 5.6% Weighted average cost basis(2) $105.9 $105.9 AGENCY PORTFOLIO COMPOSITION 15.0% 10.0% 5.0% 0.0% Q1-2016 Q2-2016 Q3-2016 Q4-2016 Q1-2017 9.2% 8.6% 9.7% 7.1% 5.6% 30-Year Fixed 4-4.5% 45.9% 30-Year Fixed 3-3.5% 47.0% 30-Year Fixed 5% & above 3.2% IO & Inverse IO 2.2% Hybrid ARMs and Other 1.7%

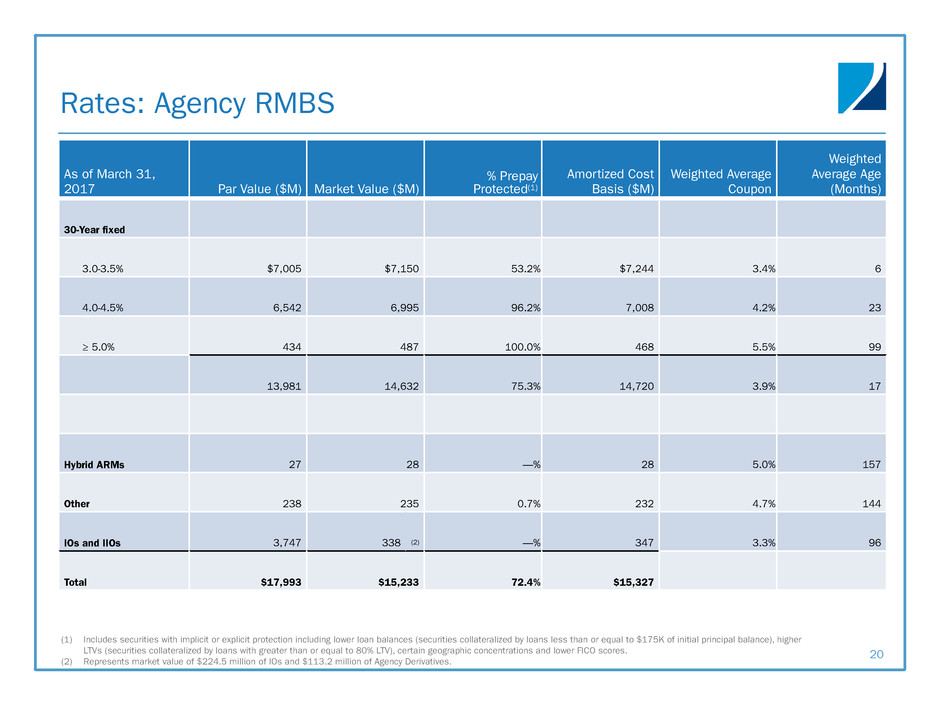

Rates: Agency RMBS 20 As of March 31, 2017 Par Value ($M) Market Value ($M) % Prepay Protected(1) Amortized Cost Basis ($M) Weighted Average Coupon Weighted Average Age (Months) 30-Year fixed 3.0-3.5% $7,005 $7,150 53.2% $7,244 3.4% 6 4.0-4.5% 6,542 6,995 96.2% 7,008 4.2% 23 ≥ 5.0% 434 487 100.0% 468 5.5% 99 13,981 14,632 75.3% 14,720 3.9% 17 Hybrid ARMs 27 28 —% 28 5.0% 157 Other 238 235 0.7% 232 4.7% 144 IOs and IIOs 3,747 338 (2) —% 347 3.3% 96 Total $17,993 $15,233 72.4% $15,327 (1) Includes securities with implicit or explicit protection including lower loan balances (securities collateralized by loans less than or equal to $175K of initial principal balance), higher LTVs (securities collateralized by loans with greater than or equal to 80% LTV), certain geographic concentrations and lower FICO scores. (2) Represents market value of $224.5 million of IOs and $113.2 million of Agency Derivatives.

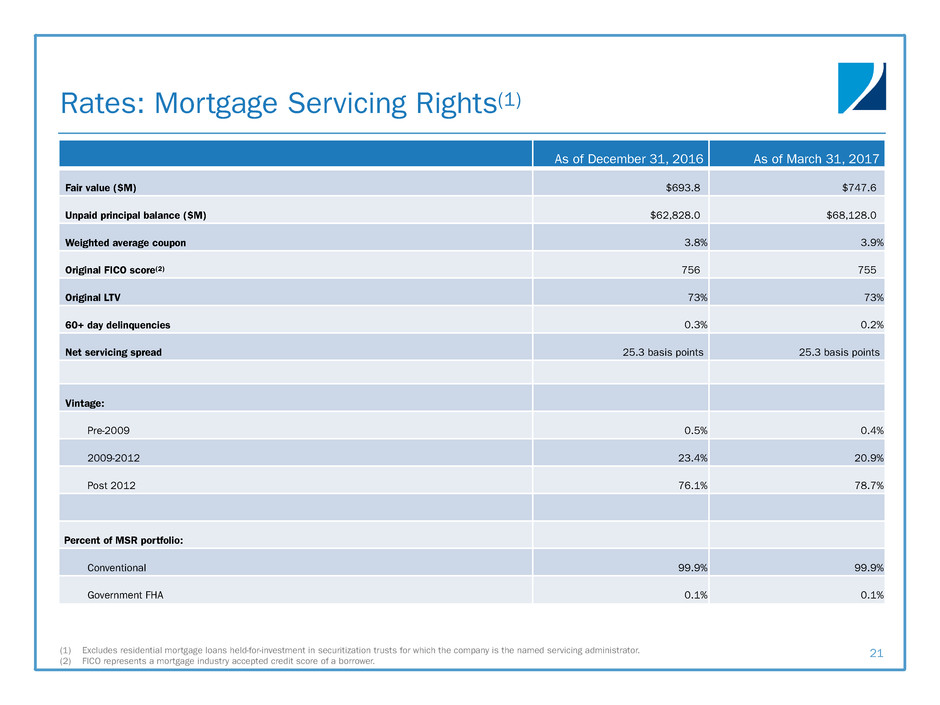

Rates: Mortgage Servicing Rights(1) 21 As of December 31, 2016 As of March 31, 2017 Fair value ($M) $693.8 $747.6 Unpaid principal balance ($M) $62,828.0 $68,128.0 Weighted average coupon 3.8% 3.9% Original FICO score(2) 756 755 Original LTV 73% 73% 60+ day delinquencies 0.3% 0.2% Net servicing spread 25.3 basis points 25.3 basis points Vintage: Pre-2009 0.5% 0.4% 2009-2012 23.4% 20.9% Post 2012 76.1% 78.7% Percent of MSR portfolio: Conventional 99.9% 99.9% Government FHA 0.1% 0.1% (1) Excludes residential mortgage loans held-for-investment in securitization trusts for which the company is the named servicing administrator. (2) FICO represents a mortgage industry accepted credit score of a borrower.

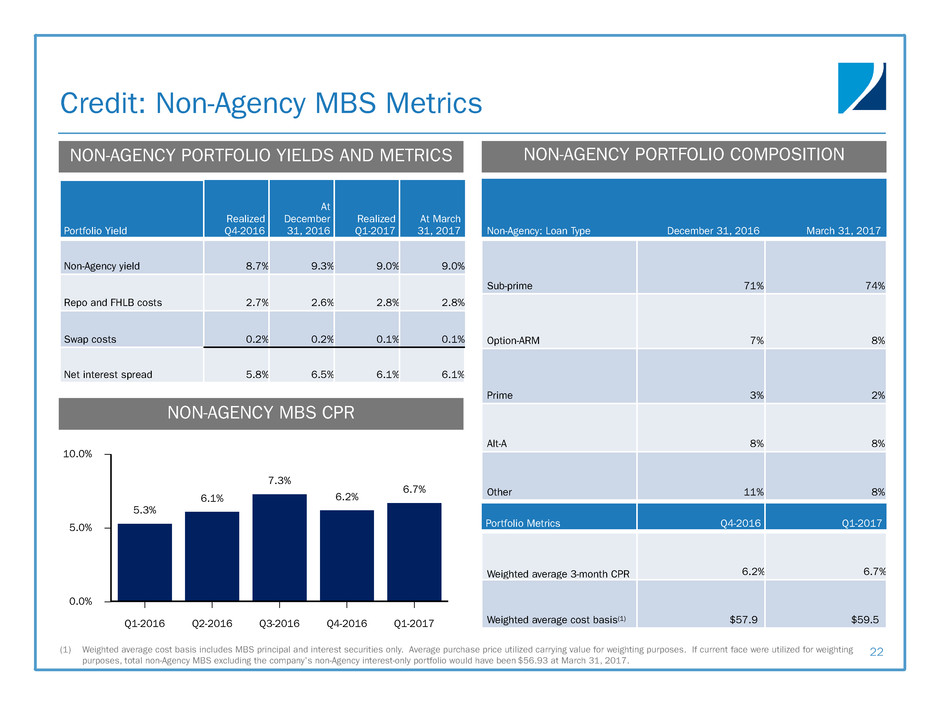

Credit: Non-Agency MBS Metrics 22 NON-AGENCY PORTFOLIO COMPOSITIONNON-AGENCY PORTFOLIO YIELDS AND METRICS (1) Weighted average cost basis includes MBS principal and interest securities only. Average purchase price utilized carrying value for weighting purposes. If current face were utilized for weighting purposes, total non-Agency MBS excluding the company’s non-Agency interest-only portfolio would have been $56.93 at March 31, 2017. Portfolio Yield Realized Q4-2016 At December 31, 2016 Realized Q1-2017 At March 31, 2017 Non-Agency yield 8.7% 9.3% 9.0% 9.0% Repo and FHLB costs 2.7% 2.6% 2.8% 2.8% Swap costs 0.2% 0.2% 0.1% 0.1% Net interest spread 5.8% 6.5% 6.1% 6.1% NON-AGENCY MBS CPR Non-Agency: Loan Type December 31, 2016 March 31, 2017 Sub-prime 71% 74% Option-ARM 7% 8% Prime 3% 2% Alt-A 8% 8% Other 11% 8% Portfolio Metrics Q4-2016 Q1-2017 Weighted average 3-month CPR 6.2% 6.7% Weighted average cost basis(1) $57.9 $59.5 10.0% 5.0% 0.0% Q1-2016 Q2-2016 Q3-2016 Q4-2016 Q1-2017 5.3% 6.1% 7.3% 6.2% 6.7%

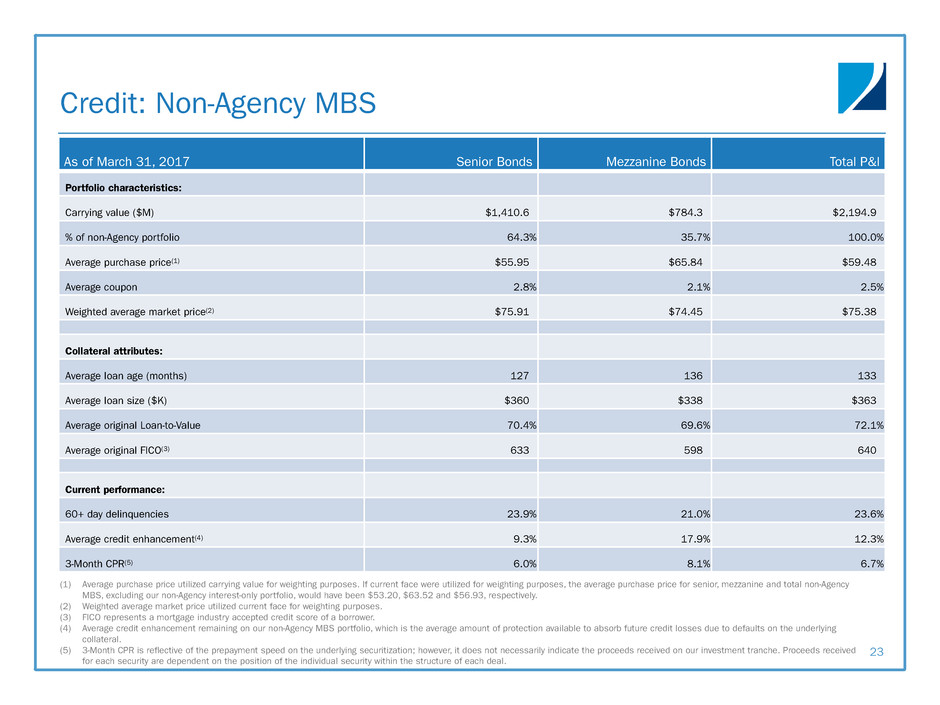

Credit: Non-Agency MBS 23 As of March 31, 2017 Senior Bonds Mezzanine Bonds Total P&I Portfolio characteristics: Carrying value ($M) $1,410.6 $784.3 $2,194.9 % of non-Agency portfolio 64.3% 35.7% 100.0% Average purchase price(1) $55.95 $65.84 $59.48 Average coupon 2.8% 2.1% 2.5% Weighted average market price(2) $75.91 $74.45 $75.38 Collateral attributes: Average loan age (months) 127 136 133 Average loan size ($K) $360 $338 $363 Average original Loan-to-Value 70.4% 69.6% 72.1% Average original FICO(3) 633 598 640 Current performance: 60+ day delinquencies 23.9% 21.0% 23.6% Average credit enhancement(4) 9.3% 17.9% 12.3% 3-Month CPR(5) 6.0% 8.1% 6.7% (1) Average purchase price utilized carrying value for weighting purposes. If current face were utilized for weighting purposes, the average purchase price for senior, mezzanine and total non-Agency MBS, excluding our non-Agency interest-only portfolio, would have been $53.20, $63.52 and $56.93, respectively. (2) Weighted average market price utilized current face for weighting purposes. (3) FICO represents a mortgage industry accepted credit score of a borrower. (4) Average credit enhancement remaining on our non-Agency MBS portfolio, which is the average amount of protection available to absorb future credit losses due to defaults on the underlying collateral. (5) 3-Month CPR is reflective of the prepayment speed on the underlying securitization; however, it does not necessarily indicate the proceeds received on our investment tranche. Proceeds received for each security are dependent on the position of the individual security within the structure of each deal.

Commercial Real Estate Portfolio (1) Cash coupon does not include origination or exit fees. (2) Yield includes net origination fees and exit fees, but does not include future fundings. (3) Initial LTV considers the original appraisal at the time of origination. (4) Stabilized LTV considers the prospective market value “as stabilized” which reflects the property’s market value as of the time the property is projected to achieve stabilized occupancy. Stabilized occupancy is the occupancy level that a property is expected to achieve after the property is exposed to the market for lease over a reasonable period of time and at comparable terms and conditions to other similar properties. 24 $ in millions Type Origination Date Principal Balance Book Value Cash Coupon(1) Yield(2) Original Term (Years) State Property Type Initial LTV(3) Stabilized LTV(4) Asset 1 Senior 12/15 $120.0 $119.9 L + 4.20% 5.91% 4 LA Mixed-Use 65.5% 60.0% Asset 2 Senior 09/15 105.0 105.1 L + 3.42% 4.76% 3 CA Retail 70.9% 66.9% Asset 3 Senior 07/16 95.5 94.3 L + 4.45% 5.89% 4 Multi-state Office 62.8% 61.5% Asset 4 Senior 04/16 82.0 81.4 L + 4.75% 6.09% 3 NY Industrial 75.9% 55.4% Asset 5 Senior 11/15 77.1 77.0 L + 4.20% 5.80% 3 NY Office 66.4% 68.7% Asset 6 Senior 10/16 73.8 73.0 L + 4.37% 5.85% 4 NC Office 72.4% 68.1% Asset 7 Senior 12/16 62.3 60.6 L + 4.11% 6.76% 4 FL Office 73.3% 63.2% Asset 8 Senior 01/17 51.1 50.4 L + 4.75% 6.90% 4 SC Office 67.6% 67.1% Asset 9 Senior 06/16 50.7 50.3 L + 4.49% 5.95% 4 HI Retail 76.2% 57.4% Asset 10 Mezzanine 03/15 45.9 45.9 L + 6.75% 7.94% 5 Multi-state Hotel 70.3% 63.5% Asset 11 Mezzanine 11/15 45.6 45.6 L + 7.25% 8.15% 3 Multi-state Office 77.6% 77.5% Asset 12 Senior 12/15 44.5 44.5 L + 4.65% 6.43% 4 PA Office 74.5% 67.5% Asset 13 Senior 12/15 43.5 43.5 L + 4.5% 5.61% 3 TX Multifamily 82.3% 76.8% Asset 14 Senior 04/16 43.5 43.0 L + 4.40% 6.11% 3 NY Office 66.9% 62.1% Asset 15 Senior 02/16 42.9 42.6 L + 4.30% 5.63% 3 TX Office 72.9% 70.4% Assets 16-40 Various Various 576.5 571.5 L + 5.21% 6.83% 4 Various Various 70.3% 62.7% Total/Weighted Average $ 1,560.0 $ 1,548.6 L + 4.78% 6.37% 4 70.6% 64.0%

Financing 25 (1) Weighted average of 3.0 years to maturity. (2) Includes FHLB advances of $2.5 billion with original maturities of 20 years. (3) Excludes FHLB membership and activity stock totaling $148.1 million. (4) Revolving credit facilities over-collateralized due to operational considerations. $ in millions Outstanding Borrowings and Maturities(1) Repurchase Agreements FHLB Advances Revolving Credit Facilities Convertible Notes Total Outstanding Borrowings Percent (%) Within 30 days $ 3,090.1 $ 60.0 $ — $ — $ 3,150.1 18.0% 30 to 59 days 2,232.0 163.0 — — 2,395.0 13.7% 60 to 89 days 2,993.3 — — — 2,993.3 17.1% 90 to 119 days 2,029.2 — — — 2,029.2 11.6% 120 to 364 days 3,080.8 — 15.0 — 3,095.8 17.7% One to three years 215.3 815.0 — — 1,030.3 5.9% Three to five years — — — 282.3 282.3 1.6% Ten years and over(2) — 2,533.8 — — 2,533.8 14.4% $ 13,640.7 $ 3,571.8 $ 15.0 $ 282.3 $ 17,509.7 100.0% Collateral Pledged for Borrowings(3) Repurchase Agreements FHLB Advances Revolving Credit Facilities(4) Convertible Notes Total Collateral Pledged Percent (%) Available-for-sale securities, at fair value $ 14,053.0 $ 3,096.8 $ — n/a $ 17,149.8 89.6% Derivative assets, at fair value 113.0 — — n/a 113.0 0.6% Commercial real estate assets 756.8 728.6 — n/a 1,485.4 7.8% Mortgage servicing rights, at fair value — — 175.4 n/a 175.4 0.9% Net economic interests in consolidated securitization trusts 215.5 2.0 — n/a 217.5 1.1% $ 15,138.3 $ 3,827.4 $ 175.4 n/a $ 19,141.1 100.0%

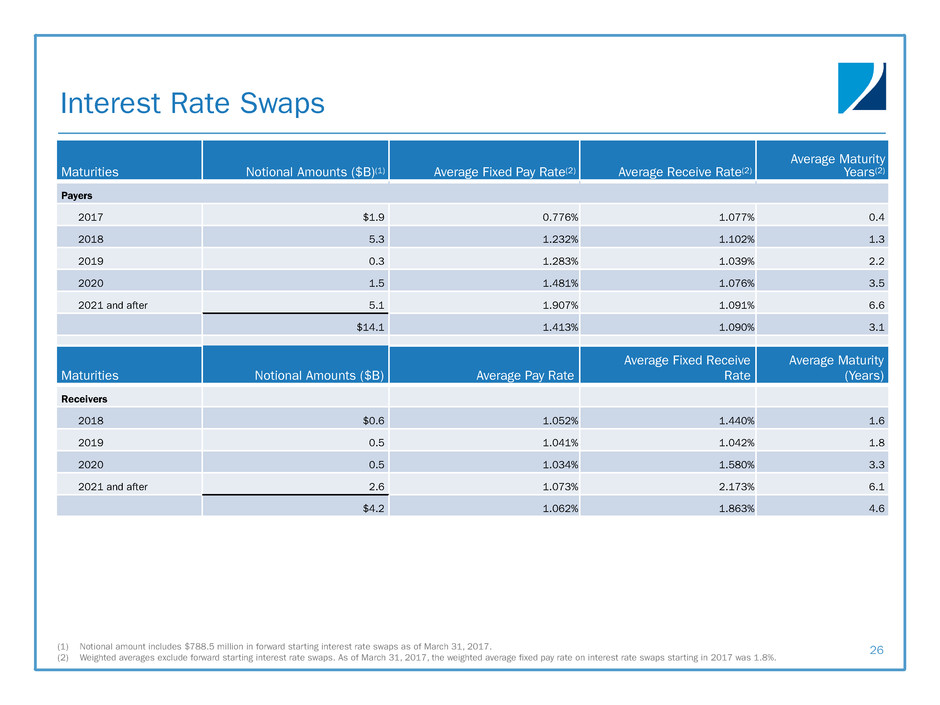

Maturities Notional Amounts ($B)(1) Average Fixed Pay Rate(2) Average Receive Rate(2) Average Maturity Years(2) Payers 2017 $1.9 0.776% 1.077% 0.4 2018 5.3 1.232% 1.102% 1.3 2019 0.3 1.283% 1.039% 2.2 2020 1.5 1.481% 1.076% 3.5 2021 and after 5.1 1.907% 1.091% 6.6 $14.1 1.413% 1.090% 3.1 Maturities Notional Amounts ($B) Average Pay Rate Average Fixed Receive Rate Average Maturity (Years) Receivers 2018 $0.6 1.052% 1.440% 1.6 2019 0.5 1.041% 1.042% 1.8 2020 0.5 1.034% 1.580% 3.3 2021 and after 2.6 1.073% 2.173% 6.1 $4.2 1.062% 1.863% 4.6 Interest Rate Swaps 26(1) Notional amount includes $788.5 million in forward starting interest rate swaps as of March 31, 2017. (2) Weighted averages exclude forward starting interest rate swaps. As of March 31, 2017, the weighted average fixed pay rate on interest rate swaps starting in 2017 was 1.8%.

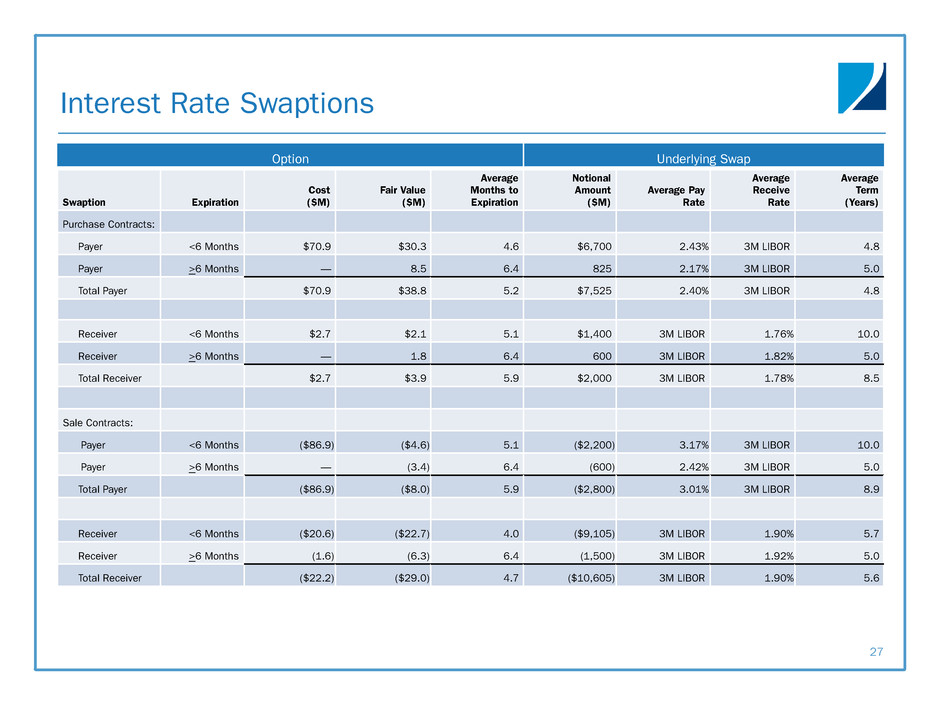

Interest Rate Swaptions 27 Option Underlying Swap Swaption Expiration Cost ($M) Fair Value ($M) Average Months to Expiration Notional Amount ($M) Average Pay Rate Average Receive Rate Average Term (Years) Purchase Contracts: Payer <6 Months $70.9 $30.3 4.6 $6,700 2.43% 3M LIBOR 4.8 Payer >6 Months — 8.5 6.4 825 2.17% 3M LIBOR 5.0 Total Payer $70.9 $38.8 5.2 $7,525 2.40% 3M LIBOR 4.8 Receiver <6 Months $2.7 $2.1 5.1 $1,400 3M LIBOR 1.76% 10.0 Receiver >6 Months — 1.8 6.4 600 3M LIBOR 1.82% 5.0 Total Receiver $2.7 $3.9 5.9 $2,000 3M LIBOR 1.78% 8.5 Sale Contracts: Payer <6 Months ($86.9) ($4.6) 5.1 ($2,200) 3.17% 3M LIBOR 10.0 Payer >6 Months — (3.4) 6.4 (600) 2.42% 3M LIBOR 5.0 Total Payer ($86.9) ($8.0) 5.9 ($2,800) 3.01% 3M LIBOR 8.9 Receiver <6 Months ($20.6) ($22.7) 4.0 ($9,105) 3M LIBOR 1.90% 5.7 Receiver >6 Months (1.6) (6.3) 6.4 (1,500) 3M LIBOR 1.92% 5.0 Total Receiver ($22.2) ($29.0) 4.7 ($10,605) 3M LIBOR 1.90% 5.6