Case 1:18-cv-11156 Document 1 Filed 06/01/18 Page 1 of 22 UNITED STATES DISTRICT COURT DISTRICT OF MASSACHUSETTS X FRAN STONE, Individually and on Behalf of ) All Others Similarly Situated, ) ) Plaintiff, ) ) Civil Action No. ___________ v. ) ) CYS INVESTMENTS, INC., KEVIN E. ) CLASS ACTION COMPLAINT FOR GRANT, TANYA S. BEDER, KAREN ) VIOLATIONS OF SECTIONS 14(a) AND HAMMOND, RAYMOND A. ) 20(a) OF THE SECURITIES EXCHANGE REDLINGSHAFER, JR., DALE A. REISS, ) ACT OF 1934 JAMES A. STERN, EIGER MERGER ) SUBSIDIARY LLC, and TWO HARBORS ) INVESTMENT CORP., ) ) JURY TRIAL DEMAND Defendants, ) CLASS ACTION COMPLAINT Plaintiff Fran Stone (“Plaintiff”), individually and on behalf of all others similarly situated, alleges the following upon information and belief, including investigation of counsel and review of publicly-available information, except as to those allegations pertaining to Plaintiff, which are alleged upon personal knowledge: NATURE OF THE ACTION 1. Plaintiff brings this class action on behalf of the public stockholders of CYS Investments, Inc. (“CYS” or the “Company”) against CYS’s Board of Directors (the “Board” or the “Individual Defendants”) for their violations of Section 14(a) and 20(a) of the Securities Exchange Act of 1934, 15.U.S.C. §§ 78n(a), 78t(a), and SEC Rule 14a-9, 17 C.F.R. 240.14a-9, arising out of the Board’s attempt to sell the Company to Two Harbors Investment Corp. through 1

Case 1:18-cv-11156 Document 1 Filed 06/01/18 Page 2 of 22 its wholly-owned subsidiary Eiger Merger Subsidiary LLC (collectively “Two Harbors”). 2. Defendants have violated the above-referenced Sections of the Exchange Act by causing a materially incomplete and misleading registration statement (the “S-4”) to be filed with the Securities and Exchange Commission (“SEC”) on May 25, 2018. The S-4 recommends that CYS stockholders vote in favor of a proposed transaction (the “Proposed Transaction”) whereby CYS is acquired by Two Harbors. The Proposed Transaction was first disclosed on April 26, 2018, when CYS and Two Harbors announced that they had entered into a definitive merger agreement (the “Merger Agreement”) pursuant to which Two Harbors will acquire all of the outstanding shares of common stock of CYS for approximately $7.79 per share in a mix of cash and Two Harbors stock (the “Merger Consideration”). 3. The Proposed Transaction is the product of an opportune decline in the Company’s stock price. Circumstances outside of the control of the Company depressed its stock price, and almost immediately other companies began their attempts to acquire CYS. A quick sales process led to the Merger Agreement, with a Merger Consideration that undervalues the Company. Indeed, the Company’s own financial advisors conducted analyses that found implied per share equity values of the Company as high as $8.98. 4. Furthermore, the S-4 is materially incomplete and contains misleading representations and information in violation of Sections 14(a) and 20(a) of the Exchange Act. Specifically, the S-4 contains materially incomplete and misleading information concerning the sales process, financial projections prepared by CYS management, as well as the financial analyses conducted by Barclays Capital Inc. (“Barclays”) and Credit Suisse Securities (USA) LLC (“Credit Suisse”), CYS’s financial advisors. 5. For these reasons, and as set forth in detail herein, Plaintiff seeks to enjoin 2

Case 1:18-cv-11156 Document 1 Filed 06/01/18 Page 3 of 22 Defendants from taking any steps to consummate the Proposed Transaction unless and until the material information discussed below is included in an amendment to the S-4 or otherwise disseminated to CYS’s stockholders. In the event the Proposed Transaction is consummated without the material omissions referenced below being remedied, Plaintiff seeks to recover damages resulting from the Defendants’ violations. PARTIES 6. Plaintiff is, and has been at all relevant times, the owner of shares of common stock of CYS. 7. Defendant CYS is a corporation organized and existing under the laws of the State of Maryland. The Company’s principal executive offices are located at 500 Totten Pond Road, 6th Floor, Waltham, Massachusetts 02451. CYS common stock trades on NYSE under the ticker symbol “CYS.” 8. Defendant Kevin E. Grant has been President, CEO, Chairman and a director of the Company since 2006. Defendant Grant founded the Company in 2006. 9. Defendant Tanya S. Beder has been a director of the Company since 2012. 10. Defendant Karen Hammond has been a director of the Company since 2014. 11. Defendant Raymond A. Redlingshafer, Jr. has been a director of the Company since 2006. 12. Defendant Dale A. Reiss has been a director of the Company since 2015. 13. Defendant James A. Stern has been a director of the Company since 2006. Defendant Stern serves as Lead Independent Director. 14. Defendants Grant, Beder, Hammond, Redlingshafer, Reiss and Stern are collectively referred to herein as the “Board.” 3

Case 1:18-cv-11156 Document 1 Filed 06/01/18 Page 4 of 22 15. Defendant Two Harbors Investment Corp. is a Maryland corporation with its principal executive offices located at 575 Lexington Avenue, Suite 2930, New York, New York 10022. 16. Defendant Eiger Merger Subsidiary LLC is a Maryland limited liability company and is a wholly owned subsidiary of Two Harbors Investment Corp. JURISDICTION AND VENUE 17. This Court has subject matter jurisdiction pursuant to Section 27 of the Exchange Act (15 U.S.C. § 78aa) and 28 U.S.C. § 1331 (federal question jurisdiction) as Plaintiff alleges violations of Section 14(a) and 20(a) of the Exchange Act and SEC Rule 14a-9. 18. Personal jurisdiction exists over each Defendant either because the Defendant conducts business in or maintains operations in this District, or is an individual who is either present in this District for jurisdictional purposes or has sufficient minimum contacts with this District as to render the exercise of jurisdiction over Defendant by this Court permissible under traditional notions of fair play and substantial justice. 19. Venue is proper in this District under Section 27 of the Exchange Act, 15 U.S.C. § 78aa, as well as under 28 U.S.C. § 1391, because: (i) the conduct at issue took place and had an effect in this District; (ii) CYS maintains its primary place of business in this District; (iii) a substantial portion of the transactions and wrongs complained of herein, including Defendants’ primary participation in the wrongful acts detailed herein, occurred in this District; and (iv) Defendants have received substantial compensation in this District by doing business here and engaging in numerous activities that had an effect in this District. 4

Case 1:18-cv-11156 Document 1 Filed 06/01/18 Page 5 of 22 CLASS ACTION ALLEGATIONS 20. Plaintiff brings this action on her own behalf and as a class action on behalf of all owners of CYS common stock and their successors in interest and/or their transferees, except Defendants and any person, firm, trust, corporation or other entity related to or affiliated with the Defendants (the “Class”). 21. This action is properly maintainable as a class action for the following reasons: (a) The Class is so numerous that joinder of all members is impracticable. As of April 25, 2018, CYS had approximately 155.4 million shares outstanding. (b) Questions of law and fact are common to the Class, including, inter alia, the following: (i) Whether Defendants have violated Section 14(a) of the Exchange Act and Rule 14a-9 promulgated thereunder; (ii) Whether the Individual Defendants have violated Section 20(a) of the Exchange Act; (iii) Whether Plaintiff and other members of the Class would suffer irreparable injury were Defendants not to file an amendment to the S-4 with the SEC that contained the material information referenced above and the Proposed Transaction is consummated as presently anticipated; (iv) Whether Plaintiff and the other members of the Class would be irreparably harmed were the transaction complained of herein consummated; and 5

Case 1:18-cv-11156 Document 1 Filed 06/01/18 Page 6 of 22 (v) whether the Class is entitled to injunctive relief or damages as a result of Individual Defendants’ wrongful conduct. (c) Plaintiff is committed to prosecuting this action, is an adequate representative of the Class, and has retained competent counsel experienced in litigation of this nature. (d) Plaintiff’s claims are typical of those of the other members of the Class. (e) Plaintiff has no interests that are adverse to the Class. (f) The prosecution of separate actions by individual members of the Class would create the risk of inconsistent or varying adjudications for individual members of the Class and of establishing incompatible standards of conduct for the party opposing the Class. (g) Conflicting adjudications for individual members of the Class might as a practical matter be dispositive of the interests of the other members not parties to the adjudications or substantially impair or impede their ability to protect their interests. (h) Plaintiff anticipates that there will be no difficulty in the management of this litigation. A class action is superior to other available methods for the fair and efficient adjudication of this controversy. FURTHER SUBSTANTIVE ALLEGATIONS A. CYS Agrees to Sell the Company at a Discount 22. CYS is a real estate investment trust (“REIT”) that invests in residential mortgage-backed securities with the principal and interest guaranteed by a federally chartered corporation, such as the Federal National Mortgage Association, Federal Home Loan Mortgage Corporation, or an agency of the U.S. government, such as the Government National Mortgage Association. The Company also invests in debt securities issued by the U.S Department of the Treasury (“Treasury”) or a government-sponsored entity. 6

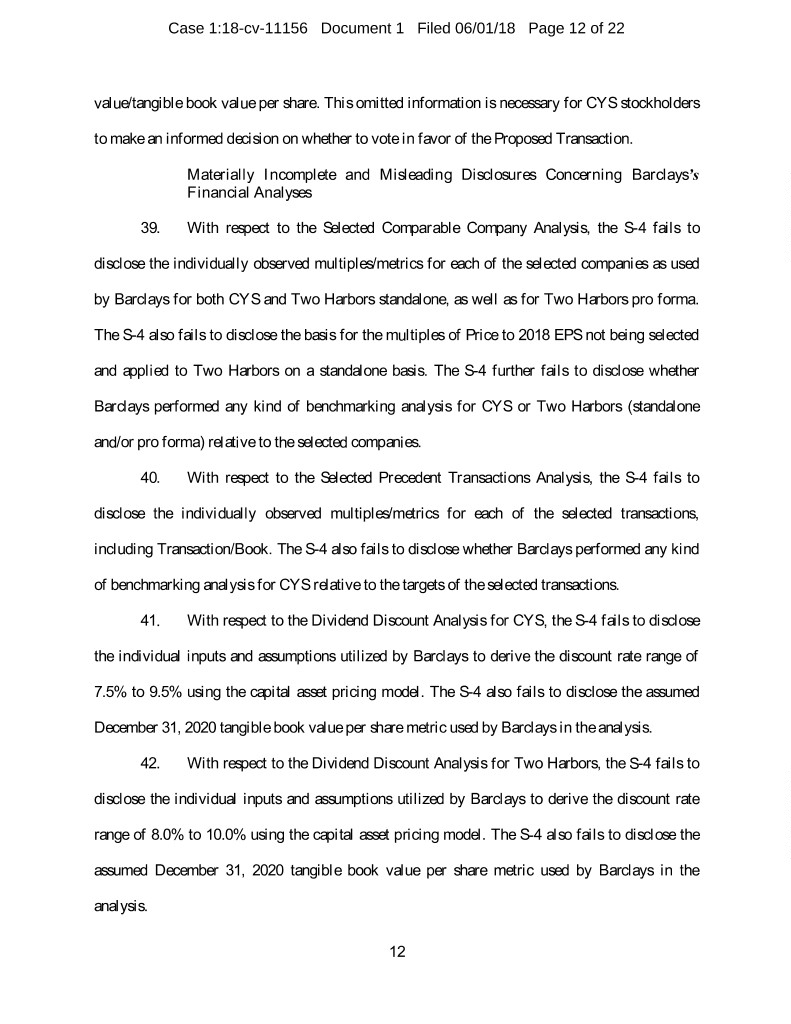

Case 1:18-cv-11156 Document 1 Filed 06/01/18 Page 7 of 22 23. As demonstrated by the following chart, the Company’s stock traded above $7.50 per share until January 17, 2018, when the stock fell approximately 16% to a low of $6.37 per share at close on February 9, 2018. 9 8.5 8 7.5 7 6.5 6 5.5 5 11/1/2017 12/1/2017 1/1/2018 2/1/2018 3/1/2018 4/1/2018 24. No negative financial results were released during that time, nor any other negative news about CYS. Instead, the stock price fell because of various uncontrollable forces. The downward trend began in December 2017, when the yield on 10-year Treasury bonds increased by 10 basis points. Many REITs like CYS saw a corresponding dip in their stock prices. Stock prices fell even more in January 2018 as the market speculated that interest rates would increase quicker than expected. The decrease continued at the end of January 2018, when the Federal Reserve essentially announced an increase in interest rates in March 2018. 25. At the same time that CYS saw its stock price declining, other companies saw an opportunity. Unsolicited, on February 8, 2018 Company C sent Defendant Grant a proposal to acquire CYS. About two weeks later, Company B similarly sent an unsolicited acquisition proposal to Defendant Grant. On February 27 and 28, 2018, Barclays and Credit Suisse reached out to six other mortgage REITs about their interest in a transaction with CYS; five entered into 7

Case 1:18-cv-11156 Document 1 Filed 06/01/18 Page 8 of 22 non-disclosure agreements with CYS and three submitted proposals to acquire CYS. 26. On March 9, 2018, CYS’ common stock closed at $6.49 per share. Three companies submitted preliminary proposals to acquire CYS, in addition to the proposal submitted by Company C on February 8, 2018. Company B proposed an all-cash tender offer with a purchase price of $7.27 per share. Company C proposed an all-stock merger with a purchase price of $7.33 to $7.47 per share. Company D proposed an all-stock merger with a purchase price of $7.42 per share. Company E proposed a part-cash, part-stock merger with a purchase price of $7.15 per share. And Two Harbors proposed an all-stock merger with a purchase price of $7.33 per share. Company B indicated its willingness to pay up to 50% of merger consideration in common stock, but demanded access to CYS’s virtual data room (to which Company C already had access). CYS appears to have denied that request, and Company B was removed from the process. Instead, CYS determined to allow Two Harbors and Company C to move forward, despite Company D’s offering a higher price than Two Harbors. The special committee decided to enter into an exclusivity agreement with Two Harbors after Company C revised its offer downward, never discussing whether to go back to Company D. 27. On April 26, 2018, the Board entered into the Merger Agreement with Two Harbors. 28. The analyses of the Company’s financial advisors illustrate that the Merger Consideration does not reflect a fair price. For example, Barclays’s Selected Comparable Company Analysis for CYS implied a per share equity value as high as $8.80, the Dividend Discount Analysis for CYS implied a per share equity value as high as $8.30, and its consideration of CYS’s historical trading implied a per share equity value as high as $8.98. And Credit Suisse’s Dividend Discount Analysis for CYS implied a per share equity value as high as 8

Case 1:18-cv-11156 Document 1 Filed 06/01/18 Page 9 of 22 $8.36. Both Barclays and Credit Suisse calculated that the Merger Consideration implied a per share value for CYS of $7.75. B. The Preclusive Deal Protection Devices 29. As part of the Merger Agreement, Defendants agreed to certain preclusive deal protection devices that ensure that no competing offers for the Company will emerge. 30. By way of example, section 6.3(b) of the Merger Agreement includes a “no solicitation” provision barring the Company from soliciting or encouraging the submission of an acquisition proposal. Section 6.3(a) demands that the Company cease and terminate all solicitations, discussions or negotiations with any party concerning an acquisition proposal. 31. Despite already locking up the Proposed Transaction by agreeing not to solicit alternative bids, the Board consented to additional provisions in the Merger Agreement that further guarantee the Company’s only suitor will be Two Harbors. For example, pursuant to section 6.3(c) of the Merger Agreement, the Company must notify Two Harbors of any offer, indication of interest, or request for information made by an unsolicited bidder. Thereafter, should the Board determine that the unsolicited offer is superior, section 6.3(e) requires that the Board grant Two Harbors three (3) business days to negotiate the terms of the Merger Agreement to render the superior proposal no longer superior. Two Harbors is able to match the unsolicited offer because, pursuant to section 6.3(c) of the Merger Agreement, the Company must provide Two Harbors with the material terms of the superior proposal, eliminating any leverage that the Company has in receiving the unsolicited offer. 32. In other words, the Merger Agreement gives Two Harbors access to any rival bidder’s information and allows Two Harbors a free right to top any superior offer. Accordingly, no rival bidder is likely to emerge and act as a stalking horse for CYS, because the Merger 9

Case 1:18-cv-11156 Document 1 Filed 06/01/18 Page 10 of 22 Agreement unfairly assures that any “auction” will favor Two Harbors and allow Two Harbors to piggy-back upon the due diligence of the foreclosed second bidder. 33. In addition, pursuant to section 8.3(b) of the Merger Agreement, CYS must pay Two Harbors a termination fee of $43.2 million if the Company decides to pursue another offer, thereby essentially requiring that the alternate bidder agree to pay a naked premium for the right to provide the stockholders with a superior offer. 34. Ultimately, these preclusive deal protection provisions restrain the Company’s ability to solicit or engage in negotiations with any third party regarding a proposal to acquire all or a significant interest in the Company. The circumstances under which the Board may respond to an unsolicited written bona fide proposal for an alternative acquisition that constitutes or would reasonably be expected to constitute a superior proposal are too narrowly circumscribed to provide an effective “fiduciary out” under the circumstances. Likewise, these provisions also foreclose any likely alternate bidder from providing the needed market check of Two Harbors’s inadequate offer price. C. The Materially Incomplete and Misleading S-4 35. The Individual Defendants owe the stockholders a duty of candor. They must disclose all material information regarding the Proposed Transaction to CYS stockholders so that they can make a fully informed decision whether to vote in favor of the Proposed Transaction. 36. On May 25, 2018, Defendants filed the S-4 with the SEC. The purpose of the S-4 is, inter alia, to provide the Company’s stockholders with all material information necessary for them to make an informed decision on whether to vote their shares in favor of the Proposed Transaction. However, significant and material facts were not provided to Plaintiff and the Class. Without such information, CYS stockholders cannot make a fully informed decision concerning 10

Case 1:18-cv-11156 Document 1 Filed 06/01/18 Page 11 of 22 whether or not to vote in favor of the Proposed Transaction. Materially Misleading Statements/Omissions Regarding the Management- Prepared Financial Forecasts 37. The S-4 discloses management-prepared financial projections for the Company which are materially misleading. The S-4 indicates that in connection with the rendering of Barclays’s fairness opinion, Barclays reviewed “and analyzed financial and operating information with respect to the business, operations and prospects of CYS furnished to Barclays by CYS, including financial projections of CYS prepared by CYS's management furnished to Barclays by CYS.” In connection with the rendering of its fairness opinion, Credit Suisse reviewed “financial forecasts relating to CYS for the fiscal years ending December 31, 2018 through December 31, 2020 (which are referred to in this section as the ‘CYS Projections’) prepared and provided to Credit Suisse by the management of CYS.” Accordingly, the S-4 should have, but failed to, provide certain information in the projections that CYS’s management provided to the Board as well as Barclays and Credit Suisse. 38. Defendants failed to disclose the financial projections for CYS for 2018 to 2020 for: (a) interest income; (b) interest expense; (c) other income (loss); (d) compensation and benefits; (e) general, administrative and other; (f) dividends on preferred stock; (g) net income to common; (h) share based compensation; (i) book value/book value per share; and (j) tangible book value/tangible book value per share. Defendants also failed to disclose the financial projections for Two Harbors for 2018 to 2020 for: (a) interest income; (b) interest expense; (c) other income (loss); (d) management fees; (e) servicing expenses; (f) other operating expenses; (g) provision for income taxes; (h) dividends on preferred stock; (i) net income to common; (j) equity based compensation; (k) book value/book value per share; and (l) tangible book 11

Case 1:18-cv-11156 Document 1 Filed 06/01/18 Page 12 of 22 value/tangible book value per share. This omitted information is necessary for CYS stockholders to make an informed decision on whether to vote in favor of the Proposed Transaction. Materially Incomplete and Misleading Disclosures Concerning Barclays’s Financial Analyses 39. With respect to the Selected Comparable Company Analysis, the S-4 fails to disclose the individually observed multiples/metrics for each of the selected companies as used by Barclays for both CYS and Two Harbors standalone, as well as for Two Harbors pro forma. The S-4 also fails to disclose the basis for the multiples of Price to 2018 EPS not being selected and applied to Two Harbors on a standalone basis. The S-4 further fails to disclose whether Barclays performed any kind of benchmarking analysis for CYS or Two Harbors (standalone and/or pro forma) relative to the selected companies. 40. With respect to the Selected Precedent Transactions Analysis, the S-4 fails to disclose the individually observed multiples/metrics for each of the selected transactions, including Transaction/Book. The S-4 also fails to disclose whether Barclays performed any kind of benchmarking analysis for CYS relative to the targets of the selected transactions. 41. With respect to the Dividend Discount Analysis for CYS, the S-4 fails to disclose the individual inputs and assumptions utilized by Barclays to derive the discount rate range of 7.5% to 9.5% using the capital asset pricing model. The S-4 also fails to disclose the assumed December 31, 2020 tangible book value per share metric used by Barclays in the analysis. 42. With respect to the Dividend Discount Analysis for Two Harbors, the S-4 fails to disclose the individual inputs and assumptions utilized by Barclays to derive the discount rate range of 8.0% to 10.0% using the capital asset pricing model. The S-4 also fails to disclose the assumed December 31, 2020 tangible book value per share metric used by Barclays in the analysis. 12

Case 1:18-cv-11156 Document 1 Filed 06/01/18 Page 13 of 22 Materially Incomplete and Misleading Disclosures Concerning Credit Suisse’s Financial Analyses 43. With respect to the Selected Companies Analysis for CYS, the S-4 fails to disclose the individually observed multiples/metrics for each of the selected companies, including price to TBVPS. The S-4 also fails to disclose whether Credit Suisse performed any kind of benchmarking analysis for CYS relative to the selected companies. 44. With respect to the Selected Companies Analysis for Two Harbors, the S-4 fails to disclose the individually observed multiples/metrics for each of the selected companies, including price to TBVPS. The S-4 also fails to disclose whether Credit Suisse performed any kind of benchmarking analysis for Two Harbors relative to the selected companies. 45. With respect to the Selected Precedent Transactions Analysis, the S-4 fails to disclose the individually observed multiples/metrics for each of the selected comparable transactions, including price to TBVPS. The S-4 also does not disclose whether Credit Suisse performed any kind of benchmarking analysis for either CYS or Two Harbors relative to the targets of the selected transactions. 46. With respect to the Dividend Discount Analysis for CYS, the S-4 fails to disclose the individual inputs and assumptions utilized by Credit Suisse to derive the discount rate range of 7.25% to 13.75%. The S-4 also fails to disclose the assumed December 31, 2020 tangible book value per share metric used by Credit Suisse in the analysis. 47. With respect to the Dividend Discount Analysis for Two Harbors, the S-4 fails to disclose the individual inputs and assumptions utilized by Credit Suisse to derive the discount rate range of 7.0% to 15.0%. The S-4 also fails to disclose the assumed December 31, 2020 tangible book value per share metric used by Barclays in the analysis. 13

Case 1:18-cv-11156 Document 1 Filed 06/01/18 Page 14 of 22 Materially Incomplete and Misleading Disclosures Concerning the Flawed Process 48. The S-4 also fails to disclose material information concerning the sales process. For example, the S-4 fails to state whether the confidentiality agreements CYS entered into with seven parties (other than Two Harbors) are still in effect and/or contain DADW standstill provisions that are presently precluding each and every of these parties from making a topping bid for the Company. 49. The disclosure of the terms of any standstill provisions is crucial to CYS stockholders being fully informed of whether their fiduciaries have put in place restrictive devices to foreclose a topping bid for the Company. This information is especially important where, as here, the S-4 is silent as to whether any standstill agreements have been waived. Six other parties had indicated interest in a transaction with CYS, including Company D, whose proposal originally indicated a higher merger consideration as of March 19, 2018. Yet the S-4 is silent as to whether Company D may now be foreclosed from making a superior proposal. 50. In addition, section 6.3(a) of the Merger Agreement prohibits the Board from waiving any previously executed standstill agreement (the “Anti-Waiver Provision”). Whether the Board agreed to that provision knowing that agreements with Company D, or any other party, contained a standstill agreement, must be disclosed to CYS stockholders before they decide on voting for or against the Proposed Transaction. 51. The S-4 fails to disclose the fees that Barclays has earned from services provided to Two Harbors, stating only that Barclays “has received, and expects to receive, customary fees for such services.” Without this information, stockholders will not know if there were biases or conflicts that permeated Barclays’s advice to the Board and/or the special committee and stockholders cannot know what credence, if any, to give to Barclay’s opinion. 14

Case 1:18-cv-11156 Document 1 Filed 06/01/18 Page 15 of 22 52. The Company received a number of indications of interest from 2016 through the time that the Merger Agreement was signed. However, the S-4 does not disclose details of those indications of interest, including the indication of interest sent by Company B to Defendant Grant in 2016, the indication of interest sent to Defendant Grant by Company C on February 8, 2018, the indication of interest sent to Defendant Grant by Company B on February 21, 2018, the indications of interest received around March 12, 2018 by Company D, Company E and Two Harbors, and the revised indication of interest by Company C received on March 20, 2018. Similarly, the S-4 fails to disclose the details of the revisions of the draft merger agreement as submitted by Company C on April 11, 2018 that effectively reduced its per share offer price. 53. Throughout the sales process, Barclays and Credit Suisse provided the Board and the special committee with their preliminary analyses of the indications of interest. However, those analyses have not been disclosed to the stockholders, including the preliminary financial analyses of a transaction with Company C as discussed at the February 13, 2018 Board meeting, the preliminary financial analyses of Company C’s proposal as discussed at the February 16, 2018 meeting of the special committee, the preliminary financial analyses of the indications of interest made by Company B, Company C, Company D, Company E and Two Harbors as discussed with the special committee on March 14, 2018, the preliminary financial analyses of “each bid” as discussed at the April 5, 2018 Board meeting, and the preliminary financial analyses of the Proposed Transaction as discussed at the Board meeting on April 25, 2018. These preliminary analyses are important to stockholders, as they are indicative of whether the financial advisors revised their own estimates of the Company’s value and whether another transaction offered better value to the stockholders. 15

Case 1:18-cv-11156 Document 1 Filed 06/01/18 Page 16 of 22 54. As the special committee considered which parties should move forward in the sales process, it discussed “significant concessions” made by certain parties to the draft merger agreement as of April 4, 2018. However, the S-4 does not disclose which parties and what “significant concessions” were made. This information will help stockholders determine whether the special committee favored a transaction with Two Harbors or whether the Proposed Transaction provides the best value for stockholders. 55. Towards the end of the sales process, the Board discussed financial projections prepared by CYS’s management, specifically at meetings on April 13, 2018 and April 17, 2018. The S-4 does not disclose whether those projections had been provided to any of the parties in the sales process, whether the projections had changed and, if so how, between April 13 and April 17, 2018, and whether the projections deemed “reasonable on April 17, 2018 were the projections utilized by Barclays and Credit Suisse for their fairness opinions. 56. This information is necessary to provide Company stockholders a complete and accurate picture of the sales process and its fairness. Without this information, stockholders were not fully informed as to the defendants’ actions, including those that may have been taken in bad faith, and cannot fairly assess the process. And without all material information, CYS stockholders are unable to make a fully informed decision in connection with the Proposed Transaction and face irreparable harm, warranting the injunctive relief sought herein. 57. In addition, the Individual Defendants knew or recklessly disregarded that the S-4 omits the material information concerning the Proposed Transaction and contains the materially incomplete and misleading information discussed above. 58. Specifically, the Individual Defendants undoubtedly reviewed the contents of the S-4 before it was filed with the SEC. Indeed, as directors of the Company, they were required to 16

Case 1:18-cv-11156 Document 1 Filed 06/01/18 Page 17 of 22 do so. The Individual Defendants thus knew or recklessly disregarded that the S-4 omits the material information referenced above and contains the incomplete and misleading information referenced above. 59. Further, the S-4 indicates that on April 25, 2018, Barclays and Credit Suisse reviewed with the Board their financial analyses of the Merger Consideration and delivered to the Board their oral opinions, which were confirmed by delivery of written opinions of the same date, to the effect that the Merger Consideration was fair, from a financial point of view, to CYS stockholders. Accordingly, the Individual Defendants undoubtedly reviewed or were presented with the material information concerning Barclays’s and Credit Suisse’s financial analyses which has been omitted from the S-4, and thus knew or should have known that such information has been omitted. 60. Plaintiff and the other members of the Class are immediately threatened by the wrongs complained of herein, and lack an adequate remedy at law. Accordingly, Plaintiff seeks injunctive and other equitable relief to prevent the irreparable injury that the Company’s stockholders will continue to suffer absent judicial intervention. CLAIMS FOR RELIEF COUNT I On Behalf of Plaintiff and the Class Against All Defendants for Violations of Section 14(a) of the Exchange Act and Rule 14a-9 61. Plaintiff incorporates each and every allegation set forth above as if fully set forth herein. 62. Defendants have filed the S-4 with the SEC with the intention of soliciting CYS stockholder support for the Proposed Transaction. Each of the Individual Defendants reviewed and authorized the dissemination of the S-4, which fails to provide the material information 17

Case 1:18-cv-11156 Document 1 Filed 06/01/18 Page 18 of 22 referenced above. 63. In so doing, Defendants made materially incomplete and misleading statements and/or omitted material information necessary to make the statements made not misleading. Each of the Individual Defendants, by virtue of their roles as officers and/or directors of CYS, were aware of the omitted information but failed to disclose such information, in violation of Section 14(a). 64. Rule 14a-9, promulgated by the SEC pursuant to Section 14(a) of the Exchange Act, provides that such communications with stockholders shall not contain “any statement which, at the time and in the light of the circumstances under which it is made, is false or misleading with respect to any material fact, or which omits to state any material fact necessary in order to make the statements therein not false or misleading.” 17 C.F.R. § 240.14a-9. 65. Specifically, and as detailed above, the S-4 violates Section 14(a) and Rule 14a-9 because it omits material facts concerning: (i) management’s financial projections; (ii) the value of CYS shares and the financial analyses performed by Barclays and Credit Suisse in support of their fairness opinions; and (iii) the sales process. 66. Moreover, in the exercise of reasonable care, the Individual Defendants knew or should have known that the S-4 is materially misleading and omits material information that is necessary to render it not misleading. The Individual Defendants undoubtedly reviewed and relied upon the omitted information identified above in connection with their decision to approve and recommend the Proposed Transaction; indeed, the S-4 states that Barclays and Credit Suisse reviewed and discussed their financial analyses with the Board during various meetings including on April 25, 2018, and further states that the Board relied upon Barclays’s and Credit Suisse’s financial analyses and fairness opinions in connection with approving the Proposed 18

Case 1:18-cv-11156 Document 1 Filed 06/01/18 Page 19 of 22 Transaction. The Individual Defendants knew or should have known that the material information identified above has been omitted from the S-4, rendering the sections of the S-4 identified above to be materially incomplete and misleading. 67. The misrepresentations and omissions in the S-4 are material to Plaintiff and the Class, who will be deprived of their right to cast an informed vote if such misrepresentations and omissions are not corrected prior to the vote on the Proposed Transaction. Plaintiff and the Class have no adequate remedy at law. Only through the exercise of this Court’s equitable powers can Plaintiff and the Class be fully protected from the immediate and irreparable injury that Defendants’ actions threaten to inflict. COUNT II On Behalf of Plaintiff and the Class against the Individual Defendants for Violations of Section 20(a) of the Exchange Act 68. Plaintiff incorporates each and every allegation set forth above as if fully set forth herein. 69. The Individual Defendants acted as controlling persons of CYS within the meaning of Section 20(a) of the Exchange Act as alleged herein. By virtue of their positions as officers and/or directors of CYS and participation in and/or awareness of the Company’s operations and/or intimate knowledge of the incomplete and misleading statements contained in the S-4 filed with the SEC, they had the power to influence and control and did influence and control, directly or indirectly, the decision making of the Company, including the content and dissemination of the various statements that Plaintiff contends are materially incomplete and misleading. 70. Each of the Individual Defendants was provided with or had unlimited access to copies of the S-4 and other statements alleged by Plaintiff to be misleading prior to the time the 19

Case 1:18-cv-11156 Document 1 Filed 06/01/18 Page 20 of 22 S-4 was filed with the SEC and had the ability to prevent the issuance of the statements or cause the statements to be corrected. 71. In particular, each of the Individual Defendants had direct and supervisory involvement in the day-to-day operations of the Company, and, therefore, is presumed to have had the power to control or influence the particular transactions giving rise to the Exchange Act violations alleged herein, and exercised the same. The omitted information identified above was reviewed by the Board prior to voting on the Proposed Transaction. The S-4 at issue contains the unanimous recommendation of each of the Individual Defendants to approve the Proposed Transaction. They were, thus, directly involved in the making of the S-4. 72. In addition, as the S-4 sets forth at length, and as described herein, the Individual Defendants were involved in negotiating, reviewing, and approving the Merger Agreement. The S-4 purports to describe the various issues and information that the Individual Defendants reviewed and considered. The Individual Defendants participated in drafting and/or gave their input on the content of those descriptions. 73. By virtue of the foregoing, the Individual Defendants have violated Section 20(a) of the Exchange Act. 74. As set forth above, the Individual Defendants had the ability to exercise control over and did control a person or persons who have each violated Section 14(a) and Rule 14a-9, by their acts and omissions as alleged herein. By virtue of their positions as controlling persons, these defendants are liable pursuant to Section 20(a) of the Exchange Act. As a direct and proximate result of Individual Defendants’ conduct, Plaintiff and the Class will be irreparably harmed. 20

Case 1:18-cv-11156 Document 1 Filed 06/01/18 Page 21 of 22 RELIEF REQUESTED WHEREFORE, Plaintiff demands injunctive relief in her favor and in favor of the Class and against the Defendants jointly and severally, as follows: A. Declaring that this action is properly maintainable as a Class Action and certifying Plaintiff as Class Representative and her counsel as Class Counsel; B. Preliminarily and permanently enjoining Defendants and their counsel, agents, employees and all persons acting under, in concert with, or for them, from filing an amendment to the S-4 with the SEC or otherwise disseminating an amendment to the S-4 to CYS stockholders unless and until Defendants agree to include the material information identified above; C. Preliminarily and permanently enjoining Defendants and their counsel, agents, employees and all persons acting under, in concert with, or for them, from proceeding with, consummating, or closing the Proposed Transaction, unless and until Defendants disclose the material information identified above which has been omitted from the S-4; D. In the event that the transaction is consummated prior to the entry of this Court’s final judgment, rescinding it or awarding Plaintiff and the Class rescissory damages; E. Directing the Defendants to account to Plaintiff and the Class for all damages suffered as a result of their wrongdoing; F. Awarding Plaintiff the costs and disbursements of this action, including reasonable attorneys’ and expert fees and expenses; and G. Granting such other and further equitable relief as this Court may deem just and proper. 21

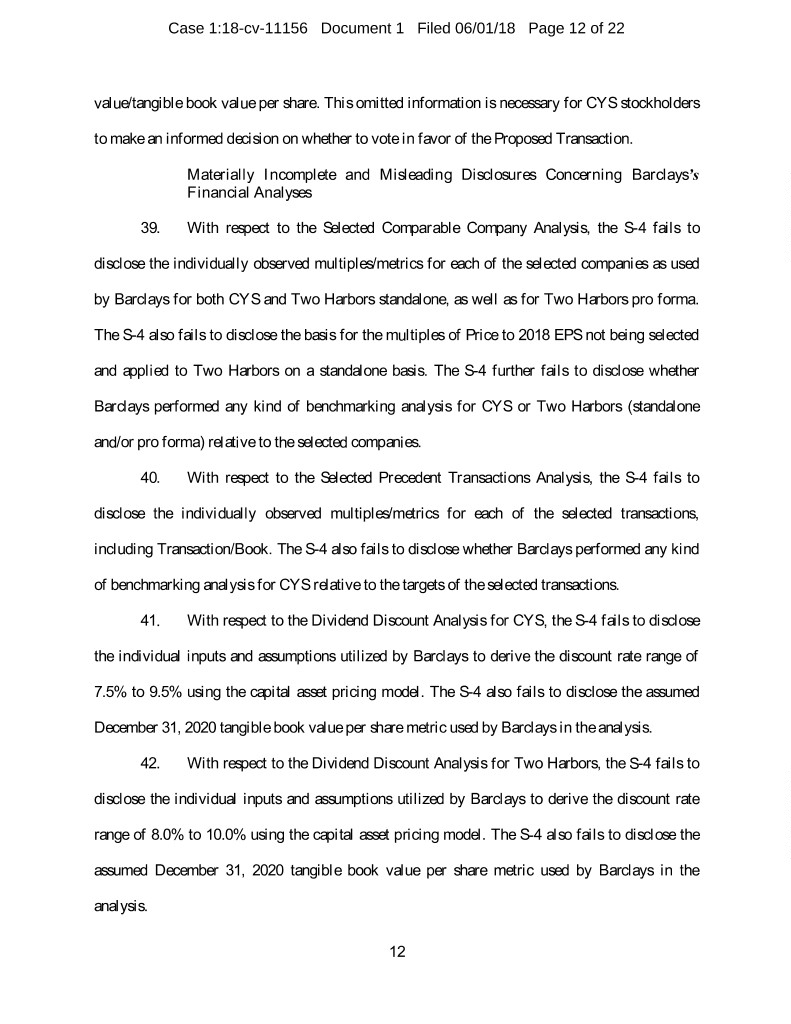

Case 1:18-cv-11156 Document 1 Filed 06/01/18 Page 22 of 22 JURY DEMAND Plaintiff demands a trial by jury. Dated: June 1, 2018 HUTCHINGS BARSAMIAN MANDELCORN, LLP /s/Theodore M. Hess-Mahan Theodore M. Hess-Mahan, BBO #557109 110 Cedar Street, Suite 250 Wellesley Hills, MA 02481 Tel: (781) 431-2231 Fax: (781) 431-8726 thess-mahan@hutchingsbarsamian.com OF COUNSEL: ROWLEY LAW PLLC Shane T. Rowley Danielle Rowland Lindahl 50 Main Street, Suite 1000 White Plains, NY 10606 Tel: (914) 400-1920 Fax: (914) 301-3514 22