An MSR-Focused REIT Fourth Quarter 2024 Earnings Call Presentation January 30, 2025

Safe Harbor Statement 2 FORWARD-LOOKING STATEMENTS This presentation of Two Harbors Investment Corp., or TWO, includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ from expectations, estimates and projections and, consequently, readers should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “target,” “assume,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believe,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from expected results, including, among other things, those described in our Annual Report on Form 10-K for the year ended December 31, 2023, and any subsequent Quarterly Reports on Form 10-Q, under the caption “Risk Factors.” Factors that could cause actual results to differ include, but are not limited to: the state of credit markets and general economic conditions; changes in interest rates and the market value of our assets; changes in prepayment rates of mortgages underlying our target assets; the rates of default or decreased recovery on the mortgages underlying our target assets; declines in home prices; our ability to establish, adjust and maintain appropriate hedges for the risks in our portfolio; the availability and cost of our target assets; the availability and cost of financing; changes in the competitive landscape within our industry; our ability to effectively execute and to realize the benefits of strategic transactions and initiatives we have pursued or may in the future pursue; our ability to recognize the benefits of our acquisition of RoundPoint Mortgage Servicing LLC and to manage the risks associated with operating a mortgage loan servicer and originator; our decision to terminate our management agreement with PRCM Advisers LLC and the ongoing litigation related to such termination; our ability to manage various operational risks and costs associated with our business; interruptions in or impairments to our communications and information technology systems; our ability to acquire mortgage servicing rights (MSR) and to maintain our MSR portfolio; our exposure to legal and regulatory claims; legislative and regulatory actions affecting our business; our ability to maintain our REIT qualification; and limitations imposed on our business due to our REIT status and our exempt status under the Investment Company Act of 1940. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. TWO does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statement to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Additional information concerning these and other risk factors is contained in TWO’s most recent filings with the Securities and Exchange Commission (SEC). All subsequent written and oral forward- looking statements concerning TWO or matters attributable to TWO or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. This presentation may include industry and market data obtained through research, surveys, and studies conducted by third parties and industry publications. We have not independently verified any such market and industry data from third-party sources. This presentation is provided for discussion purposes only and may not be relied upon as legal or investment advice, nor is it intended to be inclusive of all the risks and uncertainties that should be considered. This presentation does not constitute an offer to purchase or sell any securities, nor shall it be construed to be indicative of the terms of an offer that the parties or their respective affiliates would accept. Readers are advised that the financial information in this presentation is based on company data available at the time of this presentation and, in certain circumstances, may not have been audited by the company’s independent auditors.

Book Value per Share $14.47 Common Stock Dividend $0.45 Economic Return on Book Value(1) 0.0% Comprehensive Loss per Share $(0.03) Investment Portfolio(2) $14.8b Quarter-End Economic Debt-to-Equity(3) 6.5x Note: Financial data throughout this presentation is as of or for the quarter ended December 31, 2024, unless otherwise noted. Per share metrics utilize basic common shares as the denominator. The End Notes are an integral part of this presentation. See slides 29 through 33 at the back of this presentation for information related to certain financial metrics and defined terms used herein. Quarterly Financials Overview 3

4 I. FED FUND RATE EXPECTATIONS(1) Markets Overview II. QUARTERLY YIELD CURVE CHANGE(2) THE FED AND MARKET REMAIN KEENLY FOCUSED ON INFLATION DATA • The Federal Reserve (Fed) cut the federal funds target rate by 50 basis points in the quarter, bringing the total to 100 basis points of rate cuts in 2024 • Hawkish comments at the Fed’s December meeting tempered rate expectations for 2025, with market expectations for additional cuts going from 4.5 at the beginning of the fourth quarter to 1.5 by quarter-end • The yield curve bear steepened on the heels of the US presidential election, led by expectations for expansionary fiscal policy and the economic impacts from tariffs +92bps 2yr Tsy +60bps 10yr Tsy +79bps

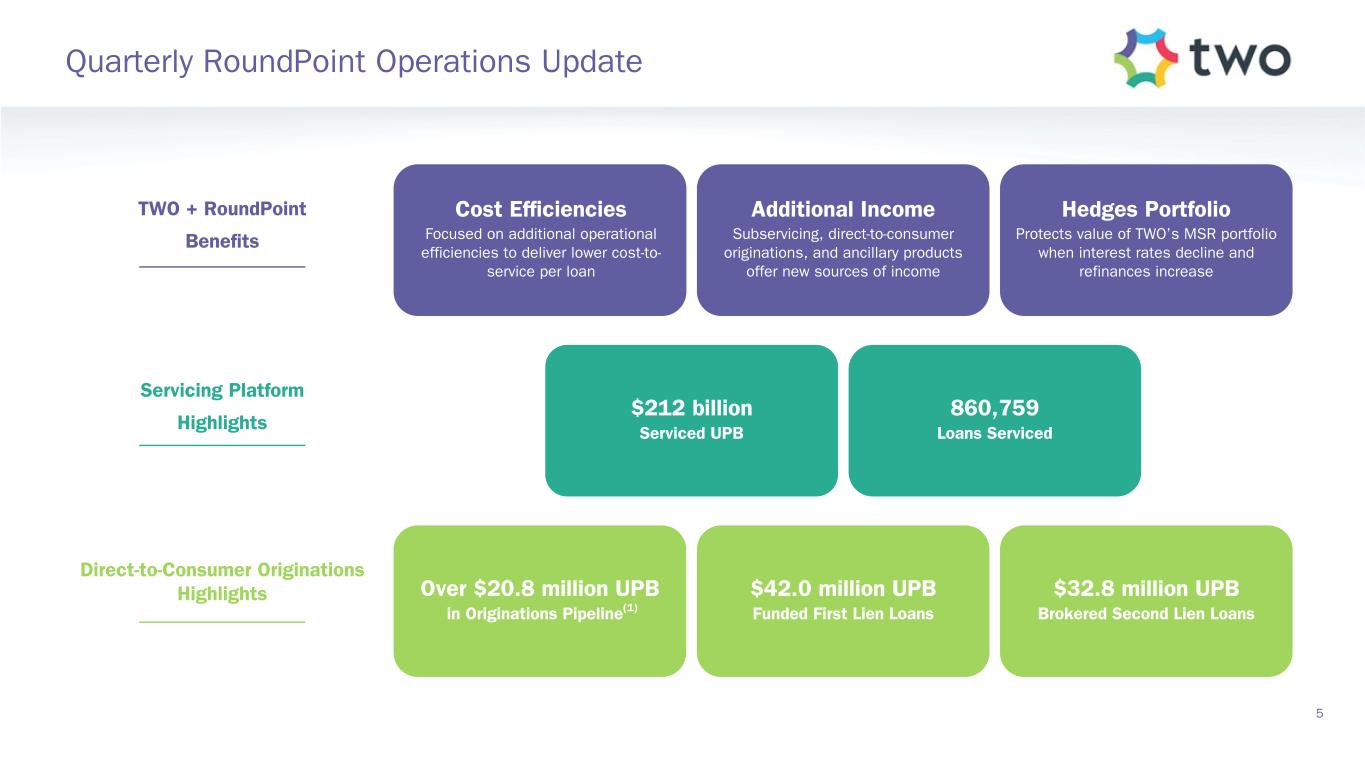

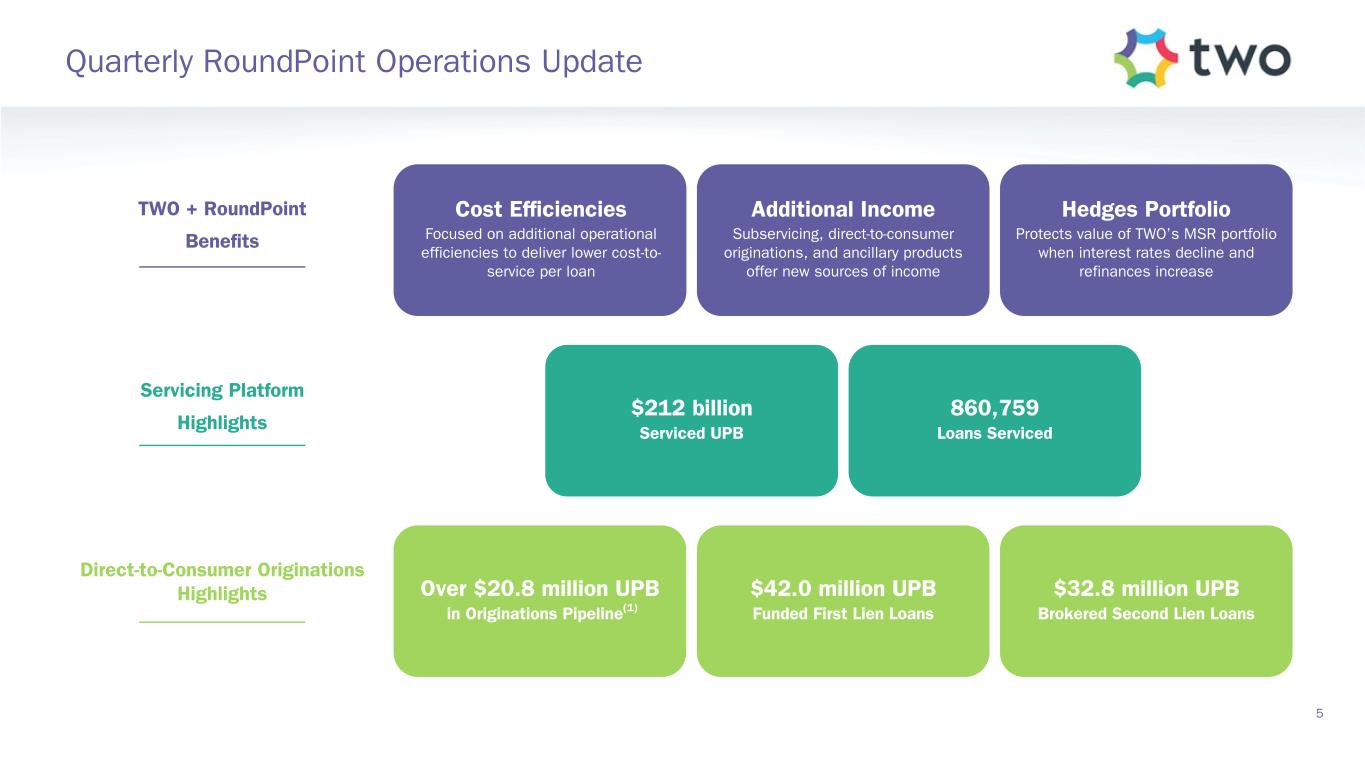

Over $20.8 million UPB in Originations Pipeline(1) $212 billion Serviced UPB 860,759 Loans Serviced Hedges Portfolio Protects value of TWO’s MSR portfolio when interest rates decline and refinances increase Cost Efficiencies Focused on additional operational efficiencies to deliver lower cost-to- service per loan Additional Income Subservicing, direct-to-consumer originations, and ancillary products offer new sources of income Quarterly RoundPoint Operations Update 5 $42.0 million UPB Funded First Lien Loans Direct-to-Consumer Originations Highlights Servicing Platform Highlights TWO + RoundPoint Benefits $32.8 million UPB Brokered Second Lien Loans

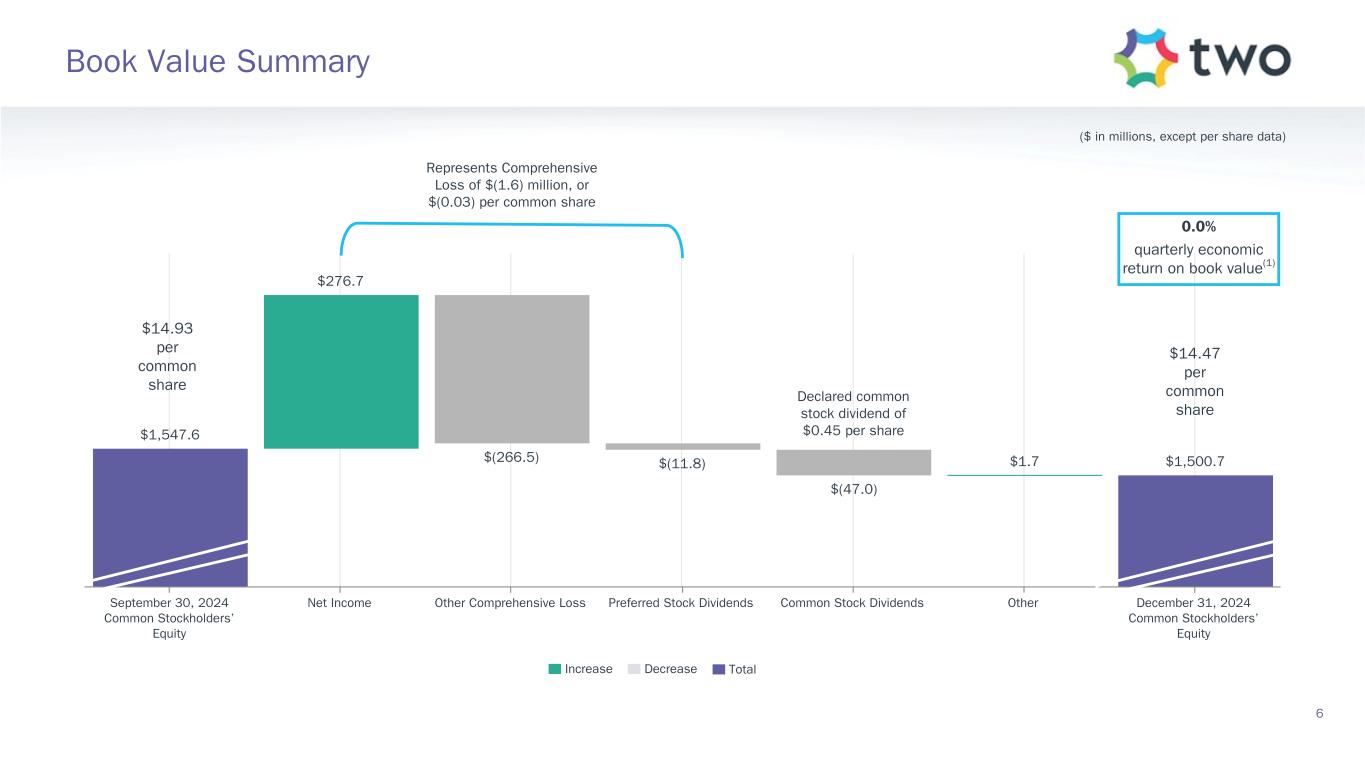

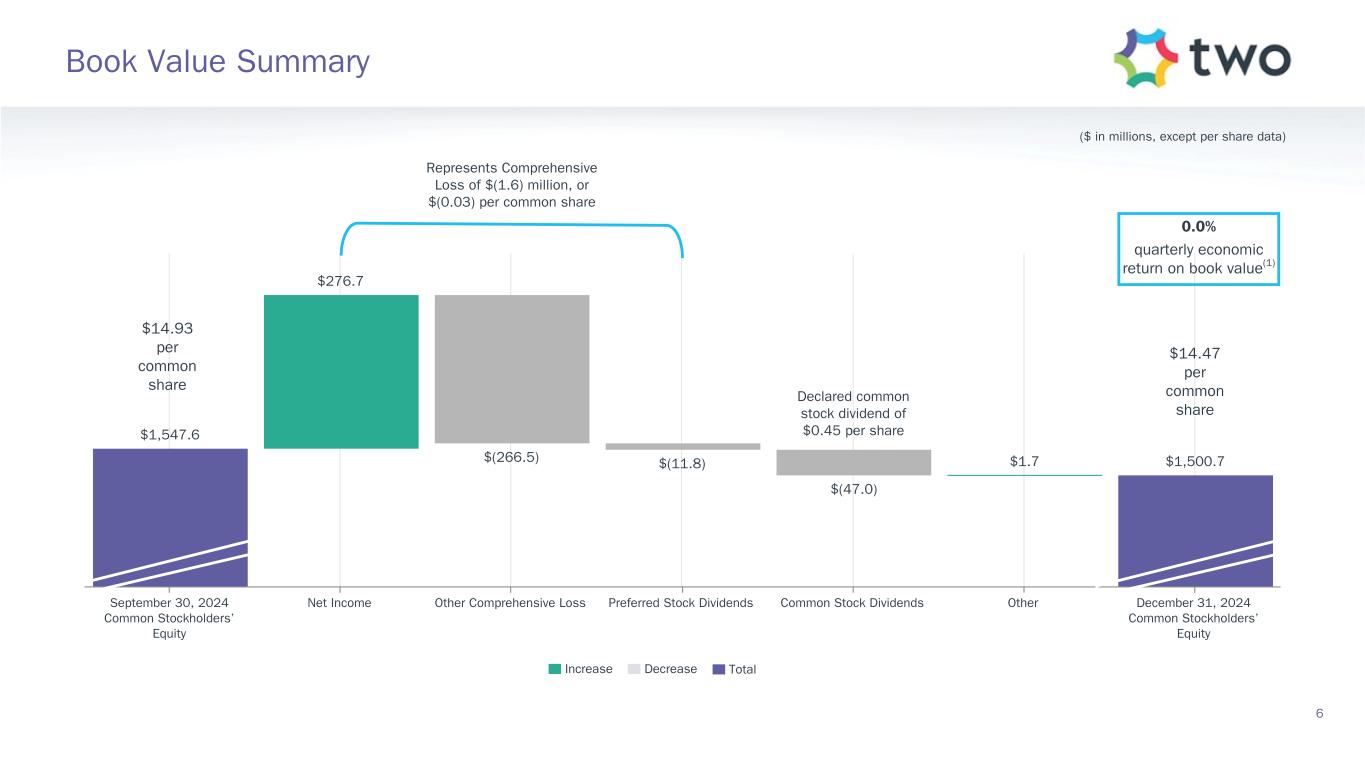

$1,547.6 $276.7 $(266.5) $(11.8) $(47.0) $1.7 $1,500.7 September 30, 2024 Common Stockholders’ Equity Net Income Other Comprehensive Loss Preferred Stock Dividends Common Stock Dividends Other December 31, 2024 Common Stockholders’ Equity ($ in millions, except per share data) $14.93 per common share $14.47 per common share Represents Comprehensive Loss of $(1.6) million, or $(0.03) per common share Declared common stock dividend of $0.45 per share Increase Decrease Total Book Value Summary 6 0.0% quarterly economic return on book value(1)

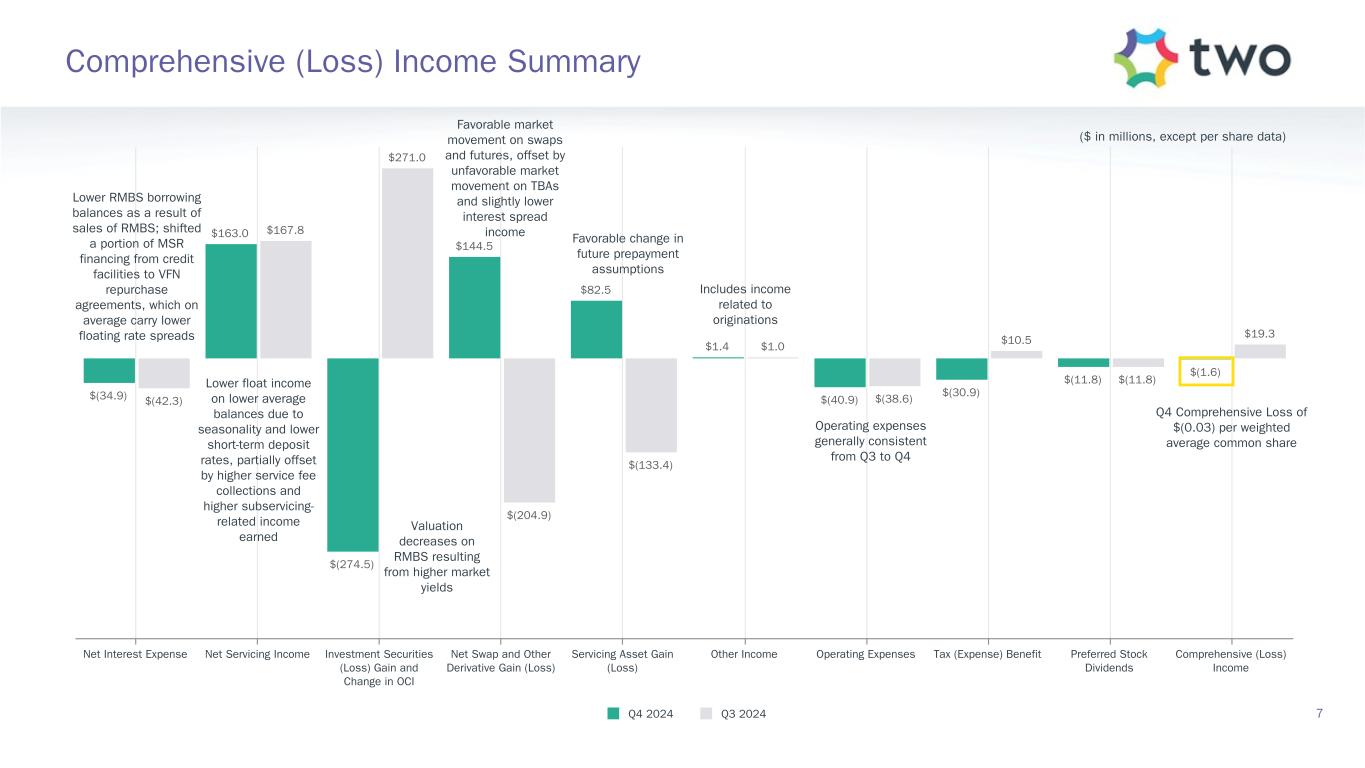

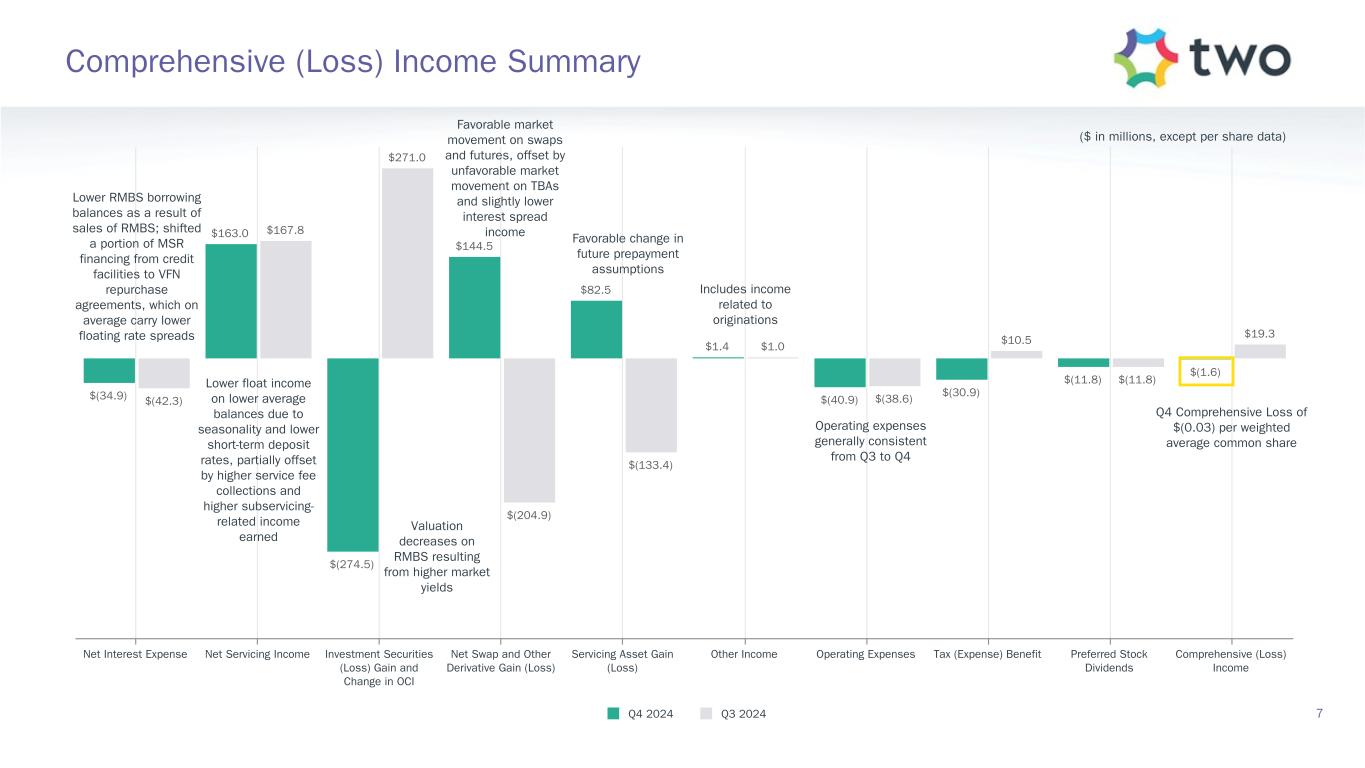

$(34.9) $163.0 $(274.5) $144.5 $82.5 $1.4 $(40.9) $(30.9) $(11.8) $(1.6) $(42.3) $167.8 $271.0 $(204.9) $(133.4) $1.0 $(38.6) $10.5 $(11.8) $19.3 Q4 2024 Q3 2024 Net Interest Expense Net Servicing Income Investment Securities (Loss) Gain and Change in OCI Net Swap and Other Derivative Gain (Loss) Servicing Asset Gain (Loss) Other Income Operating Expenses Tax (Expense) Benefit Preferred Stock Dividends Comprehensive (Loss) Income Q4 Comprehensive Loss of $(0.03) per weighted average common share Lower float income on lower average balances due to seasonality and lower short-term deposit rates, partially offset by higher service fee collections and higher subservicing- related income earned Lower RMBS borrowing balances as a result of sales of RMBS; shifted a portion of MSR financing from credit facilities to VFN repurchase agreements, which on average carry lower floating rate spreads Valuation decreases on RMBS resulting from higher market yields Favorable change in future prepayment assumptions Favorable market movement on swaps and futures, offset by unfavorable market movement on TBAs and slightly lower interest spread income Operating expenses generally consistent from Q3 to Q4 Comprehensive (Loss) Income Summary 7 Includes income related to originations ($ in millions, except per share data)

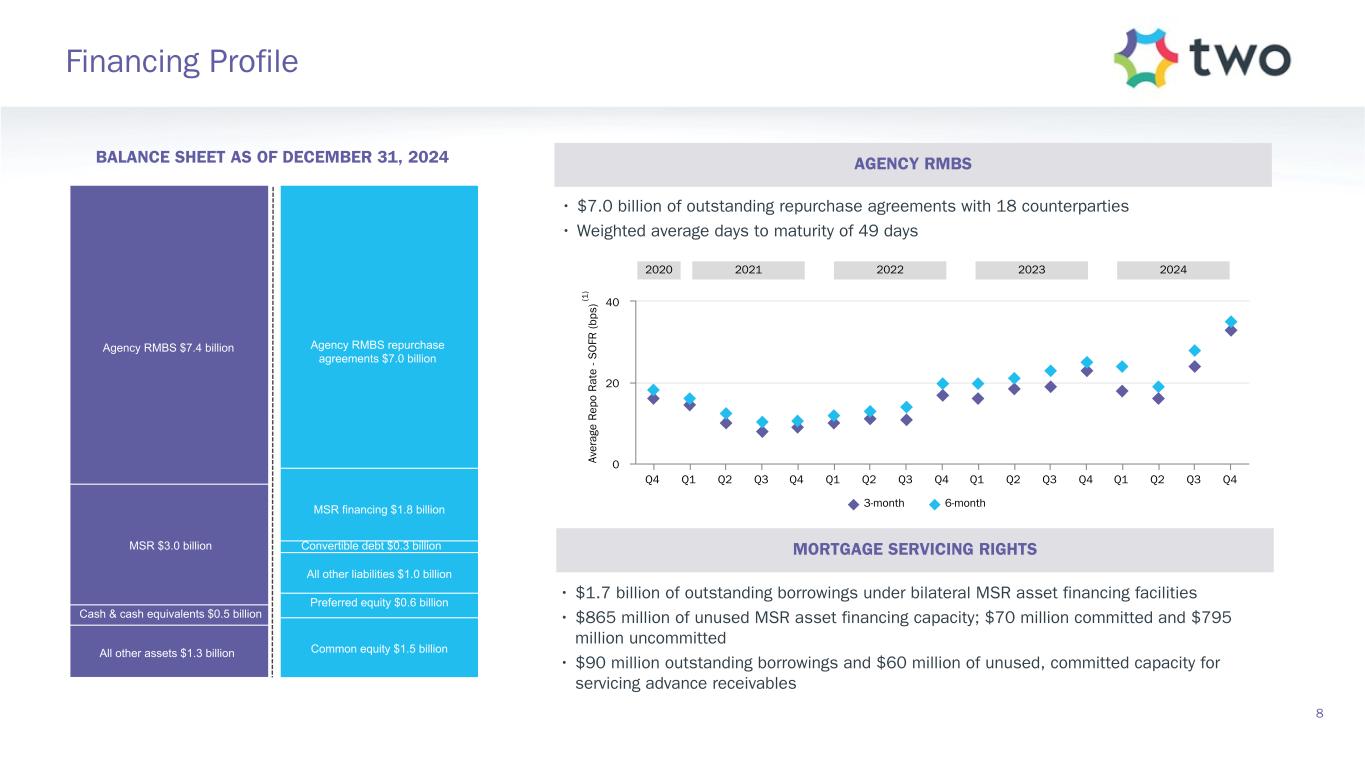

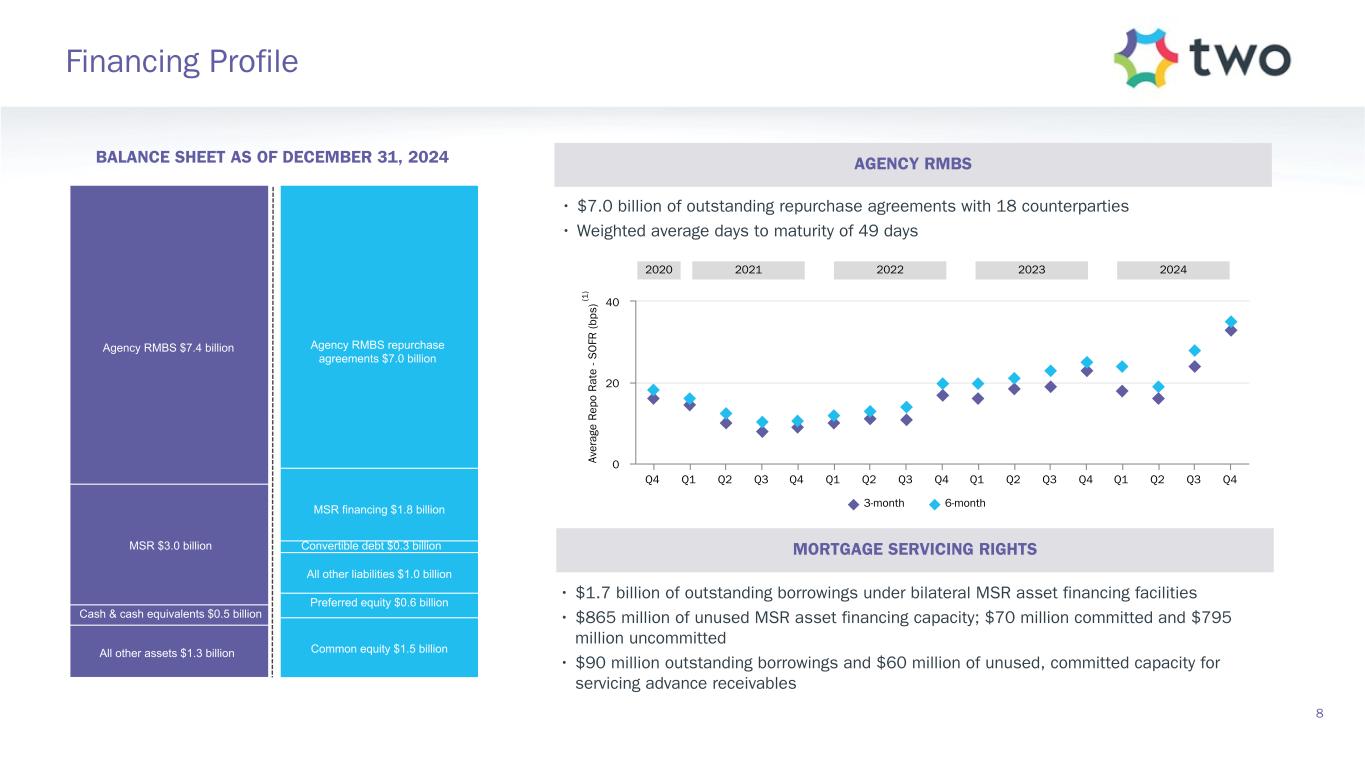

• $1.7 billion of outstanding borrowings under bilateral MSR asset financing facilities • $865 million of unused MSR asset financing capacity; $70 million committed and $795 million uncommitted • $90 million outstanding borrowings and $60 million of unused, committed capacity for servicing advance receivables BALANCE SHEET AS OF DECEMBER 31, 2024 • $7.0 billion of outstanding repurchase agreements with 18 counterparties • Weighted average days to maturity of 49 days Av er ag e R ep o R at e - S O FR ( bp s) 3-month 6-month Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 0 20 40(1 ) Agency RMBS $7.4 billion MSR $3.0 billion Cash & cash equivalents $0.5 billion All other assets $1.3 billion Agency RMBS repurchase agreements $7.0 billion MSR financing $1.8 billion All other liabilities $1.0 billion Preferred equity $0.6 billion Common equity $1.5 billion Convertible debt $0.3 billion 2021 2022 2023 2024 Financing Profile 8 AGENCY RMBS MORTGAGE SERVICING RIGHTS 2020

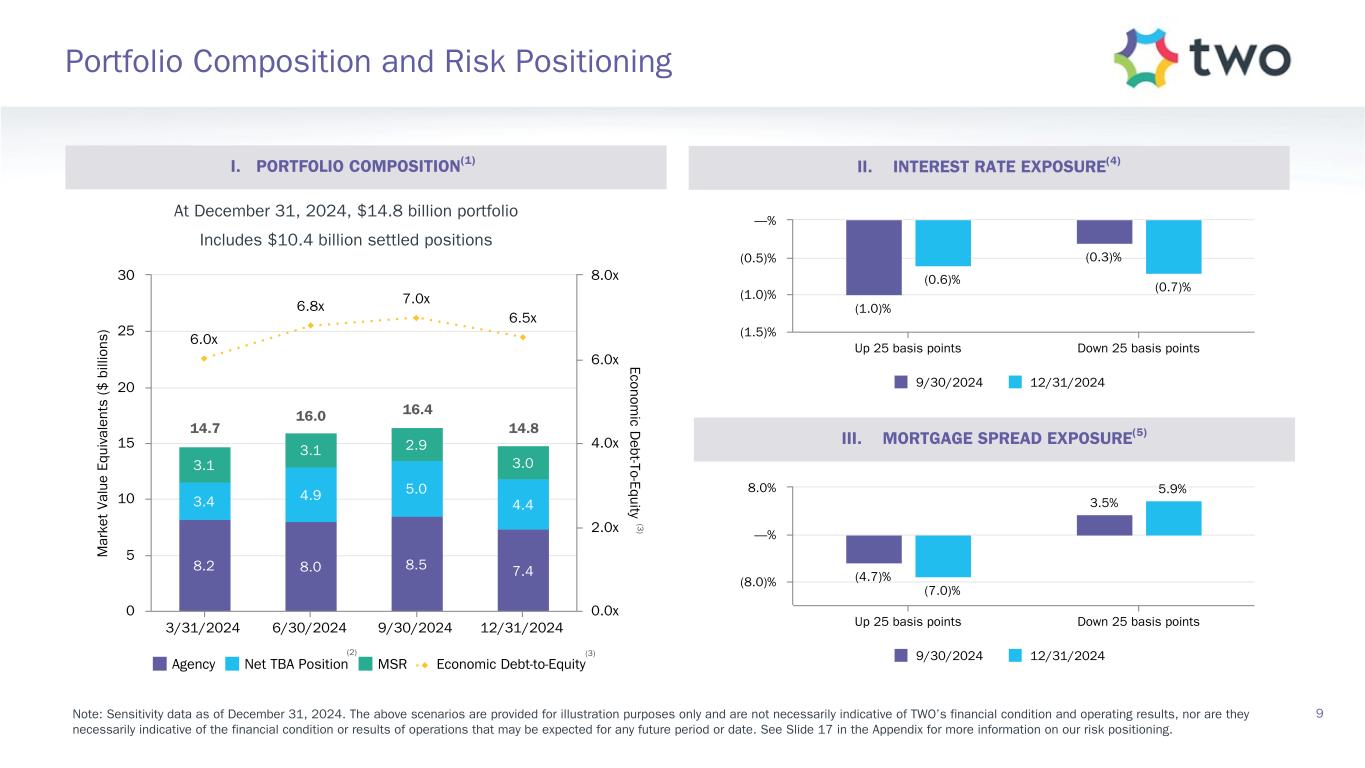

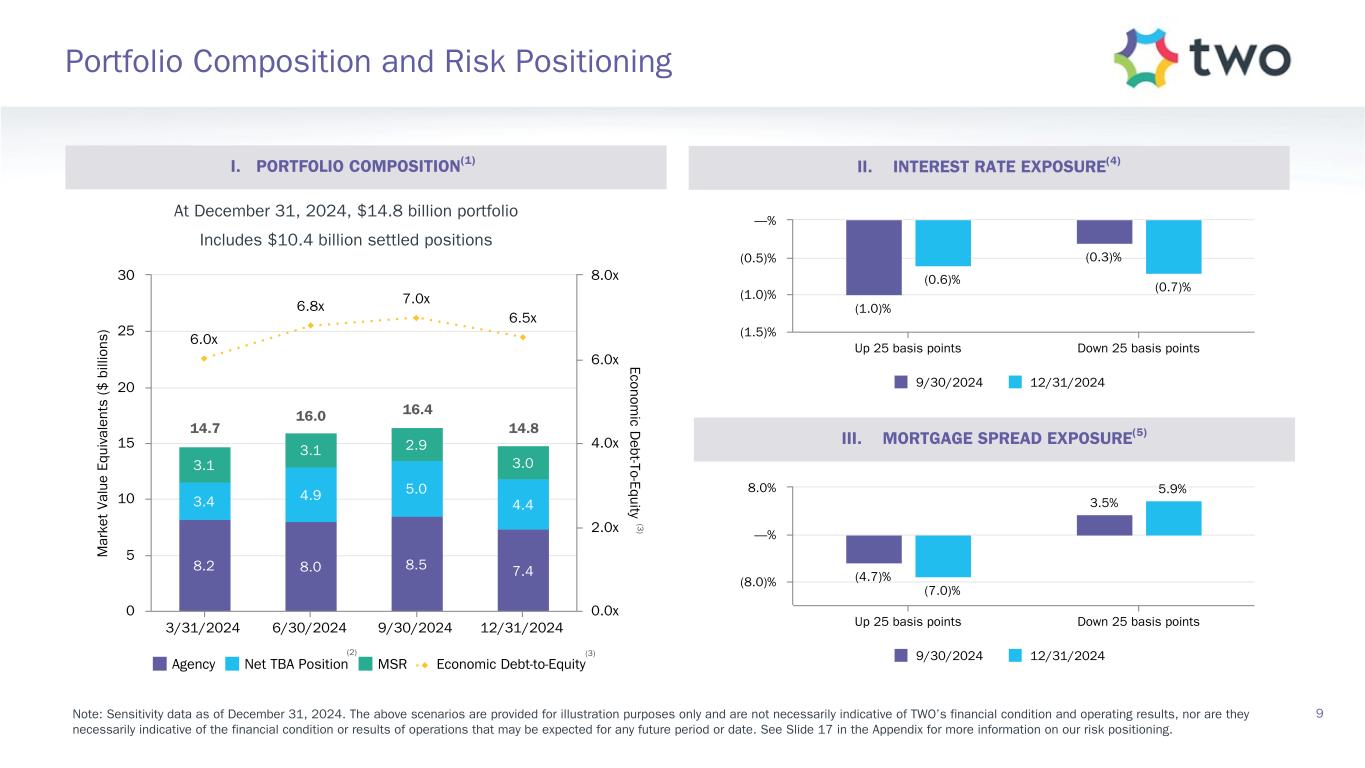

At December 31, 2024, $14.8 billion portfolio Includes $10.4 billion settled positions M ar ke t Va lu e Eq ui va le nt s ($ b ill io ns ) Econom ic D ebt-To-Equity 8.2 8.0 8.5 7.4 3.4 4.9 5.0 4.4 3.1 3.1 2.9 3.0 6.0x 6.8x 7.0x 6.5x Agency Net TBA Position MSR Economic Debt-to-Equity 3/31/2024 6/30/2024 9/30/2024 12/31/2024 0 5 10 15 20 25 30 0.0x 2.0x 4.0x 6.0x 8.0x (3) (3 ) (2) 14.8 16.4 14.7 16.0 Note: Sensitivity data as of December 31, 2024. The above scenarios are provided for illustration purposes only and are not necessarily indicative of TWO’s financial condition and operating results, nor are they necessarily indicative of the financial condition or results of operations that may be expected for any future period or date. See Slide 17 in the Appendix for more information on our risk positioning. (1.0)% (0.3)% (0.6)% (0.7)% 9/30/2024 12/31/2024 Up 25 basis points Down 25 basis points (1.5)% (1.0)% (0.5)% —% (4.7)% 3.5% (7.0)% 5.9% 9/30/2024 12/31/2024 Up 25 basis points Down 25 basis points (8.0)% —% 8.0% 9 Portfolio Composition and Risk Positioning I. PORTFOLIO COMPOSITION(1) II. INTEREST RATE EXPOSURE(4) III. MORTGAGE SPREAD EXPOSURE(5)

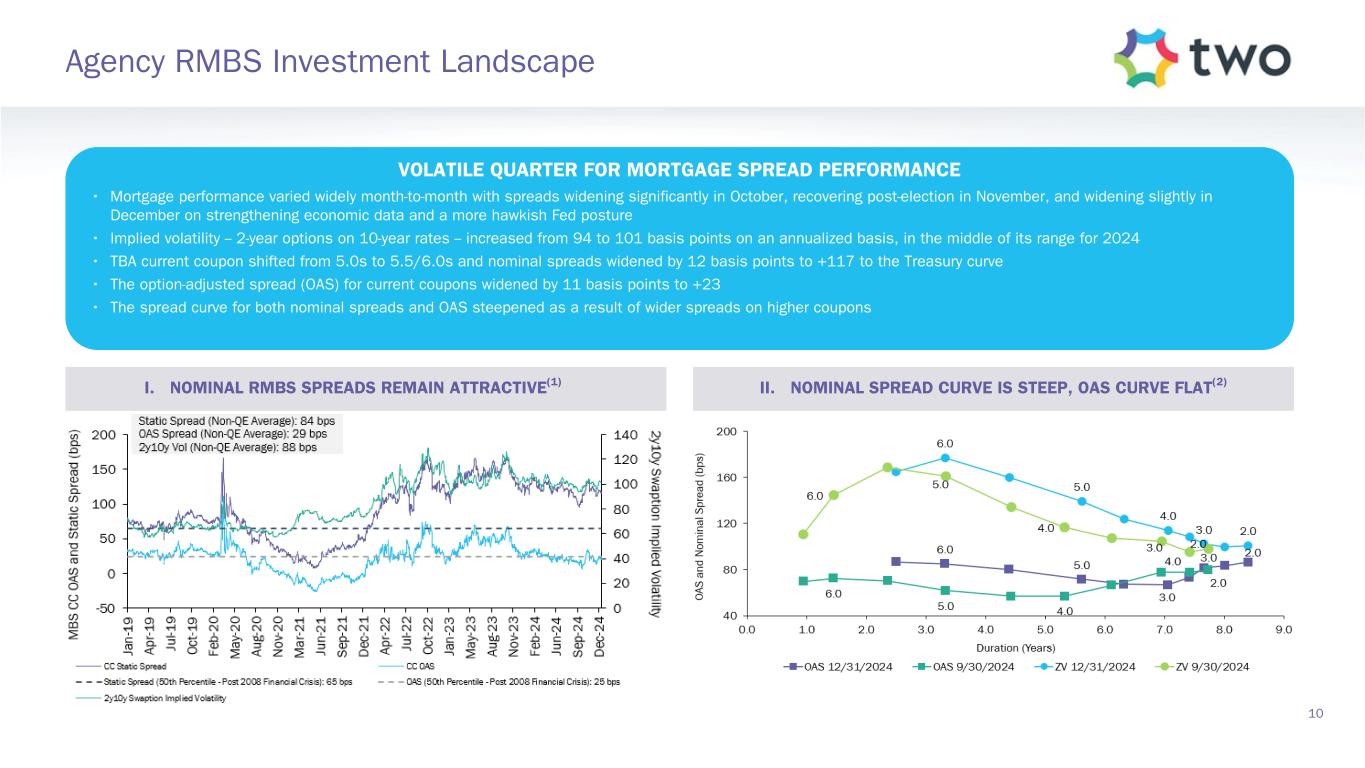

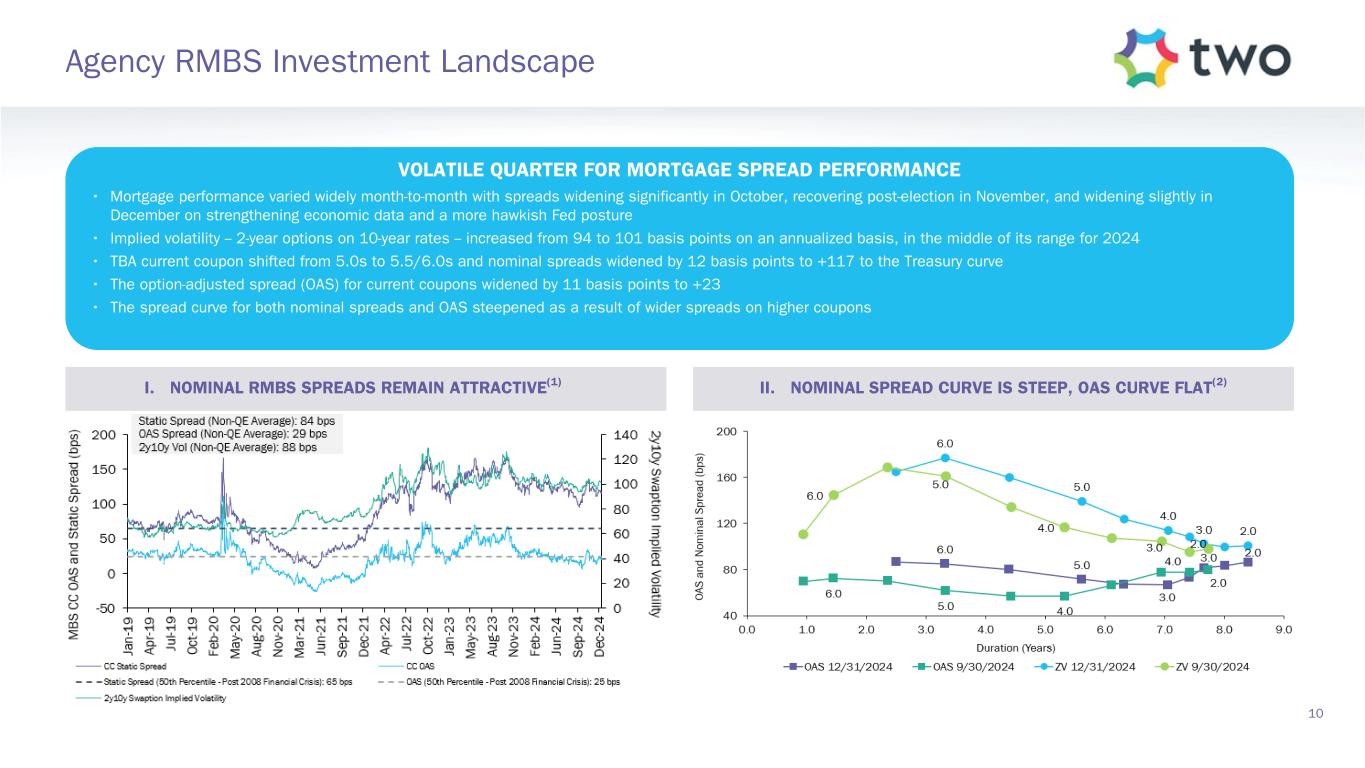

10 Agency RMBS Investment Landscape VOLATILE QUARTER FOR MORTGAGE SPREAD PERFORMANCE • Mortgage performance varied widely month-to-month with spreads widening significantly in October, recovering post-election in November, and widening slightly in December on strengthening economic data and a more hawkish Fed posture • Implied volatility -- 2-year options on 10-year rates -- increased from 94 to 101 basis points on an annualized basis, in the middle of its range for 2024 • TBA current coupon shifted from 5.0s to 5.5/6.0s and nominal spreads widened by 12 basis points to +117 to the Treasury curve • The option-adjusted spread (OAS) for current coupons widened by 11 basis points to +23 • The spread curve for both nominal spreads and OAS steepened as a result of wider spreads on higher coupons I. NOMINAL RMBS SPREADS REMAIN ATTRACTIVE(1) II. NOMINAL SPREAD CURVE IS STEEP, OAS CURVE FLAT(2)

Coupon Ti ck s (3 2 nd s) TBAs TWO Specified Pools 2.5 3.0 3.5 4.0 4.5 5.0 5.5 6 6.5 -20 -10 0 10 20 TWO Specified Pools (Q4-2024)TBAs (Q4-2024)(5) TBAs (Q3-2024)(5) TWO Specified Pools (Q3-2024) Market Value(4) ($ billions) $— $— $0.19 $0.10 $0.54 $1.97 $1.71 $1.40 $0.51 $0.39 11 Agency RMBS Portfolio I. RMBS QUARTERLY PERFORMANCE II. SPECIFIED POOL PREPAYMENT SPEEDS (2) (3) QUARTERLY HIGHLIGHTS • The bear steepening of the rates curve and uptick in implied volatility led to underperformance of lower coupons, and outperformance of higher coupons • Higher coupon specified pools were the best performer, outperforming TBAs by at least a quarter point and rate hedges by about a half point • Shifted about $4 billion 4.5 and 5.0 TBAs into $3 billion 5.5 and 6.0 TBAs as our MSR current coupon exposure moved higher • Speeds for higher coupon TBAs and pools picked up, capturing the decline in rates at the end of the third quarter, whereas 5% coupons and lower were unchanged to slightly slower • Weighted average specified pool portfolio prepayment speed of 8.1%, compared to 7.6% in the third quarter(1)

12 MSR Investment Landscape MSR SPREADS STABLE AND WELL SUPPORTED • Several large scale bids and acquisitions lifted 2024 transfers to $662 billion UPB • Bulk bid opportunities dropped by 25% year-over-year • Demand for MSR continues to come from bank and non-bank portfolios • Expect ample opportunities to add MSR at attractive spreads, even as transfer volume continues to normalize to pre-COVID levels • With rates around 7%, only 0.2% of the UPB of TWO's MSR portfolio has 50 basis points or more of a rate incentive to refinance I. BULK MSR BIDS(1) II. COMPOSITION OF MARKET VS. CURRENT RATES(2)

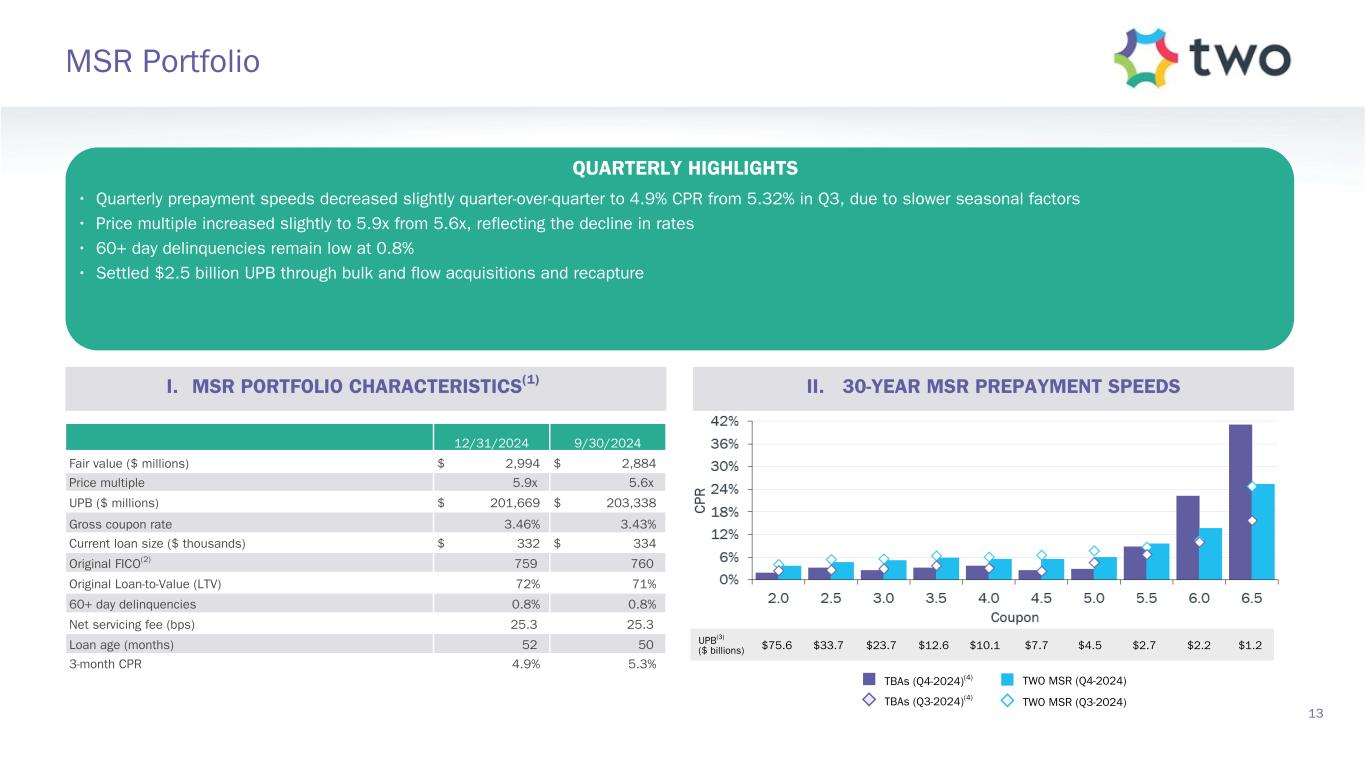

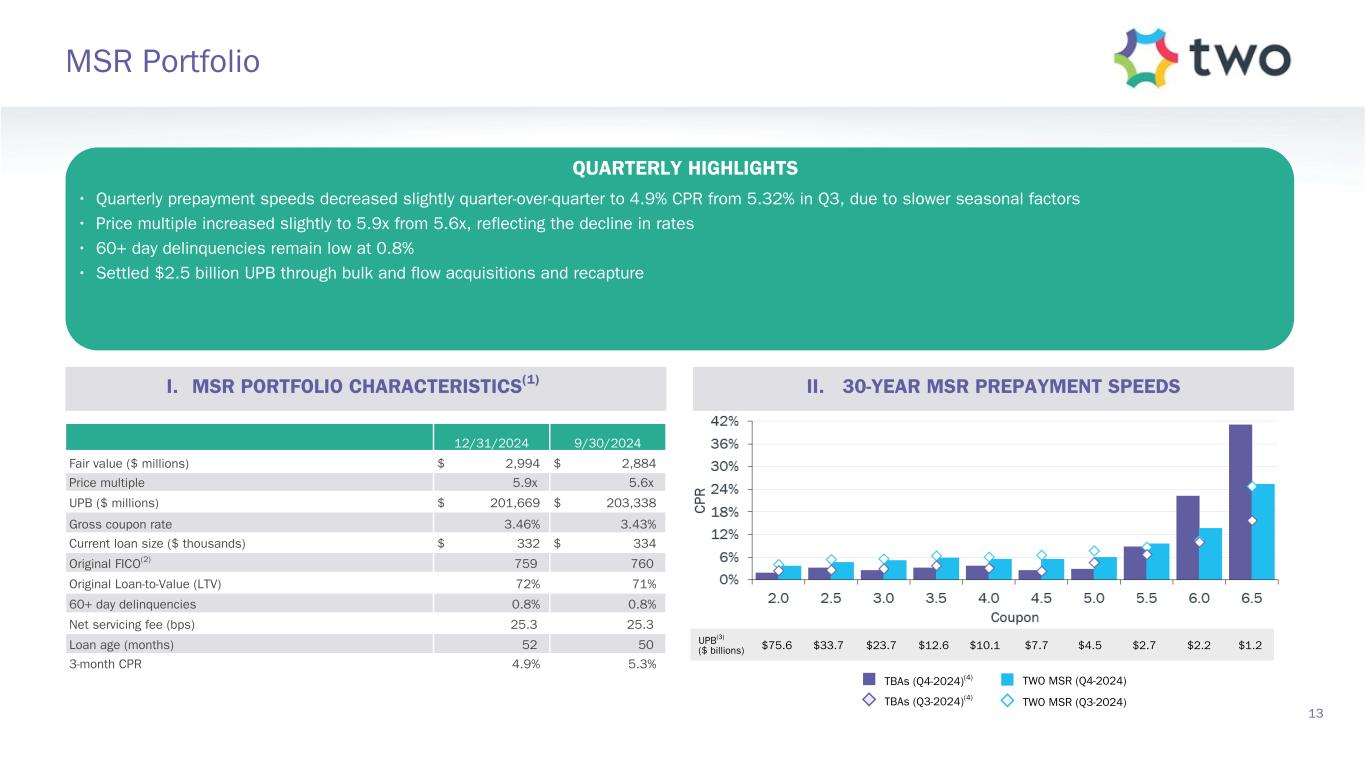

UPB(3) ($ billions) $75.6 $33.7 $23.7 $12.6 $10.1 $7.7 $4.5 $2.7 $2.2 $1.2 QUARTERLY HIGHLIGHTS • Quarterly prepayment speeds decreased slightly quarter-over-quarter to 4.9% CPR from 5.32% in Q3, due to slower seasonal factors • Price multiple increased slightly to 5.9x from 5.6x, reflecting the decline in rates • 60+ day delinquencies remain low at 0.8% • Settled $2.5 billion UPB through bulk and flow acquisitions and recapture 12/31/2024 9/30/2024 Fair value ($ millions) $ 2,994 $ 2,884 Price multiple 5.9x 5.6x UPB ($ millions) $ 201,669 $ 203,338 Gross coupon rate 3.46 % 3.43 % Current loan size ($ thousands) $ 332 $ 334 Original FICO(2) 759 760 Original Loan-to-Value (LTV) 72 % 71 % 60+ day delinquencies 0.8 % 0.8 % Net servicing fee (bps) 25.3 25.3 Loan age (months) 52 50 3-month CPR 4.9 % 5.3 % TWO MSR (Q4-2024)TBAs (Q4-2024)(4) TBAs (Q3-2024)(4) TWO MSR (Q3-2024) 13 MSR Portfolio I. MSR PORTFOLIO CHARACTERISTICS(1) II. 30-YEAR MSR PREPAYMENT SPEEDS

• Market Presence: Our scale, expertise and ability to leverage our own servicer allows us to find attractive incremental investments in hedged MSR. • Investment Strategy: Our portfolio is focused on hedged MSR. Ongoing enhancements at RoundPoint uniquely position us to shape our return profile beyond just owning traditional Agency RMBS. • Market Environment: Our MSR is almost 400 basis points out of the money, keeping prepayment risk low and generating stable cashflows over a wide range of market scenarios. • Financing and Liquidity: We have a strong balance sheet and diversified financing for both MSR and Agency RMBS. 14 Return Potential and Outlook Why TWO? ATTRACTIVE RETURN OPPORTUNITIES FOR UNIQUELY POSITIONED PORTFOLIO As of December 31, 2024 PORTFOLIO MARKET VALUE ($ millions) INVESTED CAPITAL ALLOCATED(1) STATIC RETURN ESTIMATE(2) SERVICING MSR 2,994 RMBS(3) 3,765 Total 6,759 61% 11% - 14% SECURITIES RMBS(3) 7,542 Other Securities 576 Total 8,118 39% 14% - 15% INVESTED CAPITAL ($ millions) STATIC TWO HARBORS RETURN ESTIMATE(4) Total Portfolio Before Corporate and Tax Expenses 12.3% - 14.6% Corporate and Tax Expenses(5) (2.5)% - (2.5)% Total Return to Invested Capital 9.8% - 12.1% INVESTED CAPITAL Convertible Notes 262 6.2% Preferred Equity(6) 622 8.9% Common Equity 1,501 10.8% - 14.4% PROSPECTIVE QUARTERLY STATIC RETURN PER BASIC COMMON SHARE(7): $0.39 - $0.52 Note: This slide presents estimates for illustrative purposes only, using TWO’s base case assumptions (e.g., spreads, prepayment speeds, financing costs and expenses), and does not contemplate market-driven value changes, active portfolio management, or certain operating expenses. Actual results may differ materially.

Appendix

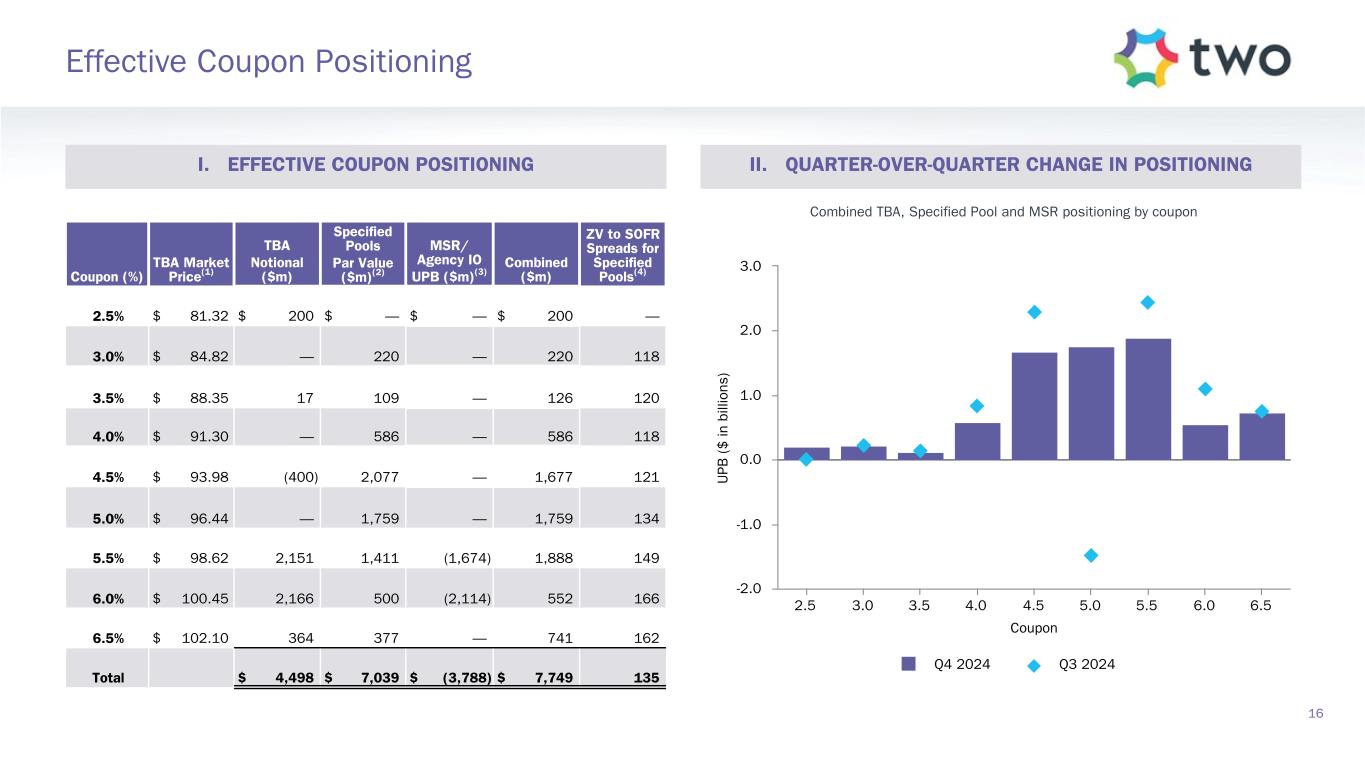

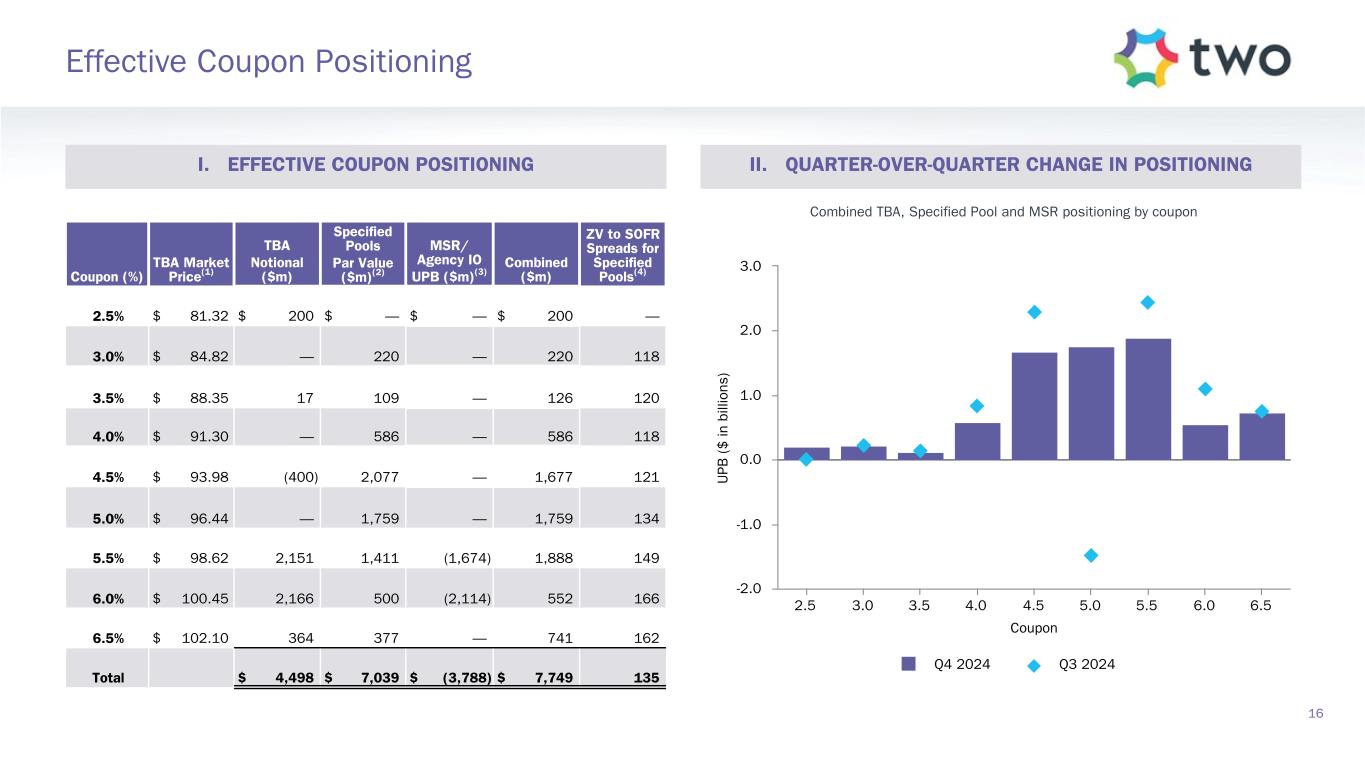

Coupon (%) TBA Market Price(1) TBA Notional ($m) Specified Pools Par Value ($m)(2) MSR/ Agency IO UPB ($m)(3) Combined ($m) ZV to SOFR Spreads for Specified Pools(4) 2.5% $ 81.32 $ 200 $ — $ — $ 200 — 3.0% $ 84.82 — 220 — 220 118 3.5% $ 88.35 17 109 — 126 120 4.0% $ 91.30 — 586 — 586 118 4.5% $ 93.98 (400) 2,077 — 1,677 121 5.0% $ 96.44 — 1,759 — 1,759 134 5.5% $ 98.62 2,151 1,411 (1,674) 1,888 149 6.0% $ 100.45 2,166 500 (2,114) 552 166 6.5% $ 102.10 364 377 — 741 162 Total $ 4,498 $ 7,039 $ (3,788) $ 7,749 135 16 Effective Coupon Positioning Coupon U PB ( $ in b ill io ns ) Q4 2024 Q3 2024 2.5 3.0 3.5 4.0 4.5 5.0 5.5 6.0 6.5 -2.0 -1.0 0.0 1.0 2.0 3.0 II. QUARTER-OVER-QUARTER CHANGE IN POSITIONINGI. EFFECTIVE COUPON POSITIONING Combined TBA, Specified Pool and MSR positioning by coupon

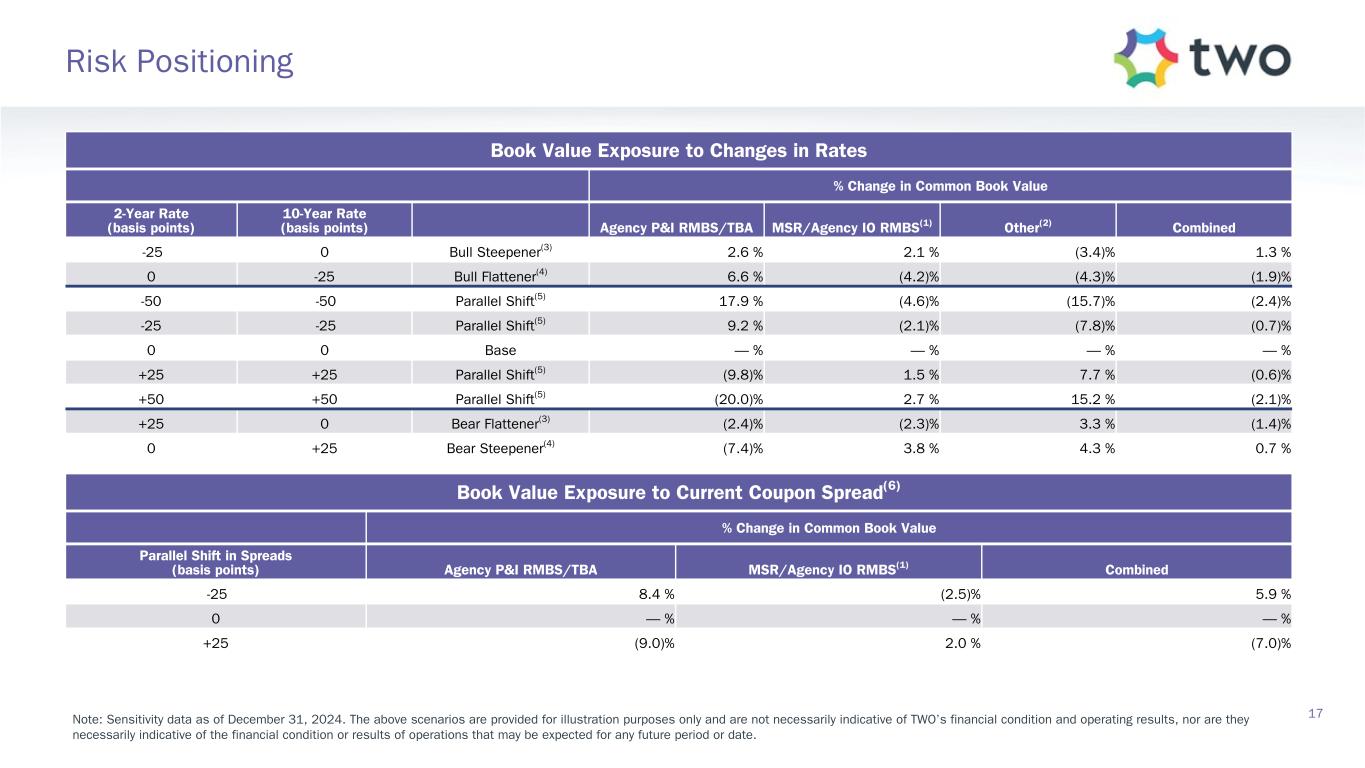

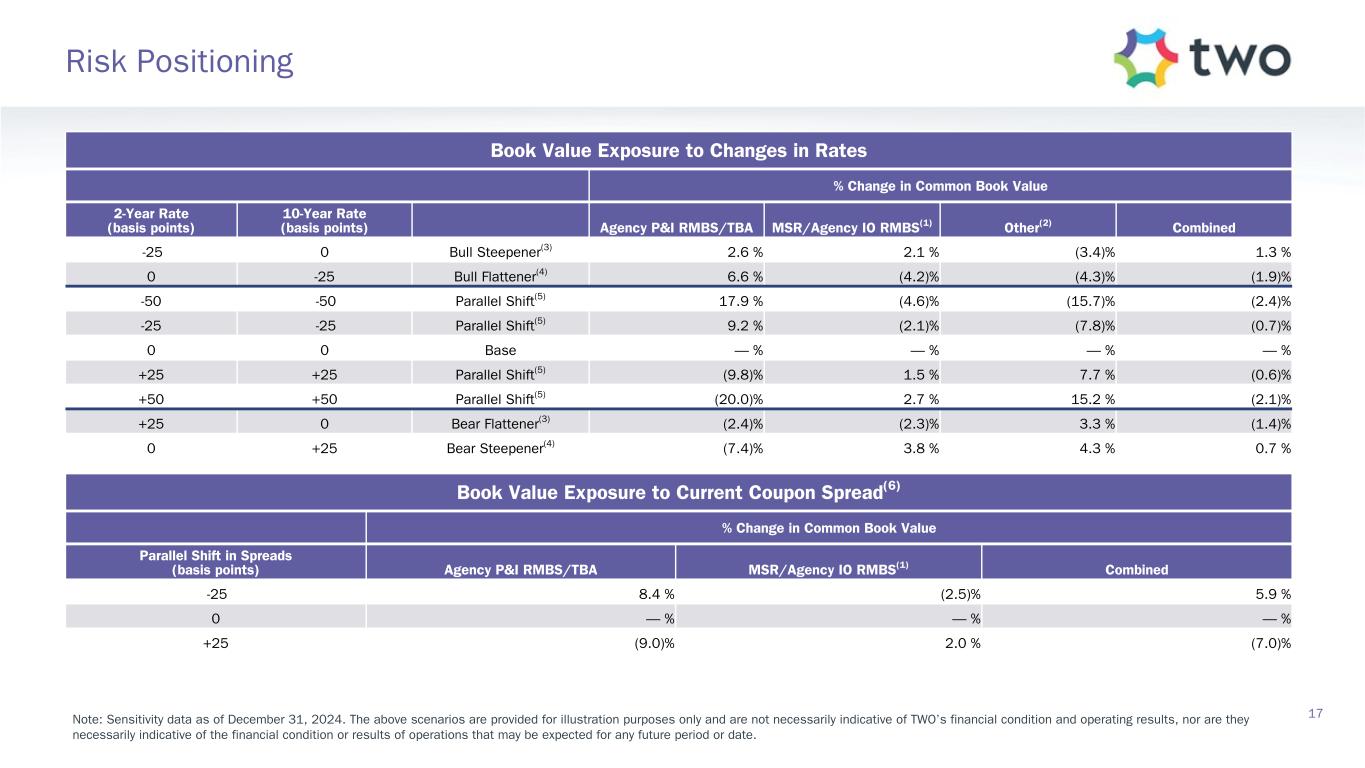

Note: Sensitivity data as of December 31, 2024. The above scenarios are provided for illustration purposes only and are not necessarily indicative of TWO’s financial condition and operating results, nor are they necessarily indicative of the financial condition or results of operations that may be expected for any future period or date. Book Value Exposure to Changes in Rates % Change in Common Book Value 2-Year Rate (basis points) 10-Year Rate (basis points) Agency P&I RMBS/TBA MSR/Agency IO RMBS(1) Other(2) Combined -25 0 Bull Steepener(3) 2.6 % 2.1 % (3.4) % 1.3 % 0 -25 Bull Flattener(4) 6.6 % (4.2) % (4.3) % (1.9) % -50 -50 Parallel Shift(5) 17.9 % (4.6) % (15.7) % (2.4) % -25 -25 Parallel Shift(5) 9.2 % (2.1) % (7.8) % (0.7) % 0 0 Base — % — % — % — % +25 +25 Parallel Shift(5) (9.8) % 1.5 % 7.7 % (0.6) % +50 +50 Parallel Shift(5) (20.0) % 2.7 % 15.2 % (2.1) % +25 0 Bear Flattener(3) (2.4) % (2.3) % 3.3 % (1.4) % 0 +25 Bear Steepener(4) (7.4) % 3.8 % 4.3 % 0.7 % Book Value Exposure to Current Coupon Spread(6) % Change in Common Book Value Parallel Shift in Spreads (basis points) Agency P&I RMBS/TBA MSR/Agency IO RMBS(1) Combined -25 8.4 % (2.5) % 5.9 % 0 — % — % — % +25 (9.0) % 2.0 % (7.0) % 17 Risk Positioning

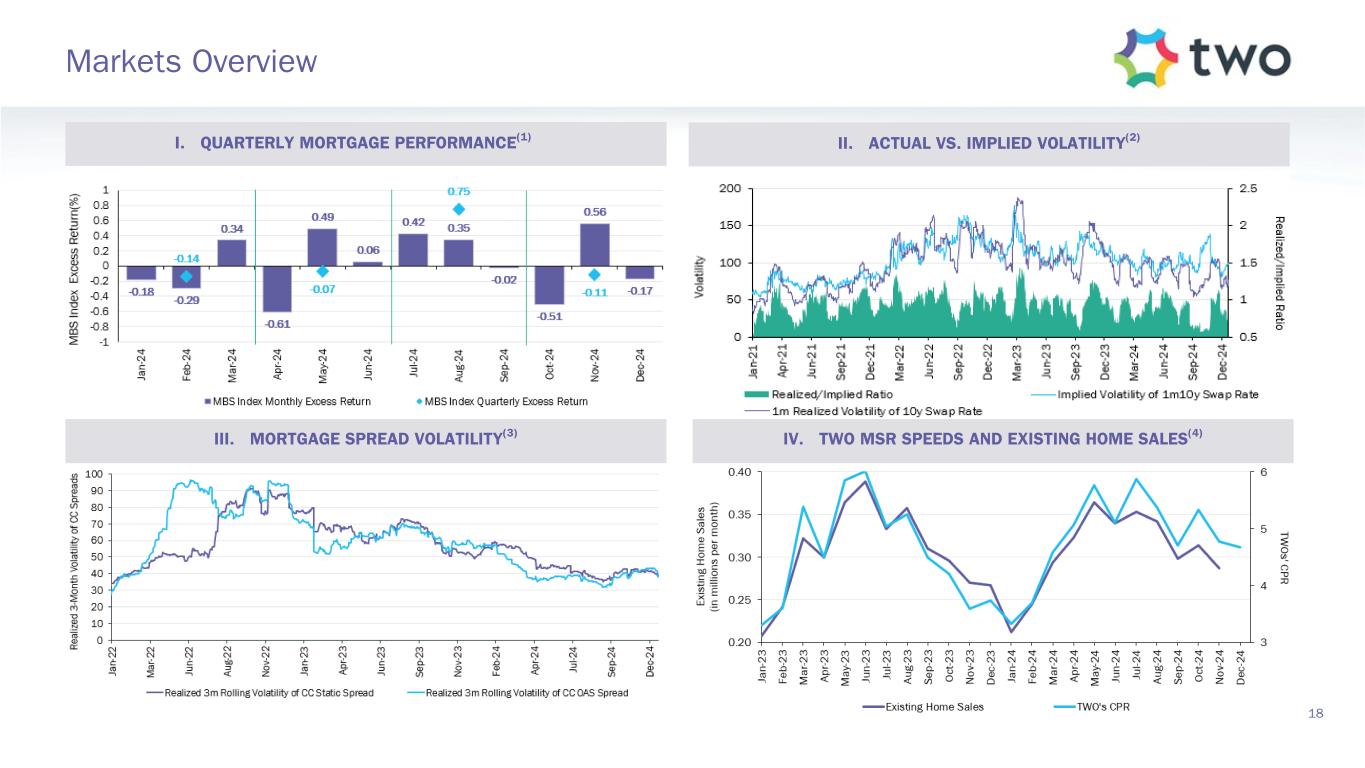

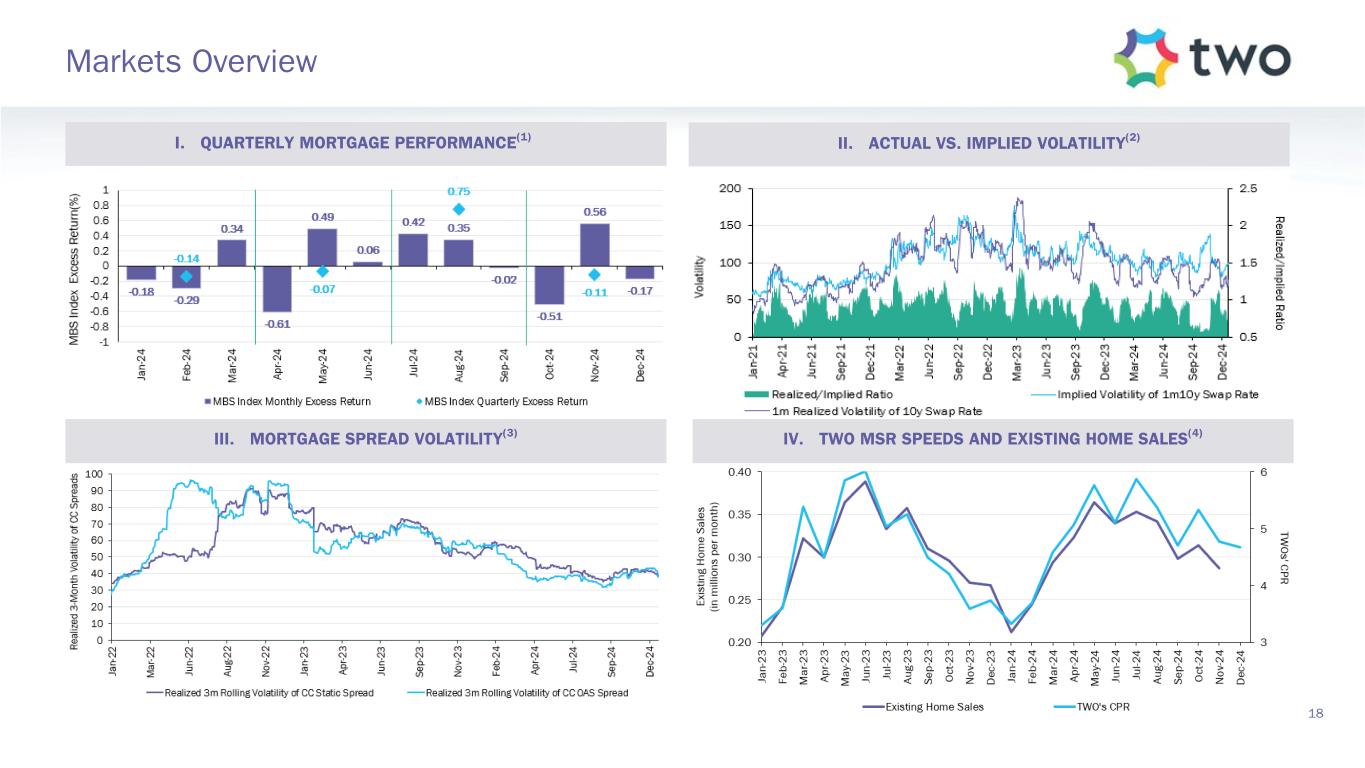

18 Markets Overview I. QUARTERLY MORTGAGE PERFORMANCE(1) II. ACTUAL VS. IMPLIED VOLATILITY(2) III. MORTGAGE SPREAD VOLATILITY(3) IV. TWO MSR SPEEDS AND EXISTING HOME SALES(4)

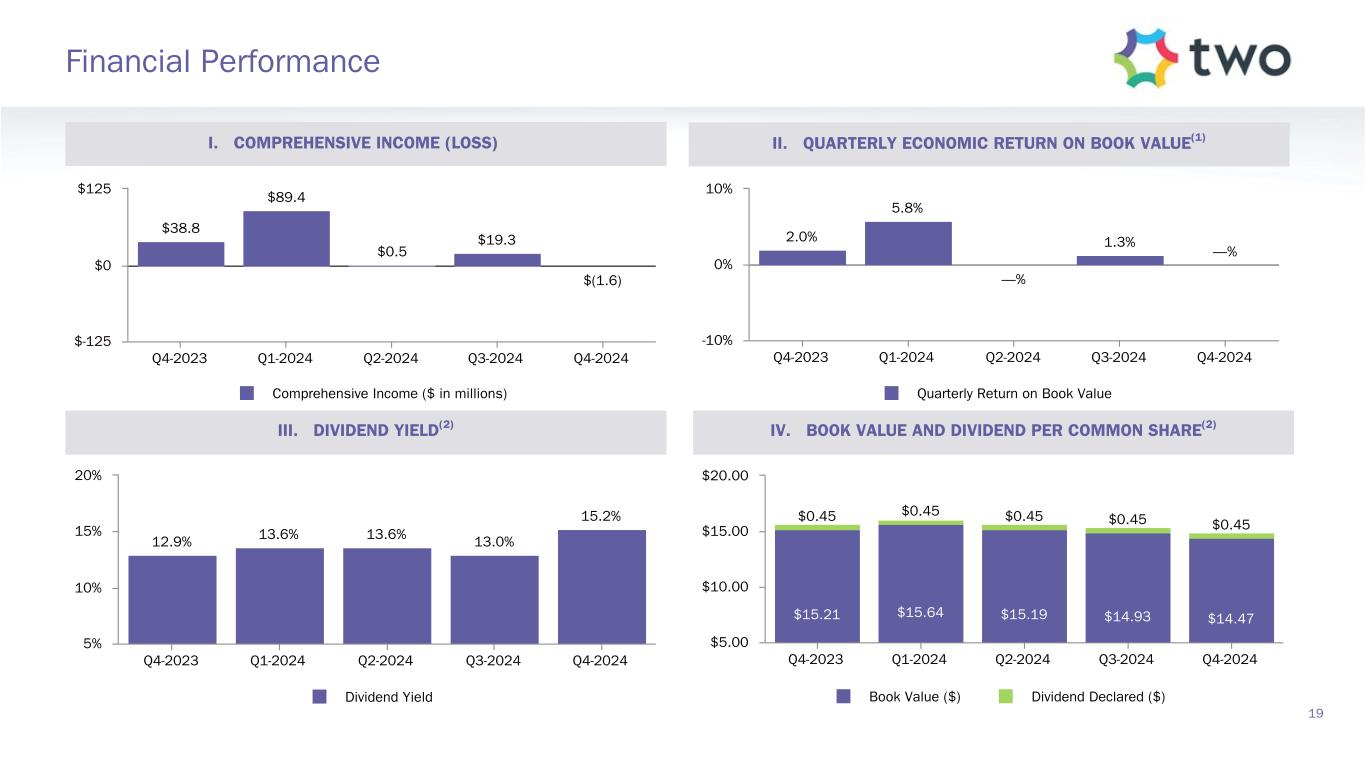

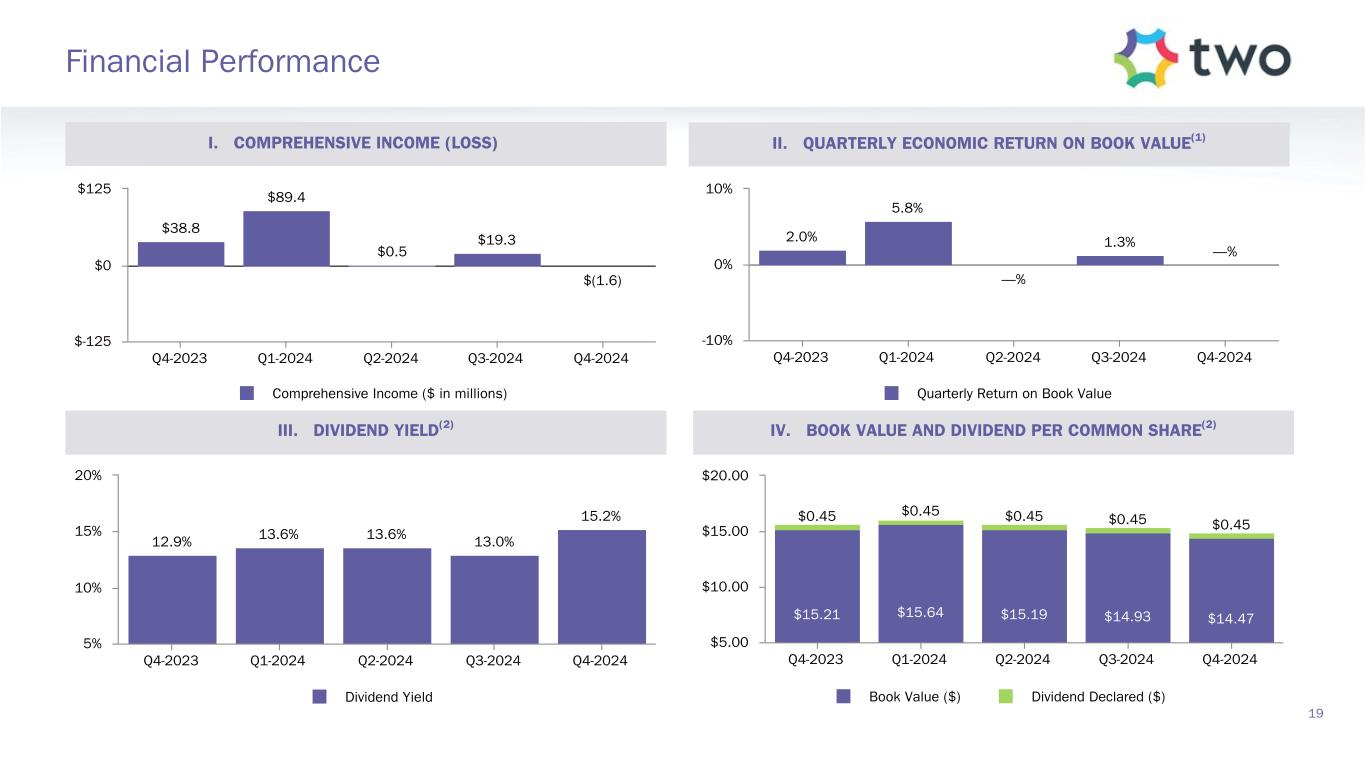

$38.8 $89.4 $0.5 $19.3 $(1.6) Comprehensive Income ($ in millions) Q4-2023 Q1-2024 Q2-2024 Q3-2024 Q4-2024 $-125 $0 $125 $15.21 $15.64 $15.19 $14.93 $14.47 $0.45 $0.45 $0.45 $0.45 $0.45 Book Value ($) Dividend Declared ($) Q4-2023 Q1-2024 Q2-2024 Q3-2024 Q4-2024 $5.00 $10.00 $15.00 $20.00 2.0% 5.8% —% 1.3% —% Quarterly Return on Book Value Q4-2023 Q1-2024 Q2-2024 Q3-2024 Q4-2024 -10% 0% 10% 12.9% 13.6% 13.6% 13.0% 15.2% Dividend Yield Q4-2023 Q1-2024 Q2-2024 Q3-2024 Q4-2024 5% 10% 15% 20% 19 Financial Performance I. COMPREHENSIVE INCOME (LOSS) II. QUARTERLY ECONOMIC RETURN ON BOOK VALUE(1) III. DIVIDEND YIELD(2) IV. BOOK VALUE AND DIVIDEND PER COMMON SHARE(2)

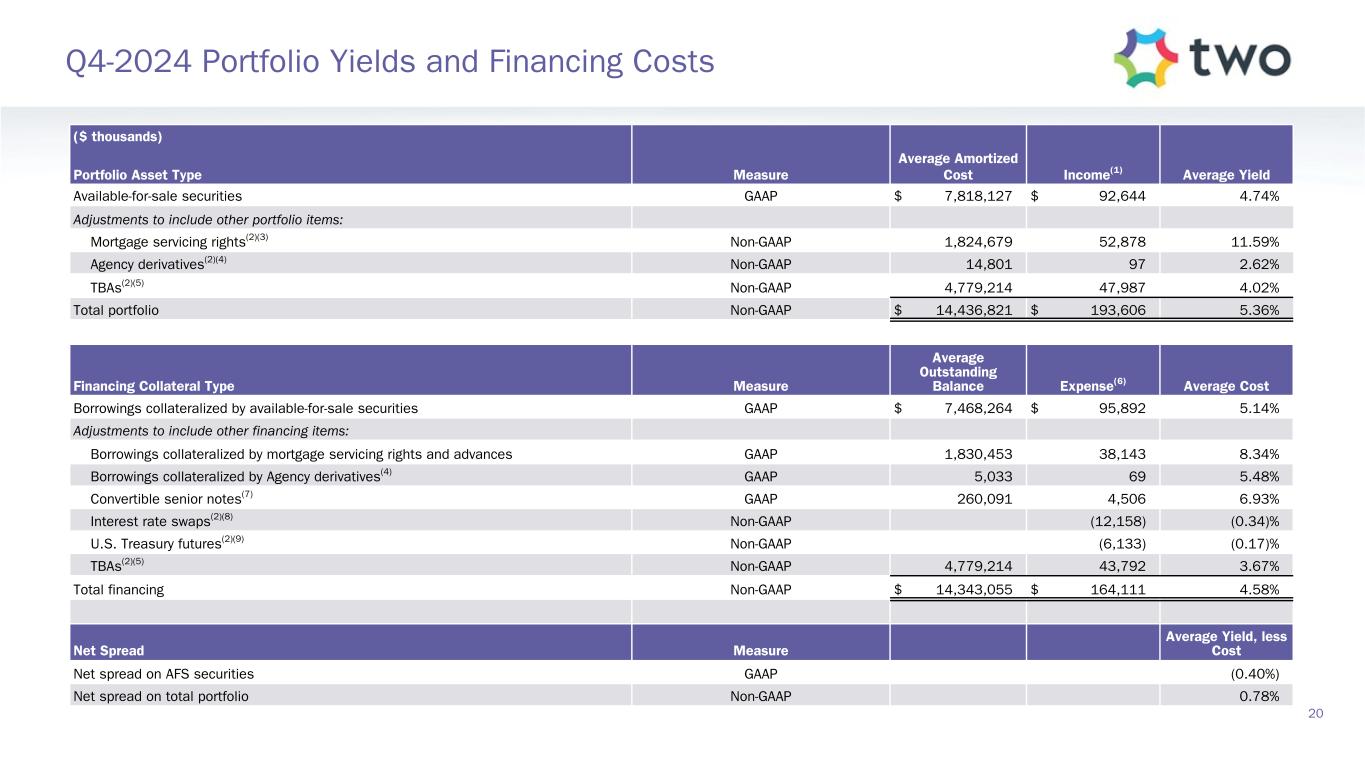

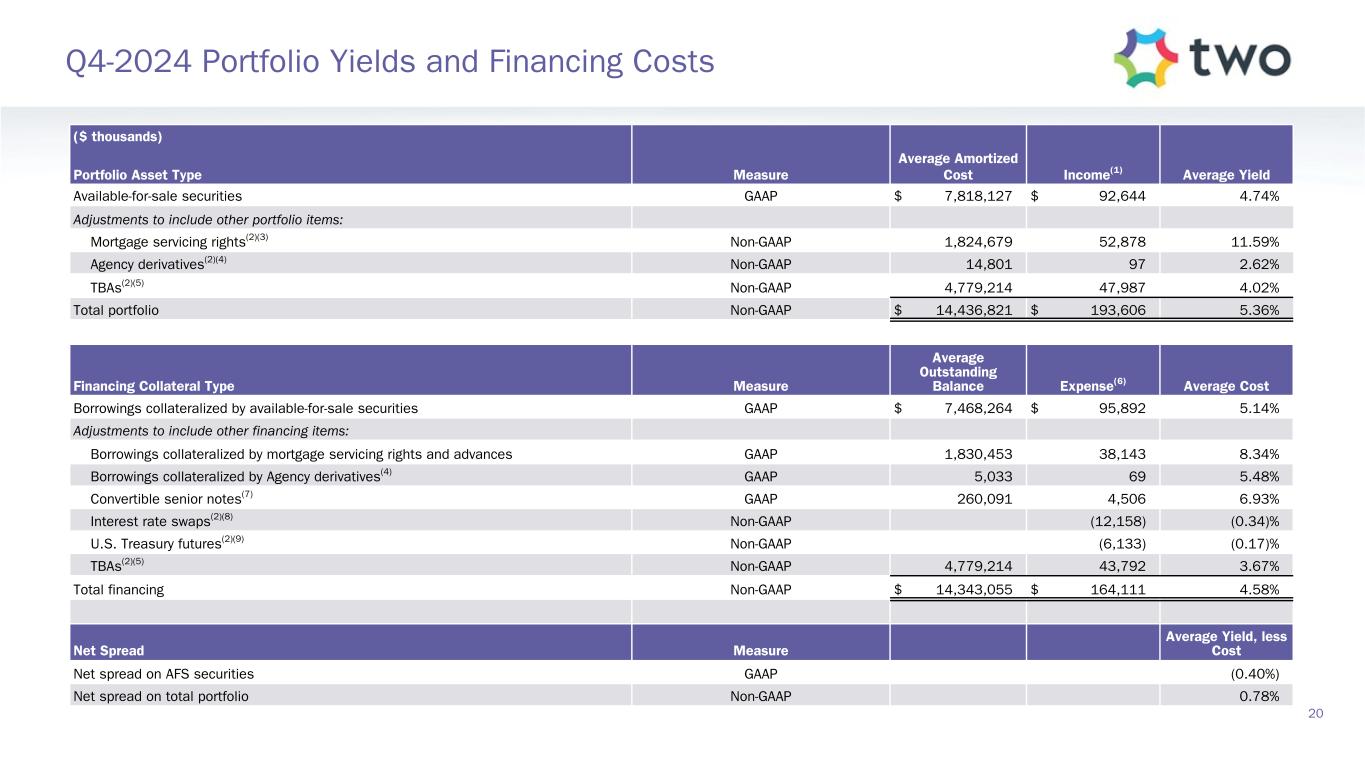

($ thousands) Portfolio Asset Type Measure Average Amortized Cost Income(1) Average Yield Available-for-sale securities GAAP $ 7,818,127 $ 92,644 4.74% Adjustments to include other portfolio items: Mortgage servicing rights(2)(3) Non-GAAP 1,824,679 52,878 11.59% Agency derivatives(2)(4) Non-GAAP 14,801 97 2.62 % TBAs(2)(5) Non-GAAP 4,779,214 47,987 4.02 % Total portfolio Non-GAAP $ 14,436,821 $ 193,606 5.36% Financing Collateral Type Measure Average Outstanding Balance Expense(6) Average Cost Borrowings collateralized by available-for-sale securities GAAP $ 7,468,264 $ 95,892 5.14% Adjustments to include other financing items: Borrowings collateralized by mortgage servicing rights and advances GAAP 1,830,453 38,143 8.34 % Borrowings collateralized by Agency derivatives(4) GAAP 5,033 69 5.48 % Convertible senior notes(7) GAAP 260,091 4,506 6.93 % Interest rate swaps(2)(8) Non-GAAP (12,158) (0.34) % U.S. Treasury futures(2)(9) Non-GAAP (6,133) (0.17) % TBAs(2)(5) Non-GAAP 4,779,214 43,792 3.67 % Total financing Non-GAAP $ 14,343,055 $ 164,111 4.58 % Net Spread Measure Average Yield, less Cost Net spread on AFS securities GAAP (0.40%) Net spread on total portfolio Non-GAAP 0.78% 20 Q4-2024 Portfolio Yields and Financing Costs

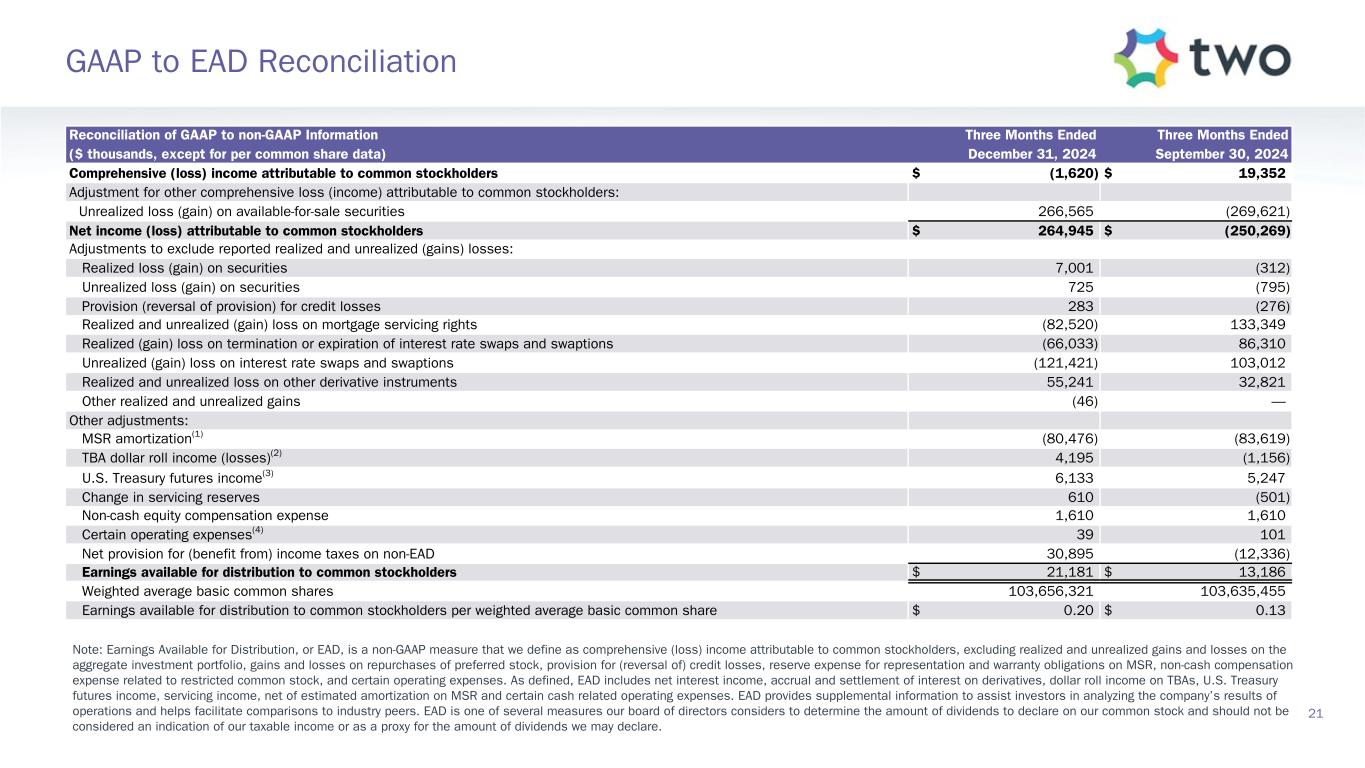

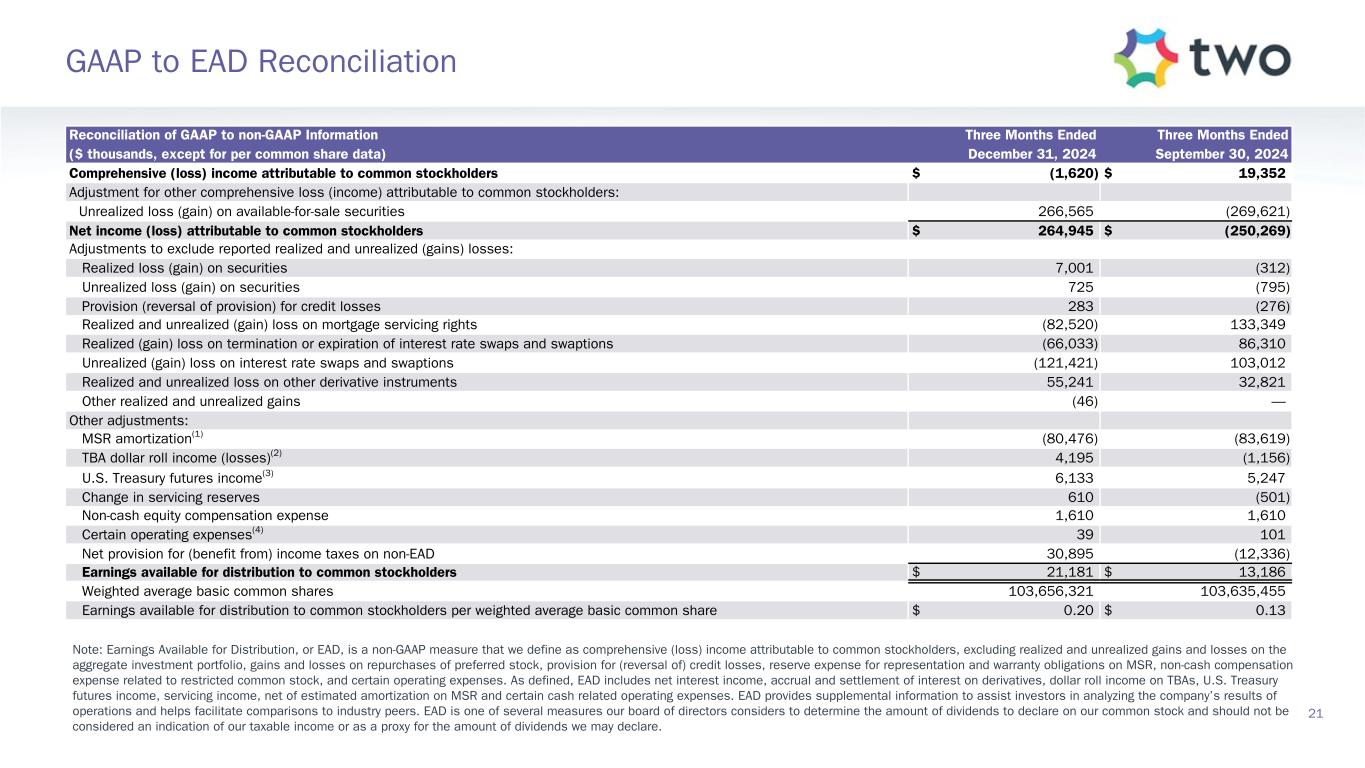

Reconciliation of GAAP to non-GAAP Information Three Months Ended Three Months Ended ($ thousands, except for per common share data) December 31, 2024 September 30, 2024 Comprehensive (loss) income attributable to common stockholders $ (1,620) $ 19,352 Adjustment for other comprehensive loss (income) attributable to common stockholders: Unrealized loss (gain) on available-for-sale securities 266,565 (269,621) Net income (loss) attributable to common stockholders $ 264,945 $ (250,269) Adjustments to exclude reported realized and unrealized (gains) losses: Realized loss (gain) on securities 7,001 (312) Unrealized loss (gain) on securities 725 (795) Provision (reversal of provision) for credit losses 283 (276) Realized and unrealized (gain) loss on mortgage servicing rights (82,520) 133,349 Realized (gain) loss on termination or expiration of interest rate swaps and swaptions (66,033) 86,310 Unrealized (gain) loss on interest rate swaps and swaptions (121,421) 103,012 Realized and unrealized loss on other derivative instruments 55,241 32,821 Other realized and unrealized gains (46) — Other adjustments: MSR amortization(1) (80,476) (83,619) TBA dollar roll income (losses)(2) 4,195 (1,156) U.S. Treasury futures income(3) 6,133 5,247 Change in servicing reserves 610 (501) Non-cash equity compensation expense 1,610 1,610 Certain operating expenses(4) 39 101 Net provision for (benefit from) income taxes on non-EAD 30,895 (12,336) Earnings available for distribution to common stockholders $ 21,181 $ 13,186 Weighted average basic common shares 103,656,321 103,635,455 Earnings available for distribution to common stockholders per weighted average basic common share $ 0.20 $ 0.13 Note: Earnings Available for Distribution, or EAD, is a non-GAAP measure that we define as comprehensive (loss) income attributable to common stockholders, excluding realized and unrealized gains and losses on the aggregate investment portfolio, gains and losses on repurchases of preferred stock, provision for (reversal of) credit losses, reserve expense for representation and warranty obligations on MSR, non-cash compensation expense related to restricted common stock, and certain operating expenses. As defined, EAD includes net interest income, accrual and settlement of interest on derivatives, dollar roll income on TBAs, U.S. Treasury futures income, servicing income, net of estimated amortization on MSR and certain cash related operating expenses. EAD provides supplemental information to assist investors in analyzing the company’s results of operations and helps facilitate comparisons to industry peers. EAD is one of several measures our board of directors considers to determine the amount of dividends to declare on our common stock and should not be considered an indication of our taxable income or as a proxy for the amount of dividends we may declare. 21 GAAP to EAD Reconciliation

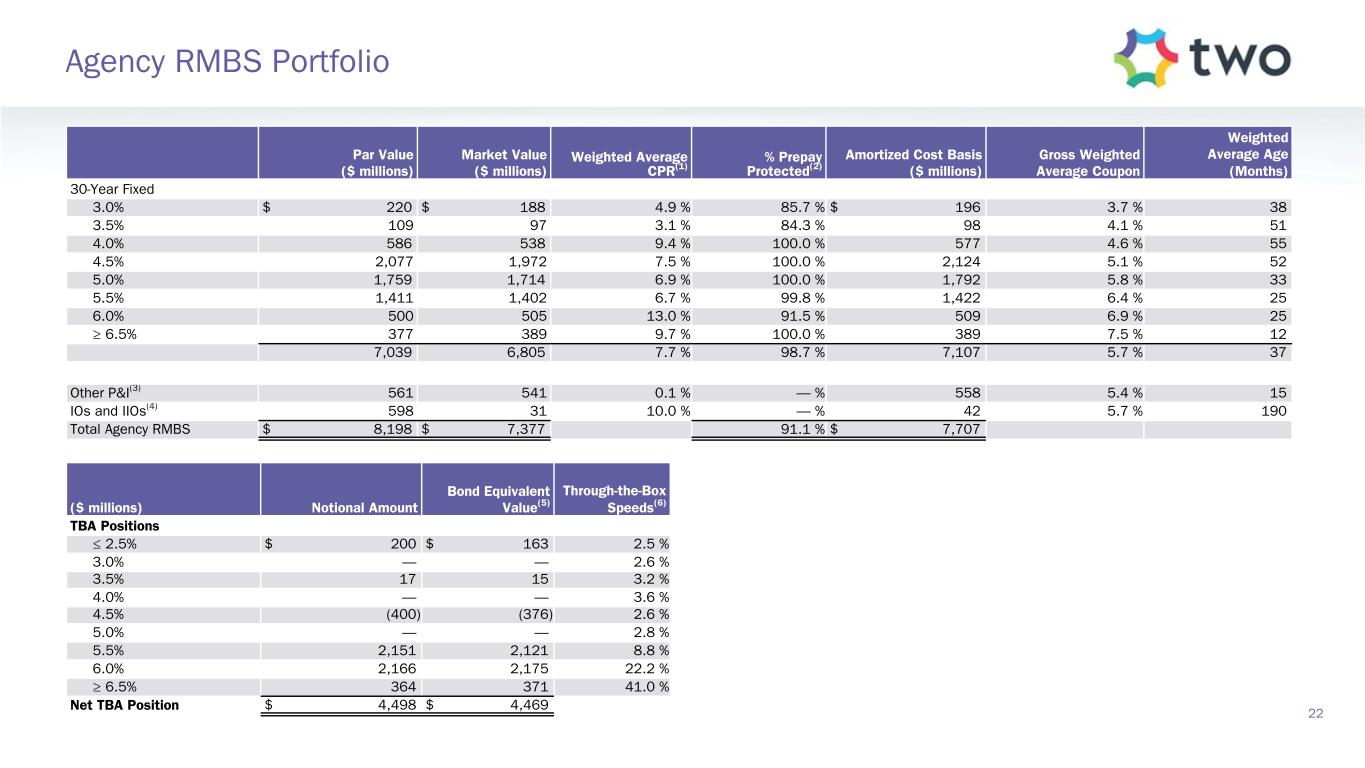

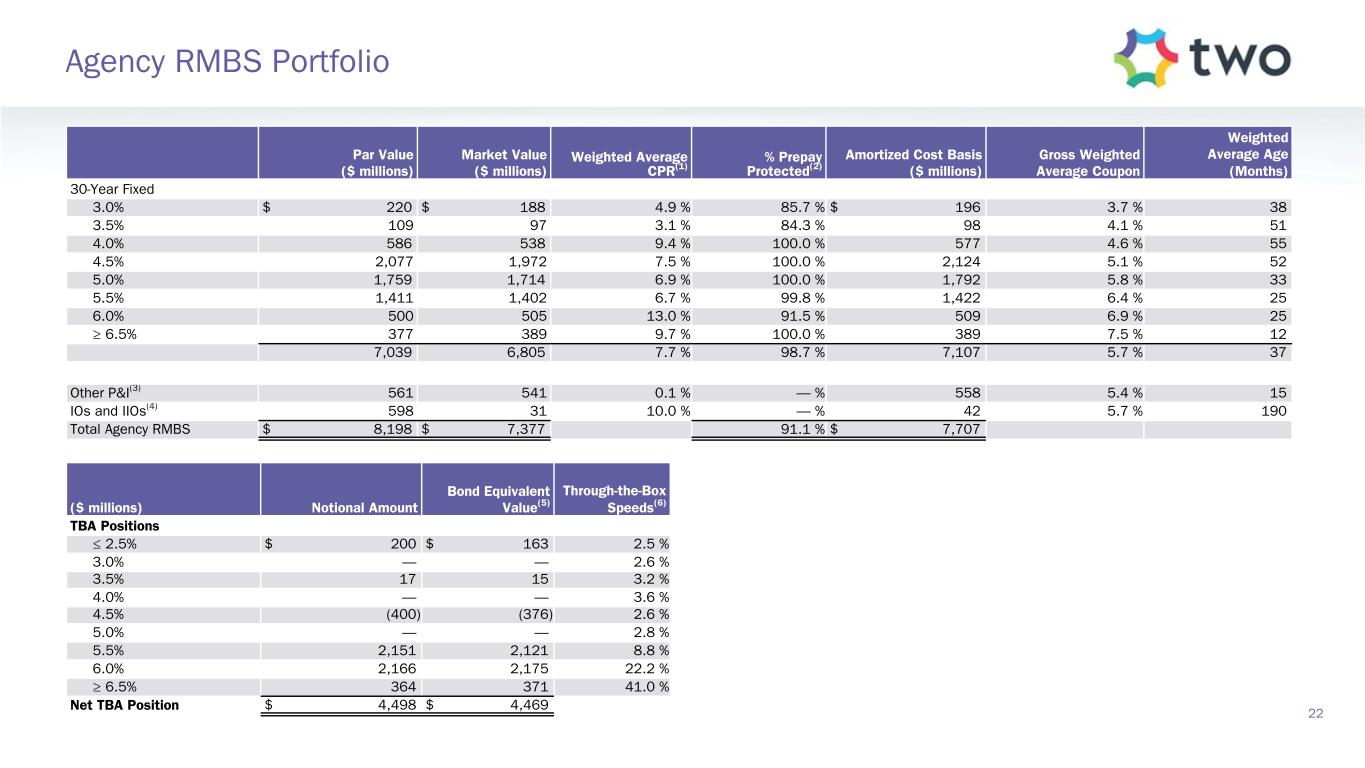

Par Value ($ millions) Market Value ($ millions) Weighted Average CPR(1) % Prepay Protected(2) Amortized Cost Basis ($ millions) Gross Weighted Average Coupon Weighted Average Age (Months) 30-Year Fixed 3.0% $ 220 $ 188 4.9 % 85.7 % $ 196 3.7 % 38 3.5% 109 97 3.1 % 84.3 % 98 4.1 % 51 4.0% 586 538 9.4 % 100.0 % 577 4.6 % 55 4.5% 2,077 1,972 7.5 % 100.0 % 2,124 5.1 % 52 5.0% 1,759 1,714 6.9 % 100.0 % 1,792 5.8 % 33 5.5% 1,411 1,402 6.7 % 99.8 % 1,422 6.4 % 25 6.0% 500 505 13.0 % 91.5 % 509 6.9 % 25 ≥ 6.5% 377 389 9.7 % 100.0 % 389 7.5 % 12 7,039 6,805 7.7 % 98.7 % 7,107 5.7 % 37 Other P&I(3) 561 541 0.1 % — % 558 5.4 % 15 IOs and IIOs(4) 598 31 10.0 % — % 42 5.7 % 190 Total Agency RMBS $ 8,198 $ 7,377 91.1 % $ 7,707 ($ millions) Notional Amount Bond Equivalent Value(5) Through-the-Box Speeds(6) TBA Positions ≤ 2.5% $ 200 $ 163 2.5 % 3.0% — — 2.6 % 3.5% 17 15 3.2 % 4.0% — — 3.6 % 4.5% (400) (376) 2.6 % 5.0% — — 2.8 % 5.5% 2,151 2,121 8.8 % 6.0% 2,166 2,175 22.2 % ≥ 6.5% 364 371 41.0 % Net TBA Position $ 4,498 $ 4,469 22 Agency RMBS Portfolio

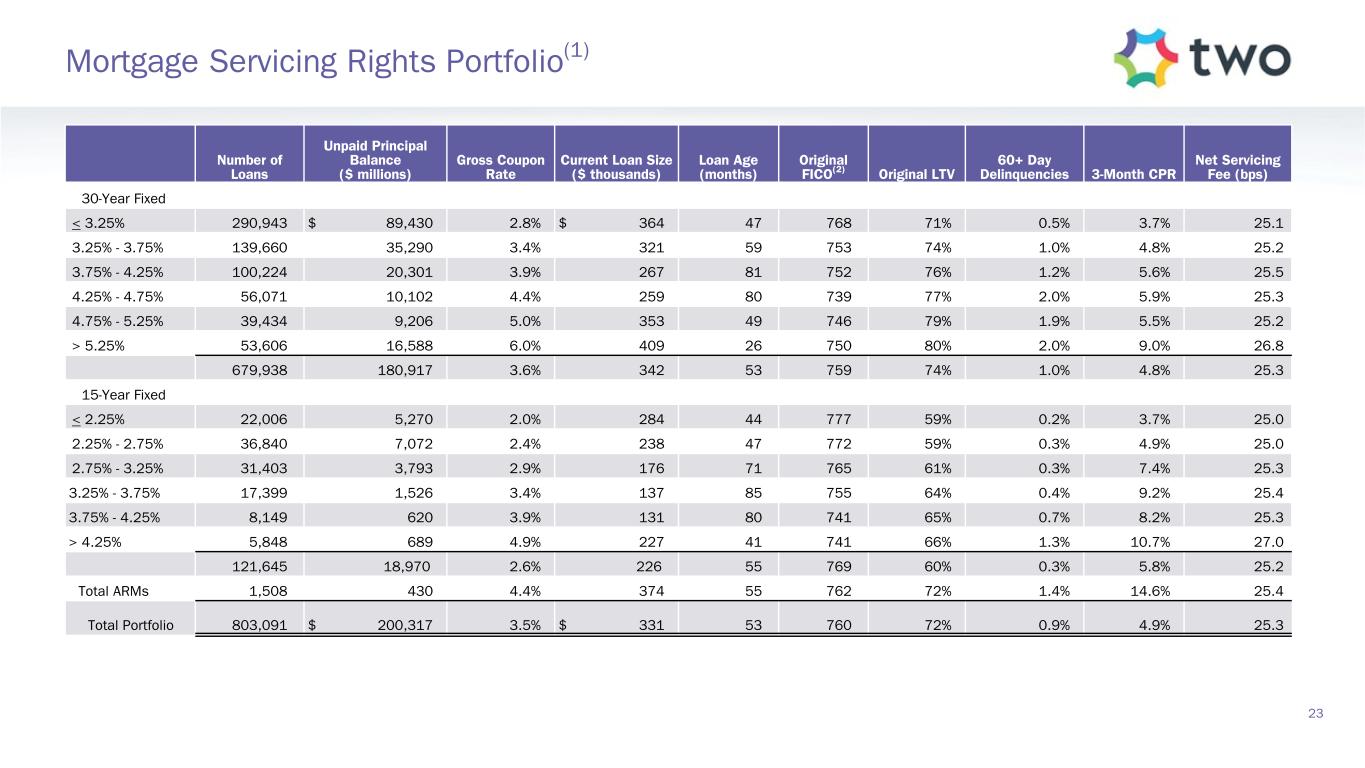

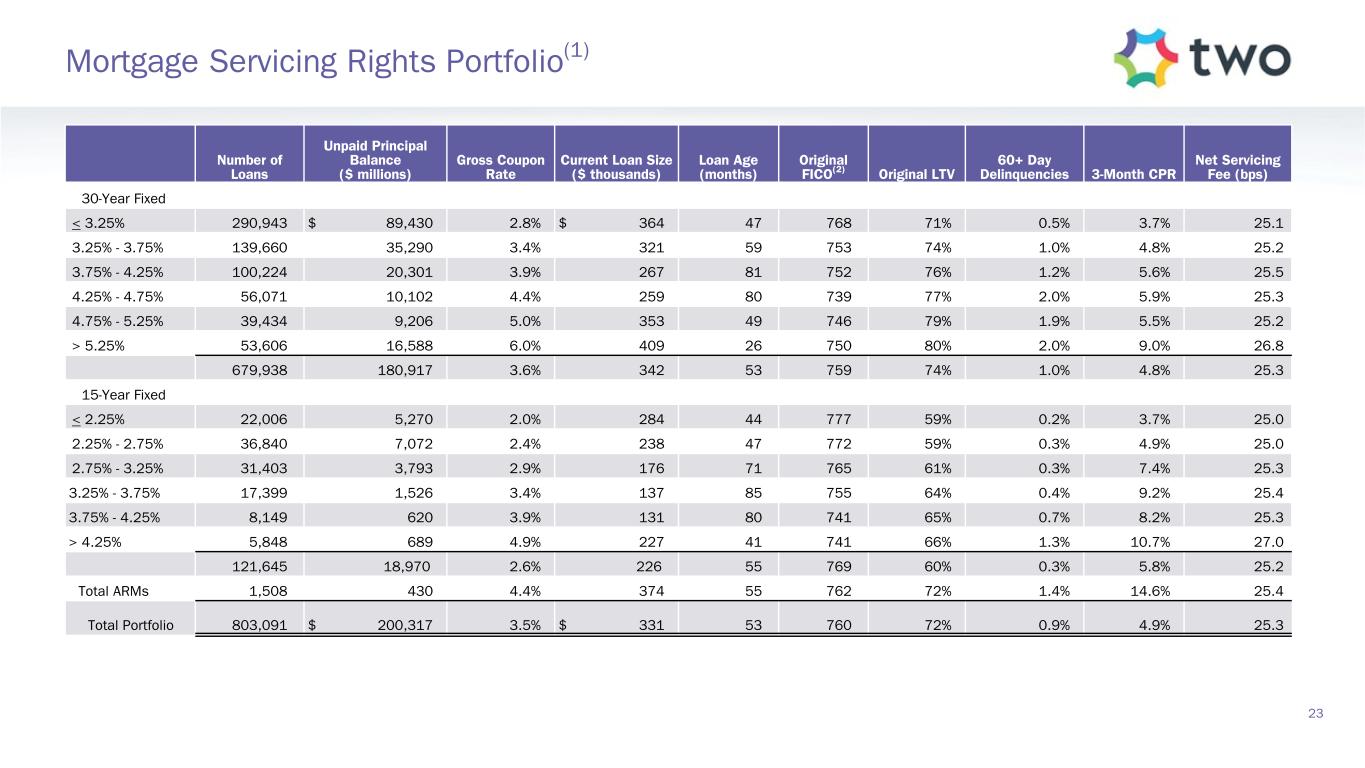

Number of Loans Unpaid Principal Balance ($ millions) Gross Coupon Rate Current Loan Size ($ thousands) Loan Age (months) Original FICO(2) Original LTV 60+ Day Delinquencies 3-Month CPR Net Servicing Fee (bps) 30-Year Fixed < 3.25% 290,943 $ 89,430 2.8% $ 364 47 768 71% 0.5% 3.7% 25.1 3.25% - 3.75% 139,660 35,290 3.4% 321 59 753 74% 1.0% 4.8% 25.2 3.75% - 4.25% 100,224 20,301 3.9 % 267 81 752 76 % 1.2 % 5.6 % 25.5 4.25% - 4.75% 56,071 10,102 4.4 % 259 80 739 77 % 2.0 % 5.9 % 25.3 4.75% - 5.25% 39,434 9,206 5.0 % 353 49 746 79 % 1.9 % 5.5 % 25.2 > 5.25% 53,606 16,588 6.0 % 409 26 750 80 % 2.0 % 9.0 % 26.8 679,938 180,917 3.6 % 342 53 759 74 % 1.0 % 4.8 % 25.3 15-Year Fixed < 2.25% 22,006 5,270 2.0 % 284 44 777 59 % 0.2 % 3.7 % 25.0 2.25% - 2.75% 36,840 7,072 2.4 % 238 47 772 59 % 0.3 % 4.9 % 25.0 2.75% - 3.25% 31,403 3,793 2.9 % 176 71 765 61 % 0.3 % 7.4 % 25.3 3.25% - 3.75% 17,399 1,526 3.4 % 137 85 755 64 % 0.4 % 9.2 % 25.4 3.75% - 4.25% 8,149 620 3.9 % 131 80 741 65 % 0.7 % 8.2 % 25.3 > 4.25% 5,848 689 4.9 % 227 41 741 66 % 1.3 % 10.7 % 27.0 121,645 18,970 2.6 % 226 55 769 60 % 0.3 % 5.8 % 25.2 Total ARMs 1,508 430 4.4 % 374 55 762 72 % 1.4 % 14.6 % 25.4 Total Portfolio 803,091 $ 200,317 3.5 % $ 331 53 760 72 % 0.9 % 4.9 % 25.3 23 Mortgage Servicing Rights Portfolio(1)

$ millions Q4-2024 Q3-2024 Q2-2024 Q1-2024 Q4-2023 UPB at beginning of period $ 202,052 $ 209,390 $ 213,597 $ 215,647 $ 218,662 Bulk purchases of mortgage servicing rights 2,063 2,573 — 2,906 — Flow purchases of mortgage servicing rights 376 715 328 211 829 Originations/recapture of mortgage servicing rights 43 17 — — — Sales of mortgage servicing rights 3 (6,248) — (1,430) (62) Scheduled payments (1,647) (1,641) (1,639) (1,646) (1,640) Prepaid (2,545) (2,779) (2,873) (2,111) (2,127) Other changes (28) 25 (23) 20 (15) UPB at end of period $ 200,317 $ 202,052 $ 209,390 $ 213,597 $ 215,647 24 Mortgage Servicing Rights UPB Roll-forward

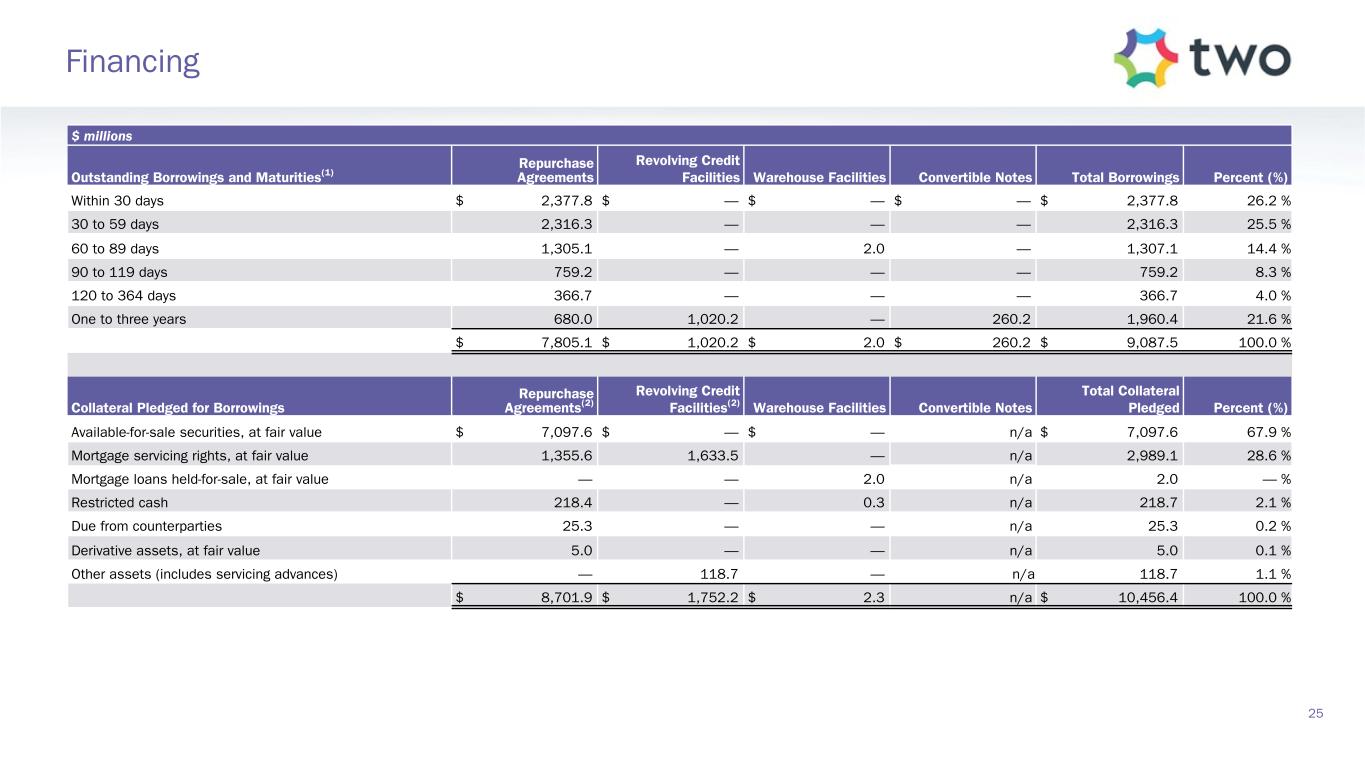

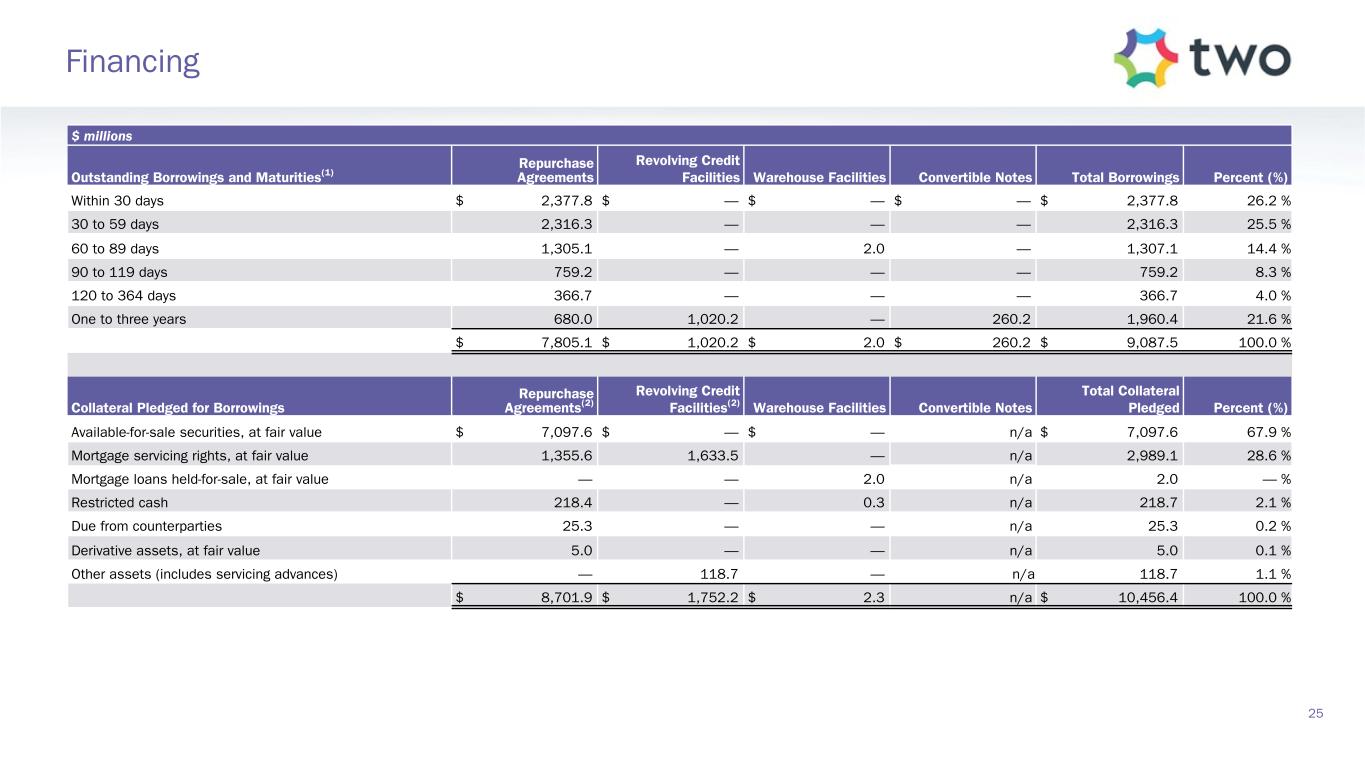

$ millions Outstanding Borrowings and Maturities(1) Repurchase Agreements Revolving Credit Facilities Warehouse Facilities Convertible Notes Total Borrowings Percent (%) Within 30 days $ 2,377.8 $ — $ — $ — $ 2,377.8 26.2 % 30 to 59 days 2,316.3 — — — 2,316.3 25.5 % 60 to 89 days 1,305.1 — 2.0 — 1,307.1 14.4 % 90 to 119 days 759.2 — — — 759.2 8.3 % 120 to 364 days 366.7 — — — 366.7 4.0 % One to three years 680.0 1,020.2 — 260.2 1,960.4 21.6 % $ 7,805.1 $ 1,020.2 $ 2.0 $ 260.2 $ 9,087.5 100.0 % Collateral Pledged for Borrowings Repurchase Agreements(2) Revolving Credit Facilities(2) Warehouse Facilities Convertible Notes Total Collateral Pledged Percent (%) Available-for-sale securities, at fair value $ 7,097.6 $ — $ — n/a $ 7,097.6 67.9 % Mortgage servicing rights, at fair value 1,355.6 1,633.5 — n/a 2,989.1 28.6 % Mortgage loans held-for-sale, at fair value — — 2.0 n/a 2.0 — % Restricted cash 218.4 — 0.3 n/a 218.7 2.1 % Due from counterparties 25.3 — — n/a 25.3 0.2 % Derivative assets, at fair value 5.0 — — n/a 5.0 0.1 % Other assets (includes servicing advances) — 118.7 — n/a 118.7 1.1 % $ 8,701.9 $ 1,752.2 $ 2.3 n/a $ 10,456.4 100.0 % 25 Financing

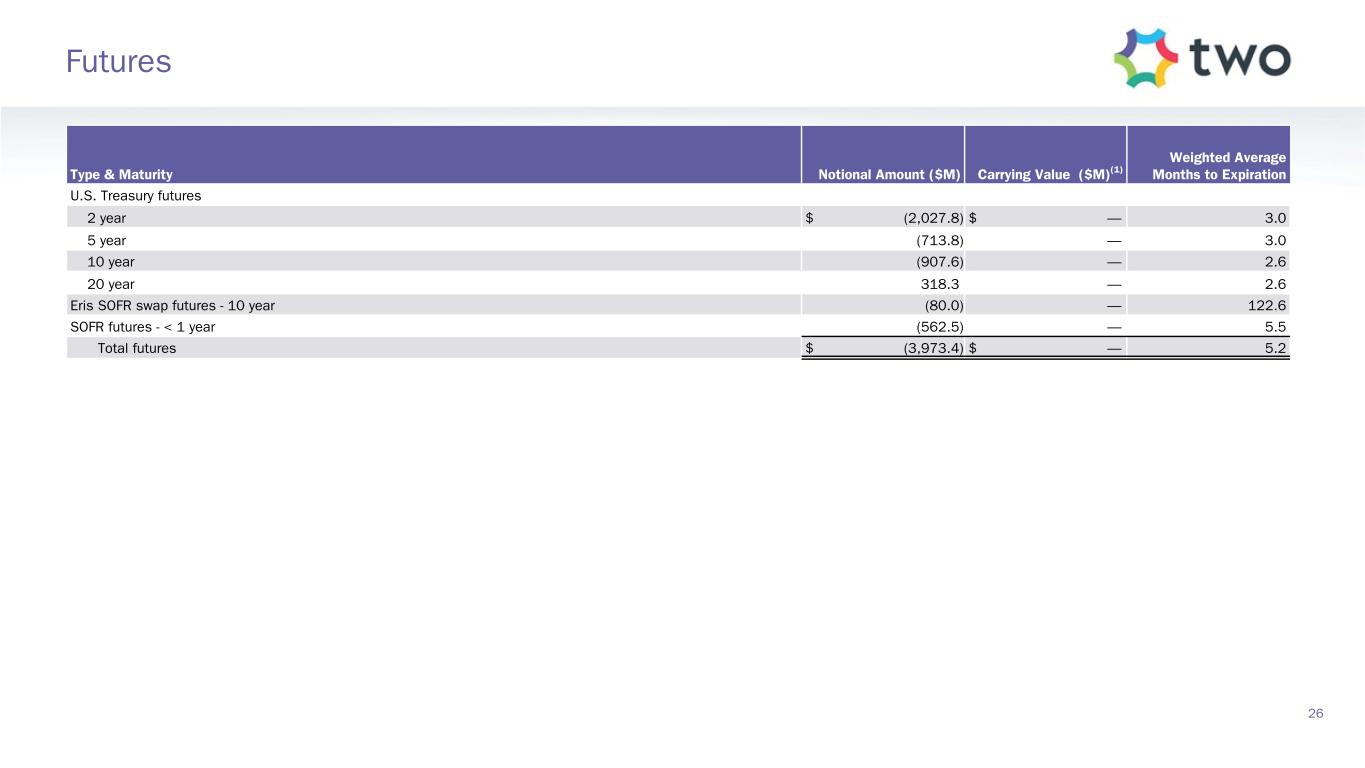

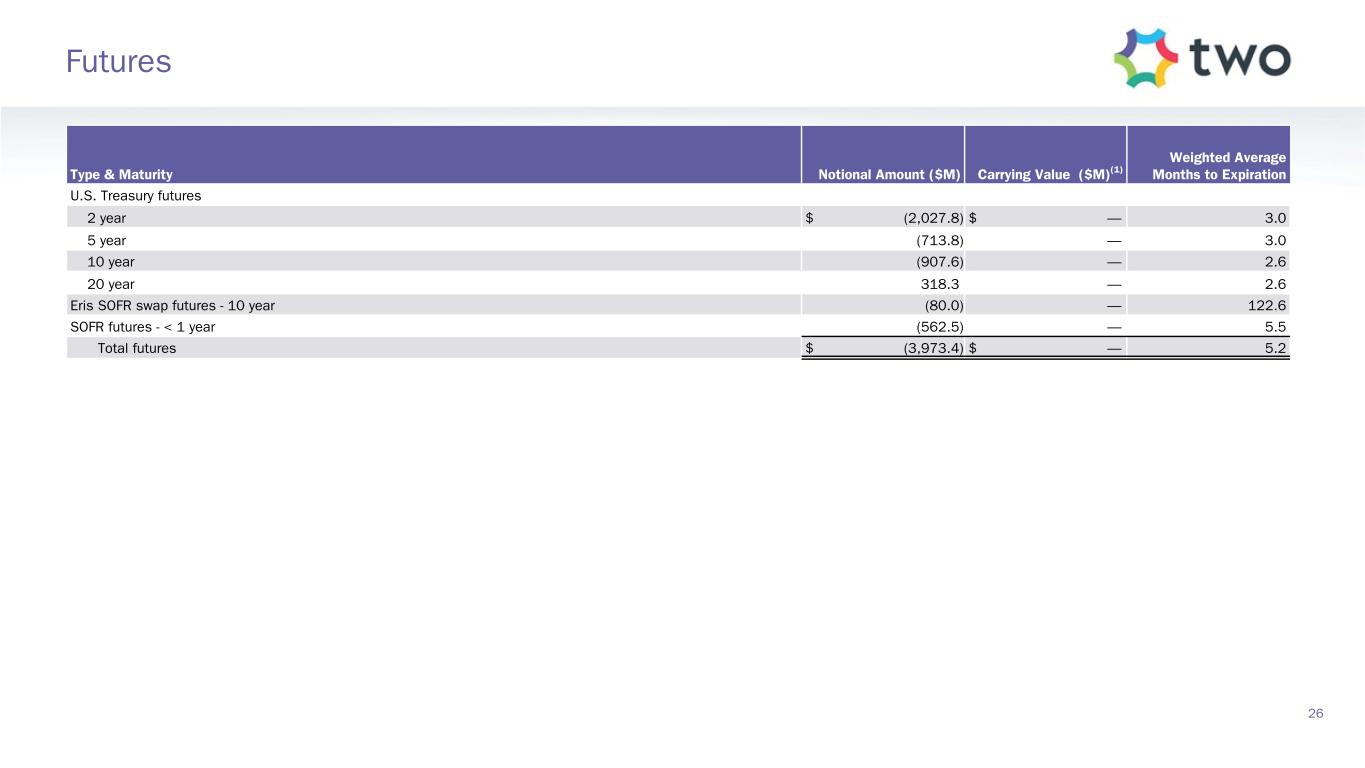

Type & Maturity Notional Amount ($M) Carrying Value ($M)(1) Weighted Average Months to Expiration U.S. Treasury futures 2 year $ (2,027.8) $ — 3.0 5 year (713.8) — 3.0 10 year (907.6) — 2.6 20 year 318.3 — 2.6 Eris SOFR swap futures - 10 year (80.0) — 122.6 SOFR futures - < 1 year (562.5) — 5.5 Total futures $ (3,973.4) $ — 5.2 26 Futures

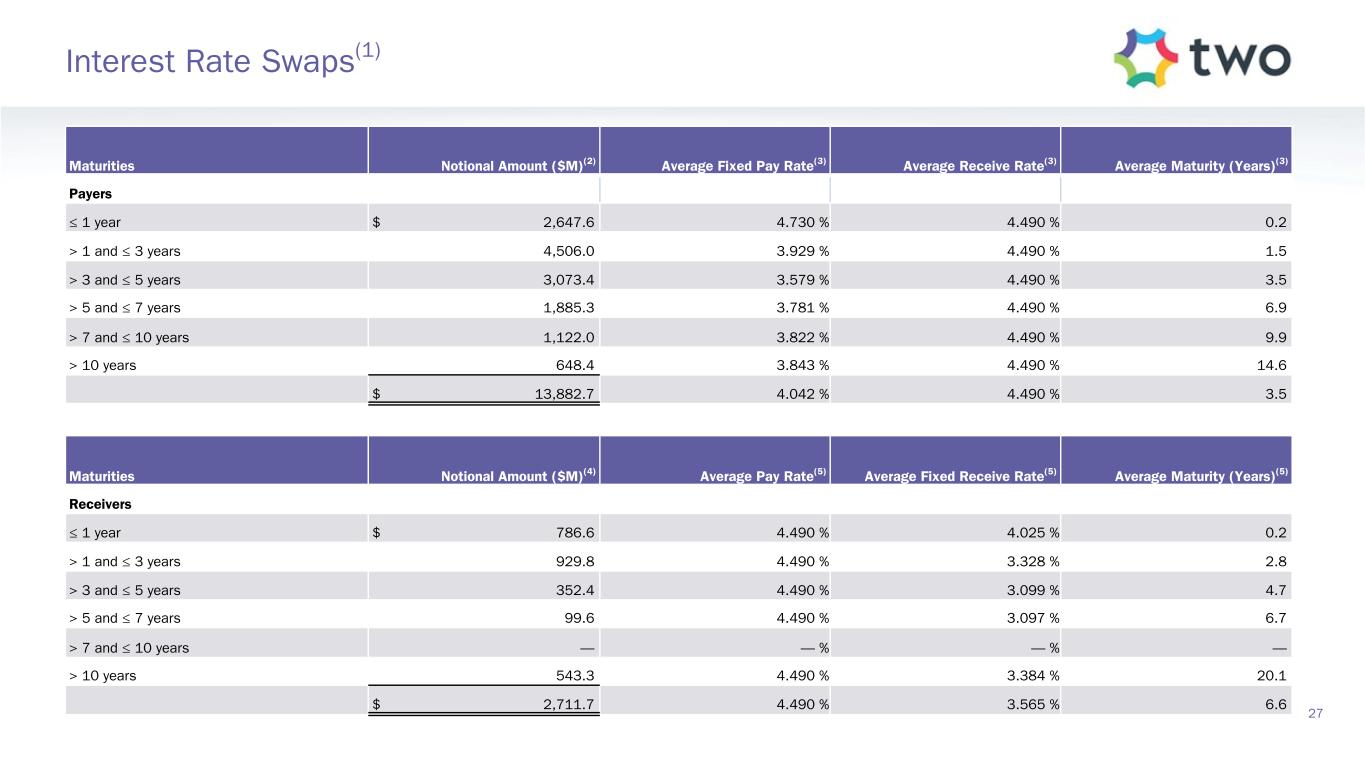

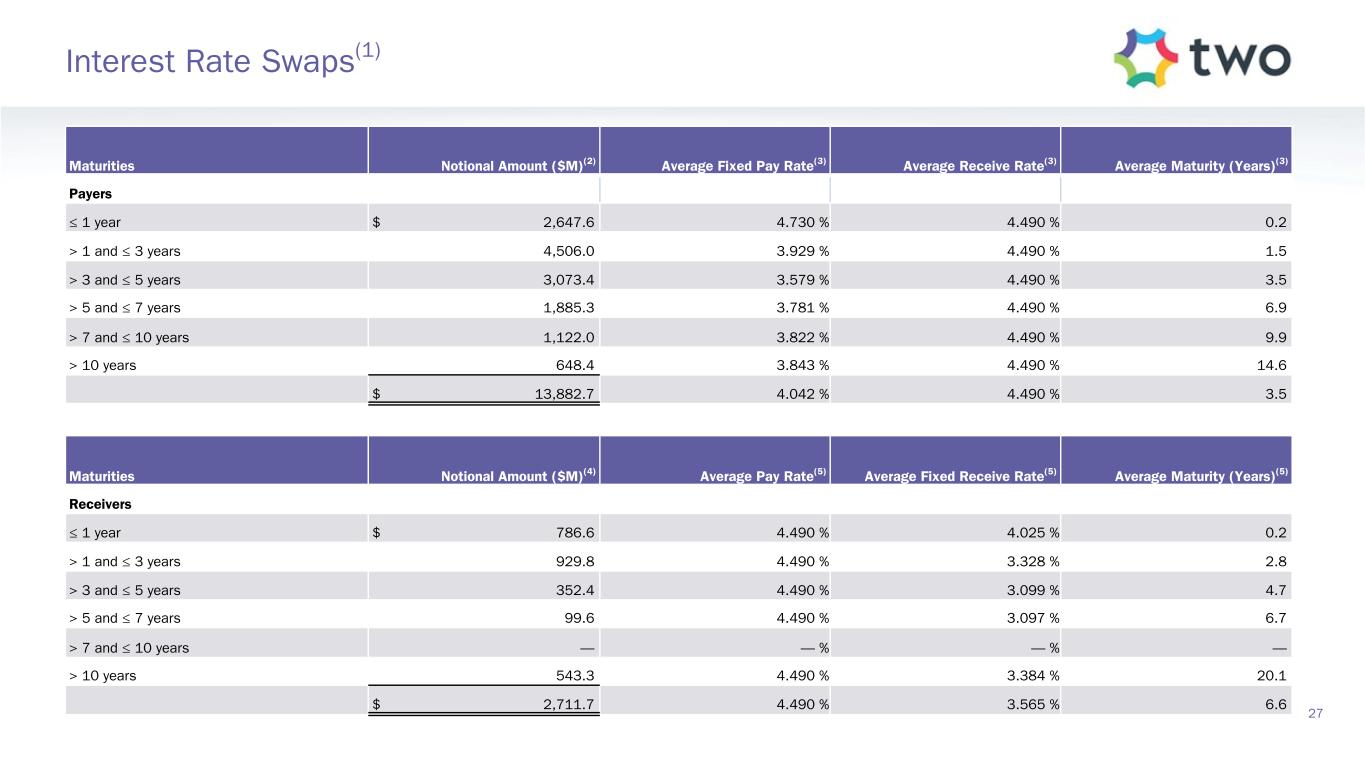

Maturities Notional Amount ($M)(2) Average Fixed Pay Rate(3) Average Receive Rate(3) Average Maturity (Years)(3) Payers ≤ 1 year $ 2,647.6 4.730 % 4.490 % 0.2 > 1 and ≤ 3 years 4,506.0 3.929 % 4.490 % 1.5 > 3 and ≤ 5 years 3,073.4 3.579 % 4.490 % 3.5 > 5 and ≤ 7 years 1,885.3 3.781 % 4.490 % 6.9 > 7 and ≤ 10 years 1,122.0 3.822 % 4.490 % 9.9 > 10 years 648.4 3.843 % 4.490 % 14.6 $ 13,882.7 4.042 % 4.490 % 3.5 Maturities Notional Amount ($M)(4) Average Pay Rate(5) Average Fixed Receive Rate(5) Average Maturity (Years)(5) Receivers ≤ 1 year $ 786.6 4.490 % 4.025 % 0.2 > 1 and ≤ 3 years 929.8 4.490 % 3.328 % 2.8 > 3 and ≤ 5 years 352.4 4.490 % 3.099 % 4.7 > 5 and ≤ 7 years 99.6 4.490 % 3.097 % 6.7 > 7 and ≤ 10 years — — % — % — > 10 years 543.3 4.490 % 3.384 % 20.1 $ 2,711.7 4.490 % 3.565 % 6.6 27 Interest Rate Swaps(1)

28 Tax Characterization of Dividends in 2024 (1) The U.S. federal income tax treatment of holding TWO stock to any particular stockholder will depend on the stockholder’s particular tax circumstances. You are urged to consult your tax advisor regarding the U.S. federal, state, local and foreign income and other tax consequences to you, in light of your particular investment or tax circumstances, of acquiring, holding and disposing of TWO stock. TWO does not provide tax, accounting or legal advice. Any tax statements contained herein were not intended or written to be used and cannot be used for the purpose of avoiding U.S., federal, state or local tax penalties. Please consult your advisor as to any tax, accounting or legal statements made herein. Full Year 2024 Distribution Summary • Generated REIT taxable income, before dividend distributions and net operating loss deductions of $171.7 million • No net operating loss carryover utilized during 2024 • 2024 distributions for tax purposes totaled $233.7 million – Consisted of distributions to common shares of $186.3 million and distributions to preferred shares of $47.4 million – Q4 2023 common stock distribution payable to shareholders on January 29, 2024 with a record date of January 12, 2024 is treated as a 2024 distribution for tax purposes – Q4 2024 common stock distribution payable to shareholders on January 29, 2025 with a record date of January 3, 2025 is treated as a 2025 distribution for tax purposes – No convertible note deemed distributions occurred in 2024 • 2024 preferred distributions are characterized for tax purposes as 100% taxable ordinary dividends • 2024 common distributions are characterized for tax purposes as 66.7% taxable ordinary dividends and 33.3% nontaxable distributions (i.e., return of capital) • Of the preferred and common taxable ordinary dividends, 56.5% are characterized as qualified dividends(1)

PAGE 3 - Quarterly Financials Overview 1. Economic return on book value is defined as the increase (decrease) in common book value from the beginning to the end of the given period, plus dividends declared to common stockholders in the period, divided by common book value as of the beginning of the period. 2. Includes $10.4 billion in settled positions and $4.4 billion net TBA position, which represents the bond equivalent value of the company’s TBA position. Bond equivalent value is defined as notional amount multiplied by market price. TBA contracts accounted for as derivative instruments in accordance with GAAP. For additional detail on the portfolio, see slides 11 and 13, and Appendix slides 22 and 23. 3. Economic debt-to-equity is defined as total borrowings to fund Agency and non-Agency investment securities, MSR and related servicing advances and mortgage loans held-for-sale, plus the implied debt on net TBA cost basis and net payable (receivable) for unsettled RMBS, divided by total equity. PAGE 4 - Markets Overview 1. Source: Bloomberg, as of the dates noted. 2. Source: Bloomberg, as of the dates noted. PAGE 5 - RoundPoint Operations Update 1. Data for loans in originations pipeline as of January 24, 2025. PAGE 6 - Book Value Summary 1. Economic return on book value is defined as the increase (decrease) in common book value from the beginning to the end of the given period, plus dividends declared to common stockholders in the period, divided by common book value as of the beginning of the period. PAGE 8 - Financing Profile 1. Source: Bloomberg. Represents the average spread between repurchase rates and the Secured Overnight Financing Rate (SOFR) over trailing three-month and six-month periods between Q4 2020 and Q4 2024 (as of December 31, 2024). PAGE 9 - Portfolio Composition and Risk Positioning 1. For additional detail on the portfolio, see slides 11 and 13, and Appendix slides 22 and 23. 2. Net TBA position represents the bond equivalent value of the company’s TBA position. Bond equivalent value is defined as notional amount multiplied by market price. TBA contracts accounted for as derivative instruments in accordance with GAAP. 3. Economic debt-to-equity is defined as total borrowings to fund Agency and non-Agency investment securities, MSR and related servicing advances and mortgage loans held-for-sale, plus the implied debt on net TBA cost basis and net payable (receivable) for unsettled RMBS, divided by total equity. 4. Interest rate exposure represents estimated change in common book value for theoretical parallel shift in interest rates. 5. Spread exposure represents estimated change in common book value for theoretical parallel shifts in spreads. PAGE 10 - Agency RMBS Investment Landscape 1. Source: J.P. Morgan DataQuery. Data is model-based and represents universal mortgage-backed securities (UMBS) generic TBA spreads as of the dates noted. In 2023, J.P. Morgan updated their model affecting only 2023 data. 2. Spreads produced using prepayment speeds generated with The Yield Book® Software using internally calibrated prepayment dials. Data as of December 31, 2024. ZV Spread stands for zero volatility spread. 29 End Notes

PAGE 11 - Agency RMBS Portfolio 1. Specified pools include securities with implicit or explicit prepayment protection, including lower loan balances (securities collateralized by loans less than or equal to $300K of initial principal balance), higher LTVs (securities collateralized by loans with greater than or equal to 80% LTV), certain geographic concentrations, loans secured by investor-owned properties, and lower FICO scores, as well as securities without such protection, including large bank-serviced and others. 2. Represents UMBS generic TBA performance during the quarter. 3. Specified pool performance excludes (1) certain coupons in which we were not invested for the full duration of the quarter and (2) certain coupons with de minimis balances. 4. Specified pool market value by coupon as of December 31, 2024. 5. Three-month prepayment speeds of delivered TBA contracts; average of J.P. Morgan, Bank of America, and Citi data. PAGE 12 - MSR Investment Landscape 1. Source: RiskSpan and TWO’s internal estimates as of December 31, 2024. 2. Source: RiskSpan. 30-year fixed-rate UMBS UPB as of December 31, 2024 Factor Date; Freddie Mac’s Primary Mortgage Market Survey (PMMS) as of December 31, 2024. PAGE 13 - MSR Portfolio 1. MSR portfolio based on the prior month-end's principal balance of the loans underlying the company's MSR, increased for current month purchases. Portfolio metrics, other than fair value and UPB, represent averages weighted by UPB. 2. FICO represents a mortgage industry accepted credit score of a borrower. 3. MSR portfolio based on the prior month-end's principal balance of the loans underlying the company's MSR, increased for current month purchases and excluding unsettled MSR on loans for which the company is the named servicer as well as MSR on loans recently settled for which transfer to the company is not yet complete. 4. Three-month prepayment speeds of delivered TBA contracts; average of J.P. Morgan, Bank of America, and Citi data. PAGE 14 - Return Potential and Outlook 1. Capital allocated represents management’s internal allocation. Certain financing balances and associated interest expenses are allocated between investments based on management’s assessment of leverage ratios and required capital or liquidity to support the investment. 2. Market return estimates reflect static assumptions using quarter-end spreads and market data. 3. Includes Agency pools and TBA positions. Net TBA position represents the bond equivalent value of the company’s TBA position. Bond equivalent value is defined as notional amount multiplied by market price. TBA contracts accounted for as derivative instruments in accordance with GAAP. 4. Estimated return on invested capital reflects static return assumptions using quarter-end portfolio valuations. 5. Total expenses includes operating expenses and tax expenses within the company’s taxable REIT subsidiaries. 6. Preferred equity coupon represents the 5-year yield along the forward curve to account for floating rate resets. 7. Prospective quarterly static return estimate per basic common share reflects portfolio performance expectations given current market conditions and represents the comprehensive income attributable to common stockholders (net of dividends on preferred stock). 30 End Notes (continued)

PAGE 16 - Effective Coupon Positioning 1. Represents UMBS TBA market prices as of December 31, 2024. 2. Specified pools include securities with implicit or explicit prepayment protection, including lower loan balances (securities collateralized by loans less than or equal to $300K of initial principal balance), higher LTVs (securities collateralized by loans with greater than or equal to 80% LTV), certain geographic concentrations, loans secured by investor-owned properties, and lower FICO scores, as well as securities without such protection, including large bank-serviced and others. 3. MSR/Agency IO represents an internally calculated exposure of a synthetic TBA position and the current coupon equivalents of our MSR, including the effect of unsettled MSR, and Agency IO RMBS. 4. Spreads generated with The Yield Book® Software using internally calibrated dials. PAGE 17 - Risk Positioning 1. MSR/Agency IO RMBS includes the effect of unsettled MSR. 2. Other includes all other derivative assets and liabilities and borrowings. Other excludes TBAs, which are included in the Agency P&I RMBS/TBA category. 3. Bull Steepener/Bear Flattener is a shift in short-term rates that represents estimated change in common book value for theoretical non-parallel shifts in the yield curve. Analysis uses a +/- 25 basis point shift in 2- year rates while holding long-term rates constant. 4. Bull Flattener/Bear Steepener is a shift in long-term rates that represents estimated change in common book value for theoretical non-parallel shifts in the yield curve. Analysis uses a +/- 25 basis point shift in 10- year rates while holding short-term rates constant. 5. Parallel shift represents estimated change in common book value for theoretical parallel shift in interest rates. 6. Book value exposure to current coupon spread represents estimated change in common book value for theoretical parallel shifts in spreads. PAGE 18 - Markets Overview 1. Source: Bloomberg, US MBS Index Monthly Treasury Excess Return data as of dates noted. 2. Source: Bloomberg, as of dates noted. 3. Source: J.P. Morgan DataQuery. 4. Source: National Association of Realtors via Bloomberg and RiskSpan as of December 31, 2024. PAGE 19 - Financial Performance 1. Economic return on book value is defined as the increase (decrease) in common book value from the beginning to the end of the given period, plus dividends declared to common stockholders in the period, divided by the common book value as of the beginning of the period. 2. Historical dividends may not be indicative of future dividend distributions. The company ultimately distributes dividends based on its taxable income per common share, not GAAP earnings. The annualized dividend yield on the company’s common stock is calculated based on the closing price of the last trading day of the relevant quarter. 31 End Notes (continued)

PAGE 20 - Q4-2024 Portfolio Yields and Financing Costs 1. Includes interest income, net of premium amortization/discount accretion, on Agency and non-Agency investment securities, servicing income, net of estimated amortization and servicing expenses, on MSR, and the implied asset yield portion of dollar roll income on TBAs. Amortization on MSR refers to the portion of change in fair value of MSR primarily attributed to the realization of expected cash flows (runoff) of the portfolio, which is deemed a non-GAAP measure due to the company’s decision to account for MSR at fair value. TBA dollar roll income is the non-GAAP economic equivalent to holding and financing Agency RMBS using short-term repurchase agreements. 2. As reported elsewhere in the company’s filings with the Securities and Exchange Commission, MSR, Agency derivatives, TBA, interest rate swap agreements and U.S. Treasury futures are reported at fair value in the company’s consolidated financial statements in accordance with GAAP, and the GAAP presentation and disclosure requirements for these items do not define or include the concepts of yield or cost of financing, amortized cost, or outstanding borrowings. 3. Amortized cost on MSR for a given period equals the net present value of the remaining future cash flows (obtained by applying original prepayment assumptions to the actual unpaid principal balance at the start of the period) using a discount rate equal to the original pricing yield. Original pricing yield is the discount rate which makes the net present value of the cash flows projected at purchase equal to the purchase price. MSR amortized cost is deemed a non-GAAP measure due to the company’s decision to account for MSR at fair value. 4. Represents inverse interest-only Agency RMBS which are accounted for as derivative instruments in accordance with GAAP. 5. Both the implied asset yield and implied financing benefit/cost of dollar roll income on TBAs are calculated using the average cost basis of TBAs as the denominator. TBA dollar roll income is the non-GAAP economic equivalent to holding and financing Agency RMBS using short-term repurchase agreements. TBAs are accounted for as derivative instruments in accordance with GAAP. 6. Includes interest expense and amortization of deferred debt issuance costs on borrowings under repurchase agreements (excluding those collateralized by U.S. Treasuries), revolving credit facilities, term notes payable and convertible senior notes, interest spread income/expense and amortization of upfront payments made or received upon entering into interest rate swap agreements, and the implied financing benefit/ cost portion of dollar roll income on TBAs. TBA dollar roll income is the non-GAAP economic equivalent to holding and financing Agency RMBS using short-term repurchase agreements. 7. Unsecured convertible senior notes. 8. The cost of financing on interest rate swaps held to mitigate interest rate risk associated with the company’s outstanding borrowings is calculated using average borrowings balance as the denominator. 9. The cost of financing on U.S. Treasury futures held to mitigate interest rate risk associated with the company’s outstanding borrowings is calculated using average borrowings balance as the denominator. U.S. Treasury futures income is the economic equivalent to holding and financing a relevant cheapest-to-deliver U.S. Treasury note or bond using short-term repurchase agreements. PAGE 21 - GAAP to EAD Reconciliation 1. MSR amortization refers to the portion of change in fair value of MSR primarily attributed to the realization of expected cash flows (runoff) of the portfolio, which is deemed a non-GAAP measure due to the company’s decision to account for MSR at fair value. 2. TBA dollar roll income is the economic equivalent to holding and financing Agency RMBS using short-term repurchase agreements. 3. U.S. Treasury futures income is the economic equivalent to holding and financing a relevant cheapest-to-deliver U.S. Treasury note or bond using short-term repurchase agreements. 4. Certain operating expenses predominantly consists of expenses incurred in connection with the company’s ongoing litigation with PRCM Advisers LLC. 32 End Notes (continued)

PAGE 22 - Agency RMBS Portfolio 1. Weighted average actual one-month CPR released at the beginning of the following month based on RMBS held as of the preceding month-end. 2. Determination of the percentage of prepay protected 30-year fixed Agency RMBS includes securities with implicit or explicit prepayment protection, including lower loan balances (securities collateralized by loans less than or equal to $300K of initial principal balance), higher LTVs (securities collateralized by loans with greater than or equal to 80% LTV), certain geographic concentrations, loans secured by investor-owned properties, and lower FICO scores. 3. Other P&I includes 15-year fixed, Hybrid ARMs, CMO and DUS pools. 4. IOs and IIOs represent market value of $9.0 million of Agency derivatives and $22.0 million of interest-only Agency RMBS. Agency derivatives are inverse interest-only Agency RMBS, which are accounted for as derivative instruments in accordance with GAAP. 5. Bond equivalent value is defined as the notional amount multiplied by market price. TBA contracts accounted for as derivative instruments in accordance with GAAP. 6. Three-month prepayment speeds of delivered TBA contracts; average of J.P. Morgan, Bank of America, and Citi data. PAGE 23 - Mortgage Servicing Rights Portfolio 1. MSR portfolio excludes residential mortgage loans for which the company is the named servicing administrator. Portfolio metrics, other than fair value and UPB, represent averages weighted by UPB. 2. FICO represents a mortgage industry-accepted credit score of a borrower. PAGE 25 - Financing 1. As of December 31, 2024, outstanding borrowings had a weighted average of 5.1 months to maturity. 2. Repurchase agreements and revolving credit facilities secured by MSR and/or other assets may be over-collateralized due to operational considerations. PAGE 26 - Futures 1. Exchange-traded derivative instruments (futures and options on futures) require the posting of an “initial margin” amount determined by the clearing exchange, which is generally intended to be set at a level sufficient to protect the exchange from the derivative instrument’s maximum estimated single-day price movement. The company also exchanges “variation margin” based upon daily changes in fair value, as measured by the exchange. The exchange of variation margin is considered a settlement of the derivative instrument, as opposed to pledged collateral. Accordingly, the receipt or payment of variation margin is accounted for as a direct reduction to the carrying value of the exchange-traded derivative asset or liability. PAGE 27 - Interest Rate Swaps 1. The company did not hold any interest rate swaptions at December 31, 2024. 2. Includes $2.4 billion notional amount of forward starting interest rate swaps. 3. Weighted averages exclude forward starting interest rate swaps. As of December 31, 2024, forward starting interest rate swap payers had a weighted average fixed pay rate of 3.8% and weighted average maturities of 5.5 years. 4. Includes $719.8 million notional amount of forward starting interest rate swaps. 5. Weighted averages exclude forward starting interest rate swaps. As of December 31, 2024, forward starting interest rate swap receivers had a weighted average fixed receive rate of 4.0% and weighted average maturities of 2.6 years. 33 End Notes (continued)