UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| | | | | |

Filed by the Registrant x |

| |

Filed by a Party other than the Registrant o |

| | |

| Check the appropriate box: |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material under §240.14a‑12 |

| | | | | | | | | | | | | | |

| WESTERN ASSET MORTGAGE CAPITAL CORPORATION |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check all boxes that apply): |

| x | | No fee required |

| o | | Fee paid previously with preliminary materials |

| o | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(l) and 0-11 |

WESTERN ASSET MORTGAGE CAPITAL CORPORATION

385 EAST COLORADO BOULEVARD

PASADENA, CALIFORNIA 91101

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 23, 2023

TO THE STOCKHOLDERS OF WESTERN ASSET MORTGAGE CAPITAL CORPORATION:

Notice is hereby given that the Annual Meeting of Stockholders of Western Asset Mortgage Capital Corporation, a Delaware corporation (the "Company"), will be held on June 23, 2023 at 9:00 A.M., Pacific Time, online at https://web.lumiagm.com/239581234. This year's Annual Meeting of Stockholders will be held in a virtual-only meeting format. Additional details about how you may obtain virtual access to the Annual Meeting are set forth below under the heading "Voting Securities."

At the Annual Meeting of Stockholders, stockholders will be invited to consider and vote upon for the following matters, all of which are more completely set forth in the accompanying Proxy Statement:

1.To elect the Board of Directors, with each director serving a one‑year term and until his or her successor is elected and qualified;

2.To hold an advisory vote on executive compensation;

3.To ratify the selection of PricewaterhouseCoopers LLP, independent certified public accountants, as auditors for the Company for the year ending December 31, 2023; and

4.To transact such other business as may properly come before the meeting.

Only stockholders of record at the close of business on May 1, 2023 are entitled to notice of and to vote at the Annual Meeting or any adjournments or postponements thereof. Stockholders should review the information provided herein in conjunction with the Company’s 2022 Annual Report to Stockholders, which accompanies this Proxy Statement.

An additional copy of our Annual Report on Form 10‑K for the year ended December 31, 2022, as filed with the Securities and Exchange Commission, except for exhibits, will be furnished without charge to any stockholder upon written or oral request to:

WESTERN ASSET MORTGAGE CAPITAL CORPORATION

Attn: Secretary

385 East Colorado Boulevard

Pasadena, California 91101

Phone: (626) 844-9400

The Company’s Proxy Statement and Proxy accompany this notice.

| | | | | |

| By order of the Board of Directors, |

| |

| Adam C.E. Wright, Secretary |

Pasadena, California

Date: May 1, 2023

Enclosures

****YOUR VOTE IS IMPORTANT****

YOU ARE URGED TO DATE, SIGN, AND PROMPTLY RETURN YOUR PROXY SO THAT YOUR SHARES MAY BE VOTED IN ACCORDANCE WITH YOUR WISHES AND IN ORDER THAT THE PRESENCE OF A QUORUM MAY BE ASSURED. THE PROMPT RETURN OF YOUR SIGNED PROXY, REGARDLESS OF THE NUMBER OF SHARES YOU HOLD, WILL AID THE COMPANY IN REDUCING THE EXPENSE OF ADDITIONAL PROXY SOLICITATION. THE GIVING OF SUCH PROXY DOES NOT AFFECT YOUR RIGHT TO VOTE IN THE EVENT YOU ATTEND THE VIRTUAL MEETING.

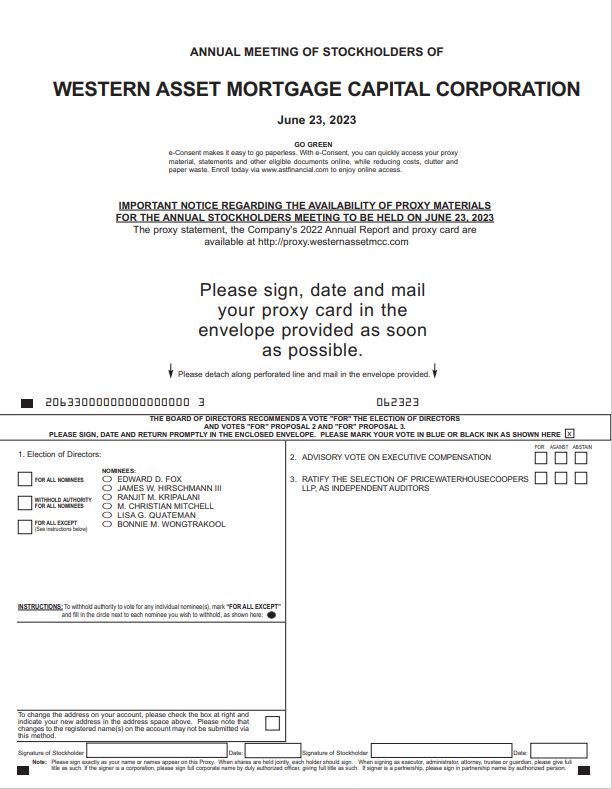

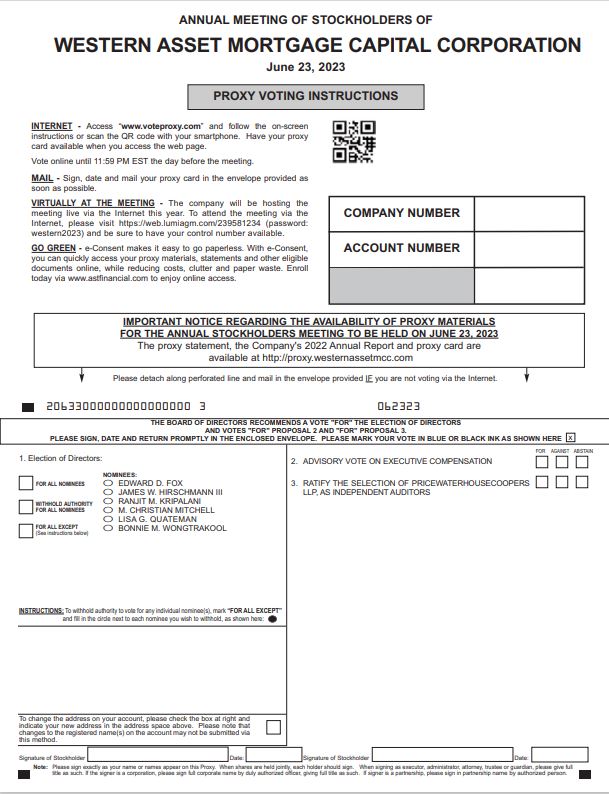

NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS

Important Notice Regarding the Availability of Proxy Materials for the

Annual Stockholder Meeting to be Held on June 23, 2023

Pursuant to rules promulgated by the Securities and Exchange Commission, we have elected to provide access to these proxy statement materials (which includes this Proxy Statement, a proxy card and our 2022 Annual Report to Stockholders) both by sending you this full set of proxy statement materials, including a proxy card, and by notifying you of the availability of such materials on the Internet.

This Proxy Statement, the Company’s 2022 Annual Report and a proxy card will be made available at http://proxy.westernassetmcc.com.

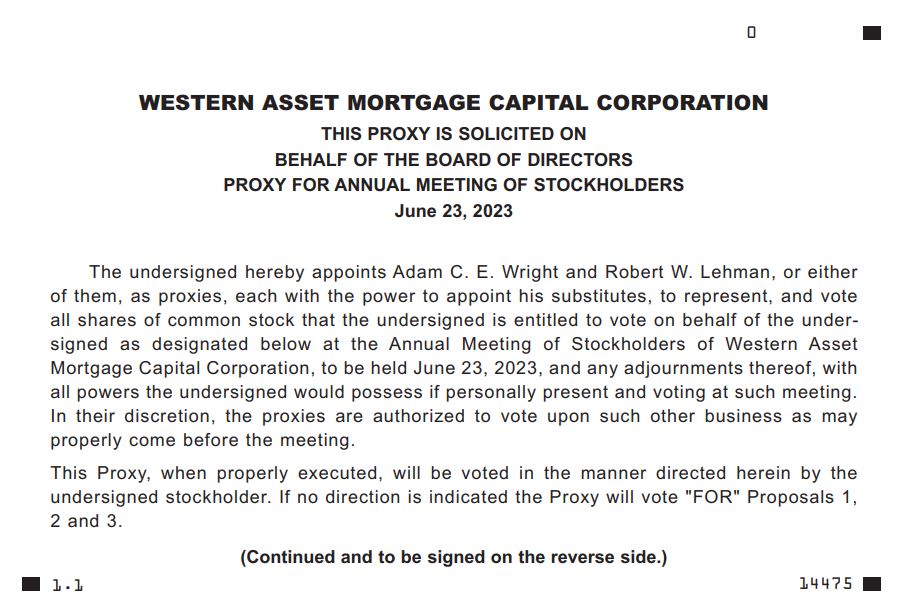

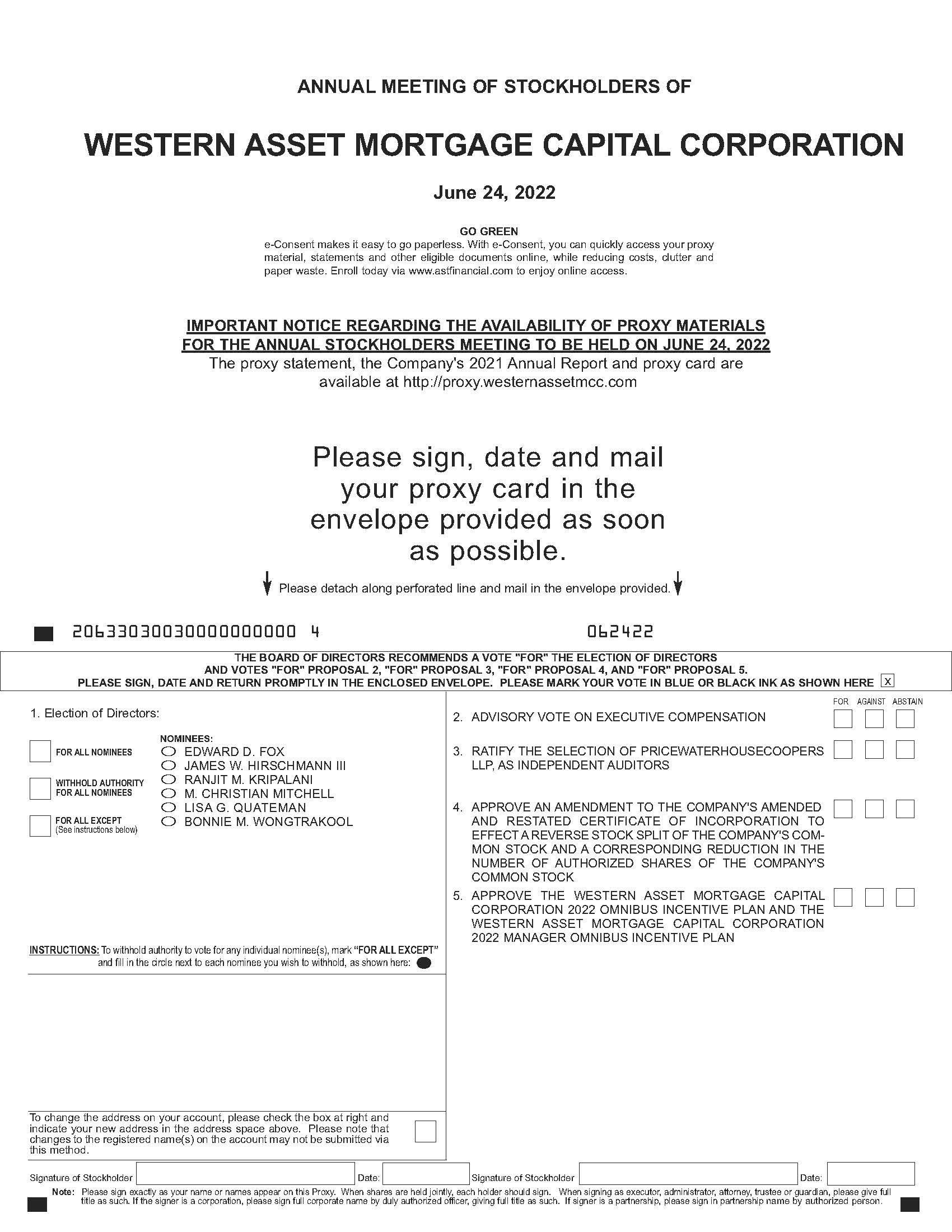

The Annual Meeting of Stockholders will be held June 23, 2023 at 9:00 A.M. Pacific Time, online at https://web.lumiagm.com/239581234. This year's Annual Meeting of Stockholders will be held in a virtual-only meeting format. Additional details about how you may obtain virtual access to the Annual Meeting are set forth below under the heading "Voting Securities." The Proposals to be voted upon at the Annual Meeting of Stockholders, all of which are more completely set forth in this Proxy Statement, are as follows:

1. To elect the Board of Directors, with each director serving a one‑year term and until his or her successor is elected and qualified;

2. To hold an advisory vote on executive compensation; and

3. To ratify the selection of PricewaterhouseCoopers LLP, independent certified public accountants, as auditors for the Company for the year ending December 31, 2023.

Our Board of Directors recommends that you vote "FOR" the approval of Proposals 1, 2 and 3.

For information on how to vote at the Annual Meeting of Stockholders, please see the sections entitled "Solicitation and Revocation of Proxy" and "Voting Securities" below.

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 23, 2023

This Proxy Statement is furnished in connection with the Annual Meeting (the "Annual Meeting") of Stockholders of Western Asset Mortgage Capital Corporation (the "Company") to be held June 23, 2023 at 9:00 A.M. Pacific Time, online at https://web.lumiagm.com/239581234. This year's Annual Meeting of Stockholders will be held in a virtual-only meeting format. Additional details about how you may obtain virtual access to the Annual Meeting are set forth below under the heading "Voting Securities." This Proxy Statement and accompanying proxy are first being mailed to stockholders on or about May 1, 2023. A copy of the Company’s 2022 Annual Report to Stockholders is being mailed with this Proxy Statement but is not to be regarded as proxy solicitation material.

SOLICITATION AND REVOCATION OF PROXY

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of the Company (the "Board") to be used at the Annual Meeting of the holders of the Company’s common stock, par value $0.01 per share, to be held June 23, 2023. The enclosed proxy may be revoked at any time before it is exercised by logging into and voting at the virtual meeting, by giving written notice of revocation to the Secretary of the Company prior to the taking of the vote for which such proxy has been given, or by delivery to the Secretary of the Company of a duly executed proxy bearing a later date. Notice and delivery shall occur upon actual receipt by the Secretary of the Company at its principal place of business. The cost of soliciting proxies will be borne by the Company. In addition to the use of the mails, proxies may be solicited personally, by telephone, by the directors, officers, and employees of the Company, or by the Company’s transfer agent. Directors, officers and other employees of the Company will receive no additional compensation for any such further solicitations. Also, the Company will make arrangements with banks, brokerage houses, and other nominees, fiduciaries, and custodians holding shares in their names or in those of their nominees to forward proxy materials to the beneficial owners of shares, and the Company will, upon request, reimburse such entities for their reasonable expenses in sending the proxy materials. In addition, we have engaged Morrow Sodali LLC to assist in soliciting proxies from brokers, banks and other nominee holders of our common stock at an estimated cost of approximately $7,000, plus reasonable out-of-pocket expenses.

All properly executed unrevoked proxies received in time for the meeting will be voted as specified. If no other indication is made, the proxies will be voted for the election of directors shown as nominees and as recommended by the Board with regard to all other matters.

VOTING SECURITIES

Unless otherwise noted, all share figures included in this Proxy Statement (including share figures relating to periods on or before July 11, 2022) reflect the Company's one-for-ten reverse stock split that was effected on July 11, 2022. At the close of business on May 1, 2023, there were 6,038,012 shares of common stock outstanding and entitled to vote at the Annual Meeting. The holders of such shares are entitled to one vote for each share of common stock held by them on any matter to be presented at the Annual Meeting, including the election of directors. Only stockholders of record at the close of business on May 1, 2023 are entitled to vote at the Annual Meeting and any adjournment or postponement thereof.

The Annual Meeting will be held entirely online this year. You may attend the Annual Meeting, as well as vote and submit questions during the Annual Meeting, by visiting https://web.lumiagm.com/239581234. If you were a stockholder of record as of May 1, 2023, the record date for the Annual Meeting, you should click on "I have a login," enter the control number found on your proxy card or Notice of Internet Availability of Proxy Materials you previously received, and enter the password "western2023" (the password is case sensitive). We encourage you to access the meeting prior to the start time leaving ample time for the check in.

If your shares are held in "street name" through a broker, bank or other nominee, in order to participate in the virtual Annual Meeting you must first obtain a legal proxy from your broker, bank or other nominee reflecting the number of shares of the Company's common stock you held as of the record date, your name and email address. You then must submit a request for registration to American Stock Transfer & Trust Company, LLC: (1) by email to proxy@astfinancial.com; (2) by facsimile to 718-765-8730 or (3) by mail to American Stock Transfer & Trust Company, LLC, Attn: Proxy Tabulation Department, 6201 15th Avenue, Brooklyn, NY 11219. Requests for registration must be labeled as "Legal Proxy" and be received by American Stock Transfer & Trust Company, LLC no later than 5:00 p.m. Eastern time on June 15, 2023.

Stockholders participating in the virtual meeting are considered to be attending the meeting "in person." The presence at the virtual Annual Meeting, in person or by proxy, of a majority of the outstanding shares of the common stock will constitute a quorum.

ABOUT THIS PROXY STATEMENT

In this Proxy Statement, the terms "we," "our," "us," and "the Company" refer to Western Asset Mortgage Capital Corporation. The Company is externally managed and advised by Western Asset Management Company, LLC, which is referred to herein as "our Manager" or "the Manager."

HOUSEHOLDING

In order to reduce printing and postage costs, we have undertaken an initiative to deliver only one copy of the Company’s 2022 Annual Report to Stockholders, one copy of the Proxy Statement and one copy of the Notice of Internet Availability of Proxy Materials to multiple stockholders sharing an address. This delivery method, called "householding," will not be used, however, if we receive contrary instructions from one or more of the stockholders sharing an address. If your household has received only one copy of these materials, we will deliver promptly a separate copy of each of the Company’s 2022 Annual Report to Stockholders, the Proxy Statement and Notice of Internet Availability of Proxy Materials to any stockholder who sends a written request to the Secretary, Western Asset Mortgage Capital Corporation, 385 East Colorado Boulevard, Pasadena, California 91101. You may also contact our Secretary at (626) 844-9400. You may also notify us that you would like to receive separate copies of the Company’s 2022 Annual Report to the Stockholders, Proxy Statement and Notice of Internet Availability of Proxy Materials in the future by writing to our Secretary. Even if your household has received only one copy of the Company’s 2022 Annual Report to Stockholders, one copy of the Proxy Statement and one copy of the Notice of Internet Availability of Proxy Materials, a separate proxy card has been provided for each stockholder account. If you are submitting a proxy by mail, each proxy card should be marked, signed, dated and returned in the enclosed self‑addressed envelope.

If your household has received multiple copies of the Company’s 2022 Annual Report to Stockholders, Proxy Statement and Notice of Internet Availability of Proxy Materials, you can request the delivery of single copies in the future by marking the designated box on the enclosed proxy card.

SPECIAL NOTE TO

STOCKHOLDERS HOLDING SHARES

WITH THEIR BROKER

THE NEW YORK STOCK EXCHANGE PROHIBITS YOUR BROKER FROM VOTING YOUR SHARES IN ELECTIONS FOR DIRECTORS, FOR MATTERS RELATED TO EXECUTIVE COMPENSATION OR ANY OTHER SIGNIFICANT MATTER, AS DETERMINED BY THE SECURITIES AND EXCHANGE COMMISSION (THE "SEC"), UNLESS YOU GIVE YOUR BROKER WRITTEN INSTRUCTIONS IN EACH PROPOSAL (OTHER THAN RATIFYING THE APPOINTMENT OF AUDITOR) ON HOW YOU WANT YOUR SHARES VOTED. YOUR VOTING DESIRES WILL NOT BE COUNTED UNLESS YOU DO THIS.

PROPOSAL 1

ELECTION OF DIRECTORS

Pursuant to the Company’s Bylaws, the Board has fixed the number of the Company’s directors at six (6). Each director elected at the Annual Meeting shall hold office until his or her respective successor has been elected and qualified, or until such individual’s earlier resignation or removal. Vacancies may be filled by a majority vote of the remaining directors then in office.

The Board has selected each of the following persons as a nominee for election by the holders of the Company’s common stock as a director at the 2023 Annual Meeting of Stockholders:

Edward D. Fox

James W. Hirschmann III

Ranjit M. Kripalani

M. Christian Mitchell

Lisa G. Quateman

Bonnie M. Wongtrakool

Experience, Qualifications, Attributes, and Skills

Edward D. Fox has been a member of our Board since May 2012 and is the chair of our Nominating and Corporate Governance Committee. Mr. Fox has served as chairman and chief executive officer of Vantage Property Investors, LLC, a private real estate investment and development company, since January 2003. Mr. Fox was chairman and chief executive officer of Center Trust, a real estate investment trust, from 1998 to January 2003, when Center Trust was acquired by Pan Pacific Retail Properties. Mr. Fox co‑founded and served as the chairman of CommonWealth Partners, a fully integrated real estate operating company, from 1995 through October 2003. Prior to forming CommonWealth Partners, Mr. Fox was a senior partner with Maguire Thomas Partners, a national full‑service real estate operating company. A certified public accountant, Mr. Fox started his career in public accounting specializing in real estate transactions. Mr. Fox serves on the Dean’s advisory council for the USC School of Architecture, is a director of the Orthopaedic Institute for Children and serves on the board of trustees of its foundation. He received a bachelor’s degree in accounting and a master’s degree in business, both with honors, from the University of Southern California.

The Board believes Mr. Fox is qualified to serve as a director due to the depth of his experience in the real estate industry, his previous management experience in both real estate operating companies and real estate investment trusts and his experience on public and private boards.

James W. Hirschmann III has been the Chairman of the Board since July 2009 (the Company commenced operations in May 2012). He has also served as the chief executive officer of our Manager since 1999. Mr. Hirschmann serves on our Manager’s board of managers and chairs our Manager’s Executive Committee. Mr. Hirschmann has worked at our Manager since 1989. Mr. Hirschmann also served as the president of our Manager’s former parent company, Legg Mason, Inc., from May 2006 to April 2007. Mr. Hirschmann received a bachelor of science degree from Widener University.

The Board believes Mr. Hirschmann is qualified to serve as a director because of his experience as chief executive officer and member of the board of directors of our Manager and his depth of experience in the financial and investment management industry.

Ranjit M. Kripalani has been a member of our Board since November 2014 and is the chair of our Risk Committee. From 2009 to 2013, Mr. Kripalani served as the chief executive officer of CRT, LLC, an institutionally focused broker‑dealer. Prior to joining CRT, Mr. Kripalani worked at Countrywide Capital Markets, Inc. and Countrywide Financial Corporation from 1998 to 2008, where he served in a number of roles, including as president of capital markets and executive managing director of Countrywide Financial Corp. and chief executive officer and president of Countrywide Capital Markets from 2000 to 2008. Mr. Kripalani also served as president and chief executive officer of Countrywide Securities Corporation from 2001 to 2008 and was the executive vice president and national sales manager for Countrywide Securities Corporation from 1998 to 2001. Prior to joining Countrywide, Mr. Kripalani served as managing director and head of mortgage trading for Chase Securities, Inc. from 1995 to 1998, and as managing director and head of mortgage trading for PaineWebber, Inc. from 1985 to 1995. He is also a director for Griffin Capital Essential Asset REIT, an SEC registered non-traded real estate investment trust (real estate investment trusts are hereinafter referred to as "REITs"). Mr. Kripalani has a bachelor of arts degree in International Relations from Tufts University and a Graduate Diploma in Business Studies from the London School of Economics.

The Board believes Mr. Kripalani is qualified to serve as a director because he is a longtime executive in the financial industry with significant experience in the investment in and trading of mortgages and mortgage backed securities.

M. Christian Mitchell has been a member of our Board since May 2012 and is the Lead Independent Director of the Board and the chair of our Audit Committee. Mr. Mitchell retired from Deloitte & Touche LLP in 2003, where he was the national managing partner of the mortgage banking and finance companies practice. During his 26 year career at Deloitte, he also served as regional managing partner for various practices including audit, enterprise risk services and financial services. He was also a founding board member of Deloitte Consulting USA. Mr. Mitchell serves as a consultant for Marshall & Stevens, a national valuation and financial advisory firm, where he previously served on the Board of Directors. He is also a director of Pacific Premier Bancorp Inc., an Irvine, California-based bank holding company, Parsons Corporation, a Centreville, Virginia-based provider of technology-driven solutions in the defense, intelligence and critical infrastructure markets, and Huntington Health, a Cedars Sinai-affiliated hospital located in Pasadena, California. Mr. Mitchell previously served as a director of numerous public, private equity-backed, and private companies, and an adjunct professor of accounting at the University of Redlands. He is the chairman emeritus of the National Association of Corporate Directors ("NACD"), Pacific Southwest, and was a member of the national board of NACD from 2017 to 2019. Mr. Mitchell received a bachelor of science degree from the University of Alabama. In 2011 and 2012, Mr. Mitchell was named "one of the 100 most influential people in corporate governance" by Directorship magazine.

The Board believes Mr. Mitchell is qualified to serve as a director because of his extensive experience in the real estate and mortgage industry, his professional and educational background in accounting, and finance and his previous experience serving on boards of directors.

Lisa G. Quateman has been a member our Board since June 2020 and is the chair of our Compensation Committee. Ms. Quateman is the chief executive officer of Voyager Advisory LLC, a corporate strategic advisory firm. She retired as a senior partner of the national law firm Polsinelli in October 2020, where she had specialized in financial services, real estate, regulatory matters and corporate transactions. She was the founding Office Managing Partner for the firm's Los Angeles office. Previously, she was the Managing Partner of Quateman LLP and a partner at Dentons. Ms. Quateman serves on the boards of directors of ITR Concession Company and affiliates (a public-private partnership operator of the Indiana Toll Road), Scherzer International Corporation, NACD Pacific Southwest Chapter and Heidi Duckler Dance. She is a member of the Advisory Boards of Lyles Diversified, Inc. and the UCLA Ziman Center for Real Estate and of the City of Hope Board of Governors. Previously she served as Vice Chair and General Counsel for the UCLA Alumni Association and as a Mayoral appointee to the City of Los Angeles Industrial Development Authority. Ms. Quateman is an NACD Certified Director and Board Leadership Fellow, and she earned her bachelor of arts and juris doctor degrees from the University of California at Los Angeles.

The Board believes Ms. Quateman is qualified to serve as a director because of her extensive experience working on real estate matters, advising issuers and financial institutions in complex financing transactions, and her previous experience serving on boards of directors.

Bonnie M. Wongtrakool, CFA, has been a member of our Board and our Chief Executive Officer since October 2021. Ms. Wongtrakool is the global head of ESG investments and a portfolio manager for the Manager, which she joined in 2003. She leads the Manager’s ESG research, engagement, strategies and portfolios, which express the Manager’s ESG capabilities across a wide range of fixed-income mandates. She is also a member of the Firm’s US Broad Strategy Committee, which formulates domestic investment themes and strategies. Prior to her ESG leadership role, Ms. Wongtrakool was a portfolio manager on the Manager's mortgage-backed securities ("MBS") and asset-backed securities ("ABS") team, where she managed the Manager’s dedicated mortgage funds and was responsible for mortgage allocations across the Manager’s multi-sector portfolios. Prior to joining the Manager, she worked at Mercer Management Consulting in strategy consulting and at Orion Partners in private equity. Ms. Wongtrakool began her career at Donaldson, Lufkin & Jenrette Securities in investment banking. Ms. Wongtrakool earned her juris doctor degree from Harvard Law School and her bachelor of arts degree from Harvard College. She also serves on the board of trustees of Crestview Preparatory School in La Canada Flintridge, California. She is a Chartered Financial Analyst.

The Board believes Ms. Wongtrakool is qualified to serve as a director because of her leadership role at the Manager, her knowledge of mortgages, MBS, ABS and other structured products and her depth of experience in the investment management industry.

Vote Required

Stockholders participating in the virtual meeting are considered to be attending the meeting "in person." Directors will be elected by a plurality of the votes cast by stockholders represented, either in person or by proxy, at the virtual meeting and entitled to vote thereon. Withheld votes and broker non‑votes will have no effect.

The Board recommends an affirmative vote FOR the above director nominees.

It is the intention of the persons named in the accompanying form of proxy to nominate and, unless otherwise directed, vote such proxies for the election of the nominees named above as directors. The Board knows of no reason why any nominee for director would be unable to serve as a director. If any nominee should for any reason become unable to serve, the shares represented by all valid proxies will be voted for the election of such other person as the Board may designate, or the Board may reduce the number of directors to eliminate the vacancy.

DIRECTORS AND EXECUTIVE OFFICERS

The names, principal occupation or employment, and ages of each of our directors and executive officers as of May 1, 2023 are listed in the following table: | | | | | | | | |

| Name and Principal Occupation or Employment | | Age |

| Directors | | |

Edward D. Fox, Chairman and Chief Executive Officer of Vantage Property Investors, LLC | | 75 |

James W. Hirschmann III, Chief Executive Officer of our Manager | | 62 |

Ranjit M. Kripalani, Consultant | | 63 |

M. Christian Mitchell, Corporate Board Member and Advisor | | 68 |

Lisa G. Quateman, Chief Executive Officer of Voyager Advisory LLC | | 69 |

Bonnie M. Wongtrakool, Chief Executive Officer of the Company and global head of ESG investments and a portfolio manager at our Manager | | 49 |

| Executive Officers | | |

Greg Handler, Chief Investment Officer of the Company and head of our Manager's Mortgage and Consumer Credit Group | | 42 |

Sean O. Johnson, Deputy Chief Investment Officer of the Company and a portfolio manager in our Manager's Mortgage and Consumer Credit Group | | 56 |

Robert W. Lehman

Chief Financial Officer of the Company | | 62 |

Elliott Neumayer,

Chief Operating Officer of the Company and product specialist and head of mortgage-related business at our

Manager | | 42 |

Biographies of Directors and Executive Officers

Biographical information for each of our nominees for director is provided under "Proposal No. 1, Election of Directors—Experience, Qualifications, Attributes, and Skills."

In addition to Ms. Wongtrakool, the following individuals serve as our executive officers.

Greg Handler, CFA, was appointed Chief Investment Officer of the Company in July 2021 and is the head of our Manager's Mortgage and Consumer Credit Group. Previously, Mr. Handler served as co-head of our Manager's Mortgage and Consumer Credit Group since March 2019. Before that, he was a lead portfolio manager on the Manager's structured product portfolios. Mr. Handler began his career at the Manager in 2002 and has focused his research on the non-Agency MBS sector for more than 18 years. Mr. Handler holds a bachelor of science degree from Pomona College. He is a Chartered Financial Analyst.

Sean O. Johnson, CFA, was appointed Deputy Chief Investment Officer of the Company in July 2021. Mr. Johnson is a portfolio manager in the Manager’s Mortgage and Consumer Credit Group, focusing on both Agency and Non-Agency MBS and residential and commercial whole loans. Mr. Johnson joined the Manager in 1995 and prior to that was a portfolio analyst at Pacific Investment Management Company and a Supervisor of Investment Performance at Wilshire Associates, Inc.

Mr. Johnson holds a bachelor of science degree from the University of Southern California. He is a Chartered Financial Analyst.

Robert W. Lehman, CPA, was appointed Chief Financial Officer of the Company in June 2022. Previously he served as Senior Partner, Major Real Estate Accounts and Eastern Region Market Sector Leader at Ernst & Young LLP (“EY”) from 2008 to 2021. During his career at EY, he held several leadership positions, including serving as Global Real Estate Investment Trust Leader and Senior Partner – Major Real Estate, counselling high-visibility clients on accounting considerations and overseeing complex real estate acquisitions and initial public offerings. In July 2021, he retired from EY after more than 38 years. Mr. Lehman is a real estate and REIT specialist with extensive experience in accounting, auditing, strategic plan creation and execution, capital markets, and mergers and acquisitions. Mr. Lehman received a B.A. in accounting from the City University of New York - Queens College and he is a Certified Public Accountant in the State of New York and the State of New Jersey.

Elliott Neumayer has been our Chief Operating Officer since October 2015. Mr. Neumayer has also served as a product specialist and head of mortgage-related business efforts at our Manager since October 2015. From May 2014 through October 2015, Mr. Neumayer supported our Manager’s mutual fund business. From July 2007 through May 2014, Mr. Neumayer was a member of our Manager’s product group, where he worked on our Manager’s mortgage-related and mutual fund products. From 2004 through July 2007, Mr. Neumayer was a member of our Manager’s client service department. Mr. Neumayer joined our Manager in 2004 from Marshall & Stevens, where he served as a senior associate. Mr. Neumayer received an MBA and bachelor of arts degree from Loyola Marymount University.

ENVIRONMENTAL, SOCIAL AND CORPORATE GOVERNANCE INFORMATION

The Company and our Manager are committed to corporate responsibility and recognize the importance of integrating environmental, social and governance ("ESG") policies into our day-to-day operations. As an externally-managed company with only one employee, the bulk of our environmental and social efforts are conducted through our Manager. The following are notable ESG policies we and our Manager had in place as of December 31, 2022.

Environmental

The Company and our Manager recognize that environmental issues are increasingly a concern in today's world and that sustainable business practices can effectively drive business competitiveness. Our Manager is committed to an environmental policy that promotes operational practices to minimize its impact on the environment. For example, our Manager has purchased renewable energy credits to offset its direct operations in previous years and will continue to assess the advisability of doing so in the future. Our Manager also makes efforts to reduce energy use and water waste wherever possible and manages its electronic waste per local guidelines. Our Manager participates in local waste recycling efforts that meet all regional ordinances for plastics, glass, paper and compostable waste at all of its global office locations. An example of these efforts is the refurbishment of the London office of the Manager's UK company that was completed in 2021. Our Manager set the foundations of the refurbishment project on sustainability and employee well-being goals. The refurbishment achieved:

•Energy efficiency and climate change mitigation: implementation of energy efficient HVAC at the office reduces energy usage and lowers operating costs by up to 31%;

•Pollution prevention and control: 98.1% of the waste generated during the refurbishment was diverted from landfills;

•Conservation of resources: our Manager selected optimal materials and ethical suppliers, including natural and renewable sources and recycled materials;

•Ensuring occupant health and well-being: the refurbishment resulted in optimal levels of thermal comfort, reduced volatile organic compounds (VOCs), maximization of natural daylight and suitable levels of ventilation; and

•Sustainable material use: The refurbishment used environmentally sustainable materials including A+ efficient flooring and low-VOC paints.

In addition, in its capacity as an investment manager, our Manager, either directly or through a non-US affiliate, is also a signatory to Principles for Responsible Investment (PRI) and the 2020 UK Stewardship Code and is a founding member of the UN PRI Sustainable Goals Advisory Committee, the UN PRI Sovereign Working Group and the UN PRI Sub-sovereign Debt Advisory Committee. In its 2020 UNPRI signatory assessment, our Manager received an "A" across all categories, including higher-than-the-median ratings in the Sovereign/Supranational/Agency, Corporate Non-Financials, Financials and Securitized fixed-income categories and an at-the-median rating in Strategy & Governance. Our Manager is also a supporter of the Task Force on Climate-related Financial Disclosures and Transition Pathway Initiative, and a signatory and participant in Climate Action 100+.

Social

Human Capital

To foster the health, well-being and satisfaction of our Manager's employees and their families, our Manager's employees have access to robust compensation, health and wellness programs, including:

•A competitive total compensation program, consisting of benefits, base salary and incentive compensation;

•Our Manager bears all premiums for its medical, dental, vision, basic life and disability insurance plans;

•Paid parental leave;

•Wellness incentives;

•Employee assistance program;

•401(k) plan including company matching; and

•In-office flu shot clinics.

To attract and retain talent, our Manager supports and encourages the development of its employees with a variety of opportunities for personal growth through training and education support, including:

•Regular in-person and online professional training sessions and reimbursement for university or other recognized institution course work, reimbursement for enrollment in the CFA program and reimbursement of reasonable expenses incurred in connection with the Certified Public Accounting and other professional credentialing programs;

•All employees participate in mid-year and/or annual performance reviews; and

•Approximately 22% of open positions were filled internally in 2022 and the average tenure of our Manager's employees is over 11 years.

Community Engagement

Our Manager believes that as a good corporate citizen, it has the responsibility to assist the communities in which it operates. Because of this commitment, our Manager established the Western Asset Management Company Charitable Foundation (the "Foundation") in 2005. The Foundation's goal is to foster educational and civic programs and services, advocate cultural institutions, and aid the underprivileged in the communities in which our Manager operates. Our Manager encourages employee involvement in the community through its volunteer efforts committee and its charitable contribution gift match program. Our Manager's volunteer efforts committee carries out the mission of the Foundation by offering the Manager's employees opportunities to contribute their time and show their support to the Manager's community partners. By providing the necessary human resources to select local, regional and national organizations for events and program services, the committee brings the Manager's employees and their community together. Additionally, our Manager believes in the importance of supporting the communities in which it does business. To this end, our Manager will match employee contributions to bonafide 501(c)(3) charitable organizations on a dollar-for-dollar basis, up to $1,000 per year per employee.

Diversity, Equity and Inclusion (DEI)

Our Manager has a comprehensive approach to DEI globally and affirmative action in the United States which provides that all applicants and employees shall be recruited, trained, promoted, retained and compensated strictly on the basis of qualifications for the role and treated equally in these and all aspects of the employment relationship. As part of its ongoing DEI efforts, our Manager supports the following employee resource groups spanning a variety of shared interests and perspectives:

•Asian Pacific Islanders for Engagement and Excellence (APEX): APEX seeks to celebrate and support Asian-Pacific Islander cultures within our Manager by embracing differences and promoting professional and personal development.

•Black Heritage Network (BHN): BHN aims to facilitate the professional development of black employees by providing an educational forum, creating connections and promoting an inclusive environment at our Manager.

•Latinos for Engagement, Advancement and Development (LEAD): LEAD seeks to cultivate a community within the Manager that promotes and integrates the Latin/Hispanic culture and traditions, provides support for professional development and contributes to the success of the Manager’s mission.

•Unify, Network, Inspire, Teach, and Empower (UNITE) women: UNITE seeks to unify, provide a network and space to inspire, an environment to teach, and a way to empower our Manager's female employees.

•Western Asset Pride: Western Asset Pride seeks to provide a forum for education and awareness supporting the professional growth of LGBTQ+ (Lesbian, Gay, Bisexual, Transgender, Queer and Questioning) individuals by fostering a safe environment within our Manager for staff to be authentic in the workplace.

Corporate Governance

We believe good corporate governance is critical to achieving long-term shareholder value and we are committed to governance practices and policies that serve the long-term interests of the Company and its shareholders. Highlights of our corporate governance practices, many of which are discussed at greater length elsewhere in this Proxy Statement, include:

•Our Board represents a well-rounded and diverse combination of skills, knowledge, experience and perspectives.

•Two-thirds of our directors are independent.

•The Board regularly meets in executive sessions with its independent directors which are presided over by the Lead Independent Director.

•All of the members of the Board's four standing committees are independent.

•One-third of the Board's directors are female.

•We separate the Chairman of the Board and Chief Executive Officer roles.

•Our Board is fully declassified and directors are elected annually.

•Each share of our common stock has equal voting rights with one vote per share.

•The Board and each Board committee conducts an annual evaluation of its performance.

•During 2022, director attendance for Board and committee meetings was greater than 75% for each director.

Board Leadership Structure

Our Board leadership structure is currently comprised of: (i) the Chairman of the Board, (ii) the Chief Executive Officer of the Company, and (iii) the Lead Independent Director who is "independent" under the rules of the New York Stock Exchange (the "NYSE").

Four of the six nominees for election to our Board are independent under the rules of the NYSE. Our four independent directors serve as the sole members of our Audit, Compensation, Nominating and Corporate Governance and Risk Committees. We have retained our Manager to manage the day-to-day affairs of our business, subject to the supervision and oversight of our Board. Ms. Wongtrakool, our Chief Executive Officer, and Mr. Hirschmann, our Chairman of the Board, are employees of our Manager. The Board has determined that this combination of employees in leadership positions at our Manager, a two‑thirds majority of independent directors, the designation of a lead independent director and governing committees composed solely of independent directors is the most appropriate governance structure for the Company.

Mr. Hirschmann has served as the Chairman of the Board since 2009. Having been employed by our Manager for over 34 years, Mr. Hirschmann has a breadth of unique and specialized knowledge about our business operations and those of our Manager. In 2014, in light of the Company’s growth and to further enhance the Company’s governance structure, the Board, to complement Mr. Hirschmann's Chairman position, created the position of Lead Independent Director and appointed M. Christian Mitchell to the position. The Lead Independent Director is responsible for (i) serving as a liaison between the Chairman of the Board and our other directors, (ii) presiding at, and preparing the agenda for, all executive sessions of the independent directors, (iii) working with the Chairman of the Board and members of management to schedule Board meetings, prepare agendas and review with management the adequacy and timing of information provided to the Board, (iv) retaining outside advisors to the Board, if necessary or desirable, and (v) performing such other duties as may be requested by the Chairman or the Board.

In addition, as noted, each of the Board's four standing Committees, Audit, Compensation, Nominating and Corporate Governance and Risk, is composed exclusively of independent directors under the NYSE rules. To further facilitate the exercise of independent judgment by the Board, these independent directors meet regularly in executive session without any members of management present.

Board Oversight of Risk

While our Manager and our executive officers, all of whom are employees of our Manager, are responsible for the day‑to‑day management of risk, our Board is responsible for appropriate risk oversight and assisting management in addressing specific risks, such as strategic and competitive risks, financial risks, legal risks, and operational risks. In particular, our Board has established investment guidelines, which have been made a part of the Management Agreement, for our Manager to follow in its day‑to‑day management of our business.

The Board has been structured to facilitate oversight of risk by combining Board committees composed entirely of independent directors, a two‑thirds majority independent Board composition and a Lead Independent Director, with an experienced Chairman of the Board and Chief Executive Officer, each of whom has detailed knowledge of our business, our Manager, and the complex challenges we face. The Chairman of the Board and the Chief Executive Officer’s respective

in‑depth understanding of these matters and involvement in the day‑to‑day management of the Company positions them to promptly identify and raise key risks to the Board and focus the Board’s attention on areas of concern. The Lead Independent Director and the other independent directors who chair the Board's committees also are experienced professionals or executives who can and do raise issues for Board consideration and review, and are not hesitant to question the Company’s management. The Board believes there has been a well‑functioning and effective balance between the non‑management directors and the Chairman of the Board and the Chief Executive Officer, which enhances risk oversight. Finally, in 2018 the Board decided to enhance its risk oversight process by creating a Risk Committee of the Board to provide a more focused risk review process.

The Board exercises its oversight responsibility for risk both directly and through its four standing committees. The Board and each appropriate committee may spend a portion of their time reviewing and discussing specific risk topics. The full Board is kept informed of each committee’s risk oversight and related activities through reports from the committees at full Board meetings and committee meeting minutes that are available to all directors. Strategic, operational and competitive risks are presented and discussed at the Board’s regular quarterly meetings. Periodically, the Board may conduct reviews of our long‑term strategic plans, which may include reports from members of our or the Manager’s senior management on our chief risks and the steps management has taken or will take to mitigate these risks. In addition, the Risk Committee, which is responsible for overseeing the Company’s risk governance structure, risk management and risk assessment guidelines and policies and risk tolerance and capital, liquidity and funding, receives regular reports on various risk matters with a focus on investment and related risk matters and meets regularly with members of the Manager’s risk department.

As needed between Board meetings, our Chairman of the Board and Chief Executive Officer may provide reports to the Board on the critical issues we face and the recent developments in our business, including identified risks. In addition, our Chief Investment Officer and Deputy Chief Investment Officer provide the Board with a formal investment report at each quarterly meeting of the Board along with supplemental telephonic reports on our investment portfolio at least once a quarter. Since 2016, these reports have been supplemented by presentations by the Manager's risk department focused primarily on portfolio risk. These discussions provide the Board with an opportunity to ask questions regarding our investment strategy and related portfolio risks.

The Audit Committee is responsible for reviewing our financial accounting risks. The Audit Committee meets regularly with our Chief Financial Officer, other members of senior management, external accounting service providers and our independent auditors to discuss our major financial risk exposures, financial reporting, internal controls, and credit and liquidity risk. The Audit Committee meets regularly in executive session with our independent auditors to facilitate a full and candid discussion of risks and other issues.

The Compensation Committee is responsible for overseeing compensation risk, including evaluating and assessing risks arising from the terms of the Management Agreement, our compensation policies and practices for our employees and ensuring executive compensation is aligned with performance and engaging in an annual overall review of the Manager’s services to us. The Compensation Committee is charged with monitoring our equity‑based compensation plans.

The Nominating and Corporate Governance Committee oversees risk related to our overall governance, including Board and committee composition, Board size and structure, director independence, ethical and business conduct and our corporate governance profile and ratings. The Nominating and Corporate Governance Committee also is engaged in overseeing risks associated with succession planning for the Board and management and conducts an annual assessment of the Board’s overall performance and effectiveness.

Director Independence

Our common stock is listed on the NYSE. The NYSE requires that a majority of our directors be "independent," as defined by rules of the NYSE. In determining director independence, the Board reviewed, among other things, whether any transactions or relationships currently exist, or have existed in the past, between each director and the Company and its subsidiaries, affiliates and equity investors (including, but not limited to, the Manager) or the Company’s independent auditors. In particular, the Board reviewed any current or recent business transactions or relationships or other personal relationships between each director and the Company, including such director’s immediate family and companies owned or controlled by the director or with which the director was affiliated. The purpose of this review was to determine whether any such transactions or relationships failed to meet any of the objective tests promulgated by the NYSE for determining independence or were otherwise sufficiently material as to be inconsistent with a determination that the director is independent. The Board also examined whether there were any transactions or relationships between each director and members of the senior management of the Company or their affiliates.

The Board has affirmatively determined that a majority of its directors are independent directors under NYSE rules. Based on these standards, the Board determined that our independent directors include the following current directors:

Edward D. Fox

Ranjit M. Kripalani

M. Christian Mitchell

Lisa G. Quateman

Director Attendance at Meetings

The Board met on fourteen occasions during 2022. No incumbent director attended fewer than 75 percent of all meetings of our Board and the committees on which such director served during 2022.

Independent Director Meetings in Executive Sessions

Our independent directors meet separately from the other directors in regularly scheduled executive sessions. Any independent director may call an executive session of independent directors at any time. The Lead Independent Director chairs these executive sessions. The independent directors met in executive session on four occasions during 2022.

Board Committees

Our Board has established four standing committees, the Audit, Compensation, Nominating and Corporate Governance and Risk Committees, the principal functions of which are briefly described below. Matters put to a vote at any one of these four committees must be approved by a majority of the directors on the committee who are present at a meeting at which there is a quorum or by unanimous written consent of the directors on that committee. Our Board may from time to time establish certain other committees to facilitate the management of the Company.

Audit Committee

Messrs. Fox, Kripalani and Mitchell and Ms. Quateman, each of whom is an independent director of the Company and is "financially literate" under the rules of the NYSE, currently serve on the Audit Committee with Messrs. Fox and Mitchell serving since May 2012, Mr. Kripalani serving since November 2014 and Ms. Quateman serving since June 2020. Mr. Mitchell chairs our Audit Committee and the Board has determined that Mr. Mitchell and Ms. Quateman are audit committee financial experts, as that term is defined by the SEC. During 2022, the Audit Committee met on five occasions.

The Audit Committee assists our Board in overseeing:

•our financial reporting, auditing and internal control activities, including the integrity of our financial statements;

•our compliance with legal and regulatory requirements;

•our independent auditors’ qualifications and independence; and

•the performance of our independent auditors.

The Audit Committee is also responsible for engaging our independent auditors, reviewing with our independent auditors the plans and results of the audit engagement, approving professional services provided by our independent auditors, reviewing the independence of our independent auditors, considering the range of audit and non‑audit fees and reviewing the adequacy of our internal accounting controls.

Compensation Committee

Messrs. Fox, Kripalani and Mitchell and Ms. Quateman, each of whom is an independent director of the Company, currently serve on the Compensation Committee with Messrs. Fox and Mitchell serving since May 2012, Mr. Kripalani serving since November 2014 and Ms. Quateman serving since June 2020. Ms. Quateman chairs our Compensation Committee. During 2022, the Compensation Committee met on five occasions.

The Compensation Committee is responsible for:

•annually reviewing and approving the corporate goals and objectives relevant to the compensation we pay to our Manager, evaluating the performance of our Manager in light of such goals and objectives and determining and approving the compensation, if any, we pay to our Manager based on such evaluation;

•providing oversight with regard to our Chief Executive Officer's, Chief Financial Officer’s, Chief Investment Officer's and Deputy Chief Investment Officer's compensation as ultimately determined (with the exception of our Chief Financial Officer) by our Manager;

•overseeing our equity incentive plans, including whether to grant a share award to the Manager; and

•determining from time to time the remuneration for our non‑management directors.

In carrying out these responsibilities, the Compensation Committee may form subcommittees (with a minimum of two members) for any purpose that the Compensation Committee deems appropriate and may delegate to its subcommittees such power and authority as the Compensation Committee deems appropriate, to the extent permitted by applicable laws, regulations and listing standards. As of the date hereof, the Compensation Committee does not have any subcommittees.

In addition, the Compensation Committee’s charter provides the committee with sole authority to retain or terminate any compensation consultant to assist it in carrying out its responsibilities, including sole authority to approve the consultant’s fees and other retention terms. For 2022, the Compensation Committee did not engage a compensation consultant to determine the compensation of the Company's executive officers.

Nominating and Corporate Governance Committee

Messrs. Fox, Kripalani and Mitchell and Ms. Quateman, each of whom is an independent director of the Company, currently serve on the Nominating and Corporate Governance Committee with Messrs. Fox and Mitchell serving since May 2012, Mr. Kripalani serving since November 2014 and Ms. Quateman serving since June 2020. Mr. Fox chairs our Nominating and Corporate Governance Committee. During 2022, the Nominating and Corporate Governance Committee met on four occasions.

The Nominating and Corporate Governance Committee is responsible for:

•providing counsel to our Board with respect to the organization, function and composition of our Board and its committees;

•overseeing the self‑evaluation of our Board and our Board’s evaluation of management;

•periodically reviewing and, if appropriate, recommending to our Board changes to our corporate governance policies and procedures; and

•identifying and recommending to the Board potential director candidates for nomination.

Risk Committee

Messrs. Fox, Kripalani and Mitchell and Ms. Quateman, each of whom is an independent director of the Company, currently serve on the Risk Committee with Messrs. Fox, Kripalani and Mitchell serving since the Risk Committee’s formation in March 2018 and Ms. Quateman serving since June 2020. Mr. Kripalani chairs our Risk Committee. During 2022, the Risk Committee met on four occasions.

The Risk Committee is responsible for providing oversight of the following areas:

•the Company’s risk governance structure and its risk management and risk assessment guidelines and policies;

•the Company’s investment policies with respect to the risk exposures associated with the types of assets that the Company invests in; and

•significant risk exposures and the actions management has taken to limit, monitor or control such exposures, including guidelines and policies with respect to assessment of risk and risk management.

In addition, the Risk Committee also assists the Board in its oversight of the Company’s risk tolerance and capital, liquidity and funding.

Committee Charters

A copy of the charters of each of the Audit, Compensation, Nominating and Corporate Governance and Risk Committees is available on the Company’s corporate website at http://www.westernassetmcc.com and may also be obtained upon request without charge by writing to the Company’s Secretary, 385 East Colorado Boulevard, Pasadena, California 91101.

Corporate Governance Principles

We are committed to good corporate governance practices and, as such, we have adopted formal corporate governance principles to enhance our effectiveness. The principles address, among other things, board member qualifications, responsibilities, education and management succession. A copy of our corporate governance principles may be found at the

Company’s corporate website at http://www.westernassetmcc.com under the heading "Investor Relations—Governance Documents."

Code of Conduct

Our Board has established a code of conduct that applies to our directors, officers and employees. Our Manager also maintains a code of ethics to which its officers and directors are subject. Any such director, officer or employee who is also subject to our Manager’s code of ethics will, in the event of a conflict in policy, be held to the more restrictive provision. Among other matters, our code of conduct is designed to deter wrongdoing and to promote:

•honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships;

•full, fair, accurate, timely and understandable disclosure in our SEC reports and other public communications;

•compliance with applicable governmental laws, rules and regulations;

•prompt internal reporting of violations of the code of conduct to appropriate persons identified in the code of conduct; and

•accountability for adherence to the code of conduct.

Waivers of any provisions of the code of conduct may be granted in writing by our Chief Executive Officer, except that any waiver sought by one of our directors or executive officers may be granted only by the Nominating and Corporate Governance Committee. In considering any request for a waiver, the Chief Executive Officer will consult with appropriate senior management, the Manager's legal and compliance department and/or external legal advisors, as appropriate under the circumstances. Any changes to or waivers of the code of conduct will, to the extent required, be disclosed as required by applicable rules and regulations of the SEC and the NYSE. A copy of our code of conduct may be found at the Company’s corporate website at http://www.westernassetmcc.com under the heading "Investor Relations—Governance Documents."

Delinquent Section 16(a) Reports

Section 16(a) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), requires our directors, officers and certain stockholders to file with the SEC an initial statement of beneficial ownership and certain statements of changes in beneficial ownership of our equity. Based solely on our review of such forms received by us, we are unaware of any instances of noncompliance, or late compliance, with such filings during the fiscal year ended December 31, 2022, other than a Form 4 filed late by the Company on behalf of each Messrs. Fox, Kripalani, and Mitchell on July 8, 2022 with respect to award grants of 5,426 restricted stock units made on June 24, 2022 to each of Messrs. Fox, Kripalani and Mitchell and a Form 4 filed late by the Company on behalf of Ms. Quateman on July 19, 2022 with respect to an award grant of 5,426 restricted stock units made on June 24, 2022 to Ms. Quateman.

Stockholder Communications with Directors

The Board has established a process to receive communications from stockholders and other interested parties. Interested parties and stockholders may contact any or all members of the Board, including non‑management directors, by mail. To communicate with the Board, any individual director or any group or committee of directors, correspondence should be addressed to the Board or any such individual director or group or committee of directors by either name or title. All such correspondence should be sent in care of the Secretary at Western Asset Mortgage Capital Corporation, 385 East Colorado Boulevard, Pasadena, California 91101.

All communications received as set forth in the preceding paragraph will be opened by the office of the Company’s Secretary for the sole purpose of determining whether the contents represent a message to our directors. Any contents that are not in the nature of advertising, promotions of a product or service or patently offensive material will be forwarded promptly to the addressee. In the case of communications to the Board or any group or committee of directors, the office of the Secretary will make sufficient copies of the contents to send to each director who is a member of the group or committee to which the correspondence is addressed.

Director Attendance at Annual Meetings of Stockholders

We encourage all incumbent directors, as well as all director nominees, to attend the Annual Meeting of Stockholders. Of the Company’s incumbent directors in 2022, Ms. Quateman, Ms. Wongtrakool and Messrs. Fox and Mitchell attended the 2022 Annual Meeting of Stockholders.

Director Nomination Procedures

The Nominating and Corporate Governance Committee recommends director nominees to the Board of Directors based on its evaluation of a candidate’s experience, skills, expertise, diversity, personal and professional integrity, character, business judgment, time availability in light of other commitments, dedication, conflicts of interest and such other relevant factors that the Nominating and Corporate Governance Committee considers appropriate in the context of the needs of the Board.

The Nominating and Corporate Governance Committee may identify potential nominees by asking current directors and executive officers to notify the committee if they become aware of persons who meet the criteria described above, especially business and civic leaders in the communities in which we operate. It may also engage firms, at our expense, that specialize in identifying director candidates. As described below, the Nominating and Corporate Governance Committee will also consider candidates recommended by stockholders.

In addition to any other applicable requirements, if a stockholder desires to nominate a director for election at an annual meeting, such stockholder must (A) be a stockholder of record on the record date for the determination of stockholders entitled to vote at such annual meeting and (B) have given timely notice in proper written form to our Secretary. If a stockholder is entitled to vote only for a specific class or category of directors at the annual meeting, such stockholder’s right to nominate one or more persons for election as a director at the meeting shall be limited to such class or category of directors.

To be timely in connection with the annual meeting, a stockholder’s notice shall be delivered to the Secretary at our principal executive offices not less than 60 days nor more than 90 days prior to the date of the annual meeting. In the event we call a special meeting of stockholders for the purpose of electing one or more directors to the Board, any stockholder entitled to vote for the election of such director(s) at such meeting (and satisfying the requirements set forth above) may nominate a person or persons (as the case may be) for election to such position(s) as are specified in our notice of such meeting, but only if the stockholder notice is delivered to the Secretary at our principal executive office no later than the close of business on the tenth (10th) day following the day on which notice of such special meeting was given.

To be in proper written form, a stockholder’s notice to the Secretary must set forth (i) as to each individual nominated, (A) the name, date of birth, business address and residence address of such individual; (B) the business experience during the past five years of such nominee, including his or her principal occupations and employment during such period, the name and principal business of any corporation or other organization in which such occupations and employment were carried on and such other information as to the nature of his or her responsibilities and level of professional competence as may be sufficient to permit assessment of his or her prior business experience; (C) whether the nominee is or has ever been at any time a director, officer or owner of 5% or more of any class of capital stock, partnership interests or other equity interest of any corporation, partnership or other entity; (D) any directorships held by such nominee in any company with a class of securities registered pursuant to Section 12 of the Exchange Act, or subject to the requirements of Section 15(d) of the Exchange Act or any company registered as an investment company under the Investment Company Act of 1940, as amended (the "Investment Company Act"); and (E) whether, in the last five years, such nominee has been convicted in a criminal proceeding or has been subject to a judgment, order, finding or decree of any federal, state or other governmental entity, concerning any violation of federal, state or other law, or any proceeding in bankruptcy, which conviction, judgment, order, finding, decree or proceeding may be material to an evaluation of the ability or integrity of the nominee; and (ii) as to the person submitting the nomination notice and any person acting in concert with such person, (x) the name and business address of such persons, (y) the name and address of such persons and as they appear on the Company’s books (if they so appear) and (z) the class and number of shares of the Company which are beneficially owned by such persons. Such notice must also be accompanied by a written consent of each proposed nominee to being named as a nominee and to serve as a director if elected.

The Nominating and Corporate Governance Committee does not employ a specific policy, practice or formula for evaluating candidates to the Board of Directors recommended by stockholders and expects to use a similar process to evaluate candidates to the Board of Directors recommended by stockholders as the one it uses to evaluate candidates otherwise identified by the committee.

EXECUTIVE COMPENSATION

Introduction

The Management Agreement provides that our Manager is responsible for managing our affairs. Our Manager has historically employed and compensated each of our executive officers and all other personnel working on the Company's affairs and our executive officers have historically not received cash compensation from us for serving as our executive officers. Effective as of June 15, 2022, we appointed Robert W. Lehman to serve as our Chief Financial Officer. Mr. Lehman is employed directly by, and receives cash and, on occasion, has received equity compensation directly from, the Company. As a result, this Executive Compensation section describes both (1) the Company's compensation program for our Chief Financial Officer and (2) our Manager's compensation program for our other executive officers.

Pursuant to the Management Agreement, we pay our Manager the management fee and other amounts described in "Certain Relationships and Related Transactions—Management Agreement." For the year ended December 31, 2022, we paid our Manager an aggregate of $3.5 million in management fees and $989 thousand in expense reimbursements. Under the terms of the Management Agreement, we reimbursed our Manager for the compensation and related expenses for our former Chief Financial Officer prior to June 10, 2023 and for other supporting finance and accounting personnel.

Compensation of Robert W. Lehman

Mr. Lehman was appointed to serve as our Chief Financial Officer effective as of June 15, 2022. Mr. Lehman is an employee of the Company and receives cash and, on occasion, has received equity compensation directly from the Company. Mr. Lehman has an annual base salary of $350,000. For the period from June 15, 2022 through September 30, 2022, the Company guaranteed Mr. Lehman a discretionary bonus of not less than $550,000, pro-rated from his date of hire. For the period from October 1, 2022 through September 30, 2023, the Company has guaranteed Mr. Lehman a discretionary bonus of not less than $550,000. On June 30, 2022, the Company granted Mr. Lehman a total of 20,000 restricted stock units that vest in two equal installments on June 30, 2023 and June 30, 2024, generally subject to his continued employment.

The Company and the Compensation Committee determined that the compensation package offered to Mr. Lehman was necessary to attract him to serve as our Chief Financial Officer in a highly competitive market for senior executive talent. The Company and the Compensation Committee believe that Mr. Lehman’s compensation provides a strong long-term incentive that will continue to motivate him and will align his interests with those of the Company and our stockholders more generally. The Company and the Compensation Committee will monitor Mr. Lehman’s compensation to ensure that it continues to remain appropriate.

Compensation of Our Other Executive Officers

The Company has no employees other than Mr. Lehman, and all of our other executive officers are employed directly by our Manager. The compensation expenses of our executive officers (other than Mr. Lehman) are paid by the Manager and not by the Company, although the Company reimbursed our Manager for the compensation and related expenses for our former Chief Financial Officer prior to June 10, 2022. Our Manager makes all decisions relating to the compensation of the Company’s executive officers (other than Mr. Lehman) based on its overall compensation program and philosophy. However, our Manager consults with the members of the Compensation Committee on an annual basis concerning the incentive compensation to be paid to key members of the Company’s management team, including our executive officers.

Our Manager's Core Compensation Philosophy

The compensation philosophy and process of our Manager is deeply grounded in our Manager’s mission and core values. In compensation matters, our Manager takes a highly integrated global approach and strives to emphasize its core values of integrity, mutual respect, personal responsibility and teamwork. Most importantly, our Manager’s compensation structure is designed to ensure that the interests of the Manager’s employees are aligned with the interests of the Company and the Manager's other clients. Our Manager’s investment professionals, including our Chief Investment Officer and Deputy Chief Investment Officer, operate in a team environment and are therefore compensated according to the team’s total contributions to our Manager rather than individually. Our Manager’s compensation structure has been tailored to include elements of investment performance over relevant time periods and client service, among other factors.

Another aspect of our Manager’s compensation philosophy is that employee relationships should have a long-term emphasis in order to mirror the relationships the Manager seeks to maintain with its clients. Employees are encouraged to build long-term careers at our Manager. Those who are successful in building long-term value with the Manager’s clients, including the Company, have seen their total compensation increase over time.

For portfolio managers, including our Chief Investment Officer and Deputy Chief Investment Officer, the formal review process also includes a thorough review of the portfolios they were assigned to lead or with which they were otherwise

involved and includes not only investment performance, but maintaining a detailed knowledge of client portfolio objectives and guidelines, monitoring of risks and performance for adherence to these parameters, execution of asset allocation consistent with current Manager and portfolio strategy and communication with clients. In reviewing investment performance, one, three and five-year annualized returns are measured against appropriate market peer groups and, where applicable, to each portfolio’s benchmark index. Our Manager’s risk management department also provides input on key elements of the scorecards that are used for portfolio managers' compensation reviews, including with respect to information ratio, dispersion and tracking error, which allows for performance-based compensation to be risk adjusted. Ultimately, the compensation of our Manager’s portfolio managers is driven by the performance of our Manager’s entire investment team in line with our Manager’s investment management approach. The compensation focus on team achievement is designed to minimize conflicts of interest and ensure that our Manager’s investment management staff do not have an incentive to favor certain accounts over others.

Our Manager's Focus on Total Compensation

Our Manager seeks to reward its employees through total compensation, which consists of benefits, base salary and incentive compensation. Our Manager’s compensation philosophy is that total compensation for high-performing employees should be highly competitive in the investment management industry through performance based bonus awards and market competitive salaries. The goal is to pay base salaries that are competitive with market averages and bonuses and total compensation that are above market averages for high performers.

The intended results of this strategy are:

•Greater emphasis on performance rewards; and

•More upside potential and above-average total compensation for high performers.

Complementing this philosophy is the strong belief that performance rewards and salaries should be distinct and separate components of the total compensation package:

•Performance pay should be reserved for bonuses; and

•Salaries should reflect the fair market value of core job responsibilities, without regard to job performance.

Our Manager’s incentive plan is discretionary. Our Manager does not pay bonuses determined by mechanical formulas of revenues, profits or performance of certain products, although it may take these factors into account as part of its overall review. Longer term performance is a key component of our Manager's incentive policy. For example, as discussed above, our Manager’s investment professionals have the results of certain quantitative aspects of their role presented in the form of a balanced scorecard. The balanced scorecards for investment professionals contain measures including one, three and five-year investment performance versus the applicable benchmark and appropriate peer group, portfolio dispersion and tracking error over the same time periods, client relationship activity (meetings, presentations, etc.) and the financial performance of our Manager for the year. In addition, adherence to compliance, risk and operational requirements is an explicit part of our Manager’s compensation analysis. Extensive market analysis is conducted each year in order to assess competitive compensation levels based upon performance, skills, prominence in the market and business results. This analysis is used to gauge appropriate compensation levels based upon the sum of the employee’s performance rather than focusing on individual components of performance or compensation.

Our Manager's Compensation Deferral Program

Our Manager has longstanding deferral arrangements in place that are intended to deepen the alignment of its employees to its longer term goals. In broad terms, the primary deferral arrangements are as follows:

•More senior staff, which includes all of the Company’s executive officers who are employed by the Manager, are subject to a deferral.

•The deferred portion averages between 20-25% of the employee’s bonus and vests ratably over four years.

•The deferred portion of the bonus is awarded in the form of deferred cash. Recipients may allocate their deferred cash award among a menu of predetermined funds that include funds managed by our Manager and funds affiliated with our Manager’s parent company.

•Employees must remain employed and in good standing at our Manager to receive the deferred awards as they vest.

Estimated Allocation

To provide context for the compensation of our executive officers (other than Mr. Lehman) in relation to our management fee, we provide an estimate of aggregate compensation of our executive officers for 2022 (other than Mr. Lehman) that may be reasonably associated with their time and efforts on behalf of the Company based on a combination of a comparison of the assets of the Company to aggregate assets of products and accounts the executive officers managed or were associated with and a qualitative evaluation of the scope of depth of work done for the Company. Compensation for our former Chief Financial Officer through June 10, 2022, which was paid for by the Company by reimbursing our Manager, is included in our estimate in its entirety. From time to time the Manager may specially accelerate compensation into or defer compensation with respect to a year. For purposes of our estimate, these amounts are allocated to the year they originally related and not to the year paid.

Based on this methodology, the estimated total compensation of our executive officers (other than Mr. Lehman) reasonably associated with the work on behalf of the Company is approximately $1.2 million, which represents 34% of the sum of the management fee paid by the Company to our Manager and the expense reimbursement paid by the Company to our Manager for compensation paid to our former Chief Financial Officer for 2022. Of this total compensation of our executive officers (other than Mr. Lehman) reasonably associated with their work on behalf of the Company, 45% was paid in fixed compensation and 55% as variable or incentive-based compensation. In addition to our executive officers who are employed by our Manager, there are numerous additional employees of the Manager who work on matters relating to the Company and whose compensation is not included in the figures above.

2022 Summary Compensation Table

The following table sets forth the summary compensation of Mr. Lehman (paid by the Company) and Ms. Meyer (paid by the Manager and reimbursed by us) for the fiscal years ended December 31, 2022, December 31, 2021 and December 31, 2020.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and Principal Position | | Year | | Salary | | Bonus | | Stock

Awards | | All Other

Compensation | | Total | |

| Robert W. Lehman (Chief Financial Officer) | | 2022 | | $ | 179,038 | | | $ | 162,740 | | (1) | $ | 242,000 | | (2) | $ | — | | | $ | 583,778 | | |

| Lisa Meyer (Former President, Chief Financial Officer and Treasurer) | | 2022 | | $ | 168,460 | | | $ | — | | (3) | $ | — | | (4) | $ | 21,843 | | (5) | $ | 190,303 | | |

| | 2021 | | $ | 300,000 | | | $ | 275,000 | | | $ | — | | | $ | 42,494 | | | $ | 617,494 | | |

| | 2020 | | $ | 300,000 | | | $ | 535,000 | | | $ | — | | | $ | 43,588 | | | $ | 878,588 | | |

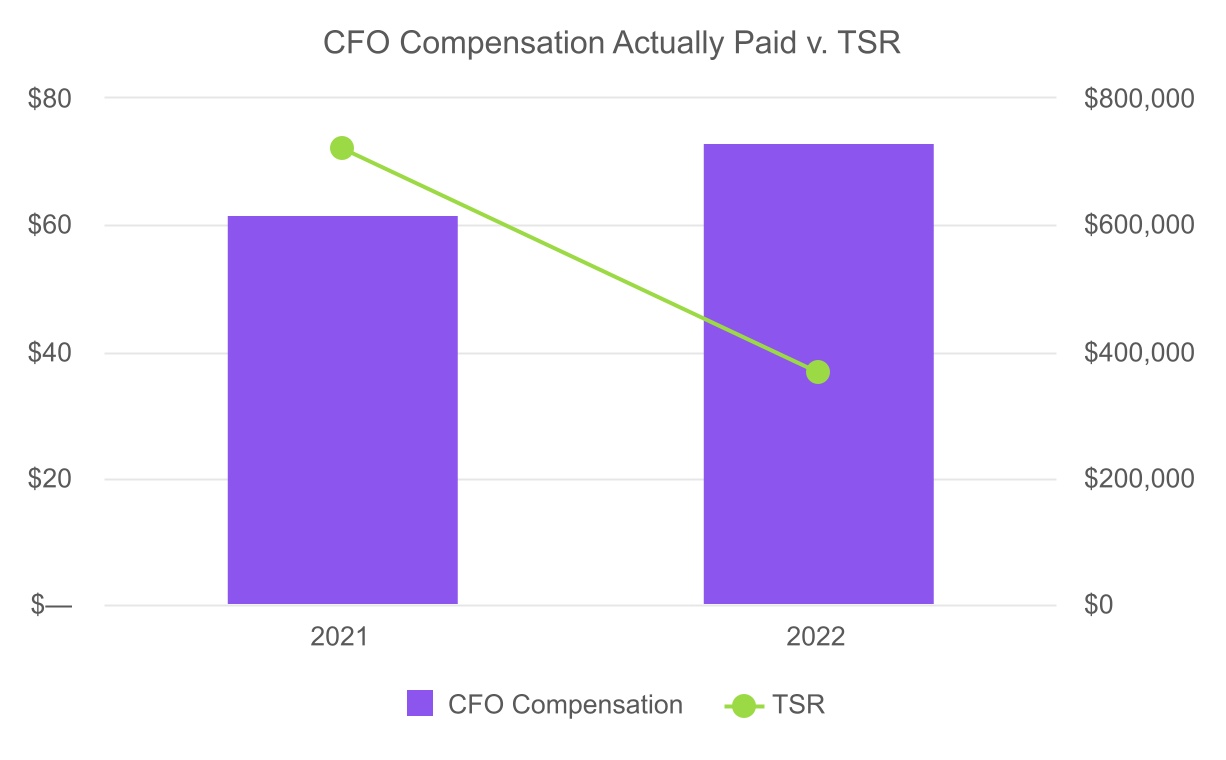

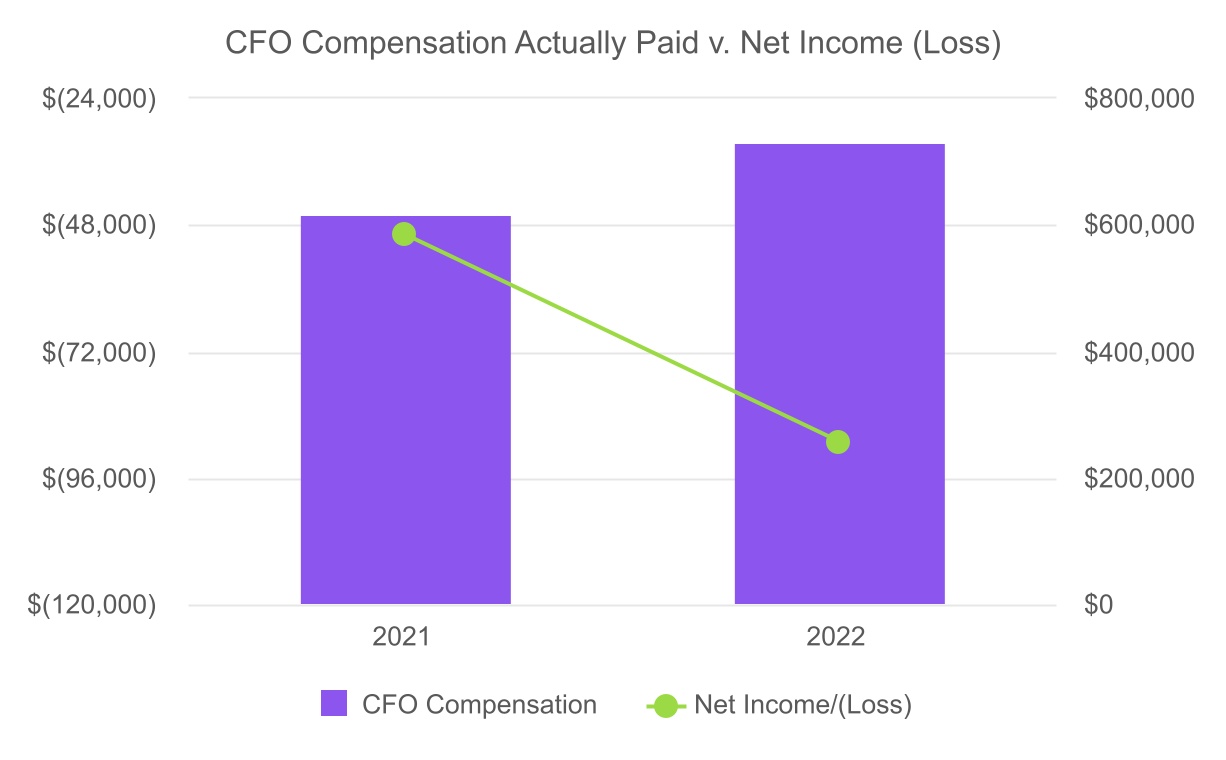

(1)Represents the discretionary bonus payable to Mr. Lehman with respect to the period commencing June 15, 2022 and ending on September 30, 2022. Mr. Lehman is also eligible to receive a discretionary bonus with respect to the period from October 1, 2022 through September 30, 2023, the actual amount of which will be included in our Proxy Statement filed in 2024.