Second Quarter 2023 Investor Presentation August 8, 2023

We make forward-looking statements in this presentation that are subject to risks and uncertainties, many of which are difficult to predict and are generally beyond the Company's control. These forward-looking statements include information about possible or assumed future results of our business, financial condition, liquidity, results of operations, plans and objectives. When we use the words "believe," "expect," "anticipate," "estimate," "plan," "continue," "intend," "should," "may" or similar expressions, we intend to identify forward-looking statements. Statements regarding the following subjects, among others, may be forward- looking: our business and investment strategy; our projected operating results; our ability to obtain financing arrangements; financing and advance rates for mortgage loans, MBS and our potential target assets; our expected leverage; general volatility of the securities markets in which we invest and the market price of our common stock; our expected investments; interest rate mismatches between mortgage loans, MBS and our potential target assets and our borrowings used to fund such investments; changes in interest rates and the market value of MBS and our potential target assets; changes in prepayment rates on mortgage loans, Agency MBS and Non-Agency MBS; effects of hedging instruments on MBS and our potential target assets; rates of default or decreased recovery rates on our potential target assets; the degree to which any hedging strategies may or may not protect us from interest rate volatility; impact of and changes in governmental regulations, tax law and rates, accounting guidance and similar matters; our ability to maintain our qualification as a REIT; our ability to maintain our exemption from registration under the Investment Company Act of 1940, as amended; availability of investment opportunities in mortgage-related, real estate- related and other securities; availability of qualified personnel; estimates relating to our ability to make distributions to our stockholders in the future; our understanding of our competition; and the uncertainty and economic impact of pandemics, epidemics or other public health emergencies, such as the COVID-19 pandemic. The forward-looking statements in this presentation are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. You should not place undue reliance on these forward- looking statements. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to us. Some of these factors are described in our filings with the SEC under the headings "Summary," "Risk factors," "Management's discussion and analysis of financial condition and results of operations" and "Business." If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made. New risks and uncertainties arise over time, and it is not possible for us to predict those events or how they may affect us. Except as required by law, we are not obligated to, and do not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. This presentation is not an offer to sell securities nor a solicitation of an offer to buy securities in any jurisdiction where the offer and sale is not permitted. Safe Harbor Statement 1

Robert W. Lehman Chief Financial Officer Bonnie M. Wongtrakool Chief Executive Officer Sean Johnson Deputy Chief Investment Officer Second Quarter 2023 WMC Earnings Call Presenters Greg Handler Chief Investment Officer 2

Western Asset Mortgage Capital Corporation (“WMC”) is a public REIT that benefits from the leading fixed income management capabilities of Western Asset Management Company, LLC ("Western Asset") • One of the world’s leading global fixed income managers, known for team management, proprietary research, robust risk management and a long-term fundamental value approach. • AUM of $388.0 billion(1) ◦ AUM of the Mortgage and Consumer Credit Group is $68.7 billion(1) ◦ Extensive mortgage and consumer credit investing track record • Publicly traded mortgage REIT positioned to capture attractive current and long-term investment opportunities in the residential mortgage markets. • Completed Initial Public Offering in May 2012 Please refer to page 29 for footnote disclosures. Overview of Western Asset Mortgage Capital Corporation 3

2023 Outlook 4

Mortgage & Consumer Credit Outlook The aftershocks of the COVID experience have been uneven across parts of the economy, geographically, across demographics, and amongst different asset classes with certain segments of the economy operating above and others below the pre-Covid economy. Additionally, geopolitical risks have arisen, broad based inflationary pressures have persisted, and the Federal Reserve’s policy accommodation has been actively reduced, significantly tightening financial conditions. Caught in the crosshairs of this uncertain backdrop, the mortgage and consumer credit spreads and yields have repriced significantly and are well wide of the levels we saw pre-COVID and in December 2018, the last time interest rate increases by the Federal Reserve resulted in an economic slowdown. After booming during the pandemic, home prices have begun to stall and even decline in certain markets under the pressure of higher mortgage rates and lack of affordability. Credit standards have remained high during this cycle and we do not see the risk of higher rates hitting borrowers who already locked in ultra-low mortgage rates. While housing activity has slowed down dramatically with fewer willing sellers and buyers, we do not anticipate a wave of delinquencies and foreclosures or meaningful downside pressure on home prices. We see attractive opportunities in non-agency residential mortgages backed by high quality borrowers with significant built up equity that we believe offer attractive yields. While housing is expected to cool, we do not see a significant risk of widespread defaults or home price correction that current market pricing implies. As the clarity around the pace and timing of tapering by the Federal Reserve is expected to be more certain, and with inflation likely to continue to moderate through the end of 2023, the volatility in rates and spreads is expected to decline significantly. Therefore, we believe that spread normalization, combined with high carry, should provide upside value to our residential holdings. Our Manager's General Investment Outlook 5

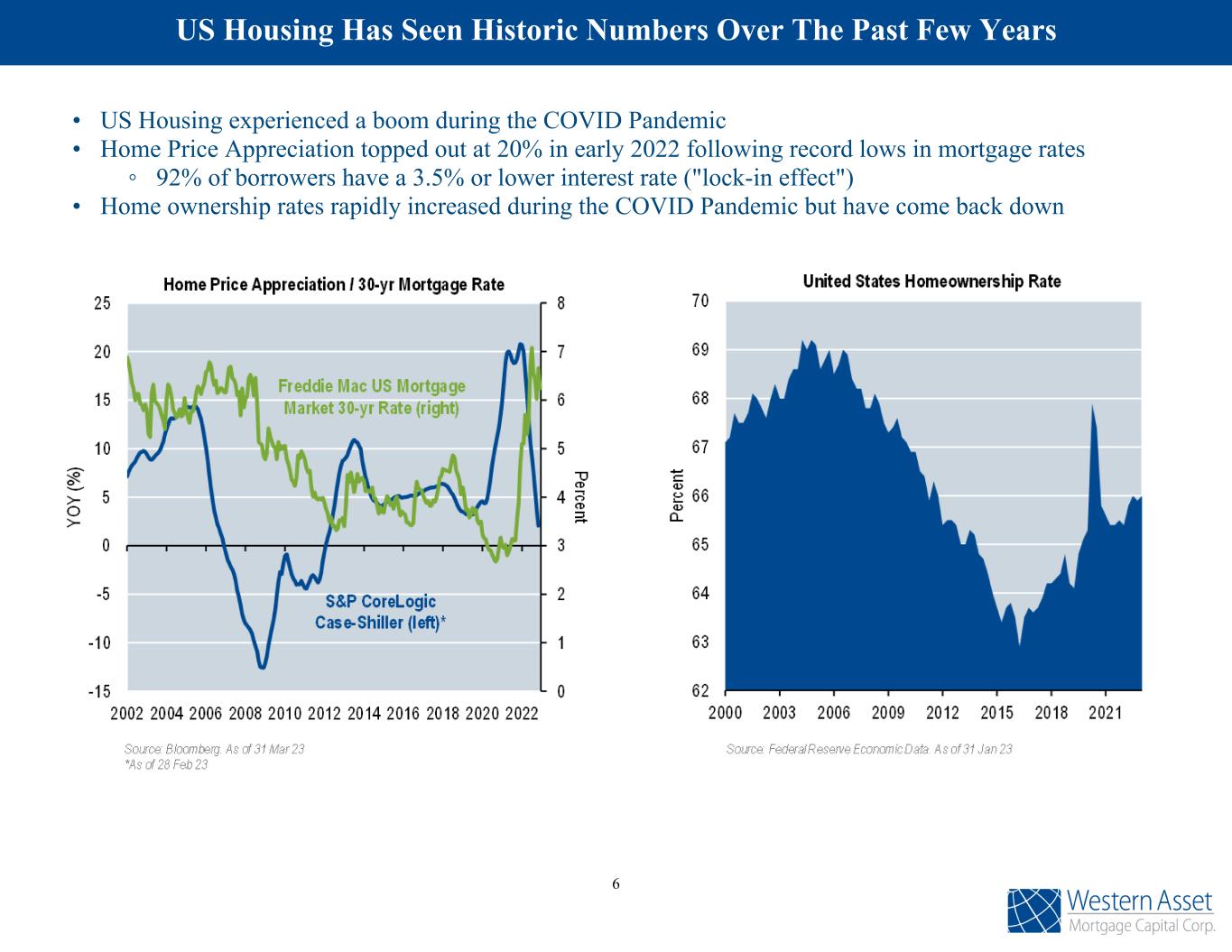

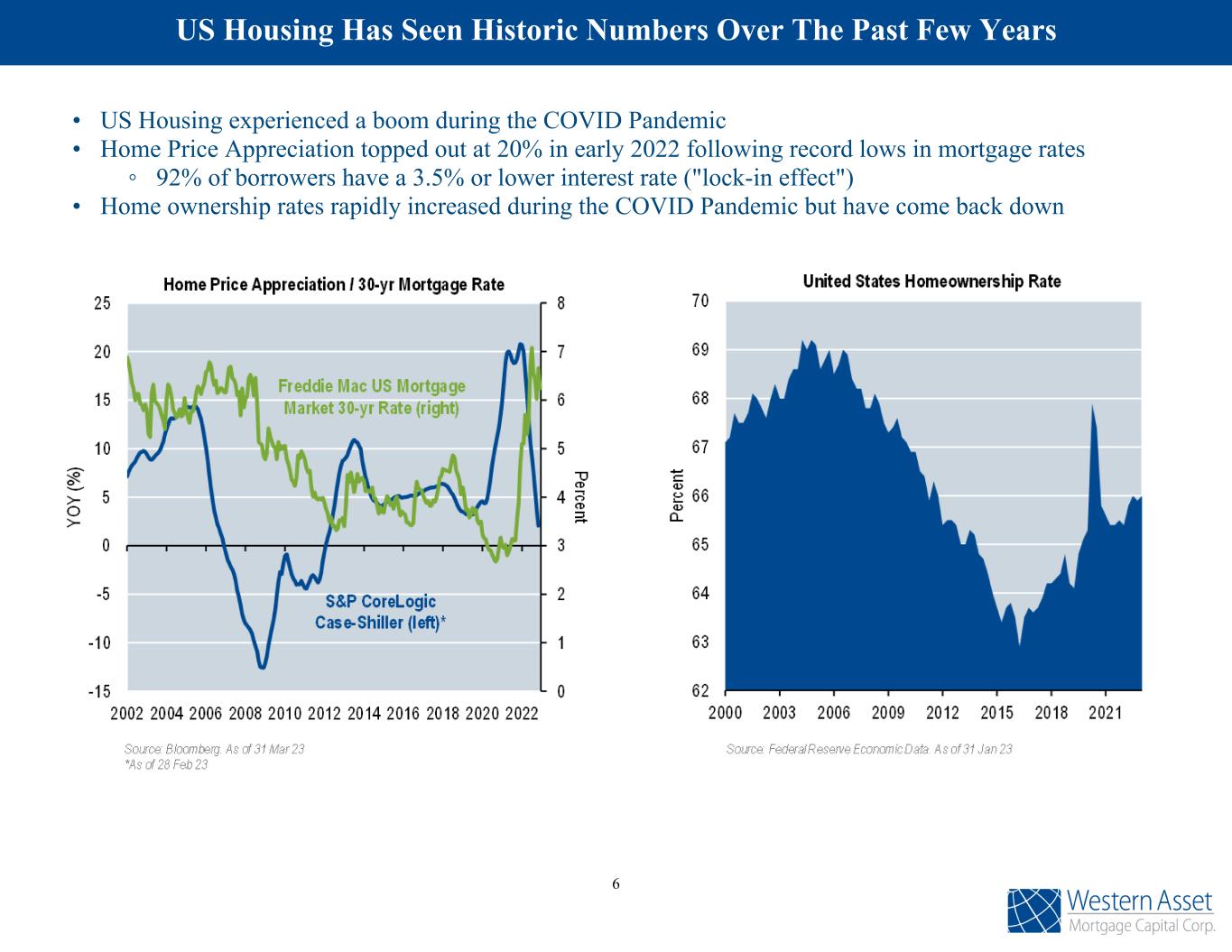

US Housing Has Seen Historic Numbers Over The Past Few Years 6 • US Housing experienced a boom during the COVID Pandemic • Home Price Appreciation topped out at 20% in early 2022 following record lows in mortgage rates ◦ 92% of borrowers have a 3.5% or lower interest rate ("lock-in effect") • Home ownership rates rapidly increased during the COVID Pandemic but have come back down

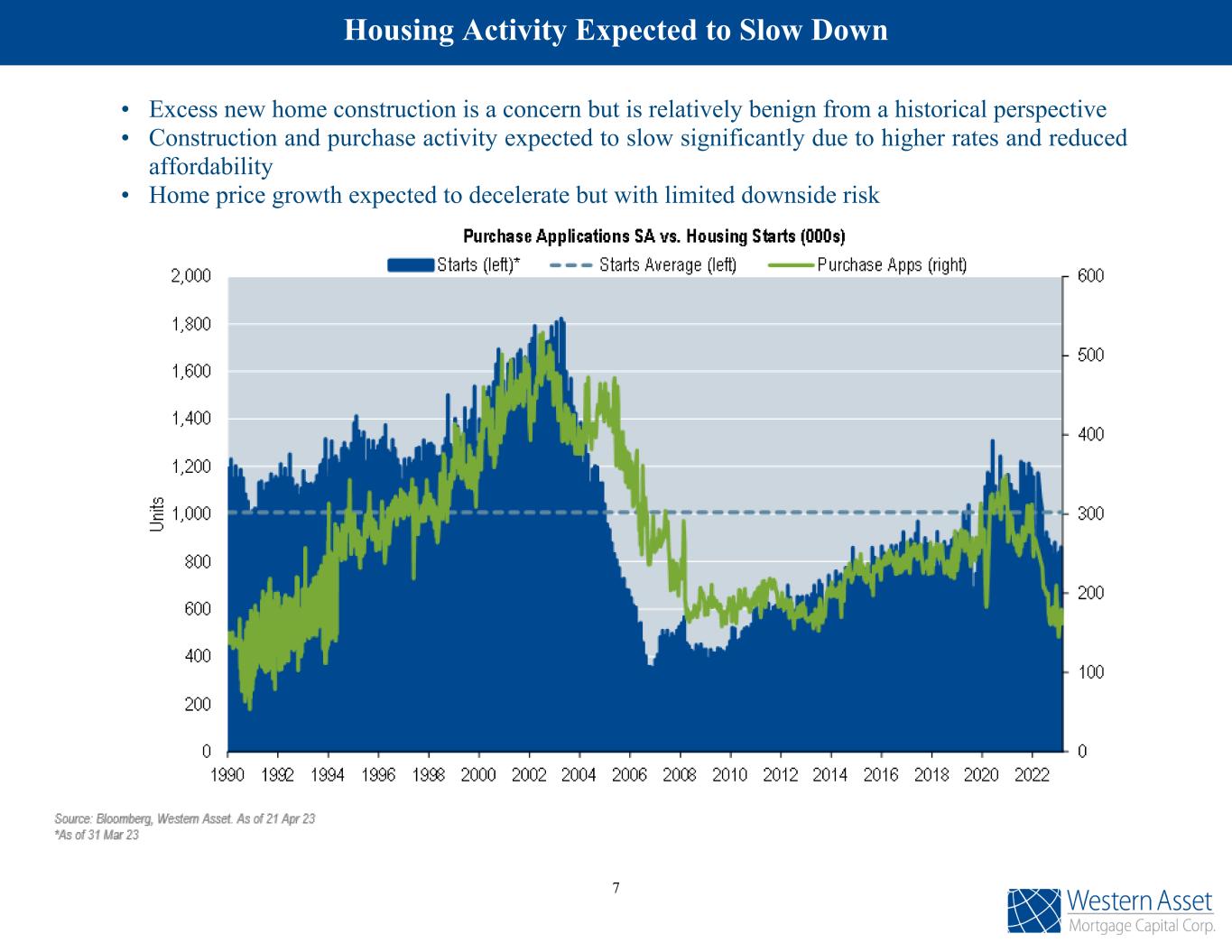

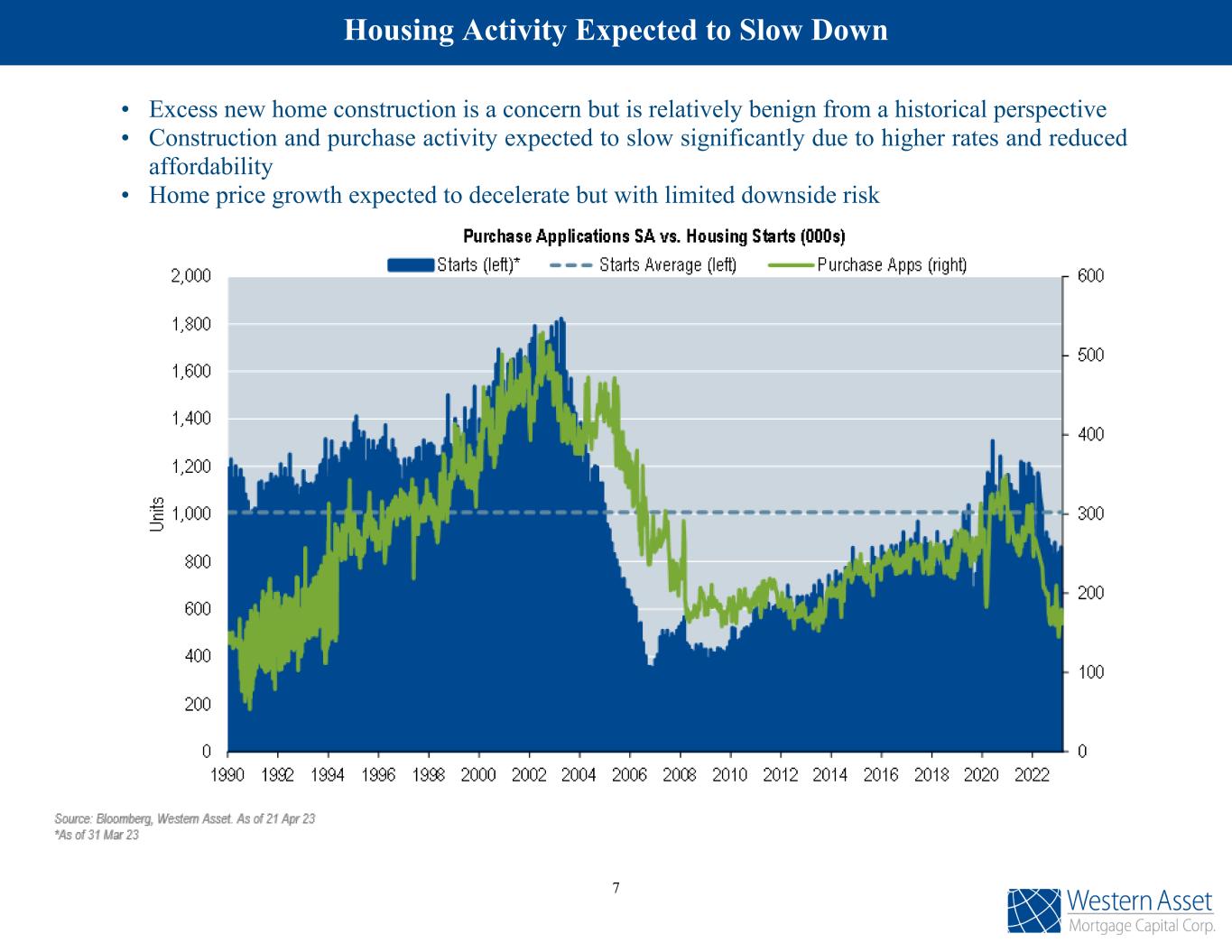

• Excess new home construction is a concern but is relatively benign from a historical perspective • Construction and purchase activity expected to slow significantly due to higher rates and reduced affordability • Home price growth expected to decelerate but with limited downside risk Housing Activity Expected to Slow Down 7

Prepayment Risk and Origination Supply Are Low 8

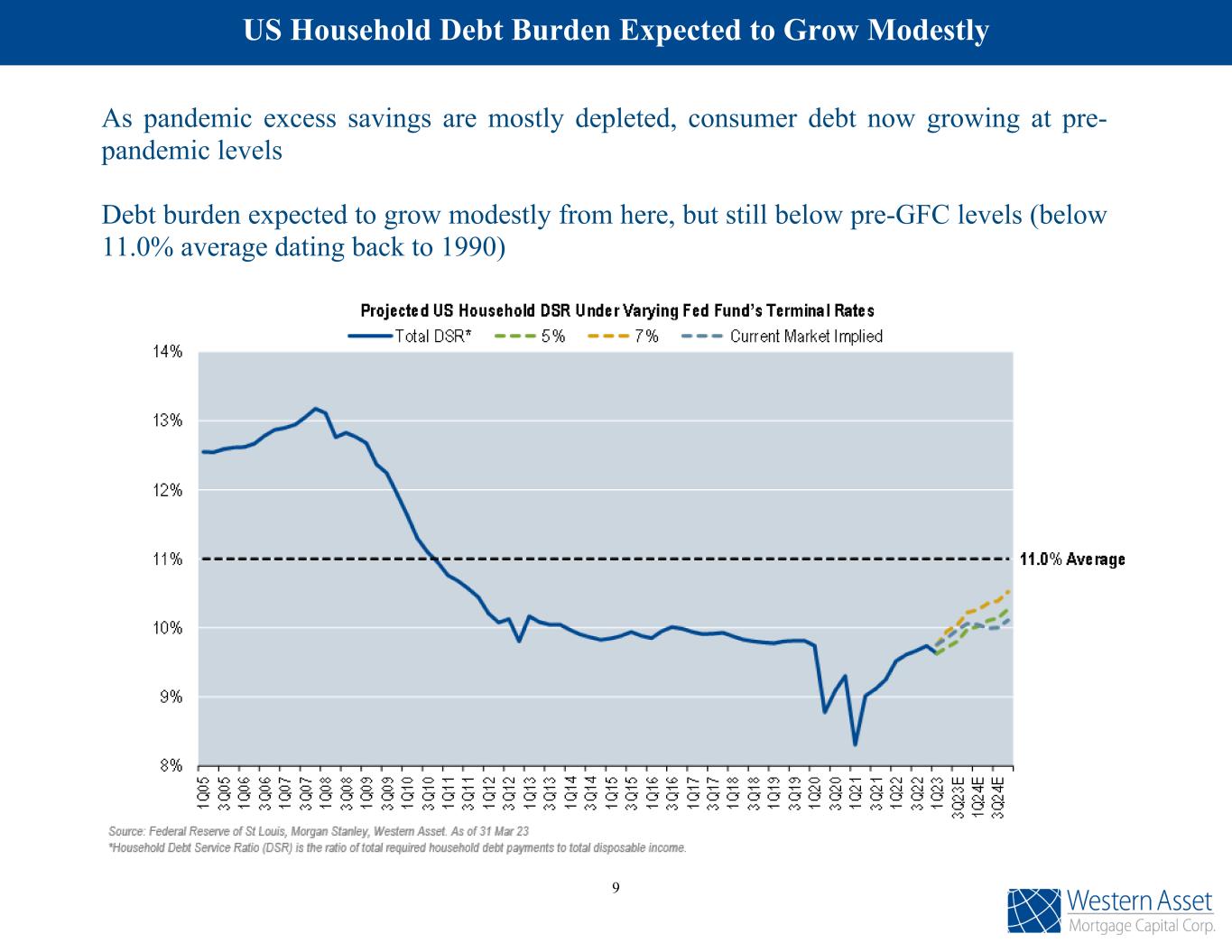

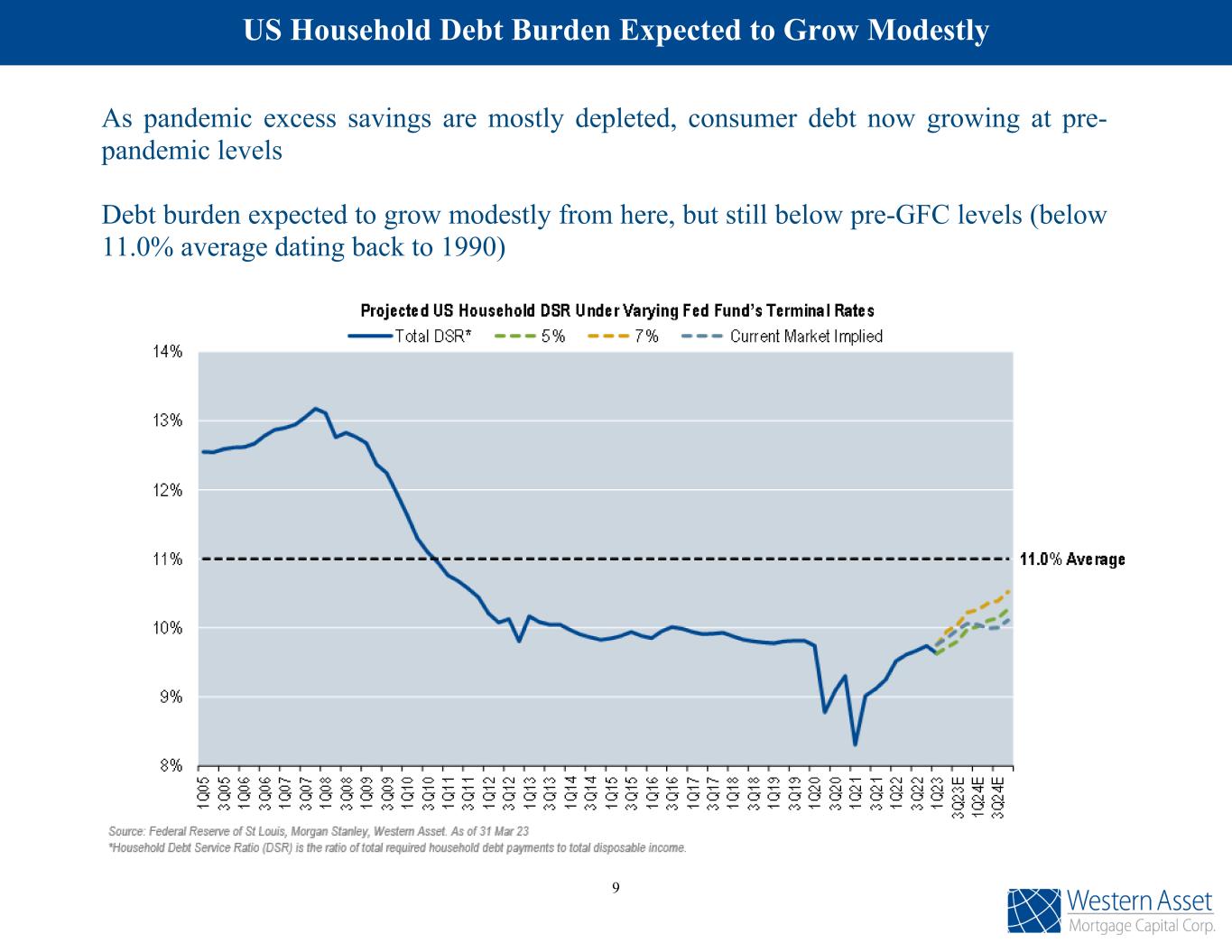

As pandemic excess savings are mostly depleted, consumer debt now growing at pre- pandemic levels Debt burden expected to grow modestly from here, but still below pre-GFC levels (below 11.0% average dating back to 1990) US Household Debt Burden Expected to Grow Modestly 9

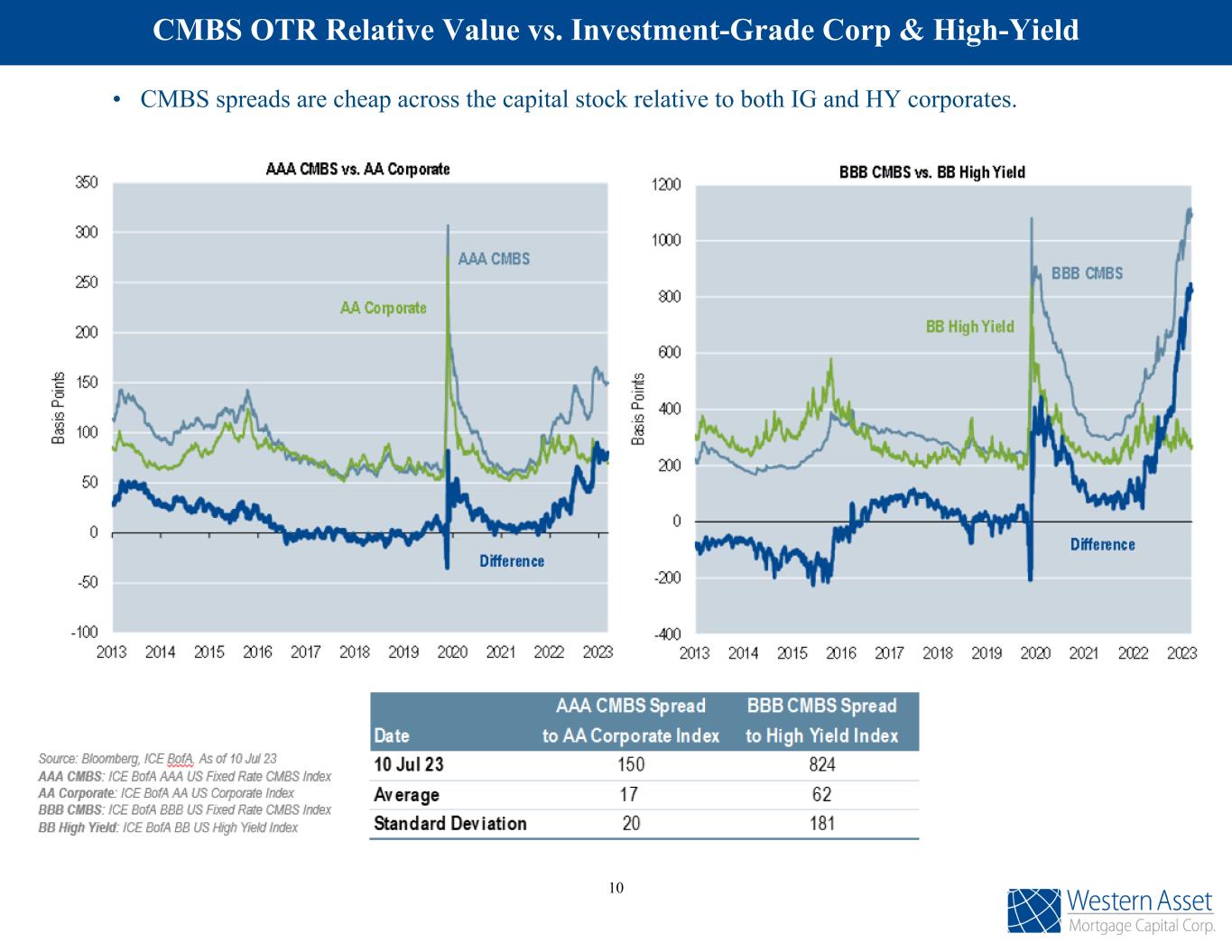

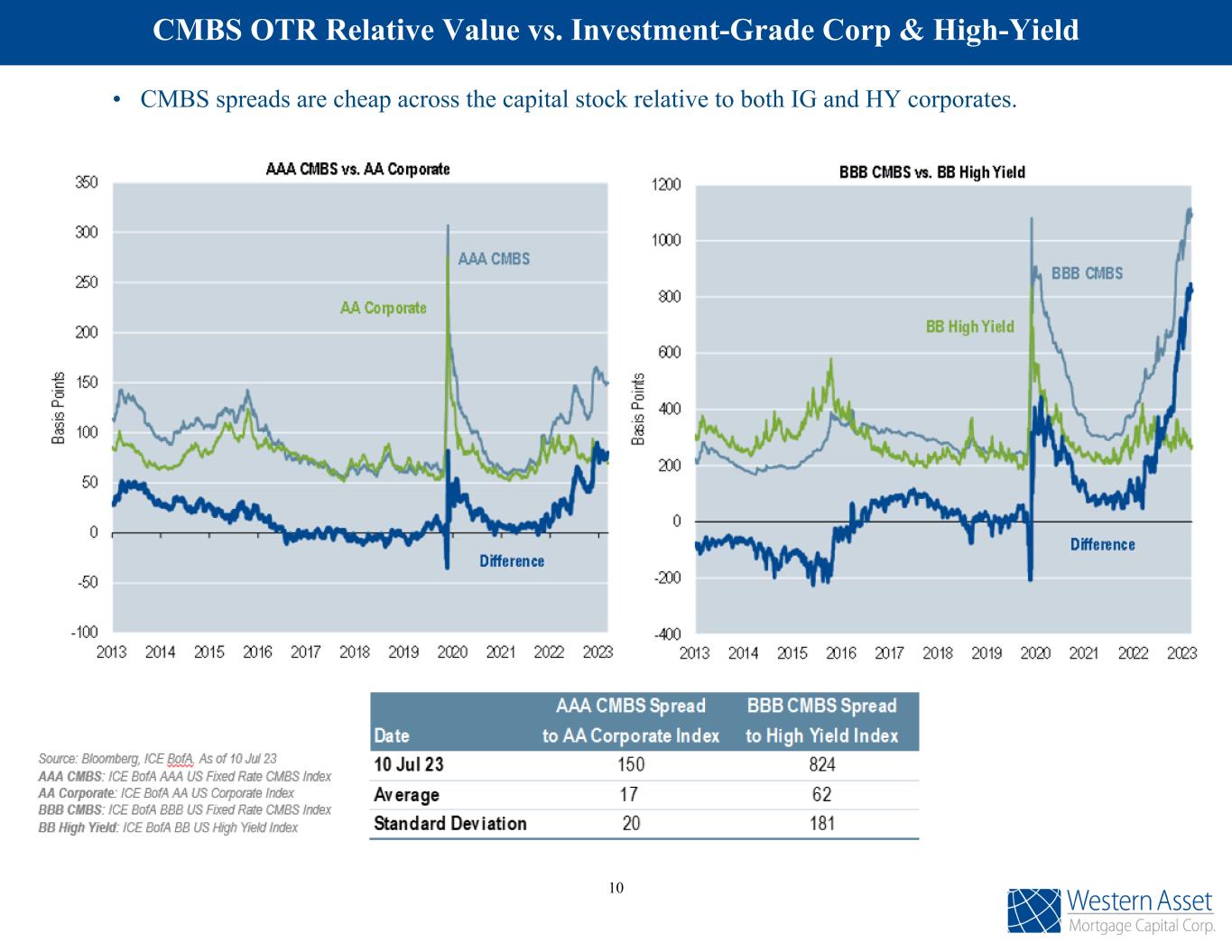

CMBS OTR Relative Value vs. Investment-Grade Corp & High-Yield • CMBS spreads are cheap across the capital stock relative to both IG and HY corporates. 10

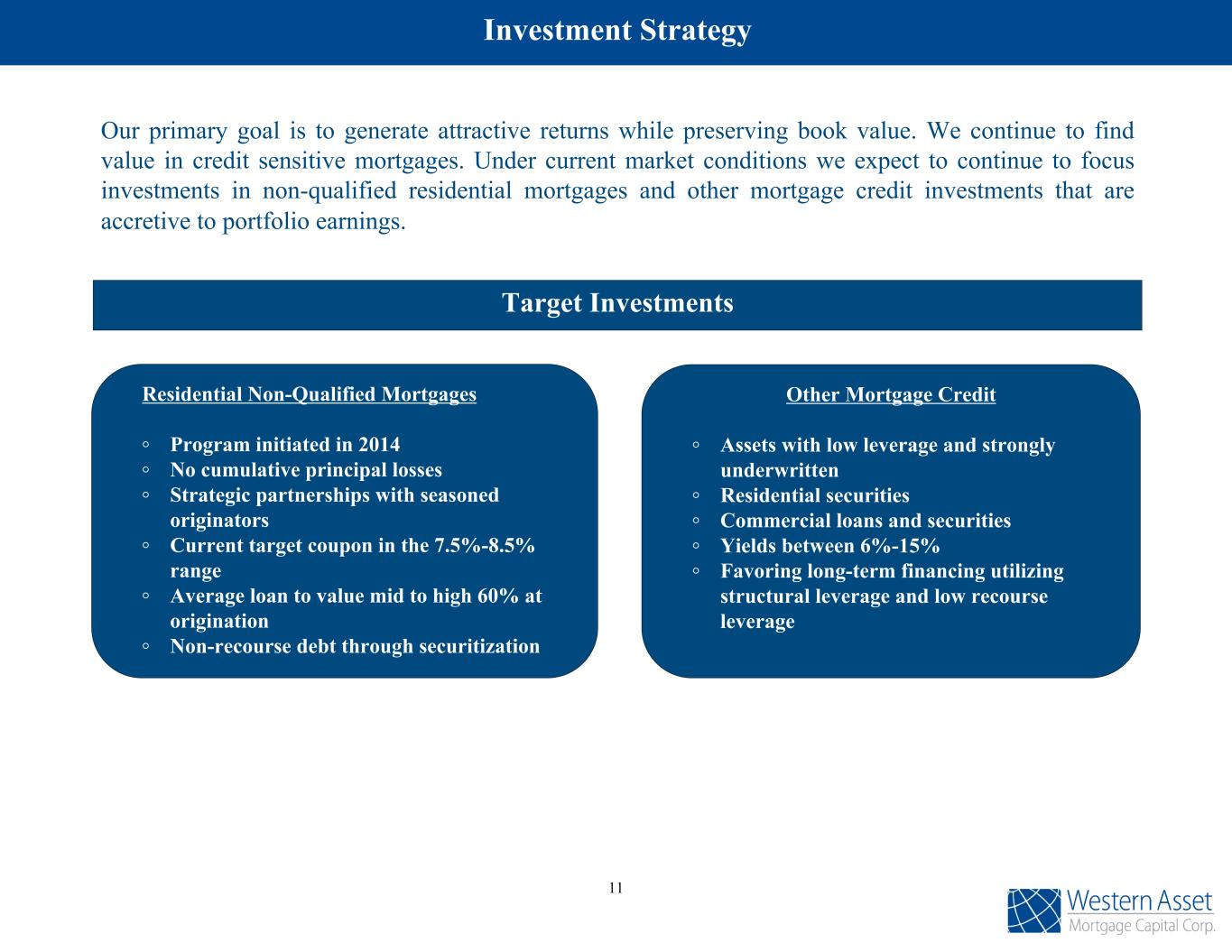

Investment Strategy Our primary goal is to generate attractive returns while preserving book value. We continue to find value in credit sensitive mortgages. Under current market conditions we expect to continue to focus investments in non-qualified residential mortgages and other mortgage credit investments that are accretive to portfolio earnings. Target Investments Residential Non-Qualified Mortgages ◦ Program initiated in 2014 ◦ No cumulative principal losses ◦ Strategic partnerships with seasoned originators ◦ Current target coupon in the 7.5%-8.5% range ◦ Average loan to value mid to high 60% at origination ◦ Non-recourse debt through securitization Other Mortgage Credit ◦ Assets with low leverage and strongly underwritten ◦ Residential securities ◦ Commercial loans and securities ◦ Yields between 6%-15% ◦ Favoring long-term financing utilizing structural leverage and low recourse leverage 11

Company Business Highlights The Company continues to execute on its business strategy to take actions to strengthen its balance sheet: • For the three months ended June 30, 2023: • the Company received $28.4 million from the sale or repayment of Residential Whole Loans, and Non-Agency RMBS. • the Company received $1.1 million from the repayment or paydown of Commercial Whole Loans, Non-Agency CMBS, and Other Securities. • the Company received $8.7 million in proceeds from the sale of Other Securities. • Subsequent to quarter end, the Company replaced an existing short-term repurchase financing facility facing Credit Suisse AG (UBS) with a new two-year term, $65 million fixed rate, non-mark-to-market securitized funding vehicle. As a result, the Company no longer has any financing arrangements with Credit Suisse AG (UBS) as a counterparty. 12

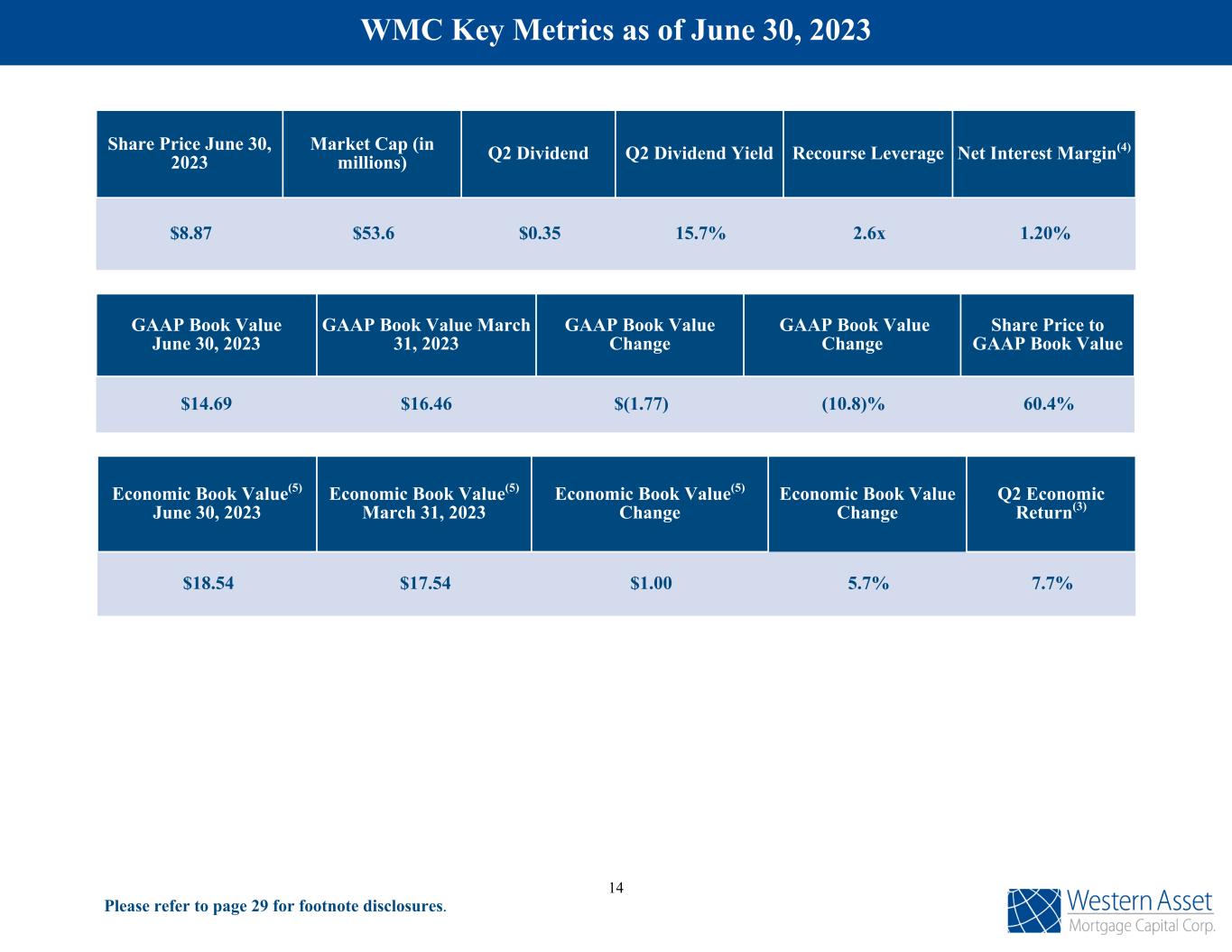

Please refer to page 29 for footnote disclosures. • GAAP book value per share of $14.69. • Economic book value(5) per share of $18.54. • GAAP net loss attributable to common shareholders and participating securities of $8.6 million, or $1.44 per basic and diluted share. • Distributable earnings(2) of $1.3 million, or $0.22 per basic and diluted share. • Economic return on GAAP book value was 8.6%(3) for the quarter. • Economic return on economic book value was 7.7% for the quarter. • 1.20%(4) annualized net interest margin on our investment portfolio. • 2.6x recourse leverage as of June 30, 2023. • On June 21, 2023 we declared a second quarter common dividend of $0.35 per share. Second Quarter Financial Results 13

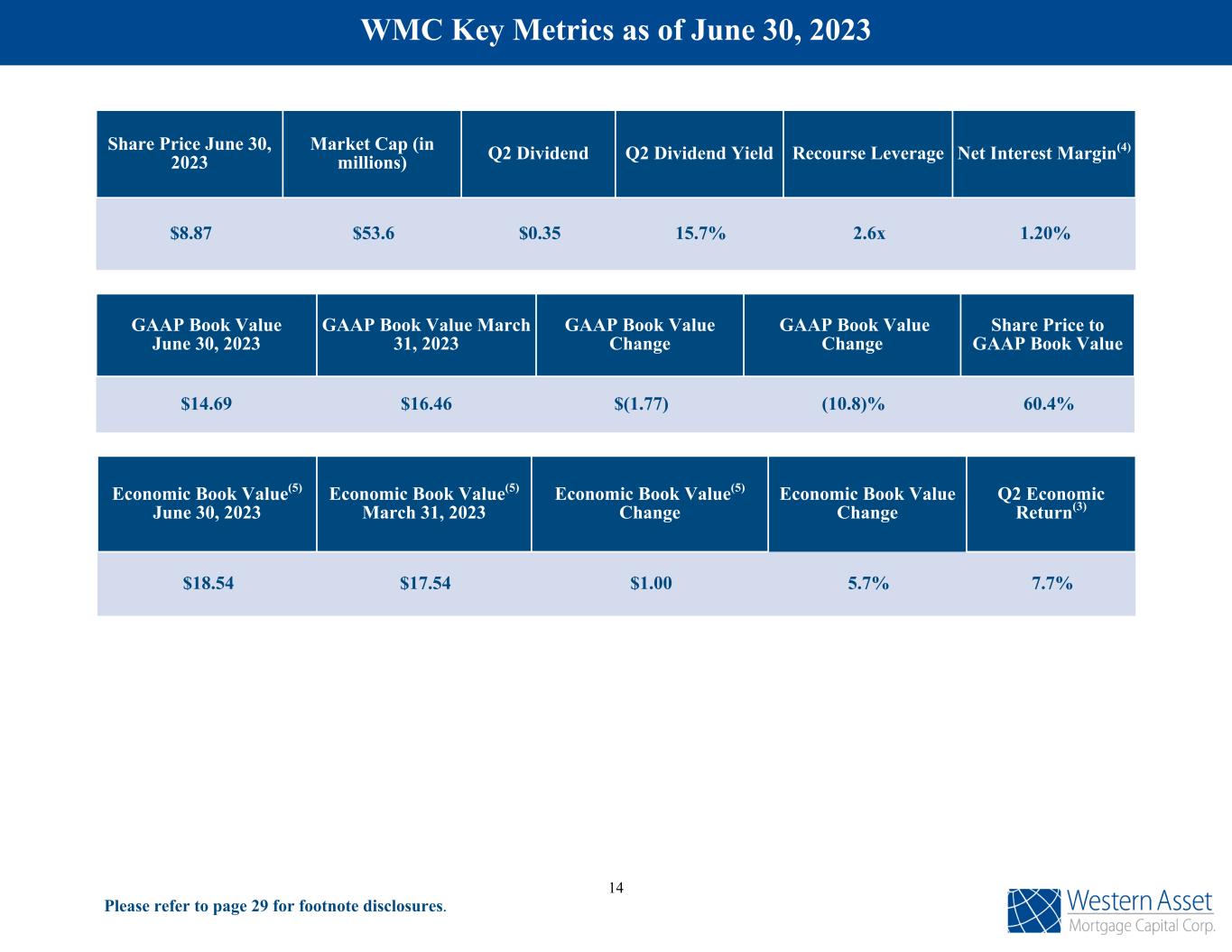

The following are the Company's key metrics as of December 31, 2021; Share Price June 30, 2023 Market Cap (in millions) Q2 Dividend Q2 Dividend Yield Recourse Leverage Net Interest Margin(4) $8.87 $53.6 $0.35 15.7% 2.6x 1.20% Economic Book Value(5) June 30, 2023 Economic Book Value(5) March 31, 2023 Economic Book Value(5) Change Economic Book Value Change Q2 Economic Return(3) $18.54 $17.54 $1.00 5.7% 7.7% Please refer to page 29 for footnote disclosures. WMC Key Metrics as of June 30, 2023 GAAP Book Value June 30, 2023 GAAP Book Value March 31, 2023 GAAP Book Value Change GAAP Book Value Change Share Price to GAAP Book Value $14.69 $16.46 $(1.77) (10.8)% 60.4% 14

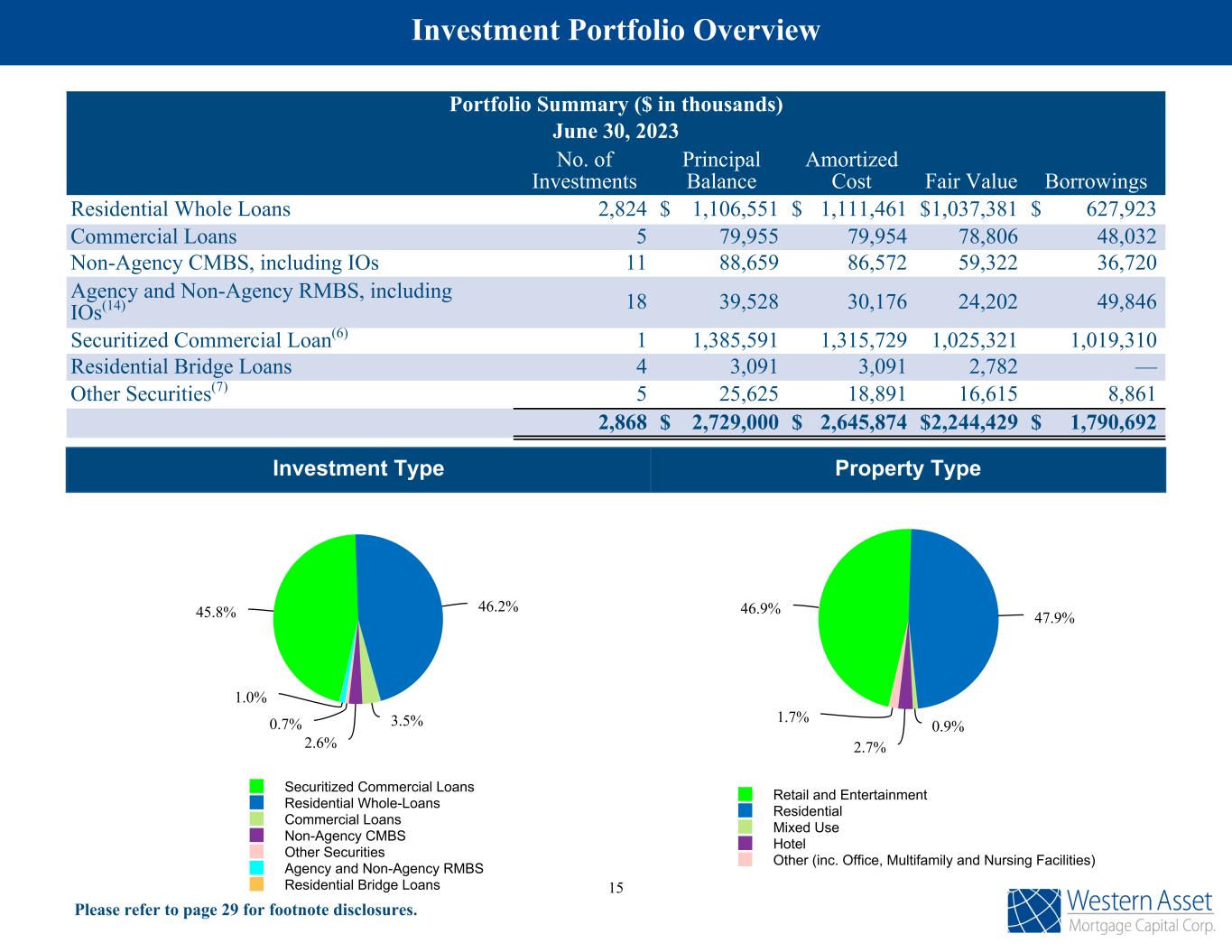

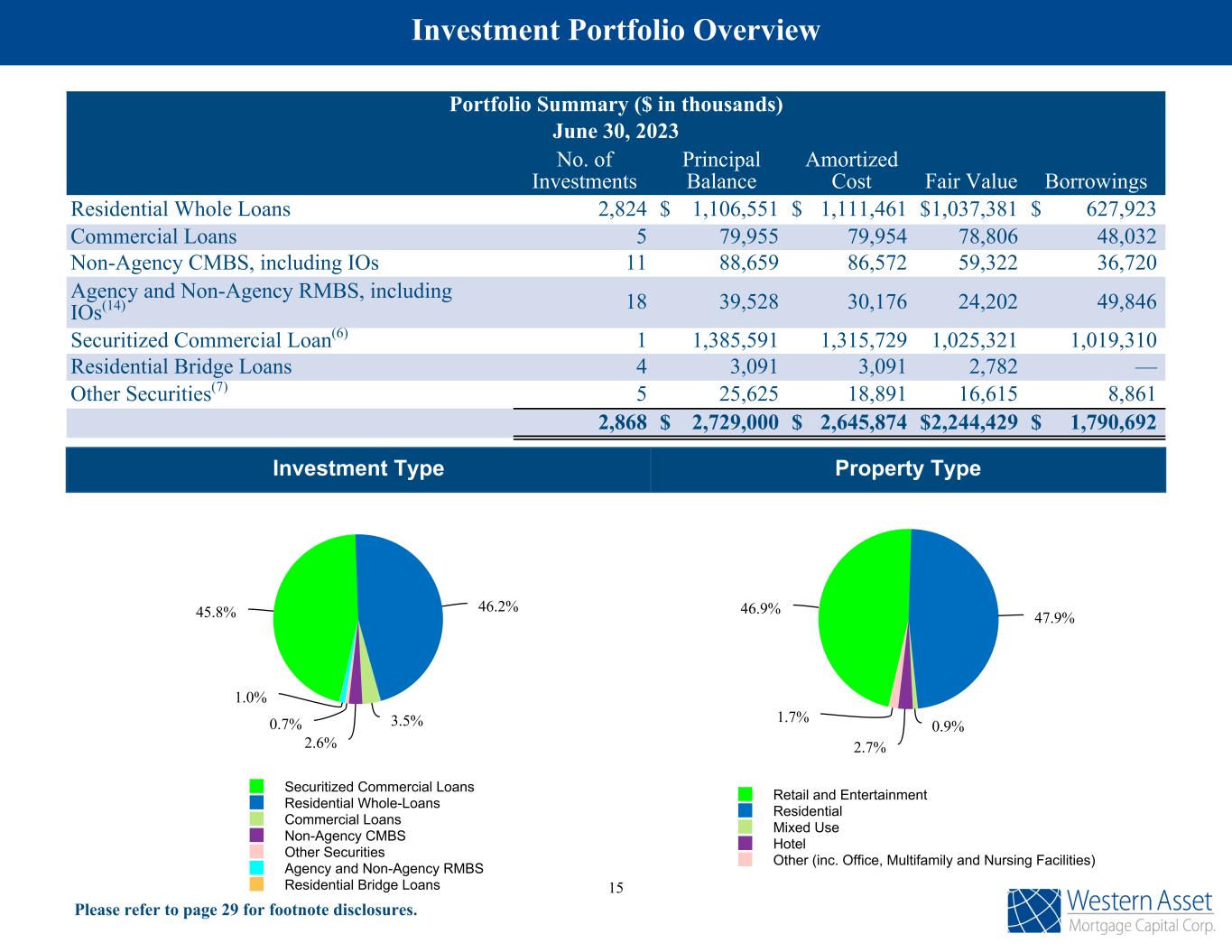

Portfolio Summary ($ in thousands) June 30, 2023 No. of Investments Principal Balance Amortized Cost Fair Value Borrowings Residential Whole Loans 2,824 $ 1,106,551 $ 1,111,461 $ 1,037,381 $ 627,923 Commercial Loans 5 79,955 79,954 78,806 48,032 Non-Agency CMBS, including IOs 11 88,659 86,572 59,322 36,720 Agency and Non-Agency RMBS, including IOs(14) 18 39,528 30,176 24,202 49,846 Securitized Commercial Loan(6) 1 1,385,591 1,315,729 1,025,321 1,019,310 Residential Bridge Loans 4 3,091 3,091 2,782 — Other Securities(7) 5 25,625 18,891 16,615 8,861 2,868 $ 2,729,000 $ 2,645,874 $ 2,244,429 $ 1,790,692 46.9% 47.9% 0.9% 2.7% 1.7% Retail and Entertainment Residential Mixed Use Hotel Other (inc. Office, Multifamily and Nursing Facilities) Property Type 45.8% 46.2% 3.5% 2.6% 0.7% 1.0% Securitized Commercial Loans Residential Whole-Loans Commercial Loans Non-Agency CMBS Other Securities Agency and Non-Agency RMBS Residential Bridge Loans Please refer to page 29 for footnote disclosures. Investment Portfolio Overview Investment Type 15

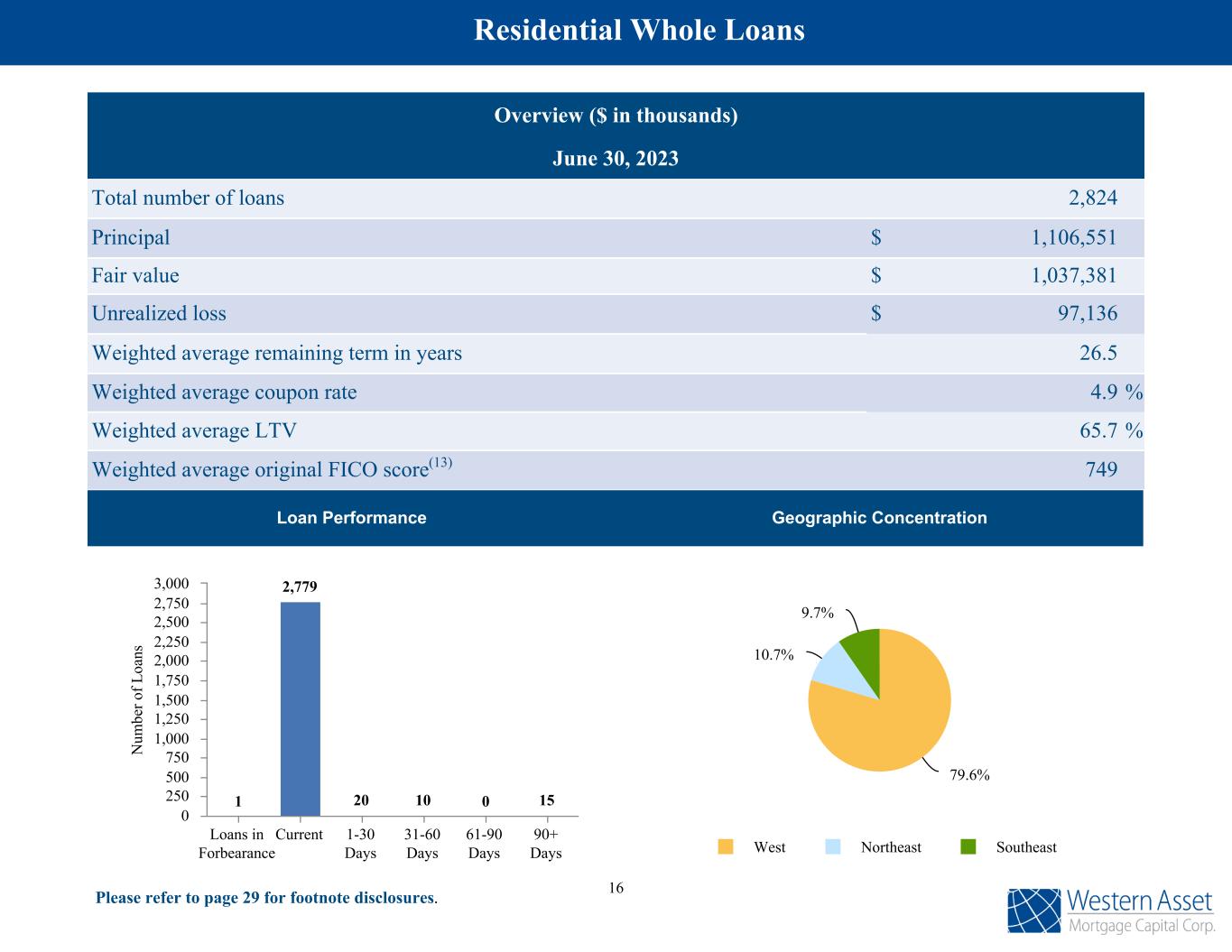

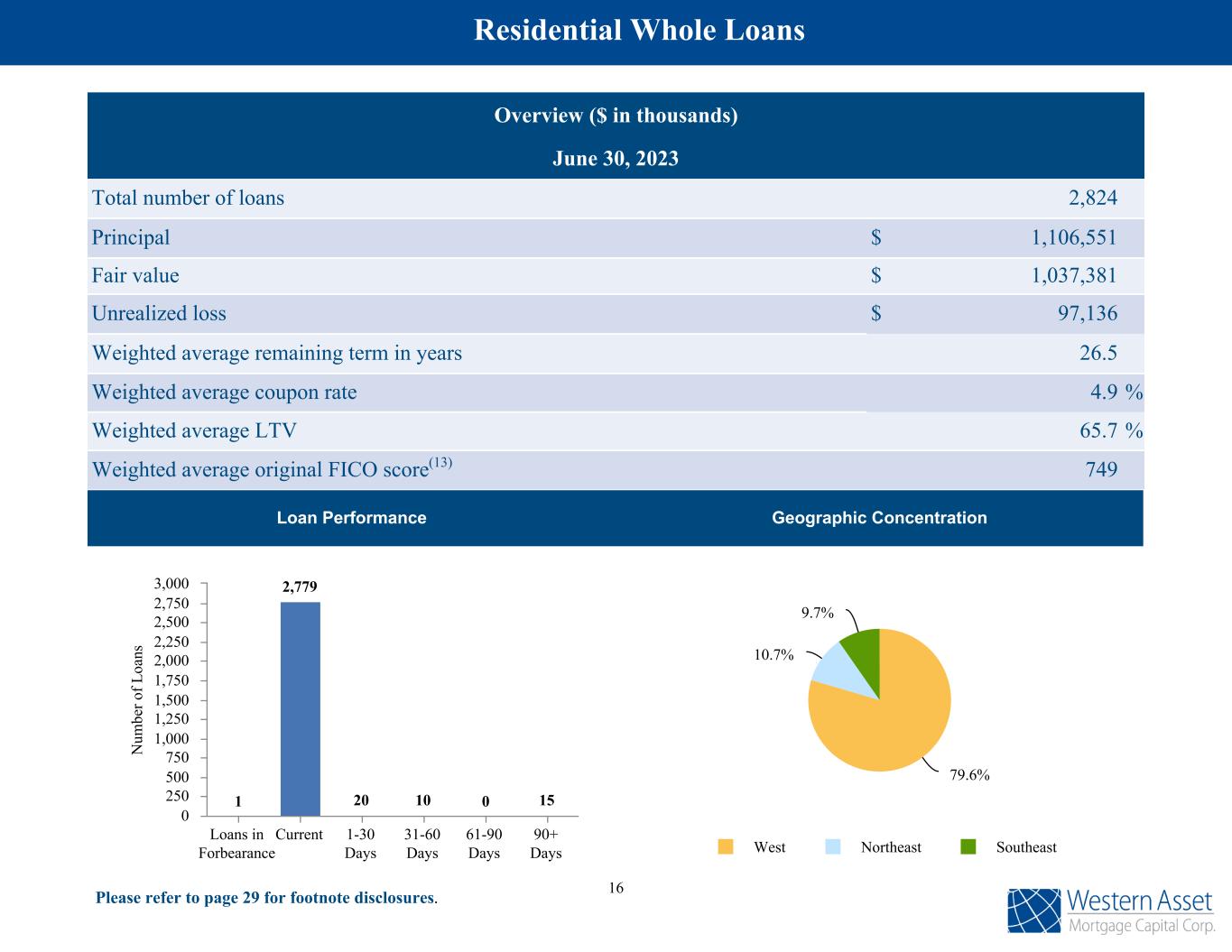

Overview ($ in thousands) June 30, 2023 Total number of loans 2,824 Principal $ 1,106,551 Fair value $ 1,037,381 Unrealized loss $ 97,136 Weighted average remaining term in years 26.5 Weighted average coupon rate 4.9 % Weighted average LTV 65.7 % Weighted average original FICO score(13) 749 Loan Performance Geographic Concentration 79.6% 10.7% 9.7% West Northeast Southeast N um be r o f L oa ns 1 2,779 20 10 0 15 Loans in Forbearance Current 1-30 Days 31-60 Days 61-90 Days 90+ Days 0 250 500 750 1,000 1,250 1,500 1,750 2,000 2,250 2,500 2,750 3,000 Residential Whole Loans Please refer to page 29 for footnote disclosures. 16

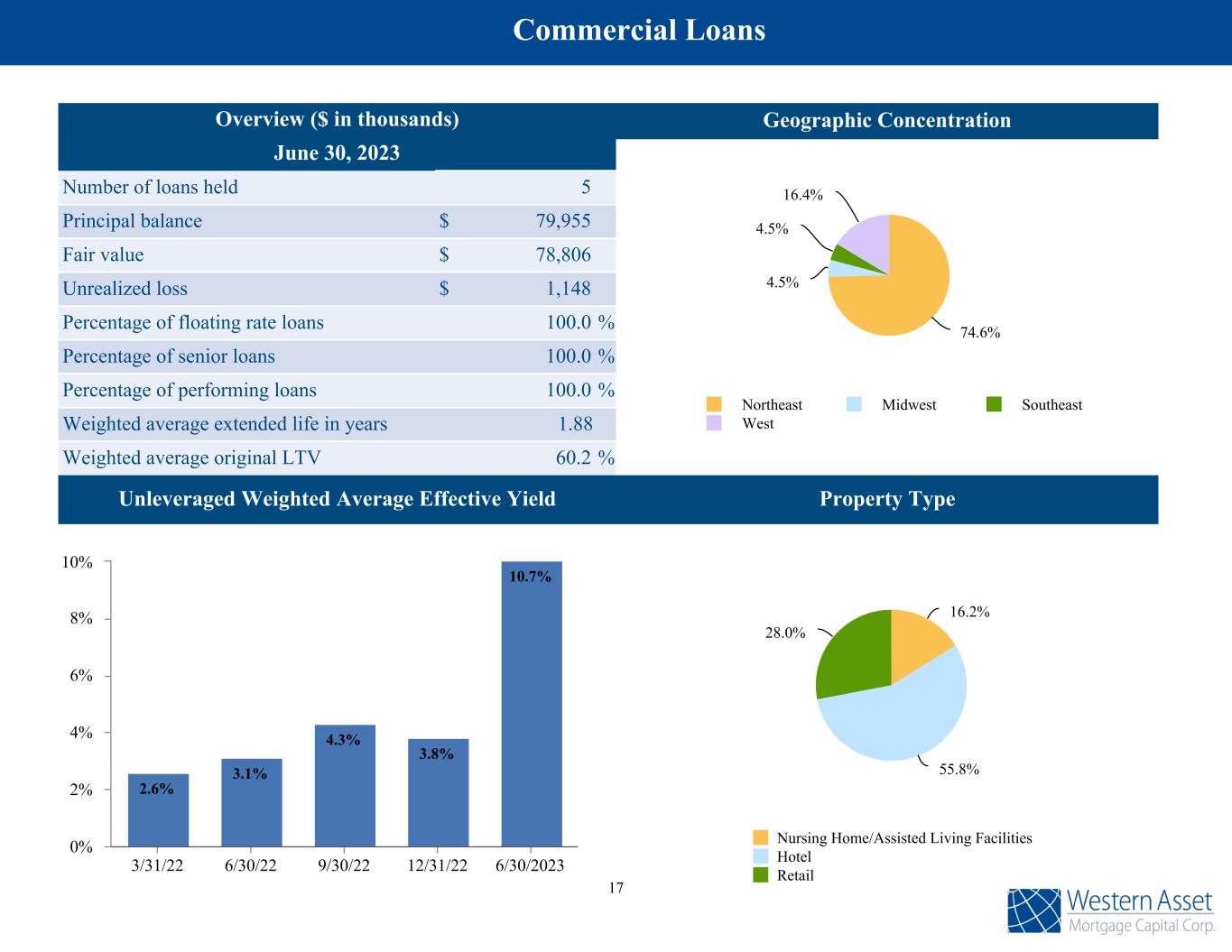

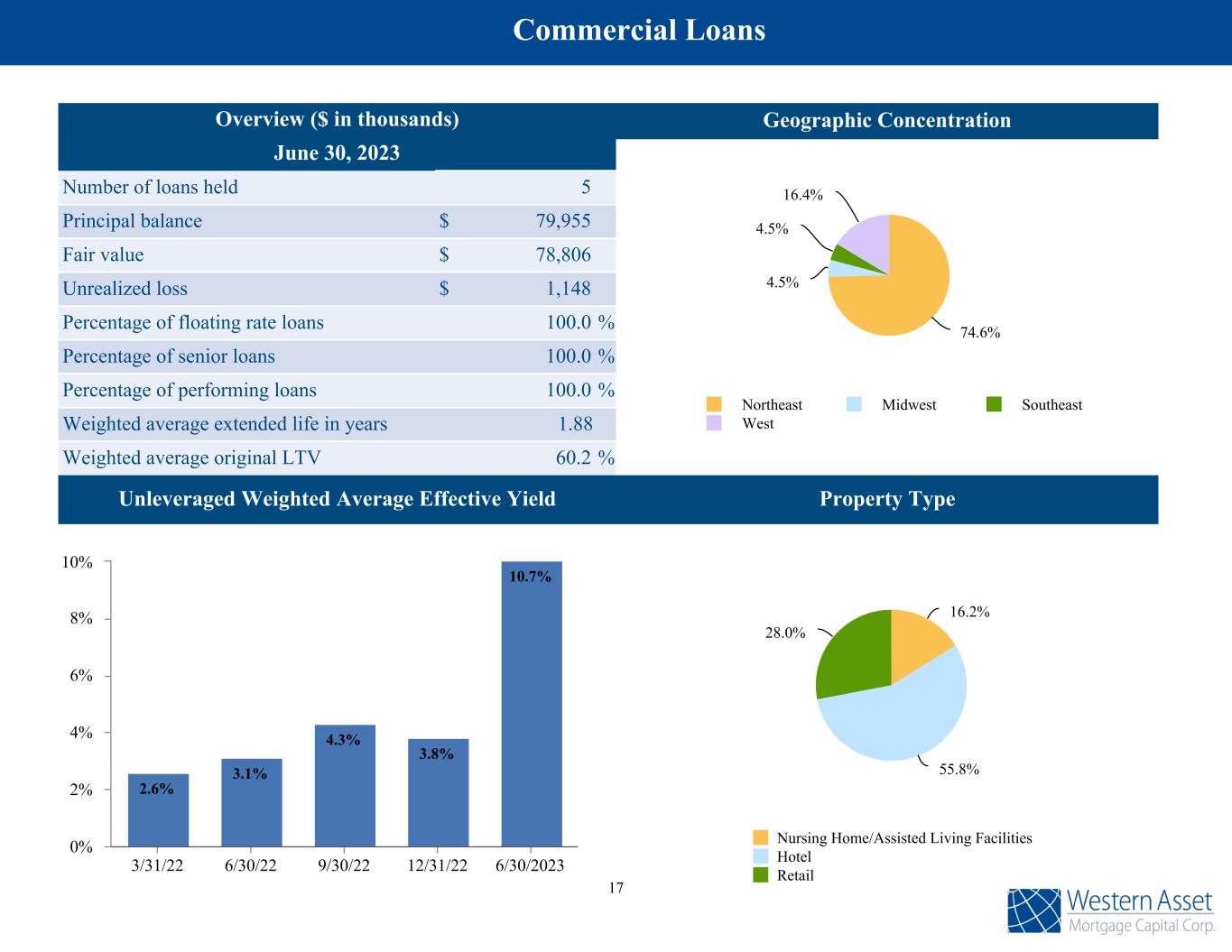

Overview ($ in thousands) June 30, 2023 Number of loans held 5 Principal balance $ 79,955 Fair value $ 78,806 Unrealized loss $ 1,148 Percentage of floating rate loans 100.0 % Percentage of senior loans 100.0 % Percentage of performing loans 100.0 % Weighted average extended life in years 1.88 Weighted average original LTV 60.2 % 16.2% 55.8% 28.0% Nursing Home/Assisted Living Facilities Hotel Retail Property Type Geographic Concentration 74.6% 4.5% 4.5% 16.4% Northeast Midwest Southeast West Unleveraged Weighted Average Effective Yield 2.6% 3.1% 4.3% 3.8% 10.7% 3/31/22 6/30/22 9/30/22 12/31/22 6/30/2023 0% 2% 4% 6% 8% 10% Commercial Loans 17

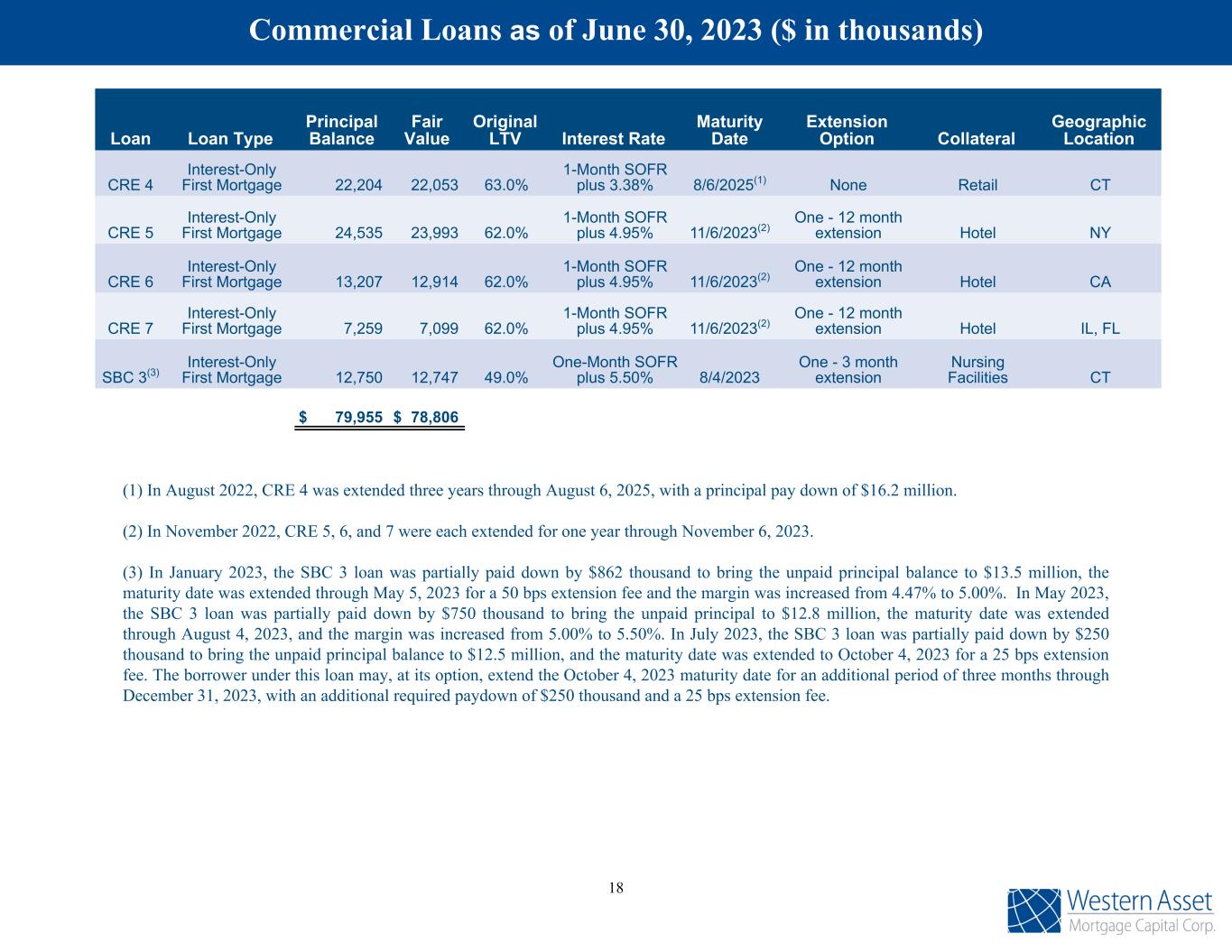

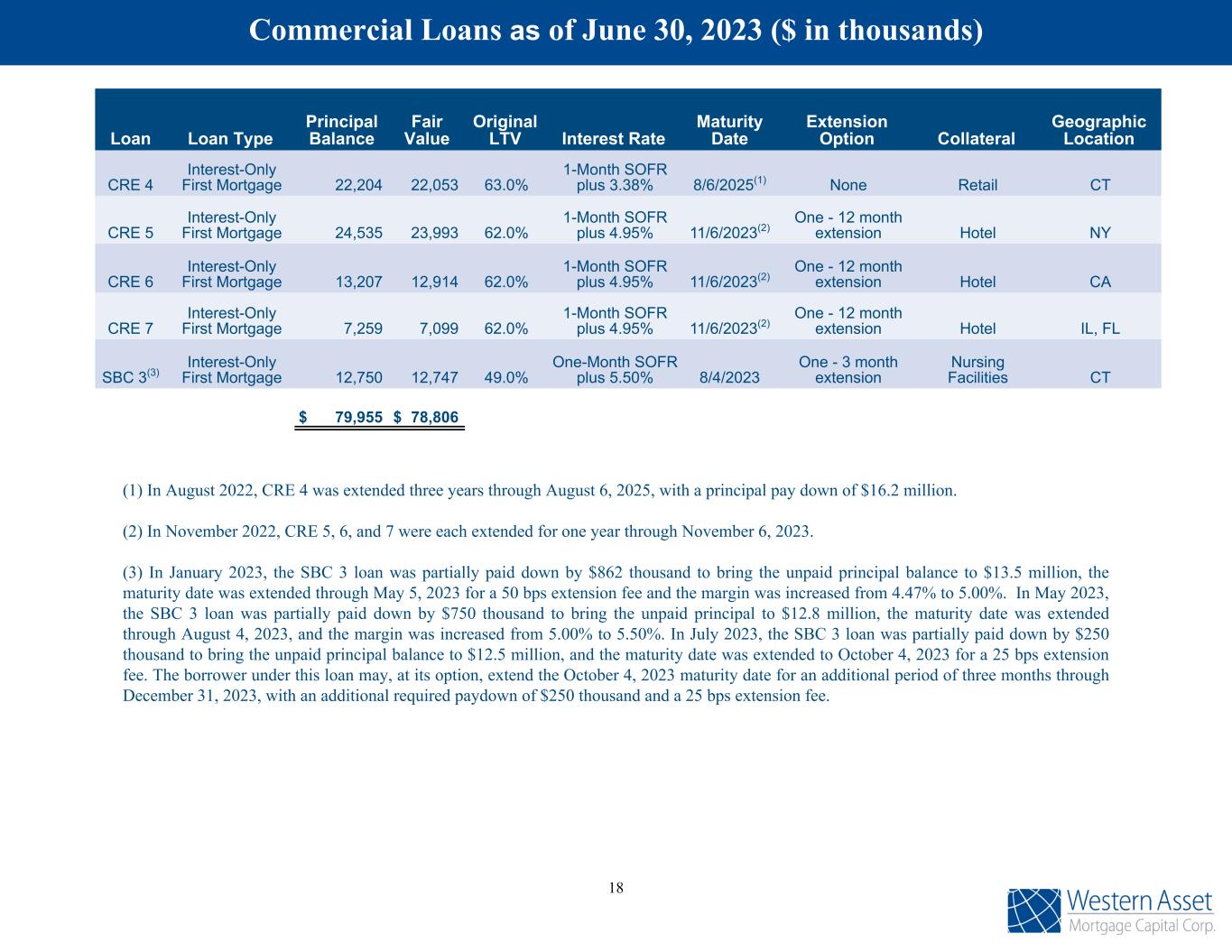

Loan Loan Type Principal Balance Fair Value Original LTV Interest Rate Maturity Date Extension Option Collateral Geographic Location CRE 4 Interest-Only First Mortgage 22,204 22,053 63.0% 1-Month SOFR plus 3.38% 8/6/2025(1) None Retail CT CRE 5 Interest-Only First Mortgage 24,535 23,993 62.0% 1-Month SOFR plus 4.95% 11/6/2023(2) One - 12 month extension Hotel NY CRE 6 Interest-Only First Mortgage 13,207 12,914 62.0% 1-Month SOFR plus 4.95% 11/6/2023(2) One - 12 month extension Hotel CA CRE 7 Interest-Only First Mortgage 7,259 7,099 62.0% 1-Month SOFR plus 4.95% 11/6/2023(2) One - 12 month extension Hotel IL, FL SBC 3(3) Interest-Only First Mortgage 12,750 12,747 49.0% One-Month SOFR plus 5.50% 8/4/2023 One - 3 month extension Nursing Facilities CT $ 79,955 $ 78,806 Commercial Loans as of June 30, 2023 ($ in thousands) (1) In August 2022, CRE 4 was extended three years through August 6, 2025, with a principal pay down of $16.2 million. (2) In November 2022, CRE 5, 6, and 7 were each extended for one year through November 6, 2023. (3) In January 2023, the SBC 3 loan was partially paid down by $862 thousand to bring the unpaid principal balance to $13.5 million, the maturity date was extended through May 5, 2023 for a 50 bps extension fee and the margin was increased from 4.47% to 5.00%. In May 2023, the SBC 3 loan was partially paid down by $750 thousand to bring the unpaid principal to $12.8 million, the maturity date was extended through August 4, 2023, and the margin was increased from 5.00% to 5.50%. In July 2023, the SBC 3 loan was partially paid down by $250 thousand to bring the unpaid principal balance to $12.5 million, and the maturity date was extended to October 4, 2023 for a 25 bps extension fee. The borrower under this loan may, at its option, extend the October 4, 2023 maturity date for an additional period of three months through December 31, 2023, with an additional required paydown of $250 thousand and a 25 bps extension fee. 18

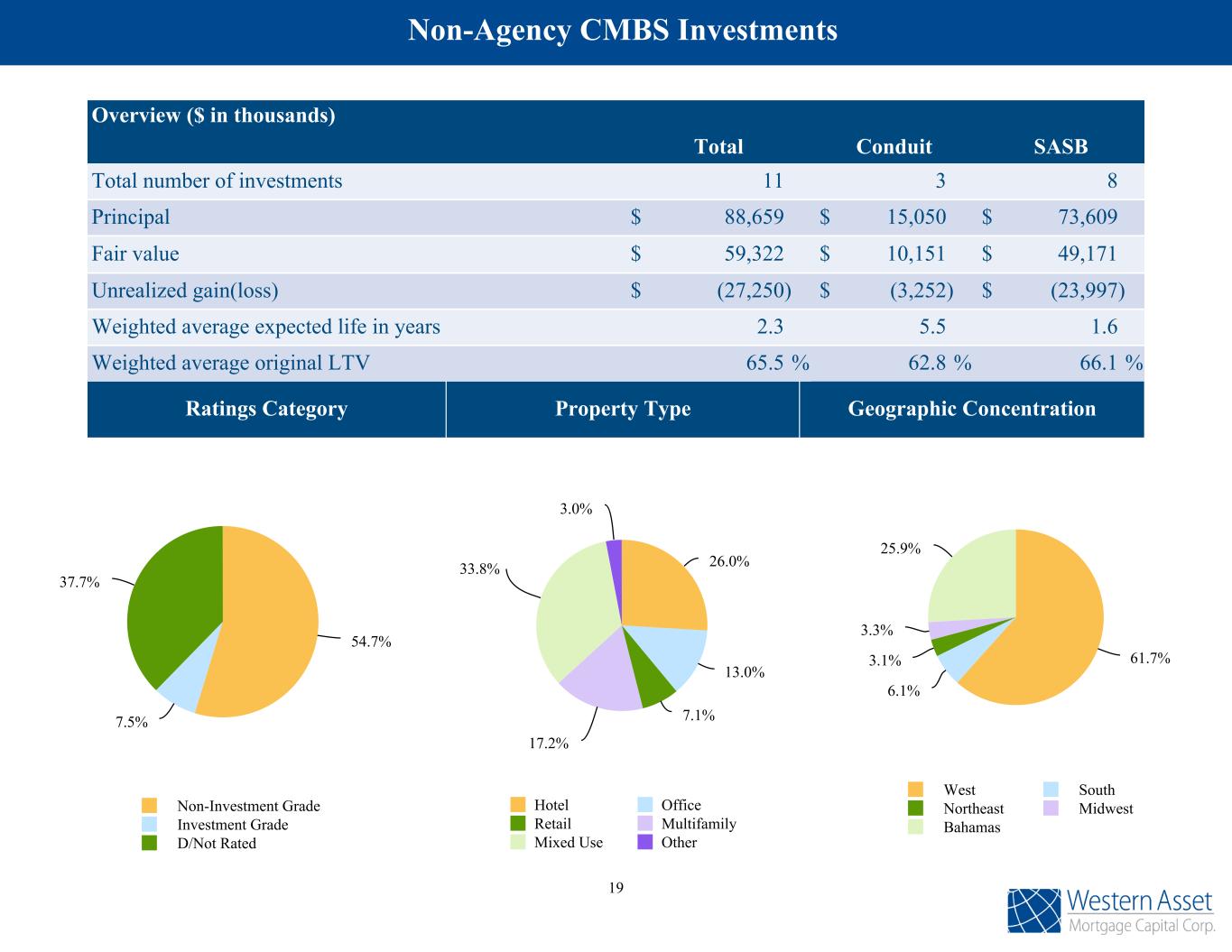

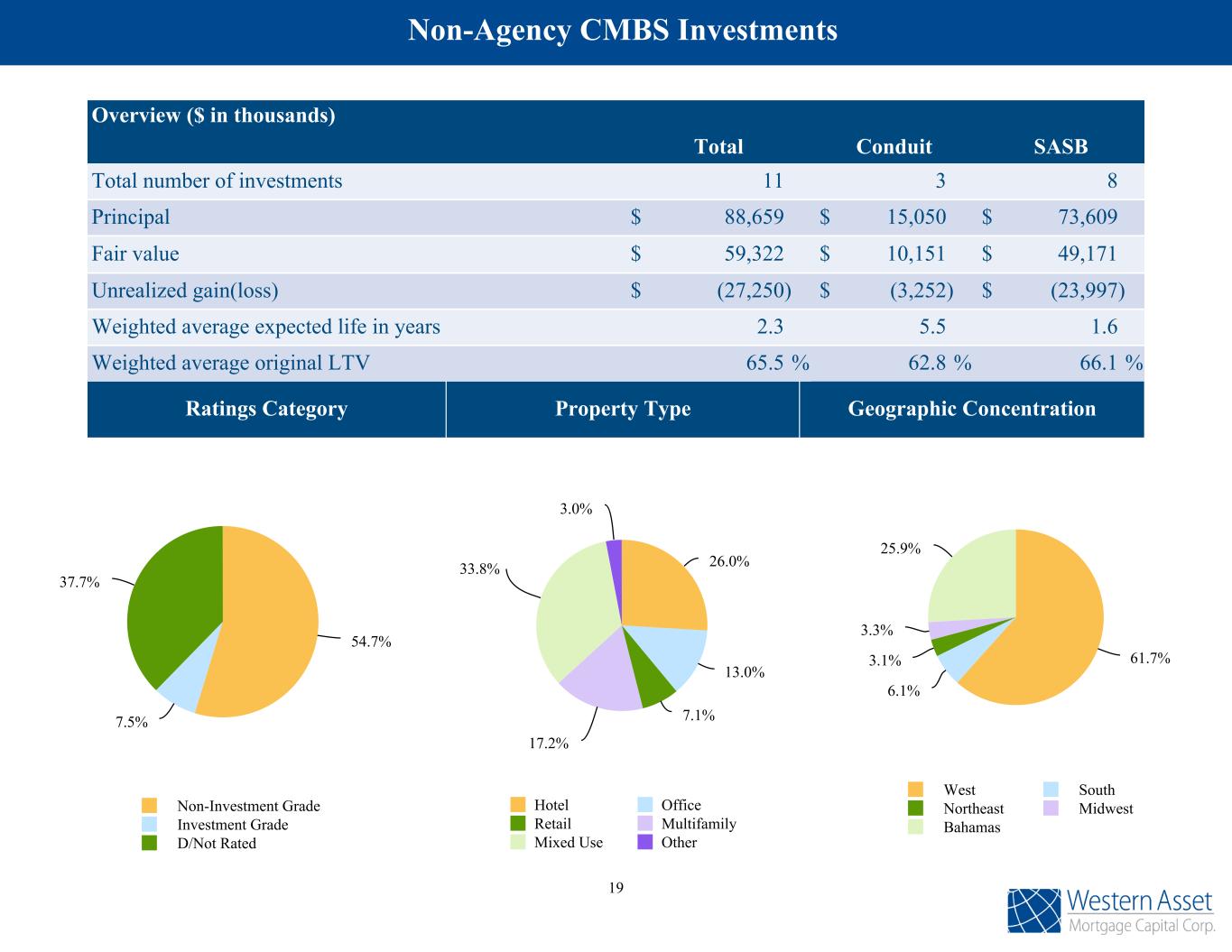

Overview ($ in thousands) Total Conduit SASB Total number of investments 11 3 8 Principal $ 88,659 $ 15,050 $ 73,609 Fair value $ 59,322 $ 10,151 $ 49,171 Unrealized gain(loss) $ (27,250) $ (3,252) $ (23,997) Weighted average expected life in years 2.3 5.5 1.6 Weighted average original LTV 65.5 % 62.8 % 66.1 % 54.7% 7.5% 37.7% Non-Investment Grade Investment Grade D/Not Rated Ratings Category 26.0% 13.0% 7.1% 17.2% 33.8% 3.0% Hotel Office Retail Multifamily Mixed Use Other Property Type Geographic Concentration 61.7% 6.1% 3.1% 3.3% 25.9% West South Northeast Midwest Bahamas Non-Agency CMBS Investments 19

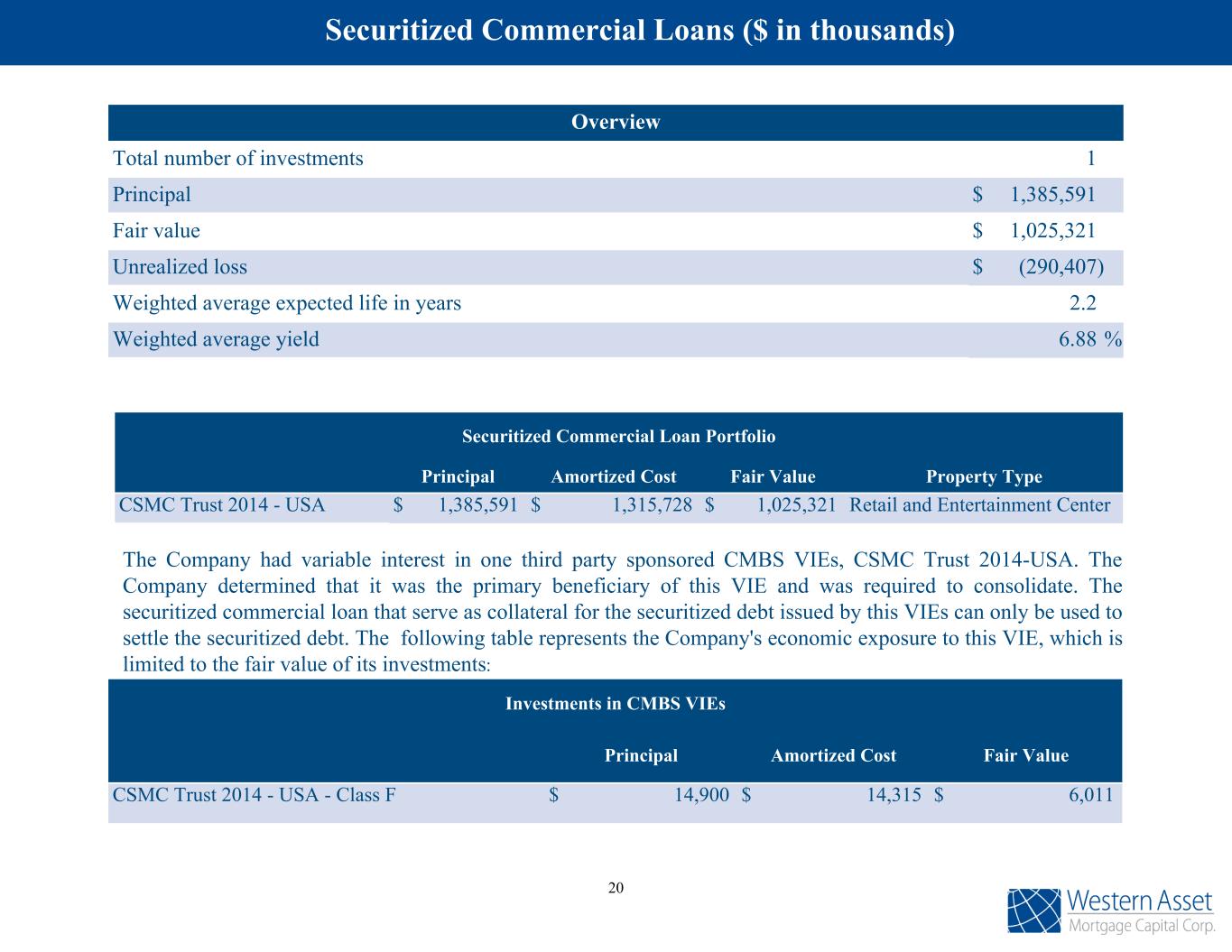

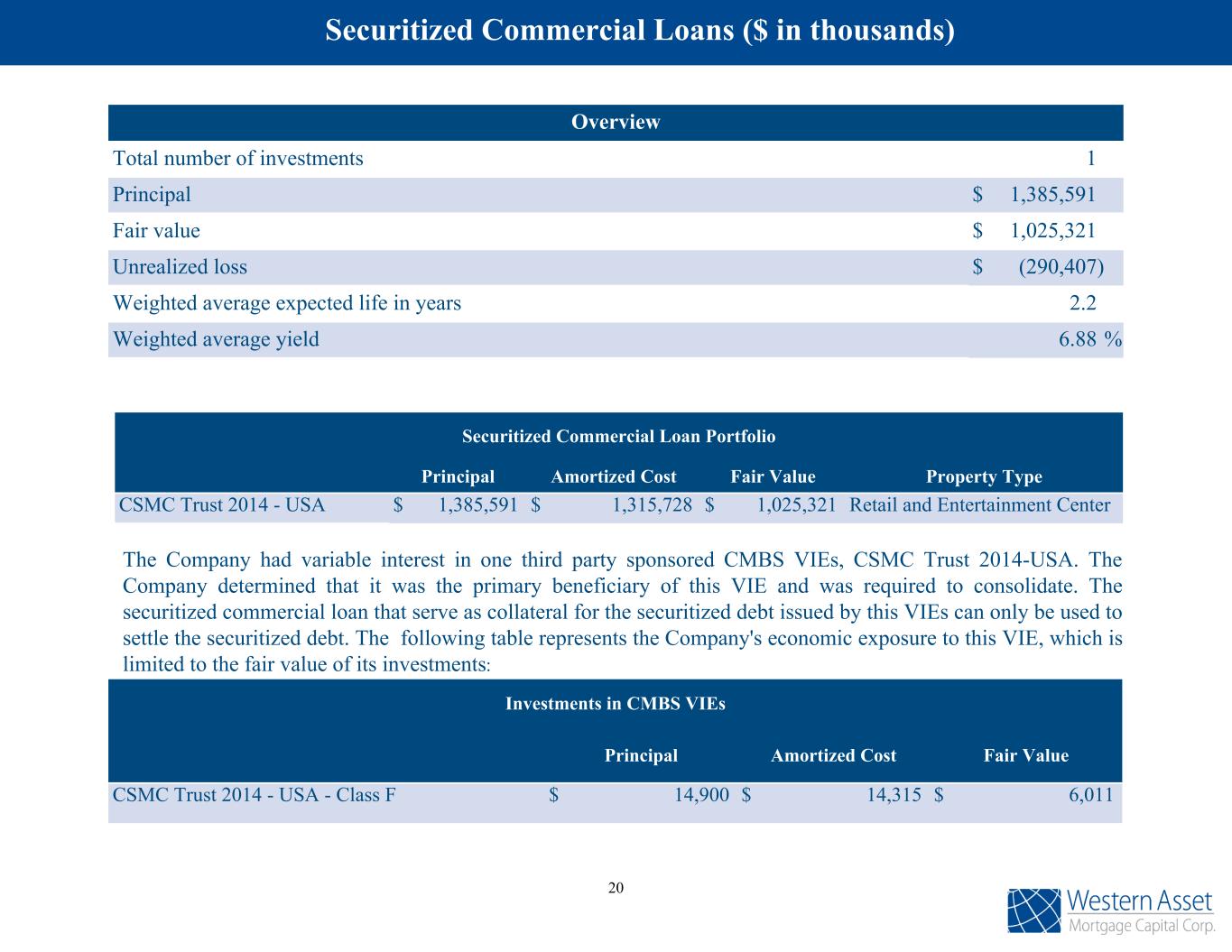

Overview Total number of investments 1 Principal $ 1,385,591 Fair value $ 1,025,321 Unrealized loss $ (290,407) Weighted average expected life in years 2.2 Weighted average yield 6.88 % Securitized Commercial Loan Portfolio Principal Amortized Cost Fair Value Property Type CSMC Trust 2014 - USA $ 1,385,591 $ 1,315,728 $ 1,025,321 Retail and Entertainment Center The Company had variable interest in one third party sponsored CMBS VIEs, CSMC Trust 2014-USA. The Company determined that it was the primary beneficiary of this VIE and was required to consolidate. The securitized commercial loan that serve as collateral for the securitized debt issued by this VIEs can only be used to settle the securitized debt. The following table represents the Company's economic exposure to this VIE, which is limited to the fair value of its investments: Investments in CMBS VIEs Principal Amortized Cost Fair Value CSMC Trust 2014 - USA - Class F $ 14,900 $ 14,315 $ 6,011 Securitized Commercial Loans ($ in thousands) 20

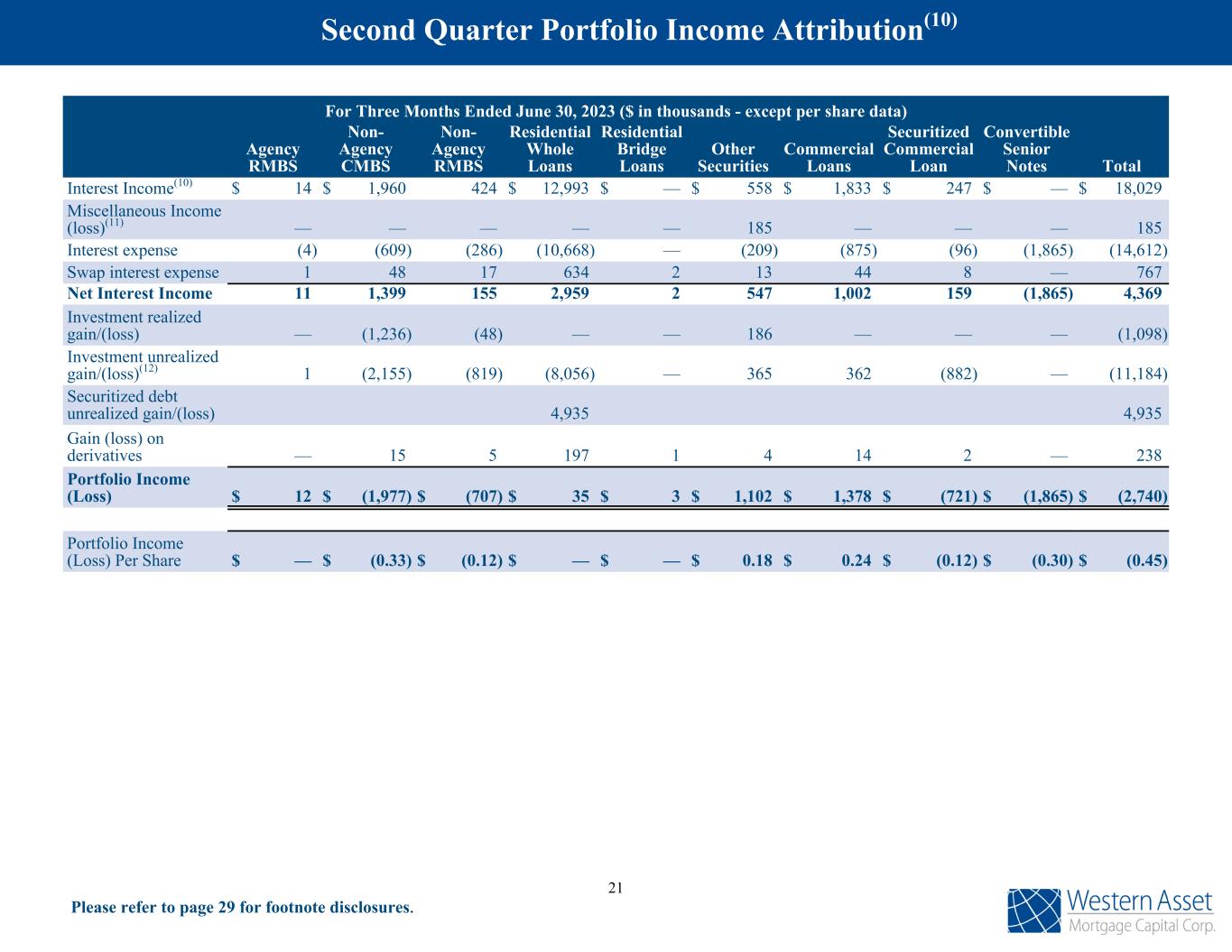

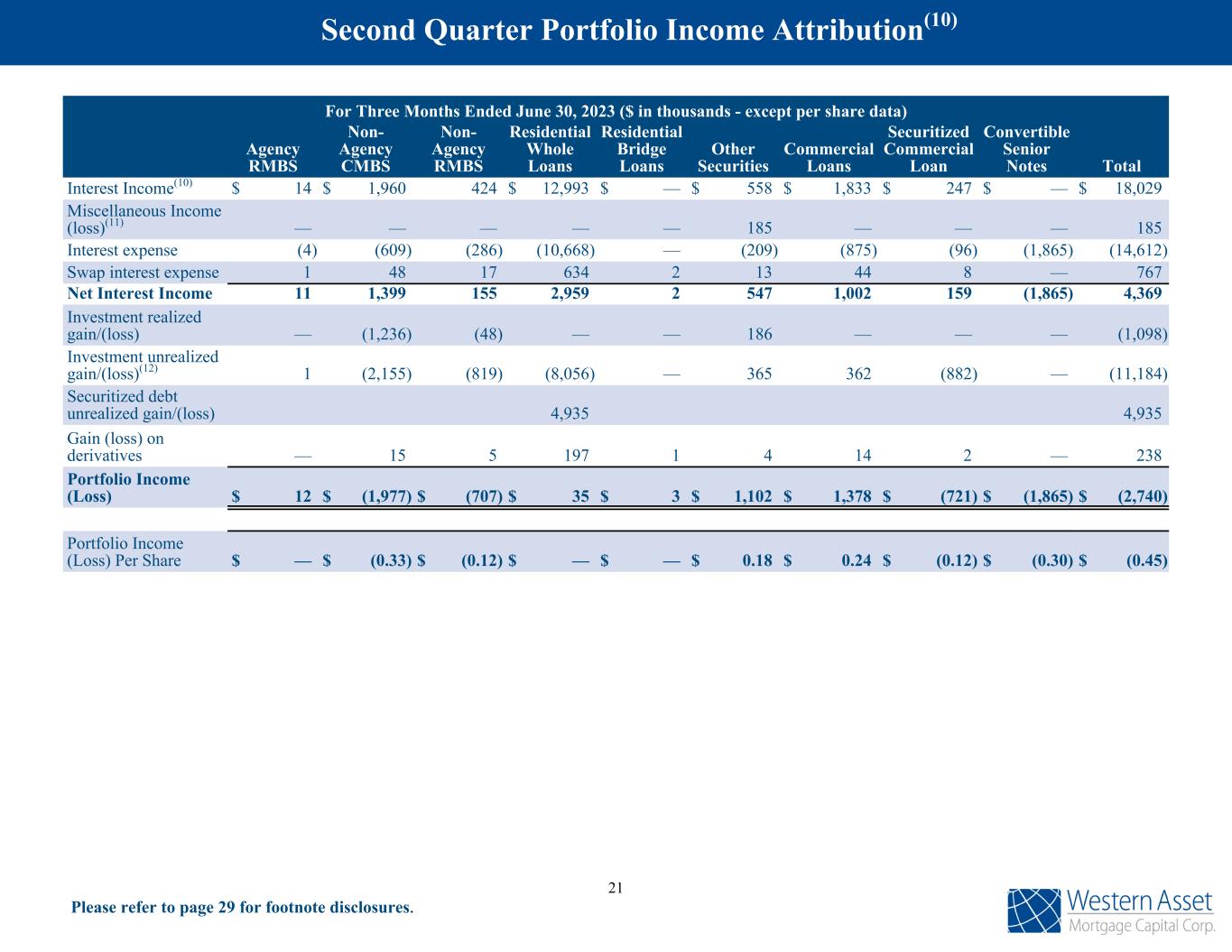

Please refer to page 29 for footnote disclosures. For Three Months Ended June 30, 2023 ($ in thousands - except per share data) Agency RMBS Non- Agency CMBS Non- Agency RMBS Residential Whole Loans Residential Bridge Loans Other Securities Commercial Loans Securitized Commercial Loan Convertible Senior Notes Total Interest Income(10) $ 14 $ 1,960 424 $ 12,993 $ — $ 558 $ 1,833 $ 247 $ — $ 18,029 Miscellaneous Income (loss)(11) — — — — — 185 — — — 185 Interest expense (4) (609) (286) (10,668) — (209) (875) (96) (1,865) (14,612) Swap interest expense 1 48 17 634 2 13 44 8 — 767 Net Interest Income 11 1,399 155 2,959 2 547 1,002 159 (1,865) 4,369 Investment realized gain/(loss) — (1,236) (48) — — 186 — — — (1,098) Investment unrealized gain/(loss)(12) 1 (2,155) (819) (8,056) — 365 362 (882) — (11,184) Securitized debt unrealized gain/(loss) 4,935 4,935 Gain (loss) on derivatives — 15 5 197 1 4 14 2 — 238 Portfolio Income (Loss) $ 12 $ (1,977) $ (707) $ 35 $ 3 $ 1,102 $ 1,378 $ (721) $ (1,865) $ (2,740) Portfolio Income (Loss) Per Share $ — $ (0.33) $ (0.12) $ — $ — $ 0.18 $ 0.24 $ (0.12) $ (0.30) $ (0.45) Second Quarter Portfolio Income Attribution(10) 21

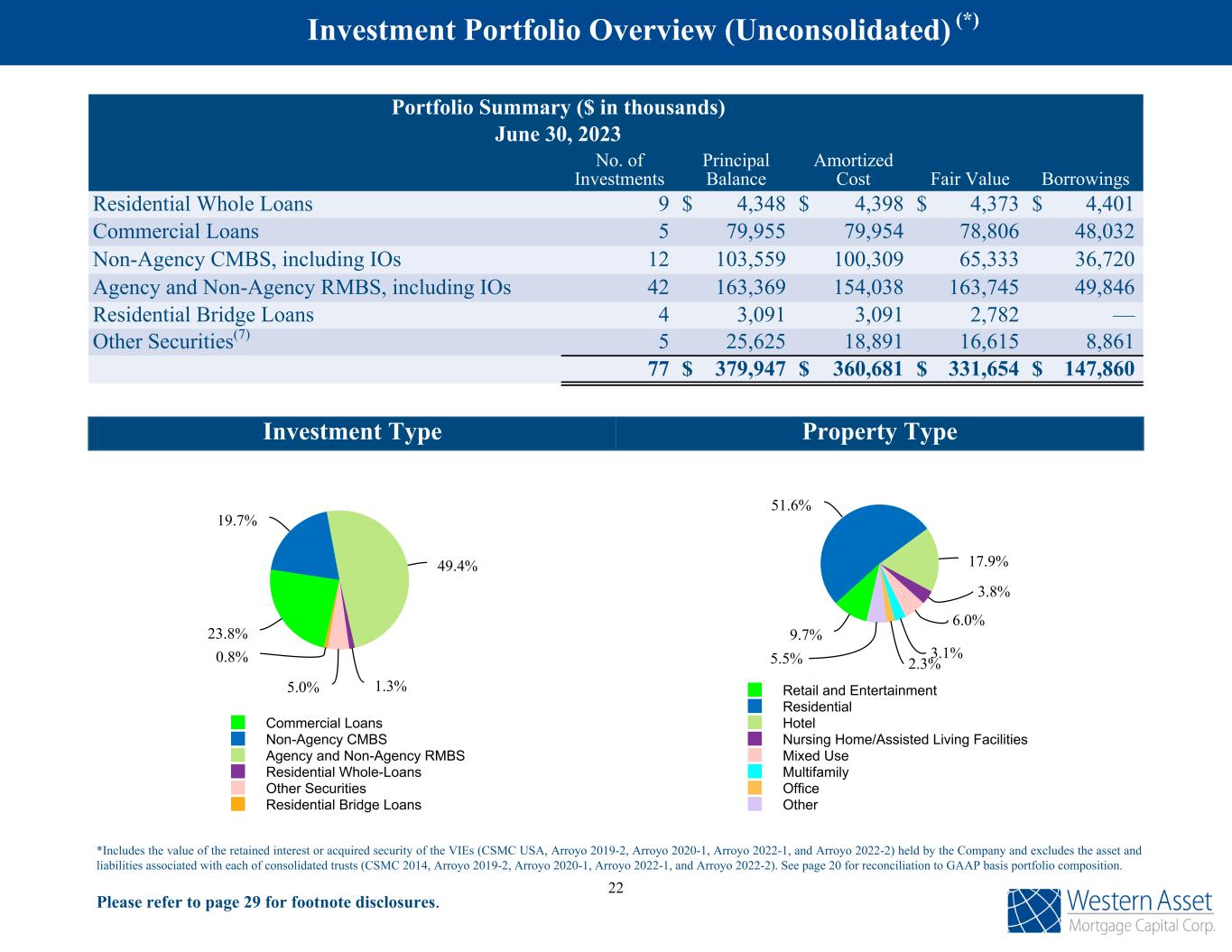

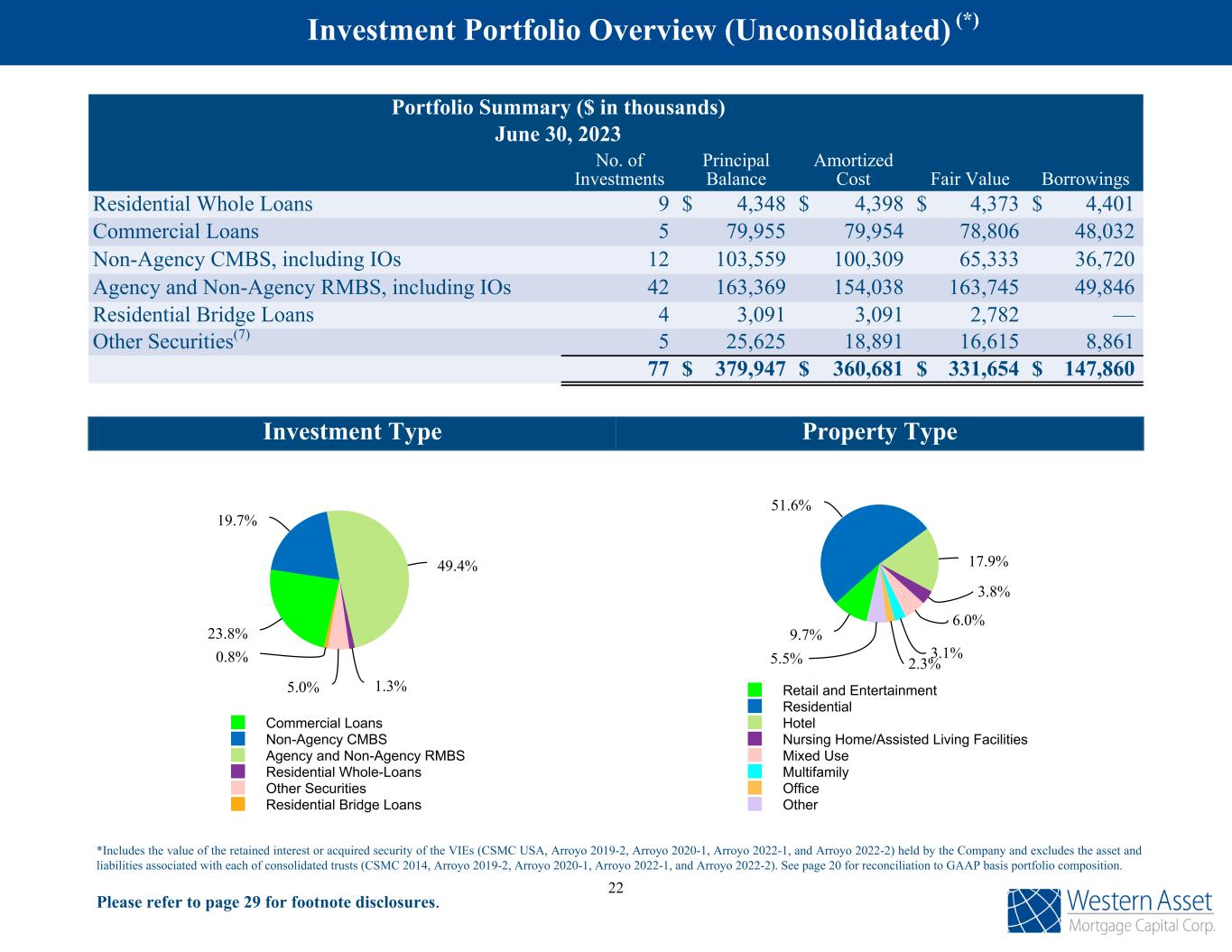

Investment Type 23.8% 19.7% 49.4% 1.3%5.0% 0.8% Commercial Loans Non-Agency CMBS Agency and Non-Agency RMBS Residential Whole-Loans Other Securities Residential Bridge Loans Portfolio Summary ($ in thousands) June 30, 2023 No. of Investments Principal Balance Amortized Cost Fair Value Borrowings Residential Whole Loans 9 $ 4,348 $ 4,398 $ 4,373 $ 4,401 Commercial Loans 5 79,955 79,954 78,806 48,032 Non-Agency CMBS, including IOs 12 103,559 100,309 65,333 36,720 Agency and Non-Agency RMBS, including IOs 42 163,369 154,038 163,745 49,846 Residential Bridge Loans 4 3,091 3,091 2,782 — Other Securities(7) 5 25,625 18,891 16,615 8,861 77 $ 379,947 $ 360,681 $ 331,654 $ 147,860 Property Type 9.7% 51.6% 17.9% 3.8% 6.0% 3.1% 2.3%5.5% Retail and Entertainment Residential Hotel Nursing Home/Assisted Living Facilities Mixed Use Multifamily Office Other *Includes the value of the retained interest or acquired security of the VIEs (CSMC USA, Arroyo 2019-2, Arroyo 2020-1, Arroyo 2022-1, and Arroyo 2022-2) held by the Company and excludes the asset and liabilities associated with each of consolidated trusts (CSMC 2014, Arroyo 2019-2, Arroyo 2020-1, Arroyo 2022-1, and Arroyo 2022-2). See page 20 for reconciliation to GAAP basis portfolio composition. Investment Portfolio Overview (Unconsolidated) (*) Please refer to page 29 for footnote disclosures. 22

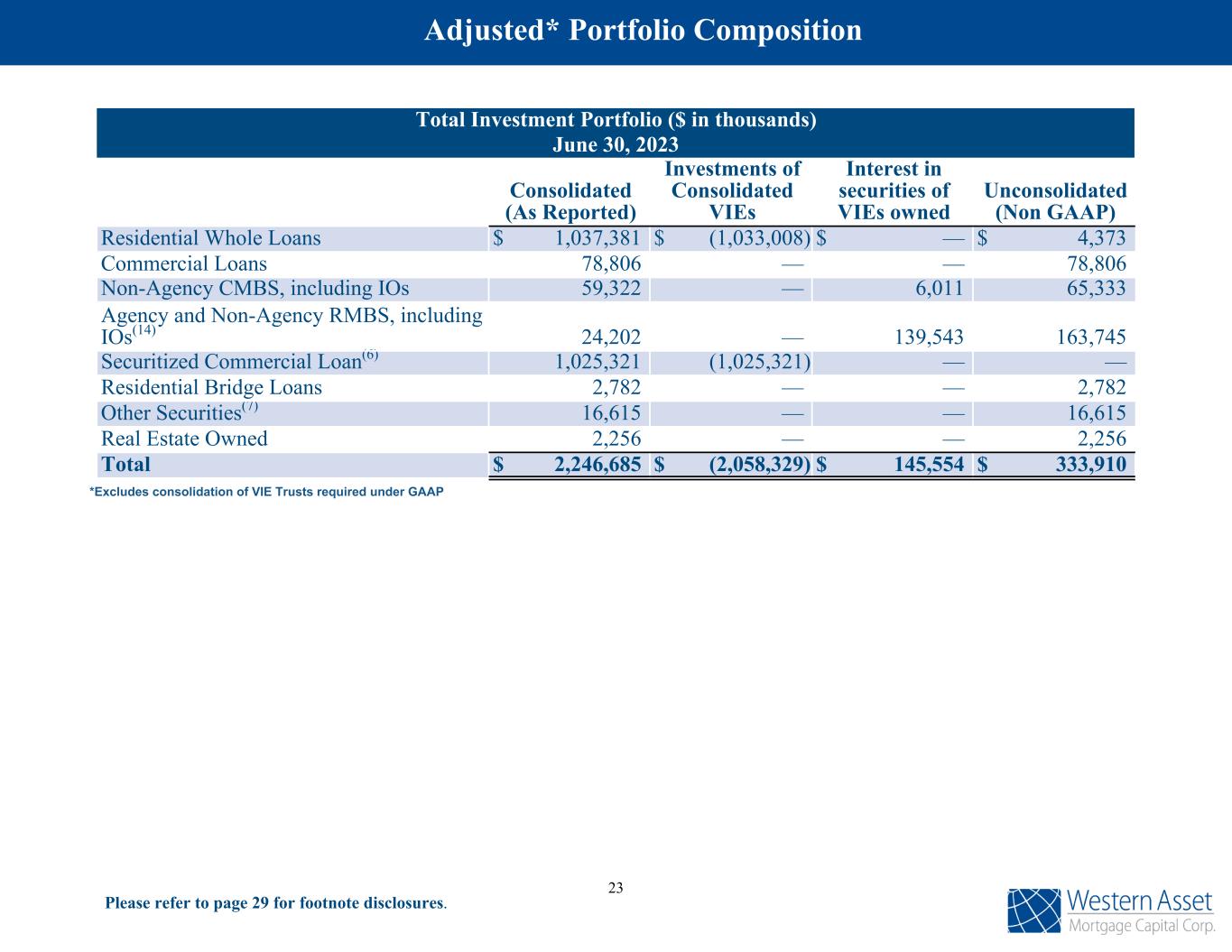

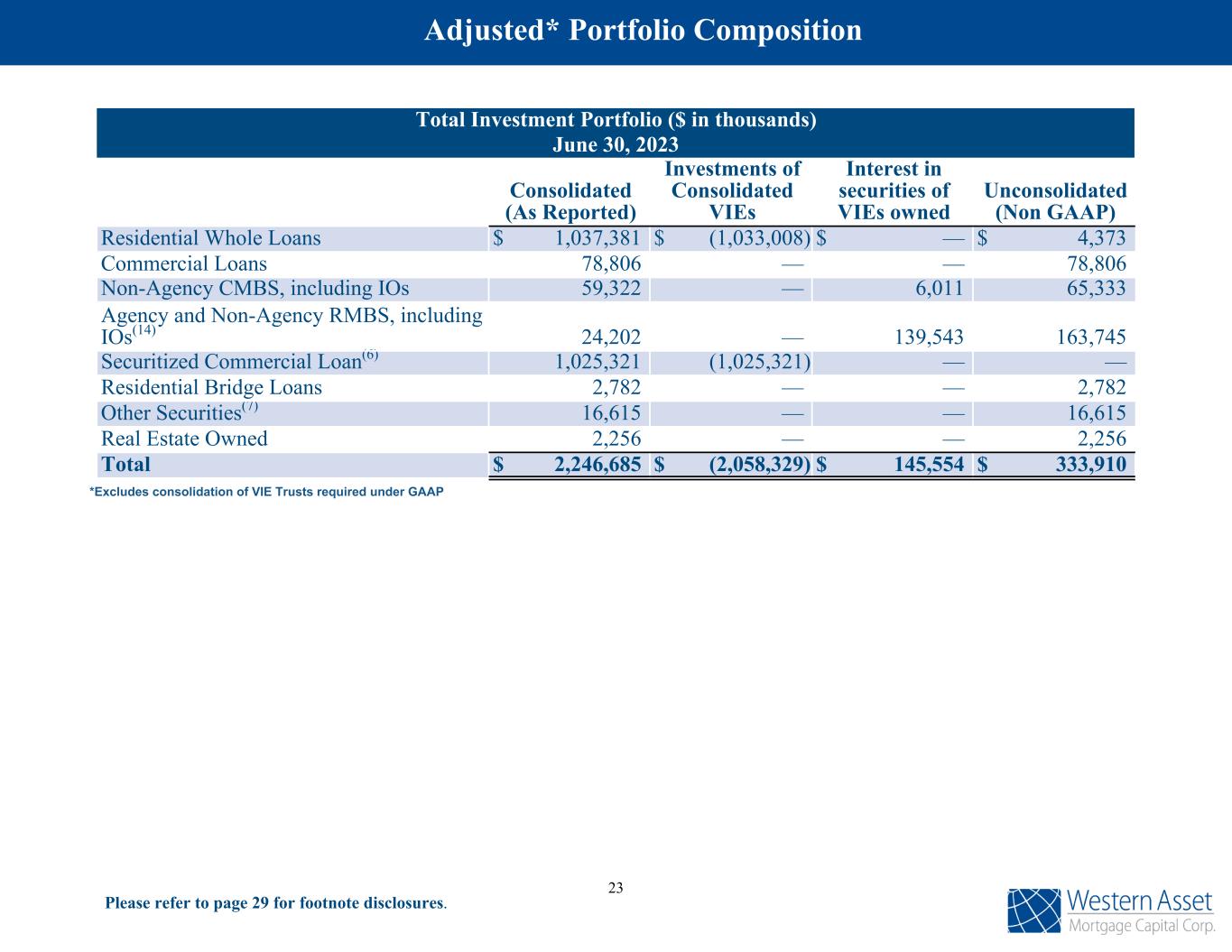

*Excludes consolidation of VIE Trusts required under GAAP Please refer to page 29 for footnote disclosures. Total Investment Portfolio ($ in thousands) June 30, 2023 Consolidated (As Reported) Investments of Consolidated VIEs Interest in securities of VIEs owned Unconsolidated (Non GAAP) Residential Whole Loans $ 1,037,381 $ (1,033,008) $ — $ 4,373 Commercial Loans 78,806 — — 78,806 Non-Agency CMBS, including IOs 59,322 — 6,011 65,333 Agency and Non-Agency RMBS, including IOs(14) 24,202 — 139,543 163,745 Securitized Commercial Loan(6) 1,025,321 (1,025,321) — — Residential Bridge Loans 2,782 — — 2,782 Other Securities(7) 16,615 — — 16,615 Real Estate Owned 2,256 — — 2,256 Total $ 2,246,685 $ (2,058,329) $ 145,554 $ 333,910 Adjusted* Portfolio Composition 23

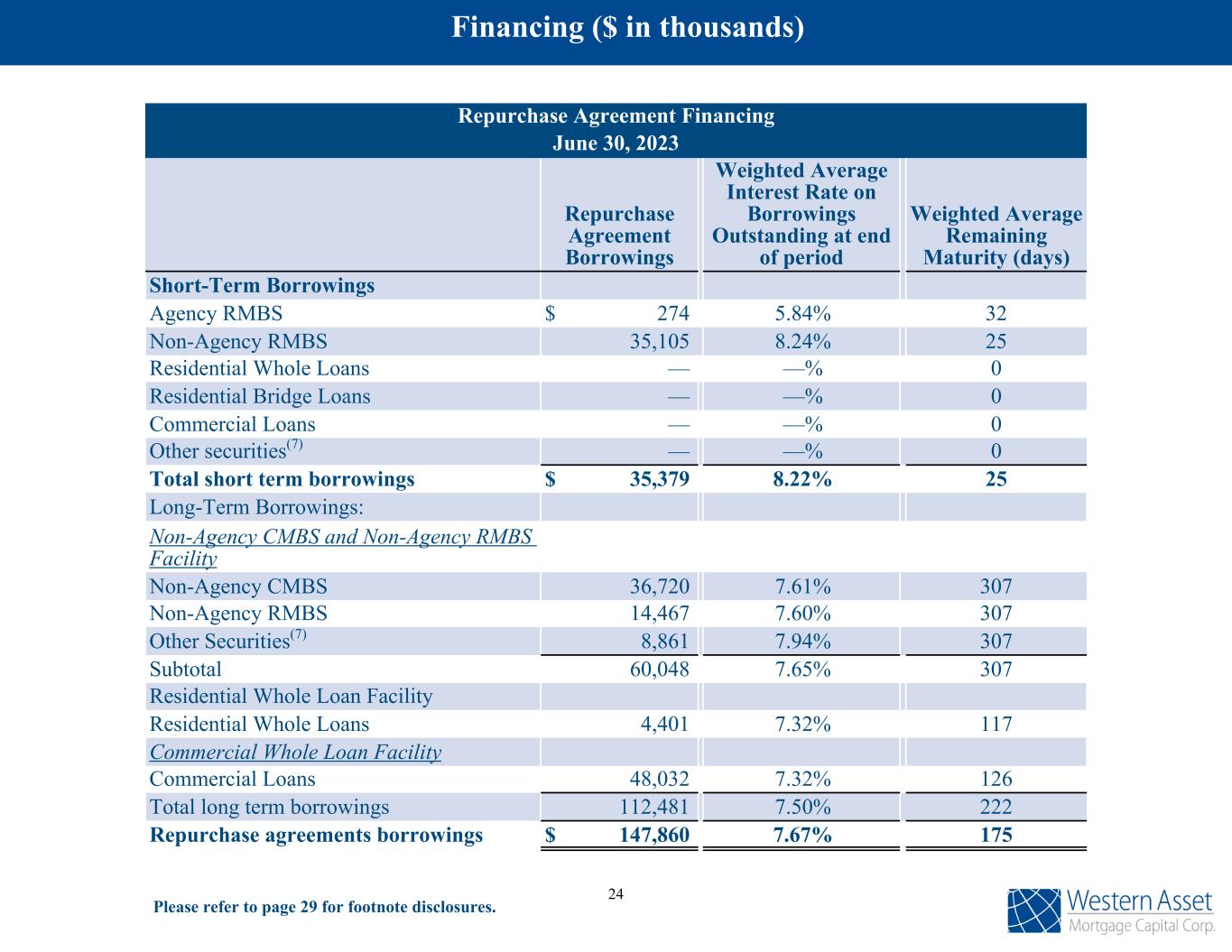

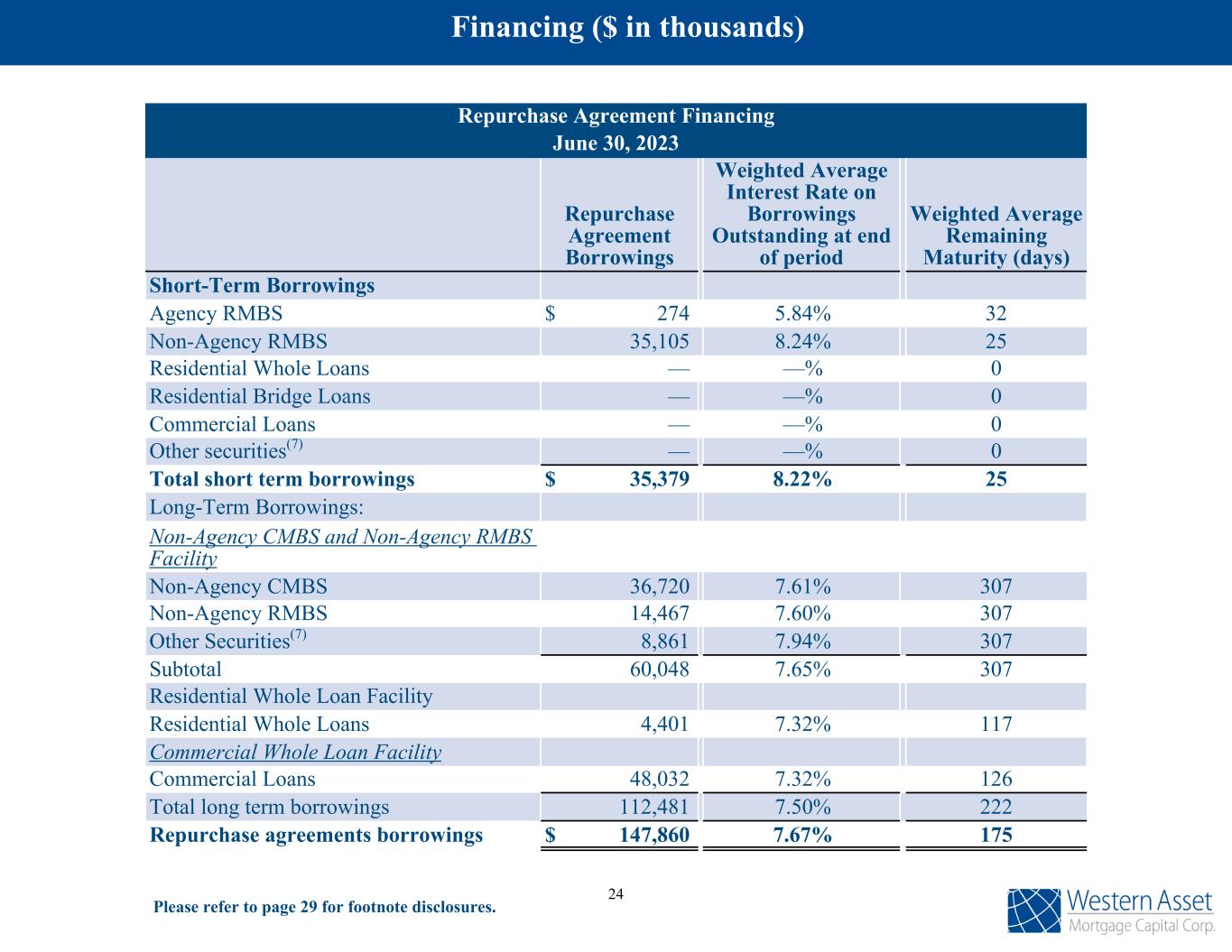

Repurchase Agreement Financing June 30, 2023 Repurchase Agreement Borrowings Weighted Average Interest Rate on Borrowings Outstanding at end of period Weighted Average Remaining Maturity (days) Short-Term Borrowings Agency RMBS $ 274 5.84% 32 Non-Agency RMBS 35,105 8.24% 25 Residential Whole Loans — —% 0 Residential Bridge Loans — —% 0 Commercial Loans — —% 0 Other securities(7) — —% 0 Total short term borrowings $ 35,379 8.22% 25 Long-Term Borrowings: Non-Agency CMBS and Non-Agency RMBS Facility Non-Agency CMBS 36,720 7.61% 307 Non-Agency RMBS 14,467 7.60% 307 Other Securities(7) 8,861 7.94% 307 Subtotal 60,048 7.65% 307 Residential Whole Loan Facility Residential Whole Loans 4,401 7.32% 117 Commercial Whole Loan Facility Commercial Loans 48,032 7.32% 126 Total long term borrowings 112,481 7.50% 222 Repurchase agreements borrowings $ 147,860 7.67% 175 Please refer to page 29 for footnote disclosures. Financing ($ in thousands) 24

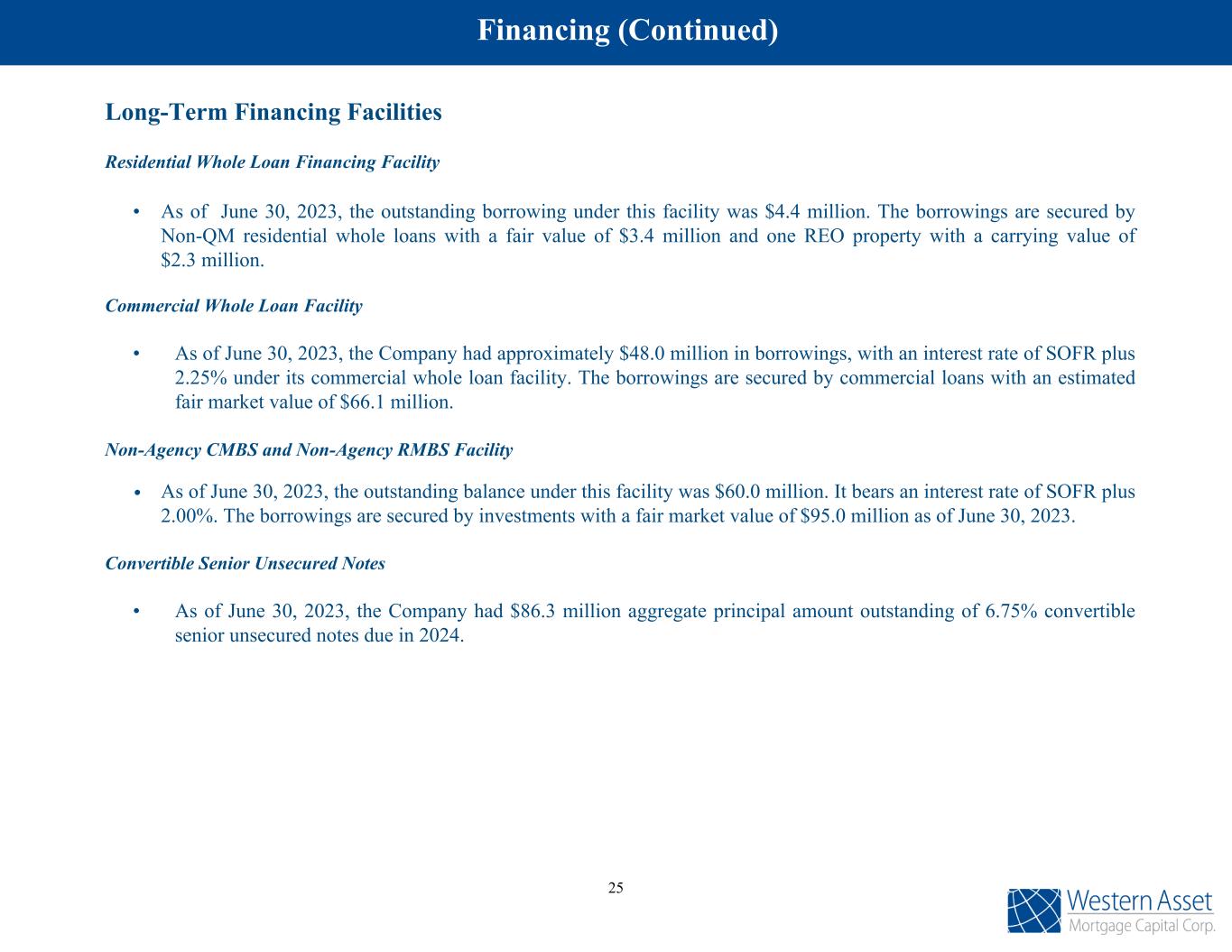

Long-Term Financing Facilities Residential Whole Loan Financing Facility • As of June 30, 2023, the outstanding borrowing under this facility was $4.4 million. The borrowings are secured by Non-QM residential whole loans with a fair value of $3.4 million and one REO property with a carrying value of $2.3 million. Commercial Whole Loan Facility • As of June 30, 2023, the Company had approximately $48.0 million in borrowings, with an interest rate of SOFR plus 2.25% under its commercial whole loan facility. The borrowings are secured by commercial loans with an estimated fair market value of $66.1 million. Non-Agency CMBS and Non-Agency RMBS Facility • As of June 30, 2023, the outstanding balance under this facility was $60.0 million. It bears an interest rate of SOFR plus 2.00%. The borrowings are secured by investments with a fair market value of $95.0 million as of June 30, 2023. Convertible Senior Unsecured Notes • As of June 30, 2023, the Company had $86.3 million aggregate principal amount outstanding of 6.75% convertible senior unsecured notes due in 2024. Financing (Continued) 25

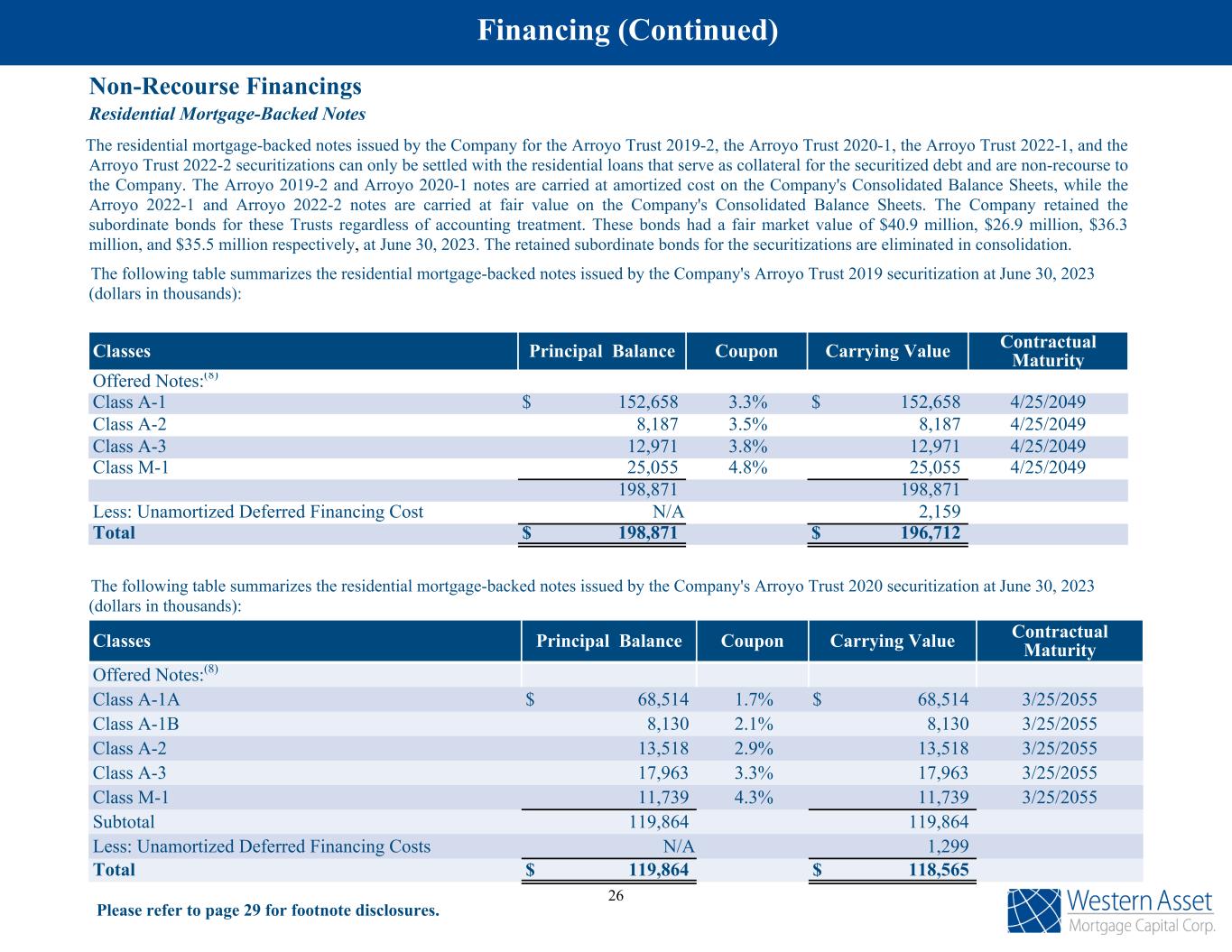

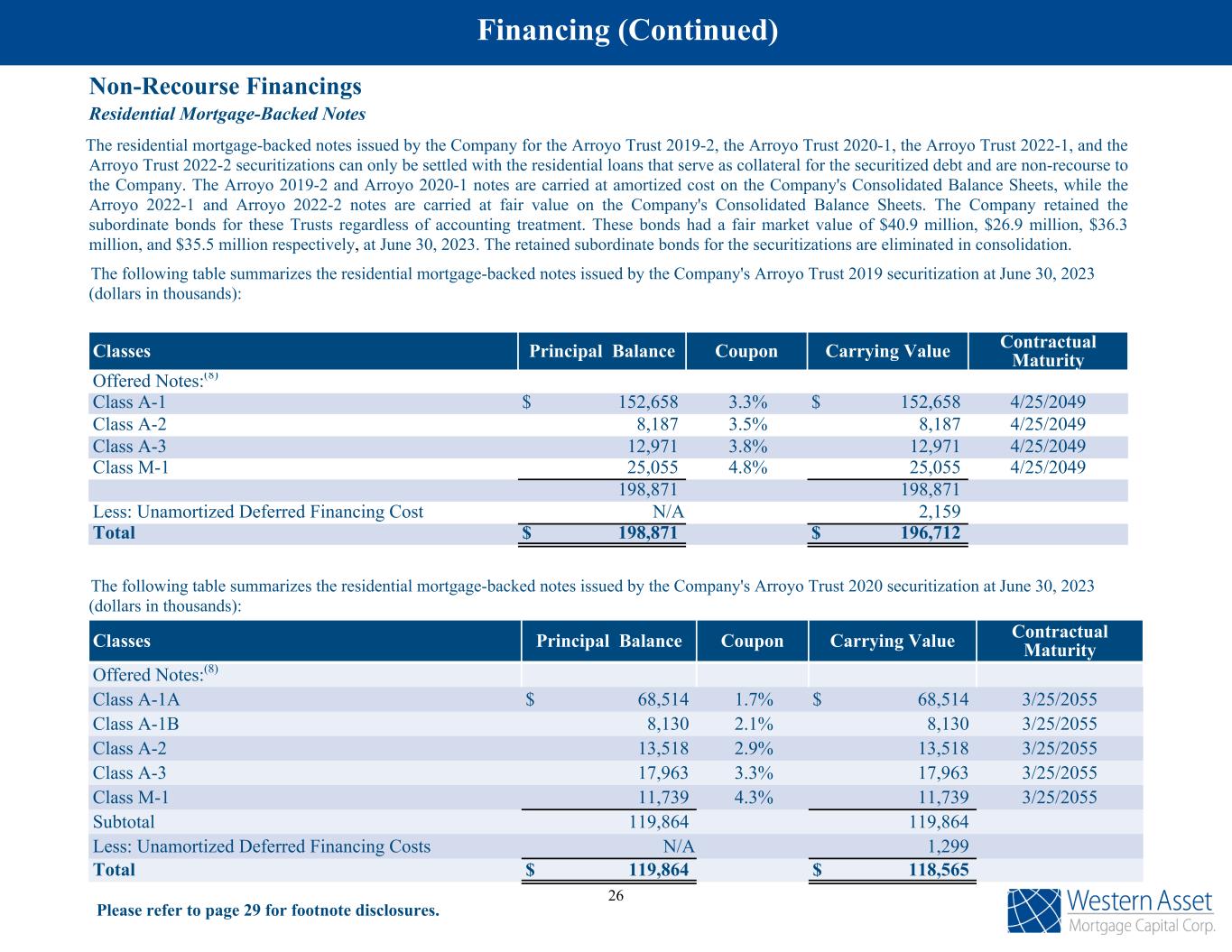

Non-Recourse Financings Residential Mortgage-Backed Notes The residential mortgage-backed notes issued by the Company for the Arroyo Trust 2019-2, the Arroyo Trust 2020-1, the Arroyo Trust 2022-1, and the Arroyo Trust 2022-2 securitizations can only be settled with the residential loans that serve as collateral for the securitized debt and are non-recourse to the Company. The Arroyo 2019-2 and Arroyo 2020-1 notes are carried at amortized cost on the Company's Consolidated Balance Sheets, while the Arroyo 2022-1 and Arroyo 2022-2 notes are carried at fair value on the Company's Consolidated Balance Sheets. The Company retained the subordinate bonds for these Trusts regardless of accounting treatment. These bonds had a fair market value of $40.9 million, $26.9 million, $36.3 million, and $35.5 million respectively, at June 30, 2023. The retained subordinate bonds for the securitizations are eliminated in consolidation. The following table summarizes the residential mortgage-backed notes issued by the Company's Arroyo Trust 2019 securitization at June 30, 2023 (dollars in thousands): The following table summarizes the residential mortgage-backed notes issued by the Company's Arroyo Trust 2020 securitization at June 30, 2023 (dollars in thousands): Please refer to page 29 for footnote disclosures. Classes Principal Balance Coupon Carrying Value Contractual Maturity Offered Notes:(8) Class A-1 $ 152,658 3.3% $ 152,658 4/25/2049 Class A-2 8,187 3.5% 8,187 4/25/2049 Class A-3 12,971 3.8% 12,971 4/25/2049 Class M-1 25,055 4.8% 25,055 4/25/2049 198,871 198,871 Less: Unamortized Deferred Financing Cost N/A 2,159 Total $ 198,871 $ 196,712 Classes Principal Balance Coupon Carrying Value Contractual Maturity Offered Notes:(8) Class A-1A $ 68,514 1.7% $ 68,514 3/25/2055 Class A-1B 8,130 2.1% 8,130 3/25/2055 Class A-2 13,518 2.9% 13,518 3/25/2055 Class A-3 17,963 3.3% 17,963 3/25/2055 Class M-1 11,739 4.3% 11,739 3/25/2055 Subtotal 119,864 119,864 Less: Unamortized Deferred Financing Costs N/A 1,299 Total $ 119,864 $ 118,565 Financing (Continued) 26

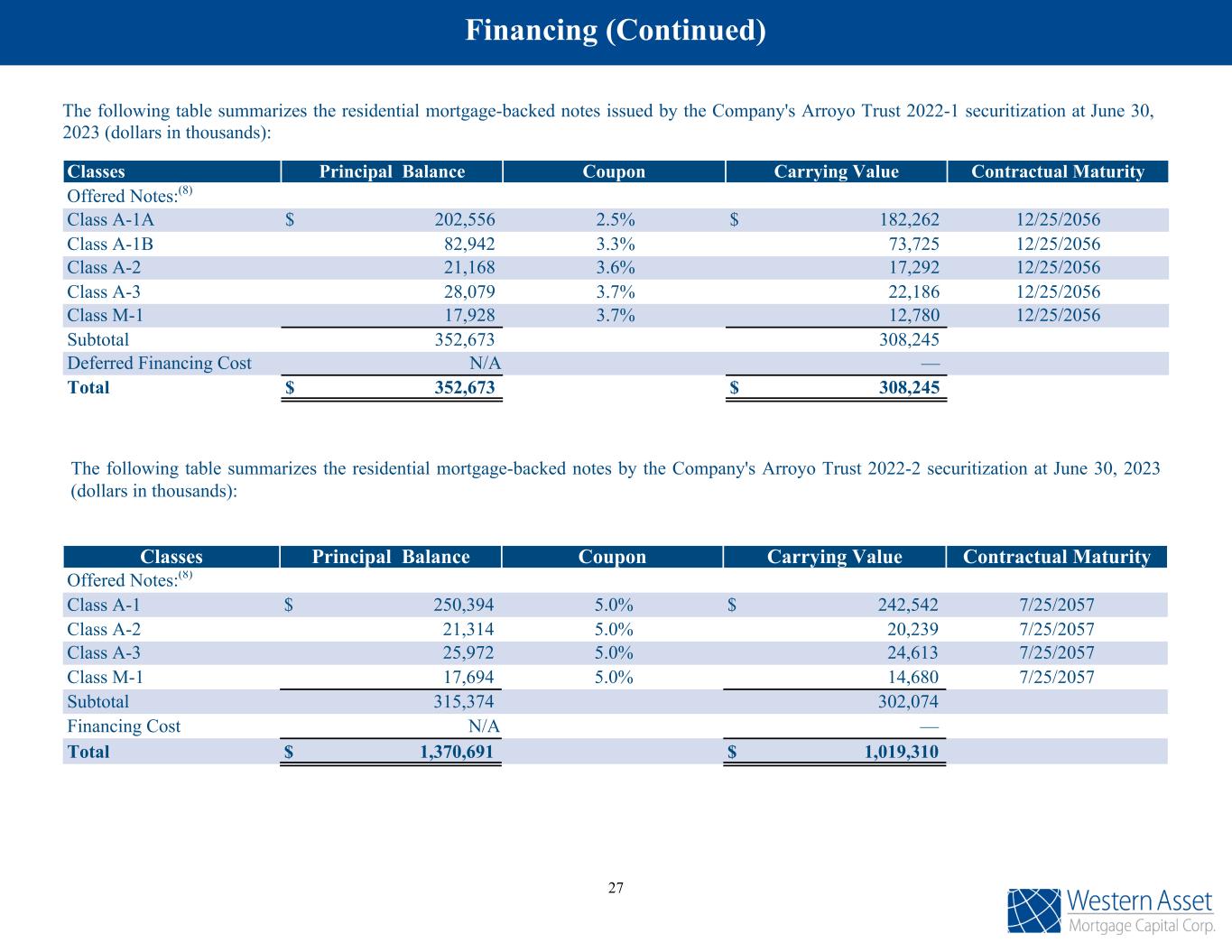

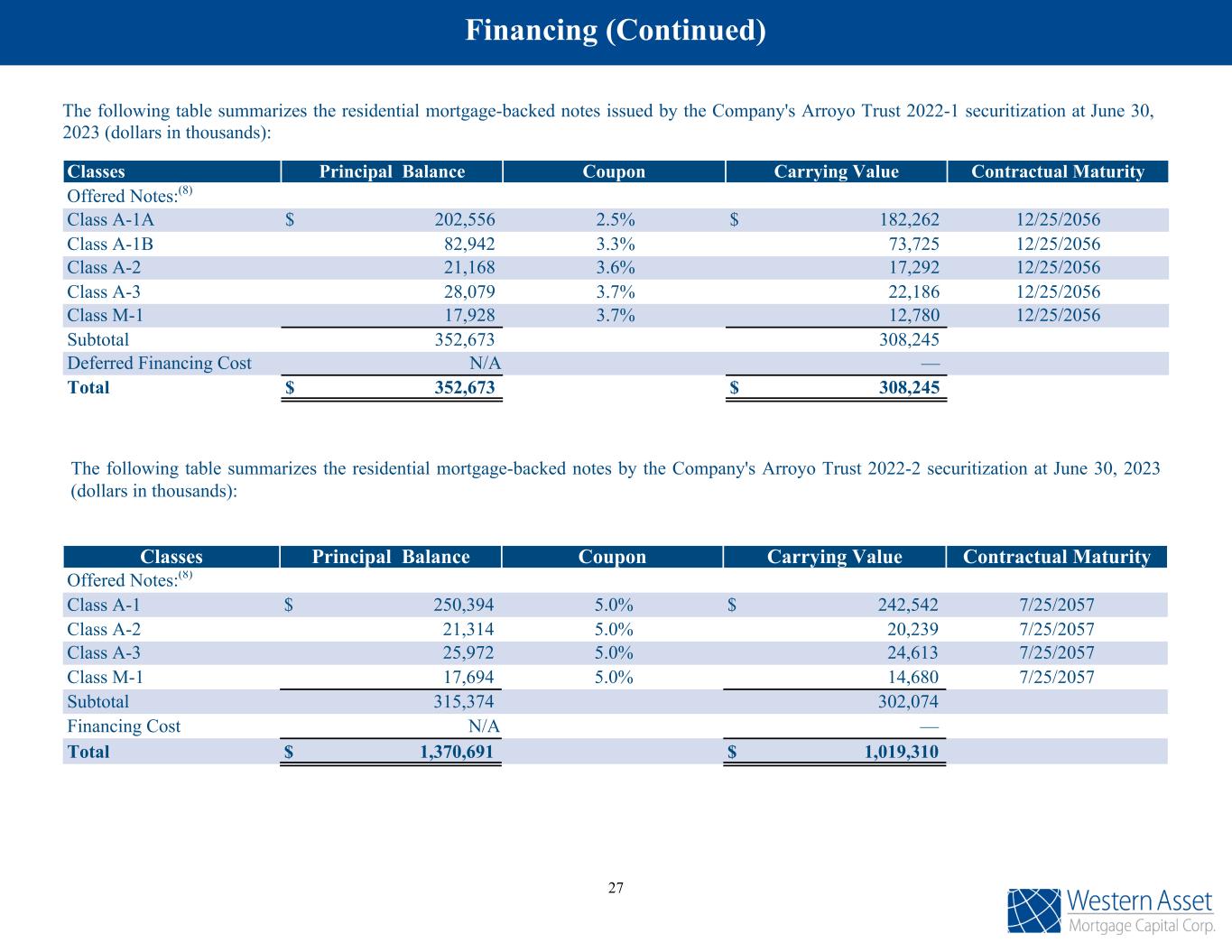

Financing (Continued) The following table summarizes the residential mortgage-backed notes issued by the Company's Arroyo Trust 2022-1 securitization at June 30, 2023 (dollars in thousands): Classes Principal Balance Coupon Carrying Value Contractual Maturity Offered Notes:(8) Class A-1A $ 202,556 2.5% $ 182,262 12/25/2056 Class A-1B 82,942 3.3% 73,725 12/25/2056 Class A-2 21,168 3.6% 17,292 12/25/2056 Class A-3 28,079 3.7% 22,186 12/25/2056 Class M-1 17,928 3.7% 12,780 12/25/2056 Subtotal 352,673 308,245 Less: Unamortized Deferred Financing Cost N/A — Total $ 352,673 $ 308,245 The following table summarizes the residential mortgage-backed notes by the Company's Arroyo Trust 2022-2 securitization at June 30, 2023 (dollars in thousands): Classes Principal Balance Coupon Carrying Value Contractual Maturity Offered Notes:(8) Class A-1 $ 250,394 5.0% $ 242,542 7/25/2057 Class A-2 21,314 5.0% 20,239 7/25/2057 Class A-3 25,972 5.0% 24,613 7/25/2057 Class M-1 17,694 5.0% 14,680 7/25/2057 Subtotal 315,374 302,074 Financing Cost N/A — Total $ 1,370,691 $ 1,019,310 27

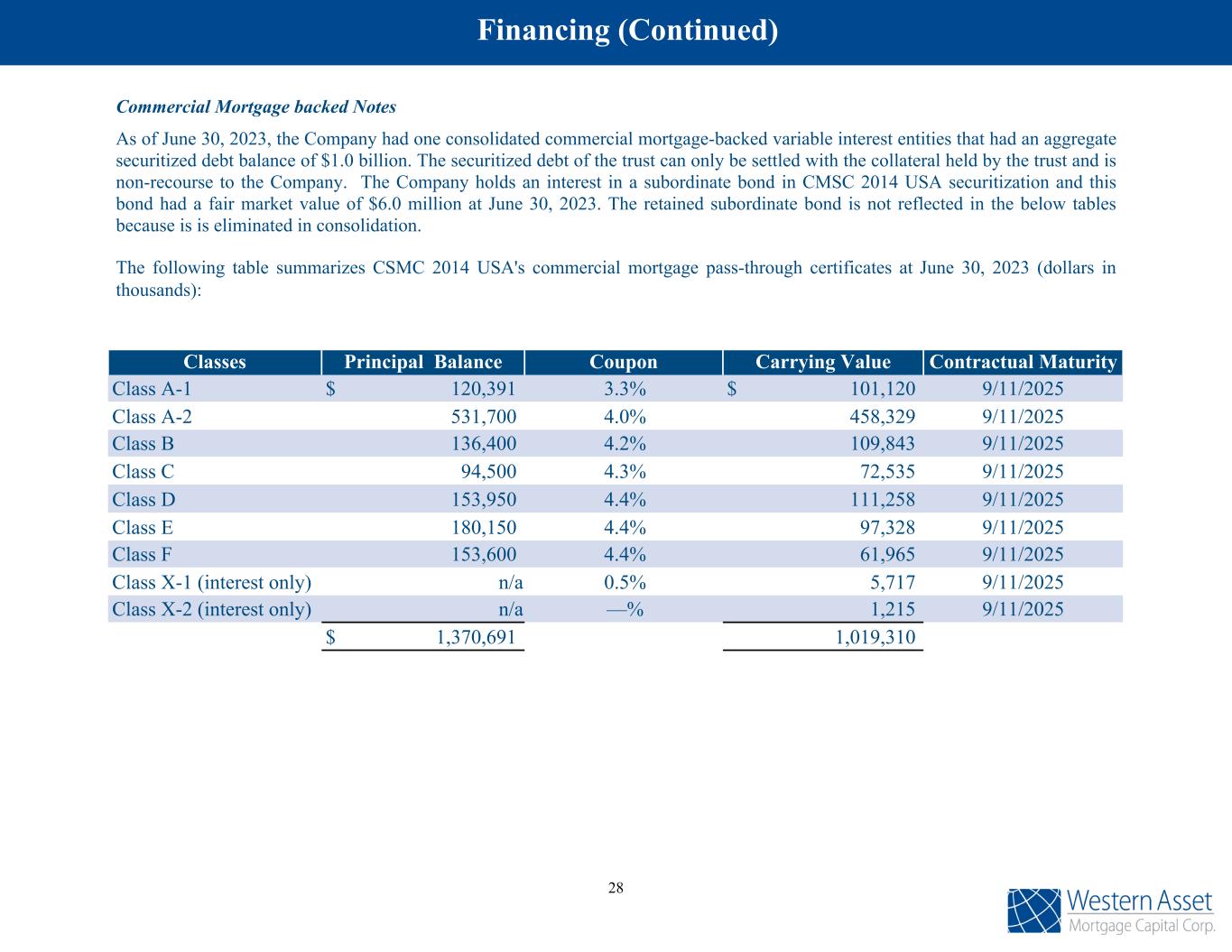

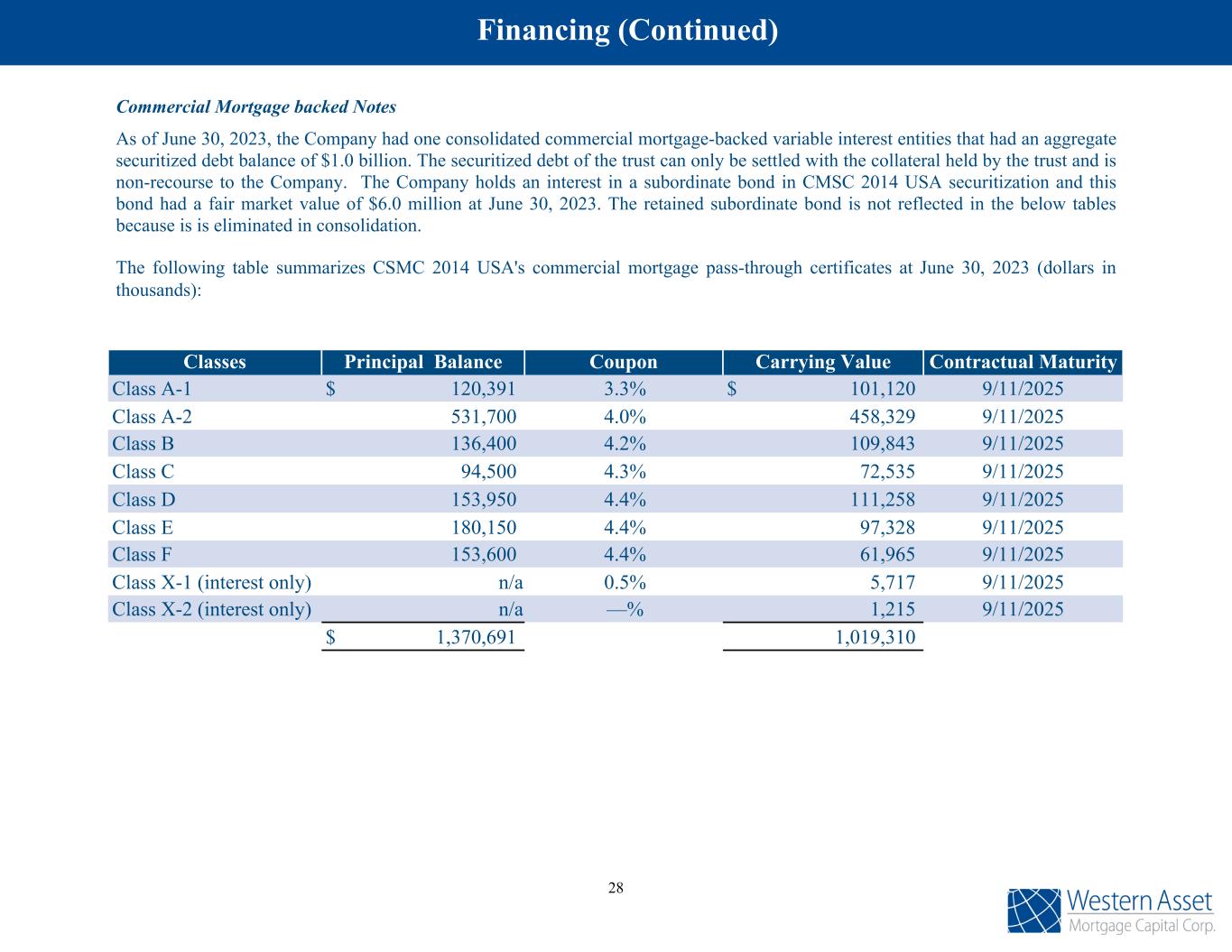

Financing (Continued) Commercial Mortgage backed Notes As of June 30, 2023, the Company had one consolidated commercial mortgage-backed variable interest entities that had an aggregate securitized debt balance of $1.0 billion. The securitized debt of the trust can only be settled with the collateral held by the trust and is non-recourse to the Company. The Company holds an interest in a subordinate bond in CMSC 2014 USA securitization and this bond had a fair market value of $6.0 million at June 30, 2023. The retained subordinate bond is not reflected in the below tables because is is eliminated in consolidation. The following table summarizes CSMC 2014 USA's commercial mortgage pass-through certificates at June 30, 2023 (dollars in thousands): Classes Principal Balance Coupon Carrying Value Contractual Maturity Class A-1 $ 120,391 3.3% $ 101,120 9/11/2025 Class A-2 531,700 4.0% 458,329 9/11/2025 Class B 136,400 4.2% 109,843 9/11/2025 Class C 94,500 4.3% 72,535 9/11/2025 Class D 153,950 4.4% 111,258 9/11/2025 Class E 180,150 4.4% 97,328 9/11/2025 Class F 153,600 4.4% 61,965 9/11/2025 Class X-1 (interest only) n/a 0.5% 5,717 9/11/2025 Class X-2 (interest only) n/a —% 1,215 9/11/2025 $ 1,370,691 1,019,310 28

(1) As of June 30, 2023. (2) Distributable Earnings is a non-GAAP financial measure that is used by us to approximate cash yield or income associated with our portfolio and is defined as GAAP net income (loss) as adjusted, excluding, net realized gain (loss) on investments and termination of derivative contracts, net unrealized gain (loss) on investments and debt, net unrealized gain (loss) resulting from mark-to-market adjustments on derivative contracts, provision for income taxes, non-cash stock- based compensation expense, non-cash amortization of the convertible senior unsecured notes discount, one-time charges such as acquisition costs and impairment on loans and one-time events pursuant to changes in GAAP and certain other non-cash charges after discussions between us, our Manager and our Independent Directors and after approval by a majority of our independent directors. (3) Economic return, for any period, is calculated by taking the sum of (i) the total dividends declared and (ii) the change in net book value during the period and dividing by the beginning book value. (4) Non-GAAP measures which include interest income, interest expense, the cost of interest rate swaps and interest income on IOs and IIOs classified as derivatives, and are weighted averages for the period. Excludes the net income from the consolidation of VIE Trusts required under GAAP. (5) Economic book value is a non-GAAP financial measure of our financial position on an unconsolidated basis. The Company owns certain securities that represent a controlling variable interest, which under GAAP requires consolidation; however, the Company's economic exposure to these variable interests is limited to the fair value of the individual investments. Economic book value is calculated by taking the GAAP book value and 1) adding the fair value of the retained interest or acquired security of the VIEs held by the Company and 2) removing the asset and liabilities associated with each of consolidated trusts (CSMC 2014 USA, Arroyo 2019-2, Arroyo 2020-1, Arroyo 2022-1 and Arroyo 2022-2). Management considers that Economic book value provides investors with a useful supplemental measure to evaluate our financial position as it reflects the actual financial interest of these investments irrespective of the variable interest consolidation model applied for GAAP reporting purposes. Economic book value does not represent and should not be considered as a substitute for Stockholders' Equity, as determined in accordance with GAAP, and our calculation of this measure may not be comparable to similarly titled measures reported by other companies. (6) At June 30, 2023, the Company held an $6.0 million Non-Agency CMBS security which resulted in the consolidation of a variable interest entity. The Securitized Commercial loan value represents the estimate fair market value of collateral within the variable interest entity. (7) At June 30, 2023 Other Securities include GSE Credit Risk Transfer securities with an estimated fair value of $15.4 million and student loans ABS with a fair value of $1.2 million. (8) The subordinate notes were retained by the Company. (9) Non-GAAP measure which includes net interest margin (as defined in footnote 4) and realized and unrealized gains or losses in the portfolio. (10) Non-GAAP measure which includes interest income on IO's and IIO's accounted for as derivatives and other income. (11) Includes miscellaneous fees and interest on cash investments. (12) Non-GAAP measure which includes net unrealized losses on IO's and IIO's accounted for as derivatives. (13) The original FICO score is not available for 219 loans with a principal balance of approximately $69.4 million at June 30, 2023. The Company has excluded these loans from the weighted average computations. (14) Borrowings reported for Agency and Non-Agency RMBS investments include borrowings for Arroyo 2019-2, Arroyo 2020-1, Arroyo 2022-1, and Arroyo 2022-2. These are eliminated in consolidation. Footnotes 29

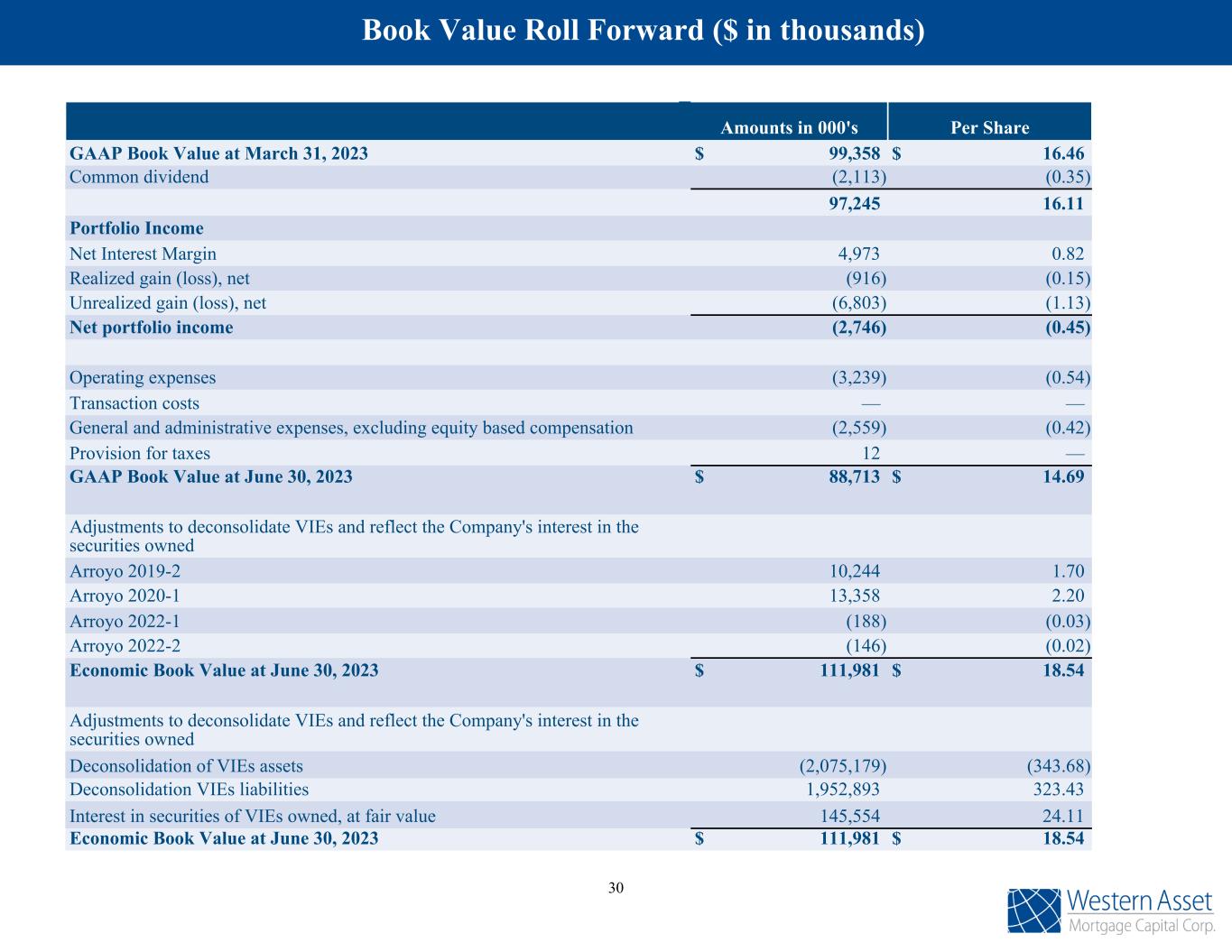

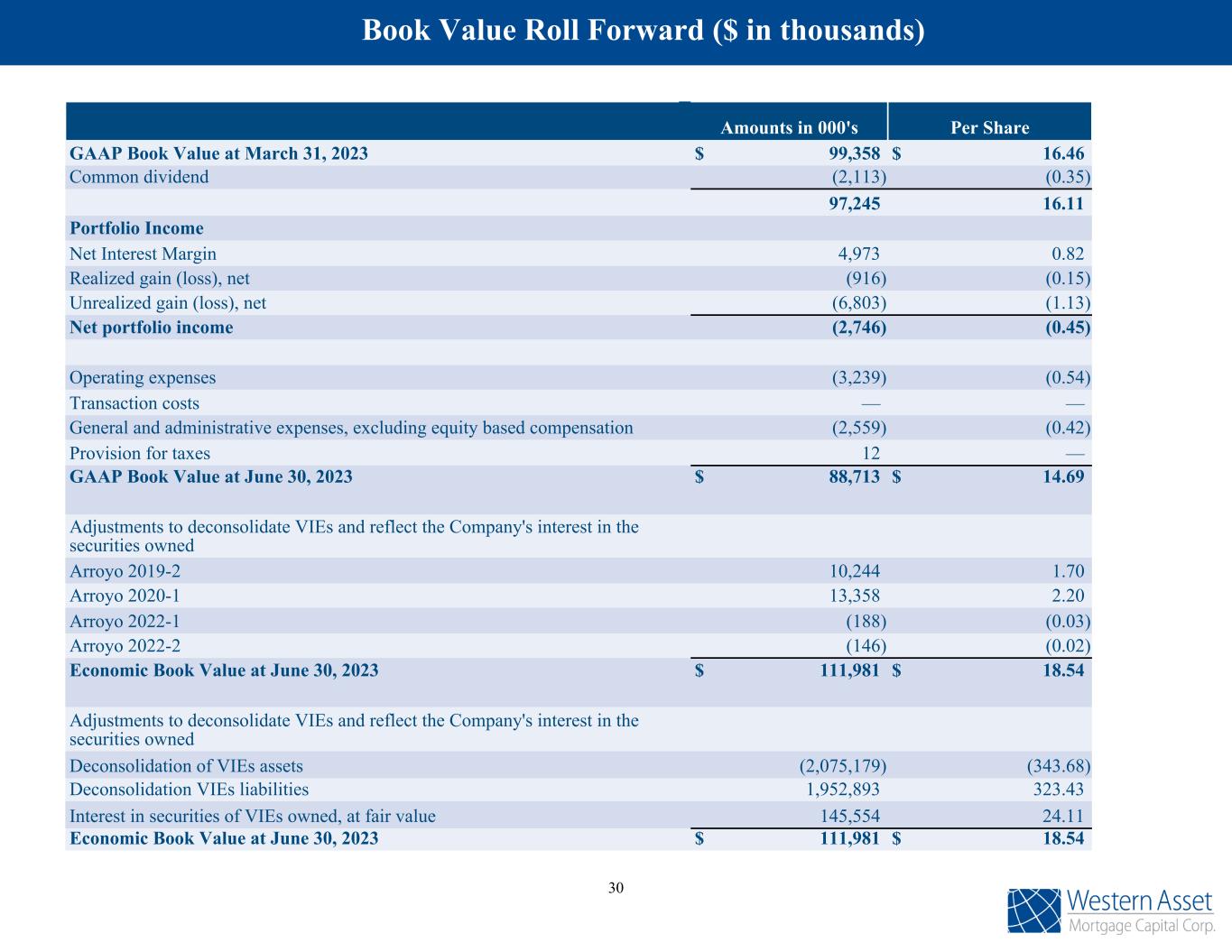

Book Value Roll Forward ($ in thousands) Amounts in 000's Per Share GAAP Book Value at March 31, 2023 $ 99,358 $ 16.46 Common dividend (2,113) (0.35) 97,245 16.11 Portfolio Income Net Interest Margin 4,973 0.82 Realized gain (loss), net (916) (0.15) Unrealized gain (loss), net (6,803) (1.13) Net portfolio income (2,746) (0.45) Operating expenses (3,239) (0.54) Transaction costs — — General and administrative expenses, excluding equity based compensation (2,559) (0.42) Provision for taxes 12 — GAAP Book Value at June 30, 2023 $ 88,713 $ 14.69 Adjustments to deconsolidate VIEs and reflect the Company's interest in the securities owned Arroyo 2019-2 10,244 1.70 Arroyo 2020-1 13,358 2.20 Arroyo 2022-1 (188) (0.03) Arroyo 2022-2 (146) (0.02) Economic Book Value at June 30, 2023 $ 111,981 $ 18.54 Adjustments to deconsolidate VIEs and reflect the Company's interest in the securities owned Deconsolidation of VIEs assets (2,075,179) (343.68) Deconsolidation VIEs liabilities 1,952,893 323.43 Interest in securities of VIEs owned, at fair value 145,554 24.11 Economic Book Value at June 30, 2023 $ 111,981 $ 18.54 30

Western Asset Mortgage Capital Corporation c/o Financial Profiles, Inc. 11601 Wilshire Blvd., Suite 1920 Los Angeles, CA 90025 www.westernassetmcc.com Investor Relations Contact: Larry Clark Tel: (310) 622-8223 lclark@finprofiles.com Contact Information 31