UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811- 22309

Transparent Value Trust

(Exact name of registrant as specified in charter)

702 King Farm Boulevard, Suite 200

Rockville, Maryland 20850

(Address of principal executive offices) (Zip code)

Amy J. Lee

Transparent Value Trust

702 King Farm Boulevard, Suite 200

Rockville, Maryland 20850

(Name and address of agent for service)

Registrant's telephone number, including area code: (301) 296-5100

Date of fiscal year end: September 30

Date of reporting period: October 1, 2022 - March 31, 2023

| Item 1. | Reports to Stockholders. |

The registrant’s semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

3.31.2023

Guggenheim Funds Semi-Annual Report

Transparent Value Trust |

Guggenheim Directional Allocation Fund | | |

Guggenheim RBP® Dividend Fund | | |

Guggenheim RBP® Large-Cap Defensive Fund | | |

Guggenheim RBP® Large-Cap Market Fund | | |

Guggenheim RBP® Large-Cap Value Fund | | |

GuggenheimInvestments.com | RBP-SEMI-0323x0923 |

| | |

DEAR SHAREHOLDER | 2 |

ECONOMIC AND MARKET OVERVIEW | 3 |

ABOUT SHAREHOLDERS’ FUND EXPENSES | 5 |

DIRECTIONAL ALLOCATION FUND | 8 |

RBP® DIVIDEND FUND | 16 |

RBP® LARGE-CAP DEFENSIVE FUND | 26 |

RBP® LARGE-CAP MARKET FUND | 35 |

RBP® LARGE-CAP VALUE FUND | 44 |

NOTES TO FINANCIAL STATEMENTS | 53 |

OTHER INFORMATION | 60 |

INFORMATION ON BOARD OF TRUSTEES AND OFFICERS | 61 |

GUGGENHEIM INVESTMENTS PRIVACY NOTICE | 67 |

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 1 |

Dear Shareholder:

Guggenheim Partners Investment Management, LLC (“GPIM” or the “Investment Adviser”), is pleased to present the shareholder report for Guggenheim RBP® Funds (the “Funds”). This report covers the semi-annual fiscal period ended March 31, 2023 (the “Reporting Period”).

The Investment Adviser is part of Guggenheim Investments, which represents the investment management businesses of Guggenheim Partners, LLC, (“Guggenheim”) a global, diversified financial services firm.

Guggenheim Funds Distributors, LLC is the distributor of the Funds. Guggenheim Funds Distributors, LLC is affiliated with Guggenheim and the Investment Adviser.

We encourage you to read the Economic and Market Overview section of the report, which follows this letter.

We are committed to providing innovative investment solutions and appreciate the trust you place in us.

Sincerely,

Guggenheim Partners Investment Management, LLC

April 30, 2023

Read a prospectus and summary prospectus (if available) carefully before investing. It contains the investment objectives, risks, charges, expenses and other information, which should be considered carefully before investing. Obtain a prospectus and summary prospectus (if available) at guggenheiminvestments.com or call 800.820.0888.

This material is not intended as a recommendation or as investment advice of any kind, including in connection with rollovers, transfers, and distributions. Such material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. All content has been provided for informational or educational purposes only and is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/or legal professional regarding your specific situation.

Funds in Transparent Value Trust may not be suitable for all investors. ● An investment in the Funds will fluctuate and is subject to investment risks, which means investors could lose money ● The intrinsic value of the underlying stocks may never be realized, or the stock may decline in value ● Certain Funds may invest in derivative instruments, which may be more volatile and less liquid, increasing the risk of loss when compared to traditional securities ● Certain Funds’ investments in other investment vehicles subject the Funds to those risks and expenses affecting the investment vehicle ● You may have a gain or loss when you sell your shares ● It is important to note that the Fund is not guaranteed by the U.S. government ● Please read the prospectus for more detailed information regarding these and other risks.

2 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | |

ECONOMIC AND MARKET OVERVIEW (Unaudited) | March 31, 2023 |

Developments in March 2023 highlighted the increasingly difficult place in which the U.S. Federal Reserve (the “Fed”) and other central banks find themselves as they work toward restoring price stability and maintaining financial stability. The collapse of Silicon Valley Bank and Signature Bank prompted banks to rush for liquidity support from the Fed, totaling $165 billion in the immediate aftermath. Overseas, the Swiss National Bank provided the equivalent of $54 billion in emergency liquidity to Credit Suisse before a deal was struck with rival UBS to buy it for $3.25 billion.

Heightened concerns about further bank stress and central banks’ ability to continue aggressively tightening monetary policy weighed heavily on market-implied expectations for the path of policy rates. Nevertheless, in March 2023 the Fed raised rates by 25 basis points and the European Central Bank raised rates by 50 basis points. One basis point equals 0.01%. We expect central banks will continue to raise rates over the next few months in their continuing effort to bring inflation to heel, despite the cracks in financial stability that are beginning to show.

While markets were volatile, data releases indicated that the U.S. economy is still on a relatively firm footing. March job growth came in at 236,000, well above the level needed to keep the unemployment rate from rising. Housing data has surprised to the upside, likely in response to the recent softening of mortgage rates. Meanwhile, the S&P Global U.S. composite Purchasing Managers’ Index (“PMI”) rose to a 10-month high, with strength especially evident in sub-indices for the service sector. Forward-looking data looks more concerning, however, with the Leading Economic Index turning down further, initial signs of job loss in the most cyclical and interest rate sensitive sectors, and business surveys souring on the economic outlook and plans for spending and hiring.

The Fed acknowledged in its March 2023 Federal Open Market Committee meeting statement that a contraction of credit emanating from volatility in the banking sector was likely to create new headwinds for the economy. In recognition of this new risk, the Fed’s updated Summary of Economic Projections showed a small downward revision of real gross domestic product growth this year, from 0.5 percent to 0.4 percent, followed by a larger downward revision for next year, from 1.6 percent to 1.2 percent. We continue to expect a recession could begin midway through the year.

For the Reporting Period, the S&P 500® Index* returned 15.62%. The MSCI Europe-Australasia-Far East (“EAFE”) Index* (gross) returned 27.52%. The return of the MSCI Emerging Markets Index* (gross) was 14.20%.

In the bond market, the Bloomberg U.S. Aggregate Bond Index* posted a 4.89% return for the Reporting Period, while the Bloomberg U.S. Corporate High Yield Index* returned 7.89%. The return of the ICE Bank of America (“BofA”) 3-Month U.S. Treasury Bill Index* was 1.94% for the six-month period.

The opinions and forecasts expressed may not actually come to pass. This information is subject to change at any time, based on market and other conditions, and should not be construed as a recommendation of any specific security or strategy.

*Index Definitions:

The following indices are referenced throughout this report. Indices are unmanaged and not available for direct investment. Index performance does not reflect transaction costs, fees, or expenses.

Bloomberg U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including U.S. Treasuries, government-related and corporate securities, mortgage-backed securities or “MBS” (agency fixed-rate and hybrid adjustable-rate mortgage, or “ARM”, pass-throughs), asset-backed securities (“ABS”), and commercial mortgage-backed securities (“CMBS”) (agency and non-agency).

Bloomberg U.S. Corporate High Yield Index measures the U.S. dollar-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB +/BB + or below.

Bloomberg 1-3 Month U.S. Treasury Bill Index includes all publicly issued zero-coupon U.S. Treasury Bills that have a remaining maturity of less than 3 months and more than 1 month, are rated investment grade, and have $250 million or more of outstanding face value. In addition, the securities must be denominated in U.S. dollars and must be fixed rate and nonconvertible. The 1-3 Month U.S. Treasury Bill Index is market capitalization weighted and the securities in the index are updated on the last business day of each month.

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 3 |

ECONOMIC AND MARKET OVERVIEW (Unaudited)(concluded) | March 31, 2023 |

Dow Jones U.S. Large-Cap Total Stock Market IndexSM is a subset of the Dow Jones U.S. Total Stock Market IndexSM, which measures all U.S. equity securities with readily available prices. It includes stocks among the largest 750.

Dow Jones U.S. Large-Cap Value Total Stock Market IndexSM is a subset of the Dow Jones U.S. Large-Cap Total Stock Market IndexSM which in turn comprises the largest 750 constituents of the Dow Jones U.S. Total Stock Market IndexSM, which measures all U.S. equity securities with readily available prices.

Dow Jones U.S. Mid-Cap Total Stock Market IndexSM is a float-adjusted market capitalization weighted index that reflects the shares of securities of the mid-cap portion of the Dow Jones U.S. Total Stock Market Index actually available to investors in the marketplace. The Mid-Cap Index includes the components ranked 501-1000 by full market.

ICE BofA 3-Month U.S. Treasury Bill Index is an unmanaged market Index of U.S. Treasury securities maturing in 90 days that assumes reinvestment of all income.

MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada.

MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market performance in the global emerging markets.

S&P 500® is a broad-based index, the performance of which is based on the performance of 500 widely held common stocks chosen for market size, liquidity, and industry group representation capitalization.

S&P 500 Value Index is a market-capitalization-weighted index developed by Standard and Poor’s consisting of those stocks within S&P 500 Index that exhibit strong value characteristics.

4 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | |

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited) | |

All mutual funds have operating expenses, and it is important for our shareholders to understand the impact of costs on their investments. Shareholders of a fund incur two types of costs: (i) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, other distributions, and exchange fees, and (ii) ongoing costs, including management fees, administrative services, and shareholder reports, among others. These ongoing costs, or operating expenses, are deducted from a fund’s gross income and reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets, which is known as the expense ratio. The following examples are intended to help investors understand the ongoing costs (in dollars) of investing in a fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 made at the beginning of the period and held for the entire six-month period beginning September 30, 2022 and ending March 31, 2023.

The following tables illustrate the Funds’ costs in two ways:

Table 1. Based on actual Fund return: This section helps investors estimate the actual expenses paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the fifth column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. Investors may use the information here, together with the amount invested, to estimate the expenses paid over the period. Simply divide the Fund’s account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number provided under the heading “Expenses Paid During Period.”

Table 2. Based on hypothetical 5% return: This section is intended to help investors compare a fund’s cost with those of other mutual funds. The table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses paid during the period. The example is useful in making comparisons because the U.S. Securities and Exchange Commission (the “SEC”) requires all mutual funds to calculate expenses based on the 5% return. Investors can assess a fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

The calculations illustrated above assume no shares were bought or sold during the period. Actual costs may have been higher or lower, depending on the amount of investment and the timing of any purchases or redemptions.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments, and contingent deferred sales charges (“CDSC”) on redemptions, if any. Therefore, the second table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

More information about the Funds’ expenses, including annual expense ratios for periods up to five years (subject to the Fund’s inception date), can be found in the Financial Highlights section of this report. For additional information on operating expenses and other shareholder costs, please refer to the appropriate Fund prospectus.

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 5 |

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited)(continued) | |

| | Expense

Ratio1 | | | Fund

Return | | | Beginning

Account Value

September 30, 2022 | | | Ending

Account Value

March 31, 2023 | | | Expenses

Paid During

Period2 | |

Table 1. Based on actual Fund return3 | | | | | | | | | | | | | | | | | | | | |

Directional Allocation Fund | | | | | | | | | | | | | | | | | | | | |

A-Class | | | 1.50 | % | | | 1.15 | % | | $ | 1,000.00 | | | $ | 1,011.50 | | | $ | 7.52 | |

C-Class | | | 2.09 | % | | | 0.85 | % | | | 1,000.00 | | | | 1,008.50 | | | | 10.47 | |

P-Class | | | 1.35 | % | | | 1.23 | % | | | 1,000.00 | | | | 1,012.30 | | | | 6.77 | |

Institutional Class | | | 1.09 | % | | | 1.32 | % | | | 1,000.00 | | | | 1,013.20 | | | | 5.47 | |

RBP® Dividend Fund | | | | | | | | | | | | | | | | | | | | |

A-Class | | | 1.17 | % | | | 15.00 | % | | | 1,000.00 | | | | 1,150.00 | | | | 6.27 | |

C-Class | | | 1.92 | % | | | 14.68 | % | | | 1,000.00 | | | | 1,146.80 | | | | 10.28 | |

P-Class | | | 1.17 | % | | | 15.17 | % | | | 1,000.00 | | | | 1,151.70 | | | | 6.28 | |

Institutional Class | | | 0.92 | % | | | 15.32 | % | | | 1,000.00 | | | | 1,153.20 | | | | 4.94 | |

RBP® Large-Cap Defensive Fund | | | | | | | | | | | | | | | | | | | | |

A-Class | | | 1.18 | % | | | 13.84 | % | | | 1,000.00 | | | | 1,138.40 | | | | 6.29 | |

C-Class | | | 1.93 | % | | | 13.48 | % | | | 1,000.00 | | | | 1,134.80 | | | | 10.27 | |

P-Class | | | 1.18 | % | | | 13.87 | % | | | 1,000.00 | | | | 1,138.70 | | | | 6.29 | |

Institutional Class | | | 0.93 | % | | | 13.95 | % | | | 1,000.00 | | | | 1,139.50 | | | | 4.96 | |

RBP® Large-Cap Market Fund | | | | | | | | | | | | | | | | | | | | |

A-Class | | | 1.19 | % | | | 11.32 | % | | | 1,000.00 | | | | 1,113.20 | | | | 6.27 | |

C-Class | | | 1.94 | % | | | 10.87 | % | | | 1,000.00 | | | | 1,108.70 | | | | 10.20 | |

P-Class | | | 1.19 | % | | | 11.39 | % | | | 1,000.00 | | | | 1,113.90 | | | | 6.27 | |

Institutional Class | | | 0.94 | % | | | 11.53 | % | | | 1,000.00 | | | | 1,115.30 | | | | 4.96 | |

RBP® Large-Cap Value Fund | | | | | | | | | | | | | | | | | | | | |

A-Class | | | 1.19 | % | | | 13.89 | % | | | 1,000.00 | | | | 1,138.90 | | | | 6.35 | |

C-Class | | | 1.94 | % | | | 13.38 | % | | | 1,000.00 | | | | 1,133.80 | | | | 10.32 | |

P-Class | | | 1.19 | % | | | 13.87 | % | | | 1,000.00 | | | | 1,138.70 | | | | 6.35 | |

Institutional Class | | | 0.94 | % | | | 14.01 | % | | | 1,000.00 | | | | 1,140.10 | | | | 5.02 | |

6 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | |

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited)(concluded) | |

| Expense

Ratio1 | Fund

Return | Beginning

Account Value

September 30, 2022 | Ending

Account Value

March 31, 2023 | Expenses

Paid During

Period2 |

Table 2. Based on hypothetical 5% return (before expenses) | | | | |

Directional Allocation Fund | | | | | |

A-Class | 1.50% | 5.00% | $ 1,000.00 | $ 1,017.45 | $ 7.55 |

C-Class | 2.09% | 5.00% | 1,000.00 | 1,014.51 | 10.50 |

P-Class | 1.35% | 5.00% | 1,000.00 | 1,018.20 | 6.79 |

Institutional Class | 1.09% | 5.00% | 1,000.00 | 1,019.50 | 5.49 |

RBP® Dividend Fund | | | | | |

A-Class | 1.17% | 5.00% | 1,000.00 | 1,019.10 | 5.89 |

C-Class | 1.92% | 5.00% | 1,000.00 | 1,015.36 | 9.65 |

P-Class | 1.17% | 5.00% | 1,000.00 | 1,019.10 | 5.89 |

Institutional Class | 0.92% | 5.00% | 1,000.00 | 1,020.34 | 4.63 |

RBP® Large-Cap Defensive Fund | | | | | |

A-Class | 1.18% | 5.00% | 1,000.00 | 1,019.05 | 5.94 |

C-Class | 1.93% | 5.00% | 1,000.00 | 1,015.31 | 9.70 |

P-Class | 1.18% | 5.00% | 1,000.00 | 1,019.05 | 5.94 |

Institutional Class | 0.93% | 5.00% | 1,000.00 | 1,020.29 | 4.68 |

RBP® Large-Cap Market Fund | | | | | |

A-Class | 1.19% | 5.00% | 1,000.00 | 1,019.00 | 5.99 |

C-Class | 1.94% | 5.00% | 1,000.00 | 1,015.26 | 9.75 |

P-Class | 1.19% | 5.00% | 1,000.00 | 1,019.00 | 5.99 |

Institutional Class | 0.94% | 5.00% | 1,000.00 | 1,020.24 | 4.73 |

RBP® Large-Cap Value Fund | | | | | |

A-Class | 1.19% | 5.00% | 1,000.00 | 1,019.00 | 5.99 |

C-Class | 1.94% | 5.00% | 1,000.00 | 1,015.26 | 9.75 |

P-Class | 1.19% | 5.00% | 1,000.00 | 1,019.00 | 5.99 |

Institutional Class | 0.94% | 5.00% | 1,000.00 | 1,020.24 | 4.73 |

1 | Annualized and excludes expenses of the underlying funds in which the Funds invest, if any. |

2 | Expenses are equal to the Fund’s annualized expense ratio, net of any applicable fee waivers, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

3 | Actual cumulative return at net asset value for the period September 30, 2022 to March 31, 2023. |

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 7 |

PERFORMANCE REPORT AND FUND PROFILE (Unaudited) | March 31, 2023 |

DIRECTIONAL ALLOCATION FUND

OBJECTIVE: Seeks to provide investment results that, before fees and expenses, correspond generally to the performance of the Guggenheim Directional Allocation IndexSM (the “Directional Allocation Index” or “Index”).

Holdings Diversification (Market Exposure as % of Net Assets)

In response to recent market and economic conditions and consistent with the Fund’s objectives and strategies, the Fund has, in recent periods, moved to 100% allocation to cash and cash equivalents and will continue to do so if market conditions warrant.

Inception Dates: |

A-Class | June 18, 2012 |

C-Class | June 18, 2012 |

P-Class | June 18, 2012 |

Institutional Class | June 18, 2012 |

8 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | |

PERFORMANCE REPORT AND FUND PROFILE (Unaudited)(concluded) | March 31, 2023 |

Average Annual Returns*

Periods Ended March 31, 2023

| 6 Month† | 1 Year | 5 Year | 10 Year |

A-Class Shares | 1.15% | (11.75%) | 5.23% | 8.06% |

A-Class Shares with sales charge‡ | (3.66%) | (15.93%) | 4.21% | 7.42% |

C-Class Shares | 0.85% | (12.36%) | 4.48% | 7.33% |

C-Class Shares with CDSC§ | (0.15%) | (13.23%) | 4.48% | 7.33% |

P-Class Shares** | 1.23% | (11.69%) | 5.27% | 8.14% |

Institutional Class Shares | 1.32% | (11.50%) | 5.53% | 8.41% |

Guggenheim Directional Allocation IndexSM | (0.00%) | (12.60%) | 6.10% | 9.37% |

Dow Jones U.S. Large-Cap Total Stock Market Index | 15.29% | (8.56%) | 10.91% | 12.05% |

* | The performance data above represents past performance that is not predictive of future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns are historical and include changes in principal and reinvested dividends and capital gains and do not reflect the effect of taxes. The Guggenheim Directional Allocation IndexSM and the Dow Jones U.S. Large-Cap Total Stock Market Index are unmanaged indices and, unlike the Fund, have no management fees or operating expenses to reduce their reported returns. |

** | F-1 Class shares redesignated as P-Class shares effective May 9, 2016. |

† | 6 month returns are not annualized. |

‡ | Effective May 9, 2016, the maximum sales charge decreased from 5.75% to 4.75%. A 5.75% maximum sales charge is used in the calculation of the Average Annual Return since inception based on subscriptions made prior to May 9, 2016, and a 4.75% maximum sales charge is used to calculate performance for periods based on subscriptions made on or after May 9, 2016. |

§ | Fund returns include a CDSC of 1% if redeemed within 12 months of purchase. |

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 9 |

SCHEDULE OF INVESTMENTS (Unaudited) | March 31, 2023 |

DIRECTIONAL ALLOCATION FUND | |

| | Shares | | | Value | |

MONEY MARKET FUND† - 2.5% |

Dreyfus Treasury Obligations Cash Management Fund — Institutional Shares, 4.69%1 | | | 5,532,181 | | | $ | 5,532,181 | |

Total Money Market Fund | | | | |

(Cost $5,532,181) | | | | | | | 5,532,181 | |

| | Face

Amount | | | Value | |

U.S. TREASURY BILLS†† - 97.8% |

U.S. Treasury Bills |

4.05% due 04/27/232 | | $ | 218,000,000 | | | | 217,331,466 | |

Total U.S. Treasury Bills | | | | |

(Cost $217,346,605) | | | | | | | 217,331,466 | |

| | | | | | | | | |

Total Investments - 100.3% | | | | |

(Cost $222,878,786) | | $ | 222,863,647 | |

Other Assets & Liabilities, net - (0.3)% | | | (726,951 | ) |

Total Net Assets - 100.0% | | $ | 222,136,696 | |

† | Value determined based on Level 1 inputs — See Note 4. |

†† | Value determined based on Level 2 inputs — See Note 4. |

1 | Rate indicated is the 7-day yield as of March 31, 2023. |

2 | Rate indicated is the effective yield at the time of purchase. |

| | |

| | See Sector Classification in Other Information section. |

The following table summarizes the inputs used to value the Fund’s investments at March 31, 2023 (See Note 4 in the Notes to Financial Statements):

Investments in Securities (Assets) | | Level 1

Quoted

Prices | | | Level 2

Significant

Observable

Inputs | | | Level 3

Significant

Unobservable

Inputs | | | Total | |

Money Market Fund | | $ | 5,532,181 | | | $ | — | | | $ | — | | | $ | 5,532,181 | |

U.S. Treasury Bills | | | — | | | | 217,331,466 | | | | — | | | | 217,331,466 | |

Total Assets | | $ | 5,532,181 | | | $ | 217,331,466 | | | $ | — | | | $ | 222,863,647 | |

10 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | |

DIRECTIONAL ALLOCATION FUND | |

STATEMENT OF ASSETS AND LIABILITIES (Unaudited) |

March 31, 2023 |

Assets: |

Investments, at value (cost $222,878,786) | | $ | 222,863,647 | |

Cash | | | 2 | |

Prepaid expenses | | | 29,359 | |

Receivables: |

Interest | | | 80,831 | |

Fund shares sold | | | 1,942 | |

Total assets | | | 222,975,781 | |

| | | | | |

Liabilities: |

Payable for: |

Fund shares redeemed | | | 491,422 | |

Management fees | | | 146,236 | |

Professional fees | | | 93,754 | |

Distribution and service fees | | | 41,074 | |

Due to Investment Adviser | | | 15,168 | |

Transfer agent/maintenance fees | | | 13,419 | |

Fund accounting/administration fees | | | 6,117 | |

Trustees’ fees* | | | 207 | |

Miscellaneous | | | 31,688 | |

Total liabilities | | | 839,085 | |

Net assets | | $ | 222,136,696 | |

| | | | | |

Net assets consist of: |

Paid in capital | | $ | 222,346,135 | |

Total distributable earnings (loss) | | | (209,439 | ) |

Net assets | | $ | 222,136,696 | |

| | | | | |

A-Class: |

Net assets | | $ | 126,597,930 | |

Capital shares outstanding | | | 8,830,111 | |

Net asset value per share | | $ | 14.34 | |

Maximum offering price per share (Net asset value divided by 95.25%) | | $ | 15.06 | |

| | | | | |

C-Class: |

Net assets | | $ | 14,851,725 | |

Capital shares outstanding | | | 1,144,150 | |

Net asset value per share | | $ | 12.98 | |

| | | | | |

P-Class: |

Net assets | | $ | 5,062,286 | |

Capital shares outstanding | | | 349,501 | |

Net asset value per share | | $ | 14.48 | |

| | | | | |

Institutional Class: |

Net assets | | $ | 75,624,755 | |

Capital shares outstanding | | | 5,060,880 | |

Net asset value per share | | $ | 14.94 | |

STATEMENT OF OPERATIONS (Unaudited) |

Six Months Ended March 31, 2023 |

Investment Income: |

Interest | | | 4,495,705 | |

Total investment income | | | 4,495,705 | |

| | | | | |

Expenses: |

Management fees | | | 1,133,257 | |

Distribution and service fees: |

A-Class | | | 196,636 | |

C-Class | | | 87,245 | |

P-Class | | | 6,722 | |

Transfer agent/maintenance fees: |

A-Class | | | 6,594 | |

C-Class | | | 2,793 | |

P-Class | | | 831 | |

Institutional Class | | | 14,953 | |

Professional fees | | | 133,772 | |

Fund accounting/administration fees | | | 54,063 | |

Custodian fees | | | 31,991 | |

Tax expense | | | 13,839 | |

Trustees’ fees* | | | 8,263 | |

Line of credit fees | | | 3,815 | |

Miscellaneous | | | 62,374 | |

Recoupment of previously waived fees: |

A-Class | | | 64,636 | |

C-Class | | | 780 | |

P-Class | | | 246 | |

Institutional Class | | | 3,940 | |

Total expenses | | | 1,826,750 | |

Less: |

A-Class | | | (4,570 | ) |

C-Class | | | (3,208 | ) |

P-Class | | | (951 | ) |

Institutional Class | | | (17,034 | ) |

Expenses waived by Adviser | | | (140,492 | ) |

Earnings credits applied | | | (25,942 | ) |

Total waived/reimbursed expenses | | | (192,197 | ) |

Net expenses | | | 1,634,553 | |

Net investment income | | | 2,861,152 | |

| | | | | |

Net Realized and Unrealized Gain (Loss): |

Net realized gain (loss) on: |

Investments | | | 25,044 | |

Net realized gain | | | 25,044 | |

Net change in unrealized appreciation (depreciation) on: |

Investments | | | (48,970 | ) |

Net change in unrealized appreciation (depreciation) | | | (48,970 | ) |

Net realized and unrealized loss | | | (23,926 | ) |

Net increase in net assets resulting from operations | | $ | 2,837,226 | |

* | Relates to Trustees not deemed “interested persons” within the meaning of Section 2(a)(19) of the 1940 Act. |

SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 11 |

DIRECTIONAL ALLOCATION FUND | |

STATEMENTS OF CHANGES IN NET ASSETS |

| | Six Months Ended

March 31, 2023

(Unaudited) | | | Year Ended

September 30,

2022 | |

Increase (Decrease) in Net Assets from Operations: | | | | | | | | |

Net investment income (loss) | | $ | 2,861,152 | | | $ | (68,833 | ) |

Net realized gain (loss) on investments | | | 25,044 | | | | (1,829,790 | ) |

Net change in unrealized appreciation (depreciation) on investments | | | (48,970 | ) | | | (26,086,263 | ) |

Net increase (decrease) in net assets resulting from operations | | | 2,837,226 | | | | (27,984,886 | ) |

| | | | | | | | | |

Distributions to shareholders: | | | | | | | | |

A-Class | | | (482,969 | ) | | | (22,873,206 | ) |

C-Class | | | — | | | | (7,531,556 | ) |

P-Class | | | (21,150 | ) | | | (1,174,381 | ) |

Institutional Class | | | (613,597 | ) | | | (18,380,858 | ) |

Total distributions to shareholders | | | (1,117,716 | ) | | | (49,960,001 | ) |

| | | | | | | | | |

Capital share transactions: | | | | | | | | |

Proceeds from sale of shares | | | | | | | | |

A-Class | | | 6,540,597 | | | | 36,607,727 | |

C-Class | | | 225,862 | | | | 499,868 | |

P-Class | | | 221,161 | | | | 87,108 | |

Institutional Class | | | 2,789,789 | | | | 5,835,101 | |

Distributions reinvested | | | | | | | | |

A-Class | | | 435,304 | | | | 20,292,140 | |

C-Class | | | — | | | | 7,433,984 | |

P-Class | | | 20,861 | | | | 1,161,691 | |

Institutional Class | | | 595,770 | | | | 17,864,833 | |

Cost of shares redeemed | | | | | | | | |

A-Class | | | (16,885,657 | ) | | | (35,849,828 | ) |

C-Class | | | (6,352,326 | ) | | | (37,540,879 | ) |

P-Class | | | (648,716 | ) | | | (2,457,640 | ) |

Institutional Class | | | (21,507,137 | ) | | | (39,972,997 | ) |

Net increase (decrease) from capital share transactions | | | (34,564,492 | ) | | | (26,038,892 | ) |

Net increase (decrease) in net assets | | | (32,844,982 | ) | | | (103,983,779 | ) |

| | | | | | | | | |

Net assets: | | | | | | | | |

Beginning of period | | | 254,981,678 | | | | 358,965,457 | |

End of period | | $ | 222,136,696 | | | $ | 254,981,678 | |

| | | | | | | | | |

Capital share activity: | | | | | | | | |

Shares sold | | | | | | | | |

A-Class | | | 458,673 | | | | 2,195,844 | |

C-Class | | | 17,468 | | | | 33,059 | |

P-Class | | | 15,336 | | | | 5,264 | |

Institutional Class | | | 187,717 | | | | 344,245 | |

Shares issued from reinvestment of distributions | | | | | | | | |

A-Class | | | 30,612 | | | | 1,196,471 | |

C-Class | | | — | | | | 481,788 | |

P-Class | | | 1,453 | | | | 67,856 | |

Institutional Class | | | 40,255 | | | | 1,011,599 | |

Shares redeemed | | | | | | | | |

A-Class | | | (1,183,928 | ) | | | (2,293,863 | ) |

C-Class | | | (492,049 | ) | | | (2,494,552 | ) |

P-Class | | | (44,918 | ) | | | (162,961 | ) |

Institutional Class | | | (1,445,515 | ) | | | (2,423,203 | ) |

Net decrease in shares | | | (2,414,896 | ) | | | (2,038,453 | ) |

12 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

DIRECTIONAL ALLOCATION FUND | |

This table is presented to show selected data for a share outstanding throughout each period and to assist shareholders in evaluating a Fund’s performance for the periods presented.

A-Class | | Six Months Ended

March 31, 2023a | | | Year Ended

September 30,

2022 | | | Year Ended

September 30,

2021 | | | Year Ended

September 30,

2020 | | | Year Ended

September 30,

2019 | | | Year Ended

September 30,

2018 | |

Per Share Data |

Net asset value, beginning of period | | $ | 14.23 | | | $ | 18.11 | | | $ | 14.00 | | | $ | 16.50 | | | $ | 18.59 | | | $ | 15.83 | |

Income (loss) from investment operations: |

Net investment income (loss)b | | | .16 | | | | (.01 | ) | | | (.06 | ) | | | .02 | | | | .03 | | | | (.03 | ) |

Net gain (loss) on investments (realized and unrealized) | | | — | | | | (1.27 | ) | | | 4.18 | | | | .07 | | | | (.12 | ) | | | 2.79 | |

Total from investment operations | | | .16 | | | | (1.28 | ) | | | 4.12 | | | | .09 | | | | (.09 | ) | | | 2.76 | |

Less distributions from: |

Net investment income | | | (.05 | ) | | | — | | | | (.01 | ) | | | — | | | | — | | | | — | |

Net realized gains | | | — | | | | (2.60 | ) | | | — | | | | (2.59 | ) | | | (2.00 | ) | | | — | |

Total distributions | | | (.05 | ) | | | (2.60 | ) | | | (.01 | ) | | | (2.59 | ) | | | (2.00 | ) | | | — | |

Net asset value, end of period | | $ | 14.34 | | | $ | 14.23 | | | $ | 18.11 | | | $ | 14.00 | | | $ | 16.50 | | | $ | 18.59 | |

|

Total Returnd | | | 1.15 | % | | | (9.40 | %) | | | 29.42 | % | | | (0.38 | %) | | | 1.13 | % | | | 17.44 | % |

Ratios/Supplemental Data |

Net assets, end of period (in thousands) | | $ | 126,598 | | | $ | 135,504 | | | $ | 152,598 | | | $ | 106,549 | | | $ | 104,877 | | | $ | 117,786 | |

Ratios to average net assets: |

Net investment income (loss) | | | 2.31 | % | | | (0.03 | %) | | | (0.38 | %) | | | 0.16 | % | | | 0.18 | % | | | (0.20 | %) |

Total expensese | | | 1.62 | % | | | 1.48 | % | | | 1.44 | % | | | 1.43 | % | | | 1.40 | % | | | 1.35 | % |

Net expensesf,g,h | | | 1.50 | % | | | 1.39 | % | | | 1.42 | % | | | 1.40 | % | | | 1.39 | % | | | 1.34 | % |

Portfolio turnover rate | | | — | | | | 149 | % | | | 131 | % | | | 313 | % | | | 203 | % | | | 92 | % |

C-Class | | Six Months Ended

March 31, 2023a | | | Year Ended

September 30,

2022 | | | Year Ended

September 30,

2021 | | | Year Ended

September 30,

2020 | | | Year Ended

September 30,

2019 | | | Year Ended

September 30,

2018 | |

Per Share Data |

Net asset value, beginning of period | | $ | 12.87 | | | $ | 16.72 | | | $ | 13.01 | | | $ | 15.59 | | | $ | 17.81 | | | $ | 15.29 | |

Income (loss) from investment operations: |

Net investment income (loss)b | | | .11 | | | | (.12 | ) | | | (.16 | ) | | | (.07 | ) | | | (.08 | ) | | | (.16 | ) |

Net gain (loss) on investments (realized and unrealized) | | | — | | | | (1.13 | ) | | | 3.87 | | | | .08 | | | | (.14 | ) | | | 2.68 | |

Total from investment operations | | | .11 | | | | (1.25 | ) | | | 3.71 | | | | .01 | | | | (.22 | ) | | | 2.52 | |

Less distributions from: |

Net realized gains | | | — | | | | (2.60 | ) | | | — | | | | (2.59 | ) | | | (2.00 | ) | | | — | |

Total distributions | | | — | | | | (2.60 | ) | | | — | | | | (2.59 | ) | | | (2.00 | ) | | | — | |

Net asset value, end of period | | $ | 12.98 | | | $ | 12.87 | | | $ | 16.72 | | | $ | 13.01 | | | $ | 15.59 | | | $ | 17.81 | |

|

Total Returnd | | | 0.85 | % | | | (10.08 | %) | | | 28.52 | % | | | (0.99 | %) | | | 0.38 | % | | | 16.48 | % |

Ratios/Supplemental Data |

Net assets, end of period (in thousands) | | $ | 14,852 | | | $ | 20,835 | | | $ | 60,153 | | | $ | 98,656 | | | $ | 176,994 | | | $ | 239,516 | |

Ratios to average net assets: |

Net investment income (loss) | | | 1.66 | % | | | (0.82 | %) | | | (1.02 | %) | | | (0.53 | %) | | | (0.53 | %) | | | (0.96 | %) |

Total expensese | | | 2.25 | % | | | 2.21 | % | | | 2.15 | % | | | 2.15 | % | | | 2.13 | % | | | 2.11 | % |

Net expensesf,g,h | | | 2.09 | % | | | 2.08 | % | | | 2.09 | % | | | 2.10 | % | | | 2.11 | % | | | 2.11 | % |

Portfolio turnover rate | | | — | | | | 149 | % | | | 131 | % | | | 313 | % | | | 203 | % | | | 92 | % |

SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 13 |

DIRECTIONAL ALLOCATION FUND | |

FINANCIAL HIGHLIGHTS (continued) |

This table is presented to show selected data for a share outstanding throughout each period and to assist shareholders in evaluating a Fund’s performance for the periods presented.

P-Class | | Six Months Ended

March 31, 2023a | | | Year Ended

September 30,

2022 | | | Year Ended

September 30,

2021 | | | Year Ended

September 30,

2020 | | | Year Ended

September 30,

2019 | | | Year Ended

September 30,

2018 | |

Per Share Data |

Net asset value, beginning of period | | $ | 14.36 | | | $ | 18.25 | | | $ | 14.10 | | | $ | 16.59 | | | $ | 18.67 | | | $ | 15.90 | |

Income (loss) from investment operations: |

Net investment income (loss)b | | | .18 | | | | — | c | | | (.05 | ) | | | .03 | | | | .04 | | | | (.04 | ) |

Net gain (loss) on investments (realized and unrealized) | | | — | | | | (1.29 | ) | | | 4.20 | | | | .07 | | | | (.12 | ) | | | 2.81 | |

Total from investment operations | | | .18 | | | | (1.29 | ) | | | 4.15 | | | | .10 | | | | (.08 | ) | | | 2.77 | |

Less distributions from: |

Net investment income | | | (.06 | ) | | | — | | | | — | c | | | — | | | | — | | | | — | |

Net realized gains | | | — | | | | (2.60 | ) | | | — | | | | (2.59 | ) | | | (2.00 | ) | | | — | |

Total distributions | | | (.06 | ) | | | (2.60 | ) | | | — | | | | (2.59 | ) | | | (2.00 | ) | | | — | |

Net asset value, end of period | | $ | 14.48 | | | $ | 14.36 | | | $ | 18.25 | | | $ | 14.10 | | | $ | 16.59 | | | $ | 18.67 | |

|

Total Return | | | 1.23 | % | | | (9.38 | %) | | | 29.45 | % | | | (0.30 | %) | | | 1.19 | % | | | 17.42 | % |

Ratios/Supplemental Data |

Net assets, end of period (in thousands) | | $ | 5,062 | | | $ | 5,424 | | | $ | 8,533 | | | $ | 9,143 | | | $ | 15,056 | | | $ | 20,892 | |

Ratios to average net assets: |

Net investment income (loss) | | | 2.46 | % | | | (0.01 | %) | | | (0.28 | %) | | | 0.22 | % | | | 0.24 | % | | | (0.22 | %) |

Total expensese | | | 1.50 | % | | | 1.43 | % | | | 1.38 | % | | | 1.40 | % | | | 1.40 | % | | | 1.37 | % |

Net expensesf,g,h | | | 1.35 | % | | | 1.33 | % | | | 1.34 | % | | | 1.35 | % | | | 1.36 | % | | | 1.36 | % |

Portfolio turnover rate | | | — | | | | 149 | % | | | 131 | % | | | 313 | % | | | 203 | % | | | 92 | % |

14 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

DIRECTIONAL ALLOCATION FUND | |

FINANCIAL HIGHLIGHTS (concluded) |

This table is presented to show selected data for a share outstanding throughout each period and to assist shareholders in evaluating a Fund’s performance for the periods presented.

Institutional Class | | Six Months Ended

March 31, 2023a | | | Year Ended

September 30,

2022 | | | Year Ended

September 30,

2021 | | | Year Ended

September 30,

2020 | | | Year Ended

September 30,

2019 | | | Year Ended

September 30,

2018 | |

Per Share Data |

Net asset value, beginning of period | | $ | 14.85 | | | $ | 18.74 | | | $ | 14.48 | | | $ | 16.93 | | | $ | 18.97 | | | $ | 16.12 | |

Income (loss) from investment operations: |

Net investment income (loss)b | | | .20 | | | | .04 | | | | (.01 | ) | | | .07 | | | | .08 | | | | .01 | |

Net gain (loss) on investments (realized and unrealized) | | | (.01 | ) | | | (1.33 | ) | | | 4.32 | | | | .07 | | | | (.12 | ) | | | 2.84 | |

Total from investment operations | | | .19 | | | | (1.29 | ) | | | 4.31 | | | | .14 | | | | (.04 | ) | | | 2.85 | |

Less distributions from: |

Net investment income | | | (.10 | ) | | | — | | | | (.05 | ) | | | — | | | | — | | | | — | |

Net realized gains | | | — | | | | (2.60 | ) | | | — | | | | (2.59 | ) | | | (2.00 | ) | | | — | |

Total distributions | | | (.10 | ) | | | (2.60 | ) | | | (.05 | ) | | | (2.59 | ) | | | (2.00 | ) | | | — | |

Net asset value, end of period | | $ | 14.94 | | | $ | 14.85 | | | $ | 18.74 | | | $ | 14.48 | | | $ | 16.93 | | | $ | 18.97 | |

|

Total Return | | | 1.32 | % | | | (9.11 | %) | | | 29.81 | % | | | (0.03 | %) | | | 1.39 | % | | | 17.68 | % |

Ratios/Supplemental Data |

Net assets, end of period (in thousands) | | $ | 75,625 | | | $ | 93,219 | | | $ | 137,682 | | | $ | 152,083 | | | $ | 266,223 | | | $ | 345,423 | |

Ratios to average net assets: |

Net investment income (loss) | | | 2.68 | % | | | 0.25 | % | | | (0.04 | %) | | | 0.47 | % | | | 0.48 | % | | | 0.04 | % |

Total expensese | | | 1.25 | % | | | 1.20 | % | | | 1.15 | % | | | 1.15 | % | | | 1.13 | % | | | 1.12 | % |

Net expensesf,g,h | | | 1.09 | % | | | 1.08 | % | | | 1.09 | % | | | 1.10 | % | | | 1.11 | % | | | 1.11 | % |

Portfolio turnover rate | | | — | | | | 149 | % | | | 131 | % | | | 313 | % | | | 203 | % | | | 92 | % |

a | Unaudited figures for the period ended March 31, 2023. Percentage amounts for the period, except total return and portfolio turnover rate, have been annualized. |

b | Net investment income (loss) per share was computed using average shares outstanding throughout the period. |

c | Less than $0.01 per share. |

d | Total return does not reflect the impact of any applicable sales charges. |

e | Does not include expenses of the underlying funds in which the Fund invests. |

f | Net expense information reflects the expense ratios after expense waivers and reimbursements, as applicable. |

g | The portion of the ratios of net expenses to average net assets attributable to recoupments of prior fee reductions or expense reimbursements for the years presented was as follows: |

| 3/31/2023a | 09/30/22 | 09/30/21 | 09/30/20 | 09/30/19 | 09/30/18 |

A-Class | 0.10% | 0.01% | — | — | 0.01% | — |

C-Class | 0.01% | 0.01% | — | 0.01% | 0.01% | 0.02% |

P-Class | 0.01% | 0.01% | — | 0.00%i | 0.00%i | 0.01% |

Institutional Class | 0.01% | 0.01% | — | 0.01% | 0.01% | 0.02% |

h | Net expenses may include expenses that are excluded from the expense limitation agreement. Excluding these expenses, the net expense ratios for the years presented would be: |

| 03/31/23a | 09/30/22 | 09/30/21 | 09/30/20 | 09/30/19 | 09/30/18 |

A-Class | 1.46% | 1.38% | 1.41% | 1.40% | 1.39% | 1.34% |

C-Class | 2.06% | 2.08% | 2.08% | 2.10% | 2.10% | 2.10% |

P-Class | 1.31% | 1.33% | 1.34% | 1.35% | 1.35% | 1.35% |

Institutional Class | 1.06% | 1.08% | 1.09% | 1.10% | 1.10% | 1.10% |

SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 15 |

PERFORMANCE REPORT AND FUND PROFILE (Unaudited) | March 31, 2023 |

RBP® DIVIDEND FUND

OBJECTIVE: Seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the Guggenheim RBP® Dividend IndexSM (the “Dividend Index” or “Index”).

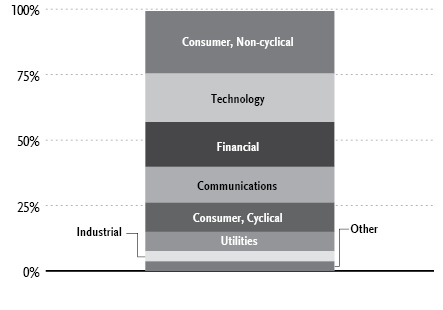

Holdings Diversification (Market Exposure as % of Net Assets)

“Holdings Diversification (Market Exposure as % of Net Assets)” excludes any temporary cash investments.

Inception Dates: |

A-Class | April 18, 2011 |

C-Class | April 18, 2011 |

P-Class | April 18, 2011 |

Institutional Class | February 10, 2011 |

Ten Largest Holdings | (% of Total

Net Assets) |

Microsoft Corp. | 6.9% |

Apple, Inc. | 5.9% |

Exxon Mobil Corp. | 2.2% |

Visa, Inc. — Class A | 2.0% |

Procter & Gamble Co. | 1.9% |

Mastercard, Inc. — Class A | 1.8% |

Home Depot, Inc. | 1.7% |

Broadcom, Inc. | 1.7% |

Merck & Company, Inc. | 1.7% |

Walmart, Inc. | 1.6% |

Top Ten Total | 27.4% |

| | |

“Ten Largest Holdings” excludes any temporary cash investments. |

16 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | |

PERFORMANCE REPORT AND FUND PROFILE (Unaudited)(concluded) | March 31, 2023 |

Average Annual Returns*

Periods Ended March 31, 2023

| 6 Month† | 1 Year | 5 Year | 10 Year |

A-Class Shares | 15.00% | (7.83%) | 7.63% | 8.80% |

A-Class Shares with sales charge‡ | 9.57% | (12.20%) | 6.59% | 8.15% |

C-Class Shares | 14.68% | (8.46%) | 6.82% | 8.03% |

C-Class Shares with CDSC§ | 13.68% | (9.37%) | 6.82% | 8.03% |

P-Class Shares** | 15.17% | (7.78%) | 7.64% | 8.85% |

Institutional Class Shares | 15.32% | (7.51%) | 7.91% | 9.13% |

Guggenheim RBP Dividend IndexSM | 15.82% | (6.68%) | 9.06% | 10.40% |

Dow Jones U.S. Large-Cap Total Stock Market Index | 15.29% | (8.56%) | 10.91% | 12.05% |

* | The performance data above represents past performance that is not predictive of future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns are historical and include changes in principal and reinvested dividends and capital gains and do not reflect the effect of taxes. The Guggenheim RBP Dividend IndexSM and Dow Jones U.S. Large-Cap Total Stock Market Index are unmanaged indices and, unlike the Fund, have no management fees or operating expenses to reduce their reported returns. |

** | F-1 Class shares redesignated as P-Class share effective May 9, 2016. |

† | 6 month returns are not annualized. |

‡ | Effective May 9, 2016, the maximum sales charge decreased from 5.75% to 4.75%. A 5.75% maximum sales charge is used in the calculation of the Average Annual Return since inception based on subscriptions made prior to May 9, 2016, and a 4.75% maximum sales charge will be used to calculate performance for periods based on subscriptions made on or after May 9, 2016. |

§ | Fund returns include a CDSC of 1% if redeemed within 12 months of purchase. |

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 17 |

SCHEDULE OF INVESTMENTS (Unaudited) | March 31, 2023 |

RBP® DIVIDEND FUND | |

| | Shares | | | Value | |

COMMON STOCKS† - 99.1% |

| | | | | | | | | |

Technology - 23.4% |

Microsoft Corp. | | | 4,214 | | | $ | 1,214,896 | |

Apple, Inc. | | | 6,250 | | | | 1,030,625 | |

Broadcom, Inc. | | | 470 | | | | 301,524 | |

Accenture plc — Class A | | | 904 | | | | 258,372 | |

Intuit, Inc. | | | 558 | | | | 248,773 | |

Applied Materials, Inc. | | | 1,856 | | | | 227,973 | |

KLA Corp. | | | 508 | | | | 202,778 | |

Monolithic Power Systems, Inc. | | | 368 | | | | 184,199 | |

Electronic Arts, Inc. | | | 1,473 | | | | 177,423 | |

NVIDIA Corp. | | | 455 | | | | 126,385 | |

QUALCOMM, Inc. | | | 921 | | | | 117,501 | |

Total Technology | | | | | | | 4,090,449 | |

| | | | | | | | | |

Financial - 19.0% |

Visa, Inc. — Class A | | | 1,547 | | | | 348,787 | |

Mastercard, Inc. — Class A | | | 880 | | | | 319,801 | |

Prologis, Inc. REIT | | | 1,862 | | | | 232,322 | |

American Express Co. | | | 1,288 | | | | 212,455 | |

Intercontinental Exchange, Inc. | | | 1,916 | | | | 199,820 | |

Chubb Ltd. | | | 985 | | | | 191,267 | |

Life Storage, Inc. REIT | | | 1,448 | | | | 189,818 | |

Rexford Industrial Realty, Inc. REIT | | | 3,035 | | | | 181,038 | |

Mid-America Apartment Communities, Inc. REIT | | | 1,102 | | | | 166,446 | |

Truist Financial Corp. | | | 4,719 | | | | 160,918 | |

Popular, Inc. | | | 2,722 | | | | 156,270 | |

American International Group, Inc. | | | 3,076 | | | | 154,908 | |

MetLife, Inc. | | | 2,435 | | | | 141,084 | |

Annaly Capital Management, Inc. REIT | | | 6,696 | | | | 127,961 | |

American Tower Corp. — Class A REIT | | | 558 | | | | 114,022 | |

Rithm Capital Corp. REIT | | | 10,463 | | | | 83,704 | |

Pinnacle Financial Partners, Inc. | | | 1,217 | | | | 67,129 | |

Blackstone Mortgage Trust, Inc. — Class A REIT | | | 3,715 | | | | 66,313 | |

New York Community Bancorp, Inc. | | | 6,573 | | | | 59,420 | |

American Homes 4 Rent — Class A REIT | | | 1,870 | | | | 58,811 | |

AGNC Investment Corp. REIT | | | 4,128 | | | | 41,610 | |

Comerica, Inc. | | | 409 | | | | 17,759 | |

JPMorgan Chase & Co. | | | 126 | | | | 16,419 | |

Sun Communities, Inc. REIT | | | 71 | | | | 10,002 | |

Total Financial | | | | | | | 3,318,084 | |

| | | | | | | | | |

Consumer, Non-cyclical - 17.3% |

Procter & Gamble Co. | | | 2,290 | | | | 340,500 | |

Merck & Company, Inc. | | | 2,773 | | | | 295,020 | |

Bristol-Myers Squibb Co. | | | 3,546 | | | | 245,773 | |

Danaher Corp. | | | 914 | | | | 230,365 | |

Becton Dickinson and Co. | | | 859 | | | | 212,637 | |

Gilead Sciences, Inc. | | | 2,543 | | | | 210,992 | |

Amgen, Inc. | | | 765 | | | | 184,939 | |

Sysco Corp. | | | 2,310 | | | | 178,402 | |

Bunge Ltd. | | | 1,864 | | | | 178,049 | |

Encompass Health Corp. | | | 3,159 | | | | 170,902 | |

Kroger Co. | | | 3,414 | | | | 168,549 | |

Constellation Brands, Inc. — Class A | | | 600 | | | | 135,534 | |

PepsiCo, Inc. | | | 663 | | | | 120,865 | |

Bruker Corp. | | | 1,300 | | | | 102,492 | |

McKesson Corp. | | | 207 | | | | 73,702 | |

UnitedHealth Group, Inc. | | | 138 | | | | 65,217 | |

Automatic Data Processing, Inc. | | | 255 | | | | 56,771 | |

Johnson & Johnson | | | 259 | | | | 40,145 | |

MarketAxess Holdings, Inc. | | | 34 | | | | 13,304 | |

Total Consumer, Non-cyclical | | | | | | | 3,024,158 | |

| | | | | | | | | |

Consumer, Cyclical - 14.6% |

Home Depot, Inc. | | | 1,030 | | | | 303,974 | |

Walmart, Inc. | | | 1,854 | | | | 273,372 | |

NIKE, Inc. — Class B | | | 2,010 | | | | 246,506 | |

Starbucks Corp. | | | 2,238 | | | | 233,043 | |

TJX Companies, Inc. | | | 2,785 | | | | 218,233 | |

Target Corp. | | | 1,218 | | | | 201,737 | |

General Motors Co. | | | 5,216 | | | | 191,323 | |

Costco Wholesale Corp. | | | 365 | | | | 181,358 | |

Dollar General Corp. | | | 810 | | | | 170,473 | |

WW Grainger, Inc. | | | 238 | | | | 163,937 | |

Watsco, Inc. | | | 458 | | | | 145,717 | |

Lowe’s Companies, Inc. | | | 716 | | | | 143,178 | |

Tractor Supply Co. | | | 334 | | | | 78,503 | |

Total Consumer, Cyclical | | | | | | | 2,551,354 | |

| | | | | | | | | |

Energy - 6.6% |

Exxon Mobil Corp. | | | 3,513 | | | | 385,236 | |

EOG Resources, Inc. | | | 1,762 | | | | 201,978 | |

Valero Energy Corp. | | | 1,422 | | | | 198,511 | |

Pioneer Natural Resources Co. | | | 838 | | | | 171,153 | |

Halliburton Co. | | | 5,243 | | | | 165,889 | |

ConocoPhillips | | | 344 | | | | 34,128 | |

Total Energy | | | | | | | 1,156,895 | |

| | | | | | | | | |

Industrial - 6.3% |

Caterpillar, Inc. | | | 981 | | | | 224,492 | |

Deere & Co. | | | 524 | | | | 216,349 | |

Eaton Corporation plc | | | 1,166 | | | | 199,782 | |

Agilent Technologies, Inc. | | | 1,366 | | | | 188,973 | |

Regal Rexnord Corp. | | | 1,132 | | | | 159,306 | |

Republic Services, Inc. — Class A | | | 478 | | | | 64,635 | |

Emerson Electric Co. | | | 542 | | | | 47,230 | |

Illinois Tool Works, Inc. | | | 26 | | | | 6,330 | |

Total Industrial | | | | | | | 1,107,097 | |

| | | | | | | | | |

Utilities - 5.2% |

NextEra Energy, Inc. | | | 2,874 | | | | 221,528 | |

Exelon Corp. | | | 4,610 | | | | 193,113 | |

Evergy, Inc. | | | 2,821 | | | | 172,420 | |

DTE Energy Co. | | | 1,173 | | | | 128,490 | |

National Fuel Gas Co. | | | 1,380 | | | | 79,681 | |

Vistra Corp. | | | 2,743 | | | | 65,832 | |

FirstEnergy Corp. | | | 1,310 | | | | 52,479 | |

Total Utilities | | | | | | | 913,543 | |

| | | | | | | | | |

18 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

SCHEDULE OF INVESTMENTS (Unaudited)(concluded) | March 31, 2023 |

RBP® DIVIDEND FUND | |

| | Shares | | | Value | |

Communications - 4.5% |

AT&T, Inc. | | | 12,426 | | | $ | 239,200 | |

Comcast Corp. — Class A | | | 6,247 | | | | 236,824 | |

Fox Corp. — Class A | | | 4,751 | | | | 161,771 | |

Interpublic Group of Companies, Inc. | | | 3,870 | | | | 144,119 | |

Fox Corp. — Class B | | | 228 | | | | 7,139 | |

Total Communications | | | | | | | 789,053 | |

| | | | | | | | | |

Basic Materials - 2.2% |

Mosaic Co. | | | 3,546 | | | | 162,691 | |

CF Industries Holdings, Inc. | | | 2,211 | | | | 160,275 | |

Air Products and Chemicals, Inc. | | | 240 | | | | 68,930 | |

Total Basic Materials | | | | | | | 391,896 | |

| | | | | | | | | |

Total Common Stocks | | | | |

(Cost $17,249,741) | | | | | | | 17,342,529 | |

| | | | | | | | | |

EXCHANGE-TRADED FUNDS† - 0.4% |

iShares Select Dividend ETF | | | 357 | | | | 41,833 | |

Vanguard Dividend Appreciation ETF | | | 177 | | | | 27,260 | |

Total Exchange-Traded Funds | | | | |

(Cost $68,948) | | | | | | | 69,093 | |

| | | | | | | | | |

Total Investments - 99.5% | | | | |

(Cost $17,318,689) | | $ | 17,411,622 | |

Other Assets & Liabilities, net - 0.5% | | | 86,768 | |

Total Net Assets - 100.0% | | $ | 17,498,390 | |

† | Value determined based on Level 1 inputs — See Note 4. |

| | plc — Public Limited Company |

| | REIT — Real Estate Investment Trust |

| | |

| | See Sector Classification in Other Information section. |

The following table summarizes the inputs used to value the Fund’s investments at March 31, 2023 (See Note 4 in the Notes to Financial Statements):

Investments in Securities (Assets) | | Level 1

Quoted

Prices | | | Level 2

Significant

Observable

Inputs | | | Level 3

Significant

Unobservable

Inputs | | | Total | |

Common Stocks | | $ | 17,342,529 | | | $ | — | | | $ | — | | | $ | 17,342,529 | |

Exchange-Traded Funds | | | 69,093 | | | | — | | | | — | | | | 69,093 | |

Total Assets | | $ | 17,411,622 | | | $ | — | | | $ | — | | | $ | 17,411,622 | |

SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 19 |

STATEMENT OF ASSETS AND LIABILITIES (Unaudited) |

March 31, 2023 |

Assets: |

Investments, at value (cost $17,318,689) | | $ | 17,411,622 | |

Cash | | | 51,627 | |

Prepaid expenses | | | 49,343 | |

Receivables: |

Securities sold | | | 87,157 | |

Dividends | | | 22,439 | |

Investment Adviser | | | 3,746 | |

Total assets | | | 17,625,934 | |

| | | | | |

Liabilities: |

Payable for: |

Fund shares redeemed | | | 96,321 | |

Professional fees | | | 13,686 | |

Fund accounting/administration fees | | | 4,330 | |

Transfer agent/maintenance fees | | | 2,868 | |

Distribution and service fees | | | 2,648 | |

Trustees’ fees* | | | 2,236 | |

Distributions to shareholders | | | 280 | |

Miscellaneous | | | 5,175 | |

Total liabilities | | | 127,544 | |

Net assets | | $ | 17,498,390 | |

| | | | | |

Net assets consist of: |

Paid in capital | | $ | 18,170,528 | |

Total distributable earnings (loss) | | | (672,138 | ) |

Net assets | | $ | 17,498,390 | |

| | | | | |

A-Class: |

Net assets | | $ | 9,106,194 | |

Capital shares outstanding | | | 744,888 | |

Net asset value per share | | $ | 12.22 | |

Maximum offering price per share (Net asset value divided by 95.25%) | | $ | 12.83 | |

| | | | | |

C-Class: |

Net assets | | $ | 733,985 | |

Capital shares outstanding | | | 59,237 | |

Net asset value per share | | $ | 12.39 | |

| | | | | |

P-Class: |

Net assets | | $ | 693,956 | |

Capital shares outstanding | | | 56,071 | |

Net asset value per share | | $ | 12.38 | |

| | | | | |

Institutional Class: |

Net assets | | $ | 6,964,255 | |

Capital shares outstanding | | | 591,384 | |

Net asset value per share | | $ | 11.78 | |

STATEMENT OF OPERATIONS (Unaudited) |

Six Months Ended March 31, 2023 |

Investment Income: |

Dividends | | $ | 229,843 | |

Total investment income | | | 229,843 | |

| | | | | |

Expenses: |

Management fees | | | 66,290 | |

Distribution and service fees: |

A-Class | | | 13,491 | |

C-Class | | | 4,267 | |

P-Class | | | 941 | |

Transfer agent/maintenance fees: |

A-Class | | | 6,289 | |

C-Class | | | 941 | |

P-Class | | | 1,364 | |

Institutional Class | | | 6,000 | |

Registration fees | | | 32,269 | |

Professional fees | | | 24,094 | |

Fund accounting/administration fees | | | 8,246 | |

Trustees’ fees* | | | 6,485 | |

Custodian fees | | | 2,942 | |

Line of credit fees | | | 346 | |

Miscellaneous | | | 6,191 | |

Total expenses | | | 180,156 | |

Less: |

Expenses reimbursed by Adviser: |

A-Class | | | (10,418 | ) |

C-Class | | | (1,119 | ) |

P-Class | | | (1,530 | ) |

Institutional Class | | | (7,482 | ) |

Expenses waived by Adviser | | | (61,583 | ) |

Total waived/reimbursed expenses | | | (82,132 | ) |

Net expenses | | | 98,024 | |

Net investment income | | | 131,819 | |

| | | | | |

Net Realized and Unrealized Gain (Loss): |

Net realized gain (loss) on: |

Investments | | | (457,705 | ) |

Net realized loss | | | (457,705 | ) |

Net change in unrealized appreciation (depreciation) on: |

Investments | | | 2,764,527 | |

Net change in unrealized appreciation (depreciation) | | | 2,764,527 | |

Net realized and unrealized gain | | | 2,306,822 | |

Net increase in net assets resulting from operations | | $ | 2,438,641 | |

* | Relates to Trustees not deemed “interested persons” within the meaning of Section 2(a)(19) of the 1940 Act. |

20 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

STATEMENTS OF CHANGES IN NET ASSETS |

| | Six Months Ended

March 31, 2023

(Unaudited) | | | Year Ended

September 30,

2022 | |

Increase (Decrease) in Net Assets from Operations: | | | | | | | | |

Net investment income | | $ | 131,819 | | | $ | 216,302 | |

Net realized loss on investments | | | (457,705 | ) | | | (201,687 | ) |

Net change in unrealized appreciation (depreciation) on investments | | | 2,764,527 | | | | (3,021,832 | ) |

Net increase (decrease) in net assets resulting from operations | | | 2,438,641 | | | | (3,007,217 | ) |

| | | | | | | | | |

Distributions to shareholders: | | | | | | | | |

A-Class | | | (54,968 | ) | | | (1,834,203 | ) |

C-Class | | | (1,949 | ) | | | (264,222 | ) |

P-Class | | | (4,576 | ) | | | (225,153 | ) |

Institutional Class | | | (51,666 | ) | | | (1,722,168 | ) |

Return of Capital: | | | | | | | | |

A-Class | | | — | | | | (32,948 | ) |

C-Class | | | — | | | | (4,746 | ) |

P-Class | | | — | | | | (4,044 | ) |

Institutional Class | | | — | | | | (30,936 | ) |

Total distributions to shareholders | | | (113,159 | ) | | | (4,118,420 | ) |

| | | | | | | | | |

Capital share transactions: | | | | | | | | |

Proceeds from sale of shares | | | | | | | | |

A-Class | | | 624,941 | | | | 1,412,013 | |

C-Class | | | 17,245 | | | | 291,601 | |

P-Class | | | 3,179 | | | | 119,455 | |

Institutional Class | | | 137,355 | | | | 1,036,840 | |

Distributions reinvested | | | | | | | | |

A-Class | | | 54,621 | | | | 1,856,196 | |

C-Class | | | 1,893 | | | | 267,192 | |

P-Class | | | 4,562 | | | | 228,813 | |

Institutional Class | | | 51,531 | | | | 1,748,080 | |

Cost of shares redeemed | | | | | | | | |

A-Class | | | (835,902 | ) | | | (2,998,436 | ) |

C-Class | | | (239,761 | ) | | | (1,659,939 | ) |

P-Class | | | (203,769 | ) | | | (752,512 | ) |

Institutional Class | | | (778,601 | ) | | | (3,271,612 | ) |

Net increase (decrease) from capital share transactions | | | (1,162,706 | ) | | | (1,722,309 | ) |

Net increase (decrease) in net assets | | | 1,162,776 | | | | (8,847,946 | ) |

| | | | | | | | | |

Net assets: | | | | | | | | |

Beginning of period | | | 16,335,614 | | | | 25,183,560 | |

End of period | | $ | 17,498,390 | | | $ | 16,335,614 | |

SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 21 |

STATEMENTS OF CHANGES IN NET ASSETS (concluded) |

| | Six Months Ended

March 31, 2023

(Unaudited) | | | Year Ended

September 30,

2022 | |

Capital share activity: | | | | | | | | |

Shares sold | | | | | | | | |

A-Class | | | 51,639 | | | | 100,195 | |

C-Class | | | 1,400 | | | | 22,625 | |

P-Class | | | 263 | | | | 8,869 | |

Institutional Class | | | 12,225 | | | | 76,424 | |

Shares issued from reinvestment of distributions | | | | | | | | |

A-Class | | | 4,522 | | | | 134,150 | |

C-Class | | | 155 | | | | 18,923 | |

P-Class | | | 373 | | | | 16,280 | |

Institutional Class | | | 4,427 | | | | 131,210 | |

Shares redeemed | | | | | | | | |

A-Class | | | (69,524 | ) | | | (248,948 | ) |

C-Class | | | (19,352 | ) | | | (119,032 | ) |

P-Class | | | (17,010 | ) | | | (56,280 | ) |

Institutional Class | | | (67,690 | ) | | | (279,603 | ) |

Net decrease in shares | | | (98,572 | ) | | | (195,187 | ) |

22 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

This table is presented to show selected data for a share outstanding throughout each period and to assist shareholders in evaluating a Fund’s performance for the periods presented.

A-Class | | Six Months Ended

March 31, 2023a | | | Year Ended

September 30,

2022 | | | Year Ended

September 30,

2021 | | | Year Ended

September 30,

2020 | | | Year Ended

September 30,

2019 | | | Year Ended

September 30,

2018 | |

Per Share Data |

Net asset value, beginning of period | | $ | 10.69 | | | $ | 14.59 | | | $ | 10.76 | | | $ | 12.00 | | | $ | 12.55 | | | $ | 12.82 | |

Income (loss) from investment operations: |

Net investment income (loss)b | | | .09 | | | | .11 | | | | .27 | | | | .30 | | | | .29 | | | | .23 | |

Net gain (loss) on investments (realized and unrealized) | | | 1.51 | | | | (1.65 | ) | | | 3.99 | | | | (.91 | ) | | | .05 | | | | 1.37 | |

Total from investment operations | | | 1.60 | | | | (1.54 | ) | | | 4.26 | | | | (.61 | ) | | | .34 | | | | 1.60 | |

Less distributions from: |

Net investment income | | | (.07 | ) | | | (.09 | ) | | | (.43 | ) | | | (.31 | ) | | | (.32 | ) | | | (.34 | ) |

Net realized gains | | | — | | | | (2.23 | ) | | | — | | | | (.21 | ) | | | (.57 | ) | | | (1.53 | ) |

Return of capital | | | — | | | | (.04 | ) | | | — | | | | (.11 | ) | | | — | | | | — | |

Total distributions | | | (.07 | ) | | | (2.36 | ) | | | (.43 | ) | | | (.63 | ) | | | (.89 | ) | | | (1.87 | ) |

Net asset value, end of period | | $ | 12.22 | | | $ | 10.69 | | | $ | 14.59 | | | $ | 10.76 | | | $ | 12.00 | | | $ | 12.55 | |

|

Total Returnc | | | 15.00 | % | | | (14.13 | %) | | | 39.75 | % | | | (5.16 | %) | | | 3.41 | % | | | 13.40 | % |

Ratios/Supplemental Data |

Net assets, end of period (in thousands) | | $ | 9,106 | | | $ | 8,103 | | | $ | 11,274 | | | $ | 5,357 | | | $ | 5,860 | | | $ | 5,775 | |

Ratios to average net assets: |

Net investment income (loss) | | | 1.43 | % | | | 0.85 | % | | | 1.89 | % | | | 2.73 | % | | | 2.49 | % | | | 1.84 | % |

Total expensesd | | | 2.10 | % | | | 1.92 | % | | | 1.91 | % | | | 2.04 | % | | | 1.95 | % | | | 2.08 | % |

Net expensese,f,g | | | 1.17 | % | | | 1.20 | % | | | 1.20 | % | | | 1.21 | % | | | 1.22 | % | | | 1.21 | % |

Portfolio turnover rate | | | 35 | % | | | 70 | % | | | 157 | % | | | 114 | % | | | 110 | % | | | 97 | % |

C-Class | | Six Months Ended

March 31, 2023a | | | Year Ended

September 30,

2022 | | | Year Ended

September 30,

2021 | | | Year Ended

September 30,

2020 | | | Year Ended

September 30,

2019 | | | Year Ended

September 30,

2018 | |

Per Share Data |

Net asset value, beginning of period | | $ | 10.83 | | | $ | 14.76 | | | $ | 10.86 | | | $ | 12.06 | | | $ | 12.53 | | | $ | 12.74 | |

Income (loss) from investment operations: |

Net investment income (loss)b | | | .04 | | | | — | | | | .20 | | | | .22 | | | | .20 | | | | .14 | |

Net gain (loss) on investments (realized and unrealized) | | | 1.55 | | | | (1.66 | ) | | | 3.99 | | | | (.92 | ) | | | .07 | | | | 1.35 | |

Total from investment operations | | | 1.59 | | | | (1.66 | ) | | | 4.19 | | | | (.70 | ) | | | .27 | | | | 1.49 | |

Less distributions from: |

Net investment income | | | (.03 | ) | | | — | i | | | (.29 | ) | | | (.18 | ) | | | (.17 | ) | | | (.17 | ) |

Net realized gains | | | — | | | | (2.23 | ) | | | — | | | | (.21 | ) | | | (.57 | ) | | | (1.53 | ) |

Return of capital | | | — | | | | (.04 | ) | | | — | | | | (.11 | ) | | | — | | | | — | |

Total distributions | | | (.03 | ) | | | (2.27 | ) | | | (.29 | ) | | | (.50 | ) | | | (.74 | ) | | | (1.70 | ) |

Net asset value, end of period | | $ | 12.39 | | | $ | 10.83 | | | $ | 14.76 | | | $ | 10.86 | | | $ | 12.06 | | | $ | 12.53 | |

|

Total Returnc | | | 14.68 | % | | | (14.78 | %) | | | 38.60 | % | | | (5.84 | %) | | | 2.66 | % | | | 12.49 | % |

Ratios/Supplemental Data |

Net assets, end of period (in thousands) | | $ | 734 | | | $ | 834 | | | $ | 2,281 | | | $ | 3,651 | | | $ | 5,223 | | | $ | 5,976 | |

Ratios to average net assets: |

Net investment income (loss) | | | 0.67 | % | | | 0.02 | % | | | 1.42 | % | | | 1.92 | % | | | 1.75 | % | | | 1.10 | % |

Total expensesd | | | 2.88 | % | | | 2.67 | % | | | 2.70 | % | | | 2.80 | % | | | 2.64 | % | | | 2.77 | % |

Net expensese,f,g | | | 1.92 | % | | | 1.95 | % | | | 1.95 | % | | | 1.96 | % | | | 1.97 | % | | | 1.96 | % |

Portfolio turnover rate | | | 35 | % | | | 70 | % | | | 157 | % | | | 114 | % | | | 110 | % | | | 97 | % |

SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 23 |

FINANCIAL HIGHLIGHTS (continued) |

This table is presented to show selected data for a share outstanding throughout each period and to assist shareholders in evaluating a Fund’s performance for the periods presented.

P-Class | | Six Months Ended

March 31, 2023a | | | Year Ended

September 30,

2022 | | | Year Ended

September 30,

2021 | | | Year Ended

September 30,

2020 | | | Year Ended

September 30,

2019 | | | Year Ended

September 30,

2018 | |

Per Share Data |

Net asset value, beginning of period | | $ | 10.82 | | | $ | 14.74 | | | $ | 10.84 | | | $ | 12.13 | | | $ | 12.67 | | | $ | 12.88 | |

Income (loss) from investment operations: |

Net investment income (loss)b | | | .09 | | | | .11 | | | | .27 | | | | .30 | | | | .29 | | | | .23 | |

Net gain (loss) on investments (realized and unrealized) | | | 1.55 | | | | (1.68 | ) | | | 4.02 | | | | (.92 | ) | | | .06 | | | | 1.37 | |

Total from investment operations | | | 1.64 | | | | (1.57 | ) | | | 4.29 | | | | (.62 | ) | | | .35 | | | | 1.60 | |

Less distributions from: |

Net investment income | | | (.08 | ) | | | (.08 | ) | | | (.39 | ) | | | (.35 | ) | | | (.32 | ) | | | (.28 | ) |

Net realized gains | | | — | | | | (2.23 | ) | | | — | | | | (.21 | ) | | | (.57 | ) | | | (1.53 | ) |

Return of capital | | | — | | | | (.04 | ) | | | — | | | | (.11 | ) | | | — | | | | — | |

Total distributions | | | (.08 | ) | | | (2.35 | ) | | | (.39 | ) | | | (.67 | ) | | | (.89 | ) | | | (1.81 | ) |

Net asset value, end of period | | $ | 12.38 | | | $ | 10.82 | | | $ | 14.74 | | | $ | 10.84 | | | $ | 12.13 | | | $ | 12.67 | |

|

Total Return | | | 15.17 | % | | | (14.18 | %) | | | 39.72 | % | | | (5.13 | %) | | | 3.43 | % | | | 13.35 | % |

Ratios/Supplemental Data |

Net assets, end of period (in thousands) | | $ | 694 | | | $ | 784 | | | $ | 1,527 | | | $ | 1,093 | | | $ | 1,444 | | | $ | 1,829 | |

Ratios to average net assets: |

Net investment income (loss) | | | 1.41 | % | | | 0.80 | % | | | 1.87 | % | | | 2.60 | % | | | 2.50 | % | | | 1.84 | % |

Total expensesd | | | 2.28 | % | | | 1.98 | % | | | 1.93 | % | | | 2.06 | % | | | 2.06 | % | | | 2.04 | % |

Net expensese,f,g | | | 1.17 | % | | | 1.20 | % | | | 1.20 | % | | | 1.21 | % | | | 1.22 | % | | | 1.21 | % |

Portfolio turnover rate | | | 35 | % | | | 70 | % | | | 157 | % | | | 114 | % | | | 110 | % | | | 97 | % |

24 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

FINANCIAL HIGHLIGHTS (concluded) |

This table is presented to show selected data for a share outstanding throughout each period and to assist shareholders in evaluating a Fund’s performance for the periods presented.

Institutional Class | | Six Months Ended

March 31, 2023a | | | Year Ended

September 30,

2022 | | | Year Ended

September 30,

2021 | | | Year Ended

September 30,

2020 | | | Year Ended

September 30,

2019 | | | Year Ended

September 30,

2018 | |

Per Share Data |

Net asset value, beginning of period | | $ | 10.29 | | | $ | 14.14 | | | $ | 10.46 | | | $ | 11.70 | | | $ | 12.28 | | | $ | 12.59 | |

Income (loss) from investment operations: |

Net investment income (loss)b | | | .10 | | | | .14 | | | | .30 | | | | .32 | | | | .31 | | | | .25 | |

Net gain (loss) on investments (realized and unrealized) | | | 1.48 | | | | (1.59 | ) | | | 3.86 | | | | (.88 | ) | | | .05 | | | | 1.35 | |

Total from investment operations | | | 1.58 | | | | (1.45 | ) | | | 4.16 | | | | (.56 | ) | | | .36 | | | | 1.60 | |

Less distributions from: |

Net investment income | | | (.09 | ) | | | (.13 | ) | | | (.48 | ) | | | (.36 | ) | | | (.37 | ) | | | (.38 | ) |

Net realized gains | | | — | | | | (2.23 | ) | | | — | | | | (.21 | ) | | | (.57 | ) | | | (1.53 | ) |

Return of capital | | | — | | | | (.04 | ) | | | — | | | | (.11 | ) | | | — | | | | — | |

Total distributions | | | (.09 | ) | | | (2.40 | ) | | | (.48 | ) | | | (.68 | ) | | | (.94 | ) | | | (1.91 | ) |

Net asset value, end of period | | $ | 11.78 | | | $ | 10.29 | | | $ | 14.14 | | | $ | 10.46 | | | $ | 11.70 | | | $ | 12.28 | |

|

Total Return | | | 15.32 | % | | | (13.97 | %) | | | 40.06 | % | | | (4.88 | %) | | | 3.66 | % | | | 13.71 | % |

Ratios/Supplemental Data |

Net assets, end of period (in thousands) | | $ | 6,964 | | | $ | 6,614 | | | $ | 10,101 | | | $ | 6,882 | | | $ | 8,979 | | | $ | 5,203 | |

Ratios to average net assets: |

Net investment income (loss) | | | 1.68 | % | | | 1.08 | % | | | 2.22 | % | | | 2.94 | % | | | 2.76 | % | | | 2.08 | % |

Total expensesd | | | 1.83 | % | | | 1.62 | % | | | 1.62 | % | | | 1.80 | % | | | 1.62 | % | | | 1.78 | % |

Net expensese,f,g | | | 0.92 | % | | | 0.95 | % | | | 0.95 | % | | | 0.96 | % | | | 0.97 | % | | | 0.96 | % |

Portfolio turnover rate | | | 35 | % | | | 70 | % | | | 157 | % | | | 114 | % | | | 110 | % | | | 97 | % |

a | Unaudited figures for the period ended March 31, 2023. Percentage amounts for the period, except total return and portfolio turnover rate, have been annualized. |

b | Net investment income (loss) per share was computed using average shares outstanding throughout the period. |

c | Total return does not reflect the impact of any applicable sales charges. |

d | Does not include expenses of the underlying funds in which the Fund invests. |

e | Net expense information reflects the expense ratios after expense waivers and reimbursements, as applicable. |

f | The portion of the ratios of net expenses to average net assets attributable to recoupments of prior fee reductions or expense reimbursements for the years presented was as follows: |

| 03/31/23a | 09/30/22 | 09/30/21 | 09/30/20 | 09/30/19 | 09/30/18 |

A-Class | — | — | — | 0.00%h | — | — |

C-Class | — | — | — | 0.00%h | — | — |

P-Class | — | — | — | — | — | — |

Institutional Class | — | — | — | — | — | — |

g | Net expenses may include expenses that are excluded from the expense limitation agreement. Excluding these expenses, the net expense ratios for the years presented would be: |

| 03/31/23a | 09/30/22 | 09/30/21 | 09/30/20 | 09/30/19 | 09/30/18 |

A-Class | 1.17% | 1.19% | 1.20% | 1.20% | 1.21% | 1.20% |

C-Class | 1.92% | 1.95% | 1.95% | 1.96% | 1.96% | 1.95% |

P-Class | 1.17% | 1.20% | 1.20% | 1.21% | 1.21% | 1.20% |

Institutional Class | 0.92% | 0.94% | 0.95% | 0.95% | 0.96% | 0.95% |

i | Less than $0.01 per share. |

SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 25 |

PERFORMANCE REPORT AND FUND PROFILE (Unaudited) | March 31, 2023 |

RBP® LARGE-CAP DEFENSIVE FUND

OBJECTIVE: Seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the Guggenheim RBP® Large-Cap Defensive IndexSM (the “Defensive Index” or “Index”).

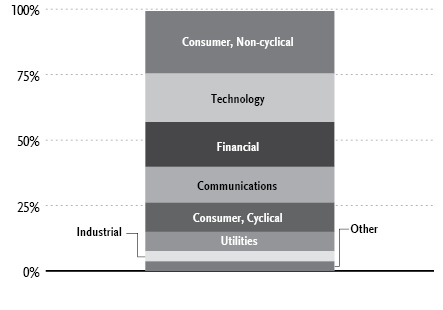

Holdings Diversification (Market Exposure as % of Net Assets)

“Holdings Diversification (Market Exposure as % of Net Assets)” excludes any temporary cash investments.

Inception Dates: |

A-Class | April 27, 2010 |

C-Class | April 18, 2011 |

P-Class | April 27, 2010 |

Institutional Class | February 15, 2011 |

Ten Largest Holdings | (% of Total

Net Assets) |

Apple, Inc. | 8.0% |

Microsoft Corp. | 7.2% |

Alphabet, Inc. — Class C | 4.6% |

Tesla, Inc. | 3.1% |

Exxon Mobil Corp. | 2.6% |

Visa, Inc. — Class A | 2.4% |

Procter & Gamble Co. | 2.4% |

Mastercard, Inc. — Class A | 2.2% |

Home Depot, Inc. | 2.1% |

Merck & Company, Inc. | 2.1% |

Top Ten Total | 36.7% |

| | |

“Ten Largest Holdings” excludes any temporary cash investments. |

26 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | |

PERFORMANCE REPORT AND FUND PROFILE (Unaudited)(concluded) | March 31, 2023 |

Average Annual Returns*

Periods Ended March 31, 2023

| 6 Month† | 1 Year | 5 Year | 10 Year |

A-Class Shares | 13.84% | (10.03%) | 5.79% | 8.30% |

A-Class Shares with sales charge‡ | 8.42% | (14.29%) | 4.76% | 7.66% |

C-Class Shares | 13.48% | (10.71%) | 5.01% | 7.54% |

C-Class Shares with CDSC§ | 12.48% | (11.61%) | 5.01% | 7.54% |

P-Class Shares** | 13.87% | (9.99%) | 5.79% | 8.36% |

Institutional Class Shares | 13.95% | (9.82%) | 6.07% | 8.63% |

Guggenheim RBP Large-Cap Defensive IndexSM | 14.56% | (9.04%) | 7.06% | 9.77% |

Dow Jones U.S. Large-Cap Total Stock Market Index | 15.29% | (8.56%) | 10.91% | 12.05% |

* | The performance data above represents past performance that is not predictive of future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns are historical and include changes in principal and reinvested dividends and capital gains and do not reflect the effect of taxes. The Guggenheim RBP Large-Cap Defensive IndexSM and the Dow Jones U.S Large-Cap Total Stock Market Index are unmanaged indices and, unlike the Fund, have no management fees or operating expenses to reduce their reported return. |

** | F-1 Class shares redesignated as P-Class shares effective May 9, 2016. |

† | 6 month returns are not annualized. |

‡ | Effective May 9, 2016, the maximum sales charge decreased from 5.75% to 4.75%. A 5.75% maximum sales charge is used in the calculation of the Average Annual Return since inception based on subscriptions made prior to May 9, 2016, and a 4.75% maximum sales charge will be used to calculate performance for periods based on subscriptions made on or after May 9, 2016. |

§ | Fund returns include a CDSC of 1% if redeemed within 12 months of purchase. |

| | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 27 |

SCHEDULE OF INVESTMENTS (Unaudited) | March 31, 2023 |

RBP® LARGE-CAP DEFENSIVE FUND | |

| | Shares | | | Value | |

COMMON STOCKS† - 98.3% |

| | | | | | | | | |

Consumer, Non-cyclical - 23.9% |

Procter & Gamble Co. | | | 1,222 | | | $ | 181,699 | |

Merck & Company, Inc. | | | 1,487 | | | | 158,202 | |

Bristol-Myers Squibb Co. | | | 2,028 | | | | 140,561 | |

Abbott Laboratories | | | 1,372 | | | | 138,929 | |

Mondelez International, Inc. — Class A | | | 1,927 | | | | 134,350 | |

Vertex Pharmaceuticals, Inc.* | | | 406 | | | | 127,918 | |

Hershey Co. | | | 471 | | | | 119,827 | |

McKesson Corp. | | | 326 | | | | 116,072 | |