UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811- 22309

Transparent Value Trust

(Exact name of registrant as specified in charter)

702 King Farm Boulevard, Suite 200

Rockville, Maryland 20850

(Address of principal executive offices) (Zip code)

Amy J. Lee

Transparent Value Trust

702 King Farm Boulevard, Suite 200

Rockville, Maryland 20850

(Name and address of agent for service)

Registrant's telephone number, including area code: (301) 296-5100

Date of fiscal year end: September 30

Date of reporting period: October 1, 2023 - September 30, 2024

| Item 1. | Reports to Stockholders. |

| (a) | The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows: |

Annual Shareholder Report | 9.30.24

This annual shareholder report contains important information about the Guggenheim Directional Allocation Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the fund at https://www.guggenheiminvestments.com/mutual-funds/literature. You can also request this information by contacting 800 820 0888 or GuggenheimClientServices@mufg-is.com.

This report describes changes to the fund that occurred during the reporting period.

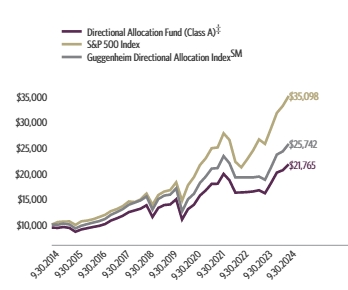

For the period of October 1, 2023 to September 30, 2024, the fund (Class A shares) returned 35.05%, underperforming the fund's benchmark, the S&P 500 Index, which returned 36.35% for the same period and underperforming the fund's secondary index, the Guggenheim Directional Allocation IndexSM, which returned 37.30% for the same period.

The fund's broad-based securities market index was changed from the Dow Jones U.S. Large-Cap Total Stock Market Index to the S&P 500 Index to comply with the regulation that requires the fund's broad-based securities market index to represent the overall applicable market.

What factors materially affected the fund's performance over the last year?

The fund's negative relative results were primarily the result of activity in the fund's allocation model. The allocation model entered the period with a 100% market position. However, at the December 2023 rebalance, the portfolio took on a 50% market / 50% defensive position, reversing back to 100% market in the March 2024 rebalance. Then, in the June 2024 rebalance, the fund again was positioned 50% market / 50 % defensive. The allocation model was impacted from weaker economic conditions and sentiment during both of these more defensive periods (50% market / 50% defensive), yet the overall market did not experience meaningful relative underperformance. At the end of the period, the portfolio maintained a 100% allocation to the Market portfolio.

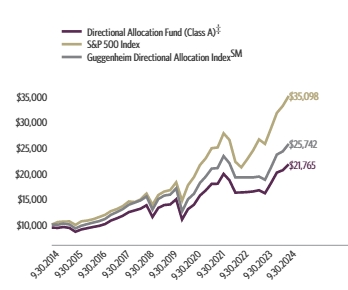

Cumulative performance* for the fund's most recently completed 10 years (as of 9.30.24), assuming a $10,000 initial investment.

| 09/30/2014 | 9423 | 10000 | 10000 |

| 12/31/2014 | 9359 | 10493 | 9978 |

| 03/31/2015 | 9529 | 10593 | 10182 |

| 06/30/2015 | 9351 | 10622 | 10028 |

| 09/30/2015 | 8603 | 9939 | 9254 |

| 12/31/2015 | 9055 | 10638 | 9777 |

| 03/31/2016 | 9299 | 10782 | 10094 |

| 06/30/2016 | 9537 | 11047 | 10398 |

| 09/30/2016 | 9751 | 11472 | 10673 |

| 12/31/2016 | 10107 | 11911 | 11103 |

| 03/31/2017 | 10796 | 12633 | 11914 |

| 06/30/2017 | 11226 | 13023 | 12436 |

| 09/30/2017 | 11730 | 13607 | 13035 |

| 12/31/2017 | 12434 | 14511 | 13873 |

| 03/31/2018 | 12760 | 14401 | 14286 |

| 06/30/2018 | 13101 | 14896 | 14721 |

| 09/30/2018 | 13775 | 16044 | 15484 |

| 12/31/2018 | 11491 | 13875 | 12936 |

| 03/31/2019 | 13264 | 15769 | 14991 |

| 06/30/2019 | 13813 | 16447 | 15663 |

| 09/30/2019 | 13931 | 16727 | 15849 |

| 12/31/2019 | 14940 | 18244 | 17065 |

| 03/31/2020 | 10994 | 14668 | 12568 |

| 06/30/2020 | 13016 | 17682 | 14943 |

| 09/30/2020 | 13879 | 19260 | 16017 |

| 12/31/2020 | 15661 | 21600 | 18121 |

| 03/31/2021 | 16673 | 22934 | 19371 |

| 06/30/2021 | 17942 | 24895 | 20920 |

| 09/30/2021 | 17962 | 25040 | 21025 |

| 12/31/2021 | 19888 | 27801 | 23360 |

| 03/31/2022 | 18653 | 26522 | 21976 |

| 06/30/2022 | 16240 | 22252 | 19208 |

| 09/30/2022 | 16274 | 21165 | 19208 |

| 12/31/2022 | 16346 | 22766 | 19208 |

| 03/31/2023 | 16461 | 24473 | 19208 |

| 06/30/2023 | 16702 | 26612 | 19369 |

| 09/30/2023 | 16117 | 25741 | 18749 |

| 12/31/2023 | 18075 | 28750 | 21130 |

| 03/31/2024 | 20154 | 31785 | 23662 |

| 06/30/2024 | 20609 | 33147 | 24282 |

| 09/30/2024 | 21765 | 35098 | 25742 |

| Class A (without sales charge) | 35.05% | 9.33% | 8.73% |

| Class A (with sales charge)† | 28.63% | 8.28% | 8.09% |

| S&P 500 Index | 36.35% | 15.98% | 13.38% |

| Guggenheim Directional Allocation IndexSMGuggenheim Directional Allocation IndexSM | 37.30% | 10.19% | 9.92% |

The fund's past performance is not a good predictor of the fund's future performance. Visit GuggenheimInvestments.com/mutual-funds/performance for more recent performance information.

| Net Assets | $204,610,948 |

| Total Number of Portfolio Holdings | 140 |

| Portfolio Turnover Rate | 125% |

| Total Advisory Fees Paid | $1,634,512 |

| Guggenheim Directional Allocation Fund | Class A | TVRAX | Annual Shareholder Report | September 30, 2024 |

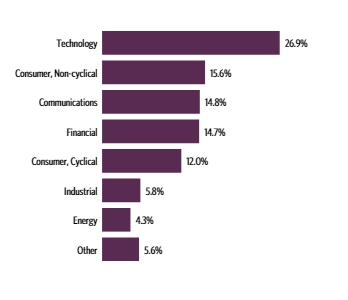

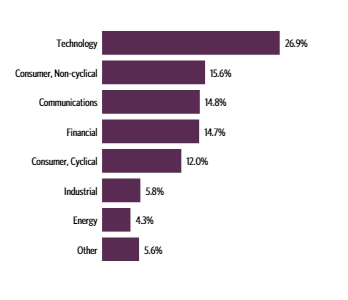

| Technology | 26.9% |

| Consumer, Non-cyclical | 15.6% |

| Communications | 14.8% |

| Financial | 14.7% |

| Consumer, Cyclical | 12.0% |

| Industrial | 5.8% |

| Energy | 4.3% |

| Other | 5.6% |

| Microsoft Corp. | 7.1% |

| Apple, Inc. | 5.4% |

| NVIDIA Corp. | 5.0% |

| Alphabet, Inc. — Class C | 4.4% |

| Meta Platforms, Inc. — Class A | 3.2% |

| Amazon.com, Inc. | 2.3% |

| Tesla, Inc. | 2.1% |

| JPMorgan Chase & Co. | 2.0% |

| Visa, Inc. — Class A | 1.7% |

| Mastercard, Inc. — Class A | 1.7% |

| Top 10 Total | 34.9% |

| |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

| |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

| Microsoft Corp. | 7.1% |

| Apple, Inc. | 5.4% |

| NVIDIA Corp. | 5.0% |

| Alphabet, Inc. — Class C | 4.4% |

| Meta Platforms, Inc. — Class A | 3.2% |

| Amazon.com, Inc. | 2.3% |

| Tesla, Inc. | 2.1% |

| JPMorgan Chase & Co. | 2.0% |

| Visa, Inc. — Class A | 1.7% |

| Mastercard, Inc. — Class A | 1.7% |

| Top 10 Total | 34.9% |

| |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

There were no changes in or disagreements with fund accountants for the period.

This is a summary of certain changes to the fund since September 30, 2023.

Subsequent to the September 30, 2024 year-end, on October 25, 2024, the fund was reorganized into New Age Alpha Allocation Fund, a series of New Age Alpha Funds Trust, pursuant to an Agreement and Plan of Reorganization approved by the Board of Trustees and shareholders of the fund.

| |  | Availability of Additional Information. For additional information, including financial information, holdings and proxy voting information, go to https://www.guggenheiminvestments.com/mutual-funds/literature or, call 800 820 0888. |

AR-TVRAX-093024

Annual Shareholder Report | 9.30.24

This annual shareholder report contains important information about the Guggenheim Directional Allocation Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the fund at https://www.guggenheiminvestments.com/mutual-funds/literature. You can also request this information by contacting 800 820 0888 or GuggenheimClientServices@mufg-is.com.

This report describes changes to the fund that occurred during the reporting period.

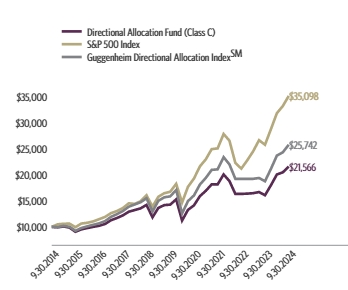

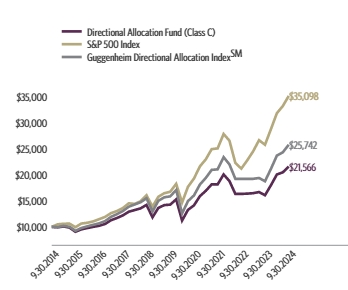

For the period of October 1, 2023 to September 30, 2024, the fund (Class C shares) returned 34.24%, underperforming the fund's benchmark, the S&P 500 Index, which returned 36.35% for the same period and underperforming the fund's secondary index, the Guggenheim Directional Allocation IndexSM, which returned 37.30% for the same period.

The fund's broad-based securities market index was changed from the Dow Jones U.S. Large-Cap Total Stock Market Index to the S&P 500 Index to comply with the regulation that requires the fund's broad-based securities market index to represent the overall applicable market.

What factors materially affected the fund's performance over the last year?

The fund's negative relative results were primarily the result of activity in the fund's allocation model. The allocation model entered the period with a 100% market position. However, at the December 2023 rebalance, the portfolio took on a 50% market / 50% defensive position, reversing back to 100% market in the March 2024 rebalance. Then, in the June 2024 rebalance, the fund again was positioned 50% market / 50 % defensive. The allocation model was impacted from weaker economic conditions and sentiment during both of these more defensive periods (50% market / 50% defensive), yet the overall market did not experience meaningful relative underperformance. At the end of the period, the portfolio maintained a 100% allocation to the Market portfolio.

Cumulative performance* for the fund's most recently completed 10 years (as of 9.30.24), assuming a $10,000 initial investment.

| 09/30/2014 | 10000 | 10000 | 10000 |

| 12/31/2014 | 9916 | 10493 | 9978 |

| 03/31/2015 | 10076 | 10593 | 10182 |

| 06/30/2015 | 9868 | 10622 | 10028 |

| 09/30/2015 | 9063 | 9939 | 9254 |

| 12/31/2015 | 9525 | 10638 | 9777 |

| 03/31/2016 | 9773 | 10782 | 10094 |

| 06/30/2016 | 10004 | 11047 | 10398 |

| 09/30/2016 | 10211 | 11472 | 10673 |

| 12/31/2016 | 10562 | 11911 | 11103 |

| 03/31/2017 | 11272 | 12633 | 11914 |

| 06/30/2017 | 11695 | 13023 | 12436 |

| 09/30/2017 | 12198 | 13607 | 13035 |

| 12/31/2017 | 12908 | 14511 | 13873 |

| 03/31/2018 | 13219 | 14401 | 14286 |

| 06/30/2018 | 13546 | 14896 | 14721 |

| 09/30/2018 | 14208 | 16044 | 15484 |

| 12/31/2018 | 11828 | 13875 | 12936 |

| 03/31/2019 | 13630 | 15769 | 14991 |

| 06/30/2019 | 14170 | 16447 | 15663 |

| 09/30/2019 | 14262 | 16727 | 15849 |

| 12/31/2019 | 15271 | 18244 | 17065 |

| 03/31/2020 | 11212 | 14668 | 12568 |

| 06/30/2020 | 13263 | 17682 | 14943 |

| 09/30/2020 | 14121 | 19260 | 16017 |

| 12/31/2020 | 15890 | 21600 | 18121 |

| 03/31/2021 | 16899 | 22934 | 19371 |

| 06/30/2021 | 18147 | 24895 | 20920 |

| 09/30/2021 | 18147 | 25040 | 21025 |

| 12/31/2021 | 20047 | 27801 | 23360 |

| 03/31/2022 | 18779 | 26522 | 21976 |

| 06/30/2022 | 16319 | 22252 | 19208 |

| 09/30/2022 | 16319 | 21165 | 19208 |

| 12/31/2022 | 16370 | 22766 | 19208 |

| 03/31/2023 | 16458 | 24473 | 19208 |

| 06/30/2023 | 16674 | 26612 | 19369 |

| 09/30/2023 | 16065 | 25741 | 18749 |

| 12/31/2023 | 17991 | 28750 | 21130 |

| 03/31/2024 | 20041 | 31785 | 23662 |

| 06/30/2024 | 20451 | 33147 | 24282 |

| 09/30/2024 | 21566 | 35098 | 25742 |

| Class C (without CDSC) | 34.24% | 8.62% | 7.99% |

| Class C (with CDSC)‡ | 33.24% | 8.62% | 7.99% |

| S&P 500 Index | 36.35% | 15.98% | 13.38% |

| Guggenheim Directional Allocation IndexSMGuggenheim Directional Allocation IndexSM | 37.30% | 10.19% | 9.92% |

The fund's past performance is not a good predictor of the fund's future performance. Visit GuggenheimInvestments.com/mutual-funds/performance for more recent performance information.

| Net Assets | $204,610,948 |

| Total Number of Portfolio Holdings | 140 |

| Portfolio Turnover Rate | 125% |

| Total Advisory Fees Paid | $1,634,512 |

| Guggenheim Directional Allocation Fund | Class C | TVRCX | Annual Shareholder Report | September 30, 2024 |

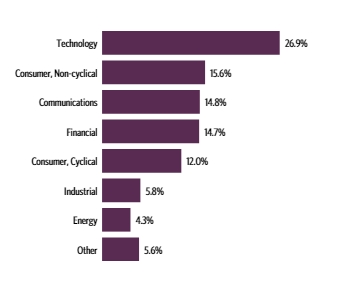

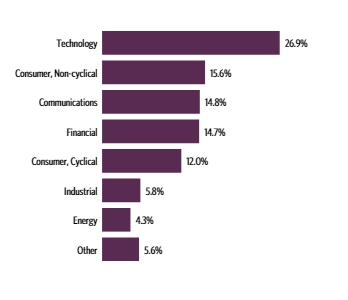

| Technology | 26.9% |

| Consumer, Non-cyclical | 15.6% |

| Communications | 14.8% |

| Financial | 14.7% |

| Consumer, Cyclical | 12.0% |

| Industrial | 5.8% |

| Energy | 4.3% |

| Other | 5.6% |

| Microsoft Corp. | 7.1% |

| Apple, Inc. | 5.4% |

| NVIDIA Corp. | 5.0% |

| Alphabet, Inc. — Class C | 4.4% |

| Meta Platforms, Inc. — Class A | 3.2% |

| Amazon.com, Inc. | 2.3% |

| Tesla, Inc. | 2.1% |

| JPMorgan Chase & Co. | 2.0% |

| Visa, Inc. — Class A | 1.7% |

| Mastercard, Inc. — Class A | 1.7% |

| Top 10 Total | 34.9% |

| |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

| |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

| Microsoft Corp. | 7.1% |

| Apple, Inc. | 5.4% |

| NVIDIA Corp. | 5.0% |

| Alphabet, Inc. — Class C | 4.4% |

| Meta Platforms, Inc. — Class A | 3.2% |

| Amazon.com, Inc. | 2.3% |

| Tesla, Inc. | 2.1% |

| JPMorgan Chase & Co. | 2.0% |

| Visa, Inc. — Class A | 1.7% |

| Mastercard, Inc. — Class A | 1.7% |

| Top 10 Total | 34.9% |

| |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

There were no changes in or disagreements with fund accountants for the period.

This is a summary of certain changes to the fund since September 30, 2023.

Subsequent to the September 30, 2024 year-end, on October 25, 2024, the fund was reorganized into New Age Alpha Allocation Fund, a series of New Age Alpha Funds Trust, pursuant to an Agreement and Plan of Reorganization approved by the Board of Trustees and shareholders of the fund.

| |  | Availability of Additional Information. For additional information, including financial information, holdings and proxy voting information, go to https://www.guggenheiminvestments.com/mutual-funds/literature or, call 800 820 0888. |

AR-TVRCX-093024

Annual Shareholder Report | 9.30.24

This annual shareholder report contains important information about the Guggenheim Directional Allocation Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the fund at https://www.guggenheiminvestments.com/mutual-funds/literature. You can also request this information by contacting 800 820 0888 or GuggenheimClientServices@mufg-is.com.

This report describes changes to the fund that occurred during the reporting period.

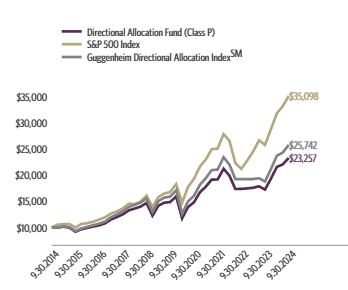

For the period of October 1, 2023 to September 30, 2024, the fund (Class P shares) returned 35.26%, underperforming the fund's benchmark, the S&P 500 Index, which returned 36.35% for the same period and underperforming the fund's secondary index, the Guggenheim Directional Allocation IndexSM, which returned 37.30% for the same period.

The fund's broad-based securities market index was changed from the Dow Jones U.S. Large-Cap Total Stock Market Index to the S&P 500 Index to comply with the regulation that requires the fund's broad-based securities market index to represent the overall applicable market.

What factors materially affected the fund's performance over the last year?

The fund's negative relative results were primarily the result of activity in the fund's allocation model. The allocation model entered the period with a 100% market position. However, at the December 2023 rebalance, the portfolio took on a 50% market / 50% defensive position, reversing back to 100% market in the March 2024 rebalance. Then, in the June 2024 rebalance, the fund again was positioned 50% market / 50 % defensive. The allocation model was impacted from weaker economic conditions and sentiment during both of these more defensive periods (50% market / 50% defensive), yet the overall market did not experience meaningful relative underperformance. At the end of the period, the portfolio maintained a 100% allocation to the Market portfolio.

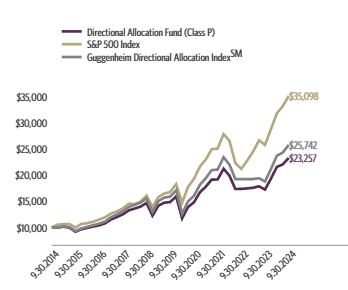

Cumulative performance* for the fund's most recently completed 10 years (as of 9.30.24), assuming a $10,000 initial investment.

| 09/30/2014 | 10000 | 10000 | 10000 |

| 12/31/2014 | 9931 | 10493 | 9978 |

| 03/31/2015 | 10112 | 10593 | 10182 |

| 06/30/2015 | 9923 | 10622 | 10028 |

| 09/30/2015 | 9139 | 9939 | 9254 |

| 12/31/2015 | 9618 | 10638 | 9777 |

| 03/31/2016 | 9884 | 10782 | 10094 |

| 06/30/2016 | 10135 | 11047 | 10398 |

| 09/30/2016 | 10371 | 11472 | 10673 |

| 12/31/2016 | 10747 | 11911 | 11103 |

| 03/31/2017 | 11485 | 12633 | 11914 |

| 06/30/2017 | 11940 | 13023 | 12436 |

| 09/30/2017 | 12473 | 13607 | 13035 |

| 12/31/2017 | 13226 | 14511 | 13873 |

| 03/31/2018 | 13571 | 14401 | 14286 |

| 06/30/2018 | 13940 | 14896 | 14721 |

| 09/30/2018 | 14646 | 16044 | 15484 |

| 12/31/2018 | 12221 | 13875 | 12936 |

| 03/31/2019 | 14106 | 15769 | 14991 |

| 06/30/2019 | 14695 | 16447 | 15663 |

| 09/30/2019 | 14820 | 16727 | 15849 |

| 12/31/2019 | 15897 | 18244 | 17065 |

| 03/31/2020 | 11695 | 14668 | 12568 |

| 06/30/2020 | 13854 | 17682 | 14943 |

| 09/30/2020 | 14776 | 19260 | 16017 |

| 12/31/2020 | 16664 | 21600 | 18121 |

| 03/31/2021 | 17754 | 22934 | 19371 |

| 06/30/2021 | 19106 | 24895 | 20920 |

| 09/30/2021 | 19127 | 25040 | 21025 |

| 12/31/2021 | 21183 | 27801 | 23360 |

| 03/31/2022 | 19867 | 26522 | 21976 |

| 06/30/2022 | 17308 | 22252 | 19208 |

| 09/30/2022 | 17333 | 21165 | 19208 |

| 12/31/2022 | 17424 | 22766 | 19208 |

| 03/31/2023 | 17545 | 24473 | 19208 |

| 06/30/2023 | 17824 | 26612 | 19369 |

| 09/30/2023 | 17194 | 25741 | 18749 |

| 12/31/2023 | 19296 | 28750 | 21130 |

| 03/31/2024 | 21529 | 31785 | 23662 |

| 06/30/2024 | 22011 | 33147 | 24282 |

| 09/30/2024 | 23257 | 35098 | 25742 |

| Class P ** | 35.26% | 9.43% | 8.81% |

| S&P 500 Index | 36.35% | 15.98% | 13.38% |

| Guggenheim Directional Allocation IndexSMGuggenheim Directional Allocation IndexSM | 37.30% | 10.19% | 9.92% |

The fund's past performance is not a good predictor of the fund's future performance. Visit GuggenheimInvestments.com/mutual-funds/performance for more recent performance information.

| Net Assets | $204,610,948 |

| Total Number of Portfolio Holdings | 140 |

| Portfolio Turnover Rate | 125% |

| Total Advisory Fees Paid | $1,634,512 |

| Guggenheim Directional Allocation Fund | Class P | TVFRX | Annual Shareholder Report | September 30, 2024 |

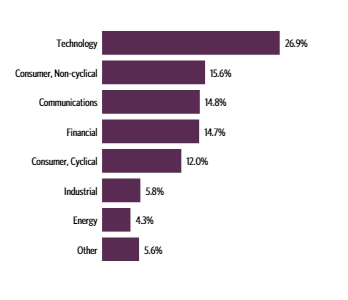

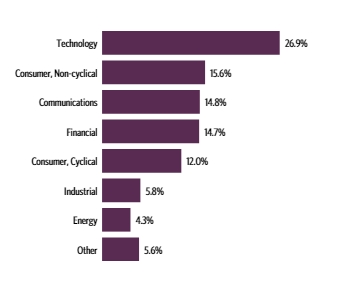

| Technology | 26.9% |

| Consumer, Non-cyclical | 15.6% |

| Communications | 14.8% |

| Financial | 14.7% |

| Consumer, Cyclical | 12.0% |

| Industrial | 5.8% |

| Energy | 4.3% |

| Other | 5.6% |

| Microsoft Corp. | 7.1% |

| Apple, Inc. | 5.4% |

| NVIDIA Corp. | 5.0% |

| Alphabet, Inc. — Class C | 4.4% |

| Meta Platforms, Inc. — Class A | 3.2% |

| Amazon.com, Inc. | 2.3% |

| Tesla, Inc. | 2.1% |

| JPMorgan Chase & Co. | 2.0% |

| Visa, Inc. — Class A | 1.7% |

| Mastercard, Inc. — Class A | 1.7% |

| Top 10 Total | 34.9% |

| |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

| |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

| Microsoft Corp. | 7.1% |

| Apple, Inc. | 5.4% |

| NVIDIA Corp. | 5.0% |

| Alphabet, Inc. — Class C | 4.4% |

| Meta Platforms, Inc. — Class A | 3.2% |

| Amazon.com, Inc. | 2.3% |

| Tesla, Inc. | 2.1% |

| JPMorgan Chase & Co. | 2.0% |

| Visa, Inc. — Class A | 1.7% |

| Mastercard, Inc. — Class A | 1.7% |

| Top 10 Total | 34.9% |

| |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

There were no changes in or disagreements with fund accountants for the period.

This is a summary of certain changes to the fund since September 30, 2023.

Subsequent to the September 30, 2024 year-end, on October 25, 2024, the fund was reorganized into New Age Alpha Allocation Fund, a series of New Age Alpha Funds Trust, pursuant to an Agreement and Plan of Reorganization approved by the Board of Trustees and shareholders of the fund.

| |  | Availability of Additional Information. For additional information, including financial information, holdings and proxy voting information, go to https://www.guggenheiminvestments.com/mutual-funds/literature or, call 800 820 0888. |

AR-TVFRX-093024

Annual Shareholder Report | 9.30.24

This annual shareholder report contains important information about the Guggenheim Directional Allocation Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the fund at https://www.guggenheiminvestments.com/mutual-funds/literature. You can also request this information by contacting 800 820 0888 or GuggenheimClientServices@mufg-is.com.

This report describes changes to the fund that occurred during the reporting period.

| Institutional Class | $126 | 1.07% |

For the period of October 1, 2023 to September 30, 2024, the fund (Institutional Class shares) returned 35.55%, underperforming the fund's benchmark, the S&P 500 Index, which returned 36.35% for the same period and underperforming the fund's secondary index, the Guggenheim Directional Allocation IndexSM, which returned 37.30% for the same period.

The fund's broad-based securities market index was changed from the Dow Jones U.S. Large-Cap Total Stock Market Index to the S&P 500 Index to comply with the regulation that requires the fund's broad-based securities market index to represent the overall applicable market.

What factors materially affected the fund's performance over the last year?

The fund's negative relative results were primarily the result of activity in the fund's allocation model. The allocation model entered the period with a 100% market position. However, at the December 2023 rebalance, the portfolio took on a 50% market / 50% defensive position, reversing back to 100% market in the March 2024 rebalance. Then, in the June 2024 rebalance, the fund again was positioned 50% market / 50 % defensive. The allocation model was impacted from weaker economic conditions and sentiment during both of these more defensive periods (50% market / 50% defensive), yet the overall market did not experience meaningful relative underperformance. At the end of the period, the portfolio maintained a 100% allocation to the Market portfolio.

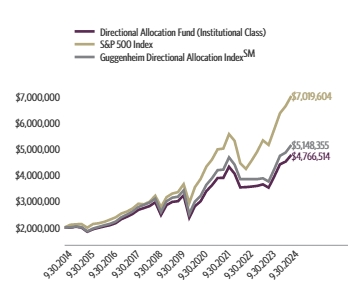

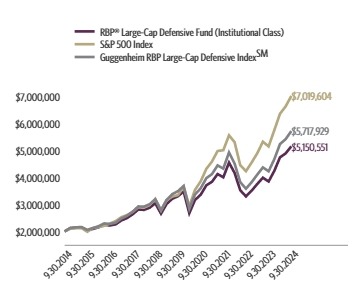

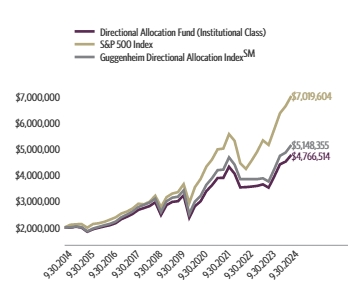

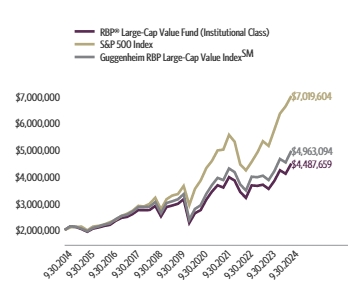

Cumulative performance* for the fund's most recently completed 10 years (as of 9.30.24), assuming a $2,000,000 initial investment.

| 09/30/2014 | 2000000 | 2000000 | 2000000 |

| 12/31/2014 | 1987838 | 2098653 | 1995683 |

| 03/31/2015 | 2025257 | 2118603 | 2036428 |

| 06/30/2015 | 1989398 | 2124494 | 2005541 |

| 09/30/2015 | 1831930 | 1987710 | 1850880 |

| 12/31/2015 | 1928593 | 2127695 | 1955411 |

| 03/31/2016 | 1983161 | 2156373 | 2018710 |

| 06/30/2016 | 2036170 | 2209317 | 2079598 |

| 09/30/2016 | 2082943 | 2294422 | 2134535 |

| 12/31/2016 | 2160897 | 2382166 | 2220540 |

| 03/31/2017 | 2310570 | 2526671 | 2382828 |

| 06/30/2017 | 2404115 | 2604699 | 2487166 |

| 09/30/2017 | 2513251 | 2721399 | 2607023 |

| 12/31/2017 | 2667601 | 2902230 | 2774628 |

| 03/31/2018 | 2737760 | 2880198 | 2857260 |

| 06/30/2018 | 2812596 | 2979101 | 2944224 |

| 09/30/2018 | 2957592 | 3208812 | 3096809 |

| 12/31/2018 | 2469201 | 2774986 | 2587157 |

| 03/31/2019 | 2851803 | 3153716 | 2998165 |

| 06/30/2019 | 2972252 | 3289447 | 3132546 |

| 09/30/2019 | 2998821 | 3345311 | 3169841 |

| 12/31/2019 | 3221410 | 3648730 | 3412979 |

| 03/31/2020 | 2370510 | 2933652 | 2513603 |

| 06/30/2020 | 2809417 | 3536320 | 2988697 |

| 09/30/2020 | 2997816 | 3852094 | 3203457 |

| 12/31/2020 | 3384864 | 4320052 | 3624174 |

| 03/31/2021 | 3607061 | 4586814 | 3874249 |

| 06/30/2021 | 3883249 | 4978933 | 4184005 |

| 09/30/2021 | 3891556 | 5007913 | 4204941 |

| 12/31/2021 | 4313578 | 5560141 | 4671909 |

| 03/31/2022 | 4049189 | 5304457 | 4395104 |

| 06/30/2022 | 3527559 | 4450380 | 3841532 |

| 09/30/2022 | 3537086 | 4233086 | 3841532 |

| 12/31/2022 | 3557292 | 4553151 | 3841532 |

| 03/31/2023 | 3583678 | 4894505 | 3841532 |

| 06/30/2023 | 3641247 | 5322389 | 3873721 |

| 09/30/2023 | 3516514 | 5148165 | 3749849 |

| 12/31/2023 | 3948838 | 5750067 | 4225982 |

| 03/31/2024 | 4406639 | 6357039 | 4732447 |

| 06/30/2024 | 4509460 | 6629362 | 4856392 |

| 09/30/2024 | 4766514 | 7019604 | 5148355 |

| Institutional Class | 35.55% | 9.71% | 9.07% |

| S&P 500 Index | 36.35% | 15.98% | 13.38% |

| Guggenheim Directional Allocation IndexSMGuggenheim Directional Allocation IndexSM | 37.30% | 10.19% | 9.92% |

The fund's past performance is not a good predictor of the fund's future performance. Visit GuggenheimInvestments.com/mutual-funds/performance for more recent performance information.

| Net Assets | $204,610,948 |

| Total Number of Portfolio Holdings | 140 |

| Portfolio Turnover Rate | 125% |

| Total Advisory Fees Paid | $1,634,512 |

| Guggenheim Directional Allocation Fund | Institutional Class | TVRIX | Annual Shareholder Report | September 30, 2024 |

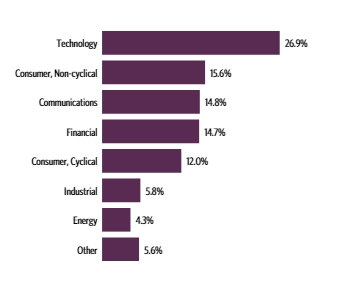

| Technology | 26.9% |

| Consumer, Non-cyclical | 15.6% |

| Communications | 14.8% |

| Financial | 14.7% |

| Consumer, Cyclical | 12.0% |

| Industrial | 5.8% |

| Energy | 4.3% |

| Other | 5.6% |

| Microsoft Corp. | 7.1% |

| Apple, Inc. | 5.4% |

| NVIDIA Corp. | 5.0% |

| Alphabet, Inc. — Class C | 4.4% |

| Meta Platforms, Inc. — Class A | 3.2% |

| Amazon.com, Inc. | 2.3% |

| Tesla, Inc. | 2.1% |

| JPMorgan Chase & Co. | 2.0% |

| Visa, Inc. — Class A | 1.7% |

| Mastercard, Inc. — Class A | 1.7% |

| Top 10 Total | 34.9% |

| |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

| |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

| Microsoft Corp. | 7.1% |

| Apple, Inc. | 5.4% |

| NVIDIA Corp. | 5.0% |

| Alphabet, Inc. — Class C | 4.4% |

| Meta Platforms, Inc. — Class A | 3.2% |

| Amazon.com, Inc. | 2.3% |

| Tesla, Inc. | 2.1% |

| JPMorgan Chase & Co. | 2.0% |

| Visa, Inc. — Class A | 1.7% |

| Mastercard, Inc. — Class A | 1.7% |

| Top 10 Total | 34.9% |

| |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

There were no changes in or disagreements with fund accountants for the period.

This is a summary of certain changes to the fund since September 30, 2023.

Subsequent to the September 30, 2024 year-end, on October 25, 2024, the fund was reorganized into New Age Alpha Allocation Fund, a series of New Age Alpha Funds Trust, pursuant to an Agreement and Plan of Reorganization approved by the Board of Trustees and shareholders of the fund.

| |  | Availability of Additional Information. For additional information, including financial information, holdings and proxy voting information, go to https://www.guggenheiminvestments.com/mutual-funds/literature or, call 800 820 0888. |

AR-TVRIX-093024

Annual Shareholder Report | 9.30.24

This annual shareholder report contains important information about the Guggenheim RBP® Dividend Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the fund at https://www.guggenheiminvestments.com/mutual-funds/literature. You can also request this information by contacting 800 820 0888 or GuggenheimClientServices@mufg-is.com.

This report describes changes to the fund that occurred during the reporting period.

For the period of October 1, 2023 to September 30, 2024, the fund (Class A shares) returned 36.91%, outperforming the fund's benchmark, the S&P 500 Index, which returned 36.35% for the same period and underperforming the fund's secondary index, the Guggenheim RBP Dividend IndexSM, which returned 39.03% for the same period.

The fund's broad-based securities market index was changed from the Dow Jones U.S. Large-Cap Total Stock Market Index to the S&P 500 Index to comply with the regulation that requires the fund's broad-based securities market index to represent the overall applicable market.

What factors materially affected the fund's performance over the last year?

The fund's leading contributor was strong security selection in Information Technology and Health Care. An overweight holding in Nvidia Corp. was the largest benefit to the Information Technology sector, up 179% over the period. The biggest contribution to the Health Care sector's strong performance was an overweight position in Eli Lily, which rose 66% over the period. Among detractors was an underweight exposure to Energy and Information Technology. Security selection in Communication Services and Materials also detracted from performance. From a selection standpoint, an underweight in Meta Platforms was the largest negative individual contributor, as the stock soared 91% over the period. At the end of the period, the portfolio was most overweight in Utilities and Real Estate and most underweight in Information Technology and Health Care. Relative to the benchmark and consistent with the investment mandate, the portfolio has a larger exposure to dividend-yielding names, as well as smaller value companies.

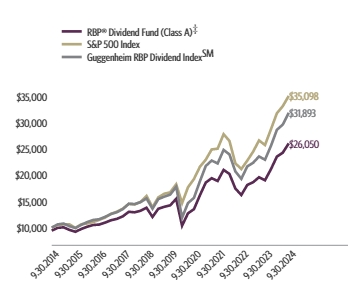

Cumulative performance* for the fund's most recently completed 10 years (as of 9.30.24), assuming a $10,000 initial investment.

| 09/30/2014 | 9422 | 10000 | 10000 |

| 12/31/2014 | 9954 | 10493 | 10612 |

| 03/31/2015 | 10055 | 10593 | 10771 |

| 06/30/2015 | 9562 | 10622 | 10272 |

| 09/30/2015 | 9208 | 9939 | 9920 |

| 12/31/2015 | 9748 | 10638 | 10543 |

| 03/31/2016 | 10172 | 10782 | 11058 |

| 06/30/2016 | 10496 | 11047 | 11455 |

| 09/30/2016 | 10578 | 11472 | 11593 |

| 12/31/2016 | 10954 | 11911 | 12051 |

| 03/31/2017 | 11397 | 12633 | 12587 |

| 06/30/2017 | 11662 | 13023 | 12933 |

| 09/30/2017 | 12151 | 13607 | 13531 |

| 12/31/2017 | 13015 | 14511 | 14554 |

| 03/31/2018 | 12915 | 14401 | 14487 |

| 06/30/2018 | 13209 | 14896 | 14864 |

| 09/30/2018 | 13778 | 16044 | 15558 |

| 12/31/2018 | 12032 | 13875 | 13604 |

| 03/31/2019 | 13597 | 15769 | 15435 |

| 06/30/2019 | 13958 | 16447 | 15893 |

| 09/30/2019 | 14248 | 16727 | 16291 |

| 12/31/2019 | 15486 | 18244 | 17779 |

| 03/31/2020 | 10360 | 14668 | 11901 |

| 06/30/2020 | 12720 | 17682 | 14672 |

| 09/30/2020 | 13513 | 19260 | 15668 |

| 12/31/2020 | 16168 | 21600 | 18831 |

| 03/31/2021 | 18587 | 22934 | 21738 |

| 06/30/2021 | 19416 | 24895 | 22781 |

| 09/30/2021 | 18885 | 25040 | 22226 |

| 12/31/2021 | 20996 | 27801 | 24804 |

| 03/31/2022 | 20233 | 26522 | 23953 |

| 06/30/2022 | 17455 | 22252 | 20713 |

| 09/30/2022 | 16216 | 21165 | 19298 |

| 12/31/2022 | 18132 | 22766 | 21667 |

| 03/31/2023 | 18649 | 24473 | 22352 |

| 06/30/2023 | 19598 | 26612 | 23558 |

| 09/30/2023 | 19028 | 25741 | 22939 |

| 12/31/2023 | 21143 | 28750 | 25585 |

| 03/31/2024 | 23531 | 31785 | 28632 |

| 06/30/2024 | 24278 | 33147 | 29633 |

| 09/30/2024 | 26050 | 35098 | 31893 |

| Class A (without sales charge) | 36.91% | 12.83% | 10.70% |

| Class A (with sales charge)† | 30.39% | 11.73% | 10.05% |

| S&P 500 Index | 36.35% | 15.98% | 13.38% |

| Guggenheim RBP Dividend IndexSMGuggenheim RBP Dividend IndexSM | 39.03% | 14.38% | 12.30% |

The fund's past performance is not a good predictor of the fund's future performance. Visit GuggenheimInvestments.com/mutual-funds/performance for more recent performance information.

| Net Assets | $17,349,060 |

| Total Number of Portfolio Holdings | 108 |

| Portfolio Turnover Rate | 69% |

| Total Advisory Fees Paid | $0 |

The fund incurred $119,773 of advisory fees which were fully waived/reimbursed by the Adviser to ensure each Share Class of the fund operated at its applicable operating expense cap.

| Guggenheim RBP® Dividend Fund | Class A | TVEAX | Annual Shareholder Report | September 30, 2024 |

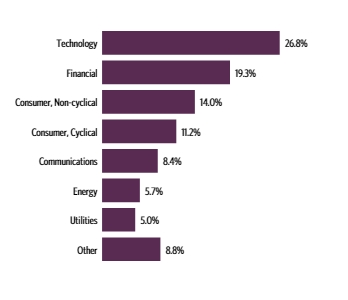

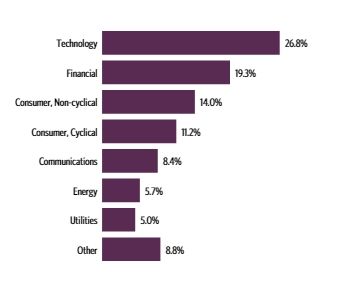

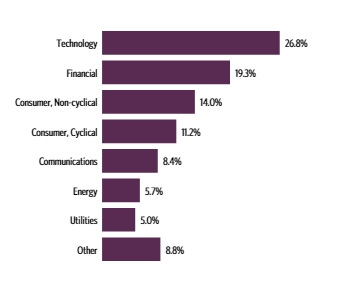

| Technology | 26.8% |

| Financial | 19.3% |

| Consumer, Non-cyclical | 14.0% |

| Consumer, Cyclical | 11.2% |

| Communications | 8.4% |

| Energy | 5.7% |

| Utilities | 5.0% |

| Other | 8.8% |

| Microsoft Corp. | 7.0% |

| NVIDIA Corp. | 6.4% |

| Apple, Inc. | 5.7% |

| Meta Platforms, Inc. — Class A | 3.4% |

| Alphabet, Inc. — Class C | 2.3% |

| Broadcom, Inc. | 2.3% |

| Eli Lilly & Co. | 2.2% |

| Mastercard, Inc. — Class A | 1.7% |

| Walmart, Inc. | 1.6% |

| Oracle Corp. | 1.5% |

| Top 10 Total | 34.1% |

| |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

| |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

| Microsoft Corp. | 7.0% |

| NVIDIA Corp. | 6.4% |

| Apple, Inc. | 5.7% |

| Meta Platforms, Inc. — Class A | 3.4% |

| Alphabet, Inc. — Class C | 2.3% |

| Broadcom, Inc. | 2.3% |

| Eli Lilly & Co. | 2.2% |

| Mastercard, Inc. — Class A | 1.7% |

| Walmart, Inc. | 1.6% |

| Oracle Corp. | 1.5% |

| Top 10 Total | 34.1% |

| |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

There were no changes in or disagreements with fund accountants for the period.

This is a summary of certain changes to the fund since September 30, 2023.

Subsequent to the September 30, 2024 year-end, on October 25, 2024, the fund was reorganized into New Age Alpha Large Cap Value Fund, a series of New Age Alpha Funds Trust, pursuant to an Agreement and Plan of Reorganization approved by the Board of Trustees and shareholders of the fund.

| |  | Availability of Additional Information. For additional information, including financial information, holdings and proxy voting information, go to https://www.guggenheiminvestments.com/mutual-funds/literature or, call 800 820 0888. |

AR-TVEAX-093024

Annual Shareholder Report | 9.30.24

This annual shareholder report contains important information about the Guggenheim RBP® Dividend Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the fund at https://www.guggenheiminvestments.com/mutual-funds/literature. You can also request this information by contacting 800 820 0888 or GuggenheimClientServices@mufg-is.com.

This report describes changes to the fund that occurred during the reporting period.

For the period of October 1, 2023 to September 30, 2024, the fund (Class C shares) returned 35.81%, underperforming the fund's benchmark, the S&P 500 Index, which returned 36.35% for the same period and underperforming the fund's secondary index, the Guggenheim RBP Dividend IndexSM, which returned 39.03% for the same period.

The fund's broad-based securities market index was changed from the Dow Jones U.S. Large-Cap Total Stock Market Index to the S&P 500 Index to comply with the regulation that requires the fund's broad-based securities market index to represent the overall applicable market.

What factors materially affected the fund's performance over the last year?

The fund's leading contributor was strong security selection in Information Technology and Health Care. An overweight holding in Nvidia Corp. was the largest benefit to the Information Technology sector, up 179% over the period. The biggest contribution to the Health Care sector's strong performance was an overweight position in Eli Lily, which rose 66% over the period. Among detractors was an underweight exposure to Energy and Information Technology. Security selection in Communication Services and Materials also detracted from performance. From a selection standpoint, an underweight in Meta Platforms was the largest negative individual contributor, as the stock soared 91% over the period. At the end of the period, the portfolio was most overweight in Utilities and Real Estate and most underweight in Information Technology and Health Care. Relative to the benchmark and consistent with the investment mandate, the portfolio has a larger exposure to dividend-yielding names, as well as smaller value companies.

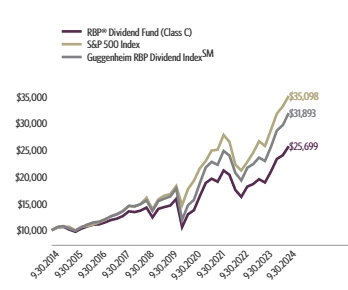

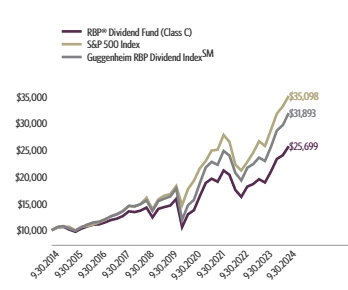

Cumulative performance* for the fund's most recently completed 10 years (as of 9.30.24), assuming a $10,000 initial investment.

| 09/30/2014 | 10000 | 10000 | 10000 |

| 12/31/2014 | 10552 | 10493 | 10612 |

| 03/31/2015 | 10641 | 10593 | 10771 |

| 06/30/2015 | 10097 | 10622 | 10272 |

| 09/30/2015 | 9707 | 9939 | 9920 |

| 12/31/2015 | 10277 | 10638 | 10543 |

| 03/31/2016 | 10701 | 10782 | 11058 |

| 06/30/2016 | 11017 | 11047 | 11455 |

| 09/30/2016 | 11093 | 11472 | 11593 |

| 12/31/2016 | 11466 | 11911 | 12051 |

| 03/31/2017 | 11901 | 12633 | 12587 |

| 06/30/2017 | 12156 | 13023 | 12933 |

| 09/30/2017 | 12641 | 13607 | 13531 |

| 12/31/2017 | 13516 | 14511 | 14554 |

| 03/31/2018 | 13385 | 14401 | 14487 |

| 06/30/2018 | 13665 | 14896 | 14864 |

| 09/30/2018 | 14221 | 16044 | 15558 |

| 12/31/2018 | 12395 | 13875 | 13604 |

| 03/31/2019 | 13986 | 15769 | 15435 |

| 06/30/2019 | 14317 | 16447 | 15893 |

| 09/30/2019 | 14599 | 16727 | 16291 |

| 12/31/2019 | 15834 | 18244 | 17779 |

| 03/31/2020 | 10572 | 14668 | 11901 |

| 06/30/2020 | 12965 | 17682 | 14672 |

| 09/30/2020 | 13746 | 19260 | 15668 |

| 12/31/2020 | 16406 | 21600 | 18831 |

| 03/31/2021 | 18829 | 22934 | 21738 |

| 06/30/2021 | 19630 | 24895 | 22781 |

| 09/30/2021 | 19052 | 25040 | 22226 |

| 12/31/2021 | 21152 | 27801 | 24804 |

| 03/31/2022 | 20340 | 26522 | 23953 |

| 06/30/2022 | 17521 | 22252 | 20713 |

| 09/30/2022 | 16236 | 21165 | 19298 |

| 12/31/2022 | 18143 | 22766 | 21667 |

| 03/31/2023 | 18619 | 24473 | 22352 |

| 06/30/2023 | 19519 | 26612 | 23558 |

| 09/30/2023 | 18922 | 25741 | 22939 |

| 12/31/2023 | 20973 | 28750 | 25585 |

| 03/31/2024 | 23316 | 31785 | 28632 |

| 06/30/2024 | 23995 | 33147 | 29633 |

| 09/30/2024 | 25699 | 35098 | 31893 |

| Class C (without CDSC) | 35.81% | 11.97% | 9.90% |

| Class C (with CDSC)‡ | 34.81% | 11.97% | 9.90% |

| S&P 500 Index | 36.35% | 15.98% | 13.38% |

| Guggenheim RBP Dividend IndexSMGuggenheim RBP Dividend IndexSM | 39.03% | 14.38% | 12.30% |

The fund's past performance is not a good predictor of the fund's future performance. Visit GuggenheimInvestments.com/mutual-funds/performance for more recent performance information.

| Net Assets | $17,349,060 |

| Total Number of Portfolio Holdings | 108 |

| Portfolio Turnover Rate | 69% |

| Total Advisory Fees Paid | $0 |

The fund incurred $119,773 of advisory fees which were fully waived/reimbursed by the Adviser to ensure each Share Class of the fund operated at its applicable operating expense cap.

| Guggenheim RBP® Dividend Fund | Class C | TVECX | Annual Shareholder Report | September 30, 2024 |

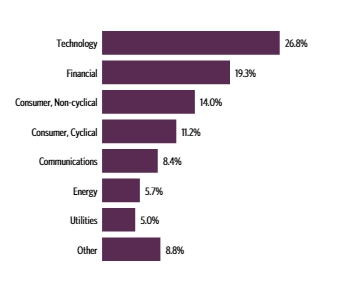

| Technology | 26.8% |

| Financial | 19.3% |

| Consumer, Non-cyclical | 14.0% |

| Consumer, Cyclical | 11.2% |

| Communications | 8.4% |

| Energy | 5.7% |

| Utilities | 5.0% |

| Other | 8.8% |

| Microsoft Corp. | 7.0% |

| NVIDIA Corp. | 6.4% |

| Apple, Inc. | 5.7% |

| Meta Platforms, Inc. — Class A | 3.4% |

| Alphabet, Inc. — Class C | 2.3% |

| Broadcom, Inc. | 2.3% |

| Eli Lilly & Co. | 2.2% |

| Mastercard, Inc. — Class A | 1.7% |

| Walmart, Inc. | 1.6% |

| Oracle Corp. | 1.5% |

| Top 10 Total | 34.1% |

| |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

| |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

| Microsoft Corp. | 7.0% |

| NVIDIA Corp. | 6.4% |

| Apple, Inc. | 5.7% |

| Meta Platforms, Inc. — Class A | 3.4% |

| Alphabet, Inc. — Class C | 2.3% |

| Broadcom, Inc. | 2.3% |

| Eli Lilly & Co. | 2.2% |

| Mastercard, Inc. — Class A | 1.7% |

| Walmart, Inc. | 1.6% |

| Oracle Corp. | 1.5% |

| Top 10 Total | 34.1% |

| |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

There were no changes in or disagreements with fund accountants for the period.

This is a summary of certain changes to the fund since September 30, 2023.

Subsequent to the September 30, 2024 year-end, on October 25, 2024, the fund was reorganized into New Age Alpha Large Cap Value Fund, a series of New Age Alpha Funds Trust, pursuant to an Agreement and Plan of Reorganization approved by the Board of Trustees and shareholders of the fund.

| |  | Availability of Additional Information. For additional information, including financial information, holdings and proxy voting information, go to https://www.guggenheiminvestments.com/mutual-funds/literature or, call 800 820 0888. |

AR-TVECX-093024

Annual Shareholder Report | 9.30.24

This annual shareholder report contains important information about the Guggenheim RBP® Dividend Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the fund at https://www.guggenheiminvestments.com/mutual-funds/literature. You can also request this information by contacting 800 820 0888 or GuggenheimClientServices@mufg-is.com.

This report describes changes to the fund that occurred during the reporting period.

| Institutional Class | $109 | 0.92% |

For the period of October 1, 2023 to September 30, 2024, the fund (Institutional Class shares) returned 37.25%, outperforming the fund's benchmark, the S&P 500 Index, which returned 36.35% for the same period and underperforming the fund's secondary index, the Guggenheim RBP Dividend IndexSM, which returned 39.03% for the same period.

The fund's broad-based securities market index was changed from the Dow Jones U.S. Large-Cap Total Stock Market Index to the S&P 500 Index to comply with the regulation that requires the fund's broad-based securities market index to represent the overall applicable market.

What factors materially affected the fund's performance over the last year?

The fund's leading contributor was strong security selection in Information Technology and Health Care. An overweight holding in Nvidia Corp. was the largest benefit to the Information Technology sector, up 179% over the period. The biggest contribution to the Health Care sector's strong performance was an overweight position in Eli Lily, which rose 66% over the period. Among detractors was an underweight exposure to Energy and Information Technology. Security selection in Communication Services and Materials also detracted from performance. From a selection standpoint, an underweight in Meta Platforms was the largest negative individual contributor, as the stock soared 91% over the period. At the end of the period, the portfolio was most overweight in Utilities and Real Estate and most underweight in Information Technology and Health Care. Relative to the benchmark and consistent with the investment mandate, the portfolio has a larger exposure to dividend-yielding names, as well as smaller value companies.

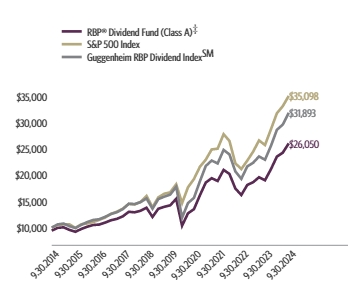

Cumulative performance* for the fund's most recently completed 10 years (as of 9.30.24), assuming a $2,000,000 initial investment.

| 09/30/2014 | 2000000 | 2000000 | 2000000 |

| 12/31/2014 | 2115306 | 2098653 | 2122356 |

| 03/31/2015 | 2140310 | 2118603 | 2154294 |

| 06/30/2015 | 2035644 | 2124494 | 2054336 |

| 09/30/2015 | 1961412 | 1987710 | 1984077 |

| 12/31/2015 | 2080551 | 2127695 | 2108613 |

| 03/31/2016 | 2172022 | 2156373 | 2211674 |

| 06/30/2016 | 2243654 | 2209317 | 2291096 |

| 09/30/2016 | 2265027 | 2294422 | 2318582 |

| 12/31/2016 | 2345682 | 2382166 | 2410262 |

| 03/31/2017 | 2442792 | 2526671 | 2517375 |

| 06/30/2017 | 2500542 | 2604699 | 2586600 |

| 09/30/2017 | 2605729 | 2721399 | 2706126 |

| 12/31/2017 | 2793829 | 2902230 | 2910793 |

| 03/31/2018 | 2775194 | 2880198 | 2897460 |

| 06/30/2018 | 2839095 | 2979101 | 2972706 |

| 09/30/2018 | 2962931 | 3208812 | 3111512 |

| 12/31/2018 | 2591198 | 2774986 | 2720815 |

| 03/31/2019 | 2928496 | 3153716 | 3086932 |

| 06/30/2019 | 3007534 | 3289447 | 3178654 |

| 09/30/2019 | 3071458 | 3345311 | 3258193 |

| 12/31/2019 | 3339374 | 3648730 | 3555815 |

| 03/31/2020 | 2235336 | 2933652 | 2380295 |

| 06/30/2020 | 2747636 | 3536320 | 2934472 |

| 09/30/2020 | 2921566 | 3852094 | 3133565 |

| 12/31/2020 | 3497688 | 4320052 | 3766164 |

| 03/31/2021 | 4021524 | 4586814 | 4347501 |

| 06/30/2021 | 4204134 | 4978933 | 4556291 |

| 09/30/2021 | 4091942 | 5007913 | 4445274 |

| 12/31/2021 | 4552126 | 5560141 | 4960894 |

| 03/31/2022 | 4389335 | 5304457 | 4790585 |

| 06/30/2022 | 3789713 | 4450380 | 4142558 |

| 09/30/2022 | 3520420 | 4233086 | 3859604 |

| 12/31/2022 | 3944552 | 4553151 | 4333370 |

| 03/31/2023 | 4059813 | 4894505 | 4470366 |

| 06/30/2023 | 4266047 | 5322389 | 4711694 |

| 09/30/2023 | 4143048 | 5148165 | 4587853 |

| 12/31/2023 | 4605195 | 5750067 | 5116949 |

| 03/31/2024 | 5134276 | 6357039 | 5726495 |

| 06/30/2024 | 5295898 | 6629362 | 5926613 |

| 09/30/2024 | 5686344 | 7019604 | 6378675 |

| Institutional Class | 37.25% | 13.11% | 11.01% |

| S&P 500 Index | 36.35% | 15.98% | 13.38% |

| Guggenheim RBP Dividend IndexSMGuggenheim RBP Dividend IndexSM | 39.03% | 14.38% | 12.30% |

The fund's past performance is not a good predictor of the fund's future performance. Visit GuggenheimInvestments.com/mutual-funds/performance for more recent performance information.

| Net Assets | $17,349,060 |

| Total Number of Portfolio Holdings | 108 |

| Portfolio Turnover Rate | 69% |

| Total Advisory Fees Paid | $0 |

The fund incurred $119,773 of advisory fees which were fully waived/reimbursed by the Adviser to ensure each Share Class of the fund operated at its applicable operating expense cap.

| Guggenheim RBP® Dividend Fund | Institutional Class | TVEIX | Annual Shareholder Report | September 30, 2024 |

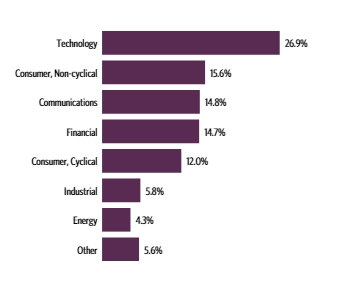

| Technology | 26.8% |

| Financial | 19.3% |

| Consumer, Non-cyclical | 14.0% |

| Consumer, Cyclical | 11.2% |

| Communications | 8.4% |

| Energy | 5.7% |

| Utilities | 5.0% |

| Other | 8.8% |

| Microsoft Corp. | 7.0% |

| NVIDIA Corp. | 6.4% |

| Apple, Inc. | 5.7% |

| Meta Platforms, Inc. — Class A | 3.4% |

| Alphabet, Inc. — Class C | 2.3% |

| Broadcom, Inc. | 2.3% |

| Eli Lilly & Co. | 2.2% |

| Mastercard, Inc. — Class A | 1.7% |

| Walmart, Inc. | 1.6% |

| Oracle Corp. | 1.5% |

| Top 10 Total | 34.1% |

| |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

| |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

| Microsoft Corp. | 7.0% |

| NVIDIA Corp. | 6.4% |

| Apple, Inc. | 5.7% |

| Meta Platforms, Inc. — Class A | 3.4% |

| Alphabet, Inc. — Class C | 2.3% |

| Broadcom, Inc. | 2.3% |

| Eli Lilly & Co. | 2.2% |

| Mastercard, Inc. — Class A | 1.7% |

| Walmart, Inc. | 1.6% |

| Oracle Corp. | 1.5% |

| Top 10 Total | 34.1% |

| |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

There were no changes in or disagreements with fund accountants for the period.

This is a summary of certain changes to the fund since September 30, 2023.

Subsequent to the September 30, 2024 year-end, on October 25, 2024, the fund was reorganized into New Age Alpha Large Cap Value Fund, a series of New Age Alpha Funds Trust, pursuant to an Agreement and Plan of Reorganization approved by the Board of Trustees and shareholders of the fund.

| |  | Availability of Additional Information. For additional information, including financial information, holdings and proxy voting information, go to https://www.guggenheiminvestments.com/mutual-funds/literature or, call 800 820 0888. |

AR-TVEIX-093024

Annual Shareholder Report | 9.30.24

This annual shareholder report contains important information about the Guggenheim RBP® Dividend Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the fund at https://www.guggenheiminvestments.com/mutual-funds/literature. You can also request this information by contacting 800 820 0888 or GuggenheimClientServices@mufg-is.com.

This report describes changes to the fund that occurred during the reporting period.

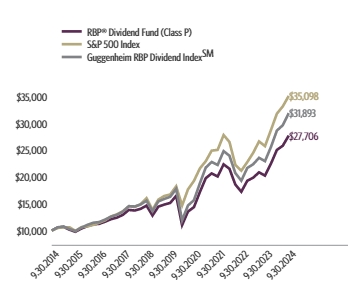

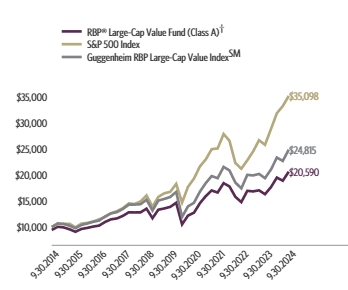

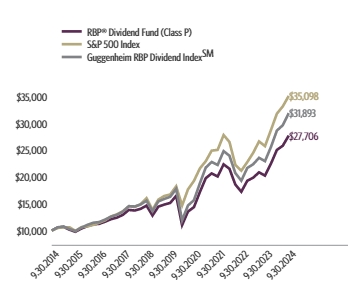

For the period of October 1, 2023 to September 30, 2024, the fund (Class P shares) returned 36.88%, outperforming the fund's benchmark, the S&P 500 Index, which returned 36.35% for the same period and underperforming the fund's secondary index, the Guggenheim RBP Dividend IndexSM, which returned 39.03% for the same period.

The fund's broad-based securities market index was changed from the Dow Jones U.S. Large-Cap Total Stock Market Index to the S&P 500 Index to comply with the regulation that requires the fund's broad-based securities market index to represent the overall applicable market.

What factors materially affected the fund's performance over the last year?

The fund's leading contributor was strong security selection in Information Technology and Health Care. An overweight holding in Nvidia Corp. was the largest benefit to the Information Technology sector, up 179% over the period. The biggest contribution to the Health Care sector's strong performance was an overweight position in Eli Lily, which rose 66% over the period. Among detractors was an underweight exposure to Energy and Information Technology. Security selection in Communication Services and Materials also detracted from performance. From a selection standpoint, an underweight in Meta Platforms was the largest negative individual contributor, as the stock soared 91% over the period. At the end of the period, the portfolio was most overweight in Utilities and Real Estate and most underweight in Information Technology and Health Care. Relative to the benchmark and consistent with the investment mandate, the portfolio has a larger exposure to dividend-yielding names, as well as smaller value companies.

Cumulative performance* for the fund's most recently completed 10 years (as of 9.30.24), assuming a $10,000 initial investment.

| 09/30/2014 | 10000 | 10000 | 10000 |

| 12/31/2014 | 10567 | 10493 | 10612 |

| 03/31/2015 | 10685 | 10593 | 10771 |

| 06/30/2015 | 10160 | 10622 | 10272 |

| 09/30/2015 | 9780 | 9939 | 9920 |

| 12/31/2015 | 10373 | 10638 | 10543 |

| 03/31/2016 | 10817 | 10782 | 11058 |

| 06/30/2016 | 11162 | 11047 | 11455 |

| 09/30/2016 | 11258 | 11472 | 11593 |

| 12/31/2016 | 11655 | 11911 | 12051 |

| 03/31/2017 | 12123 | 12633 | 12587 |

| 06/30/2017 | 12412 | 13023 | 12933 |

| 09/30/2017 | 12924 | 13607 | 13531 |

| 12/31/2017 | 13851 | 14511 | 14554 |

| 03/31/2018 | 13738 | 14401 | 14487 |

| 06/30/2018 | 14048 | 14896 | 14864 |

| 09/30/2018 | 14650 | 16044 | 15558 |

| 12/31/2018 | 12805 | 13875 | 13604 |

| 03/31/2019 | 14460 | 15769 | 15435 |

| 06/30/2019 | 14846 | 16447 | 15893 |

| 09/30/2019 | 15152 | 16727 | 16291 |

| 12/31/2019 | 16471 | 18244 | 17779 |

| 03/31/2020 | 11023 | 14668 | 11901 |

| 06/30/2020 | 13539 | 17682 | 14672 |

| 09/30/2020 | 14375 | 19260 | 15668 |

| 12/31/2020 | 17199 | 21600 | 18831 |

| 03/31/2021 | 19765 | 22934 | 21738 |

| 06/30/2021 | 20654 | 24895 | 22781 |

| 09/30/2021 | 20085 | 25040 | 22226 |

| 12/31/2021 | 22337 | 27801 | 24804 |

| 03/31/2022 | 21525 | 26522 | 23953 |

| 06/30/2022 | 18578 | 22252 | 20713 |

| 09/30/2022 | 17236 | 21165 | 19298 |

| 12/31/2022 | 19290 | 22766 | 21667 |

| 03/31/2023 | 19850 | 24473 | 22352 |

| 06/30/2023 | 20852 | 26612 | 23558 |

| 09/30/2023 | 20241 | 25741 | 22939 |

| 12/31/2023 | 22483 | 28750 | 25585 |

| 03/31/2024 | 25026 | 31785 | 28632 |

| 06/30/2024 | 25812 | 33147 | 29633 |

| 09/30/2024 | 27706 | 35098 | 31893 |

| Class P ** | 36.88% | 12.83% | 10.73% |

| S&P 500 Index | 36.35% | 15.98% | 13.38% |

| Guggenheim RBP Dividend IndexSMGuggenheim RBP Dividend IndexSM | 39.03% | 14.38% | 12.30% |

The fund's past performance is not a good predictor of the fund's future performance. Visit GuggenheimInvestments.com/mutual-funds/performance for more recent performance information.

| Net Assets | $17,349,060 |

| Total Number of Portfolio Holdings | 108 |

| Portfolio Turnover Rate | 69% |

| Total Advisory Fees Paid | $0 |

The fund incurred $119,773 of advisory fees which were fully waived/reimbursed by the Adviser to ensure each Share Class of the fund operated at its applicable operating expense cap.

| Guggenheim RBP® Dividend Fund | Class P | TVEFX | Annual Shareholder Report | September 30, 2024 |

| Technology | 26.8% |

| Financial | 19.3% |

| Consumer, Non-cyclical | 14.0% |

| Consumer, Cyclical | 11.2% |

| Communications | 8.4% |

| Energy | 5.7% |

| Utilities | 5.0% |

| Other | 8.8% |

| Microsoft Corp. | 7.0% |

| NVIDIA Corp. | 6.4% |

| Apple, Inc. | 5.7% |

| Meta Platforms, Inc. — Class A | 3.4% |

| Alphabet, Inc. — Class C | 2.3% |

| Broadcom, Inc. | 2.3% |

| Eli Lilly & Co. | 2.2% |

| Mastercard, Inc. — Class A | 1.7% |

| Walmart, Inc. | 1.6% |

| Oracle Corp. | 1.5% |

| Top 10 Total | 34.1% |

| |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

| |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

| Microsoft Corp. | 7.0% |

| NVIDIA Corp. | 6.4% |

| Apple, Inc. | 5.7% |

| Meta Platforms, Inc. — Class A | 3.4% |

| Alphabet, Inc. — Class C | 2.3% |

| Broadcom, Inc. | 2.3% |

| Eli Lilly & Co. | 2.2% |

| Mastercard, Inc. — Class A | 1.7% |

| Walmart, Inc. | 1.6% |

| Oracle Corp. | 1.5% |

| Top 10 Total | 34.1% |

| |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

There were no changes in or disagreements with fund accountants for the period.

This is a summary of certain changes to the fund since September 30, 2023.

Subsequent to the September 30, 2024 year-end, on October 25, 2024, the fund was reorganized into New Age Alpha Large Cap Value Fund, a series of New Age Alpha Funds Trust, pursuant to an Agreement and Plan of Reorganization approved by the Board of Trustees and shareholders of the fund.

| |  | Availability of Additional Information. For additional information, including financial information, holdings and proxy voting information, go to https://www.guggenheiminvestments.com/mutual-funds/literature or, call 800 820 0888. |

AR-TVEFX-093024

Annual Shareholder Report | 9.30.24

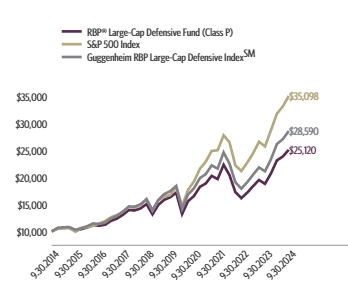

This annual shareholder report contains important information about the Guggenheim RBP® Large-Cap Defensive Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the fund at https://www.guggenheiminvestments.com/mutual-funds/literature. You can also request this information by contacting 800 820 0888 or GuggenheimClientServices@mufg-is.com.

This report describes changes to the fund that occurred during the reporting period.

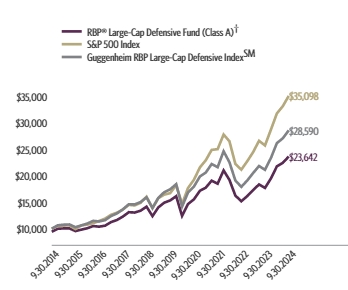

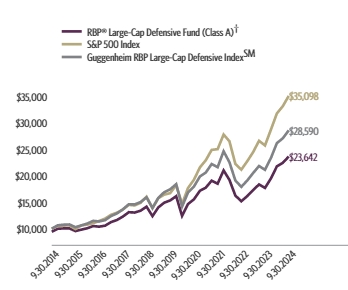

For the period of October 1, 2023 to September 30, 2024, the fund (Class A shares) returned 33.50%, underperforming the fund's benchmark, the S&P 500 Index, which returned 36.35% for the same period and underperforming the fund's secondary index, the Guggenheim RBP Large-Cap Defensive IndexSM, which returned 35.29% for the same period.

The fund's broad-based securities market index was changed from the Dow Jones U.S. Large-Cap Total Stock Market Index to the S&P 500 Index to comply with the regulation that requires the fund's broad-based securities market index to represent the overall applicable market.

What factors materially affected the fund's performance over the last year?

The fund's investment strategy targets defensive stocks, which typically offer high quality, lower volatility, and lower beta. However, stocks with these characteristics often lag in periods of strong positive market returns. The fund's leading contributor was strong security selection and an overweight exposure to Utilities, with an overweight holding in Vistra Corp. providing the largest individual benefit, up 262% over the period. Detracting most from performance was an underweight exposure to, and security selection in, Financials. An underweight in Everest Group was the largest individual detractor, as the stock soared 70% over the period. At the end of the period, the portfolio was most overweight in Utilities and Consumer Staples. The largest underweights were Information Technology and Industrials. The portfolio has high quality characteristics compared to the benchmark, with higher exposures to more profitable, less leveraged, and less volatile companies.

Cumulative performance* for the fund's most recently completed 10 years (as of 9.30.24), assuming a $10,000 initial investment.

| 09/30/2014 | 9428 | 10000 | 10000 |

| 12/31/2014 | 10002 | 10493 | 10644 |

| 03/31/2015 | 10056 | 10593 | 10760 |

| 06/30/2015 | 10065 | 10622 | 10810 |

| 09/30/2015 | 9560 | 9939 | 10297 |

| 12/31/2015 | 9830 | 10638 | 10632 |

| 03/31/2016 | 10089 | 10782 | 10977 |

| 06/30/2016 | 10507 | 11047 | 11485 |

| 09/30/2016 | 10388 | 11472 | 11376 |

| 12/31/2016 | 10580 | 11911 | 11626 |

| 03/31/2017 | 11249 | 12633 | 12392 |

| 06/30/2017 | 11645 | 13023 | 12881 |

| 09/30/2017 | 12293 | 13607 | 13658 |

| 12/31/2017 | 13127 | 14511 | 14630 |

| 03/31/2018 | 13056 | 14401 | 14589 |

| 06/30/2018 | 13408 | 14896 | 15036 |

| 09/30/2018 | 14170 | 16044 | 15917 |

| 12/31/2018 | 12382 | 13875 | 13929 |

| 03/31/2019 | 14034 | 15769 | 15842 |

| 06/30/2019 | 14922 | 16447 | 16904 |

| 09/30/2019 | 15353 | 16727 | 17455 |

| 12/31/2019 | 16147 | 18244 | 18416 |

| 03/31/2020 | 12412 | 14668 | 14184 |

| 06/30/2020 | 14659 | 17682 | 16826 |

| 09/30/2020 | 15567 | 19260 | 17977 |

| 12/31/2020 | 17178 | 21600 | 19874 |

| 03/31/2021 | 17758 | 22934 | 20613 |

| 06/30/2021 | 19084 | 24895 | 22228 |

| 09/30/2021 | 18520 | 25040 | 21631 |

| 12/31/2021 | 21022 | 27801 | 24635 |

| 03/31/2022 | 19229 | 26522 | 22563 |

| 06/30/2022 | 16268 | 22252 | 19124 |

| 09/30/2022 | 15196 | 21165 | 17915 |

| 12/31/2022 | 16169 | 22766 | 19125 |

| 03/31/2023 | 17300 | 24473 | 20524 |

| 06/30/2023 | 18373 | 26612 | 21854 |

| 09/30/2023 | 17710 | 25741 | 21132 |

| 12/31/2023 | 19519 | 28750 | 23379 |

| 03/31/2024 | 21786 | 31785 | 26174 |

| 06/30/2024 | 22450 | 33147 | 27083 |

| 09/30/2024 | 23642 | 35098 | 28590 |

| Class A (without sales charge) | 33.50% | 9.02% | 9.63% |

| Class A (with sales charge)† | 27.19% | 7.97% | 8.99% |

| S&P 500 Index | 36.35% | 15.98% | 13.38% |

| Guggenheim RBP Large-Cap Defensive IndexSMGuggenheim RBP Large-Cap Defensive IndexSM | 35.29% | 10.37% | 11.08% |

The fund's past performance is not a good predictor of the fund's future performance. Visit GuggenheimInvestments.com/mutual-funds/performance for more recent performance information.

| Net Assets | $7,529,053 |

| Total Number of Portfolio Holdings | 101 |

| Portfolio Turnover Rate | 72% |

| Total Advisory Fees Paid | $0 |

The fund incurred $57,176 of advisory fees which were fully waived/reimbursed by the Adviser to ensure each Share Class of the fund operated at its applicable operating expense cap.

| Guggenheim RBP® Large-Cap Defensive Fund | Class A | TVDAX | Annual Shareholder Report | September 30, 2024 |

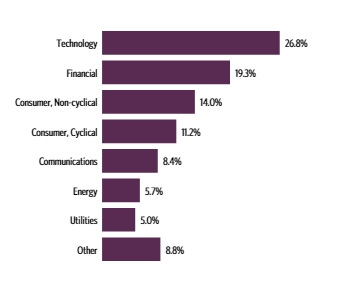

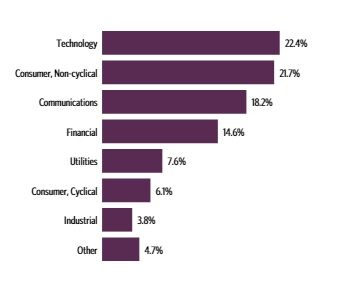

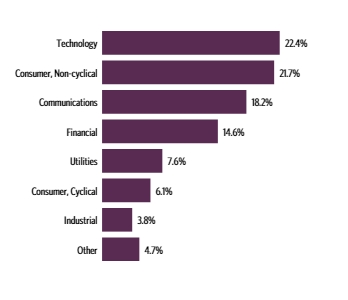

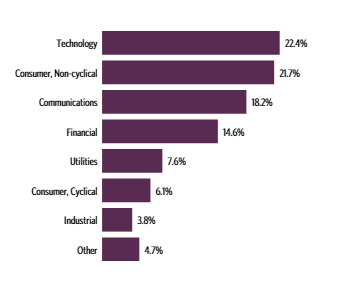

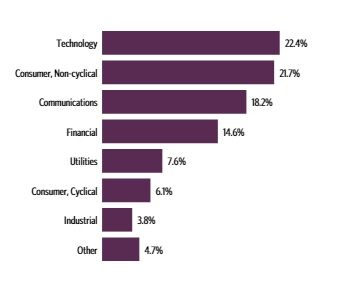

| Technology | 22.4% |

| Consumer, Non-cyclical | 21.7% |

| Communications | 18.2% |

| Financial | 14.6% |

| Utilities | 7.6% |

| Consumer, Cyclical | 6.1% |

| Industrial | 3.8% |

| Other | 4.7% |

| Microsoft Corp. | 7.4% |

| NVIDIA Corp. | 5.2% |

| Apple, Inc. | 5.1% |

| Alphabet, Inc. — Class C | 4.8% |

| Amazon.com, Inc. | 4.2% |

| Meta Platforms, Inc. — Class A | 3.9% |

| Eli Lilly & Co. | 2.7% |

| JPMorgan Chase & Co. | 2.6% |

| Visa, Inc. — Class A | 2.2% |

| Mastercard, Inc. — Class A | 2.2% |

| Top 10 Total | 40.3% |

| |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

| |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

| Microsoft Corp. | 7.4% |

| NVIDIA Corp. | 5.2% |

| Apple, Inc. | 5.1% |

| Alphabet, Inc. — Class C | 4.8% |

| Amazon.com, Inc. | 4.2% |

| Meta Platforms, Inc. — Class A | 3.9% |

| Eli Lilly & Co. | 2.7% |

| JPMorgan Chase & Co. | 2.6% |

| Visa, Inc. — Class A | 2.2% |

| Mastercard, Inc. — Class A | 2.2% |

| Top 10 Total | 40.3% |

| |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

There were no changes in or disagreements with fund accountants for the period.

This is a summary of certain changes to the fund since September 30, 2023.

Subsequent to the September 30, 2024 year-end, on October 25, 2024, the fund was reorganized into New Age Alpha Large Cap Value Fund, a series of New Age Alpha Funds Trust, pursuant to an Agreement and Plan of Reorganization approved by the Board of Trustees and shareholders of the fund.

| |  | Availability of Additional Information. For additional information, including financial information, holdings and proxy voting information, go to https://www.guggenheiminvestments.com/mutual-funds/literature or, call 800 820 0888. |

AR-TVDAX-093024

Annual Shareholder Report | 9.30.24

This annual shareholder report contains important information about the Guggenheim RBP® Large-Cap Defensive Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the fund at https://www.guggenheiminvestments.com/mutual-funds/literature. You can also request this information by contacting 800 820 0888 or GuggenheimClientServices@mufg-is.com.

This report describes changes to the fund that occurred during the reporting period.

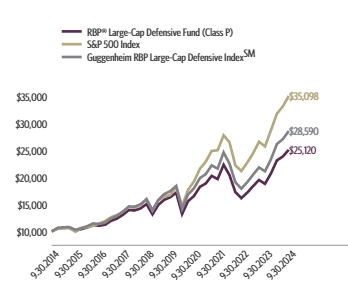

For the period of October 1, 2023 to September 30, 2024, the fund (Class P shares) returned 33.52%, underperforming the fund's benchmark, the S&P 500 Index, which returned 36.35% for the same period and underperforming the fund's secondary index, the Guggenheim RBP Large-Cap Defensive IndexSM, which returned 35.29% for the same period.

The fund's broad-based securities market index was changed from the Dow Jones U.S. Large-Cap Total Stock Market Index to the S&P 500 Index to comply with the regulation that requires the fund's broad-based securities market index to represent the overall applicable market.

What factors materially affected the fund's performance over the last year?

The fund's investment strategy targets defensive stocks, which typically offer high quality, lower volatility, and lower beta. However, stocks with these characteristics often lag in periods of strong positive market returns. The fund's leading contributor was strong security selection and an overweight exposure to Utilities, with an overweight holding in Vistra Corp. providing the largest individual benefit, up 262% over the period. Detracting most from performance was an underweight exposure to, and security selection in, Financials. An underweight in Everest Group was the largest individual detractor, as the stock soared 70% over the period. At the end of the period, the portfolio was most overweight in Utilities and Consumer Staples. The largest underweights were Information Technology and Industrials. The portfolio has high quality characteristics compared to the benchmark, with higher exposures to more profitable, less leveraged, and less volatile companies.

Cumulative performance* for the fund's most recently completed 10 years (as of 9.30.24), assuming a $10,000 initial investment.

| 09/30/2014 | 10000 | 10000 | 10000 |

| 12/31/2014 | 10601 | 10493 | 10644 |

| 03/31/2015 | 10667 | 10593 | 10760 |

| 06/30/2015 | 10686 | 10622 | 10810 |

| 09/30/2015 | 10148 | 9939 | 10297 |

| 12/31/2015 | 10438 | 10638 | 10632 |

| 03/31/2016 | 10728 | 10782 | 10977 |

| 06/30/2016 | 11174 | 11047 | 11485 |

| 09/30/2016 | 11050 | 11472 | 11376 |

| 12/31/2016 | 11247 | 11911 | 11626 |

| 03/31/2017 | 11952 | 12633 | 12392 |

| 06/30/2017 | 12375 | 13023 | 12881 |

| 09/30/2017 | 13070 | 13607 | 13658 |

| 12/31/2017 | 13956 | 14511 | 14630 |

| 03/31/2018 | 13883 | 14401 | 14589 |

| 06/30/2018 | 14260 | 14896 | 15036 |

| 09/30/2018 | 15074 | 16044 | 15917 |

| 12/31/2018 | 13158 | 13875 | 13929 |

| 03/31/2019 | 14917 | 15769 | 15842 |

| 06/30/2019 | 15861 | 16447 | 16904 |

| 09/30/2019 | 16319 | 16727 | 17455 |

| 12/31/2019 | 17181 | 18244 | 18416 |

| 03/31/2020 | 13203 | 14668 | 14184 |

| 06/30/2020 | 15590 | 17682 | 16826 |

| 09/30/2020 | 16554 | 19260 | 17977 |

| 12/31/2020 | 18256 | 21600 | 19874 |

| 03/31/2021 | 18882 | 22934 | 20613 |

| 06/30/2021 | 20291 | 24895 | 22228 |

| 09/30/2021 | 19696 | 25040 | 21631 |

| 12/31/2021 | 22343 | 27801 | 24635 |

| 03/31/2022 | 20440 | 26522 | 22563 |

| 06/30/2022 | 17287 | 22252 | 19124 |

| 09/30/2022 | 16157 | 21165 | 17915 |

| 12/31/2022 | 17188 | 22766 | 19125 |

| 03/31/2023 | 18398 | 24473 | 20524 |

| 06/30/2023 | 19528 | 26612 | 21854 |

| 09/30/2023 | 18814 | 25741 | 21132 |

| 12/31/2023 | 20744 | 28750 | 23379 |

| 03/31/2024 | 23151 | 31785 | 26174 |

| 06/30/2024 | 23867 | 33147 | 27083 |

| 09/30/2024 | 25120 | 35098 | 28590 |

| Class P** | 33.52% | 9.01% | 9.65% |

| S&P 500 Index | 36.35% | 15.98% | 13.38% |

| Guggenheim RBP Large-Cap Defensive IndexSMGuggenheim RBP Large-Cap Defensive IndexSM | 35.29% | 10.37% | 11.08% |

The fund's past performance is not a good predictor of the fund's future performance. Visit GuggenheimInvestments.com/mutual-funds/performance for more recent performance information.

| Net Assets | $7,529,053 |

| Total Number of Portfolio Holdings | 101 |

| Portfolio Turnover Rate | 72% |

| Total Advisory Fees Paid | $0 |

The fund incurred $57,176 of advisory fees which were fully waived/reimbursed by the Adviser to ensure each Share Class of the fund operated at its applicable operating expense cap.

| Guggenheim RBP® Large-Cap Defensive Fund | Class P | TVFDX | Annual Shareholder Report | September 30, 2024 |

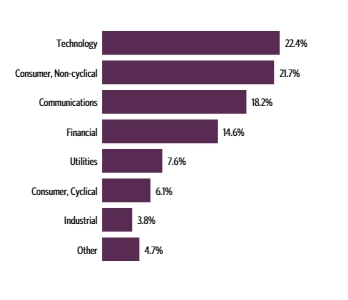

| Technology | 22.4% |

| Consumer, Non-cyclical | 21.7% |

| Communications | 18.2% |

| Financial | 14.6% |

| Utilities | 7.6% |

| Consumer, Cyclical | 6.1% |

| Industrial | 3.8% |

| Other | 4.7% |

| Microsoft Corp. | 7.4% |

| NVIDIA Corp. | 5.2% |

| Apple, Inc. | 5.1% |

| Alphabet, Inc. — Class C | 4.8% |

| Amazon.com, Inc. | 4.2% |

| Meta Platforms, Inc. — Class A | 3.9% |

| Eli Lilly & Co. | 2.7% |

| JPMorgan Chase & Co. | 2.6% |

| Visa, Inc. — Class A | 2.2% |

| Mastercard, Inc. — Class A | 2.2% |

| Top 10 Total | 40.3% |

| |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

| |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

| Microsoft Corp. | 7.4% |

| NVIDIA Corp. | 5.2% |

| Apple, Inc. | 5.1% |

| Alphabet, Inc. — Class C | 4.8% |

| Amazon.com, Inc. | 4.2% |

| Meta Platforms, Inc. — Class A | 3.9% |

| Eli Lilly & Co. | 2.7% |

| JPMorgan Chase & Co. | 2.6% |

| Visa, Inc. — Class A | 2.2% |

| Mastercard, Inc. — Class A | 2.2% |

| Top 10 Total | 40.3% |

| |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

There were no changes in or disagreements with fund accountants for the period.

This is a summary of certain changes to the fund since September 30, 2023.

Subsequent to the September 30, 2024 year-end, on October 25, 2024, the fund was reorganized into New Age Alpha Large Cap Value Fund, a series of New Age Alpha Funds Trust, pursuant to an Agreement and Plan of Reorganization approved by the Board of Trustees and shareholders of the fund.

| |  | Availability of Additional Information. For additional information, including financial information, holdings and proxy voting information, go to https://www.guggenheiminvestments.com/mutual-funds/literature or, call 800 820 0888. |

AR-TVFDX-093024

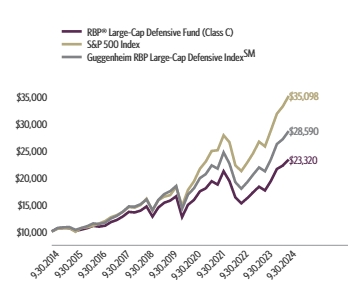

Annual Shareholder Report | 9.30.24

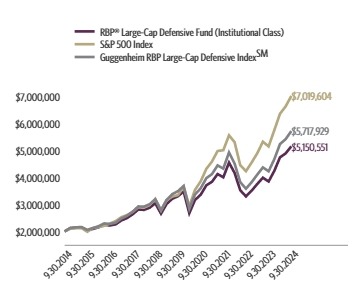

This annual shareholder report contains important information about the Guggenheim RBP® Large-Cap Defensive Fund for the period of October 1, 2023 to September 30, 2024. You can find additional information about the fund at https://www.guggenheiminvestments.com/mutual-funds/literature. You can also request this information by contacting 800 820 0888 or GuggenheimClientServices@mufg-is.com.

This report describes changes to the fund that occurred during the reporting period.

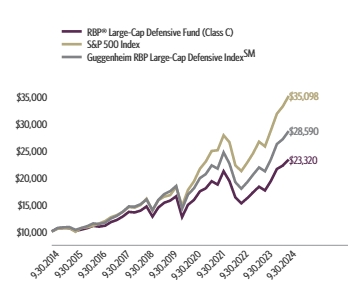

For the period of October 1, 2023 to September 30, 2024, the fund (Class C shares) returned 32.42%, underperforming the fund's benchmark, the S&P 500 Index, which returned 36.35% for the same period and underperforming the fund's secondary index, the Guggenheim RBP Large-Cap Defensive IndexSM, which returned 35.29% for the same period.

The fund's broad-based securities market index was changed from the Dow Jones U.S. Large-Cap Total Stock Market Index to the S&P 500 Index to comply with the regulation that requires the fund's broad-based securities market index to represent the overall applicable market.

What factors materially affected the fund's performance over the last year?

The fund's investment strategy targets defensive stocks, which typically offer high quality, lower volatility, and lower beta. However, stocks with these characteristics often lag in periods of strong positive market returns. The fund's leading contributor was strong security selection and an overweight exposure to Utilities, with an overweight holding in Vistra Corp. providing the largest individual benefit, up 262% over the period. Detracting most from performance was an underweight exposure to, and security selection in, Financials. An underweight in Everest Group was the largest individual detractor, as the stock soared 70% over the period. At the end of the period, the portfolio was most overweight in Utilities and Consumer Staples. The largest underweights were Information Technology and Industrials. The portfolio has high quality characteristics compared to the benchmark, with higher exposures to more profitable, less leveraged, and less volatile companies.

Cumulative performance* for the fund's most recently completed 10 years (as of 9.30.24), assuming a $10,000 initial investment.

| 09/30/2014 | 10000 | 10000 | 10000 |

| 12/31/2014 | 10585 | 10493 | 10644 |

| 03/31/2015 | 10633 | 10593 | 10760 |

| 06/30/2015 | 10624 | 10622 | 10810 |

| 09/30/2015 | 10077 | 9939 | 10297 |

| 12/31/2015 | 10344 | 10638 | 10632 |

| 03/31/2016 | 10609 | 10782 | 10977 |

| 06/30/2016 | 11032 | 11047 | 11485 |

| 09/30/2016 | 10884 | 11472 | 11376 |

| 12/31/2016 | 11065 | 11911 | 11626 |

| 03/31/2017 | 11730 | 12633 | 12392 |

| 06/30/2017 | 12118 | 13023 | 12881 |

| 09/30/2017 | 12772 | 13607 | 13658 |

| 12/31/2017 | 13615 | 14511 | 14630 |

| 03/31/2018 | 13515 | 14401 | 14589 |

| 06/30/2018 | 13851 | 14896 | 15036 |

| 09/30/2018 | 14622 | 16044 | 15917 |

| 12/31/2018 | 12745 | 13875 | 13929 |

| 03/31/2019 | 14426 | 15769 | 15842 |

| 06/30/2019 | 15312 | 16447 | 16904 |

| 09/30/2019 | 15710 | 16727 | 17455 |

| 12/31/2019 | 16505 | 18244 | 18416 |

| 03/31/2020 | 12655 | 14668 | 14184 |

| 06/30/2020 | 14927 | 17682 | 16826 |

| 09/30/2020 | 15827 | 19260 | 17977 |

| 12/31/2020 | 17421 | 21600 | 19874 |

| 03/31/2021 | 17986 | 22934 | 20613 |

| 06/30/2021 | 19293 | 24895 | 22228 |

| 09/30/2021 | 18680 | 25040 | 21631 |

| 12/31/2021 | 21145 | 27801 | 24635 |

| 03/31/2022 | 19325 | 26522 | 22563 |

| 06/30/2022 | 16314 | 22252 | 19124 |

| 09/30/2022 | 15205 | 21165 | 17915 |

| 12/31/2022 | 16167 | 22766 | 19125 |

| 03/31/2023 | 17255 | 24473 | 20524 |

| 06/30/2023 | 18280 | 26612 | 21854 |

| 09/30/2023 | 17589 | 25741 | 21132 |

| 12/31/2023 | 19367 | 28750 | 23379 |

| 03/31/2024 | 21563 | 31785 | 26174 |

| 06/30/2024 | 22191 | 33147 | 27083 |

| 09/30/2024 | 23320 | 35098 | 28590 |

| Class C (without CDSC) | 32.42% | 8.22% | 8.84% |

| Class C (with CDSC)‡ | 31.42% | 8.22% | 8.84% |

| S&P 500 Index | 36.35% | 15.98% | 13.38% |

| Guggenheim RBP Large-Cap Defensive IndexSMGuggenheim RBP Large-Cap Defensive IndexSM | 35.29% | 10.37% | 11.08% |

The fund's past performance is not a good predictor of the fund's future performance. Visit GuggenheimInvestments.com/mutual-funds/performance for more recent performance information.

| Net Assets | $7,529,053 |

| Total Number of Portfolio Holdings | 101 |

| Portfolio Turnover Rate | 72% |

| Total Advisory Fees Paid | $0 |

The fund incurred $57,176 of advisory fees which were fully waived/reimbursed by the Adviser to ensure each Share Class of the fund operated at its applicable operating expense cap.

| Guggenheim RBP® Large-Cap Defensive Fund | Class C | TVDCX | Annual Shareholder Report | September 30, 2024 |

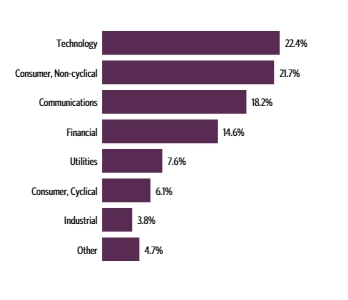

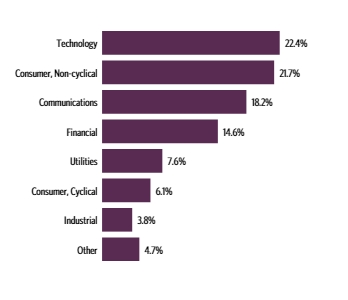

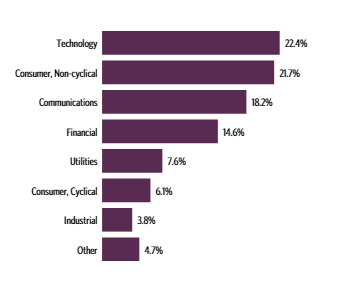

| Technology | 22.4% |

| Consumer, Non-cyclical | 21.7% |

| Communications | 18.2% |

| Financial | 14.6% |

| Utilities | 7.6% |

| Consumer, Cyclical | 6.1% |

| Industrial | 3.8% |

| Other | 4.7% |

| Microsoft Corp. | 7.4% |

| NVIDIA Corp. | 5.2% |

| Apple, Inc. | 5.1% |

| Alphabet, Inc. — Class C | 4.8% |

| Amazon.com, Inc. | 4.2% |

| Meta Platforms, Inc. — Class A | 3.9% |

| Eli Lilly & Co. | 2.7% |

| JPMorgan Chase & Co. | 2.6% |

| Visa, Inc. — Class A | 2.2% |

| Mastercard, Inc. — Class A | 2.2% |

| Top 10 Total | 40.3% |

| |

1 | "Holdings Diversification (Market Exposure as a % of Net Assets)" excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. |

| |

2 | "10 Largest Holdings (as a % of Net Assets)" excludes any temporary cash investments. |

| Microsoft Corp. | 7.4% |

| NVIDIA Corp. | 5.2% |

| Apple, Inc. | 5.1% |

| Alphabet, Inc. — Class C | 4.8% |

| Amazon.com, Inc. | 4.2% |

| Meta Platforms, Inc. — Class A | 3.9% |

| Eli Lilly & Co. | 2.7% |

| JPMorgan Chase & Co. | 2.6% |

| Visa, Inc. — Class A | 2.2% |

| Mastercard, Inc. — Class A | 2.2% |

| Top 10 Total | 40.3% |

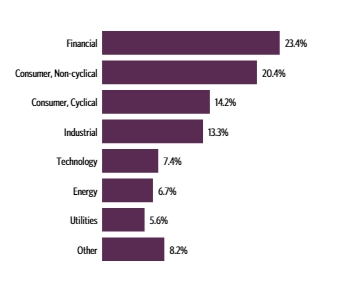

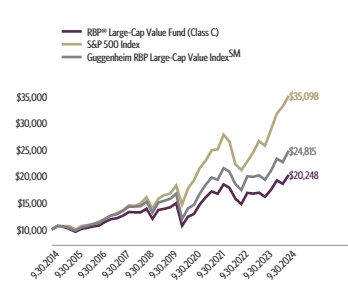

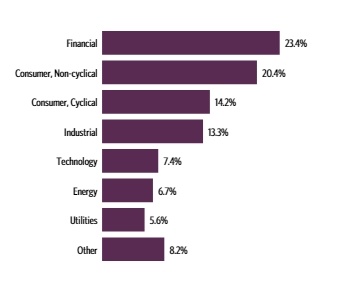

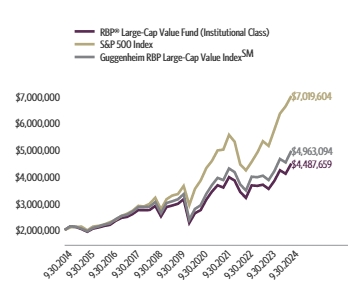

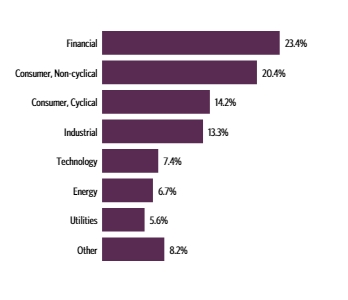

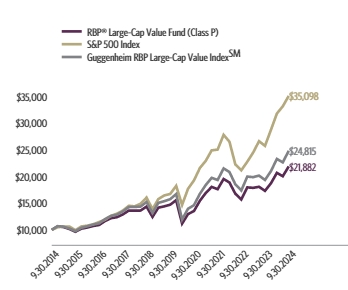

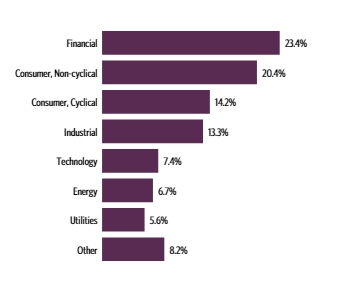

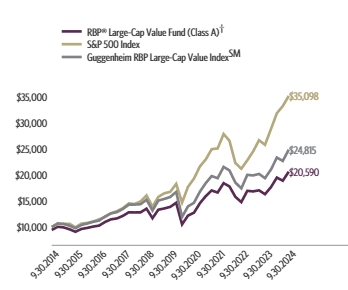

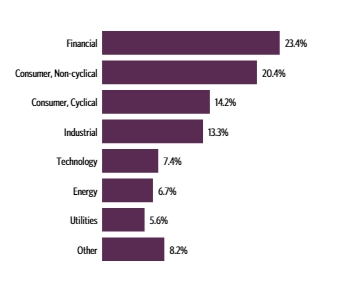

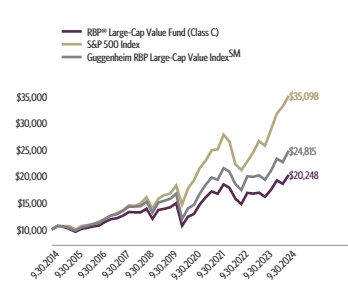

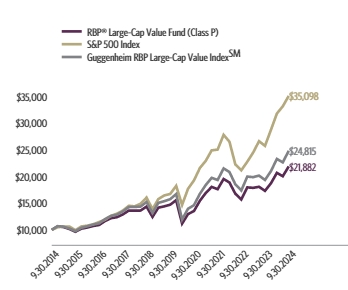

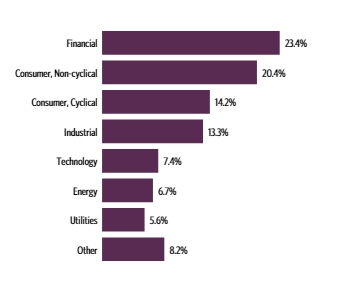

| |